- WSR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Whitestone REIT (WSR) CORRESPCorrespondence with SEC

Filed: 27 Oct 23, 12:00am

October 27, 2023

Via EDGAR Submission and

Overnight Delivery

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Real Estate & Construction

100 F St., NE

Washington, D.C. 20549

Attn: | Ameen Hamady Isaac Esquivel |

Re: | Whitestone REIT Form 10-K for the Fiscal Year Ended December 31, 2022 Form 8-K filed on August 1, 2023 File Nos. 001-34855 |

Dear Mr. Hamady and Mr. Esquivel:

Whitestone REIT (the “Company”) is submitting this letter in response to comments received from the Staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in a letter dated October 13, 2023 (the “Comment Letter”) with respect to the Company’s Annual Report on Form 10−K for the year ended December 31, 2022 (the “Annual Report”) and a Form 8-K filed on August 1, 2023 (the “Form 8-K”). For your convenience, the Staff’s numbered comments set forth in the Comment Letter have been reproduced in bold and italics herein with responses immediately following each comment. Capitalized terms used herein but not otherwise defined have the meanings given to them in the Annual Report and the Form 8-K.

Form 10-K for the Fiscal Year Ended December 31, 2022

Schedule III - Real Estate and Accumulated Depreciation, page F-44

1. | Please tell us how you complied with footnote 4 to Rule 12-28 of Regulation S-X, or tell us how you determined it was not necessary to furnish a reconciliation for the accumulated depreciation for each of the years in the three year period ended December 31, 2022, similar to the reconciliations of total real estate carrying value as presented on page F-47. |

Response to Comment No. 1

The Company respectfully acknowledges the Staff’s comment. In future filings, the Company confirms that it will furnish the applicable reconciliations required to comply with footnote 4 to Rule 12-28 of Regulation S-X.

Form 8-K filed on August 1, 2023

2023 Full Year Guidance, page 2

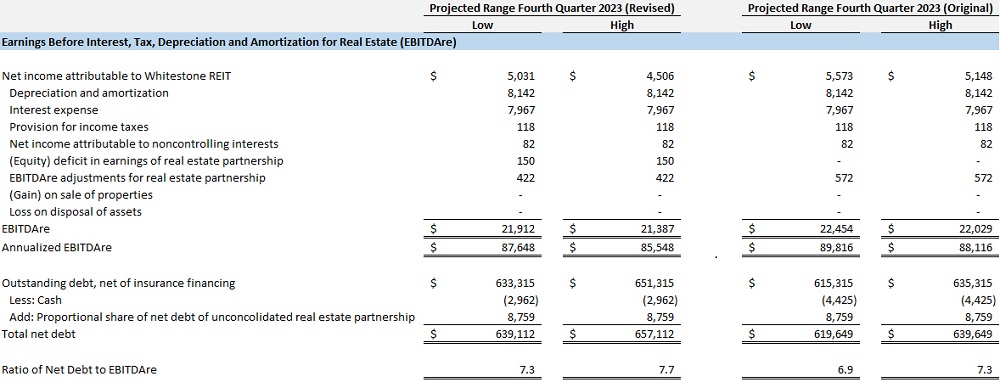

2. | In your earnings releases and accompanying presentation materials furnished as exhibits to Item 2.02 Forms 8-K for the period ended June 30, 2023, you disclose Full Year 2023 Guidance for your Net Debt to EBITDAre ratio without providing a reconciliation to the most directly related GAAP measure. In future filings, please include such reconciliation or, alternatively, provide a statement that the information could not be presented without unreasonable effort. Refer to Instruction 2 to Item 2.02 of Form 8-K, Item 10(e)(1)(i)(B) of Regulation S-K and Questions 102.10(a) and 102.10(b) of the C&DIs for Non-GAAP Financial Measures. |

Response to Comment No. 2

The Company respectfully acknowledges the Staff’s comment and confirms that it will include a reconciliation of the Net Debt to EBITDAre ratio to the most directly comparable GAAP measure in future filings, or it will provide a statement that the information could not be presented without unreasonable effort.

For illustrative purposes, the Company’s expected reporting presentation in earnings materials for the period ending September 30, 2023 is shown below based on the Full Year 2023 Guidance for the Company’s Net Debt to EBITDAre ratio presented in the Company’s earnings materials for the period ended June 30, 2023. The Company expects that presentations in subsequent periods (when the information can be presented without unreasonable efforts) will include appropriate modifications for the applicable reporting periods.

If you have any questions or would like further information concerning the Company’s responses to your Comment Letter, please do not hesitate to contact me at (713) 435-2226.

Sincerely, | ||||

/s/ John S. Hogan | ||||

John S. Hogan | ||||

Chief Financial Officer | ||||