UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-21200

The Denali Fund Inc.

(Exact Name of Registrant as Specified in Charter)

Fund Administrative Services

2344 Spruce Street, Suite A

Boulder, CO 80302

(Address of Principal Executive Offices)(Zip Code)

Fund Administrative Services

2344 Spruce Street, Suite A

Boulder, CO 80302

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:

(303) 444-5483

Date of Fiscal Year End: October 31

Date of Reporting Period: October 31, 2011

Item 1. Reports to Stockholders.

The Report to Stockholders is attached herewith.

| | |

The Denali Fund Inc. | | Letter from the Advisers |

| | | October 31, 2011 |

Dear Stockholders:

For the 12 month period ended October 31, 2011, The Denali Fund Inc. (the “Fund”) returned 1.3% on net assets. This compared to 8.1% returned by the S&P 500 during the same period. The table below shows the historic returns for the Fund for various periods ended October 31, 2011:

| | | | | | | | | | | | |

| Cumulative Returns | | 3 Months | | 6 Months | | One Year | | Three Years* | | Five Years* | | Since

October

2007** |

DNY (NAV) | | 0.3% | | -5.7% | | 1.3% | | 7.6% | | -3.6% | | -2.4% |

DNY (Market) | | 0.6% | | -8.1% | | 0.4% | | 12.3% | | -4.5% | | -2.8% |

S&P 500 Index | | -2.5% | | -7.1% | | 8.1% | | 11.4% | | 0.2% | | -3.0% |

DJIA | | -0.8% | | -5.4% | | 10.4% | | 11.8% | | 2.5% | | -1.0% |

NASDAQ Composite | | -2.4% | | -6.1% | | 8.1% | | 17.2% | | 3.5% | | -0.6% |

| ** | Annualized since October 2007, when the current Advisers became investment advisers to the Fund. |

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

From a price appreciation standpoint, the Fund’s largest holdings returned the following for the 12-month period ended October 31, 2011: Berkshire Hathaway, Inc., in which the Fund owns a $20.9 million stake (21.6% of the Fund’s assets), returned -2.0%; Ventas, Inc., a $12.6 million stake (13.0% of the Fund’s assets), returned 3.8%; Ithan Creek Partners, L.P., a hedge fund in which the Fund owns a $10.0 million stake (10.3% of the Fund’s assets), returned 7.1%; and Cohen & Steers Infrastructure Fund, a closed-end fund in which the Fund owns a $6.0 million stake (6.2% of the Fund’s assets), returned -3.3%. Based solely on price appreciation, the top performer for the period was the Fund’s investment in Unilever which was up 17.2%. The performance of the Fund’s investment in Altria, which returned 8.4% for the period, was also noteworthy.

It is of interest to note that Berkshire Hathaway announced on September 26, 2011 that its Board of Directors authorized a repurchase of Class A and Class B shares of Berkshire at prices no higher than a 10% premium over the then-current book value of the shares. For the one month period ending October 31, 2011, Class A and B shares returned 9.5% and 9.6%, respectively.

On the negative side, Alliance Bernstein, in which the Fund owns a $1.7 million stake (1.8% of the Fund’s assets), returned -41.9% during the period. Other detractors from performance included, RWE AG which returned -39.9% and Inergy which returned -26.9% for the period.

Since November 1, 2010, we have made new investments, including Cheung Kong Holdings Ltd. (1 HK), Freeport-McMoRan Copper & Gold Inc. (FCX), Public Service Enterprise (PEG), Scana Corp. (SCG) and Transocean Ltd. (RIG). Public Service Enterprise (PEG) has performed well since the Fund’s initial purchase on November 23, 2010 returning 10.5%. We also added to our positions in Alliance Bernstein, Unilever, and Inergy. During the Fund’s fiscal year, short-term weaknesses in the prices of Alliance Bernstein and Inergy allowed for an opportunity to add to our positions given our view of the positive long term prospects of both companies. We anticipate making

| | |

Annual Report | October 31, 2011 | | 1 |

| | |

Letter from the Advisers | | The Denali Fund Inc. |

| | | October 31, 2011 |

additional new investments as opportunities arise from time to time, although, because of the Fund’s investment restrictions, such positions will be on the smaller side relative to our earlier investments (e.g., not greater than 4% of the Fund’s assets at the time of purchase).

On July 25, 2011, the Fund announced the final results of its offer to purchase for cash up to 720 of its outstanding Series A auction preferred shares (“APS Shares”) at a purchase price equal to 95% of the liquidation preference of $25,000 per share (or, $23,750 per share). At the conclusion of the offering, 1,568 APS Shares were validly tendered pursuant to the tender offer. Of the 1,568 APS Shares tendered, 720 APS Shares were accepted for payment by the Fund. Payment of the aggregate consideration of approximately $17.1 million, not including accrued and unpaid dividends, was made on the 720 validly tendered APS Shares. The Fund subsequently retired the 720 APS Shares, realizing a gain of $900,000. Additional information regarding the Fund’s tender offer may be found on the Fund’s website at www.thedenalifund.com.

We are optimistic regarding the long term prospects for our investments and look forward to continuing to serve the Fund’s stockholders.

Sincerely,

Stephen C. Miller

President

The views and opinions in the preceding commentary are subject to change. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Note to Stockholders on the Fund’s Discount. As most stockholders are aware, the Fund’s shares presently trade at a significant discount to net asset value. The Fund’s board of directors is aware of this, monitors the discount and periodically reviews the limited options available to mitigate the discount. There are numerous factors affecting the Fund’s discount over which the board and management have little or no control. In the end, the market sets the Fund’s share price. For long-term stockholders of a closed-end fund, we believe the Fund’s discount should only be one of many factors taken into consideration at the time of your investment decision. If you buy shares at a 20% discount and hold for 10 years while the Fund returns 8% per annum and then sell at a 20% discount, your return on investment will be the same as if you bought the same shares at net asset value and sold at net asset value. Because the investment philosophy of the Advisers is long-term, we believe that stockholders who invest in the Fund for the short-term arbitrage on the discount ultimately may be disappointed. In contrast, we hope that stockholders who understand the Fund’s goals and, like the Fund’s largest stockholders, are long-term holders, will be rewarded for their patience.

| | |

The Denali Fund Inc. | | Financial Data |

| | | October 31, 2011 (Unaudited) |

| | | | | | | | | | | | | | | |

| | | | | Per Share of Common Stock | | |

| | | Net Asset

Value | | NYSE Closing Price | | Dividend

Paid |

10/31/10 | | | $ | 18.64 | | | | $ | 15.67 | | | | $ | 0.00 | |

11/30/10 | | | | 18.35 | | | | | 15.50 | | | | | 0.00 | |

12/31/10 | | | | 18.35 | | | | | 15.22 | | | | | 0.48 | ** |

1/31/11 | | | | 18.62 | | | | | 16.33 | | | | | 0.00 | |

2/28/11 | | | | 19.38 | | | | | 16.57 | | | | | 0.00 | |

3/31/11 | | | | 18.99 | | | | | 16.10 | | | | | 0.00 | |

4/30/11 | | | | 19.42 | | | | | 16.60 | | | | | 0.00 | |

5/31/11 | | | | 19.01 | | | | | 16.58 | | | | | 0.00 | |

6/30/11 | | | | 18.45 | | | | | 15.89 | | | | | 0.00 | |

7/31/11 | | | | 17.97 | | | | | 14.93 | | | | | 0.24 | *** |

8/31/11 | | | | 17.74 | | | | | 14.75 | | | | | 0.00 | |

9/30/11 | | | | 16.64 | | | | | 13.57 | | | | | 0.00 | |

10/31/11 | | | | 18.02 | | | | | 15.02 | | | | | 0.00 | |

** This distribution consisted of $0.28 per share short-term capital gains and $0.20 per share long-term capital gains.

*** This distribution consisted of $0.14 per share short-term capital gains and $0.10 per share long-term capital gains.

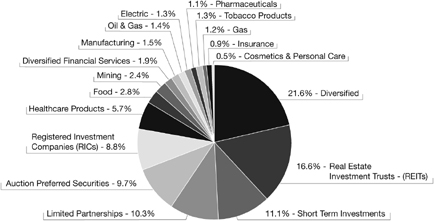

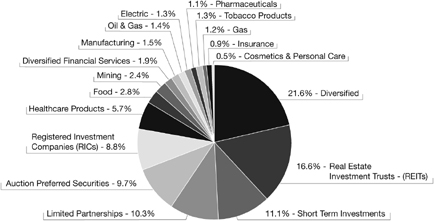

Investments as a % of Total Net Assets Available to Common Stock and Preferred Shares

| * | Less than 0.05% of total net assets available to common and preferred shares. |

| | |

Annual Report | October 31, 2011 | | 3 |

| | |

Portfolio of Investments | | The Denali Fund Inc. |

| | | October 31, 2011 |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

| |

LONG TERM INVESTMENTS 89.0% | | | | |

DOMESTIC COMMON STOCKS 63.1% | | | | |

Cosmetics & Personal Care 0.5% | | | | |

8,000 | | The Procter & Gamble Co. | | $ | 511,920 | |

| |

Diversified 21.6% | | | | |

179 | | Berkshire Hathaway, Inc., Class A* | | | 20,934,050 | |

| |

Diversified Financial Services 1.8% | | | | |

122,500 | | AllianceBernstein Holding LP | | | 1,735,825 | |

| |

Electric 1.1% | | | | |

16,600 | | Public Service Enterprise Group, Inc. | | | 559,420 | |

12,400 | | SCANA Corp. | | | 524,272 | |

| | | | | | |

| | | | | 1,083,692 | |

Gas 1.2% | | | | |

42,000 | | Inergy LP | | | 1,205,820 | |

| |

Healthcare Products 5.7% | | | | |

86,000 | | Johnson & Johnson | | | 5,537,540 | |

| |

Manufacturing 1.5% | | | | |

18,000 | | 3M Co. | | | 1,422,360 | |

| |

Mining 2.4% | | | | |

56,500 | | Freeport-McMoRan Copper & Gold, Inc. | | | 2,274,690 | |

| |

Oil & Gas 0.9% | | | | |

14,000 | | Diamond Offshore Drilling, Inc. | | | 917,560 | |

| |

Real Estate Investment Trusts (REITs) 16.3% | | | | |

112,000 | | LTC Properties, Inc. | | | 3,176,320 | |

226,200 | | Ventas, Inc. | | | 12,578,982 | |

| | | | | | |

| | | | | 15,755,302 | |

Registered Investment Companies (RICs) 8.8% | | | | |

366,952 | | Cohen & Steers Infrastructure Fund, Inc. | | | 5,992,326 | |

122,992 | | Flaherty & Crumrine/Claymore Total Return Fund, Inc. | | | 2,181,878 | |

24,411 | | RMR Asia Pacific Real Estate Fund | | | 374,953 | |

| | | | | | |

| | | | | 8,549,157 | |

Tobacco Products 1.3% | | | | |

45,000 | | Altria Group, Inc. | | | 1,239,750 | |

| | | | | | |

| |

TOTAL DOMESTIC COMMON STOCKS

(Cost $44,406,963) | | | 61,167,666 | |

| | | | | | |

| | |

The Denali Fund Inc. | | Portfolio of Investments |

| | | October 31, 2011 |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

FOREIGN COMMON STOCKS 5.9% | | | | |

Diversified Financial Services 0.1% | | | | |

5,000 | | Guoco Group, Ltd. | | $ | 47,723 | |

| |

Electric 0.2% | | | | |

4,500 | | RWE AG | | | 192,684 | |

| |

Food 2.8% | | | | |

78,000 | | Unilever NV | | | 2,694,977 | |

| |

Insurance 0.9% | | | | |

6,700 | | Muenchener Rueckversicherungs AG | | | 903,531 | |

| |

Oil & Gas 0.5% | | | | |

8,000 | | Transocean, Ltd. | | | 457,200 | |

| |

Pharmaceuticals 1.1% | | | | |

14,500 | | Sanofi | | | 1,042,507 | |

| |

Real Estate 0.0%(1) | | | | |

100 | | Cheung Kong Holdings, Ltd. | | | 1,259 | |

| |

Real Estate Investment Trusts (REITs) 0.3% | | | | |

390,199 | | Kiwi Income Property Trust | | | 332,929 | |

| | | | | | |

| |

TOTAL FOREIGN COMMON STOCKS

(Cost $5,108,273 ) | | | 5,672,810 | |

| | | | | | |

| |

AUCTION PREFERRED SECURITIES 9.7% | | | | |

160 | | Advent Claymore Global Convertible Securities & Income Fund, Series W7 | | | 3,308,316 | |

68 | | Gabelli Dividend & Income Trust, Series C | | | 1,441,906 | |

69 | | PIMCO Corporate Opportunity Fund, Series W | | | 1,255,560 | |

81 | | TS&W/Claymore Tax-Advantaged Balanced Fund | | | 1,809,637 | |

80 | | Western Asset Premier Bond Fund, Series M | | | 1,547,926 | |

| | | | | | |

| |

TOTAL AUCTION PREFERRED SECURITIES

(Cost $11,424,285) | | | 9,363,345 | |

| | | | | | |

| |

LIMITED PARTNERSHIPS 10.3% | | | | |

7 | | Ithan Creek Partners, LP*(2)(3) | | | 9,993,383 | |

| | | | | | |

| |

TOTAL LIMITED PARTNERSHIPS

(Cost $7,000,000) | | | 9,993,383 | |

| | | | | | |

| |

TOTAL LONG TERM INVESTMENTS

(Cost $67,939,521) | | | 86,197,204 | |

| | | | | | |

| | |

Annual Report | October 31, 2011 | | 5 |

| | |

Portfolio of Investments | | The Denali Fund Inc. |

| | | October 31, 2011 |

| | | | | | |

| Shares | | Description | | Value (Note 1) | |

SHORT TERM INVESTMENTS 11.1% | | | | |

Money Market Funds 11.1% | | | | |

365,227 | | Dreyfus Treasury Cash Management Money Market Fund, Institutional Class, 7 Day Yield - 0.010% | | $ | 365,227 | |

10,400,000 | | JPMorgan Prime Money Market Fund, 7 Day Yield - 0.096% | | | 10,400,000 | |

| | | | | | |

| |

Total Money Market Funds

(Cost $10,765,227) | | | 10,765,227 | |

| | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS

(Cost $10,765,227) | | | 10,765,227 | |

| | | | | | |

| |

TOTAL INVESTMENTS 100.1%

(Cost $78,704,748) | | | 96,962,431 | |

| | | | | | |

| |

OTHER ASSETS AND LIABILITIES (0.1%) | | | (95,096) | |

| | | | | | |

| |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCK AND PREFERRED SHARES 100.0% | | | 96,867,335 | |

| | | | | | |

| |

AUCTION PREFERRED SHARES (APS) REDEMPTION VALUE PLUS ACCRUED DIVIDENDS | | | (21,950,313) | |

| | | | | | |

| |

TOTAL NET ASSETS AVAILABLE TO COMMON STOCK | | $ | 74,917,022 | |

| | | | | | |

| | |

Abbreviations: |

AG - | | Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders. |

| |

LP - | | Limited Partnership. |

| |

Ltd. - | | Limited. |

| |

NV - | | Naamloze Vennootschap is the Dutch term for a public limited liability corporation. |

| |

* | | Non-income producing security. |

(1) | | Less than 0.05% of total net assets available to common stock and preferred shares. |

(2) | | Fair valued security under procedures established by the Fund’s Board of Directors. Total value of fair valued securities as of October 31, 2011 was $9,993,383, or 10.32% of total net assets available to common stock and preferred shares. |

| (3) | | Restricted Security; these securities may only be resold in transactions exempt from registration under the Securities Act of 1933. |

Percentages are stated as a percent of the Total Net Assets Available to Common Stock and Preferred Shares.

See Accompanying Notes to Financial Statements.

| | |

The Denali Fund Inc. | | Statement of Assets and Liabilities |

| | | October 31, 2011 |

| | | | |

ASSETS: | | | | |

Investments, at value (Cost $78,704,748) (Note 1) | | $ | 96,962,431 | |

Foreign Currency, at value (Cost $85,650) | | | 84,201 | |

Dividends and interest receivable | | | 45,238 | |

Prepaid expenses and other assets | | | 9,071 | |

Total Assets | | | 97,100,941 | |

| |

LIABILITIES: | | | | |

Investment co-advisory fees payable (Note 2) | | | 96,748 | |

Legal and audit fees payable | | | 56,029 | |

Administration and co-administration fees payable (Note 2) | | | 20,562 | |

Directors’ fees and expenses payable | | | 14,171 | |

Printing fees payable | | | 4,460 | |

Accrued expenses and other payables | | | 41,636 | |

Total Liabilities | | | 233,606 | |

Total Net Assets Applicable to Common and Preferred Shareholders | | $ | 96,867,335 | |

| | | | | |

| |

AUCTION PREFERRED SHARES: | | | | |

$0.0001 par value, 2,000 shares authorized, 878 shares outstanding, liquidation preference of $25,000 per share (Note 5) | | | 21,950,000 | |

Accrued dividends on auction preferred shares | | | 313 | |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 74,917,022 | |

| | | | | |

| |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) CONSIST OF: | | | | |

Par value of common stock (Note 4) | | $ | 416 | |

Paid-in capital in excess of par value of common stock | | | 54,884,904 | |

Overdistributed net investment income | | | (38,620) | |

Accumulated net realized gain on investments sold and foreign currency related transactions | | | 1,814,435 | |

Net unrealized appreciation on investments and foreign currency transactions | | | 18,255,887 | |

TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 74,917,022 | |

| | | | | |

Net Asset Value, $74,917,022/4,157,117 common stock outstanding | | $ | 18.02 | |

| | | | | |

See Accompanying Notes to Financial Statements.

| | |

Annual Report | October 31, 2011 | | 7 |

| | |

Statement of Operations | | The Denali Fund Inc. |

| | | For the Year Ended October 31, 2011 |

| | | | |

INVESTMENT INCOME: | | | | |

Dividends (Net of foreign withholding taxes $34,198) | | $ | 2,368,685 | |

Interest | | | 29,178 | |

Total Investment Income | | | 2,397,863 | |

| |

EXPENSES: | | | | |

Investment co-advisory fees (Note 2) | | | 1,386,267 | |

Administration and co-administration fees (Note 2) | | | 276,872 | |

Directors’ fees and expenses (Note 2) | | | 85,217 | |

Legal and audit fees | | | 77,528 | |

Preferred shares broker commissions and auction agent fees (Note 5) | | | 28,289 | |

Transfer agency fees | | | 20,962 | |

Insurance fees | | | 18,374 | |

Custody fees | | | 14,638 | |

Printing fees | | | 11,672 | |

Other | | | 88,474 | |

Total Expenses | | | 2,008,293 | |

Net Investment Income | | | 389,570 | |

| | |

| |

REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

Net realized gain/(loss) on: | | | | |

Investment securities | | | 2,266,797 | |

Foreign currency related transactions | | | (2,240) | |

| | | | 2,264,557 | |

Net change in unrealized appreciation/(depreciation) of: | | | | |

Investment securities | | | (3,094,318) | |

Foreign currency related translations | | | 8,251 | |

| | | | (3,086,067) | |

NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | | | (821,510) | |

PREFERRED SHARES TRANSACTIONS: | | | | |

Distributions from net investment income | | | (19,486) | |

Distributions from net realized capital gains | | | (43,820) | |

Gain on redemption of Auction Preferred Shares (Note 5) | | | 900,000 | |

Total Preferred Shares Transactions | | | 836,694 | |

| | |

NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS | | $ | 404,754 | |

| | |

See Accompanying Notes to Financial Statements.

| | |

The Denali Fund Inc. | | Statements of Changes in Net Assets |

| | | |

| | | | | | | | |

| | | For the Year Ended

October 31, 2011 | | | For the Year Ended

October 31, 2010 | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 389,570 | | | $ | 273,169 | |

Net realized gain on investment securities and foreign currency related transactions | | | 2,264,557 | | | | 2,230,967 | |

Net change in unrealized appreciation/(depreciation) on investments and foreign currency related translations | | | (3,086,067) | | | | 10,727,390 | |

| | | | (431,940) | | | | 13,231,526 | |

| | |

PREFERRED SHARES TRANSACTIONS: | | | | | | | | |

Distributions from net investment income | | | (19,486) | | | | (95,632) | |

Distributions from net realized capital gains | | | (43,820) | | | | – | |

Gain on redemption of Auction Preferred Shares (Note 5) | | | 900,000 | | | | 112,500 | |

Total Preferred Shares Transactions | | | 836,694 | | | | 16,868 | |

Net Increase in Net Assets Applicable to Common Stockholders Resulting from Operations | | | 404,754 | | | | 13,248,394 | |

| | |

DISTRIBUTIONS: COMMON STOCK | | | | | | | | |

From net investment income | | | – | | | | (332,569) | |

From net realized capital gains | | | (2,993,123) | | | | (498,854) | |

Total Distributions: Common Stock | | | (2,993,123) | | | | (831,423) | |

Net Increase/(Decrease) in Net Assets Applicable to Common Stockholders | | | (2,588,369) | | | | 12,416,971 | |

| | |

REPURCHASE OF AUCTION PREFERRED SHARES (PAR VALUE) | | | (18,000,000) | | | | (750,000) | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 117,455,391 | | | | 105,788,420 | |

End of year (Including overdistributed net investment income of $(38,620) and $(86,824), respectively) | | | 96,867,022 | | | | 117,455,391 | |

| | |

Auction Preferred Shares (APS) Par Value | | | (21,950,000) | | | | (39,950,000) | |

Net Assets Applicable to Common Stockholders | | $ | 74,917,022 | | | $ | 77,505,391 | |

| | |

See Accompanying Notes to Financial Statements.

| | |

Annual Report | October 31, 2011 | | 9 |

| | |

Statement of Cash Flows | | The Denali Fund Inc. |

| | | For the Year Ended October 31, 2011 |

| | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

Net decrease in net assets from operations excluding dividends on Auction Preferred Shares and gains on Auction Preferred Shares redemption | | $ | (431,940) | |

Adjustments to reconcile net increase/(decrease) in net assets from operations to net cash provided by operating activities: | | | | |

Purchase of investment securities | | | (8,836,213) | |

Proceeds from disposition of investment securities | | | 6,068,015 | |

Net proceeds from disposition of short-term investment securities | | | 22,635,909 | |

Net realized gain from investment securities | | | (2,266,797) | |

Net realized loss on foreign currency related transactions | | | 2,240 | |

Net change in unrealized depreciation on investments | | | 3,094,318 | |

Net change in unrealized appreciation on foreign currency related transactions | | | (8,251) | |

Amortization of discount | | | (6,740) | |

Increase in dividends and interest receivable | | | (18,674) | |

Increase in other assets | | | (815) | |

Decrease in payable for co-advisory fees | | | (27,487) | |

Increase in payable for legal and audit fees | | | 6,261 | |

Decrease in payable for administration & co-administration fees | | | (4,235) | |

Decrease in payable for printing fees | | | (6,549) | |

Decrease in payable for directors’ fees and expenses | | | (3,046) | |

Increase in accrued expenses | | | 28,070 | |

Net Cash Provided by Operating Activities | | | 20,224,066 | |

| |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

Cash distributions paid on Common Stock | | | (2,993,123) | |

Cash distributions paid on Auction Preferred Shares | | | (63,915) | |

Retirement of Auction Preferred Shares | | | (17,100,000) | |

Net Cash Used in Financing Activities | | | (20,157,038) | |

| |

Effect of exchange rates on cash | | $ | 6,011 | |

| | | | |

Net increase in cash | | $ | 73,039 | |

Cash and foreign currency, beginning balance | | $ | 11,162 | |

| | | | |

Cash and foreign currency, ending balance | | $ | 84,201 | |

| | | | |

See Accompanying Notes to Financial Statements.

Page Intentionally Left Blank.

|

Financial Highlights |

| For a Common Share Outstanding Throughout Each Period |

Contained below is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the period indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s shares.

|

OPERATING PERFORMANCE |

Net Asset Value - Beginning of Year |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

Net investment income(a) |

Net realized and unrealized gain/(loss) on investments |

Total from Investment Operations |

|

PREFERRED SHARES TRANSACTIONS |

Distributions paid from net investment income |

Distributions paid from net realized capital gains |

Gain on redemption of Auction Preferred Shares |

Total Preferred Shares* Transactions |

|

Net Increase/(Decrease) from Operations Applicable to Common Stock |

|

DISTRIBUTIONS: COMMON STOCK |

Distributions paid from net investment income |

Distributions paid from net realized capital gains |

Distributions paid from tax return of capital |

Total Distributions Paid to Common Stockholders |

|

Common Stock Net Asset Value - End of Year |

| |

Common Stock Market Value - End of Year |

| |

|

Total Return, Common Stock Net Asset Value(c) |

Total Return, Common Stock Market Value(c) |

|

RATIOS TO AVERAGE NET ASSETS AVAILABLE TO COMMON STOCKHOLDERS:(d) |

Gross operating expenses(e) |

Net operating expenses(f) |

Net investment income |

|

SUPPLEMENTAL DATA: |

Portfolio turnover rate |

Net Assets Applicable to Common Stockholders, End of Year (000s) |

See Accompanying Notes to Financial Statements.

| | | | | | | | | | |

For the Year Ended

October 31,

2011 | | | For the Year Ended

October 31,

2010 | | For the Year Ended

October 31,

2009 | | For the Year Ended

October 31,

2008 | | For the Year Ended

October 31,

2007 |

| | | | | | | | | | | |

| | $18.64 | | | $15.66 | | $15.36 | | $25.33 | | $32.22 |

| | | | | | | | | | |

| | 0.09 | | | 0.07 | | 0.07 | | 0.59 | | 1.26 |

| | (0.20) | | | 3.10 | | 0.24 | | (6.53) | | (4.03) |

| | (0.11) | | | 3.17 | | 0.31 | | (5.94) | | (2.77) |

| | | | |

| | | | | | | | | | |

| | (0.00) | (b) | | (0.02) | | (0.04) | | (0.11) | | (0.19) |

| | (0.01) | | | – | | – | | (0.29) | | (0.36) |

| | 0.22 | | | 0.03 | | 0.03 | | – | | – |

| | 0.21 | | | 0.01 | | (0.01) | | (0.40) | | (0.55) |

| | | | |

| | 0.10 | | | 3.18 | | 0.30 | | (6.34) | | (3.32) |

| | | | |

| | | | | | | | | | |

| | – | | | (0.08) | | – | | (0.40) | | (1.24) |

| | (0.72) | | | (0.12) | | – | | (2.86) | | (2.33) |

| | – | | | – | | – | | (0.37) | | – |

| | (0.72) | | | (0.20) | | – | | (3.63) | | (3.57) |

| | | | | | | | | | | |

| | $18.02 | | | $18.64 | | $15.66 | | $15.36 | | $25.33 |

| | | | | | | | | | | |

| | $15.02 | | | $15.67 | | $13.25 | | $11.27 | | $22.08 |

| | | | | | | | | | | |

| | | | |

| | 1.3% | | | 20.7% | | 2.0% | | (25.3)% | | (10.7)% |

| | 0.4% | | | 19.9% | | 17.6% | | (37.1)% | | (10.6)% |

| | | | |

| | | | | | | | | | | |

| | 2.64% | | | 2.80% | | 3.30% | | 1.77% | | 0.72% |

| | 2.64% | | | 2.80% | | 3.30% | | 1.77% | | 0.71% |

| | 0.51% | | | 0.38% | | 0.51% | | 1.98% | | 4.34% |

| | | | |

| | | | | | | | | | |

| | 7% | | | 7% | | 25% | | 91% | | 17% |

| | $74,917 | | | $77,505 | | $65,088 | | $63,854 | | $105,292 |

| | |

Annual Report | October 31, 2011 | | 13 |

| | |

Financial Highlights | | The Denali Fund Inc. |

| | | |

| * | Auction Preferred Shares (“APS”) |

| (a) | Calculated based on the average number of shares outstanding during each fiscal period. |

| (b) | Amount represents less than $(0.01) per share. |

| (c) | Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during each fiscal period. Total return based on common stock market value assumes the purchase of common stock at the market price on the first day and sale of common stock at the market price on the last day of the period indicated. Dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s distribution reinvestment plan. |

| (d) | Expense and net investment income ratios do not include the effect of transactions with preferred stockholders. Income ratios include income earned on assets attributable to APS outstanding. |

| (e) | The Fund is required to calculate an expense ratio without taking into consideration any expense reductions related to offset arrangements. The Fund has not had an offset arrangement since 2007. |

| (f) | After waiver of, depending on the period, all or a portion of the management and/or administration fees by prior management. Had prior management not undertaken such actions, the annualized ratios of net expenses to average daily net assets applicable to common stockholders would have been: |

| | | | | | | | |

| | Year Ended October 31, | | |

2011 | | 2010 | | 2009 | | 2008 | | 2007 |

– | | – | | – | | – | | 1.83% |

The table below sets out information with respect to APS currently outstanding.(1)

| | | | | | | | |

| | | Par Value (000) | | Total Shares Outstanding (000) | | Asset Coverage Per Share(2) | | Involuntary Liquidating Preference Per Share(3) |

10/31/11 | | $21,950 | | 0.88 | | $110,327 | | $25,000 |

10/31/10 | | 39,950 | | 1.60 | | 73,502 | | 25,000 |

10/31/09 | | 40,700 | | 1.63 | | 64,980 | | 25,000 |

10/31/08 | | 42,000 | | 1.68 | | 62,992 | | 25,000 |

10/31/07 | | 42,000 | | 1.68 | | 87,698 | | 25,000 |

| (2) | Calculated by subtracting the Fund’s total liabilities from the Fund’s total assets and dividing by the number of APS outstanding. |

| (3) | Excludes accumulated undeclared dividends. |

See Accompanying Notes to Financial Statements.

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | | October 31, 2011 |

1. SIGNIFICANT ACCOUNTING POLICIES

The Denali Fund Inc. (the “Fund”) (formerly known as the Neuberger Berman Real Estate Income Fund Inc.) was incorporated in Maryland on September 11, 2002 as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors of the Fund (the “Board”) may classify or re-classify any unissued shares of capital shares into one or more classes of preferred shares without the approval of stockholders.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements is in accordance with generally accepted accounting principles in the United States of America (“GAAP”) which requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Portfolio Valuation: Equity securities for which market quotations are readily available (including securities listed on national securities exchanges and those traded over-the-counter) are valued based on quoted prices from the applicable exchange. If such equity securities were not traded on the valuation date, but market quotations are readily available, they are valued at the most recently quoted bid price provided by an independent pricing service or by principal market makers. Equity securities traded on NASDAQ are valued at the NASDAQ Official Closing Price (“NOCP”). Debt securities are valued at the mean between the closing bid and asked prices, or based on a matrix system which utilizes information (such as credit ratings, yields and maturities) from independent sources. Where market quotations are not readily available or where the pricing agent or market maker does not provide a valuation or methodology, or provides a valuation or methodology that, in the judgment of the advisers, does not represent fair value (“Fair Value Securities”), securities are valued at fair value by a Pricing Committee appointed by the Board of Directors, in consultation with the advisers. Short-term debt securities with less than 60 days until maturity may be valued at cost which, when combined with interest earned, approximates market value.

The Fund’s investments in unregistered pooled investment vehicles (“Hedge Funds”) are valued, as a practical expedient, at the most recent estimated net asset value periodically determined by the respective Hedge Fund managers according to such manager’s policies and procedures based on valuation information reasonably available to the Hedge Fund manager at that time (adjusted for estimated expenses and fees accrued to the Fund since the last valuation date); provided, however, that the Pricing Committee may consider whether it is appropriate, in light of relevant circumstances, to adjust such valuation in accordance with the Fund’s valuation procedures. If a Hedge Fund does not report a value to the Fund on a timely basis, the fair value of such Hedge Fund shall be based on the most recent value reported by the Hedge Fund, as well as any other relevant information available at the time the Fund values its portfolio. As a practical matter, Hedge Fund valuations generally can be obtained from Hedge Fund managers on a weekly basis, as of close of business Thursday, but the frequency and timing of receiving valuations for Hedge Fund investments is subject to change at any time, without notice to investors, at the discretion of the Hedge Fund manager or the Fund.

| | |

Annual Report | October 31, 2011 | | 15 |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

| | | October 31, 2011 |

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the Fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the Fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the Fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The Fund may also fair value securities in other situations, such as when a particular foreign market is closed but the U.S. market is open. The Fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The Fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. If the Fund uses adjusted prices, the Fund will periodically compare closing prices, the next day’s opening prices in the same markets and those adjusted prices as a means of evaluating its security valuation process.

Various inputs are used to determine the value of the Fund’s investments. Observable inputs are inputs that reflect the assumptions market participants would use based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions based on the best information available in the circumstances. These inputs are summarized in the three broad levels listed below.

| | |

Level 1— | | Unadjusted quoted prices in active markets for identical investments |

Level 2— | | Significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

Level 3— | | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following is a summary of the inputs used as of October 31, 2011 in valuing the Fund’s investments carried at value:

| | | | | | | | | | | | | | | | |

Investments in Securities at Value* | | Level 1 - Quoted

Prices | | | Level 2 - Other

Significant Observable Inputs | | | Level 3 - Significant

Unobservable

Inputs | | | Total | |

Domestic Common Stocks | | | $61,167,666 | | | | $– | | | | $– | | | | $61,167,666 | |

Foreign Common Stocks | | | 5,672,810 | | | | – | | | | – | | | | 5,672,810 | |

Auction Preferred Securities | | | – | | | | 9,363,345 | | | | – | | | | 9,363,345 | |

Limited Partnerships | | | – | | | | – | | | | 9,993,383 | | | | 9,993,383 | |

Short Term Investments | | | 10,765,227 | | | | – | | | | – | | | | 10,765,227 | |

| |

TOTAL | | | $77,605,703 | | | | $9,363,345 | | | | $9,993,383 | | | | $96,962,431 | |

| |

During the year ended October 31, 2011, there were no significant transfers between Level 1 and 2 securities. The Fund evaluates transfers into or out of Level 1, Level 2 and Level 3 as of the end of the reporting period.

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | | October 31, 2011 |

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in Securities at Value* | | Balance as of 10/31/2010 | | | Realized gain/

(loss) | | | Change in

unrealized

appreciation/

(depreciation) | | | Net purchases/ (sales) | | | Transfer in and/or (out) of Level 3 | | | Balance as of 10/31/2011 | | | Net change in

unrealized appreciation included in the Statement of Operations attributable to Level 3 investments still held at 10/31/2011 | |

Auction Preferred Securities | | | $11,725,000 | | | | $(6,500) | | | | $(411,655) | | | | $(1,943,500) | | | | $(9,363,345) | | | $ | – | | | $ | – | |

Limited Partnerships | | | 9,334,119 | | | | – | | | | 659,264 | | | | – | | | | – | | | | 9,993,383 | | | | 659,264 | |

TOTAL | | | $21,059,119 | | | | $(6,500) | | | | $ 247,609 | | | | $(1,943,500) | | | | $(9,363,345) | | | $ | 9,993,383 | | | $ | 659,264 | |

| |

| * | For detailed descriptions, see the accompanying Portfolio of Investments. |

Recent Accounting Pronouncements: In April 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (ASU) No. 2011-03 “Transfers and Servicing (Topic 860): Reconsideration of Effective Control for Repurchase Agreements.” The ASU 2011-03 is intended to improve financial reporting of repurchase agreements and other agreements that both entitle and obligate a transferor to repurchase or redeem the financial assets before their maturity. The ASU is effective for the first interim or annual period beginning on or after December 15, 2011. Management is currently evaluating the impact this ASU may have on the Fund’s financial statements.

In May 2011, the FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements” in U.S. GAAP and International Financial Reporting Standards (“IFRSs”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between U.S. GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose quantitative information about the unobservable inputs used in the fair value measurements categorized within Level 3 of the fair value hierarchy. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements. The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. Management is currently evaluating the impact this ASU may have on the Fund’s financial statements.

Securities Transactions and Investment Income: Securities transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded as of the ex-dividend date or for certain foreign securities when the information becomes available to the Fund. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including amortization of premium and accretion of discount on short-term investments, if any, is recorded on the accrual basis using the interest method.

| | |

Annual Report | October 31, 2011 | | 17 |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

| | | October 31, 2011 |

Dividend income from investments in real estate investment trusts (“REITs”) is recorded at management’s estimate of income included in distributions received. Distributions received in excess of this amount are recorded as a reduction of the cost of investments. The actual amount of income and return of capital are determined by each REIT only after its fiscal year-end, and may differ from the estimated amounts. Such differences, if any, are recorded in the Fund’s following year.

Foreign Currency Translations: The Fund may invest a portion of its assets in foreign securities. In the event that the Fund executes a foreign security transaction, the Fund will generally enter into a forward foreign currency contract to settle the foreign security transaction. Foreign securities may carry more risk than U.S. securities, such as political, market and currency risks. See Foreign Issuer Risk below.

The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rate prevailing at the end of the period, and purchases and sales of investment securities, income and expenses transacted in foreign currencies are translated at the exchange rate on the dates of such transactions. Foreign currency gains and losses result from fluctuations in exchange rates between trade date and settlement date on securities transactions, foreign currency transactions and the difference between the amounts of foreign interest and dividends recorded on the books of the Fund and the amounts actually received. The Fund records net realized gain or loss on investment securities and foreign currency transactions separately.

The portion of foreign currency gains and losses related to fluctuation in the exchange rates between the initial purchase trade date and subsequent sale trade date is included in gains and losses as stated in the Statement of Operations under Foreign currency related transactions. The net U.S. dollar value of foreign currency underlying all contractual commitments held by the Fund and the resulting unrealized appreciation or depreciation are determined using prevailing forward foreign currency exchange rates. Unrealized appreciation and depreciation on foreign currency contracts are reported in the Fund’s Statement of Assets and Liabilities as a receivable or a payable and in the Fund’s Statement of Operations with the change in unrealized appreciation or depreciation.

Foreign Issuer Risk: Investment in non-U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers. These risks may include, but are not limited to: (i) less information about non-U.S. issuers or markets may be available due to less rigorous disclosure, accounting standards or regulatory practices; (ii) many non-U.S. markets are smaller, less liquid and more volatile thus, in a changing market, the advisers may not be able to sell the Fund’s portfolio securities at times, in amounts and at prices they consider reasonable; (iii) currency exchange rates or controls may adversely affect the value of the Fund’s investments; (iv) the economies of non-U.S. countries may grow at slower rates than expected or may experience downturns or recessions; and, (v) withholdings and other non-U.S. taxes may decrease the Fund’s return.

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | | October 31, 2011 |

Concentration Risk: The Fund operates as a “non-diversified” investment company, as defined in the 1940 Act. As a result of being “non-diversified”, with respect to 50% of the Fund’s portfolio, the Fund must limit to 5% the portion of its assets invested in the securities of a single issuer. In addition, no single investment can exceed 25% of the Fund’s total assets at the time of purchase. A more concentrated portfolio may cause the Fund’s net asset value to be more volatile and thus may subject stockholders to more risk. Thus, the volatility of the Fund’s common stock, and the Fund’s net asset value and its performance in general, depends disproportionately more on the performance of a smaller number of holdings than that of a more diversified fund.

Effective July 30, 2010, the Fund implemented a Board initiated and approved fundamental investment policy, which prohibits the Fund from investing more than 4% of its total assets (including leverage) in any single issuer at the time of purchase. The Fund’s holdings as of July 30, 2010 were grandfathered into the policy and so any positions already greater than 4% of total assets are exempt from this limitation.

Hedge Fund Risk: The Fund invests a portion of its assets in a Hedge Fund. The Fund’s investment in a Hedge Fund is a private entity that is not registered under the 1940 Act and has limited regulatory oversight and disclosure obligations. In addition, the Hedge Fund invests in and actively trades securities and other financial instruments using different strategies and investment techniques, which involve significant risks. These strategies and techniques may include, among others, leverage, employing various types of derivatives, short selling, securities lending, and commodities’ trading. Hedge Funds may invest a high percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Hedge Fund may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility. These and other risks associated with Hedge Funds may cause the Fund’s net asset value to be more volatile and more susceptible to the risk of loss than that of other funds.

Changes in Investment Policies: Effective August 1, 2011, the Board approved a proposal to eliminate the Fund’s non-fundamental policy limiting the Fund’s ability to investment more than (i) 3% of the total voting stock of any one investment company; (ii) 5% of the Fund’s total assets with respect to any one investment company; and (iii) 10% of the Fund’s total assets in the aggregate.

Distributions to Stockholders: Income distributions and capital gain distributions are determined in accordance with income tax regulations, per requirements under Subchapter M of the Internal Revenue Code. Distributions to stockholders are recorded by the Fund on the ex-dividend date.

In November 2008 the SEC issued an order approving exemptive relief for the Fund, from Section 19(b) and Rule 19b-1 under the Securities Act of 1940 (the “Order”). This would allow the Fund to employ a managed distribution plan (the “Plan”) rather than a level distribution plan. In December 2008, the Board approved adoption of the Plan. The Fund implemented the Plan for the fiscal year ended October 31, 2008.

Repurchase Agreements: The Fund may enter into repurchase agreements with institutions that management has determined are creditworthy. Each repurchase agreement is recorded at cost. The Fund requires that the securities purchased in a repurchase agreement be transferred to the custodian in a manner sufficient to enable the Fund to assert a perfected security interest in those securities in the event of a default under the repurchase agreement. The Fund monitors, on a daily basis, the value of the securities transferred to ensure that their value, including accrued interest, is greater than amounts owed to the Fund under each such repurchase agreement. The Fund had no outstanding repurchase agreements as of October 31, 2011.

| | |

Annual Report | October 31, 2011 | | 19 |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

| | | October 31, 2011 |

Indemnifications: Like many other companies, the Fund’s organizational documents provide that its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of its principal service contracts and in the normal course of its business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Fund’s maximum exposure under these arrangements is unknown as this could involve future claims against the Fund.

Federal Income Tax: For Federal income tax purposes, the Fund currently qualifies, and intends to remain qualified as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code by distributing substantially all of its earnings to its stockholders. Accordingly, no provision for federal income or excise taxes has been made.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole.

Management has concluded there are no uncertain tax positions that require recognition of a tax liability. The Fund files income tax returns in the U.S. federal jurisdiction and Colorado. The statute of limitations on the Fund’s federal and state tax filings remains open for the fiscal years ended October 31, 2008, through October 31, 2011.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Modernization Act”) was signed into law. The provisions of the Modernization Act are generally effective for tax years beginning after the date it was signed into law so the enacted provisions will apply to the Fund for the fiscal year ending October 31, 2012. The Modernization Act is the first major piece of legislation affecting regulated investment companies (“RICs”) since 1986 and it modernizes several of the federal income and excise tax provisions related to RICs. Some highlights of the enacted provisions are as follows:

| | ¡ | | New capital losses may now be carried forward indefinitely, and retain the character of the original loss. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss. |

| | ¡ | | The Modernization Act contains simplification provisions, which are aimed at preventing disqualification of a RIC for “inadvertent” failures of the asset diversification and/or qualifying income tests. Additionally, the Modernization Act exempts RICs from the preferential dividend rule, and repealed the 60-day designation requirement for certain types of paythrough income and gains. |

| | ¡ | | Finally, the Modernization Act contains several provisions aimed at preserving the character of distributions made by a RIC during the portion of its taxable year ending after October 31 or December 31, reducing the circumstances under which a RIC might be required to file amended Forms 1099 to restate previously reported distributions. |

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | | October 31, 2011 |

2. MANAGEMENT FEES, ADMINISTRATION FEES, AND OTHER AGREEMENTS

Boulder Investment Advisers, L.L.C. (“BIA”) and Stewart Investment Advisers (“SIA”) (together, the “Advisers”) serve as co-advisers to the Fund. The Fund pays the Advisers a monthly fee at an annual rate of 1.25% of the value of the Fund’s average monthly total net assets plus the principal amount of leverage, if any (“Net Assets”). At the November 8, 2010 Board of Directors meeting, the Advisers agreed to a waiver of advisory fees such that, in the future, the advisory fees would be calculated at the annual rate of 1.25% on Net Assets up to $400 million; 1.10% on Net Assets between $400-$600 million and 1.00% on Net Assets exceeding $600 million. This fee waiver has a one year term and is renewable annually at the option of the Advisers. The waiver is not subject to recapture. As the Fund’s Net Assets did not exceed $400 million at any time during the year ended October 31, 2011 there were no fees waived during the period.

The equity owners of BIA are Evergreen Atlantic, LLC, a Colorado limited liability company (“EALLC”), and the Lola Brown Trust No. 1B (the “Lola Trust”), each of which is considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act. The Lola Trust is also the Fund’s largest stockholder (See Note 6). Stewart West Indies Trading Company, Ltd. is a Barbados international business company doing business as Stewart Investment Advisers. SIA receives a fee equal to 75% of the fees earned by the Advisers and BIA receives 25% of the fees earned by the Advisers. The equity owner of SIA is the Stewart West Indies Trust, considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act.

Fund Administrative Services, LLC (“FAS”) serves as the Fund’s co-administrator. Under the Administration Agreement, FAS provides certain administrative and executive management services to the Fund. The Fund pays FAS a monthly fee, calculated at an annual rate of 0.20% of the value of the Fund’s Net Assets up to $100 million, and 0.15% of the Fund’s Net Assets over $100 million. Prior to February 1, 2010, the Fund paid FAS a monthly fee calculated at an annual rate of 0.20% of the Fund’s Net Assets. The equity owners of FAS are EALLC and the Lola Trust, each of which is considered to be an “affiliated person” of the Fund as that term is defined in the 1940 Act. The Lola Trust is also the Fund’s largest stockholder (See Note 6).

As BIA, SIA and FAS are considered affiliates of the Fund, as the term is defined in the 1940 Act, agreements between the Fund and those entities are considered affiliated transactions.

The Fund pays each Director who is not a director, officer, employee, or affiliate of the Advisers or FAS, a fee of $8,000 per annum, plus $3,000 for each in-person meeting of the Board of Directors and $500 for each telephone meeting. In addition, the Chairman of the Board and the Chairman of the Audit Committee each receive $1,000 per meeting and each member of the Audit Committee receives $500 per meeting. The Fund will also reimburse independent Directors for travel and out-of-pocket expenses incurred in connection with such meetings.

ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s co-administrator. As compensation for its services, ALPS receives certain out-of-pocket expenses and asset-based fees, which are accrued daily and paid monthly. Fees paid to ALPS are calculated based on combined Net Assets of the Fund, and the following affiliates: Boulder Total Return Fund, Inc., Boulder Growth & Income Fund, Inc., and First Opportunity Fund, Inc. (the “Fund Group”). ALPS receives the greater of the following, based on combined Net Assets of the Fund Group: an annual minimum of $460,000, or an annualized fee of 0.045% on Net Assets up to $1 billion, 0.03% on Net Assets between $1 and $3 billion, and 0.02% on Net Assets above $3 billion.

| | |

Annual Report | October 31, 2011 | | 21 |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

| | | October 31, 2011 |

Bank of New York Mellon (“BNY Mellon”) serves as the Fund’s custodian and Common Stock servicing agent (“Transfer Agent”), dividend-paying agent and registrar, and as compensation for BNY Mellon’s services as such, the Fund pays BNY Mellon a monthly fee plus certain out-of-pocket expenses. BNY Mellon also serves as the Fund’s Preferred Stock transfer agent, dividend disbursing agent and redemption agent.

3. SECURITIES TRANSACTIONS

During the year ended October 31, 2011, there were purchase and sale transactions (excluding short term securities) of $7,930,631 and $6,029,581, respectively.

On October 31, 2011, based on cost of $80,231,188 for federal income tax purposes, aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $21,227,702, and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value was $4,496,459, and gross unrealized depreciation for all foreign currency in which there is an excess of tax cost over value of $1,796, resulting in net unrealized appreciation of $16,729,447.

4. CAPITAL

The Fund has authorized a total of 999,998,000, $0.0001 par value Common Shares, which may be converted into Preferred Shares. At October 31, 2011, 4,157,117 Common Shares were outstanding.

Transactions in common stock were as follows:

| | | | | | | | |

| | | For the

Year Ended

October 31, 2011 | | | For the Year Ended

October 31, 2010 | |

Beginning Shares | | | 4,157,117 | | | | 4,157,117 | |

Shares Sold | | | – | | | | – | |

Shares Issued in Reinvestment of Distributions | | | – | | | | – | |

Total | | | 4,157,117 | | | | 4,157,117 | |

Less Shares Redeemed | | | – | | | | – | |

Ending Shares | | | 4,157,117 | | | | 4,157,117 | |

| | |

5. PREFERRED SHARES

On February 7, 2003, the Fund issued 1,260 Series A Auction Preferred Shares (“Preferred Shares”). On September 10, 2003, the Fund re-classified an additional 500 unissued shares of capital shares as Preferred Shares. On October 24, 2003, the Fund issued an additional 420 Preferred Shares. All Preferred Shares have a liquidation preference of $25,000 per share plus any accumulated unpaid distributions, whether or not earned or declared by the Fund, but excluding interest thereon (“Liquidation Value”).

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | | October 31, 2011 |

On October 23, 2009, the Fund retired 52 Preferred Shares, with a total par value of $1,300,000. Those shares were purchased at a discount, at $22,500 per share, resulting in a realized gain of $130,000.

On May 18, 2010, the Fund commenced an offer to purchase for cash up to 400 of its outstanding Series A Preferred Shares. Upon expiration of the tender offer on August 3, 2010, 30 Preferred Shares were validly tendered pursuant to the terms of the offer. Those 30 shares were tendered for an aggregate amount of approximately $637,500, or $21,250 per share. This resulted in a realized gain to the Fund of $112,500. The Fund subsequently retired the 30 Preferred Shares.

On June 22, 2011, the Fund commenced an offer to purchase for cash up to 720 of its outstanding Series A Preferred Shares. Upon expiration of the tender offer on July 22, 2011, 720 Preferred Shares were validly tendered pursuant to the terms of the offer. Those 720 shares were tendered for an aggregate amount of approximately $17,100,000, or $23,750 per share. This resulted in a realized gain to the Fund of $900,000. The Fund subsequently retired the 720 Preferred Shares.

Distributions to preferred stockholders, which are cumulative, are accrued daily and paid every 7 days. Distribution rates were reset every 7 days based on the results of an auction. In February 2008, the auction preferred shares market for closed-end funds became illiquid resulting in failed auctions for the Preferred Shares. As such, the Fund continues to pay dividends on the Preferred Shares at the maximum rate (set forth in the Fund’s governing document for the Preferred Shares), set at the current 7-day “AA” Financial Composite Commercial Paper rate times 150%.

For the year ended October 31, 2011, distribution rates ranged from 0.05% to 0.33%. The Fund declared distributions to preferred stockholders for the period November 1, 2010 to October 31, 2011 of $63,306.

The Fund is subject to certain limitations and restrictions while Preferred Shares are outstanding. Failure to comply with these limitations and restrictions could preclude the Fund from declaring any dividends or distributions to common stockholders or repurchasing common shares and/or could trigger the mandatory redemption of Preferred Shares at their liquidation value. Specifically, the Fund is required under the Fund’s Statement of Preferences and the Investment Company Act of 1940 to maintain certain asset coverage with respect to the outstanding Preferred Shares. The holders of Preferred Shares are entitled to one vote per share and will vote with holders of common stock as a single class, except that the Preferred Shares will vote separately as a class on certain matters, as required by law or the Fund’s charter. The holders of the Preferred Shares, voting as a separate class, are entitled at all times to elect two Directors of the Fund, and to elect a majority of the Directors of the Fund if the Fund fails to pay distributions on Preferred Shares for two consecutive years.

In connection with the settlement of each Preferred Share auction, the Fund pays, through the auction agent, a service fee to each participating broker-dealer based upon the aggregate liquidation preference of the Preferred Shares held by the broker-dealer’s customers. Prior to February 19, 2009 the Fund paid at an annual rate 0.25% and upon this date the annual rate was reduced to 0.05%, until further notice from the Fund. These fees are paid for failed auctions as well.

| | |

Annual Report | October 31, 2011 | | 23 |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

| | | October 31, 2011 |

6. SIGNIFICANT STOCKHOLDERS

On October 31, 2011, the Lola Trust owned 3,191,107 Common Shares of the Fund, representing approximately 76.8% of the total Fund shares. The Lola Trust is an affiliated person of the Fund, as that term is defined in the 1940 Act. Also see Note 2 – Management fees, Administration fees, and Other Agreements.

7. SHARE REPURCHASE PROGRAM

In accordance with Section 23(c) of the 1940 Act, the Fund may from time to time, effect redemptions and/or repurchases of its Preferred Shares and/or its Common Stock, in the open market or through private transactions; at the option of the Board of Directors and upon such terms as the Directors shall determine.

For the year ended October 31, 2011, the Fund purchased 720 Preferred Shares at a discount and retired them at par value, pursuant to terms of the tender offer. For the year ended October 31, 2010, the Fund purchased 30 Preferred Shares at a discount and retired them at par value. Both of these transactions are described further in Note 5 – Preferred Shares.

8. TAX BASIS DISTRIBUTIONS

As determined on October 31, 2011, permanent differences resulting primarily from different book and tax accounting for distributions and certain investments held by the Fund were reclassified at fiscal year-end. These reclassifications had no effect on the net increase in net assets resulting from operations, net asset value applicable to common stockholders or net asset value per common share of the Fund. Permanent book and tax basis differences of $(321,880), $(577,157) and $899,037 were reclassified at October 31, 2011 among undistributed net investment income, accumulated net realized gains on investments, and paid in capital, respectively, for the Fund.

The tax character of distributions paid during the years ended October 31, 2011 and October 31, 2010 was as follows:

| | | | | | | | |

| | | Year Ended

October 31, 2011 | | | Year Ended

October 31, 2010 | |

Distributions paid from: | | | | | | | | |

Ordinary Income | | | $ 1,765,474 | | | | $ 927,055 | |

Long-Term Capital Gain | | | $ 1,290,955 | | | | – | |

Tax Return of Capital | | | – | | | | – | |

| | | | $ 3,056,429 | | | | $ 927,055 | |

As of October 31, 2011, the components of distributable earnings on a U.S. federal income tax basis were as follows:

| | | | |

Undistributed Ordinary Income | | $ | 733,394 | |

Accumulated Capital Gains | | $ | 2,592,904 | |

Net Unrealized Appreciation | | $ | 16,729,447 | |

Other Cumulative Effect of Timing Differences | | $ | (24,043) | |

| | |

The Denali Fund Inc. | | Notes to Financial Statements |

| | | October 31, 2011 |

The difference between book and tax basis distributable earnings is attributable primarily to temporary differences related to mark to market of passive foreign investment companies and partnership book and tax differences.

NOTE 9. RESTRICTED SECURITIES

As of October 31, 2011, investments in securities included issues that are considered restricted. Restricted securities are often purchased in private placement transactions, are not registered under the Securities Act of 1933, may have contractual restrictions on resale, and may be valued under methods approved by the Board of Directors as reflecting fair value.

Restricted securities as of October 31, 2011 were as follows:

| | | | | | | | | | | | | | |

| Issuer Description | | Acquisition

Date | | | Cost | | | Market Value

October 31,

2011 | | | Market Value as

Percentage of Net

Assets Available to

Common Stock and

Preferred Shares

October 31, 2011 |

Ithan Creek Partners, LP | | | 06/02/08 | | | $ | 7,000,000 | | | $ | 9,993,383 | | | 10.3% |

NOTE 10. INVESTMENTS IN LIMITED PARTNERSHIPS

As of October 31, 2011, the Fund had an investment in a Hedge Fund that is organized as a limited partnership. The Fund’s investment in the Hedge Fund is reported on the Portfolio of Investments under the section titled Limited Partnerships.

Since the investment in the limited partnership is not publicly traded, the Fund’s ability to make withdrawals from its investment is subject to certain restrictions. These restrictions include notice requirements for withdrawals and additional restrictions or charges for withdrawals within a certain time period following initial investment. In addition, there could be circumstances in which such restrictions can include the suspension or delay in withdrawals from the limited partnership, or limited withdrawals allowable only during specified times during the year. In certain circumstances a limited partner may not make withdrawals that occur within certain periods following the date of admission to the partnership. As of October 31, 2011, the Fund did not have any investments in limited partnerships in which a suspension of withdrawals was in effect.

The following table summarizes the Fund’s investment in the limited partnership as of October 31, 2011.

| | | | | | | | | | | | |

| Description | | % of Net

Assets as

of 10/31/11 | | Value as of

10/31/11 | | Net Unrealized

Gain/ (Loss)

as of 10/31/11 | | Mgmt fees | | Incentive fees | | Redemption Period/ Frequency |

Ithan Creek Partners, LP | | 10.3% | | $9,993,383 | | $2,993,383 | | Annual rate of 1% of net assets | | 20% of net profits at the end of the measurement period | | June 30 upon 60 days’ notice |

Total | | 10.3% | | $9,993,383 | | $2,993,383 | | | | | | |

| |

The Fund did not have any outstanding unfunded commitments as of October 31, 2011.

| | |

Annual Report | October 31, 2011 | | 25 |

| | |

Notes to Financial Statements | | The Denali Fund Inc. |

| | | October 31, 2011 |

NOTE 11. SUBSEQUENT EVENTS

Election of New Director: Effective November 18, 2011, John Horejsi resigned as a Class II Director of the Fund. Also effective November 18, 2011, Steven K. Norgaard was appointed by the Board of Directors as a Class II Director of the Fund and will serve as nominee for election as Director by stockholders at the Fund’s 2012 annual meeting of stockholders. Mr. Norgaard was also appointed a member of the Fund’s Nominating Committee and Audit Committee.

Advisory Fee Waiver. Effective December 1, 2011, RMA and SIA agreed to waive 0.10% of the Advisory Fee applied to the Fund such that the Advisory Fee will be calculated at the annual rate of 1.15% of Net Assets. The fee waiver agreement has a one-year term and is renewable annually.

| | |

The Denali Fund Inc. | | Report of Independent Registered Public Accounting Firm |

| | | |

To the Stockholders and Board of Directors of The Denali Fund Inc.:

We have audited the accompanying statement of assets and liabilities of The Denali Fund Inc. (the “Fund”), including the portfolio of investments, as of October 31, 2011, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2011, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Denali Fund Inc. as of October 31, 2011, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Denver, Colorado

December 29, 2011

| | |

Annual Report | October 31, 2011 | | 27 |

| | |

Additional Information | | The Denali Fund Inc. |

| | | October 31, 2011 (Unaudited) |

PROXY VOTING

The policies and procedures used to determine how to vote proxies relating to securities held by the Fund are available, without charge, at www.thedenalifund.com, on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov or by calling 303-449-0426. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available at www.sec.gov.

PORTFOLIO INFORMATION

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available (1) on the Fund’s website at www.thedenalifund.com; (2) on the SEC’s website at www.sec.gov; or (3) may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

SENIOR OFFICER CODE OF ETHICS

The Fund files a copy of its code of ethics that applies to the registrant’s principal executive officer, principal financial officer or controller, or persons performing similar functions (the “Senior Officer Code of Ethics”), with the SEC as an exhibit to its annual report on Form N-CSR. The Fund’s Senior Officer Code of Ethics is available on the Fund’s website located at http://www.thedenalifund.com.

FUND BYLAWS AND CHARTER

The Fund last amended its Charter effective January 19, 2010, and last amended its Bylaws effective July 30, 2010.

PRIVACY STATEMENT

Pursuant to SEC Regulation S-P (Privacy of Consumer Financial Information) the Directors of The Denali Fund Inc. (the “Fund”) have established the following policy regarding information about the Fund’s stockholders. We consider all stockholder data to be private and confidential, and we hold ourselves to the highest standards in its safekeeping and use.

General Statement. The Fund may collect nonpublic information (e.g., your name, address, email address, Social Security Number, Fund holdings (collectively, “Personal Information”)) about stockholders from transactions in Fund shares. The Fund will not release Personal Information about current or former stockholders (except as permitted by law) unless one of the following conditions is met: (i) we receive your prior written consent; (ii) we believe the recipient to be you or your authorized representative; (iii) to service or support the business functions of the Fund (as explained in more detail below), or (iv) we are required by law to release Personal Information to the recipient. The Fund has not and will not in the future give or sell Personal Information about its current or former stockholders to any company, individual, or group (except as permitted by law) and as otherwise provided in this policy.

| | |

The Denali Fund Inc. | | Additional Information |

| | | October 31, 2011 (Unaudited) |

In the future, the Fund may make certain electronic services available to its stockholders and may solicit your email address and contact you by email, telephone or US mail regarding the availability of such services. The Fund may also contact stockholders by email, telephone or US mail in connection with these services, such as to confirm enrollment in electronic stockholder communications or to update your Personal Information. In no event will the Fund transmit your Personal Information via email without your consent.

Use of Personal Information. The Fund will only use Personal Information (i) as necessary to service or maintain stockholder accounts in the ordinary course of business and (ii) to support business functions of the Fund and its affiliated businesses. This means that the Fund may share certain Personal Information, only as permitted by law, with affiliated businesses of the Fund, and that such information may be used for non-Fund-related solicitation. When Personal Information is shared with the Fund’s business affiliates, the Fund may do so without providing you the option of preventing these types of disclosures as permitted by law.

Safeguards regarding Personal Information. Internally, we also restrict access to Personal Information to those who have a specific need for the records. We maintain physical, electronic, and procedural safeguards that comply with Federal standards to guard Personal Information. Any doubts about the confidentiality of Personal Information, as required by law, are resolved in favor of confidentiality.

NOTICE TO STOCKHOLDERS

Of the ordinary income distributions made by the Fund during the fiscal year ended October 31, 2011, 23.48% qualifies for the dividend received deduction available to corporate stockholders. For the fiscal year ended October 31, 2011, 35.15% of the taxable income qualifies for the 15% Dividend tax rate.

| | |

Annual Report | October 31, 2011 | | 29 |

| | |

Summary of Distribution Reinvestment Plan | | The Denali Fund Inc. |

| | | October 31, 2011 (Unaudited) |

The Bank of New York Mellon (“Plan Agent”) will act as Plan Agent for stockholders who have not elected in writing to receive dividends and distributions in cash (each a “Participant”), will open an account for each Participant under the Distribution Reinvestment Plan (“Plan”) in the same name as their then current Shares are registered, and will put the Plan into effect for each Participant as of the first record date for a dividend or capital gains distribution.