UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21108

Pioneer Series Trust X

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Christopher J. Kelley, Amundi Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742-7825

Date of fiscal year end: March 31, 2024

Date of reporting period: April 1, 2023 through September 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Pioneer Fundamental Growth Fund

Semiannual Report | September 30, 2023

| | | | | |

| A: PIGFX | C: FUNCX | K: PFGKX | R: PFGRX | Y: FUNYX |

visit us: www.amundi.com/us

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/231

President’s Letter

Dear Shareholders,

On February 13, 2023, Amundi US celebrated the 95th anniversary of Pioneer Fund, the second-oldest mutual fund in the United States. We recognized the anniversary with ringing of the closing bell at the New York Stock Exchange, which seemed fitting for this special milestone.

Pioneer Fund was launched on February 13, 1928 by Phil Carret, one of the earliest proponents of value investing and a leading innovator in the asset management industry. Mr. Carret began investing in the 1920s and founded Pioneer Investments (now Amundi US) in 1928, and was one of the first investors to realize he could uncover value through rigorous, innovative, fundamental research techniques.

Consistent with Mr. Carret’s investment approach and employing many of the same techniques utilized in the 1920s, Amundi US's portfolio managers have adapted Mr. Carret’s philosophy to a new age of “active” investing.

The last few years have seen investors face some unprecedented challenges, from a global pandemic that shuttered much of the world’s economy for months, to geopolitical strife, to rising inflation that has reached levels not seen in decades. Now, more than ever, Amundi US believes active management – that is, making active investment decisions across all of our portfolios – can help mitigate risk during periods of market volatility.

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating frequently with the management teams of the companies and other entities issuing the securities, and working together to identify those securities that we believe best meet our investment criteria for our family of funds. Our risk management approach begins with each security under consideration, as we strive to develop a deep understanding of the potential opportunity, while considering any potential risk factors.

Today, as shareholders, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress. As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

2Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

We greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Lisa M. Jones

Head of the Americas, President and CEO of US

Amundi Asset Management US, Inc.

November 2023

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/233

Portfolio Management Discussion | 9/30/23

In the following interview, Yves Raymond, David Chamberlain, and Andrew Acheson discuss the factors that affected the performance of Pioneer Fundamental Growth Fund during the six-month period ended September 30, 2023. Mr. Raymond, a senior vice president and a portfolio manager at Amundi Asset Management US (Amundi US); Mr. Chamberlain, a senior vice president and a portfolio manager at Amundi US; Matthew Gormley, an associate portfolio manager at Amundi US; and Mr. Acheson, Managing Director, Director of Growth, US, and a portfolio manager at Amundi UK, are responsible for the day-to-day management of the Fund.

| Q | How did the Fund perform during the six-month period ended September 30, 2023? |

| A | Pioneer Fundamental Growth Fund’s Class A shares returned 8.69% at net asset value during the six-month period ended September 30, 2023, while the Fund’s benchmark, the Russell 1000 Growth Index, returned 9.28%. During the same period, the average return of the 1,229 mutual funds in Morningstar’s Large Growth Funds category was 7.04%. |

| Q | How would you describe the investment backdrop for equities during the six-month period ended September 30, 2023? |

| A | Stocks performed well through the first four months of the reporting period, as cooling inflation prompted the US Federal Reserve (Fed) to slow the pace of its interest-rate increases. In addition, the markets appeared to grow confident that the Fed will have largely completed its tightening of monetary policy by 2024. Investor sentiment was further boosted by the fact that both economic growth and corporate profits held up well, compared to the depressed expectations seen in late 2022. |

| | The investment backdrop became less favorable in September and October of 2023, causing the market to finish below its previous highs. Renewed strength in crude oil prices fueled fears that inflation would reaccelerate and the Fed would have to keep rates elevated for longer than the markets had been anticipating. In addition, investors appeared to grow concerned that the US economy was finally beginning to slow. Despite the late sell-off, equities closed the six-month period firmly in positive territory, thanks to their earlier advance. |

4Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

| | During the period, growth stocks outpaced the broader market, as measured by the 5.16% return for the Russell 1000 Index. The Fund’s benchmark, Russell 1000 Growth Index (the Russell Index), returned 9.28% for the six-month period, as the growth category performed very well in the second calendar quarter, driven by the strong showing for mega-cap technology stocks, particularly stocks of companies that seemed poised to benefit from the advancements in artificial intelligence (AI). |

| Q | What factors contributed to and detracted from the Fund’s benchmark-relative performance during the six-month period ended September 30, 2023? |

| A | The Fund generated a positive return for the six-month period, but underperformed the Russell Index. Underweights in some of the mega-cap tech companies mentioned earlier detracted from benchmark-relative performance. Most notably, an underweight Fund position in NVIDIA, shares of which surged on excitement surrounding the company’s ability to become one of the largest winners of the developments related to AI, was a key detractor from relative returns. The portfolio’s below-benchmark weightings in Tesla and Meta Platforms were additional lags on the Fund’s relative performance in the mega-cap tech segment. |

| | In addition, two of the Fund’s holdings in the health care sector were sizable detractors from benchmark-relative results. Edwards Lifesciences, a leader in transcatheter heart valve replacement, which is a minimally invasive alternative to open heart surgery, lagged its sector peers by a wide margin during the six-month period. The company’s stock price fell after Edwards reported slightly lower-than-expected profit margins due to investments in clinical trials to generate future growth. A position in life sciences tools company Thermo Fisher Scientific was another key detractor from the Fund’s relative performance in the health care sector. The stock price came under pressure during the period on concerns about unsteady macroeconomic conditions, a decline in Thermo Fisher’s revenues from COVID-related products and services, and destocking by its customers. |

| | Outside of information technology and health care, a position in PepsiCo was a key detractor from the Fund’s relative performance. The shares lost ground during the period on worries |

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/235

| | that the company would be unable to continue passing on rising costs to consumers in the form of higher prices. |

| | On the positive side, the Fund’s position in Eli Lilly surged in price and contributed to benchmark-relative performance, based on growing optimism about the potential addressable market for the company’s weight-loss treatment. The company also reported better-than-expected sales for its diabetes product, and raised earnings guidance. The Fund further benefited from having no exposure to a number of health care companies that specialize in diabetes treatments and are expected to see their sales slow due to the rollout of Eli Lilly’s diabetes drug. |

| | The industrials sector was an additional source of outperformance for the Fund versus the Russell Index. Within the sector, a position in Verisk Analytics, the leading provider of data and analytics tools for the US property-and-casualty insurance industry, was a top positive contributor to the Fund's relative returns during the six-month period, thanks in part to the company’s decision to refocus on its core business. Positions in Eaton and United Parcel Service (UPS) also contributed positively to the Fund’s relative results in the industrials sector. Stock selection results in the energy sector also aided the Fund’s benchmark-relative performance, due largely to the portfolio’s position in oil services company Schlumberger, as rising crude oil prices led to an improved outlook for spending by the large, integrated producers, and boosted the earnings prospects of services companies. |

| | Finally, an underweight portfolio position in Apple, which lagged its mega-cap peers on concerns about its future sales growth and elevated valuation, also contributed positively to the Fund’s relative performance. |

| Q | Did the Fund have any exposure to derivative securities during the six-month period ended September 30, 2023? |

| A | No. The Fund had no derivatives exposure during the reporting period. |

6Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

| Q | How would you characterize the Fund’s overall positioning as of September 30, 2023? |

| A | Our goal is to seek to generate long-term capital growth by investing primarily in US large-cap companies. We believe risk mitigation is a critical component in meeting this goal. Our approach to managing portfolio risk is to invest in what we view as attractively valued equities of companies that have high returns on capital, that we think possess sustainable competitive advantages, and could be positioned to capitalize on secular growth opportunities. |

| | We continue to expect that economic growth will slow over the next several months, due to the effects of higher interest rates, depleted excess savings among consumers, and a resumption of student loan payments, among other factors. The continuing impact of prior fiscal stimulus, such as the Inflation Reduction Act, may offset some of those headwinds. |

| | We believe the Fed will stay hawkish with regard to monetary policy as long as inflation remains sticky, providing there are no unforeseen, adverse events. Hopes of interest-rate cuts later in the year or early in 2024 may prove to be premature, in our view, given rising wages. If the Fed does cut interest rates in the next six to nine months, we think it would likely be a response to greater-than-expected economic weakness, which could be detrimental to corporate earnings. Potential rate cuts, therefore, aren’t necessarily a positive for the markets. |

| | Corporate profit margins have remained relatively high, though well off their peaks of a year ago. We believe further contraction is likely to occur for the majority of companies, and we think that earnings estimates for the next several quarters are overly optimistic. A mild recession, in our view, is more likely than a “soft landing,” in which economic growth slows but remains positive while inflation is brought under control. In either scenario, we believe profit estimates may decline as companies take a more cautious approach due to economic uncertainty. However, if the stock market begins to discount a potential recession, we would anticipate becoming more constructive. |

| | We have been highly selective with regard to the stocks we add to the Fund, and have been seeking to avoid what we believe are |

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/237

speculative and unprofitable companies that could easily fall out of favor again. At the sector level, the Fund is overweight versus the Russell Index to financials and health care companies, and underweight to information technology. The underweight to the technology sector is primarily due to the aforementioned below-benchmark weighting in Apple, which reflects both position-size limits and our view on the stock’s valuation.

8Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

Please refer to the Schedule of Investments on pages 19 - 23 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues, armed conflict including Russia's military invasion of Ukraine, sanctions against Russia, other nations or individuals or companies and possible countermeasures, market disruptions caused by tariffs, trade disputes or other government actions, or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

The Fund may invest in fewer than 40 securities and, as a result, its performance may be more volatile than the performance of other funds holding more securities.

Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

For more information on this or any Pioneer fund, please visit amundi.com/usinvestors or call 1-800-622-9876. This material must be preceded or accompanied by the Fund's current prospectus or summary prospectus.

Any information in this shareholder report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/239

Portfolio Summary | 9/30/23

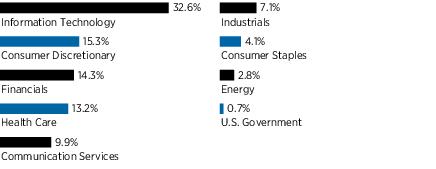

Sector Distribution

(As a percentage of total investments)*

10 Largest Holdings

| (As a percentage of total investments)* |

| 1. | Alphabet, Inc., Class C | 8.01% |

| 2. | Microsoft Corp. | 7.11 |

| 3. | Amazon.com, Inc. | 6.15 |

| 4. | Mastercard, Inc., Class A | 4.87 |

| 5. | Eli Lilly & Co. | 4.63 |

| 6. | Apple, Inc. | 4.33 |

| 7. | Adobe, Inc. | 3.17 |

| 8. | PepsiCo., Inc. | 3.02 |

| 9. | Thermo Fisher Scientific, Inc. | 2.99 |

| 10. | Visa, Inc., Class A | 2.89 |

| | |

| * | Excludes short-term investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities. |

10Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

Prices and Distributions | 9/30/23

Net Asset Value per Share

| Class | 9/30/23 | 3/31/23 |

| A | $28.52 | $26.24 |

| C | $23.69 | $21.88 |

| K | $28.81 | $26.46 |

| R | $27.27 | $25.13 |

| Y | $29.12 | $26.76 |

| | | |

Distributions per Share: 4/1/23 - 9/30/23

| Class | Net

Investment

Income | Short-Term

Capital Gains | Long-Term

Capital Gains |

| A | $— | $— | $— |

| C | $— | $— | $— |

| K | $— | $— | $— |

| R | $— | $— | $— |

| Y | $— | $— | $— |

Index Definitions

The Russell 1000 Growth Index is an unmanaged index that measures the performance of large-cap U.S. growth stocks. Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

The index defined here pertains to the “Value of $10,000 Investment” and “Value of $5 Million Investment” charts on pages 16-20.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2311

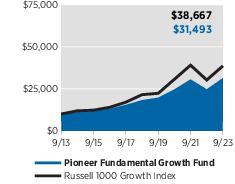

| Performance Update | 9/30/23 | Class A Shares |

Investment Returns

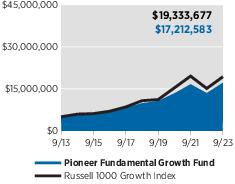

The mountain chart on the right shows the change in value of a $10,000 investment made in Class A shares of Pioneer Fundamental Growth Fund at public offering price during the periods shown, compared to that of the Russell 1000 Growth Index.

Average Annual Total Returns

(As of September 30, 2023) |

| Period | Net

Asset

Value

(NAV) | Public

Offering

Price

(POP) | Russell

1000

Growth

Index |

| 10 Years | 12.82% | 12.16% | 14.48% |

| 5 Years | 11.45 | 10.13 | 12.42 |

| 1 Year | 27.11 | 19.79 | 27.72 |

Expense Ratio

(Per prospectus dated August 1, 2023) |

| Gross |

| 1.02% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share. NAV returns would have been lower had sales charges been reflected. POP returns reflect deduction of maximum 5.75% sales charge. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

12Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

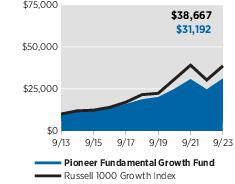

| Performance Update | 9/30/23 | Class C Shares |

Investment Returns

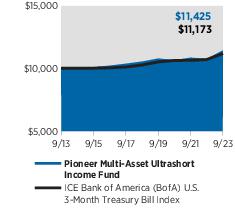

The mountain chart on the right shows the change in value of a $10,000 investment made in Class C shares of Pioneer Fundamental Growth Fund during the periods shown, compared to that of the Russell 1000 Growth Index.

Average Annual Total Returns

(As of September 30, 2023) |

| Period | If

Held | If

Redeemed | Russell

1000

Growth

Index |

| 10 Years | 12.05% | 12.05% | 14.48% |

| 5 Years | 10.68 | 10.68 | 12.42 |

| 1 Year | 26.24 | 25.24 | 27.72 |

Expense Ratio

(Per prospectus dated August 1, 2023) |

| Gross |

| 1.74% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class C shares held for less than one year are also subject to a 1% contingent deferred sales charge (CDSC). “If Held” results represent the percent change in net asset value per share. “If Redeemed” returns reflect deduction of the CDSC for the one-year period, assuming a complete redemption of shares at the last price calculated on the last business day of the period, and no CDSC for the five- and 10-year periods. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2313

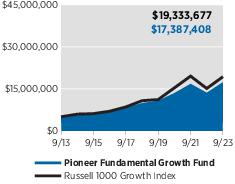

| Performance Update | 9/30/23 | Class K Shares |

Investment Returns

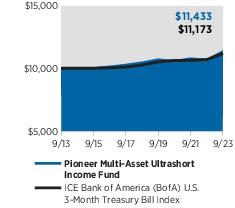

The mountain chart on the right shows the change in value of a $5 million investment made in Class K shares of Pioneer Fundamental Growth Fund during the periods shown, compared to that of the Russell 1000 Growth Index.

Average Annual Total Returns

(As of September 30, 2023) |

| Period | Net

Asset

Value

(NAV) | Russell

1000

Growth

Index |

| 10 Years | 13.27% | 14.48% |

| 5 Years | 11.87 | 12.42 |

| 1 Year | 27.55 | 27.72 |

Expense Ratio

(Per prospectus dated August 1, 2023) |

| Gross |

| 0.67% |

Value of $5 Million Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class K shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

14Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

| Performance Update | 9/30/23 | Class R Shares |

Investment Returns

The mountain chart on the right shows the change in value of a $10,000 investment made in Class R shares of Pioneer Fundamental Growth Fund during the periods shown, compared to that of the Russell 1000 Growth Index.

Average Annual Total Returns

(As of September 30, 2023) |

| Period | Net

Asset

Value

(NAV) | Russell

1000

Growth

Index |

| 10 Years | 12.45% | 14.48% |

| 5 Years | 11.05 | 12.42 |

| 1 Year | 26.68 | 27.72 |

Expense Ratio

(Per prospectus dated August 1, 2023) |

| Gross | Net |

| 1.43% | 1.40% |

Value of $10,000 Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class R shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation in effect through August 1, 2024 for Class R shares. There can be no assurance that Amundi US will extend the expense limitation beyond such time. Please see the prospectus for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for more current expense ratios.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2315

| Performance Update | 9/30/23 | Class Y Shares |

Investment Returns

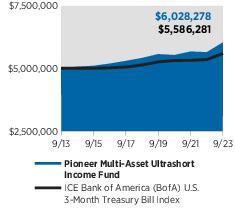

The mountain chart on the right shows the change in value of a $5 million investment made in Class Y shares of Pioneer Fundamental Growth Fund during the periods shown, compared to that of the Russell 1000 Growth Index.

Average Annual Total Returns

(As of September 30, 2023) |

| Period | Net

Asset

Value

(NAV) | Russell

1000

Growth

Index |

| 10 Years | 13.16% | 14.48% |

| 5 Years | 11.76 | 12.42 |

| 1 Year | 27.45 | 27.72 |

Expense Ratio

(Per prospectus dated August 1, 2023) |

| Gross |

| 0.76% |

Value of $5 Million Investment

Call 1-800-225-6292 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

The performance data quoted represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

Class Y shares are not subject to sales charges and are available for limited groups of eligible investors, including institutional investors. All results are historical and assume the reinvestment of dividends and capital gains. Other share classes are available for which performance and expenses will differ.

Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions or the redemption of Fund shares.

Please refer to the financial highlights for a more current expense ratio.

16Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

Comparing Ongoing Fund Expenses

As a shareowner in the Fund, you incur two types of costs:

| (1) | ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Fund expenses; and |

| (2) | transaction costs, including sales charges (loads) on purchase payments. |

This example is intended to help you understand your ongoing expenses (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 at the beginning of the Fund’s latest six-month period and held throughout the six months.

Using the Tables

Actual Expenses

The first table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period as follows:

| (1) | Divide your account value by $1,000

Example: an $8,600 account value ÷ $1,000 = 8.6 |

| (2) | Multiply the result in (1) above by the corresponding share class’s number in the third row under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. |

Expenses Paid on a $1,000 Investment in Pioneer Fundamental Growth Fund

Based on actual returns from April 1, 2023 through September 30, 2023.

| Share Class | A | C | K | R | Y |

Beginning Account

Value on 4/1/23 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value

(after expenses) on 9/30/23 | $1,086.90 | $1,082.70 | $1,088.80 | $1,085.20 | $1,088.20 |

Expenses Paid

During Period* | $5.22 | $9.06 | $3.45 | $7.09 | $3.97 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.00%, 1.74%, 0.66%, 1.36%, and 0.76% for Class A, Class C, Class K, Class R, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2317

Comparing Ongoing Fund Expenses (continued)

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as sales charges (loads) that are charged at the time of the transaction. Therefore, the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

Expenses Paid on a $1,000 Investment in Pioneer Fundamental Growth Fund

Based on a hypothetical 5% return per year before expenses, reflecting the period from April 1, 2023 through September 30, 2023.

| Share Class | A | C | K | R | Y |

Beginning Account

Value on 4/1/23 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 |

Ending Account Value

(after expenses) on 9/30/23 | $1,020.00 | $1,016.30 | $1,021.70 | $1,018.20 | $1,021.20 |

Expenses Paid

During Period* | $5.05 | $8.77 | $3.34 | $6.86 | $3.84 |

| | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.00%, 1.74%, 0.66%, 1.36%, and 0.76% for Class A, Class C, Class K, Class R, and Class Y shares, respectively, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period). |

18Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

Schedule of Investments | 9/30/23

(unaudited)

| Shares | | | | | | Value |

| | UNAFFILIATED ISSUERS — 100.0% | |

| | Common Stocks — 97.2% of Net Assets | |

| | Beverages — 3.0% | |

| 1,038,325 | PepsiCo., Inc. | $ 175,933,788 |

| | Total Beverages | $175,933,788 |

|

|

| | Broadline Retail — 6.0% | |

| 2,817,410(a) | Amazon.com, Inc. | $ 358,149,159 |

| | Total Broadline Retail | $358,149,159 |

|

|

| | Capital Markets — 3.6% | |

| 178,987 | FactSet Research Systems, Inc. | $ 78,263,855 |

| 1,222,541 | Intercontinental Exchange, Inc. | 134,503,961 |

| | Total Capital Markets | $212,767,816 |

|

|

| | Commercial Services & Supplies — 1.0% | |

| 1,371,464(a) | Copart, Inc. | $ 59,096,384 |

| | Total Commercial Services & Supplies | $59,096,384 |

|

|

| | Communications Equipment — 2.3% | |

| 514,327 | Motorola Solutions, Inc. | $ 140,020,382 |

| | Total Communications Equipment | $140,020,382 |

|

|

| | Electrical Equipment — 1.9% | |

| 352,813 | Eaton Corp. Plc | $ 75,247,957 |

| 143,830 | Rockwell Automation, Inc. | 41,116,682 |

| | Total Electrical Equipment | $116,364,639 |

|

|

| | Electronic Equipment, Instruments & Components

— 5.1% | |

| 1,991,394 | Amphenol Corp., Class A | $ 167,257,182 |

| 677,515 | CDW Corp. | 136,695,426 |

| | Total Electronic Equipment, Instruments & Components | $303,952,608 |

|

|

| | Energy Equipment & Services — 2.7% | |

| 2,805,994 | Schlumberger, NV | $ 163,589,450 |

| | Total Energy Equipment & Services | $163,589,450 |

|

|

| | Entertainment — 1.9% | |

| 436,589 | Electronic Arts, Inc. | $ 52,565,315 |

| 717,394(a) | Walt Disney Co. | 58,144,784 |

| | Total Entertainment | $110,710,099 |

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2319

Schedule of Investments | 9/30/23

(unaudited) (continued)

| Shares | | | | | | Value |

| | Financial Services — 7.6% | |

| 716,976 | Mastercard, Inc., Class A | $ 283,857,968 |

| 731,282 | Visa, Inc., Class A | 168,202,173 |

| | Total Financial Services | $452,060,141 |

|

|

| | Ground Transportation — 1.1% | |

| 1,471,961(a) | Uber Technologies, Inc. | $ 67,695,486 |

| | Total Ground Transportation | $67,695,486 |

|

|

| | Health Care Equipment & Supplies — 3.1% | |

| 1,031,768(a) | Edwards Lifesciences Corp. | $ 71,480,887 |

| 385,975(a) | Intuitive Surgical, Inc. | 112,816,633 |

| | Total Health Care Equipment & Supplies | $184,297,520 |

|

|

| | Hotels, Restaurants & Leisure — 2.5% | |

| 38,932(a) | Booking Holdings, Inc. | $ 120,064,342 |

| 193,134 | Hilton Worldwide Holdings, Inc. | 29,004,864 |

| | Total Hotels, Restaurants & Leisure | $149,069,206 |

|

|

| | Household Products — 1.1% | |

| 910,977 | Colgate-Palmolive Co. | $ 64,779,574 |

| | Total Household Products | $64,779,574 |

|

|

| | Insurance — 2.8% | |

| 1,192,238 | Progressive Corp. | $ 166,078,753 |

| | Total Insurance | $166,078,753 |

|

|

| | Interactive Media & Services — 7.8% | |

| 3,539,494(a) | Alphabet, Inc., Class C | $ 466,682,284 |

| | Total Interactive Media & Services | $466,682,284 |

|

|

| | Life Sciences Tools & Services — 5.3% | |

| 561,960 | Danaher Corp. | $ 139,422,276 |

| 343,657 | Thermo Fisher Scientific, Inc. | 173,948,864 |

| | Total Life Sciences Tools & Services | $313,371,140 |

|

|

| | Machinery — 1.1% | |

| 277,199 | Illinois Tool Works, Inc. | $ 63,841,702 |

| | Total Machinery | $63,841,702 |

|

|

| | Pharmaceuticals — 4.5% | |

| 502,191 | Eli Lilly & Co. | $ 269,741,852 |

| | Total Pharmaceuticals | $269,741,852 |

|

|

| | Professional Services — 1.8% | |

| 443,095 | Verisk Analytics, Inc. | $ 104,676,763 |

| | Total Professional Services | $104,676,763 |

|

|

The accompanying notes are an integral part of these financial statements.

20Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

| Shares | | | | | | Value |

| | Semiconductors & Semiconductor Equipment —

5.9% | |

| 851,833(a) | Advanced Micro Devices, Inc. | $ 87,585,469 |

| 695,367 | Microchip Technology, Inc. | 54,273,394 |

| 152,923 | NVIDIA Corp. | 66,519,976 |

| 1,272,073 | QUALCOMM, Inc. | 141,276,428 |

| | Total Semiconductors & Semiconductor Equipment | $349,655,267 |

|

|

| | Software — 14.4% | |

| 362,698(a) | Adobe, Inc. | $ 184,939,710 |

| 277,136 | Intuit, Inc. | 141,599,868 |

| 1,311,965 | Microsoft Corp. | 414,252,949 |

| 562,518(a) | Salesforce, Inc. | 114,067,400 |

| | Total Software | $854,859,927 |

|

|

| | Specialty Retail — 6.5% | |

| 147,878(a) | O'Reilly Automotive, Inc. | $ 134,400,399 |

| 1,077,823 | Ross Stores, Inc. | 121,740,108 |

| 1,470,459 | TJX Cos., Inc. | 130,694,396 |

| | Total Specialty Retail | $386,834,903 |

|

|

| | Technology Hardware, Storage & Peripherals —

4.2% | |

| 1,474,878 | Apple, Inc. | $ 252,513,862 |

| | Total Technology Hardware, Storage & Peripherals | $252,513,862 |

|

|

| | Total Common Stocks

(Cost $2,878,822,180) | $5,786,742,705 |

|

|

Principal

Amount

USD ($) | | | | | | |

| | U.S. Government and Agency

Obligations — 0.7% of Net Assets | |

| 40,000,000(b) | U.S. Treasury Bills, 10/24/23 | $ 39,871,025 |

| | Total U.S. Government and Agency Obligations

(Cost $39,865,120) | $39,871,025 |

|

|

The accompanying notes are an integral part of these financial statements.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2321

Schedule of Investments | 9/30/23

(unaudited) (continued)

Principal

Amount

USD ($) | | | | | | Value |

|

| | SHORT TERM INVESTMENTS — 2.1% of Net

Assets | |

| | Repurchase Agreements — 0.7% | |

| 42,000,000 | Bank of America, 5.3%, dated 9/29/23,

to be purchased on 10/2/23 for $42,018,550,

collateralized by $42,840,078 U.S. Treasury Note,

3.75%-4.00%, 4/15/26-2/28/30 | $ 42,000,000 |

| | | | | | | $ 42,000,000 |

|

|

| Shares | | | | | | |

| | Open-End Fund — 1.4% | |

| 81,020,043(c) | Dreyfus Government Cash Management,

Institutional Shares, 5.22% | $ 81,020,043 |

| | | | | | | $ 81,020,043 |

|

|

| | TOTAL SHORT TERM INVESTMENTS

(Cost $123,020,043) | $123,020,043 |

|

|

| | TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 100.0%

(Cost $3,041,707,343) | $5,949,633,773 |

| | OTHER ASSETS AND LIABILITIES — 0.0%† | $ 2,671,121 |

| | net assets — 100.0% | $5,952,304,894 |

| | | | | | | |

| (a) | Non-income producing security. |

| (b) | Security issued with a zero coupon. Income is recognized through accretion of discount. |

| (c) | Rate periodically changes. Rate disclosed is the 7-day yield at September 30, 2023. |

| † | Amount rounds to less than 0.1%. |

Purchases and sales of securities (excluding short-term investments) for the six months ended September 30, 2023, aggregated $494,368,992 and $534,459,092, respectively.

At September 30, 2023, the net unrealized appreciation on investments based on cost for federal tax purposes of $3,053,988,856 was as follows:

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $2,935,411,126 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (39,766,209) |

| Net unrealized appreciation | $2,895,644,917 |

The accompanying notes are an integral part of these financial statements.

22Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels below.

| Level 1 | – | unadjusted quoted prices in active markets for identical securities. |

| Level 2 | – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A. |

| Level 3 | – | significant unobservable inputs (including the Adviser's own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A. |

The following is a summary of the inputs used as of September 30, 2023, in valuing the Fund's investments:

| | Level 1 | Level 2 | Level 3 | Total |

| Common Stocks | $5,786,742,705 | $ — | $— | $5,786,742,705 |

| U.S. Government and Agency Obligations | — | 39,871,025 | — | 39,871,025 |

| Repurchase Agreements | — | 42,000,000 | — | 42,000,000 |

| Open-End Fund | 81,020,043 | — | — | 81,020,043 |

| Total Investments in Securities | $ 5,867,762,748 | $ 81,871,025 | $ — | $ 5,949,633,773 |

During the period ended September 30, 2023, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2323

Statement of Assets and Liabilities | 9/30/23 (unaudited)

| ASSETS: | |

| Investments in unaffiliated issuers, at value (cost $3,041,707,343) | $5,949,633,773 |

| Receivables — | |

| Fund shares sold | 8,942,050 |

| Dividends | 2,033,197 |

| Interest | 235,489 |

| Due from the Adviser | 27 |

| Other assets | 223,255 |

| Total assets | $ 5,961,067,791 |

| LIABILITIES: | |

| Payables — | |

| Fund shares repurchased | $ 6,857,310 |

| Transfer agent fees | 984,131 |

| Management fees | 395,353 |

| Administrative expenses | 169,706 |

| Distribution fees | 60,017 |

| Accrued expenses | 296,380 |

| Total liabilities | $ 8,762,897 |

| NET ASSETS: | |

| Paid-in capital | $2,853,243,361 |

| Distributable earnings | 3,099,061,533 |

| Net assets | $5,952,304,894 |

| NET ASSET VALUE PER SHARE: | |

| No par value (unlimited number of shares authorized) | |

| Class A (based on $1,152,581,202/40,412,194 shares) | $ 28.52 |

| Class C (based on $209,936,436/8,862,388 shares) | $ 23.69 |

| Class K (based on $839,506,578/29,137,770 shares) | $ 28.81 |

| Class R (based on $103,654,718/3,801,562 shares) | $ 27.27 |

| Class Y (based on $3,646,625,960/125,248,089 shares) | $ 29.12 |

| MAXIMUM OFFERING PRICE PER SHARE: | |

| Class A (based on $28.52 net asset value per share/100%-5.75% maximum sales charge) | $ 30.26 |

The accompanying notes are an integral part of these financial statements.

24Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

Statement of Operations (unaudited)

FOR THE SIX MONTHS ENDED 9/30/23

| INVESTMENT INCOME: | | |

| Dividends from unaffiliated issuers | $23,175,622 | |

| Interest from unaffiliated issuers | 2,093,339 | |

| Total Investment Income | | $ 25,268,961 |

| EXPENSES: | | |

| Management fees | $17,782,278 | |

| Administrative expenses | 770,411 | |

| Transfer agent fees | | |

| Class A | 457,750 | |

| Class C | 78,358 | |

| Class K | 901 | |

| Class R | 103,083 | |

| Class Y | 1,693,013 | |

| Distribution fees | | |

| Class A | 1,380,284 | |

| Class C | 1,109,193 | |

| Class R | 258,650 | |

| Shareowner communications expense | 130,729 | |

| Custodian fees | 31,918 | |

| Registration fees | 60,793 | |

| Professional fees | 192,843 | |

| Printing expense | 12,913 | |

| Officers' and Trustees' fees | 187,171 | |

| Miscellaneous | 208,089 | |

| Total expenses | | $ 24,458,377 |

| Net investment income | | $ 810,584 |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | |

| Net realized gain (loss) on: | | |

| Investments in unaffiliated issuers | | $202,947,823 |

| Change in net unrealized appreciation (depreciation) on: | | |

| Investments in unaffiliated issuers | | $273,605,775 |

| Net realized and unrealized gain (loss) on investments | | $476,553,598 |

| Net increase in net assets resulting from operations | | $477,364,182 |

The accompanying notes are an integral part of these financial statements.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2325

Statements of Changes in Net Assets

| | Six Months

Ended

9/30/23

(unaudited) | Year

Ended

3/31/23 |

| FROM OPERATIONS: | | |

| Net investment income (loss) | $ 810,584 | $ 1,702,215 |

| Net realized gain (loss) on investments | 202,947,823 | 4,379,884 |

| Change in net unrealized appreciation (depreciation) on investments | 273,605,775 | (430,738,196) |

| Net increase (decrease) in net assets resulting from operations | $ 477,364,182 | $ (424,656,097) |

| DISTRIBUTIONS TO SHAREOWNERS: | | |

| Class A ($— and $1.06 per share, respectively) | $ — | $ (40,524,950) |

| Class C ($— and $1.06 per share, respectively) | — | (12,076,330) |

| Class K ($— and $1.06 per share, respectively) | — | (28,722,503) |

| Class R ($— and $1.06 per share, respectively) | — | (4,002,407) |

| Class Y ($— and $1.06 per share, respectively) | — | (127,942,583) |

| Total distributions to shareowners | $ — | $ (213,268,773) |

| FROM FUND SHARE TRANSACTIONS: | | |

| Net proceeds from sales of shares | $ 714,617,386 | $ 1,286,919,419 |

| Reinvestment of distributions | — | 190,150,893 |

| Cost of shares repurchased | (708,247,877) | (1,641,920,640) |

| Net increase (decrease) in net assets resulting from Fund share transactions | $ 6,369,509 | $ (164,850,328) |

| Net increase (decrease) in net assets | $ 483,733,691 | $ (802,775,198) |

| NET ASSETS: | | |

| Beginning of period | $5,468,571,203 | $ 6,271,346,401 |

| End of period | $5,952,304,894 | $ 5,468,571,203 |

The accompanying notes are an integral part of these financial statements.

26Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

| | Six Months

Ended

9/30/23

Shares

(unaudited) | Six Months

Ended

9/30/23

Amount

(unaudited) | Year

Ended

3/31/23

Shares | Year

Ended

3/31/23

Amount |

| Class A | | | | |

| Shares sold | 6,075,289 | $ 173,066,440 | 5,572,757 | $ 141,439,708 |

| Reinvestment of distributions | — | — | 1,426,771 | 35,355,376 |

| Less shares repurchased | (4,024,503) | (113,676,356) | (8,270,446) | (210,553,850) |

Net increase

(decrease) | 2,050,786 | $ 59,390,084 | (1,270,918) | $ (33,758,766) |

| Class C | | | | |

| Shares sold | 347,155 | $ 8,169,311 | 777,200 | $ 16,585,707 |

| Reinvestment of distributions | — | — | 551,991 | 11,431,724 |

| Less shares repurchased | (1,730,074) | (40,344,727) | (5,499,084) | (117,360,748) |

| Net decrease | (1,382,919) | $ (32,175,416) | (4,169,893) | $ (89,343,317) |

| Class K | | | | |

| Shares sold | 3,774,982 | $ 108,572,867 | 6,058,204 | $ 154,002,209 |

| Reinvestment of distributions | — | — | 1,081,116 | 26,984,664 |

| Less shares repurchased | (2,264,254) | (64,530,420) | (8,262,193) | (215,969,328) |

Net increase

(decrease) | 1,510,728 | $ 44,042,447 | (1,122,873) | $ (34,982,455) |

| Class R | | | | |

| Shares sold | 309,852 | $ 8,210,949 | 454,486 | $ 11,063,987 |

| Reinvestment of distributions | — | — | 152,300 | 3,620,180 |

| Less shares repurchased | (334,943) | (9,039,010) | (747,578) | (18,143,975) |

| Net decrease | (25,091) | $ (828,061) | (140,792) | $ (3,459,808) |

| Class Y | | | | |

| Shares sold | 14,475,005 | $ 416,597,819 | 37,242,069 | $ 963,827,808 |

| Reinvestment of distributions | — | — | 4,467,470 | 112,758,949 |

| Less shares repurchased | (16,694,542) | (480,657,364) | (42,011,533) | (1,079,892,739) |

| Net decrease | (2,219,537) | $ (64,059,545) | (301,994) | $ (3,305,982) |

The accompanying notes are an integral part of these financial statements.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2327

| | Six Months

Ended

9/30/23

(unaudited) | Year

Ended

3/31/23 | Year

Ended

3/31/22 | Year

Ended

3/31/21 | Year

Ended

3/31/20 | Year

Ended

3/31/19 |

| Class A | | | | | | |

| Net asset value, beginning of period | $ 26.24 | $ 29.25 | $ 31.88 | $ 22.43 | $ 24.21 | $ 22.66 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ (0.02) | $ (0.03) | $ (0.09) | $ (0.03)(b) | $ 0.04 | $ 0.06 |

| Net realized and unrealized gain (loss) on investments | 2.30 | (1.92) | 3.87 | 12.31 | (0.36) | 2.77 |

| Net increase (decrease) from investment operations | $ 2.28 | $ (1.95) | $ 3.78 | $ 12.28 | $ (0.32) | $ 2.83 |

| Distributions to shareowners: | | | | | | |

| Net investment income | $ — | $ — | $ — | $ — | $ (0.01) | $ (0.05) |

| Net realized gain | — | (1.06) | (6.41) | (2.83) | (1.45) | (1.23) |

| Total distributions | $ — | $ (1.06) | $ (6.41) | $ (2.83) | $ (1.46) | $ (1.28) |

| Net increase (decrease) in net asset value | $ 2.28 | $ (3.01) | $ (2.63) | $ 9.45 | $ (1.78) | $ 1.55 |

| Net asset value, end of period | $ 28.52 | $ 26.24 | $ 29.25 | $ 31.88 | $ 22.43 | $ 24.21 |

| Total return (c) | 8.69%(d) | (6.44)% | 10.70% | 55.55% | (2.17)% | 12.90% |

| Ratio of net expenses to average net assets | 1.00%(e) | 1.02% | 1.00% | 1.04% | 1.07% | 1.09% |

| Ratio of net investment income (loss) to average net assets | (0.13)%(e) | (0.13)% | (0.26)% | (0.10)% | 0.16% | 0.25% |

| Portfolio turnover rate | 9%(d) | 12% | 18%(f) | 24% | 23%(f) | 26% |

| Net assets, end of period (in thousands) | $1,152,581 | $1,006,630 | $1,159,356 | $1,143,970 | $805,102 | $1,042,168 |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | The amount shown for a share outstanding does not correspond with net investment income on the Statement of Operations for the period due to timing of the sales and repurchase of shares. |

| (c) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions, the complete redemption of the investment at net asset value at the end of each period and no sales charges. Total return would be reduced if sales charges were taken into account. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

The accompanying notes are an integral part of these financial statements.

28Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

| | Six Months

Ended

9/30/23

(unaudited) | Year

Ended

3/31/23 | Year

Ended

3/31/22 | Year

Ended

3/31/21 | Year

Ended

3/31/20 | Year

Ended

3/31/19 |

| Class C | | | | | | |

| Net asset value, beginning of period | $ 21.88 | $ 24.76 | $ 28.01 | $ 20.07 | $ 21.93 | $ 20.73 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ (0.10) | $ (0.18) | $ (0.28) | $ (0.21)(b) | $ (0.12)(b) | $ (0.08)(b) |

| Net realized and unrealized gain (loss) on investments | 1.91 | (1.64) | 3.44 | 10.98 | (0.29) | 2.51 |

| Net increase (decrease) from investment operations | $ 1.81 | $ (1.82) | $ 3.16 | $ 10.77 | $ (0.41) | $ 2.43 |

| Distributions to shareowners: | | | | | | |

| Net realized gain | $ — | $ (1.06) | $ (6.41) | $ (2.83) | $ (1.45) | $ (1.23) |

| Total distributions | $ — | $ (1.06) | $ (6.41) | $ (2.83) | $ (1.45) | $ (1.23) |

| Net increase (decrease) in net asset value | $ 1.81 | $ (2.88) | $ (3.25) | $ 7.94 | $ (1.86) | $ 1.20 |

| Net asset value, end of period | $ 23.69 | $ 21.88 | $ 24.76 | $ 28.01 | $ 20.07 | $ 21.93 |

| Total return (c) | 8.27%(d) | (7.10)% | 9.91% | 54.53% | (2.81)% | 12.12% |

| Ratio of net expenses to average net assets | 1.74%(e) | 1.74% | 1.71% | 1.72% | 1.74% | 1.73% |

| Ratio of net investment income (loss) to average net assets | (0.88)%(e) | (0.86)% | (0.98)% | (0.79)% | (0.51)% | (0.39)% |

| Portfolio turnover rate | 9%(d) | 12% | 18%(f) | 24% | 23%(f) | 26% |

| Net assets, end of period (in thousands) | $209,936 | $224,126 | $356,963 | $432,822 | $372,488 | $444,786 |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | The amount shown for a share outstanding does not correspond with net investment income on the Statement of Operations for the period due to timing of the sales and repurchase of shares. |

| (c) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions, the complete redemption of the investment at net asset value at the end of each period and no sales charges. Total return would be reduced if sales charges were taken into account. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

The accompanying notes are an integral part of these financial statements.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2329

Financial Highlights (continued)

| | Six Months

Ended

9/30/23

(unaudited) | Year

Ended

3/31/23 | Year

Ended

3/31/22 | Year

Ended

3/31/21 | Year

Ended

3/31/20 | Year

Ended

3/31/19 |

| Class K | | | | | | |

| Net asset value, beginning of period | $ 26.46 | $ 29.39 | $ 31.94 | $ 22.43 | $ 24.21 | $ 22.68 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ 0.03 | $ 0.06 | $ 0.03(b) | $ 0.08 | $ 0.15 | $ 0.16 |

| Net realized and unrealized gain (loss) on investments | 2.32 | (1.93) | 3.87 | 12.34 | (0.36) | 2.76 |

| Net increase (decrease) from investment operations | $ 2.35 | $ (1.87) | $ 3.90 | $ 12.42 | $ (0.21) | $ 2.92 |

| Distributions to shareowners: | | | | | | |

| Net investment income | $ — | $ — | $ (0.04) | $ (0.08) | $ (0.12) | $ (0.16) |

| Net realized gain | — | (1.06) | (6.41) | (2.83) | (1.45) | (1.23) |

| Total distributions | $ — | $ (1.06) | $ (6.45) | $ (2.91) | $ (1.57) | $ (1.39) |

| Net increase (decrease) in net asset value | $ 2.35 | $ (2.93) | $ (2.55) | $ 9.51 | $ (1.78) | $ 1.53 |

| Net asset value, end of period | $ 28.81 | $ 26.46 | $ 29.39 | $ 31.94 | $ 22.43 | $ 24.21 |

| Total return (c) | 8.88%(d) | (6.14)% | 11.08% | 56.21% | (1.78)% | 13.39% |

| Ratio of net expenses to average net assets | 0.66%(e) | 0.67% | 0.66% | 0.65% | 0.66% | 0.66% |

| Ratio of net investment income (loss) to average net assets | 0.20%(e) | 0.22% | 0.09% | 0.28% | 0.58% | 0.68% |

| Portfolio turnover rate | 9%(d) | 12% | 18%(f) | 24% | 23%(f) | 26% |

| Net assets, end of period (in thousands) | $839,507 | $731,131 | $844,949 | $846,019 | $639,430 | $680,094 |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | The amount shown for a share outstanding does not correspond with net investment income on the Statement of Operations for the period due to timing of the sales and repurchase of shares. |

| (c) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

The accompanying notes are an integral part of these financial statements.

30Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

| | Six Months

Ended

9/30/23

(unaudited) | Year

Ended

3/31/23 | Year

Ended

3/31/22 | Year

Ended

3/31/21 | Year

Ended

3/31/20 | Year

Ended

3/31/19 |

| Class R | | | | | | |

| Net asset value, beginning of period | $ 25.13 | $ 28.17 | $ 31.03 | $ 21.95 | $ 23.79 | $ 22.31 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ (0.07) | $ (0.13) | $ (0.21) | $ (0.13)(b) | $ (0.04)(b) | $ (0.01)(b) |

| Net realized and unrealized gain (loss) on investments | 2.21 | (1.85) | 3.76 | 12.04 | (0.35) | 2.72 |

| Net increase (decrease) from investment operations | $ 2.14 | $ (1.98) | $ 3.55 | $ 11.91 | $ (0.39) | $ 2.71 |

| Distributions to shareowners: | | | | | | |

| Net realized gain | $ — | $ (1.06) | $ (6.41) | $ (2.83) | $ (1.45) | $ (1.23) |

| Total distributions | $ — | $ (1.06) | $ (6.41) | $ (2.83) | $ (1.45) | $ (1.23) |

| Net increase (decrease) in net asset value | $ 2.14 | $ (3.04) | $ (2.86) | $ 9.08 | $ (1.84) | $ 1.48 |

| Net asset value, end of period | $ 27.27 | $ 25.13 | $ 28.17 | $ 31.03 | $ 21.95 | $ 23.79 |

| Total return (c) | 8.52%(d) | (6.80)% | 10.22% | 55.07% | (2.50)% | 12.52% |

| Ratio of net expenses to average net assets | 1.36%(e) | 1.40% | 1.40% | 1.39% | 1.40% | 1.39% |

| Ratio of net investment income (loss) to average net assets | (0.49)%(e) | (0.51)% | (0.66)% | (0.46)% | (0.17)% | (0.04)% |

| Portfolio turnover rate | 9%(d) | 12% | 18%(f) | 24% | 23%(f) | 26% |

| Net assets, end of period (in thousands) | $103,655 | $96,175 | $111,781 | $108,568 | $85,892 | $114,781 |

| Ratios with no waiver of fees and assumption of expenses by the Adviser and no reduction for fees paid indirectly: | | | | | | |

| Total expenses to average net assets | 1.36%(e) | 1.43% | 1.40% | 1.39% | 1.42% | 1.39% |

| Net investment income (loss) to average net assets | (0.49)%(e) | (0.54)% | (0.66)% | (0.46)% | (0.19)% | (0.04)% |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | The amount shown for a share outstanding does not correspond with net investment income on the Statement of Operations for the period due to timing of the sales and repurchase of shares. |

| (c) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

The accompanying notes are an integral part of these financial statements.

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2331

Financial Highlights (continued)

| | Six Months

Ended

9/30/23

(unaudited) | Year

Ended

3/31/23 | Year

Ended

3/31/22 | Year

Ended

3/31/21 | Year

Ended

3/31/20 | Year

Ended

3/31/19 |

| Class Y | | | | | | |

| Net asset value, beginning of period | $ 26.76 | $ 29.73 | $ 32.25 | $ 22.63 | $ 24.42 | $ 22.86 |

| Increase (decrease) from investment operations: | | | | | | |

| Net investment income (loss) (a) | $ 0.02 | $ 0.03 | $ (0.01) | $ 0.05 | $ 0.12 | $ 0.14 |

| Net realized and unrealized gain (loss) on investments | 2.34 | (1.94) | 3.91 | 12.45 | (0.36) | 2.79 |

| Net increase (decrease) from investment operations | $ 2.36 | $ (1.91) | $ 3.90 | $ 12.50 | $ (0.24) | $ 2.93 |

| Distributions to shareowners: | | | | | | |

| Net investment income | $ — | $ — | $ (0.01) | $ (0.05) | $ (0.10) | $ (0.14) |

| Net realized gain | — | (1.06) | (6.41) | (2.83) | (1.45) | (1.23) |

| Total distributions | $ — | $ (1.06) | $ (6.42) | $ (2.88) | $ (1.55) | $ (1.37) |

| Net increase (decrease) in net asset value | $ 2.36 | $ (2.97) | $ (2.52) | $ 9.62 | $ (1.79) | $ 1.56 |

| Net asset value, end of period | $ 29.12 | $ 26.76 | $ 29.73 | $ 32.25 | $ 22.63 | $ 24.42 |

| Total return (b) | 8.82%(c) | (6.20)% | 10.97% | 56.06% | (1.89)% | 13.28% |

| Ratio of net expenses to average net assets | 0.76%(d) | 0.76% | 0.76% | 0.76% | 0.76% | 0.77% |

| Ratio of net investment income (loss) to average net assets | 0.11%(d) | 0.13% | (0.03)% | 0.18% | 0.47% | 0.58% |

| Portfolio turnover rate | 9%(c) | 12% | 18%(e) | 24% | 23%(e) | 26% |

| Net assets, end of period (in thousands) | $3,646,626 | $3,410,508 | $3,798,296 | $4,268,553 | $3,232,510 | $3,563,173 |

| (a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

| (b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions and the complete redemption of the investment at net asset value at the end of each period. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

The accompanying notes are an integral part of these financial statements.

32Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

Notes to Financial Statements | 9/30/23

(unaudited)

1. Organization and Significant Accounting Policies

Pioneer Fundamental Growth Fund (the “Fund”) is one of three portfolios comprising Pioneer Series Trust X (the “Trust”), a Delaware statutory trust. The Fund is registered under the Investment Company Act of 1940, as ammended (the "1940 Act") as a diversified, open-end management investment company. The Fund’s investment objective is to seek long-term capital growth.

The Fund offers five classes of shares designated as Class A, Class C, Class K, Class R and Class Y shares. Each class of shares represents an interest in the same portfolio of investments of the Fund and has identical rights (based on relative net asset values) to assets and liquidation proceeds. Share classes can bear different rates of class-specific fees and expenses, such as transfer agent and distribution fees. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different dividends from net investment income earned by each class. The Amended and Restated Declaration of Trust of the Trust gives the Board of Trustees the flexibility to specify either per-share voting or dollar-weighted voting when submitting matters for shareowner approval. Under per-share voting, each share of a class of the Fund is entitled to one vote. Under dollarweighted voting, a shareowner’s voting power is determined not by the number of shares owned, but by the dollar value of the shares on the record date.

Each share class has exclusive voting rights with respect to matters affecting only that class, including with respect to the distribution plan for that class. There is no distribution plan for Class K or Class Y shares.

Amundi Asset Management US, Inc., an indirect, wholly owned subsidiary of Amundi and Amundi’s wholly owned subsidiary, Amundi USA, Inc., serves as the Fund’s investment adviser (the “Adviser”).

Amundi Distributor US, Inc., an affiliate of the Adviser, serves as the Fund’s distributor (the “Distributor”).

In March 2020, FASB issued an Accounting Standard Update, ASU 2020-04, Reference Rate Reform (Topic 848) — Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (“LIBOR”) and other LIBOR-based reference rates at the end of 2021. The temporary relief

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2333

provided by ASU 2020-04 is effective for certain reference rate-related contract modifications that occur during the period from March 12, 2020 through December 31, 2023. Management is evaluating the impact of ASU 2020-04 on the Fund's investments, derivatives, debt and other contracts, if applicable, that will undergo reference rate-related modifications as a result of the reference rate reform.

The Fund is required to comply with Rule 18f-4 under the 1940 Act, which governs the use of derivatives by registered investment companies. Rule 18f-4 permits funds to enter into derivatives transactions (as defined in Rule 18f-4) and certain other transactions notwithstanding the restrictions on the issuance of “senior securities” under Section 18 of the 1940 Act. Rule 18f-4 requires a fund to establish and maintain a comprehensive derivatives risk management program, appoint a derivatives risk manager and comply with a relative or absolute limit on fund leverage risk calculated based on value-at-risk (“VaR”), unless the fund uses derivatives in only a limited manner (a "limited derivatives user"). The Fund is currently a limited derivatives user for purposes of Rule 18f-4.

The Fund is an investment company and follows investment company accounting and reporting guidance under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). U.S. GAAP requires the management of the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income, expenses and gain or loss on investments during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

| A. | Security Valuation |

| | The net asset value of the Fund is computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE. |

| | Equity securities that have traded on an exchange are valued by using the last sale price on the principal exchange where they are traded. Equity securities that have not traded on the date of valuation, or securities for which sale prices are not available, generally are valued using the mean between the last bid and asked prices or, if both last bid and asked prices are not available, at the last quoted bid price. Last sale and bid and asked prices are provided by independent third party pricing services. In the case of equity securities not traded on an exchange, |

34Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

| | prices are typically determined by independent third party pricing services using a variety of techniques and methods. |

| | The value of foreign securities is translated into U.S. dollars based on foreign currency exchange rate quotations supplied by a third party pricing source. Trading in non-U.S. equity securities is substantially completed each day at various times prior to the close of the NYSE. The values of such securities used in computing the net asset value of the Fund's shares are determined as of such times. The Adviser may use a fair value model developed by an independent pricing service to value non-U.S. equity securities. |

| | Shares of open-end registered investment companies (including money market mutual funds) are valued at such funds’ net asset value. |

| | Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser. The Adviser is designated as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Adviser’s fair valuation team is responsible for monitoring developments that may impact fair valued securities. |

| | Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Adviser may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the determination of the Fund's net asset value. Examples of a significant event might include political or economic news, corporate restructurings, natural disasters, terrorist activity or trading halts. Thus, the valuation of the Fund's securities may differ significantly from exchange prices, and such differences could be material. |

| | Repurchase agreements are valued at par. Cash may include overnight time deposits at approved financial institutions. |

| B. | Investment Income and Transactions |

| | Dividend income is recorded on the ex-dividend date, except that certain dividends from foreign securities where the ex-dividend date may have passed are recorded as soon as the Fund becomes aware of the ex-dividend data in the exercise of reasonable diligence. |

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2335

| | Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities. |

| | Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively. |

| | Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes. |

| C. | Federal Income Taxes |

| | It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its net taxable income and net realized capital gains, if any, to its shareowners. Therefore, no provision for federal income taxes is required. As of September 30, 2023, the Fund did not accrue any interest or penalties with respect to uncertain tax positions, which, if applicable, would be recorded as an income tax expense on the Statement of Operations. Tax returns filed within the prior three years remain subject to examination by federal and state tax authorities. |

| | The amount and character of income and capital gain distributions to shareowners are determined in accordance with federal income tax rules, which may differ from U.S. GAAP. Distributions in excess of net investment income or net realized gains are temporary over distributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes. Capital accounts within the financial statements are adjusted for permanent book/tax differences to reflect tax character, but are not adjusted for temporary differences. |

| | The tax character of current year distributions payable will be determined at the end of the current taxable year. The tax character of distributions paid during the year ended March 31, 2023 was as follows: |

| | 2023 |

| Distributions paid from: | |

| Ordinary income | $ 11,767,976 |

| Long-term capital gains | 201,500,797 |

| Total | $213,268,773 |

36Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/23

The following shows the components of distributable earnings (losses) on a federal income tax basis at March 31, 2023:

| | 2023 |

| Distributable earnings/(losses): | |

| Undistributed ordinary income | $ 1,675,538 |

| Capital loss carryforward | (2,017,329) |

| Net unrealized appreciation | 2,622,039,142 |

| Total | $2,621,697,351 |

The difference between book-basis and tax-basis unrealized appreciation is attributable to the tax deferral of losses on wash sales.

| D. | Fund Shares |

| | The Fund records sales and repurchases of its shares as of trade date. The Distributor earned $34,567 in underwriting commissions on the sale of Class A shares during the six months ended September 30, 2023. |

| E. | Class Allocations |

| | Income, common expenses and realized and unrealized gains and losses are calculated at the Fund level and allocated daily to each class of shares based on its respective percentage of adjusted net assets at the beginning of the day. |

| | Distribution fees are calculated based on the average daily net asset value attributable to Class A, Class C and Class R shares of the Fund, respectively (see Note 5). Class K and Class Y shares do not pay distribution fees. All expenses and fees paid to the Fund's transfer agent for its services are allocated among the classes of shares based on the number of accounts in each class and the ratable allocation of related out-of-pocket expenses (see Note 4). |

| | Distributions to shareowners are recorded as of the ex-dividend date. Distributions paid by the Fund with respect to each class of shares are calculated in the same manner and at the same time, except that net investment income dividends to Class A, Class C, Class K, Class R and Class Y shares can reflect different transfer agent and distribution expense rates. |

| F. | Risks |

| | The value of securities held by the Fund may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, recessions, the spread of infectious illness or other public health issues, inflation, changes in interest rates, armed conflict including Russia's |

Pioneer Fundamental Growth Fund | Semiannual Report | 9/30/2337

| | military invasion of Ukraine, sanctions against Russia, other nations or individuals or companies and possible countermeasures, lack of liquidity in the bond markets or adverse investor sentiment. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread. Inflation and interest rates have increased and may rise further. These circumstances could adversely affect the value and liquidity of the Fund's investments and negatively impact the Fund's performance. |