UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-21200

The Denali Fund Inc.

(Exact Name of Registrant as Specified in Charter)

Fund Administrative Services

2344 Spruce Street, Suite A

Boulder, CO 80302

(Address of Principal Executive Offices)(Zip Code)

Fund Administrative Services

2344 Spruce Street, Suite A

Boulder, CO 80302

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:

(303) 444-5483

Date of Fiscal Year End: October 31

Date of Reporting Period: April 30, 2012

| Item 1. | Reports to Stockholders. |

The Report to Stockholders is attached herewith.

| | |

The Denali Fund Inc. | | Letter from the Advisers |

| | April 30, 2012 |

Dear Stockholders:

Before delving into a discussion of the Fund’s performance, I wanted to take the opportunity to quickly introduce myself. In February of this year, I joined Boulder Investment Advisers, LLC as a portfolio manager and will work alongside Stewart Horejsi, the Fund’s other portfolio manager, in managing the Fund’s portfolio. Dispensing with any further formalities, let us proceed to the Fund’s performance.

The equity markets remained volatile during the six-month period ending April 30, 2012 as concerns related to the European sovereign debt crisis were balanced against signs of an economic recovery. While these concerns weighed on the market during the early and latter parts, growing optimism on the economy prevailed throughout most of this period and fueled a rapid market rally. This rally helped The Denali Fund Inc. (the “Fund”) deliver a 6.9% return on net assets for the six-month period ending April 30, 2012. Unfortunately, the Fund was unable to keep pace with the rebound in the S&P 500 as it generated a 12.8% return during the same period. The Fund’s underperformance relative to the S&P 500 and its other benchmarks is highlighted in the below table.

| | | | | | | | | | | | |

| | | 3 Months | | 6 Months | | One Year | | Three Years* | | Five Years* | | Since

October

2007** |

DNY (NAV) | | 3.1% | | 6.9% | | 0.8% | | 17.9% | | -3.1% | | -0.9% |

DNY (Market) | | 2.4% | | 3.5% | | -4.9% | | 20.3% | | -5.6% | | -1.7% |

S&P 500 Index | | 7.1% | | 12.8% | | 4.8% | | 19.4% | | 1.0% | | -0.1% |

DJIA | | 5.3% | | 12.0% | | 6.0% | | 20.6% | | 3.0% | | 1.7% |

NASDAQ Composite | | 8.6% | | 14.2% | | 7.2% | | 22.3% | | 4.8% | | 2.4% |

| ** | Annualized since October 2007, when the current Advisers became investment advisers to the Fund. |

The performance data quoted represents past performance. Past performance is no guarantee of future results. Fund returns include reinvested dividends and distributions, but do not reflect the reduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares and do not reflect brokerage commissions, if any. Returns of the S&P 500 Index, the Dow Jones Industrial Average (DJIA) and the NASDAQ Composite include reinvested dividends and distributions. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

While we are glad the Fund finished the six month period with a positive absolute return, we are nonetheless disappointed with the underperformance relative to the Fund’s benchmarks and will strive to improve the Fund’s performance going forward. To accomplish this, we believe we must first understand what drove the Fund’s performance during this period.

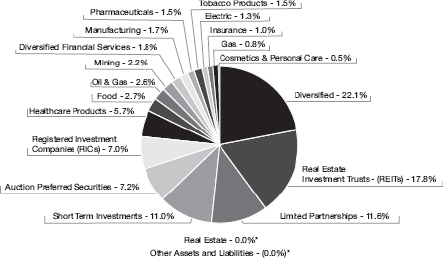

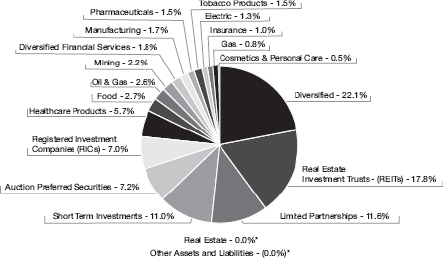

The key contributors to the Fund’s performance on an absolute and relative basis were the Fund’s positions in LTC Properties and Ithan Creek Partners, L.P. (“Ithan Creek”), a hedge fund, which generated a total return for the period of 20.6% and 13.5% respectively. The positive contribution from the Ithan Creek position was enhanced by its large weight in the Fund as it accounted for roughly 11.6% of the total portfolio. In addition, the Fund benefitted on an absolute basis from its positions in Berkshire Hathaway, Ventas and the Cohen & Steers Infrastructure Fund, which generated total returns for the period of 3.3%, 8.0% and 11.1% respectively. Unfortunately, the

| | | | |

Semi-Annual Report | April 30, 2012 | | | 1 | |

| | |

Letter from the Advisers | | The Denali Fund Inc. |

April 30, 2012 | | |

overall contribution to performance from these positions was partially due to the large weight of each in the Fund’s portfolio. As each of these positions generated returns that trailed the S&P 500 during the period, they were key factors in the Fund’s relative underperformance. This is particularly true for the Fund’s positions in Berkshire Hathaway and Ventas as they accounted for roughly 22.1% and 13.6% of the total portfolio respectively.

Further contributing to the Fund’s underperformance relative to its benchmarks and detracting from absolute return was the Fund’s elevated cash position during the period. As the market rallied, it acted as a drag on overall returns. This problem was further compounded by the Fund’s large aggregate position in low yielding Auction Rate Preferred Stocks (“ARPS”), which in total accounted for roughly 7.2% of the total portfolio. We will continue to explore the available options in relation to these positions. In addition, the Fund’s equity positions in Transocean and Freeport-McMoRan also negatively impacted performance for the period as each generated total returns for the period of a negative 8.9% and a negative 6.7% respectively.

However, the largest detractor to the Fund’s absolute and relative performance for the period was the Fund’s position in Inergy, L.P. (“Inergy”). Inergy is a master limited partnership (“MLP”) that operates retail propane and midstream businesses and owns 75.2% of the limited partner interest and all of the general partner interest and incentive distribution rights in Inergy Midstream L.P. (Ticker: NRGM). In January, Inergy’s management announced it was going to cut its distribution as the current rate was unsustainable in light of the abnormally warm winter driven collapse in propane demand and the lower than expected performance of recent acquisitions. As the market tends to value MLPs off of their distribution yield, the reaction to this announcement was unsurprisingly quite negative. The net impact was a 27.3% total decline in the market value of the Fund’s Inergy position for the period. Despite the obvious disappointment in the position’s decline and the realization that the initial analysis proved incorrect, we resisted the temptation to quickly sell the position out of the Fund and instead quickly re-evaluated the situation using information available at the time. Based on this analysis, we believed that the market’s reaction to the distribution cut was overly punitive and the valuation at the time severely undervalued Inergy’s retail propane and internal midstream operations, especially if there were a return to more normal winter weather conditions. On April 26th, we received the favorable announcement that Suburban Propane Partners agreed to acquire Inergy’s retail propane business for a total consideration of $1.8 billion. Inergy’s unit price moved higher on the news allowing for a partial recovery of the prior price decline.

Unfortunately, our decision to maintain the Fund’s position has been a pyrrhic victory as we do not expect to see a full recovery of the Fund’s losses in the Inergy position any time soon. In the end, the initial analysis on Inergy proved incorrect. As much as we believe in our investment process and philosophy, it is not infallible and we recognize that we will miss on an investment from time to time (although we try to keep this to a minimum). If there is something positive to take out of this whole episode, it is that we maintained our investment discipline. It would have been very easy to react out of disappointment in the distribution cut, in the initial analysis, in Inergy’s management and in the loss to the Fund by quickly selling the position when the distribution cut was announced. We then could have only given it a perfunctory mention in this letter and have moved on without giving it any additional thought. However, this is not how we operate. Instead, we recognized our mistake, adjusted our analysis to the prevailing conditions and made an informed decision to hold the position. Fortunately, this decision was vindicated more quickly than we expected and in a manner we did not anticipate.

| | |

The Denali Fund Inc. | | Letter from the Advisers |

| | April 30, 2012 |

It is precisely because of this discipline and commitment to its core investment philosophy that drove my decision to join Boulder Investment Advisers, LLC in February of this year. This investment philosophy is built on the core principles to, first and foremost, protect our stockholders principal investment and to generate superior returns over the long run by investing in good companies at attractive valuations. This philosophy is elegant in its simplicity, but difficult in its execution, requiring a patient temperament and the ability to separate emotion from an investment decision. When combined with rigorous fundamental research analysis steeped in value investing principles, we believe it to be the most effective investment strategy there is when correctly executed. I believe we can effectively execute this strategy, but I do not expect you to simply take me at my word. This is why another core aspect of our investment philosophy is to invest alongside our stockholders as Stewart Horejsi’s family and I are fellow stockholders. We hope this serves as an effective demonstration of our belief in and our ability to execute upon our investment philosophy.

I look forward to writing you again in six months and wish you a safe and happy summer.

|

Sincerely, |

|

|

|

Brendon Fischer, CFA Portfolio Manager |

The views and opinions in the preceding commentary are subject to change. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Portfolio weightings and other figures in the foregoing commentary are provided as of period-end, unless otherwise stated.

Note to Stockholders on the Fund’s Discount. As most stockholders are aware, the Fund’s shares presently trade at a significant discount to net asset value. The Fund’s board of directors is aware of this, monitors the discount and periodically reviews the limited options available to mitigate the discount. In addition, there are several factors affecting the Fund’s discount over which the board and management have little control. In the end, the market sets the Fund’s share price. For long-term stockholders of a closed-end fund, we believe the Fund’s discount should only be one of many factors taken into consideration at the time of your investment decision.

Note to Stockholders on Leverage. The Fund currently has Auction Rate Preferred Shares outstanding, which results in the use of leverage. Leverage creates certain risks for holders of Common Stock, including the likelihood of greater volatility of the NAV and market price of the Common Stock. The Fund utilizes leverage to seek to enhance the returns for its common stockholders over the long term; however, this objective may not be achieved in all interest rate environments. As a result of the failed auctions for the Auction Preferred Shares, the Fund pays Auction Rate Preferred Shareholders a dividend rate that is generally tied to short-term interest rates. This dividend rate has been and remains generally economical compared to the earnings of the Fund’s investments. However, to the extent that in the future short-term interest rates increase and the cost of this leverage increases, and earnings from the Fund’s investments do not increase, the Fund’s net investment returns may decline. Moreover, the Fund is required to

| | | | |

Semi-Annual Report | April 30, 2012 | | | 3 | |

| | |

Letter from the Advisers | | The Denali Fund Inc. |

April 30, 2012 | | |

maintain an asset coverage ratio of 200% on any outstanding Auction Rate Preferred Shares. If the Fund were unable to maintain the required asset coverage ratio, it could be required to deleverage and sell a portion of its investments at a time when it might be disadvantageous to do so. Fund management and the Fund’s Board of Directors continue to explore other liquidity and leverage options, including borrowing through a credit facility; this may result in Preferred Shares being redeemed or repurchased in the future. Notwithstanding this, the Board of Directors may ultimately decide to leave the current Auction Rate Preferred Stock outstanding if, after evaluating liquidity solutions that would enable the Fund to redeem the Preferred Stock, the Board determines that such solutions would be inconsistent with the interests of the Fund’s stockholders.

Note to Stockholders on Concentration of Investments. The Fund’s investment advisers feel it is important that stockholders be aware that the Fund is highly concentrated in a small number of positions. Concentrating investments in a fewer number of securities may involve a degree of risk that is greater than a fund which has less concentrated investments spread out over a greater number of securities.

| | |

The Denali Fund Inc. | | Financial Data |

| | April 30, 2012 (Unaudited) |

| | | | | | | | | | | | | | | | | | | | |

| | | | | Per Share of Common Stock | | | | |

| | | Net Asset

Value | | NYSE Closing Price | | Dividend

Paid | | |

10/31/11 | | $ 18.02 | | $ 15.02 | | $ 0.00 | | |

11/30/11 | | 17.70 | | 14.05 | | 0.00 | | |

12/31/11 | | 16.97 | | 13.23 | | 0.78** | | |

1/31/12 | | 17.70 | | 14.38 | | 0.00 | | |

2/29/12 | | 17.73 | | 14.79 | | 0.00 | | |

3/31/12 | | 18.18 | | 14.80 | | 0.00 | | |

4/30/12 | | 18.25 | | 14.72 | | 0.00 | | |

** This distribution consisted of $0.02 per share net investment income, $0.15 per share short-term capital gains, and $0.61 per share long-term capital gains.

Investments as a % of Total Net Assets Available to Common Stock and Preferred Shares

| * | Less than 0.05% of total net assets available to common and preferred shares. |

| | | | |

Semi-Annual Report | April 30, 2012 | | | 5 | |

| | |

Portfolio of Investments | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

LONG TERM INVESTMENTS 89.0% | | | | |

DOMESTIC COMMON STOCKS 64.0% | | | | |

Cosmetics & Personal Care 0.5% | | | | |

8,000 | | The Procter & Gamble Co. | | $ | 509,120 | |

Diversified 22.1% | | | | |

179 | | Berkshire Hathaway, Inc., Class A* | | | 21,623,200 | |

| |

Diversified Financial Services 1.8% | | | | |

122,500 | | AllianceBernstein Holding LP | | | 1,726,025 | |

| |

Electric 1.1% | | | | |

16,600 | | Public Service Enterprise Group, Inc. | | | 517,090 | |

12,400 | | SCANA Corp. | | | 571,888 | |

| | | | | | |

| | | | | 1,088,978 | |

| |

Gas 0.8% | | | | |

42,000 | | Inergy LP | | | 818,580 | |

| |

Healthcare Products 5.7% | | | | |

86,000 | | Johnson & Johnson | | | 5,597,740 | |

| |

Manufacturing 1.7% | | | | |

18,000 | | 3M Co. | | | 1,608,480 | |

| |

Mining 2.2% | | | | |

56,500 | | Freeport-McMoRan Copper & Gold, Inc. | | | 2,163,950 | |

| |

Oil & Gas 2.2% | | | | |

14,000 | | Diamond Offshore Drilling, Inc. | | | 959,700 | |

30,000 | | Linn Energy LLC | | | 1,207,500 | |

| | | | | | |

| | | | | 2,167,200 | |

| |

Real Estate Investment Trusts (REITs) 17.4% | | | | |

112,000 | | LTC Properties, Inc. | | | 3,727,360 | |

226,200 | | Ventas, Inc. | | | 13,298,298 | |

| | | | | | |

| | | | | 17,025,658 | |

| |

Registered Investment Companies (RICs) 7.0% | | | | |

366,952 | | Cohen & Steers Infrastructure Fund, Inc. | | | 6,384,965 | |

7,262 | | Flaherty & Crumrine/Claymore Total Return Fund, Inc. | | | 137,978 | |

18,154 | | RMR Real Estate Income Fund | | | 294,639 | |

| | | | | | |

| | | | | 6,817,582 | |

| |

Tobacco Products 1.5% | | | | |

45,000 | | Altria Group, Inc. | | | 1,449,450 | |

| | | | | | |

| |

TOTAL DOMESTIC COMMON STOCKS

(Cost $44,541,397) | | | 62,595,963 | |

| | | | | | |

| |

FOREIGN COMMON STOCKS 6.2% | | | | |

Diversified Financial Services 0.0%(1) | | | | |

5,000 | | Guoco Group, Ltd. | | | 41,889 | |

| | |

The Denali Fund Inc. | | Portfolio of Investments |

| | April 30, 2012 (Unaudited) |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

Electric 0.2% | | | | |

4,500 | | RWE AG | | $ | 193,442 | |

| |

Food 2.7% | | | | |

78,000 | | Unilever NV | | | 2,671,035 | |

| |

Insurance 1.0% | | | | |

6,700 | | Muenchener Rueckversicherungs AG | | | 972,460 | |

| |

Oil & Gas 0.4% | | | | |

8,000 | | Transocean, Ltd. | | | 403,120 | |

| |

Pharmaceuticals 1.5% | | | | |

14,500 | | Sanofi | | | 1,106,703 | |

8,800 | | Sanofi, ADR | | | 335,984 | |

| | | | | | |

| | | | | 1,442,687 | |

| |

Real Estate 0.0%(1) | | | | |

100 | | Cheung Kong Holdings, Ltd. | | | 1,330 | |

| |

Real Estate Investment Trusts (REITs) 0.4% | | | | |

390,199 | | Kiwi Income Property Trust | | | 341,421 | |

| | | | | | |

| |

TOTAL FOREIGN COMMON STOCKS

(Cost $5,449,704) | | | 6,067,384 | |

| | | | | | |

| |

AUCTION PREFERRED SECURITIES 7.2% | | | | |

160 | | Advent Claymore Convertible Securities & Income Fund II, Series W7 | | | 3,145,976 | |

68 | | Gabelli Dividend & Income Trust, Series C | | | 1,394,449 | |

69 | | PIMCO Corporate & Income Opportunity Fund, Series W | | | 1,164,309 | |

80 | | Western Asset Premier Bond Fund, Series M | | | 1,384,396 | |

| | | | | | |

| | | | | 7,089,130 | |

| |

TOTAL AUCTION PREFERRED SECURITIES

(Cost $9,399,285) | | | 7,089,130 | |

| | | | | | |

| |

LIMITED PARTNERSHIPS 11.6% | | | | |

7 | | Ithan Creek Partners, LP*(2)(3) | | | 11,346,620 | |

| |

TOTAL LIMITED PARTNERSHIPS

(Cost $7,000,000) | | | 11,346,620 | |

| | | | | | |

| |

TOTAL LONG TERM INVESTMENTS

(Cost $66,390,386) | | | 87,099,097 | |

| | | | | | |

| |

SHORT TERM INVESTMENTS 11.0% | | | | |

Money Market Funds 11.0% | | | | |

2,336,106 | | Dreyfus Treasury & Agency Cash Management Money Market Fund, Institutional Class, 7 Day Yield - 0.010% | | | 2,336,106 | |

| | | | |

Semi-Annual Report | April 30, 2012 | | | 7 | |

| | |

Portfolio of Investments | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

Money Market Funds (continued) | | | | |

| 8,400,000 | | JPMorgan Prime Money Market Fund, 7 Day Yield - 0.200% | | $ | 8,400,000 | |

| | | | | | |

| |

Total Money Market Funds

(Cost $10,736,106) | | | 10,736,106 | |

| | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS

(Cost $10,736,106) | | | 10,736,106 | |

| | | | | | |

| |

TOTAL INVESTMENTS 100.0%

(Cost $77,126,492) | | | 97,835,203 | |

| | | | | | |

| |

OTHER ASSETS AND LIABILITIES (0.0%)(1) | | | (24,061) | |

| | | | | | |

| |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCK AND PREFERRED SHARES 100.0% | | | 97,811,142 | |

| | | | | | |

| |

AUCTION PREFERRED SHARES (APS) REDEMPTION VALUE PLUS ACCRUED DIVIDENDS | | | (21,950,226) | |

| | | | | | |

| |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCK | | $ | 75,860,916 | |

| | | | | | |

Abbreviations:

ADR - American Depositary Receipt.

| AG | - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

LLC - Limited Liability Company.

LP - Limited Partnership.

Ltd. - Limited.

NV - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

| * | Non-income producing security. |

| (1) | Less than 0.05% of total net assets available to common stock and preferred shares. |

| (2) | Fair valued security under procedures established by the Fund’s Board of Directors. Total market value of fair valued securities as of April 30, 2012 was $11,346,620, or 11.6% of total net assets available to common stock and preferred shares. |

| (3) | Restricted Security; these securities may only be resold in transactions exempt from registration under the Securities Act of 1933. |

Percentages are stated as a percent of the Total Net Assets Available to Common Stock and Preferred Shares.

See Accompanying Notes to Financial Statements.

| | |

The Denali Fund Inc. | | Portfolio of Investments |

| | April 30, 2012 (Unaudited) |

Regional Breakdown as a % of Total Net Assets Available to Common and Preferred Stockholders

| | | | |

United States | | | 93.8 | % |

Netherlands | | | 2.7 | % |

France | | | 1.5 | % |

Germany | | | 1.2 | % |

Switzerland | | | 0.4 | % |

New Zealand | | | 0.4 | % |

Hong Kong | | | 0.0 | % |

Other Assets and Liabilities | | | 0.0 | % |

| | | | |

Semi-Annual Report | April 30, 2012 | | | 9 | |

| | |

Statement of Assets and Liabilities | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

| | | | |

ASSETS: | | | | |

Investments, at value (Cost $77,126,492) (Note 1) | | $ | 97,835,203 | |

Foreign Currency, at value (Cost $83,909) | | | 84,636 | |

Dividends and interest receivable | | | 53,903 | |

Receivable for investment securities sold | | | 12,363 | |

Prepaid expenses and other assets | | | 22,724 | |

| |

Total Assets | | | 98,008,829 | |

| |

| |

LIABILITIES: | | | | |

Investment co-advisory fees payable (Note 2) | | | 91,948 | |

Legal and audit fees payable | | | 39,117 | |

Administration and co-administration fees payable (Note 2) | | | 20,880 | |

Printing fees payable | | | 10,194 | |

Directors’ fees and expenses payable | | | 2,418 | |

Accrued expenses and other payables | | | 33,130 | |

| |

Total Liabilities | | | 197,687 | |

| |

Total Net Assets Applicable to Common and Preferred Shareholders | | $ | 97,811,142 | |

| |

| |

AUCTION PREFERRED SHARES: | | | | |

$0.0001 par value, 2,000 shares authorized, 878 shares outstanding, liquidation preference of $25,000 per share (Note 5) | | | 21,950,000 | |

Accrued dividends on auction preferred shares | | | 226 | |

| |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 75,860,916 | |

| |

| |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) CONSIST OF: | | | | |

Par value of common stock (Note 4) | | $ | 416 | |

Paid-in capital in excess of par value of common stock | | | 54,884,904 | |

Undistributed net investment income | | | 259,825 | |

Accumulated net realized gain on investments sold and foreign currency related transactions | | | 7,157 | |

Net unrealized appreciation on investments and foreign currency transactions | | | 20,708,614 | |

| |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 75,860,916 | |

| |

Net Asset Value, $75,860,916/4,157,117 common stock outstanding | | $ | 18.25 | |

| |

| | |

| See Accompanying Notes to Financial Statements. | | |

| | |

The Denali Fund Inc. | | Statement of Operations |

| | For the Six Months Ended April 30, 2012 (Unaudited) |

| | | | |

INVESTMENT INCOME: | | | | |

Dividends (Net of foreign withholding taxes $18,048) | | $ | 1,242,611 | |

Interest | | | 8,045 | |

| |

Total Investment Income | | | 1,250,656 | |

| |

| |

EXPENSES: | | | | |

Investment co-advisory fees (Note 2) | | | 575,098 | |

Administration and co-administration fees (Note 2) | | | 123,321 | |

Directors’ fees and expenses (Note 2) | | | 49,207 | |

Legal and audit fees | | | 42,497 | |

Preferred shares broker commissions and auction agent fees (Note 5) | | | 14,098 | |

Transfer agency fees | | | 10,433 | |

Insurance fees | | | 9,893 | |

Printing fees | | | 7,908 | |

Custody fees | | | 5,348 | |

Other | | | 38,839 | |

| |

Total Expenses | | | 876,642 | |

Less fees waived by investment advisor | | | (16,178) | |

| |

Net Expenses | | | 860,464 | |

| |

Net Investment Income | | | 390,192 | |

| |

| |

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

Net realized gain/(loss) on: | | | | |

Investment securities | | | 1,358,667 | |

Foreign currency related transactions | | | (6,536) | |

| |

| | | 1,352,131 | |

| |

Net change in unrealized appreciation/(depreciation) of: | | | | |

Investment securities | | | 2,451,028 | |

Foreign currency related translations | | | 1,699 | |

| |

| | | 2,452,727 | |

| |

NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | 3,804,858 | |

| |

PREFERRED SHARES TRANSACTIONS: | | | | |

Distributions from net investment income | | | (8,605) | |

| |

Total Preferred Shares Transactions | | | (8,605) | |

| |

NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS | | $ | 4,186,445 | |

| |

| | |

| See Accompanying Notes to Financial Statements. | | |

| | | | |

Semi-Annual Report | April 30, 2012 | | | 11 | |

| | |

Statements of Changes in Net Assets | | The Denali Fund Inc. |

| | |

| | | | | | | | |

| | | For the Six

Months Ended

April 30, 2012

(Unaudited) | | | For the

Year Ended

October 31, 2011 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 390,192 | | | $ | 389,570 | |

Net realized gain on investment securities and foreign

currency related transactions | | | 1,352,131 | | | | 2,264,557 | |

Net change in unrealized appreciation/(depreciation) on

investments and foreign currency related

translations | | | 2,452,727 | | | | (3,086,067) | |

| |

| | | 4,195,050 | | | | (431,940) | |

| |

| | |

PREFERRED SHARES TRANSACTIONS: | | | | | | | | |

Distributions from net investment income | | | (8,605) | | | | (19,486) | |

Distributions from net realized capital gains | | | – | | | | (43,820) | |

Gain on redemption of Auction Preferred Shares (Note 5) | | | – | | | | 900,000 | |

| |

Total Preferred Shares Transactions | | | (8,605) | | | | 836,694 | |

| |

Net Increase in Net Assets Applicable to Common

Stockholders Resulting from Operations | | | 4,186,445 | | | | 404,754 | |

| | |

DISTRIBUTIONS: COMMON STOCK | | | | | | | | |

From net investment income | | | (83,142) | | | | – | |

From net realized capital gains | | | (3,159,409) | | | | (2,993,123) | |

| |

Total Distributions: Common Stock | | | (3,242,551) | | | | (2,993,123) | |

| |

Net Increase/(Decrease) in Net Assets Applicable to

Common Stockholders | | | 943,894 | | | | (2,588,369) | |

| | |

REPURCHASE OF AUCTION PREFERRED

SHARES (PAR VALUE) | | | – | | | | (18,000,000) | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of period | | | 96,867,022 | | | | 117,455,391 | |

| |

End of period (Including undistributed/(overdistributed) net investment income of $259,825 and $(38,620), respectively) | | | 97,810,916 | | | | 96,867,022 | |

| | | | | | | | | |

Auction Preferred Shares (APS) Par Value | | | (21,950,000) | | | | (21,950,000) | |

| |

Net Assets Applicable to Common Stockholders | | $ | 75,860,916 | | | $ | 74,917,022 | |

| | | | | | | | | |

| | |

| See Accompanying Notes to Financial Statements. | | |

| | |

The Denali Fund Inc. | | Statement of Cash Flows |

| | For the Six Months Ended April 30, 2012 (Unaudited) |

| | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

Net increase in net assets from operations excluding dividends on Auction

Preferred Shares and gains on Auction Preferred Shares redemption | | $ | 4,195,050 | |

Adjustments to reconcile net increase/(decrease) in net assets from

operations to net cash used in operating activities: | | | | |

Purchase of investment securities | | | (1,447,915) | |

Proceeds from disposition of investment securities | | | 4,355,718 | |

Net proceeds from disposition of short-term investment securities | | | 29,120 | |

Net realized gain on investment securities | | | (1,358,667) | |

Net realized loss on foreign currency related transactions | | | 6,536 | |

Net change in unrealized appreciation on investment securities | | | (2,451,028) | |

Net change in unrealized appreciation on foreign currency related transactions | | | (1,699) | |

Increase in interest and dividends receivable | | | (8,665) | |

Increase in receivable for investment securities sold | | | (12,363) | |

Increase in other assets | | | (13,653) | |

Decrease in payable for co-advisory fees | | | (4,800) | |

Decrease in payable for legal and audit fees | | | (16,912) | |

Increase in payable for administration & co-administration fees | | | 318 | |

Increase in payable for printing fees | | | 5,734 | |

Decrease in payable for directors’ fees and expenses | | | (11,753) | |

Increase in accrued expenses | | | (8,506) | |

| |

Net Cash Used in Operating Activities | | | 3,256,515 | |

| |

| |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

Cash distributions paid on Common Stock | | | (3,242,551) | |

Cash distributions paid on Auction Preferred Shares | | | (8,692) | |

| |

Net Cash Used in Financing Activities | | | (3,251,243) | |

| |

| |

Effect of exchange rates on cash | | $ | (4,837) | |

| | | | |

Net increase in cash | | $ | 435 | |

Cash and foreign currency, beginning balance | | $ | 84,201 | |

| | | | |

Cash and foreign currency, ending balance | | $ | 84,636 | |

| | | | |

| | |

| See Accompanying Notes to Financial Statements. | | |

| | | | |

Semi-Annual Report | April 30, 2012 | | | 13 | |

| | |

Financial Highlights | | |

For a Common Share Outstanding Throughout Each Period | | |

Contained below is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the period indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s shares.

|

|

OPERATING PERFORMANCE |

Net Asset Value - Beginning of Period |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

Net investment income(a) |

Net realized and unrealized gain/(loss) on investments |

Total from Investment Operations |

|

PREFERRED SHARES TRANSACTIONS |

Distributions paid from net investment income |

Distributions paid from net realized capital gains |

Gain on redemption of Auction Preferred Shares |

Total Preferred Shares* Transactions |

|

Net Increase/(Decrease) from Operations Applicable to Common Stock |

|

DISTRIBUTIONS: COMMON STOCK |

Distributions paid from net investment income |

Distributions paid from net realized capital gains |

Distributions paid from tax return of capital |

Total Distributions Paid to Common Stockholders |

| |

| |

Common Stock Net Asset Value - End of Period |

| |

Common Stock Market Value - End of Period |

| |

|

Total Return, Common Stock Net Asset Value(c) |

Total Return, Common Stock Market Value(c) |

|

RATIOS TO AVERAGE NET ASSETS AVAILABLE TO COMMON STOCKHOLDERS:(d) |

Ratio of operating expenses to average net assets including waiver |

Ratio of operating expenses to average net assets excluding waiver |

Ratio of net investment income to average net assets including waiver |

Ratio of net investment income to average net assets excluding waiver |

|

SUPPLEMENTAL DATA: |

Portfolio turnover rate |

Net Assets Applicable to Common Stockholders, End of Period (000s) |

See Accompanying Notes to Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | |

For the Six Months Ended April 30, 2012

(Unaudited) | | | For the Year Ended October 31, 2011 | | | For the Year Ended October 31, 2010 | | | For the Year Ended October 31, 2009 | | | For the Year Ended October 31, 2008 | | | For the Year Ended October 31, 2007 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | $18.02 | | | | $18.64 | | | | $15.66 | | | | $15.36 | | | | $25.33 | | | | $32.22 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 0.09 | | | | 0.09 | | | | 0.07 | | | | 0.07 | | | | 0.59 | | | | 1.26 | |

| | 0.92 | | | | (0.20) | | | | 3.10 | | | | 0.24 | | | | (6.53) | | | | (4.03) | |

| | 1.01 | | | | (0.11) | | | | 3.17 | | | | 0.31 | | | | (5.94) | | | | (2.77) | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.00) | (b) | | | (0.00) | (b) | | | (0.02) | | | | (0.04) | | | | (0.11) | | | | (0.19) | |

| | – | | | | (0.01) | | | | – | | | | – | | | | (0.29) | | | | (0.36) | |

| | – | | | | 0.22 | | | | 0.03 | | | | 0.03 | | | | – | | | | – | |

| | (0.00) | (b) | | | 0.21 | | | | 0.01 | | | | (0.01) | | | | (0.40) | | | | (0.55) | |

| | | | | |

| | 1.01 | | | | 0.10 | | | | 3.18 | | | | 0.30 | | | | (6.34) | | | | (3.32) | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.02) | | | | – | | | | (0.08) | | | | – | | | | (0.40) | | | | (1.24) | |

| | (0.76) | | | | (0.72) | | | | (0.12) | | | | – | | | | (2.86) | | | | (2.33) | |

| | – | | | | – | | | | – | | | | – | | | | (0.37) | | | | – | |

| | (0.78) | | | | (0.72) | | | | (0.20) | | | | – | | | | (3.63) | | | | (3.57) | |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | $18.25 | | | | $18.02 | | | | $18.64 | | | | $15.66 | | | | $15.36 | | | | $25.33 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | $14.72 | | | | $15.02 | | | | $15.67 | | | | $13.25 | | | | $11.27 | | | | $22.08 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | 6.9 | % | | | 1.3 | % | | | 20.7 | % | | | 2.0 | % | | | (25.3) | % | | | (10.7) | % |

| | 3.4 | % | | | 0.4 | % | | | 19.9 | % | | | 17.6 | % | | | (37.1) | % | | | (10.6) | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2.40 | %(f) | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 0.72 | %(e)(g) |

| | 2.35 | %(f) | | | 2.64 | % | | | 2.80 | % | | | 3.30 | % | | | 1.77 | % | | | 0.71 | %(g) |

| | 1.07 | %(f) | | | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 4.34 | % |

| | 1.02 | %(f) | | | 0.51 | % | | | 0.38 | % | | | 0.51 | % | | | 1.98 | % | | | 4.33 | % |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | 2 | % | | | 7 | % | | | 7 | % | | | 25 | % | | | 91 | % | | | 17 | % |

| | $75,861 | | | | $74,917 | | | | $77,505 | | | | $65,088 | | | | $63,854 | | | | $105,292 | |

| | | | |

Semi-Annual Report | April 30, 2012 | | | 15 | |

| | |

Financial Highlights | | The Denali Fund Inc. |

| | |

| * | Auction Preferred Shares (“APS”) |

| (a) | Calculated based on the average number of shares outstanding during each fiscal period. |

| (b) | Amount represents less than $(0.01) per share. |

| (c) | Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during each fiscal period. Total return based on common stock market value assumes the purchase of common stock at the market price on the first day and sale of common stock at the market price on the last day of the period indicated. Dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s distribution reinvestment plan. |

| (d) | Expense and net investment income ratios do not include the effect of transactions with preferred stockholders. Income ratios include income earned on assets attributable to APS outstanding. |

| (e) | The Fund is required to calculate an expense ratio without taking into consideration any expense reductions related to offset arrangements. The Fund has not had an offset arrangement since 2007. |

| (g) | After waiver of, depending on the period, all or a portion of the management and/or administration fees by prior management. Had prior management not undertaken such actions, the annualized expenses of net expenses to average daily assets applicable to common stockholders would have been 1.83% for the year ended October 31, 2007. |

The table below sets out information with respect to APS currently outstanding.(1)

| | | | | | | | |

| | | Par Value (000) | | Total Shares

Outstanding (000) | | Asset Coverage Per Share(2) | | Involuntary

Liquidating Preference

Per Share(3) |

04/30/12 | | $21,950 | | 0.88 | | $111,402 | | $25,000 |

10/31/11 | | 21,950 | | 0.88 | | 110,327 | | 25,000 |

10/31/10 | | 39,950 | | 1.60 | | 73,502 | | 25,000 |

10/31/09 | | 40,700 | | 1.63 | | 64,980 | | 25,000 |

10/31/08 | | 42,000 | | 1.68 | | 62,992 | | 25,000 |

10/31/07 | | 42,000 | | 1.68 | | 87,698 | | 25,000 |

| (2) | Calculated by subtracting the Fund’s total liabilities from the Fund’s total assets and dividing by the number of APS outstanding. |

| (3) | Excludes accumulated undeclared dividends. |

See Accompanying Notes to Financial Statements.

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | April 30, 2012 (Unaudited) |

1. SIGNIFICANT ACCOUNTING POLICIES

The Denali Fund Inc. (the “Fund”) (formerly known as the Neuberger Berman Real Estate Income Fund Inc.) was incorporated in Maryland on September 11, 2002 as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors of the Fund (the “Board”) may classify or re-classify any unissued shares of capital shares into one or more classes of preferred shares without the approval of stockholders.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements is in accordance with generally accepted accounting principles in the United States of America (“GAAP”) which requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Portfolio Valuation: Equity securities for which market quotations are readily available (including securities listed on national securities exchanges and those traded over-the-counter) are valued based on the closing price from the applicable exchange. If such equity securities were not traded on the valuation date, but market quotations are readily available, they are valued at the mean between the closing bid and asked prices provided by an independent pricing service or by principal market makers. Equity securities traded on NASDAQ are valued at the NASDAQ Official Closing Price (“NOCP”). Debt securities are valued at the mean between the closing bid and asked prices, or based on a matrix system which utilizes information (such as credit ratings, yields and maturities) from an independent pricing service, principal market maker, or other independent sources. Where market quotations are not readily available or where the pricing agent or market maker does not provide a valuation or methodology, or provides a valuation or methodology that, in the judgment of the advisers, does not represent fair value (“Fair Value Securities”), securities are valued at fair value by a Pricing Committee appointed by the Board of Directors, in consultation with the advisers. Short-term debt securities with less than 60 days until maturity may be valued at cost which, when combined with interest earned, approximates market value.

The Fund’s investments in unregistered pooled investment vehicles (“Hedge Funds”) are valued, as a practical expedient, at the most recent estimated net asset value periodically determined by the respective Hedge Fund managers according to such manager’s policies and procedures based on valuation information reasonably available to the Hedge Fund manager at that time (adjusted for estimated expenses and fees accrued to the Fund since the last valuation date); provided, however, that the Pricing Committee may consider whether it is appropriate, in light of relevant circumstances, to adjust such valuation in accordance with the Fund’s valuation procedures. If a Hedge Fund does not report a value to the Fund on a timely basis, the fair value of such Hedge Fund shall be based on the most recent value reported by the Hedge Fund, as well as any other relevant information available at the time the Fund values its portfolio. As a practical matter, Hedge Fund valuations generally can be obtained from Hedge Fund managers on a weekly basis, as of close of business Thursday, but the frequency and timing of receiving valuations for Hedge Fund investments is subject to change at any time, without notice to investors, at the discretion of the Hedge Fund manager or the Fund.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the Fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of

| | | | |

Semi-Annual Report | April 30, 2012 | | | 17 | |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

some or all of its portfolio securities, the Fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the Fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The Fund may also fair value securities in other situations, such as when a particular foreign market is closed but the U.S. market is open. The Fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The Fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. If the Fund uses adjusted prices, the Fund will periodically compare closing prices, the next day’s opening prices in the same markets and those adjusted prices as a means of evaluating its security valuation process.

Various inputs are used to determine the value of the Fund’s investments. Observable inputs are inputs that reflect the assumptions market participants would use based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions based on the best information available in the circumstances. These inputs are summarized in the three broad levels listed below.

| | |

Level 1— | | Unadjusted quoted prices in active markets for identical investments |

Level 2— | | Significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

Level 3— | | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following is a summary of the inputs used as of April 30, 2012 in valuing the Fund’s investments carried at value:

| | | | | | | | |

Investments in Securities at Value* | | Level 1 - Quoted Prices | | Level 2 - Other

Significant

Observable Inputs | | Level 3 - Significant

Unobservable Inputs | | Total |

Domestic Common Stocks | | $62,595,963 | | $– | | $– | | $62,595,963 |

Foreign Common Stocks | | 6,067,384 | | – | | – | | 6,067,384 |

Auction Preferred Securities | | – | | 7,089,130 | | – | | 7,089,130 |

Limited Partnerships | | – | | – | | 11,346,620 | | 11,346,620 |

Short Term Investments | | 10,736,106 | | – | | – | | 10,736,106 |

TOTAL | | $79,399,453 | | $7,089,130 | | $11,346,620 | | $97,835,203 |

| | | | | | | | | |

During the six months ended April 30, 2012, there were no significant transfers between Level 1 and 2 securities. The Fund evaluates transfers into or out of Level 1, Level 2 and Level 3 as of the end of the reporting period.

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | April 30, 2012 (Unaudited) |

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | | | | | | | | | | | |

Investments in Securities at Value* | | Balance as

of 10/31/2011 | | | Realized

gain/

(loss) | | Change in

unrealized

appreciation/

(depreciation) | | | Net

purchases/

(sales) | | Transfer in

and/or (out)

of Level 3 | | Balance as of 4/30/2012 | | | Net change in

unrealized

appreciation

included in

the Statement

of Operations

attributable to

Level 3

investments

still held at

4/30/2012 | |

Limited Partnerships | | | $9,993,383 | | | $– | | | $1,353,237 | | | $

– | | $

– | | | $11,346,620 | | | | $1,353,237 | |

TOTAL | | | $9,993,383 | | | $

– | | | $1,353,237 | | | $

– | | $

– | | | $11,346,620 | | | | $1,353,237 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| * | For detailed descriptions, see the accompanying Portfolio of Investments. |

Recent Accounting Pronouncements: In April 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (ASU) No. 2011-03 “Transfers and Servicing (Topic 860): Reconsideration of Effective Control for Repurchase Agreements.” The ASU 2011-03 is intended to improve financial reporting of repurchase agreements and other agreements that both entitle and obligate a transferor to repurchase or redeem the financial assets before their maturity. The ASU is effective for the first interim or annual period beginning on or after December 15, 2011. Management is currently evaluating the impact this ASU may have on the Fund’s financial statements.

In May 2011, the FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in U.S. GAAP and International Financial Reporting Standards (IFRS). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose quantitative information about the unobservable inputs used in the fair value measurements categorized within Level 3 of the fair value hierarchy. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. Management is currently evaluating the impact this ASU may have on the Fund’s financial statements.

Securities Transactions and Investment Income: Securities transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded as of the ex-dividend date, or for certain foreign securities, when the information becomes available to the Fund. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis, using the interest method.

| | | | |

Semi-Annual Report | April 30, 2012 | | | 19 | |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

Dividend income from investments in real estate investment trusts (“REITs”) is recorded at management’s estimate of income included in distributions received. Distributions received in excess of this amount are recorded as a reduction of the cost of investments. The actual amount of income and return of capital are determined by each REIT only after its fiscal year-end, and may differ from the estimated amounts. Such differences, if any, are recorded in the Fund’s following year.

Foreign Currency Translations: The Fund may invest a portion of its assets in foreign securities. In the event that the Fund executes a foreign security transaction, the Fund will generally enter into a forward foreign currency contract to settle the foreign security transaction. Foreign securities may carry more risk than U.S. securities, such as political, market and currency risks. See Foreign Issuer Risk below.

The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rate prevailing at the end of the period, and purchases and sales of investment securities, income and expenses transacted in foreign currencies are translated at the exchange rate on the dates of such transactions. Foreign currency gains and losses result from fluctuations in exchange rates between trade date and settlement date on securities transactions, foreign currency transactions and the difference between the amounts of foreign interest and dividends recorded on the books of the Fund and the amounts actually received.

The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Foreign Issuer Risk: Investment in non-U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers. These risks may include, but are not limited to: (i) less information about non-U.S. issuers or markets may be available due to less rigorous disclosure, accounting standards or regulatory practices; (ii) many non-U.S. markets are smaller, less liquid and more volatile thus, in a changing market, the advisers may not be able to sell the Fund’s portfolio securities at times, in amounts and at prices they consider reasonable; (iii) currency exchange rates or controls may adversely affect the value of the Fund’s investments; (iv) the economies of non-U.S. countries may grow at slower rates than expected or may experience downturns or recessions; and, (v) withholdings and other non-U.S. taxes may decrease the Fund’s return.

Concentration Risk: The Fund operates as a “non-diversified” investment company, as defined in the 1940 Act. As a result of being “non-diversified”, with respect to 50% of the Fund’s portfolio, the Fund must limit to 5% the portion of its assets invested in the securities of a single issuer. In addition, no single investment can exceed 25% of the Fund’s total assets at the time of purchase. A more concentrated portfolio may cause the Fund’s net asset value to be more volatile and thus may subject stockholders to more risk. Thus, the volatility of the Fund’s common stock, and the Fund’s net asset value and its performance in general, depends disproportionately more on the performance of a smaller number of holdings than that of a more diversified fund.

Effective July 30, 2010, the Fund implemented a Board initiated and approved fundamental investment policy, which prohibits the Fund from investing more than 4% of its total assets (including leverage) in any single issuer at the time of purchase. The Fund’s holdings as of July 30,

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | April 30, 2012 (Unaudited) |

2010 were grandfathered into the policy and so any positions already greater than 4% of total assets are exempt from this limitation.

Hedge Fund Risk: The Fund invests a portion of its assets in a Hedge Fund. The Fund’s investment in a Hedge Fund is a private entity that is not registered under the 1940 Act and has limited regulatory oversight and disclosure obligations. In addition, the Hedge Fund invests in and actively trades securities and other financial instruments using different strategies and investment techniques, which involve significant risks. These strategies and techniques may include, among others, leverage, employing various types of derivatives, short selling, securities lending, and commodities’ trading. Hedge Funds may invest a high percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Hedge Fund may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility. These and other risks associated with Hedge Funds may cause the Fund’s net asset value to be more volatile and more susceptible to the risk of loss than that of other funds with a different investment strategy.

Changes in Investment Policies: Effective August 1, 2011, the Board approved a proposal to eliminate the Fund’s non-fundamental policy limiting the Fund’s ability to investment more than (i) 3% of the total voting stock of any one investment company; (ii) 5% of the Fund’s total assets with respect to any one investment company; and (iii) 10% of the Fund’s total assets in the aggregate.

Distributions to Stockholders: Income distributions and capital gain distributions are determined in accordance with income tax regulations, per requirements under Subchapter M of the Internal Revenue Code. Distributions to stockholders are recorded by the Fund on the ex-dividend date.

In November 2008 the SEC issued an order approving exemptive relief for the Fund, from Section 19(b) and Rule 19b-1 under the Securities Act of 1940 (the “Order”). This would allow the Fund to employ a managed distribution plan (the “Plan”) rather than a level distribution plan. In December 2008, the Board approved adoption of the Plan. The Fund implemented the Plan for the fiscal year ended October 31, 2008.

Repurchase Agreements: The Fund may enter into repurchase agreements with institutions that management has determined are creditworthy. Each repurchase agreement is recorded at cost. The Fund requires that the securities purchased in a repurchase agreement be transferred to the custodian in a manner sufficient to enable the Fund to assert a perfected security interest in those securities in the event of a default under the repurchase agreement. The Fund monitors, on a daily basis, the value of the securities transferred to ensure that their value, including accrued interest, is greater than amounts owed to the Fund under each such repurchase agreement. The Fund had no outstanding repurchase agreements as of April 30, 2012.

Indemnifications: Like many other companies, the Fund’s organizational documents provide that its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of its principal service contracts and in the normal course of its business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Fund’s maximum exposure under these arrangements is unknown as this could involve future claims against the Fund.

Federal Income Tax: For Federal income tax purposes, the Fund currently qualifies, and intends to remain qualified as a regulated investment company under the provisions of Subchapter M of

| | | | |

Semi-Annual Report | April 30, 2012 | | | 21 | |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

the Internal Revenue Code by distributing substantially all of its earnings to its stockholders. Accordingly, no provision for federal income or excise taxes has been made.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole.

Management has concluded there are no uncertain tax positions that require recognition of a tax liability. The Fund files income tax returns in the U.S. federal jurisdiction and Colorado. The statute of limitations on the Fund’s federal and state tax filings remains open for the fiscal years ended October 31, 2008, through October 31, 2011.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Modernization Act”) was signed into law. The provisions of the Modernization Act are generally effective for tax years beginning after the date it was signed into law so the enacted provisions will apply to the Fund for the fiscal year ending October 31, 2012. The Modernization Act is the first major piece of legislation affecting regulated investment companies (“RICs”) since 1986 and it modernizes several of the federal income and excise tax provisions related to RICs. Some highlights of the enacted provisions are as follows:

| | ¡ | | New capital losses may now be carried forward indefinitely, and retain the character of the original loss. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss. |

| | ¡ | | The Modernization Act contains simplification provisions, which are aimed at preventing disqualification of a RIC for “inadvertent” failures of the asset diversification and/or qualifying income tests. Additionally, the Modernization Act exempts RICs from the preferential dividend rule,and repealed the 60-day designation requirement for certain types of paythrough income and gains. |

| | ¡ | | Finally, the Modernization Act contains several provisions aimed at preserving the character of distributions made by a RIC during the portion of its taxable year ending after October 31 or December 31, reducing the circumstances under which a RIC might be required to file amended Forms 1099 to restate previously reported distributions. |

2. MANAGEMENT FEES, ADMINISTRATION FEES, AND OTHER AGREEMENTS

Boulder Investment Advisers, L.L.C. (“BIA”) and Stewart Investment Advisers (“SIA”) (together, the “Advisers”) serve as co-advisers to the Fund. The Fund pays the Advisers a monthly fee at an annual rate of 1.25% of the value of the Fund’s average monthly total net assets plus the principal amount of leverage, if any (“Net Assets”) (“Advisory Fee”). Effective December 1, 2011, BIA and SIA agreed to waive 0.10%of the Advisory Fee such that the Advisory Fee will be calculated at the annual rate of 1.15% of Net Assets. The fee waiver agreement has a one-year term and is renewable annually.

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | April 30, 2012 (Unaudited) |

The equity owners of BIA are Evergreen Atlantic, LLC, a Colorado limited liability company (“EALLC”), and the Lola Brown Trust No. 1B (the “Lola Trust”), each of which is considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act. The Lola Trust is also a stockholder of the Fund (See Note 6). Stewart West Indies Trading Company, Ltd. is a Barbados international business company doing business as Stewart Investment Advisers. The equity owner of SIA is the Stewart West Indies Trust. SIA and BIA are considered “affiliated persons”, as that term is defined in the 1940 Act, of the Fund and Fund Administrative Services, LLC (“FAS”). SIA receives a fee equal to 75% of the fees earned by the Advisers and BIA receives 25% of the fees earned by the Advisers.

FAS serves as the Fund’s co-administrator. Under the Administration Agreement, FAS provides certain administrative and executive management services to the Fund. The Fund pays FAS a monthly fee, calculated at an annual rate of 0.20% of the value of the Fund’s Net Assets up to $100 million, and 0.15% of the Fund’s Net Assets over $100 million. The equity owners of FAS are EALLC and the Lola Trust, each of which is considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act.

As BIA, SIA and FAS are considered affiliates of the Fund, as the term is defined in the 1940 Act, agreements between the Fund and those entities are considered affiliated transactions.

The Fund pays each Director who is not a director, officer, employee, or affiliate of the Advisers or FAS, a fee of $8,000 per annum, plus $3,000 for each in-person meeting of the Board of Directors and $500 for each telephone meeting. In addition, the Chairman of the Board and the Chairman of the Audit Committee each receive $1,000 per meeting and each member of the Audit Committee receives $500 per meeting. Each member of the Nominating Committee receives $500 per meeting. The Fund will also reimburse independent Directors for travel and out-of-pocket expenses incurred in connection with such meetings.

ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s co-administrator. As compensation for its services, ALPS receives certain out-of-pocket expenses and asset-based fees, which are accrued daily and paid monthly. Fees paid to ALPS are calculated based on combined Net Assets of the Fund, and the following affiliates of the Fund: Boulder Total Return Fund, Inc., Boulder Growth & Income Fund, Inc., and First Opportunity Fund, Inc. (the “Fund Group”). ALPS receives the greater of the following, based on combined Net Assets of the Fund Group: an annual minimum of $460,000, or an annualized fee of 0.045% on Net Assets up to $1 billion, an annualized fee of 0.03% on Net Assets between $1 and $3 billion, and an annualized fee of 0.02% on Net Assets above $3 billion.

Bank of New York Mellon (“BNY Mellon”) serves as the Fund’s custodian and Computershare Shareowner Services (“Computershare”) serves as the Fund’s Common Stock servicing agent, dividend-paying agent and registrar. As compensation for BNY Mellon’s and Computershare’s services, the Fund pays each a monthly fee plus certain out-of-pocket expenses. BNY Mellon also serves as the Fund’s Preferred Stock transfer agent, dividend disbursing agent and redemption agent.

| | | | |

Semi-Annual Report | April 30, 2012 | | | 23 | |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

3. SECURITIES TRANSACTIONS

During the six months ended April 30, 2012, there were purchase and sale transactions (excluding short term securities) of $1,447,915 and $4,355,718, respectively.

On April 30, 2012, based on cost of $79,792,154 for federal income tax purposes, aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $23,117,307, and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value was $5,074,258, resulting in net unrealized appreciation of $18,043,049.

4. CAPITAL

The Fund has authorized a total of 999,998,000, $0.0001 par value Common Shares, which may be converted into Preferred Shares. At April 30, 2012, 4,157,117 Common Shares were outstanding.

Transactions in common stock were as follows:

| | | | | | | | |

| | | For the Six Months Ended

April 30, 2012

(Unaudited) | | | For the Year Ended

October 31, 2011 | |

Beginning Shares | | | 4,157,117 | | | | 4,157,117 | |

Shares Sold | | | – | | | | – | |

Shares Issued in Reinvestment of Distributions | | | – | | | | – | |

Total | | | 4,157,117 | | | | 4,157,117 | |

Less Shares Redeemed | | | – | | | | – | |

Ending Shares | | | 4,157,117 | | | | 4,157,117 | |

| | | | | | | | | |

5. PREFERRED SHARES

On February 7, 2003, the Fund issued 1,260 Series A Auction Preferred Shares (“Preferred Shares”). On September 10, 2003, the Fund re-classified an additional 500 unissued shares of capital shares as Preferred Shares. On October 24, 2003, the Fund issued an additional 420 Preferred Shares. All Preferred Shares have a liquidation preference of $25,000 per share plus any accumulated unpaid distributions, whether or not earned or declared by the Fund, but excluding interest thereon (“Liquidation Value”).

On October 23, 2009, the Fund retired 52 Preferred Shares, with a total par value of $1,300,000. Those shares were purchased at a discount, at $22,500 per share, resulting in a realized gain of $130,000.

On May 18, 2010, the Fund commenced an offer to purchase for cash up to 400 of its outstanding Series A Preferred Shares. Upon expiration of the tender offer on August 3, 2010, 30 Preferred Shares were validly tendered pursuant to the terms of the offer. Those 30 shares were tendered for an aggregate amount of approximately $637,500, or $21,250 per share. This resulted in a realized gain to the Fund of $112,500. The Fund subsequently retired the 30 Preferred Shares.

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | April 30, 2012 (Unaudited) |

On June 22, 2011, the Fund commenced an offer to purchase for cash up to 720 of its outstanding Series A Preferred Shares. Upon expiration of the tender offer on July 22, 2011, 720 Preferred Shares were validly tendered pursuant to the terms of the offer. Those 720 shares were tendered for an aggregate amount of approximately $17,100,000, or $23,750 per share. This resulted in a realized gain to the Fund of $900,000. The Fund subsequently retired the 720 Preferred Shares.

Distributions to preferred stockholders, which are cumulative, are accrued daily and paid every 7 days. Distribution rates were reset every 7 days based on the results of an auction. In February 2008, the auction preferred shares market for closed-end funds became illiquid resulting in failed auctions for the Preferred Shares. As such, the Fund continues to pay dividends on the Preferred Shares at the maximum rate (set forth in the Fund’s governing document for the Preferred Shares), set at the current 7-day “AA” Financial Composite Commercial Paper rate times 150%.

For the six months ended April 30, 2012, distribution rates ranged from 0.03% to 0.09%. The Fund declared distributions to preferred stockholders for the period November 1, 2011 to April 30, 2012 of $8,605.

The Fund is subject to certain limitations and restrictions while Preferred Shares are outstanding. Failure to comply with these limitations and restrictions could preclude the Fund from declaring any dividends or distributions to common stockholders or repurchasing common shares and/or could trigger the mandatory redemption of Preferred Shares at their liquidation value. Specifically, the Fund is required under the Fund’s Statement of Preferences and the Investment Company Act of 1940 to maintain certain asset coverage with respect to the outstanding Preferred Shares. The holders of Preferred Shares are entitled to one vote per share and will vote with holders of common stock as a single class, except that the Preferred Shares will vote separately as a class on certain matters, as required by law or the Fund’s charter. The holders of the Preferred Shares, voting as a separate class, are entitled at all times to elect two Directors of the Fund, and to elect a majority of the Directors of the Fund if the Fund fails to pay distributions on Preferred Shares for two consecutive years.

In connection with the settlement of each Preferred Share auction, the Fund pays, through the auction agent, a service fee to each participating broker-dealer based upon the aggregate liquidation preference of the Preferred Shares held by the broker-dealer’s customers. Prior to February 19, 2009 the Fund paid at an annual rate 0.25% and upon this date the annual rate was reduced to 0.05%, until further notice from the Fund. These fees are paid for failed auctions as well.

6. SIGNIFICANT STOCKHOLDERS

On April 30, 2012, the Lola Trust owned 3,193,182 Common Shares of the Fund, representing approximately 76.8% of the total Fund shares. The Lola Trust is an affiliated person of the Fund, as that term is defined in the 1940 Act. Also see Note 2 – Management fees, Administration fees, and Other Agreements.

7. SHARE REPURCHASE PROGRAM

In accordance with Section 23(c) of the 1940 Act, the Fund may from time to time, effect redemptions and/or repurchases of its Preferred Shares and/or its Common Stock, in the open

| | | | |

Semi-Annual Report | April 30, 2012 | | | 25 | |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

market or through private transactions; at the option of the Board of Directors and upon such terms as the Directors shall determine.

For the year ended October 31, 2011, the Fund purchased 720 Preferred Shares at a discount and retired them at par value, pursuant to terms of the tender offer. For the year ended October 31, 2010, the Fund purchased 30 Preferred Shares at a discount and retired them at par value. Both of these transactions are described further in Note 5 – Preferred Shares. The Fund did not repurchase any Preferred Shares during the six months ended April 30, 2012.

8. TAX BASIS DISTRIBUTIONS

As determined on October 31, 2011, permanent differences resulting primarily from different book and tax accounting for distributions and certain investments held by the Fund were reclassified at fiscal year-end. These reclassifications had no effect on the net increase in net assets resulting from operations, net asset value applicable to common stockholders or net asset value per common share of the Fund. Permanent book and tax basis differences of $(321,880), $(577,157) and $899,037 were reclassified at October 31, 2011 among undistributed net investment income, accumulated net realized gains on investments, and paid in capital, respectively, for the Fund.

The tax character of distributions paid during the years ended October 31, 2011 and October 31, 2010 was as follows:

| | | | |

| | | Year Ended October 31, 2011 | | Year Ended October 31, 2010 |

Distributions paid from: | | | | |

Ordinary Income | | $1,765,474 | | $927,055 |

Long-Term Capital Gain | | $1,290,955 | | – |

Tax Return of Capital | | – | | – |

| | | $3,056,429 | | $927,055 |

As of October 31, 2011, the components of distributable earnings on a U.S. federal income tax basis were as follows:

| | |

Undistributed Ordinary Income | | $ 733,394 |

Accumulated Capital Gains | | $ 2,592,904 |

Net Unrealized Appreciation | | $ 16,729,447 |

Other Cumulative Effect of Timing Differences | | $ (24,043) |

The difference between book and tax basis distributable earnings is attributable primarily to temporary differences related to mark to market of passive foreign investment companies and partnership book and tax differences.

NOTE 9. RESTRICTED SECURITIES

As of April 30, 2012, investments in securities included issues that are considered restricted. Restricted securities are often purchased in private placement transactions, are not registered under the Securities Act of 1933, may have contractual restrictions on resale, and may be valued under methods approved by the Board of Directors as reflecting fair value.

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | April 30, 2012 (Unaudited) |

Restricted securities as of April 30, 2012 were as follows:

| | | | | | | | | | | | | | | | | | | | |

| Issuer Description | | Acquisition

Date | | Cost | | Market Value

April 30, 2012 | | Market Value as

Percentage of Net

Assets Available to

Common Stock and

Preferred Shares

April 30, 2012 |

Ithan Creek Partners, LP | | | | 06/02/08 | | | | $ | 7,000,000 | | | | $ | 11,346,620 | | | | | 11.6 | % |

NOTE 10. INVESTMENTS IN LIMITED PARTNERSHIPS

As of April 30, 2012, the Fund had an investment in a Hedge Fund that is organized as a limited partnership. The Fund’s investment in the Hedge Fund is reported on the Portfolio of Investments under the section titled Limited Partnerships.

Since the investment in the limited partnership is not publicly traded, the Fund’s ability to make withdrawals from its investment is subject to certain restrictions. These restrictions include notice requirements for withdrawals and additional restrictions or charges for withdrawals within a certain time period following initial investment. In addition, there could be circumstances in which such restrictions can include the suspension or delay in withdrawals from the limited partnership, or limited withdrawals allowable only during specified times during the year. In certain circumstances a limited partner may not make withdrawals that occur within certain periods following the date of admission to the partnership. As of April 30, 2012, the Fund did not have any investments in limited partnerships in which a suspension of withdrawals was in effect.

The following table summarizes the Fund’s investment in the limited partnership as of April 30, 2012.

| | | | | | | | | | | | | | | | | | | | | |

| Description | | % of Net

Assets as

of 4/30/12 | | Value as of

4/30/12 | | Net Unrealized

Gain/ (Loss)

as of 4/30/12 | | Mgmt fees | | Incentive fees | | Redemption

Period/

Frequency |

Ithan Creek Partners, LP | | | | 11.6 | % | | | $ | 11,346,620 | | | | $ | 4,346,620 | | | Annual rate of 1% of net assets | | 20% of net profits at the end of the measurement period | | June 30 upon 60 days’ notice |

Total | | | | 11.6 | % | | | $ | 11,346,620 | | | | $ | 4,346,620 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

The Fund did not have any outstanding unfunded commitments as of April 30, 2012.

| | | | |

Semi-Annual Report | April 30, 2012 | | | 27 | |

| | |

Additional Information | | The Denali Fund Inc. |

April 30, 2012 (Unaudited) | | |

PROXY VOTING

The policies and procedures used to determine how to vote proxies relating to securities held by the Fund are available, without charge, at www.thedenalifund.com, on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov or by calling 303-449-0426. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available at www.sec.gov.

PORTFOLIO INFORMATION

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available (1) on the Fund’s website located at www.thedenalifund.com; (2) on the SEC’s website at www.sec.gov; or (3) may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

SENIOR OFFICER CODE OF ETHICS

The Fund files a copy of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer or controller, or persons performing similar functions (the “Senior Officer Code of Ethics”), with the SEC as an exhibit to its annual report on Form N-CSR. The Fund’s Senior Officer Code of Ethics is available on the Fund’s website located at http://www.thedenalifund.com.

FUND BYLAWS AND CHARTER

The Fund last amended its Charter effective January 19, 2010, and last amended its Bylaws effective July 30, 2010.

PRIVACY STATEMENT

Pursuant to SEC Regulation S-P (Privacy of Consumer Financial Information) the Directors of The Denali Fund Inc. (the “Fund”) have established the following policy regarding information about the Fund’s stockholders. We consider all stockholder data to be private and confidential, and we hold ourselves to the highest standards in its safekeeping and use.