Exhibit 99.2

2015a

Investor day

February 12, 2015 / new York, new York

Cautionary Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This slide presentation

and our accompanying oral remarks contain numerous “forward-looking statements” regarding, without

limitation: our future business plans; the expected start dates of our Medicare-Medicaid Plan (MMP)

implementations; our expansion plans in Florida; our expansion plans and expected operational start date in

Puerto Rico; our Marketplace plans’ growth and operations; the Affordable Care Act annual health industry fee

and its expected reimbursement by states, including any tax impact; and various other matters. All of our

forward-looking statements are subject to numerous risks, uncertainties, and other factors that could cause our

actual results to differ materially. Anyone viewing or listening to this presentation is urged to read the risk factors

and cautionary statements found under Item 1A in our annual report on Form 10-K, as well as the risk factors and

cautionary statements in our quarterly reports and in our other reports and filings with the Securities and

Exchange Commission and available for viewing on its website at www.sec.gov. Except to the extent otherwise

required by federal securities laws, we do not undertake to address or update forward-looking statements in

future filings or communications regarding our business or operating results.

2

©

2015

MOLINA

HEALTHCARE,

INC.

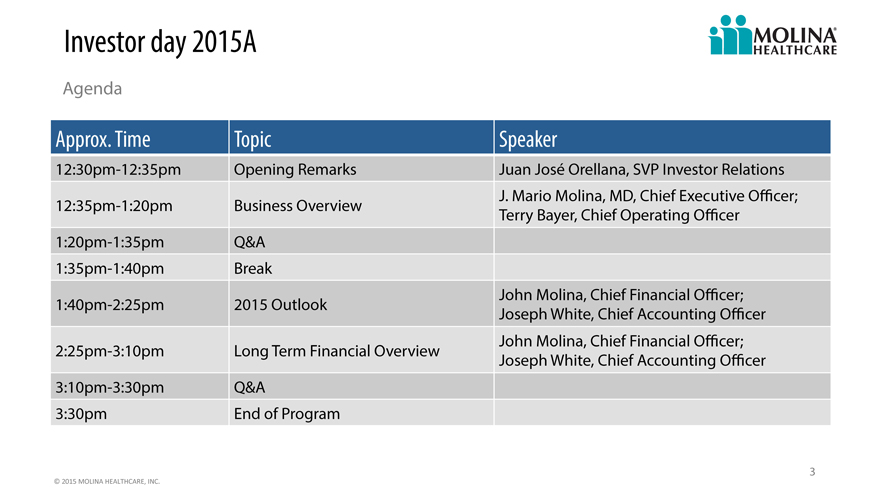

Investor day 2015A

Agenda

Approx. Time Topic Speaker

12:30pm-12:35pm Opening Remarks Juan José Orellana, SVP Investor Relations

J. Mario Molina, MD, Chief Executive Officer;

12:35pm-1:20pm Business Overview Terry Bayer, Chief Operating Officer

1:20pm-1:35pm Q&A

1:35pm-1:40pm Break

John Molina, Chief Financial Officer;

1:40pm-2:25pm 2015 Outlook Joseph White, Chief Accounting Officer

John Molina, Chief Financial Officer;

2:25pm-3:10pm Long Term Financial Overview Joseph White, Chief Accounting Officer

3:10pm-3:30pm Q&A

3:30pm End of Program

3

©

2015

MOLINA

HEALTHCARE,

INC.

2015a

Investor day

Business overview

j. Mario Molina, president & chief executive officer

February 12, 2015 / new York, new York

The future

We envision a future where every American has access to quality and affordable healthcare

C. David Molina, circa 1983

5

©

2015

MOLINA

HEALTHCARE,

INC.

Our mission

To provide quality health care to people receiving government assistance

6

©

2015

MOLINA

HEALTHCARE,

INC.

One of a kind

Flexible health services portfolio (health plans, direct delivery, MMIS)

Focused on people receiving government assistance

Scalable administrative infrastructure

Consistent national brand

Seasoned management team

Unique culture

7

©

2015

MOLINA

HEALTHCARE,

INC.

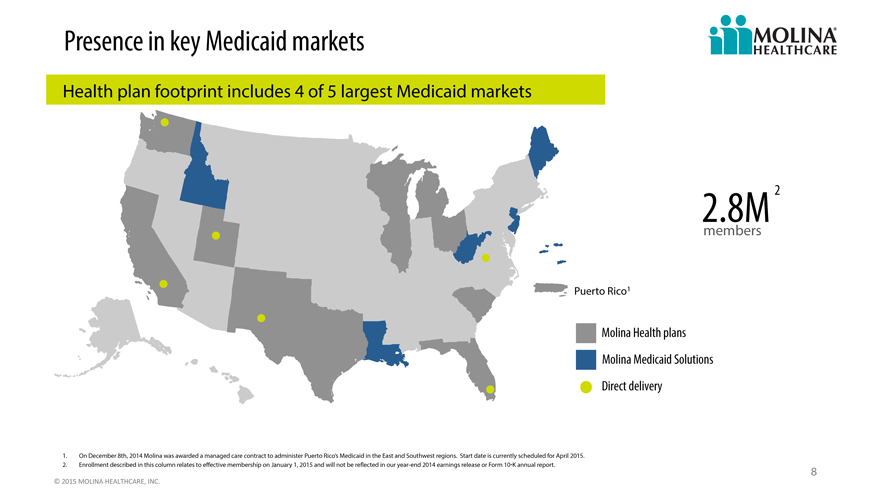

Presence in key Medicaid markets

Health plan footprint includes 4 of 5 largest Medicaid markets

2.8M 2

members

Puerto Rico1

Molina Health plans

Molina Medicaid Solutions

Direct delivery

1. On December 8th, 2014 Molina was awarded a managed care contract to administer Puerto Rico’s Medicaid in the East and Southwest regions. Start date is currently scheduled for April 2015.

2. Enrollment described in this column relates to effective membership on January 1, 2015 and will not be reflected in our year-end 2014 earnings release or Form 10-K annual report.

8

©

2015

MOLINA

HEALTHCARE,

INC.

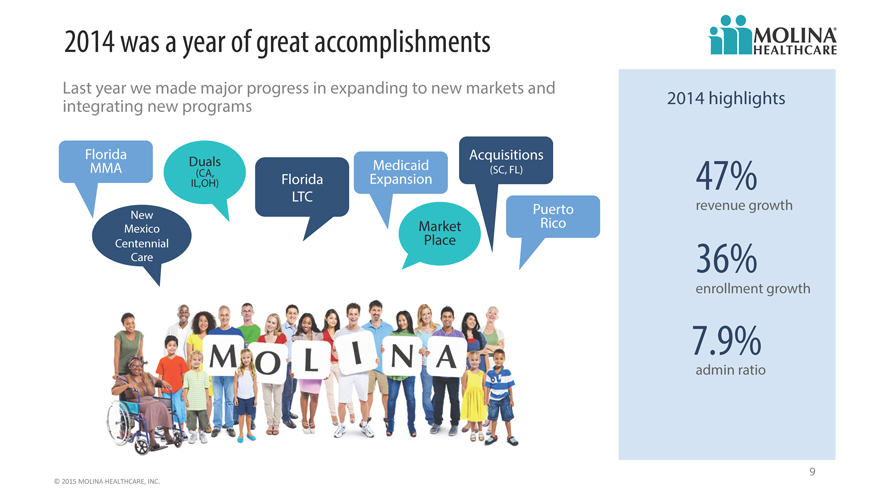

2014 was a year of great accomplishments

Last year we made major progress in expanding to new markets and

integrating new programs 2014 highlights

Florida Acquisitions

MMA Duals (CA, Medicaid (SC, FL)

IL,OH) Florida Expansion 47%

LTC

New Puerto revenue growth

Mexico Market Rico

Centennial Place

Care 36%

enrollment growth

7.9%

admin ratio

9

©

2015

MOLINA

HEALTHCARE,

INC.

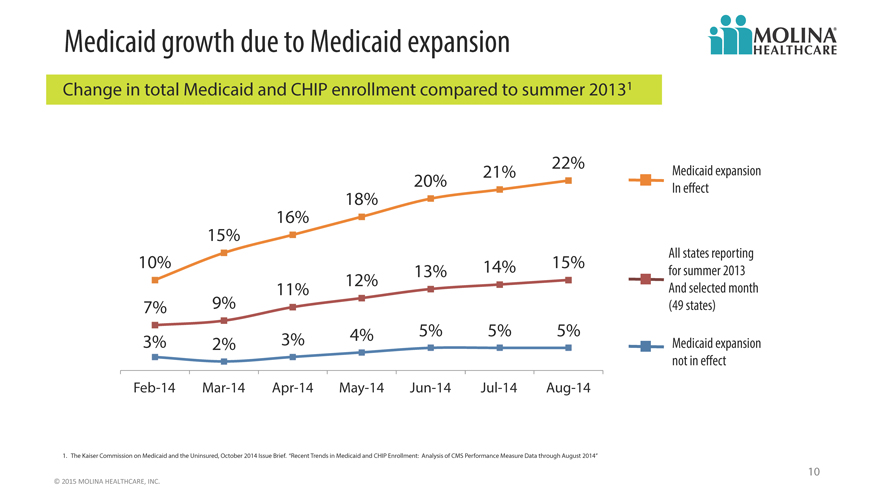

Medicaid growth due to Medicaid expansion

Change in total Medicaid and CHIP enrollment compared to summer 20131

22%

20% 21% Medicaid expansion

18% In effect

16%

15%

10% 13% 14% 15% for All states summer reporting 2013

12%

11% And selected month

7% 9% (49 states)

3% 2% 3% 4% 5% 5% 5% Medicaid expansion

not in effect

Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14

1. The Kaiser Commission on Medicaid and the Uninsured, October 2014 Issue Brief. “Recent Trends in Medicaid and CHIP Enrollment: Analysis of CMS Performance Measure Data through August 2014”

10

©

2015

MOLINA

HEALTHCARE,

INC.

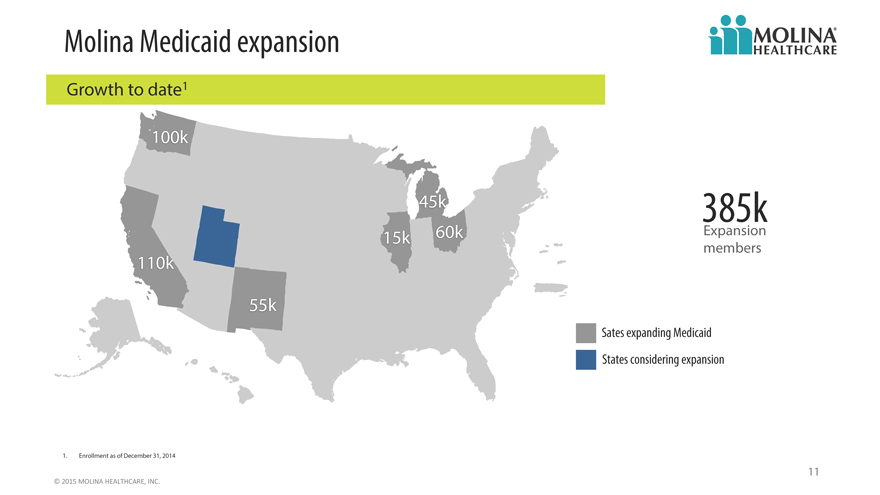

Molina Medicaid expansion

Growth to date1

100k

45k 385k

15k 60k Expansion

members

110k

55k

Sates expanding Medicaid

States considering expansion

1. Enrollment as of December 31, 2014

11

©

2015

MOLINA

HEALTHCARE,

INC.

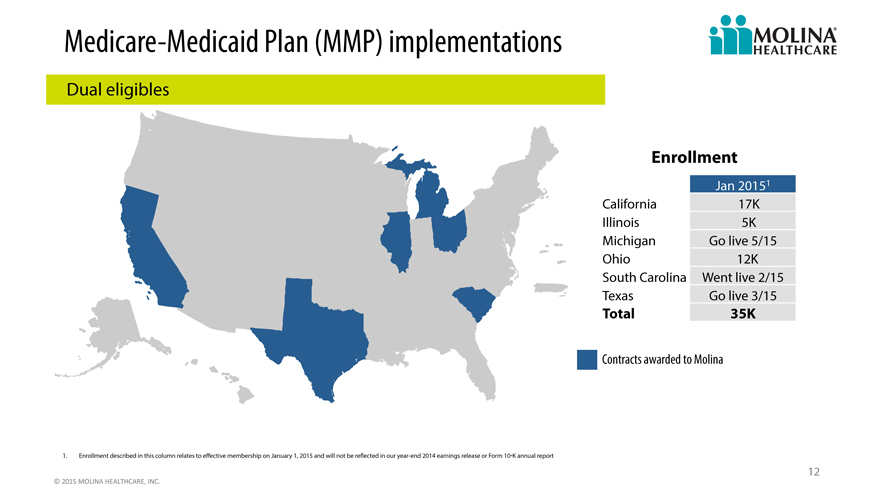

Medicare -Medicaid Plan (MMP) implementations

Dual eligibles

Enrollment

Jan 20151

California 17K

Illinois 5K

Michigan Go live 5/15

Ohio 12K

South Carolina Went live 2/15

Texas Go live 3/15

Total 35K

Contracts awarded to Molina

1. Enrollment described in this column relates to effective membership on January 1, 2015 and will not be reflected in our year-end 2014 earnings release or Form 10-K annual report

12

©

2015

MOLINA

HEALTHCARE,

INC.

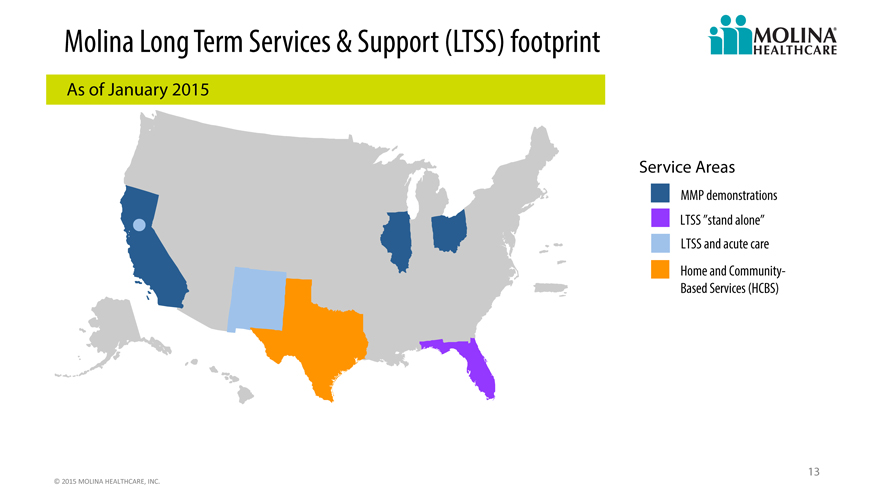

Molina Long Term Services & Support (LTSS) footprint

As of January 2015

Service Areas

MMP demonstrations

LTSS “stand alone”

LTSS and acute care

Home and Community-

Based Services (HCBS)

13

©

2015

MOLINA

HEALTHCARE,

INC.

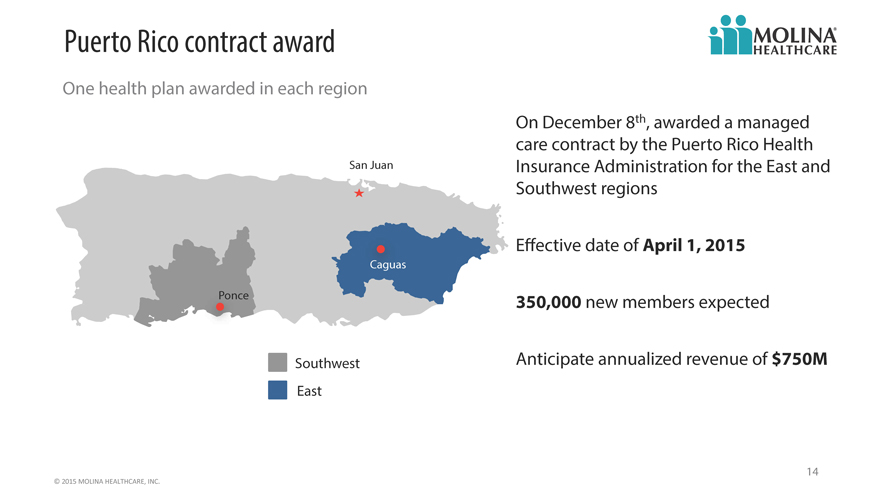

Puerto Rico contract award

One health plan awarded in each region

On December 8th, awarded a managed

care contract by the Puerto Rico Health

San Juan Insurance Administration for the East and

Southwest regions

Effective date of April 1, 2015

Ponce 350,000 new members expected

Southwest Anticipate annualized revenue of $750M

East

14

©

2015

MOLINA

HEALTHCARE,

INC.

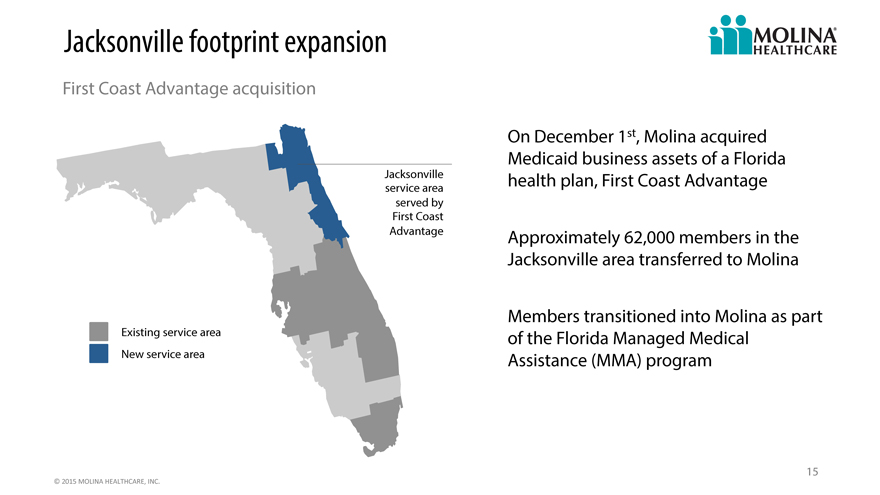

Jacksonville footprint expansion

First Coast Advantage acquisition

On December 1st, Molina acquired

Medicaid business assets of a Florida

Jacksonville health plan, First Coast Advantage

service area

served by

First Coast

Advantage Approximately 62,000 members in the

Jacksonville area transferred to Molina

Members transitioned into Molina as part

Existing service area of the Florida Managed Medical

New service area Assistance (MMA) program

15

©

2015

MOLINA

HEALTHCARE,

INC.

Marketplace year two

2014 pricing assumed higher medical costs

and utilization compared to existing

membership

2015 focused on competitive pricing in

existing markets

Significant sign up activity during 2015 open

enrollment

16

©

2015

MOLINA

HEALTHCARE,

INC.

Managing our growth

2013 2014 2015 2016+

INCUBATE TRANSITION & GROW DEVELOP & GROW FORTIFY

Acquire new business Transition members into Transition members into Improve model of care

Design systems model of care model of care Enhance systems

Test readiness Address pent-up demand Address pent-up demand Improve margins

Invest in infrastructure Adjust premiums Adjust premiums

New business: Process transition issues Improve systems

SC, Duals, Marketplace, Begin leveraging Ensure equitable rates

Medicaid Expansion, NM & FL infrastructure Leverage administrative costs

re-procurements, WI Medicare Invest to prepare for 2015

revenue

17

©

2015

MOLINA

HEALTHCARE,

INC.

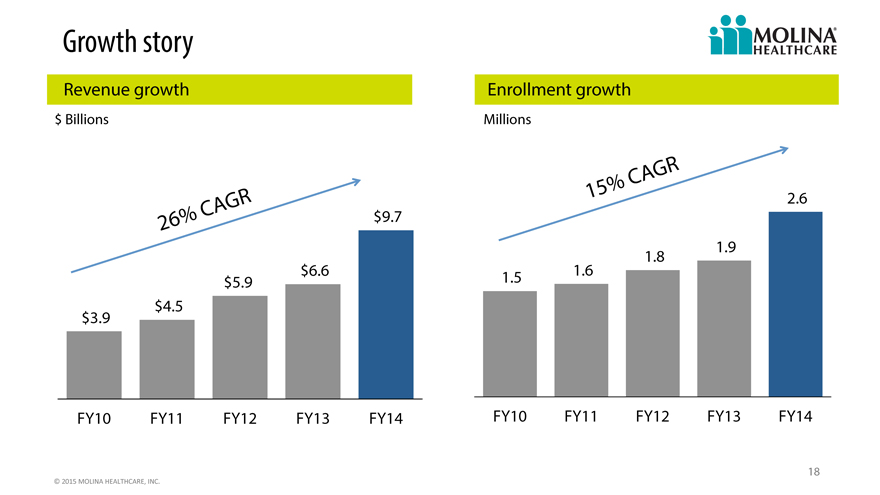

Growth story

Revenue growth Enrollment growth

$ Billions Millions

CAGR

GR 15% 2.6

CA $9.7

26%

1.8 1.9

$5.9 $6.6 1.5 1.6

$3.9 $4.5

FY10 FY11 FY12 FY13 FY14 FY10 FY11 FY12 FY13 FY14

18

©

2015

MOLINA

HEALTHCARE,

INC.

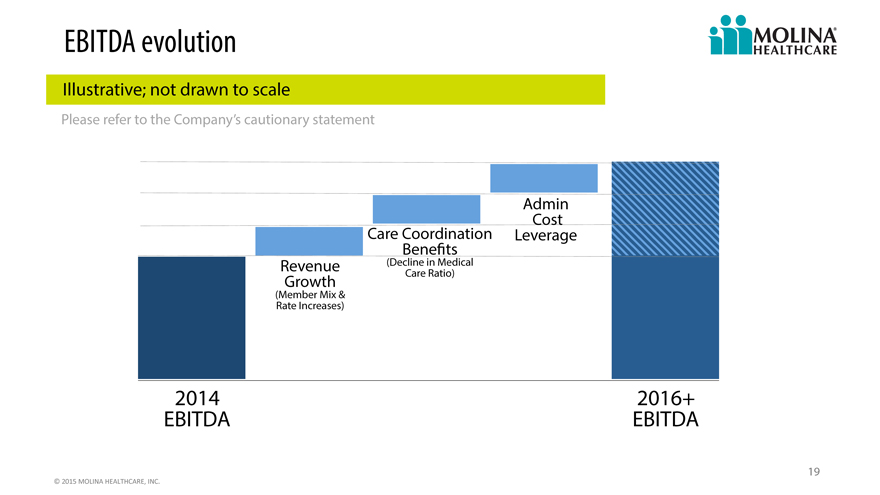

EBITDA evolution

Illustrative; not drawn to scale

Please refer to the Company’s cautionary statement

Admin

Cost

Care Coordination Leverage

Benefits

Revenue (Decline in Medical

Growth Care Ratio)

(Member Mix &

Rate Increases)

2014 2016+

EBITDA EBITDA

19

©

2015

MOLINA

HEALTHCARE,

INC.

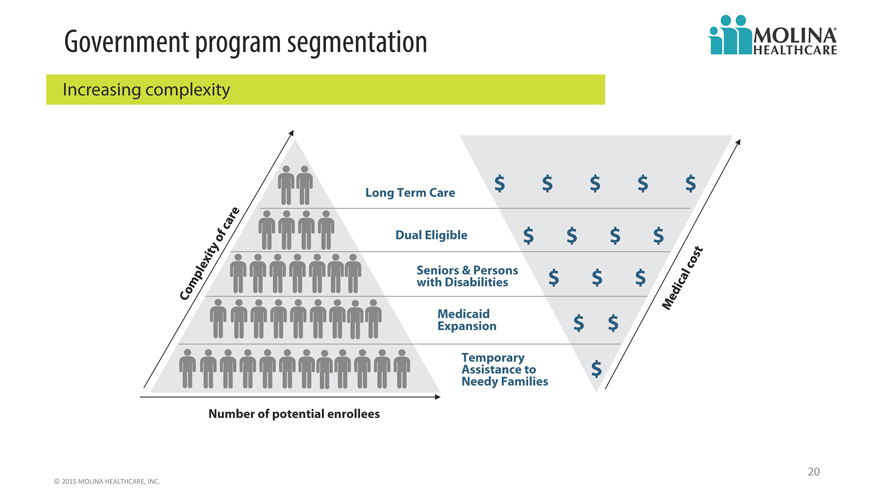

Government program segmentation

Increasing complexity

Long Term Care $ $ $ $ $

Dual Eligible $ $ $ $

Seniors & Persons $ $ $

with Disabilities

Medicaid

Expansion $ $

Assistance Temporary to $

Needy Families

Number of potential enrollees

20

©

2015

MOLINA

HEALTHCARE,

INC.

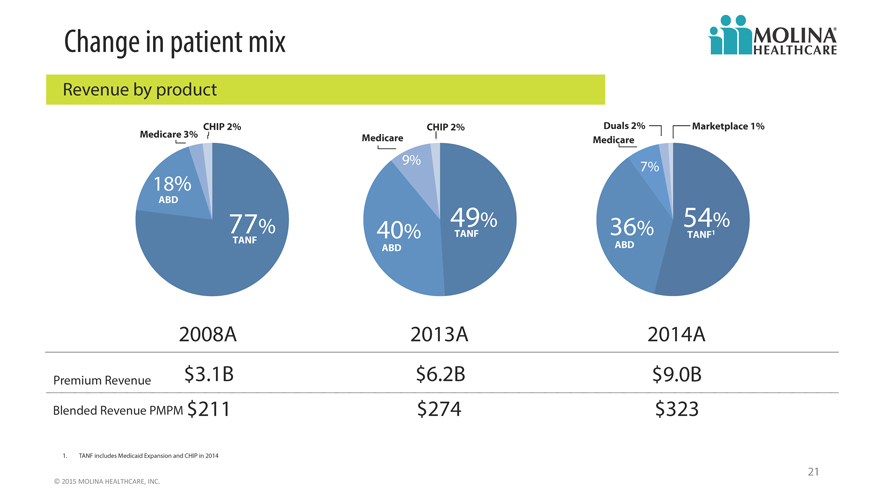

Change in patient mix

Revenue by product

CHIP 2% CHIP 2% Duals 2% Marketplace 1%

Medicare 3% Medicare Medicare

9% 7%

18%

ABD

77% 40% 49% TANF 36% 54% TANF1

TANF ABD ABD

2008A 2013A 2014A

Premium Revenue $3.1B $6.2B $9.0B

Blended Revenue PMPM $211 $274 $323

1. TANF includes Medicaid Expansion and CHIP in 2014

21

©

2015

MOLINA

HEALTHCARE,

INC.

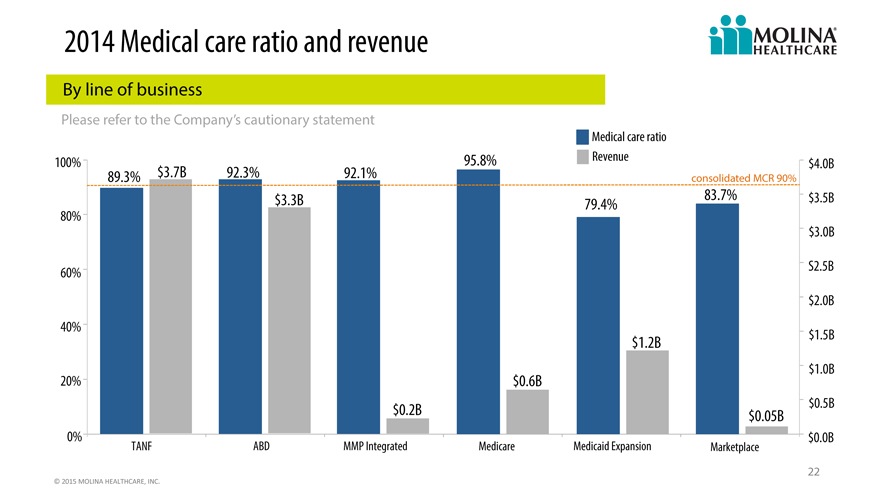

2014 Medical care ratio and revenue

By line of business

Please refer to the Company’s cautionary statement

Medical care ratio

100% 95.8% Revenue $4.0B

89.3% $3.7B 92.3% 92.1% consolidated MCR 90%

$3.3B 79.4% 83.7% $3.5B

80%

$3.0B

60% S2.5B

$2.0B

40%

$1.2B $1.5B

$1.0B

20% $0.6B

$0.5B

$0.2B $0.05B

0% $0.0B

TANF ABD MMP Integrated Medicare Medicaid Expansion Marketplace

22

©

2015

MOLINA

HEALTHCARE,

INC.

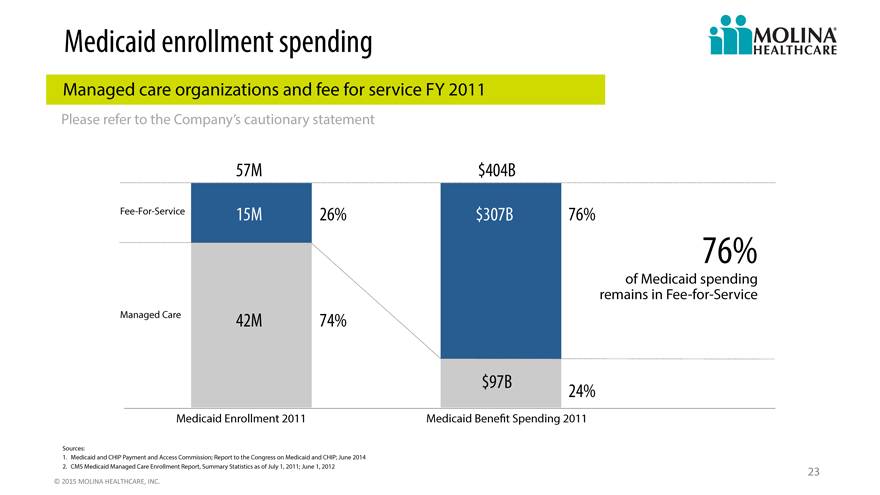

Medicaid enrollment spending

Managed care organizations and fee for service FY 2011

Please refer to the Company’s cautionary statement

57M $404B

Fee-For-Service 15M 26% $307B 76%

76%

of Medicaid spending

remains in Fee-for-Service

Managed Care 42M 74%

$97B 24%

Medicaid Enrollment 2011 Medicaid Benefit Spending 2011

Sources:

1. Medicaid and CHIP Payment and Access Commission; Report to the Congress on Medicaid and CHIP; June 2014

2. CMS Medicaid Managed Care Enrollment Report, Summary Statistics as of July 1, 2011; June 1, 2012 23

©

2015

MOLINA

HEALTHCARE,

INC.

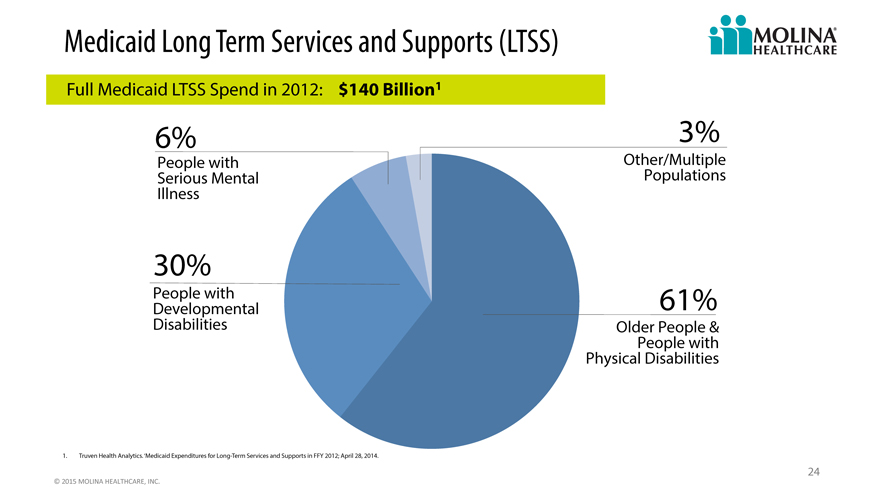

Medicaid Long Term Services and Supports (LTSS)

Full Medicaid LTSS Spend in 2012: $140 Billion1

6% 3%

People with Other/Multiple

Serious Mental Populations

Illness

30%

Developmental People with 61%

Disabilities Older People &

People with

Physical Disabilities

1. Truven Health Analytics. ‘Medicaid Expenditures for Long-Term Services and Supports in FFY 2012; April 28, 2014.

24

©

2015

MOLINA

HEALTHCARE,

INC.

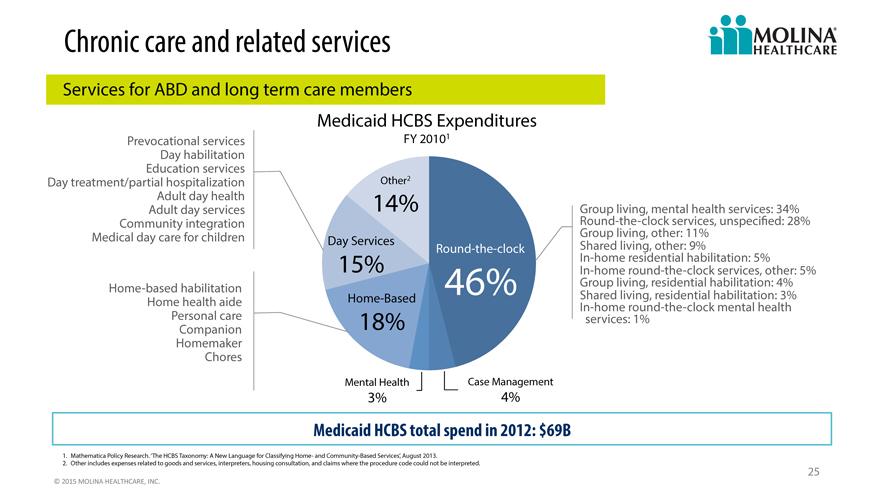

Chronic care and related services

Services for ABD and long term care members

Medicaid HCBS Expenditures

Prevocational services FY 20101

Day habilitation

Education services

Day treatment/partial hospitalization Other2

Adult day health 14% Group

Adult day services living, mental health services: 34%

Community integration Round-the-clock services, unspecified: 28%

Medical day care for children Day Services Group living, other: 11%

Round-the-clock Shared living, other: 9%

In-home residential habilitation: 5%

In-home round-the-clock services, other: 5%

Home-based habilitation 15% 46% Group living, residential habilitation: 4%

Home health aide Home-Based In-home Shared living, round-the-clock residential habilitation: mental health 3%

Personal Companion care 18% services: 1%

Homemaker

Chores

Mental Health Case Management

3% 4%

Medicaid HCBS total spend in 2012: $69B

1. Mathematica Policy Research. ‘The HCBS Taxonomy: A New Language for Classifying Home- and Community-Based Services’, August 2013.

2. Other includes expenses related to goods and services, interpreters, housing consultation, and claims where the procedure code could not be interpreted.

25

©

2015

MOLINA

HEALTHCARE,

INC.

The landscape

Post ACA

26

©

2015

MOLINA

HEALTHCARE,

INC.

Regulation

27

©

2015

MOLINA

HEALTHCARE,

INC.

Technology

28

©

2015

MOLINA

HEALTHCARE,

INC.

Drug spending

29

©

2015

MOLINA

HEALTHCARE,

INC.

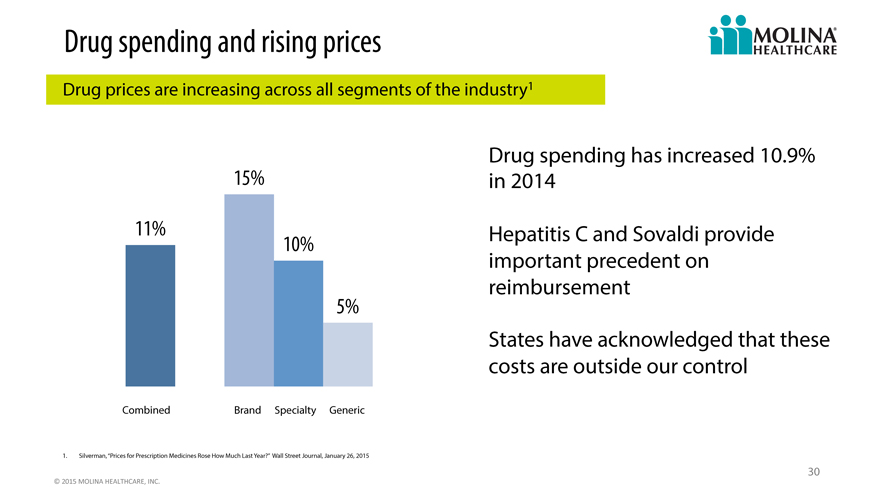

Drug spending and rising prices

Drug prices are increasing across all segments of the industry1

Drug spending has increased 10.9%

15% in 2014

11% 10% Hepatitis C and Sovaldi provide

important precedent on

reimbursement

5%

States have acknowledged that these

costs are outside our control

Combined Brand Specialty Generic

1. Silverman, “Prices for Prescription Medicines Rose How Much Last Year?” Wall Street Journal, January 26, 2015

30

©

2015

MOLINA

HEALTHCARE,

INC.

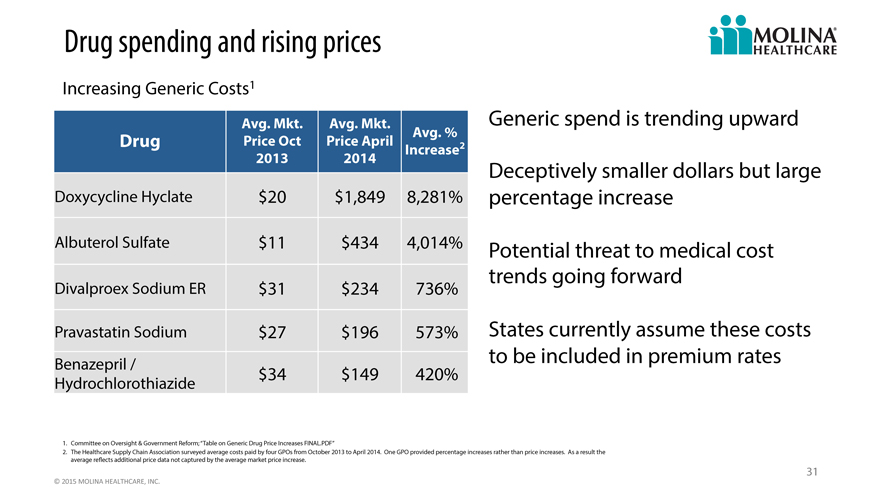

Drug spending and rising prices

Increasing Generic Costs1

Avg. Mkt. Avg. Mkt. Generic spend is trending upward

Drug Price Oct Price April Avg. % 2

Increase

2013 2014 Deceptively smaller dollars but large

Doxycycline Hyclate $ 20 $1,849 8,281% percentage increase

Albuterol Sulfate $ 11 $434 4,014% Potential threat to medical cost

Divalproex Sodium ER $ 31 $234 736% trends going forward

Pravastatin Sodium $ 27 $196 573% States currently assume these costs

Benazepril / to be included in premium rates

Hydrochlorothiazide $ 34 $149 420%

1. Committee on Oversight & Government Reform; “Table on Generic Drug Price Increases FINAL.PDF”

2. The Healthcare Supply Chain Association surveyed average costs paid by four GPOs from October 2013 to April 2014. One GPO provided percentage increases rather than price increases. As a result the

average reflects additional price data not captured by the average market price increase.

31

©

2015

MOLINA

HEALTHCARE,

INC.

Strategic priorities

Mission Priorities

Our mission is to provide quality healthcare to Continued revenue growth and

people receiving government assistance diversification

Care of complex patients

Quality

Administrative expense

Improve profitability

We sustain our mission and invest in the organization by being profitable.

32

©

2015

MOLINA

HEALTHCARE,

INC.

The year ahead

Headwinds Tailwinds

Delay in state program Medicaid expansion

implementations

Footprint includes 4 of 5 largest

ACA reimbursement Medicaid markets

Medical cost pressure associated Uniquely positioned to capture Dual

with new contracts/populations Eligible enrollment

Flu season Marketplace open enrollment

33

©

2015

MOLINA

HEALTHCARE,

INC.

Q&A

34

2015a

Investor day

2015 outlook

John c. Molina, chief financial officer

February 12, 2015 / new York, new York

Cautionary Statement

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This slide presentation and our accompanying oral remarks contain numerous “forward-looking statements” regarding, without limitation: our new health plan in Puerto Rico; our Marketplace plans’ growth and operations; our overall growth, consolidation, and profitability improvement measures and strategy; drug pricing trends; and our 2015 financial guidance and outlook, including among other things expected rates, medical cost ratios, and ACA fee reimbursement and revenue recognition; and various other matters. All of our forward-looking statements are subject to numerous risks, uncertainties, and other factors that could cause our actual results to differ materially. Anyone viewing or listening to this presentation is urged to read the risk factors and cautionary statements found under Item 1A in our annual report on Form 10-K, as well as the risk factors and cautionary statements in our quarterly reports and in our other reports and filings with the Securities and Exchange Commission and available for viewing on its website at www.sec.gov. Except to the extent otherwise required by federal securities laws, we do not undertake to address or update forward-looking statements in future filings or communications regarding our business or operating results.

36

©

2015

MOLINA

HEALTHCARE,

INC.

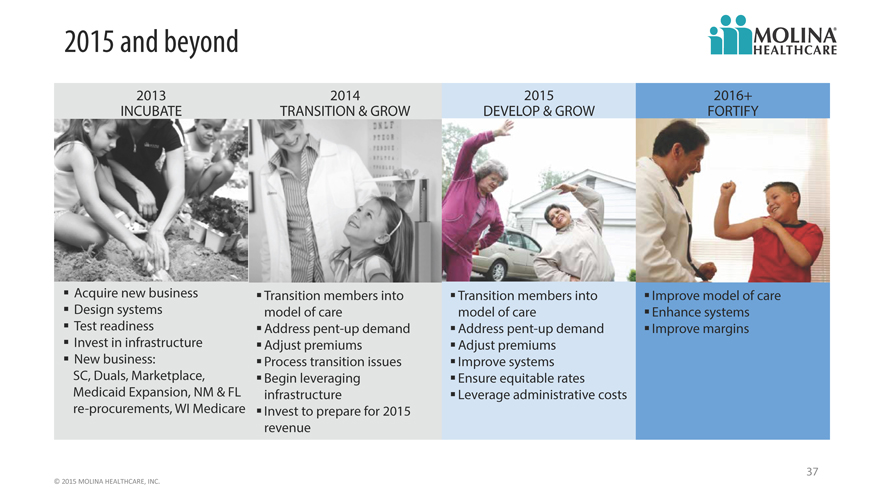

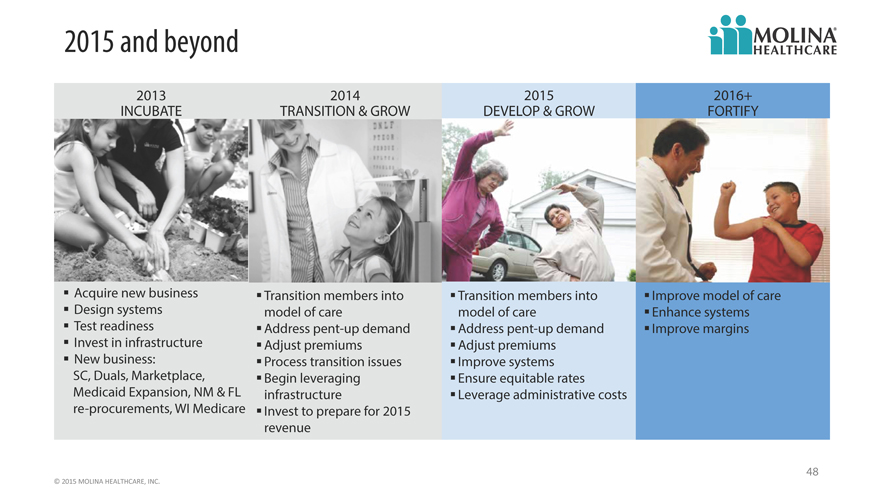

2015 and beyond

2013 2014 2015 2016+

INCUBATE TRANSITION & GROW DEVELOP & GROW FORTIFY

Acquire new business Transition members into Transition members into Improve model of care

Design systems model of care model of care Enhance systems

Test readiness Address pent-up demand Address pent-up demand Improve margins

Invest in infrastructure Adjust premiums Adjust premiums

New business: Process transition issues Improve systems

SC, Duals, Marketplace, Begin leveraging Ensure equitable rates

Medicaid Expansion, NM & FL infrastructure Leverage administrative costs

re-procurements, WI Medicare Invest to prepare for 2015

revenue

37

©

2015

MOLINA

HEALTHCARE,

INC.

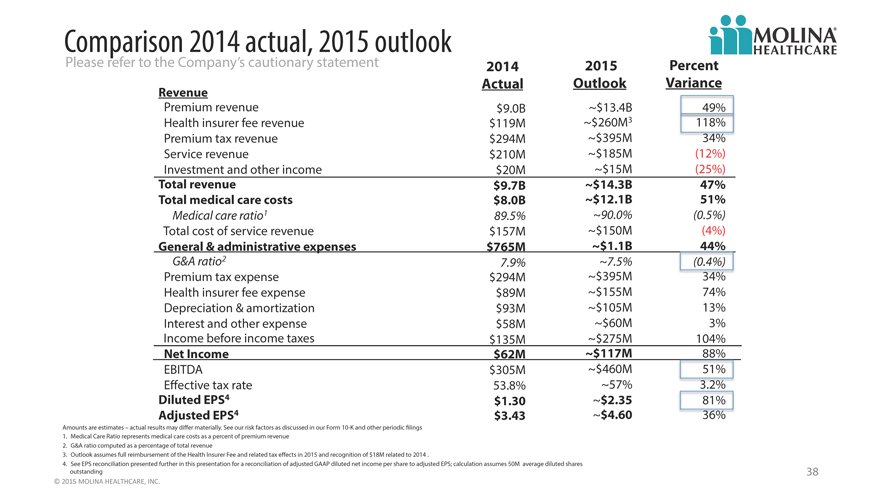

Comparison 2014 actual, 2015 outlook

Please refer to the Company’s cautionary statement 2014 2015 Percent

Revenue Actual Outlook Variance

Premium revenue $9.0B ~$13.4B 49%

Health insurer fee revenue $119M ~$260M3 118%

Premium tax revenue $294M ~$395M 34%

Service revenue $210M ~$185M (12%)

Investment and other income $20M ~$15M (25%)

Total revenue $9.7B ~$14.3B 47%

Total medical care costs $8.0B ~$12.1B 51%

Medical care ratio1 89.5% ~90.0% (0.5%)

Total cost of service revenue $157M ~$150M (4%)

General & administrative expenses $765M ~$1.1B 44%

G&A ratio2 7.9% ~7.5% (0.4%)

Premium tax expense $294M ~$395M 34%

Health insurer fee expense $89M ~$155M 74%

Depreciation & amortization $93M ~$105M 13%

Interest and other expense $58M ~$60M 3%

Income before income taxes $135M ~$275M 104%

Net Income $62M ~$117M 88%

EBITDA $305M ~$460M 51%

Effective tax rate 53.8% ~57% 3.2%

Diluted EPS4 $1.30 ~$2.35 81%

Adjusted EPS4 $3.43 ~$4.60 396%

Amounts are estimates – actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings

1. Medical Care Ratio represents medical care costs as a percent of premium revenue

2. G&A ratio computed as a percentage of total revenue

3. Outlook assumes full reimbursement of the Health Insurer Fee and related tax effects in 2015 and recognition of $18M related to 2014 .

4. See EPS reconciliation presented further in this presentation for a reconciliation of adjusted GAAP diluted net income per share to adjusted EPS; calculation assumes 50M average diluted shares

outstanding

©

2015

MOLINA

HEALTHCARE,

INC.

38

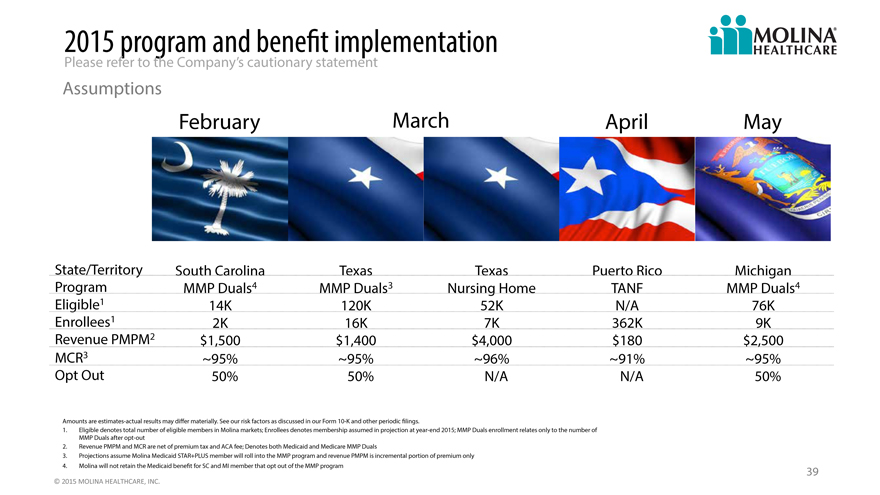

2015 program and benefit implementation

Please refer to the Company’s cautionary statement

Assumptions

February March April May

State/Territory South Carolina Texas Texas Puerto Rico Michigan

Program MMP Duals4 MMP Duals3 Nursing Home TANF MMP Duals4

Eligible1 14K 120K 52K N/A 76K

Enrollees1 2K 16K 7K 362K 9K

Revenue PMPM2 $1,500 $1,400 $4,000 $180 $2,500

MCR3 ~95% ~95% ~96% ~91% ~95%

Opt Out 50% 50% N/A N/A 50%

Amounts are estimates-actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

1. Eligible denotes total number of eligible members in Molina markets; Enrollees denotes membership assumed in projection at year-end 2015; MMP Duals enrollment relates only to the number of

MMP Duals after opt-out

2. Revenue PMPM and MCR are net of premium tax and ACA fee; Denotes both Medicaid and Medicare MMP Duals

3. Projections assume Molina Medicaid STAR+PLUS member will roll into the MMP program and revenue PMPM is incremental portion of premium only

4. Molina will not retain the Medicaid benefit for SC and MI member that opt out of the MMP program 39

©

2015

MOLINA

HEALTHCARE,

INC.

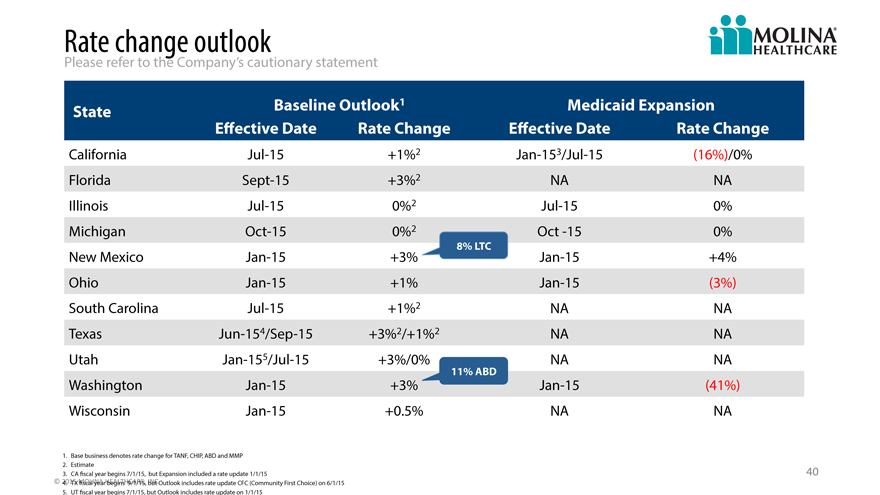

Rate change outlook

Please refer to the Company’s cautionary statement

State Baseline Outlook1 Medicaid Expansion

effective Date Rate Change effective Date Rate Change

California Jul-15 +1%2 Jan-153/Jul-15 (16%)/0%

Florida Sept-15 +3%2 NA NA

Illinois Jul-15 0%2 Jul-15 0%

Michigan Oct-15 0%2 Oct -15 0%

8% LTC

New Mexico Jan-15 +3% Jan-15 +4%

Ohio Jan-15 +1% Jan-15 (3%)

South Carolina Jul-15 +1%2 NA NA

Texas Jun-154/Sep-15 +3%2/+1%2 NA NA

Utah Jan-155/Jul-15 +3%/0% NA NA

11% ABD

Washington Jan-15 +3% Jan-15 (41%)

Wisconsin Jan-15 +0.5% NA NA

1. Base business denotes rate change for TANF, CHIP, ABD and MMP

2. Estimate

3. CA fiscal year begins 7/1/15, but Expansion included a rate update 1/1/15 40

©

2015

MOLINA

HEALTHCARE,4. TX fiscal year begins 9/1/15,

INC.but Outlook

includes rate update CFC (Community First Choice) on 6/1/15

5. UT fiscal year begins 7/1/15, but Outlook includes rate update on 1/1/15

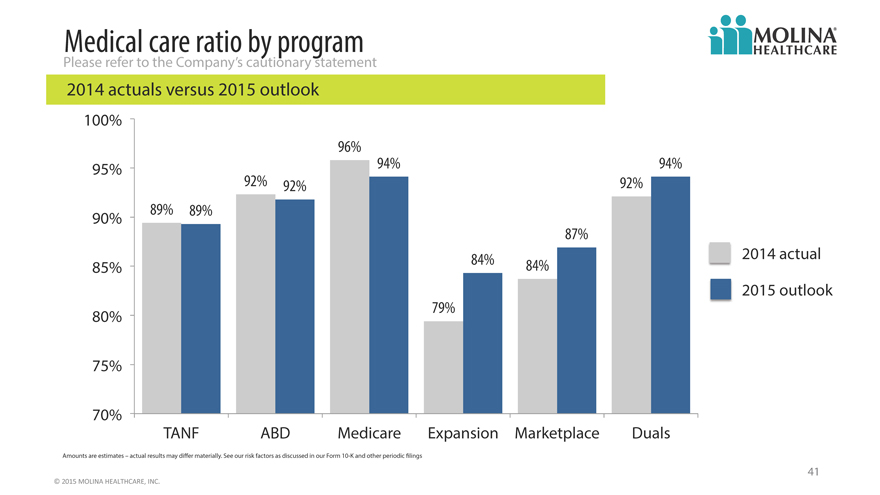

Medical care ratio by program

Please refer to the Company’s cautionary statement

2014 actuals versus 2015 outlook

100%

96%

95% 94% 94%

92% 92% 92%

90% 89% 89%

87%

84% 2014 actual

85% 84%

2015 outlook

80% 79%

75%

70%

TANF ABD Medicare Expansion Marketplace Duals

Amounts are estimates – actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings

41

©

2015

MOLINA

HEALTHCARE,

INC.

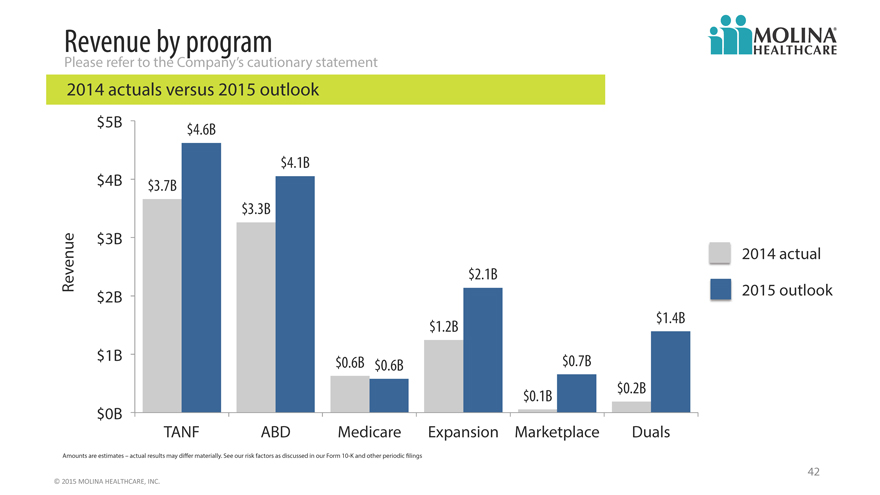

Revenue by program

Please refer to the Company’s cautionary statement

2014 actuals versus 2015 outlook

$ 5B $ 4.6B

$ 4.1B

$ 4B $3.7B

$ 3.3B

$ 3B

2014 actual

Revenue $ 2.1B

$ 2B 2015 outlook

$1.2B $ 1.4B

$ 1B $0.6B $ 0.6B $ 0.7B

$ 0.1B $0.2B

$ 0B

TANF ABD Medicare Expansion Marketplace Duals

Amounts are estimates – actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings

42

©

2015

MOLINA

HEALTHCARE,

INC.

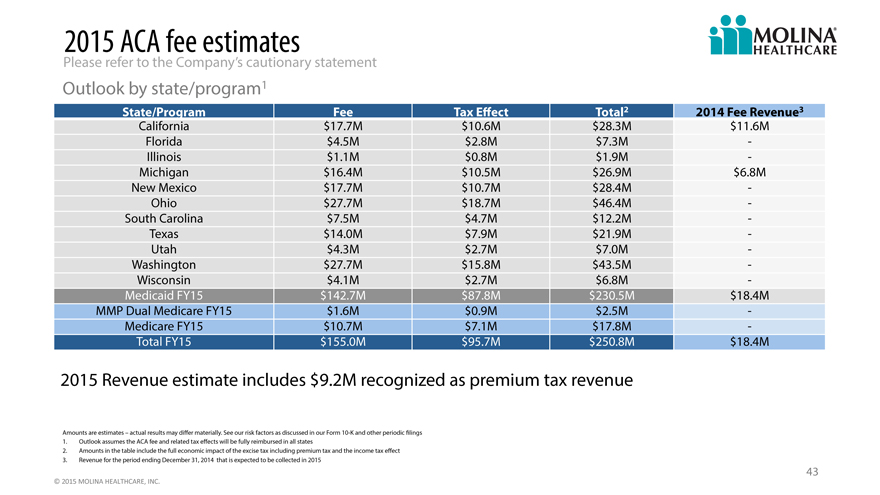

2015 ACA fee estimates

Please refer to the Company’s cautionary statement

Outlook by state/program1

State/Program Fee Tax Effect Total 2 2014 Fee Revenue3

California $17.7M $10.6M $28.3M $11.6M

Florida $4.5M $2.8M $7.3M —

Illinois $1.1M $0.8M $1.9M —

Michigan $16.4M $10.5M $26.9M $6.8M

New Mexico $17.7M $10.7M $28.4M —

Ohio $27.7M $18.7M $46.4M —

South Carolina $7.5M $4.7M $12.2M —

Texas $14.0M $7.9M $21.9M —

Utah $4.3M $2.7M $7.0M —

Washington $27.7M $15.8M $43.5M —

Wisconsin $4.1M $2.7M $6.8M —

Medicaid FY15 $142.7M $87.8M $230.5M $18.4M

MMP Dual Medicare FY15 $1.6M $0.9M $2.5M —

Medicare FY15 $10.7M $7.1M $17.8M —

Total FY15 $155.0M $95.7M $250.8M $18.4M

2015 Revenue estimate includes $9.2M recognized as premium tax revenue

Amounts are estimates – actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings

1. Outlook assumes the ACA fee and related tax effects will be fully reimbursed in all states

2. Amounts in the table include the full economic impact of the excise tax including premium tax and the income tax effect

3. Revenue for the period ending December 31, 2014 that is expected to be collected in 2015

43

©

2015

MOLINA

HEALTHCARE,

INC.

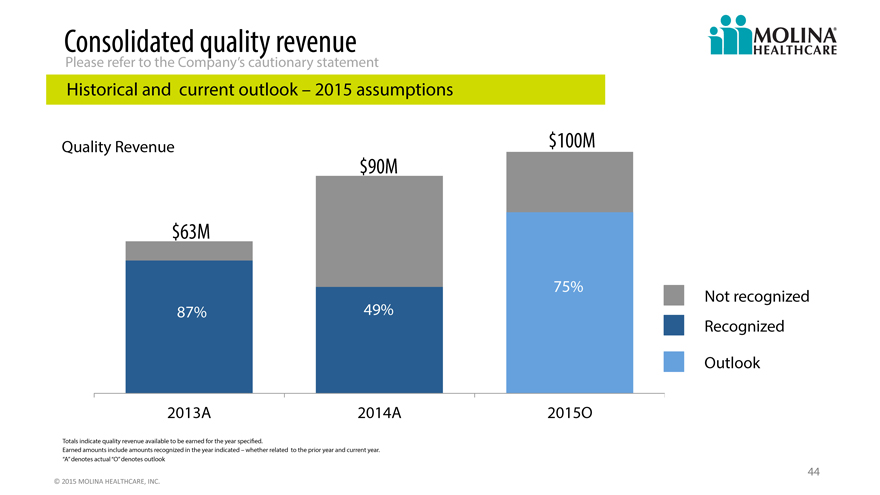

Consolidated quality revenue

Please refer to the Company’s cautionary statement

Historical and current outlook – 2015 assumptions

Quality Revenue $100M

$90M

$63M

75% Not recognized

87% 49%

Recognized

Outlook

2013A 2014A 2015O

Totals indicate quality revenue available to be earned for the year specified.

Earned amounts include amounts recognized in the year indicated – whether related to the prior year and current year.

“A” denotes actual “O” denotes outlook

44

©

2015

MOLINA

HEALTHCARE,

INC.

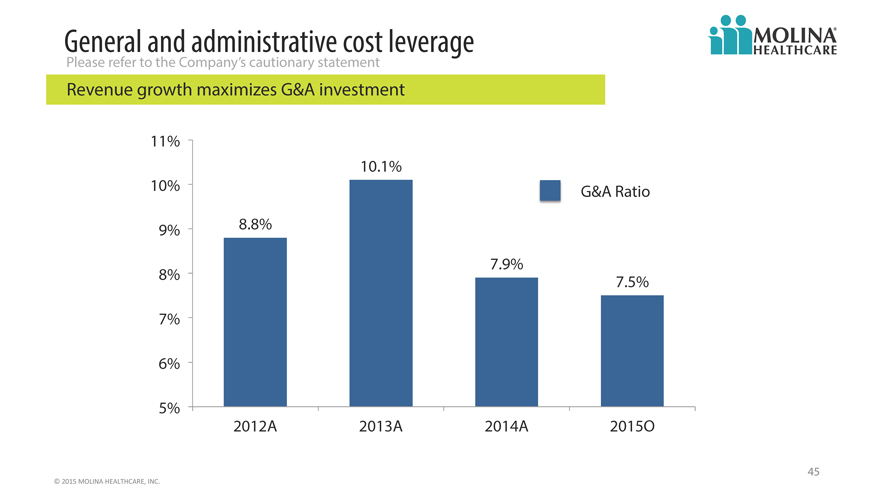

General and administrative cost leverage

Please refer to the Company’s cautionary statement

Revenue growth maximizes G&A investment

11%

10.1%

10% G&A Ratio

9% 8.8%

7.9%

8% 7.5%

7%

6%

5%

2012A 2013A 2014A 2015O

45

©

2015

MOLINA

HEALTHCARE,

INC.

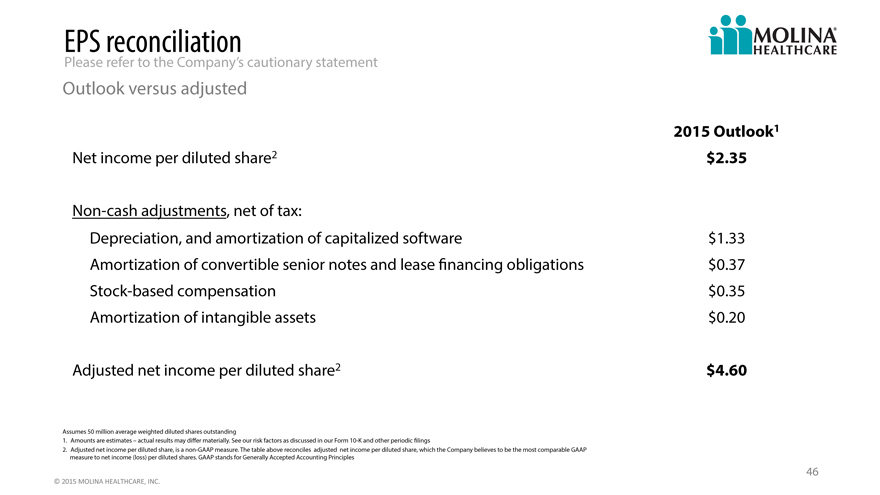

EPS reconciliation

Please refer to the Company’s cautionary statement

Outlook versus adjusted

2015 Outlook1

Net income per diluted share2 $2.35

Non-cash adjustments, net of tax:

Depreciation, and amortization of capitalized software $1.33

Amortization of convertible senior notes and lease financing obligations $0.37

Stock-based compensation $0.35

Amortization of intangible assets $0.20

Adjusted net income per diluted share2 $4.60

Assumes 50 million average weighted diluted shares outstanding

1. Amounts are estimates – actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings

2. Adjusted net income per diluted share, is a non-GAAP measure. The table above reconciles adjusted net income per diluted share, which the Company believes to be the most comparable GAAP

measure to net income (loss) per diluted shares. GAAP stands for Generally Accepted Accounting Principles

46

©

2015

MOLINA

HEALTHCARE,

INC.

2015a

Investor day

Long term financial improvement

John c. Molina, chief financial officer

February 12, 2015 / new York, new York

2015 and beyond

2013 2014 2015 2016+

INCUBATE TRANSITION & GROW DEVELOP & GROW FORTIFY

Acquire new business Transition members into Transition members into Improve model of care

Design systems model of care model of care Enhance systems

Test readiness Address pent-up demand Address pent-up demand Improve margins

Invest in infrastructure Adjust premiums Adjust premiums

New business: Process transition issues Improve systems

SC, Duals, Marketplace, Begin leveraging Ensure equitable rates

Medicaid Expansion, NM & FL infrastructure Leverage administrative costs

re-procurements, WI Medicare Invest to prepare for 2015

revenue

48

©

2015

MOLINA

HEALTHCARE,

INC.

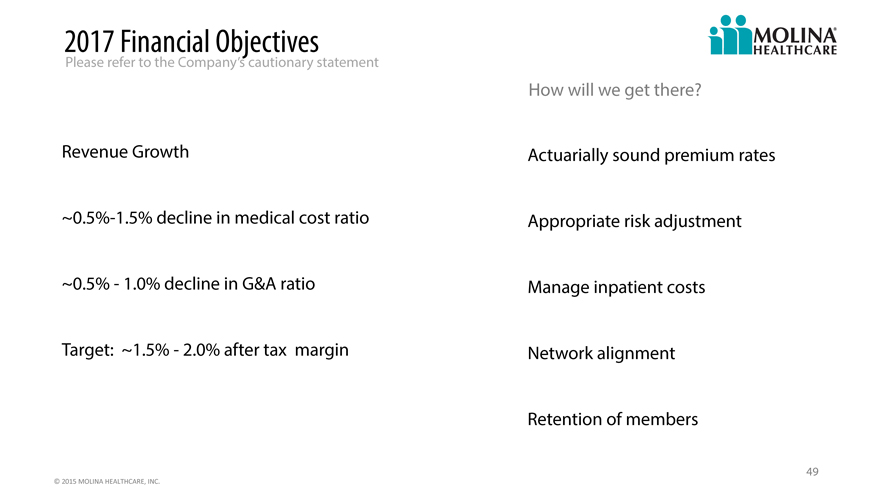

2017 Financial Objectives

Please refer to the Company’s cautionary statement

How will we get there?

Revenue Growth Actuarially sound premium rates

~0.5%-1.5% decline in medical cost ratio Appropriate risk adjustment

~0.5%—1.0% decline in G&A ratio Manage inpatient costs

Target: ~1.5%—2.0% after tax margin Network alignment

Retention of members

49

©

2015

MOLINA

HEALTHCARE,

INC.

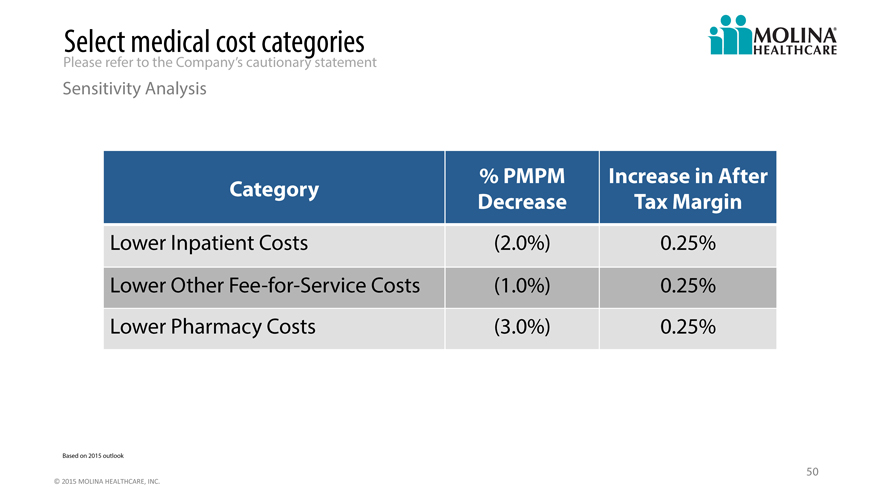

Select medical cost categories

Please refer to the Company’s cautionary statement

Sensitivity Analysis

% PMPM Increase in After

Category Decrease Tax Margin

Lower Inpatient Costs (2.0%) 0.25%

Lower Other Fee -for-Service Costs (1.0%) 0.25%

Lower Pharmacy Costs (3.0%) 0.25%

Based on 2015 outlook

50

©

2015

MOLINA

HEALTHCARE,

INC.

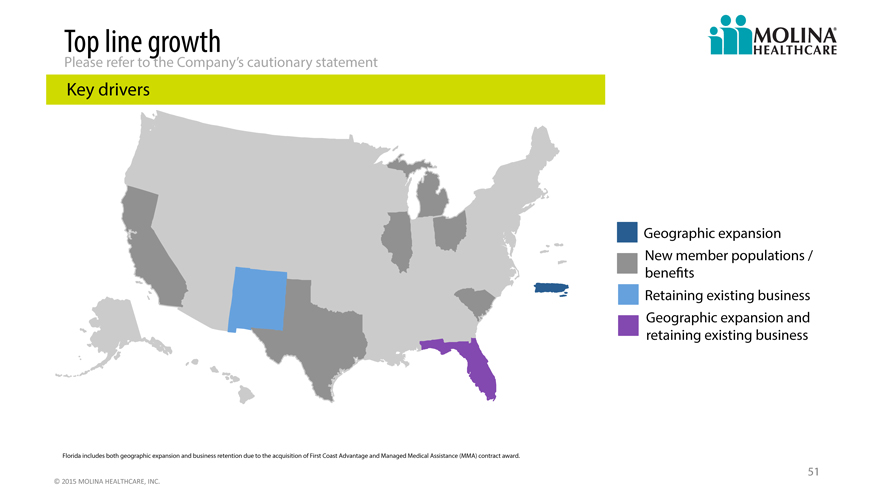

Top line growth

Please refer to the Company’s cautionary statement

Key drivers

Geographic expansion

New member populations /

benefits

Retaining existing business

Geographic expansion and

retaining existing business

Florida includes both geographic expansion and business retention due to the acquisition of First Coast Advantage and Managed Medical Assistance (MMA) contract award.

51

©

2015

MOLINA

HEALTHCARE,

INC.

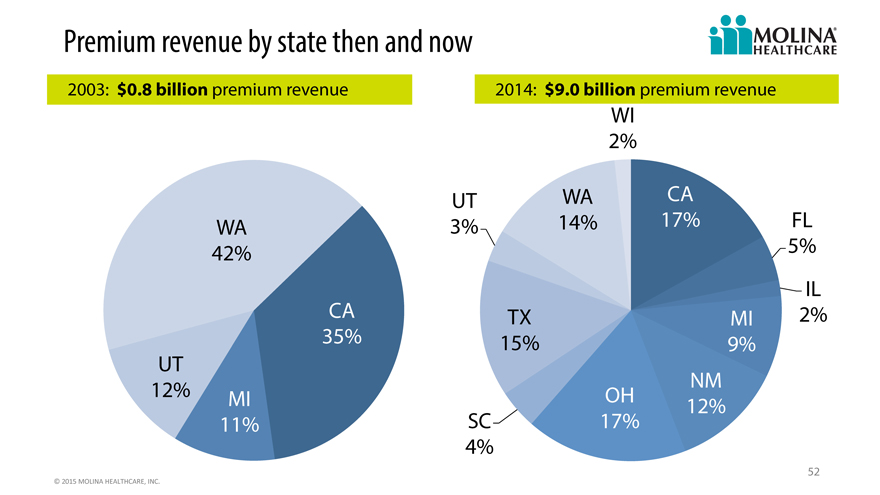

Premium revenue by state then and now

2003: $0.8 billion premium revenue 2014: $9.0 billion premium revenue

WI

2%

UT WA CA

WA 3% 14% 17% FL

42% 5%

IL

CA TX MI 2%

35% 15% 9%

UT

12% OH NM

MI 12%

11% SC 17%

4%

52

©

2015

MOLINA

HEALTHCARE,

INC.

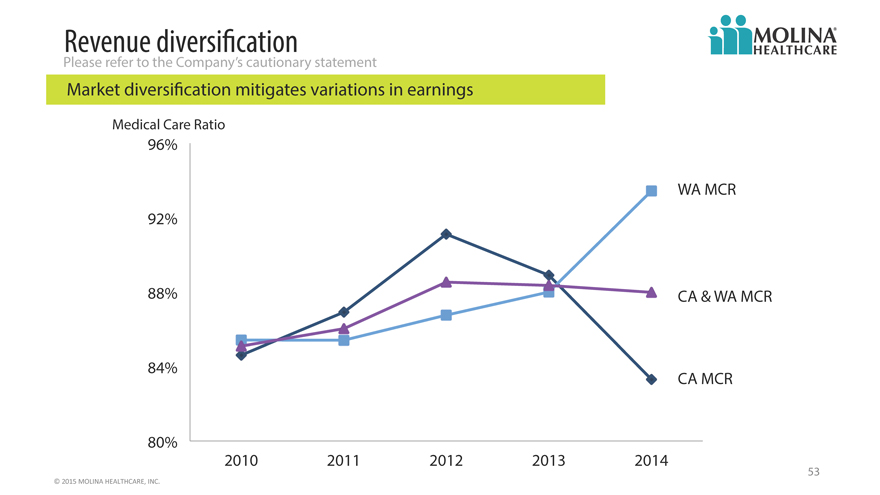

Revenue diversification

Please refer to the Company’s cautionary statement

Market diversification mitigates variations in earnings

Medical Care Ratio

96%

WA MCR

92%

88% CA & WA MCR

84% CA MCR

80%

2010 2011 2012 2013 2014

53

©

2015

MOLINA

HEALTHCARE,

INC.

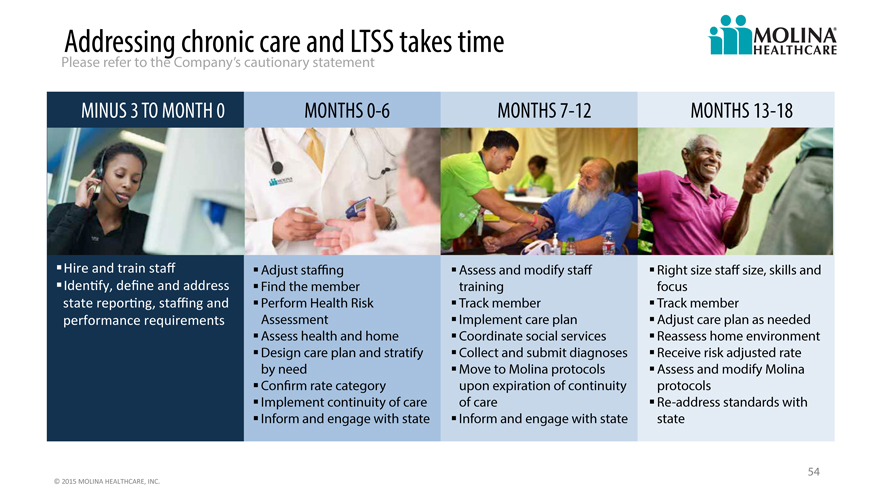

Addressing chronic care and LTSS takes time

Please refer to the Company’s cautionary statement

MINUS 3 TO MONTH 0 MONTHS 0-6 MONTHS 7-12 MONTHS 13-18

Hire

and

train

staff

Adjust staffing Assess and modify staff Right size staff size, skills and

Identify,

define

and

address

Find the member training focus

state

reporting,

staffing

and

Perform Health Risk Track member Track member

performance

requirements

Assessment Implement care plan Adjust care plan as needed

Assess health and home Coordinate social services Reassess home environment

Design care plan and stratify Collect and submit diagnoses Receive risk adjusted rate

by need Move to Molina protocols Assess and modify Molina

Confirm rate category upon expiration of continuity protocols

Implement continuity of care of care Re-address standards with

Inform and engage with state Inform and engage with state state

54

©

2015

MOLINA

HEALTHCARE,

INC.

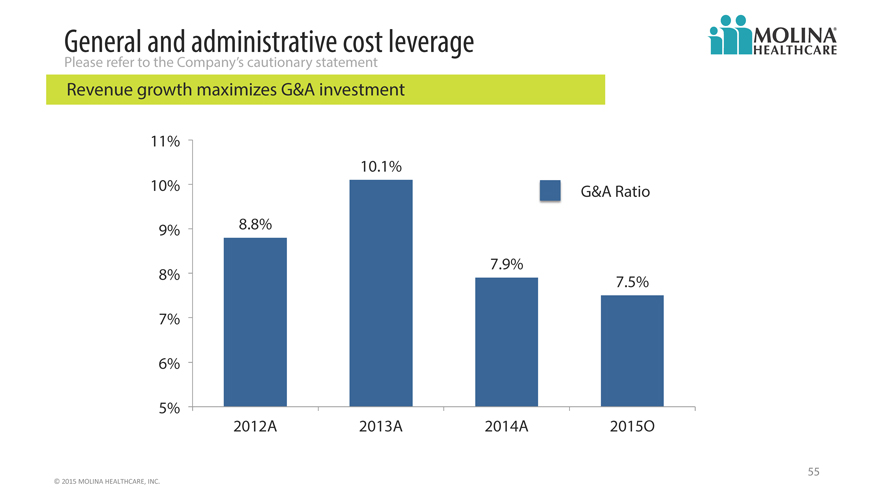

General and administrative cost leverage

Please refer to the Company’s cautionary statement

Revenue growth maximizes G&A investment

11%

10.1%

10% G&A Ratio

9% 8.8%

7.9%

8% 7.5%

7%

6%

5%

2012A 2013A 2014A 2015O

55

©

2015

MOLINA

HEALTHCARE,

INC.

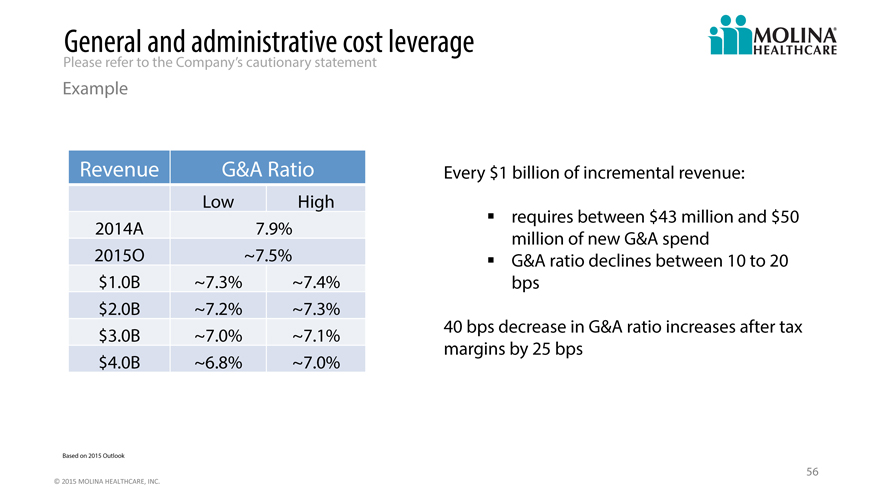

General and administrative cost leverage

Please refer to the Company’s cautionary statement

Example

Revenue G&A Ratio Every $1 billion of incremental revenue:

Low High

requires between $43 million and $50

2014A 7.9% million of new G&A spend

2015O ~7.5% G&A ratio declines between 10 to 20

$ 1.0B ~7.3% ~7.4% bps

$ 2.0B ~7.2% ~7.3%

$ 3.0B ~7.0% ~7.1% 40 bps decrease in G&A ratio increases after tax

margins by 25 bps

$ 4.0B ~6.8% ~7.0%

Based on 2015 Outlook

56

©

2015

MOLINA

HEALTHCARE,

INC.

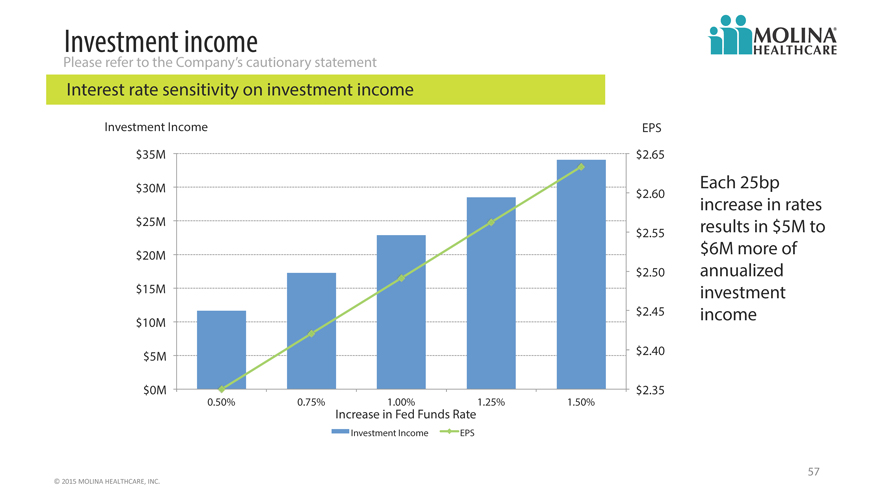

Investment income

Please refer to the Company’s cautionary statement

Interest rate sensitivity on investment income

Investment Income EPS

$35M $ 2.65

$30M $ 2.60 Each 25bp

increase in rates

$25M $ 2.55 results in $5M to

$20M $6M more of

$ 2.50 annualized

$15M investment

$10M $ 2.45 income

$5M $ 2.40

$0M $ 2.35

0.50% 0.75% 1.00% 1.25% 1.50%

Increase in Fed Funds Rate

Investment Income EPS

57

©

2015

MOLINA

HEALTHCARE,

INC.

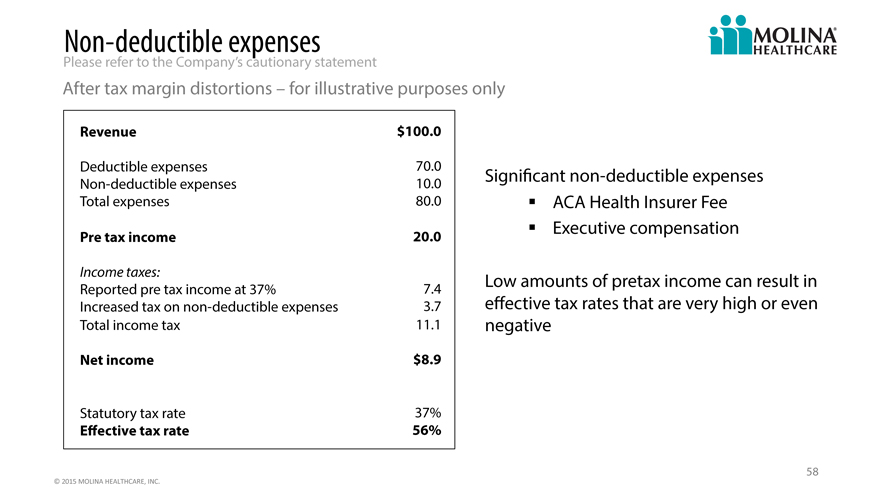

Non- deductible expenses

Please refer to the Company’s cautionary statement

After tax margin distortions – for illustrative purposes only

Revenue $100.0

Deductible expenses 70.0

Non-deductible expenses 10.0 Significant non-deductible expenses

Total expenses 80.0 ACA Health Insurer Fee

Pre tax income 20.0 Executive compensation

Income taxes:

Reported pre tax income at 37% 7.4 Low amounts of pretax income can result in

Increased tax on non-deductible expenses 3.7 effective tax rates that are very high or even

Total income tax 11.1 negative

Net income $8.9

Statutory tax rate 37%

Effective tax rate 56%

58

©

2015

MOLINA

HEALTHCARE,

INC.

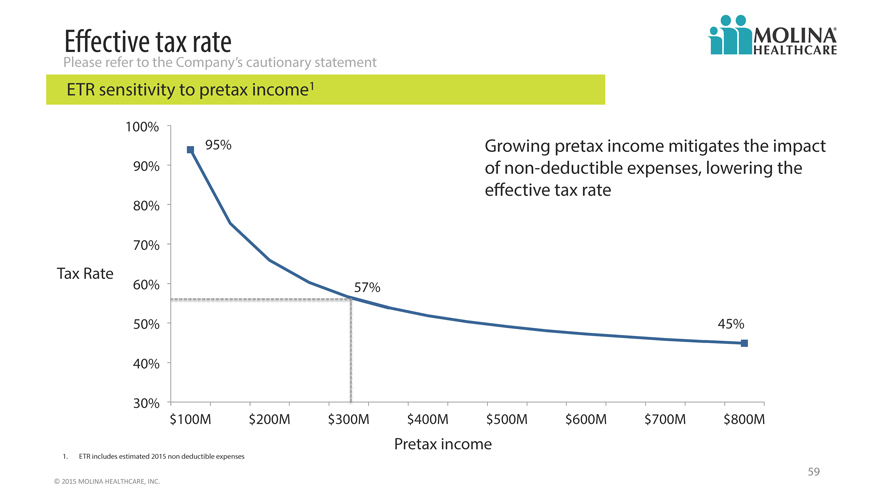

Effective tax rate

Please refer to the Company’s cautionary statement

ETR sensitivity to pretax income1

100%

95% Growing pretax income mitigates the impact

90% of non-deductible expenses, lowering the

effective tax rate

80%

70%

Tax Rate

60% 57%

50% 45%

40%

30%

$100M $200M $300M $400M $500M $600M $700M $800M

Pretax income

1. ETR includes estimated 2015 non deductible expenses

59

©

2015

MOLINA

HEALTHCARE,

INC.

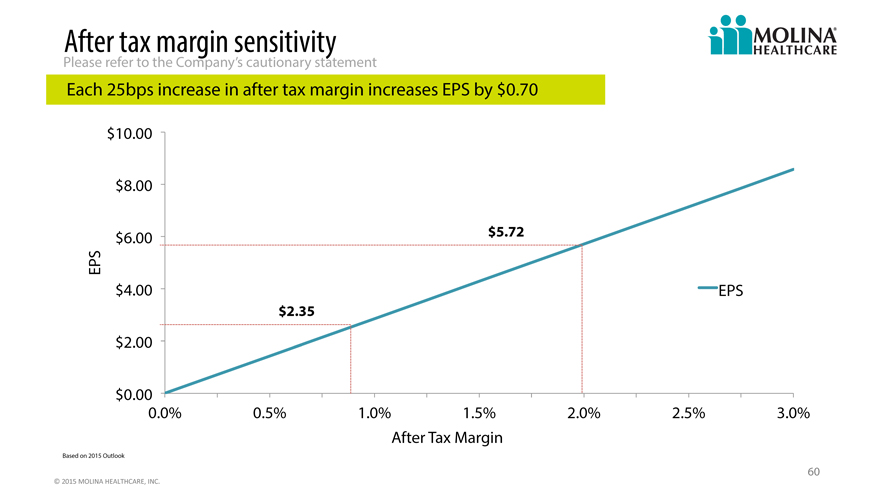

After tax margin sensitivity

Please refer to the Company’s cautionary statement

Each 25bps increase in after tax margin increases EPS by $0.70

$10.00

$8.00

$6.00 $5.72

EPS

$4.00 EPS

$2.35

$2.00

$0.00

0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0%

After Tax Margin

Based on 2015 Outlook

60

©

2015

MOLINA

HEALTHCARE,

INC.

Q&A

61