Exhibit 99.1

ALGONQUIN POWER CO.

as Borrower

- and -

ALGONQUIN POWER & UTILITIES CORP.

as covenantor

- and -

THE FINANCIAL INSTITUTIONS LISTED

ON THE SIGNATURE PAGES

as Lenders

- and -

NATIONAL BANK OF CANADA

as Administrative Agent

Financing Arranged by

NATIONAL BANK FINANCIAL

as Sole Lead Arranger and Sole Bookrunner

FOURTH AMENDED AND RESTATED CREDIT AGREEMENT

Dated as of February 14, 2011

FOURTH AMENDED AND RESTATED CREDIT AGREEMENT

TABLE OF CONTENTS

| ARTICLE 1 INTERPRETATION | ||||||||||

1.01 | Defined Terms | 1 | ||||||||

1.02 | Schedules | 29 | ||||||||

1.03 | Business Days | 29 | ||||||||

1.04 | Terms Generally | 29 | ||||||||

1.05 | Headings | 30 | ||||||||

1.06 | Currency References and Calculations | 30 | ||||||||

1.07 | GAAP | 30 | ||||||||

1.08 | Conflicts and Inconsistencies | 30 | ||||||||

1.09 | Entire Agreement | 30 | ||||||||

1.10 | Amended and Restated Agreement | 31 | ||||||||

| ARTICLE 2 CREDIT FACILITIES | ||||||||||

2.01 | Revolving Credit | 31 | ||||||||

2.02 | Revolving Credit Limit | 31 | ||||||||

2.03 | Overdrafts | 31 | ||||||||

2.04 | Mandatory Prepayments and Credit Reductions | 33 | ||||||||

2.05 | Conversions and Continuations of Advances | 35 | ||||||||

2.06 | Standby Fee | 36 | ||||||||

2.07 | Rateable Advances and Payments | 36 | ||||||||

2.08 | Payments under this Agreement | 37 | ||||||||

2.09 | Application of Payments | 38 | ||||||||

2.10 | Netting | 38 | ||||||||

2.11 | Computation of Interest and Fees | 38 | ||||||||

2.12 | Agency Fees | 39 | ||||||||

| ARTICLE 3 CDN. AND US DOLLAR LOANS | ||||||||||

3.01 | Cdn. and US Dollar Loans | 39 | ||||||||

3.02 | Conversion and Continuation Rights | 40 | ||||||||

3.03 | Voluntary Prepayments | 40 | ||||||||

3.04 | Suspension of LIBOR and US Base Rate Borrowings | 41 | ||||||||

3.05 | Interest on Loans | 42 | ||||||||

| (a | ) | Cdn. Prime Rate Loans | 42 | |||||||

| (b | ) | US Base Rate Loans | 42 | |||||||

| (c | ) | LIBOR Loans | 42 | |||||||

| ARTICLE 4 BANKERS’ ACCEPTANCES | ||||||||||

4.01 | Creation and Purchase of Bankers’ Acceptances | 43 | ||||||||

4.02 | Stamping Fee | 44 | ||||||||

4.03 | Conversion and Continuation Rights | 44 | ||||||||

4.04 | Bankers’ Acceptances Unavailable | 45 | ||||||||

| ARTICLE 5 LETTERS OF CREDIT | ||||||||||

5.01 | Letters of Credit | 45 | ||||||||

5.02 | Fees | 46 | ||||||||

5.03 | Participation | 46 | ||||||||

5.04 | Reimbursement Obligations | 47 | ||||||||

5.05 | Dealing with Letters of Credit | 48 | ||||||||

5.06 | Responsibility of Issuing Lender to Other Lenders | 49 | ||||||||

5.07 | Participation in Sanger LC Payment Obligations | 50 | ||||||||

5.08 | Conflict with LC Documents | 51 | ||||||||

5.09 | Survival | 51 | ||||||||

| ARTICLE 6 CONDITIONS PRECEDENT | ||||||||||

6.01 | Conditions Precedent to Initial Borrowing after the Restatement Date | 51 | ||||||||

6.02 | Conditions Precedent to Subsequent Advances | 54 | ||||||||

6.03 | Conditions Precedent to Certain New Advances under the Revolving Credit | 54 | ||||||||

6.04 | Waivers | 55 | ||||||||

| ARTICLE 7 SECURITY | ||||||||||

7.01 | Extent and Priority of Security | 55 | ||||||||

7.02 | Guarantees and Security Documents from New APCO Entities | 55 | ||||||||

7.03 | Registrations, Filings and Delivery of Certificated Capital Stock | 56 | ||||||||

7.04 | Consents Relating to Granting and Realizing on Security | 56 | ||||||||

7.05 | St. Leon Facility | 57 | ||||||||

7.06 | Postponement and Subordination Agreements | 57 | ||||||||

7.07 | Priority of Liens in favour of the Administrative Agent | 57 | ||||||||

| ARTICLE 8 REPRESENTATIONS AND WARRANTIES | ||||||||||

8.01 | Representations and Warranties | 59 | ||||||||

| (a | ) | Status, Power and Qualification | 59 | |||||||

| (b | ) | Valid Authorization | 60 | |||||||

| (c | ) | Management and Supervision of the Obligors | 60 | |||||||

| (d | ) | No Contravention or Consents | 60 | |||||||

| (e | ) | Enforceability | 60 | |||||||

| (f | ) | Business of APUC and other Non-APCO Entities | 60 | |||||||

| (g | ) | Business of APCO Entities | 61 | |||||||

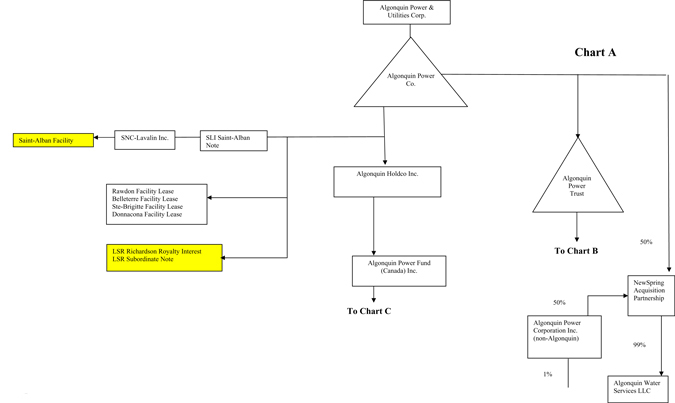

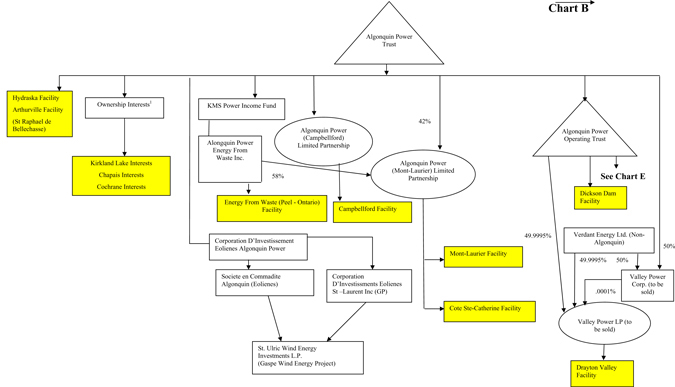

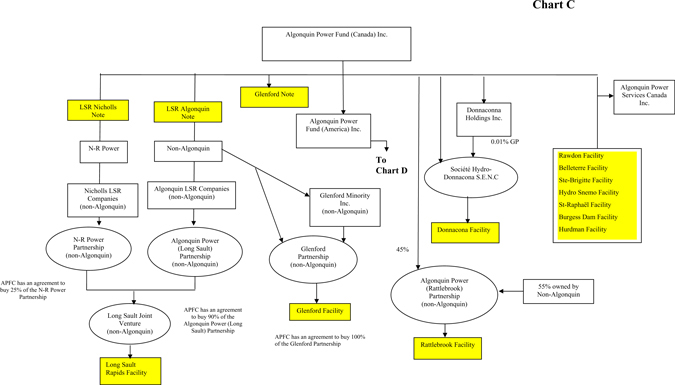

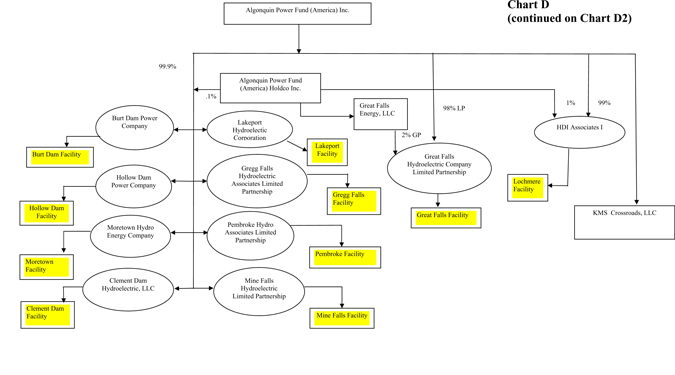

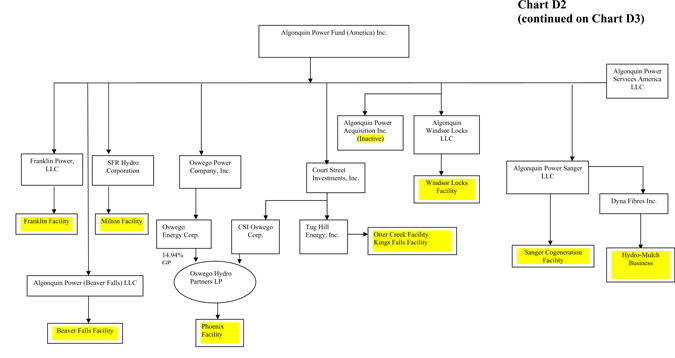

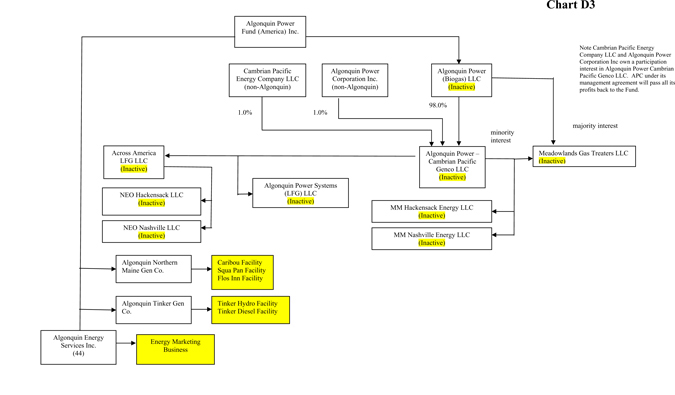

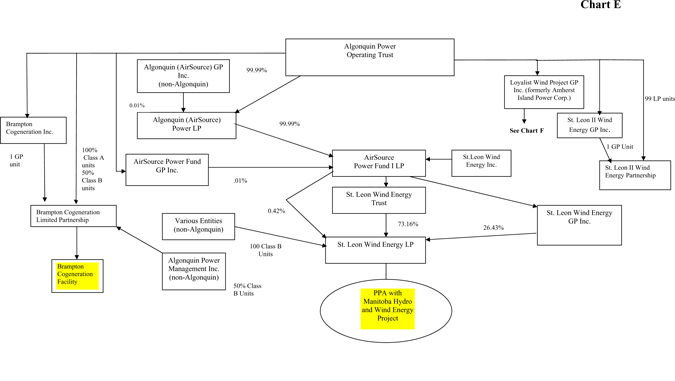

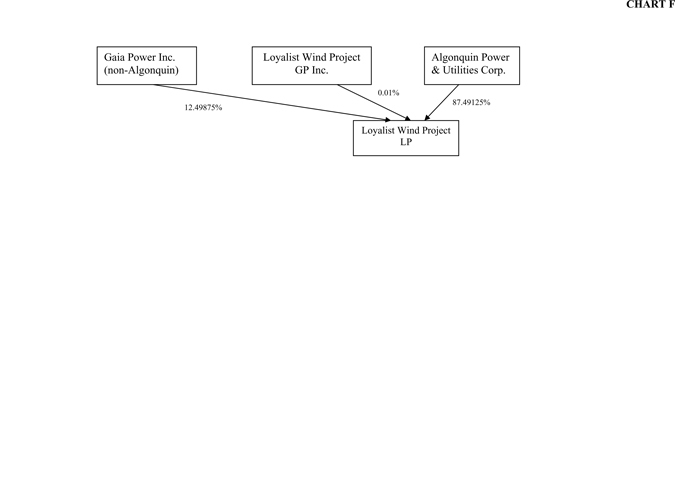

| (h | ) | Organizational Chart and Information Relating to Obligors | 61 | |||||||

| (i | ) | Title to Assets | 62 | |||||||

| (j | ) | Rights to Purchase and Restrictions on Transfers of Capital Stock | 62 | |||||||

| (k | ) | Material Agreements | 62 | |||||||

| (l | ) | Intellectual Property | 62 | |||||||

| (m | ) | Non-Default | 62 | |||||||

| (n | ) | Financial Condition | 63 | |||||||

| (o | ) | Absence of Litigation | �� | 63 | ||||||

| (p | ) | Taxes and Other Statutory Claims | 63 | |||||||

| (q | ) | Compliance with Applicable Laws | 63 | |||||||

- ii -

| (r | ) | Environmental Policy | 63 | |||||||

| (s | ) | Change to Applicable Laws | 64 | |||||||

| (t | ) | Information in Public Filings | 64 | |||||||

| (u | ) | Full Disclosure | 64 | |||||||

| (v | ) | APCO Units | 64 | |||||||

8.02 | Knowledge of the Borrower | 64 | ||||||||

8.03 | Survival of Representations and Warranties | 64 | ||||||||

| ARTICLE 9 COVENANTS | ||||||||||

9.01 | Affirmative Covenants | 65 | ||||||||

| (a | ) | Punctual Payment | 65 | |||||||

| (b | ) | Conduct of Business | 65 | |||||||

| (c | ) | Material Authorizations | 65 | |||||||

| (d | ) | Compliance with Applicable Laws and Material Obligations | 65 | |||||||

| (e | ) | Maintenance of Facilities | 65 | |||||||

| (f | ) | Payment of Taxes and Other Statutory Claims | 66 | |||||||

| (g | ) | Notice of Litigation and Other Matters | 66 | |||||||

| (h | ) | Books and Records and Rights of Examination | 66 | |||||||

| (i | ) | Financial and Other Information | 67 | |||||||

| (j | ) | Net Cash and Bank Accounts | 68 | |||||||

| (k | ) | Insurance | 69 | |||||||

| (l | ) | Information and Rights of Inspection | 69 | |||||||

9.02 | Negative Covenants | 70 | ||||||||

| (a | ) | Indebtedness | 70 | |||||||

| (b | ) | Liens | 70 | |||||||

| (c | ) | Capital Expenditures | 71 | |||||||

| (d | ) | Investments by APCO Entities | 71 | |||||||

| (e | ) | Distributions | 71 | |||||||

| (f | ) | No Mergers or Other Reorganizations | 71 | |||||||

| (g | ) | Sale or Other Disposition | 72 | |||||||

| (h | ) | Material Agreements | 72 | |||||||

| (i | ) | Financial Year | 72 | |||||||

| (j | ) | Business of APUC and other Non-APCO Entities | 72 | |||||||

| (k | ) | Business of APCO Entities | 72 | |||||||

| (l | ) | Matters Affecting Perfection and Security | 73 | |||||||

| (m | ) | New APCO Entities | 73 | |||||||

| (n | ) | No Hostile Acquisitions | 74 | |||||||

| (o | ) | No Speculative Hedging and Form of Hedging Agreements | 74 | |||||||

| (p | ) | Non-Arm’s Length Transactions | 74 | |||||||

9.03 | Financial Covenants | 74 | ||||||||

9.04 | Lenders Entitled to Perform Covenants | 75 | ||||||||

| ARTICLE 10 EVENTS OF DEFAULT | ||||||||||

10.01 | Events of Default | 76 | ||||||||

| (a | ) | Payment Default | 76 | |||||||

| (b | ) | Other Material Covenant Defaults | 76 | |||||||

- iii -

| (c | ) | Other Document Defaults | 76 | |||||||

| (d | ) | Misrepresentation | 77 | |||||||

| (e | ) | Hedging Agreement Defaults | 77 | |||||||

| (f | ) | Change in Enforceability and Priority | 77 | |||||||

| (g | ) | Default under Other Indebtedness | 77 | |||||||

| (h | ) | Winding-up, Liquidation or Dissolution | 78 | |||||||

| (i | ) | Reorganization | 78 | |||||||

| (j | ) | Ceasing to Carry on Business | 78 | |||||||

| (k | ) | Voluntary Insolvency Actions | 78 | |||||||

| (l | ) | Insolvency Proceedings | 78 | |||||||

| (m | ) | Appointment of Receiver | 79 | |||||||

| (n | ) | Encumbrances | 79 | |||||||

| (o | ) | Unpaid Judgments | 79 | |||||||

| (p | ) | Ownership of APCO | 79 | |||||||

| (q | ) | Failure to Remain a Reporting Issuer in Good Standing | 79 | |||||||

| (r | ) | Material Adverse Change | 80 | |||||||

10.02 | Rights and Remedies | 80 | ||||||||

| (a | ) | Termination of Commitments | 80 | |||||||

| (b | ) | Acceleration | 80 | |||||||

| (c | ) | Cash Collateral | 80 | |||||||

| (d | ) | Enforcement of Rights | 81 | |||||||

10.03 | Remedies Not Exclusive | 81 | ||||||||

| ARTICLE 11 [INTENTIONALLY DELETED] | ||||||||||

| ARTICLE 12 THE AGENT AND THE LENDERS | ||||||||||

12.01 | Authorization and Action | 81 | ||||||||

12.02 | No Liability | 82 | ||||||||

12.03 | Accommodations by Administrative Agent | 83 | ||||||||

12.04 | Security and Payments | 83 | ||||||||

12.05 | Credit Decisions | 85 | ||||||||

12.06 | Indemnification | 85 | ||||||||

12.07 | No Implied Liability to Other Lenders | 85 | ||||||||

12.08 | Successor Administrative Agents | 86 | ||||||||

12.09 | Secured Hedging Agreements | 86 | ||||||||

12.10 | Continuing Secured Hedging Agreements | 86 | ||||||||

| ARTICLE 13 MISCELLANEOUS | ||||||||||

13.01 | Amendment | 87 | ||||||||

13.02 | Waiver | 88 | ||||||||

13.03 | Evidence of Indebtedness and Borrowing Notices | 88 | ||||||||

13.04 | Notices | 88 | ||||||||

13.05 | Confidentiality | 89 | ||||||||

13.06 | Costs, Expenses and Indemnity | 90 | ||||||||

13.07 | Environmental Indemnity | 91 | ||||||||

13.08 | Taxes and Other Taxes | 91 | ||||||||

- iv -

13.09 | Survival of Indemnities | 92 | ||||||||

13.10 | Successors and Assigns | 92 | ||||||||

13.11 | Right of Set-off | 96 | ||||||||

13.12 | Judgment Currency | 96 | ||||||||

13.13 | Interest on Overdue Amounts Generally | 96 | ||||||||

13.14 | Survival | 97 | ||||||||

13.15 | Governing Law | 97 | ||||||||

13.16 | Most Favored Lender Provision | 97 |

- v -

FOURTH AMENDED AND RESTATED CREDIT AGREEMENT

Agreement made as of February 14, 2011 between (i) National Bank of Canada, one of the chartered banks of Canada, as Administrative Agent; (ii) the financial institutions listed on the signature pages as Lenders; and (iii) Algonquin Power Co. (formerly named Algonquin Power Income Fund), a trust created and existing under the laws of the Province of Ontario, as Borrower.

For good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE 1

INTERPRETATION

| 1.01 | Defined Terms |

In this Agreement:

“Advance” means a Loan, Bankers’ Acceptance or Letter of Credit, depending upon the context, made to, or accepted or issued for the account of, the Borrower by a Lender under the Revolving Credit;

“Affiliate” means with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified;

“Administrative Agent” and“Agent” means National Bank of Canada, as administrative agent for the Lenders under this Agreement and any successor appointed pursuant to Section 12.08;

“Agreement” means this agreement, including the schedules hereto, as it may from time to time be amended, supplemented or otherwise modified and “herein”, “hereof”, “hereunder” and like expressions refer to this Agreement and not to any particular provisions hereof;

“APCO” means Algonquin Power Co., a trust formed and existing under the laws of the Province of Ontario;

“APCO Trust Declaration” means the amended and restated declaration of trust dated as of May 26, 2004, amending and restating the declaration of trust creating APCO and providing for certain matters relating to its undertaking and governance dated as of September 8, 1997, as amended by Extraordinary Resolutions of the unitholders dated as of December 18, 1998, June 1, 2000, May 24, 2001, May 23, 2002, June 26, 2003, May 26, 2004, April 26, 2005, April 24, 2008, July 27, 2009 and June 8, 2010, as

such declaration may from time to time be further amended, supplemented or otherwise modified;

“APCO Entity” means APCO or any Person Controlled by APCO, other than an Inactive APCO Entity;

“APCO Unit Holder” means any Person that holds or owns any Units of APCO;

“Applicable Laws” means in respect of any Person, property, transaction or event, all applicable federal, provincial, state, local, municipal and regional laws, statutes, ordinances, rules, by-laws, policies, guidelines, treaties and all applicable regulations, guidelines, directives, standards, requirements, judgments, orders, decisions, rulings, permits, authorizations, injunctions, awards and decrees of any Governmental Authority and all applicable common laws and laws of equity;

“Applicable Margin” applying to a Loan or Bankers’ Acceptance and the “Applicable Rate” applying to the LC Issuance Fee payable in respect of a Letter of Credit or Standby Fees shall, subject to the following provisions of this definition, during a particular Fiscal Quarter (in this definition, the “Relevant Fiscal Quarter”) be determined by reference to the following table based on the Leverage Ratio (in this definition, the “Relevant Leverage Ratio”) as at the end of the 12 month period (in this definition, the “Relevant Calculation Period”) ending on the last day of the immediately preceding Fiscal Quarter:

Level | Leverage Ratio | Cdn. Prime Rate Loans, | Bankers’ Acceptances, | Performance Letters of | Standby Fees | |||||

I | £ 1.5 | 1.00% per annum | 2.00% per annum | 1.34% per annum | 0.50% per annum | |||||

II | > 1.5 and£ 2.0 | 1.25% per annum | 2.25% per annum | 1.50% per annum | 0.5625% per annum | |||||

III | > 2.0 and£ 3.0 | 1.50% per annum | 2.50% per annum | 1.67% per annum | 0.625% per annum | |||||

IV | > 3.0 and£ 3.5 | 1.875% per annum | 2.875% per annum | 1.92% per annum | 0.71875% per annum | |||||

V | > 3.5 | 2.25% per annum | 3.25% per annum | 2.17% per annum | 0.8125% per annum |

The Relevant Leverage Ratio shall be (i) the Leverage Ratio as calculated and determined in the Compliance Certificate (in this definition, the “Relevant Compliance

- 2 -

Certificate”) delivered by the Borrower to the Administrative Agent in respect of the Relevant Calculation Period in accordance with Section 9.03(2) with such calculated Leverage Ratio to be applied on the second day after delivery of the Relevant Compliance Certificate; or (ii) if and for so long as the Borrower fails to deliver the Relevant Compliance Certificate in accordance with Section 9.03(2), be deemed to be greater than 3.5 to 1.00. In the event that a new Applicable Margin or new Applicable Rate comes into effect prior to the expiration of the term of a BA or Letter of Credit, the Administrative Agent shall promptly determine and notify the relevant Lenders and the Borrower of any adjustment required as a result thereof . The parties agree that the Applicable Margins and Applicable Rates for the period commencing on the Restatement Date and ending on March 31, 2011 shall be rates set out on Level III of the preceding table;

“Applicable Securities Laws” means the Applicable Laws applying to APUC as a “Reporting Issuer” under theSecurities Act (Ontario);

“Approved Fund” means any Fund that is administered or managed by (i) a Lender, (ii) an Affiliate of a Lender or (iii) a Person or an Affiliate of a Person that administers or manages a Lender;

“Approved Reinvestment” means (i) in the case of the Net Proceeds of a Capital Transaction of the type referred to in clause (iii) of the definition thereof, the use of such Net Proceeds to rebuild, repair or replace the property lost or damaged in accordance with the terms of Section 9.01(k), (ii) any Permitted Acquisition by an APCO Entity or (iii) any other Investment by an APCO Entity that is forecasted by APCO, acting reasonably, to increase the Consolidated Adjusted EBITDA of APCO during the 3 year period following the Investment;

“APUC” means Algonquin Power & Utilities Corp.;

“APUC Entity” means APUC and any Person Controlled by APUC;

“Assignment and Assumption” means an assignment and assumption entered into by a Lender and an Eligible Assignee and accepted by the Administrative Agent, in substantially the form of Schedule “I” or any other form approved by the Administrative Agent;

“Associate” means an “associate” as defined in theSecurities Act (Ontario);

“Authorized Representative” of the Borrower or APUC means its Chief Executive Officer or Chief Financial Officer;

- 3 -

“Available Commitment” means the amount obtained by (i) subtracting the aggregate Outstanding Principal Amount of the Revolving Credit; from (ii) the Revolving Credit Limit;

“Bankers’ Acceptance”, “BA” or “Acceptance” means (i) with respect to any BA Lender, a non-interest bearing bill of exchange, in the form customarily used by the Lender, drawn on the Lender by the Borrower and accepted by the Lender under the Revolving Credit and includes a depository bill under theDepository Bills and Notes Act (Canada); and (ii) with respect to any Non-BA Lender, means a BA Equivalent Note;

“BA Discount Proceeds” means with respect to any Bankers’ Acceptance, an amount calculated on the applicable Borrowing Date which is (rounded to the nearest full cent) equal to the face amount of such Bankers’ Acceptance divided by the sum of one plus the product of (i) the BA Discount Rate multiplied by (ii) a fraction, the numerator of which is the term of such Bankers’ Acceptance and the denominator of which is 365;

“BA Discount Rate” means the average rate for bankers’ acceptances denominated in Cdn. Dollars, in an amount and having a maturity comparable to the Bankers’ Acceptances requested by the Borrower, which appears on the Reuters Screen CDOR page as of 10:00 a.m., Montreal time, on the Borrowing Date. In the event that the CDOR page is not available for determining the BA Discount Rate for any reason, the rate shall be determined by the Administrative Agent, acting reasonably;

“BA Equivalent Note” means a non-interest bearing promissory note issued under the Revolving Credit in favour of a Non-BA Lender in the form of Schedule “D” or in such other form as the Non-BA Lender may customarily use for bankers’ acceptance equivalent notes and includes a depository note under the Depository Bills and Notes Act (Canada);

“BA Lender” means any Lender which is a bank chartered under the Bank Act (Canada);

“Borrower” means Algonquin Power Co.;

“Borrowing” means the making, Conversion or Continuation of any Advances;

“Borrowing Date” means the date on which a Borrowing occurs;

“Borrowing Notice” means a duly completed notice in the form attached hereto as Schedule “B” executed and delivered by the Borrower in respect of a proposed Borrowing;

- 4 -

“Business Day” means a day (other than a Saturday or Sunday) which is not a legal holiday or a day on which banking institutions are authorized by Applicable Laws or local proclamation to close in Montreal or Toronto, Canada, and (i) in respect of Advances by way of LIBOR Loans and payments in respect thereof, a day that is also a day that is not a legal holiday or day on which banking institutions are authorized by Applicable Laws or local proclamation to close in New York, U.S.A. or London, England; and (ii) with respect to any transaction requiring a transfer of US Dollars, a day which is not a legal holiday or day on which banks are authorized by Applicable Laws or local proclamation to close in New York, United States of America;

“Canadian Dollars”,“Cdn. Dollars” and“Cdn. $” each means the lawful currency of Canada;

“Capital Lease Obligation” of any Person means the obligation to pay rent or other payment amounts under a lease of (or other arrangement conveying the right to use) real or personal property of such Person which is required to be classified and accounted for as a capital lease on the balance sheet of such Person in accordance with GAAP;

“Capital Stock” means (i) in the case of a corporation, capital stock, (ii) in the case of an association or business entity, any and all shares, interests, participations, rights or other equivalents (however designated) of capital stock, (iii) in the case of a partnership, partnership interests (whether general or limited), (iv) in the case of a limited liability company, membership interests; (v) any other interest or participation that confers on a Person the right to receive a share of the profits and losses of, or distributions of assets of, the issuing Person; and (vi) any agreement, option, warrant or other right to acquire any property described in the preceding clauses (i), (ii) (iii), (iv) or (v) or any securities convertible into or other rights to acquire any such property;

“Capital Transaction” means (i) any Transfer or series of related Transfers of any property of any APCO Entity to a third party that generates Net Proceeds in excess of $1,000,000, other than in the ordinary course of business; (ii) any expropriation or other taking of any property of any APCO Entity by any Governmental Authority; (iii) the destruction or damage of any property of any APCO Entity and the payment of insurance proceeds in respect thereof in an amount equal to or greater than $1,000,000 (but only to the extent that such proceeds do not relate to business interruption insurance); (iv) any financing or series of related financings of any property of any APCO Entity, other than (A) the refinancing of any existing Permitted Indebtedness provided that the amount of Indebtedness incurred in such refinancing is not increased; and (B) financings between APCO Entities or repayments of Indebtedness owing by one APCO Entity to another APCO Entity; (v) any prepayment or other payment made prior to a scheduled due date under any Cash Flow Agreement to any

- 5 -

APCO Entity; or (vi) any Distribution to any APCO Entity, in respect of capital (other than from another APCO Entity);

“Cash Collateral” has the meaning set out in Sections 2.04(1) and 2.04(5);

“Cash Collateralized Obligations” has the meaning set out in Sections 2.04(1) and 2.04(5);

“Cash Flow Agreement” means any agreement, instrument or document creating any rights to receive, or securing or determining the priority of payment of, any cash in favour of any Principal Obligor, including any agreement creating “accounts” as defined under thePersonal Property Security Act (Ontario) or “payment intangibles” as defined in theUniform Commercial Code of the State of New York, or any rights to funds on deposit in bank and other accounts;

“Cdn. Prime Rate” at any time means the greater of (a) the rate of interest per annum quoted or announced by the Administrative Agent, in the City of Montreal as the reference rate of interest for the determination of interest rates that the Administrative Agent charges to customers of varying degrees of creditworthiness for loans in Cdn. Dollars made by the Administrative Agent in Canada and commonly known as the “prime rate” of the Administrative Agent; and (b) the sum of (i) the average rate for bankers’ acceptances denominated in Cdn. Dollars having a maturity of 1 month which appears on the Reuters Screen CDOR Page as of 10:00 a.m. (Montreal time) on the date of determination, as reported by the Administrative Agent (and if such screen is not available, any successor or similar service as may be selected by the Administrative Agent); and (ii) 1.00% per annum;

“Cdn. Prime Rate Loan” means a Loan in Cdn. $, bearing interest at a rate of interest based on the Cdn. Prime Rate;

“Claim” means any claim of any nature whatsoever including any demand, cause of action, suit or proceeding;

“Collateral” means all present and after-acquired property of the APCO Entities, other than Excluded Property, and all present and future issued and outstanding Capital Stock of APCO, including all Units of APCO currently held by APUC;

“Collateral Covenant Agreement” means an agreement, in form and substance satisfactory to the Administrative Agent, acting reasonably, pursuant to which all APCO Entities (other than the Borrower) agree, among other things, to perform and observe covenants that the Borrower has agreed to cause them to perform and observe under this Agreement;

- 6 -

“Combined Priority Debt” means, without duplication and excluding (i) all Obligations under this Agreement, (ii) all Indebtedness under any Refinancing Debt Issues and (iii) all future income taxes, the aggregate amount of: (A) all debts, liabilities and obligations which in accordance with GAAP would be recorded as a liability on the balance sheet of any APCO Entity subsisting under the laws of, or owning real or tangible property located in, any of the United States of America; and (B) all debts, liabilities and obligations the payment or performance of which is secured by a Lien in favour of Person, other than the Administrative Agent;

“Commitment” of a Lender in respect of the Revolving Credit means the amount set out as such in the attached Schedule “A” as adjusted from time to time in accordance with this Agreement;

“Common Control Facility” means a Power Generation Facility over which the Borrower, as determined by the Majority Lenders, acting reasonably, exerts significant influence over its management and operation, through management agreements or otherwise, and at the date hereof means the facilities described as the “Campbellford Facility” and the “Rattlebrook Facility” in written correspondence of the Borrower to the Administrative Agent prior to the date hereof;

“Compliance Certificate” means a duly completed certificate, executed and delivered by an Authorized Representative of APUC and an Authorized Representative of the Borrower, in substantially the form of the certificate attached hereto as Schedule “E”;

“Consolidated Adjusted EBITDA” of APCO for any period means (i) the Consolidated EBITDA of APCO for the period, plus (ii) principal payments received by APCO during the period on a consolidated basis from Persons that are not APCO Entities;

“Consolidated Amortization Expense” of a Person for any period means the amortization expenses of the Person for the period, on a consolidated basis, as determined in accordance with GAAP;

“Consolidated Capital of APUC” means the aggregate, as at the date of determination, of (i) Consolidated Indebtedness of APUC; (ii) consolidated shareholders’ equity of APUC; and (iii) the aggregate outstanding principal amount of all Convertible Debentures of APUC;

“Consolidated Capital Expenditures” of a Person for a period means the consolidated capital expenditures of the Person for the period, as determined in accordance with GAAP, excluding expansionary capital expenditures funded from the proceeds of Permitted Indebtedness;

- 7 -

“Consolidated Depreciation Expense” of a Person for any period means the depreciation expenses of the Person for the period, on a consolidated basis, as determined in accordance with GAAP;

“Consolidated EBITDA” of a Person means, for any period, Consolidated Net Income of the Person plus, without duplication, (i) Consolidated Interest Expense of the Person, (ii) Consolidated Income Tax Expense of the Person, (iii) Consolidated Depreciation Expense of the Person, and (iv) Consolidated Amortization Expense of the Person and shall exclude, without duplication, (v) foreign exchange gains and losses of the Person for such period (vi) non-cash items of the Person for such period and (vii) other extraordinary, non-recurring or unusual items of the Person for such period, all as determined for the period in accordance with GAAP;

“Consolidated Entity” with respect of any Person (in this definition the “parent”) means any other Person, the accounts of whom are or should be consolidated in accordance with GAAP with those of the parent in the consolidated financial statements of the parent, prepared as of the relevant date;

“Consolidated Fixed Charges” of a Person for any period means, the aggregate of (i) all Consolidated Interest Expenses of the Person for such period; (ii) all regularly scheduled principal or capital lease payments of the Person for such period determined on a consolidated basis, and (iii) all payments of the Person in respect of preference shares or other like Capital Stock for such period;

“Consolidated Income Tax Expense” of a Person for any period, means the aggregate amount of any income tax expense of the Person for the period, as determined in accordance with GAAP;

“Consolidated Indebtedness” of a Person means Indebtedness of the Person, other than Convertible Debentures, determined on a consolidated basis in accordance with GAAP;

“Consolidated Interest Expense” of a Person means, for any period, without duplication, interest expense of the Person determined on a consolidated basis as the same would be set forth or reflected in a consolidated statement of earnings of the Person and, in any event shall include (i) all interest accrued or payable in respect of such period, including capitalized interest; (ii) all fees (including standby, letter of credit, Guarantee, commitment and bankers’ acceptance fees, but excluding any and all underwriting and arrangement fees paid or payable by the Person for the establishment of any credit facilities with the Person’s bankers from time to time) accrued or payable in respect of such period and which relate to any indebtedness or credit agreement, prorated (as required) over such period; (iii) any difference between the face amount and the discount proceeds of any bankers’ acceptances, commercial paper and other obligations issued at a discount, prorated (as required) over such period; and (iv) all net amounts

- 8 -

charged or credited to interest expense under any Hedging Agreements in respect of such period;

“Consolidated Net Income” of a Person for any period, means the net income (or deficit) after taxes of the Person, as would appear on the consolidated statement of income of the Person for the period, prepared in accordance with GAAP;

“Continuation” means (i) the continuation of a Loan as a LIBOR Loan; or (ii) the rollover of any Bankers’ Acceptance into one or more new Acceptances;

“Control” by a Person of another Person (in this definition a “controlled entity”) means the beneficial ownership by the Person at the relevant time of Capital Stock in the controlled entity or other rights in circumstances where it can reasonably be expected that the Person is entitled to elect or appoint a majority of the directors, trustees, general partners or other comparable Persons of the controlled entity or to otherwise direct the affairs of the controlled entity and a Person shall be deemed to Control a controlled entity if the Person is required, in accordance with GAAP, to include more than 50% of the income of the controlled entity in its consolidated financial statements and the words “Controlled by”, “Controlling” and similar words have corresponding meanings. The Person who Controls a controlled entity shall be deemed to Control a Person Controlled by the controlled entity and so on;

“Conversion” means (i) the conversion of a Loan from one type to another or to any Bankers’ Acceptances; or (ii) the conversion of any Bankers’ Acceptances to a Loan;

“Conversion Date” means the date on which the Conversion of an Advance is made;

“Convertible Debentures” means any Indebtedness (i) the principal amount of which and the interest on which may be paid in full by the issuer, at its option, in Capital Stock of the issuer; (ii) if issued by an APCO Entity, the payment of which is unsecured and subordinated to the payment of the Obligations; and (iii) if issued by an APCO Entity, the principal portion of which is not due and payable or capable of becoming due and payable (whether by operation of an acceleration clause or otherwise), in whole or in part, prior to the Maturity Date;

“corporation” means a corporation, company, limited liability company or other body corporate;

“Debt Issue” means the issuance by the Borrower or any other APCO Entity of any notes, debentures, bonds or other like instruments evidencing Indebtedness of the issuer, to or for the benefit of Persons, other than Related Parties;

- 9 -

“Distributable Cash” for any Fiscal Quarter means, without duplication, the Adjusted EBITDA of the Borrower for the Fiscal Quarter minus (i) the consolidated capital maintenance expenditures of the Borrower during the Fiscal Quarter, minus (ii) the cash Taxes of the Borrower for the Fiscal Quarter; minus (iii) the consolidated principal payments made by the Borrower on Indebtedness during the Fiscal Quarter; minus (iv) the Consolidated Interest Expense of the Borrower for the Fiscal Quarter; and plus or minus (v) any change in the consolidated working capital of the Borrower from the previous Fiscal Quarter;

“Default” means the occurrence of any event that with notice, the lapse of time or both would constitute an Event of Default;

“Defaulting Lender” means any Lender that has wrongfully refused to make available its rateable portion of any Loan pursuant to Section 5.04(1) or 5.07(1) or to fund any Required Overdraft Repayment Loan pursuant to Section 2.03(3);

“Designated Cash Flow Agreements” means (i) each Cash Flow Agreement (or group of related Cash Flow Agreements) providing for aggregate annual payments from a non-APCO Entity to any APCO Entity of more than Cdn. $2,500,000; and (ii) such other Cash Flow Agreements as may be designated by the Lenders from time to time as “Designated Cash Flow Agreements” for purposes hereof;

“Directly Owned Facility” means any Power Generation Facility having one or more Direct Owners that are APCO Entities that in aggregate have a direct beneficial ownership interest in the Power Generation Facility of more than 50%;

“Direct Owner” as used in the context of any Power Generation Facility means a Person that has a direct beneficial ownership interest in the Power Generation Facility;

“Distribution” means (i) any payment, dividend or other distribution on or in respect of any Capital Stock in any APCO Entity; and (ii) any payment to purchase, redeem, retire or acquire any Capital Stock in any APCO Entity;

“Documents” means this Agreement, the LC Documents, the Secured Hedging Agreements, the Security Documents the Guarantees delivered by the APCO Entities in favour of the Administrative Agent, the limited recourse Guarantee delivered by any Limited Recourse Obligor in favour of the Administrative Agent and all other present and future agreements, instruments and documents executed and delivered by any APCO Entities or APCO Unit Holders in favour of the Administrative Agent or any Lenders in connection with the transactions contemplated thereby;

“Draft” means a depository bill within the meaning of the Depository Bills and Notes Act (Canada) or a bill of exchange within the meaning of the Bills of Exchange Act (Canada), in each case, drawn by the Borrower on a Lender and bearing

- 10 -

such distinguishing letters and numbers as the Lender may determine, but which has not been completed as to the payee or accepted by the Lender;

“Eligible Assignee” means any Person, other than an individual, an APCO Entity, an APCO Unit Holder, any Affiliate of an APCO Entity, any APCO Unit Holder or, prior to an Event of Default that is continuing, any competitor of any APCO Entity or any Affiliate of any competitor of any APCO Entity;

“Environmental Laws” means all Applicable Laws pertaining to environmental or occupational health and safety matters, in effect as at the date hereof and as may be brought into effect or amended at any time hereafter, including, without limitation, those pertaining to reporting, licensing, permitting, investigation, remediation and clean-up in connection with any presence or Release of a Hazardous Substance or relating to the manufacture, processing, distribution, use, treatment, storage, disposal, transportation or handling of a Hazardous Substance;

“Equivalent Cdn. Dollar Amount” means, on any day, with respect to any amount in US Dollars, the amount of Cdn. Dollars that would be required to purchase the amount of US Dollars, using the rate quoted by the Bank of Canada as the daily noon rate for conversion of US Dollars into Cdn. Dollars on the Business Day immediately preceding the day in question;

“Equivalent US Dollar Amount” means, on any day, with respect to any amount in Cdn. Dollars, the amount of US Dollars that would be required to purchase the amount of Cdn. Dollars, using the rate quoted by the Bank of Canada as the daily noon rate for conversion of Cdn. Dollars into US Dollars on the Business Day immediately preceding the day in question;

“Event of Default” has the meaning ascribed thereto in Section 10.01;

“Excluded Property” of a Person means all present and after-acquired Special Property of the Person, other than Special Property subject to any Liens held by or for the benefit of any Related Parties of the Person. For greater certainty Excluded Property of a Person shall not include any property (i) from and after it ceases to qualify as Special Property of the Person; or (ii) derived directly or indirectly from any dealing with Excluded Property of the Person, unless the property so derived would qualify as Excluded Property of the Person;

“Excluded Taxes” means, with respect to the Administrative Agent, any Lender or any other recipient of any payment to be made by or on account of any obligation of the Borrower hereunder, income or franchise Taxes imposed on (or measured by) its taxable income or capital Taxes imposed on (or measured by) its taxable capital, in each case by Canada, or by the jurisdiction under the Laws of which such recipient is organized or in which its principal office is located.

- 11 -

“Existing Letters of Credit” means the Letters of Credit described in the attached Schedule “J”;

“Federal Funds Rate” means for any day, a fluctuating interest rate per annum equal to the weighted average of the rates on overnight federal funds transactions with members of the Federal Reserve System arranged by federal funds brokers as published for such day (or, if such day is not a Business Day, for the preceding Business Day) by the Federal Reserve Bank of New York or, for any day on which that rate is not published for that day by the Federal Reserve Bank of New York, the simple average of the quotations for that day for such transactions received by the Administrative Agent from 3 federal funds brokers of recognized standing selected by the Administrative Agent;

“Finance Parties” means the Administrative Agent and the Lenders;

“Financial Guarantee” means a Guarantee of Indebtedness;

“Financial Letter of Credit” means a Letter of Credit that is a “direct credit substitute” within the meaning of the Guideline A-1 – Capital Adequacy Requirement of the Office of the Superintendent of Financial Institutions Canada, as determined by the Issuing Lender (“direct credit substitutes” include standby letters of credit serving as financial guarantees);

“Fiscal Quarter” means the 3 month period ending on each of March 31, June 30, September 30 or December 31 during a Fiscal Year;

“Fiscal Year” means the fiscal year of the Borrower ending on December 31;

“Fixed Charge Ratio” has the meaning set out in Section 9.03(1)(a);

“Fund” means any Person (other than a natural person) that is (or will be) engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in the ordinary course of its business;

“Funding Notice” has the meaning set out in Section 2.03(2);

“Funding Shortfall” has the meaning set out in Section 2.03(3)

“GAAP” means generally accepted accounting principles for financial reporting in the United States of America, as determined by the Financial Accounting Standards Board or any successor institute;

“Glenford Facility” means the 4,950 KW hydro-electric facility on the Ste. Anne River near the Village of Ste-Christine d’Auvergne, Quebec;

- 12 -

“Glenford Senior Debt” means the financing in the original principal amount of $6,900,000 provided by Corpfinance International Limited to Société en Commandite Chute Ford, a Quebec limited partnership pursuant to a credit agreement made as of November 15, 1994 or any Indebtedness incurred in refinancing such Indebtedness provided that the amount thereof is not increased;

“Governmental Authority” means any government, parliament, legislature or commission or board of government, parliament or legislature, or any political subdivision thereof, or any quasi-governmental authority, or any court or, without limitation of the foregoing, any other law, regulation or rule-making entity, including, any central bank, fiscal or monetary authority or authority regulating financial institutions, having or purporting to have jurisdiction in the relevant circumstances, or any Person acting or purporting to act under the authority of any of the foregoing, including, any arbitrator, or any other authority charged with the administration or enforcement of Applicable Laws;

“Guarantee” by any Person means any obligation, contingent or otherwise, of such Person guaranteeing or having the economic effect of guaranteeing any debts, liabilities or obligations (in this definition, collectively “debt”) of any other Person (in this definition, the “primary obligor”) in any manner, whether directly or indirectly, and including, without limitation, any lien on the assets of such Person securing obligations of the primary obligor and any obligation of such Person (i) to purchase or pay (or advance or supply funds for the purchase or payment of) such debt or to purchase (or to advance or supply funds for the purchase or payment of) any security for the payment of such debt, (ii) to purchase property, securities or services for the purpose of assuring the holder of such debt of the payment of such debt, or (iii) to maintain working capital, equity capital or other financial statement condition of liquidity of the primary obligor so as to enable the primary obligor to pay such debt (and “Guaranteed” and “Guaranteeing” shall have meanings correlative to the foregoing); provided, however, that a Guarantee by any Person shall not include endorsements by such Person for collection or deposit, in either case, in the ordinary course of business. The amount of a Guarantee shall, subject to any limitations set out therein, be equal to the amount of the Guaranteed obligations and if the amount of the Guaranteed obligations is not determinable, an estimate of the Guaranteed obligations, as determined by APCO, acting reasonably;

“Hedging Agreements” means any agreement or arrangement designed to protect a Person against fluctuations in interest rates, currency exchange rates or commodity prices;

“Inactive APCO Entities” means Across America LFG LLC, Algonquin Power – Cambrian Pacific Genco LLC, Algonquin Power (Biogas) LLC, Algonquin Power Systems (LFG) LLC, Algonquin Water Resources of North Carolina, Inc., Meadowlands Gas Treaters LLC, MM Hackensack Energy LLC, MM Nashville Energy

- 13 -

LLC, Neo Hackensack, LLC, NEO Nashville LLC, Algonquin Power Acquisition Inc. and such other Persons as may be designated as such from time to time pursuant to a written agreement between the Majority Lenders and APCO;

“Income Tax Act” means theIncome Tax Act (Canada);

“Indebtedness” of any Person means, at any time without duplication and whether or not contingent (i) any obligation of such Person for borrowed money, including the principal thereof, premium thereon (if any), interest thereon and all other fees, charges, costs and expenses on or related thereto; (ii) any obligation of such Person evidenced by bonds, debentures, notes or other similar instruments, including, any such obligations incurred in connection with the acquisition of property, assets or businesses; (iii) any reimbursement obligation of such Person with respect to letters of credit, bankers’ acceptances or similar facilities issued for the account of such Person; (iv) any obligation of such Person issued or assumed as the deferred purchase price of property or services; (v) any Capital Lease Obligation of such Person; (vi) the amount for which any Capital Stock in such Person may be redeemed if the holders thereof are entitled at such time to require such redemption, or if such Person is otherwise obligated at such time to make such redemption, whether on notice or otherwise; (vii) any net payment obligation of the Person under any Hedging Agreement at the time of determination; and (viii) any obligation of the type referred to in clauses (i) through (vii) of this paragraph of another Person and all dividends of another Person the payment of which, in either case, such Person has Guaranteed. The amount of Indebtedness of any Person at any date shall be the outstanding balance at such date of all unconditional obligations as described above and the maximum liability of any contingent obligations in respect thereof at such date;

“Indemnified Taxes” means Taxes other than Excluded Taxes.

“Interbank Rate” as it relates to any obligation owing to or by the Administrative Agent, means an annual rate of interest fluctuating with and at all times equal to the interbank rate for overnight funds of the Administrative Agent in the currency of the obligation;

“Investment” means any loans, advances or Financial Guarantees or other extensions of credit or capital expenditures or contributions to (by means of Transfers of property, money or otherwise) or any purchase of any Capital Stock or Indebtedness of any Person or the acquisition of all or any material part of the property of any Person or of any business carried on by any Person;

“Issuing Lender” means National Bank of Canada, its successors and assigns;

“LC Documents” means the standard form application and other agreements customarily obtained by the Issuing Lender in connection with the issuance of a Letter of Credit;

- 14 -

“LC Fronting Fee” means, with respect to any Letter of Credit issued by the Issuing Lender, 0.25% of the Principal Amount of the Letter of Credit;

“LC Issuance Fee” has the meaning set out in Section 5.02;

“LC Obligations” means, at any time and as applied to any Letter of Credit, the sum of (i) the maximum amount which is, or at any time thereafter may become, available to be drawn under the Letter of Credit, assuming compliance with all requirements for drawings plus (ii) the aggregate amount of all drawings under the Letter of Credit honoured by the Issuing Lender but not reimbursed by the Borrower;

“Lenders” means the Persons from time to time parties to this Agreement as Lenders, including, National Bank of Canada in its respective capacities as a Lender, the Issuing Lender, the Overdraft Lender and the Sanger Lender together with its successors and assigns in such capacities;

“Letter of Credit” means an Existing Letter of Credit or a standby letter of credit or bank guarantee issued under the Revolving Credit after the date hereof by the Issuing Lender on the instructions of the Borrower, denominated in Cdn. Dollars or US Dollars, having a term of not more than 12 months, issued to a named beneficiary and otherwise in a form satisfactory to the Issuing Lender;

“Leverage Ratio” has the meaning set out in Section 9.03(1)(b);

“LIBOR” means for each LIBOR Period applying to a LIBOR Loan, the rate of interest per annum (based on a year of 360 days), rounded upwards, if necessary, to the nearest whole multiple of 1/16th of 1%, established by the Administrative Agent to be the rate at which deposits in US Dollars are offered to leading banks by the Administrative Agent in the London Interbank Market, for delivery on the first day of the relevant LIBOR Period, as determined in London, England at or about 11:00 a.m. (London time) 2 Business Days before the first day of the LIBOR Period for a period equal or comparable to the LIBOR Period in an amount equal or comparable to the amount of the LIBOR Loan;

“LIBOR Loan” means a Loan in US Dollars bearing interest at a rate of interest based on LIBOR;

“LIBOR Period” means, for each LIBOR Loan, a period which commences (i) in the case of the initial LIBOR Period, on the date the Loan is made or converted from another type of Advance, and (ii) in the case of any subsequent LIBOR Period, on the last day of the immediately preceding LIBOR Period, and which ends, in either case, on the day selected by the relevant Borrower in the applicable Borrowing Notice. The duration of each LIBOR Period shall be 1, 2, 3 or 6 months (or such shorter or longer period as may be approved by the Lenders), unless the last day of the LIBOR Period would otherwise occur on a day other than a Business Day, in which case the last

- 15 -

day of the LIBOR Period shall be extended to occur on the next Business Day, or if such extension would cause the last day of the LIBOR Period to occur in the next calendar month, the last day of the LIBOR Period shall occur on the preceding Business Day;

“Liens” means all mortgages, charges, assignments, hypothecs, pledges, security interests, liens, restrictions and other encumbrances and adverse claims of every nature and kind and howsoever arising;

“Limited Recourse Obligors” means the APCO Unit Holders;

“Loan” means a loan in Cdn. $ or US $ made to the Borrower by a Lender under the Revolving Credit, including by way of Overdraft;

“Long Sault Facility” means the 18,000 KW hydro-electric facility approximately 19 kilometres from Cochrane, Ontario;

“Loss” means any loss whatsoever, whether direct or indirect, including expenses, costs, damages, judgments, penalties, awards, assessments, fines and any and all reasonable fees, disbursements and expenses of counsel, experts and consultants;

“LSR Senior Debt” means the financing in the original principal amount of approximately $45,000,000 provided jointly and severally to Algonquin Power (Long Sault) Partnership, an Ontario partnership, and N-R Power Partnership, an Ontario partnership by a syndicate of life insurance lenders, with The Mutual Life Assurance Company of Canada as one of the lenders and acting as agent for the other lenders or any Indebtedness incurred in refinancing such Indebtedness provided that the amount thereof is not increased;

“LW” means Liberty Water Co.;

“Mandatory Prepayment” has the meaning ascribed thereto in Section 2.04(4);

“Majority Lenders” at any particular time means one or more Lenders (other than Defaulting Lenders) whose aggregate Commitments are at least 66 2/3% of the aggregate of all Commitments;

“Material Adverse Change” means a material adverse effect on, or a material adverse change in, (i) the use, management, operations, condition, value or marketability of the Collateral, taken as a whole; (ii) the business, operations, management, property or condition (financial or otherwise) of the APCO Entities, taken as whole; (iii) the ability of the Borrower to pay any Obligations when due; or (iv) the ability of the Administrative Agent or any Lender to enforce its rights under the Documents or to realize on the Collateral in order to collect payment of the Obligations;

- 16 -

“Material Agreements” means (i) the APCO Trust Declaration; (ii) any agreements designated by the Majority Lenders, acting reasonably, from time to time as being a Material Agreement for purposes hereof; and (iii) any agreement which if terminated or cancelled would or could reasonably be expected to result in a Material Adverse Change;

“Material Authorization” means any approval, permit, licence or similar authorization (including, without limitation, any trademark, trade name or patent) from, and any filing or registration with, any Governmental Authority required to own any property or to carry on any business, where the failure to have such approval, permit, licence, authorization, filing or registration would or could reasonably be expected to result in a Material Adverse Change;

“Maturity Date” means February 14, 2014;

“Maximum Credit Limit” means Cdn. $142,000,000, as adjusted from time to time in accordance with this Agreement;

“Maximum Sanger LC Amount” at any particular time means US $19,460,383.67 minus the aggregate of all Sanger LC Payment Advances made prior thereto;

“Net Cash” as at the end of a calendar month means the cash received by the APCO Entities during such month, on a consolidated basis, less the costs and expenses (other than costs and expenses expressly prohibited by this Agreement) of the APCO Entities, on a consolidated basis, which were due and payable and paid during the month;

“Net Close Amount” means the net amount payable by the Borrower to the Lenders or by the Lenders to the Borrower upon the termination of all Secured Hedging Agreements;

“Net Proceeds” means the net proceeds of any Capital Transaction or Debt Issue;

“New Advance” means an Advance (including by way of Letter of Credit) representing a new advance of money or money’s worth as opposed to the Conversion or Continuation of an existing Advance;

“New APCO Entity” means a Person who becomes an APCO Entity upon the completion of a Permitted Acquisition and each New Purchaser completing all or any part of the Permitted Acquisition;

“New Purchaser” means an APCO Entity incorporated or formed for the sole purpose of completing all or any part of a Permitted Acquisition who prior to such

- 17 -

completion has no property or obligations, other than (i) rights and obligations under or in respect of the transaction documents relating to the Permitted Acquisition and (ii) funds in a nominal amount paid to it in connection with its formation;

“Non-APCO Entities” means the APUC Entities that are not APCO Entities;

“Non-BA Lender” means a Lender which is not governed by the Bank Act (Canada) and which does not accept bankers’ acceptances;

“Obligors” means the Principal Obligors and the Limited Recourse Obligors;

“Obligations” means all present and future indebtedness, liabilities and obligations of any Obligor to any Finance Party under or in connection with this Agreement or any Secured Hedging Agreements, LC Documents, Security Documents or any other Documents;

“Operating Accounts” means such Cdn. Dollar and US Dollar Accounts as the Borrower and the Administrative Agent may from time to time designate as “Operating Accounts” for purposes of this Agreement;

“Organizational Chart” means an organizational chart and report in respect of the APCO Entities, in form and substance satisfactory to the Majority Lenders, acting reasonably;

“Original Credit Agreement” means the credit agreement made as of September 30, 1999 between National Bank of Canada, as administrative agent and lender, and Algonquin Power Income Fund (now named Algonquin Power Co.), as borrower, as amended prior to, and further amended and restated pursuant to, the First Amended and Restated Credit Agreement made as of April 26, 2002, as thereafter amended prior to, and further amended and restated pursuant to, the Second Amended and Restated Credit Agreement dated as of January 17, 2005, as thereafter amended prior to, and further amended and restated by the Third Amended and Restated Credit Agreement dated as of August 30, 2005, and as thereafter amended prior to the date hereof;

“Other Statutory Claims” means any indebtedness, liabilities or obligations, other than Taxes, the payment or performance of which is secured by any Lien created by statute;

“Outstanding Principal Amount” of (i) an Advance means (A) the outstanding principal amount of the Loan, in the case of a Loan; (B) the face amount of the Bankers’ Acceptance, in the case of a Bankers’ Acceptance; (C) the LC Obligations

- 18 -

under a Letter of Credit, in the case of a Letter of Credit, and (ii) the Revolving Credit means the aggregate Outstanding Principal Amount of all Advances thereunder;

“Overdraft Accounts” has the meaning set out in Section 2.03(1);

“Overdraft Exposure” has the meaning set out in Section 2.03(2);

“Overdraft Lender” means National Bank of Canada;

“Overdraft Repayment Notice” has the meaning set out in Section 2.03(2);

“Overdrafts” has the meaning set out in Section 2.03(1);

“Payment Notice” means a duly completed notice in the form attached hereto as Schedule “C” executed and delivered by the Borrower in respect of any proposed payment to be applied in reduction of the Outstanding Principal Amount of any Advance;

“Performance Letter of Credit” means a Letter of Credit that is a “transaction-related contingency” within the meaning of the Guideline A-1 – Capital Adequacy Requirement of the Office of the Superintendent of Financial Institutions Canada, as determined by the Issuing Lender (“transaction-related contingencies” include performance bonds and standby and documentary letters of credit that support particular performance of non-financial or commercial contracts or undertakings rather than supporting general financial obligations);

“Permitted Acquisition” means an acquisition (or series of related acquisitions) (i) by any APCO Entities from any Persons, not at the time APCO Entities, of all or any part of the property comprising a Power Generation Facility or any Capital Stock in, or any Indebtedness of, any Persons who own, directly or indirectly (through the ownership of Capital Stock), all or any part of a Power Generation Facility; (ii) that is forecasted by APCO, acting reasonably, to increase the Consolidated Adjusted EBITDA of APCO during the following 3 year period and would not result in a default under Sections 9.02(j) or 9.02(k); (iii) which is consented to in writing by the Majority Lenders, in the case of an acquisition having a total cost of more than Cdn. $40,000,000; (iv) which, in the case of the acquisition of Capital Stock, is consented to by the board of directors or other comparable body of the issuer and, if required, of the owners of the Power Generation Facility being acquired; (v) which is completed at a time when no Default or Event of Default has occurred and is continuing; (vi) the completion of which would not result in any Default or Event of Default; (vii) which would not result, based on pro forma calculations for the 4 Fiscal Quarters immediately following the completion of the acquisition, in any breach of any covenants in Section 9.03(1); (viii) which does not result in any additional Consolidated Indebtedness of the Borrower, other than Permitted Acquisition Debt or Indebtedness under this Agreement; (ix) where the only

- 19 -

Liens in respect of the Capital Stock being acquired, if applicable, or in respect of any present or after-acquired property of any New APCO Entity are Permitted Encumbrances and (x) which would not result in the aggregate of the book value, on a consolidated basis, of the (A) Directly Owned Facilities; (B) the Common Control Facilities, and (C) debt instruments held by the APCO Entities and the cash on hand of the Borrower, in each case, to the extent that such debt instruments and cash on hand are subject to a first ranking perfected security interest that secures payment and performance of the Obligations, being less than 80% of Total Assets;;

“Permitted Acquisition Debt” means (i) any Indebtedness of any New APCO Entity resulting from a Permitted Acquisition which existed prior to, and not in contemplation of, the Permitted Acquisition (or any Indebtedness incurred in refinancing such Indebtedness provided that the amount thereof is not increased) provided that recourse for payment of the Indebtedness is limited to the property of the New APCO Entity; and (ii) any unsecured Financial Guarantees required of APCO to complete the Permitted Acquisition;

“Permitted Encumbrances” means

| (i) | title defects or irregularities in respect of any real property which are of a minor nature and which, in the aggregate, do not materially detract from the value of, or the use or operation of, the real property or any Power Generation Facilities located thereon; |

| (ii) | the reservations, limitations, provisos and conditions, if any, expressed in any original grant from the Crown in respect of any real property or in any comparable grant in jurisdictions other than Canada, provided they do not, in the aggregate, materially detract from the value of, or materially interfere with the use or operation of the real property or any Power Generation Facilities located thereon; |

| (iii) | all rights reserved to or vested in any Governmental Authority by any statutory provision or by the terms of any lease, grant or permit to terminate any such lease, grant or permit which do not or could not reasonably be expected to materially detract from the value of any real property or materially impair the use or operation of any Power Generation Facilities; |

| (iv) | Liens given to a public utility or other Governmental Authority in the ordinary course of business that secure payment or performance of obligations not due or delinquent or the amount or validity of which are being diligently contested in good faith by appropriate proceedings (and provided further in the case of contested obligations, reserves in respect of the contested obligations are maintained in accordance with GAAP and no |

- 20 -

material property subject to the Liens may be forfeited or disposed or otherwise realized on during such contest); |

| (v) | servicing agreements, development agreements, site plan agreements and other agreements with Governmental Authorities pertaining to the use or development of any real property, provided such agreements are complied with and will not materially impair the use or operation of any Power Generation Facilities located thereon; |

| (vi) | easements, rights-of-way, servitudes, restrictions and similar rights in respect of any real property granted or reserved to other Persons, provided such rights do not in the aggregate materially detract from the value of, or materially interfere with the use or operation of, the real property or any Power Generation Facilities located thereon; |

| (vii) | applicable municipal and other governmental restrictions, including zoning, building and municipal by-laws, ordinances and regulations, affecting the use of land or the nature of any structures which may be erected thereon, provided such restrictions are complied with and will not materially impair the use or operation of any Power Generation Facilities located thereon; |

| (viii) | Liens incurred or pledges and deposits made in the ordinary course of business in connection with workmen’s compensation, unemployment insurance, old-age pensions and similar legislation that secure payment or performance of obligations not due or delinquent or the amount or validity of which are being diligently contested in good faith by appropriate proceedings (and provided further in the case of contested obligations, reserves in respect of the contested obligations are maintained in accordance with GAAP and no material property subject to the Liens may be forfeited or disposed or otherwise realized on during such contest); |

| (ix) | Liens arising from the deposit of cash as security for the performance of bids, tenders, leases, contracts (other than contracts relating to Indebtedness) and statutory obligations of a like nature, incurred in the ordinary course of business; |

| (x) | undetermined or inchoate liens and other liens arising in the ordinary course of business by operation of law (including carrier’s, warehousemen’s, mechanic’s, construction, materialmen’s and vendor’s liens) that secure payment or performance of obligations not due or delinquent or the amount or validity of which are being diligently contested in good faith by appropriate proceedings (and provided further in the case of contested obligations, reserves in respect of the contested |

- 21 -

obligations are maintained in accordance with GAAP and no material property subject to the Liens may be forfeited or disposed or otherwise realized on during such contest); |

| (xi) | other than a claim for mechanic’s or construction liens, the Lien of any judgment rendered or action, claim, lis pendens or certificate of pending litigation filed against title to any real property, that is being contested diligently and in good faith by appropriate proceedings, provided the Lien does not adversely affect the use of the real property or any Power Generation Facilities located thereon and there shall have been paid either into court or deposited with the Administrative Agent for the benefit of the Lenders, appropriate collateral, including a bond issued by a licenced bonding company, in either case in an amount and of a type, in form and substance satisfactory to the Majority Lenders, acting reasonably; |

| (xii) | statutory Liens securing payment of Taxes and Other Statutory Claims not due or delinquent or the amount or validity of which are being diligently contested in good faith by appropriate proceedings (and provided further in the case of contested obligations, reserves in respect of the contested obligations are maintained in accordance with GAAP and no material property subject to the Liens may be forfeited or disposed or otherwise realized on during such contest); |

| (xiii) | Liens securing Purchase Money Obligations that are Permitted Indebtedness, provided that the Liens extend only to the equipment acquired or subject to the Capital Lease, as the case may be; |

| (xiv) | all present and future Liens on the Long Sault Facility to the extent that they secure payment of the LSR Senior Debt; |

| (xv) | all present and future Liens on the Glenford Facility to the extent that they secure payment of the Glenford Senior Debt; |

| (xvi) | all present and future Liens on the St. Leon Facility to the extent that they secure payment of the St. Leon Senior Debt; |

| (xvii) | all present and future Liens on the Sanger Facility to the extent that they secure payment of the Sanger Senior Debt; |

| (xviii) | Liens on property acquired pursuant to a Permitted Acquisition, to the extent that they secure payment or performance of related Permitted Acquisition Debt; |

- 22 -

| (xix) | Liens (collectively, the “Refinancing Debt Security”) on Collateral to the extent that they secure payment and performance of Indebtedness of the Borrower under any Refinancing Debt Issues effected by way of private placement, provided the Refinancing Debt Security do not extend to any Collateral that is not subject to a Lien in favour of the Administrative Agent pursuant to one or more Security Documents, the priority of the Refinancing Debt Security would not result in a breach of Section 7.07 and such Refinancing Debt Security is subject to an intercreditor agreement in form and substance satisfactory to the Majority Lenders, acting reasonably; and |

| (xx) | Liens in favour of or consented to in writing by the Majority Lenders after the Restatement Date; |

“Permitted Indebtedness” means the (i) Obligations; (ii) the LSR Senior Debt; (iii) the Glenford Senior Debt; (iv) the Sanger Senior Debt; (v) the St. Leon Senior Debt; (vi) Permitted Acquisition Debt; (vi) any Indebtedness of the Borrower under any Refinancing Debt Issues; (vii) Purchase Money Obligations of the APCO Entities in an aggregate outstanding principal amount not exceeding $5,000,000; (viii) any unsecured Financial Guarantee of APCO that is an Investment permitted hereby; (ix) any unsecured Indebtedness owing by an APCO Entity to another APCO Entity; (x) any unsecured Indebtedness owing by an APCO Entity to APUC, the payment of which is postponed to the payment of the Obligations on terms and conditions satisfactory to the Majority Lenders; and (xi) any other Indebtedness consented to in writing by the Lenders after the Restatement Date;

“Permitted Reorganization” means (1) any reorganization of any APCO Entities which is consented to in writing by the Majority Lenders or which satisfies the following conditions: (i) the Borrower has given the Lenders not less than 30 days’ prior written notice (the “Reorganization Notice”) of the proposed reorganization; (ii) the reorganization is (A) an amalgamation or merger of APCO Entities that are wholly owned, directly or indirectly, by the Borrower; or (B) a winding up of an APCO Entity into another APCO Entity that is wholly owned, directly or indirectly, by the Borrower; (iii) the Majority Lenders have determined that the rights of the Lenders under the Security Documents are not adversely affected by the reorganization (if the Majority Lenders have not notified APCO of their determination within or prior to the 20th day following their receipt of the Reorganization Notice, they shall be deemed to have determined that the rights of the Lenders under the Security Documents are not adversely affected by the reorganization); and (iv) no Default or Event of Default exists at the time of the reorganization or would exist after giving effect thereto; and (2) any reorganization of any APCO Unit Holder which satisfies the following conditions: (i) the Borrower has given the Lenders not less than 30 days’ prior written notice (also a “Reorganization Notice”) of the proposed reorganization; (ii) the reorganization does not affect the validity of the Security Documents or the enforceability and priority of the Liens granted

- 23 -

pursuant thereto; and (iii) no Default or Event of Default exists at the time of the reorganization or would exist after giving effect thereto;

“Person” means an individual, partnership, body corporate, trust or other juridical entity;

“Personal Property Collateral” means Collateral that is personal property;

“Power Generation Facility” means a power generation facility located in Canada or the United States of America;

“Principal Amount” of an Advance means (i) the outstanding principal amount of the Loan, in the case of a Loan; (ii) the face amount (or principal amount in the case of a BA Equivalent Note) of the Bankers’ Acceptance, in the case of a Bankers’ Acceptance; and (iii) the face amount of a Letter of Credit, in the case of a Letter of Credit;

“Principal Obligors” means the APCO Entities;

“Purchase Money Obligations” of a Person means Indebtedness incurred or assumed by the Person in respect of the acquisition of equipment (including Indebtedness under Capital Leases but excluding Permitted Acquisition Debt) provided that the principal amount of the Indebtedness is not more than 100% of the acquisition cost of the equipment and includes any Indebtedness incurred in refinancing such Indebtedness, provided that the amount thereof is not increased;

“Quarterly Reporting Date” in respect of any Fiscal Quarter means the date that is the earlier of the date on which the Borrower delivers, or by which time the Borrower is required to deliver, its consolidated financial statements in respect of the fiscal period ending as at the end of the Fiscal Quarter to the Administrative Agent pursuant to Section 9.01(i)(i) or 9.01(i)(ii);

“Real Property Collateral” means Collateral that is real property;

“Refinancing Debt Issues” means Debt Issues of the Borrower, in an aggregate principal amount of not more than $120,000,000, completed by way of public offering or private placement on or prior to October 30, 2011, that are on terms and conditions satisfactory to the Majority Lenders, who shall act reasonably and without any requirement for a fee or other consideration (save and except for all reasonable fees, disbursements and expenses of counsel, experts and consultants);

“Related Parties” means (i) all Affiliates and Associates of any APUC Entities; and (ii) any directors, officers, employees, agents or advisors of any Person described in (i);

- 24 -

“Release” is to be broadly interpreted and shall include deposit, leak, emit, add, spray, inject, inoculate, abandon, spill, seep, pour, empty, throw, dump, place and exhaust, and when used as a noun has a similar meaning;

“Required Cash Collateral Payments” at any particular time means the aggregate, at such time, of (i) the aggregate Outstanding Principal Amount of all Bankers’ Acceptances; (ii) the aggregate Outstanding Principal Amount of all Letters of Credit; and (iii) an amount equal to the Maximum Sanger LC Amount;

“Required Overdraft Repayment Loan” has the meaning set out in Section 2.03(2);

“Responsible Representative” means an employee of the Borrower having responsibility for any Borrowings or other transactions contemplated by this Agreement and includes the Authorized Representatives of the Borrower, and the APUC’s Vice Chair, Director of Treasury Services & Treasurer, Director, Corporate Finance and Controller and in-house counsel of the Borrower;

“Restatement Date” means the date hereof;

“Revolving Credit” has the meaning set out in Section 2.01(1);

“Revolving Credit Limit” means the lesser of (i) the aggregate of the Commitments in respect of the Revolving Credit; and (ii) the Maximum Credit Limit;

“Revolving Period” means the period commencing the date hereof and ending on the Banking Day preceding the Maturity Date;

“Sanger Cash Collateral” has the meaning set out in Section 2.04(1);

“Sanger Facility” means the 56,000 KW natural gas-fired generating facility located in Sanger, California;

“Sanger LC” means the Letter of Credit as defined in the Sanger LC Reimbursement Agreement;

“Sanger LC Bank” has the meaning set out in the Sanger LC Reimbursement Agreement;

“Sanger Lender” means National Bank of Canada, as a party to the Sanger LC Reimbursement Agreement, and its successors and assigns;

“Sanger LC Payment Advance” means a Loan made pursuant to a Sanger LC Payment Advance Obligation;

- 25 -

“Sanger LC Payment Advance Obligation” means the obligation of the Sanger Lender to make a Loan to APCO and to pay the proceeds thereof directly to the Sanger LC Bank as authorized and directed pursuant to the Sanger LC Reimbursement Agreement;

“Sanger LC Reimbursement Agreement” means the reimbursement agreement for irrevocable direct pay letter of credit to be dated as of May 1, 2002 between Banque Nationale du Canada, National Bank of Canada, New York Branch, as Letter of Credit Bank (as defined therein and referred to herein as the Sanger LC Bank), Algonquin Power Income Fund (now named Algonquin Power Co.), as Guarantor (as defined therein) and Sanger Power, L.L.C., as Borrower (as defined therein);

“Sanger Senior Debt” means the Variable Rate Demand Resource Recovery Revenue Bond due September 1, 2020 in the original principal amount of US $19,200,000 provided by the California Pollution Control Finance Authority to Algonquin Power Sanger LLC, a California limited liability company or any Indebtedness incurred in refinancing such Indebtedness provided that the amount thereof is not increased

“Security Documents” means all agreements and documents executed and delivered by an APCO Entity or an APCO Unit Holder in favour of the Administrative Agent, that create or purport to create, or relate to the priority of, any Liens in favour of the Administrative Agent securing payment or performance of any Obligations, including all of the security agreements executed and delivered by the APCO Entities and the APCO Unit Holders in favour of the Administrative Agent pursuant to ARTICLE 6 or ARTICLE 7 ;

“Secured Hedging Agreement” means an existing or any future Hedging Agreement between the Borrower and a Lender that is designed to protect the Borrower or any other APCO Entity (other than a St. Leon Entity) against fluctuations in interest rates, currency exchange rates or commodity prices relating to its day-to-day operations, including the Hedging Agreements described in the attached Schedule “G”;

“SEDAR” means the System for Electronic Document Analysis and Retrieval developed for the Canadian Securities Administrators;

“Special Property” of a Person means (i) any right, title or interest of the Person in or to, and all benefits of the Person under, any agreement, right, franchise, licence, lease or permit which if made subject to the Liens granted or to be granted to the Administrative Agent pursuant to the Security Documents would result in the termination of, or entitle another Person (other than a Related Party) to terminate, such right, title, interest or benefit; (ii) any property in which the Person is prohibited from granting the Liens granted or to be granted to the Administrative Agent pursuant to the Security Documents by Applicable Laws (statutory only); or (iii) any property in which the Person is prohibited from granting the Liens granted or to be granted to the Administrative Agent

- 26 -

pursuant to the Security Documents by the terms of any Permitted Acquisition Debt (other than Permitted Acquisition Debt held by or for the benefit of a Related Party);

“St. Leon Collateral” means the St. Leon Shares and the property comprising the St. Leon Facility and all other present and after-acquired property of the St. Leon Direct Owners;

“St. Leon Credit Agreement” means the financing in the original principal amount of $73,300,000 provided to St. Leon Wind Energy Trust, a trust created by a declaration of trust dated June 28, 2005 in accordance with the laws of the Province of Manitoba, by a syndicate of lenders, with the Bank of Montreal as one of the lenders and acting as agent for the other lenders pursuant to the St. Leon Wind Power Energy Credit Agreement dated August 12, 2005;

“St. Leon Direct Owner” means any Person holding or owning any property forming part of the St. Leon Facility;

“St. Leon Entities” means (i) the St. Leon Direct Owners; and (ii) the St. Leon Shareholders;