December 18, 2020

Via EDGAR Submission and

Overnight Delivery

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Real Estate & Construction

100 F St., NE

Washington, D.C. 20549

Attn: Ameen Hamady, Accountant

Shannon Menjivar, Accountant

Re: Whitestone REIT

Form 10-K for the Fiscal Year Ended December 31, 2019

Form 8-K filed on October 26, 2020

File Nos. 001-34855

Dear Mr. Hamady and Ms. Menjivar:

Whitestone REIT (the “Company”) is submitting this letter in response to comments received from the Staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in a letter dated December 10, 2020 (the “Comment Letter”) with respect to the Company’s Annual Report on Form 10−K for the year ended December 31, 2019 (the “Annual Report”) and a Form 8-K filed on October 26, 2020 (the “Form 8-K”). For your convenience, the Staff’s numbered comments set forth in the Comment Letter have been reproduced in bold and italics herein with responses immediately following each comment. Capitalized terms used herein but not otherwise defined have the meanings given to them in the Annual Report and the Form 8-K.

Form 8-K filed on October 26, 2020

General

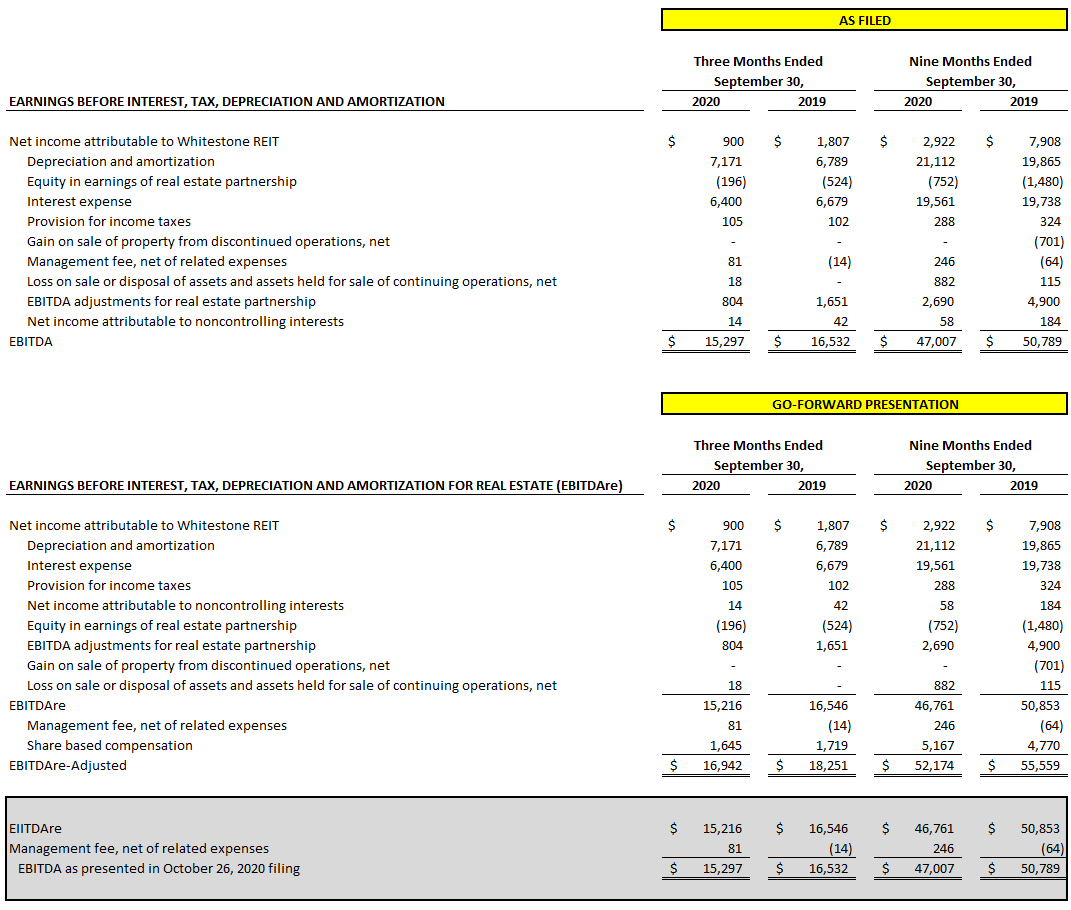

1.It appears that you have made adjustments in calculating a non-GAAP measure identified as EBITDA beyond those which are typical (e.g., management fee, net of related expenses, loss on sale or disposal of assets, gain on sale from discontinued operations, net and EBITDA adjustments for real estate partnership). Please revise to present EBITDA or rename the non-GAAP measure you have presented. For additional guidance, refer to question 103.01 of the Compliance and Disclosure Interpretations regarding Non-GAAP Financial Measures.

Mr. Hamady and Ms. Menjivar

December 18, 2020

Page 2

Response to Comment No. 1

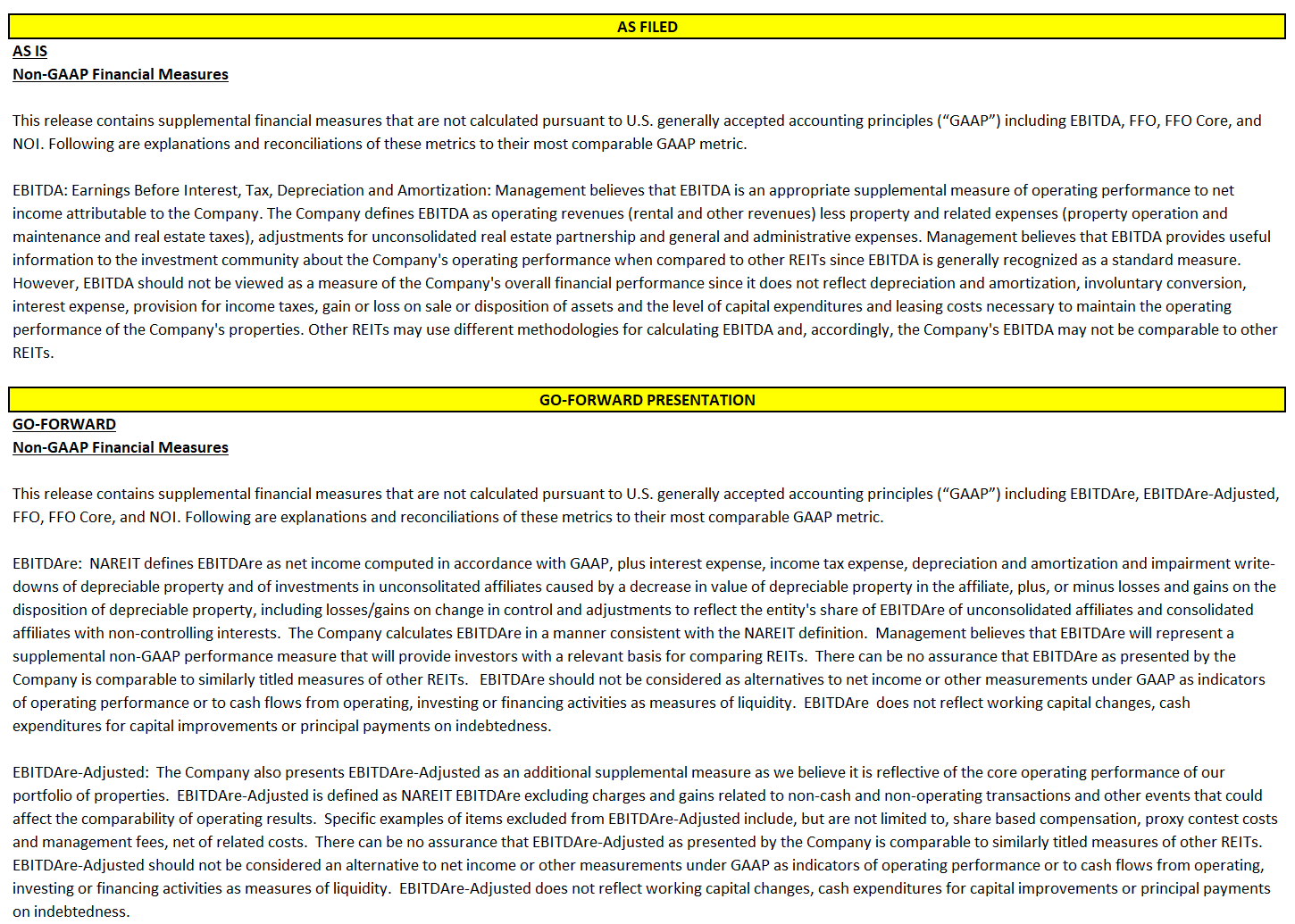

Exchange Act Release No. 47226 defines EBITDA as earnings before interest, taxes, depreciation and amortization. It is common in the REIT industry to also exclude additional items such as gains or losses from sales of depreciable real estate property. Since our definition of EBITDA is calculated differently than as defined in Question 103.01, in future filings, we will rename our EBITDA to “EBITDAre”, calculated as defined by the National Association of Real Estate Investment Trusts, Inc. (“NAREIT”). Should the Company present “EBITDA,” it will do so with the typical non-GAAP adjustments as described in Exchange Act Release No. 47226. The Company’s future reporting presentation will also include Adjusted EBITDAre, which we define as EBITDAre – Adjusted. EBITDAre – Adjusted will exclude charges and gains related to non-cash and non-operating transactions such as share-based compensation, proxy contest fees and management fees, net of related costs.

For illustrative purposes, the Company’s future reporting presentation is shown below under the caption “Go-Forward Presentation” along with the EBITDA disclosures from the Form 8-K under the caption “As Filed.” The grey box is presented solely to reconcile the future reporting to the historical reporting and will not be included in future presentations. Future presentations will include appropriate modifications for the applicable reporting periods.

Mr. Hamady and Ms. Menjivar

December 18, 2020

Page 3

Mr. Hamady and Ms. Menjivar

December 18, 2020

Page 4

Mr. Hamady and Ms. Menjivar

December 18, 2020

Page 5

If you have any questions or would like further information concerning the Company’s responses to your Comment Letter, please do not hesitate to contact me at (713) 435-2227.

| | | | | | | | | | | | | | |

|

| | | | |

| | | Sincerely, | | |

| | | | | |

| | | /s/ David K. Holeman | |

| | | David K. Holeman | |

| | | Chief Financial Officer | |