Exhibit 99.1

ALGONQUIN POWER & UTILITIES CORP.

ANNUAL INFORMATION FORM

March 28, 2013

TABLE OF CONTENTS

| | | | | | | | | | |

| 1. | | CORPORATE STRUCTURE | | | 2 | |

| | | |

| | 1.1 | | Name, Address and Incorporation | | | 2 | |

| | 1.2 | | Intercorporate Relationships | | | 2 | |

| | | | |

| | | | (a) | | Subsidiaries | | | 2 | |

| | | | (b) | | Other Interests in Energy Related Developments | | | 9 | |

| | |

| 2. | | GENERAL DEVELOPMENT OF THE BUSINESS | | | 9 | |

| | | |

| | 2.1 | | General | | | 9 | |

| | | | |

| | | | (a) | | The Unit Exchange | | | 9 | |

| | | | (b) | | Business Strategy | | | 10 | |

| | | |

| | 2.2 | | Three Year History and Significant Acquisitions | | | 12 | |

| | | | |

| | | | (a) | | Fiscal 2010 | | | 12 | |

| | | | (b) | | Fiscal 2011 | | | 14 | |

| | | | (c) | | Fiscal 2012 | | | 16 | |

| | | |

| | 2.3 | | Recent Developments – 2013 | | | 20 | |

| | |

| 3. | | DESCRIPTION OF THE BUSINESS | | | 22 | |

| | | |

| | 3.1 | | General Description of the Regulatory Regimes in which the Business Operates. | | | 22 | |

| | | | |

| | | | (a) | | Power Generation Regulatory Regimes | | | 22 | |

| | | | (b) | | Water Utility Services Regulatory Regimes | | | 24 | |

| | | | (c) | | Electrical Utility Services Regulatory Regimes | | | 24 | |

| | | | (d) | | Natural Gas Utility Services Regulatory Regimes | | | 25 | |

| | | |

| | 3.2 | | Production Method, Principal Markets, Distribution Methods and Material Facilities | | | 26 | |

| | | | |

| | | | (a) | | Power Generation: Renewable – Hydroelectric | | | 26 | |

| | | | (b) | | Power Generation: Renewable – Wind Power | | | 33 | |

| | | | (c) | | Power Generation: Thermal – Energy From Waste | | | 37 | |

| | | | (d) | | Power Generation: Thermal – Cogeneration | | | 39 | |

| | | | (e) | | Power Generation: Algonquin Energy Services | | | 42 | |

| | | | (f) | | APCo: Development Division | | | 43 | |

| | | | (g) | | Utilities: Water and Wastewater | | | 47 | |

| | | | (h) | | Liberty Utilities: Electrical Distribution | | | 51 | |

| | | | (i) | | Liberty Utilities: Natural Gas Distribution | | | 56 | |

| | | |

| | 3.3 | | Business Associations with APMI and Senior Executives | | | 59 | |

| | 3.4 | | Principal Revenue Sources | | | 61 | |

| | 3.5 | | Specialized Skill and Knowledge | | | 62 | |

| | 3.6 | | Competitive Conditions | | | 62 | |

| | 3.7 | | Environmental Protection | | | 64 | |

| | 3.8 | | Employees | | | 64 | |

| | 3.9 | | Foreign Operations | | | 65 | |

| | 3.10 | | Cycles and Seasonality | | | 65 | |

| | 3.11 | | Customers | | | 66 | |

| | 3.12 | | Economic Dependence | | | 66 | |

| | 3.13 | | Safety or Environmental Policies | | | 67 | |

| | |

| 4. | | RISK FACTORS | | | 67 | |

| | | |

| | 4.1 | | Financial Risk Management | | | 67 | |

| | | | |

| | | | (a) | | Foreign currency risk | | | 68 | |

| | | | (b) | | Market price risk | | | 68 | |

-i-

TABLE OF CONTENTS

(continued)

| | | | | | | | | | |

| | | | (c) | | Credit/Counterparty risk | | | 69 | |

| | | | (d) | | Interest rate risk | | | 70 | |

| | | | (e) | | Liquidity risk | | | 71 | |

| | | | (f) | | Commodity price risk | | | 71 | |

| | | |

| | 4.2 | | Operational Risk Management | | | 73 | |

| | | | |

| | | | (a) | | Risks inherent to APUC’s businesses | | | 73 | |

| | | | (b) | | Asset Retirement Obligations | | | 74 | |

| | | | (c) | | Environmental Risks | | | 76 | |

| | | | (d) | | Cycles and Seasonality Risk | | | 78 | |

| | | | (e) | | Specific Environmental Risks | | | 78 | |

| | | | (f) | | Regimes that Could Impact APUC | | | 83 | |

| | | | (g) | | Litigation risks and other contingencies | | | 84 | |

| | | | (h) | | Tax Related Risks | | | 84 | |

| | | | (i) | | Tax Risks Associated with the Unit Exchange | | | 85 | |

| | | | (j) | | Obligations to Serve | | | 85 | |

| | | |

| | 4.3 | | Regulatory Climate and Permitting Risks | | | 85 | |

| | 4.4 | | Dependence upon APUC Businesses | | | 86 | |

| | 4.5 | | Safety Considerations | | | 86 | |

| | 4.6 | | Labour Relations | | | 86 | |

| | 4.7 | | Dependence Upon Key Customers | | | 87 | |

| | 4.8 | | Potential Conflicts of Interest | | | 87 | |

| | 4.9 | | Construction / Development Risk | | | 88 | |

| | 4.10 | | Acquisitions and Divestitures | | | 88 | |

| | |

| 5. | | DIVIDENDS | | | 88 | |

| | | |

| | 5.1 | | Dividend Reinvestment Plan | | | 89 | |

| | |

| 6. | | DESCRIPTION OF CAPITAL STRUCTURE | | | 89 | |

| | | |

| | 6.1 | | Common Shares | | | 89 | |

| | 6.2 | | Private Placements of Subscription Receipts and Common Shares to Emera | | | 89 | |

| | 6.3 | | Preferred Shares | | | 90 | |

| | 6.4 | | Convertible Debentures | | | 91 | |

| | | | |

| | | | (a) | | Series 1A Debentures | | | 91 | |

| | | | (b) | | Series 2A Debentures | | | 91 | |

| | | | (c) | | Series 3 Debentures | | | 91 | |

| | | |

| | 6.5 | | Employee Share Purchase Plan | | | 92 | |

| | 6.6 | | Directors Deferred Share Units | | | 92 | |

| | 6.7 | | Performance Share Units | | | 92 | |

| | 6.8 | | Shareholders’ Rights Plan | | | 92 | |

| | 6.9 | | Stock Option Plan | | | 93 | |

| | |

| 7. | | MARKET FOR SECURITIES | | | 97 | |

| | | |

| | 7.1 | | Trading Price and Volume | | | 97 | |

| | | | |

| | | | (a) | | Common Shares | | | 97 | |

| | | | (b) | | Preferred Shares | | | 97 | |

| | | | (c) | | Series 2A Debentures | | | 97 | |

| | | | (d) | | Series 3 Debentures | | | 98 | |

| | | |

| | 7.2 | | Prior Sales | | | 98 | |

| | 7.3 | | Escrowed Securities and Securities Subject to Contractual Restrictions on Transfer | | | 99 | |

-ii-

TABLE OF CONTENTS

(continued)

| | | | | | | | | | |

| 8. | | DIRECTORS AND OFFICERS | | | 99 | |

| | | |

| | 8.1 | | Name, Occupation and Security Holdings | | | 99 | |

| | 8.2 | | Audit Committee | | | 103 | |

| | | | |

| | | | (a) | | Audit Committee Charter | | | 103 | |

| | | | (b) | | Relevant Education and Experience | | | 103 | |

| | | | (c) | | Pre-Approval Policies and Procedures | | | 104 | |

| | | |

| | 8.3 | | Corporate Governance and Compensation Committees | | | 104 | |

| | 8.4 | | Bankruptcies | | | 105 | |

| | 8.5 | | Potential Material Conflicts of Interest | | | 105 | |

| | |

| 9. | | LEGAL PROCEEDINGS AND REGULATORY ACTIONS | | | 106 | |

| | | |

| | 9.1 | | Legal Proceedings | | | 106 | |

| | | | |

| | | | (a) | | Trafalgar | | | 106 | |

| | | | (b) | | Côte Ste-Catherine Water Lease Dues | | | 106 | |

| | | |

| | 9.2 | | Regulatory Actions | | | 107 | |

| | |

| 10. | | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | | | 107 | |

| | |

| 11. | | TRANSFER AGENTS AND REGISTRARS | | | 107 | |

| | |

| 12. | | MATERIAL CONTRACTS | | | 107 | |

| | |

| 13. | | INTERESTS OF EXPERTS | | | 109 | |

| | |

| 14. | | ADDITIONAL INFORMATION | | | 109 | |

| |

SCHEDULE A – RENEWABLE – HYDROELECTRIC AND WIND FACILITIES | | | A-1 | |

| |

SCHEDULE B – THERMAL – BIOMASS, COGENERATION, STEAM, DIESEL AND ENERGY FROM WASTE FACILITIES | | | B-1 | |

| |

SCHEDULE C – WASTEWATER AND WATER DISTRIBUTION FACILITIES | | | C-1 | |

| |

SCHEDULE D – ELECTRICAL DISTRIBUTION FACILITIES | | | D-1 | |

| |

SCHEDULE E – Natural Gas Distribution Facilities | | | E-1 | |

| |

SCHEDULE F – MANDATE OF THE AUDIT COMMITTEE | | | F-1 | |

| |

SCHEDULE G – GLOSSARY OF TERMS | | | G-1 | |

All information contained in this Annual Information Form (“AIF”) is presented as at March 28, 2013, unless otherwise specified. In this AIF, all dollar figures are in Canadian dollars, unless otherwise indicated.

-iii-

Caution concerning forward-looking statements

Certain statements included in this AIF contain information that is forward-looking within the meaning of certain securities laws, including information and statements regarding prospective results of operations, financial position or cash flows. Forward-looking information is included throughout this Annual Information Form, including among other places, under the heading “General Development of the Business”, “Description of the Business” and “Legal Proceedings and Regulatory Actions”. These statements and information are forward-looking, and are based on factors or assumptions that were applied in drawing a conclusion or making a forecast or projection, including assumptions based on historical trends, current conditions and expected future developments, and other factors believed to be appropriate in the circumstances.

Since forward-looking statements relate to future events and conditions, by their very nature they require making assumptions and involve inherent risks and uncertainties. APUC cautions that although it is believed that the assumptions are reasonable in the circumstances, these risks and uncertainties give rise to the possibility that actual results may differ materially from the expectations set out in the forward-looking statements. Material risk factors include those set out in this AIF under “Risk Factors. Readers are cautioned that such risks and uncertainties may cause APUC’s actual results to vary materially from those expressed in, or implied by, the forward-looking statements and information. Given these risks, undue reliance should not be placed on these forward-looking statements, which apply only as of their dates. Other than as specifically required by law, APUC undertakes no obligation to update any forward-looking statements or information to reflect new information, subsequent or otherwise.

| 1.1 | Name, Address and Incorporation |

Algonquin Power & Utilities Corp. (“APUC” or the “Corporation”) was originally incorporated under theCanada Business Corporations Act (“CBCA”) on August 1, 1988 as Traduction Militech Translation Inc. Pursuant to articles of amendment dated August 20, 1990 and January 24, 2007, the corporation amended its articles to change its name to Societe Hydrogenique Incorporée – Hydrogenics Corporation and Hydrogenics Corporation – Corporation Hydrogenique, respectively. Pursuant to a certificate and articles of arrangement dated October 27, 2009, the corporation, among other things, created a new class of common shares (the “Common Shares”), transferred its existing operations to a newly formed independent corporation and changed its name to Algonquin Power & Utilities Corp. The head and principal office of APUC is located at 2845 Bristol Circle, Oakville, Ontario, L6H 7H7. APUC contemporaneously acquired all of the outstanding trust units of Algonquin Power Co. (“APCo”) (SeeGeneral Development of the Business – The Unit Exchange).

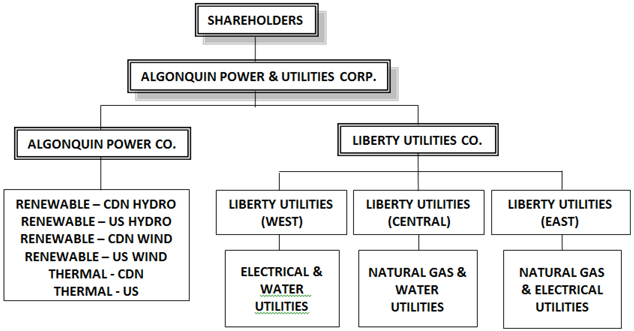

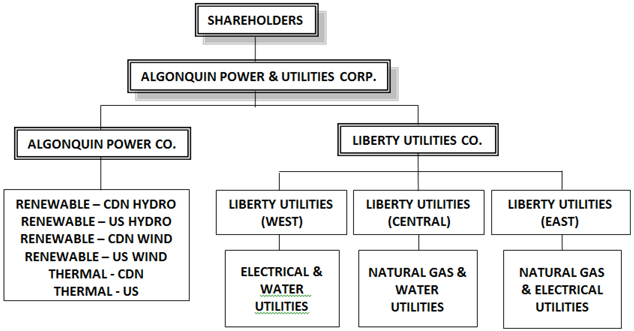

APUC’s principal holdings are its trust units (“Trust Units”) of APCo and shares of Liberty Utilities Co. (“Liberty Utilities”). Liberty Utilities’ businesses operate under three separately managed regions – Liberty Utilities (West), Liberty Utilities (Central), and Liberty Utilities (East).

Unless the context indicates otherwise, references in this AIF to “APUC” include, for reporting purposes only, the direct or indirect subsidiary entities of APUC and partnership interests held by APUC and its subsidiary entities. Such use of “APUC” to refer to these other legal entities and partnership interests does not constitute a waiver by APUC or such entities or partnerships of their separate legal status, for any purpose.

| 1.2 | Intercorporate Relationships |

The subsidiaries of APUC are grouped into the independent power generation and the utilities businesses. The principal holding for APUC’s independent power generation business is an investment in 100% of the issued and outstanding Trust Units of APCo. The principal holding for APUC’s utilities business is an investment in 100% of the issued and outstanding common shares of Liberty Utilities (Canada) Corp., a federal corporation, which in turn owns all of the issued and outstanding common shares of Liberty Utilities (America) Co., a Delaware corporation, which in turn owns all of the issued and outstanding common shares of Liberty Utilities (America) Holdco Inc., a Delaware corporation, which in turn owns all of the issued and outstanding shares of Liberty Utilities, a Delaware corporation, which in turn owns and operates the entities within the Liberty Utilities (West), Liberty Utilities (Central), and Liberty Utilities (East) regions. Each of APCo, Liberty Utilities (West), Liberty Utilities (Central), and Liberty Utilities (East) regions have their own subsidiaries and ownership chains.

The subsidiaries of APCo include the ownership chains of Algonquin Power Trust (“APT”), and Algonquin Power Fund (Canada) Inc. (“APFC”). APT’s subsidiaries include the ownership chain of Algonquin Power Operating Trust (“APOT”), and APFC’s subsidiaries include the ownership chain of Algonquin Power Fund (America) Inc. (“APFA”). The Liberty Utilities operating regions include Liberty Utilities (West), a region currently holding an electrical distribution utility located

- 2 -

in California, and water distribution and wastewater treatment utilities located in Arizona. The Liberty Utilities (Central) region currently holds water distribution and wastewater treatment utilities located in Arkansas, Illinois, Missouri, and Texas, and natural gas utilities located in Illinois, Iowa, and Missouri. The Liberty Utilities (East) region holds an electrical distribution utility and a natural gas distribution utility located in New Hampshire.

The following chart summarizes the principal operating subsidiaries of the Corporation and their major lines of business.

The major chains are defined below, including a detailed description of the legal entities that comprise these chains and the facilities they own. Additional information on the facilities is described in Schedules A, B, C, D, and E.

| | (i) | Independent Power Generation Business – APCo Chain |

APCo Chain Entities

APCo is the sole beneficiary of APT. APCo also owns Algonquin Holdco Inc., an Ontario corporation, which owns 68.9% of APFC, and 62.5% of the issued and outstanding shares of Cornwall Solar Inc.

APT Group

APT forms part of the APCo business unit. APT is an unincorporated open ended trust created by a declaration of trust dated June 30, 2000 in accordance with the laws of the Province of Ontario. APT owns all the Trust Units of APOT.

- 3 -

APT controls the entities that own some of the Canadian hydroelectric facilities, and indirectly owns the energy-from-waste facility (the “EFW Facility”) located in the Regional Municipality of Peel, Ontario (“Peel”) by virtue of owning all the Trust Units in KMS Power Income Fund, an unincorporated open ended trust created by a declaration of trust dated February 18, 1997 in accordance with the laws of the Province of Alberta. This trust owns Algonquin Power Energy From Waste Inc. (“APEFW”), an Ontario corporation that owns the EFW Facility.

APT also holds interests in certain of APCo’s Canadian hydroelectric Facilities. It directly owns the hydroelectric Hydraska Facility and the Arthurville Facility, and owns both the general partnership and the limited partnership interests in Algonquin Power (Campbellford) Limited Partnership (“Campbellford LP”), an Ontario limited partnership which operates a 4 megawatt (“MW”) hydroelectric generation station on the Trent River near Campbellford, Ontario (the “Campbellford Facility”). APT also directly owns a 42% limited partnership interest in the Algonquin Power (Mont-Laurier) Limited Partnership (the “Mont-Laurier Partnership”), a Québec limited partnership, which owns the Mont-Laurier facility and the Côte Ste.-Catherine facility. APEFW owns the remaining 58% partnership interests, comprised of a 46.5% limited partnership interest and an 11.5% general partnership interest.

APT owns Corporation D’Investissements Éoliennes Algonquin Power (“Éoliennes”), a Canadian corporation. Éoliennes indirectly owns St. Ulric Wind Energy Investments L.P. (“St. Ulrich LP”), a Québec limited partnership, through its ownership of the limited partnership of St. Ulrich LP and Société en Commandite Algonquin (Éoliennes), a Québec limited partnership, and its direct ownership of the general partner of St. Ulrich LP, named Corporation D’Investissements Éoliens St-Laurent Inc. (“Corporation St-Laurent”), a Québec corporation. Corporation St-Laurent is the 50% owner of Saint-Damase Wind Energy Fleur de Lis General Partner Corporation, a federal corporation, which is the general partner of the partnership known as Saint-Damase Wind Energy Fleur de Lis Limited Partnership (“St. Damase LP”). St. Damase LP has an interest in the Saint – Damase wind energy project and described below in “Description of the business – Production Method, Principal Markets, Distribution Methods and Material Facilities – Power Generation: Development – Current Development Projects”. St. Ulrich LP owns a 49.995% equity interest in the St. Damase LP, the general partner owns a .01% equity interest, and a non-Algonquin party owns the remaining 49.995% equity interest. APT also has an interest in Éoliennes Belle- Rivière, société en commandite (“Belle Rivière”), a Quebec partnership and the owner of the Val- Éo wind energy project, also described below in “Description of the business – Production Method, Principal Markets, Distribution Methods and Material Facilities – Power Generation: Development – Current Development Projects”. It owns a 25% equity interest in the general partner, 9231-5498 Québec Inc. and it also holds a 24.995% limited partner interest.

APOT Group

APOT is an unincorporated open ended trust created by an amended and restated trust indenture effective January 2, 1997, in accordance with the laws of the Province of Alberta.

APOT controls the entities that own the Canadian cogeneration facility located at Brampton, Ontario (the “BCI Facility”). The BCI Facility is owned by Brampton Cogeneration Limited Partnership, an Ontario partnership, the partners of which are Brampton Cogeneration Inc. (“BCI”), which is the general partner and holds one general partnership unit, and APOT, which owns 100% of the Class A Units (entitled to vote on all matters) and 50% of the Class B Units (vote on only specific matters) in the limited partnership. BCI is an Ontario corporation and is owned by APOT.

- 4 -

APOT controls the entities that own the 104 MW wind facility located at St. Leon, Manitoba (the “St. Leon Facility”). The APOT entity that owns the St. Leon Facility is St. Leon Wind Energy LP, an Ontario partnership (“St. Leon LP”). St. Leon LP is owned by its general partner, St. Leon Wind Energy GP Inc. (“St. Leon GP”), by St. Leon Wind Energy Trust, a Manitoba trust (“St. Leon Trust”) and by AirSource Power Fund I LP, a Manitoba limited partnership (“AirSource”). St. Leon LP holds a 30.11% interest in APFC. St. Leon LP has also issued 100 Class B limited partnership units which were acquired by APUC on January 1, 2013 in exchange for newly issued APUC Class C Preferred Shares. St. Leon Trust is owned 100% by AirSource, the limited partner of which is Algonquin (AirSource) Power LP (“AAP LP”) which holds a 99.99% interest in the limited partnership, and which in turn is owned 99.99% by APOT as limited partner. APOT also controls the general partner of AAP LP, AirSource Power Fund GP Inc, a Canadian corporation. AirSource is also the 100% owner of St. Leon GP. St. Leon GP is a Canadian corporation and St. Leon Trust is a trust created by a declaration of trust dated June 28, 2005 in accordance with the laws of the Province of Manitoba. The AirSource and AAP LP limited partnerships were formed in Manitoba and Ontario, respectively.

St. Leon GP also owns 100% of the ownership interests in St. Leon II Wind Energy LP (“St. Leon II”), a Manitoba partnership, the general partner of which is St. Leon II Wind Energy GP Inc., a Manitoba corporation, which is also owned by St. Leon LP. St. Leon II owns the 16.5 MW wind facility (the “St. Leon II Facility”), an expansion of the St. Leon Facility, located at St. Leon, Manitoba.

APOT is the sole limited partner in Red Lily Wind Power II Limited Partnership, a Saskatchewan limited partnership, the general partner of which is Red Lily Wind Power II GP Inc., a Saskatchewan corporation, which is also owned by APOT. APOT also owns Loyalist Wind Project GP Inc., an Ontario corporation, which is the general partner, holding 0.01% interest in Loyalist Wind Project LP (“Loyalist LP”), an Ontario limited partnership. APUC is the majority limited partner of Loyalist LP, holding the remaining 99.99% interest.

APOT has two ownership interests in Alberta. First, it is the beneficial owner of one hydroelectric facility in Alberta (the “Dickson Dam Facility”). APOT owns 50% of Valley Power Corp., an Ontario corporation, which holds a 0.0001% limited partnership interest partner in Valley Power LP, an Alberta limited partnership which owns the Alberta biomass facility (the “Valley Power Facility”). APOT also directly holds a 49.9995% limited partnership interest in Valley Power LP.

APFC Group

APFC, a subsidiary of APUC, is an Ontario corporation and it controls the entities that own the majority of APUC’s hydroelectric facilities in Canada. APFC owns Algonquin Power (America) Inc., (“APA”) a Delaware corporation, which is the parent company of APCo’s operations in the United States.

In Ontario, APFC directly owns the Burgess and Hurdman Facilities, and has an agreement in place to buy ownership interests in the parties to the joint venture that owns the interests in the Long Sault Rapids facility. In Québec, APFC directly owns the facilities known as Rawdon, Hydro Snemo, St. Raphael, Belleterre and St. Brigette Facilities. APFC also holds a direct interest in Société Hydro-Donnacona, S.E.N.C. (the “S.E.N.C.”), the owner of the Donnacona Facility. The S.E.N.C. is a Québec general partnership, and is owned 99.99% by APFC and 0.01% by Donnacona Holdings Inc., an Ontario corporation 100% owned by APFC. In Newfoundland, APFC holds a 45% partnership interest in the Algonquin Power (Rattlebrook)

- 5 -

Partnership, a Newfoundland partnership that owns the Rattlebrook Facility. APFC also owns 100% of Algonquin Power Services Canada Inc., a Canadian corporation that provides purchasing services to Canadian APCo entities.

APFC also owns 1631667 Alberta ULC, an Alberta unlimited liability corporation.

APFA Group

APFA, a Delaware corporation, is owned by APA. APFA owns or holds interest in the hydroelectric, thermal cogeneration, and wind energy entities and facilities in the U.S.

APFA owns Algonquin Power Sanger LLC (“Sanger LLC”), a California limited liability company, and Algonquin Power Windsor Locks LLC (“Windsor LLC”), a Connecticut limited liability company. These entities own the U.S. cogeneration Sanger and Windsor Locks facilities. Sanger LLC directly owns 100% of Dyna Fibers Inc., a California corporation that operates a hydro-mulch business at the Sanger facility site. APFA also owns KMS Crossroads, LLC, a Delaware limited liability corporation.

APFA indirectly owns numerous hydroelectric facilities through majority interests ranging from 99.7% to 99.99% in the subsidiaries described in this paragraph, with Algonquin Power Fund (America) Holdco Inc. (“Algonquin Holdco”), a Delaware corporation owned by APFA, holding the remaining interests. The Vermont partnership Moretown Hydro Energy Company owns the Moretown Facility. The New Hampshire limited partnerships Gregg Falls Hydroelectric Associates Limited Partnership, Pembroke Hydro Associates Limited Partnership and Mine Falls Limited Partnership own the Gregg Falls, Pembroke and Mine Falls Facilities, respectively.

APFA owns the New Hampshire limited liability company Clement Dam Hydroelectric, LLC which owns the Clement Dam Facility. The Franklin, Beaver Falls and Lakeport Facilities are owned by, respectively, Franklin Power, LLC, a New Hampshire company, Algonquin Power (Beaver Falls) LLC, a Delaware corporation and Lakeport Hydroelectric Corp., a New Hampshire corporation. Court Street Investments Inc. (“Court Street”), a Massachusetts corporation, is owned 100% by APFA and owns CSI Oswego Corp., a Delaware corporation, which is a partner in Oswego Hydro Partners L.P., the Delaware partnership that owns the Phoenix Facility. The other partner in this partnership is Oswego Energy Corp., a Delaware corporation, which is 100% owned by Oswego Power Company, Inc., a Massachusetts corporation, which in turn is 100% owned by APFA. The remaining hydroelectric facilities in the United States are the Great Falls and Lochmere Facilities. The Great Falls Facility is owned by the Great Falls Hydroelectric Company Limited Partnership, a Maryland limited partnership in which APFA holds a 98% limited partner interest. Great Falls Energy, LLC holds the remaining 2% general partner interest. Great Falls Energy, LLC is a Maryland limited liability company wholly owned by APFA. The Lochmere Facility is owned by the Indiana general partnership HDI Associates I, which is held 0.1% by Algonquin Holdco and 99.9% by APFA.

On March 14, 2013, affiliates of APCo entered into an agreement to sell the following facilities: Phoenix Facility, Beaver Falls Facility, Greggs Falls Facility, Pembroke Facility, Clement Facility, Franklin Facility, Lochmere Facility, Lakeport Facility, Mine Falls Facility, and Great Falls Facility. The sale is subject to certain regulatory approvals and other conditions precedent. The transaction is expected to close in 2013.

APFA owns Algonquin Tinker Gen Co. (“Tinker Gen Co.”) and Algonquin Northern Maine Gen Co. (“Northern Maine Gen Co.”), both Wisconsin companies. Tinker Gen Co. is also registered

- 6 -

in New Brunswick, and Northern Maine Gen Co. is also registered in Maine. Tinker Gen Co. operates the 36.8MW of electrical generating assets in New Brunswick (the “Tinker Assets”), and Northern Maine Gen Co. is the owner of the Caribou and Squa Pan diesel facilities. APFA also 100% owns Algonquin Energy Services Inc., a Delaware corporation (“AES”) that is also registered in Connecticut, District of Columbia, Maine, Maryland, New Brunswick and Ohio. AES provides the electrical energy requirements for commercial and industrial customers in northern Maine.

APFA owns a 60% equity interest in Wind Portfolio SponsorCo LLC (“SponsorCo”), a Delaware LLC; the remaining 40% interest is held by Gamesa Energy USA, LLC (“Gamesa USA”), an independent party unrelated to APUC. SponsorCo owns 100% of the Class B managing interests in Wind Portfolio Holdings, LLC (“WP HoldCo”), a Delaware LLC. Non-Algonquin partners, JPM Capital Corporation, Morgan Stanley Wind LLC, and Gear Wind LLC, collectively hold 100% of the non-managing Class A interest in WP HoldCo, which in turn owns Wind Energy Portfolio Holdings I, LLC (“WE HoldCo”). WE Holdco directly owns the three entities which each own separate wind projects in the USA. Sandy Ridge Wind, LLC, a Delaware LLC, owns the Sandy Ridge Wind Facility in Pennsylvania; Minonk Wind, LLC, a Delaware LLC, owns the Minonk wind facility in Illinois; and Senate Wind, LLC, a Delaware LLC, owns the Senate wind facility in Texas.

Through a chain of subsidiaries, APFA owns Shady Oaks Holdings, LLC, a Delaware LLC, which owns TianRun Shady Oaks, LLC, a Delaware LLC, which owns GSG6, LLC, a Delaware LLC, which owns the Shady Oaks wind facility in Illinois. These subsidiaries were acquired effective January 1, 2013.

APFC also 100% owns Algonquin Power Services America LLC, a Delaware corporation that provides purchasing services to APCo entities operating in the U.S.

Liberty Utilities (West) & Liberty Utilities (Central) Region Water and Wastewater Utilities

Liberty Water Co. (“Liberty Water”), a Delaware company, is the parent company of the water and wastewater entities within the Liberty Utilities (West) and Liberty Utilities (Central) regions. On December 22, 2010, APCo completed a corporate reorganization involving Liberty Water wherein 100% of the issued and outstanding common shares of Liberty Water were transferred from APCo to Liberty Utilities.

Liberty Water indirectly owns the water and wastewater businesses located in Arizona, Texas, Missouri, Illinois and Arkansas, in each case through a 100% wholly-owned subsidiary, with the exception of Northwest Sewer Inc., which it owns directly and the Entrada Del Oro Sewer Company, Inc. (“Entrada”) which it currently operates and in which it holds a beneficial interest in the shares of the company pending regulatory approval of its acquisition by Liberty Water. All of these 100% wholly-owned subsidiaries (except Northwest Sewer, Inc.) are currently conducting business as “Liberty Utilities”; however the actual legal names of the relevant entities are set out below.

In Arizona, the following Arizona corporations own the following facilities: Bella Vista Water Co., Inc. owns the Bella Vista Facility; Black Mountain Sewer Corporation owns the Black Mountain Facility; Gold Canyon Sewer Company owns the Gold Canyon facility; Litchfield Park Service Company owns the Litchfield facility; Northern Sunrise Water Company, Inc. owns the Northern

- 7 -

Sunrise facility; Rio Rico Utilities, Inc. owns the Rio Rico facility; and Southern Sunrise Water Company, Inc. owns the Southern Sunrise facility. Northwest Sewer, Inc., an Arizona corporation, has undertaken to a group of developers and homeowner’s associations located to the west of Phoenix to apply for a Certificate of Convenience and Necessity and, if successful, operate a wastewater treatment utility in those areas. Entrada, discussed above, is an Arizona corporation, and it owns the beneficial interest in the Entrada Del Oro facility. In Texas, the following Texas corporations own the following facilities: Tall Timbers Utility Company, Inc. owns the Tall Timbers facility; Woodmark Utilities, Inc. owns the Woodmark facility; Algonquin Water Resources of Texas, LLC, a Texas limited liability company, owns water and wastewater treatment assets at the Holly Lake Ranch, Hill County, Piney Shores and The Villages (also known as “Big Eddy”) Resorts; and Algonquin Seaside Resort, LLC., a Texas limited liability company, owns water and wastewater treatment assets at the Seaside Resort. In Missouri, Algonquin Water Resources of Missouri, LLC, a Missouri limited liability company, owns assets associated with the Holiday Hills, Ozark Mountain, Timbercreek resorts, the water utility in Noel, Missouri and a utility in eastern Missouri. In Illinois, Algonquin Water Resources of Illinois, LLC, an Illinois limited liability company, owns assets for the Fox River Resort.

Liberty Energy Utilities Co. (“Liberty Energy”), a Delaware corporation, is owned by Liberty Utilities. Liberty Energy owns Liberty Utilities (Pine Bluff Water) Inc., which owns and operates the Pine Bluff Water Facility located in Pine Bluff, Arkansas. This facility was acquired by Liberty Utilities on February 1, 2013.

Liberty Utilities (West) Region Electrical Distribution Utility

Liberty Energy owns California Pacific Utilities Ventures, LLC, a California limited liability company (“CPUV”), which in turn owns California Pacific Electric Company, LLC, a California limited liability company (“Calpeco”). Calpeco owns an electricity distribution utility in the Lake Tahoe basin and surrounding areas in California (“California Utility”).

Liberty Utilities (Central) Region Natural Gas Distribution Utility

Liberty Energy also owns Liberty Energy (Midstates) Corp. (“Liberty Midstates”), a Missouri corporation. Liberty Midstates owns natural gas distribution utility assets in Missouri, Iowa and Illinois (the “Midwest Gas Utilities”). These assets were purchased from Atmos Energy Corporation (“Atmos”) on August 1, 2012.

Liberty Utilities (East) Region Electrical Distribution and Natural Gas Distribution Utility

Liberty Energy also owns Liberty Energy Utilities (New Hampshire) Corp. (“Liberty Energy (NH)”), a Delaware corporation registered in New Hampshire. Liberty Energy Utilities (NH) owns Granite State Electric Company (“Granite State Electric Utility”) and EnergyNorth Natural Gas Inc. (“EnergyNorth Gas Utility”). Both Granite State Electric Utility and EnergyNorth Gas Utility were acquired from National Grid USA (“National Grid”) on July 3, 2012.

Liberty Energy also owns Liberty Energy (Georgia) Corp. (“Liberty Georgia”), a Georgia corporation. Liberty Georgia will own natural gas distribution utility assets in Georgia (the “Georgia Utility”). Liberty Georgia has entered into an agreement to acquire these assets from Atmos. The acquisition is expected to close on or about April 1, 2013.

- 8 -

Outside of APCo, Liberty Utilities (West), Liberty Utilities (Central) and Liberty Utilities (East) and their respective subsidiary entities as described above, APUC beneficially owns, directly or indirectly 100% of the following: 3793257 Canada Inc. (“3793257”), a holding company incorporated under the CBCA; and Windlectric Inc. (“Windlectric”), a federal corporation that is developing various wind projects including one in Saskatchewan and one in Ontario.

APUC also owns the following group of special purpose financing companies, including 90% of Liberty Utilities Finance GP 1 (“LU GP1”), a Delaware general partnership. LU GP1 owns 99.9% of Liberty Utilities Finance GP 2 (“LU GP2”), a Delaware general partnership. The minority partner in both LU GP1 and LU GP2 is 3793257. LU GP2 owns Liberty Utilities Finance (Canada) ULC, an Alberta unlimited liability corporation which in turn owns Liberty Utilities Finance (US) LLC, a Delaware limited liability company. The above entities were formed as special purpose financing entities used in Liberty Utilities financings.

| | (b) | Other Interests in Energy Related Developments |

The Corporation also has notes receivable and equity in companies owning generating facilities as described below. APT owns 25% of the Class B non-voting shares issued by Cochrane Power Corporation, the owner of a combined cycle cogeneration facility located in Cochrane, Ontario. APT also owns 32.4% of the Class B non-voting shares in Kirkland Lake Power Corporation, an entity which burns natural gas and wood waste to generate electricity. APT also owns a 12.1% interest in Tranche A and Tranche B term loan interests issued by Chapais Energie, Société en Commandite (“Chapais”) which owns a wood waste facility in Chapais, Québec. It also owns a 33.9% interest in the Class B non-voting preferred shares of Chapais. The loans bear interest at the rate of 10.789% and 4.91%, respectively.

In addition, APCo is entitled to a royalty in the form of cash flows generated by the Long Sault Rapids facility (the “LSR Royalty Interest”). It is also the owner of a 14.14% secured, subordinated note (the “LSR Subordinate Note”) in the principal amount of $2,000,000 issued jointly and severally by Algonquin Power (Long Sault) Corporation Inc., Energy Acquisition (Long Sault) Ltd., Nicholls Holdings Inc. and Radtke Holdings Inc.

As of January 1, 2013 APUC owns the Class B limited partnership units of St. Leon Wind Energy LP, the legal owner of the St. Leon facility.

| 2. | GENERAL DEVELOPMENT OF THE BUSINESS |

APUC is incorporated under theCanada Business CorporationsAct. This is the parent company to Algonquin Power Co. (“APCo”) through a transaction (the “Unit Exchange”) in which APCo’s unitholders exchanged their Trust Units of APCo, on a one-for-one basis, for Common Shares of the Corporation. As a result of the Unit Exchange, APCo itself became a wholly-owned subsidiary of the Corporation and all of the unitholders of APCo became shareholders of the Corporation. The Unit Exchange did not result in any change to the underlying business operations of APCo and accordingly, for accounting purposes, the Corporation is considered a continuation of APCo.

- 9 -

APUC’s business strategy is to maximize long term shareholder value as a dividend paying, growth-oriented corporation in the independent power and rate regulated utilities business sectors. APUC is committed to delivering a total shareholder return comprised of dividends augmented by capital appreciation arising through dividend growth supported by increasing cash flows and earnings. Through an emphasis on sustainable, long-view renewable power and utility investments, over a medium-term planning horizon, APUC strives to deliver annualized per share earnings growth of more than 5% and continued growth in its dividend supported by these increasing cash flows, earnings and additional investment prospects.

APUC’s current quarterly dividend to shareholders is $0.0775 per share or $0.31 per share per annum. APUC believes its annual dividend payout allows for both an immediate return on investment for shareholders and retention of sufficient cash within APUC to fund growth opportunities, reduce short term debt obligations and mitigate the impact of fluctuations in foreign exchange rates. Additional increases in the level of dividends paid by APUC are at the discretion of the APUC Board of Directors (the “Board”) and dividend levels shall be reviewed periodically by the Board in the context of available cash and earnings together with an assessment of the growth prospects available to APUC. APUC strives to achieve its results in the context of a moderate risk profile consistent with top-quartile North American power and utility operations.

APUC produces stable earnings through a diversified portfolio of renewable power and utility businesses owned and operated by its subsidiary entities. APUC conducts its business primarily through two autonomous subsidiaries: APCo, which owns and operates a diversified portfolio of non-regulated renewable and thermal electric generation utility assets; and Liberty Utilities, a diversified rate regulated utility which owns and operates a portfolio of North American electric, natural gas and water distribution utility systems. These businesses of APUC are herein referred to as the “APUC Businesses”.

APCo – Independent Power Generation

APCo generates and sells electrical energy through a diverse portfolio of renewable power generation and clean thermal power generation facilities across North America. APCo seeks to deliver continuing growth through development of greenfield power generation projects, accretive acquisitions of electrical energy generation facilities as well as development of expansion opportunities within APCo’s existing portfolio of independent power facilities. APCo’s renewable energy division develops and operates APCo’s hydroelectric, solar and wind power facilities. APCo’s thermal energy division develops and operates co-generation, energy-from-waste, and steam production facilities.

The renewable power and thermal energy generation business of APCo is managed with an emphasis on growth through the development of green-field projects and opportunities within APCo’s existing portfolio. This is achieved through APCo’s development division which seeks to build on APCo’s expertise in the origination of greenfield renewable energy projects, expanding APCo’s existing portfolio of renewable and thermal energy assets for further growth, and capitalizing on new opportunities as they arise.

- 10 -

APCo’s renewable energy division generates and sells electrical energy through a diverse portfolio of clean, renewable power generation and thermal power generation facilities across North America. APCo owns or has interests in hydroelectric facilities with a combined generating capacity of approximately 170 MW.

APCo also owns or has interests in wind powered generating stations with a combined generating capacity of 650 MW.

Approximately 84% of the electrical output from the hydroelectric and wind generating facilities is sold pursuant to long term power purchase agreements (“PPAs”) which have a weighted average remaining contract life of 15 years

APCo owns or has interests in thermal energy facilities with approximately 341 MW of installed generating capacity. Approximately 95% of the electrical output from the owned thermal facilities is sold pursuant to long term PPA and which have a weighted average remaining contract life of 7 years. Detailed information on the facilities owned and operated by APCo is set out in Schedules A and B.

Liberty Utilities - Utilities

Liberty Utilities is a diversified rate regulated utility providing electricity, natural gas, water distribution and wastewater collection utility services. Liberty Utilities provides safe, high quality and reliable services to its ratepayers through its nationwide portfolio of utility systems and delivers stable and predictable earnings to APUC. In addition to encouraging and supporting organic growth within its service territories, Liberty Utilities delivers continued growth in earnings through accretive acquisition of additional utility systems.

The utility systems owned by Liberty Utilities operate under rate regulation, generally overseen by the public utility commissions of the states in which they operate. Liberty Utilities reports the performance of its utility operations through three regions – West, Central, and East.

The Liberty Utilities (West) region is comprised of regulated electrical and water distribution and wastewater collection utility systems. The regulated electrical distribution utility and related generation assets of the California Utility serve approximately 46,955 active electric connections in the State of California. Liberty Utilities (West) region’s regulated water and wastewater utility systems serve approximately 66,550 water and wastewater connections located in the State of Arizona.

The Liberty Utilities (Central) region is comprised of regulated natural gas and water distribution and wastewater collection utility systems. The regulated natural gas utilities serve approximately 82,050 active natural gas connections located in the States of Missouri, Illinois, and Iowa and the regulated water distribution and wastewater collection utilities serve approximately 11,500 water and wastewater customers located in the States of, Illinois, Missouri, Texas and, as of February 1, 2013, the State of Arkansas.

Liberty Utilities (East) region is comprised of regulated natural gas and electric distribution utility systems located in the State of New Hampshire providing regulated local electrical utility services to approximately 43,250 active electric connections and regulated local gas distribution utility services to approximately 87,650 active natural gas connections. Upon completion of certain pending acquisitions of natural gas utility systems located in Georgia and Massachusetts, an additional 114,000 customers will be added to the Liberty Utilities (East) region.

- 11 -

These utilities generally operate under rate regulation, overseen by public utility commissions of the State in which they operate. Detailed information on the water distribution and wastewater, electrical distribution, and natural gas distribution utilities owned and operated by Liberty Utilities are set out in Schedule C, D, and E, respectively.

| 2.2 | Three Year History and Significant Acquisitions |

The following is a description of the general development of the business of the Corporation over the last three fiscal years.

Corporate

At the annual general meeting on June 23, 2010 (the “Meeting”), APUC adopted a Shareholders’ Rights Plan (the “Rights Plan”). See “Description of Capital Structure – Shareholders’ Rights Plan”.

APCo – Power Generation

On January 12, 2010, APCo completed the acquisition of three hydroelectric generating stations, a 34.5MW hydroelectric generating facility with sufficient reservoir storage capability to move significant amounts of energy from off-peak to on-peak generation located on the Aroostook River near the Town of Perth-Andover, New Brunswick (the “Tinker Facility”), a 0.9MW run-of-river hydroelectric generating facility located in Northern Maine (the “Caribou Facility”) and a 1.4MW run-of-river hydroelectric generating facility located in Northern Maine (the “Squa Pan Facility”).

APCo also acquired certain thermal generating facilities in Northern Maine and New Brunswick utilized for installed reserve capacity, not continuous generation, and New Brunswick Public Utilities Board regulated transmission lines and interconnections which allow direct and indirect access to multiple electricity markets (Northern Maine ISA, New Brunswick ISO and ISO-NE).

| | (ii) | Algonquin Energy Services Inc. |

In connection with the acquisition of the Tinker Facility, on February 4, 2010, APCo acquired an energy marketing company which markets the energy generated from the Tinker Facility. AES is managing this business and it is anticipated that the majority of the energy sold by AES will be supplied through generation from the Tinker Assets, based on historical long term average levels of hydroelectric energy generation of these facilities. AES primarily involves standard offer contracts for the supply of energy to commercial and industrial customers in northern Maine, as well as energy purchase obligations with the ISO-NE required to supplement self-generated energy.

AES’ business consists of a series of short-term energy supply agreements. These include energy sales to a town in New Brunswick, standard offer service contracts with three local electric utilities in northern Maine, and a series of direct energy contracts with commercial buyers also in northern Maine.

- 12 -

A capital upgrade at the EFW Facility was completed in July 2010 and has resulted in higher throughput and lower operating costs per tonne at the Facility in 2011 as compared to periods prior to the upgrade.

Liberty Utilities

On January 1, 2011, APUC, in partnership with Emera, completed the transaction and acquired the assets comprising an electrical generation and regulated utility (the “California Utility”) for a gross purchase price of U.S. $136.1 million, subject to certain working capital and other closing adjustments from Sierra Pacific Power Company d/b/a NV Energy and Calpeco dated April 22, 2009. Liberty Utilities acquired 50.001% and Emera acquired 49.999% of California Pacific Utility Ventures LLC, which owns 100% of the purchaser of the California Utility assets, Calpeco. On December 21, 2012, APUC acquired the remaining 49.999% ownership in California Pacific Utility Ventures LLC from Emera and as a result, APUC now owns 100% of the California Utility (see Fiscal 2012 highlights).

| | (ii) | New Hampshire Utility |

On December 9, 2010, APUC announced that Liberty Energy had entered into agreements to acquire all issued and outstanding shares of Granite State Electric Utility, a regulated electric distribution utility, and EnergyNorth Gas Utility, a regulated natural gas distribution utility from National Grid, as outlined in the share purchase agreements by and between National Grid and Liberty Energy entered into on December 8, 2010 and amended and restated on January 11, 2011.

For a more detailed discussion of this acquisition, see “General Development of the Business – Three Year History and Significant Acquisitions – Fiscal 2012 – Liberty Utilities – Acquisition of New Hampshire Utility”.

Liberty Utilities (West) had ongoing rate cases at a number of its utilities which were processed throughout 2010. During the year ended December 31, 2010, Liberty Utilities completed rate case proceedings at nine utilities in Arizona and Texas which on an annualized basis were expected to contribute an additional U.S. $10.2 million in revenue. As these rate cases were settled at various times throughout the year ended December 31, 2010, approximately U.S. $2.3 million of the overall annualized revenue increase from rate cases completed in Arizona and Texas was achieved in the year. One additional rate case requesting U.S. $1.1 million in annual revenue requirement was concluded in the first quarter of 2011.

| | (iv) | Senior Debt Financing |

The acquisition of the California Utility was funded in part with the proceeds of a U.S. $70 million senior unsecured private debt placement at the utility entered into on December 29, 2010. The

- 13 -

private placement is a senior unsecured private placement with U.S. institutional investors, and is an obligation solely of the California Utility. The notes are fixed rate and split into two tranches, U.S. $45 million of ten year 5.19% notes and U.S. $25 million of 5.59% fifteen year notes.

On December 22, 2010, Liberty Water completed a private placement financing of senior unsecured 5.6% notes for gross proceeds of approximately U.S. $50 million. The private placement is a senior unsecured private placement with U.S. institutional investors, and is an obligation solely of Liberty Water. The notes have a 10 year term bearing interest until June 2016, at which point annual principal repayments of U.S. $5.0 million will commence. The funds were used to reduce outstanding indebtedness under APCo’s senior credit facility (“APCo Credit Facility”).

Corporate

| | (i) | Issuance of $95.3 million of Common Shares |

On October 27, 2011, APUC completed a public offering (the “Offering”) of 15,100,000 common shares at a price of $5.65 per share, for gross proceeds of approximately $85.3 million. On November 14, 2011, the underwriters exercised a portion of the over-allotment option granted with the Offering and an additional 1,769,000 common shares were issued on the same terms and conditions of the Offering. As a result, APUC issued an aggregate of 16,869,000 common shares under the Offering for the total gross proceeds of approximately $95.3 million.

The net proceeds of the Offering were used to fund growth initiatives for both Liberty Utilities and APCo, to partially repay existing indebtedness and for other general corporate purposes.

| | (ii) | Conversion of Convertible Debentures to Equity |

Effective May 16, 2011 (“Series 1A Redemption Date”), APUC redeemed $2.1 million, all of the remaining issued and outstanding principal amount, of Series 1A 7.5% convertible unsecured subordinated debentures due November 30, 2014 (the “Series 1A Debentures”) and issued 430,666 Common Shares of APUC upon the redemption. Between January 1, 2011 and the Series 1A Redemption Date, $60.339 million principal amount of Series 1A Debentures were converted by debenture holders into 14,788,976 shares of APUC.

| | (iii) | Strategic Investment Agreement with Emera |

On April 29, 2011, APUC entered into a strategic investment agreement (the “Strategic Investment Agreement”) with Emera which establishes how APUC and Emera will work together to pursue specific strategic investments of mutual benefit. The Strategic Investment Agreement builds on the strategic partnership effectively established between the two companies in April 2009.

The Strategic Investment Agreement outlines “areas of pursuit” for each of APUC and Emera. For APUC, these include investment opportunities relating to unregulated renewable generation, small electric utilities and gas distribution utilities. For Emera, these include investment opportunities related to regulated renewable generation and transmission projects within its service territories and large electric utilities. APUC is committed to working with Emera on opportunities that fit within APUC’s “areas of pursuit”.

- 14 -

As an element of the Strategic Investment Agreement, Emera is able to acquire up to 25% of APUC through the purchase of common shares issued by APUC to fund certain investment opportunities under the Strategic Investment Agreement. The Strategic Investment Agreement was approved by shareholders at the annual and special general meeting held on June 21, 2011.

APUC share purchases are made through the acquisition of subscription receipts in exchange for promissory notes at an agreed upon price, which are then exchangeable into common shares upon meeting certain transaction specific conditions, or at a later date at Emera’s option, as applicable. The acquisition and conversion of subscription receipts is subject to approvals required under applicable laws, including the rules of the TSX.

APCo – Power Generation

| | (i) | AES Standard Offer Contract |

In 2011, AES entered into a three year contract with Maine Public Service Company (“MPS”), a regulated electric transmission and distribution utility serving approximately 36,000 electricity customer accounts in Northern Maine starting March 1, 2011 to provide standard offer service to multiple commercial and industrial customers in Northern Maine. The anticipated customer load associated with the standard offer service is approximately 135,000 MW-hrs.

| | (ii) | Windsor Locks Repowering |

The Windsor Locks facility is a 56 MW natural gas powered electrical and steam energy generating station located in Windsor Locks, Connecticut. This facility delivers 100% of its steam capacity and a portion of its electrical generating capacity to Ahlstrom pursuant to an energy services agreement (“ESA”).

APCo has entered into an agreement to extend the ESA with Ahlstrom from 2017 to 2027. As a result, APCo initiated the process to acquire a new combustion gas turbine which would be more appropriately sized to meet the electrical and steam requirements of the steam host. The new turbine was placed in operation in 2012.

| | (iii) | APCo Senior Unsecured Debentures |

On July 25, 2011, APCo issued $135 million in senior unsecured debentures (the “2011 APCo Debentures”) by way of private placement. The net proceeds from the 2011 APCo Debentures were used to repay the outstanding senior project debt financing related to the St. Leon facility (the “AirSource Senior Debt”) and to reduce amounts outstanding under APCo’s senior revolving credit facility. The 2011 APCo Debentures mature on July 25, 2018, and bear interest at a rate of 5.50% per annum, calculated semi-annually payable on January 25 and July 25 each year, commencing on January 25, 2012.

| | (iv) | APCo Credit Facility Renewal |

On January 14, 2011, APCo received commitments from a syndicate of Canadian banks for a new $142 million credit facility with a three year term. APCo reduced the amount of the APCo Credit Facility to $120 million following the completion of the Senior Unsecured Debenture private placement by APCo in July 2011.

- 15 -

Liberty Utilities

On April 29, 2011, pursuant to the Strategic Investment Agreement, Emera and APUC agreed to the general terms by which Emera would sell its 49.999% direct ownership in the California Utility to APUC, with closing of such transaction subject to, among other things, execution of a definitive purchase agreement and regulatory approval. On September 12, 2011, Emera US Holdings Inc., a subsidiary of Emera through which it holds its interest in the California Utility, entered into a definitive purchase agreement with Liberty Utilities. In connection with this transaction, Emera entered into a subscription agreement with APUC dated September 12, 2011, pursuant to which Emera subscribed for an aggregate of 8,211,000 subscription receipts from APUC at a price of $4.72 per subscription receipt. Payment for these subscription receipts was satisfied by delivery by Emera of two non-interest bearing promissory notes, one in the amount of $22,608,800 and one in the amount of $16,147,120. The transaction was completed in 2012, as further described below under “General Development of the Business – Three Year History and Significant Acquisitions – Fiscal 2012 – Liberty Utilities – Acquisition of Remaining Interest in California Utility”.

Corporate

| | (i) | Dividend Increased to $0.31 per Common Share Annually |

APUC completed several acquisitions and advanced a number of other initiatives that have raised the growth profile for APUC’s earnings and cash flows which in turn supports an increase in the dividend to shareholders. As a result, on August 9, 2012, the Board approved a dividend increase of $0.03 per share annually bringing the total annual dividend to $0.31, paid quarterly at the rate of $0.0775 per common share.

| | (ii) | Issuance of $120M Preferred Shares |

On November 9, 2012, APUC issued 4.8 million cumulative rate reset preferred shares, Series A (the “Series A Shares”) at a price of $25 per share, for aggregate gross proceeds of $120 million. The shares yield 4.5% annually for the initial six-year period ending on December 31, 2018. The preferred shares have been assigned a rating of P-3 and Pfd-3(low) by Standard and Poor’s (“S&P”) and DBRS respectively. The proceeds of the offering were used primarily to partially fund the acquisition of the interest in the Gamesa wind powered generating stations (“Gamesa Wind Facilities”) which closed on December 10, 2012.

| | (iii) | Private Placements to Emera |

During fiscal 2012, APUC issued a total of 26,380,750 Common Shares for cash proceeds of $142.6 million pursuant to the conversion of subscription receipts issued to Emera in connection with certain previously announced and completed transactions. The shares were issued in the context of the existing Strategic Investment Agreement which contemplates Emera’s investment in APUC of up to 25%.

- 16 -

As at December 31, 2012, Emera owned 34,903,750 Common Shares representing approximately 18.5% of the total outstanding Common Shares of APUC.

Subsequent to December 31, 2012 and pursuant to previously issued subscription receipts or commitments to subscribe for subscription receipts, APUC issued 2,614,005 Common Shares at a price of $5.74 per share, 5,228,011 Common Shares at a price of $5.74 per share and 3,421,000 Common Shares at a price representing $4.72 per share pursuant to conversion of subscription receipts issued to Emera.

On March 26, 2013, Emera subscribed for and purchased 3,960,000 Common Shares of APUC at a price of $7.40 per share for total proceeds of approximately $29 million.

As a result of the transactions after December 31, 2012, Emera owns, as of March 26, 2013, 50,126,766 Common Shares, representing approximately 24.51% of the total outstanding Common Shares of APUC.

APUC believes issuance of shares to Emera is an efficient way to raise equity as it avoids underwriting fees, legal expenses and other costs associated with raising equity in the capital markets.

| | (iv) | Conversion of Series 2A Convertible Debentures to Equity |

On February 24, 2012 (“Series 2A Redemption Date”), APUC redeemed $57.0 million, representing the remaining issued and outstanding, 6.35% convertible unsecured subordinated debentures due November 30, 2016 (“Series 2A Debentures”) by issuing and delivering 9,836,520 Common Shares. Between January 1, 2012 and the Series 2A Redemption Date, a principal amount of $2.9 million of Series 2A Debentures were converted by the holders of such debentures into 485,998 common shares of APUC.

| | (v) | Conversion and Redemption of Series 3 Convertible Debentures to Equity |

On December 31, 2012, holders of $55.3 million of principal amount of 7.0% convertible unsecured debentures due June 30, 2017 (the “Series 3 Debentures”) converted their debentures into 13,172,619 Common Shares of APUC. On January 1, 2013 (the “Series 3 Redemption Date”), APUC completed a redemption of the outstanding Series 3 Debentures by issuing and delivering 150,816 APUC common shares for the remaining $0.9 million in Series 3 Debentures.

On November 19, 2012, APUC entered into an agreement for a $30.0 million senior unsecured revolving credit facility (“APUC Credit Facility”) with a Canadian chartered bank. The credit facility will be used for general corporate purposes and has a maturity date of November 19, 2015.

Liberty Utilities

| | (i) | Agreement to Acquire Georgia Utility |

On August 8, 2012, Liberty Utilities entered into an agreement with Atmos to acquire certain regulated natural gas distribution utility systems comprising of the Georgia Utility serving

- 17 -

approximately 64,000 connections located in the State of Georgia. The total purchase price for the Georgia Utility is approximately U.S. $140.7 million representing a 1.1x premium to net assets for regulatory purposes of U.S. $128.1 million and is subject to certain working capital and other closing adjustments.

On February 22, 2013, Liberty Utilities has received all federal and state regulatory approvals required to complete the acquisition. Closing is expected to occur on or about April 1, 2013 and will be reported as part of the Liberty Utilities (East) region.

| | (ii) | Acquisition of Remaining Interest in the California Utility |

On December 21, 2012, a subsidiary of APUC completed the acquisition of the remaining 49.999% ownership in California Pacific Utility Ventures LLC, which owns 100% of the California Utility assets. The subsidiary of APUC acquired the remaining 49.999% interest from Emera through proceeds received from the issuance of 8,211,000 Common Shares of APUC on the conversion of subscription receipts previously issued to Emera. 4,790,000 of such shares which were issued on December 27, 2012, and the remaining 3,421,000 shares were issued on February 14, 2013.

| | (iii) | Acquisition of New Hampshire Utility |

On July 3, 2012, Liberty Utilities completed the acquisition of all issued and outstanding shares of the Granite State Electric Utility and the EnergyNorth Gas Utility, both from National Grid, for consideration of U.S. $285.0 million plus working capital and other closing adjustments for a total consideration of U.S. $295.8 million. The purchase price for the utility assets represents a multiple of aggregate expected regulatory assets of approximately 1.14x. The regulated electric distribution company provides electric service to over 43,000 connections in 21 communities in New Hampshire and the regulated natural gas distribution utility provides natural gas service to over 87,000 connections in five counties and 30 communities in New Hampshire.

In the first half of 2013, Granite State Electric Utility will file a rate case with the New Hampshire Public Utilities Commission (“NHPUC”) seeking an increase in distribution base rates. The filing is based on a 2012 test year, with revenues and expenses reflecting known and measurable changes. The regulatory process associated with the rate case is expected to last one year, with temporary rates expected to be implemented on or about July 1, 2013 and the final permanent rates determined in the rate case going into effect on or about March 2014.

| | (iv) | Acquisition of Missouri Utility |

On August 1, 2012, Liberty Utilities completed the acquisition of regulated natural gas distribution utility systems (the “Midwest Gas Utilities”) located in Missouri, Illinois, and Iowa from Atmos for consideration of U.S. $127.7 million plus working capital and other closing adjustments for a total consideration of U.S. $128.2 million.

The acquisition was originally announced in May 2011 and final regulatory approvals were received in June 2012. The purchase price for the utility assets represented a multiple of net assets for regulatory purposes of approximately 1.1x. Collectively, the regulated natural gas distribution systems provide natural gas service to approximately 82,000 connections.

- 18 -

| | (v) | U.S. Debt Private Placements |

In connection with the above noted gas and electric utility acquisitions during the third quarter, Liberty Utilities completed a U.S. $225 million private placement debt financing. The financing was closed in two tranches contemporaneously with the closing of the New Hampshire and Missouri Utilities acquisitions. The notes are senior unsecured notes with an average life maturity of over ten years and a weighted average coupon of 4.38%. The notes have been assigned a rating of “BBB high” by DBRS Limited. Proceeds from the private placement were used to partially fund the New Hampshire and Midwest Gas Utilities acquisitions.

On March 14, 2013 Liberty Utilities completed a U.S. $15 million private placement debt financing in connection with the acquisition of an Arkansas water utility. The notes are senior unsecured with a 10 year term and a coupon of 4.14%.

| | (vi) | Expansion of Liberty Utilities Credit Facility |

In 2012, Liberty Utilities entered into an agreement for a U.S. $100 million senior unsecured revolving credit facility (“Liberty Credit Facility”) with a consortium of U.S. banks. The Liberty Credit Facility will be used for general corporate purposes and has a three year term with a maturity date of January 18, 2015.

APCo – Power Generation

| | (i) | Acquisition of U.S. Wind Facilities |

In 2012 APCo completed its 60% equity investment in the Gamesa Wind Facilities which comprise of a portfolio of three wind powered generating stations (the Minonk wind facility (200MW), the Senate wind facility (150MW) and the Sandy Ridge wind facility (50MW) located in the states of Illinois, Texas, and Pennsylvania, respectively) for consideration of $271.7 million.

The Gamesa Wind Facilities were acquired through a newly formed partnership whose members include Class B members consisting of APCo (60% interest in Class B membership units) and Gamesa USA, a subsidiary of Gamesa Corporación Tecnológica, S.A., the original developer of the projects, (holding a 40% interest in Class B membership units), and certain Class A equity investors who are primarily entitled to the tax attributes associated with the projects. Total cost of the three wind farms was approximately $747 million.

The Gamesa Wind Facilities utilize Gamesa G9X-2.0 MW wind turbines. Gamesa USA has assumed all operations, maintenance, and capital repair responsibilities for the facilities pursuant to 20 year agreements for the turbines and balance of plant facilities.

Total annual energy production is expected to be 1,352 GW-hrs per year. The Gamesa Wind Facilities have long term energy production hedges with a weighted average life of 11.8 years (Minonk and Sandy Ridge wind facilities 10 years each, Senate wind facility 15 years). Approximately 73% of energy revenues are earned under the energy production hedges. All energy produced in excess of that included under the energy production hedges, together with ancillary services including capacity and renewable energy credits, will be sold into the energy markets in which the facilities are located.

- 19 -

| | (ii) | APCo $150 million Senior Unsecured Debentures |

On December 3, 2012, APCo issued $150 million 4.82% senior unsecured debentures with a maturity date of February 15, 2021 (the “2012 APCo Debentures”) pursuant to a private placement in Canada and the United States. The 2012 APCo Debentures were sold at a price of $99.94 per $100.00 principal amount, resulting in an effective yield to maturity of 4.83% per annum. Concurrent with the offering, APCo entered into a fixed for fixed cross currency swap, coterminous with the 2012 APCo Debentures, to economically convert the Canadian dollar denominated debentures into U.S. dollars, resulting in an effective interest rate throughout the term of 4.4%.

Net proceeds from the 2012 APCo Debentures were used primarily to fund the investment in the Gamesa Wind Facilities.

| | (iii) | APCo Credit Facility |

On November 16, 2012, APCo amended the APCo Credit Facility to increase the commitments available under the Facility to $200 million. In addition, the bank syndicate agreed to release its security previously held over certain APCo entities, such that the amended APCo Credit Facility is now fully unsecured. The APCo Credit Facility now has a maturity date of November 16, 2015.

| | (iv) | Completion of Windsor Locks Facility Repowering |

APCo has completed the repowering of the Windsor Locks facility’s electrical and steam energy generating station. The installation of a new 14 MW Solar Titan combustion gas turbine was completed in July 2012 at a total capital cost of U.S. $18.3 million (net of one-time non-recurring items: State of Connecticut grant for U.S. $6.5 million; and a U.S. Federal Government heat and power investment tax credit for U.S. $2.4 million) and is now fully operational. As part of the repowering project, APCo had previously entered into an extension of the energy services agreement with Ahlstrom for delivery of 100% of its steam capacity and a portion of its electrical generating capacity. The agreement now continues until 2027. With the new turbine operational, the existing Frame 6 is now available as a peaking turbine to generate additional revenues.

| 2.3 | Recent Developments – 2013 |

Corporate

| | (i) | Agreement with St. Leon Class B unit holders |

The St. Leon Facility is a 104 MW wind power generating facility which is owned by St. Leon LP. St. Leon LP had issued an aggregate of 100 Class B units, of which 18 units had been issued to each of Ian Robertson, currently the Chief Executive Officer of APUC and Chris Jarratt, currently the Vice Chair of APUC (the “Senior Executives”) and an aggregate of 64 units to third parties. APUC and the Class B unit holders (including the partnership owned by the Senior Executives) completed a transaction effective January 1, 2013 whereby the Class B units were exchanged for Series C preferred shares of APUC on a one-for-one basis. The characteristics of the Series C preferred shares will provide approximately the same after tax cash to individuals holding such shares as what was estimated to have been expected from the Class B units. The third parties and the partnerships owned by the Senior Executives who formerly held

- 20 -

the Class B units no longer hold Class B units in St Leon LP. The special committee of the Board retained the services of an independent advisor to review the historic financial performance of the St Leon facility, provide a valuation of the Class B units, provide estimation of distributions to Class B unit holders, and to provide advice to APUC in respect thereof.

Liberty Utilities

| | (i) | Agreement to Acquire New England Utility |

On February 11, 2013, Liberty Utilities entered into an agreement with The Laclede Group, Inc. (“Laclede”) to assume Laclede’s rights to purchase the assets of New England Gas Company (“NEGasCo Acquisition”) from Southern Union Company. New England Gas Company is a natural gas distribution utility serving over 50,000 customers in Massachusetts. The acquisition is subject to certain approvals and conditions, including state and federal regulatory approval, and is expected to close in the second half of 2013.

Total consideration for the utility asset purchase is approximately U.S. $74 million, subject to working capital and closing adjustments representing a 1.0x premium to regulatory assets of $73.9 million. The purchase price will be funded using a target capital structure of 52% equity and 48% debt and will include the assumption of U.S. $19.5 million of existing debt.

| | (ii) | Acquisition of Arkansas Utility |

On February 1, 2013, Liberty Utilities completed the acquisition of issued and outstanding shares of United Water Arkansas Inc., a regulated water distribution utility (“Pine Bluff Water Utility”) from United Waterworks Inc. The Pine Bluff Water Utility is located in Pine Bluff, Arkansas and serves approximately 17,000 customers. Total purchase price for the Pine Bluff Water Utility was approximately U.S. $27.6 million representing a 1.16x premium to net utility assets of U.S. $24.6 million and subject to certain working capital and other closing adjustments. The Pine Bluff Water Utility will be included in the Liberty Utilities (Central) region.

| | (iii) | U.S. $100 million Acquisition Term Facility |

On March 14, 2013 Liberty Utilities entered into a U.S. $100 million term loan with a U.S. bank. The loan facility is available for acquisitions and general corporate purposes and matures on December 31, 2013.

APCo – Power Generation

| | (i) | Acquisition of Shady Oaks Wind Facility |

Effective January 1, 2013, APCo acquired the Shady Oaks wind facility, a 109.5 MW contracted wind powered generating station from Goldwind International SO Limited (“Goldwind”) for total consideration of approximately US$148.9 million.

The Shady Oaks wind facility is located in Northern Illinois, approximately 80 km west of Chicago, Illinois and reached commercial operation in June 2012.

The facility is comprised of 68 Goldwind GW82 1.5MW and 3 Goldwind GW100 2.5MW permanent magnet direct-drive wind turbines; these turbines are well suited for the wind regime, and offer significant technological advantages providing proven reliability, enhanced energy

- 21 -

production efficiency and lower long term maintenance costs. Through an affiliate, Goldwind has assumed all operations, maintenance, and capital repair responsibilities for the Shady Oaks wind facility pursuant to a 20 year fixed price agreement for the turbines and balance of plant facilities.

Total annual energy production is expected to be 364 GW-hrs per year. The Shady Oaks wind facility has entered into a 20 year inflation indexed power purchase agreement with the largest electric utility in the state of Illinois, Commonwealth Edison (BBB flat stable: Moody’s, S&P) for 310 GW-hrs of energy per year. All energy produced in excess of that sold under the power purchase agreement will be sold into the energy market in which the facility is located.

| | (ii) | Sale of Small U.S. Hydro Facilities |

On March 14, 2013, APCo entered into an agreement to sell 10 small U.S. hydroelectric generating facilities that were no longer considered strategic to the ongoing operations of the Corporation for gross proceeds of U.S. $27 million. The operating results from these facilities are therefore disclosed as discontinued operations on the consolidated statements of operations and prior periods have been reclassified to conform to this presentation.

| 3. | DESCRIPTION OF THE BUSINESS |

| 3.1 | General Description of the Regulatory Regimes in which the Business Operates. |

| | (a) | Power Generation Regulatory Regimes |

In Canada, the provinces have legislative authority over the supply of energy. The majority of the electrical supply within the Canadian provinces is provided by large Crown corporations such as Ontario Power Generation Inc. and Hydro-Québec or smaller, investor-owned utilities. These large utilities have been primarily responsible for the generation, transmission and distribution of electricity.

“Green Power” is considered electricity generated from renewable energy sources that do not contribute to greenhouse gas emissions. Green Power includes technologies such as small hydroelectric (generally defined as facilities of less than 20 MW in capacity), bioenergy, landfill gas, wind and photovoltaic technologies. Since 1997, both the federal and provincial governments in Canada have provided various incentives to stimulate the production of Green Power in Canada. The incentives have varied from direct subsidies, to tax credits to higher than market rates for electricity generated from renewable energy sources.

The ecoENERGY for Renewable Power is the most recent of a series of incentive programs created by the Canadian Federal government (previous programs were the Wind Power Production Incentive (WPPI) and the Renewable Power Production Incentive (RPPI)) that provides an incentive of one cent per kilowatt hour for up to 10 years to reduce the cost gap between new technologies and traditional sources of electricity. Eligible technologies include electricity generation from renewable energy sources such as wind, low-impact hydro, biomass, photovoltaic and geothermal energy. Although no new contribution agreements were signed after March 31, 2011, signed agreements will continue to receive payments as outlined in contribution agreements and up to March 31, 2021.

- 22 -

The power generation industry in the United States is regulated by the United States Federal Energy Regulatory Commission (“FERC”) under the U.S. Federal Power Act (“FPA”) and Public Utilities Regulatory Policies Act (“PURPA”).

Certain of APCo’s US Facilities are classified as qualifying facilities (“QFs”), under PURPA. While QFs were previously exempt from rate regulation under the FPA, due to changes in PURPA, QFs are now subject to rate regulation under Section 205 and 206 of the FPA, subject to certain exceptions. Sales of energy or capacity made by QFs 20 MW or smaller, or made pursuant to a contract executed on or before March 17, 2006, or made pursuant to a state regulatory authority’s implementation of PURPA are exempt from regulation under sections 205 and 206 of the FPA. All relevant APCo facilities had PPAs in place predating March 17, 2006, and as such have not been impacted.

The APCo facilities that are not QFs have market-based rate authority under the FPA and thus are subject to less regulation than cost of service based entities.

| | b. | PURPA Regulatory Structure |

The purpose of PURPA is to encourage the development of small independent power production. To accomplish this, FERC requires electric utilities to purchase energy and capacity from QFs at the utility’s avoided cost. “Avoided Cost” means costs a utility does not incur to add new generating capacity to the system by purchasing electricity from an independent or parallel generator.

As a result of theEnergy Policy Act of 2005, electric utilities are no longer required to purchase energy or capacity from a QF if the utility can prove the QF has non-discriminatory access to:

(1)(i) Independently administered, auction-based day ahead and real time wholesale markets for the sale of electric energy; and

(ii) Wholesale markets for long-term sales of capacity and electric energy; or