UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21200 |

|

The Denali Fund Inc. |

(Exact name of registrant as specified in charter) |

|

Fund Administrative Services 2344 Spruce Street, Suite A Boulder, CO | | 80302 |

(Address of principal executive offices) | | (Zip code) |

|

Fund Administrative Services 2344 Spruce Street, Suite A Boulder, CO 80302 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (303) 444-5483 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | April 30, 2009 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

The Report to Stockholders is attached herewith.

THE DENALI FUND INC. | TABLE OF CONTENTS |

Letter from the Adviser | 1 |

| |

Financial Data | 3 |

| |

Portfolio of Investments | 4 |

| |

Statement of Assets and Liabilities | 7 |

| |

Statement of Operations | 8 |

| |

Statement of Changes in Net Assets | 9 |

| |

Financial Highlights | 10 |

| |

Notes to Financial Statements | 12 |

| |

Distribution Reinvestment Plan | 22 |

| |

Additional Information | 25 |

Directors | | Richard I. Barr |

| | Susan L. Ciciora |

| | John S. Horejsi |

| | Dean L. Jacobson |

| | Joel W. Looney |

| | |

Co-Investment Advisers | | Stewart Investment Advisers |

| | Boulder Investment Advisers, L.L.C. |

| | 2344 Spruce Street, Suite A |

| | Boulder, CO 80302 |

| | |

Co-Administrator | | Fund Administrative Services, LLC |

| | 2344 Spruce Street, Suite A |

| | Boulder, CO 80302 |

| | |

Co-Administrator | | ALPS Fund Services, Inc. |

| | 1290 Broadway, Suite 1100 |

| | Denver, CO 80203 |

| | |

Custodian | | Bank of New York Mellon |

| | One Wall Street |

| | New York, NY 10286 |

| | |

Transfer Agent | | BNY Mellon Shareholder Services Issuer Services |

| | 480 Washington Blvd |

| | Jersey City, NJ 07310 |

| | |

Independent Registered Public | | Deloitte & Touche LLP |

Accounting Firm | | 555 17th Street, Suite 3600 |

| | Denver, CO 80202 |

| | |

Legal Counsel | | Paul, Hastings, Janofsky & Walker LLP |

| | 515 South Flower Street |

| | Twenty-Fifth Floor |

| | Los Angeles, CA 90071 |

Statistics and projections in this report are derived from sources deemed to be reliable but cannot be regarded as a representation of future results of the Fund. This report is prepared for the general information of stockholders and is not a prospectus, circular or representation intended for use in the purchase or sale of shares of the Fund or of any securities mentioned in this report.

www.thedenalifund.com

LETTER FROM THE ADVISER

Dear Shareholder:

The Denali Fund Inc. had a total return on net asset value (NAV) of -18.8% for the six months ending April 30, 2009. It underperformed the S&P 500 Index which was down -8.5% over the same period.

Here’s the Fund’s performance for the trailing quarter, six months, and one year:

TOTAL RETURNS

| | 3 Months

Ended 4/30/09 | | 6 Months

Ended 4/30/09 | | One Year

Ended 10/31/08 | |

Cumulative Returns | | | | | | | |

Denali Fund NAV | | 2.2 | % | -18.8 | % | -34.1 | % |

S&P 500 Index | | 6.5 | % | -8.5 | % | -35.3 | % |

Dow Jones Industrial Average | | 3.0 | % | -10.8 | % | -34.2 | % |

NASDAQ Composite | | 16.7 | % | 0.4 | % | -28.1 | % |

We are pleased to report that your Denali Fund received two 2008 Performance Achievement Certificates from Lipper Analytical Services in its closed-end classification of Real Estate Funds:

· The Denali Fund ranks #1 in the Lipper Closed-End Equity Fund Performance Analysis for Real Estate Funds for the 1-year Ended December 31, 2008

· The Denali Fund ranks #1 in the Lipper Closed-End Equity Fund Performance Analysis for Real Estate Funds for the 5-years Ended December 31, 2008

While we didn’t manage the Fund for the full five year period cited by the Lipper award, we believe that as advisers we were able to effectuate management changes that were critical to earning this distinction. We took over as advisers to the Fund in October 2007 and immediately started selling off many of the REITs in the portfolio which we viewed as more than fully priced. We asked the new Board of Directors and stockholders to approve a change in the Fund’s investment objective to “total return” and eliminate the fundamental policy of concentrating in REITS, which were approved. This helped the Fund mitigate the losses in 2008 when the REIT market saw significant declines. While we can’t take credit for any of the Fund’s performance prior to October 2007, we will take credit for helping the Fund avoid the catastrophic losses that other REIT funds suffered in 2008. As of June 5, 2009, Lipper moved the Fund into its new investment objective (Growth & Income) and into the Core Funds Lipper classification.

The Fund’s most significant investment is still Berkshire Hathaway—slightly more than 25%. Berkshire stock was down 18.6% during the six months ending 4/30/09. Since Berkshire is such a large position in the Fund, its performance has a strong influence on the Fund’s performance. For long-term holders of Berkshire Hathaway, like us, the decline in asset prices and in the stock markets world-wide has afforded them the opportunity to find good companies selling at value-type prices.

1

The Fund still holds quite a bit of cash and “cash-equivalents,” totaling about $36 million, or about 38% of the Fund’s assets as of 4/30/09. Cash-equivalents can be a tricky term when it includes Auction Rate Preferreds (“ARPs”) which are included in the $36 million figure. The Fund holds a total of $18.85 million par value of these preferred instruments issued by other closed-end funds (which are being fair valued at 98% of par). One year ago, the Fund held over $60 million of these securities. Since then, many funds have redeemed their ARPs at their full stated par value. We consider these somewhat frozen assets (the auctions continue to fail) to be good assets — that is to say they are still rated “AAA” and continue paying dividends.

So what have we been doing with the cash? Well, the stock market’s recovery the last few months was as rapid going up as it was going down from January to March. The Fund treaded lightly during this period, adding a few small positions as the market hit new lows in early March. New positions include GE, Proctor & Gamble, 3M, and Unilever. The good news is we bought these companies at pretty low prices. The bad news is we didn’t buy enough, a mistake on our part. What were we thinking? We liked these companies we bought, and we liked the prices at which they were selling. However, the market was in such a sharp decline, we weren’t inclined to jump in with both feet. Instead, like a little boy at the swimming pool with water wings around his arms, we stuck our big toe in the water and tested. Before we could figure out that all the water in the pool was not going down the drain, the market quickly moved higher. We are still finding some places to put your money to work at good prices. What we can tell you for certain is we won’t pay a price we don’t think is reasonable. We’d rather be patient with your money.

We’ve also added a number of closed-end funds to the portfolio, all of which were trading at wide discounts when we bought them —some as wide as 25% to their net asset values. Buying these funds at discounts more than offsets the expenses of those funds and provides us with income through a diversified portfolio. For the most part, the funds we bought specialize in REITs, utilities and/or preferreds. All of the funds we bought pay a regular monthly or quarterly dividend. If the underlying assets in these funds recover, we may have the chance to double-dip in our returns if the discounts narrow at the same time.

The Fund has a website at www.thedenalifund.com. One of the new features on the website is the ability to sign up for electronic delivery of stockholder information. Through electronic delivery, you can enjoy the convenience and timeliness of receiving and viewing stockholder communications (such as annual reports, press releases, proxy statements, etc.) online in addition to, but more quickly than, the hard copies you currently receive. To enroll, simply go to www.thedenalifund.com and click on “Sign up for email updates”. We hope you find the site useful.

Sincerely,

Carl D. Johns

Boulder Investment Advisers, LLC

Boulder, Colorado

2

FINANCIAL DATA Unaudited

| | Per Share of Common Stock | |

| | Net Asset | | NYSE | | Dividend | |

| | Value | | Closing Price | | Paid | |

10/31/2008 | | 15.36 | | 11.27 | | 0.195 | |

11/30/2008 | | 13.00 | | 9.84 | | 0.000 | |

12/31/2008 | | 13.88 | | 10.49 | | 0.000 | |

1/31/2009 | | 12.21 | | 10.27 | | 0.000 | |

2/28/2009 | | 10.13 | | 7.80 | | 0.000 | |

3/31/2009 | | 10.90 | | 8.22 | | 0.000 | |

4/30/2009 | | 12.48 | | 9.49 | | 0.000 | |

|

The Denali Fund Inc.:

|

· Ranks #1 in the Lipper Closed-End Equity Fund Performance Analysis for Real Estate Funds for the 1-Year Ended December 31, 2008

· Ranks #1 in the Lipper Closed-End Equity Fund Performance Analysis for Real Estate Funds for the 5-Years Ended December 31, 2008*

LIPPER and LIPPER Corporate Marks are propriety trademarks of Lipper, a Reuters Company. Used by permission.

* BIA and SIA assumed management of The Denali Fund in October 2007.

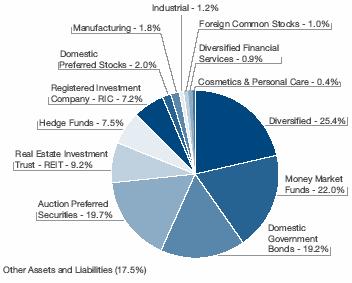

INVESTMENTS AS A % OF NET ASSETS AVAILABLE TO COMMON STOCK AND PREFERRED SHARES

3

Shares | | Description | | Value (Note 1) | |

LONG TERM INVESTMENTS 76.3% | | | |

DOMESTIC COMMON STOCKS 46.1% | | | |

Cosmetics & Personal Care 0.4% | | | |

8,000 | | The Procter & Gamble Co. | | $ | 395,520 | |

| | | | | |

Diversified 25.4% | | | |

254 | | Berkshire Hathaway, Inc., Class A* | | 23,876,000 | |

| | | | | |

Diversified Financial Services 0.9% | | | |

35,000 | | American Express Co. | | 882,700 | |

| | | | | |

Manufacturing 1.8% | | | |

18,000 | | 3M Co. | | 1,036,800 | |

50,000 | | General Electric Co. | | 632,500 | |

| | | | 1,669,300 | |

Industrial 1.2% | | | |

46,987 | | Constellation Energy Group, Inc. | | 1,131,447 | |

| | | | | |

Real Estate Investment Trust (REIT) 9.2% | | | |

66,000 | | Glimcher Realty Trust | | 161,700 | |

112,000 | | LTC Properties, Inc. | | 2,017,120 | |

226,200 | | Ventas, Inc. | | 6,478,368 | |

| | | | 8,657,188 | |

| | | | | |

Registered Investment Company (RIC) 7.2% | | | |

30,000 | | Clough Global Opportunities Fund | | 293,400 | |

220,825 | | Cohen & Steers Advantage Income Realty Fund, Inc. | | 757,430 | |

127,839 | | Cohen & Steers Premium Income Realty Fund, Inc. | | 425,704 | |

48,400 | | Cohen & Steers Quality Income Realty Fund, Inc. | | 172,788 | |

105,100 | | Cohen & Steers REIT and Preferred Income Fund, Inc. | | 616,937 | |

209,414 | | Cohen & Steers REIT and Utility Income Fund, Inc. | | 1,220,883 | |

50,000 | | Cohen & Steers Select Utility Fund, Inc. | | 489,500 | |

115,900 | | Cohen & Steers Worldwide Realty Income Fund, Inc. | | 354,654 | |

93,600 | | Flaherty & Crumrine/Claymore Preferred Securities Income Fund, Inc. | | 718,848 | |

120,000 | | Flaherty & Crumrine/Claymore Total Return Fund, Inc. | | 918,000 | |

185,100 | | ING Clarion Global Real Estate Income Fund | | 766,314 | |

| | | | 6,734,458 | |

| | | | | |

TOTAL DOMESTIC COMMON STOCKS

(Cost $45,686,924) | | 43,346,613 | |

| | | | | |

FOREIGN COMMON STOCK 1.0% | | | |

Netherlands 1.0% | | | |

45,000 | | Unilever NV | | 894,582 | |

| | | | | | |

See accompanying notes to financial statements.

4

PORTFOLIO OF INVESTMENTS

April 30, 2009 (Unaudited)

Shares | | Description | | Value (Note 1) | |

TOTAL FOREIGN COMMON STOCK

(Cost $873,834) | | $ | 894,582 | |

| | | | | |

AUCTION PREFERRED SECURITIES 19.7% | | | |

160 | | Advent Claymore Global Convertible Securities & Income Fund, Series W7(1) | | 3,920,000 | |

65 | | Blackrock Preferred and Equity Advantage Trust, Series F7(1) | | 1,592,500 | |

30 | | Calamos Convertible Opportunities and Income Fund, Series Th7(1) | | 735,000 | |

7 | | Cohen & Steers Premium Income Realty Fund, Inc., Series M(1) | | 171,500 | |

35 | | Cohen & Steers REIT and Preferred Income Fund, Inc., Series T(1) | | 857,500 | |

45 | | Cohen & Steers REIT and Utility Income Fund, Inc., Series W7(1) | | 1,102,500 | |

53 | | Cohen & Steers Select Utility Fund, Inc., Series Th7(1) | | 1,298,500 | |

16 | | Flaherty & Crumrine/Claymore Preferred Securities Income Fund, Inc., Series M7(1) | | 392,000 | |

6 | | Flaherty & Crumrine/Claymore Preferred Securities Income Fund, Inc., Series Th7(1) | | 147,000 | |

26 | | Flaherty & Crumrine/Claymore Preferred Securities Income Fund, Inc., Series W7(1) | | 637,000 | |

68 | | Gabelli Dividend & Income Trust, Series C(1) | | 1,666,000 | |

13 | | Neuberger Berman Real Estate Securities Income Fund, Inc., Series A(1) | | 318,500 | |

69 | | PIMCO Corporate Opportunity Fund, Series W(1) | | 1,690,500 | |

81 | | TS&W/Claymore Tax-Advantaged Balanced Fund(1) | | 1,984,500 | |

80 | | Western Asset Premier Bond Fund, Series M(1) | | 1,960,000 | |

| | | | | |

TOTAL AUCTION PREFERRED SECURITIES

(Cost $18,850,000) | | 18,473,000 | |

| | | | | |

DOMESTIC PREFERRED STOCKS 2.0% | | | |

Real Estate Investment Trust (REIT) 2.0% | | | |

22,800 | | Eagle Hospitality Properties Trust, Inc.* | | 4,845 | |

28,900 | | Glimcher Realty Trust Series F | | 216,750 | |

8,500 | | Glimcher Realty Trust Series G | | 58,650 | |

50,000 | | LBA Realty Fund II—WBP I LLC Series A(1) | | 1,500,000 | |

15,600 | | Strategic Hotels & Resorts, Inc. Series B | | 55,536 | |

| | | | | |

TOTAL DOMESTIC PREFERRED STOCKS

(Cost $4,395,000) | | 1,835,781 | |

| | | | | |

HEDGE FUNDS 7.5% | | | |

| | | | | |

7 | | Ithan Creek Partners, L.P.*(1) | | 7,094,157 | |

| | | | | | |

See accompanying notes to financial statements.

5

Shares | | Description | | Value (Note 1) | |

TOTAL HEDGE FUNDS

(Cost $7,000,000) | | $ | 7,094,157 | |

| | | | | |

TOTAL LONG TERM INVESTMENTS

(Cost $76,805,758) | | 71,644,133 | |

| | | | | |

SHORT TERM INVESTMENTS 41.2% | | | |

Domestic Government Bonds 19.2% | | | |

$ | 18,000,000 | | United States T-Bill, 0.040%, due 6/4/2009 | | 17,999,320 | |

| | | | | |

Total Domestic Government Bonds

(Cost $17,999,320) | | 17,999,320 | |

| | | | | |

Money Market Funds 22.0% | | | |

20,681,452 | | Dreyfus Treasury Cash Management Money Market Fund, Institutional Class, 7 Day Yield - 0.075% | | 20,681,452 | |

| | | | | |

Total Money Market Funds

(Cost $20,681,452) | | 20,681,452 | |

| | | | | |

TOTAL SHORT TERM INVESTMENTS

(Cost $38,680,772) | | 38,680,772 | |

| | | | | |

TOTAL INVESTMENTS 117.5%

(Cost $115,486,530) | | 110,324,905 | |

| | | | | |

OTHER ASSETS AND LIABILITIES (17.5%) | | (16,436,034 | ) |

| | | | | |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCK AND PREFERRED SHARES 100.0% | | 93,888,871 | |

| | | | | |

AUCTION PREFERRED SHARES (APS) REDEMPTION VALUE | | (42,000,000 | ) |

| | | | | |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCK | | $ | 51,888,871 | |

| | | | | | | |

* | Non-income producing security. |

(1) | Fair valued security under procedures established by the Fund’s Board of Directors. The market value of fair valued securities at April 30, 2009 is $27,067,157, or 28.8% of net assets available to common stock and preferred shares. |

For Fund compliance purposes, the Fund’s industry and/or geography classifications refer to any one or more of the industry/geography sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or defined by Fund management. This definition may not apply for purposes of this report, which may combine industry/ geography sub-classifications for reporting ease. Industries/geographies are shown as a percent of net assets. These industry/geography classifications are unaudited.

See accompanying notes to financial statements.

6

STATEMENT OF ASSETS AND LIABILITIES

April 30, 2009 (Unaudited)

ASSETS: | | | |

Investments, at value (Cost $115,486,530) (Note 1) | | $ | 110,324,905 | |

Receivable for investments sold | | 1,812,643 | |

Dividends and interest receivable | | 15,285 | |

Prepaid expenses and other assets | | 36,221 | |

Total Assets | | 112,189,054 | |

| | | |

LIABILITIES: | | | |

Payable for investments purchased | | 18,047,760 | |

Investment co-advisory fees payable (Note 2) | | 94,208 | |

Administration and co-administration fees payable (Note 2) | | 24,699 | |

Accumulated undeclared dividends on Auction Preferred Shares (Note 5) | | 379 | |

Legal and audit fees payable | | 50,502 | |

Printing fees payable | | 45,862 | |

Directors’ fees and expenses payable | | 18,791 | |

Accrued expenses and other payables | | 17,982 | |

Total Liabilities | | 18,300,183 | |

FUND TOTAL NET ASSETS | | $ | 93,888,871 | |

| | | |

AUCTION PREFERRED SHARES: | | | |

$0.0001 par value, 2,000 shares authorized, 1,680 shares outstanding, liquidation preference of $25,000 per share (Note 5) | | 42,000,000 | |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 51,888,871 | |

| | | |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) CONSISTS OF: | | | |

Par value of common stock (Note 4) | | $ | 416 | |

Paid-in capital in excess of par value of common stock | | 53,743,399 | |

Undistributed net investment income | | 675,456 | |

Accumulated net realized gain on investments sold and foreign currency related transactions | | 2,631,225 | |

Net unrealized depreciation on investments | | (5,161,625 | ) |

NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 51,888,871 | |

| | | |

Net Asset Value, $51,888,871/4,157,117 common stock outstanding | | $ | 12.48 | |

See accompanying notes to financial statements.

7

STATEMENT OF OPERATIONS

For the Six Months Ended April 30, 2009 (Unaudited)

INVESTMENT INCOME: | | | |

Dividends | | $ | 1,663,739 | |

Interest | | 15,511 | |

Total Investment Income | | 1,679,250 | |

| | | |

Expenses: | | | |

Investment co-advisory fee (Note 2) | | 565,686 | |

Administration and co-administation fees (Note 2) | | 131,055 | |

Legal and audit fees | | 38,284 | |

Preferred shares broker commissions and auction agent fees | | 40,850 | |

Directors’ fees and expenses (Note 2) | | 41,467 | |

Printing fees | | 10,055 | |

Transfer agency fees | | 10,461 | |

Insurance expense | | 4,409 | |

Other | | 34,204 | |

Total Expenses | | 876,471 | |

Net Investment Income | | 802,779 | |

| | | |

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | |

Net realized gain/(loss) on: | | | |

Investment Securities | | 2,638,674 | |

Foreign currency related transactions | | (7,449 | ) |

| | 2,631,225 | |

| | | |

Net change in unrealized appreciation/(depreciation) of: | | | |

Investment securities | | (15,299,431 | ) |

| | (15,299,431 | ) |

| | | |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS: | | (12,668,206 | ) |

LESS: PREFERRED SHARES DISTRIBUTIONS | | | |

From net investment income | | (99,821 | ) |

From net realized capital gains | | — | |

Total Distributions: Preferred Shares | | (99,821 | ) |

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (11,965,248 | ) |

See accompanying notes to financial statements.

8

STATEMENTS OF CHANGES IN NET ASSETS

| | Six Months Ended

April 30, 2009

(Unaudited) | | Year Ended

October 31, 2008 | |

OPERATIONS: | | | | | |

Net investment income | | $ | 802,779 | | $ | 2,441,788 | |

Net realized gain on investments sold | | 2,631,225 | | 5,591,867 | |

Net change in unrealized appreciation/(depreciation) on investments | | (15,299,431 | ) | (32,729,088 | ) |

Net Decrease in Net Assets Resulting from Operations | | (11,865,427 | ) | (24,695,433 | ) |

| | | | | |

DISTRIBUTIONS: PREFERRED SHARES | | | | | |

From net investment income | | (99,821 | ) | (466,354 | ) |

From net realized capital gains | | — | | (1,186,226 | ) |

Total Distributions: Preferred Shares | | (99,821 | ) | (1,652,580 | ) |

Net Decrease in Net Assets Resulting from Operations Applicable to Common Stockholders | | (11,965,248 | ) | (26,348,013 | ) |

| | | | | |

DISTRIBUTIONS: COMMON STOCK | | | | | |

From net investment income | | — | | (1,668,999 | ) |

From net realized capital gains | | — | | (11,863,775 | ) |

From tax return of capital | | — | | (1,557,574 | ) |

Total Distributions: Common Stock | | — | | (15,090,348 | ) |

Net Decrease in Net Assets | | (11,965,248 | ) | (41,438,361 | ) |

| | | | | |

NET ASSETS: | | | | | |

Beginning of year | | 105,854,119 | | 147,292,480 | |

End of period (including un/(over) distributed net investment income of $675,456 and $(27,502), respectively) | | $ | 93,888,871 | | $ | 105,854,119 | |

Auction Preferred Shares (APS) Redemption Value | | (42,000,000 | ) | (42,000,000 | ) |

Net Assets Applicable to Common Stockholders | | $ | 51,888,871 | | $ | 63,854,119 | |

See accompanying notes to financial statements.

9

FINANCIAL HIGHLIGHTS

For a Common Share Outstanding Throughout Each Period.

Contained below is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the period indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s shares.

| | Six Months Ended

April 30, 2009 | | For the Year Ended October 31, | |

| | (Unaudited) | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

OPERATING PERFORMANCE | | $ | 15.36 | | $ | 25.33 | | $ | 32.22 | | $ | 24.71 | | $ | 23.00 | | $ | 18.40 | |

Net Asset Value - Beginning of Period | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Income From Investment Operations: | | | | | | | | | | | | | |

Net investment income (a) | | 0.19 | | 0.59 | | 1.26 | | 1.10 | | 0.36 | | 0.87 | |

Net realized and unrealized gain/(loss) on investments | | (3.05 | ) | (6.53 | ) | (4.03 | ) | 8.70 | | 3.42 | | 4.90 | |

Total from Investment Operations | | (2.86 | ) | (5.94 | ) | (2.77 | ) | 9.80 | | 3.78 | | 5.77 | |

| | | | | | | | | | | | | |

Distributions: Preferred Shares | | | | | | | | | | | | | |

Dividends paid from net investment income (a) | | (0.02 | ) | (0.11 | ) | (0.19 | ) | (0.27 | ) | (0.08 | ) | (0.07 | ) |

Distributions paid from net realized capital gains(a) | | — | | (0.29 | ) | (0.36 | ) | (0.20 | ) | (0.22 | ) | (0.05 | ) |

Total Dividends Paid to APS* | | (0.02 | ) | (0.40 | ) | (0.55 | ) | (0.47 | ) | (0.30 | ) | (0.12 | ) |

| | | | | | | | | | | | | |

Net Increase/(Decrease) from Operations Applicable to Common Stock | | (2.88 | ) | (6.34 | ) | (3.32 | ) | 9.33 | | 3.48 | | 5.65 | |

| | | | | | | | | | | | | |

Distributions: Common Stock | | | | | | | | | | | | | |

Dividends paid from net investment income | | — | | (0.40 | ) | (1.24 | ) | (1.03 | ) | (0.45 | ) | (0.76 | ) |

Distributions paid from net realized capital gains | | — | | (2.86 | ) | (2.33 | ) | (0.79 | ) | (1.31 | ) | (0.61 | ) |

Distributions paid from tax return of capital | | — | | (0.37 | ) | — | | — | | (0.01 | ) | (0.01 | ) |

Total Dividends Paid to Common Stockholders | | — | | (3.63 | ) | (3.57 | ) | (1.82) | | (1.77) | | (1.38) | |

| | | | | | | | | | | | | |

Accretive Effect of Acquiring Treasury Shares | | — | | — | | — | | — | | — | | 0.33 | |

Common Share Net Asset Value - End of Period | | $ | 12.48 | | $ | 15.36 | | $ | 25.33 | | $ | 32.22 | | $ | 24.71 | | $ | 23.00 | |

Common Share Market Value - End of Period | | $ | 9.49 | | $ | 11.27 | | $ | 22.08 | | $ | 28.06 | | $ | 21.36 | | $ | 20.01 | |

| | | | | | | | | | | | | |

Total Return, Common Share Net Asset Value (b) | | (18.8 | )% | (25.3 | )% | (10.7 | )% | 40.5 | % | 16.9 | % | 34.4 | % |

Total Return, Common Share Market Value (b) | | (15.8 | )% | (37.1 | )% | (10.6 | )% | 41.5 | % | 16.2 | % | 24.5 | % |

| | | | | | | | | | | | | |

RATIOS TO AVERAGE NET ASSETS AVAILABLE TO COMMON STOCKHOLDERS:(c) | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Gross Operating Expenses (d) | | 1.92 | %(f) | 1.77 | % | 0.72 | % | 0.87 | % | 3.02 | % | 1.85 | % |

Net Operating Expenses(e) | | 1.92 | %(f) | 1.77 | % | 0.71 | % | 0.86 | % | 3.01 | % | 1.85 | % |

Net Investment Income | | 1.76 | %(f) | 1.98 | % | 4.34 | % | 4.00 | % | 1.52 | % | 4.23 | % |

| | | | | | | | | | | | | |

SUPPLEMENTAL DATA: | | | | | | | | | | | | | |

Portfolio Turnover Rate | | 13 | % | 91 | % | 17 | % | 15 | % | 8 | % | 5 | % |

Net Assets Applicable to Common Stockholders, End of Period (000s) | | $ | 51,889 | | $ | 63,854 | | $ | 105,292 | | $ | 133,933 | | $ | 102,721 | | $ | 95,595 | |

* | Auction Preferred Shares (“APS”). |

(a) | Calculated based on the average number of shares outstanding during each fiscal period. |

Footnotes continued on page 12.

See accompanying notes to financial statements.

10

(b) | Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during each fiscal period. Total return based on per share net asset value assumes the purchase of common shares at the market price on the first day and sales of common shares at the market price on the last day of the period indicated. Dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s distribution reinvestment plan. Results represent past performance and do not guarantee future results. Current returns may be lower or higher than the performance data quoted. Investment returns may fluctuate and shares when sold may be worth more or less than original cost. Total return would have been lower if Prior Management had not waived a portion of the investment administration fees. The calculation does not reflect brokerage commissions. |

(c) | Expense ratios do not include the effect of distributions to preferred shareholders. Income ratios include income earned on assets attributable to Preferred Shares outstanding. |

(d) | The Fund is required to calculate an expense ratio without taking into consideration any expense reductions related to offset arrangements. |

(e) | After waiver of, depending on the period, all or a portion of the management and/or administration fees by Prior Management. Had Prior Management not undertaken such actions, the annualized ratios of net expenses to average daily net assets applicable to common stockholders would have been: |

Six Months

Ended April 30 | | Year Ended October 31, | |

2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | |

— | | — | | 1.83 | % | 2.03 | % | 4.22 | % | 2.50 | % |

The table below sets out information with respect to Auction Preferred Shares currently outstanding. (1)

| | Liquidation

Value (000) | | Total Shares

Outstanding (000) | | Asset

Coverage

Per Share(2) | | Involuntary

Liquidating

Preference

Per Share(3) | | Average

Market

Value

Per Share(3) | |

04/30/09 | | $ | 42,000 | | 1.68 | | $ | 55,886 | | $ | 25,000 | | $ | 25,000 | |

10/31/08 | | 42,000 | | 1.68 | | 62,992 | | 25,000 | | 25,000 | |

10/31/07 | | 42,000 | | 1.68 | | 87,698 | | 25,000 | | 25,000 | |

10/31/06 | | 42,000 | | 1.68 | | 104,743 | | 25,000 | | 25,000 | |

10/31/05 | | 42,000 | | 1.68 | | 86,156 | | 25,000 | | 25,000 | |

10/31/04 | | 42,000 | | 1.68 | | 81,907 | | 25,000 | | 25,000 | |

| | | | | | | | | | | | | | | |

(1) | See Note 5. |

(2) | Calculated by subtracting the Fund’s total liabilities (excluding accumulated unpaid distributions on Preferred Shares) from the Fund’s total assets and dividing by the number of Preferred Shares outstanding. |

(3) | Excludes accumulated undeclared dividends. |

See accompanying notes to financial statements.

11

NOTES TO FINANCIAL STATEMENTS Unaudited

April 30, 2009

NOTE 1. SIGNIFICANT ACCOUNTING POLICIES

The Denali Fund Inc. (the “Fund”) (formerly known as the Neuberger Berman Real Estate Income Fund Inc.) was incorporated in Maryland on September 11, 2002 as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors of the Fund (the “Board”) may classify or re-classify any unissued shares of capital shares into one or more classes of preferred shares without the approval of stockholders.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements is in accordance with generally accepted accounting principles in the United States of America, which requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Portfolio Valuation: Investments in equity securities by the Fund are valued at the latest sale price where that price is readily available; securities for which no sales were reported, unless otherwise noted, are valued at the last available bid price. Securities traded primarily on the NASDAQ Stock Market are normally valued by the Fund at the NASDAQ Official Closing Price (“NOCP”) provided by NASDAQ each business day. Because of delays in reporting trades, the NOCP may not be based on the price of the last trade to occur before the market closes. In the absence of sales of listed securities and with respect to securities for which the most recent sale prices are not deemed to represent fair market value, and unlisted securities (other than money market instruments), securities are valued at the mean between the closing bid and asked prices, or based on a matrix system which utilizes information (such as credit ratings, yields and maturities) from independent sources. Investments for which market quotations are not readily available or do not otherwise accurately reflect the fair value of the investment are valued at fair value as determined in good faith by or under the direction of the Board of Directors of the Fund, including reference to valuations of other securities which are considered comparable in quality, maturity and type. Short-term debt securities with less than 60 days until maturity may be valued at cost which, when combined with interest earned, approximates market value.

The Fund adopted Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”), effective November 1, 2008. In accordance with FAS 157, fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. FAS 157 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including

12

such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

· Level 1—quoted prices in active markets for identical investments

· Level 2—significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

· Level 3—significant unobservable inputs (including the Fund’s own assumption in determining the fair value of investments)

The valuation techniques used by the Fund to measure fair value during the six months ended April 30, 2009 maximized the use of observable inputs and minimized the use of unobservable inputs. The Fund utilized the following fair value techniques: discounted future cash flow models, weighted average of last available trade prices and multi-dimensional relational pricing model.

The following is a summary of the inputs used as of April 30, 2009 in valuing the Fund’s investments carried at value:

| | Valuation Inputs

Investments in Securities | |

Level 1—Quoted Prices | | $ | 65,253,583 | |

Level 2—Significant Observable Inputs | | 36,477,165 | |

Level 3—Significant Unobservable Inputs | | 8,594,157 | |

Total | | $ | 110,324,905 | |

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| | Investments in Securities | |

Balance as of 11/01/08 | | $ | 8,568,741 | |

Realized gain/(loss) | | — | |

Change in unrealized appreciation | | 25,416 | |

Net purchases/(sales) | | — | |

Transfer in and/or out of Level 3 | | — | |

Balance as of 4/30/09 | | $ | 8,594,157 | |

Securities Transactions and Investment Income: Securities transactions are recorded on trade date for financial reporting purposes. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including accretion of

13

NOTES TO FINANCIAL STATEMENTS Unaudited

April 30, 2009

original issue discount, where applicable, and accretion of discount on short-term investments, if any, is recorded on the accrual basis. Realized gains and losses from securities transactions and foreign currency transactions, if any, are recorded on the basis of identified cost and stated separately in the Statement of Operations.

Foreign Currency Translation: The Fund may invest a portion of its assets in foreign securities. Foreign securities may carry more risk than U.S. securities, such as political, market and currency risks. The books and records of the Fund are maintained in US dollars. Foreign currencies, investments and other assets and liabilities denominated in foreign currencies are translated into US dollars at the exchange rate prevailing at the end of the period, and purchases and sales of investment securities, income and expenses transacted in foreign currencies are translated at the exchange rate on the dates of such transactions. Foreign currency gains and losses result from fluctuations in exchange rates between trade date and settlement date on securities transactions, foreign currency transactions and the difference between the amounts of interest and dividends recorded on the books of the Fund and the amounts actually received. The portion of foreign currency gains and losses related to fluctuation in the exchange rates between the initial purchase trade date and subsequent sale trade date is included in gains and losses as stated in the Statement of Operations under Foreign currency related transactions.

Distributions to Stockholders: Prior to November 10, 2008, it was the policy of the Fund to declare quarterly and pay monthly distributions to common stockholders (the “Policy”). In an effort to maintain a stable distribution amount, the Fund could have paid distributions consisting of net investment income, realized gains and return of paid-in capital. Return of paid-in capital should not be considered yield by investors in the Fund. To the extent stockholders receive a return of paid-in capital they will be required to adjust their cost basis by the same amount upon the sale of their Fund shares. The composition of the Fund’s distributions, if any, for the calendar year 2009 will be reported to Fund stockholders on IRS Form 1099-DIV. The Fund may pay distributions in excess of those required to avoid excise tax or to satisfy the requirements of Subchapter M of the Internal Revenue Code. Distributions to common stockholders are recorded on the ex-date. Net realized capital gains, if any, will be offset to the extent of any available capital loss carryforwards.

The Fund’s Policy was suspended, as approved by the Board, at the regular meeting held November 10, 2008.

In November 2008 the SEC issued an order approving exemptive relief for the Fund, from Section 19(b) and Rule 19b-1 under the Securities Act of 1940 (the “Order”). At a special meeting of the Board of Directors of the Fund, held December 3, 2008, the Board approved adoption of a managed distribution plan (the “Plan”), allowed by the Order received from the SEC. The Fund implemented the Plan for the fiscal year ended October 31, 2008.

14

Historically, the Fund has had a significant portion of its assets invested in securities issued by real estate companies, including real estate investment trusts (“REITs”). The distributions the Fund receives from REITs are generally comprised of income, capital gains, and return of capital, but the REITs do not report this information to the Fund until the following calendar year. At April 30, 2009, the Fund estimated these amounts within the financial statements since the information is not available from the REITs until after the Fund’s fiscal year-end. For the six months ended April 30, 2009, the character of distributions paid to stockholders is disclosed within the Statement of Changes and is also based on these estimates. All estimates are based upon REIT information sources available to the Fund together with actual IRS Forms 1099-DIV received to date. Based on past experience, it is probable that a portion of the Fund’s distributions during the current fiscal year will be considered tax return of capital but the actual amount of tax return of capital, if any, is not determinable until after the Fund’s fiscal year-end. After calendar year-end, when the Fund learns the nature of the distributions paid by REITs during that year, distributions previously identified as income are often recharacterized as return of capital and/or capital gain. After all applicable REITs have informed the Fund of the actual breakdown of distributions paid to the Fund during its fiscal year, estimates previously recorded are adjusted on the books of the Fund to reflect actual results. As a result, the composition of the Fund’s distributions as reported herein may differ from the final composition determined after calendar year-end and reported to Fund stockholders on IRS Form 1099-DIV.

Interest Rate Swaps: The Fund may enter into interest rate swap transactions, with institutions that Management has determined are creditworthy, to reduce the risk that an increase in short-term interest rates could reduce common share net earnings as a result of leverage. Under the terms of the interest rate swap contracts, the Fund agrees to pay the swap counter party a fixed-rate payment in exchange for the counter party’s paying the Fund a variable-rate payment that is intended to approximate all or a portion of the Fund’s variable-rate payment obligation on the Fund’s Preferred Shares. The fixed-rate and variable-rate payment flows are netted against each other, with the difference being paid by one party to the other on a monthly basis. The Fund segregates cash or liquid securities having a value at least equal to the Fund’s net payment obligations under any swap transaction, marked to market periodically.

Risks may arise if the counterparty to a swap contract fails to comply with the terms of its contract. The loss incurred by the failure of a counter party is generally limited to the net interest payment to be received by the Fund and/or the termination value at the end of the contract. Additionally, risks may arise from movements in interest rates unanticipated by Management.

Periodic expected interim net interest payments or receipts on the swaps are recorded as an adjustment to unrealized gains/losses, along with the fair value of the future periodic payment streams on the swaps. The unrealized gains/losses associated with the periodic interim net interest payments are reclassified to realized gains/losses in conjunction with the actual net receipt or payment of such amounts. The reclassifications do not impact

15

NOTES TO FINANCIAL STATEMENTS Unaudited

April 30, 2009

the Fund’s total net assets applicable to common stockholders or its total net increase/(decrease) in net assets applicable to common stockholders resulting from operations. At April 30, 2009, the Fund had no outstanding interest rate swap contracts.

Repurchase Agreements: The Fund may enter into repurchase agreements with institutions that Management has determined are creditworthy. Each repurchase agreement is recorded at cost. The Fund requires that the securities purchased in a repurchase agreement be transferred to the custodian in a manner sufficient to enable the Fund to assert a perfected security interest in those securities in the event of a default under the repurchase agreement. The Fund monitors, on a daily basis, the value of the securities transferred to ensure that their value, including accrued interest, is greater than amounts owed to the Fund under each such repurchase agreement. The Fund had no outstanding repurchase agreements as of April 30, 2009.

Concentration of Risk: The Fund operates as a “non-diversified” investment company, as defined in the 1940 Act. As a result of being “non-diversified”, with respect to 50% of the Fund’s portfolio, the Fund must limit to 5% the portion of its assets invested in the securities of a single issuer. There are no such limitations with respect to the balance of the Fund’s portfolio, although no single investment can exceed 25% of the Fund’s total assets at the time of purchase. A more concentrated portfolio may cause the Fund’s net asset value to be more volatile than it has been historically and thus may subject stockholders to more risk. The Fund may hold a substantial position (up to 25% of its assets) in the common stock of a single issuer. As of April 30, 2009, the Fund held close to 25% of its assets in Berkshire Hathaway, Inc. Thus, the volatility of the Fund’s common stock, and the Fund’s net asset value and its performance in general, depends disproportionately more on the performance of this single issuer than that of a more diversified fund.

In March 2008, the Fund changed its investment objective and eliminated its concentration policy in the real estate industry. Pending transitioning the Fund’s portfolio to accommodate these changes, the Fund’s investments may continue to be concentrated in income-producing common equity securities, preferred securities, convertible securities and non-convertible debt securities issued by companies deriving the majority of their revenue from the ownership, construction, financing, management and/or sale of commercial, industrial, and/or residential real estate. During this transition, value of the Fund’s shares may fluctuate more due to economic, legal, cultural, geopolitical or technological developments affecting the United States real estate industry, or a segment of the United States real estate industry in which the Fund owns a substantial position, than would the shares of a fund not concentrated in the real estate industry.

Indemnifications: Like many other companies, the Fund’s organizational documents provide that its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of its principal service contracts and in the normal course of its business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Fund’s maximum exposure under these arrangements is unknown as this could involve future claims against the Fund.

16

Federal Income Tax: It is the policy of the Fund to continue to qualify as a regulated investment company by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its earnings to its stockholders. Therefore, no federal income or excise tax provision is required.

Income distributions and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles. These differences are primarily due to differing treatments of income and gains on various investment securities and swap contracts held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole.

The Fund follows FASB Interpretation No. 48 (“FIN 48”) “Accounting for Uncertainty in Income Taxes,” which requires that the financial statement effects of a tax position taken or expected to be taken in a tax return be recognized in the financial statements when it is more likely than not, based on the technical merits, that the position will be sustained upon examination. Management has concluded that the Fund has taken no uncertain tax positions that require adjustment to the financial statements to comply with the provisions of FIN 48. The Fund files income tax returns in the U.S. federal jurisdiction and Colorado. The statue of limitations on the Fund’s federal and state tax filings remains open for the fiscal years ended October 31, 2008, October 31, 2007, October 31, 2006 and October 31, 2005.

NOTE 2. MANAGEMENT FEES, ADMINISTRATION FEES, AND OTHER TRANSACTIONS WITH AFFILIATES

On February 22, 2008, stockholders approved Boulder Investment Advisers, L.L.C. (“BIA”) and Stewart Investment Advisers (“SIA”) (together, the “Advisers”) as co-advisers to the Fund. The Fund pays the Advisers a monthly fee at an annual rate of 1.25% of the value of the Fund’s average monthly net assets (including the principal amount of leverage, if any) (“Net Assets”). The equity owners of BIA are Evergreen Atlantic, LLC, a Colorado limited liability company (“EALLC”), and the Lola Brown Trust No. 1B (the “Lola Trust”), each of which is considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act. Stewart West Indies Trading Company, Ltd. is a Barbados international business company doing business as Stewart Investment Advisers. SIA receives a fee equal to 75% of the fees earned by the Advisers and BIA receives 25% of the fees earned by the Advisers. The equity owner of SIA is the Stewart West Indies Trust, considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act. Fund Administrative Services, LLC (“FAS”) serves as the Fund’s co-administrator. Under the Administration Agreement, FAS provides certain administrative and executive management services to the Fund. The Fund pays FAS a monthly fee calculated at an annual rate of 0.20% of the Fund’s Net Assets. The equity owners of FAS are EALLC and the Lola Trust, each of which is considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act.

17

NOTES TO FINANCIAL STATEMENTS Unaudited

April 30, 2009

The Fund pays each Director who is not a director, officer, employee, or affiliate of the Advisers or FAS, a fee of $8,000 per annum, plus $3,000 for each in-person meeting of the Board of Directors and $500 for each telephone meeting. In addition, the Chairman of the Board and the Chairman of the Audit Committee each receive $1,000 per meeting and each member of the Audit Committee receives $500 per meeting. The Fund will also reimburse independent Directors for travel and out-of-pocket expenses incurred in connection with such meetings.

ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s co-administrator. As compensation for its services, ALPS receives certain out-of-pocket expenses and asset-based fees, which are accrued daily and paid monthly. Fees paid to ALPS are calculated based on combined assets of the Fund, the Boulder Total Return Fund, Inc., the Boulder Growth & Income Fund, Inc., and First Opportunity Fund, Inc. (the “Fund Group”). ALPS receives the greater of the following, based on combined assets of the Fund Group: an annual minimum of $460,000, or an annualized fee of 0.045% on assets up to $1 billion, an annualized fee of 0.03% on assets between $1 and $3 billion, and an annualized fee of 0.02% on assets above $3 billion.

Bank of New York Mellon (“BNY Mellon”) serves as the Fund’s custodian and Common Stock servicing agent (“Transfer Agent”), dividend-paying agent and registrar, and as compensation for BNY Mellon’s services as such, the Fund pays BNY Mellon a monthly fee plus certain out-of-pocket expenses

NOTE 3. SECURITIES TRANSACTIONS

During the six months ended April 30, 2009, there were purchase and sale transactions (excluding short term securities and interest rate swap contracts) of $10,509,095 and $24,788,465, respectively.

On April 30, 2009, based on cost of $115,212,729 for federal income tax purposes, aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $5,638,007 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value was $10,525,831, resulting in net unrealized depreciation of $4,887,824.

NOTE 4. CAPITAL

The Fund has authorized a total of 999,998,000, $0.0001 par value Common Shares, which may be converted into Preferred Shares. At April 30, 2009, 4,157,117 Common Shares were outstanding.

18

Transactions in common stock were as follows:

| | Six Months Ended

April 30, 2009 | | Year Ended

October 31, 2008 | |

Common Stock outstanding – beginning of period | | 4,157,117 | | 4,157,117 | |

Common Stock issued as reinvestment of dividends | | — | | — | |

Common Stock outstanding – end of period | | 4,157,117 | | 4,157,117 | |

NOTE 5. PREFERRED SHARES

On December 12, 2002, the Fund re-classified 1,500 unissued capital shares as Series A Auction Preferred Shares (“Preferred Shares”). On February 7, 2003, the Fund issued 1,260 Preferred Shares. On September 10, 2003, the Fund re-classified an additional 500 unissued shares of capital shares as Preferred Shares. On October 24, 2003, the Fund issued an additional 420 Preferred Shares. All Preferred Shares have a liquidation preference of $25,000 per share plus any accumulated unpaid distributions, whether or not earned or declared by the Fund, but excluding interest thereon (“Liquidation Value”).

Except when the Fund has declared a special rate period, distributions to preferred stockholders, which are cumulative, are accrued daily and paid every 7 days. Distribution rates are reset every 7 days based on the results of an auction, except during special rate periods. In February 2008, the Preferred Shares market across all closed-end funds became illiquid resulting in failed auctions for the Preferred Shares. A failed auction is not an event of default for the Fund but it has a negative impact on the liquidity of the Preferred Shares. A failed auction occurs when there are more sellers of a fund’s APS than buyers. It is impossible to predict how long this imbalance will last. A successful auction for the Preferred Shares may not occur for some time, if ever, and even if liquidity does resume, holders of Preferred Shares may not have the ability to sell the Preferred Shares at its liquidation preference. As such, the Fund continues to pay dividends on the Preferred Shares at the maximum rate (set forth in the Fund’s governing document for the Preferred Shares), set at the current “AA” Financial Composite Commercial Paper rate times 150%.

For the six months ended April 30, 2009, distribution rates ranged from 0.15% to 1.32%. The Fund declared distributions to preferred stockholders for the period November 1, 2008 to April 30, 2009 of $99,821.

The Fund may redeem Preferred Shares, in whole or in part, on the second business day preceding any distribution payment date at Liquidation Value. The Fund is also subject to certain restrictions relating to the Preferred Shares. Specifically, the Fund is required under the 1940 Act to maintain an asset coverage with respect to the Preferred Shares of 200% or greater. The Fund is also required to maintain certain

19

NOTES TO FINANCIAL STATEMENTS Unaudited

April 30, 2009

coverage amounts for Fitch and Moody’s (“rating agencies”). Failure to comply with these restrictions could preclude the Fund from declaring any distributions to common stockholders or repurchasing common shares and/or could trigger the mandatory redemption of Preferred Shares at Liquidation Value. The holders of Preferred Shares are entitled to one vote per share and will vote with holders of common stock as a single class, except that the Preferred Shares will vote separately as a class on certain matters, as required by law or the Fund’s charter. The holders of the Preferred Shares, voting as a separate class, are entitled at all times to elect two Directors of the Fund, and to elect a majority of the Directors of the Fund if the Fund fails to pay distributions on Preferred Shares for two consecutive years.

In connection with the settlement of each Preferred Share auction, the Fund pays, through the auction agent, a service fee to each participating broker-dealer based upon the aggregate liquidation preference of the Preferred Shares held by the broker-dealer’s customers. Prior to February 19, 2009 the Fund paid at an annual rate 0.25% and upon this date the annual rate was reduced to 0.05%, until further notice from the Fund. These fees are paid for failed auctions as well.

In order to satisfy rating agencies’ requirements, the Fund is required to provide each rating agency a report on a monthly basis verifying that the Fund is maintaining eligible assets having a discounted value equal to or greater than the Preferred Shares Basic Maintenance Amount, which is a minimum level set by each rating agency as one of the conditions to maintain the AAA/Aaa rating on the Preferred Shares. “Discounted value” refers to the fact that the rating agencies require the Fund, in performing this calculation, to discount portfolio securities below their face value, at rates determined by the rating agencies. The Fund was in compliance with these requirements as of April 30, 2009.

NOTE 6. SHARE REPURCHASE PROGRAM

In accordance with Section 23(c) of the 1940 Act, the Fund may from time to time, effect redemptions and/or repurchases of its Preferred Shares and/or its Common Stock, in the open market or through private transactions; at the option of the Board of Directors and upon such terms as the Directors shall determine.

For the six months ended April 30, 2009, the Fund did not repurchase any of its own shares.

NOTE 7. TAX BASIS DISTRIBUTIONS

As determined on October 31, 2008, permanent differences resulting primarily from different book and tax accounting for distributions in excess of earnings were reclassified at fiscal year-end. These reclassifications had no effect on the net decrease in net assets resulting from operations, net asset value applicable to common stockholders

20

NOTES TO FINANCIAL STATEMENTS (Unaudited)

April 30, 2009

or net asset value per common share of the Fund. Permanent book and tax basis differences of $1,292,844, $280,809 and $(1,573,653) were reclassified at October 31, 2008 among distributions in excess of net investment income, accumulated net realized gains on investments, and paid in capital, respectively, for the Fund.

The tax character of distributions paid during the years ended October 31, 2008 and October 31, 2007 was as follows:

| | Year Ended October 31, 2008 | | Year Ended October 31, 2007 | |

Distributions paid from: | | | | | |

Ordinary Income | | $ | 2,135,353 | | $ | 5,929,318 | |

Long-Term Capital Gain | | 13,050,001 | | 11,192,139 | |

Tax Return of Capital | | 1,557,574 | | — | |

| | $ | 16,742,928 | | $ | 17,121,457 | |

As of October 31, 2008, the components of distributable earnings (accumulated losses) on a U.S. federal income tax basis were as follows:

Unrealized Appreciation | | $ | 10,137,806 | |

Other Cumulative Effect of Timing Differences | | (27,502 | ) |

| | $ | 10,110,304 | |

The difference between book and tax basis distributable earnings is attributable primarily to temporary differences of distribution payments.

NOTE 8. RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

In March 2008, FASB issued Statement of Financial Accounting Standards No. 161 (“SFAS 161”) “Disclosures about Derivative Instruments and Hedging Activities”—an amendment of FASB Statement No. 133 (“SFAS 133”), expands the disclosure requirements in SFAS 133 about an entity’s derivative instruments and hedging activities. SFAS 161 is effective for fiscal years and interim periods beginning after November 15, 2008. Management is currently evaluating the impact the adoption of SFAS No. 161 will have on the Fund’s financial statement disclosures.

Management believes that the adoption SFAS No. 161 will not have a material impact on the Fund’s financial statements.

21

DISTRIBUTION REINVESTMENT PLAN Unaudited

April 30, 2009

The Bank of New York Mellon (“Plan Agent”) will act as Plan Agent for stockholders who have not elected in writing to receive dividends and distributions in cash (each a “Participant”), will open an account for each Participant under the Distribution Reinvestment Plan (“Plan”) in the same name as their then current Shares are registered, and will put the Plan into effect for each Participant as of the first record date for a dividend or capital gains distribution.

Whenever the Fund declares a dividend or distribution with respect to the common shares of the Fund (“Shares”), each Participant will receive such dividends and distributions in additional Shares, including fractional Shares acquired by the Plan Agent and credited to each Participant’s account. If on the payment date for a cash dividend or distribution, the net asset value is equal to or less than the market price per Share plus estimated brokerage commissions, the Plan Agent shall automatically receive such Shares, including fractions, for each Participant’s account. Except in the circumstances described in the next paragraph, the number of additional Shares to be credited to each Participant’s account shall be determined by dividing the dollar amount of the dividend or distribution payable on their Shares by the greater of the net asset value per Share determined as of the date of purchase or 95% of the then current market price per Share on the payment date.

Should the net asset value per Share exceed the market price per Share plus estimated brokerage commissions on the payment date for a cash dividend or distribution, the Plan Agent or a broker-dealer selected by the Plan Agent shall endeavor, for a purchase period lasting until the last business day before the next date on which the Shares trade on an “ex-dividend” basis, but in no event, except as provided below, more than 30 days after the payment date, to apply the amount of such dividend or distribution on each Participant’s Shares (less their pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open-market purchases in connection with the reinvestment of such dividend or distribution) to purchase Shares on the open market for each Participant’s account. No such purchases may be made more than 30 days after the payment date for such dividend or distribution except where temporary curtailment or suspension of purchase is necessary to comply with applicable provisions of federal securities laws. If, at the close of business on any day during the purchase period the net asset value per Share equals or is less than the market price per Share plus estimated brokerage commissions, the Plan Agent will not make any further open-market purchases in connection with the reinvestment of such dividend or distribution. If the Plan Agent is unable to invest the full dividend or distribution amount through open-market purchases during the purchase period, the Plan Agent shall request that, with respect to the uninvested portion of such dividend or distribution amount, the Fund issue new Shares at the close of business on the earlier of the last day of the purchase period or the first day during the purchase period on which the net asset value per Share equals or is less than the market price per Share, plus estimated brokerage commissions, such Shares to be issued in accordance with the terms specified in the third paragraph hereof. These newly issued Shares will be valued at the then-current market price per Share at the time such Shares are to be issued.

For purposes of making the reinvestment purchase comparison under the Plan, (a) the market price of the Shares on a particular date shall be the last sales price on the New

22

York Stock Exchange (or if the Shares are not listed on the New York Stock Exchange, such other exchange on which the Shares are principally traded) on that date, or, if there is no sale on such Exchange (or if not so listed, in the over-the-counter market) on that date, then the mean between the closing bid and asked quotations for such Shares on such Exchange on such date and (b) the net asset value per Share on a particular date shall be the net asset value per Share most recently calculated by or on behalf of the Fund. All dividends, distributions and other payments (whether made in cash or Shares) shall be made net of any applicable withholding tax. Open-market purchases provided for above may be made on any securities exchange where the Fund’s Shares are traded, in the over-the-counter market or in negotiated transactions and may be on such terms as to price, delivery and otherwise as the Plan Agent shall determine. Each Participant’s uninvested funds held by the Plan Agent will not bear interest, and it is understood that, in any event, the Plan Agent shall have no liability in connection with any inability to purchase Shares within 30 days after the initial date of such purchase as herein provided, or with the timing of any purchases effected. The Plan Agent shall have no responsibility as to the value of the Shares acquired for each Participant’s account. For the purpose of cash investments, the Plan Agent may commingle each Participant’s funds with those of other shareholders of the Fund for whom the Plan Agent similarly acts as agent, and the average price (including brokerage commissions) of all Shares purchased by the Plan Agent as Plan Agent shall be the price per Share allocable to each Participant in connection therewith.

The Plan Agent may hold each Participant’s Shares acquired pursuant to the Plan together with the Shares of other stockholders of the Fund acquired pursuant to the Plan in noncertificated form in the Plan Agent’s name or that of the Plan Agent’s nominee. The Plan Agent will forward to each Participant any proxy solicitation material and will vote any Shares so held for each Participant only in accordance with the instructions set forth on proxies returned by the Participant to the Fund.

The Plan Agent will confirm to each Participant each acquisition made for their account as soon as practicable but not later than 60 days after the date thereof. Although each Participant may from time to time have an undivided fractional interest (computed to three decimal places) in a Share, no certificates for a fractional Share will be issued. However, dividends and distributions on fractional Shares will be credited to each Participant’s account. In the event of termination of a Participant’s account under the Plan, the Plan Agent will adjust for any such undivided fractional interest in cash at the market value of the Shares at the time of termination, less the pro rata expense of any sale required to make such an adjustment.

Any Share dividends or split Shares distributed by the Fund on Shares held by the Plan Agent for Participants will be credited to their accounts. In the event that the Fund makes available to its shareholders rights to purchase additional Shares or other securities, the Shares held for each Participant under the Plan will be added to other Shares held by the Participant in calculating the number of rights to be issued to each Participant.

23

The Plan Agent’s service fee for handling capital gains distributions or income dividends will be paid by the Fund. Participants will be charged their pro rata share of brokerage commissions on all open-market purchases.

Each Participant may terminate their account under the Plan by notifying the Plan Agent in writing. Such termination will be effective immediately if the Participant’s notice is received by the Plan Agent not less than ten days prior to any dividend or distribution record date, otherwise such termination will be effective the first trading day after the payment date for such dividend or distribution with respect to any subsequent dividend or distribution. The Plan may be terminated by the Plan Agent or the Fund upon notice in writing mailed to each Participant at least 30 days prior to any record date for the payment of any dividend or distribution by the Fund.

These terms and conditions may be amended or supplemented by the Plan Agent or the Fund at any time or times but, except when necessary or appropriate to comply with applicable law or the rules or policies of the Securities and Exchange Commission or any other regulatory authority, only by mailing to each Participant appropriate written notice at least 30 days prior to the effective date thereof. The amendment or supplement shall be deemed to be accepted by each Participant unless, prior to the effective date thereof, the Plan Agent receives written notice of the termination of their account under the Plan. Any such amendment may include an appointment by the Plan Agent in its place and stead of a successor Plan Agent under these terms and conditions, with full power and authority to perform all or any of the acts to be performed by the Plan Agent under these terms and conditions. Upon any such appointment of any Plan Agent for the purpose of receiving dividends and distributions, the Fund will be authorized to pay to such successor Plan Agent, for each Participant’s account, all dividends and distributions payable on Shares held in their name or under the Plan for retention or application by such successor Plan Agent as provided in these terms and conditions.

The Plan Agent shall at all times act in good faith and agrees to use its best efforts within reasonable limits to ensure the accuracy of all services performed under this Agreement and to comply with applicable law, but assumes no responsibility and shall not be liable for loss or damage due to errors unless such error is caused by the Plan Agent’s negligence, bad faith, or willful misconduct or that of its employees.

These terms and conditions shall be governed by the laws of the State of Maryland.

24

Significant Events

The Board of Directors, including a majority of the Independent Directors, ratified Deloitte & Touche LLP as the Fund’s independent registered public accounting firm to replace Briggs, Bunting & Dougherty LLP, for the Fund’s fiscal year ending October 31, 2008. The report of the financial statements audited by Briggs, Bunting & Dougherty LLP for the Fund for the year ended October 31, 2007 did not contain an adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. For the six years prior to that, Ernst & Young LLP served as the Fund’s independent registered public accounting firm and those reports of financial statements audited by Ernst & Young LLP did not contain an adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. There were no disagreements between the Fund, Briggs, Bunting & Dougherty LLP or Ernst & Young LLP on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Briggs, Bunting & Dougherty LLP and/or Ernst & Young LLP would have caused it to make reference to the subject matter of the disagreements in connection with its reports on the financial statements of such years, and there were no “reportable events” of the kind described in Item 304(a)(1)(v) of Regulation S-K. The Fund did not consult Deloitte & Touche LLP regarding either (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Fund’s financial statements, or (2) any matter that was the subject of a disagreement or a reportable event, as such terms are defined in Item S-K 304 of Regulation S-K.

Proxy Voting Policies and Procedures

The policies and procedures used to determine how to vote proxies relating to securities held by the Fund are available, without charge, at www.thedenalifund.com. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available at www.sec.gov.

Portfolio Information

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available (1) on the Fund’s website at www.thedenalifund.com; (2) on the SEC’s website at www.sec.gov; or (3) may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Senior Officer Code of Ethics

The Fund files a copy of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer or controller, or persons performing similar functions (the “Senior Officer Code of Ethics”), with the SEC as an exhibit to its annual report on Form N-CSR. The Fund’s Senior Officer Code of Ethics is available on the Fund’s website located at http://www.thedenalifund.com.

Fund Bylaws and Charter

The Fund amended and restated its Bylaws, and amended its charter, both effective October 26, 2007. The Fund also amended its Bylaws effective July 28, 2008.

25

��

ADDITIONAL INFORMATION Unaudited

April 30, 2009

Privacy Statement

Pursuant to SEC Regulation S-P (Privacy of Consumer Financial Information) the Directors of The Denali Fund Inc. (the “Fund”) have established the following policy regarding information about the Fund’s stockholders. We consider all stockholder data to be private and confidential, and we hold ourselves to the highest standards in its safekeeping and use.

General Statement. The Fund may collect nonpublic information (e.g., your name, address, email address, Social Security Number, Fund holdings (collectively, “Personal Information”)) about stockholders from transactions in Fund shares. The Fund will not release Personal Information about current or former stockholders (except as permitted by law) unless one of the following conditions is met: (i) we receive your prior written consent; (ii) we believe the recipient to be you or your authorized representative; (iii) to service or support the business functions of the Fund (as explained in more detail below), or (iv) we are required by law to release Personal Information to the recipient. The Fund has not and will not in the future give or sell Personal Information about its current or former stockholders to any company, individual, or group (except as permitted by law) and as otherwise provided in this policy.

In the future, the Fund may make certain electronic services available to its stockholders and may solicit your email address and contact you by email, telephone or US mail regarding the availability of such services. The Fund may also contact stockholders by email, telephone or US mail in connection with these services, such as to confirm enrollment in electronic stockholder communications or to update your Personal Information. In no event will the Fund transmit your Personal Information via email without your consent.

Use of Personal Information. The Fund will only use Personal Information (i) as necessary to service or maintain stockholder accounts in the ordinary course of business and (ii) to support business functions of the Fund and its affiliated businesses. This means that the Fund may share certain Personal Information, only as permitted by law, with affiliated businesses of the Fund, and that such information may be used for non-Fundrelated solicitation. When Personal Information is shared with the Fund’s business affiliates, the Fund may do so without providing you the option of preventing these types of disclosures as permitted by law.

Safeguards regarding Personal Information. Internally, we also restrict access to Personal Information to those who have a specific need for the records. We maintain physical, electronic, and procedural safeguards that comply with Federal standards to guard Personal Information. Any doubts about the confidentiality of Personal Information, as required by law, are resolved in favor of confidentiality.

26

Meeting of Stockholders - Voting Results

On April 24, 2009, the Fund held its Annual Meeting of Stockholders to consider the election of Directors of the Fund. The following votes were recorded:

Proposal 1: Election of Directors of the Fund

Election of Joel W. Looney as a Class I

Director of the Fund (both common and

preferred stockholders vote) | | # of Votes Cast | | % of Votes Cast | |

Affirmative | | 3,967,728 | | 98.54 | % |

Withheld | | 58,826 | | 1.46 | % |

Total | | 4,026,554 | | 100.00 | % |

Election of Dr. Dean Jacobson as a Class III

Director of the Fund (both common and

preferred stockholders vote) | | # of Votes Cast | | % of Votes Case | |

Affirmative | | 3,966,537 | | 98.51 | % |

Withheld | | 60,017 | | 1.49 | % |

Total | | 4,026,554 | | 100.00 | % |

Election of Ms. Susan L. Ciciora as a Class III

Director of the Fund (only preferred

stockholders vote) | | # of Votes Cast | | % of Votes Case | |

Affirmative | | 591 | | 56.18 | % |

Withheld | | 461 | | 43.82 | % |

Total | | 1,052 | | 100.00 | % |

27

THE DENALI FUND INC.

c/o BNY Mellon Sharehowner Services

480 Washington Blvd

Jersey City, NJ 07310

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

The Registrant’s full schedule of investments is included as part of the report to stockholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

No reportable purchases for the period covered by this report.

Item 10. Submission of Matters to a Vote of Security Holders.

On February 9, 2009, the Board of Directors of the Registrant adopted amended and restated bylaws of the Registrant (the “Bylaws”) that designate revised procedures by which stockholders may submit proposals to the Registrant’s Board of Directors. The applicable sections of the Bylaws are set forth below: