UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21193

First American Minnesota Municipal Income Fund II, Inc.

(Exact name of registrant as specified in charter)

| | |

| 800 Nicollet Mall, Minneapolis, MN | | 55402 |

| (Address of principal executive offices) | | (Zip code) |

Jill M. Stevenson, 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: August 31

Date of reporting period: August 31, 2012

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ANNUAL REPORT

August 31, 2012

| | | | |

| MXN | | | | Minnesota Municipal

Income Fund II |

Minnesota Municipal Income Fund II

PRIMARY INVESTMENTS

First American Minnesota Municipal Income Fund II (the “fund”) invests primarily in a wide range of Minnesota municipal securities that, at the time of purchase, are rated investment-grade or are unrated and deemed to be of comparable quality by Nuveen Asset Management, LLC (“NAM”), one of the fund’s sub-advisors. The fund may invest up to 20% of its total assets in municipal securities that, at the time of purchase, are rated lower than investment-grade (securities commonly referred to as “high yield” securities or “junk bonds”) or are unrated and deemed to be of comparable quality by NAM. The fund’s investments may include municipal derivative securities, such as inverse floating-rate and inverse interest-only municipal securities, which may be more volatile than traditional municipal securities in certain market conditions. The fund’s investments also may include repurchase agreements, futures contracts, options on futures contracts, options, and interest-rate swaps, caps, and floors.

FUND OBJECTIVE

The fund is a nondiversified, closed-end management investment company. The investment objective of the fund is to provide current income exempt from both regular federal income tax and regular Minnesota personal income tax. The fund’s income may be subject to federal and/or Minnesota alternative minimum tax. Distributions of capital gains will be taxable to shareholders. Investors should consult their tax advisors. As with other investment companies, there can be no assurance the fund will achieve its objective.

|

| NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE |

EXPLANATION OF FINANCIAL STATEMENTS

As a shareholder in the fund, you receive shareholder reports semiannually. We strive to present this financial information in an easy-to-understand format; however, for many investors, the information contained in this shareholder report may seem very technical. So, we would like to take this opportunity to explain several sections of the shareholder report.

The Schedule of Investments details all of the securities held in the fund and their related dollar values on the last day of the reporting period. Securities are usually presented by type (bonds, common stock, etc.) and by industry classification (healthcare, education, etc.). This information is useful for analyzing how your fund’s assets are invested and seeing where your portfolio manager believes the best opportunities exist to meet your objectives. Holdings are subject to change without notice and do not constitute a recommendation of any individual security. The Notes to Financial Statements provide additional details on how the securities are valued.

The Statement of Assets and Liabilities lists the assets and liabilities of the fund on the last day of the reporting period and presents the fund’s net asset value (NAV) and market price per share. The NAV is calculated by dividing the fund’s net assets (assets minus liabilities) by the number of shares outstanding. The market price is the closing price on the exchange on which the fund’s shares trade. This price, which may be higher or lower than the fund’s NAV, is the price an investor pays or receives when shares of the fund are purchased or sold. The investments, as presented in the Schedule of Investments, comprise substantially all of the fund’s assets. Other assets include cash and receivables for items such as income earned by the fund but not yet received. Liabilities include payables for items such as fund expenses incurred but not yet paid.

The Statement of Operations details the dividends and interest income earned from investments as well as the expenses incurred by the fund during the reporting period. Fund expenses may be reduced through fee waivers or reimbursements. This statement reflects total expenses before any waivers or reimbursements, the amount of waivers and reimbursements (if any), and the net expenses. This statement also shows the net realized and unrealized gains and losses from investments owned during the period. The Notes to Financial Statements provide additional details on investment income and expenses of the fund.

The Statement of Changes in Net Assets describes how the fund’s net assets were affected by its operating results and distributions to shareholders during the reporting period. This statement is important to investors because it shows exactly what caused the fund’s net asset size to change during the period.

The Statement of Cash Flows is required when a fund has a substantial amount of illiquid investments, a substantial amount of the fund’s securities are internally fair valued, or the fund carries some amount of debt. When presented, this statement explains the change in cash during the reporting period. It reconciles net cash provided by and used for operating activities to the net increase or decrease in net assets from operations and classifies cash receipts and payments as resulting from operating, investing, and financing activities.

The Financial Highlights provide a per-share breakdown of the components that affected the fund’s NAV for the current and past reporting periods. It also shows total return, net investment income ratios, expense ratios and portfolio turnover rates. The net investment income ratios summarize the income earned less expenses, divided by the average net assets. The expense ratios represent the percentage of average net assets that were used to cover operating expenses during the period. The portfolio turnover rate represents the percentage of the fund’s holdings that have changed over the course of the period, and gives an idea of how long the fund holds onto a particular security. A 100% turnover rate implies that an amount equal to the value of the entire portfolio is turned over in a year through the purchase or sale of securities.

The Notes to Financial Statements disclose the organizational background of the fund, its significant accounting policies, federal tax information, fees and compensation paid to affiliates, and significant risks and contingencies.

We hope this guide to your shareholder report will help you get the most out of this important resource.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 1 | |

Fund Overview

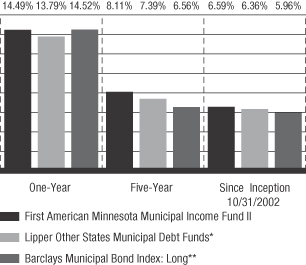

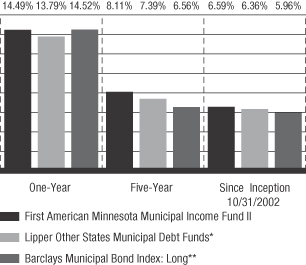

Average Annual Total Returns

Based on NAV for the period ended August 31, 2012

*The Lipper Other States Municipal Debt Funds category median is calculated using the returns of all closed-end exchange traded funds in this category for each period disclosed. Lipper returns assume reinvestment of dividends.

**The Barclays Municipal Bond Index: Long is comprised of municipal bonds with more than 22 years to maturity and an average credit quality of AA. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and since-inception periods ended August 31, 2012, were 17.43%, 11.07%, and 6.83%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

| | | | |

| 2 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

Fund Overview

Investment Advisor

U.S. Bancorp Asset Management, Inc.

Sub-Advisors

Nuveen Asset Management, LLC

Nuveen Fund Advisors, Inc.

Fund Management

Douglas J White, CFA

of Nuveen Asset Management, LLC is primarily responsible for the management of the fund. He has 29 years of financial experience.

Christopher L. Drahn

of Nuveen Asset Management, LLC assists with the management of the fund. He has 32 years of financial experience.

What factors affected the economic and municipal market environments during the 12-month reporting period ended August 31, 2012?

During the period, the U.S. economy’s progress toward recovery from recession remained sluggish but, for the most part, positive. The most recent figures available for U.S. gross domestic product (GDP) showed the economy slowed to an annualized growth rate of 1.3% in the second quarter of 2012. While this marked the twelfth consecutive quarter of positive growth, it was also a significant slowdown from the previous few quarters. Inflation remained well contained, with the Consumer Price Index (CPI) rising 1.7% year-over-year as of August 2012. Core CPI (which excludes food and energy) increased 1.9% during the period, its smallest increase since July 2011 and just below the Fed’s unofficial objective of 2.0% or lower for this inflation measure.

Labor market conditions barely improved, with the national unemployment rate registering 8.1% in August 2012. U.S. unemployment has been stalled out in the low 8% range since the beginning of the year. However, the housing market was an unfamiliar bright spot as home prices rose for three consecutive months at the end of the reporting period. The most recent data available showed the average home price in the Standard & Poor’s (S&P)/Case-Shiller Index of 20 major metropolitan areas increased 1.2% for the year ended July 2012. With prices down more than one-third from their peak in the summer of 2006, however, housing still has a long way to rebound.

The Federal Reserve (Fed) maintained its efforts to improve the overall economic environment by continuing to hold the benchmark Fed Funds rate at the record low level of zero to 0.25% that it had established in December 2008. At its June meeting, the Fed also announced that it would extend its so-called Operation Twist program, whereby it is lengthening the average maturity of its holdings of U.S. Treasury securities, through the end of December 2012. The goals of this program are to lower longer-term interest rates, make broader financial conditions more accommodating, support a stronger economic recovery and help ensure that inflation remains at levels consistent with the Fed’s mandates of maximum employment and price stability. Then at its most recent meeting after the reporting period ended, bank members responded to the ongoing job market weakness by voting to pump even more money into the economy through a third round of quantitative easing. Through the so-called QE3 plan, the Fed will purchase $40 billion a month of mortgage-backed securities to further spur on economic growth until the job market shows a significant improvement. At the same time, the central bank extended its time horizon for keeping short-term interest rates at record-low levels to at least mid-2015.

State economies also appeared to be slowly improving as revenues at the state level began coming in stronger in year-over-year comparisons as well as compared to pre-recession levels. The firming economic strength also trickled down to the local government level. Slight improvements in both housing prices and housing starts began to boost property taxes.

With the extremely low interest rate environment as a backdrop, municipal bond prices generally rallied during this period, amid tight supply and strong demand. Concurrent with rising prices, yields declined across most maturities particularly at the longer end, which in turn caused the yield curve to flatten. Although the availability of tax-exempt supply increased across all sectors as calendar year 2012 progressed, the pattern of new issuance remained lighter than long-term historical trends. The lower level of municipal issuance, especially earlier in this period, reflected lingering political distaste for additional borrowing by state and local governments and the prevalent atmosphere of municipal budget austerity. In recent months, we have seen an increasing number of

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 3 | |

Fund Overview

borrowers come to market seeking to take advantage of the current rate environment by calling existing debt and refinancing at lower rates. Over the 12 months ended August 31, 2012, municipal bond issuance nationwide totaled $384 billion, an increase of 15% compared with issuance during the 12-month period ended August 31, 2011.

At the same time, demand for municipal bonds remained very strong, especially from individual investors in search of higher yields. Positive flows into municipal bond funds easily absorbed any increased supply. Municipal bond investors also were willing to take on more risk in exchange for higher yields, leading the riskier sectors, credit rating categories and maturities to perform the best during the period.

Minnesota

Due to some temporary setbacks, Minnesota’s pace of economic recovery, which had been fairly brisk going into the fourth quarter of 2011, has slightly lagged that of the nation as a whole. For 2011, the state’s economy expanded 1.2%, compared with the national rate of 1.5%, ranking Minnesota 23rd in terms of GDP growth by state. The shutdown of Minnesota’s state government for 20 days in July 2011 due to a budget dispute along with higher crude oil prices presented obstacles to the state’s economic growth. However, recovery continued, as demonstrated by employment gains in most sectors of the state’s diverse economy, especially high-paying jobs in the professional and business services sector. Education, health care services and tourism also showed strong employment gains. In addition, Minnesota’s manufacturing firms reported strong production, investment, employment and export expectations, signaling continued expansion. Together, these four sectors account for almost 50% of the state’s jobs. As of August 2012, Minnesota’s unemployment rate was 5.9%, down from 6.5% a year ago and well below the national average of 8.1%. Record-low mortgage rates have helped to boost demand for housing in some parts of the state, primarily Rochester, Duluth and Minneapolis/St. Paul. According to the S&P/Case-Shiller Index of 20 major metropolitan areas, housing prices in Minneapolis rose 6.4% during the twelve months ending July 2012 (the most recent data available at the time this report was prepared), bringing home prices in the area to 2001 levels.

Minnesota enacted a $35.7 billion biennial budget for fiscal 2012 and 2013. As of August 2012, the state’s tax collections were reportedly running ahead of budget. However, rating agencies viewed the budget as structurally imbalanced, as the state used a one-time tobacco bond issuance and yet another deferral of state aid to school districts to close budget gaps. This led Fitch and S&P to downgrade their ratings on the state’s general obligation bonds to AA+ from AAA in July and September 2011, respectively. Moody’s also revised its outlook for the state to negative from stable in August 2011, while maintaining its Aa1 rating. Despite rating agency downgrades, Minnesota retained a solid credit profile reflective of its well-balanced economy, above-average wealth levels, moderate debt burden and strong debt management. For the twelve months ended August 31, 2012, Minnesota issued approximately $7 billion in municipal bonds, an increase of 20% from the twelve months ended August 31, 2011. However, most of the increase in the state’s issuance was in very high-quality (AA and higher) school district bonds.

How did the fund perform during the twelve-month period ended August 31, 2012?

Minnesota Municipal Income Fund II earned a total return of 14.49% based on NAV for the fiscal year ended August 31, 2012. The fund’s market price return was 17.43% during the period. The fund’s closed-end competitive group, the Lipper Other States Municipal Debt Funds Average,

| | | | |

| 4 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

produced a median return of 13.79% over the same timeframe. The Barclays Long Municipal Index, the benchmark comparison for the fund, which reflects no fees or expenses, returned 14.52%.

Portfolio Allocation1

As a percentage of total investments on August 31, 2012

| | | | |

Health Care Revenue | | | 25 | % |

Housing Revenue | | | 22 | |

Education Revenue | | | 14 | |

Miscellaneous Authority Revenue | | | 9 | |

Utility Revenue | | | 7 | |

Pre-refunded Securities2 | | | 7 | |

Leasing Revenue | | | 7 | |

General Obligations | | | 6 | |

Economic Development Revenue | | | 2 | |

Recreation Authority Revenue | | | 1 | |

| | | 100 | % |

1 Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2 Within the Schedule of Investments, pre-refunded issues are classified under their applicable industries.

The fund performed in line with its Barclays benchmark, and outperformed its Lipper peer group during the reporting period. As noted in the economic and market overview, municipal bonds turned in very strong performance over the fund’s fiscal year. The riskier segments of the municipal market performed best as investors continued their quest for higher yielding securities in a very low interest rate environment. While all sectors, maturities and credit ratings produced positive absolute returns during the reporting period, the fund’s performance benefited the most from its long duration and emphasis on longer maturity bonds in its portfolio (22 years and beyond). In fact, the fund’s longer duration, or interest rate sensitivity, was the primary factor in its outperformance of the Lipper peer group average.

The second most influential contributor to performance was the fund’s credit quality distribution. The fund’s overweights in lower rated categories, particularly non-rated, BBB-rated and A-rated bonds, aided results as these segments performed best. The fund also benefited from underweight positions in AAA and AA-rated bonds, as those ratings categories underperformed.

Fund results were also aided by our security selection in some of the higher yielding sectors including our perennial favorite healthcare, along with education and housing. In addition to offering generally higher yields, the healthcare sector benefited from the Supreme Court’s decision to uphold the Healthcare Reform Act of 2010. The fund owns securities from hospitals and healthcare systems that the market perceives will be stronger performers under the new act. Additionally, the fund’s slight overweight and security selection in education helped performance as the sector experienced a supply-and-demand imbalance. While municipal bond supply generally increased in Minnesota during the period much like the rest of the country, the majority of the issuance consisted of AA-rated school district bonds backed by the state’s school district enhancement program. The

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 5 | |

Fund Overview

education sector did not experience much new issuance in higher yielding opportunities like charter schools and BBB-rated higher education issues that we often consider for this fund. The Fund also benefited from an overweight position and stronger issue selection in the housing sector.

Certain other areas of the portfolio, while producing positive absolute returns, hindered the fund’s relative performance. For example, we owned a significant overweight of pre-refunded bonds versus the Barclays index. These bonds are older, higher yielding issues that have been called in advance of their call date and refunded with new issues. Once pre-refunded, these bonds become very high-quality, short duration issues, which caused them to underperform during this fiscal year period. Although we would typically prefer to own lower quality, longer duration assets in the fund’s portfolio, we don’t want to sell these bonds because of their superior coupon levels. Also, if we sold these positions, the fund would incur significant capital gains. The fund also experienced a slight drag on its performance from the local general obligation (GO) sector during the fiscal year period. While we had a slight overweight in this strongly performing sector, our security selection was not as favorable. Local GOs snapped back this fiscal year as revenue trends appeared to hit bottom and begin recovery, causing investors to become more comfortable with the sector’s increased risk.

Minnesota, U.S. and global economies appear to be slowly on the mend, bolstered by the dramatic actions of the Federal Reserve and other central banks around the world. However, a number of issues are still creating headwinds for economies and markets, including the sovereign debt crisis in Europe, a growth slowdown in emerging markets and the looming elections and “fiscal cliff” here in the United States. That being said, U.S. municipal bonds are fairly insulated from many global factors because they are domestic credits. In addition, Minnesota has historically fared better than many other states in economic tough times due to its diverse economy, lower unemployment, higher income levels and more educated workforce.

Bond Credit Quality Breakdown1

As a percentage of long-term investments on August 31, 2012

| | | | |

AAA | | | 9 | % |

AA | | | 30 | |

A | | | 16 | |

BBB | | | 25 | |

BB or Lower | | | 3 | |

NR | | | 17 | |

| | | 100 | % |

1 Individual security ratings are based on information from Moody’s Investors Service Inc. (“Moody’s”), Standard & Poor’s Financial Services LLC (“S&P”), and/or Fitch Ratings, Ltd (“Fitch”). If there are multiple ratings for a security, the lowest rating is used unless ratings are provided by all three agencies, in which case the middle rating is used.

However, Minnesota continues to be hampered by the limited supply of higher yielding new bonds in the state. Because of the lack of attractive new issuance, we’ve had to be very selective in the secondary market to find bonds in those higher yielding sectors and ratings categories. We continue to believe the fund is getting adequately compensated for the additional risk of investing in longer duration assets, lower rated credits and higher yielding sectors. Although spreads between higher

| | | | |

| 6 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

and lower quality bonds have narrowed significantly, we expect we could still see some additional narrowing as they remain above long-term historical averages. As always, our research team remains vigilant regarding its mandate to closely monitor the credit quality of the fund’s holdings. We will continue to focus on bottom-up security selection, while actively managing the fund’s overall risk profile.

Thank you for your ongoing trust in our process and your investment in the Minnesota Municipal Income Fund II. If you have any questions, please don’t hesitate to contact us at 800.677.3863.

Douglas J. White, CFA

Senior Vice President & Portfolio Manager

Nuveen Asset Management, LLC

Christopher L. Drahn

Senior Vice President & Portfolio Manager

Nuveen Asset Management, LLC

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 7 | |

Fund Overviews

Preferred Shares

The preferred shares issued by the fund pay dividends at a specified rate and have preference over common shares in the payments of dividends and the liquidation of assets. Rates paid on preferred shares are reset every seven days and are based on short-term tax-exempt interest rates. Preferred shareholders accept these short-term rates in exchange for low credit risk (preferred shares are rated Aa2 by Moody’s and AAA by S&P). The proceeds from the sale of preferred shares are invested at intermediate- and long-term tax-exempt rates. Because these intermediate- and long-term rates are normally higher than the short-term rates paid on preferred shares, common shareholders benefit by receiving higher dividends and/or an increase to the dividend reserve. However, the risk of having preferred shares is that if short-term rates rise higher than intermediate- and long-term rates, creating an inverted yield curve, common shareholders may receive a lower rate of return than if their fund did not have any preferred shares outstanding. This type of economic environment is unusual and historically has been short term in nature. Investors should also be aware that the issuance of preferred shares results in the leveraging of common shares, which increases the volatility of both the NAV of the fund and the market value of common shares.

Normally, the dividend rates on the preferred shares are set at the market clearing rate determined through an auction process that brings together bidders who wish to buy preferred shares and holders of preferred shares who wish to sell. Since February 15, 2008, however, sell orders have exceeded bids and the regularly scheduled auctions for the fund’s preferred shares have failed. When an auction fails, the fund is required to pay the maximum applicable rate on the preferred shares to holders of such shares for successive dividend periods until such time as the shares are successfully auctioned. The maximum applicable rate on the preferred shares is 110% of the higher of (1) the applicable AA Composite Commercial Paper Rate or (2) 90% of the Taxable Equivalent of the Short-Term Municipal Bond Rate.

During any dividend period, the maximum applicable rate could be higher than the dividend rate that would have been set had the auction been successful. In addition, the maximum applicable rate could be higher than the fund’s investment yield. Higher maximum applicable rates increase the fund’s cost of leverage and reduce the fund’s common share earnings.

| | | | |

| 8 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of First American Minnesota Municipal Income Fund II, Inc.

We have audited the accompanying statement of assets and liabilities of First American Minnesota Municipal Income Fund II, Inc. (the “fund”), including the schedule of investments, as of August 31, 2012, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the fund’s internal control over financial reporting. Accordingly, we express no such opinion An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2012, by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of First American Minnesota Municipal Income Fund II, Inc. at August 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Minneapolis, Minnesota

October 22, 2012

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 9 | |

| | |

| Schedule of Investments | | August 31, 2012 |

Minnesota Municipal Income Fund II (MXN)

| | | | | | | | |

DESCRIPTION | | PAR | | | FAIR

VALUE ¶ | |

| | |

(Percentages of each investment category relate to total net assets applicable to outstanding common shares) | | | | | | | | |

| | |

Municipal Long-Term Investments — 156.0% | | | | | | | | |

Economic Development Revenue — 3.2% | | | | | | | | |

Minneapolis Development, Limited Tax Supported Common Bond, Series 2007-2A (AMT), 5.13%, 6/1/22 | | $ | 500,000 | | | $ | 531,645 | |

Moorhead, American Crystal Sugar Company, Recovery Zone Facility, Series 2010, 5.65%, 6/1/27 | | | 200,000 | | | | 219,694 | |

| | | | | | | | |

| | | | | | | 751,339 | |

| | | | | | | | |

Education Revenue — 22.0% | | | | | | | | |

Baytown Township, St. Croix Preparatory Academy Project, Series 2008-A, 7.00%, 8/1/38 | | | 350,000 | | | | 373,016 | |

Higher Education Facilities, Augsburg College, Series 6J1, 5.00%, 5/1/28 | | | 200,000 | | | | 205,766 | |

Higher Education Facilities, Bethel University, Series 6R, 5.50%, 5/1/24 | | | 500,000 | | | | 530,080 | |

Higher Education Facilities, St. Catherine College, Series 5N1, 5.38%, 10/1/32 | | | 500,000 | | | | 500,580 | |

Higher Education Facilities, University of St. Thomas, | | | | | | | | |

5.00%, 10/1/39, Series 7A | | | 1,000,000 | | | | 1,116,610 | |

5.25%, 4/1/39, Series 6X | | | 300,000 | | | | 326,817 | |

St. Paul Housing & Redevelopment Authority, Community Peace Academy Project, Series 2006-A, 5.00%, 12/1/36 | | | 510,000 | | | | 483,878 | |

St. Paul Housing & Redevelopment Authority, Nova Classical Academy, Series 2011-A, 6.38%, 9/1/31 | | | 350,000 | | | | 379,655 | |

University of Minnesota, Series 2011-A, 5.25%, 12/1/29 | | | 1,000,000 | | | | 1,222,170 | |

| | | | | | | | |

| | | | | | | 5,138,572 | |

| | | | | | | | |

General Obligations — 9.1% | | | | | | | | |

Crow Wing County Jail, Series B (NATL), 5.00%, 2/1/21 | | | 550,000 | | | | 599,038 | |

Hennepin County, Series D, 5.00%, 12/1/25 | | | 1,000,000 | | | | 1,156,970 | |

Puerto Rico Commonwealth, Series A, 5.00%, 7/1/28 | | | 350,000 | | | | 360,108 | |

| | | | | | | | |

| | | | | | | 2,116,116 | |

| | | | | | | | |

Healthcare Revenue — 45.4% | | | | | | | | |

Bemidji Health Care Facilities, North Country Health Services, Series 2002 (RAAI), (Pre-refunded 9/1/12 @ 100), 5.00%, | | | | | | | | |

9/1/31 ¯ | | | 1,020,000 | | | | 1,020,000 | |

Center City Health Care Facilities, Hazelden Foundation Project, 5.00%, 11/1/41 | | | 200,000 | | | | 215,834 | |

Cuyuna Range Hospital District, Health Facilities, Series 2005, 5.50%, 6/1/35 | | | 400,000 | | | | 406,816 | |

Golden Valley Covenant Retirement Communities, Series A, 5.50%, 12/1/25 | | | 600,000 | | | | 602,004 | |

Maple Grove Health Care Facilities, North Memorial Health Care, 5.00%, 9/1/35 | | | 205,000 | | | | 209,289 | |

Marshall Medical Center, Weiner Medical Center Project, Series A, (Pre-refunded 11/1/13 @ 100), 5.35%, 11/1/17 ¯ | | | 350,000 | | | | 368,424 | |

Minneapolis & St. Paul Housing & Redevelopment Authority, HealthPartners Obligated Group Project, Series 2003, | | | | | | | | |

5.88%, 12/1/29 | | | 750,000 | | | | 771,367 | |

Minneapolis Health Care Facilities, Walker Campus Project, 4.75%, 11/15/28 « | | | 450,000 | | | | 451,777 | |

Minneapolis Health Care Systems, Fairview Health Services, Series A, 6.63%, 11/15/28 | | | 750,000 | | | | 897,225 | |

Minneapolis Health Care Systems, Fairview Health Services, Series B (AGC), 6.50%, 11/15/38 | | | 495,000 | | | | 591,169 | |

Minnesota Agricultural & Economic Development Board, Fairview Health Care System, Series A, 6.38%, 11/15/29 | | | 25,000 | | | | 25,051 | |

Monticello-Big Lake Community Hospital District, Health Care Facilities, Series C, 6.20%, 12/1/22 ¥ | | | 400,000 | | | | 402,076 | |

New Hope Housing & Health Care Facility, Masonic Home North Ridge, Series 1999, 5.75%, 3/1/15 ¥ | | | 400,000 | | | | 400,536 | |

Prior Lake Senior Housing, Shepard’s Path Senior Housing, Series B, 5.70%, 8/1/36 | | | 200,000 | | | | 200,266 | |

Shakopee Health Care Facilities, St. Francis Regional Medical Center, Series 2004, 5.10%, 9/1/25 | | | 500,000 | | | | 511,505 | |

St. Louis Park Health Care Facilities, Park Nicollet Health Services, Series 2009, 5.75%, 7/1/39 | | | 705,000 | | | | 791,066 | |

St. Paul Housing & Redevelopment Authority, Allina Health System, Series A-1, 5.25%, 11/15/29 | | | 450,000 | | | | 501,565 | |

St. Paul Housing & Redevelopment Authority, HealthEast Project, Series 2005, 6.00%, 11/15/30 | | | 200,000 | | | | 211,108 | |

St. Paul Housing & Redevelopment Authority, Nursing Home Episcopal, 5.63%, 10/1/33 ¥ | | | 460,238 | | | | 469,318 | |

St. Paul Housing & Redevelopment Authority, Regions Hospital, | | | | | | | | |

5.25%, 5/15/18 | | | 500,000 | | | | 501,080 | |

5.30%, 5/15/28 | | | 170,000 | | | | 170,165 | |

St. Paul Housing & Redevelopment Authority, Rossy & Richard Shaller, Series A, 5.25%, 10/1/42 | | | 250,000 | | | | 250,983 | |

St. Paul Port Authority, HealthEast Midway Campus, Series A, 5.75%, 5/1/25 | | | 600,000 | | | | 625,806 | |

| | | | | | | | |

| | | | | | | 10,594,430 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 10 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

Minnesota Municipal Income Fund II (MXN)

| | | | | | | | |

DESCRIPTION | | PAR | | | FAIR

VALUE ¶ | |

| | |

Housing Revenue — 34.8% | | | | | | | | |

Minneapolis Housing, Keeler Apartments Project, Series A, 5.00%, 10/1/37 | | $ | 300,000 | | | $ | 290,814 | |

Minneapolis Multifamily Housing, Seward Towers Project, Series 2003 (GNMA), 5.00%, 5/20/36 | | | 1,190,000 | | | | 1,224,427 | |

Minneapolis-St. Paul Housing Finance Board, Single Family Mortgage, Mortgage-Backed City Living, Series A4 (AMT) | | | | | | | | |

(FHLMC) (FNMA) (GNMA), 5.00%, 11/1/38 | | | 84,376 | | | | 87,159 | |

Minnesota Housing Finance Agency, Homeownership Finance, Series D (FHLMC) (FNMA) (GNMA), 4.70%, 1/1/31 | | | 100,000 | | | | 111,052 | |

Minnesota Housing Finance Agency, Nonprofit Housing, State Appropriation, Series 2011, 5.00%, 8/1/31 | | | 1,000,000 | | | | 1,141,150 | |

Minnesota Housing Finance Agency, Rental Housing, Series 2011A, 5.45%, 8/1/41 | | | 1,700,000 | | | | 1,903,592 | |

Minnesota Housing Finance Agency, Residential Housing, Series B (AMT), 5.65%, 7/1/33 | | | 35,000 | | | | 36,850 | |

Minnesota Housing Finance Agency, Residential Housing (AMT), | | | | | | | | |

4.70%, 7/1/27, Series D | | | 915,000 | | | | 947,217 | |

4.85%, 7/1/38, Series I | | | 10,000 | | | | 10,238 | |

Minnesota Housing Finance Agency, Series E, 5.10%, 1/1/40 | | | 890,000 | | | | 956,901 | |

Moorhead Economic Development Authority, Housing Development Eventide Project, Series A, 5.15%, 6/1/29 | | | 300,000 | | | | 299,274 | |

Moorhead Senior Housing, Sheyenne Crossing Project, Series 2006, 5.65%, 4/1/41 ¥ | | | 330,000 | | | | 332,277 | |

St. Paul Multifamily Housing, Selby Grotto Housing Project, Series 2003 (AMT) (FHA) (GNMA), 5.50%, 9/20/44 | | | 655,000 | | | | 663,797 | |

Wayzata Senior Housing Revenue, Folkestone Senior Living Community, Series 2012A, 6.00%, 5/1/47 | | | 110,000 | | | | 115,520 | |

| | | | | | | | |

| | | | | | | 8,120,268 | |

| | | | | | | | |

Leasing Revenue — 12.4% | | | | | | | | |

Andover Economic Development Authority, Public Facility, Community Center, Series 2004 (Crossover Refunded 2/1/14 @ 100), | | | | | | | | |

5.13%, 2/1/24 z | | | 295,000 | | | | 312,086 | |

5.13%, 2/1/24 z | | | 205,000 | | | | 216,874 | |

Duluth Capital Appreciation Independent School District Number 709, Series A, Certificate of Participation, Zero Coupon Bond (MSDCEP), 4.02%, 2/1/28 ° | | | 600,000 | | | | 320,448 | |

Otter Tail County Housing & Redevelopment Authority, Building Lease, Series A (Pre-refunded 2/1/13 @ 100), 5.00%, | | | | | | | | |

2/1/19 ¯ | | | 525,000 | | | | 535,421 | |

St. Paul Housing & Redevelopment Authority, Jimmy Lee Recreation Center, Series 2008, 5.00%, 12/1/32 | | | 100,000 | | | | 108,028 | |

St. Paul Port Authority, Office Building Facility, Robert Street, Series 2002-9, 5.25%, 12/1/27 | | | 1,000,000 | | | | 1,006,450 | |

Washington County Housing & Redevelopment Authority, Lower St. Croix Valley Fire Protection, 5.13%, 2/1/24 | | | 400,000 | | | | 402,720 | |

| | | | | | | | |

| | | | | | | 2,902,027 | |

| | | | | | | | |

Miscellaneous Revenue — 14.1% | | | | | | | | |

Seaway Port Authority of Duluth, Cargill Incorporated Project, Series 2004, 4.20%, 5/1/13 | | | 500,000 | | | | 510,485 | |

St. Paul Housing & Redevelopment Authority, Parking Facilities Project, Series A, 5.00%, 8/1/30 | | | 340,000 | | | | 378,573 | |

Tobacco Securitization Authority, Series B, 5.25%, 3/1/31 | | | 2,125,000 | | | | 2,397,701 | |

| | | | | | | | |

| | | | | | | 3,286,759 | |

| | | | | | | | |

Recreation Authority Revenue — 1.5% | | | | | | | | |

Moorhead Golf Course, Series B, 5.88%, 12/1/21 ¥ | | | 355,000 | | | | 355,178 | |

| | | | | | | | |

Tax Revenue — 0.7% | | | | | | | | |

Minneapolis Tax Increment, Village at St. Anthony Falls Project, Series 2005, 5.65%, 2/1/27 ¥ | | | 150,000 | | | | 150,599 | |

| | | | | | | | |

Transportation Revenue — 2.2% | | | | | | | | |

Minneapolis & St. Paul Metropolitan Airports Commission, Series A (NATL) (Pre-refunded 1/1/13 @ 100), 5.00%, 1/1/19 ¯ | | | 500,000 | | | | 508,010 | |

| | | | | | | | |

Utility Revenue — 10.6% | | | | | | | | |

Chaska Electric, Series A, | | | | | | | | |

5.00%, 10/1/30 | | | 500,000 | | | | 530,140 | |

6.10%, 10/1/30 | | | 10,000 | | | | 10,038 | |

Northern Municipal Power Agency, Minnesota Electric System, Series A (AGC), | | | | | | | | |

5.00%, 1/1/18 | | | 300,000 | | | | 357,522 | |

5.00%, 1/1/20 | | | 250,000 | | | | 290,917 | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority, Series A, 6.00%, 7/1/38 | | | 600,000 | | | | 638,718 | |

Puerto Rico Electric Power Authority, Series VV (NATL), 5.25%, 7/1/29 | | | 520,000 | | | | 566,946 | |

Southern Minnesota Municipal Power Agency, Series A, Zero Coupon Bond (NATL), | | | | | | | | |

3.51%, 1/1/26 ° | | | 100,000 | | | | 62,880 | |

3.60%, 1/1/27 ° | | | 5,000 | | | | 2,998 | |

| | | | | | | | |

| | | | | | | 2,460,159 | |

| | | | | | | | |

| | |

Total Municipal Long-Term Investments

(Cost: $33,958,199) | | | | | | | 36,383,457 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 11 | |

| | |

| Schedule of Investments | | August 31, 2012 |

Minnesota Municipal Income Fund II (MXN)

| | | | | | | | |

DESCRIPTION | | SHARES | | | FAIR

VALUE ¶ | |

| | |

Short-Term Investment — 0.2% | | | | | | | | |

Federated Minnesota Municipal Cash Trust, Institutional Shares, 0.01% W | | | | | | | | |

(Cost: $48,865) | | | 48,865 | | | $ | 48,865 | |

| | | | | | | | |

Total Investments p — 156.2% | | | | | | | | |

(Cost: $34,007,064) | | | | | | | 36,432,322 | |

| | | | | | | | |

Preferred Shares at Liquidation Value — (55.7)% | | | | | | | (13,000,000 | ) |

| | | | | | | | |

Other Assets and Liabilities, Net — (0.5)% | | | | | | | (112,614 | ) |

| | | | | | | | |

Total Net Assets Applicable to Outstanding Common Shares — 100.0% | | | | | | $ | 23,319,708 | |

| | | | | | | | |

| ¶ | Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements. |

| ¯ | Pre-refunded issues are typically backed by U.S. Government obligations, which secure the timely payment of principal and interest. These bonds mature at the call date and price indicated. |

| « | Security purchased on a when-issued basis. On August 31, 2012, the total cost of investments purchased on a when-issued basis was $450,000 or 1.9% of total net assets applicable to outstanding common shares. See note 2 in Notes to Financial Statements. |

| ¥ | Security considered illiquid. As of August 31, 2012, the fair value of these investments was $2,109,984 or 9.0% of total net assets applicable to outstanding common shares. See note 2 in Notes to Financial Statements. |

| z | Crossover refunded securities are typically backed by the credit of the refunding issuer, which secures the timely payment of principal and interest. These bonds mature at the call date and price indicated. |

| ° | Zero coupon bonds make no periodic interest payments, but are issued at deep discounts from par value. The rate shown is the effective yield as of August 31, 2012. |

| W | The rate shown is the annualized seven-day effective yield as of August 31, 2012. |

| p | On August 31, 2012, the cost of investments for federal income tax purposes was $34,009,185. The aggregate gross unrealized appreciation and depreciation of investments, based on this cost, were as follows: |

| | | | |

Gross unrealized appreciation | | $ | 2,450,050 | |

Gross unrealized depreciation | | | (26,913 | ) |

| | | | |

Net unrealized appreciation | | $ | 2,423,137 | |

| | | | |

AGC–Assured Guaranty Corporation

AMT–Alternative Minimum Tax. As of August 31, 2012, the aggregate fair value of securities subject to the AMT was $2,276,906, which represents 9.8% of total net assets applicable to common shares.

FHA–Federal Housing Administration

FHLMC–Federal Home Loan Mortgage Corporation

FNMA–Federal National Mortgage Association

GNMA–Government National Mortgage Association

MSDCEP–Minnesota School District Credit Enhancement Program

NATL–National Public Finance Guarantee Corporation

RAAI–Radian Asset Assurance Inc.

The accompanying notes are an integral part of the financial statements.

| | | | |

| 12 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

| | |

| Statement of Assets and Liabilities | | August 31, 2012 |

| | | | |

Assets: | | | | |

Unaffiliated investments, at fair value (Cost: $34,007,064) (note 2) | | $ | 36,432,322 | |

Cash | | | 8,750 | |

Receivable for accrued interest | | | 488,510 | |

Prepaid expenses and other assets | | | 31,551 | |

| | | | |

Total assets | | | 36,961,133 | |

| | | | |

| |

Liabilities: | | | | |

Payable for investments purchased | | | 579,968 | |

Payable for preferred share distributions (note 3) | | | 435 | |

Payable for investment advisory fees | | | 10,557 | |

Payable for administration fees | | | 6,032 | |

Payable for postage and printing fees | | | 2,138 | |

Payable for audit fees | | | 13,720 | |

Payable for legal fees | | | 15,169 | |

Payable for pricing fees | | | 212 | |

Payable for transfer agent fees | | | 4,040 | |

Payable for other expenses | | | 9,154 | |

| | | | |

Total liabilities | | | 641,425 | |

| | | | |

Preferred shares, at liquidation value (note 3) | | | 13,000,000 | |

| | | | |

Net assets applicable to outstanding common shares | | $ | 23,319,708 | |

| | | | |

| |

Net assets applicable to outstanding common shares consist of: | | | | |

Common shares and additional paid-in capital | | $ | 20,798,974 | |

Undistributed net investment income | | | 139,175 | |

Accumulated net realized loss on investments | | | (43,699 | ) |

Net unrealized appreciation of investments | | | 2,425,258 | |

| | | | |

Net assets applicable to outstanding common shares | | $ | 23,319,708 | |

| | | | |

| |

Net asset value and market price of common shares: | | | | |

Net assets applicable to outstanding common shares | | $ | 23,319,708 | |

Common shares outstanding (authorized 200 million shares of $0.01 par value) | | | 1,472,506 | |

Net asset value per share | | $ | 15.84 | |

Market price per share | | $ | 16.94 | |

| |

Liquidation preference of preferred shares (note 3): | | | | |

Net assets applicable to preferred shares | | $ | 13,000,000 | |

Preferred shares outstanding (authorized one million shares) | | | 520 | |

Liquidation preference per share | | $ | 25,000 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 13 | |

| | |

| Statement of Operations | | For the year ended August 31, 2012 |

| | | | |

Investment Income: | | | | |

Interest from unaffiliated investments | | $ | 1,774,418 | |

Dividends from unaffiliated money market fund | | | 23 | |

| | | | |

Total investment income | | | 1,774,441 | |

| | | | |

| |

Expenses (note 5): | | | | |

Investment advisory fees | | | 124,187 | |

Administration fees | | | 70,964 | |

Auction agent fees | | | 34,122 | |

Custodian fees | | | 1,781 | |

Auction commission fees | | | 6,796 | |

Postage and printing fees | | | 20,120 | |

Transfer agent fees | | | 24,747 | |

Listing fees | | | 8,750 | |

Directors’ fees | | | 86,796 | |

Legal fees | | | 48,724 | |

Audit fees | | | 47,890 | |

Insurance fees | | | 37,629 | |

Pricing fees | | | 8,904 | |

Other expenses | | | 30,329 | |

| | | | |

Total expenses | | | 551,739 | |

| | | | |

| |

Net investment income | | | 1,222,702 | |

| | | | |

| |

Net realized and unrealized gains on investments (notes 2 and 4): | | | | |

Net realized gain on investments | | | 132,302 | |

Net change in unrealized appreciation or depreciation of investments | | | 1,698,269 | |

| | | | |

Net gain on investments | | | 1,830,571 | |

| | | | |

| |

Distributions to preferred shareholders (note 2): | | | | |

From net investment income | | | (31,257 | ) |

| | | | |

| |

Net increase in net assets applicable to outstanding common shares resulting from operations | | $ | 3,022,016 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 14 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended

8/31/12 | | | Year Ended

8/31/11 | |

Operations: | | | | | | | | |

Net investment income | | $ | 1,222,702 | | | $ | 1,283,813 | |

Net realized gain (loss) on investments | | | 132,302 | | | | (40,169 | ) |

Net change in unrealized appreciation or depreciation of investments | | | 1,698,269 | | | | (682,141 | ) |

Distribution to preferred shareholders from net investment income (note 2) | | | (31,257 | ) | | | (46,179 | ) |

| | | | | | | | |

| | |

Net increase in net assets applicable to outstanding common shares resulting from operations | | | 3,022,016 | | | | 515,324 | |

| | | | | | | | |

| | |

Distributions to common shareholders (note 2): | | | | | | | | |

From net investment income | | | (1,189,049 | ) | | | (1,229,543 | ) |

| | | | | | | | |

| | |

Total increase (decrease) in net assets applicable to outstanding common shares | | | 1,832,967 | | | | (714,219 | ) |

| | | | | | | | |

| | |

Net assets applicable to outstanding common shares at beginning of period | | | 21,486,741 | | | | 22,200,960 | |

| | | | | | | | |

| | |

Net assets applicable to outstanding common shares at end of period | | $ | 23,319,708 | | | $ | 21,486,741 | |

| | | | | | | | |

| | |

Undistributed net investment income | | $ | 139,175 | | | $ | 136,779 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 15 | |

Financial Highlights

Per-share data for an outstanding common share throughout each period and selected information for each period are as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended August 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

Per-Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, common shares, beginning of period | | $ | 14.59 | | | $ | 15.08 | | | $ | 13.34 | | | $ | 13.78 | | | $ | 14.26 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.83 | | | | 0.87 | | | | 0.92 | | | | 0.89 | | | | 0.91 | |

Net realized and unrealized gain (losses) on investments and futures contracts | | | 1.25 | | | | (0.49 | ) | | | 1.72 | | | | (0.45 | ) | | | (0.37 | ) |

Distributions to preferred shareholders: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.02 | ) | | | (0.03 | ) | | | (0.03 | ) | | | (0.15 | ) | | | (0.25 | ) |

From net realized gain on investments | | | — | | | | — | | | | — | | | | — | | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from operations | | | 2.06 | | | | 0.35 | | | | 2.61 | | | | 0.29 | | | | 0.24 | |

| | | | | | | | | | | | | | | | | | | | |

Distributions to common shareholders: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.81 | ) | | | (0.84 | ) | | | (0.87 | ) | | | (0.73 | ) | | | (0.64 | ) |

From net realized gain on investments | | | — | | | | — | | | | — | | | | — | | | | (0.08 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to common shareholders | | | (0.81 | ) | | | (0.84 | ) | | | (0.87 | ) | | | (0.73 | ) | | | (0.72 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, common shares, end of period | | $ | 15.84 | | | $ | 14.59 | | | $ | 15.08 | | | $ | 13.34 | | | $ | 13.78 | |

| | | | | | | | | | | | | | | | | | | | |

Market value, common shares, end of period | | $ | 16.94 | | | $ | 15.15 | | | $ | 15.22 | | | $ | 14.13 | | | $ | 13.00 | |

| | | | | | | | | | | | | | | | | | | | |

Selected Information | | | | | | | | | | | | | | | | | | | | |

Total return, common shares, net asset value 1 | | | 14.49 | % | | | 2.64 | % | | | 20.20 | % | | | 2.76 | % | | | 1.74 | % |

Total return, common shares, market value 2 | | | 17.43 | % | | | 5.34 | % | | | 14.22 | % | | | 15.43 | % | | | 3.64 | % |

Net Assets applicable to outstanding common shares at end of period (in millions) | | $ | 23 | | | $ | 21 | | | $ | 22 | | | $ | 20 | | | $ | 20 | |

Ratio of expenses to average weekly net assets applicable to outstanding common shares before fee reimbursements 3 | | | 2.45 | % | | | 2.25 | % | | | 1.86 | % | | | 2.09 | % | | | 1.98 | % |

Ratio of expenses to average weekly net assets applicable to outstanding common shares after fee reimbursements 3 | | | 2.45 | % | | | 2.25 | % | | | 1.86 | % | | | 2.09 | % | | �� | 1.90 | % |

Ratio of net investment income to average weekly net assets applicable to outstanding common shares before fee reimbursements 3 | | | 5.44 | % | | | 6.18 | % | | | 6.50 | % | | | 7.25 | % | | | 6.46 | % |

Ratio of net investment income to average weekly net assets applicable to outstanding common shares after fee reimbursements 3 | | | 5.44 | % | | | 6.18 | % | | | 6.50 | % | | | 7.25 | % | | | 6.54 | % |

Portfolio turnover rate | | | 11 | % | | | 15 | % | | | 17 | % | | | 17 | % | | | 22 | % |

Net assets applicable to remarketed preferred shares, end of period (in millions) | | $ | 13 | | | $ | 13 | | | $ | 13 | | | $ | 13 | | | $ | 13 | |

Asset coverage per remarketed preferred share (in thousands) 4 | | $ | 70 | | | $ | 66 | | | $ | 68 | | | $ | 63 | | | $ | 64 | |

Liquidation preference and market value per remarketed preferred share (in thousands) | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | |

| 1 | Assumes reinvestment of distributions at net asset value. |

| 2 | Assumes reinvestment of distributions at actual prices pursuant to the fund’s dividend reinvestment plan. |

| 3 | Ratios do not reflect the effect of dividend payments to preferred shareholders; income ratios reflect income earned on assets attributable to preferred shares, where applicable. |

| 4 | Represents net assets applicable to outstanding common shares plus preferred shares at liquidation value divided by preferred shares outstanding. |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 16 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

Notes to Financial Statements

First American Minnesota Municipal Income Fund II, Inc. (the fund) is registered under the Investment Company Act of 1940, as amended (the Investment Company Act), as a non-diversified, closed-end management investment company. The fund invests primarily in Minnesota municipal securities that, at the time of purchase, are rated investment grade or are unrated and deemed to be of comparable quality by one of the fund’s sub-advisors, Nuveen Asset Management, LLC (NAM). The fund may invest up to 20% of its total assets in municipal securities that, at the time of purchase, are rated lower than investment grade or are unrated and deemed to be of comparable quality by NAM. The fund’s investments may include municipal derivative securities, such as inverse floating rate and inverse interest-only municipal securities, which may be more volatile than traditional municipal securities in certain market conditions. The fund’s investments also may include repurchase agreements, futures contracts, options on futures contracts, options, and interest rate swaps, caps, and floors. Fund shares are listed on the NYSE MKT under the symbol MXN.

The fund concentrates its investments in Minnesota and therefore, may have more credit risk related to the economic conditions of Minnesota than a portfolio with a broader geographical diversification.

| (2) | Summary of

Significant

Accounting

Policies |

Security Valuations

Security valuations for the fund’s investments are generally furnished by an independent pricing service that has been approved by the fund’s board of directors. Debt obligations exceeding 60 days to maturity are valued by an independent pricing service that has been approved by the fund’s board of directors. Securities for which prices are not available from an independent pricing service but where an active market exists are valued using market quotations obtained from one or more dealers that make markets in the securities or from a widely-used quotation system. Debt obligations with 60 days or less remaining until maturity may be valued at their amortized cost, which approximates market value. Investments in open-end funds are valued at their respective net asset values on the valuation date.

The following investment vehicles, when held by the fund, are priced as follows: exchange listed futures and options on futures are priced at their last sale price on the exchange on which they are principally traded, as determined by the fund’s investment advisor, U.S. Bancorp Asset Management, Inc. (USBAM), on the day the valuation is made. If there were no sales on that day, futures and options on futures will be valued at the last reported bid price. Options on securities, indices, and currencies traded on Nasdaq or listed on a stock exchange are valued at the last sale price on Nasdaq or on any exchange on the day the valuation is made. If there were no sales on that day, the options will be valued at the last sale price on the previous valuation date. Last sale prices are obtained from an independent pricing service. Swaps and over-the-counter options on securities and indices, are valued at the quotations received from an independent pricing service, if available.

When market quotations are not readily available, securities are internally valued at fair value as determined in good faith by procedures established and approved by the fund’s board of directors. As of August 31, 2012, the fund held no internally fair valued securities.

The Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) is the exclusive reference of authoritative U.S. generally accepted accounting principles (GAAP) recognized by the FASB to be applied by nongovernmental entities. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

GAAP requires disclosures regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or techniques. The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a three-tier fair value hierarchy for observable and unobservable inputs used in measuring fair value. Observable inputs reflect the assumptions market participants would use in pricing an asset or liability and are based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 17 | |

Notes to Financial Statements

market participants would use in pricing the asset or liability. Unobservable inputs are based on the best information available in the circumstances. Fair value inputs are summarized in the three broad levels listed below:

Level 1 - Quoted prices in active markets for identical securities.

Level 2 - Other significant observable inputs (including quoted prices for similar securities, with similar interest rates, prepayment speeds, credit risk, etc.).

Level 3 - Significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments). Generally, the types of securities included in Level 3 of the fund are securities for which there is limited or no observable fair value inputs available, and as such the fair value is determined through independent broker quotations or management’s fair value procedures established by the fund’s board of directors.

The fair value levels are not necessarily an indication of the risk associated with investing in these investments.

As of August 31, 2012, the fund’s investments were classified as follows:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total

Fair Value | |

Investments | | | | | | | | | | | | | | | | |

Municipal Long-Term Investments | | $ | — | | | $ | 36,383,457 | | | $ | — | | | $ | 36,383,457 | |

Short-Term Investment | | | 48,865 | | | | — | | | | — | | | | 48,865 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 48,865 | | | $ | 36,383,457 | | | $ | — | | | $ | 36,432,322 | |

| | | | | | | | | | | | | | | | |

Refer to the Schedule of Investments for further security classification.

During the fiscal year ended August 31, 2012, the fund recognized no transfers between fair value levels.

Valuation Methodologies for Fair Value Measurements Categorized within Level 2

Municipal Long-Term Investments

Municipal long-term investments are valued by an independent pricing service. The pricing service may employ methodologies that utilize actual market transactions, broker-dealer supplied valuations, or other formula-driven valuation techniques. These techniques generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings and general market conditions.

Valuation Process for Fair Value Measurements

The fund’s board of directors (the board) has adopted policies and procedures for the valuation of the fund’s investments (the valuation procedures). The valuation procedures establish a valuation committee consisting of representatives from USBAM investment management, legal, treasury and compliance departments (the valuation committee). The board has authorized the valuation committee to make fair value determinations in accordance with the valuation procedures. The audit committee of the board meets on a regular basis to, among other things, review fair value determinations made by the valuation committee, monitor the appropriateness of any previously determined fair value methodology, and approve in advance any proposed changes to such methodology and presents such changes for ratification by the board.

Security Transactions and Investment Income

For financial statement purposes, the fund records security transactions on the trade date of the security purchase or sale. Dividend income is recorded on the ex-dividend date. Interest income, including accretion of bond discounts and amortization of bond premiums, is recorded on an accrual basis. Security gains and losses are determined on the basis of identified cost, which is the same basis used for federal income tax purposes. The resulting gain/loss is calculated as the difference between the sales price and the underlying cost of the security on the transaction date.

| | | | |

| 18 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

Distributions to Shareholders

Distributions from net investment income are made monthly for common shareholders and weekly for preferred shareholders. Common share distributions are recorded as of the close of business on the ex-dividend date and preferred share dividends are accrued daily. Net realized gain distributions, if any, will be made at least annually. Distributions are payable in cash or, for common shareholders pursuant to the fund’s dividend reinvestment plan, reinvested in additional common shares of the fund. Under the dividend reinvestment plan, common shares will be purchased in the open market.

Taxes

Federal

The fund intends to continue to qualify as a regulated investment company (RIC) as provided in Subchapter M of the Internal Revenue Code, as amended, and to distribute all taxable income, if any, to its shareholders. Accordingly, no provision for federal income taxes is required.

As of August 31, 2012, the fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable taxing authority. Generally, tax authorities can examine all the tax returns filed for the last three years.

Net investment income and net realized gains and losses may differ for financial statement and tax purposes because of temporary or permanent book/tax differences. These differences are primarily due to deferred straddle losses. To the extent these differences are permanent, reclassifications are made to the appropriate capital accounts in the fiscal period in which the differences arise.

The character of distributions made during the fiscal period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal period in which amounts are distributed may differ from the fiscal period that the income or realized gains or losses were recorded by the fund.

The character of common and preferred share distributions paid during the fiscal years ended August 31, 2012 and the fiscal year ended August 31, 2011, were as follows:

| | | | | | | | |

| | | 8/31/12 | | | 8/31/11 | |

Distributions paid from: | | | | | | | | |

Tax exempt income | | $ | 1,213,723 | | | $ | 1,274,286 | |

Ordinary income | | | 6,474 | | | | 1,438 | |

| | | | | | | | |

| | $ | 1,220,197 | | | $ | 1,275,724 | |

| | | | | | | | |

As of August 31, 2012, the components of accumulated earnings (deficit) on a tax basis were as follows:

| | | | |

Undistributed tax-exempt income | | $ | 139,851 | |

Undistributed taxable income | | | 4,994 | |

Accumulated capital and post-October losses | | | (41,578 | ) |

Unrealized appreciation (depreciation) | | | 2,423,137 | |

Other accumulated gain (loss) | | | (5,670 | ) |

| | | | |

Accumulated earnings (deficit) | | $ | 2,520,734 | |

| | | | |

Under the Regulated Investment Company Modernization Act of 2010, the funds are permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Any losses incurred during those taxable years will be required to be utilized prior to the losses incurred in pre-enactment

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 19 | |

Notes to Financial Statements

taxable years. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under the previous law.

For federal income tax purposes, the fund had capital loss carryovers at August 31, 2012, which, if not offset by subsequent capital gains, will expire on the fund’s fiscal year-ends as follows:

| | | | | | |

Capital Loss

Carryover | | | Expiration | |

| $ | 35,278 | | | | 2017 | |

| | 6,198 | | | | 2018 | |

| | 102 | | | | 2019 | |

| | | | | | |

| $ | 41,578 | | | | | |

| | | | | | |

During the fiscal year ended August 31, 2012, the fund utilized $92,432 of capital loss carryovers.

State

Minnesota taxable net income is generally based on federal taxable income. The portion of tax-exempt dividends paid by the fund that is derived from interest on Minnesota municipal bonds will be excluded from Minnesota taxable net income of individuals, estates, and trusts, provided that the portion of the tax-exempt dividends paid from these obligations represents 95% or more of the exempt-interest dividends paid by the fund. The remaining portion of these dividends, and dividends that are not exempt-interest dividends or capital gains distributions, will be included in the Minnesota taxable net income of individuals, estates, and trusts, except for dividends directly attributable to interest on obligations of the U.S. Government, its territories and possessions.

In 1995, Minnesota enacted a statement of intent that interest on obligations of Minnesota governmental units and Indian tribes be included in the net income of individuals, estates and trusts for Minnesota income tax purposes if a court determines that Minnesota’s exemption of such interest and its taxation of interest on obligations of governmental issuers in other states unlawfully discriminates against interstate commerce. See Minn. Stat. § 289A.50, subd. 10. This provision applies to taxable years that begin during or after the calendar year in which any such determination becomes final.

The U.S. Supreme Court has held that a state which exempts from taxation interest on the bonds of the state and its political subdivisions, while subjecting to tax interest on bonds of other states and their political subdivisions, does not violate the Commerce Clause. However, the Court has not dealt with the treatment of private activity bonds, which leaves open the possibility that a court in the future could hold that a state’s discriminatory treatment of private activity bonds of issuers located within or outside the state violates the Commerce Clause.

Derivatives

The fund may invest in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. The fund’s investment objective allows the fund to enter into various types of derivative contracts, including, but not limited to, futures contracts, options on futures contracts, options, and interest rate swaps, caps, and floors. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements that may expose the fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities. As of August 31, 2012, the fund had no outstanding derivative contracts.

Futures Transactions

In order to protect against changes in interest rates, the fund may buy and sell interest rate futures contracts. Upon entering into a futures contract, the fund is required to deposit cash or pledge U.S. Government securities. The margin required for a futures contract is set by the exchange in which the contract is traded. Subsequent payments, which are dependent on the daily fluctuations in the value of the underlying security or securities, are made or received by the fund each day (daily variation margin) and recorded as unrealized gains (losses) until the

| | | | |

| 20 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT |

contract is closed. When the contract is closed, the fund records a realized gain (loss) equal to the difference between the proceeds from (or cost of) the closing transaction and the fund’s basis in the contract.

Risks of entering into futures contracts, in general, include the possibility that there will not be a perfect price correlation between the futures contracts and the underlying securities. Second, it is possible that a lack of liquidity for futures contracts could exist in the secondary market, resulting in an inability to close a futures position prior to its maturity date. Third, the purchase of a futures contract involves the risk that the fund could lose more than the original margin deposit required to initiate a futures transaction. These contracts involve market risk in excess of the amount reflected in the fund’s Statement of Assets and Liabilities. Unrealized gains (losses) on outstanding positions in futures contracts held at the close of the period will be recognized as capital gains (losses) for federal income tax purposes. As of August 31, 2012, the fund had no outstanding futures contracts.

Securities Purchased on a When-Issued Basis

Delivery and payment for securities that have been purchased by the fund on a when-issued or forward-commitment basis can take place a month or more after the transaction date. Such securities do not earn interest, are subject to market fluctuation, and may increase or decrease in value prior to their delivery. The fund segregates assets with a market value equal to or greater than the amount of its purchase commitments. The purchase of securities on a when-issued or forward-commitment basis may increase the volatility of the fund’s net asset value if the fund makes such purchases while remaining substantially fully invested. As of August 31, 2012, the fund had when-issued or forward-commitment securities outstanding with a total cost of $450,000.

In connection with the ability to purchase securities on a when-issued basis, the fund may also enter into dollar rolls in which the fund sells securities purchased on a forward-commitment basis and simultaneously contracts with a counterparty to repurchase similar (same type, coupon and maturity), but not identical securities on a specified future date. As an inducement for the fund to “rollover” its purchase commitments, the fund receives negotiated amounts in the form of reductions of the purchase price of the commitment. Dollar rolls are considered a form of leverage. As of August 31, 2012, the fund had no dollar roll transactions.

Illiquid or Restricted Securities

A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the value at which the security is valued by the fund. Illiquid securities may be valued under methods approved by the fund’s board of directors as reflecting fair value. Illiquid securities may include restricted securities, which are often purchased in private placement transactions, are not registered under the Securities Act of 1933, and may have contractual restrictions on resale.

As of August 31, 2012, the fund held 6 illiquid securities, the fair value of which was $2,109,984, which represents 9.0% of total net assets applicable to outstanding common shares. As of August 31, 2012, there were no restricted securities. Information concerning illiquid securities, including restricted securities considered to be illiquid, is as follows:

| | | | | | | | | | | | |

Security | | Par | | | Date

Acquired | | | Cost

Basis | |

Minneapolis Tax Increment, Village at St. Anthony Falls Project, Series 2005, 5.65%, 2/1/27 | | $ | 150,000 | | | | 11/05 | | | $ | 150,000 | |

Monticello-Big Lake Community Hospital District, Health Care Facilities, Series C, 6.20%, 12/1/22 | | | 400,000 | | | | 05/03 | | | | 405,911 | |

Moorhead Golf Course, Series B, 5.88%, 12/1/21 | | | 355,000 | | | | 11/02 | | | | 357,554 | |

Moorhead Senior Housing, Sheyenne Crossing Project, Series 2006, 5.65%, 4/1/41 | | | 330,000 | | | | 04/06 | | | | 325,382 | |

New Hope Housing & Health Care Facility, Masonic Home North Ridge, Series 1999, 5.75%, 3/1/15 | | | 400,000 | | | | 11/02 | | | | 397,356 | |

St. Paul Housing & Redevelopment Authority, Nursing Home Episcopal, 5.63%, 10/1/33 | | | 460,238 | | | | 10/06 | | | | 468,023 | |

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2012 ANNUAL REPORT | | | 21 | |

Notes to Financial Statements

Inverse Floaters