UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-21128

Legg Mason Partners Variable Equity Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira.

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code:

877-6LM-FUND/656-3863

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Semi-Annual Report to Stockholders is filed herewith.

ClearBridge Variable Small Cap Growth Portfolio |  | |

Class Itrue | ||

| Semi-Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class I1 | $39 | 0.80% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| † | Annualized. |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

Total Net Assets | $397,927,393 |

Total Number of Portfolio Holdings* | 90 |

Portfolio Turnover Rate | 19% |

| * | Does not include derivatives, except purchased options, if any. |

| * | Does not include derivatives, except purchased options, if any. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| ClearBridge Variable Small Cap Growth Portfolio | PAGE 1 | 7877-STSR-0824 |

ClearBridge Variable Small Cap Growth Portfolio |  | |

Class IItrue | ||

| Semi-Annual Shareholder Report | June 30, 2024 | ||

| ||

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 877-6LM-FUND/656-3863.

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class II1 | $52 | 1.05% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| † | Annualized. |

| 1 | Does not reflect expenses incurred from investing through variable annuity or variable life insurance products. |

Total Net Assets | $397,927,393 |

Total Number of Portfolio Holdings* | 90 |

Portfolio Turnover Rate | 19% |

| * | Does not include derivatives, except purchased options, if any. |

| * | Does not include derivatives, except purchased options, if any. |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: | |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| ClearBridge Variable Small Cap Growth Portfolio | PAGE 1 | 7935-STSR-0824 |

| ITEM 2. | CODE OF ETHICS. |

Not applicable.

| ITEM 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

Not applicable.

| ITEM 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

Not applicable.

| ITEM 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

Not applicable.

| ITEM 6. | SCHEDULE OF INVESTMENTS. |

| a) | Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR. |

| b) | Not applicable. |

| ITEM 7. | FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

Variable Small Cap Growth Portfolio

1 | |

6 | |

7 | |

8 | |

9 | |

11 | |

20 | |

20 | |

20 | |

21 |

Security | Shares | Value | |||

Common Stocks — 97.9% | |||||

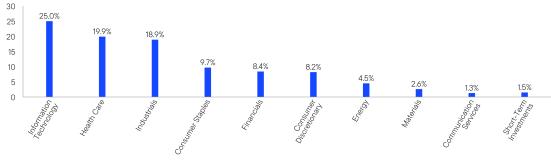

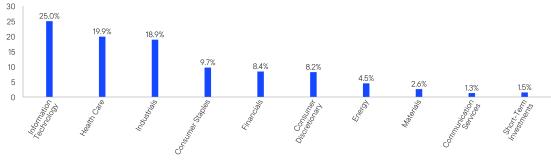

Communication Services — 1.3% | |||||

Diversified Telecommunication Services — 0.7% | |||||

Iridium Communications Inc. | 110,304 | $2,936,293 | |||

Media — 0.6% | |||||

Integral Ad Science Holding Corp. | 238,700 | 2,320,164 * | |||

Total Communication Services | 5,256,457 | ||||

Consumer Discretionary — 8.1% | |||||

Automobile Components — 0.8% | |||||

Fox Factory Holding Corp. | 63,839 | 3,076,401 * | |||

Broadline Retail — 1.1% | |||||

Global-e Online Ltd. | 118,100 | 4,283,487 * | |||

Diversified Consumer Services — 0.7% | |||||

Duolingo Inc. | 14,400 | 3,004,848 * | |||

Hotels, Restaurants & Leisure — 4.1% | |||||

Dutch Bros Inc., Class A Shares | 82,905 | 3,432,267 * | |||

Wingstop Inc. | 30,441 | 12,866,193 | |||

Total Hotels, Restaurants & Leisure | 16,298,460 | ||||

Household Durables — 0.5% | |||||

Installed Building Products Inc. | 10,300 | 2,118,504 | |||

Specialty Retail — 0.9% | |||||

National Vision Holdings Inc. | 275,642 | 3,608,154 * | |||

Total Consumer Discretionary | 32,389,854 | ||||

Consumer Staples — 9.7% | |||||

Consumer Staples Distribution & Retail — 8.5% | |||||

BJ’s Wholesale Club Holdings Inc. | 131,283 | 11,531,899 * | |||

Casey’s General Stores Inc. | 31,473 | 12,008,838 | |||

Grocery Outlet Holding Corp. | 239,886 | 5,306,278 * | |||

Performance Food Group Co. | 74,066 | 4,896,503 * | |||

Total Consumer Staples Distribution & Retail | 33,743,518 | ||||

Food Products — 0.0%†† | |||||

Calavo Growers Inc. | 10,221 | 232,017 | |||

Personal Care Products — 1.2% | |||||

e.l.f. Beauty Inc. | 22,500 | 4,741,200 * | |||

Total Consumer Staples | 38,716,735 | ||||

Energy — 4.5% | |||||

Energy Equipment & Services — 3.0% | |||||

Cactus Inc., Class A Shares | 140,080 | 7,387,819 | |||

ChampionX Corp. | 67,548 | 2,243,269 | |||

Expro Group Holdings NV | 104,700 | 2,399,724 * | |||

Total Energy Equipment & Services | 12,030,812 | ||||

1

Security | Shares | Value | |||

Oil, Gas & Consumable Fuels — 1.5% | |||||

Matador Resources Co. | 100,200 | $5,971,920 | |||

Total Energy | 18,002,732 | ||||

Financials — 8.4% | |||||

Capital Markets — 4.8% | |||||

Hamilton Lane Inc., Class A Shares | 93,503 | 11,555,101 | |||

PJT Partners Inc., Class A Shares | 70,501 | 7,607,763 | |||

Total Capital Markets | 19,162,864 | ||||

Financial Services — 3.3% | |||||

NMI Holdings Inc., Class A Shares | 81,500 | 2,774,260 * | |||

Shift4 Payments Inc., Class A Shares | 138,125 | 10,131,469 * | |||

Total Financial Services | 12,905,729 | ||||

Insurance — 0.3% | |||||

Trupanion Inc. | 39,339 | 1,156,566 * | |||

Total Financials | 33,225,159 | ||||

Health Care — 19.6% | |||||

Biotechnology — 4.2% | |||||

Biohaven Ltd. | 40,549 | 1,407,456 * | |||

Blueprint Medicines Corp. | 18,700 | 2,015,486 * | |||

Insmed Inc. | 90,800 | 6,083,600 * | |||

Mirum Pharmaceuticals Inc. | 58,000 | 1,983,020 * | |||

Ultragenyx Pharmaceutical Inc. | 56,421 | 2,318,903 * | |||

Vaxcyte Inc. | 15,800 | 1,193,058 * | |||

Viking Therapeutics Inc. | 32,800 | 1,738,728 * | |||

Total Biotechnology | 16,740,251 | ||||

Health Care Equipment & Supplies — 3.7% | |||||

CONMED Corp. | 19,400 | 1,344,808 | |||

Inari Medical Inc. | 23,000 | 1,107,450 * | |||

Insulet Corp. | 13,576 | 2,739,637 * | |||

Lantheus Holdings Inc. | 28,000 | 2,248,120 * | |||

Penumbra Inc. | 40,626 | 7,311,461 * | |||

Total Health Care Equipment & Supplies | 14,751,476 | ||||

Health Care Providers & Services — 6.2% | |||||

HealthEquity Inc. | 92,332 | 7,959,018 * | |||

Progyny Inc. | 214,147 | 6,126,746 * | |||

RadNet Inc. | 62,500 | 3,682,500 * | |||

Surgery Partners Inc. | 295,498 | 7,029,897 * | |||

Total Health Care Providers & Services | 24,798,161 | ||||

Health Care Technology — 1.2% | |||||

Certara Inc. | 349,300 | 4,837,805 * | |||

2

Security | Shares | Value | |||

Life Sciences Tools & Services — 2.8% | |||||

Azenta Inc. | 46,383 | $2,440,673 * | |||

CryoPort Inc. | 58,525 | 404,408 * | |||

Medpace Holdings Inc. | 19,800 | 8,154,630 * | |||

Total Life Sciences Tools & Services | 10,999,711 | ||||

Pharmaceuticals — 1.5% | |||||

Intra-Cellular Therapies Inc. | 85,948 | 5,886,579 * | |||

Total Health Care | 78,013,983 | ||||

Industrials — 18.9% | |||||

Aerospace & Defense — 2.0% | |||||

BWX Technologies Inc. | 33,800 | 3,211,000 | |||

Moog Inc., Class A Shares | 29,000 | 4,851,700 | |||

Total Aerospace & Defense | 8,062,700 | ||||

Air Freight & Logistics — 1.6% | |||||

GXO Logistics Inc. | 123,185 | 6,220,843 * | |||

Building Products — 3.5% | |||||

Hayward Holdings Inc. | 180,820 | 2,224,086 * | |||

Trex Co. Inc. | 154,527 | 11,453,541 * | |||

Total Building Products | 13,677,627 | ||||

Construction & Engineering — 0.4% | |||||

Construction Partners Inc., Class A Shares | 31,200 | 1,722,552 * | |||

Electrical Equipment — 1.0% | |||||

Bloom Energy Corp., Class A Shares | 216,369 | 2,648,356 * | |||

Shoals Technologies Group Inc., Class A Shares | 181,715 | 1,133,902 * | |||

Total Electrical Equipment | 3,782,258 | ||||

Ground Transportation — 2.1% | |||||

XPO Inc. | 79,380 | 8,426,187 * | |||

Machinery — 4.9% | |||||

Albany International Corp., Class A Shares | 47,780 | 4,035,021 | |||

RBC Bearings Inc. | 37,536 | 10,126,462 * | |||

Tennant Co. | 53,297 | 5,246,557 | |||

Total Machinery | 19,408,040 | ||||

Professional Services — 0.9% | |||||

Paycor HCM Inc. | 293,326 | 3,725,240 * | |||

Trading Companies & Distributors — 2.5% | |||||

H&E Equipment Services Inc. | 140,922 | 6,224,525 | |||

McGrath RentCorp. | 25,200 | 2,685,060 | |||

Xometry Inc., Class A Shares | 101,387 | 1,172,034 * | |||

Total Trading Companies & Distributors | 10,081,619 | ||||

Total Industrials | 75,107,066 | ||||

3

Security | Shares | Value | |||

Information Technology — 24.7% | |||||

Communications Equipment — 0.3% | |||||

Viavi Solutions Inc. | 200,078 | $1,374,536 * | |||

Electronic Equipment, Instruments & Components — 2.6% | |||||

Brain Corp. | 52,367 | 274,492 *(a)(b)(c) | |||

Fabrinet | 9,700 | 2,374,463 * | |||

nLight Inc. | 85,280 | 932,111 * | |||

Novanta Inc. | 15,300 | 2,495,583 * | |||

OSI Systems Inc. | 30,643 | 4,214,025 * | |||

Total Electronic Equipment, Instruments & Components | 10,290,674 | ||||

IT Services — 2.6% | |||||

Wix.com Ltd. | 65,347 | 10,394,747 * | |||

Semiconductors & Semiconductor Equipment — 4.7% | |||||

Allegro MicroSystems Inc. | 240,615 | 6,794,968 * | |||

Lattice Semiconductor Corp. | 126,150 | 7,315,438 * | |||

Monolithic Power Systems Inc. | 5,391 | 4,429,677 | |||

Total Semiconductors & Semiconductor Equipment | 18,540,083 | ||||

Software — 14.5% | |||||

Aspen Technology Inc. | 29,088 | 5,777,749 * | |||

Blackbaud Inc. | 30,000 | 2,285,100 * | |||

Envestnet Inc. | 101,974 | 6,382,553 * | |||

Intapp Inc. | 64,000 | 2,346,880 * | |||

Jamf Holding Corp. | 169,395 | 2,795,018 * | |||

Klaviyo Inc., Class A Shares | 137,549 | 3,423,595 * | |||

nCino Inc. | 108,900 | 3,424,905 * | |||

PagerDuty Inc. | 324,254 | 7,435,144 * | |||

Qualys Inc. | 19,865 | 2,832,749 * | |||

Sprout Social Inc., Class A Shares | 159,350 | 5,685,608 * | |||

Varonis Systems Inc. | 224,167 | 10,753,291 * | |||

Zeta Global Holdings Corp., Class A Shares | 256,370 | 4,524,930 * | |||

Total Software | 57,667,522 | ||||

Total Information Technology | 98,267,562 | ||||

Materials — 2.7% | |||||

Chemicals — 2.7% | |||||

Balchem Corp. | 37,856 | 5,827,931 | |||

Element Solutions Inc. | 172,900 | 4,689,048 | |||

Total Materials | 10,516,979 | ||||

Total Common Stocks (Cost — $278,380,019) | 389,496,527 | ||||

4

Security | Rate | Shares | Value | ||

Preferred Stocks — 0.3% | |||||

Health Care — 0.1% | |||||

Pharmaceuticals — 0.1% | |||||

Caris Life Sciences Inc., Series C | — | 183,481 | $349,087 *(a)(b)(c) | ||

Caris Life Sciences Inc., Series D | — | 31,383 | 168,980 *(a)(b)(c) | ||

Total Health Care | 518,067 | ||||

Information Technology — 0.2% | |||||

Electronic Equipment, Instruments & Components — 0.2% | |||||

Brain Corp. | — | 170,237 | 892,332 *(a)(b)(c) | ||

Total Preferred Stocks (Cost — $1,658,695) | 1,410,399 | ||||

Total Investments before Short-Term Investments (Cost — $280,038,714) | 390,906,926 | ||||

Short-Term Investments — 1.5% | |||||

JPMorgan 100% U.S. Treasury Securities Money Market Fund, Institutional Class | 5.145% | 3,007,514 | 3,007,514 (d) | ||

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares | 5.235% | 3,007,514 | 3,007,514 (d)(e) | ||

Total Short-Term Investments (Cost — $6,015,028) | 6,015,028 | ||||

Total Investments — 99.7% (Cost — $286,053,742) | 396,921,954 | ||||

Other Assets in Excess of Liabilities — 0.3% | 1,005,439 | ||||

Total Net Assets — 100.0% | $397,927,393 | ||||

†† | Represents less than 0.1%. |

* | Non-income producing security. |

(a) | Security is fair valued in accordance with procedures approved by the Board of Trustees (Note 1). |

(b) | Security is valued using significant unobservable inputs (Note 1). |

(c) | Restricted security (Note 9). |

(d) | Rate shown is one-day yield as of the end of the reporting period. |

(e) | In this instance, as defined in the Investment Company Act of 1940, an “Affiliated Company” represents Portfolio ownership of at least 5% of the outstanding voting securities of an issuer, or a company which is under common ownership or control with the Portfolio. At June 30, 2024, the total market value of investments in Affiliated Companies was $3,007,514 and the cost was $3,007,514 (Note 8). |

5

Assets: | |

Investments in unaffiliated securities, at value (Cost — $283,046,228) | $393,914,440 |

Investments in affiliated securities, at value (Cost — $3,007,514) | 3,007,514 |

Cash | 4,482,636 |

Receivable for Portfolio shares sold | 144,622 |

Receivable for securities sold | 111,801 |

Dividends receivable from unaffiliated investments | 88,569 |

Dividends receivable from affiliated investments | 18,167 |

Prepaid expenses | 171 |

Total Assets | 401,767,920 |

Liabilities: | |

Payable for securities purchased | 2,753,776 |

Payable for Portfolio shares repurchased | 748,592 |

Investment management fee payable | 243,703 |

Service and/or distribution fees payable | 26,354 |

Trustees’ fees payable | 7,844 |

Accrued expenses | 60,258 |

Total Liabilities | 3,840,527 |

Total Net Assets | $397,927,393 |

Net Assets: | |

Par value (Note 7) | $152 |

Paid-in capital in excess of par value | 269,802,460 |

Total distributable earnings (loss) | 128,124,781 |

Total Net Assets | $397,927,393 |

Net Assets: | |

Class I | $270,419,346 |

Class II | $127,508,047 |

Shares Outstanding: | |

Class I | 10,083,057 |

Class II | 5,147,918 |

Net Asset Value: | |

Class I | $26.82 |

Class II | $24.77 |

6

Investment Income: | |

Dividends from unaffiliated investments | $594,646 |

Dividends from affiliated investments | 79,321 |

Total Investment Income | 673,967 |

Expenses: | |

Investment management fee (Note 2) | 1,527,619 |

Service and/or distribution fees (Notes 2 and 5) | 165,912 |

Fund accounting fees | 34,685 |

Legal fees | 17,943 |

Audit and tax fees | 14,906 |

Trustees’ fees | 13,326 |

Shareholder reports | 12,373 |

Commitment fees (Note 10) | 1,834 |

Insurance | 1,539 |

Transfer agent fees (Notes 2 and 5) | 1,284 |

Custody fees | 931 |

Miscellaneous expenses | 2,952 |

Total Expenses | 1,795,304 |

Less: Fee waivers and/or expense reimbursements (Notes 2 and 5) | (1,412 ) |

Net Expenses | 1,793,892 |

Net Investment Loss | (1,119,925 ) |

Realized and Unrealized Gain (Loss) on Investments (Notes 1 and 3): | |

Net Realized Gain From Unaffiliated Investment Transactions | 18,593,920 |

Change in Net Unrealized Appreciation (Depreciation) From Unaffiliated Investments | (25,523,076 ) |

Net Loss on Investments | (6,929,156 ) |

Decrease in Net Assets From Operations | $(8,049,081 ) |

7

For the Six Months Ended June 30, 2024 (unaudited) and the Year Ended December 31, 2023 | 2024 | 2023 |

Operations: | ||

Net investment loss | $(1,119,925 ) | $(1,847,124 ) |

Net realized gain | 18,593,920 | 7,137,541 |

Change in net unrealized appreciation (depreciation) | (25,523,076 ) | 25,330,717 |

Increase (Decrease) in Net Assets From Operations | (8,049,081 ) | 30,621,134 |

Distributions to Shareholders From (Notes 1 and 6): | ||

Total distributable earnings | (313,815 ) | — |

Decrease in Net Assets From Distributions to Shareholders | (313,815 ) | — |

Portfolio Share Transactions (Note 7): | ||

Net proceeds from sale of shares | 43,314,885 | 103,773,800 |

Reinvestment of distributions | 313,815 | — |

Cost of shares repurchased | (60,176,440 ) | (89,733,194 ) |

Increase (Decrease) in Net Assets From Portfolio Share Transactions | (16,547,740 ) | 14,040,606 |

Increase (Decrease) in Net Assets | (24,910,636 ) | 44,661,740 |

Net Assets: | ||

Beginning of period | 422,838,029 | 378,176,289 |

End of period | $397,927,393 | $422,838,029 |

8

For a share of each class of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | ||||||

Class I Shares1 | 20242 | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $27.35 | $25.23 | $36.32 | $36.60 | $27.54 | $23.88 |

Income (loss) from operations: | ||||||

Net investment loss | (0.06 ) | (0.10 ) | (0.12 ) | (0.18 ) | (0.15 ) | (0.14 ) |

Net realized and unrealized gain (loss) | (0.45 ) | 2.22 | (10.42 ) | 4.70 | 11.83 | 6.50 |

Total income (loss) from operations | (0.51) | 2.12 | (10.54) | 4.52 | 11.68 | 6.36 |

Less distributions from: | ||||||

Net realized gains | (0.02 ) | — | (0.55 ) | (4.80 ) | (2.62 ) | (2.70 ) |

Total distributions | (0.02 ) | — | (0.55 ) | (4.80 ) | (2.62 ) | (2.70 ) |

Net asset value, end of period | $26.82 | $27.35 | $25.23 | $36.32 | $36.60 | $27.54 |

Total return3 | (1.86 )% | 8.40 % | (28.85 )% | 12.61 % | 43.26 % | 26.87 % |

Net assets, end of period (millions) | $270 | $287 | $261 | $368 | $351 | $267 |

Ratios to average net assets: | ||||||

Gross expenses | 0.80 %4 | 0.80 % | 0.80 % | 0.80 % | 0.81 % | 0.81 % |

Net expenses5,6 | 0.80 4 | 0.80 | 0.80 | 0.80 | 0.81 | 0.81 |

Net investment loss | (0.47 )4 | (0.39 ) | (0.43 ) | (0.46 ) | (0.52 ) | (0.49 ) |

Portfolio turnover rate | 19 % | 15 % | 8 % | 16 % | 21 % | 21 % |

1 | Per share amounts have been calculated using the average shares method. |

2 | For the six months ended June 30, 2024 (unaudited). |

3 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Total returns do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total return for all periods shown. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

4 | Annualized. |

5 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class I shares did not exceed 1.00%. This expense limitation arrangement cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Portfolio’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

6 | Reflects fee waivers and/or expense reimbursements. |

9

For a share of each class of beneficial interest outstanding throughout each year ended December 31, unless otherwise noted: | ||||||

Class II Shares1 | 20242 | 2023 | 2022 | 2021 | 2020 | 2019 |

Net asset value, beginning of period | $25.29 | $23.39 | $33.81 | $34.46 | $26.11 | $22.81 |

Income (loss) from operations: | ||||||

Net investment loss | (0.09 ) | (0.15 ) | (0.17 ) | (0.27 ) | (0.21 ) | (0.20 ) |

Net realized and unrealized gain (loss) | (0.41 ) | 2.05 | (9.70 ) | 4.42 | 11.18 | 6.20 |

Total income (loss) from operations | (0.50) | 1.90 | (9.87) | 4.15 | 10.97 | 6.00 |

Less distributions from: | ||||||

Net realized gains | (0.02 ) | — | (0.55 ) | (4.80 ) | (2.62 ) | (2.70 ) |

Total distributions | (0.02 ) | — | (0.55 ) | (4.80 ) | (2.62 ) | (2.70 ) |

Net asset value, end of period | $24.77 | $25.29 | $23.39 | $33.81 | $34.46 | $26.11 |

Total return3 | (1.98 )% | 8.12 % | (29.01 )% | 12.31 % | 42.91 % | 26.55 % |

Net assets, end of period (millions) | $128 | $136 | $117 | $175 | $153 | $105 |

Ratios to average net assets: | ||||||

Gross expenses | 1.05 %4 | 1.05 % | 1.05 % | 1.05 % | 1.06 % | 1.06 % |

Net expenses5,6 | 1.05 4 | 1.05 | 1.04 | 1.05 | 1.06 | 1.06 |

Net investment loss | (0.72 )4 | (0.64 ) | (0.69 ) | (0.71 ) | (0.76 ) | (0.74 ) |

Portfolio turnover rate | 19 % | 15 % | 8 % | 16 % | 21 % | 21 % |

1 | Per share amounts have been calculated using the average shares method. |

2 | For the six months ended June 30, 2024 (unaudited). |

3 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Total returns do not reflect expenses associated with separate accounts such as administrative fees, account charges and surrender charges which, if reflected, would reduce the total return for all periods shown. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

4 | Annualized. |

5 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses, other than interest, brokerage commissions, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of Class II shares did not exceed 1.25%. This expense limitation arrangement cannot be terminated prior to December 31, 2025 without the Board of Trustees’ consent. In addition, the manager has agreed to waive the Portfolio’s management fee to an extent sufficient to offset the net management fee payable in connection with any investment in an affiliated money market fund. |

6 | Reflects fee waivers and/or expense reimbursements. |

10

11

12

ASSETS | ||||

Description | Quoted Prices (Level 1) | Other Significant Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total |

Long-Term Investments†: | ||||

Common Stocks: | ||||

Information Technology | $97,993,070 | — | $274,492 | $98,267,562 |

Other Common Stocks | 291,228,965 | — | — | 291,228,965 |

Preferred Stocks: | ||||

Health Care | — | — | 518,067 | 518,067 |

Information Technology | — | — | 892,332 | 892,332 |

Total Long-Term Investments | 389,222,035 | — | 1,684,891 | 390,906,926 |

Short-Term Investments† | 6,015,028 | — | — | 6,015,028 |

Total Investments | $395,237,063 | — | $1,684,891 | $396,921,954 |

† | See Schedule of Investments for additional detailed categorizations. |

13

14

During the six months ended June 30, 2024, fees waived and/or expenses reimbursed amounted to $1,412, all of which was an affiliated money market fund waiver.

15

Purchases | $77,956,433 |

Sales | 85,623,506 |

Cost | Gross Unrealized Appreciation | Gross Unrealized Depreciation | Net Unrealized Appreciation | |

Securities | $286,053,742 | $149,543,711 | $(38,675,499) | $110,868,212 |

Service and/or Distribution Fees | Transfer Agent Fees | |

Class I | — | $1,140 |

Class II | $165,912 | 144 |

Total | $165,912 | $1,284 |

16

Waivers/Expense Reimbursements | |

Class I | $952 |

Class II | 460 |

Total | $1,412 |

Six Months Ended June 30, 2024 | Year Ended December 31, 2023 | |

Net Realized Gains: | ||

Class I | $206,331 | — |

Class II | 107,484 | — |

Total | $313,815 | — |

Six Months Ended June 30, 2024 | Year Ended December 31, 2023 | |||

Shares | Amount | Shares | Amount | |

Class I | ||||

Shares sold | 868,152 | $23,440,377 | 1,951,132 | $51,419,251 |

Shares issued on reinvestment | 7,792 | 206,331 | — | — |

Shares repurchased | (1,274,283 ) | (34,458,393 ) | (1,819,083 ) | (47,643,235 ) |

Net increase (decrease) | (398,339 ) | $(10,811,685 ) | 132,049 | $3,776,016 |

Class II | ||||

Shares sold | 794,660 | $19,874,508 | 2,130,966 | $52,354,549 |

Shares issued on reinvestment | 4,394 | 107,484 | — | — |

Shares repurchased | (1,035,388 ) | (25,718,047 ) | (1,752,872 ) | (42,089,959 ) |

Net increase (decrease) | (236,334 ) | $(5,736,055 ) | 378,094 | $10,264,590 |

17

Affiliate Value at December 31, 2023 | Purchased | Sold | |||

Cost | Shares | Proceeds | Shares | ||

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares | $8,472,870 | $18,822,839 | 18,822,839 | $24,288,195 | 24,288,195 |

(cont’d) | Realized Gain (Loss) | Dividend Income | Net Increase (Decrease) in Unrealized Appreciation (Depreciation) | Affiliate Value at June 30, 2024 |

Western Asset Premier Institutional U.S. Treasury Reserves, Premium Shares | — | $79,321 | — | $3,007,514 |

Security | Number of Shares | Acquisition Date | Cost | Fair Value at 6/30/2024 | Value Per Share | Percent of Net Assets |

Brain Corp., Common Shares | 52,367 | 3/21 | $228,844 | $274,492 | $5.24 | 0.07 % |

Brain Corp., Preferred Shares | 170,237 | 4/20, 11/20 | 898,085 | 892,332 | 5.24 | 0.22 |

Caris Life Sciences Inc., Series C, Preferred Shares | 183,481 | 10/20 | 506,408 | 349,087 | 1.90 | 0.09 |

Caris Life Sciences Inc., Series D, Preferred Shares | 31,383 | 5/21 | 254,202 | 168,980 | 5.38 | 0.04 |

$1,887,539 | $1,684,891 | 0.42 % |

18

19

20

21

22

23

24

25

Chair

Services, LLC

3344 Quality Drive

Rancho Cordova, CA 95670-7313

Baltimore, MD

Legg Mason Funds

620 Eighth Avenue, 47th Floor

New York, NY 10018

Your Privacy Is Our Priority

https://www.franklintempleton.com/help/privacy-policy or contact us for a copy at (800) 632-2301.

| ITEM 8. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 9. | PROXY DISCLOSURES FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 10. | REMUNERATION PAID TO DIRECTORS, OFFICERS, AND OTHERS OF OPEN-END MANAGEMENT INVESTMENT COMPANIES. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 11. | STATEMENT REGARDING BASIS FOR APPROVAL OF INVESTMENT ADVISORY CONTRACT. |

The information is disclosed as part of the Financial Statements included in Item 7 of this Form N-CSR.

| ITEM 12. | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 13. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 14. | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

Not applicable.

| ITEM 15. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

Not applicable.

| ITEM 16. | CONTROLS AND PROCEDURES. |

| (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a- 3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)) are effective as of a date within 90 days of the filing date of this report that includes the disclosure required by this paragraph, based on their evaluation of the disclosure controls and procedures required by Rule 30a-3(b) under the 1940 Act and 15d-15(b) under the Securities Exchange Act of 1934. |

| (b) | There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that occurred during the period covered by this report that have materially affected, or are likely to materially affect the registrant’s internal control over financial reporting. |

| ITEM 17. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

Not applicable.

| ITEM 18. | RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION. |

| (a) | Not applicable. |

| (b) | Not applicable. |

| ITEM 19. | EXHIBITS. |

| (a) (1) Not applicable. | ||

| Exhibit 99.CODE ETH | ||

| (a) (2) Certifications pursuant to section 302 of the Sarbanes-Oxley Act of 2002 attached hereto. | ||

| Exhibit 99.CERT | ||

| (b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 attached hereto. | ||

| Exhibit 99.906CERT | ||

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this Report to be signed on its behalf by the undersigned, there unto duly authorized.

Legg Mason Partners Variable Equity Trust

| By: | /s/ Jane Trust | |

| Jane Trust | ||

| Chief Executive Officer |

Date: August 14, 2024

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Jane Trust | |

| Jane Trust | ||

| Chief Executive Officer | ||

| Date: | August 14, 2024 |

| By: | /s/ Christopher Berarducci | |

| Christopher Berarducci | ||

| Principal Financial Officer | ||

| Date: | August 14, 2024 |