Management Discussion & Analysis

Management Discussion & AnalysisManagement of Algonquin Power & Utilities Corp. (“AQN” or the “Company” or the “Corporation”) has prepared the following discussion and analysis to provide information to assist its shareholders’ understanding of the financial results for the three and six months ended June 30, 2021. This Management Discussion & Analysis (“MD&A”) should be read in conjunction with AQN’s unaudited interim consolidated financial statements for the three and six months ended June 30, 2021 and 2020. This MD&A should also be read in conjunction with AQN's annual consolidated financial statements for the years ended December 31, 2020 and 2019. This material is available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov/edgar, and on the AQN website at www.AlgonquinPowerandUtilities.com. Additional information about AQN, including the most recent Annual Information Form (“AIF”), can be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.

Unless otherwise indicated, financial information provided for the three and six months ended June 30, 2021 and 2020 has been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). As a result, the Company's financial information may not be comparable with financial information of other Canadian companies that provide financial information on another basis.

All monetary amounts are in U.S. dollars, except where otherwise noted. We denote any amounts denominated in Canadian dollars with "C$" immediately prior to the stated amount.

Capitalized terms used herein and not otherwise defined will have the meanings assigned to them in the Company's most recent AIF.

This MD&A is based on information available to management as of August 12, 2021.

Contents

| | | | | |

| Caution Concerning Forward-Looking Statements, Forward-Looking Information and non-GAAP Measures | |

| Overview and Business Strategy | |

| Significant Updates | |

| 2021 Second Quarter Results From Operations | |

| 2021 Year-to-Date Results from Operations | |

| 2021 Adjusted EBITDA Summary | |

| Regulated Services Group | |

| Renewable Energy Group | |

| AQN: Corporate and Other Expenses | |

| Non-GAAP Financial Measures | |

| Corporate Development Activities | |

| Summary of Property, Plant and Equipment Expenditures | |

| Liquidity and Capital Reserves | |

| Share-Based Compensation Plans | |

| Related Party Transactions | |

| Enterprise Risk Management | |

| Quarterly Financial Information | |

| Disclosure Controls and Internal Controls Over Financial Reporting | |

| Critical Accounting Estimates and Policies | |

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 1 |

Caution Concerning Forward-Looking Statements, Forward-Looking Information and Non-GAAP Measures

Forward-Looking Statements and Forward-Looking Information

This document may contain statements that constitute "forward-looking information" within the meaning of applicable securities laws in each of the provinces of Canada and the respective policies, regulations and rules under such laws or "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking information”). The words “anticipates”, “believes”, “budget”, “could”, “estimates”, “expects”, “forecasts”, “intends”, “may”, “might”, “plans”, “projects”, “schedule”, “should”, “will”, “would” and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. Specific forward-looking information in this document includes, but is not limited to, statements relating to: expected future growth, earnings and results of operations; liquidity, capital resources and operational requirements; rate reviews, including resulting decisions and rates and expected impacts and timing; sources of funding, including adequacy and availability of credit facilities, debt maturation and future borrowings; expectations regarding the impact of the 2019 novel coronavirus (“COVID-19”) on the Company; expectations regarding the use of proceeds from financings, including the offering of Green Equity Units (as defined herein); ongoing and planned acquisitions, projects and initiatives, including expectations regarding costs, financing, results, ownership structures, power purchase arrangements, regulatory matters, in-service dates and completion dates; the estimated impact of the February 2021 extreme winter storm conditions experienced in Texas and parts of the central U.S. (the "Midwest Extreme Weather Event") and as a result of the Midwest Extreme Weather Event, the significantly elevated pricing that persisted in the Electric Reliability Council of Texas (ERCOT) market over several days (the "Market Disruption Event") on the Company, its operations, its facilities and its financial results; expectations regarding the anticipated closing of AQN's acquisition of New York American Water (as defined herein); expectations regarding the Company's corporate development activities and the results thereof, including the expected business mix between the Regulated Services Group and Renewable Energy Group; expectations regarding the Company's development pipeline; the potential impacts of interconnection study results on the Neosho Ridge Wind Facility, and the expected timing for the next interconnection study results for the North Fork Ridge, Kings Point and Neosho Ridge Wind Facilities; expectations regarding regulatory hearings, motions, filings and approvals; expectations regarding the cost of operations, capital spending and maintenance, and the variability of those costs; expected future generation of the Company’s energy facilities; expected future capital investments, including expected timing, investment plans, sources of funds and impacts; expectations regarding future "greening the fleet" initiatives; expectations regarding generation availability, capacity and production; expectations regarding the sale of renewable energy credits; expectations regarding the outcome of existing or potential legal and contractual claims and disputes; expectations regarding the ability to access the capital market on reasonable terms; strategy and goals; expectations regarding the impacts of a failed restructuring by the subsidiary of Abengoa S.A ("Abengoa") that holds the interest in AAGES (as defined herein); expectations regarding the timing for completion of, and apportionment of liability for, the blade remediation work at the Sugar Creek Wind Facility; contractual obligations and other commercial commitments; environmental liabilities; dividends to shareholders; expectations regarding the maturity and redemption of AQN's outstanding subordinated notes; expectations regarding the maturity and settlement of AQN's outstanding Green Equity Units; expectations regarding the impact of tax reforms; credit ratings; anticipated growth and emerging opportunities in AQN’s target markets; anticipated customer benefits; the future impact on the Company of actual or proposed laws, regulations and rules; accounting estimates; interest rates; currency exchange rates; and commodity prices. All forward-looking information is given pursuant to the “safe harbor” provisions of applicable securities legislation.

The forecasts and projections that make up the forward-looking information contained herein are based on certain factors or assumptions which include, but are not limited to: the receipt of applicable regulatory approvals and requested rate decisions; the absence of material adverse regulatory decisions being received and the expectation of regulatory stability; the absence of any material equipment breakdown or failure; availability of financing (including tax equity financing and self-monetization transactions for U.S. federal tax credits) on commercially reasonable terms and the stability of credit ratings of the Corporation and its subsidiaries; the absence of unexpected material liabilities or uninsured losses; the continued availability of commodity supplies and stability of commodity prices; the absence of sustained interest rate increases or significant currency exchange rate fluctuations; the absence of significant operational, financial or supply chain disruptions or liability due to natural disasters, diseases or other force majeure events; the continued ability to maintain systems and facilities to ensure their continued performance; the absence of a severe and prolonged downturn in general economic, credit, social and market conditions; the successful and timely development and construction of new projects; the closing of pending acquisitions substantially in accordance with the expected timing for such acquisitions; the absence of material capital project or financing cost overruns; sufficient liquidity and capital resources; the continuation of long term weather patterns and trends; the absence of significant counterparty defaults; the continued competitiveness of electricity pricing when compared with alternative sources of energy; the realization of the anticipated benefits of the Corporation’s acquisitions and joint ventures; the absence of a change in applicable laws, political conditions, public policies and directions by governments, materially negatively affecting the Corporation; the ability to obtain and maintain licenses and permits; maintenance of adequate insurance coverage; the absence of a material decrease in market energy prices; the absence of material disputes with taxation authorities or changes to applicable tax laws; continued maintenance of information technology infrastructure and the absence of a material breach of cybersecurity; favourable relations with

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 2 |

external stakeholders; and favourable labour relations. Given the continued uncertainty and evolving circumstances surrounding the COVID-19 pandemic and related response from governments, regulatory authorities, businesses, suppliers and customers, there is more uncertainty associated with the Corporation’s assumptions and expectations as compared to periods prior to the onset of COVID-19.

The forward-looking information contained herein is subject to risks, uncertainties and other factors that could cause actual results to differ materially from historical results or results anticipated by the forward-looking information. Factors which could cause results or events to differ materially from current expectations include, but are not limited to: changes in general economic, credit, social and market conditions; changes in customer energy usage patterns and energy demand; global climate change; the incurrence of environmental liabilities; natural disasters, diseases, pandemics and other force majeure events; critical equipment breakdown or failure; the failure of information technology infrastructure and cybersecurity; physical security breach; the loss of key personnel and/or labour disruptions; seasonal fluctuations and variability in weather conditions and natural resource availability; reductions in demand for electricity, gas and water due to developments in technology; reliance on transmission systems owned and operated by third parties; issues arising with respect to land use rights and access to the Corporation’s facilities; terrorist attacks; fluctuations in commodity prices; capital expenditures; reliance on subsidiaries; the incurrence of an uninsured loss; a credit rating downgrade; an increase in financing costs or limits on access to credit and capital markets; sustained increases in interest rates; currency exchange rate fluctuations; restricted financial flexibility due to covenants in existing credit agreements; an inability to refinance maturing debt on commercially reasonable terms; disputes with taxation authorities or changes to applicable tax laws; failure to identify, acquire, develop or timely place in service projects to maximize the value of production tax credit qualified equipment; requirement for greater than expected contributions to post-employment benefit plans; default by a counterparty; inaccurate assumptions, judgments and/or estimates with respect to asset retirement obligations; failure to maintain required regulatory authorizations; changes to health and safety laws, regulations or permit requirements; failure to comply with and/or changes to environmental laws, regulations and other standards; changes in laws and regulations; compliance with foreign laws or regulations; failure of compliance programs; failure to identify attractive acquisition or development candidates necessary to pursue the Corporation’s growth strategy; delays and cost overruns in the design and construction of projects, including as a result of COVID-19; loss of key customers; failure to realize the anticipated benefits of acquisitions or joint ventures, including Atlantica (as defined herein) or Abengoa-Algonquin Global Energy Solutions ("AAGES") acting in a manner contrary to the Corporation’s interests; a drop in the market value of Atlantica's ordinary shares; facilities being condemned or otherwise taken by governmental entities; increased external-stakeholder activism adverse to the Corporation’s interests; fluctuations in the price and liquidity of the Corporation’s common shares and the Corporation's other securities; and the severity and duration of the COVID-19 pandemic and its collateral consequences, including the disruption of economic activity, volatility in capital and credit markets and legislative and regulatory responses. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Some of these and other factors are discussed in more detail under the heading Enterprise Risk Management in this MD&A and in the Corporation's management discussion and analysis for the three and twelve months ended December 31, 2020 (the "Annual MD&A"), and under the heading Enterprise Risk Factors in the Corporation's most recent AIF.

Forward-looking information contained herein (including any financial outlook) is provided for the purposes of assisting the reader in understanding the Corporation and its business, operations, risks, financial performance, financial position and cash flows as at and for the periods indicated and to present information about management’s current expectations and plans relating to the future and the reader is cautioned that such information may not be appropriate for other purposes. Forward-looking information contained herein is made as of the date of this document and based on the plans, beliefs, estimates, projections, expectations, opinions and assumptions of management on the date hereof. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. While subsequent events and developments may cause the Corporation’s views to change, the Corporation disclaims any obligation to update any forward-looking information or to explain any material difference between subsequent actual events and such forward-looking information, except to the extent required by law. All forward-looking information contained herein is qualified by these cautionary statements.

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

Non-GAAP Financial Measures

The terms “Adjusted Net Earnings”, “Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization” (“Adjusted EBITDA”), “Adjusted Funds from Operations”, "Net Energy Sales", "Net Utility Sales" and "Divisional Operating Profit" are used throughout this MD&A. The terms “Adjusted Net Earnings”, “Adjusted Funds from Operations”, "Adjusted EBITDA", "Net Energy Sales", "Net Utility Sales" and "Divisional Operating Profit" are not recognized measures under U.S. GAAP. There is no standardized measure of “Adjusted Net Earnings”, "Adjusted EBITDA", “Adjusted Funds from Operations”, "Net Energy Sales", "Net Utility Sales", and "Divisional Operating Profit"; consequently, AQN’s method of calculating these measures may differ from methods used by other companies and therefore may not be comparable to similar measures presented by other companies. An explanation, calculation and analysis of “Adjusted Net Earnings”, "Adjusted EBITDA", “Adjusted Funds from Operations”, "Net Energy Sales", "Net Utility Sales", and "Divisional Operating Profit", including a reconciliation to the most directly comparable U.S. GAAP measure, where applicable, can be found in this MD&A.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP measure used by many investors to compare companies on the basis of ability to generate cash from operations. AQN uses these calculations to monitor the amount of cash generated by AQN. AQN uses Adjusted EBITDA to assess the operating performance of AQN without the effects of (as applicable): depreciation and amortization expense, income tax expense or recoveries, acquisition costs, certain litigation expenses, interest expense, gain or loss on derivative financial instruments, write down of intangibles and property, plant and equipment, earnings attributable to non-controlling interests, non-service pension and post-employment costs, cost related to tax equity financing, costs related to management succession and executive retirement, costs related to prior period adjustments due to the Tax Cuts and Jobs Act ("U.S. Tax Reform"), costs related to condemnation proceedings, financial impacts from the Market Disruption Event on the Company's Senate Wind Facility, gain or loss on foreign exchange, earnings or loss from discontinued operations, changes in value of investments carried at fair value, and other typically non-recurring or unusual items. AQN adjusts for these factors as they may be non-cash, unusual in nature and are not factors used by management for evaluating the operating performance of the Company. AQN believes that presentation of this measure will enhance an investor’s understanding of AQN’s operating performance. Adjusted EBITDA is not intended to be representative of cash provided by operating activities or results of operations determined in accordance with U.S. GAAP, and can be impacted positively or negatively by these items.

Adjusted Net Earnings

Adjusted Net Earnings is a non-GAAP measure used by many investors to compare net earnings from operations without the effects of certain volatile primarily non-cash items that generally have no current economic impact or items such as acquisition expenses or certain litigation expenses that are viewed as not directly related to a company’s operating performance. AQN uses Adjusted Net Earnings to assess its performance without the effects of (as applicable): gains or losses on foreign exchange, foreign exchange forward contracts, interest rate swaps, acquisition costs, one-time costs of arranging tax equity financing, certain litigation expenses and write down of intangibles and property, plant and equipment, earnings or loss from discontinued operations, unrealized mark-to-market revaluation impacts (other than those realized in connection with the sales of development assets), costs related to management succession and executive retirement, costs related to prior period adjustments due to U.S. Tax Reform, costs related to condemnation proceedings, financial impacts from the Market Disruption Event on the Company's Senate Wind Facility, changes in value of investments carried at fair value, and other typically non-recurring or unusual items as these are not reflective of the performance of the underlying business of AQN. The non-cash accounting charge related to the revaluation of U.S. deferred income tax assets and liabilities as a result of implementation of the effects of U.S. Tax Reform is adjusted as it is also considered a non-recurring item not reflective of the performance of the underlying business of AQN. AQN believes that analysis and presentation of net earnings or loss on this basis will enhance an investor’s understanding of the operating performance of its businesses. Adjusted Net Earnings is not intended to be representative of net earnings or loss determined in accordance with U.S. GAAP, and can be impacted positively or negatively by these items.

Adjusted Funds from Operations

Adjusted Funds from Operations is a non-GAAP measure used by investors to compare cash flows from operating activities without the effects of certain volatile items that generally have no current economic impact or items such as acquisition expenses that are viewed as not directly related to a company’s operating performance. AQN uses Adjusted Funds from Operations to assess its performance without the effects of (as applicable): changes in working capital balances, acquisition expenses, certain litigation expenses, cash provided by or used in discontinued operations, financial impacts from the Market Disruption Event on the Company's Senate Wind Facility, and other typically non-recurring items affecting cash from operations as these are not reflective of the long-term performance of the underlying businesses of AQN. AQN believes that analysis and presentation of funds from operations on this basis will enhance an investor’s understanding of the operating performance of its businesses. Adjusted Funds from Operations is not intended to be representative of cash flows from operating activities as determined in accordance with U.S. GAAP, and can be impacted positively or negatively by these items.

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

Net Energy Sales

Net Energy Sales is a non-GAAP measure used by investors to identify revenue after commodity costs used to generate revenue where such revenue generally increases or decreases in response to increases or decreases in the cost of the commodity used to produce that revenue. AQN uses Net Energy Sales to assess its revenues without the effects of fluctuating commodity costs as such costs are predominantly passed through either directly or indirectly in the rates that are charged to customers. AQN believes that analysis and presentation of Net Energy Sales on this basis will enhance an investor’s understanding of the revenue generation of its businesses. It is not intended to be representative of revenue as determined in accordance with U.S. GAAP.

Net Utility Sales

Net Utility Sales is a non-GAAP measure used by investors to identify utility revenue after commodity costs, either natural gas or electricity, where these commodity costs are generally included as a pass through in rates to its utility customers. AQN uses Net Utility Sales to assess its utility revenues without the effects of fluctuating commodity costs as such costs are predominantly passed through and paid for by utility customers. AQN believes that analysis and presentation of Net Utility Sales on this basis will enhance an investor’s understanding of the revenue generation of its utility businesses. It is not intended to be representative of revenue as determined in accordance with U.S. GAAP.

Divisional Operating Profit

Divisional Operating Profit is a non-GAAP measure. AQN uses Divisional Operating Profit to assess the operating performance of its business groups without the effects of (as applicable): depreciation and amortization expense, corporate administrative expenses, income tax expense or recoveries, acquisition costs, certain litigation expenses, interest expense, gain or loss on derivative financial instruments, write down of intangibles and property, plant and equipment, gain or loss on foreign exchange, earnings or loss from discontinued operations, non-service pension and post-employment costs, financial impacts from the Market Disruption Event on the Company's Senate Wind Facility, and other typically non-recurring items. AQN adjusts for these factors as they may be non-cash, unusual in nature and are not factors used by management for evaluating the operating performance of the divisional units. Divisional Operating Profit is calculated inclusive of interest, dividend and equity income earned from indirect investments, and Hypothetical Liquidation at Book Value (“HLBV”) income, which represents the value of net tax attributes earned in the period from electricity generated by certain of its U.S. wind power and U.S. solar generation facilities. AQN believes that presentation of this measure will enhance an investor’s understanding of AQN’s divisional operating performance. Divisional Operating Profit is not intended to be representative of cash provided by operating activities or results of operations determined in accordance with U.S. GAAP.

Overview and Business Strategy

AQN is incorporated under the Canada Business Corporations Act. AQN owns and operates a diversified portfolio of regulated and non-regulated generation, distribution, and transmission utility assets which are expected to deliver predictable earnings and cash flows. AQN seeks to maximize total shareholder value through real per share growth in earnings and cash flows to support a growing dividend and share price appreciation. AQN strives to achieve these results while also seeking to maintain a business risk profile consistent with its BBB flat investment grade credit ratings and a strong focus on Environmental, Social and Governance factors.

AQN’s current quarterly dividend to shareholders is $0.1706 per common share or $0.6824 per common share per annum. Based on the Bank of Canada exchange rate on August 11, 2021, the quarterly dividend is equivalent to C$0.2134 per common share or C$0.8536 per common share per annum. AQN believes its annual dividend payout allows for both an immediate return on investment for shareholders and retention of sufficient cash within AQN to fund growth opportunities. Changes in the level of dividends paid by AQN are at the discretion of the AQN Board of Directors (the “Board”), with dividend levels being reviewed periodically by the Board in the context of AQN's financial performance and growth prospects.

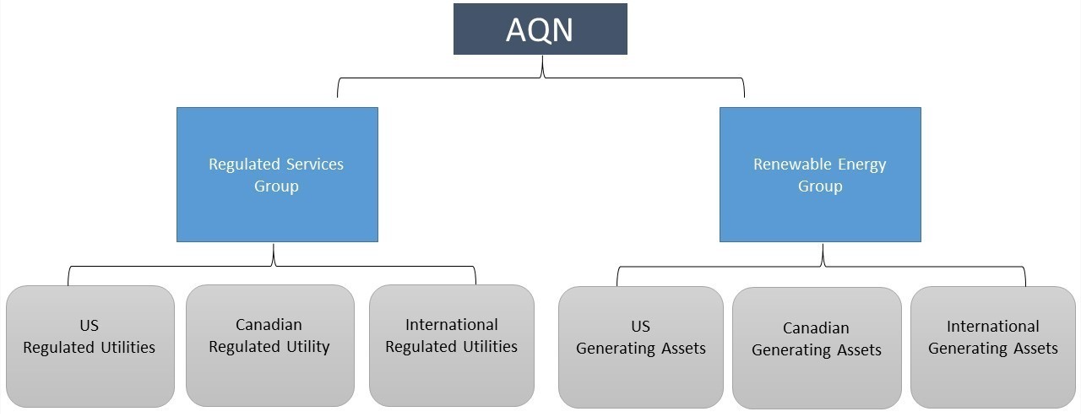

AQN's operations are organized across two primary business units consisting of: the Regulated Services Group, which primarily owns and operates a portfolio of regulated assets in the United States, Canada, Chile and Bermuda, and the Renewable Energy Group, which primarily owns and operates a diversified portfolio of renewable generation assets.

AQN pursues investment opportunities with an objective of maintaining the current business mix between its Regulated Services Group and Renewable Energy Group and with leverage consistent with its current credit ratings1. The business mix target may from time to time require AQN to grow its Regulated Services Group or implement other strategies in order to pursue investment opportunities within its Renewable Energy Group.

1 See Treasury Risk Management -Downgrade in the Company's Credit Rating Risk in the Company's Annual MD&A.

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

The Company also undertakes development activities for both business units, working with a global reach to identify, develop, acquire, or invest in renewable power generating facilities, regulated utilities and other complementary infrastructure projects. See additional discussion in Corporate Development Activities.

Summary Structure of the Business

The following chart depicts, in summary form, AQN's key businesses. A more detailed description of AQN's organizational structure can be found in the most recent AIF.

Regulated Services Group

The Regulated Services Group operates a diversified portfolio of regulated utility systems throughout the United States, Canada, Chile and Bermuda serving approximately 1,093,000 customer connections (using an average of 2.5 customers per household, this translates into approximately 2,733,000 customers). The Regulated Services Group seeks to provide safe, high quality, and reliable services to its customers and to deliver stable and predictable earnings to AQN. In addition to encouraging and supporting organic growth within its service territories, the Regulated Services Group seeks to deliver continued growth in earnings through accretive acquisitions of additional utility systems.

The Regulated Services Group's regulated electrical distribution utility systems and related generation assets are located in the U.S. States of California, New Hampshire, Missouri, Kansas, Oklahoma, and Arkansas, as well as in Bermuda, which together serve approximately 306,000 electric customer connections. The group also owns and operates generating assets with a gross capacity of approximately 2.0 GW and has investments in generating assets with approximately 0.3 GW of net generation capacity.

The Regulated Services Group's regulated natural gas distribution utility systems are located in the U.S. States of Georgia, Illinois, Iowa, Massachusetts, New Hampshire, Missouri, and New York, and in the Canadian Province of New Brunswick, which together serve approximately 371,000 natural gas customer connections.

The Regulated Services Group's regulated water distribution and wastewater collection utility systems are located in the U.S. States of Arizona, Arkansas, California, Illinois, Missouri, and Texas as well as in Chile which together serve approximately 416,000 customer connections.

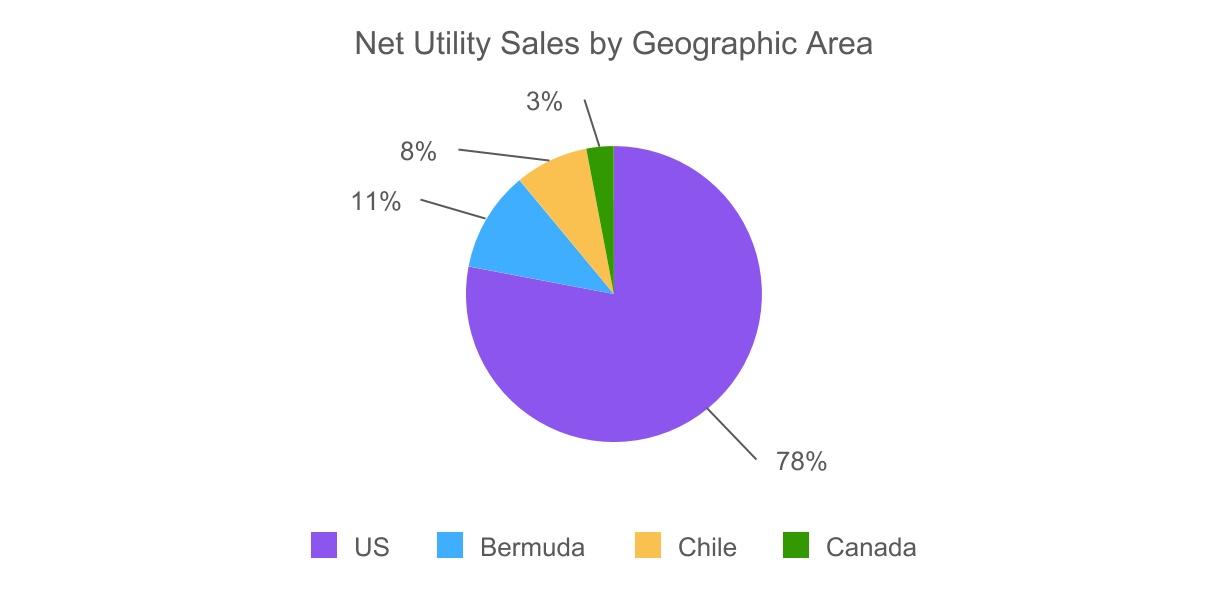

Below is a breakdown of the Regulated Services Group's Net Utility Sales by geographic area for the six months ended June 30, 2021 (see Non-GAAP Financial Measures).

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 6 |

Renewable Energy Group

The Renewable Energy Group generates and sells electrical energy produced by its diverse portfolio of renewable power generation and clean power generation facilities primarily located across the United States and Canada. The Renewable Energy Group seeks to deliver continuing growth through development of new power generation projects and accretive acquisitions of additional electrical energy generation facilities.

The Renewable Energy Group directly owns and operates hydroelectric, wind, solar, and thermal facilities with a combined gross generating capacity of approximately 2.3 GW. Approximately 81% of the electrical output is sold pursuant to long term contractual arrangements which as of June 30, 2021 had a production-weighted average remaining contract life of approximately 13 years.

In addition to directly owned and operated assets, the Renewable Energy Group has investments in generating assets with approximately 1.5 GW of net generating capacity which includes the Company's 44.2% interest in Atlantica Sustainable Infrastructure PLC ("Atlantica"). Atlantica owns and operates a portfolio of international clean energy and water infrastructure assets under long term contracts with a Cash Available for Distribution (CAFD) weighted average remaining contract life of approximately 16 years as of June 30, 2021.

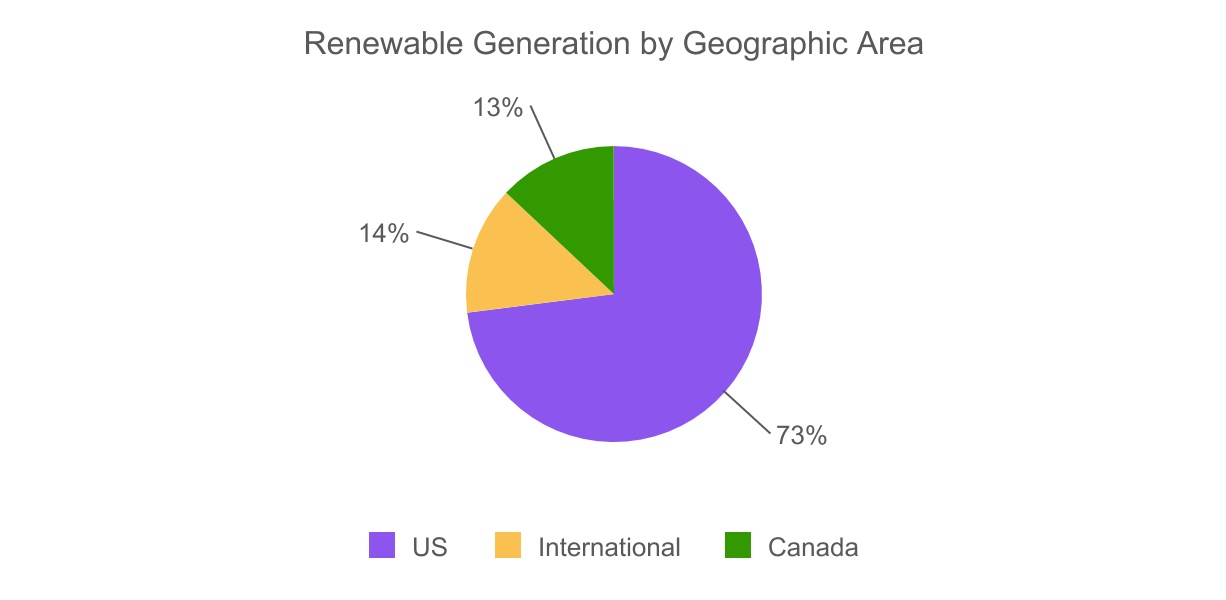

Below is a breakdown of the Renewable Energy Group's generating capacity by geographic area as of June 30, 2021, which is comprised of gross generating capacity of facilities owned and operated and net generating capacity of investments (including the Company's 44.2% interest in Atlantica).

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

Significant Updates

Operating Results

AQN operating results relative to the same period last year are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (all dollar amounts in $ millions except per share information) | Three Months Ended June 30 | | | | |

| 2021 | | 2020 | | Change | | | | | | | | | | | | |

| Net earnings attributable to shareholders | $103.2 | | $286.2 | | (64)% | | | | | | | | | | | | |

Adjusted Net Earnings1 | $91.7 | | $47.4 | | 93% | | | | | | | | | | | | |

Adjusted EBITDA1 | $244.9 | | $176.3 | | 39% | | | | | | | | | | | | |

| Net earnings per common share | $0.16 | | $0.54 | | (70)% | | | | | | | | | | | | |

Adjusted Net Earnings per common share1 | $0.15 | | $0.09 | | 67% | | | | | | | | | | | | |

| | | | | |

| 1 | See Non-GAAP Financial Measures. |

Declaration of 2021 Third Quarter Dividend of $0.1706 (C$0.2134) per Common Share

AQN currently targets annual growth in dividends payable to shareholders underpinned by increases in earnings and cash flow. In setting the appropriate dividend level, the Board considers the Company’s current and expected growth in earnings per share as well as a dividend payout ratio as a percentage of earnings per share and cash flow per share.

On August 12, 2021, AQN announced that the Board declared a third quarter 2021 dividend of $0.1706 per common share payable on October 15, 2021 to shareholders of record on September 30, 2021.

Based on the Bank of Canada exchange rate on August 11, 2021, the Canadian dollar equivalent for the third quarter 2021 dividend is C$0.2134 per common share.

The previous four quarter U.S and Canadian dollar equivalent dividends per common share have been as follows:

| | | | | | | | | | | | | | | | | |

| Q4 2020 | Q1

2021 | Q2

2021 | Q3 2021 | Total |

| U.S. dollar dividend | $ | 0.1551 | | $ | 0.1551 | | $ | 0.1706 | | $ | 0.1706 | | $0.6514 |

| Canadian dollar equivalent | $ | 0.2019 | | $ | 0.1959 | | $ | 0.2094 | | $ | 0.2134 | | $0.8206 |

Inaugural Issuance of Green Equity UnitsOn June 23, 2021, the Company closed an underwritten marketed public offering of 20,000,000 equity units (the "Green Equity Units") for total gross proceeds of $1.0 billion (the "Offering"). The underwriters subsequently exercised their option to purchase an additional 3,000,000 Green Equity Units on the same terms as the Offering, bringing total gross proceeds including the over-allotment to $1.15 billion.

Each Green Equity Unit consists of a 1/20 or 5% undivided beneficial interest in a $1,000 principal amount remarketable senior note of the Company due June 15, 2026, and a contract to purchase AQN common shares on June 15, 2024 based on a reference price determined by the volume-weighted average AQN common share price over the preceding 20 day trading period. Total annual distributions on the Green Equity Units will be at the rate of 7.75%. The net proceeds from the Offering have been or will be, as applicable, used to finance or refinance investments in renewable energy generation or facilities or other clean energy technologies in accordance with the Company's Green Financing Framework. See additional discussion in Long Term Debt.

Progress on Renewable Construction Projects

To date the Company has completed approximately 1,400 MW of its 1,600 MW pipeline of renewable energy generation construction projects that were under construction in 2020, with the remainder expected to be completed before the end of 2021. This 1,600 MW pipeline of new projects is expected to approximately double the size of the Company's portfolio of renewable energy generation facilities that it owns and operates, providing renewable energy to an equivalent of 500,000 homes each year. In the second quarter of 2021, significant milestones were achieved:

Completion of Midwest Greening the Fleet Initiative

The Regulated Services Group successfully completed the construction and acquisition of all the wind facilities related to its inaugural 'greening the fleet' initiative. The initiative consists of 600 MWs of new strategically located wind energy generation which is expected to provide benefits to the Regulated Services Group's electric customers in Missouri, Arkansas, Oklahoma and Kansas. The initiative also resulted in the early retirement of the 200 MW Asbury Coal Facility ("Asbury") on March 1, 2020, approximately 15 years ahead of its original retirement schedule.

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 8 |

The early retirement of Asbury has reduced the Company's CO2e emissions by more than 900,000 metric tons, bringing the Company's total reduction of greenhouse gas ("GHG") emissions to over 1 million metric tons since 2017. With the drive to responsibly minimize CO2e emissions, AQN's commitment to 'greening the fleet' supports important growth and sustainability levers. The early retirement has also contributed to the reduction in the Company’s total Scope 1 GHG emissions as well as reductions in emission intensity per dollar of revenue since 2017, the year in which the Company acquired The Empire District Electric Company ("Empire"), which owns Asbury.

On January 27, 2021, Empire closed its acquisition of the North Fork Ridge Wind Facility and on May 5, 2021, Empire closed the acquisitions of the Kings Point and Neosho Ridge Wind Facilities (collectively, the "Empire Wind Facilities"). Since 2017, Empire has seen an approximately 26% reduction in emission intensity per dollar of revenue, an attestation to the Company’s responsible stewardship of energy infrastructure. AQN was an early pioneer in building renewables into rate base to promote customer savings and minimize CO2e emissions, and maintains a commitment to further "greening the fleet" initiatives congruent with its sustainability and growth strategies.

Completion of the Altavista Solar Project

On June 1, 2021, the Renewable Energy Group achieved full commercial operations ("COD") at its 80 MW Altavista Solar Facility, located in Campbell County, Virginia. The Altavista Solar Facility is the Renewable Energy Group's sixth solar powered electric generating facility and is expected to generate approximately 174 GW-hrs of energy per year with the majority of output being sold to Facebook Operations, LLC, a wholly-owned subsidiary of Facebook, Inc., pursuant to a power purchase agreement ("PPA").

Acquisition of Majority Interest in Fourth Texas Coastal Wind Facility

On August 12, 2021, the Renewable Energy Group closed the acquisition of a 51% interest in the West Raymond Wind Facility that it had previously agreed to purchase from RWE Renewables Americas, LLC, a subsidiary of RWE AG. The West Raymond Wind Facility is located in the coastal region of south Texas, achieved COD in the third quarter of 2021 and has a generating capacity of approximately 240 MW. With the acquisition of the West Raymond Wind Facility and the three wind facilities that were acquired in the first quarter of 2021 (Stella, Cranell, and East Raymond) (collectively the "Texas Coastal Wind Facilities"), the Renewable Energy Group now owns a 51% interest in the portfolio of four wind facilities that have a total generating capacity of approximately 861 MW.

Impact of COVID-19 on Operating Results

For the three months ended June 30, 2021, the Company's operating results were not materially impacted by the COVID-19 pandemic. Approximately 60% of the Company's workforce continues to work remotely and the Company continues to employ operational measures intended to protect the health and safety of its employees and customers. Over the coming months the Company is planning a return to base operations as the impacts of the pandemic further diminish.

The Company’s business, financial condition, cash flows and results of operations continue to be subject to actual and potential future impacts resulting from COVID-19, the full extent of which are not currently known. The extent of the future impact of the COVID-19 pandemic on the Company will depend on, among other things, the duration of the pandemic, the extent of the related public health measures taken in response to the pandemic and the Company's efforts to mitigate the impact on its operations.

For a discussion of the risks the Company faces related to COVID-19 please refer to Enterprise Risk Management.

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

2021 Second Quarter Results From Operations

| | | | | | | | | | | |

| Key Financial Information | Three Months Ended June 30 |

| (all dollar amounts in $ millions except per share information) | 2021 | | 2020 |

| Revenue | $ | 527.5 | | | $ | 343.6 | |

| | | |

| Net earnings attributable to shareholders | 103.2 | | | 286.2 | |

| Cash provided by operating activities | 103.3 | | | 142.9 | |

Adjusted Net Earnings1 | 91.7 | | | 47.4 | |

Adjusted EBITDA1 | 244.9 | | | 176.3 | |

Adjusted Funds from Operations1 | 161.3 | | | 93.4 | |

| Dividends declared to common shareholders | 105.7 | | | 83.8 | |

| Weighted average number of common shares outstanding | 614,013,963 | | | 529,440,246 | |

| Per share | | | |

| | | |

| Basic net earnings | $ | 0.16 | | | $ | 0.54 | |

| Diluted net earnings | $ | 0.16 | | | $ | 0.53 | |

Adjusted Net Earnings1,2 | $ | 0.15 | | | $ | 0.09 | |

| Dividends declared to common shareholders | $ | 0.17 | | | $ | 0.16 | |

| | | | | |

| 1 | See Non-GAAP Financial Measures. |

| 2 | AQN uses per share Adjusted Net Earnings to enhance assessment and understanding of the performance of AQN. |

For the three months ended June 30, 2021, AQN experienced an average exchange rate of Canadian to U.S. dollars of approximately 0.8143 as compared to 0.7216 in the same period in 2020. As such, any quarter over quarter variance in revenue or expenses, in local currency, at any of AQN’s Canadian entities is affected by a change in the average exchange rate upon conversion to AQN’s reporting currency.

For the three months ended June 30, 2021, AQN reported total revenue of $527.5 million as compared to $343.6 million during the same period in 2020, an increase of $183.9 million or 53.5%. The major factors impacting AQN's revenue in the three months ended June 30, 2021 as compared to the same period in 2020 are set out as follows:

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 10 |

| | | | | |

| (all dollar amounts in $ millions) | Three Months Ended June 30 |

| Comparative Prior Period Revenue | $ | 343.6 | |

| REGULATED SERVICES GROUP | |

| Existing Facilities | |

| Electricity: Increase is primarily due to higher pass through commodity costs and out of period resettlement adjustments at the Empire Electric System, reflecting residual impacts as a result of the Midwest Extreme Weather Event. | 54.1 | |

| Gas: Increase is primarily due to higher pass through commodity costs at the EnergyNorth and New England Gas Systems as well as increased commercial and industrial consumption at the Midstates Gas System. | 12.0 | |

| Water: Increase is primarily due to growth in connections at the Midstates, Beardsley and Arkansas Water Systems. | 1.1 | |

| |

| 67.2 | |

| New Facilities | |

| Electricity: Acquisition of Liberty Group Limited (formerly Ascendant Group Limited ("Ascendant")) (November 2020) and the Empire Wind Facilities (2021). | 60.4 | |

| |

| Water: Acquisition of Empresa de Servicios Sanitarios de Los Lagos S.A.("ESSAL") (October 2020). | 23.1 | |

| |

| 83.5 | |

| Rate Reviews | |

| Electricity: Increase is due to the implementation of a Post-Test Year Adjustment Mechanism effective January 2021 at the CalPeco Electric System as well as the implementation of new rates at the Granite State Electric System. | 2.9 | |

| Gas: Increase is primarily due to the implementation of new rates at the EnergyNorth and Peach State Gas Systems. | 1.3 | |

| |

| 4.2 | |

| |

| |

Estimated Impact of COVID-19 on comparative period results1 | 10.8 | |

| |

| RENEWABLE ENERGY GROUP | |

| Existing Facilities | |

| Hydro: Decrease is primarily due to lower production in the Ontario Region, partially offset by favourable pricing in the Western Region. | (0.1) | |

| Wind Canada: Decrease is primarily due to lower production. | (0.8) | |

Wind U.S.: Decrease is primarily due to lower production and unfavourable pricing at the Senate Wind Facility as well as unfavourable pricing at the Shady Oaks Wind Facility.

| (1.4) | |

| Solar: Increase is primarily due to higher production at the Bakersfield Solar Facilities. | 0.3 | |

| |

| Thermal: Increase is primarily due to higher production at the Sanger Thermal Facility as well as favourable pricing at the Windsor Locks Thermal Facility. | 1.3 | |

| Other | (0.6) | |

| (1.3) | |

| New Facilities | |

| Wind U.S.: Sugar Creek Wind Facility (full COD in November 2020) and Maverick Creek Wind Facility (full COD in April 2021). | 13.7 | |

| Solar: Great Bay II Solar Facility (full COD in August 2020) and Altavista Solar Facility (full COD in June 2021) | 2.5 | |

| 16.2 | |

| Foreign Exchange | 3.3 | |

| Current Period Revenue | $ | 527.5 | |

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

| | | | | |

| 1 | The impacts of COVID-19 were estimated by normalizing sales in both periods for changes in weather and attributing the remaining variances to COVID-19. |

A more detailed discussion of these factors is presented within the business unit analysis.For the three months ended June 30, 2021, net earnings attributable to shareholders totaled $103.2 million as compared to net earnings of $286.2 million during the same period in 2020, a decrease of $183.0 million or 63.9%. The decrease was due to a $282.5 million change in fair value of investments carried at fair value, a $13.4 million increase in interest expense, a $22.5 million increase in depreciation and amortization expenses, a $2.8 million increase in losses from derivative instruments, a $0.3 million increase in administrative expenses, a $1.3 million increase in foreign exchange loss, and a $0.3 million increase in pension and post-employment non-service costs. These items were partially offset by a $50.6 million increase in earnings from operating facilities, an $8.2 million increase in interest, dividend, equity and other income, a $25.1 million decrease in other net losses, a $51.1 million decrease in income tax expense (tax explanations are discussed in AQN: Corporate and Other Expenses), and a $5.1 million increase in net effect of non-controlling interests as compared to the same period in 2020.

During the three months ended June 30, 2021, cash provided by operating activities totaled $103.3 million as compared to $142.9 million during the same period in 2020, a decrease of $39.6 million. During the three months ended June 30, 2021, Adjusted Funds from Operations totaled $161.3 million as compared to Adjusted Funds from Operations of $93.4 million during the same period in 2020, an increase of $67.9 million (see Non-GAAP Financial Measures).

During the three months ended June 30, 2021, Adjusted EBITDA totaled $244.9 million as compared to $176.3 million during the same period in 2020, an increase of $68.6 million or 38.9%. A more detailed analysis of these factors is presented within the reconciliation of Adjusted EBITDA to net earnings set out below (see Non-GAAP Financial Measures).

2021 Year-to-Date Results From Operations

| | | | | | | | | | | | | | | |

| Key Financial Information | Six Months Ended June 30 |

| (all dollar amounts in $ millions except per share information) | 2021 | | 2020 | | | | |

| Revenue | $ | 1,162.1 | | | $ | 808.5 | | | | | |

| | | | | | | |

| Net earnings attributable to shareholders | 117.2 | | | 222.4 | | | | | |

| Cash provided by (used in) operating activities | (140.2) | | | 209.8 | | | | | |

Adjusted Net Earnings1 | 216.2 | | | 150.7 | | | | | |

Adjusted EBITDA1 | 527.7 | | | 418.5 | | | | | |

Adjusted Funds from Operations1 | 366.6 | | | 272.9 | | | | | |

| Dividends declared to common shareholders | 200.3 | | | 158.5 | | | | | |

| Weighted average number of common shares outstanding | 606,876,299 | | | 527,634,250 | | | | | |

| Per share | | | | | | | |

| | | | | | | |

| Basic net earnings | $ | 0.19 | | | $ | 0.41 | | | | | |

| Diluted net earnings | $ | 0.18 | | | $ | 0.41 | | | | | |

Adjusted Net Earnings1,2 | $ | 0.35 | | | $ | 0.28 | | | | | |

| Dividends declared to common shareholders | $ | 0.33 | | | $ | 0.30 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | |

| 1 | See Non-GAAP Financial Measures. |

| 2 | AQN uses per share Adjusted Net Earnings to enhance assessment and understanding of the performance of AQN. |

For the six months ended June 30, 2021, AQN experienced an average exchange rate of Canadian to U.S. dollars of approximately 0.8017 as compared to 0.7325 in the same period in 2020. As such, any year-over-year variance in revenue or expenses, in local currency, at any of AQN’s Canadian entities is affected by a change in the average exchange rate upon conversion to AQN’s reporting currency.

For the six months ended June 30, 2021, AQN reported total revenue of $1,162.1 million as compared to $808.5 million during the same period in 2020, an increase of $353.6 million or 43.7%. The major factors resulting in the increase in AQN revenue for the six months ended June 30, 2021 as compared to the same period in 2020 are set out as follows:

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

| | | | | |

| (all dollar amounts in $ millions) | Six Months Ended June 30 |

| Comparative Prior Period Revenue | $ | 808.5 | |

| REGULATED SERVICES GROUP | |

| Existing Facilities | |

| Electricity: Increase is primarily due to higher consumption and pass through commodity costs at the Empire Electric System as a result of the Midwest Extreme Weather Event. | 153.3 | |

| Gas: Increase is due to higher pass through commodity costs in the New England, EnergyNorth and Georgia Gas Systems as well as increased consumption at the Midstates Gas System. | 21.2 | |

| Water: Increase is primarily due to growth in connections at the Litchfield Park, Midstates and Beardsley Water Systems. | 3.0 | |

| Other | 0.6 | |

| 178.1 | |

| New Facilities | |

| Electricity: Acquisition of Ascendant (November 2020) and the Empire Wind Facilities (2021). | 118.2 | |

| |

| Water: Acquisition of ESSAL (October 2020). | 48.5 | |

| |

| 166.7 | |

| Rate Reviews | |

| Electricity: Increase is due to the implementation of a Post-Test Year Adjustment Mechanism effective January 2021 at the CalPeco Electric System as well as the implementation of new rates at the Granite State Electric System. | 6.3 | |

| Gas: Increase is primarily due to the implementation of new rates at the EnergyNorth and Peach State Gas Systems, | 6.3 | |

| |

| 12.6 | |

| |

| |

Estimated Impact of COVID-19 on comparative period results1 | 11.0 | |

| |

| RENEWABLE ENERGY GROUP | |

| Existing Facilities | |

| Hydro: Increase is primarily due to favourable pricing in the Western Region, partially offset by lower production in the Ontario Region. | 0.4 | |

| Wind Canada: Decrease is primarily due to lower production. | (1.1) | |

| Wind U.S.: Decrease is primarily due to the impacts from the Market Disruption Event at the Senate Wind Facility. | (53.5) | |

| Solar: Increase is primarily due to higher production at the Bakersfield Solar Facilities. | 0.3 | |

| |

| Thermal: Increase is primarily due to higher production at the Sanger Thermal Facility as well as favourable pricing at the Windsor Locks Thermal Facility. | 3.5 | |

| Other | (0.3) | |

| (50.7) | |

| New Facilities | |

| |

| Wind U.S.: Sugar Creek Wind Facility (full COD in November 2020) and Maverick Creek Wind Facility (full COD in April 2021). | 26.9 | |

| Solar: Great Bay II Solar Facility (achieved COD in August 2020) and Altavista Solar Facility (full COD in June 2021). | 4.1 | |

| 31.0 | |

| Foreign Exchange | 4.9 | |

| |

| Current Period Revenue | $ | 1,162.1 | |

| | | | | |

| 1 | The impacts of COVID-19 were estimated by normalizing sales in both periods for changes in weather and attributing the remaining variances to COVID-19. |

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 13 |

A more detailed discussion of these factors is presented within the business unit analysis.

For the six months ended June 30, 2021, net earnings attributable to shareholders totaled $117.2 million as compared to $222.4 million during the same period in 2020, a decrease of $105.2 million or 47.3%. The decrease was due to a $163.5 million change in fair value of investments carried at fair value, a $41.1 million increase in depreciation and amortization expenses, a $16.7 million increase in interest expense, a $6.8 million decrease in foreign exchange gains, a $1.7 million decrease in gains from derivative instruments, and a $0.5 million increase in pension and post-employment non-service costs. These items were partially offset by a $39.3 million increase in earnings from operating facilities, a $17.6 million decrease in other net losses, a $0.9 million decrease in administration charges, a $1.3 million increase in interest, dividend, equity and other income, a $59.0 million decrease in income tax expense (tax explanations are discussed in AQN: Corporate and Other Expenses), and a $6.8 million increase in net effect of non-controlling interests as compared to the same period in 2020.

During the six months ended June 30, 2021, cash provided by (used in) operating activities totaled $(140.2) million as compared to $209.8 million during the same period in 2020. During the six months ended June 30, 2021, Adjusted Funds from Operations totaled $366.6 million as compared to $272.9 million the same period in 2020, an increase of $93.7 million (see Non-GAAP Financial Measures).

During the six months ended June 30, 2021, Adjusted EBITDA totaled $527.7 million as compared to $418.5 million during the same period in 2020, an increase of $109.2 million or 26.1%. A detailed analysis of this variance is presented within the reconciliation of Adjusted EBITDA to net earnings set out below (see Non-GAAP Financial Measures).

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

2021 Second Quarter and Year-to-Date Adjusted EBITDA Summary

Adjusted EBITDA (see Non-GAAP Financial Measures) for the three months ended June 30, 2021 totaled $244.9 million as compared to $176.3 million during the same period in 2020, an increase of $68.6 million or 38.9%. Adjusted EBITDA for the six months ended June 30, 2021 totaled $527.7 million as compared to $418.5 million during the same period in 2020, an increase of $109.2 million or 26.1%. The breakdown of Adjusted EBITDA by the Company's main business units and a summary of changes are shown below.

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted EBITDA by business units | Three Months Ended June 30 | | Six Months Ended June 30 |

| (all dollar amounts in $ millions) | 2021 | | 2020 | | 2021 | | 2020 |

| Regulated Services Group Operating Profit | $ | 165.9 | | | $ | 114.5 | | | $ | 372.8 | | | $ | 285.2 | |

| Renewable Energy Group Operating Profit | 97.9 | | | 82.7 | | | 192.8 | | | 170.7 | |

| Administrative Expenses | (18.2) | | | (17.9) | | | (33.8) | | | (34.7) | |

| Other Income & Expenses | (0.7) | | | (3.0) | | | (4.1) | | | (2.7) | |

| Total AQN Adjusted EBITDA | $ | 244.9 | | | $ | 176.3 | | | $ | 527.7 | | | $ | 418.5 | |

| Change in Adjusted EBITDA ($) | $ | 68.6 | | | | | $ | 109.2 | | | |

| Change in Adjusted EBITDA (%) | 38.9 | % | | | | 26.1 | % | | |

| | | | | | | | | | | | | | |

| Change in Adjusted EBITDA | Three Months Ended June 30, 2021 |

| (all dollar amounts in $ millions) | Regulated Services | Renewable Energy | Corporate | Total |

| Prior period balances | $ | 114.5 | | $ | 82.7 | | $ | (20.9) | | $ | 176.3 | |

| Existing Facilities and Investments | 5.6 | | (2.4) | | 2.3 | | 5.5 | |

| New Facilities and Investments | 32.1 | | 15.0 | | — | | 47.1 | |

| Rate Reviews | 4.1 | | — | | — | | 4.1 | |

Estimated Impact of COVID-19 on comparative period results1 | 9.6 | | — | | — | | 9.6 | |

| Foreign Exchange Impact | — | | 2.6 | | — | | 2.6 | |

| Administrative Expenses | — | | — | | (0.3) | | (0.3) | |

| Total change during the period | $ | 51.4 | | $ | 15.2 | | $ | 2.0 | | $ | 68.6 | |

| Current period balances | $ | 165.9 | | $ | 97.9 | | $ | (18.9) | | $ | 244.9 | |

| | | | | | | | | | | | | | |

| Change in Adjusted EBITDA | Six Months Ended June 30, 2021 |

| (all dollar amounts in $ millions) | Regulated Services | Renewable Energy | Corporate | Total |

| Prior period balances | $ | 285.2 | | $ | 170.7 | | $ | (37.4) | | $ | 418.5 | |

| Existing Facilities and Investments | (0.7) | | (0.6) | | (1.5) | | (2.8) | |

| New Facilities and Investments | 65.9 | | 18.7 | | — | | 84.6 | |

| Rate Reviews | 12.6 | | — | | — | | 12.6 | |

Estimated Impact of COVID-19 on comparative period results1 | 9.8 | | — | | — | | 9.8 | |

| Foreign Exchange Impact | — | | 4.0 | | — | | 4.0 | |

| Administrative Expenses | — | | — | | 1.0 | | 1.0 | |

| Total change during the period | $ | 87.6 | | $ | 22.1 | | $ | (0.5) | | $ | 109.2 | |

| Current period balances | $ | 372.8 | | $ | 192.8 | | $ | (37.9) | | $ | 527.7 | |

| | | | | |

| 1 | The impacts of COVID-19 were estimated by normalizing sales in both periods for changes in weather and attributing the remaining variances to COVID-19. |

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 15 |

REGULATED SERVICES GROUP

The Regulated Services Group operates rate-regulated utilities that as of June 30, 2021 provided distribution services to approximately 1,093,000 customer connections in the electric, natural gas, and water and wastewater sectors which is an increase of approximately 286,000 customer connections as compared to the prior year. The increase is primarily due to the acquisitions in the second half of 2020 of a majority interest in the ESSAL water utility in Chile and Ascendant in Bermuda.

The Regulated Services Group's strategy is to grow its business organically and through business development activities while using prudent acquisition criteria. The Regulated Services Group believes that its business results are maximized by building constructive regulatory and customer relationships, and enhancing customer connections in the communities in which it operates.

| | | | | | | | | | | | | | | | | | | | | | | |

| Utility System Type | As at June 30 |

| 2021 | | 2020 |

| (all dollar amounts in $ millions) | Assets | Net Utility Sales1 | Total Customer Connections2 | | Assets | Net Utility Sales1 | Total Customer Connections2 |

| Electricity | 5,109.1 | | 325.7 | | 306,000 | | | 2,646.0 | | 244.3 | | 267,000 | |

| Natural Gas | 900.2 | | 169.5 | | 371,000 | | | 1,412.3 | | 158.8 | | 370,000 | |

| Water and Wastewater | 846.1 | | 106.4 | | 416,000 | | | 531.7 | | 57.2 | | 170,000 | |

| | | | | | | |

| | | | | | | |

| Other | 230.1 | | 47.9 | | | | 105.3 | | 26.8 | | |

| Total | $ | 7,085.5 | | $ | 649.5 | | 1,093,000 | | | $ | 4,695.3 | | $ | 487.1 | | 807,000 | |

| | | | | | | |

| Accumulated Deferred Income Taxes Liability | $ | 554.6 | | | | | $ | 484.8 | | | |

| | | | | |

| 1 | Net Utility Sales for the six months ended June 30, 2020 and 2021. See Non-GAAP Financial Measures. |

| 2 | Total Customer Connections represents the sum of all active and vacant customer connections. |

The Regulated Services Group aggregates the performance of its utility operations by utility system type – electricity, natural gas, and water and wastewater systems.

The electric distribution systems are comprised of regulated electrical distribution utility systems and serve approximately 306,000 customer connections in the U.S. States of California, New Hampshire, Missouri, Kansas, Oklahoma and Arkansas and in Bermuda.

The natural gas distribution systems are comprised of regulated natural gas distribution utility systems and serve approximately 371,000 customer connections located in the U.S. States of New Hampshire, Illinois, Iowa, Missouri, Georgia, Massachusetts and New York and in the Canadian Province of New Brunswick.

The water and wastewater distribution systems are comprised of regulated water distribution and wastewater collection utility systems and serve approximately 416,000 customer connections located in the U.S. States of Arkansas, Arizona, California, Illinois, Missouri and Texas and in Chile.

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 16 |

2021 Second Quarter and Year-to-Date Usage Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Electric Distribution Systems | Three Months Ended June 30 | | Six Months Ended June 30 |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Average Active Electric Customer Connections For The Period | | | | | | | |

| Residential | 261,200 | | | 227,900 | | | 261,100 | | | 227,800 | |

| Commercial and industrial | 41,900 | | | 38,200 | | | 41,900 | | | 38,100 | |

| Total Average Active Electric Customer Connections For The Period | 303,100 | | | 266,100 | | | 303,000 | | | 265,900 | |

| | | | | | | |

| Customer Usage (GW-hrs) | | | | | | | |

| Residential | 572.3 | | | 512.5 | | | 1,416.2 | | | 1,169.8 | |

| Commercial and industrial | 890.9 | | | 770.2 | | | 1,791.9 | | | 1,593.0 | |

| Total Customer Usage (GW-hrs) | 1,463.2 | | | 1,282.7 | | | 3,208.1 | | | 2,762.8 | |

For the three months ended June 30, 2021, the electric distribution systems' usage totaled 1,463.2 GW-hrs as compared to 1,282.7 GW-hrs for the same period in 2020, an increase of 180.5 GW-hrs or 14.1%. The increase in electricity consumption is primarily due to the acquisition of Ascendant in the fourth quarter of 2020, which contributed 117.9 GW-hrs, increased consumption due to favorable weather at the Granite State and CalPeco Electric Systems, as well as customer growth at the Empire Electric System.

For the six months ended June 30, 2021, the electric distribution systems' usage totaled 3,208.1 GW-hrs as compared to 2,762.8 GW-hrs for the same period in 2020, an increase of 445.3 GW-hrs or 16.1%. The increase in electricity consumption is primarily due to the acquisition of Ascendant in the fourth quarter of 2020, which contributed 234.8 GW-hrs.

| | | | | | | | | | | | | | | | | | | | | | | |

| Natural Gas Distribution Systems | Three Months Ended June 30 | | Six Months Ended June 30 |

| 2021 | | 2020 | | 2021 | | 2020 |

| Average Active Natural Gas Customer Connections For The Period | | | | | | | |

| Residential | 319,600 | | | 317,800 | | | 320,100 | | | 317,900 | |

| Commercial and industrial | 38,100 | | | 37,800 | | | 38,100 | | | 38,000 | |

| Total Average Active Natural Gas Customer Connections For The Period | 357,700 | | | 355,600 | | | 358,200 | | | 355,900 | |

| | | | | | | |

| Customer Usage (One Million British Thermal Units("MMBTU")) | | | | | | | |

| Residential | 2,955,000 | | | 3,391,000 | | | 13,667,000 | | | 13,970,000 | |

| Commercial and industrial | 3,418,000 | | | 4,217,000 | | | 11,720,000 | | | 13,464,000 | |

| Total Customer Usage (MMBTU) | 6,373,000 | | | 7,608,000 | | | 25,387,000 | | | 27,434,000 | |

For the three months ended June 30, 2021, usage at the natural gas distribution systems totaled 6,373,000 MMBTU as compared to 7,608,000 MMBTU during the same period in 2020, a decrease of 1,235,000 MMBTU, or 16.2%. This was primarily due to lower sales driven by warmer weather at the New Brunswick, EnergyNorth, New England and Midstates Gas Systems.

For the six months ended June 30, 2021, usage at the natural gas distribution systems totaled 25,387,000 MMBTU as compared to 27,434,000 MMBTU during the same period in 2020, a decrease of 2,047,000 MMBTU, or 7.5%. This was primarily due to lower sales driven by warmer weather at the New Brunswick, Energy North and New England Gas Systems, as well as lower commercial and industrial customer usage at the Midstates Gas System as a result of the Midwest Extreme Weather Event.

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 17 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Water and Wastewater Distribution Systems | Three Months Ended June 30 | | Six Months Ended June 30 |

| 2021 | | 2020 | | 2021 | | 2020 |

| Average Active Customer Connections For The Period | | | | | | | |

| Wastewater customer connections | 46,500 | | | 45,100 | | | 46,300 | | | 44,900 | |

| Water distribution customer connections | 360,400 | | | 116,600 | | | 358,900 | | | 116,400 | |

| Total Average Active Customer Connections For The Period | 406,900 | | | 161,700 | | | 405,200 | | | 161,300 | |

| | | | | | | |

| Gallons Provided (millions of gallons) | | | | | | | |

| Wastewater treated | 677 | | | 614 | | | 1,340 | | | 1,263 | |

| Water provided | 6,915 | | | 3,796 | | | 13,053 | | | 6,852 | |

| Total Gallons Provided (millions of gallons) | 7,592 | | | 4,410 | | | 14,393 | | | 8,115 | |

For the three months ended June 30, 2021, the water and wastewater distribution systems provided approximately 6,915 million gallons of water to customers and treated approximately 677 million gallons of wastewater. This is compared to 3,796 million gallons of water provided and 614 million gallons of wastewater treated during the same period in 2020, an increase in total gallons provided of 3,182 million, or 72.2%. The increase is primarily due to the acquisition of ESSAL in the fourth quarter of 2020, which contributed 2,705 million gallons of water provided.

For the six months ended June 30, 2021, the water and wastewater distribution systems provided approximately 13,053 million gallons of water to customers and treated approximately 1,340 million gallons of wastewater. This is compared to 6,852 million gallons of water provided and 1,263 million gallons of wastewater treated during the same period in 2020, an increase in total gallons provided of 6,278 million, or 77.4%. The increase is primarily due to the acquisition of ESSAL in the fourth quarter of 2020, which contributed 5,612 million gallons of water provided.

2021 Second Quarter and Year-to-Date Regulated Services Group Operating Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30 | | Six Months Ended June 30 |

| (all dollar amounts in $ millions) | 2021 | | 2020 | | 2021 | | 2020 |

| Revenue | | | | | | | |

| Utility electricity sales and distribution | $ | 280.0 | | | $ | 163.6 | | | $ | 614.0 | | | $ | 344.3 | |

| Less: cost of sales – electricity | (118.9) | | | (42.8) | | | (288.3) | | | (100.0) | |

Net Utility Sales - electricity1 | 161.1 | | | 120.8 | | | 325.7 | | | 244.3 | |

| Utility natural gas sales and distribution | 84.5 | | | 71.0 | | | 269.0 | | | 241.7 | |

| Less: cost of sales – natural gas | (26.1) | | | (19.3) | | | (99.5) | | | (82.9) | |

Net Utility Sales - natural gas1 | 58.4 | | | 51.7 | | | 169.5 | | | 158.8 | |

| Utility water distribution & wastewater treatment sales and distribution | 58.1 | | | 34.9 | | | 112.5 | | | 62.7 | |

| Less: cost of sales – water | (3.4) | | | (3.2) | | | (6.1) | | | (5.5) | |

Net Utility Sales - water distribution & wastewater treatment1 | 54.7 | | | 31.7 | | | 106.4 | | | 57.2 | |

| Gas transportation | 8.3 | | | 6.9 | | | 22.3 | | | 20.9 | |

| Other revenue | 14.0 | | | 3.0 | | | 25.6 | | | 5.9 | |

Net Utility Sales1 | 296.5 | | | 214.1 | | | 649.5 | | | 487.1 | |

| Operating expenses | (144.8) | | | (105.1) | | | (297.9) | | | (213.4) | |

| Other income | 8.4 | | | 3.7 | | | 11.0 | | | 8.0 | |

HLBV2 | 5.8 | | | 1.8 | | | 10.2 | | | 3.5 | |

Divisional Operating Profit1,3 | $ | 165.9 | | | $ | 114.5 | | | $ | 372.8 | | | $ | 285.2 | |

| | | | | |

| 1 | See Non-GAAP Financial Measures. |

| 2 | HLBV income represents the value of net tax attributes monetized by the Regulated Services Group in the period at the Luning and Turquoise Solar Facilities and the Empire Wind Facilities. |

| 3 | Certain prior year items have been reclassified to conform with current year presentation. |

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | |

2021 Second Quarter Operating Results

For the three months ended June 30, 2021, the Regulated Services Group reported an operating profit (excluding corporate administration expenses) of $165.9 million as compared to $114.5 million for the comparable period in the prior year.

Highlights of the changes are summarized in the following table:

| | | | | |

| (all dollar amounts in $ millions) | Three Months Ended June 30 |

Prior Period Divisional Operating Profit1 | $ | 114.5 | |

| Existing Facilities | |

| Electricity: Decrease is due to out of period resettlements related to the Midwest Extreme Weather Event, higher non-pass through fuel costs as well as decreased net sales associated with milder temperatures. | (5.7) | |

| Gas: Increase is primarily due to favourable property tax adjustments at the EnergyNorth and Midstates Gas Systems. | 4.8 | |

| Water | 0.1 | |

| Other: Increase is primarily due to higher earnings from the San Antonio Water System investment and recoverable amounts related to the Midwest Extreme Weather Event. | 6.4 | |

| 5.6 | |

| New Facilities | |

| Electricity: Acquisition of Ascendant (November 2020) and the Empire Wind Facilities (2021). | 23.3 | |

| |

| Water: Acquisition of ESSAL (October 2020). | 8.8 | |

| |

| 32.1 | |

| Rate Reviews | |

| Electricity: Increase is primarily due to the implementation of a Post-Test Year Adjustment Mechanism effective January 2021 at the CalPeco Electric System as well as the implementation of new rates at the Granite State Electric System. | 2.9 | |

| Gas: Increase is primarily due to implementation of new rates at the EnergyNorth and Peach State Gas Systems. | 1.2 | |

| |

| 4.1 | |

| |

Estimated Impact of COVID-19 on comparative period results2 | 9.6 | |

| |

| |

Current Period Divisional Operating Profit1 | $ | 165.9 | |

| | | | | |

| 1 | See Non-GAAP Financial Measures. |

| 2 | The impacts of COVID-19 were estimated by normalizing sales in both periods for changes in weather and attributing the remaining variances to COVID-19. |

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 19 |

2021 Year-to-Date Operating Results

For the six months ended June 30, 2021, the Regulated Services Group reported an operating profit (excluding corporate administration expenses) of $372.8 million as compared to $285.2 million for the comparable period in the prior year.

Highlights of the changes are summarized in the following table:

| | | | | |

| (all dollar amounts in $ millions) | Six Months Ended June 30 |

Prior Period Divisional Operating Profit1 | $ | 285.2 | |

| Existing Facilities | |

| Electricity: Decrease is primarily due to higher non-pass through fuel costs as well as higher maintenance and operating expenses. | (13.3) | |

| Gas: Increase is primarily due to favourable property tax adjustments at the EnergyNorth and Midstates Gas Systems. | 6.8 | |

| Water: Increase is primarily due to increased consumption and growth at the Arizona Water Systems and lower operating expenses at the Park Water System. | 2.2 | |

| |

| Other: Increase is primarily due to higher earnings from the San Antonio Water System investment and recoverable amounts related to the Midwest Extreme Weather Event. | 3.6 | |

| (0.7) | |

| New Facilities | |

| Electricity: Acquisition of Ascendant (November 2020) and the Empire Wind Facilities (2021). | 46.1 | |

| |

| Water: Acquisition of ESSAL (October 2020). | 19.8 | |

| |

| 65.9 | |

| Rate Reviews | |

| Electricity: Increase is due to the implementation of a Post-Test Year Adjustment Mechanism effective January 2021 at the CalPeco Electric System as well as the implementation of new rates at the Granite State Electric System. | 6.3 | |

| Gas: Increase is primarily due to the implementation of new rates at the EnergyNorth and Peach State Gas Systems. | 6.3 | |

| |

| 12.6 | |

| |

Estimated Impact of COVID-19 on comparative period results2 | 9.8 | |

| |

| |

Current Period Divisional Operating Profit1 | $ | 372.8 | |

| | | | | |

| 1 | See Non-GAAP Financial Measures. |

| 2 | The impacts of COVID-19 were estimated by normalizing sales in both periods for changes in weather and attributing the remaining variances to COVID-19. |

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 20 |

Regulatory Proceedings

The following table summarizes the major regulatory proceedings currently underway within the Regulated Services Group:

| | | | | | | | | | | | | | |

| Utility | Jurisdiction | Regulatory Proceeding Type | Rate Request

(millions) | Current Status |

| Completed Rate Reviews | | | | |

| BELCO | Bermuda | GRC | $5.9 | On November 17, 2020, filed its initial revenue allowance application and, in consultation with the Regulatory Authority of Bermuda ("RA"), provided updates to this filing on January 18, 2021 and February 25, 2021. On April 27, 2021, BELCO submitted a revised application to establish an overall revenue requirement of $215.5 million for 2021, increasing authorized revenues by $5.9 million. Additionally, BELCO offered to defer a portion of its revenues from both 2021 and 2022, to be collected over a period of 10 years, beginning in 2022, while maintaining its weighted average cost of capital ("WACC") at 8%. On May 7, 2021, the RA issued a final decision, approving a WACC of 7.5% and authorizing $211.4 million in revenue with $13.4 million in deferred earned revenue to be collected over 5 years at a minimum WACC of 7.5%. The revenue requirement included $71.2 million for fuel and purchased power costs for the period from January 1, 2021 through December 31, 2021. The new rates were effective June 1, 2021. |

| EnergyNorth Gas System | New Hampshire | GRC | $13.5 | EnergyNorth reached a settlement in principle regarding its application filed in July 2020 requesting a permanent increase in annual revenues. The settlement provides for an increase of $1.3 million in distribution revenues effective August 1, 2021 in excess of the previously authorized temporary increase (authorized rates yield an increase of $7.6 million), a step adjustment of $4.0 million also effective August 1, 2021, a second step increase of $3.2 million effective August 1, 2022, and a property tax reconciliation mechanism. Recovery of Granite Bridge feasibility costs, which were included in a supplemental filing in November 2020, were separately litigated in hearings in June 2021. The settlement on all other issues in the rate review was filed by the parties and a hearing was held on July 13, 2021. An order on the settlement agreement was received on July 30, 2021. The order approved the settlement agreement, pending the submission of additional information and a hearing to be submitted as part of the $4.0 million step adjustment for 2021. As a result of the order, the rate increases were implemented on August 1, 2021, with the exception of the 2021 step adjustment, which is expected to be implemented in the fourth quarter of 2021 upon approval by the New Hampshire Public Utilities Commission. A separate order on recovery of litigated Granite Bridge costs is expected by October 2021. |

| Various | Various | GRC | $0.9 | Approval of approximately $0.3 million in rate increases for a wastewater utility. |

| Pending Rate Reviews | | | | |

| ESSAL | Chile | VII Tariff Process | N/A | ESSAL’s VII tariff process began in April 2020 to set rates for the five-year period from September 2021 to September 2026. A tariff decision is expected from the Superintendence of Sanitation Services in the fourth quarter of 2021. |

| | | | | |

| |

| Algonquin Power & Utilities Corp. - Management Discussion & Analysis | 21 |

| | | | | | | | | | | | | | |

| Utility | Jurisdiction | Regulatory Proceeding Type | Rate Request

(millions) | Current Status |