UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21193

First American Minnesota Municipal Income Fund II, Inc.

(Exact name of registrant as specified in charter)

| | |

| 800 Nicollet Mall, Minneapolis, MN | | 55402 |

| (Address of principal executive offices) | | (Zip code) |

Jill M. Stevenson, 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: August 31

Date of reporting period: August 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ANNUAL REPORT

August 31, 2011

| | | | |

| MXN | | | | Minnesota Municipal

Income Fund II |

Minnesota Municipal Income Fund II

PRIMARY INVESTMENTS

First American Minnesota Municipal Income Fund II (the “fund”) invests primarily in a wide range of Minnesota municipal securities that, at the time of purchase, are rated investment-grade or are unrated and deemed to be of comparable quality by Nuveen Asset Management, LLC (“NAM”), one of the fund’s sub-advisors. The fund may invest up to 20% of its total assets in municipal securities that, at the time of purchase, are rated lower than investment-grade (securities commonly referred to as “high yield” securities or “junk bonds”) or are unrated and deemed to be of comparable quality by NAM. The fund’s investments may include municipal derivative securities, such as inverse floating-rate and inverse interest-only municipal securities, which may be more volatile than traditional municipal securities in certain market conditions. The fund’s investments also may include repurchase agreements, futures contracts, options on futures contracts, options, and interest-rate swaps, caps, and floors.

FUND OBJECTIVE

The fund is a nondiversified, closed-end management investment company. The investment objective of the fund is to provide current income exempt from both regular federal income tax and regular Minnesota personal income tax. The fund’s income may be subject to federal and/or Minnesota alternative minimum tax. Distributions of capital gains will be taxable to shareholders. Investors should consult their tax advisors. As with other investment companies, there can be no assurance the fund will achieve its objective.

|

| NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE |

EXPLANATION OF FINANCIAL STATEMENTS

As a shareholder in the fund, you receive shareholder reports semiannually. We strive to present this financial information in an easy-to-understand format; however, for many investors, the information contained in this shareholder report may seem very technical. So, we would like to take this opportunity to explain several sections of the shareholder report.

The Schedule of Investments details all of the securities held in the fund and their related dollar values on the last day of the reporting period. Securities are usually presented by type (bonds, common stock, etc.) and by industry classification (healthcare, education, etc.). This information is useful for analyzing how your fund’s assets are invested and seeing where your portfolio manager believes the best opportunities exist to meet your objectives. Holdings are subject to change without notice and do not constitute a recommendation of any individual security. The Notes to Financial Statements provide additional details on how the securities are valued.

The Statement of Assets and Liabilities lists the assets and liabilities of the fund on the last day of the reporting period and presents the fund’s net asset value (“NAV”) and market price per share. The NAV is calculated by dividing the fund’s net assets (assets minus liabilities) by the number of shares outstanding. The market price is the closing price on the exchange on which the fund’s shares trade. This price, which may be higher or lower than the fund’s NAV, is the price an investor pays or receives when shares of the fund are purchased or sold. The investments, as presented in the Schedule of Investments, comprise substantially all of the fund’s assets. Other assets include cash and receivables for items such as income earned by the fund but not yet received. Liabilities include payables for items such as fund expenses incurred but not yet paid.

The Statement of Operations details the dividends and interest income earned from investments as well as the expenses incurred by the fund during the reporting period. Fund expenses may be reduced through fee waivers or reimbursements. This statement reflects total expenses before any waivers or reimbursements, the amount of waivers and reimbursements (if any), and the net expenses. This statement also shows the net realized and unrealized gains and losses from investments owned during the period. The Notes to Financial Statements provide additional details on investment income and expenses of the fund.

The Statement of Changes in Net Assets describes how the fund’s net assets were affected by its operating results and distributions to shareholders during the reporting period. This statement is important to investors because it shows exactly what caused the fund’s net asset size to change during the period.

The Statement of Cash Flows is required when a fund has a substantial amount of illiquid investments, a substantial amount of the fund’s securities are internally fair valued, or the fund carries some amount of debt. When presented, this statement explains the change in cash during the reporting period. It reconciles net cash provided by and used for operating activities to the net increase or decrease in net assets from operations and classifies cash receipts and payments as resulting from operating, investing, and financing activities.

The Financial Highlights provide a per-share breakdown of the components that affected the fund’s NAV for the current and past reporting periods. It also shows total return, net investment income ratios, expense ratios, and portfolio turnover rates. The net investment income ratios summarize the income earned less expenses, divided by the average net assets. The expense ratios represent the percentage of average net assets that were used to cover operating expenses during the period. The portfolio turnover rate represents the percentage of the fund’s holdings that have changed over the course of the period, and gives an idea of how long the fund holds onto a particular security. A 100% turnover rate implies that an amount equal to the value of the entire portfolio is turned over in a year through the purchase or sale of securities.

The Notes to Financial Statements disclose the organizational background of the fund, its significant accounting policies, federal tax information, fees and compensation paid to affiliates, and significant risks and contingencies.

We hope this guide to your shareholder report will help you get the most out of this important resource.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 1 | |

Fund Overview

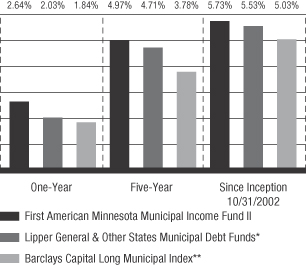

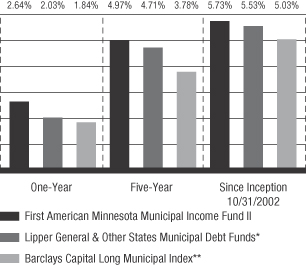

Average Annual Total Returns

Based on NAV for the period ended August 31, 2011

*The Lipper General & Other States Municipal Debt Funds category median is calculated using the returns of all closed-end exchange traded funds in this category for each period disclosed. Lipper returns assume reinvestment of dividends.

**The Barclays Capital Long Municipal Index is comprised of municipal bonds with more than 22 years to maturity and an average credit quality of AA. Index performance is for illustrative purposes only and does not reflect any fees or expenses. The index is unmanaged and is not available for direct investment.

The average annual total returns for the fund are based on the change in its NAV and assume reinvestment of distributions at NAV. NAV-based performance is used to measure investment management results.

• Average annual total returns based on the change in market price for the one-year, five-year, and since-inception periods ended August 31, 2011, were 5.34%, 6.96%, and 5.70%, respectively.

• Market price returns assume that all distributions have been reinvested at actual prices pursuant to the fund’s dividend reinvestment plan. Market price returns reflect any broker commissions or sales charges on dividends reinvested at market price.

• Please remember, you could lose money with this investment. Neither safety of principal nor stability of income is guaranteed. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that fund shares, when sold, may be worth more or less than their original cost. Closed-end funds, such as this fund, often trade at discounts to NAV. Therefore, you may be unable to realize the full NAV of your shares when you sell.

| | | | |

| 2 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

Fund Overview

Investment Advisor

U.S. Bancorp Asset Management, Inc.

Sub-Advisors

Nuveen Asset Management, LLC

Nuveen Fund Advisors, Inc.

Fund Management

Douglas J White, CFA

of Nuveen Asset Management, LLC is primarily responsible for the management of the fund. He has 28 years of financial experience.

Christopher L. Drahn

of Nuveen Asset Management, LLC assists with the management of the fund. He has 31 years of financial experience.

What factors affected the economic and municipal market environments during the 12-month reporting period ended August 31, 2011?

After showing some signs of modest improvement earlier in the period, the U.S. economy appeared to lose steam as the final months progressed. Resurfacing issues concerning the sovereign debt crisis in Europe as well as slowing economic readings on the home front caused investors to begin to worry about the possibility of a so-called “double dip” recession.

The U.S. economy continued to be weighed down by the ongoing lack of job growth, falling home prices and increasing food and energy costs. The most recent reading for U.S. economic growth, as measured by gross domestic product (“GDP”), showed an annualized rate of 1.3% in the second quarter, not much of an improvement over the downward revision to 0.4% in the first quarter. The employment situation plateaued with the national jobless rate languishing at slightly above 9% throughout the summer months. Inflation edged up during this period as the Consumer Price Index (“CPI”) rose to 3.8% on a year-over-year basis as of August 2011, reflecting increases particularly in gasoline, food, shelter and apparel. Core CPI (which excludes food and energy) reached 2.0% for the first time since November 2008, bumping up against the top limit of the Federal Reserve’s (“Fed’s”) unofficial target of 2.0% or lower for this measure. The housing market remained a major drag on the economy with the average home price falling to mid-2003 levels, according to Standard & Poor’s/Case-Shiller Indices.

Throughout the period, the Fed continued to hold the benchmark fed funds rate in a target range of zero to 0.25% since cutting it to this record low level in December 2008. The Fed also completed its second round of quantitative easing (“QE2”) in June, which lowered long-term interest rates through the purchase of $600 billion in longer-term U.S. Treasury bonds. At its August 2011 meeting, the central bank made the unusual move of stating that it anticipated keeping the fed funds rate at exceptionally low levels until mid-2013 as a way to continue supporting the recovery. After the fund’s reporting period ended, the Fed voiced more concerns about increasing downside risks to the economy and announced additional stimulus, named Operation Twist, in September. With this program, the central bank will swap out of short and intermediate maturity Treasuries into longer maturities in its account as a way to ensure that long-term rates stay low, thereby stimulating economic activity.

After rallying strongly during the first two months of the reporting period, the municipal market suffered a major reversal in mid-November 2010, due largely to investor concerns about inflation, the federal deficit and the deficit’s impact on demand for U.S. Treasury securities. Adding to this market pressure was the continued barrage of negative stories in the media about the strained finances of some state and local governments. The fear of credit problems was a key driver in causing many investors to exit municipal bond funds late in 2010 and earlier this year as yields generally rose across the curve and valuations declined.

In the final four months of the fiscal year, we saw the environment in the municipal market shift yet again. Investors began to return to the market as the segment benefited from falling long-term Treasury rates, a dramatic decrease in supply and fading fears of widespread defaults. Yields reversed course and declined across the board, causing an increase in valuations. The yield curve flattened during the final months as intermediate and long-term interest rates moved down the most.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 3 | |

Fund Overview

As mentioned, the significant decline in new tax-exempt issuance had a major impact on the market during this period. Over the twelve months ended August 31, 2011, municipal bond issuance nationwide — both tax-exempt and taxable — totaled $334.5 billion, nearly a 20% decrease from the previous year. Some of the supply decrease was the result of the credit stresses of states and municipalities around the country. With many issuers continuing to experience budget problems, they have limited capacity to pledge revenues for new borrowing. The other factor was the heavy issuance of taxable municipal debt at the end of 2010 under the Build America Bond (“BAB”) program, which was created as part of the American Recovery and Reinvestment Act in 2009. Before its expiration at the end of 2010, many borrowers pushed additional issuance through the BAB program to take advantage of its favorable terms. This has also contributed to a much lower level of issuance so far in 2011. In fact, year-to-date through August 31, 2011, municipal bond issuance was down 37% across the nation compared to the first eight months of 2010.

When looking at the fiscal year period as a whole, the municipal yield curve steepened with yields on 10-year and longer maturity bonds showing a net rise. Rates generally fell for short- and intermediate-term bonds that had maturities of less than 10 years. Total returns were positive for municipal bond maturities across the yield curve; however, intermediate bonds with maturities between five and ten years were the best-performing segment during the time frame. Overall for the reporting period, the direction of credit spreads was generally mixed to modestly wider. This was evidenced by A-rated municipal bonds outperforming the AA-rated and AAA-rated segments, while BBB-rated bonds underperformed AA-rated and AAA-rated bonds for the period.

Minnesota

Although the recovery in Minnesota’s economy stumbled somewhat at the end of 2010, it still continued to be stronger than the United States overall as unemployment figures have been lower than the national average and job growth has been above average. The state’s unemployment rate of 7.2% was below the national average of 9.1% as of August 2011. Minnesota’s biennial budget for the 2010 and 2011 fiscal years ended on June 30, 2011. State government was forced to partially shut down for nearly three weeks as newly elected Democratic governor Mark Dayton and the Republican-controlled legislature could not agree on how to close a $1.3 billion budget gap. On July 20, the governor and legislature finally agreed to a two-year $35.7 billion budget which defers $700 million in school spending into the next biennium and calls for issuing approximately $600 million in bonds secured by revenues from the 1998 tobacco companies lawsuit settlement. Although the shutdown was somewhat out of the ordinary, the magnitude of the gap was still modest compared to the deficits many other states had to close. In general, Minnesota is still regarded as having a good fiscal track record, a diversified economy and above-average wealth levels.

However, the budget wrangling was partially to blame for Minnesota losing its coveted AAA credit rating on its general obligation (“GO”) bonds from two rating agencies. Standard & Poor’s Financial Services LLC (“S&P”) and Fitch Ratings Ltd. (“Fitch”) lowered the state’s credit rating one notch to AA+. Both agencies cited the budget impasse and the state’s reliance on short-term fixes for deficits in order to balance its budget as reasons for the downgrades. Minnesota maintained is Aa1 rating from Moody’s Investors Services, Inc. (“Moody’s”).

Much of the Minnesota municipal bond issuance that took place in 2010 was in intermediate maturity securities as many borrowers used the BAB program to issue longer maturities, directing supply into the taxable marketplace. This made the availability of longer maturity, tax-exempt bonds

| | | | |

| 4 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

quite limited in the state last year. For the first eight months of 2011, state issuance continued to be down, nearly 42% lower in Minnesota versus the same period last year.

How did the fund perform during the twelve-month period ended August 31, 2011?

Minnesota Municipal Income Fund II earned a total return of 2.64% based on NAV for the fiscal year ended August 31, 2011. The fund’s market price return was 5.34% during the year. The fund’s closed-end competitive group, the Lipper General & Other States Municipal Debt Funds, produced a median return of 2.03% during the year. The Barclays Capital Long Municipal Index, the benchmark comparison for the fund, which reflects no fees or expenses, returned 1.84%.

Portfolio Allocation1

As a percentage of total investments on August 31, 2011

| | | | |

Health Care Revenue | | | 26 | % |

Housing Revenue | | | 23 | |

Leasing Revenue | | | 11 | |

Education Revenue | | | 13 | |

General Obligations | | | 7 | |

Utility Revenue | | | 7 | |

Transportation | | | 5 | |

Economic Development Revenue | | | 3 | |

Miscellaneous Authority Revenue | | | 3 | |

Pre-refunded Issues2 | | | 1 | |

Recreation Authority Revenue | | | 1 | |

| | | 100 | % |

1Portfolio allocations are subject to change and are not recommendations to buy or sell any security.

2Within the Schedule of Investments, pre-refunded issues are classified under their applicable industries.

The fund outperformed both its Lipper peer group and its Barclay’s benchmark during the fiscal year. Its performance over the period benefited the most from our security selection in specific sectors, particularly health care, housing and various corporate-backed revenue bonds. As has typically been the case, health care is an area that we favor in the fund because of the long-term value these positions have historically represented. The fund’s corporate-backed holdings also outperformed as corporations continued to strengthen their balance sheets. In terms of credit quality, the medium and lower rated segments of the fund’s quality spectrum performed best during the quarter, including nonrated, BBB-rated and A-rated securities, respectively. The fund was also rewarded for its positions within the intermediate (7 year) and longer intermediate (10 to 20 year) maturity ranges. The fund experienced strong returns during the period and exhibited few areas of underperformance. However, positions in AAA-rated bonds, state GOs, water/sewer revenue bonds and 8- to 10-year maturities had a relatively minor negative impact on results for the fiscal year.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 5 | |

Fund Overview

Bond Credit Quality Breakdown1

As a percentage of long-term investments on August 31, 2011

| | | | |

AAA | | | 10 | % |

AA | | | 38 | |

A | | | 16 | |

BBB | | | 19 | |

BB | | | 2 | |

NR | | | 15 | |

| | | 100 | % |

1Individual security ratings are based on information from Moody’s, S&P, and/or Fitch. If there are multiple ratings for a security, the lowest rating is used unless ratings are provided by all three agencies, in which case the middle rating is used. Credit Quality Breakdown is subject to change.

While the economy showed stronger signs of recovery earlier in the fund’s fiscal year, we ended the period with a more uncertain outlook. Minnesota, while having stronger employment figures and better job growth than the overall nation, still faces budgetary stresses until longer term solutions are enacted. With the recent downgrade of the state’s credit rating to AA by two credit agencies, it is more important than ever for our research team to focus on monitoring the credit quality of the fund’s holdings. In conjunction with our bottom-up security selection, we will continue to actively manage the fund’s overall risk profile.

As always, we would like to express our appreciation for your ongoing investment in the fund. If you have any questions please don’t hesitate to contact us at 800.677.3863.

Douglas J. White, CFA

Senior Vice President & Portfolio Manager

Nuveen Asset Management, LLC

Christopher L. Drahn

Senior Vice President & Portfolio Manager

Nuveen Asset Management, LLC

| | | | |

| 6 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

Preferred Shares

The preferred shares issued by the fund pay dividends at a specified rate and have preference over common shares in the payments of dividends and the liquidation of assets. Rates paid on preferred shares are reset every seven days and are based on short-term tax-exempt interest rates. Preferred shareholders accept these short-term rates in exchange for low credit risk (preferred shares are rated AAA by Moody’s and S&P). The proceeds from the sale of preferred shares are invested at intermediate- and long-term tax-exempt rates. Because these intermediate- and long-term rates are normally higher than the short-term rates paid on preferred shares, common shareholders benefit by receiving higher dividends and/or an increase to the dividend reserve. However, the risk of having preferred shares is that if short-term rates rise higher than intermediate- and long-term rates, creating an inverted yield curve, common shareholders may receive a lower rate of return than if their fund did not have any preferred shares outstanding. This type of economic environment is unusual and historically has been short term in nature. Investors should also be aware that the issuance of preferred shares results in the leveraging of common shares, which increases the volatility of both the NAV of the fund and the market value of common shares.

Normally, the dividend rates on the preferred shares are set at the market clearing rate determined through an auction process that brings together bidders who wish to buy preferred shares and holders of preferred shares who wish to sell. Since February 15, 2008, however, sell orders have exceeded bids and the regularly scheduled auctions for the fund’s preferred shares have failed. When an auction fails, the fund is required to pay the maximum applicable rate on the preferred shares to holders of such shares for successive dividend periods until such time as the shares are successfully auctioned. The maximum applicable rate on the preferred shares is 110% of the higher of (1) the applicable AA Composite Commercial Paper Rate or (2) 90% of the Taxable Equivalent of the Short-Term Municipal Bond Rate.

During any dividend period, the maximum applicable rate could be higher than the dividend rate that would have been set had the auction been successful. In addition, the maximum applicable rate could be higher than the fund’s investment yield. Higher maximum applicable rates increase the fund’s cost of leverage and reduce the fund’s common share earnings.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 7 | |

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors

First American Minnesota Municipal Income Fund II, Inc.

We have audited the accompanying statement of assets and liabilities of First American Minnesota Municipal Income Fund II, Inc. (the “fund”), including the schedule of investments, as of August 31, 2011, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the fund’s internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2011, by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of First American Minnesota Municipal Income Fund II, Inc. at August 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Minneapolis, Minnesota

October 21, 2011

| | | | |

| 8 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

| | |

| Schedule of Investments | | August 31, 2011 |

Minnesota Municipal Income Fund II (MXN)

| | | | | | | | |

DESCRIPTION | | PAR | | | FAIR

VALUE ¶ | |

| | |

(Percentages of each investment category relate to total net assets applicable to outstanding common shares) | | | | | | | | |

| | |

Municipal Long-Term Investments — 158.3% | | | | | | | | |

Economic Development Revenue — 5.2% | | | | | | | | |

Minneapolis Development, Limited Tax Supported Common Bond, Series 2A (AMT), 5.13%, 6/1/22 | | $ | 500,000 | | | $ | 510,055 | |

Minnesota Agricultural & Economic Development Board, Small Business Development Loan Program, Series 2002A, Lot 1 (AMT),

5.55%, 8/1/16 ¥ | | | 400,000 | | | | 397,504 | |

Moorhead, American Crystal Sugar Company, Recovery Zone Facility, Series 2010, 5.65%, 6/1/27 | | | 200,000 | | | | 205,114 | |

| | | | | | | | |

| | | | | | | 1,112,673 | |

| | | | | | | | |

Education Revenue — 20.6% | | | | | | | | |

Baytown Township, St. Croix Preparatory Academy Project, Series A, 7.00%, 8/1/38 | | | 350,000 | | | | 344,145 | |

Higher Education Facilities, Augsburg College, Series 6J1, 5.00%, 5/1/28 | | | 200,000 | | | | 200,450 | |

Higher Education Facilities, Bethel University, Series 6R, 5.50%, 5/1/24 ¥ | | | 500,000 | | | | 503,340 | |

Higher Education Facilities, St. Catherine College, Series 5N1, 5.38%, 10/1/32 | | | 500,000 | | | | 501,200 | |

Higher Education Facilities, University of St. Thomas, | | | | | | | | |

5.00%, 10/1/39, Series 7A | | | 1,000,000 | | | | 1,033,530 | |

5.25%, 4/1/39, Series 6X | | | 300,000 | | | | 308,157 | |

St. Paul Housing & Redevelopment Authority, Community Peace Academy Project, Series A, 5.00%, 12/1/36 | | | 510,000 | | | | 400,406 | |

University of Minnesota, Series A, 5.25%, 12/1/29 | | | 1,000,000 | | | | 1,138,910 | |

| | | | | | | | |

| | | | | | | 4,430,138 | |

| | | | | | | | |

General Obligations — 11.2% | | | | | | | | |

Crow Wing County Jail, Series B (NATL), 5.00%, 2/1/21 | | | 550,000 | | | | 608,080 | |

Hennepin County, Series D, 5.00%, 12/1/25 | | | 1,000,000 | | | | 1,102,670 | |

Hennepin County Regional Railroad Authority, Limited Tax, Series A, 4.00%, 12/1/31 | | | 150,000 | | | | 151,889 | |

Puerto Rico Commonwealth, Series A, 5.00%, 7/1/28 | | | 350,000 | | | | 337,242 | |

Rocori Area Schools Independent School District Number 750, Series B (MSDCEP), 5.00%, 2/1/28 | | | 200,000 | | | | 219,442 | |

| | | | | | | | |

| | | | | | | 2,419,323 | |

| | | | | | | | |

Healthcare Revenue — 42.5% | | | | | | | | |

Bemidji Health Care Facilities, North Country Health Services, Series 2002 (RAAI), 5.00%, 9/1/31 | | | 1,000,000 | | | | 927,220 | |

Cuyuna Range Hospital District, Health Facilities, Series 2005, 5.50%, 6/1/35 | | | 400,000 | | | | 365,852 | |

Golden Valley Covenant Retirement Communities, Series A, 5.50%, 12/1/25 | | | 600,000 | | | | 586,284 | |

Marshall Medical Center, Weiner Medical Center Project, Series A, (Pre-refunded 11/1/13 @ 100), 5.35%, 11/1/17 ¯ | | | 350,000 | | | | 382,967 | |

Minneapolis & St. Paul Housing & Redevelopment Authority, HealthPartners Obligated Group Project Series 2003, 5.88%, 12/1/29 | | | 750,000 | | | | 765,172 | |

Minneapolis Health Care Systems, Fairview Health Services, Series A, 6.63%, 11/15/28 | | | 750,000 | | | | 829,597 | |

Minneapolis Health Care Systems, Fairview Health Services, Series B (AGC), 6.50%, 11/15/38 | | | 400,000 | | | | 440,464 | |

Minnesota Agricultural & Economic Development Board, Fairview Health Care System, Series A, 6.38%, 11/15/29 | | | 25,000 | | | | 25,052 | |

Monticello-Big Lake Community Hospital District, Health Care Facilities, Series C, 6.20%, 12/1/22 ¥ | | | 400,000 | | | | 389,856 | |

New Hope Housing & Health Care Facility, Masonic Home North Ridge, Series 1999, 5.75%, 3/1/15 ¥ | | | 400,000 | | | | 390,072 | |

Prior Lake Senior Housing, Sheperd’s Path Senior Housing, Series B, 5.70%, 8/1/36 | | | 200,000 | | | | 177,456 | |

Rochester Health Care & Housing, Samaritan Bethany, Series A, 7.38%, 12/1/41 ¥ | | | 300,000 | | | | 303,918 | |

Shakopee Health Care Facilities, St. Francis Regional Medical Center, Series 2004, 5.10%, 9/1/25 | | | 500,000 | | | | 503,410 | |

St. Louis Park Health Care Facilities, Park Nicollet Health Services, Series 2009, 5.75%, 7/1/39 | | | 500,000 | | | | 504,030 | |

St. Paul Housing & Redevelopment Authority, Allina Health System, Series A-1, 5.25%, 11/15/29 | | | 450,000 | | | | 463,568 | |

St. Paul Housing & Redevelopment Authority, HealthEast Project, Series 2005, 6.00%, 11/15/30 | | | 200,000 | | | | 194,432 | |

St. Paul Housing & Redevelopment Authority, Nursing Home Episcopal, 5.63%, 10/1/33 ¥ | | | 470,920 | | | | 426,785 | |

St. Paul Housing & Redevelopment Authority, Regions Hospital, | | | | | | | | |

5.25%, 5/15/18 | | | 500,000 | | | | 500,655 | |

5.30%, 5/15/28 | | | 170,000 | | | | 169,986 | |

St. Paul Housing & Redevelopment Authority, Rossy & Richard Shaller, Series A, 5.25%, 10/1/42 | | | 250,000 | | | | 201,758 | |

St. Paul Port Authority, HealthEast Midway Campus, Series A, 5.75%, 5/1/25 | | | 600,000 | | | | 580,122 | |

| | | | | | | | |

| | | | | | | 9,128,656 | |

| | | | | | | | |

Housing Revenue — 36.6% | | | | | | | | |

Minneapolis Housing, Keeler Apartments Project, Series A, 5.00%, 10/1/37 | | | 300,000 | | | | 248,034 | |

Minneapolis Multifamily Housing, Seward Towers Project, Series 2003 (GNMA), 5.00%, 5/20/36 | | | 1,190,000 | | | | 1,205,613 | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 9 | |

| | |

| Schedule of Investments | | August 31, 2011 |

Minnesota Municipal Income Fund II (MXN)

| | | | | | | | |

DESCRIPTION | | PAR | | | FAIR

VALUE ¶ | |

| | |

Minneapolis-St. Paul Housing Finance Board, Single Family Mortgage, Mortgage-Backed City Living, Series A4 (AMT) (FHLMC) (FNMA) (GNMA), 5.00%, 11/1/38 | | $ | 113,600 | | | $ | 112,872 | |

Minnesota Housing Finance Agency, Homeownership Finance, Series D (FHLMC) (FNMA) (GNMA), 4.70%, 1/1/31 | | | 100,000 | | | | 102,128 | |

Minnesota Housing Finance Agency, Nonprofit Housing, State Appropriation, Series 2011, 5.00%, 8/1/31 | | | 1,000,000 | | | | 1,043,670 | |

Minnesota Housing Finance Agency, Rental Housing, Series 2011A, 5.45%, 8/1/41 | | | 1,700,000 | | | | 1,780,563 | |

Minnesota Housing Finance Agency, Residential Housing (AMT), | | | | | | | | |

4.70%, 7/1/27, Series D | | | 1,000,000 | | | | 985,660 | |

5.40%, 7/1/30, Series F | | | 220,000 | | | | 220,055 | |

Minnesota Housing Finance Agency, Series E, 5.10%, 1/1/40 | | | 950,000 | | | | 970,605 | |

Moorhead Economic Development Authority, Housing Development Eventide Project, Series A, 5.15%, 6/1/29 | | | 300,000 | | | | 251,781 | |

Moorhead Senior Housing, Sheyenne Crossing Project, Series 2006, 5.65%, 4/1/41 ¥ | | | 330,000 | | | | 276,286 | |

St. Paul Multifamily Housing, Selby Grotto Housing Project, Series 2003 (AMT) (FHA) (GNMA), 5.50%, 9/20/44 | | | 655,000 | | | | 659,644 | |

| | | | | | | | |

| | | | | | | 7,856,911 | |

| | | | | | | | |

Leasing Revenue — 16.9% | | | | | | | | |

Andover Economic Development Authority, Public Facility, Community Center, Series 2004 (Crossover refunded 2/1/14 @ 100), | | | | | | | | |

5.13%, 2/1/24 z | | | 295,000 | | | | 319,668 | |

5.13%, 2/1/24 z | | | 205,000 | | | | 222,142 | |

Otter Tail County Housing & Redevelopment Authority, Building Lease, Series A, 5.00%, 2/1/19 | | | 525,000 | | | | 550,882 | |

Ramsey County Public Improvement, Series A, 4.75%, 1/1/24 | | | 1,000,000 | | | | 1,004,530 | |

St. Paul Housing & Redevelopment Authority, Jimmy Lee Recreation Center, Series 2008, 5.00%, 12/1/32 | | | 100,000 | | | | 102,910 | |

St. Paul Port Authority, Office Building Facility, Robert Street, Series 2002-9, 5.25%, 12/1/27 | | | 1,000,000 | | | | 1,019,440 | |

Washington County Housing & Redevelopment Authority, Lower St. Croix Valley Fire Protection, 5.13%, 2/1/24 | | | 400,000 | | | | 404,128 | |

| | | | | | | | |

| | | | | | | 3,623,700 | |

| | | | | | | | |

Miscellaneous Revenue — 4.1% | | | | | | | | |

Seaway Port Authority of Duluth, Cargill Incorporated Project, Series 2004, 4.20%, 5/1/13 | | | 500,000 | | | | 524,840 | |

St. Paul Housing & Redevelopment Authority, Parking Facilities Project, Series A, 5.00%, 8/1/30 | | | 340,000 | | | | 354,899 | |

| | | | | | | | |

| | | | | | | 879,739 | |

| | | | | | | | |

Recreation Authority Revenue — 1.7% | | | | | | | | |

Moorhead Golf Course, Series B, 5.88%, 12/1/21 ¥ | | | 375,000 | | | | 366,923 | |

| | | | | | | | |

Tax Revenue — 0.6% | | | | | | | | |

Minneapolis Tax Increment, Village at St. Anthony Falls Project, Series 2005, 5.65%, 2/1/27 ¥ | | | 150,000 | | | | 135,930 | |

| | | | | | | | |

Transportation Revenue — 7.5% | | | | | | | | |

Minneapolis & St. Paul Metropolitan Airports Commission, Series A, | | | | | | | | |

5.00%, 1/1/19 (AMBAC) | | | 750,000 | | | | 843,052 | |

5.00%, 1/1/19 (NATL) | | | 750,000 | | | | 776,715 | |

| | | | | | | | |

| | | | | | | 1,619,767 | |

| | | | | | | | |

Utility Revenue — 11.4% | | | | | | | | |

Chaska Electric, Series A, | | | | | | | | |

5.00%, 10/1/30 | | | 500,000 | | | | 514,470 | |

6.10%, 10/1/30 | | | 10,000 | | | | 10,014 | |

Northern Municipal Power Agency, Minnesota Electric System, Series A (AGC), | | | | | | | | |

5.00%, 1/1/18 | | | 400,000 | | | | 471,040 | |

5.00%, 1/1/20 | | | 250,000 | | | | 284,975 | |

Puerto Rico Commonwealth Aqueduct & Sewer Authority, Series A, 6.00%, 7/1/38 | | | 600,000 | | | | 601,440 | |

Puerto Rico Electric Power Authority, Series VV (NATL), 5.25%, 7/1/29 | | | 500,000 | | | | 507,505 | |

Southern Minnesota Municipal Power Agency, Series A, Zero Coupon Bond (NATL), 4.68%, 1/1/26 ° | | | 100,000 | | | | 51,527 | |

| | | | | | | | |

| | | | | | | 2,440,971 | |

| | | | | | | | |

| | |

Total Municipal Long-Term Investments

(Cost: $33,287,742) | | | | | | | 34,014,731 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 10 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

Minnesota Municipal Income Fund II (MXN)

| | | | | | | | |

DESCRIPTION | | SHARES | | | FAIR

VALUE ¶ | |

| | |

Short-Term Investment — 0.3% | | | | | | | | |

Federated Minnesota Municipal Cash Trust, Institutional Shares, 0.01% W

(Cost: $53,572) | | | 53,572 | | | $ | 53,572 | |

| | | | | | | | |

| | |

Total Investments p — 158.6%

(Cost: $33,341,314) | | | | | | | 34,068,303 | |

| | | | | | | | |

| | |

Preferred Shares at Liquidation Value — (60.5)% | | | | | | | (13,000,000 | ) |

| | | | | | | | |

| | |

Other Assets and Liabilities, Net — 1.9% | | | | | | | 418,438 | |

| | | | | | | | |

| | |

Total Net Assets Applicable to Outstanding Common Shares — 100.0% | | | | | | $ | 21,486,741 | |

| | | | | | | | |

| ¶ | Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements. |

| ¥ | Security considered illiquid. As of August 31, 2011, the fair value of these investments was $3,190,614 or 14.8% of total net assets applicable to outstanding common shares. See note 2 in Notes to Financial Statements. |

| ¯ | Pre-refunded issues are typically backed by U.S. Government obligations, which secure the timely payment of principal and interest. These bonds mature at the call date and price indicated. |

| z | Crossover refunded securities are typically backed by the credit of the refunding issuer, which secures the timely payment of principal and interest. These bonds mature at the call date and price indicated. |

| ° | Zero coupon bonds make no periodic interest payments, but are issued at deep discounts from par value. The rate shown is the effective yield as of August 31, 2011. |

| W | The rate shown is the annualized seven-day effective yield as of August 31, 2011. |

| p | On August 31, 2011, the cost of investments for federal income tax purposes was $33,343,238. The aggregate gross unrealized appreciation and depreciation of investments, based on this cost, were as follows: |

| | | | |

Gross unrealized appreciation | | $ | 1,304,268 | |

Gross unrealized depreciation | | | (579,203 | ) |

| | | | |

Net unrealized appreciation | | $ | 725,065 | |

| | | | |

AGC–Assured Guaranty Corporation

AMBAC–American Municipal Bond Assurance Corporation

AMT–Alternative Minimum Tax. As of August 31, 2011, the aggregate fair value of securities subject to the AMT was $2,885,790, which represents 13.4% of total net assets applicable to common shares.

FHA–Federal Housing Administration

FHLMC–Federal Home Loan Mortgage Corporation

FNMA–Federal National Mortgage Association

GNMA–Government National Mortgage Association

MSDCEP–Minnesota School District Credit Enhancement Program

NATL–National Public Finance Guarantee Corporation

RAAI–Radian Asset Assurance Inc.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 11 | |

| | |

| Statement of Assets and Liabilities | | August 31, 2011 |

| | | | |

Assets: | | | | |

Unaffiliated investments, at fair value (Cost: $33,341,314) (note 2) | | $ | 34,068,303 | |

Receivable for accrued interest | | | 436,518 | |

Prepaid expenses and other assets | | | 50,657 | |

| | | | |

Total assets | | | 34,555,478 | |

| | | | |

| |

Liabilities: | | | | |

Payable for preferred share distributions (note 3) | | | 326 | |

Payable for investment advisory fees | | | 10,233 | |

Payable for administration fees | | | 5,848 | |

Payable for audit fees | | | 36,435 | |

Payable for legal fees | | | 12,782 | |

Payable for pricing fees | | | 2,967 | |

Payable for other expenses | | | 146 | |

| | | | |

Total liabilities | | | 68,737 | |

| | | | |

Preferred shares, at liquidation value (note 3) | | | 13,000,000 | |

| | | | |

Net assets applicable to outstanding common shares | | $ | 21,486,741 | |

| | | | |

| |

Net assets applicable to outstanding common shares consist of: | | | | |

Common shares and additional paid-in capital | | $ | 20,798,974 | |

Undistributed net investment income | | | 136,779 | |

Accumulated net realized loss on investments | | | (176,001 | ) |

Net unrealized appreciation of investments | | | 726,989 | |

| | | | |

Net assets applicable to outstanding common shares | | $ | 21,486,741 | |

| | | | |

| |

Net asset value and market price of common shares: | | | | |

Net assets applicable to outstanding common shares | | $ | 21,486,741 | |

Common shares outstanding (authorized 200 million shares of $0.01 par value) | | | 1,472,506 | |

Net asset value per share | | $ | 14.59 | |

Market price per share | | $ | 15.15 | |

| |

Liquidation preference of preferred shares (note 3): | | | | |

Net assets applicable to preferred shares | | $ | 13,000,000 | |

Preferred shares outstanding (authorized one million shares) | | | 520 | |

Liquidation preference per share | | $ | 25,000 | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 12 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

| | |

| Statement of Operations | | For the year ended August 31, 2011 |

| | | | |

Investment Income: | | | | |

Interest from unaffiliated investments | | $ | 1,751,308 | |

Dividends from unaffiliated money market fund | | | 34 | |

| | | | |

Total investment income | | | 1,751,342 | |

| | | | |

| |

Expenses (note 5): | | | | |

Investment advisory fees | | | 118,213 | |

Administration fees | | | 67,551 | |

Auction agent fees | | | 32,668 | |

Custodian fees | | | 1,741 | |

Postage and printing fees | | | 18,922 | |

Transfer agent fees | | | 22,349 | |

Listing fees | | | 13 | |

Directors’ fees | | | 81,531 | |

Legal fees | | | 33,647 | |

Audit fees | | | 38,429 | |

Insurance fees | | | 14,203 | |

Pricing fees | | | 7,423 | |

Other expenses | | | 30,839 | |

| | | | |

Total expenses | | | 467,529 | |

| | | | |

| |

Net investment income | | | 1,283,813 | |

| | | | |

| |

Net realized and unrealized gains (losses) on investments (notes 2 and 4): | | | | |

Net realized loss on investments | | | (40,169 | ) |

Net change in unrealized appreciation or depreciation of investments | | | (682,141 | ) |

| | | | |

| |

Net loss on investments | | | (722,310 | ) |

| | | | |

| |

Distributions to preferred shareholders (note 2): | | | | |

From net investment income | | | (46,179 | ) |

| | | | |

| |

Net increase in net assets applicable to outstanding common shares resulting from operations | | $ | 515,324 | |

| | | | |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 13 | |

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended

8/31/11 | | | Year Ended

8/31/10 | |

Operations: | | | | | | | | |

Net investment income | | $ | 1,283,813 | | | $ | 1,361,639 | |

Net realized gain (loss) on investments | | | (40,169 | ) | | | 218,782 | |

Net change in unrealized appreciation or depreciation of investments | | | (682,141 | ) | | | 2,316,584 | |

Distribution to preferred shareholders from net investment income (note 2) | | | (46,179 | ) | | | (52,861 | ) |

| | | | | | | | |

| | |

Net increase in net assets applicable to outstanding common shares resulting from operations | | | 515,324 | | | | 3,844,144 | |

| | | | | | | | |

| | |

Distributions to common shareholders (note 2): | | | | | | | | |

From net investment income | | | (1,229,543 | ) | | | (1,281,080 | ) |

| | | | | | | | |

| | |

Total increase (decrease) in net assets applicable to outstanding common shares | | | (714,219 | ) | | | 2,563,064 | |

| | | | | | | | |

| | |

Net assets applicable to outstanding common shares at beginning of period | | | 22,200,960 | | | | 19,637,896 | |

| | | | | | | | |

| | |

Net assets applicable to outstanding common shares at end of period | | $ | 21,486,741 | | | $ | 22,200,960 | |

| | | | | | | | |

| | |

Undistributed net investment income | | $ | 136,779 | | | $ | 128,688 | |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| | | | |

| 14 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

Financial Highlights

Per-share data for an outstanding common share throughout each period and selected information for each period are as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended August 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Per-Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, common shares, beginning of period | | $ | 15.08 | | | $ | 13.34 | | | $ | 13.78 | | | $ | 14.26 | | | $ | 15.06 | |

| | | | | | | | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.87 | | | | 0.92 | | | | 0.89 | | | | 0.91 | | | | 0.93 | |

Net realized and unrealized gain (losses) on investments and futures contracts | | | (0.49 | ) | | | 1.72 | | | | (0.45 | ) | | | (0.37 | ) | | | (0.79 | ) |

Distributions to preferred shareholders: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.03 | ) | | | (0.03 | ) | | | (0.15 | ) | | | (0.25 | ) | | | (0.30 | ) |

From net realized gain on investments | | | — | | | | — | | | | — | | | | (0.05 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total from operations | | | 0.35 | | | | 2.61 | | | | 0.29 | | | | 0.24 | | | | (0.17 | ) |

| | | | | | | | | | | | | | | | | | | | |

Distributions to common shareholders: | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | (0.84 | ) | | | (0.87 | ) | | | (0.73 | ) | | | (0.64 | ) | | | (0.62 | ) |

From net realized gain on investments | | | — | | | | — | | | | — | | | | (0.08 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total distributions to common shareholders | | | (0.84 | ) | | | (0.87 | ) | | | (0.73 | ) | | | (0.72 | ) | | | (0.63 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net asset value, common shares, end of period | | $ | 14.59 | | | $ | 15.08 | | | $ | 13.34 | | | $ | 13.78 | | | $ | 14.26 | |

| | | | | | | | | | | | | | | | | | | | |

Market value, common shares, end of period | | $ | 15.15 | | | $ | 15.22 | | | $ | 14.13 | | | $ | 13.00 | | | $ | 13.25 | |

| | | | | | | | | | | | | | | | | | | | |

Selected Information | | | | | | | | | | | | | | | | | | | | |

Total return, common shares, net asset value 1 | | | 2.64 | % | | | 20.20 | % | | | 2.76 | % | | | 1.74 | % | | | (1.22 | )% |

Total return, common shares, market value 2 | | | 5.34 | % | | | 14.22 | % | | | 15.43 | % | | | 3.64 | % | | | (2.73 | )% |

Net Assets applicable to outstanding common shares at end of period (in millions) | | $ | 21 | | | $ | 22 | | | $ | 20 | | | $ | 20 | | | $ | 21 | |

Ratio of expenses to average weekly net assets applicable to outstanding common shares before fee reimbursements 3 | | | 2.25 | % | | | 1.86 | % | | | 2.09 | % | | | 1.98 | % | | | 1.85 | % |

Ratio of expenses to average weekly net assets applicable to outstanding common shares after fee reimbursements 3 | | | 2.25 | % | | | 1.86 | % | | | 2.09 | % | | | 1.90 | % | | | 1.77 | % |

Ratio of net investment income to average weekly net assets applicable to outstanding common shares before fee reimbursements 3 | | | 6.18 | % | | | 6.50 | % | | | 7.25 | % | | | 6.46 | % | | | 6.12 | % |

Ratio of net investment income to average weekly net assets applicable to outstanding common shares after fee reimbursements 3 | | | 6.18 | % | | | 6.50 | % | | | 7.25 | % | | | 6.54 | % | | | 6.20 | % |

Portfolio turnover rate | | | 15 | % | | | 17 | % | | | 17 | % | | | 22 | % | | | 24 | % |

Net assets applicable to remarketed preferred shares, end of period (in millions) | | $ | 13 | | | $ | 13 | | | $ | 13 | | | $ | 13 | | | $ | 13 | |

Asset coverage per remarketed preferred share (in thousands) 4 | | $ | 66 | | | $ | 68 | | | $ | 63 | | | $ | 64 | | | $ | 65 | |

Liquidation preference and market value per remarketed preferred share (in thousands) | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | |

| 1 | Assumes reinvestment of distributions at net asset value. |

| 2 | Assumes reinvestment of distributions at actual prices pursuant to the fund’s dividend reinvestment plan. |

| 3 | Ratios do not reflect the effect of dividend payments to preferred shareholders; income ratios reflect income earned on assets attributable to preferred shares, where applicable. |

| 4 | Represents net assets applicable to outstanding common shares plus preferred shares at liquidation value divided by preferred shares outstanding. |

The accompanying notes are an integral part of the financial statements.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 15 | |

Notes to Financial Statements

First American Minnesota Municipal Income Fund II, Inc. is registered under the Investment Company Act of 1940 (as amended) as a non-diversified, closed-end management investment company. The fund invests primarily in Minnesota municipal securities that, at the time of purchase, are rated investment grade or are unrated and deemed to be of comparable quality by Nuveen Asset Management, LLC (“NAM”). The fund may invest up to 20% of its total assets in municipal securities that, at the time of purchase, are rated lower than investment grade or are unrated and deemed to be of comparable quality by NAM. The fund’s investments may include municipal derivative securities, such as inverse floating rate and inverse interest-only municipal securities, which may be more volatile than traditional municipal securities in certain market conditions. The fund’s investments also may include repurchase agreements, futures contracts, options on futures contracts, options, and interest rate swaps, caps, and floors. Fund shares are listed on the American Stock Exchange under the symbol MXN.

The fund concentrates its investments in Minnesota and therefore, may have more credit risk related to the economic conditions of Minnesota than a portfolio with a broader geographical diversification.

| (2) | Summary of

Significant

Accounting

Policies |

Security Valuations

Security valuations for the fund’s investments are generally furnished by an independent pricing service that has been approved by the fund’s board of directors. Debt obligations exceeding 60 days to maturity are valued by an independent pricing service that has been approved by the fund’s board of directors. The pricing service may employ methodologies that utilize actual market transactions, broker-dealer supplied valuations, or other formula-driven valuation techniques. These techniques generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings, and general market conditions. Securities for which prices are not available from an independent pricing service but where an active market exists are valued using market quotations obtained from one or more dealers that make markets in the securities or from a widely-used quotation system. Debt obligations with 60 days or less remaining until maturity may be valued at their amortized cost, which approximates fair value. Investments in open-end funds are valued at their respective net asset values on the valuation date.

The following investment vehicles, when held by the fund, are priced as follows: exchange listed futures and options on futures are priced at their last sale price on the exchange on which they are principally traded, as determined by the fund’s investment advisor, U.S. Bancorp Asset Management, Inc. (“USBAM”), on the day the valuation is made. If there were no sales on that day, futures and options on futures will be valued at the last reported bid price. Options on securities, indices, and currencies traded on Nasdaq or listed on a stock exchange are valued at the last sale price on Nasdaq or on any exchange on the day the valuation is made. If there were no sales on that day, the options will be valued at the last sale price on the previous valuation date. Last sale prices are obtained from an independent pricing service. Swaps and over-the-counter options on securities and indices, are valued at the quotations received from an independent pricing service, if available.

When market quotations are not readily available, securities are internally valued at fair value as determined in good faith by procedures established and approved by the fund’s board of directors. Some of the factors that may be considered in determining fair value are fundamental analytical data relating to the investment; the nature and duration of any restrictions on disposition; trading in similar securities of the same issuer or comparable companies; information from broker-dealers; and an evaluation of the forces that influence the market in which the securities are purchased or sold. If events occur that materially affect the value of securities between the close of trading in those securities and the close of regular trading on the New York Stock Exchange, the securities will be valued at fair value. The use of fair value pricing by the fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without fair value pricing. As of August 31, 2011, the fund held no internally fair valued securities.

Generally accepted accounting principles (“GAAP”) require disclosures regarding the inputs and valuation techniques used to measure fair value and any changes in valuation inputs or technique. These principles establish

| | | | |

| 16 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

a three-tier fair value hierarchy for inputs used in measuring fair value. Fair value inputs are summarized in the three broad levels listed below:

Level 1 - Quoted prices in active markets for identical securities.

Level 2 - Other significant observable inputs (including quoted prices for similar securities, with similar interest rates, prepayment speeds, credit risk, etc.).

Level 3 - Significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments). Generally, the types of securities included in Level 3 of the fund are securities for which there is limited or no observable fair value inputs available, and as such the fair value is determined through independent broker quotations or management’s fair value procedures established by the fund’s board of directors.

The fair value levels are not necessarily an indication of the risk associated with investing in these investments.

As of August 31, 2011, the fund’s investments were classified as follows:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total

Fair Value | |

Investments | | | | | | | | | | | | | | | | |

Municipal Long-Term Investments | | $ | — | | | $ | 34,014,731 | | | $ | — | | | $ | 34,014,731 | |

Short-Term Investment | | | 53,572 | | | | — | | | | — | | | | 53,572 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 53,572 | | | $ | 34,014,731 | | | $ | — | | | $ | 34,068,303 | |

| | | | | | | | | | | | | | | | |

Refer to the Schedule of Investments for further security classification.

During the fiscal year ended August 31, 2011, the fund recognized no transfers between fair value levels.

Security Transactions and Investment Income

For financial statement purposes, the fund records security transactions on the trade date of the security purchase or sale. Dividend income is recorded on the ex-dividend date. Interest income, including accretion of bond discounts and amortization of bond premiums, is recorded on an accrual basis. Security gains and losses are determined on the basis of identified cost, which is the same basis used for federal income tax purposes. The resulting gain/loss is calculated as the difference between the sales price and the underlying cost of the security on the transaction date.

Distributions to Shareholders

Distributions from net investment income are made monthly for common shareholders and weekly for preferred shareholders. Common share distributions are recorded as of the close of business on the ex-dividend date and preferred share dividends are accrued daily. Net realized gain distributions, if any, will be made at least annually. Distributions are payable in cash or, for common shareholders pursuant to the fund’s dividend reinvestment plan, reinvested in additional common shares of the fund. Under the dividend reinvestment plan, common shares will be purchased in the open market.

Taxes

Federal

The fund intends to continue to qualify as a regulated investment company (“RIC”) as provided in Subchapter M of the Internal Revenue Code, as amended, and to distribute all taxable income, if any, to its shareholders. Accordingly, no provision for federal income taxes is required.

As of August 31, 2011, the fund did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable taxing authority. Generally, tax authorities can examine all the tax returns filed for the last three years.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 17 | |

Notes to Financial Statements

Net investment income and net realized gains and losses may differ for financial statement and tax purposes because of temporary or permanent book/tax differences. These differences are primarily due to deferred straddle losses. To the extent these differences are permanent, reclassifications are made to the appropriate capital accounts in the fiscal period in which the differences arise.

The character of distributions made during the fiscal period from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal period in which amounts are distributed may differ from the fiscal period that the income or realized gains or losses were recorded by the fund.

The character of common and preferred share distributions paid during the fiscal years ended August 31, 2011 and August 31, 2010, were as follows:

| | | | | | | | |

| | | 8/31/11 | | | 8/31/10 | |

Distributions paid from: | | | | | | | | |

Tax exempt income | | $ | 1,274,286 | | | $ | 1,331,747 | |

Ordinary income | | | 1,438 | | | | 2,039 | |

| | | | | | | | |

| | $ | 1,275,724 | | | $ | 1,333,786 | |

| | | | | | | | |

As of August 31, 2011, the components of accumulated earnings (deficit) on a tax basis were as follows:

| | | | |

Undistributed tax-exempt income | | $ | 137,380 | |

Undistributed taxable income | | | 4,960 | |

Accumulated capital and post-October losses | | | (174,077 | ) |

Unrealized appreciation (depreciation) | | | 725,065 | |

Other accumulated gain (loss) | | | (5,561 | ) |

| | | | |

Accumulated earnings (deficit) | | $ | 687,767 | |

| | | | |

For federal income tax purposes, the fund had capital loss carryovers at August 31, 2011, which if not offset by subsequent capital gains, will expire on the fund’s fiscal year-ends as follows:

| | | | | | |

Capital Loss

Carryover | | | Expiration | |

| $ | 127,710 | | | | 2017 | |

| | 6,198 | | | | 2018 | |

| | 102 | | | | 2019 | |

| | | | | | |

| $ | 134,010 | | | | | |

| | | | | | |

The fund incurred losses of $40,067 for the period from November 1, 2010 to August 31, 2011. As permitted by tax regulations, the fund intends to elect to defer and treat those losses as arising in the fiscal year ended August 31, 2012.

State

Minnesota taxable net income is generally based on federal taxable income. The portion of tax-exempt dividends paid by the fund that is derived from interest on Minnesota municipal bonds will be excluded from Minnesota taxable net income of individuals, estates, and trusts, provided that the portion of the tax-exempt dividends paid from these obligations represents 95% or more of the exempt-interest dividends paid by the fund. The remaining portion of these dividends, and dividends that are not exempt-interest dividends or capital gains distributions, will be included in the Minnesota taxable net income of individuals, estates, and trusts, except for dividends directly attributable to interest on obligations of the U.S. Government, its territories and possessions.

In 1995, Minnesota enacted a statement of intent that interest on obligations of Minnesota governmental units and Indian tribes be included in the net income of individuals, estates and trusts for Minnesota income tax purposes if a court determines that Minnesota’s exemption of such interest and its taxation of interest on obligations of governmental issuers in other states unlawfully discriminates against interstate commerce. See Minn. Stat. § 289A.50, subd. 10. This provision applies to taxable years that begin during or after the calendar year in which any such determination becomes final.

| | | | |

| 18 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

The U.S. Supreme Court has held that a state which exempts from taxation interest on the bonds of the state and its political subdivisions, while subjecting to tax interest on bonds of other states and their political subdivisions, does not violate the Commerce Clause. However, the Court has not dealt with the treatment of private activity bonds, which leaves open the possibility that a court in the future could hold that a state’s discriminatory treatment of private activity bonds of issuers located within or outside the state violates the Commerce Clause.

Derivatives

The fund may invest in derivative financial instruments in order to manage risk or gain exposure to various other investments or markets. The fund’s investment objective allows the fund to enter into various types of derivative contracts, including, but not limited to, futures contracts, options on futures contracts, options, and interest rate swaps, caps, and floors. Derivatives may contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and the potential for market movements that may expose the fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities. As of August 31, 2011 the fund had no outstanding derivative contracts.

Futures Transactions

In order to protect against changes in interest rates, the fund may buy and sell interest rate futures contracts. Upon entering into a futures contract, the fund is required to deposit cash or pledge U.S. Government securities. The margin required for a futures contract is set by the exchange in which the contract is traded. Subsequent payments, which are dependent on the daily fluctuations in the value of the underlying security or securities, are made or received by the fund each day (daily variation margin) and recorded as unrealized gains (losses) until the contract is closed. When the contract is closed, the fund records a realized gain (loss) equal to the difference between the proceeds from (or cost of) the closing transaction and the fund’s basis in the contract.

Risks of entering into futures contracts, in general, include the possibility that there will not be a perfect price correlation between the futures contracts and the underlying securities. Second, it is possible that a lack of liquidity for futures contracts could exist in the secondary market, resulting in an inability to close a futures position prior to its maturity date. Third, the purchase of a futures contract involves the risk that the fund could lose more than the original margin deposit required to initiate a futures transaction. These contracts involve market risk in excess of the amount reflected in the fund’s Statement of Assets and Liabilities. Unrealized gains (losses) on outstanding positions in futures contracts held at the close of the period will be recognized as capital gains (losses) for federal income tax purposes. As of August 31, 2011, the fund had no outstanding futures contracts.

Securities Purchased on a When-Issued Basis

Delivery and payment for securities that have been purchased by the fund on a when-issued or forward-commitment basis can take place a month or more after the transaction date. Such securities do not earn interest, are subject to market fluctuation, and may increase or decrease in value prior to their delivery. The fund segregates assets with a market value equal to or greater than the amount of its purchase commitments. The purchase of securities on a when-issued or forward-commitment basis may increase the volatility of the fund’s net asset value if the fund makes such purchases while remaining substantially fully invested. As of August 31, 2011, the fund had no outstanding when-issued or forward-commitment securities.

In connection with the ability to purchase securities on a when-issued basis, the fund may also enter into dollar rolls in which the fund sells securities purchased on a forward-commitment basis and simultaneously contracts with a counterparty to repurchase similar (same type, coupon, and maturity), but not identical securities on a specified future date. As an inducement for the fund to “rollover” its purchase commitments, the fund receives negotiated amounts in the form of reductions of the purchase price of the commitment. Dollar rolls are considered a form of leverage. As of August 31, 2011, the fund had no dollar roll transactions.

| | | | | | |

| MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT | | | 19 | |

Notes to Financial Statements

Illiquid or Restricted Securities

A security may be considered illiquid if it lacks a readily available market. Securities are generally considered liquid if they can be sold or disposed of in the ordinary course of business within seven days at approximately the value at which the security is valued by the fund. Illiquid securities may be valued under methods approved by the fund’s board of directors as reflecting fair value. Illiquid securities may include restricted securities, which are often purchased in private placement transactions, are not registered under the Securities Act of 1933, and may have contractual restrictions on resale.

As of August 31, 2011, the fund held nine illiquid securities, the fair value of which was $3,190,614, which represents 14.8% of total net assets applicable to outstanding common shares. As of August 31, 2011, there were no restricted securities. Information concerning illiquid securities, including restricted securities considered to be illiquid, is as follows:

| | | | | | | | | | | | |

Security | | Par | | | Date

Acquired | | | Cost

Basis | |

Higher Education Facilities, Bethel University, Series 6R, 5.50%, 5/1/24 | | $ | 500,000 | | | | 10/08 | | | $ | 433,885 | |

Minneapolis Tax Increment, St. Anthony Falls Project, 5.65%, 2/1/27 | | | 150,000 | | | | 11/05 | | | | 150,000 | |

Minnesota Agricultural & Economic Development Board, Small Business Program A — Lot 1 (AMT), 5.55%, 8/1/16 | | | 400,000 | | | | 12/03 | | | | 402,743 | |

Monticello-Big Lake Community Hospital District, Health Care Facilities, Series C,

6.20%, 12/1/22 | | | 400,000 | | | | 05/03 | | | | 406,319 | |

Moorhead Golf Course, Series B, 5.88%, 12/1/21 | | | 375,000 | | | | 11/02 | | | | 377,863 | |

Moorhead Senior Housing, Sheyenne Crossing Project, 5.65%, 4/1/41 | | | 330,000 | | | | 04/06 | | | | 325,319 | |

New Hope Housing & Health Care Facility, Masonic Home North Ridge, 5.75%, 3/1/15 | | | 400,000 | | | | 11/02 | | | | 396,407 | |

Rochester Health Care & Housing, Samaritan Bethany, Series A, 7.38%, 12/1/41 | | | 300,000 | | | | 12/09 | | | | 295,522 | |

St. Paul Housing & Redevelopment Authority, Nursing Home Episcopal, 5.63%, 10/1/33 | | | 470,920 | | | | 10/06 | | | | 479,083 | |

Inverse Floaters

As part of its investment strategy, the fund may invest in certain securities for which the potential income return is inversely related to changes in a floating interest rate (“inverse floaters”). In general, income on inverse floaters will decrease when short-term interest rates increase and increase when short-term interest rates decrease. Inverse floaters may be characterized as derivative securities and may subject the fund to the risks of reduced or eliminated interest payments and losses of invested principal. In addition, inverse floaters may provide investment leverage. The market values of inverse floaters will generally be more volatile than those of fixed-rate, tax-exempt securities. Therefore, to the extent the fund invests in inverse floaters, the net asset value of the fund’s shares may be more volatile than if the fund did not invest in such securities. As of and for the year ended August 31, 2011, the fund had no outstanding investments in inverse floaters.

Repurchase Agreements

For repurchase agreements entered into with certain broker-dealers, the fund, along with other affiliated registered investment companies, may transfer uninvested cash balances into a joint trading account, the daily aggregate balance of which is invested in repurchase agreements secured by U.S. Government or agency obligations. Securities pledged as collateral for all individual and joint repurchase agreements are held by the fund’s custodian bank until maturity of the repurchase agreement. All agreements require that the daily market value of the collateral be in excess of the repurchase amount, including accrued interest, to protect the fund in the event of a default. As of August 31, 2011, the fund had no outstanding repurchase agreements.

Deferred Compensation Plan

Prior to January 1, 2011, non-interested directors of the First American Family of Funds were able to defer receipt of part or all of their annual compensation under a Deferred Compensation Plan (the “Plan”). Deferred amounts were treated as though equivalent dollar amounts had been invested in shares of open-end First American Funds, as designated by each director. The Plan was terminated effective December 31, 2010. All amounts held in the Plan are 100% vested and outstanding account balances under the Plan are obligations of the funds into which amounts were deferred. Deferred amounts remain in the funds until distributed in accordance with the Plan.

| | | | |

| 20 | | MINNESOTA MUNICIPAL INCOME FUND II | | 2011 ANNUAL REPORT |

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements, in conformity with GAAP, requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the results of operations during the reporting period. Actual results could differ from these estimates.

Events Subsequent to Fiscal Year End

Management has evaluated fund related events and transactions that occurred subsequent to August 31, 2011, through the date of issuance of the fund’s financial statements. There were no events or transactions that occurred during this period that materially impacted the amounts or disclosures in the fund’s financial statements.

| (3) | Auction

Preferred

Shares |

As of August 31, 2011, the fund had 520 auction preferred shares (“AP® shares”) outstanding with a liquidation preference of $25,000 per share. The dividend rate on the AP® shares is adjusted every seven days (on Fridays), as determined through an auction process conducted by Bank of New York (the “Auction Agent”).

Normally, the dividend rates on the AP® shares are set at the market clearing rate determined through an auction process that brings together bidders who wish to buy AP® shares and holders of AP® shares who wish to sell. Since February 15, 2008, however, sell orders have exceeded bids and the regularly scheduled auctions for the fund’s AP® shares have failed. When an auction fails, the fund is required to pay the maximum applicable rate on the AP® shares to holders of such shares for successive dividend periods until such time as the shares are successfully remarketed. The maximum applicable rate on the AP® shares is 110% of the higher of (1) the applicable AA Composite Commercial Paper Rate or (2) 90% of the Taxable Equivalent of the Short-Term Municipal Bond Rate.

During any dividend period, the maximum applicable rate may be higher than the dividend rate that would have been set had the auction been successful. This increases the fund’s cost of leverage and reduces the fund’s common share earnings. On August 31, 2011, the maximum applicable rate was 0.31%.

In the event of a failed auction, holders of AP® shares will continue to receive dividends at the maximum applicable rate, but generally will not be able to sell their shares until the next successful auction. There is no way to predict when or if future auctions might succeed in attracting sufficient buyers for the shares offered.

AP® is a registered trademark of Merrill Lynch & Company (“Merrill Lynch”).

| (4) | Investment

Security

Transactions |

Cost of purchases and proceeds from sales of securities, other than temporary investments in short-term securities, for the year ended August 31, 2011, aggregated $5,057,010 and $4,888,877, respectively.

Investment Advisory Fees

Pursuant to an investment advisory agreement, USBAM, a subsidiary of U.S. Bank National Association (“U.S. Bank”), manages the fund’s assets and furnishes related office facilities, equipment, research, and personnel. The agreement provides USBAM with a monthly investment advisory fee in an amount equal to an annualized rate of 0.35% of the fund’s average weekly net assets including preferred shares. For its fee, USBAM provides investment advice and, in general, conducts the management and investment activities of the fund.