Growth History 2002-2004

2002

December, completed IPO market cap of ~ $125 million

December 31st, total assets of $849.5 million

2003

December 31st, total assets of $1.7 billion, market cap ~ $481.1 million

Ended ’03 as 3rd largest lender of multifamily loans in California

2004

June, acquired Hawthorne Financial

$2.5 billion dollar thrift

15 banking offices

June, opened 20th bank office, Malibu, CA

December 31st, total assets of $5.0 billion, market cap ~ $1.26 billion

6

Growth History 2005

7

2005

February, acquired TIMCOR Exchange Corporation ~

$400 million exchange balances

May, acquired North American Exchange Company ~ $175

million of exchange balances

November, announced signing of agreement to acquire

Calnet Business Bank with $176.6 million of total assets,

$152.9 million deposits

December 31st, total assets of $5.5 billion

Experienced Executive Team

The Company has built its management team with

seasoned executives that have significant expertise in the

company’s areas of focus. This expertise includes tenure

with a variety of organizations in significant roles.

Large banking institutions

Fortune 1,000 companies

Regulatory experience

Real estate development

Investment banking

8

Experienced Executive Team

29

<1

EVP General Counsel

Don Royer

25

1

EVP Commercial Banking

James Daley

28

1

EVP Retail Banking

Richard Grout

27

4

EVP Relationship Banking

Chris Walsh

20

7

EVP Asset Quality

Rob Noble

16

4

Chief Administrative Officer

Richard Sanchez

30

8

Chief Lending Officer

Robert Williams

25

<1

Chief Financial Officer

Jim Leonetti

21

8

President/Chief Operating Officer*

David DePillo

22

8

Chief Executive Officer*

Stephen Gordon

Total Years

Experience

Years at

CCBI

Title

Name

* Founder

9

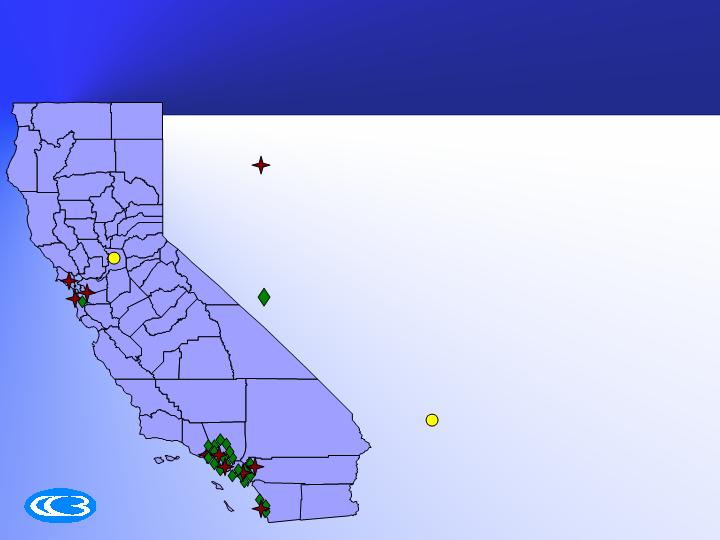

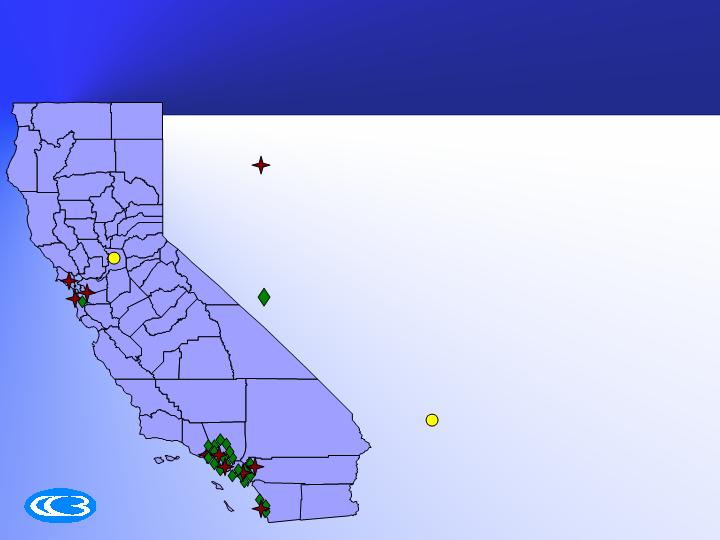

Statewide Banking Presence

10

Headquartered in Irvine, California

10 Loan Offices

Alameda County

Contra Costa County

Los Angeles County

Marin County

Orange County

San Diego County

San Mateo County

Chicago, Illinois

23 Banking Offices

Los Angeles County

Orange County

Riverside County

San Diego County

San Mateo County

Ventura County

#24 Valencia opens in Spring 2006

#25 Pasadena opens in Summer 2006

Sacramento - Pending acquisition of Calnet

Business Bank

Nationwide 1031 Exchange

Accommodator Presence

TIMCOR Exchange Corporation

North American Exchange Company

11

CCB is a leading income property lender, and the

third largest originator of multifamily loans in

California

Predominately adjustable rate portfolio lender

Fixed rate programs through Fannie Mae and conduit

Permanent and bridge

Additional loan products

Construction

Single-family residential

Business lines

Income Property Focus

12

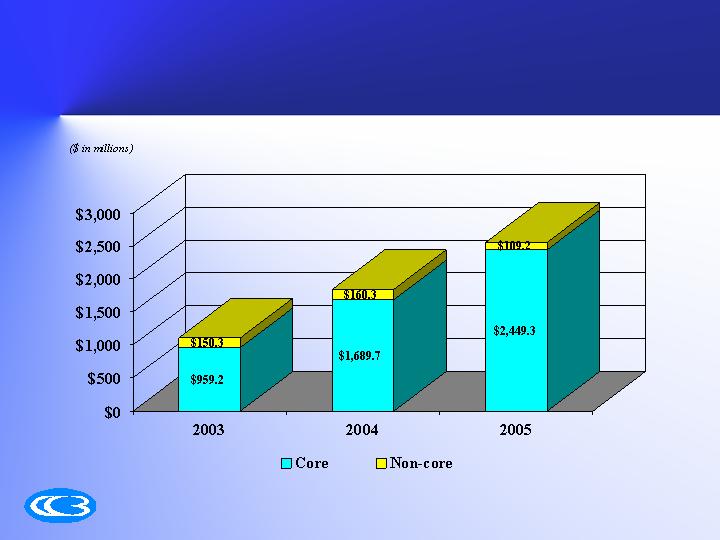

Lending Focus

The focus on retail loan production, with strict

credit underwriting has created valuable

origination franchise that is a key component

of the company’s strategy.

95.7% of loan fundings are core

Greater control over credit quality

Greater opportunity to build relationships with the customer

Avoid competition with lower margin, more highly competitive

single-family lenders

13

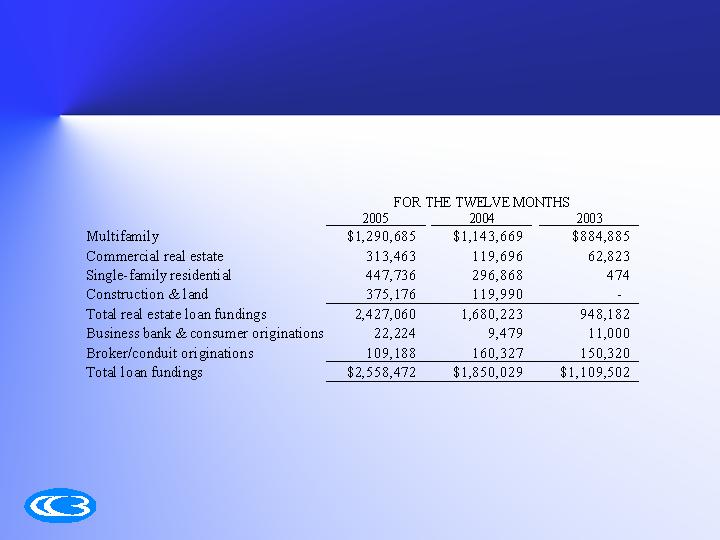

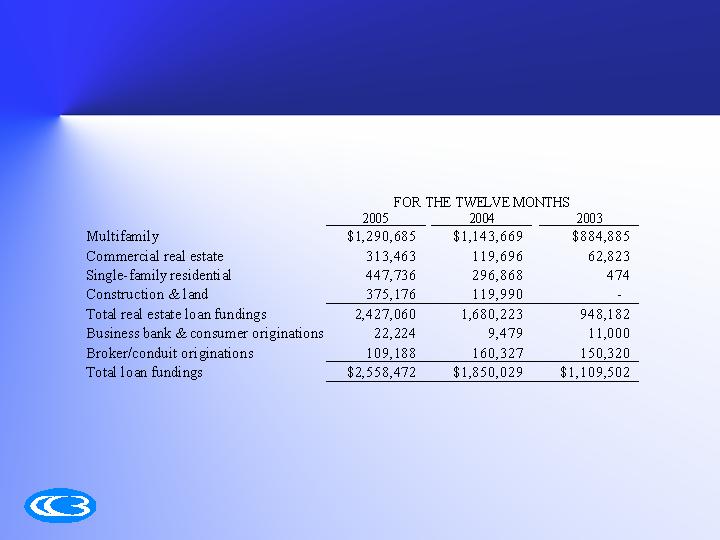

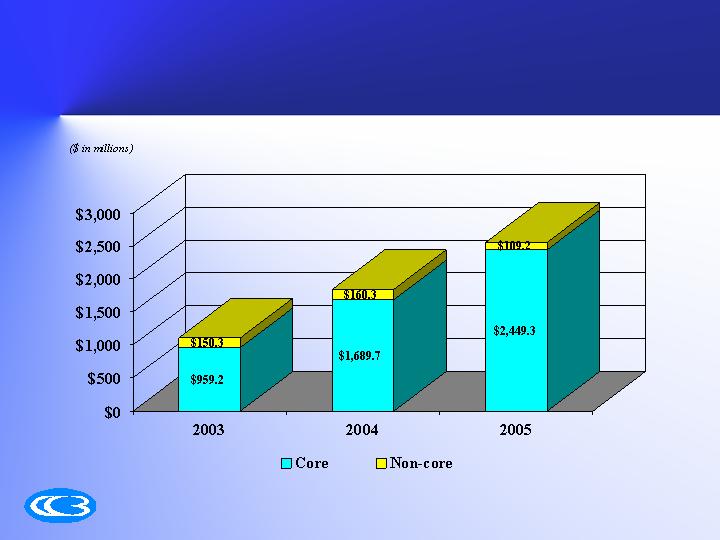

Loan Funding Composition

($ in thousands)

14

Strong Loan Fundings

15

Adjustable Rate Lender

2005

2004

2003

Fixed

73,344

$

18,897

$

11,335

$

12 MAT

1,339,048

1,084,701

715,188

6 mo CMT

189,241

159,370

73,433

Prime

370,982

146,228

13,656

COFI

250,653

165,068

4,500

LIBOR

191,164

115,438

141,070

Other

34,852

-

-

Core Loan Fundings

2,449,284

$

1,689,702

$

959,182

$

($ in thousands)

16

Income Property Loan Funding Data

17

2005

2004

2003

Multifamily

Average LTV

65.9%

68.0%

67.6%

Average DCR

1.22

1.27

1.29

Ratio of ARMS

97.8%

99.0%

98.9%

Ratio of Refinancings

45.8%

51.7%

66.4%

Commercial

Average LTV

61.5%

64.6%

62.9%

Average DCR

1.47

1.45

1.41

Ratio of ARMS

91.3%

98.9%

96.9%

Ratio of Refinancings

69.1%

62.9%

54.8%

Construction & Land

Average LTV

67.0%

61.9%

-

Average DCR

N/A

N/A

-

Ratio of ARMS

96.1%

97.7%

-

Ratio of Refinancings

N/A

N/A

-

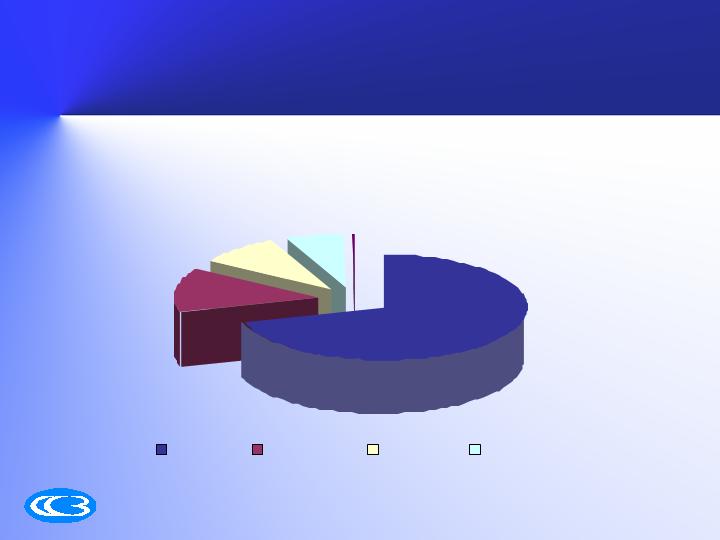

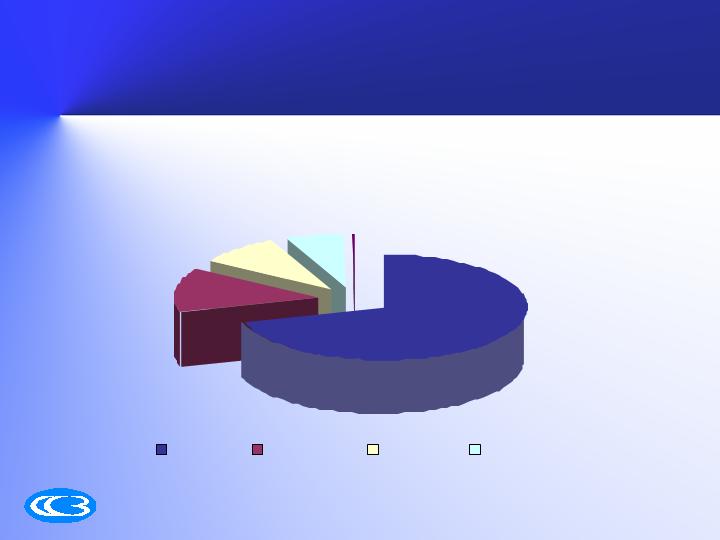

Loan Portfolio Mix

December 2005

Multifamily

70%

Commercial Real Estate

14%

Single-

family

9%

Const & Land

7%

$395

$277

$3,051

Multifamily Commercial RE Single-family Construction & Land

$602

18

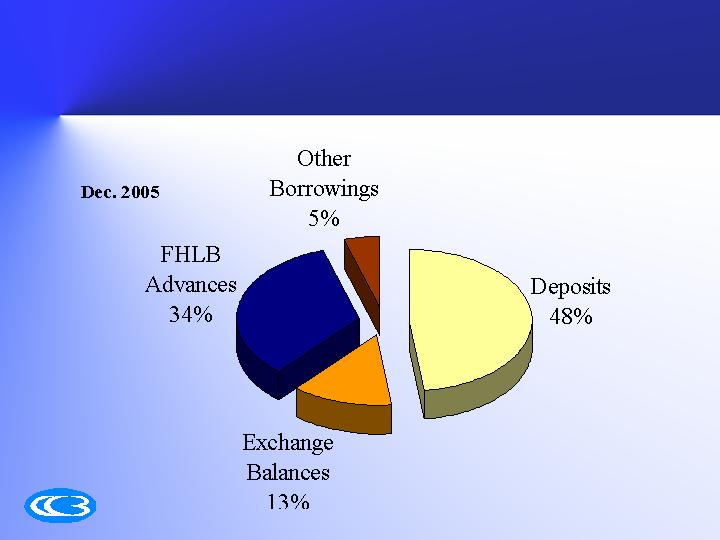

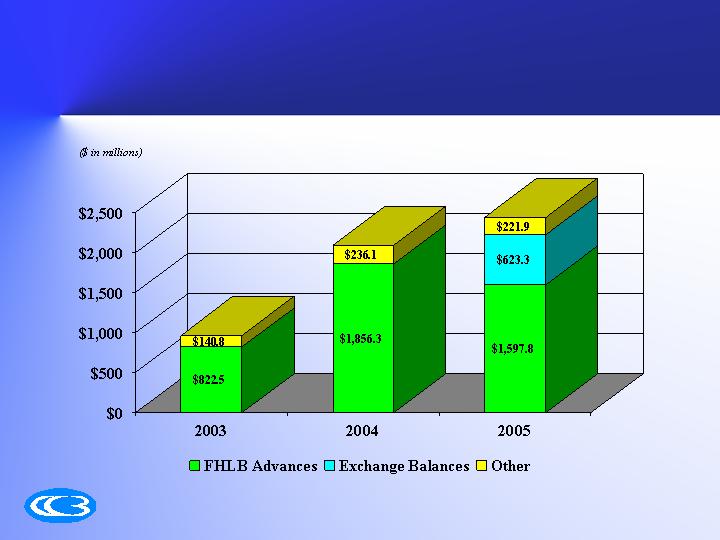

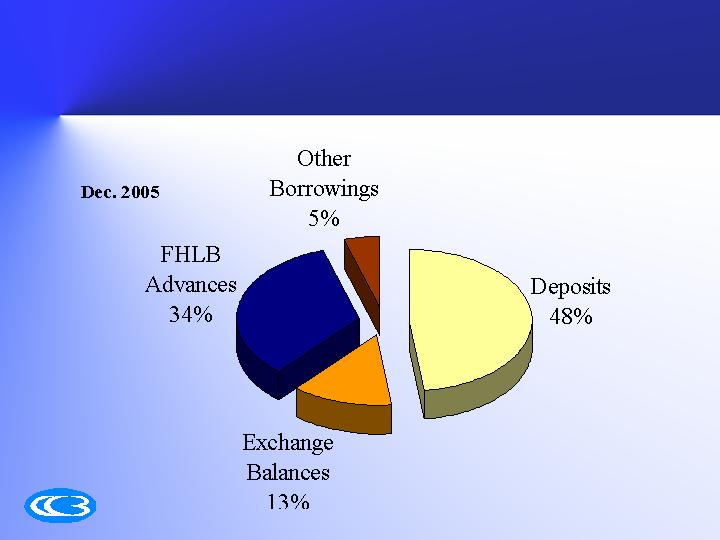

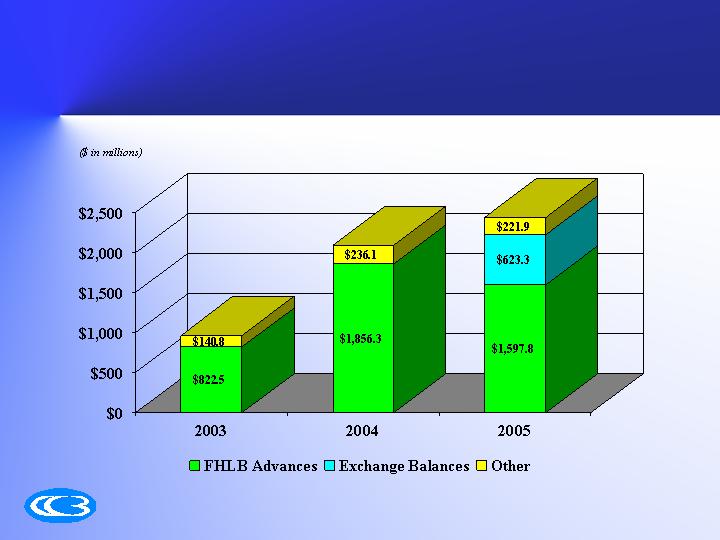

Diversified Funding Strategy

Retail banking provides stable funds and builds

banking relationships

1031 exchange accommodation strategy provides

low cost funding source which is linked to primary

lending business

Commercial banking provides cash management

and treasury services to corporate clients

Wholesale borrowing enables the Bank to have

flexibility

Relationship banking provides banking and deposit

services to franchise borrowers

19

Funding Sources

20

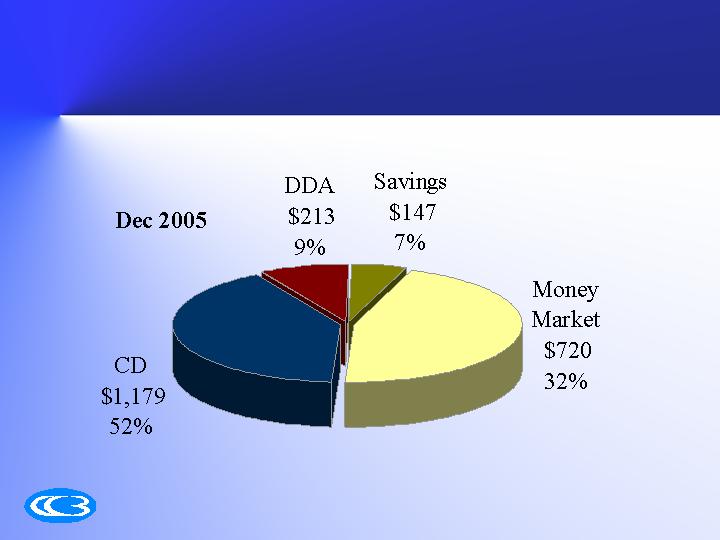

Retail & Relationship Banking

23 retail banking offices led by

Relationship Managers

Products and services to meet the needs of the

high net worth clients, including income

property investors

Deposit products and services

Loan products

Active and committed to the community

21

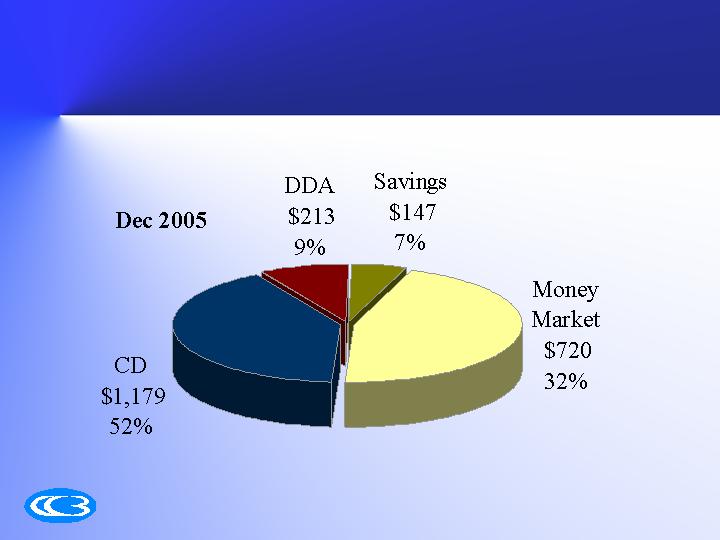

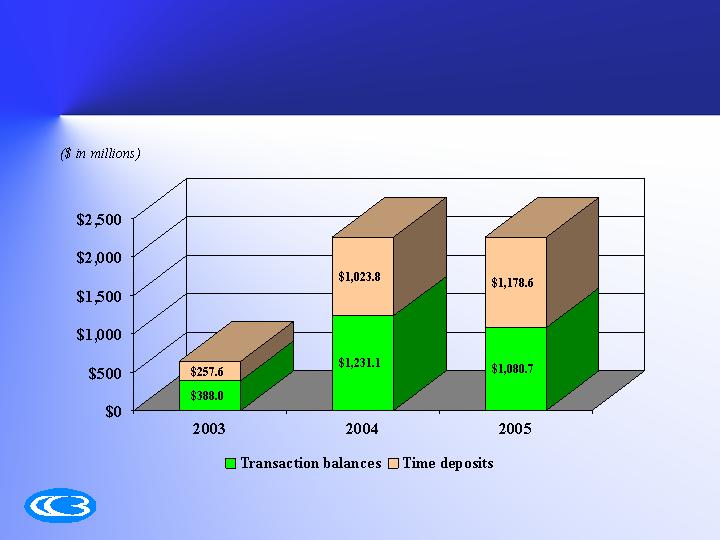

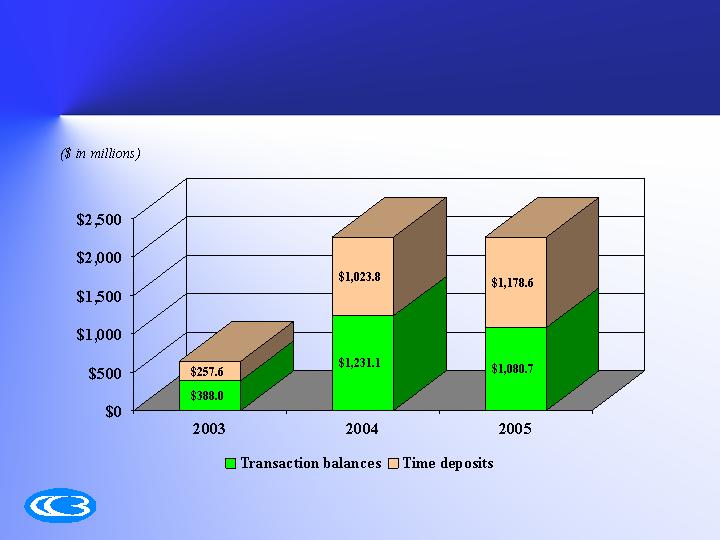

Bank Deposit Composition

22

Deposit Mix

23

Commercial Banking

Provides treasury and cash management services to:

Title and escrow companies

1031 exchange accommodators

Property management companies

Fiduciary and corporate financial services

companies

24

1031 Exchange Accommodators

1031 Exchange Accommodators provide services for real

estate investors, who are selling real estate and seek to defer

taxes and reinvest the proceeds in a replacement property. If

the transaction complies with IRS requirements, the investor

may defer the tax on the sale.

Real estate investors are required to have a qualified

intermediary hold the funds from the sale of a real estate asset

while they seek to acquire a replacement property.

1031 Exchange Accommodators fill the role of holding the

proceeds from the sale of the asset for the real estate investor,

while they search for a replacement asset.

25

1031 Exchange Accommodators

1.

Low cost source of funds (0.86% for 2005)

2.

Provides fee income from accommodation services

3.

Builds relationships with real estate investors for loan,

deposit and other banking services

Building a 1031 Exchange

Accommodation business

provides the company with a

number of strategic advantages:

26

1031 Exchange Services

North American Exchange Company

Acquired May 2005

NAEC is Headquartered in Walnut Creek, CA and facilitates

1031 exchange transactions nationwide:

Long Beach, CA Seattle, WA

Sacramento, CA Denver, CO

Miami, FL Washington DC

Dallas, TX Charlotte, NC

TIMCOR Exchange Corporation

Acquired February 2005

TIMCOR is headquartered in Los Angeles, and

facilitates 1031 exchange transactions nationwide:

Houston Chicago Miami Richmond

Total combined exchange balances of $623.3 million as of Dec. 31, 2005

27

Borrowing Mix

28

Growth Strategy

Organic

De Novo:

Crystal Cove, January 2006

Valencia, Spring 2006

Pasadena, Summer 2006

Acquisition:

Calnet Business Bank $152 million of deposits

Lawyers Asset Management $100 million of

exchange balances

29

Acquisition Strategy

The Company will evaluate potential acquisitions that:

Immediately will be accretive to earnings

Continues to build the exchange business

More fully adds financial service capabilities to serve the

banking needs of the commercial real estate investor

(title, escrow, etc)

Strengthens or expands the depository franchise

Diversifies the dependency on wholesale funding and

lending sources

Allows for greater efficiencies and cost saving opportunities

30

Operating Performance

31

($ in thousands, except per share data)

2005

2004

2003

Net interest income

152,927

$

113,022

$

41,234

$

Recapture of losses

8,109

-

-

Noninterest income

24,147

15,087

9,169

Noninterest expenses

(68,971)

(37,652)

(15,446)

Net income before taxes

116,212

90,457

34,957

Income tax expense

(41,863)

(34,195)

(13,242)

Net income

74,349

$

56,262

$

21,715

$

Diluted earnings per share

1.29

$

1.21

$

0.66

$

Performance Indicators

32

2005

2004

2003

Net interest margin

3.27%

3.40%

3.30%

Operating efficiency ratio

38.6%

29.1%

28.1%

G&A to average assets

1.31%

0.99%

1.09%

Effective income tax rate

36.0%

37.8%

39.3%

Dividend payout ratio

21.7%

7.4%

-

Return on average assets

1.42%

1.55%

1.57%

Return on average equity

11.1%

14.3%

22.7%

Return on average tangible equity

26.6%

31.1%

26.5%

Interest Yields and Costs

33

2005

2004

2003

Interest Earning Assets

Loans

5.76%

5.42%

5.84%

Securities

4.37%

4.29%

4.53%

FHLB stock

4.41%

3.98%

4.36%

Cash and cash equivalents

2.90%

1.44%

1.02%

Total yield on interest earning assets

5.60%

5.20%

5.30%

Interest bearing liabilities

Transaction accounts

2.04%

1.69%

2.17%

Certificates of deposit

2.84%

1.62%

1.93%

FHLB advances

2.66%

1.98%

2.01%

Exchange balances

0.86%

N/A

N/A

Junior subordinated debentures

6.36%

4.89%

5.02%

Other borrowings

3.23%

1.50%

1.63%

Cost of interest bearing liabilities

2.49%

1.91%

2.09%

Net spread

3.11%

3.29%

3.21%

Net interest margin

3.27%

3.40%

3.30%

Financial Indicators

34

($ in thousands, except per share data)

2005

2004

2003

Loans receivable

4,335,538

$

3,914,780

$

1,062,525

$

Investment securities

384,144

491,265

560,729

Total assets

5,463,549

5,023,924

1,723,139

Deposits

2,260,082

2,256,781

645,596

FHLB advances

1,597,806

1,856,349

822,519

Exchange balances

623,284

-

-

Shareholders' equity

698,117

625,216

102,042

Book value per share

12.36

11.47

3.41

Tangible book value per share

5.23

4.80

2.97

Tangible equity to assets ratio

5.84%

5.62%

5.20%

Regulatory Capital Ratios

35

Well

Capitalized

2005

2004

2003

Core capital

5.00%

8.75%

8.01%

7.97%

Tier I risk based capital

6.00%

11.72%

11.11%

13.47%

Risk based capital

10.00%

12.48%

12.21%

13.87%

Bank Actual

INVESTOR PRESENTATION

NASDAQ: CCBI

February 2006