FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May 2012

Commission File Number: 1-31452

KONAMI CORPORATION

(Translation of registrant’s name into English)

7-2, Akasaka 9-chome

Minato-ku, Tokyo 107-8323

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Information furnished in this form:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | | KONAMI CORPORATION |

| | |

| Date: May 10, 2012 | | By: | | /s/ Kimihiko Higashio |

| | Name: | | Kimihiko Higashio |

| | Title: | | Representative Director |

Consolidated Financial Results

for the Year Ended March 31, 2012

(Prepared in Accordance with U.S. GAAP)

May 10, 2012

KONAMI CORPORATION

| | |

| Address: | | 7-2, Akasaka 9-chome, Minato-ku, Tokyo, Japan |

| Stock code number, TSE: | | 9766 |

| Ticker symbol, NYSE: | | KNM |

| URL: | | http://www.konami.co.jp/en/index.html |

| Shares listed: | | Tokyo Stock Exchange, New York Stock Exchange, and London Stock Exchange |

| Representative: | | Kagemasa Kozuki, Representative Director and Chairman of the Board, President |

| Contact: | | Yasuyuki Yamaji, Corporate Officer, General Manager, Corporate Strategy (Phone: +81-3-5771-0222) |

| Date of General Shareholders Meeting: | | June 28, 2012 |

| Date of dividend payment: | | June 7, 2012 |

| Adoption of U.S. GAAP: | | Yes |

(Amounts are rounded to the nearest million)

1. Consolidated Financial Results for the Year Ended March 31, 2012

(1) Consolidated Results of Operations

| | | | | | | | | | | | | | | | |

| | | (Millions of Yen, except percentages and per share amounts) | |

| | | Net revenues | | | Operating

income | | | Income before

income taxes and equity

in net income of

affiliated company | | | Net income

attributable to

KONAMI

CORPORATION | |

Year ended March 31, 2012 | | | 265,758 | | | | 40,950 | | | | 40,026 | | | | 23,012 | |

% change from previous year | | | 3.0 | % | | | 97.0 | % | | | 109.8 | % | | | 77.9 | % |

Year ended March 31, 2011 | | | 257,988 | | | | 20,791 | | | | 19,082 | | | | 12,934 | |

% change from previous year | | | (1.6 | )% | | | 11.4 | % | | | 11.4 | % | | | (2.9 | )% |

| | | | | | | | |

| Note: | | Comprehensive income | | | |

| | Year ended March 31, 2012: | | | ¥22,840 million | | | a year-on-year increase of 116.2% |

| | Year ended March 31, 2011: | | | ¥10,562 million | | | a year-on-year decrease of 19.0% |

| | | | | | | | | | | | | | | | | | | | |

| | | Basic net income

attributable to

KONAMI

CORPORATION

per share (yen) | | | Diluted net income

attributable to

KONAMI

CORPORATION

per share (yen) | | | Return on

stockholders’ equity

attributable to

KONAMI

CORPORATION | | | Ratio of

income before

income taxes

to total assets | | | Ratio of

operating income

to net revenues | |

Year ended March 31, 2012 | | | 166.23 | | | | 166.23 | | | | 11.2 | % | | | 12.5 | % | | | 15.4 | % |

Year ended March 31, 2011 | | | 96.48 | | | | 96.48 | | | | 6.8 | % | | | 6.2 | % | | | 8.1 | % |

| | | | | | |

| Reference: | | Equity in net income of affiliated companies | | |

| | Year ended March 31, 2012: | | ¥52 million | | |

| | Year ended March 31, 2011: | | ¥41 million | | |

1

(2) Consolidated Financial Position

| | | | | | | | | | | | | | | | | | | | |

| | | (Millions of Yen, except percentages and per share amounts) | |

| | | Total assets | | | Total equity | | | KONAMI

CORPORATION

stockholders’ equity | | | KONAMI

CORPORATION

stockholders’ equity

ratio | | | KONAMI

CORPORATION

stockholders’ equity

per share

(yen) | |

March 31, 2012 | | | 328,006 | | | | 215,720 | | | | 215,458 | | | | 65.7 | % | | | 1,554.31 | |

March 31, 2011 | | | 313,891 | | | | 198,407 | | | | 193,914 | | | | 61.8 | % | | | 1,424.36 | |

(3) Consolidated Cash Flows

| | | | | | | | | | | | | | | | |

| | | (Millions of Yen) | |

| | | Net cash provided by (used in) | | | Cash and

cash equivalents

at end of year | |

| | | Operating

activities | | | Investing

activities | | | Financing

activities | | |

Year ended March 31, 2012 | | | 37,915 | | | | (7,646 | ) | | | (13,254 | ) | | | 76,451 | |

Year ended March 31, 2011 | | | 26,605 | | | | (10,773 | ) | | | (6,182 | ) | | | 59,541 | |

2. Cash Dividends

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Record Date | | Cash dividends per share (yen) | | | Total cash

dividends

(annual) | | | Payout ratio

(consolidated) | | | Cash dividend rate

for stockholders’

equity

(consolidated) | |

| | First

quarter end | | | Second

quarter end | | | Third

quarter end | | | Year end | | | Annual | | | | |

Year ended March 31, 2011 | | | — | | | | 16.00 | | | | — | | | | 16.00 | | | | 32.00 | | | ¥ | 4,314 million | | | | 33.2 | % | | | 2.3 | % |

Year ended March 31, 2012 | | | — | | | | 25.00 | | | | — | | | | 25.00 | | | | 50.00 | | | ¥ | 6,932 million | | | | 30.1 | % | | | 3.4 | % |

Year ending March 31, 2013 -Forecast- | | | — | | | | 25.00 | | | | — | | | | 25.00 | | | | 50.00 | | | | | | | | 30.0 | % | | | | |

3. Consolidated Earnings Forecast for the Year Ending March 31, 2013

| | | | | | | | | | | | | | | | | | | | |

| | | (Millions of Yen, except percentages and per share data) | |

| | | Net revenues | | | Operating

income | | | Net income

before

income taxes | | | Net income

attributable to

KONAMI

CORPORATION | | | Net income

attributable to

KONAMI

CORPORATION

per share (yen) | |

Year ending March 31, 2013 | | | 270,000 | | | | 41,100 | | | | 40,100 | | | | 23,100 | | | | 166.64 | |

% change from previous year | | | 1.6 | % | | | 0.4 | % | | | 0.2 | % | | | 0.4 | % | |

4. Other

(1) Changes in significant consolidated subsidiaries during the period (status changes of subsidiaries due to changes in the scope of consolidation) :None

(2) Changes in accounting principles, procedures and reporting policies for consolidated financial statements

| 1. | Changes accompanying amendment of accounting standard: None |

2

(3) Number of shares issued (Common Stock)

| | | | |

| 1. | | Number of shares issued: (Treasury stock included) | | |

| | Year ended March 31, 2012 | | 143,500,000 shares |

| | Year ended March 31, 2011 | | 143,500,000 shares |

| |

| 2. | | Number of Treasury Stock: |

| | Year ended March 31, 2012 | | 4,879,848 shares |

| | Year ended March 31, 2011 | | 7,359,029 shares |

| |

| 3. | | Average number of shares outstanding: |

| | Year ended March 31, 2012 | | 138,433,751 shares |

| | Year ended March 31, 2011 | | 134,065,450 shares |

(Reference) Summary of Non-consolidated Financial Results

1. Results for the Year Ended March 31, 2012

(1) Non-consolidated Results of Operations

| | | | | | | | | | | | | | | | |

| | | (Millions of Yen, except percentages and per share data) | |

| | | Operating revenues | | | Operating income | | | Ordinary income | | | Net income | |

Year ended March 31, 2012 | | | 18,348 | | | | 13,623 | | | | 13,869 | | | | 13,488 | |

% change from previous year | | | 11.7 | % | | | 13.4 | % | | | 16.1 | % | | | 8.6 | % |

Year ended March 31, 2011 | | | 16,430 | | | | 12,011 | | | | 11,943 | | | | 12,423 | |

% change from previous year | | | (14.8 | )% | | | (17.8 | )% | | | (17.6 | )% | | | (11.8 | )% |

| | | | | | | | |

| | | Basic net income

per share (yen) | | | Diluted net income

per share (yen) | |

Year ended March 31, 2012 | | | 97.44 | | | | — | |

Year ended March 31, 2011 | | | 92.67 | | | | — | |

(2) Non-consolidated Financial Position

| | | | | | | | | | | | | | | | |

| | | (Millions of Yen, except percentages and per share data) | |

| | | Total assets | | | Total net assets | | | Equity ratio | | | Net assets

per share | |

March 31, 2012 | | | 220,601 | | | | 175,870 | | | | 79.7 | % | | | 1,268.72 | |

March 31, 2011 | | | 190,189 | | | | 164,269 | | | | 86.4 | % | | | 1,206.61 | |

| | | | | | | | |

Reference: | | Total Stockholders’ equity |

| | Year ended March 31, 2012: | | | ¥ 175,870 million | | | |

| | Year ended March 31, 2011: | | | ¥ 164,269 million | | | |

3

Information Regarding the Audit Review Procedures:

This report is outside the scope of the procedures for audit of consolidated financial statements as required under the Financial Instruments and Exchange Act of Japan. The aforementioned procedures have not been completed as of the time of disclosure of this document.

Cautionary Statement with Respect to Forward-Looking Statements and Other Matters:

Statements made in this document with respect to our current plans, estimates, strategies and beliefs, including the above forecasts, are forward-looking statements about our future performance. These statements are based on management’s assumptions and beliefs in light of information currently available to it and, therefore, you should not place undue reliance on them. A number of important factors could cause actual results to be materially different from and worse than those discussed in forward-looking statements. Such factors include, but are not limited to: (i) changes in economic conditions affecting our operations; (ii) fluctuations in currency exchange rates, particularly with respect to the value of the Japanese yen, the U.S. dollar and the Euro; (iii) our ability to continue to win acceptance of our products, which are offered in highly competitive markets characterized by the continuous introduction of new products, rapid developments in technology and subjective and changing consumer preferences; (iv) our ability to successfully expand internationally with a focus on our Digital Entertainment business and Gaming & Systems business; (v) our ability to successfully expand the scope of our business and broaden our customer base through our Health & Fitness business; (vi) regulatory developments and changes and our ability to respond and adapt to those changes; (vii) our expectations with regard to further acquisitions and the integration of any companies we may acquire; and (viii) the outcome of existing contingencies.

Please refer to pages 9, 10 and 11 for further information regarding our business forecasts.

The Company disclosed the supplemental data for the consolidated financial statements via the Company’s website on May 10, 2012.

4

1. Business Performance

1. Analysis of Business Performance

(1) Business Overview

The business environment surrounding the Konami Group remains uncertain mainly due to the impact of the Great East Japan Earthquake, the continued strength of the Japanese yen and the European currency crisis, despite signs of a rebound in personal consumption in some quarters.

In the entertainment market, business opportunities in the game industry are increasing in step with growth in social networking services (SNS) as various mobile devices become increasingly popular. Meanwhile, the tourism market related to the gaming market, such as the tourism market in Las Vegas, where a severe business environment has persisted, is expected to bottom out. Major casino operators are still cautious about their investments; however, we intend to continue to closely monitor market trends.

In the health and fitness industry, challenging business conditions persist in the fitness club industry as consumer spending remained under pressure due to uncertainty over the future economic climate.

Against this backdrop, in the Digital Entertainment segment of Konami Group, the number of registered users for social games such asDRAGON COLLECTION,SENGOKU COLLECTION andProfessional Baseball Dream Nine continued to grow, contributing to revenue. In video game software, leading titles including theWinning Eleven (known in the U.S. and Europe as Pro Evolution Soccer) series also sold steadily.

In our Gaming & Systems segment, sales of products such as thePodium video slot machine and theAdvantage 5five-reel mechanical slot machine series continued to be favorable in the U.S. market.

In the Pachinko and Pachinko Slot Machines segment, we delivered solid performance, with the shipped volume ofMAGICAL HALLOWEEN 3 reaching the highest level of any of the Konami Group’s pachinko slot machines and the release ofGAMBARE GOEMON 2 andCastlevania III pachinko slot machines, featuring original content, reaching the highest sales level as well.

In our Health & Fitness segment, we developed and introduced new services, in order to meet the diversifying needs of customers, utilizing IT, which is one of Konami Group’s strengths, in our health management, exercise and nutritional guidance services, and we provided upgraded services to our customers whose health consciousness is on the rise.

In terms of the consolidated results for the year ended March 31, 2012, net revenues amounted to ¥265,758 million (a year-on-year increase of 3.0%), operating income was ¥40,950 million (a year-on-year increase of 97.0%), income before income taxes and equity in net income of affiliated companies was ¥40,026 million (a year-on-year increase of 109.8%), and net income attributable to KONAMI CORPORATION was ¥23,012 million (a year-on-year increase of 77.9%).

5

(2) Performance by Business Segment

Summary of net revenues by business segment:

| | | | | | | | | | | | |

| | | Millions of Yen except percentages | |

| | | Year ended

March 31, 2011 | | | Year ended

March 31, 2012 | | | % change | |

Digital Entertainment | | ¥ | 133,124 | | | ¥ | 140,400 | | | | 5.5 | |

Gaming & Systems | | | 21,868 | | | | 25,212 | | | | 15.3 | |

Pachinko & Pachinko Slot Machines | | | 17,987 | | | | 18,430 | | | | 2.5 | |

Health & Fitness | | | 85,911 | | | | 82,555 | | | | (3.9 | ) |

Eliminations | | | (902 | ) | | | (839 | ) | | | (7.0 | ) |

| | | | | | | | | | | | |

Consolidated net revenues | | ¥ | 257,988 | | | ¥ | 265,758 | | | | 3.0 | |

| | | | | | | | | | | | |

Digital Entertainment

In social games, the cumulative total number of registered users forDRAGON COLLECTION andSENGOKU COLLECTION surpassed 6 million and 3 million, respectively, at the end of March 2012, greatly contributing to revenue. The number of registered users forCROWS X WORST - Saikyou Densetsu -, based on the popular manga series CROWS and WORST, andSTARS WARS COLLECTION, based on the Star Wars film series, has enjoyed steady growth since launch. In addition to this, following launches on GREE and Mobage, online distribution ofProfessional Baseball Dream Nine was also launched on mixi from March 2012, with the number of registered users growing due to promotion on multiple SNS sites.

Further, the social games of the Konami Group, which commenced online distribution within the last two years, have received strong support. At the GREE Platform Award 2011, which recognizes outstanding content,DRAGON COLLECTION was inducted into the Hall of Fame with Special Honors,Professional Baseball Dream Nine was also inducted into the Hall of Fame, andCROWS X WORST - Saikyou Densetsu -andJ LEAGUETM Dream Eleven received awards.

In game software,WORLD SOCCER Winning Eleven 2012 (known in the U.S. and Europe asPro Evolution Soccer 2012), the latest title in theWinning Elevenseries, which boasts total cumulative sales that exceed 76 million units, was released, contributing to revenue. Further, baseball titles including theJIKKYOU PAWAFURU PUROYAKYU 2011 series andPROFESSIONAL BASEBALL SPIRITS 2011 performed strongly in conjunction with events linked with the social gameProfessional Baseball Dream Nine, as a part of the KONAMI Nippon Series 2011, a KONAMI-sponsored event. Additionally, theMETAL GEAR SOLID HD EDITION, which consists of HD versions ofMETAL GEAR SOLID 2 SONS OF LIBERTY andMETAL GEAR SOLID 3 SNAKE EATER, andNEW LOVEPLUS, a romance communication game, went on sale.

In amusement arcade video games,STEEL CHRONICLE, a network co-op action-based shooting game, andMAH-JONG FIGHT CLUB ultimate version have generated steady results. This title has adopted the e-AMUSEMENT Participation system in which operators and Konami Group share game-playing revenue. We also launchedjubeat copious, a music simulation game,Venus Fountain, a medal game andQUIZ MAGIC ACADEMY Kenja no Tobiraadopted the e-AMUSEMENT Participation system were selling steadily.

6

In card games, theYu-Gi-Oh! Card Game series performed strongly. We also introduced the newDigital Game Card product series, which combines the fun of trading cards and social games.

In terms of financial performance, consolidated net revenues for the year ended March 31, 2012 in this segment amounted to ¥140,400 million (a year-on-year increase of 5.5%).

Gaming & Systems

In the North American market, thePodium video slot machine, which has become a staple item, and theAdvantage 5 and theAdvantage Revolutionmechanical slot machine series continued to enjoy favorable sales. Sales through participation agreements (in which profits are shared with casino operators) increased and are steadily expanding in terms of market share. In the Oceania market, sales of thePodium also progressed favorably. Full-scale marketing is also in progress in Europe, Central and South America, Asia and Africa, with the goal of building a distributor network for those markets.

At the Global Gaming Expo, the world’s largest gaming equipment trade show held in October 2011, in Las Vegas, U.S., thePodium video cabinet, which is a popular product in the market, was loaded with the latest content and put on display. We also showcased our extensive product lineup and high-quality content to positive reviews. Our product lineup includedKP3, our next-generation platform offering real-time, high-definition software-controlled 3D graphics;Advantage 3, a three-reel mechanical slot machine and successor toAdvantage+;Dynamic 5, featuring a double-mechanical reel installed in a slanted video cabinet; and the premiumFortune Chaser model. On display at theKonami Casino Management System corner was the link progressiveLot-A-Bucks. A demonstration was performed to highlight the extensive range of functions that the System has to offer, winning a positive reaction from the audience.

The Konami Group exhibited ever-popular content in extensive operation in North America such asPodiumandAdvantage 5at a range of exhibitions around the world in formats suitable for each market, winning many accolades. These exhibitions included the Australasian Gaming Expo (August 2011/Sydney, Australia), the largest gaming equipment trade show in Oceania, and SAGSE Buenos Aires (September 2011/Buenos Aires, Argentina), the largest international gaming trade show in Latin America. Through localization focused on local needs, Konami Group aims to drive sales growth in the Latin American market going forward.

In terms of financial performance, consolidated net revenues for the year ended March 31, 2012 in this segment amounted to ¥25,212 million (a year-on-year increase of 15.3%).

Pachinko & Pachinko Slot Machines

In the Pachinko and Pachinko Slot Machines segment, we saw a recovery in parts procurement and other aspects of our supply chain had been were impacted by the Great East Japan Earthquake. On the other hand, we found it difficult to procure certain electronic parts due to major flooding in Thailand, although we were able to minimize the impact of such disruptions on production owing to the enhancement of the coordination with suppliers. In this context, we delivered solid performance in terms of net revenue, releasingMAGICAL HALLOWEEN 3, the latest title in the popular series, in September 2011, which recorded the highest ever sales volume for a Konami Group pachinko slot machine, and pachinko slot machines featuring original content, includingONIHAMA GAIDEN HAYATO SHIPPU DEN,GAMBARE GOEMON 2 andCastlevania III.

In terms of financial performance, consolidated net revenues for the year ended March 31, 2012 in this segment amounted to ¥18,430 million (a year-on-year increase of 2.5%).

7

Health & Fitness

In our fitness clubs business, market conditions remain challenging, but we continue to see growing health consciousness among consumers and stronger interest in preventing the need for nursing care in old age.

Against this backdrop, Konami Group opened Konami Sports Club Izumifuchu (Izumi City, Osaka Prefecture) in April 2011. In a community anticipated to become a new social hot spot for the city’s residents, Konami Group offers an extensive activities program addressing the goals and needs of many different age groups. Konami Sports Club Golf Academy opened with a new comprehensive golf instruction program. For children, a variety of activities are being made available, including swimming, gymnastics, golf, junior funk (dance lessons), karate and aikido. Furthermore, in May 2011, Konami Sports Club GRANCISE Osaka (Osaka City, Osaka Prefecture) opened. Benefitting from a prime location directly linked to JR Osaka Station, western Japan’s largest rail terminal, GRANCISE Osaka is fully equipped with a fitness studio, machine training gym, hot springs bath, and physical therapy parlor. GRANCISE Osaka provides a higher grade of premium services so that members can enjoy luxuriant moments in the heart of the bustling city. In this manner, we have worked to upgrade and diversify services that fit the characteristics of each region, and we have developed and introduced new services utilizing IT, which is one of Konami Group’s strengths, in our health management, exercise and nutritional guidance services, while also expanding services geared to customers.

With respect to the management of facilities outsourced to Konami Group, the following new facilities began operations: Yokohama International Swimming Pool (Yokohama City, Kanagawa Prefecture), Kosai City Sports Complex (Kosai City, Shizuoka Prefecture), Itoigawa City Kenko Zukuri Center (Itoigawa City, Niigata Prefecture) and Miyazaki City Ishizaki no Mori Kangei (Whale-come) Kan (Miyazaki City, Miyazaki Prefecture).

In health-related products, we released health drinks such asCollagen Cristal Rich,Biometrics Water AZUMINO,Ryokunou Aojiru Saratto NoushukuandKenkou Daizu.

Separately, with the reopening in August 2011 of Konami Sports Club Sendai Nagamachi (Sendai City, Miyagi Prefecture), which was the last of the facilities that had remained closed due to the Great East Japan Earthquake, all our directly managed facilities have resumed operations.

In terms of financial performance, consolidated net revenues for the year ended March 31, 2012 in this segment amounted to ¥82,555 million (a year-on-year decrease of 3.9%).

8

(3) Outlook for the Fiscal Year Ending March 31, 2013

Digital Entertainment

With the spread of smartphones and tablet PCs worldwide and the increased popularity of SNS sites, the available means of providing game software continue to diversify, and opportunities to reach an even greater audience for game software are increasing. Against such a backdrop, our belief is that we can increase the number of “outlets” for the Konami Group’s game content by taking advantage of opportunities presented by the emergence of new devices and developing our business around game content. We intend to develop ways of playing games that match the characteristics of each device.

In social games, the total number of registered users for the Konami Group’s social games topped 20 million and is increasing steadily. We are further focusing our managerial resources on the development of content that we believe will become major hits, following in the footsteps ofDRAGON COLLECTION,SENGOKU COLLECTION andProfessional Baseball Dream Nine. Looking ahead, we will continue to expand our lineup utilizing previously established production and operational expertise and rich content resources, while continuing to support a wide range of devices and develop towards new overseas platforms, such as the provision of content to Zynga.

In game software, we will focus efforts on continued global development utilizing the production know-how of the Konami Group, while also continuing with production using existing content for AAA titles carefully narrowed down based on selection and focus, and strive towards producing hit titles.

In amusement arcade equipment, Konami Group intends to work to revitalize the amusement arcade industry by providing entertainment that can only be enjoyed at an amusement facility through “interpersonal communication” using the e-AMUSEMENT system. Konami Group intends to propose innovative services that will lead the industry. This will include the promotion of the sequential increase of models that are compatible with the e-AMUSEMENT GATE community site services, the PASELI e-money service and e-AMUSEMENT Participation, which are currently in operation, as well as the enhancement and expansion of services.

In card games, we will continue the global development of theYu-Gi-Oh! Card Game series. Additionally, we plan to sequentially release new product lineups, including in theDigital Game Card series.

Gaming & Systems

In regard to slot machine sales, in video slot machines, we will promote the strengthening of sales together with a product expansion focusing onPodium which has been positively reviewed from the previous fiscal year onwards. Meanwhile, efforts will also be focused onKP3, a software-controlled next generation platform capable of real-time, high-resolution 3D graphics. In mechanical slot machines, we will continue to aggressively promote sales of the five-reel mechanical slot machine series,Advantage 5, which has received much acclaim. Furthermore, we intend to stabilize our operational results in this segment by increasing the amount of steady, periodical income through expansion of participation agreement (profit sharing with operators) sales and seeking to improve our sales in the European, Central and South American, Asian and African markets.

TheKonami Casino Management System continues to be adopted in the North American and Australian markets, particularly by major operators. Looking ahead, we intend to actively pursue sales to other markets and make efforts to enhance product strength while developing new product features.

Konami Group intends to further reinforce collaboration among its three bases—the United States, Australia and Japan—and promote the efficiency of our operations and reinforce our production and sales. Furthermore, we intend to develop new products that respond to changes in society and meet demands and enhance the value added of existing products. We intend to continue to use Konami Group’s strengths in the domain of entertainment as the foundation for proposing new products that will bring even greater enjoyment to our customers.

9

Pachinko & Pachinko Slot Machines

In the Pachinko and Pachinko Slot Machines business, through the sales activities of KPE-TAKASAGO Sales Co., Ltd., which was established for the purpose of enhancing our sales system, and through the opening of the Ichinomiya Office (Ichinomiya City, Aichi Prefecture), which is planned for the purpose of extending the production system to meet the market demand, we are forming a more robust sales system, and we intend to focus on maximizing sales volume. On the production side, we intend to continue to strive to expand our market share by continuing to provide value added specific to the Konami Group in the future, utilizing expertise cultivated in the Digital Entertainment business.

Health & Fitness

In the Health and Fitness business, we will continue to accurately grasp diversifying customer needs and provide a wide range of health-themed services with the aim of establishing ourselves as a ‘Total Health Partner’ with connections with the entire nation. We intend to promote our health and fitness business by leveraging our strengths in the operation of more than 300 of Japan’s large-scale sports clubs, expanding our products and services and by creating synergy through the enrichment of the programs offered at our facilities, the computerization of health management, the upgrading and expansion of our product lineup and other efforts. Market conditions are expected to remain harsh for the health and fitness segment. However, we believe that opportunities for the operation of fitness clubs and the development and marketing of health and fitness equipment will continue to increase with heightened social awareness of promoting good health, against the backdrop of an aging society and government measures taken against lifestyle diseases.

Further, it is expected that there will be further opportunities for health promotion proposals concerning sports club management and healthcare equipment development and sales spurred on by the promotion of local sport activities in association with the enactment of the Basic Act on Sports. From April 2012, a new service,Active Check, which evaluates an individual’s physical fitness based on ultrasonographic and muscular strength measurement data, providing exercise guidance, was launched. It is the first physical fitness measurement service in the industry to use ultrasonic measurement devices and will be progressively installed in Konami Sports Clubs around the country.

10

In outsourced facility management, using the know-how and accomplishments in operation and guidance nurtured up to now, we commenced management of the Hyogo Prefectural Gymnasium (Nishinomiya City, Hyogo Prefecture), the Ako Residents’ Gymnasium (Ako City, Hyogo Prefecture), the Soja City Sports Center (Soja City, Okayama Prefecture), the Ukiha City Gymnasium (Ukiha City, Fukuoka Prefecture) and the Nisshin City Sports Center (Nisshin City, Aichi Prefecture). We are making efforts towards the promotion of health of residents in local communities through the operation of public facilities in all regions.

The Konami Group will continue to strive towards facility development that meets the individual needs of local communities and the expansion of products and services that are tailored to each and every customer. Looking ahead, we will respond to changes in the business environment and continue to provide enjoyable, valuable experiences to customers through fitness in a range of situations, whether they be inside or outside facilities.

At the same time, Konami Group will promote power-saving measures in our facilities in an effort to reduce electrical power consumption at each facility, such as through the adjustment of operating hours and changes in the ways that the facilities are operated.

The Konami Group partially began operation of Ichinomiya Office (Ichinomiya City, Aichi Prefecture) in April 2012, acquired for the purpose of extending its production and logistic system in Japan and reduce risk by decentralization of its plant locations. We intend to expand the production system to suit changes in the business environment in the future, and we will strive towards the realization of a timely and stable product supply.

Projected consolidated results for the fiscal year ending March 31, 2013 are as follows: net revenue of ¥270,000 million; operating income of ¥41,100 million; income before income taxes and equity in net income of affiliated companies of ¥40,100 million; and net income attributable to KONAMI CORPORATION of ¥23,100 million.

KONAMI, as a business affected by “hit” products, requires flexibility in how its products are released and is subject to fluctuations in sales throughout the course of the fiscal year. For this reason, projected consolidated results for the half year are not disclosed.

We will to continue to elaborate on the disclosure for the quarterly financial results.

11

2. Consolidated Financial Position

(1) Total Assets, Total Liabilities and Total KONAMI CORPORATION Stockholders’ Equity

Total Assets:

Total assets amounted to ¥328,006 million as of March 31, 2012, increasing by ¥14,115 million compared with March 31, 2011. This increase mainly resulted from increases in cash and cash equivalents and trade notes and accounts receivable.

Total Liabilities:

Total liabilities amounted to ¥112,286 million as of March 31, 2012, decreasing by ¥3,198 million compared with March 31, 2011. This decrease primarily resulted from repayments of short-term borrowings and redemption of bonds and decreases in trade notes and accounts payable.

Total KONAMI CORPORATION Stockholders’ Equity:

Total KONAMI CORPORATION stockholders’ equity amounted to ¥215,458 million as of March 31, 2012, increasing by ¥21,544 million compared with March 31, 2011. This mainly resulted from a recognition of its net income and a decrease in treasury stock due to the execution of the share exchange in order to make HUDSON SOFT CO., LTD. a wholly owned subsidiary of the Company.

KONAMI CORPORATION stockholders’ equity ratio was 65.7%, increasing by 3.9% compared with March 31, 2011.

(2) Cash Flows

Cash flow summary for the year ended March 31, 2012:

| | | | | | | | | | | | |

| | | Millions of Yen | |

| | | Year ended

March 31, 2011 | | | Year ended

March 31, 2012 | | | Change | |

Net cash provided by operating activities | | ¥ | 26,605 | | | ¥ | 37,915 | | | ¥ | 11,310 | |

Net cash used in investing activities | | | (10,773 | ) | | | (7,646 | ) | | | 3,127 | |

Net cash used in financing activities | | | (6,182 | ) | | | (13,254 | ) | | | (7,072 | ) |

Effect of exchange rate changes on cash and cash equivalents | | | (849 | ) | | | (105 | ) | | | 744 | |

Net increase in cash and cash equivalents | | | 8,801 | | | | 16,910 | | | | 8,109 | |

| | | | | | | | | | | | |

Cash and cash equivalents, end of the year | | ¥ | 59,541 | | | ¥ | 76,451 | | | ¥ | 16,910 | |

| | | | | | | | | | | | |

Cash and cash equivalents (hereafter, referred to as “Net cash”), for the year ended March 31, 2012, amounted to ¥76,451 million, an increase of ¥16,910 million compared to the year ended March 31, 2011, and a year-on-year increase of 28.4%.

12

Cash flow summary for each activity for the year ended March 31, 2012 is as follows:

Cash flows from operating activities:

Net cash provided by operating activities amounted to ¥37,915 million for the year ended March 31, 2012, a year-on-year increase of 42.5%. This primarily resulted from decreases in proceeds from both sales receivables and trade notes and account payable and an increase in the amount of income tax paid, while net income has increased compared to that for the year ended March 31, 2011.

Cash flows from investing activities:

Net cash used in investing activities amounted to ¥7,646 million for the year ended March 31, 2012, a year-on-year decrease of 29.0%. This mainly resulted from decreases in capital expenditures for investments and term deposits.

Cash flows from financing activities:

Net cash used in financing activities amounted to ¥13,254 million for the year ended March 31, 2012, a year-on-year increase of 114.4%. This primarily resulted from repayments of short-term borrowings and redemption of bonds.

The trends of cash flow index are as follows:

| | | | | | | | |

| | | Year ended

March 31, 2011 | | | Year ended

March 31, 2012 | |

Equity-assets ratio (%) | | | 61.8 | | | | 65.7 | |

Equity-assets ratio at fair value (%) | | | 66.8 | | | | 99.1 | |

Liabilities to cash flow ratio (years) | | | 1.7 | | | | 1.0 | |

Interest coverage ratio (times) | | | 17.3 | | | | 26.6 | |

Equity-assets ratio: Total stockholders’ equity / Total assets

Equity-assets ratio at fair value: Total stockholders’ equity at fair value / Total assets

Liabilities to cash flow ratio: Interest-bearing liabilities / Cash flows from operating activities

Interest coverage ratio: Cash flows from operating activities / Interest expense

Notes:

| 1. | Each index is calculated from figures prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP). |

| 2. | Cash flows from operating activities derive from our consolidated cash flow statement. |

| 3. | Interest-bearing debt covers all liabilities with interest in our consolidated balance sheet. |

13

(3) Basic Policy on the Distribution of Profits

Konami Group believes that the provision of dividends and the enhancement of corporate value are important ways to return profits to our shareholders. It is our policy to use retained earnings for investments focused on business fields with good future possibility in order to continually reinforce KONAMI’s growth potential and competitiveness.

As for term-end dividends for the consolidated year ended March 31, 2012, 25 yen per share dividend was approved at the Board Meeting held on May 10, 2012. As a result, the dividends on an annual basis will be 50 yen per share, including the distributed interim dividend of 25 yen per share.

KONAMI CORPORATION plans to distribute dividends of 50 yen per share for the fiscal year ending March 31, 2013.

Special Note:

This document contains “forward-looking statements,” or statements related to future events that are based on management’s assumptions and beliefs in light of information currently available. These statements are subject to various risks and uncertainties.

When relying on forward-looking statements to make investments, you should not place undue reliance on such forward-looking statements. Actual results may be affected by a number of important factors and may be materially different from those discussed in forward-looking statements. Such factors include, but are not limited to, changes in economic conditions affecting our operations, market trends and fluctuations in currency exchange rates, particularly with respect to the value of the Japanese yen, the U.S. dollar and the Euro.

14

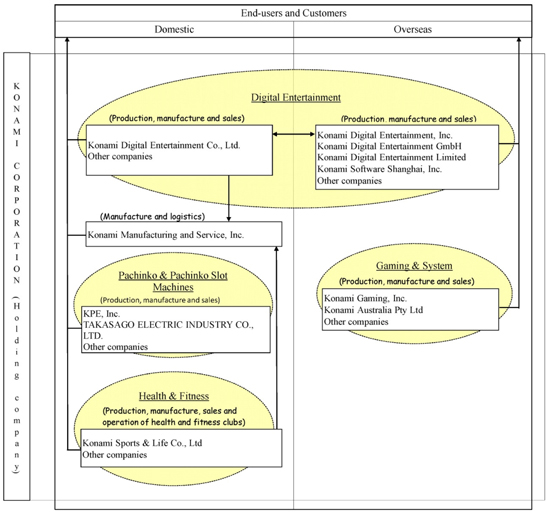

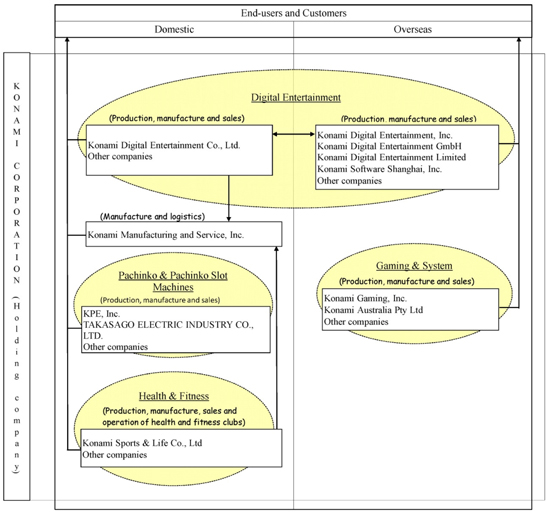

2. Organizational Structure of the Konami Group

The Konami Group is a corporate group engaged in the entertainment and health fitness industries providing customers with “High Quality Life.” The Konami Group is comprised of KONAMI CORPORATION (“the Company”) and its 24 consolidated subsidiaries and one equity-method affiliate.

The summary overview of the Company, the consolidated subsidiaries and the equity-method affiliate and the business segment in which they operate are as follows.

The four business segments shown below are based on the same categorization as described below in “6. Segment Information” under “4. Consolidated Financial Statements”.

| | | | |

Business Segments | | Major Companies |

| Digital Entertainment | | Domestic | | Konami Digital Entertainment Co., Ltd. (Note 2-2) |

| | | Konami Manufacturing & Service, Inc., others |

| | | | |

| | | | Konami Digital Entertainment, Inc. |

| | Overseas | | Konami Digital Entertainment GmbH |

| | | | Konami Digital Entertainment Limited |

| | | | Konami Software Shanghai, Inc., others |

| | | | |

| Gaming & Systems | | Overseas | | Konami Gaming, Inc. |

| | | Konami Australia Pty Ltd., others |

| | | | |

| Pachinko & Pachinko Slot Machines | | Domestic | | KPE, Inc. Takasago Electric Industry Co., Ltd., others (Note 2-1) |

| | | | |

| Health & Fitness | | | | Konami Sports & Life Co., Ltd. |

| | Domestic | | Konami Manufacturing & Service, Inc. |

| | | | Resort Solution Co., Ltd. (Note 3), others |

| | | | |

Notes:

| 1. | Major companies that have operations in more than one business segment are included in each segment in which they operate. |

| 2. | During the year ended March 31, 2012, primary changes in companies are as follows: |

| | 1) | KPE, Inc. and TAKASAGO ELECTRIC INDUSTRY CO., LTD. jointly established KPE-TAKASAGO Sales Co., Ltd. in February 2012. |

| | 2) | Konami Digital Entertainment Co., Ltd. merged with HUDSON SOFT CO., LTD. in March, 2012. |

| 3. | Resort Solution Co., Ltd. is an equity-method affiliate. |

15

Business Organization

16

3. Management Policy

1. Management Policy

We, the Konami Group, are aiming to be a business group that is always highly regarded by all people, by creating and providing them with “Valuable Time”. Furthermore, our basic management policy is to “value shareholders” and to “maintain sound relationships with all stakeholders, including our shareholders, and contribute to society as a good corporate citizen.” We aim for the optimum use of the group’s managerial resources with the following as specific guiding principles for management: to “follow global standards,” “engage in fair competition” and “pursue high profits.”

To “value shareholders,” our basic policy is to emphasize payment of dividends and enhance our corporate value to return profits to our shareholders. It is also our policy to focus the investment of retained earnings after dividends in highly promising fields so that we may increase corporate value and enlarge resources for the payment of dividends in the future.

To “maintain sound relationships with all stakeholders, including our shareholders, and contribute to society as a good corporate citizen,” we focus on maintaining sound relationships with shareholders, investors, customers, business partners, employees and society as a whole, as well as carrying out support activities in a wide range of fields including education, sports and culture. In accordance with such basic policies, Konami Group will continue to seek to deliver dreams and excitement to people around the world by creating and providing “Valuable Time.”

2. Profit Appropriation Policy

Konami Group aims to continually enhance profitability through the improvement of operational efficiency. Emphasis is placed on three managerial indexes: the ratio of operating income to net sales, the ratio of net income to net sales and return on equity.

3. Medium- to Long-term Corporate Strategies and Objectives

Build a powerful organization that can respond to rapid changes in the global economy

Although there were signs of gradual recovery from the ongoing economic slowdown from the previous fiscal year, the global economy remains uncertain. There is also concern of a difficult business climate which persisted in our businesses – Digital Entertainment, Gaming & Systems, Pachinko & Pachinko Slot Machines and Health & Fitness – due to the impact of economic uncertainty. On the other hand, in our business environment, progress has been made in developing a network environment. In the process, users have begun sharing a variety of information, and communities are starting to emerge, each with its distinct tastes.

Konami Group has shifted to a holding company structure so that it may respond appropriately to a rapidly changing market environment and evolve into a flexible and sustainable entity. As such, there is now a clear separation between the management of the Konami Group and the execution of duties for each business segment. In promoting the globalization of each business segment, we shifted to a system in which each Konami Group director is ultimately responsible for a business segment. This is to enable on-target response to the needs of each market as well as promote the agile development of each business. We also intend to promote the competitiveness and the sustainable growth of each group company. We believe that this will allow the Konami Group as a whole to make a leap forward.

17

Enhance profitability and channel managerial resources to growth areas

In the Digital Entertainment segment, the popularization of games for social networking services (SNS) and the development of a globally connected online environment have led to an increase in users who seek new modes of play that emphasize network connectivity. The needs of such users are expected to become increasingly diverse. With such diversity and globalization sought by users, Konami Group intends to channel appropriate managerial resources in selective and focused manners.

In the Gaming & Systems segment, as for the casino market where Konami Group operates, the legalization of gambling is progressing in various countries and regions around the world, and the number of casinos is increasing each year. Business opportunities are continuously increasing for Konami Group, which manufactures and markets slot machines and offers participation agreements and theKonami Casino Management System that secure stable revenues for Konami Group. We will endeavor to expand our business in the future with strategic alliances with other companies.

In the Pachinko & Pachinko Slot Machines segment, Konami Group will strive to increase its market share by providing products leveraging the Group’s extensive entertainment expertise in step with market developments such as changes in how games are played and user preferences.

In the Health & Fitness segment, against the backdrop of higher health consciousness and increase in those with more leisure time due to the retirement of baby boomers, it is anticipated that health consciousness will become even higher in the future while preferences and lifestyles will diversify. In order to achieve further growth, we will take proactive steps to create value-added Konami Sports Clubs that meet the diversifying consumer needs and offer a new lifestyle.

Konami Group plans to allocate appropriate managerial resources not only to the existing Digital Entertainment, Gaming & Systems, Pachinko & Pachinko Slot Machines and Health & Fitness but also to new business fields where growth is anticipated in the medium- to long-term.

18

4. Consolidated Financial Statements

1. Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | Millions of Yen | | | Thousands of

U.S. Dollars | |

| | | March 31, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| | | | | | % | | | | | | % | | | | |

ASSETS | | | | | | | | | | | | | | | | | | | | |

CURRENT ASSETS: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | ¥ | 59,541 | | | | | | | ¥ | 76,451 | | | | | | | $ | 930,174 | |

Trade notes and accounts receivable, net of allowance for doubtful accounts of ¥275 million and ¥380 million ($4,623 thousand) at March 31, 2011 and March 31, 2012, respectively | | | 28,564 | | | | | | | | 33,647 | | | | | | | | 409,381 | |

Inventories | | | 25,479 | | | | | | | | 22,121 | | | | | | | | 269,145 | |

Deferred income taxes, net | | | 23,239 | | | | | | | | 20,503 | | | | | | | | 249,458 | |

Prepaid expenses and other current assets | | | 12,111 | | | | | | | | 9,243 | | | | | | | | 112,459 | |

| | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 148,934 | | | | 47.4 | | | | 161,965 | | | | 49.4 | | | | 1,970,617 | |

PROPERTY AND EQUIPMENT, net | | | 59,508 | | | | 19.0 | | | | 62,251 | | | | 19.0 | | | | 757,403 | |

INVESTMENTS AND OTHER ASSETS: | | | | | | | | | | | | | | | | | | | | |

Investments in marketable securities | | | 140 | | | | | | | | 429 | | | | | | | | 5,220 | |

Investments in affiliates | | | 2,131 | | | | | | | | 2,184 | | | | | | | | 26,573 | |

Identifiable intangible assets | | | 41,565 | | | | | | | | 41,283 | | | | | | | | 502,287 | |

Goodwill | | | 21,880 | | | | | | | | 21,875 | | | | | | | | 266,152 | |

Lease deposits | | | 27,360 | | | | | | | | 26,827 | | | | | | | | 326,402 | |

Deferred income taxes, net | | | 2,934 | | | | | | | | 976 | | | | | | | | 11,875 | |

Other assets | | | 9,439 | | | | | | | | 10,216 | | | | | | | | 124,297 | |

| | | | | | | | | | | | | | | | | | | | |

Total investments and other assets | | | 105,449 | | | | 33.6 | | | | 103,790 | | | | 31.6 | | | | 1,262,806 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL ASSETS | | ¥ | 313,891 | | | | 100.0 | | | ¥ | 328,006 | | | | 100.0 | | | $ | 3,990,826 | |

| | | | | | | | | | | | | | | | | | | | |

19

| | | | | | | | | | | | | | | | | | | | |

| | | Millions of Yen | | | Thousands of

U.S. Dollars | |

| | | March 31, 2011 | | | March 31, 2012 | | | March 31, 2012 | |

| | | | | | % | | | | | | % | | | | |

LIABILITIES | | | | | | | | | | | | | | | | | | | | |

CURRENT LIABILITIES: | | | | | | | | | | | | | | | | | | | | |

Short-term borrowings | | ¥ | 4,000 | | | | | | | ¥ | 2,300 | | | | | | | $ | 27,984 | |

Current portion of long-term debt | | | 5,000 | | | | | | | | 5,000 | | | | | | | | 60,835 | |

Current portion of capital lease and financing obligations | | | 1,783 | | | | | | | | 2,458 | | | | | | | | 29,906 | |

Trade notes and accounts payable | | | 19,003 | | | | | | | | 16,290 | | | | | | | | 198,199 | |

Accrued income taxes | | | 6,121 | | | | | | | | 10,449 | | | | | | | | 127,132 | |

Accrued expenses | | | 16,747 | | | | | | | | 19,993 | | | | | | | | 243,254 | |

Deferred revenue | | | 4,804 | | | | | | | | 5,595 | | | | | | | | 68,074 | |

Other current liabilities | | | 5,697 | | | | | | | | 5,805 | | | | | | | | 70,629 | |

| | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 63,155 | | | | 20.1 | | | | 67,890 | | | | 20.7 | | | | 826,013 | |

LONG-TERM LIABILITIES: | | | | | | | | | | | | | | | | | | | | |

Long-term debt, less current portion | | | 10,000 | | | | | | | | 5,000 | | | | | | | | 60,835 | |

Capital lease and financing obligations, less current portion | | | 25,516 | | | | | | | | 24,803 | | | | | | | | 301,776 | |

Accrued pension and severance costs | | | 2,932 | | | | | | | | 1,641 | | | | | | | | 19,966 | |

Deferred income taxes, net | | | 5,503 | | | | | | | | 4,024 | | | | | | | | 48,960 | |

Other long-term liabilities | | | 8,378 | | | | | | | | 8,928 | | | | | | | | 108,626 | |

| | | | | | | | | | | | | | | | | | | | |

Total long-term liabilities | | | 52,329 | | | | 16.7 | | | | 44,396 | | | | 13.5 | | | | 540,163 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL LIABILITIES | | | 115,484 | | | | 36.8 | | | | 112,286 | | | | 34.2 | | | | 1,366,176 | |

| | | | | |

COMMITMENTS AND CONTINGENCIES | | | | | | | | | | | | | | | | | | | | |

| | | | | |

EQUITY: | | | | | | | | | | | | | | | | | | | | |

KONAMI CORPORATION stockholders’ equity: | | | | | | | | | | | | | | | | | | | | |

Common stock, no par value- Authorized 450,000,000 shares; issued 143,500,000 shares at March 31, 2011 and March 31, 2012 | | | 47,399 | | | | 15.1 | | | | 47,399 | | | | 14.4 | | | | 576,700 | |

Additional paid-in capital | | | 75,490 | | | | 24.0 | | | | 74,175 | | | | 22.6 | | | | 902,482 | |

Legal reserve | | | 284 | | | | 0.1 | | | | 284 | | | | 0.1 | | | | 3,455 | |

Retained earnings | | | 90,250 | | | | 28.8 | | | | 107,565 | | | | 32.8 | | | | 1,308,736 | |

Accumulated other comprehensive income (loss) | | | (2,547 | ) | | | (0.8 | ) | | | (2,719 | ) | | | (0.8 | ) | | | (33,082 | ) |

Treasury stock, at cost- 7,359,029 shares and 4,879,848 shares at March 31, 2011 and March 31, 2012, respectively | | | (16,962 | ) | | | (5.4 | ) | | | (11,246 | ) | | | (3.4 | ) | | | (136,829 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total KONAMI CORPORATION stockholders’ equity | | | 193,914 | | | | 61.8 | | | | 215,458 | | | | 65.7 | | | | 2,621,462 | |

| | | | | | | | | | | | | | | | | | | | |

Noncontrolling interest | | | 4,493 | | | | 1.4 | | | | 262 | | | | 0.1 | | | | 3,188 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL EQUITY | | | 198,407 | | | | 63.2 | | | | 215,720 | | | | 65.8 | | | | 2,624,650 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL LIABILITIES AND EQUITY | | ¥ | 313,891 | | | | 100.0 | | | ¥ | 328,006 | | | | 100.0 | | | $ | 3,990,826 | |

| | | | | | | | | | | | | | | | | | | | |

20

2. Consolidated Statements of Income (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | Millions of Yen | | | Thousands of

U.S. Dollars | |

| | | Year ended

March 31, 2011 | | | Year ended

March 31, 2012 | | | Year ended

March 31, 2012 | |

| | | | | | % | | | | | | % | | | | |

NET REVENUES: | | | | | | | | | | | | | | | | | | | | |

Product sales revenue | | ¥ | 156,867 | | | | | | | ¥ | 140,159 | | | | | | | $ | 1,705,305 | |

Service and other revenue | | | 101,121 | | | | | | | | 125,599 | | | | | | | | 1,528,154 | |

| | | | | | | | | | | | | | | | | | | | |

Total net revenues | | | 257,988 | | | | 100.0 | | | | 265,758 | | | | 100.0 | | | | 3,233,459 | |

| | | | | | | | | | | | | | | | | | | | |

COSTS AND EXPENSES: | | | | | | | | | | | | | | | | | | | | |

Costs of products sold | | | 102,741 | | | | | | | | 89,924 | | | | | | | | 1,094,099 | |

Costs of services rendered and others | | | 86,291 | | | | | | | | 84,491 | | | | | | | | 1,027,996 | |

Selling, general and administrative | | | 46,253 | | | | | | | | 50,051 | | | | | | | | 608,967 | |

Earthquake and related impairment charges | | | 4,455 | | | | | | | | 342 | | | | | | | | 4,161 | |

Gain on bargain purchase | | | (2,543 | ) | | | | | | | — | | | | | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total costs and expenses | | | 237,197 | | | | 91.9 | | | | 224,808 | | | | 84.6 | | | | 2,735,223 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 20,791 | | | | 8.1 | | | | 40,950 | | | | 15.4 | | | | 498,236 | |

| | | | | | | | | | | | | | | | | | | | |

OTHER INCOME (EXPENSES): | | | | | | | | | | | | | | | | | | | | |

Interest income | | | 268 | | | | | | | | 215 | | | | | | | | 2,616 | |

Interest expense | | | (1,541 | ) | | | | | | | (1,427 | ) | | | | | | | (17,362 | ) |

Foreign currency exchange gain (loss), net | | | (342 | ) | | | | | | | 331 | | | | | | | | 4,027 | |

Other, net | | | (94 | ) | | | | | | | (43 | ) | | | | | | | (523 | ) |

| | | | | | | | | | | | | | | | | | | | |

Other income (expenses), net | | | (1,709 | ) | | | (0.7 | ) | | | (924 | ) | | | (0.3 | ) | | | (11,242 | ) |

| | | | | | | | | | | | | | | | | | | | |

INCOME BEFORE INCOME TAXES AND EQUITY IN NET INCOME OF AFFILIATED COMPANIES | | | 19,082 | | | | 7.4 | | | | 40,026 | | | | 15.1 | | | | 486,994 | |

INCOME TAXES | | | 6,401 | | | | 2.5 | | | | 16,941 | | | | 6.4 | | | | 206,120 | |

EQUITY IN NET INCOME OF AFFILIATED COMPANIES, net | | | 41 | | | | 0.0 | | | | 52 | | | | 0.0 | | | | 632 | |

| | | | | | | | | | | | | | | | | | | | |

NET INCOME | | | 12,722 | | | | 4.9 | | | | 23,137 | | | | 8.7 | | | | 281,506 | |

NET INCOME (LOSS) ATTRIBUTABLE TO THE NONCONTROLLING INTEREST | | | (212 | ) | | | (0.1 | ) | | | 125 | | | | 0.0 | | | | 1,521 | |

| | | | | | | | | | | | | | | | | | | | |

NET INCOME ATTRIBUTABLE TO KONAMI CORPORATION | | ¥ | 12,934 | | | | 5.0 | | | ¥ | 23,012 | | | | 8.7 | | | $ | 279,985 | |

| | | | | | | | | | | | | | | | | | | | |

| | | |

| PER SHARE DATA: | | Yen | | | | | | U.S. Dollar | |

| | | Year ended

March 31, 2011 | | | | | | Year ended

March 31, 2012 | | | | | | Year ended

March 31, 2012 | |

Basic net income attributable to KONAMI CORPORATION per share | | ¥ | 96.48 | | | | | | | ¥ | 166.23 | | | | | | | $ | 2.02 | |

Diluted net income attributable to KONAMI CORPORATION per share | | | 96.48 | | | | | | | | 166.23 | | | | | | | | 2.02 | |

| | | | | | | | | | | | | | | | | | | | |

Weighted-average common share outstanding | | | 134,065,450 | | | | | | | | 138,433,751 | | | | | | | | | |

Diluted weighted-average common shares outstanding | | | 134,065,450 | | | | | | | | 138,433,751 | | | | | | | | | |

21

3. Consolidated Statements of Stockholders’ Equity (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Millions of Yen | |

| | | Stockholders’ Equity | | | Total

KONAMI

CORPORATION

stockholders’

equity | | | Non

controlling

Interest | | | Total Equity | |

| | | Common

Stock | | | Additional

Paid-in

Capital | | | Legal

Reserve | | | Retained

Earnings | | | Accumulated

Other

Comprehensive

Income (Loss) | | | Treasury

Stock,

at Cost | | | | |

Balance at March 31, 2010 | | ¥ | 47,399 | | | ¥ | 77,089 | | | ¥ | 284 | | | ¥ | 83,055 | | | ¥ | (175 | ) | | ¥ | (23,187 | ) | | ¥ | 184,465 | | | ¥ | 4,766 | | | ¥ | 189,231 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash dividends attributable to KONAMI CORPORATION | | | | | | | | | | | | | | | (5,739 | ) | | | | | | | | | | | (5,739 | ) | | | | | | | (5,739 | ) |

Cash dividends attributable to noncontrolling interest | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (54 | ) | | | (54 | ) |

Purchase of treasury stock | | | | | | | | | | | | | | | | | | | | | | | (101 | ) | | | (101 | ) | | | | | | | (101 | ) |

Reissuance of treasury stock | | | | | | | (1,599 | ) | | | | | | | | | | | | | | | 6,326 | | | | 4,727 | | | | | | | | 4,727 | |

Comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | | | | | | | 12,934 | | | | | | | | | | | | 12,934 | | | | (212 | ) | | | 12,722 | |

Foreign currency translation adjustments | | | | | | | | | | | | | | | | | | | (2,140 | ) | | | | | | | (2,140 | ) | | | (13 | ) | | | (2,153 | ) |

Net unrealized losses on available-for-sale securities | | | | | | | | | | | | | | | | | | | (55 | ) | | | | | | | (55 | ) | | | | | | | (55 | ) |

Pension liability adjustment | | | | | | | | | | | | | | | | | | | (177 | ) | | | | | | | (177 | ) | | | 6 | | | | (171 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | 10,562 | | | | (219 | ) | | | 10,343 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at March 31, 2011 | | ¥ | 47,399 | | | ¥ | 75,490 | | | ¥ | 284 | | | ¥ | 90,250 | | | ¥ | (2,547 | ) | | ¥ | (16,962 | ) | | ¥ | 193,914 | | | ¥ | 4,493 | | | ¥ | 198,407 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash dividends attributable to KONAMI CORPORATION | | | | | | | | | | | | | | | (5,697 | ) | | | | | | | | | | | (5,697 | ) | | | | | | | (5,697 | ) |

Purchase of treasury stock | | | | | | | | | | | | | | | | | | | | | | | (29 | ) | | | (29 | ) | | | | | | | (29 | ) |

Reissuance of treasury stock | | | | | | | (0 | ) | | | | | | | | | | | | | | | 5,745 | | | | 5,745 | | | | | | | | 5,745 | |

Equity transaction with noncontrolling interests and others | | | | | | | (1,315 | ) | | | | | | | | | | | | | | | | | | | (1,315 | ) | | | (4,356 | ) | | | (5,671 | ) |

Comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | | | | | | | 23,012 | | | | | | | | | | | | 23,012 | | | | 125 | | | | 23,137 | |

Foreign currency translation adjustments | | | | | | | | | | | | | | | | | | | (455 | ) | | | | | | | (455 | ) | | | | | | | (455 | ) |

Net unrealized losses on available-for-sale securities | | | | | | | | | | | | | | | | | | | (0 | ) | | | | | | | (0 | ) | | | | | | | (0 | ) |

Pension liability adjustment | | | | | | | | | | | | | | | | | | | 283 | | | | | | | | 283 | | | | | | | | 283 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | 22,840 | | | | 125 | | | | 22,965 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at March 31, 2012 | | ¥ | 47,399 | | | ¥ | 74,175 | | | ¥ | 284 | | | ¥ | 107,565 | | | ¥ | (2,719 | ) | | ¥ | (11,246 | ) | | ¥ | 215,458 | | | ¥ | 262 | | | ¥ | 215,720 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Thousands of U.S. Dollars | |

| | | Stockholders’ Equity | | | Total

KONAMI

CORPORATION

stockholders’

equity | | | Non

controlling

Interest | | | Total Equity | |

| | | Common

Stock | | | Additional

Paid-in

Capital | | | Legal

Reserve | | | Retained

Earnings | | | Accumulated

Other

Comprehensive

Income (Loss) | | | Treasury

Stock,

at Cost | | | | |

Balance at March 31, 2011 | | $ | 576,700 | | | $ | 918,481 | | | $ | 3,455 | | | $ | 1,098,064 | | | $ | (30,989 | ) | | $ | (206,373 | ) | | $ | 2,359,338 | | | $ | 54,666 | | | $ | 2,414,004 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash dividends attributable to KONAMI CORPORATION | | | | | | | | | | | | | | | (69,313 | ) | | | | | | | | | | | (69,313 | ) | | | | | | | (69,313 | ) |

Purchase of treasury stock | | | | | | | | | | | | | | | | | | | | | | | (353 | ) | | | (353 | ) | | | | | | | (353 | ) |

Reissuance of treasury stock | | | | | | | (0 | ) | | | | | | | | | | | | | | | 69,897 | | | | 69,897 | | | | | | | | 69,897 | |

Equity transaction with noncontrolling interests and others | | | | | | | (15,999 | ) | | | | | | | | | | | | | | | | | | | (15,999 | ) | | | (52,999 | ) | | | (68,998 | ) |

Comprehensive income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | | | | | | | | | | | | | 279,985 | | | | | | | | | | | | 279,985 | | | | 1,521 | | | | 281,506 | |

Foreign currency translation adjustments | | | | | | | | | | | | | | | | | | | (5,535 | ) | | | | | | | (5,535 | ) | | | | | | | (5,535 | ) |

Net unrealized losses on available-for-sale securities | | | | | | | | | | | | | | | | | | | (3 | ) | | | | | | | (3 | ) | | | | | | | (3 | ) |

Pension liability adjustment | | | | | | | | | | | | | | | | | | | 3,445 | | | | | | | | 3,445 | | | | | | | | 3,445 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total comprehensive income for the year | | | | | | | | | | | | | | | | | | | | | | | | | | | 277,892 | | | | 1,521 | | | | 279,413 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance at March 31, 2012 | | $ | 576,700 | | | $ | 902,482 | | | $ | 3,455 | | | $ | 1,308,736 | | | $ | (33,082 | ) | | $ | (136,829 | ) | | $ | 2,621,462 | | | $ | 3,188 | | | $ | 2,624,650 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

23

4. Consolidated Statements of Cash Flows (Unaudited)

| | | | | | | | | | | | |

| | | Millions of Yen | | | Thousands of

U.S. Dollars | |

| | | Year ended

March 31, 2011 | | | Year ended

March 31, 2012 | | | Year ended

March 31, 2012 | |

Cash flows from operating activities: | | | | | | | | | | | | |

Net income | | ¥ | 12,722 | | | ¥ | 23,137 | | | $ | 281,506 | |

Adjustments to reconcile net income to net cash provided by operating activities - | | | | | | | | | | | | |

Depreciation and amortization | | | 12,388 | | | | 9,798 | | | | 119,212 | |

Provision for doubtful receivables | | | (192 | ) | | | 44 | | | | 535 | |

Earthquake and related impairment charges | | | 4,455 | | | | — | | | | — | |

Gain on bargain purchase | | | (2,543 | ) | | | — | | | | — | |

Gain or loss on sale or disposal of property and equipment, net | | | 271 | | | | 311 | | | | 3,784 | |

Equity in net loss (income) of affiliated companies | | | (41 | ) | | | (52 | ) | | | (633 | ) |

Deferred income taxes | | | (918 | ) | | | 2,824 | | | | 34,360 | |

Change in assets and liabilities, net of business acquired: | | | | | | | | | | | | |

Decrease (increase) in trade notes and accounts receivable | | | 2,385 | | | | (5,406 | ) | | | (65,774 | ) |

Decrease (increase) in inventories | | | (2,632 | ) | | | 2,201 | | | | 26,779 | |

Decrease (increase) in other receivables | | | 20 | | | | 152 | | | | 1,849 | |

Decrease (increase) in prepaid expenses | | | 101 | | | | 790 | | | | 9,612 | |

Increase (decrease) in trade notes and accounts payable | | | 2,357 | | | | (2,458 | ) | | | (29,906 | ) |

Increase (decrease) in accrued income taxes, net of tax refunds | | | 576 | | | | 4,396 | | | | 53,486 | |

Increase (decrease) in accrued expenses | | | (425 | ) | | | 1,947 | | | | 23,689 | |

Increase (decrease) in deferred revenue | | | (1,157 | ) | | | 830 | | | | 10,099 | |

Increase (decrease) in advance received | | | (185 | ) | | | (256 | ) | | | (3,115 | ) |

Increase (decrease) in deposits | | | (117 | ) | | | 92 | | | | 1,119 | |

Other, net | | | (460 | ) | | | (435 | ) | | | (5,293 | ) |

| | | | | | | | | | | | |

Net cash provided by operating activities | | | 26,605 | | | | 37,915 | | | | 461,309 | |

24

| | | | | | | | | | | | |

| | | Millions of Yen | | | Thousands of

U.S. Dollars | |

| | | Year ended

March 31, 2011 | | | Year ended

March 31, 2012 | | | Year ended

March 31, 2012 | |

Cash flows from investing activities: | | | | | | | | | | | | |

Capital expenditures | | | (10,554 | ) | | | (9,260 | ) | | | (112,666 | ) |

Proceeds from sales of property and equipment | | | 8 | | | | 11 | | | | 134 | |

Acquisition of new subsidiaries | | | 679 | | | | — | | | | — | |

Decrease (increase) in lease deposits, net | | | 497 | | | | 466 | | | | 5,670 | |

Decrease (increase) in term deposits, net | | | (1,412 | ) | | | 1,412 | | | | 17,180 | |

Other, net | | | 9 | | | | (275 | ) | | | (3,346 | ) |

| | | | | | | | | | | | |

Net cash used in investing activities | | | (10,773 | ) | | | (7,646 | ) | | | (93,028 | ) |

Cash flows from financing activities: | | | | | | | | | | | | |

Increase (decrease) in short-term borrowings, net | | | 680 | | | | (1,700 | ) | | | (20,684 | ) |

Repayments of long-term debt | | | (278 | ) | | | — | | | | — | |

Redemption of bonds | | | — | | | | (5,000 | ) | | | (60,834 | ) |

Principal payments under capital lease and financing obligations | | | (2,678 | ) | | | (2,385 | ) | | | (29,018 | ) |

Dividends paid | | | (5,785 | ) | | | (5,689 | ) | | | (69,217 | ) |

Purchases of treasury stock by parent company | | | (101 | ) | | | (29 | ) | | | (353 | ) |

Proceeds from sale-leaseback transaction | | | 1,975 | | | | 1,547 | | | | 18,822 | |

Other, net | | | 5 | | | | 2 | | | | 24 | |

| | | | | | | | | | | | |

Net cash used in financing activities | | | (6,182 | ) | | | (13,254 | ) | | | (161,260 | ) |

Effect of exchange rate changes on cash and cash equivalents | | | (849 | ) | | | (105 | ) | | | (1,278 | ) |

| | | | | | | | | | | | |

Net increase in cash and cash equivalents | | | 8,801 | | | | 16,910 | | | | 205,743 | |

| | | | | | | | | | | | |

Cash and cash equivalents, beginning of the period | | | 50,740 | | | | 59,541 | | | | 724,431 | |

| | | | | | | | | | | | |

Cash and cash equivalents, end of the period | | ¥ | 59,541 | | | ¥ | 76,451 | | | $ | 930,174 | |

5. Going concern assumption:

None

25

6. Segment Information (Unaudited)

(1) Segment information

| | | | | | | | | | | | | | | | | | | | | | | | |

Year ended March 31, 2011 | | Digital

Entertainment | | | Gaming &

Systems | | | Pachinko &

Pachinko Slot

Machines | | | Health &

Fitness | | | Corporate and

Eliminations | | | Consolidated | |

| | | (Millions of Yen) | |

Net revenue: | | | | | | | | | | | | | | | | | | | | | | | | |

Customers | | ¥ | 132,474 | | | ¥ | 21,868 | | | ¥ | 17,985 | | | ¥ | 85,661 | | | | — | | | ¥ | 257,988 | |

Intersegment | | | 650 | | | | — | | | | 2 | | | | 250 | | | ¥ | (902 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 133,124 | | | | 21,868 | | | | 17,987 | | | | 85,911 | | | | (902 | ) | | | 257,988 | |

Operating expenses | | | 116,099 | | | | 15,420 | | | | 11,788 | | | | 88,456 | | | | 5,434 | | | | 237,197 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | ¥ | 17,025 | | | ¥ | 6,448 | | | ¥ | 6,199 | | | ¥ | (2,545 | ) | | ¥ | (6,336 | ) | | ¥ | 20,791 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Year ended March 31, 2012 | | Digital

Entertainment | | | Gaming &

Systems | | | Pachinko &

Pachinko Slot

Machines | | | Health &

Fitness | | | Corporate and

Eliminations | | | Consolidated | |

| | | (Millions of Yen) | |

Net revenue: | | | | | | | | | | | | | | | | | | | | | | | | |

Customers | | ¥ | 139,710 | | | ¥ | 25,212 | | | ¥ | 18,407 | | | ¥ | 82,429 | | | | — | | | ¥ | 265,758 | |

Intersegment | | | 690 | | | | — | | | | 23 | | | | 126 | | | ¥ | (839 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 140,400 | | | | 25,212 | | | | 18,430 | | | | 82,555 | | | | (839 | ) | | | 265,758 | |

Operating expenses | | | 107,379 | | | | 18,556 | | | | 14,251 | | | | 79,726 | | | | 4,896 | | | | 224,808 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | ¥ | 33,021 | | | ¥ | 6,656 | | | ¥ | 4,179 | | | ¥ | 2,829 | | | ¥ | (5,735 | ) | | ¥ | 40,950 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Year ended March 31, 2012 | | Digital

Entertainment | | | Gaming &

Systems | | | Pachinko &

Pachinko Slot

Machines | | | Health &

Fitness | | | Corporate and

Eliminations | | | Consolidated | |

| | | (Thousands of U.S. Dollars) | |

Net revenue: | | | | | | | | | | | | | | | | | | | | | | | | |

Customers | | $ | 1,699,841 | | | $ | 306,753 | | | $ | 223,957 | | | $ | 1,002,908 | | | | — | | | $ | 3,233,459 | |

Intersegment | | | 8,395 | | | | — | | | | 280 | | | | 1,533 | | | $ | (10,208 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 1,708,236 | | | | 306,753 | | | | 224,237 | | | | 1,004,441 | | | | (10,208 | ) | | | 3,233,459 | |

Operating expenses | | | 1,306,472 | | | | 225,770 | | | | 173,391 | | | | 970,021 | | | | 59,569 | | | | 2,735,223 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | $ | 401,764 | | | $ | 80,983 | | | $ | 50,846 | | | $ | 34,420 | | | $ | (69,777 | ) | | $ | 498,236 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Notes: | | 1. | | Primary businesses of each segment are as follows: |

| | | |

| | | | Digital Entertainment Segment: | | Production, manufacture and sale of digital content and related products including Social games, Online games, Computer & Video Games, Amusement and Card Games. |

| | | |

| | | | Gaming & Systems Segment: | | Development, manufacture, sale and service of gaming machines and the Casino Management System for overseas markets. |

| | | |

| | | | Pachinko & Pachinko Slot Machines Segment: | | Production, manufacture and sale of pachinko slot machines and LCDs units for pachinko machines. |

| | | |

| | | | Health & Fitness Segment: | | Operation of health and fitness clubs, and production, manufacture and sale of health and fitness related goods. |

| | |

| | 2. | | “Corporate” primarily consists of administrative expenses of the Company. |

| | |

| | 3. | | “Eliminations” primarily consists of eliminations of intercompany sales and of intercompany profits on inventories. |

26

(2) Geographic information

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year ended March 31, 2011 | | Japan | | | United

States | | | Europe | | | Asia/

Oceania | | | Total | | | Eliminations | | | Consolidated | |

| | | (Millions of Yen) | |

Net revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Customers | | ¥ | 194,431 | | | ¥ | 36,870 | | | ¥ | 19,525 | | | ¥ | 7,162 | | | ¥ | 257,988 | | | | — | | | ¥ | 257,988 | |

Intersegment | | | 17,368 | | | | 1,837 | | | | 1,661 | | | | 710 | | | | 21,576 | | | ¥ | (21,576 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 211,799 | | | | 38,707 | | | | 21,186 | | | | 7,872 | | | | 279,564 | | | | (21,576 | ) | | | 257,988 | |

Operating expenses | | | 201,244 | | | | 32,144 | | | | 18,670 | | | | 6,687 | | | | 258,745 | | | | (21,548 | ) | | | 237,197 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | ¥ | 10,555 | | | ¥ | 6,563 | | | ¥ | 2,516 | | | ¥ | 1,185 | | | ¥ | 20,819 | | | ¥ | (28 | ) | | ¥ | 20,791 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Year ended March 31, 2012 | | Japan | | | United

States | | | Europe | | | Asia/

Oceania | | | Total | | | Eliminations | | | Consolidated | |

| | | (Millions of Yen) | |

Net revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Customers | | ¥ | 208,641 | | | ¥ | 35,955 | | | ¥ | 14,561 | | | ¥ | 6,601 | | | ¥ | 265,758 | | | | — | | | ¥ | 265,758 | |

Intersegment | | | 12,557 | | | | 3,706 | | | | 512 | | | | 234 | | | | 17,009 | | | ¥ | (17,009 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 221,198 | | | | 39,661 | | | | 15,073 | | | | 6,835 | | | | 282,767 | | | | (17,009 | ) | | | 265,758 | |

Operating expenses | | | 189,256 | | | | 32,277 | | | | 14,149 | | | | 6,234 | | | | 241,916 | | | | (17,108 | ) | | | 224,808 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | ¥ | 31,942 | | | ¥ | 7,384 | | | ¥ | 924 | | | ¥ | 601 | | | ¥ | 40,851 | | | ¥ | 99 | | | ¥ | 40,950 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Year ended March 31, 2012 | | Japan | | | United

States | | | Europe | | | Asia/

Oceania | | | Total | | | Eliminations | | | Consolidated | |

| | | (Thousands of U.S. Dollars) | |

Net revenue: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Customers | | $ | 2,538,520 | | | $ | 437,462 | | | $ | 177,163 | | | $ | 80,314 | | | $ | 3,233,459 | | | | — | | | $ | 3,233,459 | |

Intersegment | | | 152,780 | | | | 45,091 | | | | 6,229 | | | | 2,847 | | | | 206,947 | | | $ | (206,947 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 2,691,300 | | | | 482,553 | | | | 183,392 | | | | 83,161 | | | | 3,440,406 | | | | (206,947 | ) | | | 3,233,459 | |

Operating expenses | | | 2,302,664 | | | | 392,712 | | | | 172,150 | | | | 75,849 | | | | 2,943,375 | | | | (208,152 | ) | | | 2,735,223 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | $ | 388,636 | | | $ | 89,841 | | | $ | 11,242 | | | $ | 7,312 | | | $ | 497,031 | | | $ | 1,205 | | | $ | 498,236 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the purpose of presenting its operations in geographic areas above, KONAMI CORPORATION and its subsidiaries attributes revenues from external customers to individual countries in each area based on where we sold products or rendered services, and attributes assets based on where assets are located.

27

Notes: (Unaudited)

| | - | The consolidated financial statements presented herein were prepared in accordance with U.S. generally accepted accounting principles (U.S. GAAP). |

| | - | Certain reclassifications have been made to the prior year’s consolidated financial statements to conform to the presentation used for the year ended March 31, 2012. |

- Subsequent Events

For the Fiscal Year Ended March 31, 2011 (April 1, 2010 – March 31, 2011):

In accordance with a share exchange agreement between the Company and HUDSON SOFT CO., LTD. (“HUDSON”), a consolidated subsidiary of the Company, pursuant to the resolution of the Company’s board of directors’ meeting held on January 20, 2011, the Company executed a share exchange agreement on April 1, 2011 and made HUDSON a wholly owned subsidiary of the Company. Under the terms of the agreement, 0.188 shares of the Company’s common stock were exchanged for each common share of HUDSON. The Company used approximately 2,491 million shares of its treasury stock for the allocation of shares for HUDSON’s shareholders.

For the Fiscal Year Ended March 31, 2012 (April 1, 2011 – March 31, 2012):

None

28