UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-21128

Legg Mason Partners Variable Equity Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira.

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code:

877-6LM-FUND/656-3863

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

| | |

ClearBridge Variable Dividend Strategy Portfolio | |

Class Itrue |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about ClearBridge Variable Dividend Strategy Portfolio for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class I1 | $39 | 0.75% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $437,563,654 |

Total Number of Portfolio Holdings* | 57 |

Portfolio Turnover Rate | 12% |

| * | Does not include derivatives, except purchased options, if any. |

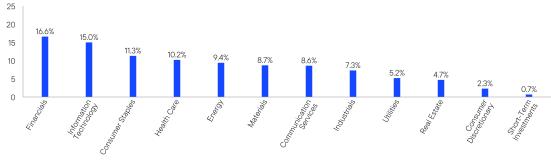

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| ClearBridge Variable Dividend Strategy Portfolio | PAGE 1 | 7947-STSR-0824 |

16.615.011.310.29.48.78.67.35.24.72.30.7

| | |

ClearBridge Variable Dividend Strategy Portfolio | |

Class IItrue |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about ClearBridge Variable Dividend Strategy Portfolio for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class II1 | $46 | 0.90% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $437,563,654 |

Total Number of Portfolio Holdings* | 57 |

Portfolio Turnover Rate | 12% |

| * | Does not include derivatives, except purchased options, if any. |

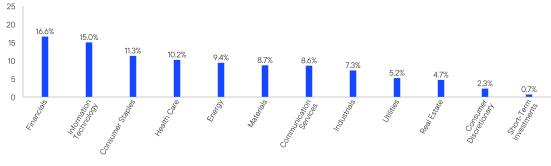

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| ClearBridge Variable Dividend Strategy Portfolio | PAGE 1 | 7723-STSR-0824 |

16.615.011.310.29.48.78.67.35.24.72.30.7

Not applicable.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

| a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

| ITEM 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

ClearBridge

Variable Dividend Strategy Portfolio

Financial Statements and Other Important Information

Semi-Annual | June 30, 2024

Financial Statements and Other Important Information — Semi-Annual

Schedule of Investments (unaudited)June 30, 2024 ClearBridge Variable Dividend Strategy Portfolio

(Percentages shown based on Portfolio net assets)

| | | | | |

|

Communication Services — 8.6% |

|

| | | |

Interactive Media & Services — 2.3% |

Alphabet Inc., Class A Shares | | | |

Meta Platforms Inc., Class A Shares | | | |

Total Interactive Media & Services | | | |

|

Comcast Corp., Class A Shares | | | |

Wireless Telecommunication Services — 2.4% |

| | | |

|

Total Communication Services | |

Consumer Discretionary — 2.3% |

|

| | | |

|

| | | |

|

Total Consumer Discretionary | |

|

|

| | | |

| | | |

| | | |

|

Mondelez International Inc., Class A Shares | | | |

| | | |

| | | |

Household Products — 1.7% |

| | | |

Personal Care Products — 2.2% |

| | | |

| | | |

Total Personal Care Products | | | |

|

| |

|

Oil, Gas & Consumable Fuels — 9.5% |

| | | |

| | | |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 ClearBridge Variable Dividend Strategy Portfolio

(Percentages shown based on Portfolio net assets)

| | | | | |

|

Oil, Gas & Consumable Fuels — continued |

| | | |

| | | |

|

| |

|

|

| | | |

PNC Financial Services Group Inc. | | | |

| | | |

|

Capital One Financial Corp. | | | |

Financial Services — 5.7% |

Apollo Global Management Inc. | | | |

Visa Inc., Class A Shares | | | |

| | | |

|

American International Group Inc. | | | |

| | | |

| | | |

| | | |

|

| |

|

|

| | | |

Health Care Equipment & Supplies — 2.9% |

| | | |

Health Care Providers & Services — 1.5% |

| | | |

|

| | | |

| | | |

| | | |

| | | |

|

| |

|

Aerospace & Defense — 2.9% |

| | | |

| | | |

Total Aerospace & Defense | | | |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

ClearBridge Variable Dividend Strategy Portfolio

(Percentages shown based on Portfolio net assets)

| | | | | |

|

Air Freight & Logistics — 0.9% |

United Parcel Service Inc., Class B Shares | | | |

Commercial Services & Supplies — 1.7% |

| | | |

Ground Transportation — 1.8% |

| | | |

|

| |

Information Technology — 15.0% |

Semiconductors & Semiconductor Equipment — 4.4% |

| | | |

| | | |

| | | |

Total Semiconductors & Semiconductor Equipment | | | |

|

| | | |

| | | |

| | | |

| | | |

Technology Hardware, Storage & Peripherals — 2.1% |

| | | |

|

Total Information Technology | |

|

|

Air Products & Chemicals Inc. | | | |

| | | |

| | | |

| | | |

Construction Materials — 2.3% |

| | | |

|

| | | |

|

| |

|

|

AvalonBay Communities Inc. | | | |

|

| | | |

| | | |

| | | |

|

| |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Schedule of Investments (unaudited) (cont’d)June 30, 2024 ClearBridge Variable Dividend Strategy Portfolio

(Percentages shown based on Portfolio net assets)

| | | | | |

|

|

Electric Utilities — 1.1% |

| | | |

|

| | | |

| | | |

| | | |

|

| |

Total Investments before Short-Term Investments (Cost — $235,274,341) | |

| | | | | |

Short-Term Investments — 0.7% |

JPMorgan 100% U.S. Treasury Securities Money Market Fund, Institutional Class | | | | |

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares | | | | |

|

Total Short-Term Investments (Cost — $3,038,404) | |

Total Investments — 100.1% (Cost — $238,312,745) | |

Liabilities in Excess of Other Assets — (0.1)% | |

Total Net Assets — 100.0% | |

| Security is fair valued in accordance with procedures approved by the Board of Trustees (Note 1). |

| Rate shown is one-day yield as of the end of the reporting period. |

| In this instance, as defined in the Investment Company Act of 1940, an “Affiliated Company” represents Portfolio ownership of at least 5% of the outstanding voting securities of an issuer, or a company which is under common ownership or control with the Portfolio. At June 30, 2024, the total market value of investments in Affiliated Companies was $1,519,202 and the cost was $1,519,202 (Note 8). |

Abbreviation(s) used in this schedule: |

| | American Depositary Receipts |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Statement of Assets and Liabilities (unaudited)June 30, 2024

| |

Investments in unaffiliated securities, at value (Cost — $236,793,543) | |

Investments in affiliated securities, at value (Cost — $1,519,202) | |

| |

Dividends receivable from unaffiliated investments | |

Receivable for Portfolio shares sold | |

Dividends receivable from affiliated investments | |

| |

| |

| |

Payable for Portfolio shares repurchased | |

Investment management fee payable | |

Service and/or distribution fees payable | |

| |

| |

| |

| |

| |

| |

Paid-in capital in excess of par value | |

Total distributable earnings (loss) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Statement of Operations (unaudited)For the Six Months Ended June 30, 2024

| |

Dividends from unaffiliated investments | |

Dividends from affiliated investments | |

Less: Foreign taxes withheld | |

| |

| |

Investment management fee (Note 2) | |

Service and/or distribution fees (Notes 2 and 5) | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Transfer agent fees (Notes 2 and 5) | |

| |

| |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 5) | |

| |

| |

Realized and Unrealized Gain (Loss) on Investments and Foreign Currency Transactions

(Notes 1 and 3): |

Net Realized Gain (Loss) From: | |

Investment transactions in unaffiliated securities | |

Foreign currency transactions | |

| |

Change in Net Unrealized Appreciation (Depreciation) From Unaffiliated Investments | |

Net Gain on Investments and Foreign Currency Transactions | |

Increase in Net Assets From Operations | |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Statements of Changes in Net Assets

For the Six Months Ended June 30, 2024 (unaudited)

and the Year Ended December 31, 2023 | | |

| | |

| | |

| | |

Change in net unrealized appreciation (depreciation) | | |

Increase in Net Assets From Operations | | |

Distributions to Shareholders From (Notes 1 and 6): | | |

Total distributable earnings | | |

Decrease in Net Assets From Distributions to Shareholders | | |

Portfolio Share Transactions (Note 7): | | |

Net proceeds from sale of shares | | |

Reinvestment of distributions | | |

Cost of shares repurchased | | |

Increase (Decrease) in Net Assets From Portfolio Share Transactions | | |

| | |

| | |

| | |

| | |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

For a share of each class of beneficial interest outstanding throughout each year ended December 31,

unless otherwise noted: |

| | | | | | |

Net asset value, beginning of period | | | | | | |

Income (loss) from operations: |

| | | | | | |

Net realized and unrealized gain (loss) | | | | | | |

Total income (loss) from operations | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Net asset value, end of period | | | | | | |

| | | | | | |

Net assets, end of period (millions) | | | | | | |

Ratios to average net assets: |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Per share amounts have been calculated using the average shares method. |

| For the six months ended June 30, 2024 (unaudited). |

| Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Total returns do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total return for all periods shown. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| |

| As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class I shares did not exceed 0.80%. This expense limitation arrangement cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Portfolio’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

| Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

For a share of each class of beneficial interest outstanding throughout each year ended December 31,

unless otherwise noted: |

| | | | | | |

Net asset value, beginning of period | | | | | | |

Income (loss) from operations: |

| | | | | | |

Net realized and unrealized gain (loss) | | | | | | |

Total income (loss) from operations | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Net asset value, end of period | | | | | | |

| | | | | | |

Net assets, end of period (millions) | | | | | | |

Ratios to average net assets: |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Per share amounts have been calculated using the average shares method. |

| For the six months ended June 30, 2024 (unaudited). |

| Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Total returns do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total return for all periods shown. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| |

| As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class II shares did not exceed 1.05%. This expense limitation arrangement cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Portfolio’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

| Reflects fee waivers and/or expense reimbursements. |

See Notes to Financial Statements.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Notes to Financial Statements (unaudited)

1. Organization and significant accounting policies

ClearBridge Variable Dividend Strategy Portfolio (the “Portfolio”) is a separate diversified investment series of Legg Mason Partners Variable Equity Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

Shares of the Portfolio may only be purchased or redeemed through variable annuity contracts and variable life insurance policies offered by the separate accounts of participating insurance companies or through eligible pension or other qualified plans.

The Portfolio follows the accounting and reporting guidance in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, Financial Services – Investment Companies (“ASC 946”). The following are significant accounting policies consistently followed by the Portfolio and are in conformity with U.S. generally accepted accounting principles (“GAAP”), including, but not limited to, ASC 946. Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services typically use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Investments in open-end funds are valued at the closing net asset value per share of each fund on the day of valuation. When the Portfolio holds securities or other assets that are denominated in a foreign currency, the Portfolio will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Portfolio calculates its net asset value, the Portfolio values these securities as determined in accordance with procedures approved by the Portfolio’s Board of Trustees. This may include using an independent third

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

party pricing service to adjust the value of such securities to the latest indications of fair value at 4:00 p.m. (Eastern Time).

Pursuant to policies adopted by the Board of Trustees, the Portfolio’s manager has been designated as the valuation designee and is responsible for the oversight of the daily valuation process. The Portfolio’s manager is assisted by the Global Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee is responsible for making fair value determinations, evaluating the effectiveness of the Portfolio’s pricing policies, and reporting to the Portfolio’s manager and the Board of Trustees. When determining the reliability of third party pricing information for investments owned by the Portfolio, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Trustees, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Trustees quarterly.

The Portfolio uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Notes to Financial Statements (unaudited) (cont’d)

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

•

Level 1 — unadjusted quoted prices in active markets for identical investments

•

Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

•

Level 3 — significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments)

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Portfolio’s assets carried at fair value:

|

| | Other Significant

Observable Inputs

(Level 2)* | Significant

Unobservable

Inputs

(Level 3) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Total Long-Term Investments | | | | |

| | | | |

| | | | |

| As a result of the fair value pricing procedures for international equities utilized by the Portfolio, which account for events occurring after the close of the principal market of the security but prior to the calculation of the Portfolio’s net asset value, certain securities were classified as Level 2 within the fair value hierarchy. |

| See Schedule of Investments for additional detailed categorizations. |

(b) Foreign currency translation. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts based upon prevailing exchange rates on the respective dates of such transactions.

The Portfolio does not isolate that portion of the results of operations resulting from fluctuations in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Portfolio’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates.

Foreign security and currency transactions may involve certain considerations and risks not typically associated with those of U.S. dollar denominated transactions as a result of, among other factors, the possibility of lower levels of governmental supervision and regulation of foreign securities markets and the possibility of political or economic instability.

(c) Foreign investment risks. The Portfolio’s investments in foreign securities may involve risks not present in domestic investments. Since securities may be denominated in foreign currencies, may require settlement in foreign currencies or may pay interest or dividends in foreign currencies, changes in the relationship of these foreign currencies to the U.S. dollar can significantly affect the value of the investments and earnings of the Portfolio. Foreign investments may also subject the Portfolio to foreign government exchange restrictions, expropriation, taxation or other political, social or economic developments, all of which affect the market and/or credit risk of the investments.

(d) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income (including interest income from payment-in-kind securities) is recorded on the accrual basis. Amortization of premiums and accretion of discounts on debt securities are recorded to interest income over the lives of the respective securities, except for premiums on certain callable debt securities, which are amortized to the earliest call date. Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Portfolio determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Portfolio may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(e) REIT distributions. The character of distributions received from Real Estate Investment Trusts (‘‘REITs’’) held by the Portfolio is generally comprised of net investment income, capital gains, and return of capital. It is the policy of the Portfolio to estimate the character of distributions received from underlying REITs based on historical data provided by the REITs. After each calendar year end, REITs report the actual tax character of these distributions. Differences between the estimated and actual amounts reported by the REITs

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Notes to Financial Statements (unaudited) (cont’d)

are reflected in the Portfolio’s records in the year in which they are reported by the REITs by adjusting related investment cost basis, capital gains and income, as necessary.

(f) Distributions to shareholders. Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Portfolio are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Share class accounting. Investment income, common expenses and realized/unrealized gains (losses) on investments are allocated to the various classes of the Portfolio on the basis of daily net assets of each class. Fees relating to a specific class are charged directly to that share class.

(h) Compensating balance arrangements. The Portfolio has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Portfolio’s cash on deposit with the bank.

(i) Federal and other taxes. It is the Portfolio’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Portfolio intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Portfolio’s financial statements.

Management has analyzed the Portfolio’s tax positions taken on income tax returns for all open tax years and has concluded that as of December 31, 2023, no provision for income tax is required in the Portfolio’s financial statements. The Portfolio’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Under the applicable foreign tax laws, a withholding tax may be imposed on interest, dividends and capital gains at various rates.

(j) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share.

2. Investment management agreement and other transactions with affiliates

Franklin Templeton Fund Adviser, LLC (“FTFA”) is the Portfolio’s investment manager and ClearBridge Investments, LLC (“ClearBridge”) is the Portfolio’s subadviser. Western Asset Management Company, LLC (“Western Asset”) manages the portion of the Portfolio’s cash and short-term instruments allocated to it. FTFA, ClearBridge and Western Asset are indirect, wholly-owned subsidiaries of Franklin Resources, Inc. (“Franklin Resources”).

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Under the investment management agreement, the Portfolio pays an investment management fee, calculated daily and paid monthly, in accordance with the following breakpoint schedule:

FTFA provides administrative and certain oversight services to the Portfolio. FTFA delegates to the subadviser the day-to-day portfolio management of the Portfolio, except for the management of the portion of the Portfolio’s cash and short-term instruments allocated to Western Asset. For its services, FTFA pays ClearBridge a fee monthly, at an annual rate equal to 70% of the net management fee it receives from the Portfolio. For Western Asset’s services to the Portfolio, FTFA pays Western Asset monthly 0.02% of the portion of the Portfolio’s average daily net assets that are allocated to Western Asset by FTFA.

As a result of expense limitation arrangements between the Portfolio and FTFA, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class I and Class II shares did not exceed 0.80% and 1.05%, respectively. These expense limitation arrangements cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Portfolio’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund (the “affiliated money market fund waiver”). The affiliated money market fund waiver is not subject to the recapture provision discussed below.

During the six months ended June 30, 2024, fees waived and/or expenses reimbursed amounted to $162,550, which included an affiliated money market fund waiver of $657.

FTFA is permitted to recapture amounts waived and/or reimbursed to a class during the same fiscal year if the class’ total annual fund operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will FTFA recapture any amount that would result, on any particular business day of the Portfolio, in the class’ total annual fund operating expenses exceeding the expense cap or any other lower limit then in effect.

Franklin Distributors, LLC (“Franklin Distributors”) serves as the Portfolio’s sole and exclusive distributor. Franklin Distributors is an indirect, wholly-owned broker-dealer subsidiary of Franklin Resources. Franklin Templeton Investor Services, LLC (“Investor Services”) serves as the Portfolio’s shareholder servicing agent and acts as the Portfolio’s transfer agent and dividend-paying agent. Investor Services is an indirect, wholly-owned subsidiary of Franklin Resources. Each class of shares of the Portfolio pays transfer agent

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Notes to Financial Statements (unaudited) (cont’d)

fees to Investor Services for its performance of shareholder servicing obligations. Investor Services charges account-based fees based on the number of individual shareholder accounts, as well as a fixed percentage fee based on the total account-based fees charged. In addition, each class reimburses Investor Services for out of pocket expenses incurred. For the six months ended June 30, 2024, the Portfolio incurred transfer agent fees as reported on the Statement of Operations, of which $288 was earned by Investor Services.

All officers and one Trustee of the Trust are employees of Franklin Resources or its affiliates and do not receive compensation from the Trust.

During the six months ended June 30, 2024, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

At June 30, 2024, the aggregate cost of investments and the aggregate gross unrealized appreciation and depreciation of investments for federal income tax purposes were substantially as follows:

| | Gross

Unrealized

Appreciation | Gross

Unrealized

Depreciation | Net

Unrealized

Appreciation |

| | | | |

4. Derivative instruments and hedging activities

During the six months ended June 30, 2024, the Portfolio did not invest in derivative instruments.

5. Class specific expenses, waivers and/or expense reimbursements

The Portfolio has adopted a Rule 12b-1 shareholder services and distribution plan and under that plan the Portfolio pays service and/or distribution fees with respect to its Class II shares calculated at the annual rate of 0.25% of the average daily net assets of the class. Service and/or distribution fees are accrued daily and paid monthly.

For the six months ended June 30, 2024, class specific expenses were as follows:

| During the six months ended June 30, 2024, Franklin Distributors voluntarily waived a portion of its distribution fees equal to 0.10% of the daily net assets of the Class II shares of the Portfolio, resulting in a waiver of $161,893. The service and/or distribution fees waiver can be terminated at any time. |

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

For the six months ended June 30, 2024, waivers and/or expense reimbursements by class were as follows:

| Waivers/Expense

Reimbursements |

| |

| |

| |

6. Distributions to shareholders by class

| Six Months Ended

June 30, 2024 | Year Ended

December 31, 2023 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

7. Shares of beneficial interest

At June 30, 2024, the Trust had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. The Portfolio has the ability to issue multiple classes of shares. Each class of shares represents an identical interest and has the same rights, except that each class bears certain direct expenses, including those specifically related to the distribution of its shares.

Transactions in shares of each class were as follows:

| Six Months Ended

June 30, 2024 | Year Ended

December 31, 2023 |

| | | | |

| | | | |

| | | | |

Shares issued on reinvestment | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Shares issued on reinvestment | | | | |

| | | | |

| | | | |

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Notes to Financial Statements (unaudited) (cont’d)

8. Transactions with affiliated company

As defined by the 1940 Act, an affiliated company is one in which the Portfolio owns 5% or more of the outstanding voting securities, or a company which is under common ownership or control with the Portfolio. The following company was considered an affiliated company for all or some portion of the six months ended June 30, 2024. The following transactions were effected in such company for the six months ended June 30, 2024.

| Affiliate

Value at

December 31,

2023 | | |

| | | |

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares | | | | | |

| | | Net Increase

(Decrease) in

Unrealized

Appreciation

(Depreciation) | Affiliate

Value at

June 30,

2024 |

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares | | | | |

The Portfolio, together with other U.S. registered and foreign investment funds (collectively, the “Borrowers”) managed by Franklin Resources or its affiliates, is a borrower in a joint syndicated senior unsecured credit facility totaling $2.675 billion (the “Global Credit Facility”). The Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests. Unless renewed, the Global Credit Facility will terminate on January 31, 2025.

Under the terms of the Global Credit Facility, the Portfolio shall, in addition to interest charged on any borrowings made by the Portfolio and other costs incurred by the Portfolio, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all the Borrowers, including an annual commitment fee of 0.15% based upon the unused portion of the Global Credit Facility. These fees are reflected in the Statement of Operations. The Portfolio did not utilize the Global Credit Facility during the six months ended June 30, 2024.

ClearBridge Variable Dividend Strategy Portfolio 2024 Semi-Annual Report

Changes in and Disagreements with AccountantsFor the period covered by this report

Results of Meeting(s) of ShareholdersFor the period covered by this report

Remuneration Paid to Directors, Officers and OthersFor the period covered by this report

Refer to the financial statements included herein.

ClearBridge Variable Dividend Strategy Portfolio

Board Approval of Management andSubadvisory Agreements (unaudited) At an in-person meeting of the Board of Trustees of Legg Mason Partners Variable Equity Trust (the “Trust”) held on May 2-3, 2024, the Board, including the Trustees who are not considered to be “interested persons” of the Trust (the “Independent Trustees”) under the Investment Company Act of 1940, as amended (the “1940 Act”), approved for an annual period the continuation of the management agreement (the “Management Agreement”) between the Trust and Franklin Templeton Fund Adviser, LLC (formerly Legg Mason Partners Fund Advisor, LLC) (the “Manager”) with respect to ClearBridge Variable Dividend Strategy Portfolio, a series of the Trust (the “Fund”), and the sub-advisory agreement pursuant to which ClearBridge Investments, LLC (“ClearBridge”) provides day-to-day management of the Fund’s portfolio, and the sub-advisory agreement pursuant to which Western Asset Management Company, LLC (“Western Asset” and, together with ClearBridge, the “Sub-Advisers”) provides day-to-day management of the Fund’s cash and short-term instruments allocated to it by the Manager. The management agreement and sub-advisory agreements are collectively referred to as the “Agreements.”

The Board received extensive information in advance of the meeting to assist it in its consideration of the Agreements and asked questions and requested additional information from management. Throughout the year the Board (including its various committees) had met with representatives of the Manager and the Sub-Advisers, and had received information relevant to the renewal of the Agreements. Prior to the meeting the Independent Trustees met with their independent legal counsel to discuss and consider the information provided and submitted questions to management, and they considered the responses provided. The Board received and considered a variety of information about the Manager and the Sub-Advisers, as well as the management, advisory and sub-advisory arrangements for the Fund and other funds overseen by the Board, certain portions of which are discussed below. The information received and considered by the Board both in conjunction with the May 2024 meeting and throughout the year was both written and oral. The contractual arrangements discussed below are the product of multiple years of review and negotiation and information received and considered by the Board during those years.

The information provided and presentations made to the Board encompassed the Fund and all funds for which the Board has responsibility. The discussion below covers both the advisory and the administrative functions being rendered by the Manager, both of which functions are encompassed by the Management Agreement, as well as the advisory functions rendered by the Sub-Advisers pursuant to the Sub-Advisory Agreements.

Board approval of management agreement and sub-advisory agreements

The Independent Trustees were advised by separate independent legal counsel throughout the process. Prior to voting, the Independent Trustees received a memorandum from their independent legal counsel discussing the legal standards for their consideration of the

ClearBridge Variable Dividend Strategy Portfolio

proposed continuation of the Agreements. The Independent Trustees also reviewed the proposed continuation of the Management Agreement and the Sub-Advisory Agreements in private sessions with their independent legal counsel at which no representatives of the Manager and Sub-Advisers were present. The Independent Trustees considered the Management Agreement and each Sub-Advisory Agreement separately in the course of their review. In doing so, they noted the respective roles of the Manager and the Sub-Advisers in providing services to the Fund.

In approving the Agreements, the Board, including the Independent Trustees, considered a variety of factors, including those factors discussed below. No single factor reviewed by the Board was identified by the Board as the principal factor in determining whether to approve the Management Agreement and the Sub-Advisory Agreements. Each Trustee may have attributed different weight to the various factors in evaluating the Management Agreement and each Sub-Advisory Agreement.

After considering all relevant factors and information, the Board, exercising its business judgment, determined that the continuation of the Agreements was in the best interests of the Fund and its shareholders and approved the continuation of each such agreement for another year.

Nature, extent and quality of the services under the management agreement and sub-advisory agreements

The Board received and considered information regarding the nature, extent and quality of services provided to the Fund by the Manager and the Sub-Advisers under the Management Agreement and the Sub-Advisory Agreements, respectively, during the past year. The Board noted information received at regular meetings throughout the year related to the services rendered by the Manager in its management of the Fund’s affairs and the Manager’s role in coordinating the activities of the Fund’s other service providers. The Board’s evaluation of the services provided by the Manager and the Sub-Advisers took into account the Board’s knowledge gained as Trustees of funds in the fund complex overseen by the Trustees, including knowledge gained regarding the scope and quality of the investment management and other capabilities of the Manager and the Sub-Advisers, and the quality of the Manager’s administrative and other services. The Board observed that the scope of services provided by the Manager and the Sub-Advisers, and of the undertakings required of the Manager and Sub-Advisers in connection with those services, including maintaining and monitoring their own and the Fund’s compliance programs, liquidity risk management programs, derivatives risk management programs, cybersecurity programs and valuation-related policies, had expanded over time as a result of regulatory, market and other developments. The Board also noted that on a regular basis it received and reviewed information from the Manager regarding the Fund’s compliance policies and procedures established pursuant to Rule 38a-1 under the 1940 Act. The Board also considered the risks

ClearBridge Variable Dividend Strategy Portfolio

Board Approval of Management andSubadvisory Agreements (unaudited) (cont’d) associated with the Fund borne by the Manager and its affiliates (such as entrepreneurial, operational, reputational, litigation and regulatory risk), as well as the Manager’s and each Sub-Adviser’s risk management processes.

The Board reviewed the qualifications, backgrounds and responsibilities of the Manager’s and each Sub-Adviser’s senior personnel and the team of investment professionals primarily responsible for the day-to-day portfolio management of the Fund. The Board also considered, based on its knowledge of the Manager and the Manager’s affiliates, the financial resources of Franklin Resources, Inc., the parent organization of the Manager and the Sub-Advisers. The Board recognized the importance of having a fund manager with significant resources.

The Board considered the division of responsibilities among the Manager and the Sub-Advisers and the oversight provided by the Manager. The Board also considered the policies and practices of the Manager and the Sub-Advisers regarding the selection of brokers and dealers and the execution of portfolio transactions. The Board considered management’s periodic reports to the Board on, among other things, its business plans, any organizational changes and portfolio manager compensation.

The Board received and considered performance information for the Fund as well as for a group of funds (the “Performance Universe”) selected by Broadridge Financial Solutions, Inc. (“Broadridge”), an independent provider of investment company data, based on classifications provided by Thomson Reuters Lipper (“Lipper”). The Board was provided with a description of the methodology used to determine the similarity of the Fund with the funds included in the Performance Universe. It was noted that while the Board found the Broadridge data generally useful, they recognized its limitations, including that the data may vary depending on the end date selected and that the results of the performance comparisons may vary depending on the selection of the peer group and its composition over time. The Board also noted that it had received and discussed with management information throughout the year at periodic intervals comparing the Fund’s performance against its benchmark and against the Fund’s peers. The Board also considered the Fund’s performance in light of overall financial market conditions.

The information comparing the Fund’s performance to that of its Performance Universe, consisting of funds underlying variable insurance products (including the Fund) classified as equity income funds by Lipper, showed, among other data, that the performance of the Fund’s Class I shares for the 1-, 3-, 5- and 10-year periods ended December 31, 2023 was above the median performance of the funds in the Performance Universe for each period and ranked in the first quintile of the funds in the Performance Universe for the

1-, 5- and 10-year periods.

ClearBridge Variable Dividend Strategy Portfolio

The Board concluded that, overall, the nature, extent and quality of services provided (and expected to be provided), including performance, under the Management Agreement and each Sub-Advisory Agreement were sufficient for renewal.

Management fees and expense ratios

The Board reviewed and considered the contractual management fee payable by the Fund to the Manager (the “Contractual Management Fee”) and the actual management fees paid by the Fund to the Manager after giving effect to breakpoints and waivers, if any (the “Actual Management Fee”), in light of the nature, extent and quality of the management and sub-advisory services provided by the Manager and the Sub-Advisers, respectively. The Board also noted that the compensation paid to the Sub-Advisers is the responsibility and expense of the Manager, not the Fund.

The Board received and considered information provided by Broadridge comparing the Contractual Management Fee and the Actual Management Fee and the Fund’s total actual expenses with those of funds in both the relevant expense group and a broader group of funds, each selected by Broadridge based on classifications provided by Lipper. It was noted that while the Board found the Broadridge data generally useful, they recognized its limitations, including that the data may vary depending on the selection of the peer group. The Board also reviewed information regarding fees charged by the Manager and/or the Sub-Advisers to other U.S. clients investing primarily in an asset class similar to that of the Fund, including, where applicable, retail managed accounts and third-party sub-advised funds.

The Manager reviewed with the Board the differences in services provided to these different types of accounts, noting that the Fund is provided with certain administrative services, office facilities, and Fund officers (including the Fund’s chief executive, chief financial and chief compliance officers), and that the Manager coordinates and oversees the provision of services to the Fund by other Fund service providers. The Board considered the fee comparisons in light of the differences in management of these different types of accounts, and the differences in the degree of entrepreneurial and other risks borne by the Manager in managing the Fund and in managing other types of accounts.

The Board considered the overall management fee, the fees of each of the Sub-Advisers and the amount of the management fee retained by the Manager after payment of the sub-advisory fees, in each case in light of the services rendered for those amounts. The Board also received an analysis of complex-wide management fees provided by the Manager, which, among other things, set out a framework of fees based on asset classes.

The Board also received and considered information comparing the Fund’s Contractual Management Fee and Actual Management Fee as well as its actual total expense ratio with those of a group of 14 equity income funds underlying variable insurance products

ClearBridge Variable Dividend Strategy Portfolio

Board Approval of Management andSubadvisory Agreements (unaudited) (cont’d) (including the Fund) selected by Broadridge to be comparable to the Fund (the “Expense Group”), and a broader group of funds selected by Broadridge consisting of equity income funds underlying variable insurance products (including the Fund) (the “Expense Universe”). This information showed that the Fund’s Contractual Management Fee was above the median of management fees payable by the funds in the Expense Group and that the Fund’s Actual Management Fee was approximately equivalent to the median of management fees paid by the funds in the Expense Group and above the median of management fees paid by the funds in the Expense Universe. This information also showed that the Fund’s actual total expense ratio was above the median of the total expense ratios of the funds in the Expense Group and above the median of the actual total expense ratios of the funds in the Expense Universe. The Board took into account management’s discussion of the Fund’s expenses.

Taking all of the above into consideration, as well as the factors identified below, the Board determined that the management fee and the sub-advisory fees for the Fund were reasonable in light of the nature, extent and quality of the services provided to the Fund under the Management Agreement and the Sub-Advisory Agreements.

The Board received and considered an analysis of the profitability of the Manager and its affiliates in providing services to the Fund. The Board also received profitability information with respect to the Legg Mason Funds complex as a whole. The Board received information with respect to the Manager’s allocation methodologies used in preparing this profitability data. It was noted that the allocation methodologies had been reviewed by an outside consultant. The profitability of the Manager and its affiliates was considered by the Board not excessive in light of the nature, extent and quality of the services provided to the Fund.

The Board received and discussed information concerning whether the Manager realizes economies of scale with respect to the management of the Fund as the Fund’s assets grow. The Board noted that the Manager had previously agreed to institute breakpoints in the Fund’s Contractual Management Fee, reflecting the potential for reducing the blended rate of the Contractual Management Fee as the Fund grows. The Board considered whether the breakpoint fee structure was a reasonable means of sharing with Fund investors any economies of scale or other efficiencies that might accrue from increases in the Fund’s asset levels. The Board noted that the Fund had not reached the specified asset level at which a breakpoint to its Contractual Management Fee would be triggered. The Board also noted the size of the Fund.

The Board determined that the management fee structure for the Fund, including breakpoints, was reasonable.

ClearBridge Variable Dividend Strategy Portfolio

Other benefits to the manager and the sub-advisers

The Board considered other benefits received by the Manager, the Sub-Advisers and their affiliates as a result of their relationship with the Fund, including the opportunity to offer additional products and services to Fund shareholders, including the appointment of an affiliate of the Manager as the transfer agent of the Fund.

In light of the costs of providing investment management and other services to the Fund and the ongoing commitment of the Manager and the Sub-Advisers to the Fund, the Board considered that the ancillary benefits that the Manager, the Sub-Advisers and their affiliates received were reasonable.

ClearBridge Variable Dividend Strategy Portfolio

(This page intentionally left blank.)

ClearBridge

Variable Dividend Strategy Portfolio

Trustees

G. Peter O’Brien

Chair

Investment manager

Franklin Templeton Fund Adviser, LLC

ClearBridge Investments, LLC

Franklin Distributors, LLC

The Bank of New York Mellon

Transfer agent

Franklin Templeton Investor

Services, LLC

3344 Quality Drive

Rancho Cordova, CA 95670-7313

Independent registered public accounting firm

PricewaterhouseCoopers LLP

Baltimore, MD

ClearBridge Variable Dividend Strategy Portfolio

The Portfolio is a separate investment series of Legg Mason Partners Variable Equity Trust, a Maryland statutory trust.

ClearBridge Variable Dividend Strategy Portfolio

Legg Mason Funds

620 Eighth Avenue, 47th Floor

New York, NY 10018

The Portfolio files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Portfolio’s Forms N-PORT are available on the SEC’s website at www.sec.gov. To obtain information on Form N-PORT, shareholders can call the Portfolio at 877-6LM-FUND/656-3863.

Information on how the Portfolio voted proxies relating to portfolio securities during the prior 12-month period ended June 30th of each year and a description of the policies and procedures that the Portfolio uses to determine how to vote proxies related to portfolio transactions are available (1) without charge, upon request, by calling the Portfolio at 877-6LM-FUND/656-3863, (2) at www.franklintempleton.com and (3) on the SEC’s website at www.sec.gov.

This report is submitted for the general information of the shareholders of ClearBridge Variable Dividend Strategy Portfolio. This report is not authorized for distribution to prospective investors in the Portfolio unless preceded or accompanied by a current prospectus.

Investors should consider the Portfolio’s investment objectives, risks, charges and expenses carefully before investing. The prospectus contains this and other important information about the Portfolio. Please read the prospectus carefully before investing.

www.franklintempleton.com

© 2024 Franklin Distributors, LLC, Member FINRA/SIPC. All rights reserved.

Franklin Templeton Funds Privacy and Security Notice

Your Privacy Is Our Priority

Franklin Templeton* is committed to safeguarding your personal information. This notice is designed to provide you with a summary of the non-public personal information Franklin Templeton may collect and maintain about current or former individual investors; our policy regarding the use of that information; and the measures we take to safeguard the information. We do not sell individual investors’ non-public personal information to anyone and only share it as described in this notice.

When you invest with us, you provide us with your non-public personal information. We collect and use this information to service your accounts and respond to your requests. The non-public personal information we may collect falls into the following categories:

•

Information we receive from you or your financial intermediary on applications or other forms, whether we receive the form in writing or electronically. For example, this information may include your name, address, tax identification number, birth date, investment selection, beneficiary information, and your personal bank account information and/or email address if you have provided that information.

•

Information about your transactions and account history with us, or with other companies that are part of Franklin Templeton, including transactions you request on our website or in our app. This category also includes your communications to us concerning your investments.

•

Information we receive from third parties (for example, to update your address if you move, obtain or verify your email address or obtain additional information to verify your identity).

•

Information collected from you online, such as your IP address or device ID and data gathered from your browsing activity and location. (For example, we may use cookies to collect device and browser information so our website recognizes your online preferences and device information.) Our website contains more information about cookies and similar technologies and ways you may limit them.

•

Other general information that we may obtain about you such as demographic information.

To better service your accounts and process transactions or services you requested, we may share non-public personal information with other Franklin Templeton companies. From time to time we may also send you information about products/services offered by other Franklin Templeton companies although we will not share your non-public personal information with these companies without first offering you the opportunity to prevent that sharing.

We will only share non-public personal information with outside parties in the limited circumstances permitted by law. For example, this includes situations where we need to share information with companies who work on our behalf to service or maintain your account or

NOT PART OF THE SEMI-ANNUAL REPORT

Franklin Templeton Funds Privacy and Security Notice (cont’d) process transactions you requested, when the disclosure is to companies assisting us with our own marketing efforts, when the disclosure is to a party representing you, or when required by law (for example, in response to legal process). Additionally, we will ensure that any outside companies working on our behalf, or with whom we have joint marketing agreements, are under contractual obligations to protect the confidentiality of your information, and to use it only to provide the services we asked them to perform.

Confidentiality and Security

Our employees are required to follow procedures with respect to maintaining the confidentiality of our investors’ non-public personal information. Additionally, we maintain physical, electronic and procedural safeguards to protect the information. This includes performing ongoing evaluations of our systems containing investor information and making changes when appropriate.

At all times, you may view our current privacy notice on our website at

https://www.franklintempleton.com/help/privacy-policy or contact us for a copy at (800) 632-2301.

*For purposes of this privacy notice Franklin Templeton shall refer to the following entities:

Fiduciary Trust International of the South (FTIOS), as custodian for individual retirement plans

Franklin Distributors, LLC, including as program manager of the Franklin Templeton 529 College Savings Plan and the NJBEST 529 College Savings Plan

Franklin Mutual Advisers, LLC

Franklin, Templeton and Mutual Series Funds

Franklin Templeton Institutional, LLC

Franklin Templeton Investments Corp., Canada

Franklin Templeton Investments Management, Limited UK

Templeton Asset Management, Limited

Templeton Global Advisors, Limited

Templeton Investment Counsel, LLC

If you are a customer of other Franklin Templeton affiliates and you receive notices from them, you will need to read those notices separately.

NOT PART OF THE SEMI-ANNUAL REPORT

© 2024 Franklin Templeton. All rights reserved.

| ITEM 8. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 9. | PROXY DISCLOSURES FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 10. | REMUNERATION PAID TO DIRECTORS, OFFICERS, AND OTHERS OF OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 11. | STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY CONTRACT. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 12. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 13. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 14. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable.

| ITEM 15. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

Not applicable.

| ITEM 16. | CONTROLS AND PROCEDURES. |

| (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a- 3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)) are effective as of a date within 90 days of the filing date of this report that includes the disclosure required by this paragraph, based on their evaluation of the disclosure controls and procedures required by Rule 30a-3(b) under the 1940 Act and 15d-15(b) under the Securities Exchange Act of 1934. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the period covered by this report that have materially affected, or are likely to materially affect the registrant’s internal control over financial reporting. |

| ITEM 17. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 18. | RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION. |

(a) (1) Not applicable.

Exhibit 99.CODE ETH

(a) (2) Certifications pursuant to section 302 of the Sarbanes-Oxley Act of 2002 attached hereto.

Exhibit 99.CERT

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto.

Exhibit 99.906CERT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this Report to be signed on its behalf by the undersigned, there unto duly authorized.

Legg Mason Partners Variable Equity Trust

| By: | /s/ Jane Trust | |

| | Jane Trust | |

| | Chief Executive Officer | |

| | | |

| Date: | August 14, 2024 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Jane Trust | |

| | Jane Trust | |

| | Chief Executive Officer | |

| | | |

| Date: | August 14, 2024 | |

| By: | /s/ Christopher Berarducci | |

| | Christopher Berarducci | |

| | Principal Financial Officer | |

| | | |

| Date: | August 14, 2024 | |