Exhibit 99.1

Endurance Specialty Holdings Ltd.

Merrill Lynch Insurance Investor

Conference

February 14, 2006

Forward Looking Statements

Statements contained in this presentation that are not based on

current or historical fact are forward-looking in nature. Such forward-

looking statements are based on current plans, estimates and

expectations and are made pursuant to the Private Securities

Litigation Reform Act of 1995. Forward-looking statements are based

on known and unknown risks, assumptions, uncertainties and other

factors. The Company's actual results, performance, or achievements

may differ materially from any future results, performance, or

achievements expressed or implied by such forward-looking

statements. The Company undertakes no obligation to publicly update

or revise any forward-looking statement.

2

Overview

3

Founded on best practices of enterprise risk management, with leading edge:

Underwriting expertise

Data

Technology

Underwriting, financial and accounting controls

Corporate governance

Strong management team that thinks and acts like shareholders

Committed to building long-term shareholder value

Focused on execution excellence

Executive compensation aligned with shareholders’ interests

Shareholder-friendly culture

Commitment to openness, transparency and industry leading disclosure practices

Endurance was named a finalist in Institutional Investor magazine’s ranking of America’s

most shareholder-friendly companies in 2005

Endurance Differentiation

4

What We Have Achieved

Established one of the leading insurance/reinsurance markets in the industry

Global reinsurance

Bermuda based insurance products

U.K./European property insurance

U.S. based specialty insurance

Developed technical underwriting culture focused on achieving superior returns on equity

Goal is to generate 15%+ return on equity throughout the P&C cycle

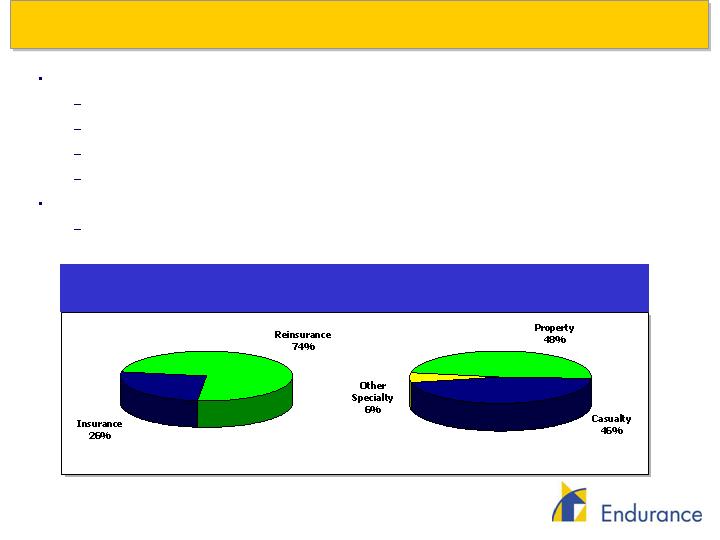

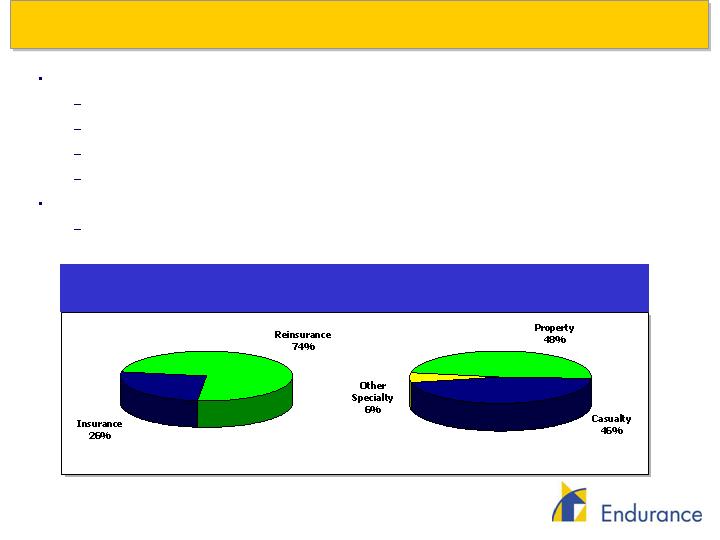

Our Business At A Glance

2005 Gross Premiums Written = $1.8B [a]

[a] Prior to deposit accounting adjustments

5

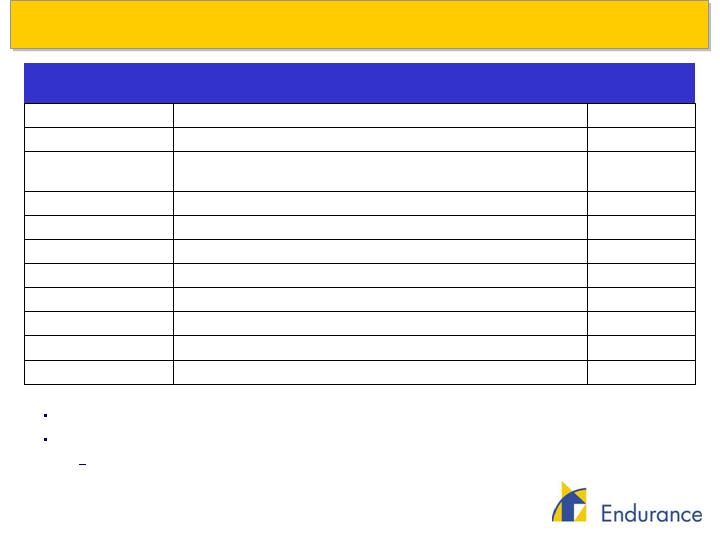

Strong Executive Management Team

22

Chief Operating Officer, Endurance Specialty Insurance Ltd.

Susan Patschak

21

President, Endurance Services Limited

John O’Connor

31

President, Endurance U.S. Insurance Operations

Michael Fujii

25

CEO of Endurance Worldwide Insurance Limited (U.K.)

Mark Boucher

25

President, Endurance Reinsurance Corporation of America

William Jewett

33

President, Endurance Specialty Insurance Ltd. (Bermuda)

Daniel Izard

21

Chief Actuary and Chief Risk Officer

Michael Angelina

15

Chief Underwriting Officer

David Cash

27

Chief Operating Officer, Chairman of the Underwriting

Committee, Chairman of Endurance Services Ltd.

Steven Carlsen

12

Chief Financial Officer

Michael McGuire

27

Chairman, President & Chief Executive Officer

Kenneth LeStrange

Years of

Experience

Position

Name

Executive Team has proven its ability to execute challenging strategies

Built a culture of meritocracy and ownership

5% of equity interests owned by management at 12/31/05

6

Underwriting & Strategy

7

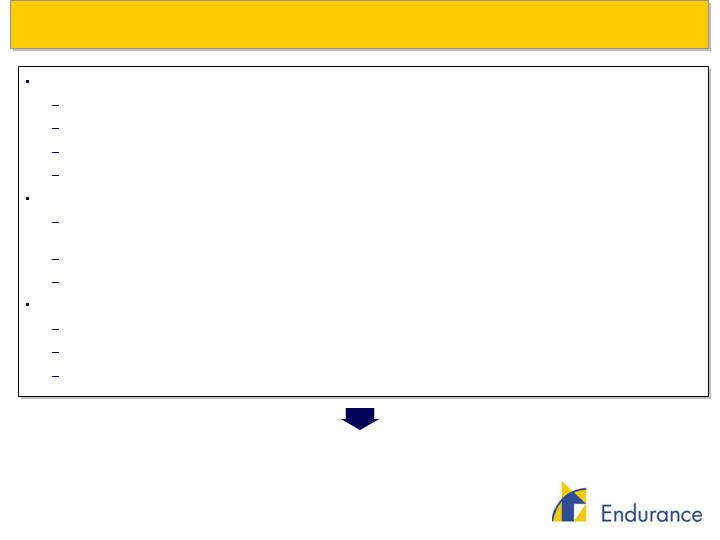

Strategy

Identify business segments with sufficient opportunities to apply expertise

Only underwrite risks that are susceptible to underwriting and actuarial analysis

Reallocate capital as different businesses become relatively less attractive

Net line underwriting with limited use of reinsurance

Culture

Understand the risk correlations within each segment and across portfolio to determine required

margins

Identify risks within each segment that meet return thresholds

Apply technical resources at the front end to evaluate and select business

Control

Focus on target returns, not premiums

Monitor underwriting decisions on a live basis

Monitor emergence of results to corroborate assumptions

Underwriting Philosophy

Philosophy that is disciplined, consistent

and embraced by underwriting teams

8

Inception-to-date Underwriting Results are Profitable

Generated an inception-to-date underwriting profit and a combined ratio of 99%, despite experiencing 7

of the 10 costliest hurricanes in history during our first four years of operation

Our non-wind exposed businesses performed well in 2005, significantly mitigating the financial loss for

the year

10.0

Wilma

2005

3.4

Georges

1998

3.7

Jeanne

2004

4.6

Frances

2004

4.7

Rita

2005

6.4

Hugo

1989

7.1

Ivan

2004

7.5

Charley

2004

20.8

Andrew

1992

34.4

Katrina

2005

Insured Loss ($, Billion)

Event

Year

Top 10 Hurricanes and Estimated Insured Loss

(Events that occurred prior to 2004 are adjusted to 2004 $)

9

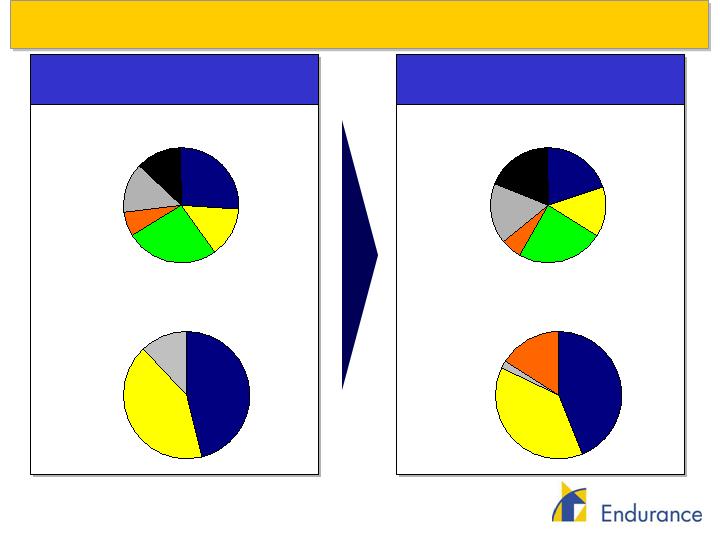

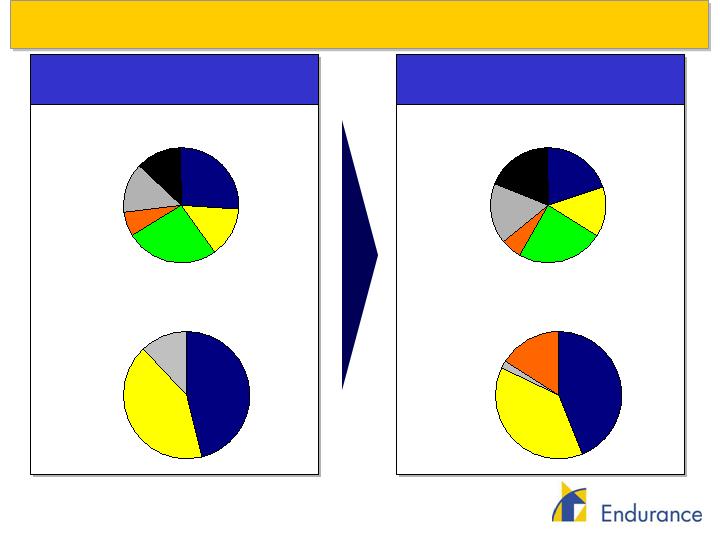

Risk Exposures Adjusted to Changing Market Conditions

2005 Gross Premiums Written =

$1.8B [a]

(a)

Prior to deposit accounting adjustments

2004 Gross Premiums Written =

$1.7B

U.S.

Reinsurance

42%

Bermuda

46%

U.K.

12%

Casualty Treaty

26%

Property

Cat

14%

Property

Per Risk

26%

Aerospace &

Other Specialty

13%

Casualty

Individual Risk

14%

Property

Individual Risk

7%

Casualty

Treaty

24%

Property

Cat

14%

Property

Per Risk

20%

Aerospace &

Other Specialty

19%

Casualty

Individual Risk

17%

Property

Individual Risk

6%

U.S.

Reinsurance

38%

Bermuda

44%

U.K.

16%

U.S.

Insurance

2%

10

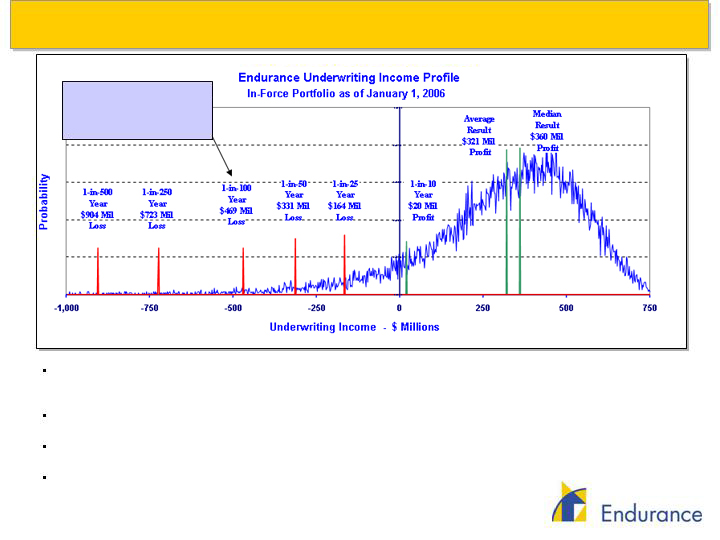

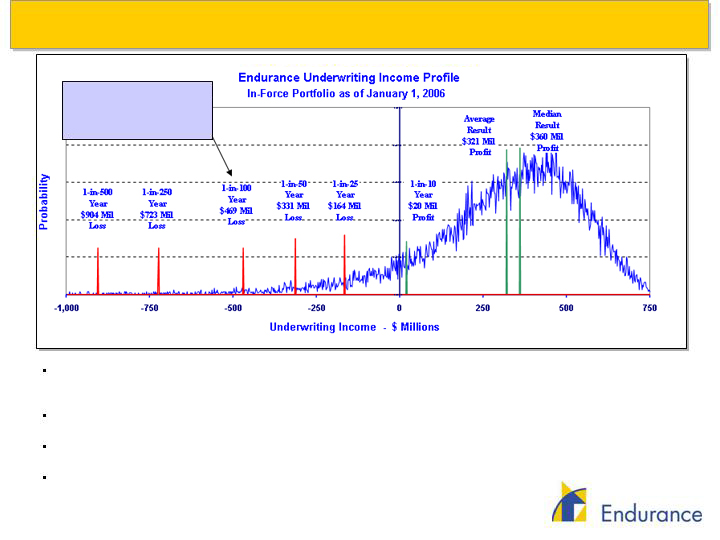

Risk Review – Portfolio Expected Risk Curve

This chart represents a cumulative simulation analysis of our in-force underwriting portfolio. Portions to the right of the

y-axis represent simulated underwriting profit and those to the left underwriting losses. Underwriting income

represents annual premiums earned less losses, acquisition expenses, G&A expenses and investment income.

Based on our business at January 1, 2006, there is approximately an 85% chance of a profitable underwriting result

and a mean expected result of a $321 million underwriting profit.

We base our budget and forecasts off of the mean result, although the nature of the curve places the median result

further to the right (i.e., more profitable).

We manage the tail of our exposures to limit our loss in a 1-in-100 year to 25% of our capital or less for a year.

Stated objective is to

limit our loss in a 1-in-

100 year to 25% of our

capital or less

11

Observations Based on Review of 2005 Hurricanes

Diversification matters

Despite the enormity of the 2005 hurricanes:

All segments inception-to-date combined ratio = 99%

Property cat inception-to-date combined ratio = 80%

All segments excluding property cat inception-to-date combined ratio = 102%

Our corporate philosophy of allowing each type of business to be written in only one location

(“Bright Lines”) served us well in identifying and limiting our loss, as well as communicating

our ongoing posture in the market

Catastrophe simulation model performance varied by line of business

We suffered a disproportionate loss on our Property Individual Risk business written out of

Bermuda

Limited use of reinsurance means our prospective risk profile needs adjustment, but not

drastic reductions

12

Actions Based on These Observations

We have shifted toward a lower, more certain catastrophic risk profile

We have adjusted the frequency and severity assumptions in the catastrophe models to reflect

current climate conditions

We have increased our underwriting margin requirements to reflect new insights in the

amounts of capital required for backing many of our business segments

We have developed new risk management tools to fill gaps in existing catastrophe models

(including flood exposure and location-by-location aggregation tools)

Key opportunities for Endurance

U.S. on-shore Property Individual Risk insurance

Property Catastrophe reinsurance

Property Per Risk Treaty reinsurance

13

Financial Review

14

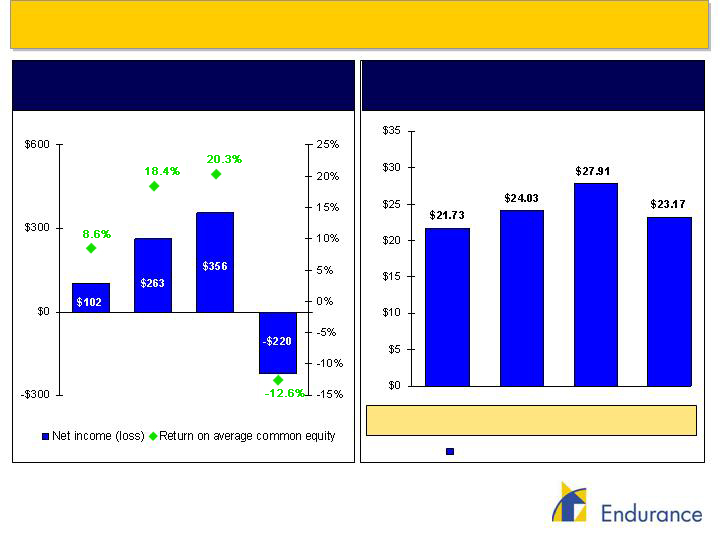

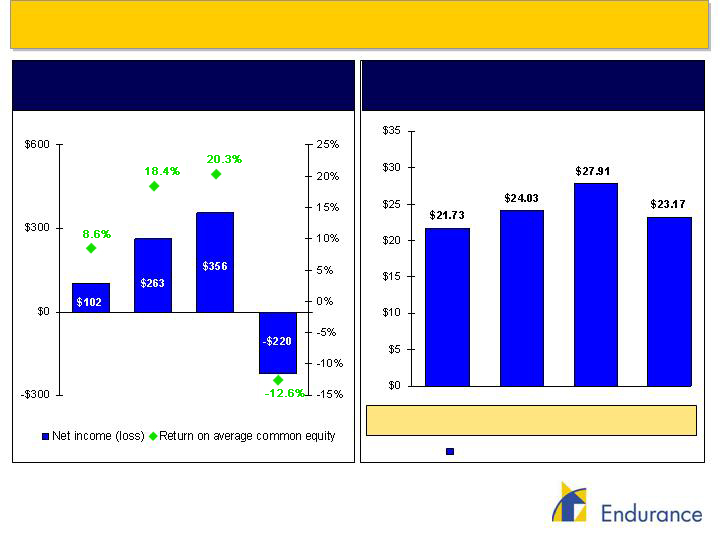

Strong Financial Performance in Volatile Segments

Net Income (Loss) ($M) and

Return on Average Common Equity

Diluted Book Value Per Common Share

2002

2003

2004

2005

2002

2003

2004

2005

Diluted Book Value Per Common Share

Dividends

per share

$0.32

$0.81

$1.00

-

15

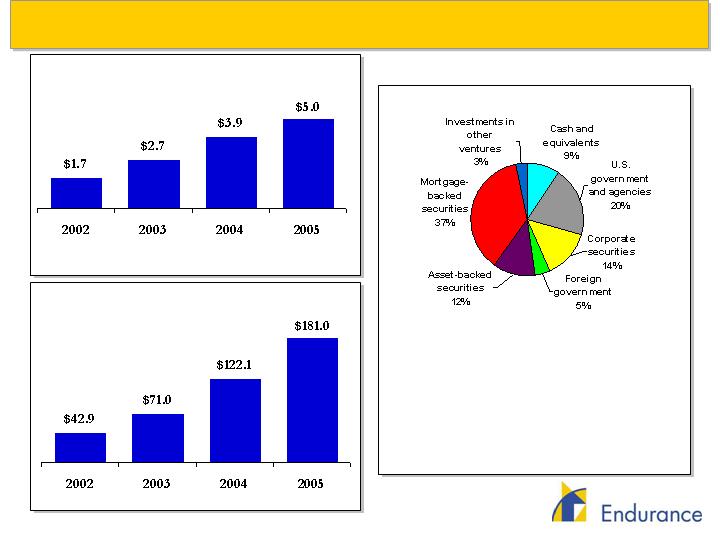

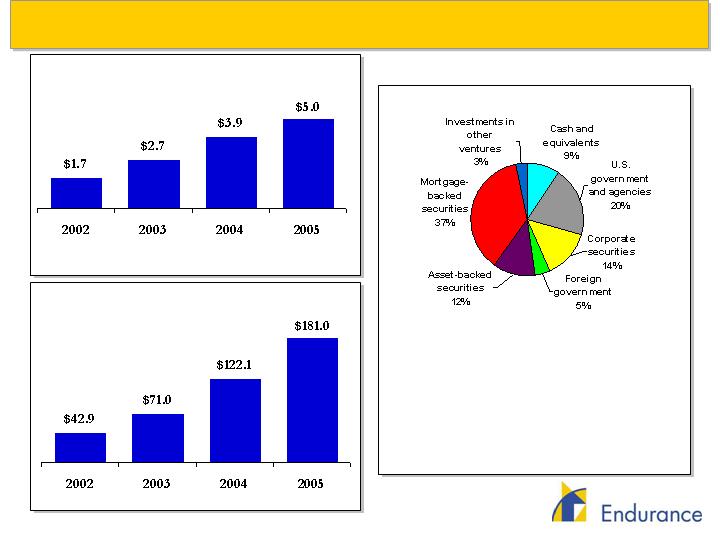

Investments Becoming A Larger Contributor to Income

Cash and Invested Assets ($, billions)

Investment Income ($, millions)

A Conservative Investment Portfolio

Fair Value at Dec. 31, 2005 = $5.0 B

Investment Ratings

AAA/U.S. Govt. & Agencies 85%

AA/Aa 4%

A/A 8%

BBB and below 0%

Not rated/Other ventures 3%

16

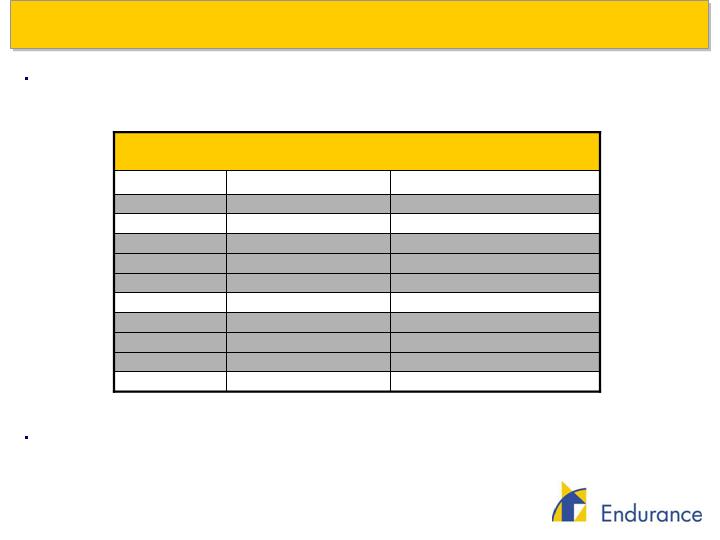

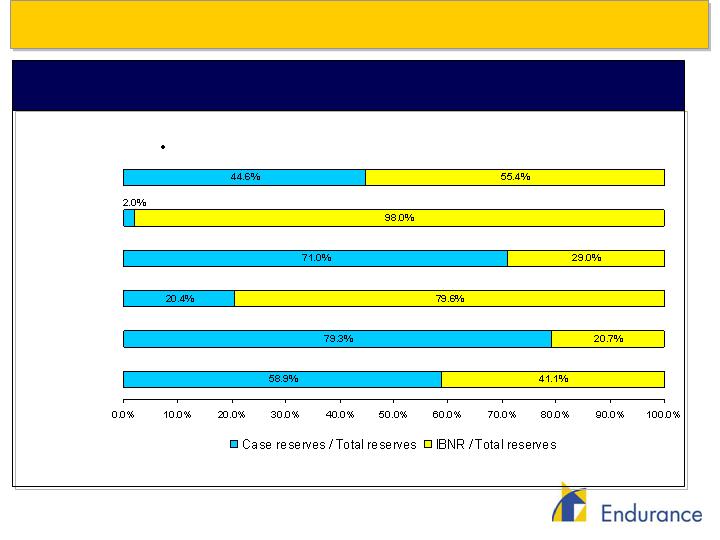

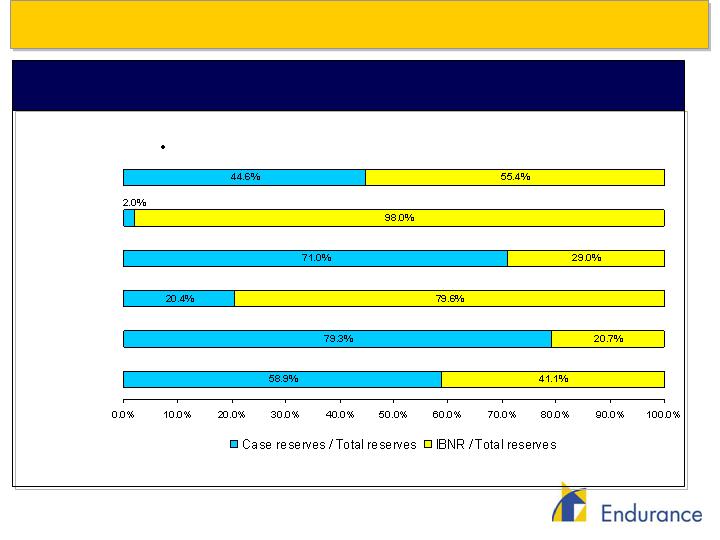

Prudent Loss Reserves

Ratio of IBNR to Total Reserves by Segment as of December 31, 2005

Aerospace &

Other Specialty

Casualty

Individual Risk

Property

Individual Risk

Casualty Treaty

Reinsurance

Property CAT

Property Per

Risk

Total Company: Case Reserves = 38.9%; IBNR = 61.1%

48% of case reserves related to 2005 hurricanes [a]

[a] % of case reserves related to 2005 hurricanes by segment: Aerospace & Other Specialty = 53%; Casualty Individual Risk = 0%; Property

Individual Risk = 59%; Casualty Treaty Reinsurance = 0%; Property CAT = 82%; Property Per Risk = 42%.

17

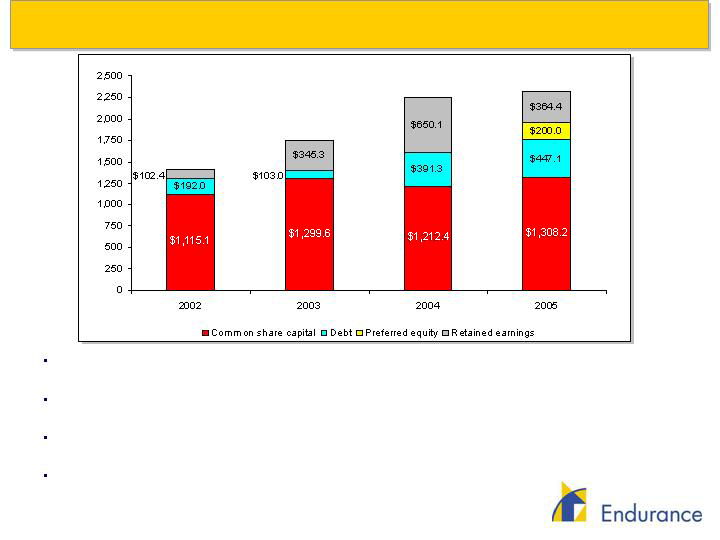

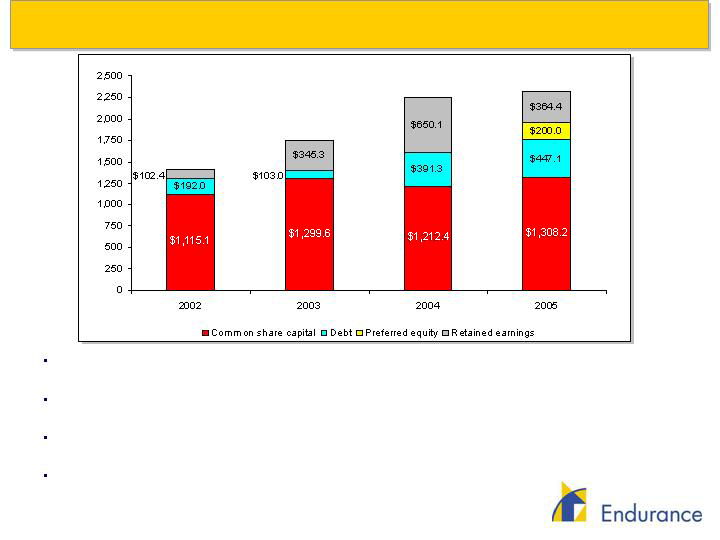

Strong and Flexible Capital Structure

Capital structure is driven by our goal to achieve a return on equity of 15% or higher throughout

the cycle

Cyclicality of industry and rating agency capital requirements necessitate a flexible capital

structure and strong relationships with capital markets

We optimize the cost, mix and access to various forms of capital, as well as the form in which

capital is returned to shareholders

2005 capital raising achieved with minimal dilution to existing shareholders

$, Millions

$1,410

$1,748

$2,254

$2,320

18

Achieving Our Targets

Return On Equity Sensitivity Analysis*

* The Projected 2006 ROE Component Build-Up is purely illustrative and should not be construed as guidance

for 2006 performance.

Operating Assumptions

2.4:1.0 Investment

Leverage at 4.0% yield

0.9:1.0 Operating

Leverage

ROE = 9.6%

ROE = 18.6%

ROE = 23.1%

---

7.4%

9.0%

9.6%

9.6%

9.6%

9.6%

13.5%

100%

Combined

Ratio

91.8%

Combined

Ratio

90%

Combined

Ratio

85%

Combined

Ratio

ROE from Underwriting Activity

ROE from Investing Activity

ROE = 17.0%

19

Capital Management Strategy

Understanding capital utilization

Catastrophe exposure

Loss reserves

Rating agency

Reducing Cost of Capital

$925 million multi-year debt facility

$250 million 30-year notes, 7% coupon

$200 million 10-year notes, 6.15% coupon

$200 million of perpetual preferred shares, 7.75% dividend

Efficient access to capital markets

Strong issuing capacity and relationships

Significant increase in public float (secondary, block trades)

Raised $600 million in new capital in response to 2005 hurricanes

Three separate capital markets transactions completed in ten days

Optimized mix of capital to minimize dilution

Returning excess capital

$264 million in stock repurchased as of 12/31/2005

1.8 million share repurchase authorization

$133 million in dividends paid to common shareholders as of 12/31/2005

Trade off between share buybacks and dividends understood

20

Conclusion

21

Conclusion

Built strong, technical, underwriting based culture that is focused on profit, not

revenue

Created robust controls, systems, and infrastructure

World class management team that thinks like shareholders

Value enhancement through capital management

Goal is to generate 15%+ return on equity throughout the cycle

Demonstrated ability to create shareholder value with significant future upside, in

spite of extreme frequency and severity of recent natural catastrophes

Well positioned with strong capitalization, balance sheet quality and diversified

strategy to take advantage of market opportunities

22

Appendix

23

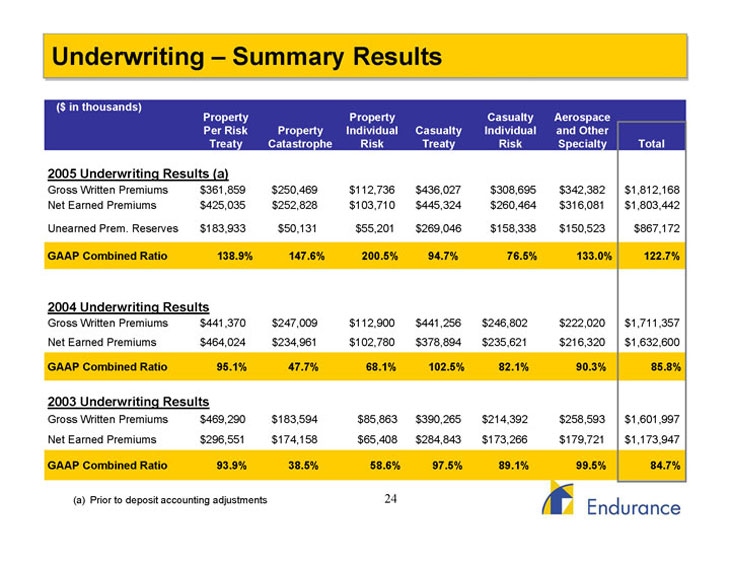

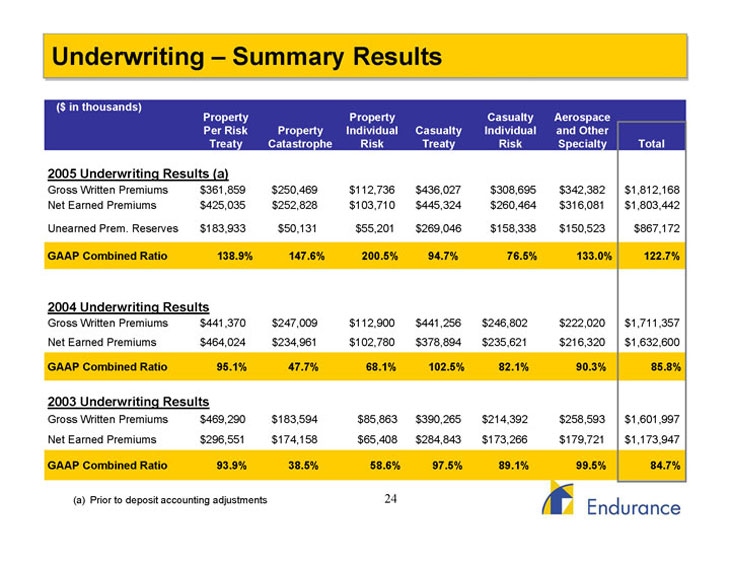

Underwriting Summary Results ($ in thousands) Property Property Casualty Aerospace Per Risk Property Individual Casualty Individual and Other Treaty Catastrophe Risk Treaty Risk Specialty Total 2005 Underwriting Results (a) Gross Written Premiums $ 361,859 $ 250,469 $ 112,736 $ 436,027 $ 308,695 $ 342,382 $1,812,168 Net Earned Premiums $ 425,035 $ 252,828 $ 103,710 $ 445,324 $ 260,464 $ 316,081 $1,803,442 Unearned Prem. Reserves $ 183,933 $ 50,131 $ 55,201 $ 269,046 $ 158,338 $ 150,523 $ 867,172 GAAP Combined Ratio 138.9% 147.6% 200.5% 94.7% 76.5% 133.0% 122.7% 2004 Underwriting Results Gross Written Premiums $ 441,370 $ 247,009 $ 112,900 $ 441,256 $ 246,802 $ 222,020 $1,711,357 Net Earned Premiums $ 464,024 $ 234,961 $ 102,780 $ 378,894 $ 235,621 $ 216,320 $1,632,600 GAAP Combined Ratio 95.1% 47.7% 68.1% 102.5% 82.1% 90.3% 85.8% 2003 Underwriting Results Gross Written Premiums $ 469,290 $ 183,594 $ 85,863 $ 390,265 $ 214,392 $ 258,593 $1,601,997 Net Earned Premiums $ 296,551 $ 174,158 $ 65,408 $ 284,843 $ 173,266 $ 179,721 $1,173,947 GAAP Combined Ratio 93.9% 38.5% 58.6% 97.5% 89.1% 99.5% 84.7% (a) Prior to deposit accounting adjustments 24

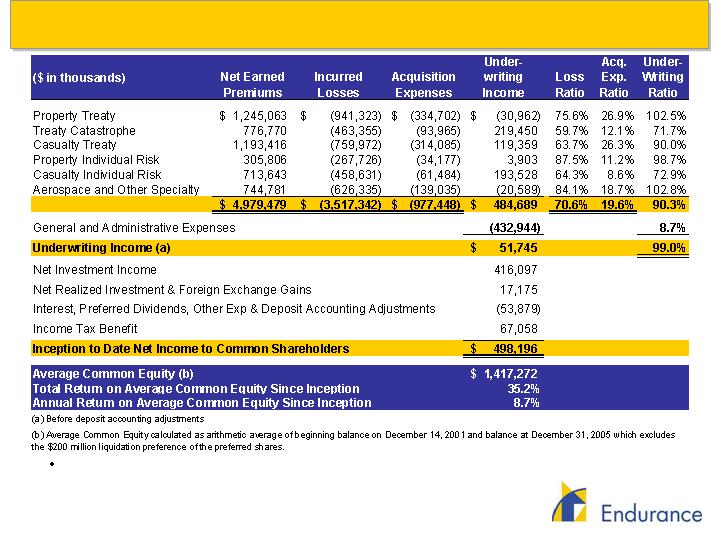

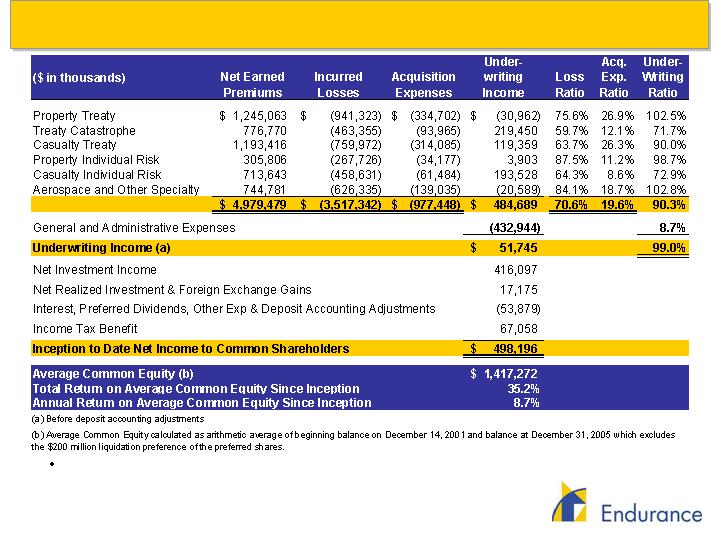

Inception to Date Results Through 12/31/05 Are Profitable

These results for just over 3 ½ years include the impact of Hurricanes

Katrina, Rita, Wilma, Charley, Ivan, Frances and Jeanne, 7 of the 10

costliest hurricanes in recorded history.

25

Summary Financial Performance ($ in thousands) Year Ended Year Ended Year Ended Year Ended Dec. 31, Dec. 31, Dec. 31, Dec. 31, Income Statement 2002 2003 2004 2005 Gross Written Premiums $798,760 $ 1,601,997 $ 1,711,357 $ 1,812,168(a) Net Earned Premiums 369,489 1,173,947 1,632,600 1,803,442(a) Operating Income (Loss) 93,024 247,938 348,443 (208,321) Combined Ratio 86.2% 84.7% 85.8% 122.7% (a) Operating ROE 7.8% 17.3% 19.9% (11.9)% Balance Sheet Total Investments & Cash $1,663,249 $2,674,232 $ 3,940,353 $ 4,953,237 Reserve for Losses & Loss Exp. 200,840 833,158 1,549,661 2,603,590 Reserve for Unearned Prem. 403,305 824,685 897,605 867,172(a) Total Shareholders' Equity 1,217,500 1,644,815 1,862,455 1,872,543 Debt / Total Capitalization 13.6% 5.9% 17.4% 19.3% (a) Prior to deposit accounting adjustments 26