With effect from 2003, the Company reviews whether any events have occurred or changes in circumstances have taken place, which might indicate that there has been an impairment of its investment in associated companies. In 2001, the Company recorded a provision for the impairment of its investment in an associated company. The investment in this associated company is presented at the lower of the investment amount, under the equity method (before making the impairment provision), and its recoverable amount, in accordance with clarification No. 1 of Accounting Standard No. 15, as long as the recoverable value, on which the impairment provision was based, remains unchanged, the company will record its share in the associated company’s losses (up to the amount of the impairment provision) by reducing the aforesaid provision, without having effect on the company’s results. In addition it was determined that the loss caused by the impairment will be reclassified as share in profits of associates companies

Since issuing FIN 46, the FASB has proposed various amendments to the Interpretation and has deferred its effective dates. Most recently, in December 2003, the FASB issued a revised version of FIN 46 (FIN 46-R), which also provides for a partial deferral of FIN 46. This partial deferral established the effective dates for public entities to apply FIN 46 and FIN 46-R based on the nature of the variable interest entity and the date upon which the public company became involved with the variable interest entity. In general, the deferral provides that (i) for variable interest entities created before February 1, 2003, a public entity must apply FIN 46-R at the end of the first interim or annual period ending after March 15, 2004, and may be required to apply FIN 46 at the end of the first interim or annual period ending after December 15, 2003, if the variable interest entity is a special purpose entity, and (ii) for variable interest entities created after January 31, 2003, a public company must apply FIN 46 at the end of the first interim or annual period ending after December 15, 2003, as previously required, and then apply FIN 46-R at the end of the first interim or annual reporting period ending after March 15, 2004.

The Company has currently no variable interests in any VIE. Accordingly, the Company believes that the adoption of FIN 46 and FIN 46-R will not have a material impact on its financial position, the results of its operations and and/or its cash flows.

SAFE HARBOR

This statement contains forward-looking statements as defined by federal securities laws which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions, and other statements which are other than statements of historical facts. In some cases, you can identify forward-looking statements by terminology such as ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘expects,’’ ‘‘intends,’’ ‘‘plans,’’ ‘‘anticipates,’’ “contemplates,” ‘‘believes,’’ ‘‘estimates,’’ ‘‘predicts,’’ ‘‘projects,’’ ‘‘potential,’’ ‘‘continue,’’ and other similar terminology or the negative of these terms. From time to time, we may publish or otherwise make available forward-looking statements of this nature. All such forward-looking statements, whether written or oral, and whether made by us or on our behalf, are expressly qualified by the cautionary statements described on this statement, including those set forth below, and any other cautionary statements which may accompany the forward-looking statements. In addition, we undertake no obligation to update or revise any forward-looking statement to reflect events, circumstances, or new information after the date of the information or to reflect the occurrence of unanticipated events, and we disclaim any such obligation.

Forward-looking statements are only predictions that relate to future events or our future performance and are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause actual results, outcomes, levels of activity, performance, developments, or achievements to be materially different from any future results, outcomes, levels of activity, performance, developments, or achievements expressed, anticipated, or implied by these forward-looking statements. As a result, we cannot guarantee future results, outcomes, levels of activity, performance, developments, or achievements, and there can be no assurance that our expectations, intentions, anticipations, beliefs, or projections will result or be achieved or accomplished.

57

ITEM 6. DIRECTORS AND SENIOR MANAGEMENT

Baran’s directors and executive officers and their ages and positions are as follows:

Name Age Principal Position

Meir Dor | 57 | Chairman of the Board of Directors and CEO |

Menachem Gal | 56 | Senior Executive Officer and Director |

Abiel Raviv | 59 | Senior Executive Officer and Director |

Israel Gotman | 57 | Executive Officer and Director |

Isaac Friedman | 54 | Executive Officer and Director |

Israel Scop | 53 | Executive Officer and Director |

Liora Ofer | 50 | Director |

Arieh Shaked | 54 | Outside Director |

Tami Gottlib | 47 | Outside Director& Chair of the Audit Committee |

Sasson Shilo | 49 | VP & Chief Financial Officer and Secretary |

Giora Gutman | 52 | Industry Division President and Director |

The business experience, principal occupation and employment, as well as the periods of service, of each of the board members and executive officers of Baran are set forth below:

Meir Dor has served as a director and CEO of Baran since 1991 and has served as the chairman of the board of directors of Baran since 1992. Mr. Dor is also a director of the following Baran subsidiaries: Baran Advanced Technologies (1986) Ltd., Baran Technical Products Management and Marketing Ltd., H.A.J.I Ltd., Mobipower Ltd., A.R.- A.D.Y.R. Constructions Ltd., Meissner-Baran Ltd., Industrial Centers E.O.D. Ltd., Lead Control Ltd., Tefen Industrial Engineering Management and Systems Analysis Ltd. and its subsidiaries, InTime Ltd., B&W Projects Inc, Baran Raviv Thailand Ltd. and Baran Telecom Inc. Mr. Dor received his B.Sc in Management and Industrial Engineering from the University of Tel-Aviv, Israel in 1978.

Menachem Gal has served as a director of Baran since 1991, and has served as co-managing director and head of business development of Baran since the second half of 2001. Mr. Gal also serves as a director of the following Baran subsidiaries: Baran Inbar Projects (1987) Ltd., Baran Energies International Ltd., Notev - Management & Operation Ltd., Baran Engineering and Projects (1983) Ltd., Baran Project Construction Ltd., Meissner-Baran Ltd., Baran Alrig Ltd,. H.A.J.I Ltd., Green Anchors Ltd., Baran Raviv Thailand Ltd. and Nes-Pan Ltd.

58

Abiel Raviv has served as a Senior Officer of Baran since 1993 and served as a director of Baran since 1997, Mr. Raviv has also served as co-managing director since 1994. Mr. Raviv served as a co-managing director of Baran Raviv Startup and Entrepreneur Ltd. until 1997. Until 1999, Mr. Raviv served as the head of Baran’s telecommunications division. Mr. Raviv serves as a director of the following Baran subsidiaries: Baran Raviv Telecom Ltd., B&W Projects Inc., Baran Raviv Thailand Ltd., Baran Telecom Inc. Mr. Raviv received his B.Sc. in Mechanical Engineering from Technion, Israel Institute of Technology in 1970 and a M.Sc. in Mechanical Engineering (Turbomechanics) from Union College, Schenectady, New York, in 1974.

Israel Gotman has served as a director and an Officer of Baran since 1991. Between the years 1990 and 2001, Mr. Gotman served as chief executive officer of several of Baran’s subsidiaries. Mr. Gotman currently serves as a director of Baran Industries (91) Ltd. Mr. Gotman holds a B.Sc. in Mechanical Engineering from the Faculty of Mechanical Engineering, Moscow (1972).

Isaac Friedman has served as a director of Baran since 1991, until 2004 Mr. Friedman served as the head of the Civil Engineering Division of Baran. Between the years 1990 and 1999, Mr. Friedman served as vice president of Baran Project Construction Ltd., where he currently serves as chief executive officer. Mr. Friedman serves as a director in the following Baran subsidiaries: Baran Project Construction Ltd., A.R.- A.D.Y.R. Constructions Ltd. and Baran Infrastructure & Construction Ltd. Mr. Friedman graduated as a Practical Construction Engineer from the Technical College of the Negev, Beer-Sheva, Israel in 1975, and received his B.Sc. in Business Management from Champlain College, Illinois, in 2000.

Israel Scop has served as a director of Baran since 1991. Until 1998, Mr. Scop served as vice president in Baran-Project Construction Ltd. Between 1998 and 2000, Mr. Scop acted as chief engineer of Baran’s engineering companies. As of 2000, he is responsible for community relations and special engineering projects for Baran. Mr. Scop holds a B.Sc. in Mechanical Engineering from the Technion, Institute of Technology, Haifa, Israel (1972).

Liora Ofer has served as a director of Baran since 1999. During the past five years Ms. Ofer has served in different roles in the Ofer Brothers group of companies, including Israel Chemicals Ltd. and its subsidiaries, and has served as the managing director of Almog Eilat Shore Ltd. Ms. Ofer also serves as a director of a number of Israeli companies: United Mizrahi Bank Ltd., Ofer Development and Investments Ltd., Malisron Ltd., Almog Eilat Shore Ltd., Neot Almog Shore (1990) Ltd., Almog Hotel Management Ltd., Almog Shore Haifa (1996) Ltd., Neve Almog Shore Ltd., Laguna Hotel Ltd., Oro Investments Ltd., Oro Foreign Investments (1999) Ltd., Halidor Entrepreneurs Ltd., and Ofer Brothers Assets (1957) Ltd. Ms. Offer is a member of the Audit Committee.

59

Arieh Shaked has served as an outside director of Baran since 2000. During the past five years Mr. Shaked has served as chairman of the board of directors of a number of Israeli companies: Enosh Security and Maintenance Ltd., Enosh Building Maintenance Ltd., Enosh Human Resources Services and Security Eilat Ltd. Mr. Shaked is also a director of Arami Shaked 2000 Ltd. and Nehushtan Investments Ltd. Mr. Shaked holds a BA in Political Sciences, Business Management from Bar-Ilan University, Tel-Aviv, Israel (1982) and an MA in Social Sciences and Mathematics from the University of Haifa, Israel (1989). Mr. Shaked is a member of the Audit Committee.

Tami Gottlieb joined Baran as an outside director in July, 2002. Ms. Gottlieb is currently joint owner and CEO of a private consulting and investment banking company - Harvest Capital Markets Ltd. and serves as a director in a number of Israeli companies: Emilia Development (M.O.F.) Ltd., RoboGroup Ltd., Maalot - The Israeli Rating Company Ltd., T.R.A. Tel Aviv Radio Ltd., “Dan” Transportation Company Ltd., Incredimail Ltd., Hassin Esh Ltd., PolySack Ltd. and Credit Information Association (CIA) Ltd. Between 1997 and 2001, Ms. Gottlieb served as CEO and director of Investec General Management and Underwriting Ltd. prior to 1997 Ms. Gottlieb served as CEO both at Oscar Gruss (Israel) Ltd. and before that at Maalot - The Israeli Rating Company Ltd.. Ms. Gottlieb holds a BA in International Relations from The Hebrew University, Jerusalem, Israel (1978) and an MA in Economics from Indiana University Bloomington, Indiana, USA (1980). Ms. Gottlieb is a member of the Audit Committee and serves as the board’s financial expert.

Sasson Shilo joined Baran in 1992 and serves as Baran’s vice president of finance and as secretary of Baran. Mr. Shilo serves as a director in the following Baran subsidiaries: Baran Technical Products Management and Marketing Ltd., , Enco Systems Projects (1997) Ltd., A. Etzion Consultants & Engineers Ltd., Baran Alrig Ltd, Tefen Industrial Engineering Management and Systems Analysis Ltd., Mobipower Ltd, BMEC Ltd., B&W Projects Inc. and Industrial Centers E.O.D. Ltd. Mr. Shilo holds a BA in Economics from the Ben Gurion University, Beer-Sheva, Israel from 1984 and an MBA in Business Management from the Ben Gurion University, Beer-Sheva, Israel (1989).

Giora Gutman has served as a director of Baran since 2003 and in various positions since joining the company in 1994. Mr. Gutman became Head of the Industry Division and CEO of Baran Engineering & Projects (1983) Ltd. in 2001. Mr. Gutman serves as a director in the following Baran subsidiaries: Baran Engineering and Projects (1983) Ltd,. Lead Control Ltd., Baran Industries (91) Ltd., Notev - Management & Operation Ltd., Intime Ltd., Carmel Desalination Ltd., Tefen Industrial Engineering Management and Systems Analysis Ltd. and Baran Inbar Projects (1987) Ltd. Mr. Gutman holds a B.Sc in Mechanical Engineering from Ben Gurion University.

60

Compensation

During 2003 Baran paid to all its directors and senior management as a group an aggregate amount of NIS 4.2 million ($1million) in salaries, fees and bonuses. Other than the payment to non-employee directors of NIS 173,000 (approximately $40,000) for their participation in board meetings, no directors received cash compensation for serving in such positions in the year ended December 2003.

Five highest compensated persons in Baran

Position | Compensation |

Industry Division

President and Director | NIS 1, 240,000 ($283,000) |

Former President, Chief

Operation Officer and

Director | NIS 875,003 ($200,000) |

Senior Executive Officer

and Director | NIS 375,000 ($86,000) |

Senior Executive Officer

and Director | NIS 375,000 ($86,000) |

Executive Officer and

Director | NIS 375,000 ($86,000) |

Board Practices

Baran’s Articles of Association provide that Baran’s board shall consist of no less than three and no more than 13 directors. Each director who is not an outside director is elected at an annual general meeting or a special meeting of Baran’s shareholders by a vote of the holders of a majority of the voting power represented and voting at that meeting. Outside directors are elected and may be removed only in accordance with the provisions of the Israeli Companies Law (described below). Baran’s Board currently consists of 13 directors, two of whom are outside directors. Each director who is not an outside director will hold office until the next annual general meeting of Baran’s shareholders, unless terminated earlier by a simple majority vote of the shareholders at a general meeting, or if he or she becomes insane, is declared bankrupt, or resigns, or upon his or her death.

A simple majority of Baran’s shareholders voting at a general meeting may remove any of Baran’s directors, other than outside directors, from office and may elect replacement directors or fill any vacancy in the board, other than vacancies created by an outside director. Each of Baran’s co-managing directors are considered to be executive officers, serve at the discretion of the board and hold office until his or her successor is elected or until his or her earlier resignation or removal. The other executive officers are appointed by management, and terms of their employment are subject to the approval of the board of directors. There are no family relationships among any of Baran’s directors or executive officers.

61

Under the Israeli Companies Law, companies incorporated under the laws of the State of Israel whose shares are listed on an exchange, including the Tel Aviv Stock Exchange or the Nasdaq National Market, are required to appoint two outside directors. Arieh Shaked and Tami Gottlib were appointed as Baran’s outside directors under the Israeli Companies Law. The Israeli Companies Law provides that a person may not be appointed as an outside director if the person, or the person’s relative, partner, employer or any entity under the person’s control has or had during the two years preceding the date of appointment any affiliation with the company or any entity controlling, controlled by or under common control with the company. Outside directors may be appointed only in accordance with the provisions of the Israeli Companies Law as described below.

The term affiliation includes:

| • | an employment relationship; |

| | |

| • | a business or professional relationship maintained on a regular basis; |

| | |

| • | control; and |

| | |

| • | service as an office holder, excluding service as a director for a period of not more than three months during which the company first offered its shares to the public. The term “office holder’’ is defined as a director, general manager, chief business manager, deputy general manager, vice general manager, executive vice president, vice president, other manager directly subordinate to the general manager or any other person assuming the responsibilities of any of the foregoing positions, without regard to such person’s title. |

No person can serve as an outside director if the person’s position or other business creates, or may create a conflict of interest with the person’s responsibilities as an outside director or may otherwise interfere with the person’s ability to serve as an outside director. If at the time an outside director is appointed all current members of the board of directors are of the same gender, then that outside director must be of the other gender.

Until the lapse of two years from termination of office, a company may not engage an outside director to serve as an office holder and cannot employ or receive services from that person, either directly or indirectly, including through a corporation controlled by that person.

Outside directors are elected by a majority vote at a shareholders’ meeting, provided that either:

| • | the majority of shares voted at the meeting, including at least one-third of the shares of non-controlling shareholders voted at the meeting, vote in favor of the election of the outside director; or |

| | |

| • | the total number of shares voted against the election of the outside director does not exceed one percent of the aggregate voting rights in the company. |

62

The initial term of an outside director is three years. The outside director may be reelected to one additional term of three years by a majority vote at a shareholders meeting, subject to the conditions described above for election of outside directors. Outside directors may only be removed by the same percentage of shareholders as is required for their election, or by a court, and even then only if the outside directors cease to meet the statutory requirements for their appointment or if they violate their duty of loyalty to the company. If an outside directorship becomes vacant, a company’s board of directors is required under Israeli Companies Law to call a shareholders’ meeting immediately to appoint a new outside director.

Each committee of a company’s board of directors is required to include at least one outside director and the audit committee is required to include both outside directors. An outside director is entitled to compensation as provided in regulations adopted under Israeli Companies Law and is otherwise prohibited from receiving any other compensation, directly or indirectly, in connection with services provided as an outside director.

Employees

As of December 31, 2003, Baran and its subsidiaries had employed approximately 1,454 employees, approximately 1,189 of whom were based in Israel, 106 in United States, 30 in United Kingdom, 104 in Germany, 18 in Thailand and 7 in Africa. The breakdown of Baran’s employees by division is as follows:

Year ended

December 31 | | 2001 | | 2002 | | 2003 | |

| |

| |

| |

| |

Baran management | | 39 | | 42 | | 34 | |

Communication

division | | 380 | | 645 | | 416 | |

Civil Engineering

division | | 125 | | 134 | | 124 | |

Industrial division | | 490 | | 466 | | 440 | |

Technology and

Services division | | 390 | | 388 | | 440 | |

| |

| |

| |

| |

Total | | 1,424 | | 1,675 | | 1,454 | |

| |

| |

| |

| |

Share Ownership

| • | On November 3, 2003 Baran’s board of directors resolved to approve an Employees Option Plan to Baran’s Israeli Employees. Five (5) employees of Baran and its subsidiaries participate in the Option Plan and will receive, up to 82,000 options. The options are non-tradable registered bonds, and will be granted for no consideration. Each option grants the employee the right to purchase one Baran’s ordinary share par value 1.00 NIS each, against payment of the exercise price. The Shares will be registered for trade in the Tel-Aviv Stock Exchange. |

63

| | Each one of the employees, covered by the plan, is domiciled in Israel and is not a “controlling shareholder” and/or “interested shareholder” and/or director and/or CEO in the Baran, and will not become “controlling shareholder” and/or “interested shareholder” in Baran Group, following the grant of the options, based on the assumption that he/she will exercise all the options to be granted to him/her. On December 22, 2003, 74,000 options were granted under the plan. |

| | The options granted are equally divided into two classes, series 1 options and series 2 options. The exercise price for exercising the option and converting it into a share shall be as follows: The exercise price of series 1 options, shall be the price of the share in the Tel- Aviv Stock Exchange at the end of the trading date on the date of granting. The exercise price of series 2 options, shall be the price of the Share in the Tel- Aviv Stock Exchange at the end of the trading date on the date of granting plus $5; according to the representative rate known on the morning of the worker’s submission of his/her notice to exercise options. |

| | The exercise period of each option shall be twelve months from the end of the barring period. |

| | |

| | The options shall be barred for a period of not less than twelve months (12) from the end of the tax year during which the options have been granted and deposited with the trustee. Half of the options are barred for a period of two years from their date of grant and the other half is barred for a period of three year from the date of their grant. |

| | |

| | The option holders shall receive a bonus in NIS equal to $2 per option, in the event the options cannot be excised due to the fact the exercise price will be equal or lower than the share trading price. Please see Note 12 for more details. |

| | |

| • | On December 1, 2003, Baran granted 74,000 out of 116,000 options included in the 2003 Employees and Consultant Stock Option Plan, to its US domiciled employees, which was filed on November 11, 2003. As a result of Baran’s decision on June 25, 2004 to delist its shares from the Nasdaq National Market, Baran requested removal from registration of the Shares registered for the purpose of the Stock Option Plan, to its US domiciled employees. Accordingly, on June 25, 2004 Baran filed a Post-Effective Amendment to the Registration Statement to deregister the 116,000 Ordinary Shares issued for the Stock Option Plan, to its US domiciled employees. Baran US domiciled employees shall continue to enjoy the above Stock Option Plan and Baran intends to amend the Plan in accordance with the delisting decision. |

| | |

| | Under the Plan, any employee of Baran or of an affiliate of Baran who is domiciled in the United States and certain consultants will be eligible to receive Stock Options awards, provided, the individual is not (i) an owner of Ordinary Shares representing more than five (5%) of the equity rights in the Company, (ii) a director of the Company, or (iii) a “Baal Inyan” (interested party) as that term is defined in Section 1 of the Israeli Securities Act. |

64

| | A Stock Option granted under the Plan represents the right to purchase the number of Ordinary Shares of Baran, par value NIS 1.00 per share, set forth in the Option Agreement evidencing the Option. When a Stock Option is granted the recipient becomes the owner of the Stock Option, subject to such vesting and forfeiture provisions as may be set forth in the Option Agreement. Only upon exercise of the Stock Option, subject to the terms of the Stock Option Agreement, does the recipient become the owner of the Ordinary Shares subject to the Stock Option. The Plan provides for the grant of Incentive Stock Options, which meet the criteria set forth in the Internal Revenue Code and non-qualified stock options which do not meet the criteria of the Internal Revenue Code. The tax consequences to a participant vary depending upon whether his or her option is an Incentive Stock Option or a non-qualified stock option. |

| | |

| | The purchase price per share covered by each option is $7.02, which equaled the average price of a Baran’s shares on the Nasdaq National Market at the end of each of the fourteen (14) consecutive trading days, such period ending on the trading day immediately prior to the date of the grant of the options. The options granted are exercisable for a one-year period commencing on the second anniversary of the granting date and ending on the third anniversary of the granting date. The period from the date of the granting of the options to the second anniversary of the date of the granting of the options is referred to as the “Barring Period”. The options may not be exercised after the third anniversary of the granting date. |

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

Major Shareholders

The following table sets forth information as of June 28, 2004 concerning the beneficial ownership of the Baran ordinary shares by each shareholder known by Baran to be the beneficial owner of more than 5% of the outstanding shares, current members of the board of directors of Baran, certain Baran executive officers, and all directors and current executive officers as a group. Except as otherwise indicated, the business address for each of the following persons is Baran House,8 Omarim St. Industrial Park, Omer 84965,Israel, as well as 5 Menachem Begin Ave., Beit Dagan 50200, Israel.

65

Name of Beneficial Owner | | Number of Shares

Beneficially

Owned | | Percentage

Beneficially

Owned | |

| | | | | |

Meir Dor (2) | | 1,351,914 | | | | 16.14 | % | |

Bank Leumi LeIsrael B.M. Funds (1) | | 1,134,681 | | | | 13.55 | % | |

Clal Insurance Enterprises Holdings Ltd | | 701,436 | | | | 8.37 | % | |

Bank Hapoalim | | 421,695 | | | | 5.03 | % | |

Israel Gotman (2) | | 201,923 | | | | 2.41 | % | |

Israel Scop (2) | | 185,719 | | | | 2.22 | % | |

Abiel Raviv (2) | | 183,100 | | | | 2.19 | % | |

Menahem Gal (2) | | 129,252 | | | | 1.54 | % | |

Isaac Friedman (2) | | 88,615 | | | | 1.06 | % | |

Sasson Shilo | | 11,000 | | | | 0.13 | % | |

Giora Gutman | | 35,000 | | | | 0.42 | % | |

Liora Ofer | | 0 | | | | | | |

| | | | | |

| | |

Arieh Shaked | | 0 | | | | | | |

| | | | | |

| | |

Tami Gottlib | | 0 | | | | | | |

| | | | | |

| | |

All current officers and directors as a group (11 persons) | | 2,186,523 | | | | 26.1 | % | |

(1)Bank Leumi LeIsrael B.M. controls the voting shares of various investment and other funds that own the Baran ordinary shares. These numbers of shares are based on reports provided to Baran by the Bank.

(2) Meir Dor, Menachem Gal, Isaac Friedman, Israel Gotman, Abiel Raviv and Israel Scop are directors of Baran and have entered into a voting agreement pursuant to which they have agreed to vote their shares to elect directors of Baran.

Related Party Transactions

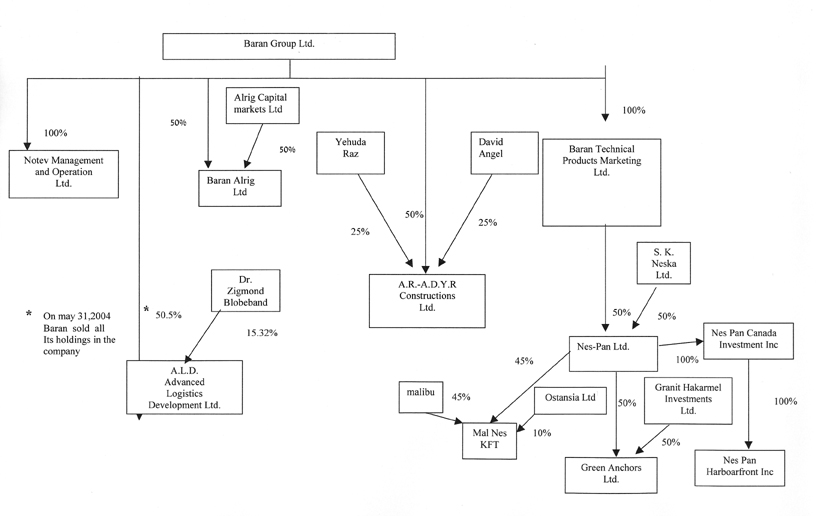

On January 31, 2000 Baran entered into an agreement with a shareholder of A.L.D. Advanced Logistics Development Ltd. (“A.L.D.”), whereby the parties granted each other several rights with respect to the disposition of their shares, determined the dividend distribution policy in the company and agree to coordinate their voting with respect to the election of directors as well as other matters to be voted on at Advanced Logistics’ general meeting of shareholders. All such agreements are no longer valid as a result of the sale of Baran holdings in A.L.D on May 31, 2004.

In addition, Baran has oral agreements with all its wholly owned subsidiaries, pursuant to which Baran receives management fees from the subsidiaries in amounts ranging from 4% to 5% of each subsidiary’s annual revenues. Baran has a written agreement with Tefen, pursuant to which Baran receives consulting fees from Tefen in an amount equal to the cost of the yearly compensation of a co-managing director in Tefen (NIS 1,038,000, $237,000 in 2003). Baran has a written agreement with A.L.D., pursuant to which Baran receives consulting fees from A.L.D in an amount equal to the cost of the yearly compensation of the president of A.L.D (NIS 324,000, $73,990 in 2003). The above agreement was automatically terminated as a result of the sale of Baran holdings in A.L.D on May 31, 2004

On October 18, 1999, Mr. Raviv transferred all his rights in connection with the appointment of directors of Baran to Meir Dor. During the year 2001, Mr. Gal and Mr. Friedman transferred all their rights in connection with the appointment of directors of Baran to Meir Dor, the above transfer shall remain valid until its cancellation.

66

On July 7, 1998, Baran and Baran Industries (1991) Ltd. entered into an agreement with several shareholders of Tefen Industrial Engineering Management and Systems Analysis Ltd. under which the parties granted each other several rights with respect to their disposition and purchase of shares in Tefen, and agree to coordinate their voting with respect to the election of directors as well as other matters to be voted on at Tefen’s general meetings.

In an agreement dated March 27, 1992 Meir Dor, Menachem Gal, Isaac Friedman, Israel Gotman, Jonathan Inbar and Israel Scop, agreed to coordinate their vote with respect to the election of directors to the board of Baran as well as other matters to be voted on at Baran’s general meetings of shareholders and granted each other several rights with respect to the disposition of their shares. The parties signed subsequent agreements with Abiel Raviv, dated October 21, 1997 and October 7, 1998 joining Mr. Raviv to the agreement, and modifying the manner in which directors shall be elected to the Baran board. An addendum dated December 10, 2000 specified certain conditions for the effectiveness of these agreements. An explanation regarding controlling shareholders transactions and board of directors election under Israeli law may be found in Item 10.

Legal Proceedings

During 2003 the number of legal claims in which Baran is a party increased materially. This increase is a direct result of the recession in Israel and economic slow down, as well as the high profile nature of Baran’s projects, which leads to an automatic joinder of Baran as a party. Until now the legal treatment resulted in remarkable achievements. A number of legal claims held in Israel, the alleged sum of which reached millions of New Israeli Shekels, were eventually settled for less than $20,000. More details on Baran’s legal affairs appear in Note 11 of the financial statements.

ITEM 8. FINANCIAL INFORMATION

Our consolidated financial statements are incorporated herein by reference to pages F-1 through F-108.

ITEM 9. OFFERS AND LISTING

Market and Share Price History

Baran ordinary shares have been traded on the Tel Aviv Stock Exchange under the symbol “BRAN’’ since March 26, 1992.

67

The following table sets forth the high and low sales prices, in NIS, of Baran ordinary shares as quoted on the Tel Aviv Stock Exchange for the periods indicated:

| | High | | Low | |

2002 | | | | | |

1st quarter | | 97.53 | | 77.34 | |

2nd quarter | | 79.49 | | 43.30 | |

3rd quarter | | 50.10 | | 26.86 | |

4th quarter | | 28.55 | | 23.62 | |

| | | | | |

2003 | | | | | |

1st quarter | | 35 | | 26.37 | |

2nd quarter | | 39.24 | | 33.1 | |

3rd quarter | | 38.5 | | 24.98 | |

4th quarter | | 33.62 | | 25.14 | |

The annual high and low market prices for Baran ordinary shares (in NIS) for the five most recent full fiscal years:

| | High | | Low | |

2003 | | 39.24 | | 24.98 | |

2002 | | 97.53 | | 23.62 | |

2001 | | 119.75 | | 60.95 | |

2000 | | 161.65 | | 93.84 | |

1999 | | 104.56 | | 26.48 | |

The high and low market prices for Baran ordinary shares (in NIS) for the most recent six months:

| | High | | Low | |

June 20, 2004 | | 28.12 | | 26.69 | |

May 30, 2004 | | 33.06 | | 26.11 | |

April 31, 2004 | | 37.03 | | 33.63 | |

March 31, 2004 | | 37.87 | | 29.29 | |

February 2004 | | 32.76 | | 29.6 | |

January 2004 | | 36.31 | | 31.75 | |

On November 15, 2002, Baran’s shares commenced trading on the Nasdaq National Market, under the symbol “BRAN” the following table sets forth, for the periods indicated and available, the high and low reported sales prices of the ordinary shares on the Nasdaq National Market:

The annual high and low market prices for Baran ordinary shares (in $) for the two most recent full fiscal years:

| | High | | Low | |

2003 | | 8.87 | | 5.41 | |

2002 | | 8.48 | | 5.32 | |

68

| | High | | Low | |

2003 | | | | | |

1st quarter | | 7.9 | | 5.41 | |

2nd quarter | | 8.87 | | 6.99 | |

3rd quarter | | 8.76 | | 5.82 | |

4th quarter | | 7.6 | | 5.63 | |

The high and low market prices for Baran ordinary shares (in $) for the most recent six months:

| | High | | Low | |

June 14, 2004 | | 6.01 | | 5.88 | |

May 30, 2004 | | 7.34 | | 5.75 | |

April 31, 2004 | | 8.31 | | 7.43 | |

March 31, 2004 | | 8.1 | | 6.43 | |

February 2004 | | 7.58 | | 6.51 | |

January 2004 | | 8.4 | | 7.3 | |

Baran’s resolution to delist its shares from the NASDAQ National Market

On June 25, 2004, Baran announced that Baran’s board of directors resolved to concentrate the trading of its securities on the Tel-Aviv Stock Exchange (hereunder, “TASE”) and to voluntarily delist its shares from listing in the Nasdaq. In addition to delisting Baran’s shares from Nasdaq, Baran currently intends, under applicable SEC rules, to thereby cease filing annual and other reports with the SEC once the delisting is effective by filing a Form 15. As part of the delisting process, the board further resolved to file a post-effective amendment to Baran’s registration statement on Form S-8, which was filed with the SEC late last year in connection with Baran’s employee option incentive program for United States employees, in order to deregister the unsold shares registered by that registration statement.

The deregistration process shall commence no later than July 10th, 2004. The board resolved to authorize Baran’s management to set the filing of Form 15 timing and to take all measures and acts required for the implementation of the deregistration process.

Baran’s plan to deregister its ordinary shares was made after careful consideration of the advantages and disadvantages of continuing its share registration in the United States and the rising costs and demands on management time arising in connection with SEC and NASDAQ compliance requirements. After considering the limited number of Baran’s US holders of record and the low trade volume of Baran’s shares on NASDAQ, as well as the growing internationalization of stock markets. And in light of the related high costs and continuous increase in the onerous duties set upon Baran and its officers, resulting of being a NASDAQ traded entity, the board resolved that the listing is no longer justified. Baran is eligible to deregister because it has fewer than 300 shareholders of record world-wide. Baran’s shares shall continue to trade in the TASE and Baran shall continue to make public reports in accordance with the Israeli Securities and Exchange Committee rules and regulations.

69

The board believes that currently, burdens associated with being a “reporting company” under the 1934 Act, including those arising under the provisions of the Sarbanes-Oxley Act of 2002 outweigh the advantages of being a dual-traded company. The board farther believes that since the registration of Baran’s shares for trade in the NASDAQ, Baran’s chances to raise funds through the NASDAQ in the near future have reduced and at present this possibility seems improbable. It is the board’s opinion that the deregistration resolution is for the benefit of Baran and all its shareholders, including its US holders of record, who will be able to continue their trade in Baran’s shares through the TASE, where Baran enjoys a substantially higher trade volume.

Whether at some later point Baran will re-establish itself as dual-traded is an open question and will be taken up at an appropriate time. For the foreseeable future, the board believes that the best course is to deregister Baran shares from trade in the NASDAQ and to remain listed in the TASE.

ITEM 10. ADDITIONAL INFORMATION

Articles of Association

Under Israeli law, the founders of a company must present to the Israeli Registrar of Companies the company’s Articles of Association. Upon receipt of a certificate of registration from the Registrar of Companies, the company is considered duly incorporated. Following incorporation, an Israeli company must notify the Registrar of Companies of, among other things, all issuance of shares, amendments to the Articles of Association and the name and addresses of its shareholders of record and directors. A company must also submit to the Registrar of Companies the annual reports and, as Baran is a publicly traded company, the audited financial statements that it submits to its shareholders, which all become a matter of public record. Baran’s Israeli incorporation number is 52- 003725-0.

Audit Committee

Under Israeli Companies Law, the board of directors of any company whose shares are listed on any exchange must appoint an audit committee comprised of at least three directors including all of the outside directors, but excluding the:

| • | chairman of the board of directors; |

| • | general manager; |

| • | chief executive officer (or managing director); |

| • | controlling shareholder; and |

| • | any director employed by the company or who provides services to the company on a regular basis. |

70

Baran’s board has appointed Tami Gottlib, Liora Ofer and Arieh Shaked as members of its audit committee. Under Israeli Companies Law, the role of the audit committee is to identify irregularities in the business management of the company, in consultation with the internal auditor and the company’s independent accountants, and suggest an appropriate course of action.

Approval of Transactions with Office Holders and Controlling Shareholders

The approval of the audit committee is required to effect specified actions and transactions with office holders and controlling shareholders. The term controlling shareholder, includes a shareholder that holds 50% or more of the voting rights in a public company; if the company has no shareholder that owns more than 50% of its voting rights, then the term also includes any shareholder that holds 25% or more of the voting rights of the company. An audit committee may not approve an action or a transaction with a controlling shareholder or with an office holder unless at the time of approval the two outside directors are serving as members of the audit committee and at least one of them was present at the meeting at which the approval was granted.

Internal Auditor

Under the Israeli Companies Law, the board of directors must appoint an internal auditor nominated by the audit committee. The role of the internal auditor is to examine whether a company’s actions comply with the law and orderly business procedure. Under the Israeli Companies Law, the internal auditor may be an employee of the company but may not be an interested party or an office holder, an affiliate, or a relative of an interested party or an office holder, nor may the internal auditor be the company’s independent accountant or its representative. An interested party is defined in the Israeli Companies Law as a 5% or greater shareholder, any person or entity who has the right to designate one director or more or the chief executive officer (or managing director) of the company or any person who serves as a director or as a chief executive officer (or managing director).

Approval of Specified Related Party Transactions under Israeli Law

The Israeli Companies Law imposes a duty of care and a duty of loyalty on all office holders of a company, including directors and executive officers. The duty of care requires an office holder to act with the degree of care with which a reasonable office holder in the same position would have acted under the same circumstances. The duty of care includes a duty to use reasonable means to obtain:

| • | information on the appropriateness of a given action brought for his or her approval or performed by virtue of his or her position; and |

| | |

| • | all other important information pertaining to these actions. |

71

The duty of loyalty of an office holder includes a duty to:

| • | refrain from any conflict of interest between the performance of his or her duties to the company and his or her personal affairs; |

| | |

| • | refrain from any activity that is competitive with the company; |

| | |

| • | refrain from exploiting any business opportunity of the company to receive a personal gain for himself or herself or others; and |

| | |

| • | disclose to the company any information or documents relating to a company’s affairs that the office holder received as a result of his or her position as an office holder. |

The Israeli Companies Law requires that an office holder promptly disclose any personal interest that he or she may have and all related material information known to him or her relating to any existing or proposed transaction by the company, and in any event not later than the first meeting of the board of directors at which such transaction is considered. If the transaction is an extraordinary transaction, the office holder must also disclose any personal interest held by:

| • | the office holder’s spouse, siblings, parents, grandparents, descendants, spouse’s descendants and the spouses of any of these people; or |

| | |

| • | any corporation in which the office holder is a 5% or greater shareholder, director or general manager or in which he or she has the right to appoint at least one director or the general manager. |

Under the Israeli Companies Law, an extraordinary transaction is a transaction:

| • | other than in the ordinary course of business; |

| | |

| • | that is not on market terms; or |

| | |

| • | that is likely to have a material impact on the company’s profitability, assets or liabilities. |

Under the Israeli Companies Law, once an office holder complies with the above disclosure requirement, the board of directors may approve a transaction between the company and an office holder, or a third party in which an office holder has a personal interest, however, a transaction that is adverse to the company’s interest may not be approved. If the transaction is an extraordinary transaction, both the audit committee and the board of directors must approve the transaction. Under specific circumstances, shareholder approval may also be required. A director who has a personal interest in a transaction, other than a transaction which is not an extraordinary transaction, and which is considered at a meeting of the board of directors or the audit committee, may not be present at this meeting or vote on this matter unless a majority of the directors or members of the audit committee have a personal interest in the matter. If a majority of the directors have a personal interest in the matter, the transaction also requires the approval of the shareholders of the company.

72

Under the Israeli Companies Law, all arrangements as to compensation of office holders who are not directors require approval by the board of directors, and any undertaking to indemnify or insure an office holder who is not a director requires both board and audit committee approval. In general, arrangements regarding the compensation, indemnification and insurance of directors require audit committee and shareholders approval in addition to board approval.

Under the Israeli Companies Law, the disclosure requirements, which apply to an office holder, also apply to a controlling shareholder of a public company. Extraordinary transactions with a controlling shareholder or in which a controlling shareholder has a personal interest, and the terms of compensation of a controlling shareholder who is an office holder, require the approval of the audit committee, the board of directors and a majority of the shareholders of the company. In addition, the shareholders’ approval must fulfill one of the following requirements:

| • | at least one-third of the shareholders who have no personal interest in the transaction and are present and voting, in person, by proxy or by written ballot, at the meeting must vote in favor of approving the transaction; or |

| | |

| • | the shareholders who have no personal interest in the transaction who vote against the transaction may not represent more than 1% of the voting rights in the company. |

Under Israeli Companies Law, a shareholder has a duty to refrain from abusing his or her power in the company and to act in good faith and in an acceptable manner in exercising its rights and performing its obligations to the company and the other shareholders, including, among other things, voting at general meetings of shareholders on the following matters:

| • | an amendment to the articles of association; |

| • | an increase in the company’s authorized share capital; |

| • | a merger; and |

| • | approval of related party transactions that require shareholder approval. |

In addition, any controlling shareholder, any shareholder who knows that his or her vote can determine the outcome of a shareholder vote and any shareholder who, under the company’s articles of association, can appoint or prevent the appointment of an office holder, is required to act with fairness towards the company. The Israeli Companies Law does not describe the substance of this duty and there is no binding case law that addresses this subject directly. The above also applies to any voting agreement among shareholders of the company.

73

Exculpation, Insurance and Indemnification of Directors and Officers

Under Israeli Companies Law, an Israeli company may not exculpate an office holder from liability for a breach of the duty of loyalty of the office holder. However, the company may approve an act which otherwise will be treated as a breach of the duty of loyalty of an office holder provided that the office holder is acting in good faith, the act or its approval does not harm the company, and the office holder discloses the nature of his or her personal interest in the act and all material facts and documents a reasonable time before discussion of the approval. An Israeli company may exculpate an office holder in advance from liability to the company, in whole or in part, for a breach of duty of care but only if a provision authorizing such exculpation is inserted in its Articles of Association. Baran’s current Articles of Association do not include such a provision. An Israeli company may indemnify an office holder in respect of certain liabilities either in advance of an event or following an event provided that a provision authorizing such indemnification is inserted in its Articles of Association, and provided that the indemnification undertaking is limited to foreseeable liabilities and was in reasonable amounts as determined by the board of directors. Baran’s Articles of Association contain such a provision, and limit it further by stating that the aggregate indemnification amount will not exceed 25% of Baran’s net equity, as stated in its most recent financial reports before the actual indemnification. Baran may indemnify an office holder against the following liabilities incurred for acts performed as an office holder:

| • | a financial liability imposed on him or her in favor of another person pursuant to a judgment, settlement or arbitrator’s award approved by court; and |

| | |

| • | reasonable litigation expenses, including attorneys’ fees, incurred by the office holder or imposed by a court in proceedings instituted against him or her by the company, on its behalf or by a third party, or in connection with criminal proceedings in which the office holder was acquitted or as a result of a conviction for a crime that does not require proof of criminal intent. |

An Israeli company may insure an office holder against the following liabilities incurred for acts performed as an office holder:

| • | a breach of duty of loyalty to the company, to the extent that the office holder acted in good faith and had a reasonable basis to believe that the act would not prejudice the company; |

| | |

| • | a breach of duty of care to the company or to a third party; and |

| | |

| • | a financial liability imposed on the office holder in favor of a third party. |

74

An Israeli company may not indemnify or insure an office holder against any of the following:

| • | a breach of duty of loyalty, except to the extent that the office holder acted in good faith and had a reasonable basis to believe that the act would not prejudice the company; |

| | |

| • | a breach of duty of care committed intentionally or recklessly; |

| | |

| • | an act or omission committed with intent to derive illegal personal benefit; or |

| | |

| • | a fine levied against the office holder. |

Under the Israeli Companies Law, exculpation, indemnification and insurance of office holders must be approved by the audit committee and the board of directors of a company, and, in respect of its directors, by the shareholders. Baran’s directors and office holders are currently covered by a directors’ and officers’ liability insurance policy, which has an aggregate claims limit of $15 million, no claims for directors and officers’ liability insurance have been filed under this policy.

Baran has entered into agreements with each of its office holders undertaking to indemnify them to the fullest extent permitted by its Articles of Association. The procuring of insurance is subject to Baran’s discretion depending on its availability, effectiveness and cost. In the view of the U.S. Securities and Exchange Commission, however, indemnification of directors and officers for liabilities arising under the Securities Act is against public policy and therefore unenforceable.

Baran’s board may declare a dividend to be paid to the holders of ordinary shares in proportion to the shares of the company that they hold. Dividends may only be paid out of profits and other surplus funds, as defined in the Israeli Companies Law, as of the end of the most recent fiscal year or as accrued over a period of the most recent two years, whichever is higher, provided that there is no reasonable concern that a payment of a dividend will prevent Baran from satisfying existing and foreseeable obligations as they become due.

In the case of a share dividend or bonus shares, holders of each class of shares can receive shares of the same class that confer upon the holder the right to receive the share dividend or shares of another class whether the class was preexisting or was created for the purpose of issuing the share dividend or bonus shares, or a combination of such classes of shares.

The Board of Directors may, before offering any dividend whatsoever, set aside certain amounts from the Company’s profits as it sees fit, as a reserve to be kept for certain purposes, and the Board can invest the sums that have been so set aside in such investments as it sees fit, and it may from time to time deal with these investments and change them and use all or some of them for the Company’s benefit, and the Board may use the reserve or any part of it in the Company’s business, without being required to hold it separately from the Company’s other assets. Subject to all of the special or limited rights attached to any of the shares, a cash dividend will be distributed to shareholders proportionately to the paid-in capital on the par value of the shares held by them, without regard for the premium paid for the shares.

75

The Board of Directors may from time to time determine the manner of the payment of the dividends or the distribution of stock dividends and the arrangements relating to this with respect to the shareholders. Without limiting the generality of the above, the Board of Directors may pay any dividends or funds for shares by sending a check by mail to the shareholder’s address as it is recorded in the shareholders’ register. The shareholder will bear the risk with regard to any such mailing of a check.

On those occasions when the Board of Directors provides for the payment of dividends, or the distribution of shares or debentures out of the Company’s capital, or the granting of a right to subscribe for shares that have not yet been issued and which are offered to shareholders against the delivery of an appropriate coupon which is attached to the shareholders’ share certificates, such payment, distribution or granting of a right to subscribe against an appropriate coupon to the holder of the said coupon will constitute a discharge of the Company’s debt with respect to such activity to any person claiming a right to such payment, distribution, or granting of a right to subscribe, whichever is relevant.

The Board of Directors may defer the payment of a dividend, benefit, or right that was to be paid for shares regarding which the Company has a lien, and to use the consideration received upon the forfeiture of such for the purpose of paying the debts for which the Company has the lien.

The transfer of a share will not give the transferee the right to receive a dividend or any other distribution which is declared after the date of the transfer of the share and before the transfer of the share is recorded, except that in the event that the transfer of the share requires the approval of the Board of Directors, the date of such approval will for this purpose take the place of the date on which the transfer is recorded. If payment of a dividend is not demanded within a period of 7 years from the date on which its distribution applies, the party entitled to it will be viewed as having waived it and the payment will be restored to the Company’s ownership.

The Board of Directors may deduct from any dividend, grant or other monies that are to be paid in connection with shares that are held by a shareholder, whether such shareholder is the sole owner or owns it jointly with another shareholder, any amounts of money owed by the shareholder which he alone is required to pay to the Company or which he is required to pay to the Company together with any other person, such as payments to be made in response to demands for payment, and such-like. In the event that there are joint holders of a single share, either one of them can give a valid receipt for any dividend that is paid on that share, or for any other funds or privileges given in relation to that share.

76

Baran’s ordinary shares do not have cumulative voting rights for the election of directors. As a result, the holders of Baran’s ordinary shares that represent more than 50 percent of the voting power present or represented at a shareholders meeting have the power to elect or remove any or all of Baran’s directors, subject to special approval requirements for outside directors described above.

In the event of Baran’s liquidation, after satisfaction of liabilities to creditors, Baran’s assets will be distributed to the holders of ordinary shares in proportion to the nominal value of their respective shares. This right may be affected by the grant of preferential dividend or distribution rights to the holders of a class of shares with preferential rights that may be authorized in the future.

Baran is required to convene an annual meeting of its shareholders once every calendar year within a period of not more than 15 months following the preceding annual general meeting. Baran’s board is required to convene a special meeting of its shareholders at the request of two directors or one quarter of the members of its board or at the request of one or more holders of 5% or more of its share capital and 1% of its voting power or the holder or holders of 5% or more of its voting power. Shareholder meetings require prior notice of at least 21 days, or under certain circumstances, 14 days. The chairman of Baran’s board or any director appointed the chairman or the secretary of Baran presides over its shareholder meetings.

Under the Israeli Companies Law, Baran is not required to send out proxy statements to its shareholders in connection with an annual or special meeting. Baran must provide notice of any shareholders’ meeting, which notice shall include the agenda for the meeting. The Israeli Companies Law permits a company to allow its shareholders, if so permitted by its Articles of Association, to vote by written proxy, by appointing a representative with a power of attorney to vote at the shareholders’ meeting on behalf of the shareholders.

Baran has adopted a provision in its Articles of Association permitting voting by proxy. When Baran solicits the votes of its shareholders in the United States, it sends proxy cards to them. The Israeli Companies Law also permits shareholders to vote by written ballot by signing a voting instrument attached to the proxy statement; however, this provision of the law is not yet in force, and will only take effect once the Minister of Justice issues regulations providing the procedure for such vote. Holders of Baran ordinary shares have one vote for each ordinary share held on all matters submitted to a vote of shareholders at a shareholder meeting. Shareholders may vote at shareholder meetings either in person or by proxy. Israeli law does not provide for public companies such as Baran to have shareholder resolutions adopted by means of a written consent in lieu of a shareholder meeting. Shareholder voting rights may be affected by the grant of any special voting rights to the holders of a class of shares with preferential rights that may be authorized in the future. The Israeli Companies Law provides that a shareholder, in exercising his or her rights and performing his or her obligations toward the company and its other shareholders, must act in good faith and in an acceptable manner, and avoid abusing his or her powers. This is required, when, for example, voting at shareholder meetings on matters such as changes to the Articles of Association, increasing the company’s registered capital, mergers and approval of related party transactions. A shareholder must also avoid oppression of other shareholders. In addition, any controlling shareholder, any shareholder who knows that his or her vote can determine the outcome of a shareholder vote and any shareholder who, under the company’s Articles of Association, can appoint or prevent the appointment of an office holder, is required to act with fairness towards the company. The Israeli Companies Law does not describe the substance of this duty and there is no binding case law that addresses this subject directly. Any voting agreement is also subject to observance of these duties.

77

An ordinary resolution requires approval by the holders of a simple majority of the voting rights represented at the meeting, in person, by proxy or by written ballot (if permitted), and voting on the resolution. Under the Israeli Companies Law, a resolution for the winding up of the company or for changing its Articles of Association requires approval by holders of 75% of the voting rights represented at the meeting, in person, by proxy or by written ballot (if permitted) and voting on the resolution. Unless otherwise provided in the Articles of Association or the Israeli Companies Law, all other resolutions of Baran shareholders require a simple majority.

The quorum required for a shareholder meeting consists of at least two shareholders present, in person or by proxy, who hold or represent between them at least 25% of Baran’s issued share capital. If a quorum is not present within 30 minutes from the time scheduled for the meeting, the meeting will be cancelled.

All of Baran’s issued and outstanding ordinary shares are duly authorized, validly issued and fully paid. Baran’s ordinary shares are not redeemable and have no preemptive rights.

The ownership or voting of ordinary shares by non-residents of Israel is not restricted in any way by Baran’s Articles of Association, or the laws of the State of Israel, except that citizens of countries which are, or have been, in a state of war with Israel may not be recognized as owners of ordinary shares.

Issuance of shares to a person holding 5% or more of the company’s shares or that will become 5% shareholder, requires the approval of the general meeting, in addition to the board of directors’ approval. Other issuance of shares to interested parties is subject to several restrictions.

The approval of a merger will be given in a resolution of the general meeting adopted by an ordinary majority.

Through a resolution adopted by a regular majority, Baran may:

| • | Enlarge its share capital in an amount to be decided, through the creation of new shares at a par value, with terms and rights as shall be decided. Such a decision can be taken whether or not all the existing shares have been issued or a resolution has been made to issue them, or whether they have not all been issued or a resolution has not been made to issue all of them. |

78

| • | Issue shares whether they are included in its original capital or are the result of an increase in the share capital, giving them either preferential or subordinate rights, or issue shares from the capital that has not yet been issued that will be redemption shares and redeem them, or issue shares and give them special limited rights or limitations in connection with the distribution of dividends, voting rights, repayment of capital, or in connection with other matters as may be determined in the resolution. |

| | |

| • | Issue redemption shares and to redeem them, to the extent permitted by law. |

| | |

| • | Unless the terms of the issuance of such shares provide otherwise, to convert, cancel, exchange, expand, add or change in any other manner the rights, preferences, advantages, limitations and provisions connected to or that are not at such time connected to any of the classes of shares. |

| | |

| • | Cancel authorized share capital that has not yet been issued, to the extent permitted by law. |

| | |

| • | Combine and re-divide its share capital into shares with larger par values than the existing par values. |

| | |

| • | Re-divide all or some of its share capital through a redistribution of the existing shares into shares of smaller par value than that of the existing shares, in accordance with the provisions of the law. |

| | |

| • | Reduce its share capital, in the same manner and under the same conditions, and subject to having obtained the approvals as required by law. |

| | |

| • | The special rights granted to holders of shares or of a class of shares that have been issued, including shares that have been issued with senior rights or other special rights, will not be considered to have been changed by the creation or issuance of additional shares of the same rank, unless otherwise provided in the terms of the issuance of those shares. |

Any change, conversion, cancellation, expansion, addition or other change in the rights, preferences, advantages, limitations or provisions connected with a specific class of shares that has been issued to shareholders of Baran shall be subject to the consent of the holders of the outstanding shares of that class, such consent to be given in writing by the owners of all outstanding shares of that class, or by a resolution adopted by an ordinary majority at the meeting of shareholders of that class – i.e., a class shareholder meeting.

79

The Board of Directors may, in its discretion, resolve any difficulty that may arise in order to carry out any such resolution. Without limiting the said authority of the Board of Directors, in the event that as a result of a combination of shares, there are shareholders, the combination of whose shares leaves them with fractional shares, the Board of Directors may:

| • | Sell the total of all the fractional shares, and appoint a trustee for this purpose in whose name the certificates will be issued for the shares made up of the fractions, which will be sold and the consideration for which will be distributed to the entitled shareholders, after deducting fees and expenses; or |

| | |

| • | Allot to each of the shareholders regarding whom the combination has left with fractional shares, shares of the same class as were held before the combination, paid in full, in an amount, which after being combined with the fractional share will come to a single full combined share. Such allotment will be considered to have taken effect immediately before the combination; |

| | |

| • | Determine that the shareholders will not be entitled to receive a combined share for any fraction of a combined share that results from a combination of half or less than the number of shares the combination of which creates one single combined share. Such shareholders will be entitled to receive one combined share only for every fraction of a combined share that results from the combination of shares that number more than half of the number of shares the combination of which creates one single combined share. |

In the event the board action taken requires the issuance of additional shares, then the payment shall be done in the manner in which dividend shares may be paid up. Such combinations and divisions will not be considered to be a change in the rights of the shares that are the subject of the combination and division.

In any event of a combination of shares into shares with a larger par value, the Board of Directors may establish arrangements for the purpose of overcoming any difficulty that may arise in connection with the combination, and the board is permitted to determine which shares are to be combined into a particular share or into another. In the event of combination of shares that are not owned by the same owners, the Board may establish arrangements for the sale of the combined share, the manner of its sale and the manner of distribution of the net consideration received, and to appoint a person who shall carry out the transfer, and every action taken by such person shall be valid and may not be challenged.

Subject to the provisions of the Articles of Association, the Board of Directors may issue shares and other securities which are convertible or which may be realized as shares, up to the limit of the Company’s authorized share capital. It may, within the scope of the authority thus granted to it, and in return for cash or other form of consideration, issue shares (or otherwise deal with them), and with those reservations and conditions, whether regarding the premium paid, the par value or the deduction, and at those times that it sees fit, and to grant to any person the right to demand the issuance of shares during a particular period, and for such consideration as the Board of Directors may determine.

80

In the event that Baran’s shares are offered for sale, there is no obligation to make a similar offer to all or to some of the holders of the Company’s shares. Upon the issuance of shares, the Board of Directors may establish various conditions for the shareholders, with regard to consideration, the amounts the payment of which is demanded and/or the time of the payment of such shares.

Material Contracts

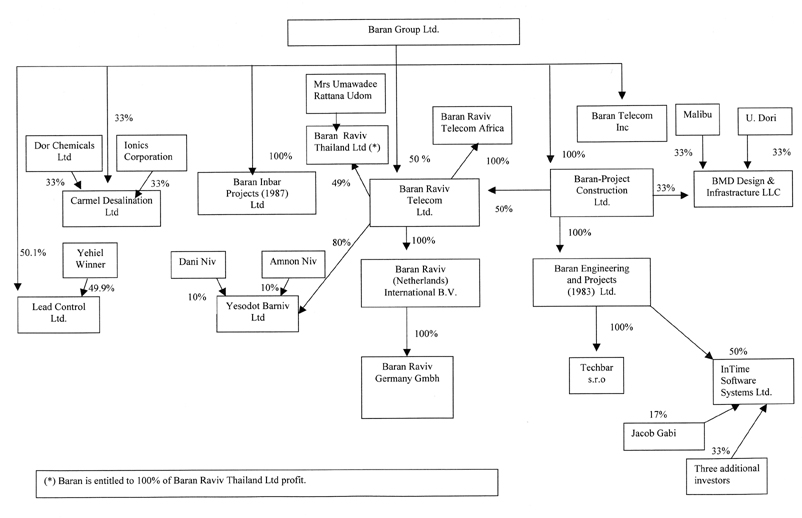

As part of a compromise agreement, a consortium, which is composed of Baran (50%) and Ionics Inc. (50%), was announced by Mekorot The Water Company (the Israeli National Water Company), as the exclusive winner of a tender to the construction of a water desalination facility in Ashdod, Israel. The project will be erected on a “Turn Key” basis and its construction estimated cost is approximately $95 million.

On July 4, 2003 BMD was awarded the exclusive right to negotiate the performance of a bid for the construction and operation in Romania of a 13 KM, four lanes and four bridges highway. The construction of the project shall be accomplished within two years and BMD will be granted with the right to operate the highway for 10 years. The estimated cost of the project is approximately 25 million Euro and the expected income is approximately 46 million Euro, during 10 years.

On October 23, 2003, Nes Pan Ltd., which is held (50%) by Baran, has entered, as a partner, into a real estate project in Toronto Canada. The Project includes the construction of about 470 dwelling units in an area next to Lake Ontario in Toronto, Canada. The value of the Project is approximately 95 million Canadian Dollars. Nes Pan’s Ltd. share in the Project shall be 45% (consequently Baran’s share is 22.5%) and 50% in the control of the Project; 45% of the Project are held by another Israeli Company and the rest 10% are held by an American financial investor.

The construction of the Project and its progression is conditioned upon the scope of early sales of the dwelling unites, and expected to commence on the beginning of 2004 and last approximately two years.

On May 31st, 2004 the Company’s board of directors resolved to approve the sale of Baran holdings in A.L.D Advanced Logistics Developments Ltd. (“A.L.D”), amounting to 50.5% of A.L.D’s issued capital, to Dr. Zigmond Bluvband, for consideration in the sum of $1.65 million. Baran resolution to sell its holdings in A.L.D resulted from the fact that A.L.D’s activity is external to Baran’s core business scope. The above sale is in consistence with Baran’s policy as of mid 2003, to focus Baran’s activity on its core business, i.e. engineering, technology and construction solutions global services and following reduce in none engineering activities

81

Exchange Controls

Under Israeli law, non-residents of Israel who purchase ordinary shares with certain non-Israeli currencies (including US dollars) may freely repatriate in such non-Israeli currencies all amounts received in Israeli currency in respect of the ordinary shares, whether as a dividend, as a liquidating distribution, or as proceeds from any sale in Israel of the ordinary shares, provided in each case that any applicable Israeli income tax is paid or withheld on such amounts. The conversion into the non-Israeli currency must be made at the rate of exchange prevailing at the time of conversion. Under Israeli law and our company’s Memorandum and Articles of Association both residents and non-residents of Israel may freely hold, vote and trade ordinary shares.

Israeli Taxation

The following discussion is not intended to constitute a complete analysis of all tax consequences relating to the receipt, ownership or disposition of Baran’s ordinary shares and does not address any non-income tax or any non-Israeli tax consequences of the merger. On July 24, 2002, the Law for Amendment of the Income Tax Ordinance (Amendment No. 132), 2002 (the “Amendment’’) was enacted by the Israeli authorities. This Amendment became effective as of January 1, 2003.

Taxation of Baran Shareholders Capital Gains on Sales of Baran Ordinary Shares

Israeli law imposes a capital gains tax on the sale of capital assets. The law distinguishes between real gain and inflationary surplus. The inflationary surplus is a portion of the total capital gain that is equivalent to the increase of the relevant asset’s purchase price, which is attributable to the increase in the Israeli consumer price index between the date of purchase and the date of sale. Foreign residents, as described below, who purchased an asset in non-Israeli currency, may request that the inflationary surplus will be computed on the basis of the devaluation of the NIS against such foreign currency. The real gain is the excess of the total capital gain over the inflationary surplus. The inflationary surplus accumulated from and after December 31, 1993, is exempt from any capital gains tax in Israel while the real gain is added to ordinary income, which is currently taxed at ordinary rates of up to 50% for individuals and 36% for corporations. Currently, sales of ordinary shares of Israeli public companies whose shares are quoted on the Tel Aviv Stock Exchange (such as Baran) are generally exempt from Israeli capital gain tax. Dealers in securities in Israel or any other seller whose income from selling shares is classified as current income and not as capital gain under the Income Tax Law (Inflationary Adjustment), 1985, are taxed at regular tax rates applicable to business income.

A foreign resident is a person who is not an Israeli resident. An Israeli resident is: an entity registered in Israel whose principal activity is in Israel, an entity that is registered as a foreign company, if it elects to be treated as an Israeli resident. This election is irrevocable for the three tax years after the election, unless the entity obtains a special permit. Under the Amendment, as of the effective date, any corporation that incorporated in Israel, an entity over which control and the management of its business are exercised in Israel, an individual residing in Israel, except for temporary absences, which do not contradict the individual’s claim of residence in Israel, would be considered an Israeli resident.

82

Pursuant to the Amendment, the above-described exemption on capital gains on sales by Israeli residents of listed securities, which were accrued since the effective date will be terminated. Under the Amendment, the general rate of capital gains will be reduced to 25% and the rate of capital gains on sales of publicly traded securities will be 15%. Shareholders whose income from selling Baran’s shares is classified as business profits (in contrast to capital gain) would be taxed at ordinary income tax rates (up to 50% for individuals and 36% for corporations).

Under the Amendment, the exemption on capital gain of foreign residents from selling publicly traded securities on the Tel Aviv Stock Exchange will continue to apply, and therefore the Amendment will not affect any tax exemptions applicable to foreign residents prior to the effective date.

Israeli Taxation of Non-Israeli Holders of Shares

Israeli law provides that non-Israeli residents are subject to capital gains tax on the gains from the sale of a capital asset (including securities) in Israel or an asset located outside Israel that is a right, direct or indirect, to an asset in Israel unless an exemption is provided under any provision of a double-taxation treaty with Israel. Under the double-taxation treaty between Israel and the U.S. (the “Treaty’’), Israeli capital gains tax will not apply to the sale, exchange or disposition of ordinary shares by a person who qualifies as a resident of the United States within the meaning of the Treaty, and who is entitled to claim the benefits available to the person by the Treaty.

This exemption will not apply, among other cases, if the gain is attributable to a permanent establishment of such person in Israel, or if the U.S. resident holds, directly or indirectly, shares representing 10% or more of Baran’s voting power during any part of the 12-month period preceding the sale, exchange or disposition, subject to certain conditions. In this case, the sale, exchange or disposition would be subject to Israeli tax, to the extent applicable. However, the U.S. resident generally would be permitted to claim a credit for the taxes against the U.S. federal income tax imposed on the sale, exchange or disposition, subject to the limitations in U.S. laws applicable to foreign tax credits. The Treaty does not apply to U.S. state or local taxes. Sales of Baran ordinary shares by non-Israeli holders, whether on the Tel Aviv Stock Exchange or on the Nasdaq National Market, would be exempt from Israeli capital gains tax under the Amendment as long as the shares are listed on the Tel Aviv Stock Exchange. Non-residents of Israel are subject to tax on income accrued or derived from sources in Israel or received in Israel. These sources of income include passive income such as dividends, royalties and interest, as well as non-passive income, such as income received for services rendered in Israel. Baran is required to withhold income tax at the rate of 25% (or 15% for dividends distributed from certain income generated by an entity, such as two of Baran’s subsidiaries, that enjoys approved enterprise status under certain Israeli tax incentive law) unless a different rate or an exemption is provided in a tax treaty between Israel and the shareholder’s country of residence. Under the Treaty, the maximum rate on dividends paid to a U.S. resident is 25%. In addition, under the Treaty, if the income out of which the dividend is being paid is not attributable to an approved enterprise and the non-resident is a U.S. corporation that holds 10% of Baran’s voting power for a certain minimum period, the rate is generally 12.5%. Under an amendment to the Inflationary Adjustments Law, non-Israeli corporations may be subject to Israeli taxes on the sale of shares in an Israeli company, which shares are traded on certain stock markets, including the Nasdaq National Market, subject to the provisions of any applicable double taxation treaty.

83

Documents on Display