Exhibit 99.3

Management Discussion & Analysis

(All monetary amounts are in thousands of Canadian dollars, except per share amounts or where otherwise noted.)

Management of Algonquin Power & Utilities Corp. (“APUC” or the “Company”) has prepared the following discussion and analysis to provide information to assist its shareholders’ understanding of the financial results for the three and twelve months ended December 31, 2014. The Management Discussion & Analysis (“MD&A”) should be read in conjunction with APUC’s audited consolidated financial statements for the years ended December 31, 2014 and 2013. This material is available on SEDAR at www.sedar.com and on the APUC website at www.AlgonquinPowerandUtilities.com. Additional information about APUC, including the most recent Annual Information Form (“AIF”) can be found on SEDAR at www.sedar.com.

This MD&A is based on information available to management as of March 15, 2015.

Caution concerning forward-looking statements and non-GAAP Measures

Forward-looking statements

Certain statements included herein contain forward-looking information within the meaning of certain securities laws. These statements reflect the views of APUC with respect to future events, based upon assumptions relating to, among others, the performance of APUC’s assets and the business, interest and exchange rates, commodity market prices, and the financial and regulatory climate in which it operates. These forward looking statements include, among others, statements with respect to the expected performance of APUC, its future plans and its dividends to shareholders. Statements containing expressions such as “anticipates”, “believes”, “continues”, “could”, “expect”, “estimates”, “intends”, “may”, “outlook”, “plans”, “project”, “strives”, “will”, and similar expressions generally constitute forward-looking statements.

Since forward-looking statements relate to future events and conditions, by their very nature they require APUC to make assumptions and involve inherent risks and uncertainties. APUC cautions that although it believes its assumptions are reasonable in the circumstances, these risks and uncertainties give rise to the possibility that actual results may differ materially from the expectations set out in the forward-looking statements. Material risk factors include the impact of movements in exchange rates and interest rates; the effects of changes in environmental and other laws and regulatory policy applicable to the energy and utilities sectors; decisions taken by regulators on monetary policy; and the state of the Canadian and the United States (“U.S.”) economies and accompanying business climate. APUC cautions that this list is not exhaustive, and other factors could adversely affect results. Given these risks, undue reliance should not be placed on these forward-looking statements. In addition, such statements are made based on information available and expectations as of the date of this MD&A and such expectations may change after this date. APUC reviews material forward-looking information it has presented, not less frequently than on a quarterly basis. APUC is not obligated to nor does it intend to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by law.

Non-GAAP Financial Measures

The terms “adjusted net earnings”, “adjusted earnings before interest, taxes, depreciation and amortization” (“Adjusted EBITDA”), “adjusted funds from operations”, “per share cash provided by adjusted funds from operations”, “per share cash provided by operating activities”, "net energy sales", and "net utility sales", are used throughout this MD&A. The terms “adjusted net earnings”, “per share cash provided by operating activities”, “adjusted funds from operations”, “per share cash provided by adjusted funds from operations”, Adjusted EBITDA, "net energy sales" and "net utility sales" are not recognized measures under GAAP. There is no standardized measure of “adjusted net earnings”, Adjusted EBITDA, “adjusted funds from operations”, “per share cash provided by adjusted funds from operations”, “per share cash provided by operating activities”, "net energy sales", and "net utility sales" consequently APUC’s method of calculating these measures may differ from methods used by other companies and therefore may not be comparable to similar measures presented by other companies. A calculation and analysis of “adjusted net earnings”, Adjusted EBITDA, “adjusted funds from operations”, “per share cash provided by adjusted funds from operations”, “per share cash provided by operating activities”, "net energy sales" and "net utility sales" can be found throughout this MD&A. Per share cash provided by operating activities is not a substitute measure of performance for earnings per share. Amounts represented by per share cash provided by operating activities do not represent amounts available for distribution to shareholders and should be considered in light of various charges and claims against APUC.

|

| |

| 2014 Annual Report | 1 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

Use of Non-GAAP Financial Measures

Adjusted EBITDA

EBITDA is a non-GAAP measure used by many investors to compare companies on the basis of ability to generate cash from operations. APUC uses these calculations to monitor the amount of cash generated by APUC as compared to the amount of dividends paid by APUC. APUC uses Adjusted EBITDA to assess the operating performance of APUC without the effects of (as applicable): depreciation and amortization expense, income tax expense or recoveries, acquisition costs, litigation expenses, interest expense, gain or loss on derivative financial instruments, write down of intangibles and property, plant and equipment, earnings attributable to non-controlling interests and gain or loss on foreign exchange, earnings or loss from discontinued operations and other typically non-recurring items. APUC adjusts for these factors as they may be non-cash, unusual in nature and are not factors used by management for evaluating the operating performance of the company. APUC believes that presentation of this measure will enhance an investor’s understanding of APUC’s operating performance. Adjusted EBITDA is not intended to be representative of cash provided by operating activities or results of operations determined in accordance with GAAP.

Adjusted net earnings

Adjusted net earnings is a non-GAAP measure used by many investors to compare net earnings from operations without the effects of certain volatile primarily non-cash items that generally have no current economic impact or items such as acquisition expenses or litigation expenses and are viewed as not directly related to a company’s operating performance. Net earnings of APUC can be impacted positively or negatively by gains and losses on derivative financial instruments, including foreign exchange forward contracts, interest rate swaps and energy forward purchase contracts as well as to movements in foreign exchange rates on foreign currency denominated debt and working capital balances. Adjusted weighted average shares outstanding represents weighted average shares outstanding adjusted to remove the dilution effect related to shares issued in advance of funding requirements. APUC uses adjusted net earnings to assess its performance without the effects of (as applicable): gains or losses on foreign exchange, foreign exchange forward contracts, interest rate swaps, acquisition costs, litigation expenses and write down of intangibles and property, plant and equipment, earnings or loss from discontinued operations and other typically non-recurring items as these are not reflective of the performance of the underlying business of APUC. APUC believes that analysis and presentation of net earnings or loss on this basis will enhance an investor’s understanding of the operating performance of its businesses. It is not intended to be representative of net earnings or loss determined in accordance with GAAP.

Adjusted funds from operations

Adjusted funds from operations is a non-GAAP measure used by investors to compare cash flows from operating activities without the effects of certain volatile items that generally have no current economic impact or items such as acquisition expenses and are viewed as not directly related to a company’s operating performance. Cash flows from operating activities of APUC can be impacted positively or negatively by changes in working capital balances, acquisition expenses, litigation expenses cash provided or used in discontinued operations. Adjusted weighted average shares outstanding represents weighted average shares outstanding adjusted to remove the dilution effect related to shares issued in advance of funding requirements. APUC uses adjusted funds from operations to assess its performance without the effects of (as applicable) changes in working capital balances, acquisition expenses, litigation expenses, cash provided or used in discontinued operations and other typically non-recurring items affecting cash from operations as these are not reflective of the long-term performance of the underlying businesses of APUC. APUC believes that analysis and presentation of funds from operations on this basis will enhance an investor’s understanding of the operating performance of its businesses. It is not intended to be representative of cash flows from operating activities as determined in accordance with GAAP.

Net energy sales

Net energy sales is a non-GAAP measure used by investors to identify revenue after commodity costs used to generate revenue where revenue generally is increased or decreased in response to increases or decreases in the cost of the commodity to produce that revenue. APUC uses net energy sales to assess its revenues without the effects of fluctuating commodity costs as such costs are predominantly passed through either directly or indirectly in the revenue that is charged. APUC believes that analysis and presentation of net energy sales on this basis will enhance an investor’s understanding of the revenue generation of its businesses. It is not intended to be representative of revenue as determined in accordance with GAAP.

Net utility sales

Net utility sales is a non-GAAP measure used by investors to identify utility revenue after commodity costs, either natural gas or electricity, where these commodities are generally included as a pass through in rates to its utility customers. APUC uses net utility sales to assess its utility revenues without the effects of fluctuating commodity costs as such costs are predominantly passed through and paid for by the utility customer. APUC believes that analysis and presentation of net utility sales on this

|

| |

| 2014 Annual Report | 2 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

basis will enhance an investor’s understanding of the revenue generation of its utility businesses. It is not intended to be representative of revenue as determined in accordance with GAAP.

Overview and Business Strategy

APUC is incorporated under the Canada Business Corporations Act. APUC owns and operates a diversified portfolio of regulated and non-regulated generation, distribution and transmission utility assets which deliver predictable earnings and cash flows. APUC seeks to maximize total shareholder value through a quarterly dividend augmented by share price appreciation arising from dividend growth supported by increasing per share cash flows and earnings.

APUC’s current quarterly dividend to shareholders is U.S. $0.0875 per share or U.S. $0.35 per share per annum. Based on exchange rates as at December 31, 2014, the quarterly dividend is equivalent to CAD $0.10 per share or CAD $0.41 per share per annum. APUC believes its annual dividend payout allows for both an immediate return on investment for shareholders and retention of sufficient cash within APUC to fund growth opportunities and mitigate the impact of fluctuations in foreign exchange rates. Further increases in the level of dividends paid by APUC are at the discretion of the APUC Board of Directors (the “Board”) with dividend levels being reviewed periodically by the Board in the context of cash available for distribution and earnings together with an assessment of the growth prospects available to APUC. APUC strives to achieve its results in the context of a moderate risk profile consistent with top-quartile North American power and utility operations.

APUC's operations are organized across three business units consisting of Generation, Transmission and Distribution. The Generation Business Group ("Generation Group") owns and operates a diversified portfolio of non-regulated renewable and thermal electric generation utility assets; the recently formed Transmission Business Group ("Transmission Group") is responsible for evaluating and capitalizing upon natural gas pipeline and electric transmission asset opportunities in North America; and the Distribution Business Group ("Distribution Group") owns and operates a portfolio of North American electric, natural gas and water distribution and wastewater collection utility systems.

Generation Business Group

The Generation Group generates and sells electrical energy produced by its diverse portfolio of non-regulated renewable power generation and clean energy power generation facilities located across North America. The Generation Group seeks to deliver continuing growth through development of new greenfield power generation projects and accretive acquisitions of additional electrical energy generation facilities.

The Generation Group owns or has interests in hydroelectric, wind, and solar facilities with a combined generating capacity of approximately 120 MW, 675 MW, and 10MW, respectively. Approximately 83% of the electrical output from the hydroelectric, wind and solar generating facilities is sold pursuant to long term contractual arrangements which have a weighted average remaining contract life of 14 years.

The Generation Group owns or has interests in thermal energy facilities with approximately 335 MW of installed generating capacity. Approximately 91% of the electrical output from the owned thermal facilities is sold pursuant to long term power purchase agreements (“PPA”) with major utilities, which have a weighted average remaining contract life of 7 years.

The Generation Group also has a portfolio of development projects that between 2015 and 2018 will add approximately 529 MW of generation capacity from wind and solar powered generating stations with an average contract life of 22 years.

Distribution Business Group

The Distribution Group operates diversified rate regulated electricity, natural gas, water distribution and wastewater collection utility services to approximately 488,000 connections. The Distribution Group provides safe, high quality and reliable services to its ratepayers through its nationwide portfolio of utility systems and delivers stable and predictable earnings to APUC. In addition to encouraging and supporting organic growth within its service territories, the Distribution Group delivers continued growth in earnings through accretive acquisition of additional utility systems.

The Distribution Group's regulated electrical distribution utility systems and related generation assets are located in the States of California and New Hampshire; and together serve approximately 93,000 electric connections.

The Distribution Group's regulated natural gas distribution utility systems are located in the States of Georgia, Illinois, Iowa, Massachusetts, Missouri and New Hampshire; and together serve approximately 292,000 natural gas connections.

The Distribution Group's regulated water distribution and wastewater collection utility systems are located in the States of Arizona, Arkansas, Illinois, Missouri, and Texas; and together serve approximately 103,000 connections.

|

| |

| 2014 Annual Report | 3 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

Transmission Business Group

In 2014, APUC created a Transmission Group that is responsible for identifying, evaluating and capitalizing upon natural gas pipeline and electric transmission investment opportunities in North America. The Company believes that the creation of the Transmission Group complements the growth of both the Generation and Distribution Groups.

Major Highlights

2014 Corporate Highlights

Dividend Increased to U.S. $0.35 Per Common Share Annually

APUC has completed several acquisitions and advanced on other initiatives including its power development projects that have raised the growth profile for APUC’s earnings and cash flows which in turn supports an increase in the dividend to shareholders. As a result, on August 14, 2014, the Board approved a dividend increase to U.S. $0.35 per share per annum, paid quarterly at a rate of U.S. $0.0875 per share per annum, a 12.4% increase over the previous dividend of CDN $0.34 calculated using the exchange rate in effect at that time. The change in the currency of the dividend better aligns APUC's dividend with the currency profile of its underlying operations. APUC's consolidated assets are approximately 80% based in the U.S. and generate approximately 77% of its underlying cash flows.

Management believes that the increase in dividend is consistent with APUC’s stated strategy of delivering total shareholder return comprised of attractive current dividend yield and capital appreciation founded on increased earnings and cash flows.

Strengthening the Balance Sheet and Poising for Continued Growth

Issuance of $100 million Preferred Shares

On March 5, 2014, APUC issued 4.0 million cumulative rate reset preferred shares, Series D at a price of $25 per share, for aggregate gross proceeds of $100.0 million. The Series D shares will yield 5.0% annually for the initial five-year period ending March 31, 2019. The preferred shares have been assigned a rating of P-3 (High) and Pfd-3 (Low) by S&P and DBRS, respectively. The net proceeds of the offering were used to partially finance certain of APUC’s previously disclosed growth opportunities, reduce amounts outstanding on APUC’s revolving credit facilities, and for general corporate purposes.

Issuance of Common Shares

On September 16, 2014, APUC completed a public offering (the "September Offering") of 16,860,000 common shares at a price of $8.90 per share, for gross proceeds of approximately $150.0 million. On September 26, 2014, the underwriters exercised the over-allotment option granted with the September Offering and an additional 2,529,000 common shares were issued on the same terms and conditions of the September Offering. As a result, APUC issued an aggregate of 19,389,000 common shares under the September Offering for the total gross proceeds of approximately $172.6 million.

On December 11, 2014, APUC completed a public offering of 10,055,000 common shares at a price of $9.95 per share, for gross proceeds of approximately $100.0 million.

Net proceeds of both common share offerings were used to finance certain of APUC's previously disclosed growth opportunities, reduce amounts outstanding on APUC's revolving credit facilities, and for general corporate purposes.

Private Placement of Subscription Receipts to Emera Inc.

On September 4, 2014, APUC and Emera Inc. (“Emera”) entered into a subscription agreement pursuant to which Emera agreed to subscribe for an aggregate of 7,865,170 subscription receipts (“Subscription Receipts”) of APUC at a price of $8.90 per Subscription Receipt, for a subscription price of $70.0 million.

On September 26, 2014, as a result of the Underwriters exercising the Over-Allotment Option, an additional 843,000 Subscription Receipts were issued to Emera at a price of $8.90 per Subscription Receipt, for an aggregate subscription price of $77.5 million.

On December 2, 2014, APUC and Emera entered into an additional subscription agreement to which Emera agreed to subscribe for an aggregate of 3,316,583 Subscription Receipts at a price of $9.95 per Subscription Receipt, for a subscription price of $33.0 million.

The proceeds of the Subscription Receipts private placements are intended to be used to partially finance the acquisitions of the Odell Wind Project and the Park Water Facility (described below).

|

| |

| 2014 Annual Report | 4 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

2014 Generation Group Highlights

Acquisition of Odell Wind Project

On September 4, 2014, the Generation Group announced an opportunity to acquire an interest in the Odell Wind Project, of Minnesota. The Odell Wind Project is a 200 MW wind development located in Cottonwood, Jackson, Martin, and Watonwan counties in Minnesota and is being constructed on approximately 23,000 acres of leased land. The project will utilize 100 Vestas V110-2.0 wind turbines. Pursuant to a 20-year PPA, all energy, capacity and renewable energy credits from the project will be sold to Northern States Power Company, a subsidiary of Xcel Energy Inc., which is a diversified utility operating in the Midwest U.S. Construction is expected to begin in the second quarter of 2015, with total costs estimated at U.S. $322.8 million. It is anticipated that the Odell Project will qualify for U.S. federal production tax credits having satisfied the Internal Revenue Service 5% beginning of construction investment safe-harbor guidance. Accordingly, approximately 60% of the permanent project financing is expected to be funded by tax equity investors.

The Generation Group's participation in the project will be via a 50% equity interest in a new joint venture with a third party developer. The Company is accounting for the joint venture as an equity method investment since both partners have joint control of the new venture. The Generation Group holds an option to acquire the other 50% interest on commencement of operations, which is expected in late 2015 or early 2016.

Completion of Cornwall Solar Project

During the quarter ended March 31, 2014, the Generation Group completed the construction of its 10 MWac solar project located near Cornwall, Ontario. The facility reached commercial operation on March 27, 2014 for a total capital cost of approximately $47.6 million. The facility represents the first solar project in the Generation Group’s portfolio. The facility is expected to generate approximately 14,400 MW-hrs of electricity annually with the power sold under a 20 year FIT PPA with the Ontario Power Authority.

Completion of St. Damase Wind Project

On December 2, 2014, the first phase of the wind facility located in the local municipality of St. Damase reached commercial operations. The 24 MW facility is expected to generate 76,900 MW-hrs of electricity annually with the power sold under a 20 year PPA with Hydro Quebec.

It is expected that the turbines and other components utilized in the first 24 MW phase of the St. Damase Wind Project will qualify as Canadian Renewable and Conservation Expense ("CRCE"), and therefore a significant portion of the Phase I capital cost will be eligible for a refundable Quebec tax credit ("Quebec CRCE Tax Credit"). The estimated value of the Quebec CRCE tax credit for the St. Damase project is expected to be approximately $16.6 million. Phase II of the project will be constructed following evaluation of the wind resource at the site, completion of satisfactory permitting, and entering into appropriate energy sales arrangements.

Significant Progress on Power Development Projects

During 2014, the Generation Group made significant progress advancing several of its development projects. Construction on the Bakersfield I Solar Project near Bakersfield, California began in the second quarter of 2014 and was placed in service on December 30, 2014. Final construction efforts continue with the project expected to reach full commercial operations in the first quarter of 2015.

Construction of the Morse Wind Project near Morse, Saskatchewan is in its final stages. Installation of access roads and foundations are complete, turbine delivery commenced in January 2015, and seven of ten turbines have been erected. The project is expected to be operational by March 31, 2015.

Expansion of Bakersfield I Solar Project

On November 24, 2014, APUC announced that it intends to proceed with a 10 MW project adjacent to its 20MW Bakersfield I Solar project in Kern County, California, which is currently under construction.

The 10MW Bakersfield II Solar project executed a 20 year PPA on September 22, 2014 with a large California based electric utility. The project will be located on 64 acres of land adjacent to the 20MW Bakersfield I Solar project. Construction of Bakersfield I Solar is nearing completion, with commercial operations expected to occur in the first quarter of 2015.

The total project cost for Bakersfield II Solar of approximately U.S. $27.0 million will be funded with a combination of senior debt, common equity, and contributions from tax equity investors. Consistent with financing structures utilized for U.S. based renewable energy projects including Bakersfield I Solar, it is anticipated that Bakersfield II Solar will source financing in the amount of approximately 40% of the capital costs from certain tax equity investors.

Acquisition of the Remaining 40% of a 400 MW Wind Power Portfolio

On March 31, 2014, the Generation Group acquired from Gamesa Wind US, LLC (“Gamesa”) the remaining 40% of the Class B partnership units of the entity which owns a three facility 400 MW wind power portfolio (the “U.S. Wind Portfolio”)

|

| |

| 2014 Annual Report | 5 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

in the United States for total consideration of approximately U.S. $115.0 million. As a result of the transaction, the Generation Group now owns 100% of the Class B partnership units of the entity that owns the U.S. Wind Portfolio.

The Generation Group originally acquired 60% of the Class B units of the entity which owns the U.S. Wind Portfolio in 2012. The U.S. Wind Portfolio is a 400 MW wind portfolio consisting of three facilities: Minonk (200MW), Senate (150MW), and Sandy Ridge (50MW) located in the states of Illinois, Texas, and Pennsylvania, respectively. Gamesa will continue to provide operations, warranty and maintenance services for the wind turbines and balance of plant facilities under 20 year contracts.

$200 million Senior Unsecured Debentures

On January 17, 2014, the Generation Group issued $200.0 million 4.65% senior unsecured debentures with a maturity date of February 15, 2022 (the "Generation Group Debentures") pursuant to a private placement in Canada and the United States. The Generation Group Debentures were sold at a price of $99.864 per $100.00 principal amount resulting in an effective yield of 4.67%. Concurrent with the offering, the Generation Group entered into a fixed for fixed cross currency swap, coterminous with the debentures, to economically convert the Canadian dollar denominated debentures into U.S. dollars, resulting in an effective interest rate throughout the term of approximately 4.77%.

Net proceeds were used towards financing the acquisition of the remaining 40% ownership interest in its U.S. Wind Portfolio, to reduce amounts outstanding on project debt related to its Shady Oaks Wind Facility, to reduce amounts outstanding under the Generation Group's senior unsecured revolving credit facility ("Generation Credit Facility"), and for general corporate purposes.

Additional Liquidity

On July 31, 2014, the Generation Group increased the credit available under the Generation Credit Facility to $350 million from $200 million. The larger credit facility will be used to provide additional liquidity in support of the group's $1,225.0 million development portfolio to be completed over the next three years. In addition to the larger size, the maturity of the facility has been extended from three to four years and now extends until July 31, 2018.

2014 Distribution Group Highlights

Agreement to acquire Park Water System

On September 19, 2014, the Distribution Group announced the entering into an agreement with Western Water Holdings, a wholly-owned investment of Carlyle Infrastructure, to acquire the regulated water distribution utility Park Water Company (“Park Water System”). Park Water System owns and operates three regulated water utilities engaged in the production, treatment, storage, distribution, and sale of water in Southern California and Western Montana. The three utilities collectively serve approximately 74,000 customer connections and have more than 1,000 miles of distribution mains.

Total consideration for the utility purchase is expected to be approximately U.S. $327 million, which includes the assumption of approximately U.S. $77 million of existing long-term utility debt. The acquisition will maintain APUC’s strategic business mix and further enhance its investment grade consolidated capital structure.

Acquisition of White Hall Water System

On May 30, 2014, the Distribution Group acquired the assets of the White Hall Water System, a regulated water distribution and wastewater treatment utility located in White Hall, Arkansas. The White Hall Water System serves approximately 1,900 water distribution and 2,400 wastewater treatment customers. Total purchase price for the White Hall Water System assets, adjusted for certain working capital and other closing adjustments, is approximately U.S. $4.5 million.

Acquisition of New Hampshire Gas

On January 2, 2015, the Distribution Group completed the acquisition of New Hampshire Gas, a regulated propane gas distribution utility located in Keene, New Hampshire. The New Hampshire Gas System services approximately 1,200 propane gas distribution customers. Total purchase price for the New Hampshire Gas System is approximately U.S. $3.0 million, subject to certain closing adjustments.

Successful Rate Case Outcomes

A core strategy of the Distribution Group is to ensure appropriate return on the rate base at its various utility systems. The group has successfully completed several rate cases throughout 2014, representing a cumulative annual revenue increase of approximately U.S. $29.1 million. The full annualized impact of these rate cases will be realized in 2015. Further detail on the various regulatory proceedings of the Distribution Group can be found under Regulatory Proceedings.

|

| |

| 2014 Annual Report | 6 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

2014 Transmission Group Highlights

Agreement to acquire interest in Natural Gas Transmission Pipeline

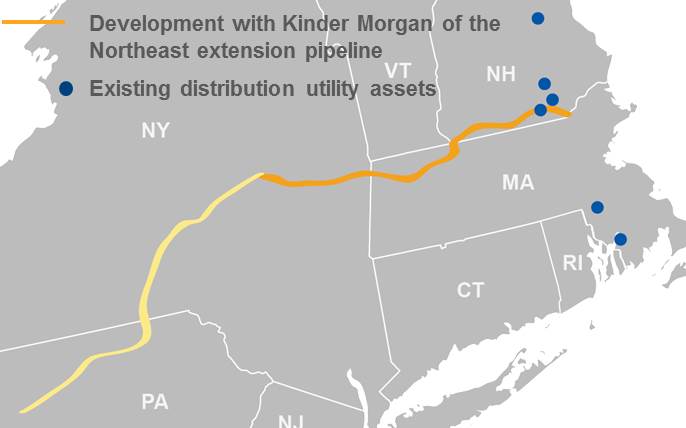

On November 24, 2014, APUC announced its agreement to participate in a natural gas pipeline transmission project in partnership with Kinder Morgan, Inc. Specifically, Kinder Morgan Operating L.P. “A,” a wholly owned subsidiary of Kinder Morgan, Inc., and Liberty Utilities (Pipeline & Transmission) Corp., a wholly owned subsidiary of APUC, have agreed to form a new entity ("Northeast Expansion LLC") to undertake the development, construction and ownership of a 30-inch or 36-inch natural gas transmission pipeline to be located between Wright, New York and Dracut, Massachusetts(the “Project”), which will be operated by Tennessee Gas Pipeline Company, L.L.C. (“Tennessee”) . The Project is scalable up to 2.2 billion cubic feet per day (Bcf/d), and the pipeline capacity will be contracted with local distribution utilities, and other customers, to help ease constraints on natural gas supply in the northeast U.S. and help ensure much needed reliability to the power-generation grid. It is anticipated that Tennessee will receive a FERC certificate in the fourth quarter of 2016, with commercial operations occurring by late 2018.

Under the agreement, APUC will initially subscribe for a 2.5% interest in Northeast Expansion LLC with an opportunity to increase its participation up to 10%. The total capital investment opportunity for APUC could be up to U.S. $400 million, depending on the final pipeline configuration and design capacity.

|

| |

| 2014 Annual Report | 7 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

2014 Annual Results From Operations

As outlined, APUC has continued to advance growth initiatives throughout 2014 that had a positive contribution to the annual results. In addition, the results now reflect full year operations from the gas and water systems acquisitions completed by the Distribution Group in 2013.

|

| | | | | | | | | | | | |

Key Selected Annual Financial Information | | Year ended December 31 |

| (all dollar amounts in $ millions except per share information) | | 2014 | | 2013 | | 2012 |

| Revenue | | $ | 943.6 |

| | $ | 675.3 |

| | $ | 348.8 |

|

Adjusted EBITDA 1 | | 290.6 |

|

| 228.1 |

| | 88.1 |

|

| Cash provided by operating activities | | 192.7 |

| | 98.9 |

| | 63.0 |

|

Adjusted funds from operations1 | | 206.5 |

|

| 154.9 |

| | 66.8 |

|

| Net earnings attributable to Shareholders from continuing operations | | 77.8 |

|

| 62.3 |

| | 13.5 |

|

| Net earnings attributable to Shareholders | | 75.7 |

| | 20.3 |

| | 14.5 |

|

Adjusted net earnings 1 | | 88.4 |

|

| 59.5 |

| | 18.9 |

|

| Dividends declared to Common Shareholders | | 82.9 |

|

| 68.3 |

| | 50.2 |

|

| Weighted Average number of common shares outstanding | | 213,953,870 |

|

| 204,350,689 |

| | 158,304,340 |

|

| Per share | | | | | | |

| Basic net earnings from continuing operations | | $ | 0.32 |

|

| $ | 0.28 |

| | $ | 0.08 |

|

| Basic net earnings | | $ | 0.31 |

| | $ | 0.07 |

| | $ | 0.09 |

|

Adjusted net earnings 1, 2 | | $ | 0.37 |

|

| $ | 0.26 |

| | $ | 0.11 |

|

| Diluted net earnings | | $ | 0.31 |

| | $ | 0.07 |

| | $ | 0.09 |

|

Cash provided by operating activities 1, 2 | | $ | 0.90 |

| | $ | 0.48 |

| | $ | 0.40 |

|

Adjusted funds from operations1, 2 | | $ | 0.92 |

|

| $ | 0.73 |

| | $ | 0.42 |

|

| Dividends declared to Common Shareholders | | $ | 0.37 |

|

| $ | 0.33 |

| | $ | 0.30 |

|

| Total assets | | 4,113.7 |

| | 3,476.5 |

| | 2,779.0 |

|

Long term liabilities 3 | | 1,280.0 |

| | 1,255.6 |

| | 770.8 |

|

|

| |

| 1 | Non-GAAP Financial Measures |

| 2 | APUC uses per share adjusted net earnings, cash provided by operating activities and adjusted funds from operations to enhance assessment and understanding of the performance of APUC. |

| 3 | Includes long-term liabilities and current portion of long-term liabilities |

For the year ended December 31, 2014, APUC experienced an average U.S. exchange rate of approximately $1.1049 as compared to $1.0300 in the same period in 2013. As such, any year over year variance in revenue or expenses, in local currency, at any of APUC’s U.S. entities are affected by a change in the average exchange rate, upon conversion to APUC’s Canadian dollar reporting currency.

For the year ended December 31, 2014, APUC reported total revenue of $943.6 million as compared to $675.3 million during the same period in 2013, an increase of $268.3 million or 39.7%. The major factors resulting in the increase in APUC revenue for the year ended December 31, 2014 as compared to the corresponding period in 2013 are set out as follows:

|

| |

| 2014 Annual Report | 8 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

|

| | | |

| (all dollar amounts in $ millions) | Year to date December 31, 2014 |

| Comparative Prior Period Revenue | $ | 675.3 |

|

| Significant Changes: | |

| Generation Group | |

| Renewable: | |

| Increased wind resources net of hedge settlements at the Minonk, Senate, and Sandy Ridge Wind Facilities | 1.1 |

|

| Higher realized prices from Renewable Energy Credits generated from the U.S. Wind Facilities | 4.8 |

|

| Start of commercial operations of the Cornwall Solar Facility | 5.5 |

|

| Increased customer load in the Maritime region | 1.7 |

|

| Thermal: | |

| Increased average prices at the Windsor Locks and Sanger Thermal Facilities | 5.3 |

|

| Increased sale of Renewable Energy Credits generated at the Windsor Locks Thermal Facility | 0.7 |

|

| Distribution Group | |

| Natural Gas Systems - Increased revenue due to acquisition of the Peach State Gas System (U.S. $32.9 million), and the New England Gas System (U.S. $76.3 million) | 108.2 |

|

| Natural Gas Systems - Revenue increase due to higher customer demand as a result of colder than average weather at the EnergyNorth and Midstates Natural Gas Systems | 35.2 |

|

| Electric Systems - Revenue increase at the electric systems predominantly due to higher customer demand at the Granite State Electric System | 13.8 |

|

| Rate Cases – Revenue increase due to higher electricity rates at the Granite State Electric System (U.S. $11.8 million) and Peach State Gas System (U.S. $5.5 million) | 17.2 |

|

| Water and Waste Systems – Revenue increase due to the increased customer demand | 3.5 |

|

| Increase due to acquisition of New England Gas System's water heater rental service (U.S. $2.8 million) and increased revenues at Peach State Gas System's Fort Benning operation (U.S. $1.0 million) | 3.8 |

|

| Impact of the stronger U.S. dollar | 68.4 |

|

| Other | (0.9 | ) |

| Current Period Revenue | $ | 943.6 |

|

A more detailed discussion of these factors is presented within the business unit analysis.

Adjusted EBITDA in the year ended December 31, 2014 totalled $290.6 million as compared to $228.1 million during the same period in 2013, an increase of $62.5 million or 27.4%. The increase in Adjusted EBITDA was primarily due to acquisitions completed in 2014 and 2013, impact of rate case settlements, increased customer demand for Gas distribution, and the increase in REC transactions. A more detailed analysis of these factors is presented within the reconciliation of Adjusted EBITDA to net earnings set out below (see Non-GAAP Performance Measures).

For the year ended December 31, 2014, net earnings from continuing operations attributable to Shareholders totalled $77.8 million as compared to $62.3 million during the same period in 2013, an increase of $15.5 million. The increase was due to $63.7 million in increased earnings from operating facilities, $0.5 million in increased foreign exchange gains, and $1.2 million due to a gain on sale of assets, as compared to the same period in 2013. These items were partially offset by $18.0 million in increased depreciation and amortization expenses, $11.2 million in increased administration charges, $9.0 million in increased interest expense, $0.4 million in increased acquisition costs, $8.5 million in increased write-downs on notes receivable and property, plant, and equipment, $6.6 million in increased loss from derivative instruments, $11.4 million in increased allocations of earnings to non-controlling interests, and $7.7 million in increased income tax expense (tax explanations are discussed in APUC: Corporate and Other Expenses), as compared to the same period in 2013.

For the year ended December 31, 2014, net earnings (including discontinued operations) attributable to Shareholders totalled $75.7 million as compared to $20.3 million during the same period in 2013, an increase of $55.4 million. Net earnings per share totalled $0.31 for the year ended December 31, 2014, as compared to $0.07 during the same period in 2013.

|

| |

| 2014 Annual Report | 9 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

During the year ended December 31, 2014, cash provided by operating activities totalled $192.7 million or $0.90 per share as compared to cash provided by operating activities of $98.9 million, or $0.48 per share during the same period in 2013. During the year ended December 31, 2014, adjusted funds from operations, a non-GAAP measure, totalled $206.5 million or $0.92 per share as compared to adjusted funds from operations of $154.9 million, or $0.73 per share during the same period in 2013, an increase of $51.6 million.

Cash per share provided by operating activities and per share adjusted funds from operations are non-GAAP measures. Per share cash provided by operating activities and per share adjusted funds from operations are not substitute measures of performance for earnings per share. Amounts represented by per share cash provided by operating activities and per share adjusted funds from operations do not represent amounts available for distribution to shareholders and should be considered in light of various charges and claims against APUC.

2014 Fourth Quarter Results From Operations

|

| | | | | | | | |

Key Selected Fourth Quarter Financial Information | | Three months ended December 31 |

| (all dollar amounts in $ millions except per share information) | | 2014 | | 2013 |

| Revenue | | $ | 259.3 |

| | $ | 205.3 |

|

Adjusted EBITDA 1 | | 84.3 |

|

| 68.5 |

|

| Cash provided by operating activities | | 96.5 |

| | 28.4 |

|

Adjusted funds from operations1 | | 65.9 |

|

| 46.0 |

|

| Net earnings attributable to Shareholders from continuing operations | | 33.1 |

|

| 19.8 |

|

| Net earnings attributable to Shareholders | | 31.6 |

| | 13.2 |

|

Adjusted net earnings1 | | 35.2 |

|

| 18.8 |

|

| Dividends declared to Common Shareholders | | 25.4 |

|

| 17.6 |

|

| Weighted Average number of common shares outstanding | | 230,664,583 |

|

| 206,219,121 |

|

| Per share | | | | |

| Basic net earnings/(loss) from continuing operations | | $ | 0.13 |

|

| $ | 0.09 |

|

| Basic net earnings/(loss) | | $ | 0.13 |

| | $ | 0.06 |

|

Adjusted net earnings1, 2, | | $ | 0.14 |

|

| $ | 0.08 |

|

| Diluted net earnings/(loss) | | $ | 0.12 |

| | $ | 0.06 |

|

Cash provided by operating activities 1, 2, | | $ | 0.42 |

| | $ | 0.14 |

|

Adjusted funds from operations1, 2 | | $ | 0.27 |

|

| $ | 0.22 |

|

| Dividends declared to Common Shareholders | | $ | 0.10 |

|

| $ | 0.09 |

|

|

| |

| 1 | Non-GAAP Financial Measures |

| 2 | APUC uses per share adjusted net earnings, cash provided by operating activities and adjusted funds from operations to enhance assessment and understanding of the performance of APUC. |

For the three months ended December 31, 2014, APUC experienced an average U.S. exchange rate of approximately $1.136 as compared to $1.050 in the same period in 2013. As such, any quarter over quarter variance in revenue or expenses, in local currency, at any of APUC’s U.S. entities are affected by a change in the average exchange rate, upon conversion to APUC’s reporting currency.

For the three months ended December 31, 2014, APUC reported total revenue of $259.3 million as compared to $205.3 million during the same period in 2013, an increase of $54.0 million. The major factors resulting in the increase in APUC revenue in the three months ended December 31, 2014 as compared to the corresponding period in 2013 are set out as follows:

|

| |

| 2014 Annual Report | 10 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

|

| | | |

| (all dollar amounts in $ millions) | Quarter ended December 31, 2014 |

| Comparative Prior Period Revenue | $ | 205.3 |

|

| Significant Changes: | |

| Generation Group | |

| Renewable: | |

| Effect of hydrology resource compared to comparable period in prior year | 1.6 |

|

| Increased wind resources net of hedge settlements at the Minonk, Senate, and Sandy Ridge Wind Facilities | 1.2 |

|

| Higher realized prices from Renewable Energy Credits generated from the U.S. Wind Facilities | 1.1 |

|

| Start of commercial operations of the Cornwall Solar Facility | 0.7 |

|

| Decreased sales due to reduced retail customer load at the Maritime region | (0.9 | ) |

| Distribution Group | |

| Increased revenue due to acquisition of the New England Gas System | 10.5 |

|

| Electric Systems - Revenue increase at the electric systems predominantly due to higher customer demand at the Granite State Electric System | 4.3 |

|

| Natural Gas Systems - Revenue increase due to higher customer demand as a result of colder than average weather at the EnergyNorth, Midstates, and Peach State Natural Gas Systems | 8.5 |

|

| Rate Cases – Revenue increase due to higher electricity rates at the Granite State Electric System (U.S. $1.6 million) and Peach State Gas System (U.S. $2.2 million) | 3.8 |

|

| Water and Waste Systems – Revenue increase due to the increased customer demand | 1.1 |

|

| Increase due to acquisition of New England Gas System's water heater rental service (U.S. $0.8 million) and increased revenues at Peach State Gas System's Fort Benning operation (U.S. $1.0 million) | 1.8 |

|

| Impact of the stronger U.S. dollar | 21.2 |

|

| Other | (0.9 | ) |

| Current Period Revenue | $ | 259.3 |

|

A more detailed discussion of these factors is presented within the business unit analysis.

Adjusted EBITDA in the three months ended December 31, 2014 totalled $84.3 million as compared to $68.5 million during the same period in 2013, an increase of $15.8 million or 23.1%. The increase in Adjusted EBITDA was primarily due to acquisitions completed in December 2013, impact of rate case settlements, increased hydrology and wind resources, and increase customer demand at the EnergyNorth and Midstates Gas Systems. A more detailed analysis of these factors is presented within the reconciliation of Adjusted EBITDA to net earnings set out below (see Non-GAAP Performance Measures).

For the three months ended December 31, 2014, net earnings attributable to Shareholders from continued operations totalled $33.1 million as compared to $19.8 million during the same period in 2013, an increase of $13.3 million. The increase was due to $20.3 million in increased earnings from operating facilities, $1.5 million in decreased income tax expense (tax explanations are discussed in APUC: Corporate and Other Expenses), $0.3 million in decreased interest expense, $0.7 million due to a gain on sale of assets, and $4.9 million in increased allocation of earnings to non-controlling interests, as compared to the same period in 2013. These items were partially offset by $2.1 million in increased depreciation and amortization expenses, $5.4 million in increased administration charges, $0.4 million in decreased foreign exchange gains, $0.5 million in decreased interest and dividend income, $1.0 million in increased acquisition costs, $0.3 million in increased write-downs on notes receivable and property, plant, and equipment, and $4.7 million in decreased gains from derivative instruments.

For the three months ended December 31, 2014, net earnings (including discontinued operations) attributable to Shareholders totalled $31.6 million as compared to net earnings attributable to Shareholders of $13.2 million during the same period in 2013, an increase of $18.4 million. Net earnings per share totalled $0.13 for the three months ended December 31, 2014, as compared to net earnings per share of $0.06 during the same period in 2013.

|

| |

| 2014 Annual Report | 11 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

During the three months ended December 31, 2014, cash provided by operating activities totalled $96.5 million or $0.42 per share as compared to cash provided by operating activities of $28.4 million, or $0.14 per share during the same period in 2013. During the three months ended December 31, 2014, adjusted funds from operations totalled $65.9 million or $0.27 per share as compared to adjusted funds from operations of $46.0 million, or $0.22 per share during the same period in 2013. The change in adjusted funds from operations in the three months ended December 31, 2014, is primarily due to increased earnings from operations, as compared to the same period in 2013.

Cash per share provided by operating activities and per share adjusted funds from operations are non-GAAP measures. Per share cash provided by operating activities and per share adjusted funds from operations are not substitute measures of performance for earnings per share. Amounts represented by per share cash provided by operating activities and per share adjusted funds from operations do not represent amounts available for distribution to shareholders and should be considered in light of various charges and claims against APUC.

GENERATION BUSINESS GROUP

|

| | | | | | | | | | | | | | | | | | |

| Renewable Energy Division | | | | Three months ended December 31 | | | | Year ended December 31 |

| | | Long Term Average Resource | | 2014 | | 2013 | | Long Term Average Resource | | 2014 | | 2013 |

| Performance (GW-hrs sold) | | | | | | | | | | | | |

| Hydro Facilities: | | | | | | | | | | | | |

| Maritime Region | | 45.8 |

| | 38.0 |

| | 37.9 |

| | 177.8 |

| | 146.2 |

| | 203.1 |

|

Quebec Region1 | | 72.8 |

| | 72.3 |

| | 68.1 |

| | 274.9 |

| | 259.4 |

| | 277.7 |

|

Ontario Region2 | | 33.8 |

| | 38.7 |

| | 39.3 |

| | 139.8 |

| | 144.5 |

| | 90.4 |

|

| Western Region | | 12.6 |

| | 13.4 |

| | 12.1 |

| | 65.0 |

| | 74.1 |

| | 66.6 |

|

| | 165.0 |

| | 162.4 |

|

| 157.4 |

| | 657.5 |

| | 624.2 |

| | 637.8 |

|

| Wind Facilities: | | | | | | | | | | | | |

St. Damase3 | | 6.7 |

| | 4.7 |

| | — |

| | 6.7 |

| | 4.7 |

| | — |

|

| St. Leon | | 121.4 |

| | 119.9 |

| | 116.5 |

| | 430.2 |

| | 441.4 |

| | 398.0 |

|

Red Lily4 | | 24.1 |

| | 23.8 |

| | 22.8 |

| | 88.5 |

| | 87.7 |

| | 79.0 |

|

| Sandy Ridge | | 43.6 |

| | 46.7 |

| | 38.7 |

| | 158.3 |

| | 149.0 |

| | 138.7 |

|

| Minonk | | 195.8 |

| | 195.4 |

| | 182.8 |

| | 673.3 |

| | 648.5 |

| | 621.8 |

|

| Senate | | 140.0 |

| | 139.0 |

| | 133.8 |

| | 520.4 |

| | 537.6 |

| | 524.5 |

|

| Shady Oaks | | 100.4 |

| | 92.2 |

| | 88.7 |

| | 364.0 |

| | 339.9 |

| | 317.1 |

|

| | 632.0 |

|

| 621.7 |

|

| 583.3 |

|

| 2,241.4 |

|

| 2,208.8 |

|

| 2,079.1 |

|

| Solar Facilities: | | | | | | | | | | | | |

| Cornwall | | 2.2 |

| | 1.8 |

| | — |

| | 11.8 |

| | 12.8 |

| | — |

|

| Total Performance | | 799.2 |

| | 785.9 |

| | 740.7 |

|

| 2,910.7 |

|

| 2,845.8 |

|

| 2,716.9 |

|

|

| |

| 1 | The Generation Group's Donnacona Hydro Facility was offline during the second half of 2014. Insurance proceeds were received to compensate for lost revenue. |

| 2 | The Generation Group's Long Sault hydro facility was offline during most of the first nine months of 2013. Insurance proceeds were received to compensate for lost revenue. |

| 3 | The St Damase Wind Facility achieved commercial operation on December 2, 2014. Long term average resource and production represent production from December 2 to December 31, 2014. |

| 4 | APUC does not consolidate the operating results from this facility in its financial statements. Production from the facility is included as APUC manages the facility under contract and has an option to acquire a 75% equity interest in the facility in 2016. |

|

| |

| 2014 Annual Report | 12 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

For the twelve months ended December 31, 2014, the Renewable Energy Division generated 2,845.8 GW-hrs of electricity. This level of production represents sufficient energy to supply the equivalent of 210,800 homes on an annualized basis with renewable power. As a result of renewable energy production, the equivalent of 2,086,900 tons of CO2 gas was prevented from entering the atmosphere.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31 | | | | Year ended December 31 |

| (all dollar amounts in $ millions) | | 2014 | | 2013 | | | | 2014 |

| 2013 |

Revenue1 | | | | | | | | | | |

| Hydro Sales | | $ | 16.8 |

| | $ | 15.9 |

| | | | $ | 65.1 |

| | $ | 61.9 |

|

| Wind | | 26.9 |

| | 24.5 |

| | | | 88.8 |

| | 83.8 |

|

| Solar | | 0.7 |

| | — |

| | | | 5.5 |

| | — |

|

| Total Revenue | | $ | 44.4 |

| | $ | 40.4 |

| — |

|

| — |

| $ | 159.4 |

| — |

| $ | 145.7 |

|

| | | | | | | | | | |

| Less: | | | | | | | | | | |

Cost of Sales - Energy2 | | (1.5 | ) | | (3.8 | ) | | | | (16.7 | ) |

| (8.7 | ) |

Realized gain/(loss) on hedges3 | | (0.2 | ) | | 0.3 |

| | | | 3.6 |

| | 0.5 |

|

| Net Energy Sales | | $ | 42.7 |

| | $ | 36.9 |

| | | | $ | 146.3 |

| | $ | 137.5 |

|

| | | | | | | | | | |

Renewable Energy Credits ("REC")4 | | 4.0 |

| | 2.6 |

| | | | 11.7 |

|

| 5.9 |

|

| Other Revenue | | 0.4 |

| | 0.2 |

| | | | 1.6 |

|

| 1.2 |

|

| Total Net Revenue | | $ | 47.1 |

| | $ | 39.7 |

| | | | $ | 159.6 |

| | $ | 144.6 |

|

| | | | | | | | | | |

| Expenses & Other Income | | | | | | | | | | |

| Operating expenses | | (11.0 | ) | | (11.2 | ) | | | | (46.1 | ) | | (40.3 | ) |

| Interest and Other income | | 0.4 |

| | 0.5 |

| | | | 1.7 |

|

|

| 1.9 |

|

| HLBV income/(loss) | | 8.9 |

| | 6.8 |

| | | | 27.2 |

| | 20.4 |

|

| Divisional operating profit | | $ | 45.4 |

| 45.4 |

| $ | 35.8 |

| — |

| | — |

| $ | 142.4 |

| — |

| $ | 126.6 |

|

|

| |

| 1 | While most of the Generation Group's PPAs include annual rate increases, a change to the weighted average production levels resulting in higher average production from facilities that earn lower energy rates can result in a lower weighted average energy rate earned by the division, as compared to the same period in the prior year. |

| 2 | Cost of Sales - Energy consists of energy purchases in the Maritime Region to manage the energy sales from the Tinker Facility which is sold to retail and industrial customers under multi-year contracts. |

| 3 | See financial statements note 25(b)(iv). |

| 4 | Qualifying renewable energy projects receive Renewable Energy Credits (RECs) for the generation and delivery of renewable energy to the power grid. The energy credit certificates represent proof that 1 MW of electricity was generated from an eligible energy source. The RECs can be traded and the owner of the REC can claim to have purchases of renewable energy. REC revenue is recognized only at the time a generated REC unit is matched up with a previously signed REC sales contract with a third party. Generated REC units not immediately available to match against a signed contract are recorded as inventory with the offset recorded as a decrease in operating expenses. |

2014 Fourth Quarter Operating Results

For the three months ended December 31, 2014, the hydro facilities generated 162.4 GW-hrs of electricity, as compared to 157.4 GW-hrs produced in the same period in 2013, an increase of 3.2%. The increased generation is largely attributable to significantly better hydrology in Quebec that more than offset the Donnacona Hydro Facility being offline throughout the quarter. See the "Quebec Dam Safety Act" section for a further discussion on the Donnacona Hydro Facility.

During the three months ended December 31, 2014, the hydro facilities generated electricity equal to 98.4% of long-term projected average resources as compared to 95.2% during the same period in 2013. During the three months ended December 31, 2014, the Ontario and Western Hydro regions achieved production greater than their long-term averages. The Quebec region was below the long term average due to Donnacona being offline. Excluding Donnacona, the Quebec region would have achieved 108% of the LTAR.

|

| |

| 2014 Annual Report | 13 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

For the three months ended December 31, 2014, revenue from the hydro facilities totalled $16.8 million as compared to $15.9 million during the same period in 2013, an increase of $0.9 million. Revenue from generation at the hydro facilities located in the Quebec region increased by $1.4 million, as compared to the same period in 2013. The increase is attributed to more favorable hydrology in the Quebec region. This was offset by decreased revenues in the Maritime region of $0.7 million, primarily due to decreased customer load served. Revenue in the Maritime region primarily consists of the sale of the off-take from the Tinker Hydro Facility through wholesale deliveries to local electric utilities, retail sales to commercial and industrial customers in Northern Maine, merchant sales of production in excess of committed customer deliveries from the Tinker Hydro Facility, and other revenue.

For the three months ended December 31, 2014, energy purchase costs at the Maritime region totalled $1.5 million, as compared to $3.8 million during the same period in 2013, a decrease of $2.3 million. The decrease in the energy purchase costs for the three months ended December 31, 2014 were primarily due to decreased retail customer load served in the quarter requiring reduced energy purchases from the market as the Maritime region was able to generate sufficient energy to meet its retail demand. During this period, approximately 21.4 GW-hrs of energy was purchased at market and fixed rates averaging U.S. $61 per MW-hr.

During the three months ended December 31, 2014, the Maritime region generated approximately 69% of the load required to service its customers, as compared to 44% in the same period in 2013. To mitigate the risk of higher average energy prices, certain power hedges are entered into as part of risk mitigation strategies. For the three months ended December 31, 2014, $0.2 million was realized in connection with these hedges and is recorded as a realized gain on derivative financial instruments in the financial statements.

For the three months ended December 31, 2014, the wind facilities produced 621.7 GW-hrs of electricity, as compared to 583.3 GW-hrs produced in the same period in 2013, an increase of 6.6%. The higher generation was a result of increased wind resources at all sites and the start of production at the newest facility, the St. Damase Wind Facility, which achieved COD on December 2, 2014. The St. Damase wind facility generated 4.7 GW-hrs.

During the three months ended December 31, 2014, the wind facilities (excluding the St. Damase Wind Facility) generated electricity equal to 98.4% of long-term projected average resources, as compared to 93.3% during the same period in 2013, due to variability in the wind resource.

For the three months ended December 31, 2014, revenue from the wind facilities totalled $26.9 million as compared to $24.5 million during the same period in 2013, an increase of $2.4 million. Revenue increases were evident at all wind facilities due mainly to the 38.4 GW/h increase in production due to an increase in wind resources, as compared to the same period last year. As a result, revenues from the Generation Group’s Canadian wind facilities increased $0.8 million, while the U.S. wind facilities increased $1.9 million, as compared to the same period last year. These gains were partly offset by $0.3 million in hedge settlements under the Minonk, Senate and Sandy Ridge Wind Facilities' power hedges.

For the three months ended December 31, 2014, REC revenue totalled $4.0 million, as compared to $2.6 million in the same period in 2013, an increase of $1.4 million, primarily attributed to increased market pricing in all regions with the PJM region having the largest impact. The increase in market pricing is largely caused by the annually increasing renewable requirement of the RPS (Renewable Portfolio Standard) outpacing the increase in supply of available RECs. REC units are generated at a ratio of one REC unit per one MW-hr generated and are sold in the market in which the REC is generated. For the three months ended December 31, 2014, REC units and related revenues were generated at the Sandy Ridge, Minonk, Senate, and Shady Oaks Wind Facilities.

During the three months ended December 31, 2014, the Generation Group's solar facility located in Ontario had its third full quarter of operations generating 1.8 GW-hrs of electricity, which is equal to 18.2% below long-term average resources. The facility reached commercial operation on March 27, 2014 and has a 20 year FIT PPA with the Ontario Power Authority.

Revenue from generation at the Generation Group’s new solar facility located in Cornwall, Ontario totalled $0.7 million for the period. As commercial operation was achieved late in the first quarter of 2014, there is no comparative data from the previous year.

For the three months ended December 31, 2014, operating expenses excluding energy purchases totalled $11.0 million, as compared to $11.2 million during the same period in 2013, a decrease of $0.2 million. The decrease was primarily attributable to greater inventorying of REC costs at the Senate Wind facility partly offset by operating costs at the new Cornwall Solar Facility.

The Red Lily I Wind Facility located in Saskatchewan produced 23.8 GW-hrs of electricity for the three months ended December 31, 2014. The Generation Group's economic return from its investment in Red Lily currently comes in the form of interest payments, fees and other charges and is not reflected in revenue from energy sales. Under the terms of the agreements, the Generation Group has the right to exchange these contractual and debt interests in the Red Lily I Wind Facility for a direct 75% equity interest in 2016. For the three months ended December 31, 2014, the Generation Group earned fees of $0.3 million (which is classified as other revenue) and interest income of $0.4 million from the Red Lily I Wind Facility.

For the three months ended December 31, 2014, interest and other income totalled $0.4 million, consistent with the same period in 2013. Interest and other income primarily consist of interest related to the senior and subordinated debt interest in Red Lily I Wind Facility. This amount is included as part of the Generation Group’s earnings from its investment in the Red Lily I Wind Facility, as discussed above.

For the three months ended December 31, 2014, the value of net tax attributes generated amounted to an approximate HLBV income of $8.9 million, an increase of $2.1 million compared to the prior year. The increase was attributable to increased production, a stronger U.S. dollar exchange rate, and the reduced economic interest in the projects attributable to tax equity.

For the three months ended December 31, 2014, the Renewable Energy Division’s operating profit totalled $45.4 million, as compared to $35.8 million during the same period in 2013, an increase of $9.6 million; $2.5 million of the increase is attributable to the stronger U.S. dollar.

2014 Twelve Month Operating Results

For the twelve months ended December 31, 2014, the hydro facilities generated 624.2 GW-hrs of electricity, as compared to 637.8 GW-hrs produced in the same period in 2013, a decrease of 2.1%. The slight decrease in generation is largely due to a decrease in production in the Maritime region due to lower hydrology in the first 3 quarters of the year, almost completely offset by an increased production in the Ontario region with the Long Sault facility return to service, which was offline for the majority of the first and second quarter of 2013.

During the twelve months ended December 31, 2014, the hydro facilities generated electricity equal to 94.9% of long-term projected average resources, as compared to 103.4% during the same period in 2013. During the twelve months ended December 31, 2014, the Ontario and Western Hydro regions achieved production above their long-term averages. The Quebec and Maritime regions were below the long term average production. Had the Quebec region's Donnacona facility been on line, the region would have achieved 102% of the long term average hydrological resource.

For the twelve months ended December 31, 2014, revenue from the hydro facilities totalled $65.1 million, as compared to $61.9 million during the same period in 2013, an increase of $3.2 million. Revenue from generation in the Ontario region increased by $0.7 million due to the Long Sault Hydro Facility being back on-line for the full year 2014. The Quebec and Western regions experienced a decrease of $0.3 million and $0.7 million, respectively. The decrease in the Quebec region is primarily due to the Donnacona Hydro Facility being offline, while the decrease in the Western region is primarily due to lower market pricing on the unhedged portion of the production. The increase in production at the Western region caused the market exposed production amount to increase 8% while the weighted average market price fell by more than 50%. Revenue from the Maritime region increased $3.5 million, primarily due to increased retail customer load served.

For the twelve months ended December 31, 2014, energy purchases totalled $16.7 million, as compared to $8.7 million during the same period in 2013, an increase of $8.0 million. Increased energy purchase costs for the twelve months ended December 31, 2014 were primarily due to lower hydrology in the Maritime region in the first half of the year, which required increased energy purchases from external suppliers at higher average prices. During this period, purchases of approximately 166.0 GW-hrs of energy at market and fixed rates averaging U.S. $91 per MW-hr were made. During the twelve months ended December 31, 2014, the Maritime region generated approximately 46% of the load required to service its customers, as compared to 67% in the same period in 2013. To mitigate the risk of higher average energy prices, the Maritime region had previously entered into certain power hedges as part of its risk mitigation strategies. For the twelve months ended December

|

| |

| 2014 Annual Report | 14 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

31, 2014, $3.6 million was realized in connection with these hedges and is recorded as a realized gain on derivative financial instruments on the Consolidated Statement of Operations.

For the twelve months ended December 31, 2014, the wind facilities produced 2,208.8 GW-hrs of electricity, as compared to 2,079.1 GW-hrs produced in the same period in 2013, an increase of 6.2%. The increased generation was a result of stronger wind resources at the St. Leon, Minonk, Sandy Ridge, and Senate Wind Facility along with the St. Damase Wind Facility which achieved COD on December 2, 2014.

During the twelve months ended December 31, 2014, the wind facilities generated electricity equal to 98.5% of long-term projected average resources, as compared to 93.1% during the same period in 2013. For the twelve months ended December 31, 2014, revenue from the wind facilities totalled $88.8 million, as compared to $83.8 million during the same period in 2013, an increase of $5.0 million. The increase in revenue was due primarily to a 129.7 GW/h increase in production from stronger wind resources, as compared to the same period last year. As a result, revenues from the Generation Group’s Canadian wind facilities increased $3.5 million, while the U.S. wind facilities increased $1.5 million, net of hedge settlements under the Minonk, Senate and Sandy Ridge Wind Facilities' power hedges.

For the twelve months ended December 31, 2014, REC revenue totalled $11.7 million, as compared to $5.9 million in the same period in 2013, an increase of $5.8 million, primarily a result of increased market pricing and a greater number of RECs generated and sold. REC units are generated at a ratio of one REC unit per one MW-hr generated and are sold in the market in which the REC is generated. For the twelve months ended December 31, 2014, REC units and related revenues were generated at the Sandy Ridge, Minonk, Senate, and Shady Oaks Wind Facilities.

During the twelve months ended December 31, 2014, the Generation Group's solar facility located in Ontario generated 12.8 GW-hrs of electricity, which is equal to 8.5% above long-term average resources from the commercial operation date. The facility reached commercial operation on March 27, 2014 and has a 20 year FIT PPA with the Ontario Power Authority.

Revenue from generation totalled $5.5 million for the period. The facility achieved commercial operation on March 27, 2014 and therefore there is no comparative data from the previous year.

For the twelve months ended December 31, 2014, operating expenses excluding energy purchases totalled $46.1 million, as compared to $40.3 million during the same period in 2013, an increase of $5.8 million. The increase was due to the appreciation of the U.S. dollar, operating costs for Cornwall's first year of operations, and cost of RECs contracted in the first quarter of 2014 but produced in the fourth quarter of 2013.

For the twelve months ended December 31, 2014, interest and other income totalled $1.7 million, as compared to $1.9 million during the same period in 2013. Interest and other income primarily consist of interest related to the senior and subordinated debt interest in Red Lily I Wind Facility. This amount is included as part of the Generation Group’s earnings from its investment in Red Lily I Wind Facility, as discussed below.

The Red Lily I Wind Facility located in Saskatchewan produced 87.7 GW-hrs of electricity for the twelve months ended December 31, 2014. The Generation Group's economic return from its investment in Red Lily currently comes in the form of interest payments, fees and other charges and is not reflected in revenue from energy sales. Under the terms of the agreements, the Generation Group has the right to exchange these contractual and debt interests in the Red Lily I Wind Facility for a direct 75% equity interest in 2016. For the twelve months ended December 31, 2014, the Generation Group earned fees of $1.3 million (which is classified as other revenue) and interest income of $1.6 million from the Red Lily I Wind Facility.

Hypothetical Liquidation at Book Value (“HLBV”) income represents the value of net tax attributes, primarily related to electricity production generated by the Generation Group in the period from certain of its U.S. wind power generation facilities. The value of net tax attributes generated in the twelve months ended December 31, 2014 amounted to an approximate HLBV income of $27.2 million, as compared to $20.4 million in the prior year. The increase of $6.8 million was primarily a result of a stronger U.S. dollar exchange rate, increased production at all U.S. sites, and a higher income allocation to the Generation Group due to the reduced economic interest of Tax Equity investors in the projects.

For the twelve months ended December 31, 2014, the Renewable Energy Division’s operating profit totalled $142.4 million, as compared to $126.6 million during the same period in 2013, an increase of $15.8 million; $3.5 million of the increase is attributable to the stronger U.S. dollar.

|

| |

| 2014 Annual Report | 15 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

GENERATION BUSINESS GROUP

|

| | | | | | | | | | | | | | | | | | | |

| Thermal Energy Division | Three months ended December 31, 2014 |

| Three months ended December 31, 2013 |

| Windsor Locks | Sanger | Total |

| Windsor Locks | Sanger | Total |

Performance (GW-hrs sold) | 26.3 |

| 35.1 |

| 61.4 |

|

| 28.8 |

| 35.6 |

| 64.4 |

|

Performance (steam sales – billion lbs) | 157.3 |

| — |

| 157.3 |

|

| 161.3 |

| — |

| 161.3 |

|

| | | | | | | | |

| (all dollar amounts in $ millions) | | | | | | | |

| Revenue | | | | | | | |

| Energy/steam sales | $ | 4.7 |

| $ | 4.3 |

| $ | 9.0 |

| | $ | 4.6 |

| $ | 3.9 |

| $ | 8.5 |

|

| Less: | | | | | | | |

| Cost of Sales – Fuel | (3.1 | ) | (1.9 | ) | (5.0 | ) | | (3.1 | ) | (1.5 | ) | (4.6 | ) |

| Net Energy/Steam Sales | $ | 1.6 |

| $ | 2.4 |

| $ | 4.0 |

| | $ | 1.5 |

| $ | 2.4 |

| $ | 3.9 |

|

| Other Revenue | 0.1 |

| 0.6 |

| 0.7 |

| | 0.2 |

| 0.6 |

| 0.8 |

|

| Total Net Revenue | $ | 1.7 |

| $ | 3.0 |

| $ | 4.7 |

| | $ | 1.7 |

| $ | 3.0 |

| $ | 4.7 |

|

| Expenses | | | | | | | |

| Operating Expenses | $ | (0.7 | ) | $ | (1.3 | ) | $ | (2.0 | ) | | $ | (0.9 | ) | $ | (1.2 | ) | $ | (2.1 | ) |

| Facility operating profit | $ | 1.0 |

| $ | 1.7 |

| $ | 2.7 |

| | $ | 0.8 |

| $ | 1.8 |

| $ | 2.6 |

|

| Interest and other income | | | (0.3 | ) | | | | 0.1 |

|

| Divisional operating profit | | | $ | 2.4 |

| | | | $ | 2.7 |

|

2014 Fourth Quarter Operating Results

The Generation Group’s Sanger and Windsor Locks Thermal Facilities purchase natural gas from different suppliers and at prices based on different regional hubs. As a result, the average landed cost per unit of natural gas will differ between the two facilities in the average landed cost for natural gas and may result in the facilities showing differing costs per unit compared to each other and compared to the same period in the prior year. Total natural gas expense will vary based on the volume of natural gas consumed and the average landed cost of natural gas for each MMBTU.

Production data, revenue and expenses have been adjusted to remove the results of the EFW and BCI Thermal Facilities, which were divested on April 4, 2014 for proceeds approximating the carrying value of the net assets on the Consolidated Balance Sheet of the Company as at March 31, 2014. The results of the EFW and BCI Thermal Facilities for the period up to the date of sale are reported as discontinued operations. See Financial Statement note 17 for details.

For the three months ended December 31, 2014, the Thermal Energy Division’s operating profit was $2.4 million, as compared to $2.7 million in the same period in 2013, a decrease of $0.3 million. Operating profit contributions for the three months ended December 31, 2014 were $1.0 million from the Windsor Locks Thermal Facility and $1.7 million from the Sanger Thermal Facility, as compared to $0.8 million and $1.8 million, respectively, during the same period in 2013. Interest and other income for the three months ended December 31, 2014 was a loss of $0.3 million, as compared to income of $0.1 million in the prior period. As a result of the stronger U.S. dollar, operating profit increased by $0.2 million.

Windsor Locks Thermal Facility

For the three months ended December 31, 2014, the Windsor Locks Thermal Facility sold 157.3 billion lbs of steam and 26.3 GW-hrs of electricity, as compared to 161.3 billion lbs of steam and 28.8 GW-hrs of electricity in the comparable period of 2013.

The Windsor Locks Thermal Facility’s operating profit was driven by energy/steam sales of $4.7 million (U.S. $4.1 million), as compared to $4.6 million (U.S. $4.4 million) in the same period in 2013. The change in electricity/steam sales is attributed to lower production, but partly offset by a higher average price for gas as a result of the better ISO NE electricity market price. Gas costs for the period were $3.1 million (U.S. $2.7 million), as compared to$3.1 million (U.S. $2.9 million) in the same period in 2013. The change in gas costs is a result of decreased production, partly offset by increases in the average landed cost of natural gas per MMBTU in the quarter, as compared to the same period in 2013.

|

| |

| 2014 Annual Report | 16 |

| Algonquin Power & Utilities Corp. - Management's Discussion & Analysis |

As natural gas expense is a significant revenue driver and component of operating expenses, the division compares ‘net energy sales’ (see non-GAAP Financial Measures) as an appropriate measure of the division’s results. For the three months ended December 31, 2014, net sales at the Windsor Locks Thermal Facility totalled $1.6 million (U.S. $1.4 million) as compared to $1.5 million (U.S. $1.5 million) in the same period in 2013. This variance was driven by a small increase in revenue, which was largely the result of the stronger US dollar, and a small decrease in gas costs.