| | |

| Ticker Symbols: |

| |

| Class A | | HYCAX |

| |

| Class C | | HYCCX |

| |

| Class Y | | HYCYX |

Beginning in February 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer, bank or insurance company. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary or, if you invest directly with the Fund, by calling 1-800-225-6292.

You may elect to receive all future reports in paper free of charge. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-225-6292. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the Pioneer Fund complex if you invest directly.

visit us: www.amundipioneer.com/us

| | | | |

| Table of Contents | | | | |

| |

President’s Letter | | | 2 | |

| |

Portfolio Management Discussion | | | 4 | |

| |

Portfolio Summary | | | 11 | |

| |

Prices and Distributions | | | 12 | |

| |

Performance Update | | | 13 | |

| |

Comparing Ongoing Fund Expenses | | | 16 | |

| |

Schedule of Investments | | | 18 | |

| |

Financial Statements | | | 29 | |

| |

Notes to Financial Statements | | | 36 | |

| |

Report of Independent Registered Public Accounting Firm | | | 47 | |

| |

Additional Information | | | 49 | |

| |

Trustees, Officers and Service Providers | | | 50 | |

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 1 |

President’s Letter

Since 1928, active portfolio management based on in-depth, fundamental research, has been the foundation of Amundi Pioneer’s investment approach. We believe an active management investment strategy is a prudent approach to investing, especially during periods of market volatility, which can result from any number of risk factors, including slow U.S. economic growth, rising interest rates, and geopolitical factors. Of course, in today’s global economy, risk factors extend well beyond U.S. borders. In fact, it’s not unusual for political and economic issues on the international front to cause or contribute to volatility in U.S. markets.

At Amundi Pioneer, each security under consideration is researched by our team of experienced investment professionals, who communicate directly with the management teams of those companies. At the end of this research process, if we have conviction in a company’s business model and management team, and regard the security as a potentially solid investment opportunity, an Amundi Pioneer portfolio manager makes an active decision to invest in that security. The portfolio resulting from these decisions represents an expression of his or her convictions, and strives to balance overall risk and return opportunity.

As an example, the Standard & Poor’s 500 Index – the predominant benchmark for many U.S. Large-Cap Core Equity funds – has 500 stocks. An Amundi Pioneer portfolio manager chooses to invest in only those companies that he or she believes can offer the most attractive opportunities to pursue the fund’s investment objective, thus potentially benefiting the fund’s shareowners. This process results in a portfolio that does not own all 500 stocks, but a much narrower universe.

The same active decision to invest in a company is also applied when we decide to sell a security, due to changing fundamentals, valuation concerns, or market risks. We apply this active decision-making across all of our equity, fixed-income, and global portfolios.

Today, as investors, we have many options. It is our view that active management can serve shareholders well not only when markets are thriving, but also during periods of market volatility and uncertainty, thus making it a compelling investment choice. As you consider the many choices today, we encourage you to work with your financial advisor to develop an overall investment plan that addresses both your short- and long-term goals, and to implement such a plan in a disciplined manner.

| | | | |

| 2 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

We greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Sincerely,

Lisa M. Jones

Head of the Americas, President and CEO of U.S.

Amundi Pioneer Asset Management USA, Inc.

August 31, 2019

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 3 |

Portfolio Management Discussion | 8/31/19

In the following interview, Matthew Shulkin discusses the factors that influenced the performance of Pioneer Corporate High Yield Fund during the 12-month period ended August 31, 2019. Mr. Shulkin, a vice president and a portfolio manager at Amundi Pioneer Asset Management, Inc. (Amundi Pioneer), and Andrew Feltus, Co-Director of High Yield and a portfolio manager at Amundi Pioneer, are responsible for the day-to-day management of the Fund, along with Kenneth Monaghan, Co-Director of High Yield and a portfolio manager at Amundi Pioneer*.

| Q | How did the Fund perform during the 12-month period ended August 31, 2019? |

| A | Pioneer Corporate High Yield Fund’s Class A shares returned 7.13% at net asset value during the 12-month period ended August 31, 2019, while the Fund’s benchmark, the ICE Bank of America Merrill Lynch U.S. High Yield Index (the ICE BofA ML Index), returned 6.58%. During the same period, the average return of the 712 mutual funds in Morningstar’s High Yield Bond Funds category was 5.34%. |

| Q | Could you please describe the market environment for high-yield corporate bonds during the 12-month period ended August 31, 2019? |

| A | Entering the period, robust economic data and corporate earnings results boosted market sentiment for riskier assets, outweighing concerns over increasingly protectionist U.S. trade policy. The markets continued to focus heavily on economic growth and inflation indicators in an effort to predict likely U.S. Federal Reserve (Fed) policy, as the Fed was in the process of tightening monetary conditions by raising interest rates, having done so twice in the first half of 2018. At that time, the general expectation among market participants was for two additional quarter-point federal funds rate increases by year-end, for a total of four in 2018. Treasury yields rose in advance of the Fed’s September 25, 2018, meeting, the result of which was an increase to the upper band for the benchmark overnight lending rate from 2.00% to 2.25%. Meanwhile, equities continued to grind higher, and credit-oriented segments of the bond market performed well through September of 2018. |

| * | Mr. Monaghan became a portfolio manager on the Fund effective September 30, 2019. |

| | | | |

| 4 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

Conditions reversed in the fourth quarter of 2018, however, and it proved to be one of the most challenging three-month periods for investors since the end of the financial crisis in March of 2009. A number of issues converged to produce exceptionally poor returns for riskier assets heading into the end of the calendar year. Escalating trade tensions between the U.S. and some of its key trading partners, especially China, with associated implications for economic growth and corporate profit margins, was perhaps the biggest issue. Another concern was that the Fed would “overshoot” and raise interest rates too high after doing so again in December, the fourth rate increase in 2018, which had the potential to produce an inverted yield curve and raise recession fears. (An inverted yield curve occurs when longer-term rates dip below shorter-term rates.) Finally, the prospect of a looming U.S. government shutdown also concerned the markets towards the end of 2018. (A shutdown did occur, but it proved relatively short-lived.)

After the difficult fourth quarter, capped by December’s rout in the credit and equity markets, investor sentiment rebounded in January 2019 as Fed Chairman Powell indicated that interest-rate policy was not on a fixed course. Powell’s words led market participants to conclude that the Fed was unlikely to raise its benchmark rate again in 2019. The view received further support from the Fed’s statement at the end of January that it was prepared to be “patient” on further rate hikes, given “muted inflation pressures.” In addition, positive readouts from employment and manufacturing data helped boost risk sentiment at the beginning of the new calendar year.

Despite some interim volatility, credit-sensitive and other riskier assets generally maintained a firm tone through the end of April 2019. In May, however, President Trump’s announcement of plans to institute a 25% tariff on some $200 billion worth of Chinese goods – an indication that a trade deal between the two countries was not going to be as easy to achieve as the market initially believed – led to another brief market downturn. At that point, the Fed signaled a willingness to implement one or more cuts in the federal funds rate before the end of 2019, and later implemented a 0.25% rate reduction in July 2019, prior to period-end. The Fed’s continued softer tone on monetary policy spurred a strong rally in bonds over the final weeks of the 12-month period.

The Treasury yield curve finished the 12-month period significantly lower along its length, boosting returns for fixed-income assets in general.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 5 |

| Q | Can you review the Fund’s principal strategies during the 12-month period ended August 31, 2019, and the degree to which they added to or detracted from benchmark-relative performance? |

| A | Security selection results drove the Fund’s strong performance relative to the benchmark during the 12-month period, led by portfolio holdings within the energy, health care, and basic industry sectors. In energy for example, our overall focus on holding higher-quality issues in the portfolio helped bolster the Fund’s benchmark-relative performance during the sell-off of riskier assets we witnessed in late 2018. |

With regard to individual securities, the Fund’s lack of exposure to the debt of Weatherford International was the top positive contributor to benchmark-relative performance for the period. The over-levered oil & gas services firm had entered into a restructuring support agreement with bondholders in May of 2019, but ultimately filed Chapter 11 bankruptcy in July. Another positive contributor to the Fund’s benchmark-relative results was a portfolio overweight to the long-term debt of CF Industries. CF, an agricultural fertilizer company, experienced improved operating results during the period; meanwhile, the prices of CF’s bonds benefited from declining Treasury yields. Finally, a portfolio overweight position in bonds financing the construction of a new Hard Rock hotel/casino in Sacramento, California, also aided the Fund’s relative performance for the period. The Fund participated in structuring the bonds’ terms and pricing after performing significant due diligence on the casino project, which has surpassed construction targets in terms of both cost and timing.

On the negative side, the Fund’s sector weightings and duration positioning versus the benchmark detracted modestly from relative performance. (Duration is a measure of the sensitivity of the price, or the value of principal, of a fixed-income investment to changes in interest rates, expressed as a number of years.)

Individual investments that detracted from the Fund’s benchmark-relative returns during the 12-month period included an overweight portfolio position in the bonds of Halcon Resources. The highly levered exploration & production company burned through its free cash as it experienced ongoing production misses and weak natural gas realizations. Those developments led Halcon to file for reorganization under Chapter 11 bankruptcy. An overweight position in agricultural tire manufacturer Titan Tire also weighed on the Fund’s benchmark-relative returns as tariffs, soft farm prices, and higher commodity input costs led to weaker operating results. The Fund’s overweight holdings of the bonds of network infrastructure

| | | | |

| 6 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

company CommScope was another detractor from benchmark-relative performance. Lower-than-expected spending on cable networks and some integration issues with a recent acquisition constrained CommScope’s results over the 12-month period.

| Q | Can you discuss the factors that affected the Fund’s income-generation, or distributions** to shareholders, either positively or negatively, during the 12-month period ended August 31, 2019? |

| A | The Fund’s income generation and distributions to shareholders remained relatively stable over the period. Even though our more “up-in-quality” and higher-rated bias with regard to the Fund’s holdings resulted in a marginally lower yield versus the benchmark BofA ML Index, we view the portfolio’s positioning as appropriate given where we are in the current credit cycle. |

| Q | What role did derivatives play in the Fund’s investment process and results during the 12-month period ended August 31, 2019? |

| A | We have the ability to utilize derivatives from time to time in order to maintain the desired level of portfolio exposure to the high-yield market, while also seeking to maintain sufficient liquidity to make opportunistic purchases and help meet any unanticipated shareholder redemptions. During the 12-month period, the Fund had light exposure to credit default swap index contracts, which had no material impact on performance. |

| Q | What is your assessment of the current climate for high-yield investing? |

| A | Based on historical averages, high-yield valuations are relatively tight. That said, we do not view current valuations as extreme, given our expectations for a continued low default rate and a strong technical backdrop in the high-yield market. |

We believe the greatest threat to high-yield returns is a recession that increases economic stress on leveraged issuers, which could then lead to a spike in defaults. Those who anticipate a near-term recession frequently note that economic expansions do not last forever and point to possible contagion from the global manufacturing recession triggered by the U.S. trade war with China. From our perspective, we are less concerned with the age of the economic expansion than with the potential spreading of manufacturing weakness into the broader U.S. economy. The length of any particular economic expansion is always unpredictable, and alarmists have been claiming for years that we are “in the 9th inning” of the current expansion.

| ** | Distributions are not guaranteed. |

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 7 |

As for the impact of trade disputes on manufacturing, we assess data related to the topic as part of our top-down evaluation process, while asking our fundamental investment analysts if the companies they cover have been feeling the effects of the trade uncertainty. So far, the manufacturing weakness and whatever effect it has had on the service sector has not weighed on employment. However, if the trade war expands, that situation will likely change quickly.

We believe the coupon (interest) component of returns as opposed to further spread tightening will most likely drive near-term high-yield market performance. (Credit spreads are commonly defined as the differences in yield between Treasuries and other types of fixed-income securities with similar maturities.) We believe issuers of high-yield securities are of a much better quality than usually seen at the end of other economic expansions. While there have been some aggressive financings, they are nowhere near as widespread as in 2008.

We feel that geopolitics and the upcoming U.S. election cycle will likely trigger periods of high market volatility, but we believe the Fund is well positioned to take advantage of any market dislocations. Our intent is to attempt to generate positive performance relative to the Fund’s benchmark through both security selection and sector allocations, while maintaining the portfolio’s risk level at close to that of the benchmark ICE BofA ML Index. If spreads do happen to widen because of market volatility not rooted in real economic weakness, we may then take the opportunity to increase the portfolio’s risk profile.

| | | | |

| 8 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

Please refer to the Schedule of Investments on pages 18–28 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread.

Investments in high-yield or lower rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default.

When interest rates rise, the prices of fixed income securities held by the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities held by the Fund will generally rise.

Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations.

Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation.

The portfolio may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to prepayments.

Investing in foreign and/or emerging market securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

The Fund may use derivatives, such as options, futures, inverse floating rate obligations, swaps, and others, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Derivatives may have a leveraging effect on the Fund.

At times, the Fund’s investments may represent industries or sectors that are interrelated or have common risks, making them more susceptible to any economic, political, or regulatory developments or other risks affecting those industries and sectors.

These risks may increase share price volatility.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 9 |

Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your advisor or Amundi Pioneer Asset Management, Inc., for a prospectus or summary prospectus containing this information. Read it carefully.

Any information in this shareholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

| | | | |

| 10 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

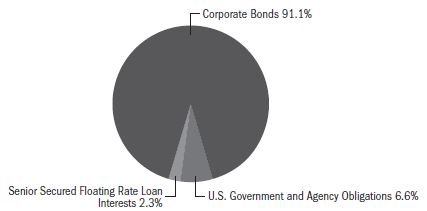

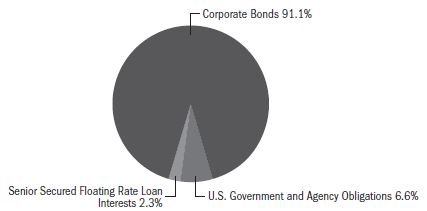

Portfolio Summary | 8/31/19

Portfolio Diversification

(As a percentage of total investments)*

10 Largest Holdings

(As a percentage of total investments)*

| | | | |

1. U.S. Treasury Bills, 9/17/19 | | | 4.42 | % |

2. U.S. Treasury Bills, 9/10/19 | | | 1.47 | |

3. Scientific Games International, Inc., 8.25%, 3/15/26 (144A) | | | 1.09 | |

4. Altice Luxembourg SA, 10.5%, 5/15/27 (144A) | | | 1.07 | |

5. CSC Holdings LLC, 5.5%, 4/15/27 (144A) | | | 1.05 | |

6. UBS Group Funding Switzerland AG, 7.0% (5 Year USD Swap Rate + 434 bps) (144A) | | | 1.04 | |

7. CSC Holdings LLC, 5.5%, 5/15/26 (144A) | | | 1.04 | |

8. OCI NV, 6.625%, 4/15/23 (144A) | | | 1.04 | |

9. Ardagh Packaging Finance Plc/Ardagh Holdings USA, Inc., 6.0%, 2/15/25 (144A) | | | 1.03 | |

10. Horizon Pharma USA, Inc., 5.5%, 8/1/27 (144A) | | | 1.02 | |

| * | Excludes temporary cash investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities. |

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 11 |

Prices and Distributions | 8/31/19

Net Asset Value per Share

| | | | | | | | |

| Class | | 8/31/19 | | | 8/31/18 | |

A | | $ | 10.15 | | | $ | 9.97 | |

C | | $ | 10.14 | | | $ | 9.96 | |

Y | | $ | 10.15 | | | $ | 9.97 | |

Distributions per Share: 9/1/18–8/31/19

| | | | | | | | | | | | |

| Class | | Net Investment Income | | | Short-Term Capital Gains | | | Long-Term Capital Gains | |

A | | $ | 0.5046 | | | $ | — | | | $ | — | |

C | | $ | 0.4309 | | | $ | — | | | $ | — | |

Y | | $ | 0.5306 | | | $ | — | | | $ | — | |

Index Definition

The ICE BofA ML U.S. High Yield Index is an unmanaged, commonly accepted measure of the performance of high-yield securities. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index.

The index defined here pertains to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts on pages 13–15.

| | | | |

| 12 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

| | |

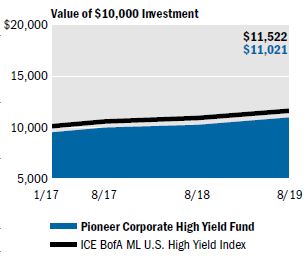

| Performance Update | 8/31/19 | | Class A Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer Corporate High Yield Fund at public offering price during the periods shown, compared to that of the ICE BofA ML U.S. High Yield Index.

| | | | | | | | | | | | |

| Average Annual Total Returns | | | | | |

| (As of August 31, 2019) | |

| | | |

| | | Net | | | Public | | | ICE BofA | |

| | | Asset | | | Offering | | | ML U.S. | |

| | | Value | | | Price | | | High Yield | |

Period | | (NAV) | | | (POP) | | | Index | |

Life of Class (1/3/17) | | | 5.54 | % | | | 3.73 | % | | | 5.90 | % |

1 year | | | 7.13 | | | | 2.31 | | | | 6.58 | |

|

| Expense Ratio | |

| (Per prospectus dated December 31, 2018) | |

| | | |

Gross | | Net | | | | | | | |

1.91% | | | 1.05 | % | | | | | | | | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share. NAV returns would have been lower had sales charges been reflected. POP returns reflect deduction of maximum 4.50% sales charge. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through January 1, 2020, for Class A shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 13 |

| | |

| Performance Update | 8/31/19 | | Class C Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C shares of Pioneer Corporate High Yield Fund during the periods shown, compared to that of the ICE BofA ML U.S. High Yield Index.

| | | | | | | | | | | | |

| Average Annual Total Returns | | | | | |

| (As of August 31, 2019) | |

| | | |

| | | | | | | | | ICE BofA | |

| | | | | | | | | ML U.S. | |

| | | If | | | If | | | High Yield | |

Period | | Held | | | Redeemed | | | Index | |

Life of Class (1/3/17) | | | 4.74 | % | | | 4.74 | % | | | 5.90 | % |

1 year | | | 6.34 | | | | 6.34 | | | | 6.58 | |

| | |

| Expense Ratio | | | | | | | | | |

| (Per prospectus dated December 31, 2018) | |

| | | |

Gross | | Net | | | | | | | |

2.65% | | | 1.80 | % | | | | | | | | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class C shares held for less than one year are also subject to a 1% contingent deferred sales charge (CDSC). If you paid a 1% sales charge, your returns would be lower than those shown above. “If Held” results represent the percent change in net asset value per share. “If Redeemed” returns would have been lower had sales charges been reflected. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through January 1, 2020, for Class C shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

| | | | |

| 14 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

| | |

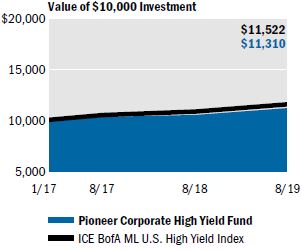

| Performance Update | 8/31/19 | | Class Y Shares |

Investment Returns

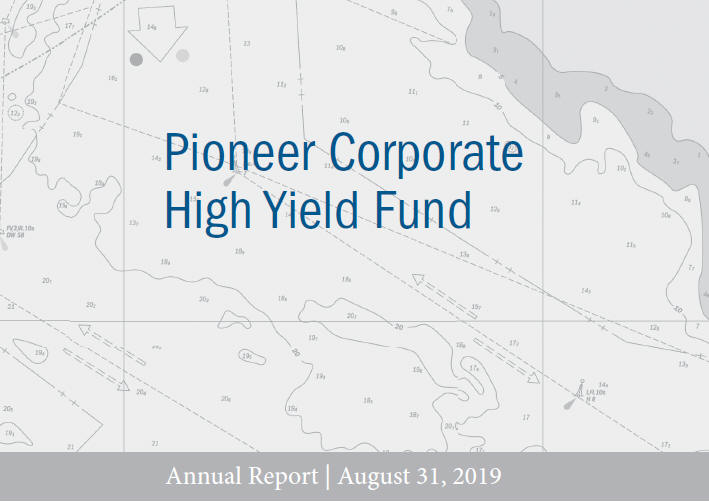

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer Corporate High Yield Fund during the periods shown, compared to that of the ICE BofA ML U.S. High Yield Index.

| | | | | | | | |

| Average Annual Total Returns | | | | | |

| (As of August 31, 2019) | |

| | |

| | | Net | | | ICE BofA | |

| | | Asset | | | ML U.S. | |

| | | Value | | | High Yield | |

Period | | (NAV) | | | Index | |

Life of Class (1/3/17) | | | 5.80 | % | | | 5.90 | % |

1 year | | | 7.41 | | | | 6.58 | |

| | |

| Expense Ratio | | | | | | | | |

| (Per prospectus dated December 31, 2018) | |

| | |

Gross | | Net | | | | |

1.66% | | | 0.75 | % | | | | |

Call 1-800-225-6292 or visit www.amundipioneer.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through January 1, 2020, for Class Y shares. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 15 |

Comparing Ongoing Fund Expenses

As a shareowner in the Fund, you incur two types of costs:

| (1) | ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and |

| (2) | transaction costs, including sales charges (loads) on purchase payments. |

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

| (1) | Divide your account value by $1,000 |

Example: an $8,600 account value ÷ $1,000 = 8.6

| (2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

Expenses Paid on a $1,000 Investment in Pioneer Corporate High Yield Fund

Based on actual returns from March 1, 2019 through August 31, 2019.

| | | | | | | | | | | | |

| Share Class | | A | | | C | | | Y | |

Beginning Account Value on 3/1/19 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value (after expenses) 8/31/19 | | $ | 1,050.91 | | | $ | 1,047.07 | | | $ | 1,052.32 | |

Expenses Paid During Period* | | $ | 5.17 | | | $ | 9.03 | | | $ | 3.88 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, 1.75% and 0.75% for Class A, Class C and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365, (to reflect the one-half year period). |

| | | | |

| 16 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Corporate High Yield Fund

Based on a hypothetical 5% per year return before expenses, reflecting the period from March 1, 2019 through August 31, 2019.

| | | | | | | | | | | | |

| Share Class | | A | | | C | | | Y | |

Beginning Account Value on 3/1/19 | | $ | 1,000.00 | | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value (after expenses) 8/31/19 | | $ | 1,020.16 | | | $ | 1,016.38 | | | $ | 1,021.42 | |

Expenses Paid During Period* | | $ | 5.09 | | | $ | 8.89 | | | $ | 3.82 | |

| * | Expenses are equal to the Fund’s annualized net expense ratio of 1.00%, 1.75% and 0.75% for Class A, Class C and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 184/365, (to reflect the one-half year period). |

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 17 |

Schedule of Investments | 8/31/19

| | | | | | | | |

Principal Amount USD ($) | | | | | Value | |

| | | | UNAFFILIATED ISSUERS — 98.7% | | | | |

| | | | CORPORATE BONDS — 89.9% of Net Assets | | | | |

| | | | Advertising — 0.7% | | | | |

| | 168,000 | | | MDC Partners, Inc., 6.5%, 5/1/24 (144A) | | $ | 152,880 | |

| | | | | | | | |

| | | | Total Advertising | | $ | 152,880 | |

| | | | | | | | |

| | | | Aerospace & Defense — 1.0% | | | | |

| | 100,000 | | | Bombardier, Inc., 6.0%, 10/15/22 (144A) | | $ | 99,250 | |

| | 38,000 | | | Bombardier, Inc., 7.5%, 3/15/25 (144A) | | | 37,002 | |

| | 61,000 | | | Bombardier, Inc., 7.875%, 4/15/27 (144A) | | | 59,094 | |

| | | | | | | | |

| | | | Total Aerospace & Defense | | $ | 195,346 | |

| | | | | | | | |

| | | | Agriculture — 0.2% | | | | |

| | 45,000 | | | Darling Ingredients, Inc., 5.25%, 4/15/27 (144A) | | $ | 47,925 | |

| | | | | | | | |

| | | | Total Agriculture | | $ | 47,925 | |

| | | | | | | | |

| | | | Auto Manufacturers — 0.5% | | | | |

| | 104,000 | | | JB Poindexter & Co., Inc., 7.125%, 4/15/26 (144A) | | $ | 106,340 | |

| | | | | | | | |

| | | | Total Auto Manufacturers | | $ | 106,340 | |

| | | | | | | | |

| | | | Auto Parts & Equipment — 1.4% | | | | |

| | 204,000 | | | American Axle & Manufacturing, Inc., 6.25%, 3/15/26 | | $ | 189,210 | |

| | 129,000 | | | Titan International, Inc., 6.5%, 11/30/23 | | | 102,878 | |

| | | | | | | | |

| | | | Total Auto Parts & Equipment | | $ | 292,088 | |

| | | | | | | | |

| | | | Banks — 3.4% | | | | |

| | 200,000 | (a)(b) | | Barclays Plc, 7.75% (5 Year USD Swap Rate + 484 bps) | | $ | 204,250 | |

| | 95,000 | | | Freedom Mortgage Corp., 8.125%, 11/15/24 (144A) | | | 82,650 | |

| | 90,000 | | | Freedom Mortgage Corp., 8.25%, 4/15/25 (144A) | | | 78,300 | |

| | 121,000 | | | Provident Funding Associates LP/PFG Finance Corp., 6.375%, 6/15/25 (144A) | | | 117,672 | |

| | 200,000 | (a)(b) | | UBS Group Funding Switzerland AG, 7.0% (5 Year USD Swap Rate + 434 bps) (144A) | | | 212,000 | |

| | | | | | | | |

| | | | Total Banks | | $ | 694,872 | |

| | | | | | | | |

| | | | Building Materials — 2.0% | | | | |

| | 41,000 | | | American Woodmark Corp., 4.875%, 3/15/26 (144A) | | $ | 41,205 | |

| | 60,000 | | | Builders FirstSource, Inc., 5.625%, 9/1/24 (144A) | | | 62,475 | |

| | 90,000 | | | Builders FirstSource, Inc., 6.75%, 6/1/27 (144A) | | | 98,325 | |

| | 99,000 | | | Standard Industries, Inc., 5.375%, 11/15/24 (144A) | | | 101,846 | |

| | 94,000 | | | Summit Material LLC/Summit Materials Finance Corp., 6.5%, 3/15/27 (144A) | | | 101,050 | |

| | | | | | | | |

| | | | Total Building Materials | | $ | 404,901 | |

| | | | | | | | |

| | | | Chemicals — 4.5% | | | | |

| | 150,000 | | | CF Industries, Inc., 5.375%, 3/15/44 | | $ | 151,587 | |

| | 156,000 | | | Chemours Co., 7.0%, 5/15/25 | | | 154,050 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 18 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

| | | | | | | | |

Principal Amount USD ($) | | | | | Value | |

| | | | Chemicals — (continued) | | | | |

| | 103,000 | | | Hexion, Inc., 7.875%, 7/15/27 (144A) | | $ | 99,652 | |

| | 88,000 | | | NOVA Chemicals Corp., 5.0%, 5/1/25 (144A) | | | 89,980 | |

| | 200,000 | | | OCI NV, 6.625%, 4/15/23 (144A) | | | 211,000 | |

| | 100,000 | | | Olin Corp., 5.0%, 2/1/30 | | | 99,875 | |

| | 28,000 | | | Olin Corp., 5.625%, 8/1/29 | | | 29,085 | |

| | 106,000 | | | Trinseo Materials Operating SCA/Trinseo Materials Finance, Inc., 5.375%, 9/1/25 (144A) | | | 99,640 | |

| | | | | | | | |

| | | | Total Chemicals | | $ | 934,869 | |

| | | | | | | | |

| | | | Coal — 0.5% | | | | |

| | 116,000 | | | SunCoke Energy Partners LP/SunCoke Energy Partners Finance Corp., 7.5%, 6/15/25 (144A) | | $ | 109,838 | |

| | | | | | | | |

| | | | Total Coal | | $ | 109,838 | |

| | | | | | | | |

| | | | Commercial Services — 4.7% | | | | |

| | 101,000 | | | Brink’s Co., 4.625%, 10/15/27 (144A) | | $ | 102,767 | |

| | 144,000 | | | Cardtronics, Inc./Cardtronics USA, Inc., 5.5%, 5/1/25 (144A) | | | 144,000 | |

| | 50,000 | | | Carriage Services, Inc., 6.625%, 6/1/26 (144A) | | | 51,125 | |

| | 83,000 | | | Garda World Security Corp., 8.75%, 5/15/25 (144A) | | | 85,618 | |

| | 106,000 | | | Herc Holdings, Inc., 5.5%, 7/15/27 (144A) | | | 109,710 | |

| | 53,000 | | | Hertz Corp., 7.125%, 8/1/26 (144A) | | | 54,087 | |

| | 35,000 | | | Prime Security Services Borrower LLC/Prime Finance, Inc., 5.25%, 4/15/24 (144A) | | | 36,152 | |

| | 35,000 | | | Prime Security Services Borrower LLC/Prime Finance, Inc., 5.75%, 4/15/26 (144A) | | | 36,487 | |

| | 93,000 | | | Prime Security Services Borrower LLC/Prime Finance, Inc., 9.25%, 5/15/23 (144A) | | | 97,799 | |

| | 44,000 | | | United Rentals North America, Inc., 5.25%, 1/15/30 | | | 47,025 | |

| | 94,000 | | | United Rentals North America, Inc., 6.5%, 12/15/26 | | | 102,225 | |

| | 96,000 | | | Verscend Escrow Corp., 9.75%, 8/15/26 (144A) | | | 102,776 | |

| | | | | | | | |

| | | | Total Commercial Services | | $ | 969,771 | |

| | | | | | | | |

| | | | Computers — 0.7% | | | | |

| | 150,000 | | | Western Digital Corp., 4.75%, 2/15/26 | | $ | 153,518 | |

| | | | | | | | |

| | | | Total Computers | | $ | 153,518 | |

| | | | | | | | |

| | | | Diversified Financial Services — 1.9% | | | | |

| | 17,000 | | | Nationstar Mortgage Holdings, Inc., 8.125%, 7/15/23 (144A) | | $ | 17,605 | |

| | 98,000 | | | Nationstar Mortgage Holdings, Inc., 9.125%, 7/15/26 (144A) | | | 103,635 | |

| | 89,000 | | | Nationstar Mortgage LLC/Nationstar Capital Corp., 6.5%, 7/1/21 | | | 89,111 | |

| | 185,000 | | | Oxford Finance LLC/Oxford Finance Co-Issuer II, Inc., 6.375%, 12/15/22 (144A) | | | 192,632 | |

| | | | | | | | |

| | | | Total Diversified Financial Services | | $ | 402,983 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 19 |

Schedule of Investments | 8/31/19 (continued)

| | | | | | | | |

Principal Amount USD ($) | | | | | Value | |

| | | | Electric — 1.7% | | | | |

| | 60,000 | | | Clearway Energy Operating LLC, 5.75%, 10/15/25 (144A) | | $ | 62,551 | |

| | 145,185 | | | NSG Holdings LLC/NSG Holdings, Inc., 7.75%, 12/15/25 (144A) | | | 155,711 | |

| | 40,000 | | | Talen Energy Supply LLC, 6.625%, 1/15/28 (144A) | | | 38,700 | |

| | 31,000 | | | Talen Energy Supply LLC, 7.25%, 5/15/27 (144A) | | | 30,768 | |

| | 72,000 | | | Vistra Operations Co. LLC, 5.625%, 2/15/27 (144A) | | | 76,230 | |

| | | | | | | | |

| | | | Total Electric | | $ | 363,960 | |

| | | | | | | | |

| | | | Electrical Components & Equipment — 0.1% | | | | |

| | 14,000 | | | Energizer Holdings, Inc., 6.375%, 7/15/26 (144A) | | $ | 14,752 | |

| | | | | | | | |

| | | | Total Electrical Components & Equipment | | $ | 14,752 | |

| | | | | | | | |

| | | | Entertainment — 2.5% | | | | |

| | 101,000 | | | Caesars Resort Collection LLC/CRC Finco, Inc., 5.25%, 10/15/25 (144A) | | $ | 102,767 | |

| | 101,000 | | | Enterprise Development Authority, 12.0%, 7/15/24 (144A) | | | 113,191 | |

| | 15,000 | | | Penn National Gaming, Inc., 5.625%, 1/15/27 (144A) | | | 15,395 | |

| | 210,000 | | | Scientific Games International, Inc., 8.25%, 3/15/26 (144A) | | | 222,600 | |

| | 51,000 | | | Scientific Games International, Inc., 10.0%, 12/1/22 | | | 52,912 | |

| | | | | | | | |

| | | | Total Entertainment | | $ | 506,865 | |

| | | | | | | | |

| | | | Environmental Control — 2.2% | | | | |

| | 100,000 | | | Covanta Holding Corp., 6.0%, 1/1/27 | | $ | 104,000 | |

| | 143,000 | | | GFL Environmental, Inc., 5.375%, 3/1/23 (144A) | | | 143,715 | |

| | 55,000 | | | GFL Environmental, Inc., 8.5%, 5/1/27 (144A) | | | 60,225 | |

| | 142,000 | | | Tervita Corp., 7.625%, 12/1/21 (144A) | | | 144,130 | |

| | | | | | | | |

| | | | Total Environmental Control | | $ | 452,070 | |

| | | | | | | | |

| | | | Food — 4.5% | | | | |

| | 54,000 | | | Albertsons Cos LLC / Safeway, Inc. / New Albertsons LP / Albertson’s LLC,

5.875%, 2/15/28 (144A) | | $ | 56,908 | |

| | 98,000 | | | Albertsons Cos. LLC/Safeway, Inc./New Albertsons LP/Albertson’s LLC, 5.75%, 3/15/25 | | | 100,450 | |

| | 30,000 | | | Albertsons Cos. LLC/Safeway, Inc./New Albertsons LP/Albertson’s LLC,

7.5%, 3/15/26 (144A) | | | 33,375 | |

| | 200,000 | | | FAGE International SA/FAGE USA Dairy Industry, Inc., 5.625%, 8/15/26 (144A) | | | 175,625 | |

| | 148,000 | | | Ingles Markets, Inc., 5.75%, 6/15/23 | | | 150,960 | |

| | 96,000 | | | JBS USA LUX SA/JBS USA Finance, Inc., 6.75%, 2/15/28 (144A) | | | 107,040 | |

| | 65,000 | | | JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc., 5.5%, 1/15/30 (144A) | | | 68,900 | |

| | 30,000 | | | JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc., 6.5%, 4/15/29 (144A) | | | 33,225 | |

| | 60,000 | | | Pilgrim’s Pride Corp., 5.875%, 9/30/27 (144A) | | | 64,650 | |

| | 135,000 | | | Simmons Foods, Inc., 5.75%, 11/1/24 (144A) | | | 127,913 | |

| | | | | | | | |

| | | | Total Food | | $ | 919,046 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

| | | | | | | | |

Principal Amount USD ($) | | | | | Value | |

| | | | Forest Products & Paper — 0.5% | | | | |

| | 110,000 | | | Schweitzer-Mauduit International, Inc., 6.875%, 10/1/26 (144A) | | $ | 113,300 | |

| | | | | | | | |

| | | | Total Forest Products & Paper | | $ | 113,300 | |

| | | | | | | | |

| | | | Healthcare-Services — 5.1% | | | | |

| | 120,000 | | | BCPE Cycle Merger Sub II, Inc., 10.625%, 7/15/27 (144A) | | $ | 117,000 | |

| | 115,000 | | | Centene Corp., 5.375%, 6/1/26 (144A) | | | 122,941 | |

| | 55,000 | | | CHS/Community Health Systems, Inc., 6.25%, 3/31/23 | | | 53,218 | |

| | 150,000 | | | HCA, Inc., 5.375%, 2/1/25 | | | 166,500 | |

| | 29,000 | | | HCA, Inc., 5.625%, 9/1/28 | | | 32,997 | |

| | 19,000 | | | HCA, Inc., 5.875%, 2/1/29 | | | 21,874 | |

| | 100,000 | | | Molina Healthcare, Inc., 5.375%, 11/15/22 | | | 106,879 | |

| | 73,000 | | | RegionalCare Hospital Partners Holdings, Inc., 8.25%, 5/1/23 (144A) | | | 78,041 | |

| | 119,000 | | | Surgery Centre Holdings, Inc., 10.0%, 4/15/27 (144A) | | | 113,943 | |

| | 60,000 | | | Tenet Healthcare Corp., 4.875%, 1/1/26 (144A) | | | 61,656 | |

| | 50,000 | | | Tenet Healthcare Corp., 5.125%, 11/1/27 (144A) | | | 51,688 | |

| | 98,000 | | | WellCare Health Plans, Inc., 5.25%, 4/1/25 | | | 102,611 | |

| | | | | | | | |

| | | | Total Healthcare-Services | | $ | 1,029,348 | |

| | | | | | | | |

| | | | Holding Companies-Diversified — 0.4% | | | | |

| | 80,000 | | | VistaJet Malta Finance Plc/XO Management Holding, Inc., 10.5%, 6/1/24 (144A) | | $ | 78,600 | |

| | | | | | | | |

| | | | Total Holding Companies-Diversified | | $ | 78,600 | |

| | | | | | | | |

| | | | Home Builders — 3.8% | | | | |

| | 190,000 | | | Beazer Homes USA, Inc., 6.75%, 3/15/25 | | $ | 191,425 | |

| | 140,000 | | | KB Home, 6.875%, 6/15/27 | | | 157,500 | |

| | 192,000 | | | Lennar Corp., 4.75%, 11/15/22 | | | 202,560 | |

| | 25,000 | | | Meritage Homes Corp., 6.0%, 6/1/25 | | | 27,594 | |

| | 189,000 | | | Taylor Morrison Communities, Inc./Taylor Morrison Holdings II, Inc., 5.875%, 4/15/23 (144A) | | | 201,285 | |

| | | | | | | | |

| | | | Total Home Builders | | $ | 780,364 | |

| | | | | | | | |

| | | | Home Furnishings — 0.7% | | | | |

| | 134,000 | | | Tempur Sealy International, Inc., 5.5%, 6/15/26 | | $ | 140,030 | |

| | | | | | | | |

| | | | Total Home Furnishings | | $ | 140,030 | |

| | | | | | | | |

| | | | Insurance — 0.4% | | | | |

| | 70,000 | | | CNO Financial Group, Inc., 5.25%, 5/30/29 | | $ | 77,350 | |

| | | | | | | | |

| | | | Total Insurance | | $ | 77,350 | |

| | | | | | | | |

| | | | Internet — 0.7% | | | | |

| | 136,000 | | | Netflix, Inc., 5.375%, 11/15/29 (144A) | | $ | 147,900 | |

| | | | | | | | |

| | | | Total Internet | | $ | 147,900 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 21 |

Schedule of Investments | 8/31/19 (continued)

| | | | | | | | |

Principal Amount USD ($) | | | | | Value | |

| | | | Iron & Steel — 0.6% | | | | |

| | 100,000 | | | Commercial Metals Co., 5.375%, 7/15/27 | | $ | 99,750 | |

| | 30,000 | | | Commercial Metals Co., 5.75%, 4/15/26 | | | 30,750 | |

| | | | | | | | |

| | | | Total Iron & Steel | | $ | 130,500 | |

| | | | | | | | |

| | | | Leisure Time — 0.8% | | | | |

| | 96,000 | | | Viking Cruises, Ltd., 6.25%, 5/15/25 (144A) | | $ | 99,360 | |

| | 50,000 | | | VOC Escrow, Ltd., 5.0%, 2/15/28 (144A) | | | 51,250 | |

| | | | | | | | |

| | | | Total Leisure Time | | $ | 150,610 | |

| | | | | | | | |

| | | | Lodging — 0.3% | | | | |

| | 65,000 | | | MGM Resorts International, 5.5%, 4/15/27 | | $ | 70,444 | |

| | | | | | | | |

| | | | Total Lodging | | $ | 70,444 | |

| | | | | | | | |

| | | | Machinery-Diversified — 0.6% | | | | |

| | 111,000 | | | Cloud Crane LLC, 10.125%, 8/1/24 (144A) | | $ | 119,325 | |

| | | | | | | | |

| | | | Total Machinery-Diversified | | $ | 119,325 | |

| | | | | | | | |

| | | | Media — 7.3% | | | | |

| | 200,000 | | | Altice Luxembourg SA, 10.5%, 5/15/27 (144A) | | $ | 217,500 | |

| | 194,000 | | | CCO Holdings LLC/CCO Holdings Capital Corp., 5.5%, 5/1/26 (144A) | | | 204,427 | |

| | 137,000 | | | Clear Channel Worldwide Holdings, Inc., 9.25%, 2/15/24 (144A) | | | 150,186 | |

| | 200,000 | | | CSC Holdings LLC, 5.5%, 5/15/26 (144A) | | | 211,500 | |

| | 200,000 | | | CSC Holdings LLC, 5.5%, 4/15/27 (144A) | | | 214,000 | |

| | 24,000 | | | Diamond Sports Group LLC/Diamond Sports Finance Co., 5.375%, 8/15/26 (144A) | | | 25,200 | |

| | 103,000 | | | Diamond Sports Group LLC/Diamond Sports Finance Co., 6.625%, 8/15/27 (144A) | | | 107,892 | |

| | 93,000 | | | Gray Television, Inc., 7.0%, 5/15/27 (144A) | | | 101,691 | |

| | 100,000 | | | Sinclair Television Group, Inc., 5.875%, 3/15/26 (144A) | | | 104,750 | |

| | 35,000 | | | Sirius XM Radio, Inc., 4.625%, 7/15/24 (144A) | | | 36,531 | |

| | 100,000 | | | Sirius XM Radio, Inc., 5.375%, 7/15/26 (144A) | | | 105,625 | |

| | 30,000 | | | Sirius XM Radio, Inc., 5.5%, 7/1/29 (144A) | | | 32,691 | |

| | | | | | | | |

| | | | Total Media | | $ | 1,511,993 | |

| | | | | | | | |

| | | | Mining — 2.7% | | | | |

| | 200,000 | | | Century Aluminum Co., 7.5%, 6/1/21 (144A) | | $ | 199,000 | |

| | 50,000 | | | Coeur Mining, Inc., 5.875%, 6/1/24 | | | 49,857 | |

| | 104,000 | | | Freeport-McMoRan, Inc., 5.25%, 9/1/29 | | | 103,117 | |

| | 98,000 | | | Hudbay Minerals, Inc., 7.25%, 1/15/23 (144A) | | | 101,170 | |

| | 100,000 | | | Novelis Corp., 5.875%, 9/30/26 (144A) | | | 105,625 | |

| | | | | | | | |

| | | | Total Mining | | $ | 558,769 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 22 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

| | | | | | | | |

Principal

Amount USD ($) | | | | | Value | |

| | | | Miscellaneous Manufacturers — 1.6% | | | | |

| | 193,000 | | | Amsted Industries, Inc., 5.375%, 9/15/24 (144A) | | $ | 198,307 | |

| | 120,000 | | | EnPro Industries, Inc., 5.75%, 10/15/26 | | | 125,700 | |

| | | | | | | | |

| | | | Total Miscellaneous Manufacturers | | $ | 324,007 | |

| | | | | | | | |

| | | | Oil & Gas — 8.2% | | | | |

| | 85,000 | | | Ensign Drilling, Inc., 9.25%, 4/15/24 (144A) | | $ | 79,475 | |

| | 122,000 | | | Great Western Petroleum LLC/Great Western Finance Corp., 9.0%, 9/30/21 (144A) | | | 107,055 | |

| | 170,000 | | | Indigo Natural Resources LLC, 6.875%, 2/15/26 (144A) | | | 140,250 | |

| | 70,000 | | | Jagged Peak Energy LLC, 5.875%, 5/1/26 | | | 70,245 | |

| | 86,000 | | | MEG Energy Corp., 7.0%, 3/31/24 (144A) | | | 81,807 | |

| | 200,000 | | | Neptune Energy Bondco Plc, 6.625%, 5/15/25 (144A) | | | 200,100 | |

| | 142,000 | | | Oasis Petroleum, Inc., 6.875%, 3/15/22 | | | 132,060 | |

| | 48,000 | | | Parkland Fuel Corp., 5.875%, 7/15/27 (144A) | | | 50,400 | |

| | 150,000 | | | Parsley Energy LLC/Parsley Finance Corp., 5.625%, 10/15/27 (144A) | | | 154,500 | |

| | 202,000 | | | PBF Holding Co. LLC/PBF Finance Corp., 7.0%, 11/15/23 | | | 207,555 | |

| | 144,000 | | | Shelf Drilling Holdings, Ltd., 8.25%, 2/15/25 (144A) | | | 128,160 | |

| | 80,000 | | | SM Energy Co., 6.125%, 11/15/22 | | | 74,400 | |

| | 56,000 | | | SM Energy Co., 6.75%, 9/15/26 | | | 47,600 | |

| | 62,000 | | | Transocean Sentry, Ltd., 5.375%, 5/15/23 (144A) | | | 61,380 | |

| | 65,000 | | | Transocean, Inc., 7.25%, 11/1/25 (144A) | | | 59,150 | |

| | 160,000 | | | Whiting Petroleum Corp., 6.25%, 4/1/23 | | | 125,600 | |

| | | | | | | | |

| | | | Total Oil & Gas | | $ | 1,719,737 | |

| | | | | | | | |

| | | | Oil & Gas Services — 1.8% | | | | |

| | 100,000 | | | Archrock Partners LP/Archrock Partners Finance Corp., 6.875%, 4/1/27 (144A) | | $ | 104,750 | |

| | 70,000 | | | Exterran Energy Solutions LP/EES Finance Corp., 8.125%, 5/1/25 | | | 70,306 | |

| | 194,000 | | | FTS International, Inc., 6.25%, 5/1/22 | | | 161,384 | |

| | 34,000 | | | USA Compression Partners LP/USA Compression Finance Corp., 6.875%, 9/1/27 (144A) | | | 34,972 | |

| | | | | | | | |

| | | | Total Oil & Gas Services | | $ | 371,412 | |

| | | | | | | | |

| | | | Packaging & Containers — 2.8% | | | | |

| | 200,000 | | | Ardagh Packaging Finance Plc/Ardagh Holdings USA, Inc., 6.0%, 2/15/25 (144A) | | $ | 208,875 | |

| | 125,000 | | | Crown Cork & Seal Co., Inc., 7.375%, 12/15/26 | | | 151,875 | |

| | 117,000 | | | Greif, Inc., 6.5%, 3/1/27 (144A) | | | 122,850 | |

| | 100,000 | | | Plastipak Holdings, Inc., 6.25%, 10/15/25 (144A) | | | 91,000 | |

| | | | | | | | |

| | | | Total Packaging & Containers | | $ | 574,600 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 23 |

Schedule of Investments | 8/31/19 (continued)

| | | | | | | | |

Principal

Amount USD ($) | | | | | Value | |

| | | | Pharmaceuticals — 3.4% | | | | |

| | 91,000 | | | Bausch Health Americas, Inc., 8.5%, 1/31/27 (144A) | | $ | 101,008 | |

| | 70,000 | | | Bausch Health Cos., Inc., 5.5%, 11/1/25 (144A) | | | 73,411 | |

| | 67,000 | | | Bausch Health Cos., Inc., 5.875%, 5/15/23 (144A) | | | 67,838 | |

| | 36,000 | | | Bausch Health Cos., Inc., 7.0%, 1/15/28 (144A) | | | 37,725 | |

| | 36,000 | | | Bausch Health Cos., Inc., 7.25%, 5/30/29 (144A) | | | 38,070 | |

| | 200,000 | | | Horizon Pharma USA, Inc., 5.5%, 8/1/27 (144A) | | | 208,500 | |

| | 80,000 | | | Par Pharmaceutical, Inc., 7.5%, 4/1/27 (144A) | | | 74,600 | |

| | 105,000 | | | Teva Pharmaceutical Finance Netherlands III BV, 2.8%, 7/21/23 | | | 88,463 | |

| | | | | | | | |

| | | | Total Pharmaceuticals | | $ | 689,615 | |

| | | | | | | | |

| | | | Pipelines — 5.5% | | | | |

| | 109,000 | | | American Midstream Partners LP/American Midstream Finance Corp., 9.5%, 12/15/21 (144A) | | $ | 105,185 | |

| | 95,000 | | | Cheniere Corpus Christi Holdings LLC, 5.875%, 3/31/25 | | | 105,925 | |

| | 95,000 | | | Cheniere Energy Partners LP, 5.625%, 10/1/26 | | | 100,225 | |

| | 101,000 | | | DCP Midstream Operating LP, 3.875%, 3/15/23 | | | 102,263 | |

| | 20,000 | | | DCP Midstream Operating LP, 5.375%, 7/15/25 | | | 21,150 | |

| | 6,000 | | | EnLink Midstream LLC, 5.375%, 6/1/29 | | | 5,871 | |

| | 100,000 | | | Genesis Energy LP/Genesis Energy Finance Corp., 6.5%, 10/1/25 | | | 97,375 | |

| | 167,000 | | | Global Partners LP/GLP Finance Corp., 7.0%, 6/15/23 | | | 168,670 | |

| | 29,000 | | | Global Partners LP/GLP Finance Corp., 7.0%, 8/1/27 (144A) | | | 29,362 | |

| | 75,000 | | | Hess Infrastructure Partners LP/Hess Infrastructure Partners Finance Corp., 5.625%, 2/15/26 (144A) | | | 77,625 | |

| | 200,000 | | | PBF Logistics LP/PBF Logistics Finance Corp., 6.875%, 5/15/23 | | | 205,500 | |

| | 100,000 | | | Targa Resources Partners LP/Targa Resources Partners Finance Corp., 5.0%, 1/15/28 | | | 100,500 | |

| | 27,000 | | | Targa Resources Partners LP/Targa Resources Partners Finance Corp., 6.5%, 7/15/27 (144A) | | | 29,295 | |

| | | | | | | | |

| | | | Total Pipelines | | $ | 1,148,946 | |

| | | | | | | | |

| | | | REITs — 1.3% | | | | |

| | 100,000 | | | Iron Mountain, Inc., 4.875%, 9/15/27 (144A) | | $ | 102,688 | |

| | 100,000 | | | Iron Mountain, Inc., 5.75%, 8/15/24 | | | 101,250 | |

| | 66,000 | | | MPT Operating Partnership LP/MPT Finance Corp., 4.625%, 8/1/29 | | | 68,640 | |

| | | | | | | | |

| | | | Total REITs | | $ | 272,578 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 24 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

| | | | | | | | |

Principal

Amount USD ($) | | | | | Value | |

| | | | Retail — 1.4% | | | | |

| | 70,000 | | | AAG FH LP/AAG FH Finco, Inc., 9.75%, 7/15/24 (144A) | | $ | 64,750 | |

| | 93,000 | | | Golden Nugget, Inc., 8.75%, 10/1/25 (144A) | | | 97,534 | |

| | 140,000 | | | Michaels Stores, Inc., 8.0%, 7/15/27 (144A) | | | 134,081 | |

| | | | | | | | |

| | | | Total Retail | | $ | 296,365 | |

| | | | | | | | |

| | | | Software — 0.1% | | | | |

| | 19,000 | | | Rackspace Hosting, Inc., 8.625%, 11/15/24 (144A) | | $ | 17,432 | |

| | | | | | | | |

| | | | Total Software | | $ | 17,432 | |

| | | | | | | | |

| | | | Telecommunications — 7.4% | | | | |

| | 100,000 | | | CenturyLink, Inc., 6.45%, 6/15/21 | | $ | 105,375 | |

| | 138,000 | | | CommScope Technologies LLC, 6.0%, 6/15/25 (144A) | | | 123,165 | |

| | 35,000 | | | CommScope, Inc., 8.25%, 3/1/27 (144A) | | | 34,300 | |

| | 100,000 | | | Frontier Communications Corp., 8.5%, 4/1/26 (144A) | | | 97,250 | |

| | 75,000 | | | Frontier Communications Corp., 11.0%, 9/15/25 | | | 38,062 | |

| | 150,000 | | | Hughes Satellite Systems Corp., 5.25%, 8/1/26 | | | 159,000 | |

| | 150,000 | | | Level 3 Financing, Inc., 5.375%, 5/1/25 | | | 156,000 | |

| | 185,000 | | | Sprint Corp., 7.125%, 6/15/24 | | | 204,510 | |

| | 192,000 | | | Sprint Corp., 7.25%, 9/15/21 | | | 206,534 | |

| | 50,000 | | | Sprint Corp., 7.625%, 2/15/25 | | | 55,938 | |

| | 50,000 | | | Sprint Corp., 7.625%, 3/1/26 | | | 56,188 | |

| | 100,000 | | | T-Mobile USA, Inc., 4.75%, 2/1/28 | | | 105,248 | |

| | 155,000 | | | Windstream Services LLC/Windstream Finance Corp., 8.625%, 10/31/25 (144A) | | | 155,775 | |

| | | | | | | | |

| | | | Total Telecommunications | | $ | 1,497,345 | |

| | | | | | | | |

| | | | TOTAL CORPORATE BONDS

(Cost $18,311,786) | | $ | 18,542,594 | |

| | | | | | | | |

| | | | SENIOR SECURED FLOATING RATE LOAN INTERESTS — 2.3% of Net Assets*(c) | | | | |

| | | | Diversified & Conglomerate Service — 0.5% | | | | |

| | 112,343 | | | Filtration Group Corp., Initial Dollar Term Loan, 5.112% (LIBOR + 300 bps), 3/29/25 | | $ | 112,484 | |

| | | | | | | | |

| | | | Total Diversified & Conglomerate Service | | $ | 112,484 | |

| | | | | | | | |

| | | | Healthcare, Education & Childcare — 0.4% | | | | |

| | 91,580 | | | Regionalcare Hospital Partners Holdings, Inc., First Lien Term B Loan, 6.645% (LIBOR + 450 bps), 11/16/25 | | $ | 91,030 | |

| | | | | | | | |

| | | | Total Healthcare, Education & Childcare | | $ | 91,030 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 25 |

Schedule of Investments | 8/31/19 (continued)

| | | | | | | | |

Principal

Amount USD ($) | | | | | Value | |

| | | | Metals & Mining — 0.3% | | | | |

| | 54,450 | | | Aleris International, Inc., Initial Term Loan, 6.862% (LIBOR + 475 bps), 2/27/23 | | $ | 54,563 | |

| | | | | | | | |

| | | | Total Metals & Mining | | $ | 54,563 | |

| | | | | | | | |

| | | | Oil & Gas — 0.4% | | | | |

| | 95,000 | | | Encino Acquisition Partners Holdings LLC, Second Lien Initial Term Loan, 8.862%

(LIBOR + 675 bps), 10/29/25 | | $ | 71,250 | |

| | | | | | | | |

| | | | Total Oil & Gas | | $ | 71,250 | |

| | | | | | | | |

| | | | Personal, Food & Miscellaneous Services — 0.4% | | | | |

| | 97,923 | | | Revlon Consumer Products Corp., Initial Term B Loan, 5.624% (LIBOR + 350 bps), 9/7/23 | | $ | 78,257 | |

| | | | | | | | |

| | | | Total Personal, Food & Miscellaneous Services | | $ | 78,257 | |

| | | | | | | | |

| | | | Retail — 0.3% | | | | |

| | 79,023 | | | Neiman Marcus Group Ltd. LLC, Cash Pay Extended Term Loan, 8.229%

(LIBOR + 600 bps), 10/25/23 | | $ | 64,848 | |

| | | | | | | | |

| | | | Total Retail | | $ | 64,848 | |

| | | | | | | | |

| | | | TOTAL SENIOR SECURED FLOATING RATE LOAN INTERESTS

(Cost $516,051) | | $ | 472,432 | |

| | | | | | | | |

| | | | U.S. GOVERNMENT AND AGENCY OBLIGATIONS — 6.5% of Net Assets | | | | |

| | 300,000 | (d) | | U.S. Treasury Bills, 9/10/19 | | $ | 299,883 | |

| | 900,000 | (d) | | U.S. Treasury Bills, 9/17/19 | | | 899,291 | |

| | 150,000 | (d) | | U.S. Treasury Bills, 9/24/19 | | | 149,821 | |

| | | | | | | | |

| | | | TOTAL U.S. GOVERNMENT AND AGENCY OBLIGATIONS

(Cost $1,348,839) | | $ | 1,348,995 | |

| | | | | | | | |

| | | | TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 98.7%

(Cost $20,176,676) | | $ | 20,364,021 | |

| | | | | | | | |

| | | | OTHER ASSETS AND LIABILITIES — 1.3% | | $ | 261,910 | |

| | | | | | | | |

| | | | NET ASSETS — 100.0% | | $ | 20,625,931 | |

| | | | | | | | |

| | |

| bps | | Basis Points. |

| LIBOR | | London Interbank Offered Rate. |

| REIT | | Real Estate Investment Trust. |

| (144A) | | Security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers in a transaction exempt from registration. At August 31, 2019, the value of these securities amounted to $11,757,590, or 57.0% of net assets. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 26 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

| * | Senior secured floating rate loan interests in which the Fund invests generally pay interest at rates that are periodically redetermined by reference to a base lending rate plus a premium. These base lending rates are generally (i) the lending rate offered by one or more major European banks, such as LIBOR, (ii) the prime rate offered by one or more major United States banks, (iii) the rate of a certificate of deposit or (iv) other base lending rates used by commercial lenders. The interest rate shown is the rate accruing at August 31, 2019. |

| (a) | The interest rate is subject to change periodically. The interest rate and/or reference index and spread is shown at August 31, 2019. |

| (b) | Security is perpetual in nature and has no stated maturity date. |

| (c) | Floating rate note. Coupon rate, reference index and spread shown at August 31, 2019. |

| (d) | Security issued with a zero coupon. Income is recognized through accretion of discount. |

SWAP CONTRACT

CENTRALLY CLEARED CREDIT DEFAULT SWAP CONTRACT — SELL PROTECTION

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Annual | | | | | | | | | | | | | |

| Notional | | Reference | | Pay/ | | | Fixed | | | Expiration | | | Premiums | | | Unrealized | | | Market | |

| Amount ($)(1) | | Obligation/Index | | Receive(2) | | | Rate | | | Date | | | Paid | | | Appreciation | | | Value | |

504,900 | | Markit CDX North America

High Yield Index Series 32 | | | Receive | | | | 5.00 | % | | | 6/20/24 | | | $ | 26,045 | | | $ | 12,678 | | | $ | 38,723 | |

| (1) | The notional amount is the maximum amount that a seller of credit protection would be obligated to pay upon occurrence of a credit event. |

Purchases and sales of securities (excluding temporary cash investments) for the year ended August 31, 2019, aggregated $11,408,018 and $11,992,422, respectively.

The Fund is permitted to engage in purchase and sale transactions (“cross trades”) with certain funds and accounts for which Amundi Pioneer Asset Management, Inc. (the “Adviser”) serves as the Fund’s investment adviser, as set forth in Rule 17a-7 under the Investment Company Act of 1940, pursuant to procedures adopted by the Board of Trustees. Under these procedures, cross trades are effected at current market prices. During the year ended August 31, 2019, the Fund engaged in sales of $28,902 which resulted in a net realized gain/(loss) of $175. During the year ended August 31, 2019, the Fund did not engage in purchases pursuant to these procedures.

At August 31, 2019, the net unrealized appreciation on investments based on cost for federal tax purposes of $20,218,495 was as follows:

| | | | |

Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | | $ | 583,646 | |

Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | | | (399,397 | ) |

| | | | |

Net unrealized appreciation | | $ | 184,249 | |

| | | | |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

| | | | |

| Level 1 | | – | | quoted prices in active markets for identical securities. |

| | |

| Level 2 | | – | | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A. |

| | |

| Level 3 | | – | | significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A. |

The accompanying notes are an integral part of these financial statements.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 27 |

Schedule of Investments | 8/31/19 (continued)

The following is a summary of the inputs used as of August 31, 2019, in valuing the Fund’s investments:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Corporate Bonds | | $ | — | | | $ | 18,542,594 | | | $ | — | | | $ | 18,542,594 | |

Senior Secured Floating Rate Loan Interests | | | — | | | | 472,432 | | | | — | | | | 472,432 | |

U.S. Government and Agency Obligations | | | — | | | | 1,348,995 | | | | — | | | | 1,348,995 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | — | | | $ | 20,364,021 | | | $ | — | | | $ | 20,364,021 | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments | | | | | | | | | | | | | | | | |

Swap contracts, at value | | $ | — | | | $ | 38,723 | | | $ | — | | | $ | 38,723 | |

| | | | | | | | | | | | | | | | |

Total Other Financial Instruments | | $ | — | | | $ | 38,723 | | | $ | — | | | $ | 38,723 | |

| | | | | | | | | | | | | | | | |

During the year ended August 31, 2019, there were no transfers between Levels 1, 2 and 3.

The accompanying notes are an integral part of these financial statements.

| | | | |

| 28 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

Statement of Assets and Liabilities | 8/31/19

| | | | |

ASSETS: | | | | |

Investments in unaffiliated issuers, at value (cost $20,176,676) | | $ | 20,364,021 | |

Cash | | | 25,144 | |

Swaps collateral | | | 27,805 | |

Variation margin for centrally cleared swap contracts | | | 100 | |

Swap contracts, at value (net premiums paid $26,045) | | | 38,723 | |

Receivables — | | | | |

Interest | | | 329,285 | |

Due from the Adviser | | | 28,787 | |

Other assets | | | 10,917 | |

| | | | |

Total assets | | $ | 20,824,782 | |

| | | | |

LIABILITIES: | | | | |

Payables — | | | | |

Fund shares repurchased | | $ | 1,088 | |

Distributions | | | 82,023 | |

Trustees’ fees | | | 1,380 | |

Administrative fees | | | 8,230 | |

Professional fees | | | 48,242 | |

Due to broker for swaps | | | 38,906 | |

Due to affiliates — | | | | |

Management fees | | | 12,074 | |

Others due to affiliates | | | 719 | |

Accrued expenses | | | 6,189 | |

| | | | |

Total liabilities | | $ | 198,851 | |

| | | | |

NET ASSETS: | | | | |

Paid-in capital | | $ | 20,759,856 | |

Distributable earnings (loss) | | | (133,925 | ) |

| | | | |

Net assets | | $ | 20,625,931 | |

| | | | |

NET ASSET VALUE PER SHARE: | | | | |

No par value (unlimited number of shares authorized) | | | | |

Class A (based on $8,373,728/825,224 shares) | | $ | 10.15 | |

Class C (based on $4,088,782/403,291 shares) | | $ | 10.14 | |

Class Y (based on $8,163,421/804,474 shares) | | $ | 10.15 | |

MAXIMUM OFFERING PRICE PER SHARE: | | | | |

Class A (based on $10.15 net asset value per share/100%-4.50% maximum sales charge) | | $ | 10.63 | |

The accompanying notes are an integral part of these financial statements.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 29 |

Statement of Operations

For the Year Ended 8/31/19

| | | | | | | | |

INVESTMENT INCOME: | | | | | | | | |

Interest from unaffiliated issuers | | $ | 1,203,579 | | | | | |

Dividends from unaffiliated issuers | | | 12,194 | | | | | |

| | | | | | | | |

Total investment income | | | | | | $ | 1,215,773 | |

| | | | | | | | |

EXPENSES: | | | | | | | | |

Management fees | | $ | 119,573 | | | | | |

Administrative expense | | | 70,631 | | | | | |

Transfer agent fees | | | | | | | | |

Class A | | | 86 | | | | | |

Class C | | | 59 | | | | | |

Class Y | | | 26 | | | | | |

Distribution fees | | | | | | | | |

Class A | | | 19,953 | | | | | |

Class C | | | 39,918 | | | | | |

Shareowner communications expense | | | 359 | | | | | |

Custodian fees | | | 5,830 | | | | | |

Registration fees | | | 56,192 | | | | | |

Professional fees | | | 63,121 | | | | | |

Printing expense | | | 36,202 | | | | | |

Pricing fees | | | 10,775 | | | | | |

Trustees’ fees | | | 7,307 | | | | | |

Miscellaneous | | | 2,729 | | | | | |

| | | | | | | | |

Total expenses | | | | | | $ | 432,761 | |

Less fees waived and expenses reimbursed by the Adviser | | | | | | | (222,891 | ) |

| | | | | | | | |

Net expenses | | | | | | $ | 209,870 | |

| | | | | | | | |

Net investment income | | | | | | $ | 1,005,903 | |

| | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investments in unaffiliated issuers | | $ | (239,320 | ) | | | | |

Swap contracts | | | (2,964 | ) | | $ | (242,284 | ) |

| | | | | | | | |

Change in net unrealized appreciation (depreciation) on: | | | | | | | | |

Investments in unaffiliated issuers | | $ | 588,903 | | | | | |

Swap contracts | | | 12,678 | | | $ | 601,581 | |

| | | | | | | | |

Net realized and unrealized gain (loss) on investments | | | | | | $ | 359,297 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | | | | $ | 1,365,200 | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 30 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year | | | Year | |

| | | Ended | | | Ended | |

| | | 8/31/19 | | | 8/31/18 | |

FROM OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | 1,005,903 | | | $ | 937,578 | |

Net realized gain (loss) on investments | | | (242,284 | ) | | | (86,017 | ) |

Change in net unrealized appreciation (depreciation) on investments | | | 601,581 | | | | (341,816 | ) |

| | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 1,365,200 | | | $ | 509,745 | |

| | | | | | | | |

DISTRIBUTIONS TO SHAREOWNERS: | | | | | | | | |

Class A ($0.50 and $0.51 per share, respectively) | | $ | (407,169 | ) | | $ | (408,315 | )* |

Class C ($0.43 and $0.43 per share, respectively) | | | (174,094 | ) | | | (173,360 | )* |

Class Y ($0.53 and $0.53 per share, respectively) | | | (426,817 | ) | | | (429,473 | )* |

| | | | | | | | |

Total distributions to shareowners | | $ | (1,008,080 | ) | | $ | (1,011,148 | ) |

| | | | | | | | |

FROM FUND SHARE TRANSACTIONS: | | | | | | | | |

Net proceeds from sales of shares | | $ | 322,953 | | | $ | 20,516,902 | |

Reinvestment of distributions | | | 3,515 | | | | 327,726 | |

Cost of shares repurchased | | | (71,105 | ) | | | (20,519,096 | ) |

| | | | | | | | |

Net increase in net assets resulting from Fund share transactions | | $ | 255,363 | | | $ | 325,532 | |

| | | | | | | | |

Net increase (decrease) in net assets | | $ | 612,483 | | | $ | (175,871 | ) |

NET ASSETS: | | | | | | | | |

Beginning of year | | $ | 20,013,448 | | | $ | 20,189,319 | |

| | | | | | | | |

End of year** | | $ | 20,625,931 | | | $ | 20,013,448 | |

| | | | | | | | |

* For the year ended August 31, 2018, distributions to shareowners were presented as follows: | | | | |

Net investment income: | | | | | | | | |

Class A ($0.46 per share) | | | | | | $ | (365,959 | ) |

Class C ($0.38 per share) | | | | | | | (152,224 | ) |

Class Y ($0.48 per share) | | | | | | | (387,078 | ) |

Net realized gain: | | | | | | | | |

Class A ($0.05 per share) | | | | | | $ | (42,356 | ) |

Class C ($0.05 per share) | | | | | | | (21,136 | ) |

Class Y ($0.05 per share) | | | | | | | (42,395 | ) |

| ** | For the year ended August 31, 2018, undistributed net investment income was presented as follows: $43,630. |

The accompanying notes are an integral part of these financial statements.

| | |

| Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | 31 |

Statements of Changes in Net Assets (continued)

| | | | | | | | | | | | | | | | |

| | | Year | | | Year | | | Year | | | Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | |

| | | 8/31/19 | | | 8/31/19 | | | 8/31/18 | | | 8/31/18 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Class A | | | | | | | | | | | | | | | | |

Shares sold | | | 27,056 | | | $ | 271,209 | | | | 803,296 | | | $ | 8,201,723 | |

Reinvestment of distributions | | | 180 | | | | 1,815 | | | | 12,871 | | | | 132,015 | |

Less shares repurchased | | | (5,310 | ) | | | (52,361 | ) | | | (803,196 | ) | | | (8,200,629 | ) |

| | | | | | | | | | | | | | | | |

Net increase | | | 21,926 | | | $ | 220,663 | | | | 12,971 | | | $ | 133,109 | |

| | | | | | | | | | | | | | | | |

Class C | | | | | | | | | | | | | | | | |

Shares sold | | | 5,155 | | | $ | 51,744 | | | | 402,165 | | | $ | 4,101,707 | |

Reinvestment of distributions | | | 154 | | | | 1,508 | | | | 5,698 | | | | 58,368 | |

Less shares repurchased | | | (1,878 | ) | | | (18,744 | ) | | | (402,861 | ) | | | (4,108,583 | ) |

| | | | | | | | | | | | | | | | |

Net increase | | | 3,431 | | | $ | 34,508 | | | | 5,002 | | | $ | 51,492 | |

| | | | | | | | | | | | | | | | |

Class Y | | | | | | | | | | | | | | | | |

Shares sold | | | — | | | $ | — | | | | 804,453 | | | $ | 8,213,472 | |

Reinvestment of distributions | | | 20 | | | | 192 | | | | 13,389 | | | | 137,343 | |

Less shares repurchased | | | — | | | | — | | | | (804,102 | ) | | | (8,209,884 | ) |

| | | | | | | | | | | | | | | | |

Net increase | | | 20 | | | $ | 192 | | | | 13,740 | | | $ | 140,931 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 32 | | Pioneer Corporate High Yield Fund | Annual Report | 8/31/19 | | |

Financial Highlights

| | | | | | | | | | | | |

| | | Year | | | Year | | | | |

| | | Ended | | | Ended | | | 1/3/17* to | |

| | | 8/31/19 | | | 8/31/18 | | | 8/31/17 | |

Class A | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 9.97 | | | $ | 10.22 | | | $ | 10.00 | |

| | | | | | | | | | | | |

Increase (decrease) from investment operations: | | | | | | | | | | | | |