BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | December 31 | |

| |

| |

| | 2001 | | 2002 | | 2002 | |

| |

| |

| |

| |

| | Adjusted NIS | | Convenience

translation

into U.S.

dollars | |

| |

| |

| |

| | In thousands | |

| |

| |

2) Shareholders’ equity: | | | | | | | | | | | | | |

As reported in these financial statements, | | | | | | | | | | | | | |

under Israeli GAAP | | | 219,860 | | | | 247,434 | | | | 52,234 | | |

Effect of the treatment of the following | | | | | | | | | | | | | |

items under U.S. GAAP: | | | | | | | | | | | | | |

Goodwill amortization (see k below) | | | 146 | | | | 2,578 | | | | 544 | | |

Goodwill amount with respect to a subsidiary (see w below) | | | | | | | (504 | ) | | | (106 | ) | |

Derivative instruments and embedded | | | | | | | | | | | | | |

derivatives (see l below) | | | 224 | | | | | | | | | | |

Issuance of shares and capital notes | | | | | | | | | | | | | |

by a development stage subsidiary (see m below) | | | 10,217 | | | | 10,625 | | | | 2,243 | | |

Inclusion of a proportionately, | | | | | | | | | | | | | |

consolidated company’s data (see n below) | | | (985 | ) | | | (66 | ) | | | (14 | ) | |

Litigation settlement with YES (see p below) | | | (2,648 | ) | | | (1,189 | ) | | | (251 | ) | |

Goodwill translation of consolidated companies | | | | | | | | | | | | | |

(see o below) | | | | | | | 1,494 | | | | 315 | | |

Potential dilution in the Company’s | | | | | | | | | | | | | |

shareholding in associated | | | | | | | | | | | | | |

companies as a result of convertible | | | | | | | | | | | | | |

securities issued by them (see q below) | | | 125 | | | | | | | | | | |

Investment in an associated company (see w below)* | | | (504 | ) | | | | | | | | | |

Tax effect on the above U.S. GAAP adjustments | | | (2,568 | ) | | | (3,012 | ) | | | (636 | ) | |

Income tax with respect to investments | | | | | | | | | | | | | |

in associated and proportionately | | | | | | | | | | | | | |

consolidated companies (see s1 below) | | | (2,317 | ) | | | (1,886 | ) | | | (398 | ) | |

Tax effect related to employee and non-employee stock | | | | | | | | | | | | | |

based awards (see s2 below) | | | 14,003 | | | | 14,512 | | | | 3,063 | | |

Company’s share in Israeli - U.S. | | | | | | | | | | | | | |

GAAP differences relating | | | | | | | | | | | | | |

to associated companies (see t below) | | | (1,445 | ) | | | (1,836 | ) | | | (387 | ) | |

| |

|

| | | |

| | | |

| | |

Shareholders’ equity under U.S. GAAP | | | *234,108 | | | | 268,151 | | | | 56,607 | | |

| |

|

| | | |

| | | |

| | |

* Adjusted retroactively (see-w below).

F-82

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| c. | Proportionate consolidation |

| | |

| | Under Israeli GAAP, joint ventures and jointly controlled companies are accounted for using the proportionate consolidation method. Under U.S. GAAP, investments in joint ventures and in jointly controlled companies are accounted for by the equity method. Proportionate consolidation, however, is permitted by the reconciliation requirements of item 18 to Form 20-F, provided that the joint ventures or the jointly controlled companies are operating entities, the significant financial and operating policies of which are, by contractual agreement, jointly controlled by all parties having an equity interest in these entities, and provided that summarized financial data are given. These data are presented in note 2d. |

| | |

| d. | Earnings per share (EPS) |

| | |

| | Israeli GAAP relating to computation of EPS are described in note 1p. |

| | |

| | As applicable to the Company, the main difference between Israeli GAAP and U.S. GAAP methods of EPS computation is that the Company’s restricted non-vested contingent returnable shares taken into account in the computation of basic EPS in Israel, whereas in the United States, in computing basic EPS, only the weighted average number of Company’s unrestricted shares actually outstanding in the reported year is taken into account, and restricted shares are included in the computation of diluted EPS. Another difference is that under U.S. GAAP separate presentation of basic and diluted EPS is required as long as they are not identical, while, under Israeli GAAP, such separate presentation is only required if the difference between basic and diluted EPS is in excess of 5%. |

| | |

| e. | Reporting comprehensive income |

| | |

| | U.S. GAAP require reporting and display of comprehensive income and its components in a full set of general purpose financial statements. The purpose of reporting comprehensive income is to report a measure of all changes in equity of an enterprise during a period from transactions and other events from non-owner sources (i.e. all changes in equity except those resulting from investments by owners and distributions to owners). With respect to the Company, in addition to net income, other comprehensive income represents gain on issuance of shares and capital notes by a development stage subsidiary gain on issuance of shares by an associated company and differences from translation of foreign currency financial statements of subsidiaries and a proportionately consolidated company (see also l, n and o below). Israeli GAAP does not contain such a requirement. |

F-83

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| f. | Segment reporting |

| | |

| | Under Israeli GAAP, as noted in note 18, the Company reports segment information based on its “business segments”. Business segment is defined as a distinguishable component of an enterprise that is engaged in providing an individual product or service or group of related products and services and that is subject to risks and returns that are different from those of other business segments. Accordingly, and as presented in the Company’s Israeli GAAP financial statements, the Company’s business segments, as of 2002, are based on eight business activities which are comprised of its six operating divisions, plus the separation of its technology division into three business segments: technology, marketing and recycling of food products the building for lease. |

| | |

| | According to U.S. GAAP, under FAS 131, segment reporting is based on “Operating Segments”. Operating segment is defined as a component of an enterprise that engages in business activities from which it may earn revenues and incur expenses, has its operating results regularly reviewed by the enterprise’s chief operating decision maker, and for which discrete financial information is available. This concept, the “management approach”, corresponds with the Company’s internal reporting. Accordingly, under FAS 131, the Company’s operating segment for 2002 are based only on its six operating divisions (hence, the technology, the marketing and recycling of food products are, and building for lease considered as one operating segment). |

| | |

| g. | Income statement presentation |

| | |

| | Under Israeli GAAP, the Company included capital gains on sale of fixed assets aggregating adjusted NIS 80,000, adjusted NIS 80,000 and adjusted NIS 1,657,000 for the years ended December 31, 2000, 2001 and 2002, respectively, under “other income (expenses) - net”, in the consolidated income statements for these years. |

| | |

| | Under U.S. GAAP, such expenses are included in “operating income”. |

| | |

| | Consequently, the operating income under U.S. GAAP would be as follows: |

| | | | Year ended December 31 | |

| | | |

| |

| | | | 2000 | | 2001 | | 2002 | |

| | | |

| |

| |

| |

| | | | Adjusted NIS in thousands | |

| | | |

| |

| | Operating income, as reported | | | | | | | | | | | | | |

| | Under Israeli GAAP | | | 84,481 | | | | 108,267 | | | | 55,666 | | |

| | Effect of reclassification of capital gains | | | | | | | | | | | | | |

| | under U.S. GAAP | | | 80 | | | | 80 | | | | 1,657 | | |

| | | | |

| | | |

| | | |

| | |

| | Operating income under U.S. GAAP | | | 84,561 | | | | 108,347 | | | | 57,323 | | |

| | | | |

| | | |

| | | |

| | |

F-84

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

| h. | Statements of cash flows |

| | | | |

| | 1. | Under Israeli GAAP, cash flows relating to investments in, and proceeds from the sale of marketable securities classified as trading securities, are classified as investing activities in the statements of cash flows, while under U.S. GAAP, these items should be classified as operating activities. Consequently, the operating activities and investing activities under U.S. GAAP would be as follows: |

| | | | | Year ended December 31 | | |

| | | | |

| | |

| | | | | 2000 | | 2001 | | 2002 | | |

| | | | |

| |

| |

| | |

| | | | | Adjusted NIS | | |

| | | | |

| | |

| | | | | In thousands | | |

| | | | |

| | |

| | | Net cash provided by (used in) | | | | | | | | | | | | | | |

| | | operating activities | | | 65,338 | | | | 155,181 | | | | (239,917 | ) | | |

| | | | | |

| | | |

| | | |

| | | |

| | | Net cash used in investing activities | | | (24,732 | ) | | | (34,992 | ) | | | (29,116 | ) | | |

| | | | | |

| | | |

| | | |

| | | |

F-85

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | | |

| | 2. | The company presents its cash flow information, under Israeli GAAP, exclusive of the effects of inflation. |

| | | |

| | | The information to be included under US GAAP, as described above, for the years ended December 31, 2000, 2001 and 2002 is presented below: |

| | 2000 | | 2001 | | 2002 | |

| |

| |

| |

| |

| | Adjusted NIS | |

| |

| |

| | (In thousands) | |

| |

| |

Net cash provided by (used in) operating activities | | | 62,545 | | | | 196,996 | | | | (118,991 | ) | |

Net cash used in investing activities | | | (21,939 | ) | | | (35,387 | ) | | | (114,562 | ) | |

Net cash provided by (used in) financing activities | | | (24,541 | ) | | | 2,546 | | | | 138,351 | | |

Effect of inflation on cash and cash equivalent | | | | | | | (41,420 | ) | | | (34,623 | ) | |

| | |

| | | |

| | | |

| | |

Translation differences on cash balances of | | | | | | | | | | | | | |

Subsidiaries operating independently | | | | | | | (10 | ) | | | 100 | | |

Increase (decrease) in cash and cash equivalents | | | 16,065 | | | | 122,725 | | | | (130,781 | ) | |

| | | | | | | | | | | | | |

Balance of cash and cash equivalents at beginning | | | | | | | | | | | | | |

Of year | | | 83,999 | | | | 100,064 | | | | 222,789 | | |

| | |

| | | |

| | | |

| | |

Balance of cash and cash equivalents at end of year | | | 100,064 | | | | 222,789 | | | | 92,008 | | |

| | |

| | | |

| | | |

| | |

| | | | | | | | | | | | | | |

| i. | Liability for employee rights upon retirement, net of amount funded |

| | |

| | Under Israeli GAAP, amounts funded with severance pay funds and managerial insurance policies are deducted from the related severance pay liability. In addition, under Israeli GAAP, the income from such funds is offset against severance pay expenses. |

| | |

| | Under U.S. GAAP, the amounts funded as above should be presented as a long-term investment included among the Company’s assets. Also, under U.S. GAAP income from severance pay funds and severance pay expenses are presented at their gross amounts (see also note 10d-f). |

F-86

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| j. | Restricted shares granted to employees and non-employees of the Group: |

| | | |

| | 1) | Restricted shares granted to the Group employees |

| | | |

| | | Under Israeli GAAP, the Company has not recognized any compensation charge for its employee restricted share awards. |

| | | |

| | | Under U.S. GAAP, as permitted by FAS 123 “Accounting for Stock Based Compensation”, as amended by FAS 148, the Company accounts for the awards using the accounting treatment prescribed by Accounting Principle Board Opinion No. 25-”Accounting for Stock Issued to Employees” (APB 25), i.e. using the intrinsic-value-based method of accounting. The restricted shares value was determined based on the market price of the Company shares on the date of grant, and was recorded as unearned compensation, which is being amortized ratably over the applicable restricted share vesting period. |

| | | |

| | | In addition, under Israeli GAAP, dividends paid with respect to such restricted shares are credited to retained earnings (i.e. identical to the treatment of dividends with respect to ordinary shares), while under U.S. GAAP, such dividends are charged to income as part of the compensation expenses relating to the awards. |

| | | |

| | | Compensation expenses relating to such awards granted to employees for the year ended 2000, 2001 and 2002 were approximately adjusted NIS 8,274,000, adjusted NIS 11,403,000 and adjusted NIS 8,883,000, respectively. Since the Company’s awards are in a form of restricted shares, compensation expenses calculated under the intrinsic value method are also reflecting compensation expenses using the fair value method. Accordingly, no pro forma information, as prescribed by FAS 123, has been given in these financial statements. |

F-87

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | | |

| | 2) | Restricted shares granted to non-employees |

| | | |

| | | Under Israeli GAAP, the Company has not recognized any compensation charge for restricted shares granted to non-employees. |

| | | |

| | | Under U.S. GAAP, the Company is required to measure compensation expense with respect to such awards granted to non-employees based on the fair value model, under the provisions of FAS 123 and EITF 96-18 (“Accounting for Equity Instruments that are Issued to Other than Employees for Acquiring, or in Conjunction with Selling, Goods or Services”). |

| | | |

| | | In addition, under Israeli GAAP, dividends paid with respect to such restricted shares are credited to retained earnings (i.e. identical to the treatment of dividends with respect to ordinary shares), which under U.S. GAAP, such dividends are charged to income as part of the compensation expenses relating to the awards. |

| | | |

| | | Compensation expenses relating to such awards granted to non-employees were adjusted NIS 7,882,000, which relate to related parties, adjusted NIS 2,996,000 (including 2,948,000) which relate to related parties, and adjusted NIS 35,000 for the years ended December 31, 2000, 2001 and 2002, respectively. |

| | | |

| | k. | Goodwill and other intangible assets |

| | | |

| | | Under Israeli GAAP, goodwill arising from business combinations accounted for by the purchase method, is generally amortized in equal annual installment over a period of 10 years. |

| | | |

| | | Under U.S. GAAP, the Company adopted FAS 141 (“Business Combinations”) and FAS 142 (“Goodwill and Other Intangible Assets”) for business combinations initiated after June 30, 2001 and as of January 1, 2002 for goodwill and other intangible assets for business combinations initiated previously. |

| | | |

| | | Among the most significant changes made by FAS 142, as applicable to the Company: goodwill (resulting from acquisition of subsidiaries and associated companies) is no longer to be amortized and is to be tested for impairment at least annually. |

| | | |

| | | Prior to January 1, 2002 (except with respect to business combinations initiated after June 30, 2001) goodwill was amortized on a straight-line basis over a period of 10 years. |

| | | |

| | | The Company identified its various reporting units which consist of its operating segments (see also f above). The Company has utilized expected future discounted cash flows to determine the fair value of the reporting units and whether any impairment of goodwill existed as of the date of adoption. |

F-88

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | |

| | | As a result of the transitional impairment test, the Company does not have to record a cumulative effect of accounting change for the estimated impairment of goodwill. The Company has selected December 31 of each year as the date on which it will perform its annual goodwill impairment test. No impairment resulted from the annual review performed in 2002. |

| | | |

| | | Hereafter additional disclosures required by FAS 142, under U.S. GAAP: |

| | | |

| | | a. | The changes in the carrying value of goodwill for the year ended December 31, 2002, are as follows: |

| | | | | | Communications

segment | | Technology

segment | | Total | |

| | | | | |

| |

| |

| |

| | | | | | Adjusted NIS, in thousands | |

| | | | | |

| |

| | | | Balance as of January 1, 2002 | | | 5,272 | | | | | | | | 5,272 | | |

| | | | Additional amount paid, | | | | | | | | | | | | | |

| | | | carried to goodwill (see | | | | | | | | | | | | | |

| | | | note 2b(2)) 2a(1), 2a2 | | | 93,835 | | | | 2,220 | | | | 96,055 | | |

| | | | Differences from translation of | | | | | | | | | | | | | |

| | | | foreign currency financial | | | | | | | | | | | | | |

| | | | statements of subsidiaries | | | | | | | | | | | | | |

| | | | (see also o below) | | | 1,494 | | | | | | | | 1,494 | | |

| | | | | | |

| | | |

| | | |

| | |

| | | | Balance as of December 31, 2002 | | | 100,601 | | | | 2,220 | | | | 102,821 | | |

| | | | | | |

| | | |

| | | |

| | |

| | | b. | The following table illustrates the Company’s adjusted results, under U.S. GAAP, adjusted to eliminate the effect of goodwill amortization expense, including goodwill with respect to an associated company accounted for by the equity method: |

| | | | | | Year ended December 31 | |

| | | | | |

| |

| | | | | | 2000 | | 2001 | | 2002 | |

| | | | | |

| |

| |

| |

| | | | | | Adjusted NIS, in thousands | |

| | | | | |

| |

| | | | Net income - under U.S. GAAP | | | 53,602 | | | | 52,704 | | | | 21,762 | | |

| | | | Add back: | | | | | | | | | | | | | |

| | | | Goodwill amortization | | | 21 | | | | 67 | | | | | | |

| | | | Goodwill amortization | | | | | | | | | | | | | |

| | | | included in share of profits | | | | | | | | | | | | | |

| | | | of associated company | | | 589 | | | | 380 | | | | | | |

| | | | | | |

| | | |

| | | |

| | |

| | | | Net income under U.S. GAAP as | | | | | | | | | | | | | |

| | | | adjusted | | | 54,212 | | | | 53,151 | | | | 21,762 | | |

| | | | | | |

| | | |

| | | |

| | |

F-89

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | Year ended December 31 | |

| | |

| |

| | | 2000 | | 2001 | | 2002 | |

| | |

| |

| |

| |

| | | Adjusted NIS, in thousands | |

| | |

| |

| Earnings per share - under U.S. GAAP: | | | | | | | | | | | | | |

| Basic - as reported | | | 7.73 | | | | 7.53 | | | | 3.00 | | |

| Add back: | | | | | | | | | | | | | |

| Goodwill amortization | | | * | | | | 0.01 | | | | | | |

| Goodwill amortization included in | | | | | | | | | | | | | |

| share of profits of associated | | | | | | | | | | | | | |

| company | | | 0.08 | | | | 0.05 | | | | | | |

| | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | |

| Basic - adjusted | | | 7.81 | | | | 7.61 | | | | 3.00 | | |

| | | |

| | | |

| | | |

| | |

| Diluted - as reported | | | 7.31 | | | | 6.97 | | | | 2.82 | | |

| Add back: | | | | | | | | | | | | | |

| Goodwill amortization | | | * | | | | 0.01 | | | | | | |

| Goodwill amortization included in | | | | | | | | | | | | | |

| share of profits of associated | | | | | | | | | | | | | |

| company | | | 0.08 | | | | 0.05 | | | | | | |

| | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | |

| Diluted - adjusted | | | 7.41 | | | | 7.03 | | | | 2.82 | | |

| | | |

| | | |

| | | |

| | |

* less then 0.01.

| | | c. | Estimated amortization expenses of other intangible assets (see also note 7), for the years following December 31, 2002, are as follows: |

| | Adjusted NIS | |

| |

| |

| | In thousands | |

| |

| |

Year ended December 31: | | | | | |

2003 | | | 2,545 | | |

2004 | | | 2,545 | | |

2005 | | | 1,027 | | |

| l. | Derivative instruments and embedded derivatives |

| | |

| | Under U.S. GAAP, as of January 1, 2002, the Group applied FAS 133 “Accounting for Derivative Instruments and Hedging Activities”, as amended by FAS 137 and FAS 138. Under the provisions of FAS 133, the Group’s derivative instruments do not qualify for hedge accounting. |

| | |

| | In addition, under U.S. GAAP, certain contracts contain embedded derivatives instruments. Such embedded derivatives are separated under U.S. GAAP from the host contracts and accounted for as derivative instruments pursuant to FAS 133. Israeli GAAP does not contain such separation and measurement requirements. At December 31, 2002, the Company does not have any embedded derivates outstanding. |

F-90

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | | |

| m. | Issuance of shares and capital notes by a development stage subsidiary (Mobipower - - formerly TPS) |

| | |

| | Mobipower is mainly financed by funds from all of its shareholders, through capital notes. These capital notes are linked to the Israeli CPI and bear 4% annual interest. No repayment date exists with respect to such notes. Under the terms of the agreement of the capital notes any repayment of amounts related to the capital note arrangements, including adjustments for CPI and interest, requires a majority shareholder vote and is required to be paid pro rata in proportion to the existing shareholders’ common stock interests at time of repayment. Accordingly, repayment of the capital notes and any interest is at the sole discretion of Baran, the majority owner. |

| | |

| | Under Israeli GAAP, total proceeds from such issuance were allocated to the shares issued based on the par value, while the balance was allocated to the capital notes. Interest expense was recorded with respect to such notes. Under U.S. GAAP, due to the capital notes terms and conditions, as described above, the total proceeds from the issuance of shares and capital notes are reflected as minority interests in Baran Group’s consolidated financial statements. Accordingly, interest expenses and credits to minority interest recorded under Israeli GAAP must be reversed for U.S. GAAP purposes. |

| | |

| | In addition, under Israeli GAAP, an investor gain resulting from share issuance made by a development stage investee, is deferred and recognized in income over a period of 3 years or in an amount equal to the investor’s share in the investee losses, based on the higher amount, on a cumulative basis. Under U.S. GAAP, according to Staff Accounting Bulletin (SAB) Topic 5H, the entire gain is credited in Baran Group consolidated financial statements directly to capital surplus at the said transaction date. |

F-91

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| | Based on the above, hereunder is a table which summarizes the effects of Mobipower’s transactions relating to the issuance of shares and capital notes in 2000 as described in note 2f and note 9 on the Company’s consolidated financial statements under Israeli GAAP and U.S. GAAP: |

| | | | | Year ended December 31 | |

| | | | |

| |

| | | | | 2000 | | 2001 | | 2002 | |

| | | | |

| |

| |

| |

| | | | | Adjusted NIS | |

| | | | |

| |

| | | | | In thousands | |

| | | | |

| |

| | | Income statement data: | | | | | | | | | | | | | |

| | | As reported under Israeli GAAP: | | | | | | | | | | | | | |

| | | Financial income (expenses), net | | | 6,023 | | | | 7,965 | | | | (17,454 | ) | |

| | | | | |

| | | |

| | | |

| | |

| | | Other income (expenses), net | | | 7,302 | | | | (4,023 | ) | | | 1,056 | | |

| | | | | |

| | | |

| | | |

| | |

| | | Taxes on income | | | 29,338 | | | | 45,351 | | | | 17,279 | | |

| | | | | |

| | | |

| | | |

| | |

| | | Minority interests in losses of | | | | | | | | | | | | | |

| | | subsidiaries, net | | | 1,971 | | | | 585 | | | | 2,183 | | |

| | | | | |

| | | |

| | | |

| | |

| | | Under U.S. GAAP: | | | | | | | | | | | | | |

| | | Financial income (expenses), net | | | 6,491 | | | | 8,684 | | | | (16,707 | ) | |

| | | | | |

| | | |

| | | |

| | |

| | | Other income (expenses), net | | | 6,633 | | | | (4,023 | ) | | | 1,056 | | |

| | | | | |

| | | |

| | | |

| | |

| | | Taxes on income | | | 29,098 | | | | 45,351 | | | | 17,279 | | |

| | | | | |

| | | |

| | | |

| | |

| | | Minority interests in losses of | | | | | | | | | | | | | |

| | | subsidiaries, net | | | 1,764 | | | | 269 | | | | 1,844 | | |

| | | | | |

| | | |

| | | |

| | |

| | | Difference between Israeli and U.S. GAAP: | | | | | | | | | | | | | |

| | | Increase in financial income, net from | | | | | | | | | | | | | |

| | | reversal of interest expense | | | 467 | | | | 719 | | | | 747 | | |

| | | Reduction in other income (expense) from | | | | | | | | | | | | | |

| | | reversal of SAB 51 gain | | | (669 | ) | | | | | | | | | |

| | | Reduction in minority interest in losses | | | | | | | | | | | | | |

| | | of subsidiaries, net | | | (206 | ) | | | (316 | ) | | | (339 | ) | |

| | | | | |

| | | |

| | | |

| | |

| | | Adjustment “m” reflected in U.S. GAAP | | | | | | | | | | | | | |

| | | reconciliation | | | (408 | ) | | | 403 | | | | 408 | | |

| | | | | |

| | | |

| | | |

| | |

F-92

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | | | Year ended December 31 | |

| | | | |

| |

| | | | | 2001 | | 2002 | |

| | | | |

| |

| |

| | | | | Adjusted NIS | |

| | | | |

| |

| | | | | In thousands | |

| | | | |

| |

| | | Balance sheet data: | | | | | | | | | |

| | | As reported under Israeli GAAP: | | | | | | | | | |

| | | Capital notes issued to minority | | | | | | | | | |

| | | shareholders of a subsidiary | | | 18,690 | | | | 19,436 | | |

| | | Minority’s share in Mobipower’s capital | | | | | | | | | |

| | | deficiency | | | (4,691 | ) | | | (8,278 | ) | |

| | | | | |

| | | |

| | |

| | | Capital notes issued to minority | | | | | | | | | |

| | | shareholders of a subsidiary, net | | | 13,999 | | | | 11,158 | | |

| | | | | |

| | | |

| | |

| | | Shareholders’ equity: | | | | | | | | | |

| | | Capital surplus | | | 55,095 | | | | 72,197 | | |

| | | | | |

| | | |

| | |

| | | Retained earnings | | | 154,014 | | | | 165,900 | | |

| | | | | |

| | | |

| | |

| | | Under U.S. GAAP: | | | | | | | | | |

| | | Capital notes issued to minority | | | | | | | | | |

| | | shareholders of a subsidiary | | | - | | | | - | | |

| | | | | |

| | | |

| | |

| | | Minority’s share in Mobipower’s equity | | | | | | | | | |

| | | (capital deficiency) | | | 3,284 | | | | 538 | | |

| | | | | |

| | | |

| | |

| | | Shareholders’ equity: | | | | | | | | | |

| | | Capital surplus | | | 61,638 | | | | 78,741 | | |

| | | | | |

| | | |

| | |

| | | Retained earnings | | | 154,249 | | | | 166,543 | | |

| | | | | |

| | | |

| | |

| | | Difference between Israeli and U.S. GAAP in | | | | | | | | | |

| | | shareholders’ equity: | | | | | | | | | |

| | | Adjustment “m” reflected in U.S. GAAP | | | | | | | | | |

| | | adjustments | | | 10,217 | | | | 10,625 | | |

| | | Included in tax effect of U.S. GAAP | | | | | | | | | |

| | | adjustments | | | (3,438 | ) | | | (3,438 | ) | |

| | | | | |

| | | |

| | |

| | | | | | 6,778 | | | | 7,187 | | |

| | | | | |

| | | |

| | |

F-93

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| n. | Inclusion of data for a proportionately consolidated company (Meissner Baran) |

| | |

| | Under Israeli GAAP, the financial data of Meissner-Baran, included by the proportionate consolidation method in the Company’s consolidated financial statements, is based on Meissner-Baran’s financial statements prepared in adjusted NIS, under the provisions of Opinion No. 36 of the Israeli Institute. |

| | |

| | Under U.S. GAAP, according to the provisions of FAS 52 the functional currency of Meissner-Baran is the U.S. dollar. Accordingly, the financial data of Meissner Baran included in the Company’s consolidated financial statements, for U.S. GAAP purposes, are remeasured from local currency (NIS) into its functional currency (U.S. dollar) using historical exchange rates. |

| | |

| | Following are data pertaining to Meissner Baran, based upon the Company’s percentage of holding, as presented in the Company’s consolidated financial statements and the respective remeasured data under U.S. GAAP: |

| | | | December 31 | |

| | | |

| |

| | | | 2001 | | 2002 | |

| | | |

| |

| |

| | | | Adjusted NIS | |

| | | |

| |

| | | | In thousands | |

| | | |

| |

| | Balance sheet data: | | | | | | | | | |

| | As reported under Israeli GAAP: | | | | | | | | | |

| | Current assets | | | 155,758 | | | | 47,827 | | |

| | Fixed assets, net | | | 2,180 | | | | 989 | | |

| | Deferred income taxes | | | 157 | | | | 142 | | |

| | | | |

| | | |

| | |

| | T o t a l assets | | | 158,095 | | | | 48,958 | | |

| | | | |

| | | |

| | |

| | Current liabilities | | | 142,453 | | | | 38,012 | | |

| | Long-term liabilities | | | 439 | | | | 395 | | |

| | | | |

| | | |

| | |

| | T o t a l liabilities | | | 142,892 | | | | 38,407 | | |

| | | | |

| | | |

| | |

| | Under U.S. GAAP: | | | | | | | | | |

| | Current assets | | | 153,263 | | | | 47,827 | | |

| | Fixed assets, net | | | 2,289 | | | | 923 | | |

| | Deferred income taxes | | | 748 | | | | 914 | | |

| | | | |

| | | |

| | |

| | T o t a l assets | | | 156,300 | | | | 49,664 | | |

| | | | |

| | | |

| | |

| | Current liabilities | | | 141,056 | | | | 38,012 | | |

| | Long-term liabilities | | | 1,026 | | | | 1,167 | | |

| | | | |

| | | |

| | |

| | T o t a l liabilities | | | 142,082 | | | | 39,179 | | |

| | | | |

| | | |

| | |

| | Shareholders’ equity: | | | | | | | | | |

| | Israeli GAAP | | | 15,203 | | | | 10,551 | | |

| | U.S. GAAP | | | 14,218 | | | | 10,485 | | |

| | | | |

| | | |

| | |

| | Adjustment (n) | | | (985 | ) | | | (66 | ) | |

| | | | |

| | | |

| | |

F-94

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | Year ended December 31 | |

| | |

| |

| | | 2000 | | 2001 | | 2002 | |

| | |

| |

| |

| |

| | | Adjusted NIS | |

| | |

| |

| | | In thousands | |

| | |

| |

| Statement of income data: | | | | | | | | | | | | | |

| As reported under Israeli GAAP: | | | | | | | | | | | | | |

| Total revenues | | | 89,943 | | | | 288,570 | | | | 116,357 | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | | | 11,687 | | | | 39,794 | | | | 15,032 | | |

| | | |

| | | |

| | | |

| | |

| Income before taxes on income | | | 9,323 | | | | 37,042 | | | | 11,513 | | |

| | | |

| | | |

| | | |

| | |

| Net income | | | 5,906 | | | | 23,484 | | | | 9,552 | | |

| | | |

| | | |

| | | |

| | |

| Under U.S. GAAP: | | | | | | | | | | | | | |

| Total revenues | | | 90,515 | | | | 279,968 | | | | 119,747 | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | | | 11,687 | | | | 41,158 | | | | 17,308 | | |

| | | |

| | | |

| | | |

| | |

| Income before taxes on income | | | 9,373 | | | | 35,315 | | | | 12,587 | | |

| | | |

| | | |

| | | |

| | |

| Net income | | | 5,927 | | | | 21,742 | | | | 10,664 | | |

| | | |

| | | |

| | | |

| | |

| Difference between Israeli and | | | | | | | | | | | | | |

| U.S. GAAP | | | 21 | | | | (1,742 | ) | | | 1,112 | | |

| | | |

| | | |

| | | |

| | |

| Adjustment “n” reflected in | | | | | | | | | | | | | |

| U.S. GAAP reconciliation | | | 21 | | | | (1,742 | ) | | | 1,112 | | |

| | | |

| | | |

| | | |

| | |

| o. | Translation of subsidiaries financial statements |

| | |

| | Under Israeli GAAP, balance sheet and income statement items, of investee companies whose functional currency is other than NIS, are translated by using the exchange rate at balance sheet date. Under U.S. GAAP, balance sheet items are translated using the exchange rate at balance sheet date, while income statement items are translated using the exchange rate at the dates on which these elements are recognized or the weighted average exchange rate for the period. |

| | |

| | Goodwill allocated to investee companies whose functional currency is other than NIS is translated, under Israeli GAAP, by using the exchange rate at acquisition date, while under U.S. GAAP, goodwill is translated using the exchange rate at each balance sheet date. |

F-95

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| p. | Litigation settlement with D.B.S. Satellite Services (1988) Ltd. (“YES”) (see also note 11(a)(1)) |

| | |

| | As the result of a court settlement in February 2002, it was agreed between the Company and YES that YES would be required to pay the Company an amount of adjusted NIS 59,105,000, in installments through 2004, which was equal to the original amount of accounts receivable recorded by the Company in the normal course of business, which previously was due immediately. Such amounts have repayment terms in March 2002, 2003 and 2004 and are included adjusted for inflation.

Under Israeli GAAP, above long-term accounts receivable are recorded at the original amount (on an undiscounted basis). |

| | |

| | Under U.S. GAAP, in light of the above litigation settlement, the Company adjusted its December 31, 2002 accounts receivable recorded in the normal course of business, to its estimated fair value in accordance with APB 21, using a discount rate of 4%, resulting in recognition of a discount to the original accounts receivable of NIS 2,648,000 and an expense in the same amount. The Company recognizes this discount in income over the repayment period (through December 31, 2004). The resulting income recorded during the year 2002 was adjusted NIS 1,459,000. |

| | |

| q. | Potential dilution in the Company’s shareholding in associated companies as a result of convertible securities issued by them |

| | |

| | According to Israeli GAAP, under the provisions of Opinion 48 of the Israeli Institute, an investor company is required to create a provision for losses, which it may incur from the dilution of its holding in associated companies, when the likelihood of the exercise of the exercisable securities is probable. Under U.S. GAAP, such loss is recognized on the exercise date. |

| | |

| r. | Change in Company’s ownership in A.L.D., resulting from additional equity raised by A.L.D. and subsequent repurchase of A.L.D. shares made by the Company |

| | |

| | Under Israeli GAAP, the Company accounts for the decrease in its share holding in an investee and the subsequent purchases of its shares, within one year, as separate transactions. Accordingly, under Israeli GAAP, as described in note 2c, the Company recognized in 2000 a capital gain in an amount of adjusted NIS 6,150,000, resulting from the decrease in its share holding in A.L.D., and the related tax effect, in an amount of adjusted NIS 2,214,000. |

| | |

| | According to the U.S. Securities and Exchange Commission (“SEC”), Staff Accounting Bulletin (SAB) Topic 5H gain recognition is not appropriate in situations where subsequent capital transactions are contemplated that raise concerns about the likelihood of the registrant realizing that gain, such as, where reacquisition of shares is contemplated at the time of issuance. Under SAB Topic 5H, repurchases of shares within one year of issuance will be presumed by the SEC staff to have been contemplated at the date of issuance. Accordingly, under U.S. GAAP, the Company accounted for its net decrease in A.L.D.’s shareholding as an equity transaction and recognized adjusted NIS 3,936,000 (net of the related tax effect in an amount of adjusted NIS 2,214,000), as an addition to capital surplus in its shareholders’ equity. |

F-96

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| s. | Income taxes: |

| | | |

| | 1) | Taxes with respect to investments in associated and proportionately consolidated companies |

| | | | |

| | | As noted in note 1j(2), according to Israeli GAAP, taxes which would apply in the event of disposal of investments in the above mentioned companies have not been provided for, as it is the Company’s policy to hold these investments, not to realize them. Under U.S. GAAP, there is no such an exemption for domestic equity investees’, and the Company needs to provide for deferred taxes with respect to the differences between the amounts of the investments in these companies presented in the financial statements and those taken into account for tax purposes. |

| | | |

| | 2) | Tax benefit related to employee and non-employee stock based awards. |

| | | |

| | | Under Israeli GAAP, the tax benefit resulting from the employee and non-employee sale of restricted stock is recognized in the statement of income as a reduction of income tax expense. Under U.S. GAAP, the Company recognized deferred tax assets and the related tax benefit for the recorded compensation cost that ordinarily results in a future tax deduction. Any aditional benefit actually realized is credited directly to capital surplus. |

| | | As of December 31,2001 and 2002, deferred tax assets recorded in the amount of adjusted NIS 14,003,000 and adjusted NIS 14,512,000, respectively, exist with respect to this U.S.GAAP difference. |

| | |

| t. | Company’s share in Israeli - U.S. GAAP differences relating to associated companies |

| | |

| | Following is a reconciliation of the Company’s share in profits of its associated companies as reported under Israeli GAAP, to its share in such profits under U.S. GAAP: |

| | | Year ended December 31 | |

| | |

| |

| | | 2000 | | 2001 | | 2002 | |

| | |

| |

| |

| |

| | | Adjusted NIS | |

| | |

| |

| | | In thousands | |

| | |

| |

| Share in profits of associated | | | | | | | | | | | | | |

| companies, net, as reported under | | | | | | | | | | | | | |

| Israeli GAAP | | | 6,491 | | | | 1,208 | | | | 1,060 | | |

| Effect of the treatment of the | | | | | | | | | | | | | |

| following items under U.S. GAAP: | | | | | | | | | | | | | |

| Employee stock based awards | | | (484 | ) | | | (397 | ) | | | (587 | ) | |

| Issuance of shares by a | | | | | | | | | | | | | |

| development stage subsidiary | | | (26 | ) | | | (89 | ) | | | (100 | ) | |

| Goodwill amortization | | | | | | | | | | | 130 | | |

| Tax effect in respect of Israeli - | | | | | | | | | | | | | |

| U.S. GAAP differences | | | 114 | | | | 122 | | | | 105 | | |

| Other | | | | | | | (179 | ) | | | 61 | | |

| | | |

| | | |

| | | |

| | |

| Share in profits of associated | | | | | | | | | | | | | |

| companies, net, under U.S. GAAP | | | 6,095 | | | | 665 | | | | 669 | | |

| | | |

| | | |

| | | |

| | |

F-97

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| u. | Recognition of profits on building contractual work |

| | |

| | Under Israeli GAAP, profits from contractual work involving the construction of buildings is recognized by the percentage of completion method if the state of completion has reached at least 25% and certain other conditions are met. |

| | |

| | Under U.S. GAAP, a completion rate of 25% is not required in order to commence recognition of such profits, although it is necessary to have the ability to make reliable estimates regarding the stage of completion revenues and costs. |

| | |

| | No quantifiable U.S. GAAP difference exists as of and for the years ended December 31, 2000, 2001 and 2002 related to this potential U.S. GAAP difference. |

F-98

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| v. | Investment in subsidiary of an acquired company designated for sale |

| | |

| | As stated in note 2a(1), as of the acquisition date of o2 - November 14, 2002 - a subsidiary of o2 was designated as held for sale. |

| | |

| | Under Israeli GAAP, consolidation of a temporarily controlled subsidiary is prohibited. Therefore, the consolidated financial statements do not include the assets and liabilities or the results of operations of the acquired subsidiary held for sale. Rather, this subsidiary is presented in the balance sheet at its fair value, less cost to sale, in one line item “investment in subsidiary designated for sale”, among accounts receivable. |

| | |

| | Under U.S. GAAP, according to the provisions of FAS 144 (“Accounting for the Impairment or Disposal of Long-Lived Assets”) a newly acquired subsidiary to be disposed of by sale, shall be established based on its fair value less cost to sale at the acquisition date (as under Israeli GAAP); nevertheless, under US GAAP, such subsidiary needs to be consolidated in the consolidated financial statements. The assets and liabilities of the subsidiary to be disposed of shall be presented separately in the asset and liability sections, respectively, in the consolidated balance sheet. Following are the major classes of assets and liabilities of the said subsidiary, classified as held for sale: |

| | Adjusted NIS

in thousands | |

| |

| |

Assets: | | | | | |

Current assets | | | 12,545 | | |

| | |

| | |

| | | | | |

Current liabilities | | | 7,992 | | |

| | |

| | |

| | | | | |

Net amount as presented in the balance | | | | | |

sheet under Israeli GAAP | | | 4,553 | | |

| | |

| | |

F-99

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | |

| w. | Change from the cost method of accounting to the consolidation method |

| | In November 2000 the Company invested in Mobipower B.V. adjusted NIS 504,000 in shares, representing 10 % of Mobipower B.V.’s outstanding shares. Through October 31, 2002, the Company accounted for this investment under the cost method. Commencing October 2002, as a result of the acquisition of a further 90% of the share capital of Mobipower B.V., in consideration of adjusted NIS 2,220,000 in cash and adjusted NIS 504,000 in loans, the Company changed its method of accounting for this investment from the cost method to the consolidation method. |

| | Under U.S. GAAP, a change from the cost method to the consolidation method requires adjustment of the financial statement retroactively in order to apply the equity method to the prior cost basis investment (i.e. the 10% share investment) while under Israeli GAAP such adjustment is not accepted. |

| | As of October 31, 2002, prior to the additional acquisition, after retroactive application of the equity method, the balance as December 2002 of the 10% investment in Mobipower B.V. stands at zero. Under Israeli GAAP the balance of the investment representing its cost basis amounting adjusted NIS 504,000. In addition under U.S. GAAP the balance of the goodwill at December 31, 2002 with respect to Mobipower is adjusted NIS 2,220,000, while under Israeli GAAP is adjusted NIS 2,679,000. |

| | |

| | The U.S. GAAP consolidated financial statements for the years 2001 and 2000 have been adjusted retroactively to reflect the adoption of the equity method. |

| | The effect of such adjustments on the consolidated financial statements, under U.S. GAAP, is as follows: |

| | | As

previously

reported | | Effect of

restatement | | As reported

in these

financial

statements | |

| | |

| |

| |

| |

| | | Adjusted NIS in thousands | |

| | |

| |

| 1) The effect on the balance sheet at | | | | | | | | | | | | | |

| December 31, 2001 under U.S. GAAP: | | | | | | | | | | | | | |

| Investments in associated companies | | | 25,901 | | | | - | | | | 25,901 | | |

| | | |

| | | |

| | | |

| | |

| Other investments, loans and a long-term | | | 41,723 | | | | (504 | ) | | | 41,219 | | |

| | | |

| | | |

| | | |

| | |

| receivable Shareholders’ equity | | | 234,612 | | | | (504 | ) | | | 234,108 | | |

| | | |

| | | |

| | | |

| | |

| 2) The effect on the statements of operations | | | | | | | | | | | | | |

| in the year ended December 31, 2001: | | | | | | | | | | | | | |

| Share in gains of associated companies | | | 665 | | | | (271 | ) | | | 394 | | |

| | | |

| | | |

| | | |

| | |

| Net income | | | 52,975 | | | | (271 | ) | | | 52,704 | | |

| | | |

| | | |

| | | |

| | |

| EPS: | | | | | | | | | | | | | |

| Basic | | | 7.58 | | | | (0.04 | ) | | | 7.53 | | |

| | | |

| | | |

| | | |

| | |

| Diluted | | | 7.01 | | | | (0.04 | ) | | | 6.97 | | |

| | | |

| | | |

| | | |

| | |

| 3) The effect on the statements of income | | | | | | | | | | | | | |

| in the year ended December 31, 2000: | | | | | | | | | | | | | |

| Share in gains of associated companies | | | 6,095 | | | | (233 | ) | | | 5,862 | | |

| | | |

| | | |

| | | |

| | |

| Net income | | | 53,835 | | | | (233 | ) | | | 53,602 | | |

| | | |

| | | |

| | | |

| | |

| EPS: | | | | | | | | | | | | | |

| Basic | | | 7.76 | | | | (0.03 | ) | | | 7.73 | | |

| | | |

| | | |

| | | |

| | |

| Diluted | | | 7.34 | | | | (0.03 | ) | | | 7.31 | | |

| | | |

| | | |

| | | |

| | |

F-100

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | | |

| x. | Pro forma financial information: |

| | | |

| | 1) | The following unaudited pro forma data summarizes the results of operations for the period indicated as if the o2 and Mobipower new B.V acquisitions had been completed as of the beginning of the periods presented. The unaudited pro forma data gives effect to actual operating results prior to the November 14, 2002 and October 30, 2002 acquisitions, respectively adjusted to include the pro forma effect of adjustments, including amortization of intangibles, deferred stock compensation costs, and the tax effects of the pro forma adjustments. These pro forma amounts do not purport to be indicative of the results that would have actually been obtained if the acquisition occurred as of the beginning of the periods presented or that may be obaained in the future (in thousands, except per share data): |

| | | Year ended December 31 | |

| | |

| |

| | | 2001 | | 2002 | |

| | |

| |

| |

| | | Adjusted NIS | |

| | |

| |

| | | In thousands | |

| | |

| |

| | | (except per share date) | |

| | |

| |

| | | (unaudited) | |

| | |

| |

| | | | |

| Revenues | | | 1,549,120 | | | | 1,114,141 | | |

| | | |

| | | |

| | |

| Net loss for the year: | | | | | | | | | |

| Net loss from continuing operations | | | (25,286 | ) | | | (140,888 | ) | |

| Net loss from discontinuing operations | | | (1,760 | ) | | | (15,041 | ) | |

| | | |

| | | |

| | |

| Net loss for the year | | | (27,046 | ) | | | (155,929 | ) | |

| | | |

| | | |

| | |

| Loss per share : | | | | | | | | | |

| Continuing operations – basic and diluted | | | (3.39 | ) | | | (18.44 | ) | |

| Discontinuing operations – basic and diluted | | | (0.24 | ) | | | (1.97 | ) | |

| | | |

| | | |

| | |

| Loss per share – basic and diluted | | | (3.63 | ) | | | (20.41 | ) | |

| | | |

| | | |

| | |

| Weighted average numbers of shares issued and | | | | | | | | | |

| Outstanding-net of company’s shares held by | | | | | | | | | |

| Subsidiaries used in computation of basic earning | | | | | | | | | |

| Per share | | | 7,452 | | | | 7,640 | | |

| | | |

| | | |

| | |

F-101

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | | |

| | 2) | The following unaudited pro forma data summarizes the results of operations for the period indicated as if the LEAD and Westmontage acquisitions had been completed as of the beginning of the periods presented. The unaudited pro forma data gives effect to actual operating results prior to the October 1, 2001 and September 30, 2001 acquisitions, adjusted to include the pro forma effect of adjustments, including amortization of intangibles, deferred stock compensation costs, and the tax effects of the pro forma adjustments. These pro forma amounts do not purport to be indicative of the results that would have actually been obtained if the acquisition occurred as of the beginning of the periods presented or that may be obtained in the future (in thousands, except per share data): |

| | | Year ended December 31 | |

| | |

| |

| | | 2000 | | 2001 | |

| | |

| |

| |

| | | Adjusted NIS | |

| | |

| |

| | | (except per share date) | |

| | |

| |

| | | (unaudited) | |

| | |

| |

| | | | |

| Revenues | | | 991,717 | | | | 1,060,557 | | |

| | | |

| | | |

| | |

| Net income for the year | | | 78,445 | | | | 70,427 | | |

| | | |

| | | |

| | |

| Earnings per share – basic | | | 11.31 | | | | 10.07 | | |

| | | |

| | | |

| | |

| Earnings per share – diluted | | | 10.69 | | | | 9.31 | | |

| | | |

| | | |

| | |

| Weighted average numbers of shares issued and | | | | | | | | | |

| outstanding-net of company’s shares held by | | | | | | | | | |

| subsidiaries used in computation of basic earning | | | | | | | | | |

| per share | | | 6,933 | | | | 6,997 | | |

| | | |

| | | |

| | |

| Weighted average numbers of shares used in | | | | | | | | | |

| computation of diluted earning per share | | | 7,341 | | | | 7,565 | | |

| | | |

| | | |

| | |

| y. | Recently issued accounting pronouncement in the United States of America: |

| | | | |

| | | 1) | FAS 143 |

| | | | |

| | | | In July 2001, the FASB issued FAS 143, “Accounting for Asset Retirement Obligations”. FAS 143 prescribes the accounting for retirement obligations associated with tangible long-lived assets, including the timing of liability recognition and initial measurement of the liability. FAS 143 requires that an asset retirement cost should be capitalized as part of the cost of the related long-lived asset and subsequently allocated to expense using a systematic and rational method. FAS 143 is effective for fiscal years beginning after June 15, 2002 (January 1, 2003 for the Company). The Company does not believe that the adoption of FAS 143 will have any material effect on its consolidated financial statements. |

F-102

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | | |

| | 2) | FAS 145 |

| | | |

| | | In May 2002, the FASB issued FAS 145, “Revision of FAS Nos. 4, 44 and 64, Amendment of FAS 13 and Technical Corrections as of April 2002”. FAS 145 is effective for fiscal periods beginning after May 15, 2002 (as applicable to the Company, January 1, 2003). The Company does not believe that the adoption of FAS 145 will have any material effect on its consolidated financial statements. |

| | | |

| | 3) | FAS 146 |

| | | |

| | | In June 2002, the FASB issued SFAS No. 146 “Accounting for Costs Associated with Exit or Disposal Activities” (“FAS 146”). FAS 146 addresses financial accounting and reporting for costs associated with exit or disposal activities and nullifies EITF 94-3 “Liability Recognition for Certain Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in a Restructuring)”. FAS 146 required that a liability for a cost associated with an exit or disposal activity to be recognized when the liability is incurred. Under EITF 94-3, a liability for an exit cost as generally defined in EITF 94-3 was recognized at the date of the commitment to an exit plan. FAS 146 states that a commitment to a plan, by itself, does not create an obligation that meets the definition of a liability. Therefore, FAS 146 eliminates the definition and requirements for recognition of exit costs in EITF 94-3. It also establishes that fair value is the objective for initial measurement of the liability. FAS 146 is to be applied prospectively to exit or disposal activities initiated after December 31, 2002. |

| | | |

| | | The Company does not expect the adoption of FAS 146 to have a material effect on its consolidated financial statements. |

| | | |

| | 4) | FAS 148 |

| | | |

| | | In December 2002, the FASB issued FAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure – an Amendment of FASB Statement No. 123”. FAS 148 amends FAS 123 to provide alternative methods of transition for a voluntary change to the fair value based method of accounting for stock-based employee compensation. In addition, FAS 148 amends the disclosure requirements of FAS 123 to require prominent disclosures in the financial statements about the method of accounting for stock-based employee compensation and the effect of the method used on reported results. The transition guidance and annual disclosure provisions of FAS 148 are effective for financial statements issued for fiscal years ending after December 15, 2002. |

| | | |

| | | The Company has elected to continue accounting for employee stock-based compensation in accordance with APB 25 and related interpretations. |

F-103

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 20 - | RECONCILIATION BETWEEN GENERALLY ACCEPTED ACCOUNTING PRINCIPLES IN ISRAEL AND IN THE UNITED STATES(continued): |

| | | | |

| | 5) | FIN 45 |

| | | |

| | | In November 2002, the FASB issued FASB Interpretation No. 45 “Guarantor’s Accounting and Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others” (“FIN 45”). FIN 45 requires the guarantor to recognize, at the inception of a guarantee, a liability for the fair value of the obligation undertaken in issuing the guarantee. It also elaborates on the disclosures to be made by a guarantor in its financial statements about its obligations under certain guarantees that it has issued. Disclosures required under FIN 45 are already included in these financial statements. However, the initial recognition and initial measurement provisions of FIN 45 are applicable on a prospective basis to guarantees issued or modified after December 31, 2002. |

| | | |

| | | The Company does not expect the adoption of FIN 45 to have a material effect on its consolidated financial statements. |

| | | |

| | 6) | FIN 46 |

| | | |

| | | In January 2003, the FASB issued FASB Interpretation No. 46 “Consolidation of Variable Interest Entities” (“FIN 46”). Under this FIN, entities are separated into two populations: (1) those for which voting interests are used to determine consolidation (this is the most common situation) and (2) those for which variable interests are used to determine consolidation. The FIN explains how to identify Variable Interest Entities (VIE) and how to determine when a business enterprise should include the assets, liabilities, noncontrolling interests, and results of activities of a VIE in its consolidated financial statements. |

| | | |

| | | The FIN is effective as follows: for variable interests in variable interest entities created after January 31, 2003, the FIN shall apply immediately; for variable interests in variable interest entities created before that date, the FIN shall apply – for public entities - as of the beginning of the first interim or annual reporting period beginning after June 15, 2003. |

| | | |

| | | The Company does not expect the adoption of this FIN to have a material effect on its consolidated financial statements. |

F-104

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

APPENDIX I

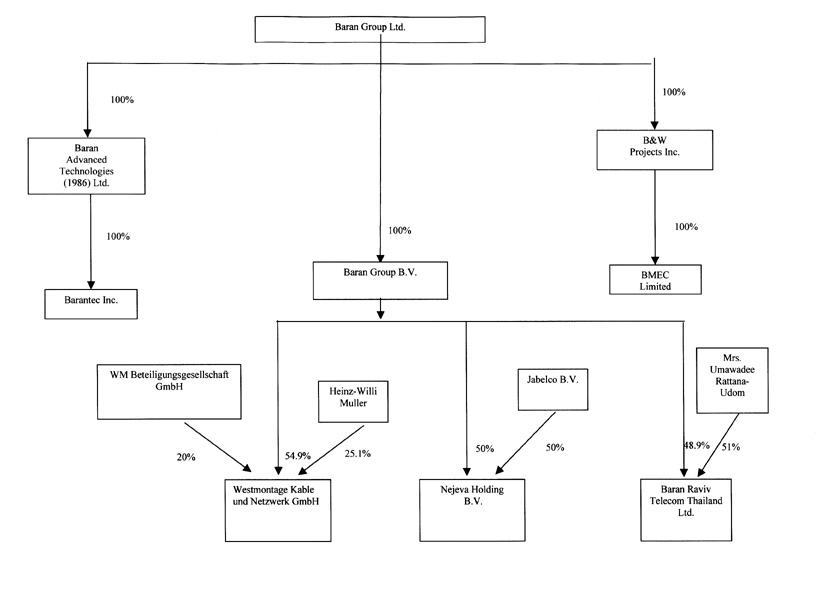

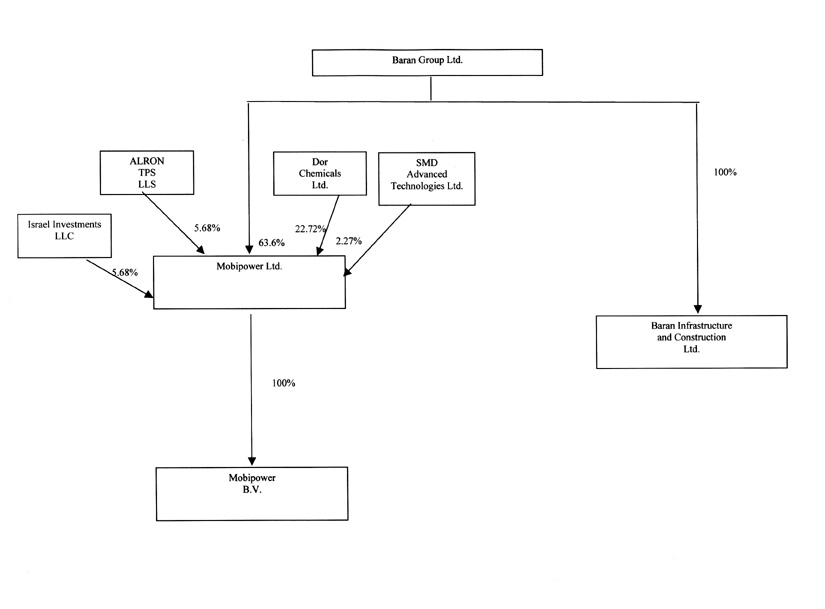

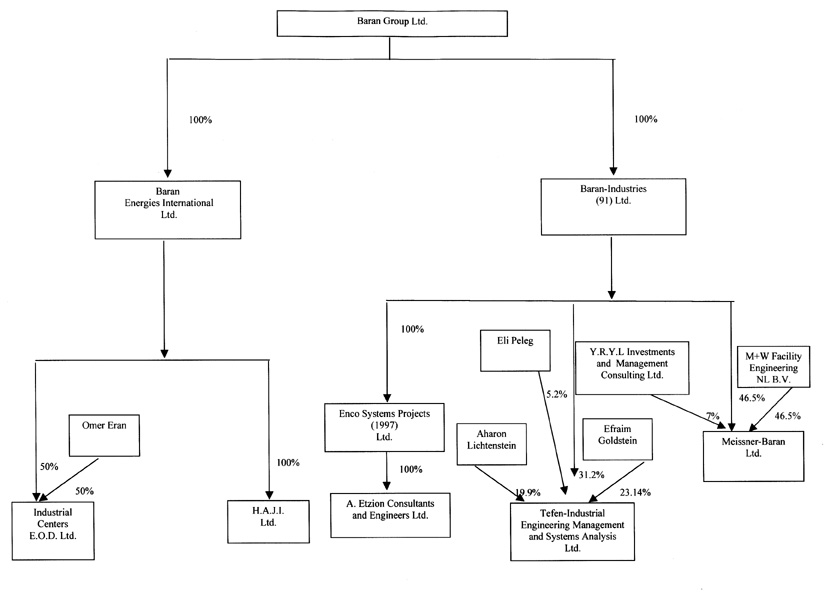

Details of subsidiaries, proportionately consolidated companies, proportionately consolidated joint ventures and associated companies as of December 31, 2002:

Name of company | | Percentage

shareholding | |

| |

| |

Subsidiaries: | | | | | |

Baran Projects Construction Ltd. (hereafter - Baran Construction) | | | 100 | | |

Baran Inbar Projects (1987) Ltd. (hereafter - Inbar Projects) – 99% owned | | | | | |

directly and 1% owned through Baran Construction | | | 100 | | |

Baran Advanced Technologies (1986) Ltd. (hereafter - Baran Technologies) | | | 100 | | |

Baran Technology Products Management and Marketing Ltd. (hereafter - Baran | | | 100 | | |

Management) | | | | | |

Baran Industries (91) Ltd. (hereafter - Baran Industries) | | | 100 | | |

Baran International Energies Ltd. (hereafter - Baran Energies) | | | 100 | | |

Baran – Raviv Telecom Ltd. (hereafter - Baran Raviv) – 50.1% owned directly | | | | | |

and 49.9% owned through Baran Construction | | | 100 | | |

Baran Infrastructure and Construction Ltd. (hereafter - Baran Infrastructure) | | | 100 | | |

Baran Engineering and Projects (1983) Ltd. (hereafter - Baran Engineering) | | | | | |

(formerly – Baran Petrochemical Engineering Ltd.) | | | 100 | | |

Enco Systems Projects (1997) Ltd. (hereafter - Enco) - through Baran Industries | | | 100 | | |

A. Etzion Consultants and Engineers Ltd. (hereafter - A. Etzion) - through Enco | | | 100 | | |

Mobipower Ltd. (former TPS) | | | 63.64 | | |

Mobipower B.V. - through Mobipower Ltd. | | | 95 | | |

B & W Projects Inc. (hereafter - B&W) | | | 100 | | |

BMEC Limited - through B&W | | | 100 | | |

Barantec Inc. (hereafter - Barantec) - through Baran Technologies | | | 100 | | |

Notev Management and Operation Ltd. (hereafter - Notev) | | | 100 | | |

H.A.J.I. Ltd. (hereafter - H.A.J.I.) - through Baran Energies | | | 100 | | |

Industrial Centers E.O.D. Ltd. (hereafter - E.O.D.) - through Baran Energies | | | 50 (1) | | |

Baran Group B.V. (hereafter - Group B.V.) - through Baran Group | | | 100 | | |

Baran Raviv (Netherlands) International B.V. (hereafter – Baran Raviv B.V.) - - | | | | | |

through Baran Raviv | | | 100 | | |

Baran Raviv GmbH - through Baran Raviv B.V. | | | 100 | | |

LEAD Control Ltd. | | | 50.1 | | |

Westmontage GmbH (hereafter - Westmontage) - through Group B.V. | | | 55 | | |

Baran Raviv Telecom (Thailand) Limited - through Group B.V. | | | 100 | | |

Baran Telecom Inc. | | | 100 | | |

Proportionately Consolidated Companies: | | | | | |

Nejeva Holding B.V – through Group B.V. | | | 50 | | |

Nes-Pan Ltd. (hereafter - Nes-Pan) - through Baran Management | | | 50 | | |

A.R. - A.D.I.R. Constructions Ltd. (hereafter - A.R. - A.D.I.R.) | | | 50 | | |

Meissner Baran Ltd. (hereafter - Meissner Baran) - through Baran Industries | | | 46. 5 (2) | | |

Baran Mer International Telecommunications, Technology, Industry and Trade Ltd. | | | | | |

(hereafter - Baran Mer) - through Baran Raviv | | | 50 | | |

Green Anchors Ltd. - through Nas Pan | | | 25 | | |

Proportionately Consolidated Joint Ventues: | | | | | |

A.A.B. Joint Venture “Nachshonim Project” (hereafter - Nachshonim) | | | 33.33 | | |

Joint Venture Dagan Areas (hereafter - Dagan Areas) | | | 25 | | |

Associated Companies: | | | | | |

Tefen Industrial Engineering and System Analysis Ltd. (hereafter - Tefen) - through | | | | | |

Baran Industries | | | 31.19 | | |

A.L.D. - Advanced Logistics Developments Ltd. (hereafter - A.L.D.) | | | 55.32 (3) | | |

(1) Percentage of control – 60%. | | | | | |

(2) Percentage of control – 50%. | | | | | |

(3) Percentage of control – 33.3% | | | | | |

F-105

BARAN GROUP LTD.

(An Israeli Corporation)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

APPENDIX II

SCHEDULE - VALUATION AND QUALIFYING ACCOUNTS

| | Three years ended December 31, 2002 | |

| |

| |

Column A | | Column B | | Column C | | Column D | | Column E | | Column F | |

| |

| |

| |

| |

| |

| |

| | Balance at

beginning

of year | | Additions in

respect of

companies

consolidated

for the

first time | | Additions

charged to

cost and

expense | | Deductions

from

reserves | | Balance

at end

of period | |

| |

| |

| |

| |

| |

| |

Description | | | | | | | | | | | | | | | | | | | | | |

Allowance for doubtful accounts: | | | | | | | | | | | | | | | | | | | | | |

Adjusted NIS (in thousands): | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31, 2000 | | | 136 | | | | 38 | | | | 136 | | | | | | | | 310 | | |

| | |

| | | |

| | | |

| | | | | | | |

| | |

Year ended December 31, 2001 | | | 310 | | | | 2,418 | | | | | | | | (122 | ) | | | 2,609 | | |

| | |

| | | |

| | | | | | | |

| | | |

| | |

Year ended December 31, 2002 | | | 2,606 | | | | 7,323 | | | | | | | | (2,154 | ) | | | 7,775 | | |

| | |

| | | |

| | | | | | | |

| | | |

| | |

Valuation allowance for deferred tax | | | | | | | | | | | | | | | | | | | | | |

assets: | | | | | | | | | | | | | | | | | | | | | |

Adjusted NIS (in thousands): | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31, 2000 | | | (4,343 | ) | | | | | | | (1,094 | ) | | | | | | | (5,437 | ) | |

| | |

| | | | | | | |

| | | | | | | |

| | |

Year ended December 31, 2001 | | | (5,437 | ) | | | | | | | (5,782 | ) | | | | | | | (11,219 | ) | |

| | |

| | | | | | | |

| | | | | | | |

| | |

Year ended December 31, 2002 | | | (11,219 | ) | | | | | | | (1,489 | ) | | | | | | | (12,708 | ) | |

| | |

| | | | | | | |

| | | | | | | |

| | |

Warranty provision | | | | | | | | | | | | | | | | | | | | | |

Adjusted NIS (in thousands): | | | | | | | | | | | | | | | | | | | | | |

Year ended December 31, 2000 | | | 16,417 | | | | | | | | 5,634 | | | | | | | | 22,051 | | |

| | |

| | | | | | | |

| | | | | | | |

| | |

Year ended December 31, 2001 | | | 22,051 | | | | | | | | | | | | (470 | ) | | | 21,581 | | |

| | |

| | | | | | | | | | | |

| | | |

| | |

Year ended December 31, 2002 | | | 21,581 | | | | (263 | ) | | | 1,840 | | | | (12,193 | ) | | | 10,965 | | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

F-106

Brightman Almgor

1 Azrieli Center

Tel Aviv 67021

P.O.B. 16593, Tel Aviv 61164

Israel

Tel: +972 (3)6085555

Fax: +972 (3)609 4022

Info@deloitte.co.il

www.deloitte.co.il

Independent Auditor’s Report

To The Shareholders of

Meissner-Baran Ltd.

We have the accompanying balance sheets of Meissner-Baran Ltd. (“the Company”) as of December 31, 2002 and 2001 and the related statements of operations, changes in shareholders’ equity and cash flows for each of the three years in the period ended December 31, 2002. These financial statements are the responsibility of the Company’s Board of Directors and management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America, and in Israel, including those prescribed by the Israeli Auditors’ regulations (Mode of Performance), 1973. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statements presentation, we believe that our audits provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all respects, the financial position of the Company as of December 31, 2002 and 2001 and results of its operations, its changes in shareholders’ equity and its cash flows for each of the three years in the period ended December 31, 2002, in conformity with accounting principles generally accepted in Israel. Accounting principles generally accepted in Israel vary in certain respects from accounting principles generally accepted in the United States of America. The application of the latter would have affected the determination of the results of operations of each three years in the period ended December 31, 2002 and determination os shareholders’ equity and financial position as of December 31, 2002 and 2001, to the extent summarized in Note 18.

As explained in Note 2b, the aforementioned financial statements are presents in values adjusted for changes in the general purchasing power of the Israeli currency, in accordance with Opinions of the Institute of certified Public Accountants in Israel.

s / Brightman Almagor & Co.

Certified Public Accountants

A member firm of Deloitte Touche Tohmatsu

Tel-Aviv, Israel

March 13, 2003

F-107

Brightman Almgor

1 Azrieli Center

Tel Aviv 67021

P.O.B. 16593, Tel Aviv 61164

Israel

Tel: +972 (3)6085555

Fax: +972 (3)609 4022

Info@deloitte.co.il

www.deloitte.co.il

Independent Auditor’s Report

To The Joint Venture of

A.A.B JOINT VENTURE – ABB SUSA / A. Arenson/ Baran Group

We have the accompanying balance sheets of A.A.B JOINT VENTURE – ABB SUSA / A. Arenson/ Baran Group (the “Joint Venture”) as of December 31, 2002 and 2001 and the related statements of operations and cash flows for each of the year ended December 31, 2002 and for the period from inception (April 5, 2001) to December 31, 2001. These financial statements are the responsibility of the Joint Venture’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America, and in Israel, including those prescribed by the Israeli Auditors’ regulations (Mode of Performance), 1973. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statements presentation, we believe that our audits provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all respects, the financial position of the Joint Venture as of December 31, 2002 and 2001 and results of its operations and its cash flows for the year ended December 31, 2002 and for the period from inception (April 5, 2001) to December 31, 2001, in conformity with accounting principles generally accepted principles. Accounting principles generally accepted in Israel vary in certain respects from accounting principles generally accepted in the United States of America. In addition, in our opinion, theses financial statements have been prepared in accordance with the Israeli Securities Regulations (Preparation of annual Financial Statements) , 1993.

As explained in Note 2A, these financial statements are presented in values adjusted for changes in the general purchasing power of the Israeli currency, in accordance with pronouncements of the Institute of certified Public Accountants in Israel.

s / Brightman Almagor & Co.

Certified Public Accountants

A member firm of Deloitte Touche Tohmatsu

Tel-Aviv, Israel

February 3, 2003

F-108

AUDITORS’ REPORT

To the Shareholders of

Tefen — Industrial Engineering And System Analysis Ltd.

We have audited the consolidated balance sheets of Tefen — Industrial Engineering And System Analysis Ltd. (hereafter — the Company) as of December 31, 2002 and 2001, and related consolidated statements of income, changes in shareholders’ equity and cash flows for each of the three years in the period ended December 31, 2002. These financial statements are the responsibility of the company’s Board of Directors and management. Our responsibility is to express an opinion on these financial statements based on our audit.

We did not audit the financial statements of subsidiaries, whose assets included in consolidation constitute approximately 61% and 47% of the total consolidated assets as at December 31, 2002 and 2001, respectively and whose revenues included in consolidation constitute approximately 80%, 65%% and 72% of the total consolidated revenues for the three years ended December 31, 2002, respectively. The financial statements of the above subsidiaries were audited by other auditors, whose report have been furnished to us and our opinion, insofar as it relates to amounts included for those companies, is based solely on the reports of the other auditors.

We conducted our audits with auditing standards generally accepted in Israel and in the United State of America including those prescribed by the Israeli Auditors (Mode of Performance) Regulation, 1973. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by the company’s Board of Directors and management, as well as evaluating the overall financial statements presentation. We believe that our audits, and the reports of the other auditors, provide a reasonable basis for our opinion.

In our opinion, based upon our audits and on the reports of the above-mentioned other auditors referred to above, the financial statements referred to above, present fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2002 and 2001 and the consolidated results of operations, changes in shareholders’ equity and cash flows for each of the three years in the period ended December 31, 2002, in conformity with accounting principles generally accepted in (“GAAP”) Israel.

Accounting principles generally accepted in Israel vary in certain respects from accounting principles generally accepted in the United States as allowed by item 18 to Form 20-F. The application of the latter would have affected the determination of consolidated income for each of the three years in the period ended December 31, 2002, and the determination of shareholder’s equity as of December 31, 2002 and 2001 to the extent summarized in our letter dated March 3, 2003 in respect thereof.

As explained in note 2, the consolidated financial statements refered to above are presented in values adjusted for the changes in the general purchasing power of the Israeli currency, in accordance with pronouncements of the Institute of Certified Public Accountants in Israel.