UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Under Rule 14a-12 |

Cypress Semiconductor Corporation

(Name of Registrant as Specified In Its Charter)

T.J. Rodgers

J. Daniel McCranie

Camillo Martino

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

T.J. Rodgers, J. Daniel McCranie and Camillo Martino (collectively, “CypressFirst”) have filed a definitive proxy statement and an accompanying GOLD proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of CypressFirst’s two director nominees at the 2017 annual meeting of stockholders of Cypress Semiconductor Corporation (the “Company”).

On May 26, 2017, Mr. McCranie sent the following email to a stockholder of the Company:

This is Dan McCranie, one of the two nominees that, along with T.J. Rodgers and Camillo Martino, spoke to you yesterday regarding the current proxy contest with Cypress Semiconductor and CypressFirst.

In that meeting, it was obvious that your organization had thoroughly reviewed all of the written material that had been previously forwarded to you by CypressFirst through the team at Mackenzie Partners. There was a lot of material in our multiple mailings, and we very much appreciate the work done by your team in preparation for our conference, as well as for our previous conference call regarding the earlier consent solicitation.

The reason for my personal email is that, in listening and responding to your questions, it’s possible that even the large amount of material sent to you by us didn’t fully address all of your comments, concerns, and clarifying questions. So, I wanted to write this brief email to add some details in one particular area of discussion.

Your team, I think, is correctly addressing the multiple facets of this proxy contest. The material regarding the strong conflict of interest and excessive compensation of the current Executive Chairman at Cypress, as well as the significant shortcomings regarding the current Cypress board’s corporate governance, is fulsome and, I believe, adequate for your group to review and come to consensus.

I know that, once you’ve made a decision concerning the current Cypress board’s failures and shortcomings, you then need to have confidence that the CypressFirst solution (i.e., the election of Camillo Martino and myself to the Cypress board) will, when elected:

| | • | | Drive the necessary changes at Cypress to eliminate their current board governance shortcomings |

| | • | | Enhance the skills and diversity composition of the current board to enable Cypress to grow top line simultaneous with enhancing gross margins, and to further strengthen the fundamental governance elements of the board |

| | • | | Provide guidance and oversight to executive management with respect to the continued M/A activity |

As I said above, I felt that our material didn’t fully address our competencies and historical successes in those areas.

We do have the experience and the personal and technical skills to address those issues. I believe our short slate is unusually strong, for I have seen the quality of proxy nominees in other company contests. I know that, for Cypress Semiconductor, the skill sets and personal attributes provided by Camillo Martino and myself are superior to any of the other slates that I’ve viewed in these companies.

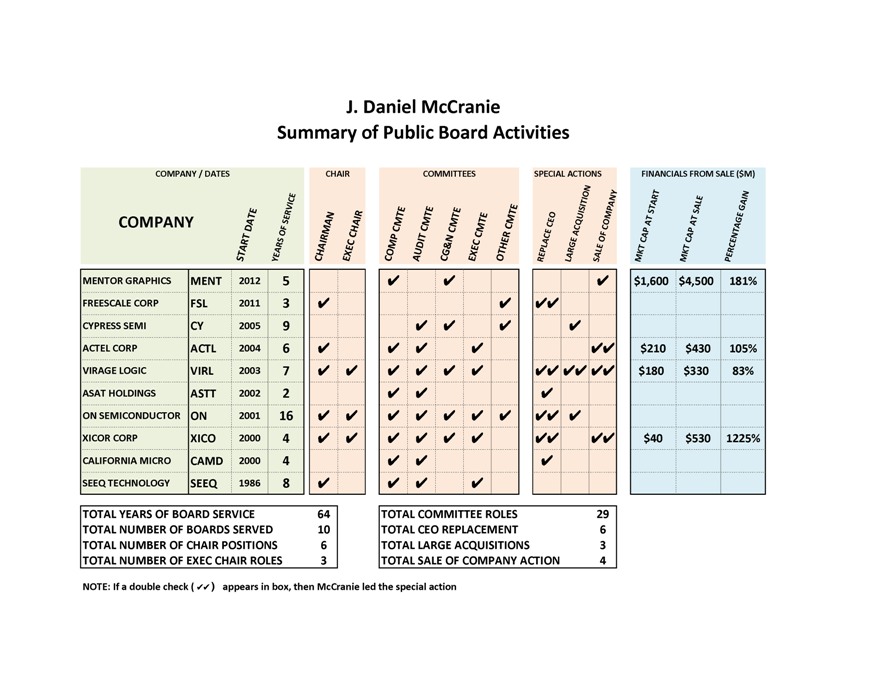

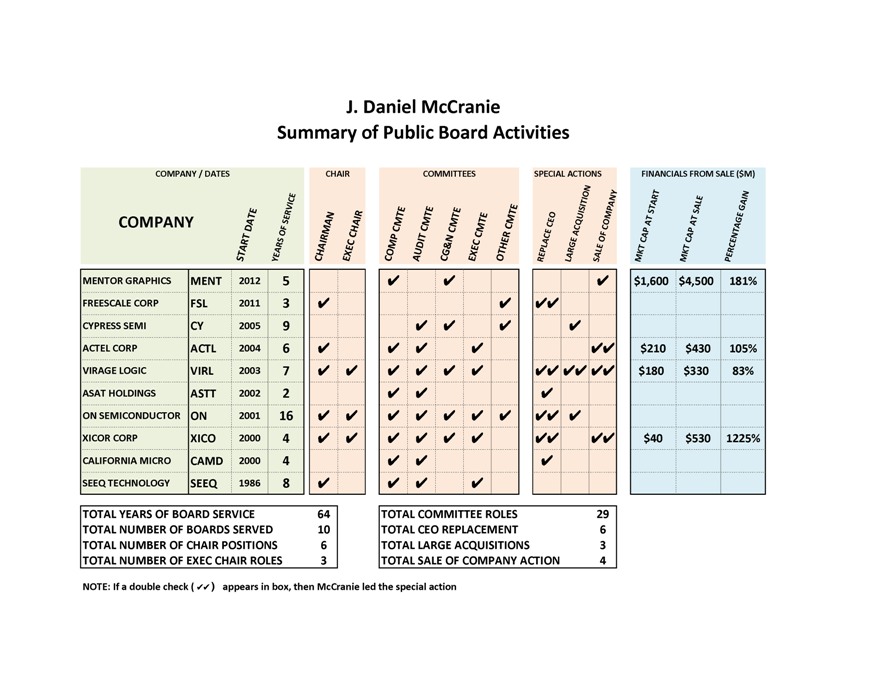

I have attached one slide that was embedded in a larger slide in the deck we recently sent you. It shows, in table format, my experiences as director/chairman/executive chair of 10 semiconductor companies. That table highlights the work done in governance, in committees, in M/A activity, in CEO changeout and, in the cases where I was leading the sale of the company, the resultant improvement in market capitalization. It’s a busy slide, embedded in the blizzard of material that we sent you, but I would encourage you to look at it again for three reasons:

| | 1. | To get a perspective of my history with other semiconductor companies in effecting positive change for shareholders |

| | 2. | To provide you with a list of companies from which you may want to do reference checking on my work with these companies. I would encourage you to talk to ANY of the current/former board members and CEOs of these companies as a reference for my work.In particular, I would highlight your discussing my competencies and capabilities with any of the directors of ON Semiconductor, a company that initially had similar operational challenges as Cypress Semiconductor. |

| | 3. | Much of the work done by myself with these past companies has been involved in working with the full board on improving corporate governance and in strengthening the work done by the board committees. I think you could get a sense of this effort through interviews. In particular: |

| | 1. | Improved quality of board through driving diversity with regard to skills, gender, geographic area and industry |

| | 2. | Enhancing committee effectiveness through addition of Science and Technology as well as Integration Oversight committees |

| | 3. | Structuring the development of board materials and pre-reads, along with improved board calendar meeting structures in order to maximize information transfer while still providing sufficient time for board deliberation and feedback |

| | 4. | Establishing Annual Individual Director Performance reviews, where each director is reviewed by his peer, on an anonymous basis, and that material reconstructed and used as a learning tool for the individual director |

| | 5. | Establishing a robust and continuous (on a quarterly basis) Risk Management structure, where executive management, in concert with the full board, review all elements of corporate risk in a detailed and structured way. |

| | 6. | Driving a formal method for board review and approval of M/A activities, as well as a method for the board to oversee the actual financial result of these acquisitions relative to the plan of record at the time of acquisition. |

| | 7. | Individual board member mentoring, in concert with the Individual Director Performance reviews. |

In summary, I know that a key part of your analysis rests on whether or not your group believes that the CypressFirst nominees can be effective in bringing about the changes in corporate governance as well as enabling the executive management team to have future success in all of the companies important financial metrics. I believe both Camillo and I have those skills. I believe that our skills are superior to the ‘average’ nominee that you may see in other proxy contests....and I think that fact is both critical to your decision process and was, perhaps, buried in all the material that we had previously sent to you.

Thanks again for all the work that you’ve put into your analysis of our proposal. Of course, I just added to your time by sending you this long email, and I apologize for that. However, I have special feelings for Cypress Semiconductor. Between my operational career at Cypress, along with my eight+ years as a director, I’ve been involved with the company for over 17 years. I know that I was instrumental in getting Cypress current phase (Cypress 3.0) launched, and I know that the company can achieve strong future performance...with the right support, guidance and mentoring from a strong, engaged and selfless Cypress Board of Directors. I’d like to be a part of that new Cypress board.

Thanks again everyone,

J. Daniel McCranie

J. (Daniel (McCranie Summary (of (Public (Board (Activities COMPANY (DATES CHAIR COMMITTEES SPECIAL(ACTIONS FINANCIALS(FROM SALE(($M) COMPANY STRAT DATE YEARS OF SERVICE CHAIRMAN EXEC CHAIR COMP CMTE AUDIT CMTE CG&N CMTE EXEC CMTE OTHER CMTE REPLACE CEO LARGE ACQUISTION SALES OF COMPANY MKT CAP AT START REPLACEMENTAGE GAIN MENTOR GRAPHICS MENT 2012 5 $1,600 $4,500 181% FREESCALE(CORP FSL 2011 3 CYPRESS(SEMI CY 2005 9 ACTEL(CORP ACTL 2004 6 $210 $430 105% VIRAGE(LOGIC VIRL 2003 7 $180 $330 83% ASAT(HOLDINGS ASTT 2002 2 ON(SEMICONDUCTOR ON 2001 16 XICOR CORP XICO 2000 4 $40 $530 1225% CALIFORNIA MICRO CAMD 2000 4 SEEQ TECHNOLOGY SEEQ 1986 8 TOTAL(YEARS(OF BOARD(SERVICE 64 TOTAL(NUMBER OF BOARDS(SERVED 10 TOTAL(NUMBER OF CHAIR POSITIONS 6 TOTAL(NUMBER OF EXEC(CHAIR ROLES 3 TOTAL(COMMITTEE(ROLES 29 TOTAL(CEO(REPLACEMENT 6 TOTAL(LARGE(ACQUISITIONS 3 TOTAL(SALE(OF COMPANY(ACTION 4 NOTE:(If(a(double(check (() appears(in(box,(then(McCranie(led(the(special(action