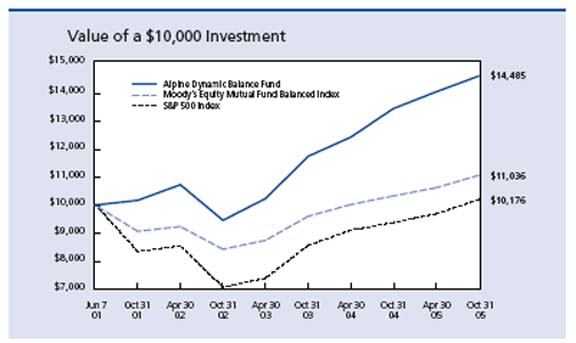

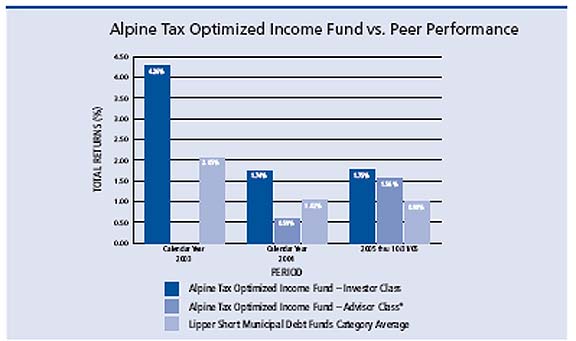

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver of certain fees. Without the waiver of fees, the Fund’s total return would have been lower.

The Lehman Brothers Municipal 1 Year Bond Index is the 1-year (1-2) component of the Municipal Bond Index. The Lehman Brothers Municipal Bond Index is a rules-based, market-value weighted index engineered for the long-term, tax-exempt bond market. Lipper Short Municipal Debt Funds Index is an unmanaged index that tracks funds that invest in municipal debt issues with dollar-weighted average maturities of less than three years. The Lehman Brothers Municipal 1 Year Bond Index and the Lipper Short Municipal Debt Funds Average are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment advisor fees. The performance for the Tax Optimized Income Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Alpine Municipal Money Market Fund / Alpine Tax Optimized Income Fund — Commentary

We are pleased to provide you with the commentary for the Alpine Income Trust for the period ending October 31, 2005. The Income Trust includes both the Alpine Municipal Money Market Fund and the Alpine Tax Optimized Income Fund.

Performance Summary

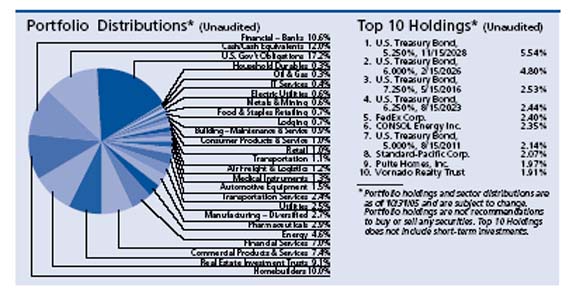

For the one-year period, each Fund continued to produce relative performance leadership when compared against its counterparts in their respective categories. Based on total returns, The Alpine Municipal Money Market Fund was ranked number one out of 118 Tax Exempt Money Market Funds according to Lipper Analytical. It had a total return for the period of 2.24%. Lipper ranked the Alpine Tax Optimized Income Fund number eight out of 63 funds in the Short Municipal Debt category and had a total return for the period of 1.84%. The Lipper Analytical peer average of the period was 1.49% and 1.06% for the Tax Exempt Money Market Fund and Short Municipal Debt peer groups, respectively.

Market Overview

Economic growth remained relatively strong during the course of your fund’s fiscal year. Consequently, the Federal Reserve Board continued increasing the federal funds rate in an effort to restrain inflation. In September, the Fed implemented its 11th increase in the federal funds rate since June 2004. In a typical cycle, the Fed tightens monetary conditions in an attempt to reduce rising inflationary pressure generated by an overheating economy, a condition that may cause long-term rates to rise. But these increases in short-term rates, according to the Fed have not been intended to forestall a major inflationary threat or cool economic overheating. Instead the Fed is gradually removing the extra stimulus it applied to support a recessionary, post-bubble economy. The Fed’s gradual approach to reining in economic growth may have helped allay investor fears of higher longer-term rates, as long-term bond yields at the end of our reporting period were lower then where they were at the start of the calendar year despite rising short-term rates. As shorter and longer-term interest rates began to converge, the yield curve flattened significantly.

Soon after our reporting period ended, the Fed raised the federal funds rate in early November for a 12th time to 4.00%. The continued rate increases indicate the Fed’s belief that the economy is strong enough to withstand the long-term effects and higher energy costs associated with Hurricane Katrina. Unless a disruptive event jars the U.S economy, we do not anticipate the Fed will stop lifting interest rates for the foreseeable future. We do, however, expect the impact of the Fed’s tightenings to become more pronounced in the first half of 2006.

Alpine Tax Optimized Income Fund

Municipal issuance throughout the past six months been remained on pace to equal last year’s record. Despite the large issuance and lackluster demand by mutual funds, the ratio of AAA municipal versus US Treasury yields for the most part remained range-bound throughout the period. The one exception was in late August as Treasuries rallied and municipals underperformed in the wake of Hurricane Katrina. Credit spreads for areas damaged by the hurricane widened out, with insured bonds trading slightly wider in early September.

We have examined both portfolios in the wake of the hurricane and are pleased to report that we have no holdings with any direct exposure to issuers in the area. Though the Funds hold a very small portion of securities in the region, all of them are credit enhanced with a direct pay letter of credit from a major financial institution.

Alpine Tax Optimized Income Fund

Given our expectation for rising interest rates, your portfolio’s maturity was short at the start of the fiscal year and we continued to shorten it as the year progressed. We continued to move out of a laddered strategy by selling securities in the two to four year range that were most sensitive to the rise in short-term interest rates and developed more of a barbelled approach. It most be noted, that although we did make some select purchases on the long end of the curve, we remain committed to capital preservation and therefore will be very sensitive to maintaining a conservative posture in this interest rate environment.

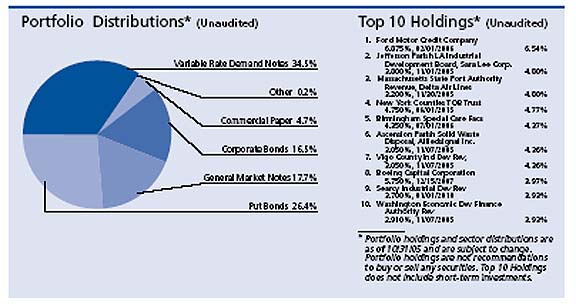

While we continue to explore all areas of the fixed income market for attractive after-tax returns, we find ourselves with limited choices because of the attractive ratio of municipal securities relative to their taxable counterparts. One area of the corporate market that we chose to invest in again was short-term bonds issued by Ford Motor Credit. With the auto industry going through a very volatile period now, very attractive yields can be attained with minimum price fluctuation on this debt. Although we have explored other depressed areas of the corporate bond market, we have been hesitant to make investments as high demand from investors looking for greater returns has resulted in the narrowing of spreads for these securities.

The one area on the long end of the curve that we have invested in is tobacco settlement bonds. There has been strong interest from buyers in search of higher yields and we have chosen to pursue only maturities with short turbo call features. This type of call feature allows the issuer to redeem the bonds at an earlier date should surplus collections or partial lump sum payments occur. We are hoping that with continued favorable legal rulings, demand for these securities will increase and yields will fall.

The remainder of our investments have been in municipal securities with one year or less to maturity. With the two to ten year part of the yield curve so flat now, we have chosen step back for a moment until we see a reason to justify extending out on the curve. In addition, with short-term rates backing up so much the past year, attractive yields are now available justify staying short for the meantime.

Going forward, we will continue to search for the most attractive opportunities among fixed-income securities and work to balance the pursuit of current income with prudent risk management.

Alpine Municipal Money Market Fund

The Fed’s hikes impacted money market funds the most, pushing yields up as older, lower-yielding securities matured and new, higher-yielding securities took their place. In addition, municipal money market securities saw some seasonal volatility due to various supply and demand factors that affected municipal securities much more than taxable securities. For example, in early May, tax-time redemptions caused yields to reach levels of taxable securities while in July and August, yields fell as cash flooded into funds due to maturing securities and coupon payments. Yields then backed up again throughout September as investments in the short-term municipal market declined as corporations made quarterly tax payments and parents sold holdings to pay for college tuition.

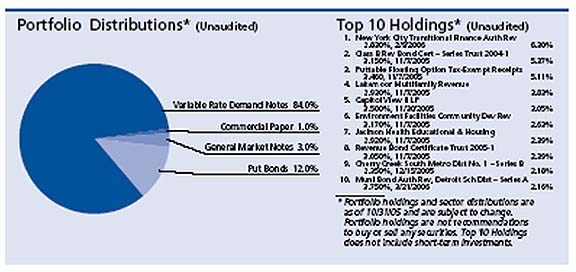

We continued to pursue the fund’s objective, seeking preservation of principal and high current income that is exempt from federal income tax. Over the reporting period, we maintained a very defensive position by keeping the average maturity of the fund very short. On October 31, 2005, the fund’s average weighted maturity was 25 days which was shorter than the industry average of 30 days. We focused primarily on investing in variable rate demand notes in an attempt to maintain liquidity and keep funds available for higher yielding instruments as they became available. VRDNs, which comprised over 80% of our portfolio, have long-term maturities, but their coupons reset daily and weekly making them highly responsive to changes interest rates. Our other investments include short-term put bonds and a very small amount of commercial paper.

Alpine Tax Optimized Income Fund

With our expectations of continued moderate economic growth and gradual Fed tightenings, our investment decisions will continue to focus on keeping the portfolio responsive to rising interest rates. While we plan to maintain a defensive position for the fund, we will continue to search for fixed-rate opportunities in the market whose pricing incorporates our view of higher rates.

Thank you for your investment in the Alpine Mutual Funds.

Steven C. Shachat

Portfolio Manager

An investment in these Funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Funds.

Investing in these funds involves special risks, including but not limited to, investing in municipal obligations and derivative securities, mortgage-related and asset-backed investments. Please refer to the prospectus for further details. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

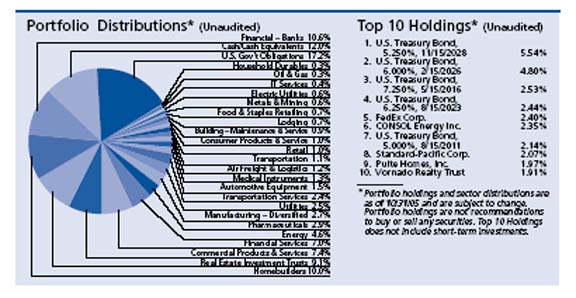

Please refer to the Schedule of Investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Lipper Analytical Services, Inc. is an independent mutual fund research and rating service. Each Lipper average represents a universe of Funds with similar invest objectives. Rankings for the periods shown include dividends and distributions reinvested and do not reflect sales charges.

The federal government guarantees interest payments from government securities, such as U.S. Treasury bills, while dividend payments carry no such guarantee. Government securities, if held to maturity, guarantee the timely payment of principal and interest.

Alpine Mutual Funds - Dynamic Balance Fund

Schedule of Portfolio Investments

October 31, 2005

Shares/ | | Security | | |

Par Value | | Description | | Value |

| | | | | |

Common Stocks—70.8% | | |

| Commercial Products & Services—9.5% | | |

| 13,000 | | AMETEK, Inc. | $ | 529,490 |

| 35,000 | | Autoliv, Inc. | | 1,503,600 |

| 10,000 | | Certegy, Inc. | | 374,600 |

| 14,290 | | Eagle Materials, Inc.—Class B | | 1,421,712 |

| 5,443 | | Eagle Materials, Inc. | | 579,625 |

| 300 | | Hubbell, Incorporated — Class A | | 13,155 |

| 6,500 | | Hubbell, Incorporated — Class B | | 313,040 |

| 32,500 | | McGrath Rentcorp | | 927,875 |

| 15,500 | | PACCAR, Inc. | | 1,085,310 |

| 30,000 | | Ryder System, Inc. | | 1,190,100 |

| 20,000 | | W.W. Grainger, Inc. | | 1,339,600 |

| | | | | 9,278,107 |

| | | | | |

| Conglomerates—2.5% | | |

| 20,000 | | 3M Co. | | 1,519,600 |

| 25,000 | | Temple-Inland Inc. | | 920,750 |

| | | | | 2,440,350 |

| | | | | |

| Consumer Products & Services—3.2% | | |

| 18,000 | | The Black & Decker Corporation | | 1,478,340 |

| 20,000 | | Briggs & Stratton Corporation | | 639,600 |

| 18,000 | | The Procter & Gamble Company | | 1,007,820 |

| | | | | 3,125,760 |

| | | | | |

| Energy, Oil, & Gas—2.5% | |

| 2,000 | | Amerada Hess Corp. | | 250,200 |

| 15,000 | | Chevron Corporation | | 856,050 |

| 10,000 | | Murphy Oil Corporation | | 468,500 |

| 16,000 | | Penn Virginia Corporation | | 869,760 |

| | | | | 2,444,510 |

| | | | | |

| Financial—Banks—8.9% | | |

| 12,730 | | Arrow Financial Corporation | | 342,437 |

| 18,000 | | Bancorp Rhode Island, Inc. | | 648,000 |

| 6,000 | | Bancshares of Florida, Inc. (a) | | 136,500 |

| 8,000 | | Comerica Incorporated | | 462,240 |

| 45,000 | | Doral Financial Corp. (b) | | 385,200 |

| 20,000 | | Golden West Financial Corporation | | 1,174,600 |

| 10,000 | | Hudson United Bancorp | | 414,700 |

| 40,000 | | J.P. Morgan Chase & Co. | | 1,464,800 |

| 31,500 | | New York Community Bancorp, Inc. | | 509,355 |

| 25,500 | | North Fork Bancorporation, Inc. | | 646,170 |

| 2,200 | | Penns Woods Bancorp, Inc. | | 100,100 |

| 8,000 | | PNC Financial Services Group | | 485,680 |

| 5,500 | | Rurban Financial Corp. | | 70,400 |

| 5,871 | | Southside Bancshares, Inc. | | 114,895 |

| | | | | |

Shares/ | | Security | | |

Par Value | | Description | | Value |

| | | | | |

Common Stocks—continued | | |

| Financial—Banks—continued | | |

| 20,000 | | Sovereign Bancorp, Inc. | $ | 431,400 |

| 15,000 | | Susquehanna Bancshares, Inc. | | 346,350 |

| 20,000 | | Webster Financial Corporation | | 923,400 |

| | | | | 8,656,227 |

| | | | | |

| Financial Services—8.8% | | |

| 10,000 | | Ambac Financial Group, Inc. | | 708,900 |

| 26,000 | | American International Group, Inc. | | 1,684,800 |

| 4,000 | | The Chubb Corporation | | 371,880 |

| 10,000 | | Countrywide Financial Corporation | | 317,700 |

| 10,000 | | Fannie Mae | | 475,200 |

| 10,000 | | Fidelity National Financial, Inc. | | 374,600 |

| 1,750 | | Fidelity National Title Group, Inc. | | 38,063 |

| 13,000 | | The Goldman Sachs Group, Inc. | | 1,642,810 |

| 46,000 | | MBNA Corporation | | 1,176,220 |

| 8,000 | | The Student Loan Corporation | | 1,753,600 |

| | | | | 8,543,773 |

| | | | | |

| | | | | |

| Food & Staples Retailing—0.7% | | |

| 26,000 | | Albertson’s, Inc. | | 652,860 |

| | | | | |

| | | | | |

| Homebuilders — 10.0% | | |

| 30,000 | | Hovnanian Enterprises, Inc. — Class A (a) | | 1,349,700 |

| 28,000 | | Lennar Corporation—Class A | | 1,556,240 |

| 7,150 | | M.D.C. Holdings, Inc. | | 490,490 |

| 50,000 | | Pulte Homes, Inc. | | 1,889,500 |

| 17,000 | | The Ryland Group, Inc. | | 1,144,100 |

| 51,400 | | Standard-Pacific Corp. | | 1,983,012 |

| 35,000 | | Toll Brothers, Inc. (a) | | 1,291,850 |

| | | | | 9,704,892 |

| | | | | |

| Medical Instruments—1.3% | | |

| 12,200 | | Beckman Coulter, Inc. | | 600,972 |

| 10,000 | | Guidant Corporation | | 630,000 |

| | | | | 1,230,972 |

| | | | | |

| Metals & Mining—2.9% | | |

| 37,000 | | CONSOL Energy Inc. | | 2,253,300 |

| 5,000 | | Phelps Dodge Corp. | | 602,350 |

| | | | | 2,855,650 |

| | | | | |

| Pharmaceuticals—2.9% | | |

| 22,000 | | Johnson & Johnson | | 1,377,640 |

| 25,000 | | Pfizer Inc. | | 543,500 |

| 20,000 | | Wyeth | | 891,200 |

| | | | | 2,812,340 |

| | | | | |

See notes to financial statements.

Alpine Mutual Funds - Dynamic Balance Fund

Schedule of Portfolio Investments—Continued

October 31, 2005

Shares/ | | Security | | |

Par Value | | Description | | Value |

| | | | | |

Common Stocks—continued | | |

| | | Real Estate Investment Trusts—9.7% | | |

| 15,000 | | Boston Properties, Inc. | $ | 1,038,300 |

| 10,000 | | Developers Diversified Realty Corporation | | 436,800 |

| 60,000 | | DiamondRock Hospitality Company | | 669,000 |

| 20,000 | | General Growth Properties, Inc. | | 849,600 |

| 45,000 | | Impac Mortgage Holdings, Inc | | 451,800 |

| 10,000 | | Mack-Cali Realty Corporation | | 426,500 |

| 45,000 | | Origen Financial, Inc | | 322,650 |

| 23,000 | | Simon Property Group, Inc. | | 1,647,260 |

| 80,000 | | Sunstone Hotel Investors, Inc. | | 1,792,000 |

| 23,000 | | Vornado Realty Trust | | 1,863,000 |

| | | | | 9,496,910 |

| | | | | |

| Retail—1.4% | | |

| 10,000 | | Ethan Allen Interiors, Inc. | | 338,200 |

| 20,000 | | J.C. Penney Company, Inc. | | 1,024,000 |

| | | | | 1,362,200 |

| | | | | |

| Transportation—1.0% | | |

| 15,000 | | Union Pacific Corporation | | 1,037,700 |

| | | | | |

| Transportation Services—2.3% | | |

| 25,000 | | FedEx Corp. | | 2,298,250 |

| | | | | |

| Utilities—3.2% | | |

| 61,000 | | Allegheny Energy, Inc. (a) | | 1,723,860 |

| 21,500 | | ITC Holdings Corp. | | 591,250 |

| 15,600 | | SJW Corp. | | 763,152 |

| | | | | 3,078,262 |

| | | Total Common Stocks | | 69,018,763 |

| | | | | |

Shares/ | | Security | | |

Par Value | | Description | | Value |

| | | | | |

Bonds and Notes—17.2% | | |

| U.S. Government Obligations—17.2% | | |

| 2,000,000 | | 7.250%, 05/15/2016 | $ | 2,427,814 |

| 2,000,000 | | 6.250%, 08/15/2023 | | 2,334,766 |

| 4,000,000 | | 6.000%, 02/15/2026 | | 4,599,688 |

| 5,000,000 | | 5.250%, 11/15/2028 | | 5,303,910 |

| 2,000,000 | | 5.000%, 08/15/2011 | | 2,052,502 |

| | | Total Bonds and Notes | | 16,718,680 |

| | | | | |

| | | | | |

Short-Term Investments—10.3% | | |

| 10,059,019 | | Alpine Municipal Money Market Fund | $ | 10,059,019 |

| 558 | | Fidelity Institutional Government Portfolio | | 558 |

| 14 | | Milestone Funds Treasury | | |

| | | Obligations Portfolio | | 14 |

| | | Total Short-term Investments | | 10,059,591 |

| | | | | |

| | | Total Investments | | |

| | | (Cost $84,551,535)—98.3% | | 95,797,034 |

| | | Other Assets, less Liabilities—1.7% | | 1,673,628 |

| | | | | |

| | | TOTAL NET ASSETS—100.0% | $ | 97,470,662 |

| | | | | |

| (a) | Non-income producing securities |

| (b) | Foreign security which trades on U.S. exchange |

See notes to financial statements.

Alpine Mutual Funds - Dynamic Dividend Fund

Schedule of Portfolio Investments

October 31, 2005

Shares/ | | Security | | |

Par Value | | Description | | Value |

| | | | | |

Common Stocks—98.6% | | |

| Building—Maintenance & Service — 2.0% | | |

| 171,580 | | Healthcare Services Group, Inc. | $ | 3,198,251 |

| 101,626 | | McGrath Rentcorp | | 2,901,423 |

| | | | | 6,099,674 |

| | | | | |

| Business Services—0.4% | | |

| 79,500 | | Angelica Corporation . | | 1,128,105 |

| | | | | |

| Capital Markets—1.3% | | |

| 75,000 | | Morgan Stanley | | 4,080,750 |

| | | | | |

| Chemicals—2.2% | | |

| 146,500 | | The Dow Chemical Company. | | 6,718,490 |

| | | | | |

| Commercial Banks—1.2% | | |

| 90,000 | | Marshall & Ilsley Corp. | | 3,866,400 |

| | | | | |

| Commercial Products & Services —3.8% | | |

| 47,000 | | Hubbell, Incorporated—Class B. | | 2,263,520 |

| 117,700 | | MSC Industrial Direct Co., Inc.. | | 4,493,786 |

| 135,000 | | Temple-Inland Inc. | | 4,972,050 |

| | | | | 11,729,356 |

| | | | | |

| Computers & Peripherals—1.1% | | |

| 40,000 | | International Business Machines Corp | | 3,275,200 |

| | | | | |

| Conglomerate—2.2% | | |

| 199,000 | | General Electric Company | | 6,748,090 |

| | | | | |

| Construction—2.4% | | |

| 600,000 | | Dorbyl Limited (c) | | 1,059,849 |

| 35,000 | | KB HOME | | 2,287,250 |

| 75,000 | | Lennar Corporation—Class A | | 4,168,500 |

| | | | | 7,515,599 |

| | | | | |

| Consumer Products & Services—2.1% | | |

| 127,400 | | Aldila, Inc. | | 3,122,574 |

| 25,000 | | Altria Group, Inc. | | 1,876,250 |

| 90,358 | | Bassett Furniture Industries, Incorporated | | 1,691,502 |

| | | | | 6,690,326 |

| | | | | |

| Diversified Telecommunication Services — 1.2% | | |

| 208,000 | | Chunghwa Telecom Co., Ltd. — ADR | | 3,602,560 |

| | | | | |

| | | | | |

| Electronic Equipment & Instruments —2.1% | | |

| 180,000 | | Anixter International, Inc. | | 6,674,400 |

| | | | | |

| Energy—6.0% | | |

| 25,000 | | BP p.l.c.—ADR (b) | | 1,660,000 |

| 95,000 | | Diamond Offshore Drilling, Inc. | | 5,363,700 |

| 70,000 | | Exxon Mobil Corporation | | 3,929,800 |

| 57,000 | | GlobalSantaFe Corporation (b) | | 2,539,350 |

| 85,000 | | Marathon Oil Corporation | | 5,113,600 |

| | | | | 18,606,450 |

| | | | | |

| Energy Equipment & Services—2.9% | | |

| 62,400 | | Rowan Companies, Inc. | | 2,058,576 |

| 156,000 | | Todco | | 6,981,000 |

| | | | | 9,039,576 |

| | | | | |

| Entertainment—3.4% | | |

| 103,700 | | Harrah’s Entertainment, Inc. | | 6,271,776 |

Shares/ | | Security | | |

Par Value | | Description | | Value |

| | | | | |

Common Stocks—continued | | |

| Entertainment—continued | | |

| 238,700 | | Regal Entertainment Group— Class A | $ | 4,399,241 |

| | | | | 10,671,017 |

| | | | | |

| Financial—Banks—6.0% | | |

| 97,000 | | Bank of America Corporation | | 4,242,780 |

| 122,300 | | Citigroup Inc | | 5,598,894 |

| 56,700 | | J.P. Morgan Chase & Co | | 2,076,354 |

| 54,500 | | Wachovia Corporation | | 2,753,340 |

| 66,000 | | Wells Fargo & Company | | 3,973,200 |

| | | | | 18,644,568 |

| | | | | |

| Financial Services—2.0% | | |

| 300,000 | | Ameritrade Holding Corporation (a) | | 6,309,000 |

| | | | | |

| | | | | |

| Food & Beverages—1.6% | | |

| 56,000 | | PepsiCo, Inc. | | 3,308,480 |

| 113,516 | | Rocky Mountain Chocolate Factory, Inc. | | 1,800,364 |

| | | | | 5,108,844 |

| | | | | |

| Food & Staples Retailing—1.2% | | |

| 150,000 | | Albertson’s, Inc | | 3,766,500 |

| | | | | |

| Health Care Providers & Services— 0.6% | | |

| 48,500 | | Computer Programs & Systems, Inc. | | 1,789,650 |

| | | | | |

| | | | | |

| Hotels Restaurants & Leisure—6.1% | | |

| 60,000 | | Carnival Corporation | | 2,980,200 |

| 36,000 | | Enterprise Inns plc (c) | | 496,699 |

| 230,000 | | Hilton Hotels Corporation | | 4,473,500 |

| 200,000 | | Hilton Group plc (c) | | 1,200,949 |

| 111,000 | | Hyatt Regency SA (c) | | 1,359,547 |

| 203,733 | | Stanley Leisure PLC (a) | | 2,188,897 |

| 108,000 | | Starwood Hotels & Resorts Worldwide, Inc. | | 6,310,440 |

| | | | | 19,010,232 |

| | | | | |

| Industrial Conglomerates—0.7% | | |

| 30,000 | | Textron, Inc. | | 2,161,200 |

| | | | | |

| Investment Advice—0.7% | | |

| 105,000 | | CapitalSource, Inc. (a) | | 2,310,000 |

| | | | | |

| | | | | |

| IT Services—1.0% | | |

| 85,000 | | Certegy, Inc | | 3,184,100 |

| | | | | |

| | | | | |

| Machinery—0.7% | | |

| 40,000 | | Ingersoll-Rand Co. (b) | | 1,511,600 |

| 82,600 | | Metka S.A. (c) | | 736,501 |

| | | | | 2,248,101 |

| | | | | |

| Manufacturing—Diversified—3.1% | | |

| 55,000 | | 3M Co | | 4,178,900 |

| 105,000 | | American Power Conversion Corporation | | 2,245,950 |

| 145,000 | | Nam Tai Electronics, Inc | | 3,284,250 |

| | | | | 9,709,100 |

| | | | | |

| Media—1.1% | | |

| 75,000 | | Cablevision Systems | | |

| | | Corporation (a) | | 1,860,000 |

See notes to financial statements.

Alpine Mutual Funds - Dynamic Dividend Fund

Schedule of Portfolio Investments—Continued

October 31, 2005

Shares/ | | Security | | |

Par Value | | Description | | Value |

| | | | | |

Common Stocks—continued | | |

| Media—continued | | |

| 50,000 | | Viacom, Inc.—Class B | $ | 1,548,500 |

| | | | | 3,408,500 |

| | | | | |

| Medical Supplies—5.5% | | |

| 40,250 | | Chr. Hansen Holding A/S © | | 3,774,821 |

| 450,000 | | Gambro AB—Class A © | | 6,357,688 |

| 139,750 | | Meridian Bioscience, Inc. | | 2,926,365 |

| 121,500 | | PolyMedica Corporation | | 4,010,715 |

| | | | | 17,069,589 |

| | | | | |

| Metals & Mining—6.8% | | |

| 240,000 | | Algoma Steel, Inc. | | 4,680,000 |

| 80,000 | | BHP Billiton Limited — ADR (b) | | 2,484,000 |

| 82,500 | | Companhia Siderurgica Nacional S.A.—ADR | | 1,584,000 |

| 940,913 | | Gloucester Coal Ltd. © | | 2,040,339 |

| 75,500 | | Kumba Resources Ltd © | | 1,115,475 |

| 400,000 | | Macarthur Coal Limited © | | 1,749,729 |

| 80,000 | | Mittal Steel South Africa Ltd © | | 630,245 |

| 58,350 | | Phelps Dodge Corp. | | 7,029,424 |

| | | | | 21,313,212 |

| | | | | |

| Oil & Gas —5.4% | | |

| 147,500 | | Double Hull Tankers, Inc. (a) (b) | | 1,744,925 |

| 60,000 | | ConocoPhillips | | 3,922,800 |

| 800,000 | | New Hope Corporation Limited © | | 819,531 |

| 269,000 | | OMI Corp. | | 4,863,520 |

| 70,000 | | Overseas Shipholding Group | | 3,332,000 |

| 89,000 | | Woodside Petroleum Limited | | 2,102,965 |

| | | | | 16,785,741 |

| | | | | |

| Pharmaceuticals—2.0% | | |

| 75,000 | | Abbott Laboratories | | 3,228,750 |

| 49,000 | | Johnson & Johnson | | 3,068,380 |

| | | | | 6,297,130 |

| | | | | |

| Retail—1.2% | | |

| 50,000 | | Home Depot, Inc. | | 2,052,000 |

| 65,000 | | Sears Canada, Inc. © | | 1,763,822 |

| | | | | 3,815,822 |

| | | | | |

| Semiconductors—0.6% | | |

| 75,000 | | Intel Corporation | | 1,762,500 |

| | | | | |

| Software—1.3% | | |

| 160,000 | | Microsoft Corporation | | 4,112,000 |

| | | | | |

Shares/ | | Security | | |

Par Value | | Description | | Value |

| | | | | |

Common Stocks—continued | | |

| SpecialtyRetail—0.8% | | |

| 50,000 | | Abercrombie & Fitch Co.—Class A | $ | 2,599,500 |

| | | | | |

| | | | | |

| Telecommunications—2.3% | | |

| 287,500 | | Consolidated Communications Holdings, Inc. | | 3,812,250 |

| 195,700 | | Iowa Telecommunications Services Incorporated | | 3,229,050 |

| | | | | 7,041,300 |

| | | | | |

| Transportation—7.7% | | |

| 284,700 | | Aries Maritime Transport Ltd. (a) (b) | | 3,963,024 |

| 232,100 | | Diana Shipping Inc. (b) | | 3,632,365 |

| 238,000 | | Dryships Inc. (b) | | 3,581,900 |

| 43,500 | | Frontline Limited (b) | | 1,727,385 |

| 92,100 | | Genco Shipping & Trading Ltd (a) (b) | | 1,513,203 |

| 151,763 | | Ship Finance International Limited (b) | | 2,889,568 |

| 291,000 | | Quintana Maritime Ltd. (b) | | 3,148,620 |

| 103,600 | | Tsakos Energy Navigation Ltd (b) | | 3,556,588 |

| | | | | 24,012,653 |

| | | | | |

| Utilities—5.9% | | |

| 50,000 | | Exelon Corp. | | 2,601,500 |

| 3,800 | | ITC Holdings Corp. | | 104,500 |

| 207,300 | | Macquarie Infrastructure Company Trust | | 6,219,000 |

| 333,469 | | National Grid PLC (a) | | 3,048,600 |

| 60,000 | | PPL Corporation | | 1,880,400 |

| 44,000 | | TXU Corp. | | 4,433,000 |

| | | | | 18,287,000 |

| | | Total Common Stocks | | 307,192,235 |

| | | | | |

Short-Term Investments—0.4% | | |

| 1,000,000 | | Alpine Municipal Money Market Fund | $ | 1,000,000 |

| 148,574 | | Fidelity Institutional Government Portfolio | | 148,574 |

| | | Total Short-Term Investments | | 1,148,574 |

| | | Total Investments | | |

| | | (Cost $319,063,559)—99.0% | | 308,340,809 |

| | | Other Assets, less Liabilities—1.0% | | 3,000,083 |

| | | | | |

| | | TOTAL NET ASSETS—100.0% | | |

| | | | $ | 311,340,892 |

| | | | | |

Percentages are stated as a percent of net assets.ADR—American Depository Receipt

(a) Non-income producing securities

(b) Foreign Security which trades on U.S. exchange

(c) Foreign security

See notes to financial statements.

Alpine Mutual Funds - Municipal Money Market Fund

Schedule of Portfolio Investments

October 31, 2005

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds —98.9% | | |

| Alabama—4.4% | | |

| 830,000 | | Butler County Industrial | | |

| | | Development Authority | | |

| | | Revenue—Series A | | |

| | | (LOC: Whitney National | | |

| | | Bank; SunTrust Bank) | | |

| | | 3.020%, 11/07/2005 (a) (b) | $ | 830,000 |

| 1,325,000 | | Forsyth Housing Authority | | |

| | | Multi-Family Revenue, Union | | |

| | | Hill Apartments Project | | |

| | | (LOC: Columbus | | |

| | | Bank & Trust) | | |

| | | 2.990%, 11/07/2005 (a) (b) | | 1,325,000 |

| 2,000,000 | | Mobile Industrial Development | | |

| | | Revenue, Hosea O Weaver & | | |

| | | Sons | | |

| | | (LOC: Regions Bank) | | |

| | | 2.920%, 11/07/2005 (a) (b) | | 2,000,000 |

| 280,000 | | Montgomery Industrial | | |

| | | Development Revenue, | | |

| | | Dev-Kinpak Inc. | | |

| | | (LOC: Regions Bank) | | |

| | | 2.970%, 11/07/2005 (a) (b) | | 280,000 |

| 1,260,000 | | Montgomery Industrial | | |

| | | Development Revenue, | | |

| | | Norment Industries Inc. | | |

| | | (LOC: LaSalle Bank N.A.) | | |

| | | 2.920%, 11/07/2005 (a) (b) | | 1,260,000 |

| 320,000 | | Pell City Industrial | | |

| | | Development Revenue, | | |

| | | Kinder Gorbel | | |

| | | (LOC: Key Bank of New York) | | |

| | | 2.970%, 11/01/2005 (a) | | 320,000 |

| 1,675,000 | | Tuscaloosa County Industrial | | |

| | | Development Revenue, | | |

| | | Automotive Corridor LLC | | |

| | | (LOC: Regions Bank) | | |

| | | 2.920%, 11/07/2005 (a) (b) | | 1,675,000 |

| 1,295,000 | | Tuscaloosa County Industrial | | |

| | | Development Revenue, | | |

| | | Automotive Corridor LLC | | |

| | | (LOC: Regions Bank) | | |

| | | 2.920%, 11/07/2005 (a) (b) | | 1,295,000 |

| | | | | 8,985,000 |

| | | | | |

| Alaska—0.9% | | |

| 930,000 | | Alaska Industrial Development | | |

| | | & Export Authority—Lot 6 | | |

| | | (LOC: Bank of America N.A.) | | |

| | | 3.150%, 11/07/2005 (a) (b) | | 930,000 |

| 940,000 | | Alaska Industrial Development | | |

| | | & Export Authority—Lot 12 | | |

| | | (LOC: Bank of America N.A.) | | |

| | | 3.150%, 11/07/2005 (a)(b) | | 940,000 |

| | | | | 1,870,000 |

| | | | | |

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| California—0.5% | | |

| 1,000,000 | | Stockton Certificates, United | | |

| | | Christian Schools | | |

| | | (LOC: Pacific Capital Bank) | | |

| | | 3.050%, 11/07/2005 (a)(b) | $ | 1,000,000 |

| | | | | |

| Colorado—11.5% | | |

| 3,000,000 | | Bachelor Gulch Metropolitan | | |

| | | District General Obligation | | |

| | | (LOC: Compass Bank) | | |

| | | 2.350%, 12/01/2005 (a) | | 3,000,000 |

| 1,900,000 | | Broomfield Village | | |

| | | Metropolitan District 2, | | |

| | | Special Obligation Revenue | | |

| | | (LOC: Compass Bank) | | |

| | | 3.050%, 11/07/2005 (a)(b) | | 1,900,000 |

| 4,549,000 | | Cherry Creek South Metro | | |

| | | District No. 1—Series B | | |

| | | (LOC: Compass Bank) | | |

| | | 2.350%, 12/15/2005 (a)(b) | | 4,547,934 |

| 1,475,000 | | Colorado Housing & Finance | | |

| | | Authority Economic | | |

| | | Development Revenue, | | |

| | | Top Shop—Series A | | |

| | | (LOC: JP Morgan Chase Bank) | | |

| | | 2.910%, 11/07/2005 (a)(b) | | 1,475,000 |

| 1,000,000 | | Colorado Housing & Finance | | |

| | | Authority Economic Revenue, | | |

| | | Casarosa & Denver Gasket | | |

| | | 2.930%, 11/07/2005 (a)(b) | | 1,000,000 |

| 1,000,000 | | Four Mile Ranch Metro District | | |

| | | No 1 Ltd Tax | | |

| | | (LOC: Zions First National) | | |

| | | 2.800%, 12/01/2005 (a)(b) | | 1,000,000 |

| 2,177,000 | | Jefferson County Industrial | | |

| | | Development Revenue, | | |

| | | EPI-Center LLC | | |

| | | (LOC: JP Morgan Chase Bank) | | |

| | | 2.910%, 11/01/2005 (a)(b) | | 2,177,000 |

| | | Triview Metropolitan District— | | |

| | | Series A | | |

| | | (LOC: Compass Bank) | | |

| 1,000,000 | | 1.375%, 10/31/2005 (a)(b) | | 1,000,000 |

| 1,000,000 | | 2.100%, 11/01/2005 (a)(b) | | 1,000,000 |

| 3,000,000 | | Vail Multifamily Housing | | |

| | | Revenue, Middle Creek | | |

| | | Village Apartments—Series A | | |

| | | (LOC: California | | |

| | | Bank & Trust) | | |

| | | 2.950%, 11/07/2005 (a)(b) | | 3,000,000 |

| 3,500,000 | | Wildgrass Metro District | | |

| | | (LOC: Compass Bank) | | |

| | | 2.400%, 12/01/2005 | | 3,500,019 |

| | | | | 23,599,953 |

| | | | | |

See notes to financial statements.

Alpine Mutual Funds - Municipal Money Market Fund

Schedule of Portfolio Investments—Continued

October 31, 2005

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| | | Delaware—0.4% | | |

| 800,000 | | Delaware St. Economic | | |

| | | Development Authority | | |

| | | Waste Disposal, CIBA | | |

| | | Specialty Chemicals—Series A | | |

| | | 2.980%, 11/01/2005 (a) (b) | $ | 800,000 |

| | | | | |

| Georgia—1.7% | | |

| 1,310,000 | | De Kalb County Housing | | |

| | | Authority Revenue, Stone | | |

| | | Mill Run Apartments | | |

| | | (LOC: First Tennessee Bank) | | |

| | | 2.950%, 11/07/2005 (a) (b) | | 1,310,000 |

| 1,605,000 | | Douglas County Development | | |

| | | Authority Revenue, Denyse Signs Inc. | | |

| | | (LOC: Bank of North Georgia) | | |

| | | 2.950%, 11/07/2005 (a) (b) | | 1,605,000 |

| 580,000 | | Franklin County Industrial | | |

| | | Building Authority Revenue, | | |

| | | Ross Operating Valve Co. | | |

| | | (LOC: Comerica Bank) | | |

| | | 2.970%, 11/07/2005 (a) (b) | | 580,000 |

| | | | | 3,495,000 |

| | | | | |

| Illinois—8.0% | | |

| 1,240,000 | | Carol Stream Industrial | | |

| | | Development Revenue, MI | | |

| | | Enterprises | | |

| | | (LOC: JP Morgan | | |

| | | Chase & Co) | | |

| | | 2.95%, 11/07/2005 (a)(b) | | 1,240,000 |

| 1,105,000 | | Clinton Industrial Development | | |

| | | Revenue | | |

| | | (LOC: AmSouth Bank) | | |

| | | 2.970%, 11/07/2005 (a)(b) | | 1,105,000 |

| 1,275,000 | | Harvard Health Care Facility | | |

| | | Revenue, Harvard Memorial | | |

| | | Hospital Inc. | | |

| | | (LOC: M&I Bank) | | |

| | | 2.910%, 11/07/2005 (a)(b) | | 1,275,000 |

| 800,000 | | Illinois Development Finance | | |

| | | Authority Multifamily | | |

| | | Revenue, Butterfield Creek | | |

| | | (LOC: LaSalle Bank N.A.) | | |

| | | 2.950%, 11/07/2005 (a)(b) | | 800,000 |

| 8,000,000 | | Lakemoor Multifamily Revenue | | |

| | | (CS: Bayerische) | | |

| | | 2.930%, 11/07/2005 (a)(b) | | 8,000,000 |

| 4,000,000 | | Phoenix Realty Special Account | | |

| | | -U LP Multifamily Revenue, | | |

| | | Brightons Mark | | |

| | | (LOC: Northern Trust Company) | | |

| | | 2.910%, 11/07/2005 (a)(b) | | 4,000,000 |

| | | | | 16,420,000 |

| | | | | |

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds —continued | | |

| Indiana—2.1% | | |

| 980,000 | | Lawrence Industrial Economic | | |

| | | Development Revenue, | | |

| | | Southwark Metal | | |

| | | Manufacturing Co. | | |

| | | (LOC: Citizens Bank) | | |

| | | 2.900%, 11/07/2005 (a) (b) | $ | 980,000 |

| 1,000,000 | | Monroe County Industrial | | |

| | | Economic Development | | |

| | | Revenue | | |

| | | (LOC: Old National Bank) | | |

| | | 3.290%, 11/07/2005 (a) (b) | | 1,000,000 |

| 300,000 | | Princeton Industrial | | |

| | | Development Revenue, Orion | | |

| | | Denki American Inc. | | |

| | | (LOC: Bank of Tokyo | | |

| | | Mitsubishi) | | |

| | | 3.000%, 11/07/2005 (a) (b) | | 300,000 |

| 2,150,000 | | Shelbyville Industrial Economic | | |

| | | Development Revenue, AFR | | |

| | | Properties & American | | |

| | | Resources | | |

| | | (LOC: Associated Bank N.A.) | | |

| | | 3.000%, 11/07/2005 (a) (b) | | 2,150,000 |

| | | | | 4,430,000 |

| | | | | |

| Louisiana—3.2% | | |

| 1,050,000 | | Caddo-Bossier Parishes Port | | |

| | | Commission, Shreveport | | |

| | | Fabrications | | |

| | | (LOC: Hibernia | | |

| | | National Bank) | | |

| | | 3.170%, 11/07/2005 (a) (b) | | 1,050,000 |

| 5,500,000 | | Environment Facilities | | |

| | | Community Development | | |

| | | Authority Revenue, Caddo- | | |

| | | Bossier Parishes | | |

| | | (LOC: Hibernia | | |

| | | National Bank) | | |

| | | 3.170%, 11/07/2005 (a) (b) | | 5,500,000 |

| | | | | 6,550,000 |

| | | | | |

| Maine—2.5% | | |

| | | Dover & Foxcroft Revenue, | | |

| | | Pleasant River Lumber Co. | | |

| | | (LOC: CoBank ACB; Wachovia | | |

| | | Bank N.A.) | | |

| 3,000,000 | | 2.940%, 11/07/2005 (a) (b) | | 3,000,000 |

| 2,050,000 | | 2.940%, 11/07/2005 (a) (b) | | 2,050,000 |

| | | | | 5,050,000 |

| | | | | |

| Michigan—4.6% | | |

| 4,500,000 | | Municipal Bond Authority | | |

| | | Revenue, Detroit School | | |

| | | District—Series A | | |

| | | (LOC: JP Morgan Chase Bank) | | |

| | | 3.750%, 03/21/2006 | | 4,513,309 |

| | | | | |

See notes to financial statements.

Alpine Mutual Funds - Municipal Money Market Fund

Schedule of Portfolio Investments—Continued

October 31, 2005

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| Michigan—continued | | |

| 1,000,000 | | Strategic Fund Ltd. Obligation | | |

| | | Revenue Series A, Waterland | | |

| | | Battle Creek Properties LLC | | |

| | | (LOC: Fifth Third Bank) | | |

| | | 3.050%, 11/07/2005 (a) (b) | $ | 1,000,000 |

| 4,000,000 | | Strategic Fund Ltd. Obligation | | |

| | | Revenue, Rudolph Etta | | |

| | | Dejong—1982 | | |

| | | (LOC: Farm Credit Services | | |

| | | America; Bank of the West) | | |

| | | 2.940%, 11/07/2005 (a) (b) | | 4,000,000 |

| | | | | 9,513,309 |

| | | | | |

| Minnesota—2.6% | | |

| 3,810,000 | | Ramsey Industrial Development | | |

| | | Revenue, Kilkenny Ltd.— | | |

| | | Series A | | |

| | | 2.900%, 11/07/2005 (a) (b) | | 3,810,000 |

| 1,580,000 | | St. Cloud Housing & | | |

| | | Redevelopment Authority | | |

| | | Industrial Development | | |

| | | Revenue, CMMB LLP | | |

| | | 3.250%, 11/07/2005 (a) (b) | | 1,580,000 |

| | | | | 5,390,000 |

| | | | | |

| Missouri—6.5% | | |

| 2,105,000 | | Springfield Industrial | | |

| | | Development Authority | | |

| | | Revenue, DMP Properties LLC | | |

| | | (LOC: U.S. Bank N.A.) | | |

| | | 2.950%, 11/07/2005 (a) (b) | | 2,105,000 |

| 1,700,000 | | Springfield Industrial | | |

| | | Development Authority | | |

| | | Revenue, DMP Properties LLC | | |

| | | (LOC: U.S. Bank N.A.) | | |

| | | 2.950%, 11/07/2005 (a) (b) | | 1,700,000 |

| 3,760,000 | | St. Charles County Industrial | | |

| | | Development Authority | | |

| | | Revenue, Dev-Craftsmen | | |

| | | Industries | | |

| | | 2.910%, 11/07/2005 (a) (b) | | 3,760,000 |

| 2,000,000 | | St. Joseph Industrial | | |

| | | Development Authority | | |

| | | Industrial Development | | |

| | | Revenue, Albaugh Inc.— | | |

| | | Series A | | |

| | | (LOC: Mercantile Bank N.A.) | | |

| | | 3.050%, 11/07/2005 (a) (b) | | 2,000,000 |

| 3,750,000 | | Washington Industrial | | |

| | | Development Authority | | |

| | | Industrial Revenue, Clemco | | |

| | | Industries | | |

| | | 2.980%, 11/07/2005 (a) (b) | | 3,750,000 |

| | | | | 13,315,000 |

| | | | | |

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| New Mexico���1.4% | | |

| 1,300,000 | | New Mexico Housing Authority | | |

| | | Region III Multifamily | | |

| | | Revenue, El Pueblo | | |

| | | Apartments—Series A | | |

| | | (LOC: PNC Bank N.A.) | | |

| | | 2.950%, 11/07/2005 (a) (b) | $ | 1,300,000 |

| 1,500,000 | | New Mexico Housing Authority | | |

| | | Region III Multifamily | | |

| | | Revenue, Madeira Court | | |

| | | Apartments—Series B | | |

| | | (LOC: PNC Bank N.A.) | | |

| | | 2.950%, 11/07/2005 (a) (b) | | 1,500,000 |

| | | | | 2,800,000 |

| | | | | |

| New York—6.9% | | |

| 910,000 | | Erie County Industrial | | |

| | | Development Agency | | |

| | | Revenue, MMars—B&G | | |

| | | Properties—Class B | | |

| | | 3.250%, 11/07/2005 (a) (b) | | 910,000 |

| 13,160,000 | | New York City Transitional | | |

| | | Finance Authority Revenue — PT 406 | | |

| | | (SPA: Merrill Lynch) | | |

| | | 2.830%, 02/09/2006 (a) | | 13,160,000 |

| 145,000 | | Niagara County Industrial | | |

| | | Development Agency | | |

| | | Revenue, MMars Second | | |

| | | Program—Series A | | |

| | | 3.250%, 11/07/2005 (a) (b) | | 145,000 |

| | | | | 14,215,000 |

| | | | | |

| Ohio—1.1% | | |

| 800,000 | | Cuyahoga County Industrial | | |

| | | Development Revenue, Edge | | |

| | | Seal Technologies | | |

| | | (LOC: FirstMerit Bank) | | |

| | | 2.950%, 11/07/2005 (a) (b) | | 800,000 |

| 1,400,000 | | Hamilton County Economic | | |

| | | Development Revenue, | | |

| | | Union Institute | | |

| | | (LOC: Huntington National | | |

| | | Bank) | | |

| | | 2.930%, 11/07/2005 (a) (b) | | 1,400,000 |

| | | | | 2,200,000 |

| | | | | |

| South Carolina—1.7% | | |

| 3,500,000 | | Dorchester County School | | |

| | | District—No. 002 | | |

| | | 4.000%, 06/01/2006 | | 3,519,544 |

| | | | | |

| | | | | |

| South Dakota —1.2% | | |

| 1,500,000 | | Brookings Industrial | | |

| | | Development Revenue, | | |

| | | Lormar Development Co. | | |

| | | (LOC: U.S. Bank N.A.) | | |

| | | 2.850%, 11/07/2005 (a) (b) | | 1,500,000 |

| | | | | |

See notes to financial statements.

Alpine Mutual Funds - Municipal Money Market Fund

Schedule of Portfolio Investments—Continued

October 31, 2005

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

| | | | | |

Municipal Bonds—continued | | |

| South Dakota —continued | | |

| 985,000 | | South Dakota Economic | | |

| | | Development Finance | | |

| | | Authority Economic Revenue, | | |

| | | Vicom Ltd. | | |

| | | (LOC: Associated Bank N.A.) | | |

| | | 2.980%, 11/07/2005 (a)(b) | $ | 985,000 |

| | | | | 2,485,000 |

| | | | | |

| Tennessee—6.3% | | |

| 6,380,000 | | Capitol View II Limited | | |

| | | Partnership Grantor Trust | | |

| | | 3.500, 11/30/2005 (a) (b) | | 6,380,000 |

| 1,300,000 | | Hamilton County Industrial | | |

| | | Development Revenue, | | |

| | | Hamilton Plastics Inc. | | |

| | | (LOC: First American | | |

| | | National Bank) | | |

| | | 2.970%, 11/07/2005 (a)(b) | | 1,300,000 |

| 355,000 | | Jackson Health Educational & | | |

| | | Housing Facility Board | | |

| | | Revenue, Creekside | | |

| | | Apartments | | |

| | | (LOC: First Tennessee Bank) | | |

| | | 3.000%, 12/01/2005 (a) | | 355,000 |

| 5,000,000 | | Jackson Health Educational & | | |

| | | Housing Facility Board | | |

| | | Revenue, Park Ridge | | |

| | | Apartments | | |

| | | (LOC: First Tennessee Bank) | | |

| | | 2.920%, 11/07/2005 (a)(b) | | 5,000,000 |

| | | | | 13,035,000 |

| | | | | |

| Texas—3.9% | | |

| 2,000,000 | | Gulf Coast Waste Disposal | | |

| | | Authority, Republic Waste | | |

| | | Services | | |

| | | 3.050%, 11/07/2005 (a)(b) | | 2,000,000 |

| 2,000,000 | | Montgomery County Industrial | | |

| | | Development Revenue, | | |

| | | Medical Manufacturing | | |

| | | Partners | | |

| | | (LOC: Bank One Texas N.A.) | | |

| | | 2.830%, 11/07/2005 (a)(b) | | 2,000,000 |

| 1,500,000 | | Port Corpus Christi Authority | | |

| | | Nueces County Waste | | |

| | | Disposal, Flint Hills | | |

| | | Resources LP | | |

| | | 3.000%, 11/07/2005 (a)(b) | | 1,500,000 |

| 1,500,000 | | Port Corpus Christi Authority | | |

| | | Nueces County Waste | | |

| | | Disposal, Flint Hills | | |

| | | Resources LP | | |

| | | 3.000%, 11/07/2005 (a)(b) | | 1,500,000 |

| 1,000,000 | | Travis County Health Facilities | | |

| | | Development Corporation | | |

| | | Revenue, Ascension Health | | |

| | | Credit—Series A | | |

| | | 5.000%, 11/15/2005 | | 1,000,770 |

| | | | | 8,000,770 |

| | | | | |

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

| | | | | |

Municipal Bonds—continued | | |

| Utah—1.2% | | |

| 2,500,000 | | Utah Housing Corporation | | |

| | | Multifamily Revenue, Todd | | |

| | | Hollow Apartments—A | | |

| | | (CS: AIG) | | |

| | | 3.150%, 11/07/2005 (a)(b) | $ | 2,500,000 |

| | | | | |

| Washington—1.5% | | |

| 1,985,000 | | Washington Economic | | |

| | | Development Finance | | |

| | | Authority Revenue, B&H | | |

| | | Dental Laboratory | | |

| | | 3.100%, 11/07/2005 (a)(b) | | 1,985,000 |

| 1,110,000 | | Washington Economic | | |

| | | Development Finance | | |

| | | Authority Revenue, Belina | | |

| | | Interiors Inc.—Series F | | |

| | | (LOC: Keybank N.A.) | | |

| | | 2.910%, 11/07/2005 (a)(b) | | 1,110,000 |

| | | | | 3,095,000 |

| | | | | |

| Wisconsin—8.2% | | |

| 635,000 | | Fox Lake Redevelopment | | |

| | | Authority Revenue, Karavan | | |

| | | Trailers Inc. | | |

| | | (LOC: Associated Bank N.A.) | | |

| | | 2.980%, 11/07/2005 (a)(b) | | 635,000 |

| 2,750,000 | | Fox Lake Redevelopment | | |

| | | Authority Revenue, Karavan | | |

| | | Trailers Inc. | | |

| | | (LOC: Associated Bank N.A.) | | |

| | | 2.980%, 11/07/2005 (a)(b) | | 2,750,000 |

| 1,380,000 | | Franklin Industrial | | |

| | | Development Revenue, | | |

| | | Howard Henz Co. Inc. | | |

| | | (LOC: Associated Bank N.A.) | | |

| | | 3.000%, 11/07/2005 (a)(b) | | 1,380,000 |

| 1,750,000 | | Franklin Industrial | | |

| | | Development Revenue, | | |

| | | Smyczek/ECS | | |

| | | (LOC: Wells Fargo Bank N.A.) | | |

| | | 2.970%, 11/07/2005 (a)(b) | | 1,750,000 |

| 4,500,000 | | Hull Industrial Development | | |

| | | Revenue, Welcome Dairy Inc. | | |

| | | (LOC: Associated Bank N.A.) | | |

| | | 2.950%, 11/07/2005 (a)(b) | | 4,500,000 |

| 560,000 | | Neenah Industrial Development | | |

| | | Revenue, Galloway Co. | | |

| | | (LOC: Bank One Wisconsin) | | |

| | | 2.940%, 11/07/2005 (a)(b) | | 560,000 |

| 1,980,000 | | Reedsburg Industrial | | |

| | | Development Revenue, | | |

| | | Cellox LLC | | |

| | | (LOC: Associated Bank N.A.) | | |

| | | 3.000%, 11/07/2005 (a)(b) | | 1,980,000 |

| | | | | |

See notes to financial statements

Alpine Mutual Funds - Municipal Money Market Fund

Schedule of Portfolio Investments—Continued

October 31, 2005

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| Wisconsin—continued | | |

| 1,700,000 | | Rhinelander Industrial | | |

| | | Development Revenue, | | |

| | | Superior Diesel/SDI Properties | | |

| | | (LOC: Associated Bank N.A.) | | |

| | | 3.000%, 11/07/2005 (a)(b) | $ | 1,700,000 |

| 1,300,000 | | Sheboygan Industrial | | |

| | | Development Revenue, | | |

| | | Polyfab & Gill-Janssen | | |

| | | (LOC: Associated Bank | | |

| | | Lakeshore) | | |

| | | 2.980%, 11/07/2005 (a)(b) | | 1,300,000 |

| 200,000 | | Sturgeon Bay Industrial | | |

| | | Development Revenue, | | |

| | | Midwest Wire Realty | | |

| | | (LOC: Associated Bank | | |

| | | Milwaukee) | | |

| | | 3.000%, 11/07/2005 (a)(b) | | 200,000 |

| | | | | 16,755,000 |

| | | | | |

| Multistate—16.6% | | |

| 11,220,000 | | Class B Revenue Bond | | |

| | | Certificates—Series Trust | | |

| | | 2004-1 | | |

| | | (SPA: AIG Retirement | | |

| | | Services) | | |

| | | 3.150%, 11/07/2005 (a)(b) | | 11,220,000 |

| 10,685,000 | | Puttable Floating Option | | |

| | | Tax-Exempt Receipts, Regular | | |

| | | Floats Mode A PPT-38 | | |

| | | (LOC: Lloyds TSB Bank Plc) | | |

| | | 3.460, 11/07/2005 (a)(b) | | 10,685,000 |

| 5,000,000 | | Revenue Bond Certificate Trust | | |

| | | 2005-1 | | |

| | | (CS: AIG) | | |

| | | 3.050%, 11/07/2005 (a)(b) | | 5,000,000 |

| | | | | |

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| Multistate—continued | | |

| 2,000,000 | | Revenue Bond Certificate Series | | |

| | | Trust 2004-1, Castlegate 1 | | |

| | | (CS: AIG Retirement Services, Inc.) | | |

| | | 3.150%, 11/07/2005 (a)(b) | $ | 2,000,000 |

| 2,000,000 | | Revenue Bond Certificate Series | | |

| | | Trust 2004-1, Castlegate 2 | | |

| | | (CS: AIG Retirement Services, Inc.) | | |

| | | 3.150%, 11/07/2005 (a)(b) | | 2,000,000 |

| 3,100,000 | | Revenue Bond Certificate Series | | |

| | | Trust 2004-13, Centennial | | |

| | | (CS: AIG) | | |

| | | 3.150%, 11/07/2005 (a)(b) | | 3,100,000 |

| | | | | 34,005,000 |

| | | Total Municipal Bonds | | 203,028,576 |

| | | | | |

| | | | | |

Money Market Funds—0.0% | | |

| 92,393 | | Federated Government | | |

| | | Obligations Fund | | 92,393 |

| | | Total Money Market Funds | | 92,393 |

| | | | | |

Variable RateDemand Notes—1.3% | | |

| 2,600,000 | | Puerto Rico GDB | | 2,600,000 |

| | | Total Variable Rate Demand | | |

| | | Notes | | 2,600,000 |

| | | Total Investments | | |

| | | (Cost $205,720,969)—100.2% | | 205,720,969 |

| | | Liabilities, less Other Assets—(0.2)% | | (415,688) |

| | | | | |

| | | TOTAL NET ASSETS—100.0% | $ | 205,305,281 |

| | | | | |

(a) Variable Rate Security—The rate reported is the rate in effect as of October 31, 2005. The date shown is the next reset date.(b) Maturity date represents first available put date.

CS—Credit Support

LOC—Letter of Credit

SPA—Stand by Purchase Agreement

GDB—Government Development Bank

See notes to financial statements.

Alpine Mutual Funds - Tax Optimized Income Fund

Schedule of Portfolio Investments

October 31, 2005

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Corporate Bonds—16.3% | | |

| 1,000,000 | | AOL Time Warner Inc | | |

| | | 6.150%, 05/01/2007 | $ | 1,017,641 |

| 1,800,000 | | Boeing Capital Corporation | | |

| | | 5.750%, 02/15/2007 | | 1,821,317 |

| | | CIT Group Inc. | | |

| 500,000 | | 4.000%, 05/08/2008 | | 489,954 |

| 1,150,000 | | 5.910%, 11/23/2005 | | 1,150,978 |

| 3,000,000 | | Ford Motor Credit Company | | |

| | | 6.875%, 02/01/2006 | | 2,998,641 |

| | | Total Corporate Bonds | | 7,478,531 |

| | | | | |

| | | | | |

Municipal Bonds—77.9% | | |

| Alabama—4.4% | | |

| 2,000,000 | | Birmingham Special Care | | |

| | | Facilities Financing Authority | | |

| | | Revenue, Baptist Medical | | |

| | | Centers | | |

| | | 4.350%, 07/01/2006 | | 2,004,300 |

| | | Arizona—1.0% | | |

| 445,000 | | Maricopa County Industrial | | |

| | | Development Authority | | |

| | | Multifamily Revenue, San | | |

| | | Fernando Apartments LP— | | |

| | | Series A (Fannie Mae) | | |

| | | 3.010%, 11/07/2005 (a) (b) | | 445,000 |

| | | | | |

| Arkansas—4.1% | | |

| 100,000 | | Magnolia Industrial | | |

| | | Development Revenue, | | |

| | | American Fuel Cell | | |

| | | (LOC: HSBC Bank USA N.A.) | | |

| | | 3.050%, 11/07/2005 (a) (b) | | 100,000 |

| 1,800,000 | | Searcy Industrial Development | | |

| | | Revenue, Yarnell Ice Cream | | |

| | | Co. (SPA: AmSouth Bank of | | |

| | | Alabama) | | |

| | | 3.700%, 01/01/2010 . | | 1,800,000 |

| | | | | 1,900,000 |

| | | | | |

| California—4.3% | | |

| 1,000,000 | | California Pollution Control | | |

| | | Financing Authority Solid | | |

| | | Waste Disposal Revenue, | | |

| | | Republic Services Inc. | | |

| | | 2.850%, 12/01/2005 . | | 999,340 |

| 1,000,000 | | California Statewide | | |

| | | Communities Development | | |

| | | Authority Solid Waste | | |

| | | Facilities Revenue, Waste | | |

| | | Management Inc. (CS: Waste | | |

| | | Management) | | |

| | | 2.900%, 04/01/2007 (a) (b) | | 987,590 |

| | | | | 1,986,930 |

| | | | | |

| Indiana—4.4% | | |

| 2,000,000 | | Vigo County Industrial | | |

| | | Development Revenue | | |

| | | Republic Services Inc. | | |

| | | 3.050%, 11/07/2005 (a) (b) | | 2,000,000 |

| | | | | |

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| Kentucky—1.7% | | |

| 785,000 | | Shelby County Industrial | | |

| | | Building Revenue, Roll | | |

| | | Forming Corp. | | |

| | | (LOC: Bayerishe) | | |

| | | 3.100%, 11/07/2005 (a)(b) | $ | 785,000 |

| | | | | |

| | | | | |

| Louisiana—9.2% | | |

| 2,000,000 | | Ascension Parish Solid Waste | | |

| | | Disposal, Alliedsignal Inc. | | |

| | | 3.050%, 11/07/2005 (a)(b) | | 2,000,000 |

| 2,200,000 | | Jefferson Parish LA Industrial | | |

| | | Development Board, Sara Lee | | |

| | | Corp. | | |

| | | 3.800%, 11/01/2005 (a)(b) | | 2,200,000 |

| | | | | 4,200,000 |

| | | | | |

| Massachusetts —7.3% | | |

| 1,150,000 | | Massachusetts State Industrial | | |

| | | Finance Agency Revenue, | | |

| | | Asahi/America Inc. | | |

| | | 3.125%, 03/01/2009 (a)(b) | | 1,124,505 |

| 2,200,000 | | Massachusetts State Port | | |

| | | Authority Revenue, Delta Air | | |

| | | Lines | | |

| | | 3.200%, 11/30/2005 (a)(b) | | 2,200,000 |

| | | | | 3,324,505 |

| | | | | |

| Michigan—4.4% | | |

| 1,000,000 | | Michigan Strategic Fund, Dow | | |

| | | Chemical Company | | |

| | | 3.800%, 06/01/2006 (a)(b) | | 1,002,760 |

| 1,000,000 | | Michigan Strategic Fund, Waste | | |

| | | Management Inc. | | |

| | | 3.150%, 02/01/2006 (a)b) | | 999,030 |

| | | | | 2,001,790 |

| | | | | |

| Missouri—3.7% | | |

| 1,700,000 | | St. Charles County Industrial | | |

| | | Development Authority | | |

| | | Revenue, Dev-Craftsmen | | |

| | | Industries | | |

| | | 2.910%, 11/07/2005 (a)(b) | | 1,700,000 |

| | | | | |

| | | | | |

| New Jersey—9.3% | | |

| 1,000,000 | | Bayonne BD Anticipation Notes | | |

| | | 4.500%, 06/29/2006 | | 1,003,350 |

| 1,000,000 | | Bayonne Tax Anticipation Notes, | | |

| | | Series B | | |

| | | 5.000%, 11/15/2005 | | 1,000,470 |

| 500,000 | | Bayonne Tax Anticipation Notes, | | |

| | | Series A | | |

| | | 5.000%, 10/13/2006 | | 504,440 |

| 515,000 | | New Jersey St Educational | | |

| | | Facilities Authority Revenue, | | |

| | | Stevens Institute of | | |

| | | Technology | | |

| | | 4.000%, 07/01/2006 | | 517,086 |

| 1,205,000 | | Tobacco Settlement Finance | | |

| | | Corporation | | |

| | | 5.750%, 06/01/2012 | | 1,251,657 |

| | | | | 4,277,003 |

| | | | | |

See notes to financial statements.

Alpine Mutual Funds - Tax Optimized Income Fund

Schedule of Portfolio Investments—Continued

October 31, 2005

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| New Mexico—2.2% | | |

| 1,000,000 | | Sandoval County Incentive | | |

| | | Payment Revenue | | |

| | | 4.250%, 12/01/2006 | $ | 1,012,080 |

| | | | | |

| | | | | |

| New York—5.9% | | |

| 2,245,000 | | New York Counties TOB Trust | | |

| | | 4.750%, 06/01/2015 | | 2,185,665 |

| 500,000 | | Westchester Tobacco Asset | | |

| | | Securitization Corporation | | |

| | | 5.000%, 06/01/2015 | | 501,110 |

| | | | | 2,686,775 |

| | | | | |

| Ohio—3.9% | | |

| 1,500,000 | | Ohio Water Development | | |

| | | Authority Pollution Control | | |

| | | Facilities Revenue, Ohio Edison | | |

| | | Company | | |

| | | 3.350%, 12/01/2005 (a)(b) | | 1,499,745 |

| 310,000 | | Summit County Industrial | | |

| | | Development Revenue, LKL | | |

| | | Properties Inc. | | |

| | | (LOC: Firstmerit Bank N.A.) | | |

| | | 3.870%, 11/07/2005 (a)(b) | | 310,000 |

| | | | | 1,809,745 |

| | | | | |

| South Carolina—2.2% | | |

| 1,000,000 | | Charleston County Industrial | | |

| | | Revenue, Tandy Corporation | | |

| | | 4.050%, 11/07/2005 (a)(b) | | 1,000,000 |

| | | | | |

| | | | | |

| Texas—6.0% | | |

| 1,200,000 | | Cypress-Fairbanks Independent | | |

| | | School District—Series B | | |

| | | 5.000%, 08/15/2007 (a)(b) | | 1,234,992 |

| | | | | |

Principal | | Security | | |

Amount | | Description | | Value |

| | | | | |

Municipal Bonds—continued | | |

| Texas—continued | | |

| 1,500,000 | | Port Corpus Christi Authority | | |

| | | Nueces County Waste Disposal, | | |

| | | Flint Hills Resources LP | | |

| | | 3.000%, 11/07/2005 (a)(b) | $ | 1,500,000 |

| | | | | 2,734,992 |

Washington—3.9% | | |

| 1,800,000 | | Washington Economic | | |

| | | Development Finance | | |

| | | Authority Revenue, Hillstrom | | |

| | | Ventures LLC | | |

| | | 2.910%, 11/07/2005 (a)(b) | | 1,800,000 |

| | | Total Municipal Bonds | | 35,668,120 |

| | | | | |

| | | | | |

Short-Term Investments—4.8% | | |

| Money Market Funds—0.2% | | |

| 86,009 | | Federated Government | | |

| | | Obligations Fund | | 86,009 |

| | | Variable Rate Demand Notes—4.6% | | |

| | | Puerto Rico GDB | | |

| 1,136,000 | | 3.500%, 01/19/2006 | | 1,136,000 |

| 1,000,000 | | 3.500%, 01/21/2006 | | 1,000,000 |

| | | | | 2,136,000 |

| | | Total Short-Term Investments | | 2,222,009 |

| | | Total Investments | | |

| | | (Cost $45,377,771)—99.0% | | 45,368,660 |

| | | Other Assets, Less | | |

| | | Liabilities—1.0% . | | 435,221 |

| | | TOTAL NET ASSETS—100.0% | $ | 45,803,881 |

| | | | | |

| (a) | Variable Rate Security—The rate reported is the rate in effect as of October 31, 2005. The date shown is the next reset date. |

| (b) | Maturity date represents first available put date. |

CS—Credit Support

LOC—Letter of Credit

SPA—Stand by Purchase Agreement

GDB—Government Development Bank

See notes to financial statements.

Statements of Assets and Liabilities

October 31, 2005

| | | Dynamic Balance Fund | | Dynamic Dividend Fund | |

| | | | | | |

ASSETS: | | | | | |

Investments, at value (1) | | $ | 95,797,034 | | $ | 308,340,809 | |

Dividends receivable | | | 49,993 | | | 843,343 | |

Interest receivable | | | 314,966 | | | 14,418 | |

Receivable for capital shares issued | | | 67,067 | | | 1,116,635 | |

Receivable for investment securities sold | | | 1,490,569 | | | 9,557,245 | |

Prepaid expenses and other assets | | | 7,923 | | | 27,000 | |

Total assets | | | 97,727,552 | | | 319,899,450 | |

| | | | | | | | |

LIABILITIES: | | | | | | | |

Payable for investment securities purchased | | | — | | | 7,553,354 | |

Payable for capital shares redeemed | | | 115,234 | | | 568,400 | |

Accrued expenses and other liabilities: | | | | | | | |

Investment advisory fees | | | 83,365 | | | 261,125 | |

Other | | | 58,291 | | | 175,679 | |

Total liabilities | | | 256,890 | | | 8,558,558 | |

Net Assets | | $ | 97,470,662 | | $ | 311,340,892 | |

| | | | | | | | |

| | | | | | | | |

Net assets represented by | | | | | | | |

Capital Stock | | $ | 84,462,024 | | $ | 323,900,566 | |

Accumulated undistributed net investment income | | | 96,291 | | | 3,463,833 | |

Accumulated net realized gains/(losses) on investments sold and foreign currency related | | | | | | | |

transactions | | | 1,666,848 | | | (5,293,731 | ) |

Net unrealized appreciation/(depreciation) on: | | | | | | | |

investments | | | 11,245,499 | | | (10,722,750 | ) |

Foreign currency translation | | | — | | | (7,026 | ) |

Total Net Assets | | $ | 97,470,662 | | $ | 311,340,892 | |

| | | | | | | | |

| | | | | | | | |

Net asset value | | | | | | | |

Net assets | | $ | 97,470,662 | | $ | 311,340,892 | |

Shares of beneficial interest issued and outstanding | | | 7,693,028 | | | 25,980,128 | |

Net asset value, offering price and redemption price per share | | $ | 12.67 | | $ | 11.98 | |

| (1) Cost of Investments | | $ | 84,551,535 | | $ | 319,063,559 | |

| | | | | | | | |

See notes to financial statements.

Statements of Assets and Liabilities

October 31, 2005

| | | Municipal Money Market Fund | | Tax Optimized Income Fund | |

ASSETS: | | | | | |

Investments, at value for Tax Optimized Income Fund; at amortized cost for | | | | | |

Municipal Money Market Fund (1) | | $ | 205,720,969 | | $ | 45,368,660 | |

Interest receivable | | | 857,134 | | | 462,731 | |

Receivable for capital shares issued | | | 316,269 | | | 100 | |

Receivable for investment securities sold | | | 2,305,405 | | | — | |

Prepaid expenses and other assets | | | 72,881 | | | 20,248 | |

Total assets | | | 209,272,658 | | | 45,851,739 | |

| | | | | | | | |

| | | | | | | | |

LIABILITIES: | | | | | | | |

Payable for investment securities purchased | | | 3,000,167 | | | — | |

Payable for capital shares redeemed | | | 683,564 | | | 270 | |

Accrued expenses and other liabilities: | | | | | | | |

Investment advisory fees | | | 93,477 | | | 29,247 | |

Distribution fees | | | 596 | | | 167 | |

Payable to custodian | | | 6,795 | | | 1,153 | |

Other | | | 182,778 | | | 17,021 | |

Total liabilities | | | 3,967,377 | | | 47,858 | |

Net Assets | | $ | 205,305,281 | | $ | 45,803,881 | |

| | | | | | | | |

| | | | | | | | |

Net assets represented by | | | | | | | |

Capital Stock | | $ | 205,305,693 | | $ | 45,796,449 | |

Accumulated undistributed net investment income | | | — | | | 5,475 | |

Accumulated net realized gains from investments sold | | | (412 | ) | | 11,068 | |

Net unrealized (depreciation) on investments | | | — | | | (9,111 | ) |

Total Net Assets | | $ | 205,305,281 | | $ | 45,803,881 | |

| | | | | | | | |

| | | | | | | | |

Net asset value | | | | | | | |

Adviser Class Shares | | | | | | | |

Net assets | | $ | 616,521 | | $ | 112,454 | |

Shares of beneficial interest issued and outstanding | | | 616,595 | | | 11,209 | |

Net asset value, offering price and redemption price per share | | $ | 1.00 | | $ | 10.03 | |

Investor Class Shares | | | | | | | |

Net assets | | $ | 204,688,760 | | $ | 45,691,427 | |

Shares of beneficial interest issued and outstanding | | | 204,713,442 | | | 4,554,331 | |

Net asset value, offering price and redemption price per share | | $ | 1.00 | | $ | 10.03 | |

| (1) Cost of Investments | | $ | 205,720,969 | | $ | 45,377,771 | |

| | | | | | | | |

See notes to financial statements.

Statements of Operations

Year Ended October 31, 2005

| | | Dynamic Balance Fund | | Dynamic Dividend Fund | |

INVESTMENT INCOME: | | | | | |

Interest income | | $ | 939,444 | | $ | 270,068 | |

Dividend income* | | | 1,651,000 | | | 32,201,543 | |

Total investment income | | | 2,590,444 | | | 32,471,611 | |

| | | | | | | | |

| | | | | | | | |

EXPENSES: | | | | | | | |

Investment advisory fees | | | 889,124 | | | 2,102,039 | |

Administration fees | | | 38,856 | | | 89,241 | |

Fund accounting fees | | | 22,993 | | | 51,691 | |

Audit and tax fees | | | 19,395 | | | 21,976 | |

Custodian fees | | | 8,826 | | | 20,420 | |

Interest expense | | | 54 | | | — | |

Legal fees | | | 1,624 | | | 4,083 | |

Registration and filing fees | | | 26,501 | | | 77,445 | |

Printing fees | | | 15,268 | | | 47,760 | |

Transfer agent fees | | | 39,372 | | | 90,116 | |

Trustee fees | | | 3,732 | | | 3,632 | |

Other fees | | | 6,266 | | | 5,052 | |

| Total expenses before expense recovery by Adviser | | | 1,072,011 | | | 2,513,455 | |

Expense recovery by Adviser. | | | 91,794 | | | 76,518 | |

Net expenses | | | 1,163,805 | | | 2,589,973 | |

| Net investment income | | | 1,426,639 | | | 29,881,638 | |

| | | | | | | | |

| | | | | | | | |

REALIZED/UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | |

Net realized gain/(loss) on: | | | | | | | |

Investment transactions | | | 1,579,292 | | | (5,293,810 | ) |

Foreign currency translation | | | — | | | (285,088 | ) |

Net realized gain (loss) | | | 1,579,292 | | | (5,578,898 | ) |

Change in unrealized appreciation/(depreciation) on investments | | | | | | | |

Investments | | | 2,912,439 | | | (12,570,661 | ) |

Foreign currency translation | | | — | | | (6,945 | ) |

Net change in unrealized appreciation/(depreciation) | | | 2,912,439 | | | (12,577,606 | ) |

| Net realized/unrealized gain (loss) on investments | | | 4,491,731 | | | (18,156,504 | ) |

| Change in net assets resulting from operations | | $ | 5,918,370 | | $ | 11,725,134 | |

| | | | | | | | |

| * Net of foreign taxes withheld | | $ | — | | $ | 1,600,723 | |

| | | | | | | | |

See notes to financial statements.

Statements of Operations

Year Ended October 31, 2005

| | | Municipal Money Market Fund | | Tax Optimized Income Fund | |

| | | | | | |

INVESTMENT INCOME: | | | | | |

Interest income | | $ | 5,800,749 | | $ | 1,751,436 | |

Total investment income | | | 5,800,749 | | | 1,751,436 | |

| | | | | | | | |

EXPENSES: | | | | | | | |

Investment advisory fees | | | 1,029,823 | | | 366,768 | |

Administration fees | | | 23,143 | | | 5,029 | |

Distribution fees—Adviser Class | | | 569 | | | 167 | |

Fund accounting fees | | | 23,143 | | | 5,054 | |

Audit and tax fees | | | 15,176 | | | 15,450 | |

Custodian fees | | | 23,140 | | | 5,050 | |

Interest expense | | | 249 | | | 166 | |

Legal fees | | | 3,995 | | | 963 | |

Registration and filing fees | | | 54,662 | | | 28,293 | |

Printing fees | | | 3,881 | | | 946 | |

Transfer agent fees | | | 23,118 | | | 5,072 | |

Trustee fees | | | 3,924 | | | 3,782 | |

Other fees | | | 7,575 | | | 5,240 | |

| Total expenses before expense reimbursement by Adviser | | | 1,212,398 | | | 441,980 | |

Less: Reimbursement by Adviser | | | (574,245 | ) | | (148,232 | ) |

Net expenses | | | 638,153 | | | 293,748 | |

| Net investment income | | | 5,162,596 | | | 1,457,688 | |

| | | | | | | | |

REALIZED/UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | |

Net realized gain on investments | | | 2,815 | | | 46,520 | |

Change in unrealized appreciation (depreciation) on investments | | | — | | | (616,587 | ) |

| Net realized/unrealized loss on investments | | | 2,815 | | | (570,067 | ) |

| Change in net assets resulting from operations | | $ | 5,165,411 | | $ | 887,621 | |

| | | | | | | | |

See notes to financial statements.

Statements of Changes in Net Assets

| | | Dynamic Balance Fund | |

| | | Year Ended October 31, 2005 | | Year Ended October 31, 2004 | |

OPERATIONS: | | | | | |

Net investment income | | $ | 1,426,639 | | $ | 1,066,776 | |

Net realized gain on investments | | | 1,579,292 | | | 3,750,643 | |

Change in unrealized appreciation on investments | | | 2,912,439 | | | 3,043,286 | |

Change in net assets resulting from operations | | | 5,918,370 | | | 7,860,705 | |

| | | | | | | | |

| | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

Distributions to Shareholders: | | | | | | | |

From net investment income | | | (1,322,306 | ) | | (1,016,661 | ) |

From net realized gain on investment | | | (3,659,345 | ) | | — | |

Change in net assets resulting from distributions to shareholders | | | (4,981,651 | ) | | (1,016,661 | ) |

| | | | | | | | |

| | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | |

Proceeds from shares sold | | | 30,307,445 | | | 10,731,576 | |

Dividends reinvested | | | 4,421,872 | | | 898,869 | |

Cost of shares redeemed | | | (8,900,384 | ) | | (1,525,813 | ) |

Change in net assets from capital share transactions | | | 25,828,933 | | | 10,104,632 | |

Total change in net assets | | | 26,765,652 | | | 16,948,676 | |

| | | | | | | | |

| | | | | | | | |

NET ASSETS: | | | | | | | |

Beginning of period | | | 70,705,010 | | | 53,756,334 | |

End of period* | | $ | 97,470,662 | | $ | 70,705,010 | |

| | | | | | | | |

| | | | | | | | |

| * Including undistributed net investment income of | | $ | 96,291 | | $ | 79,511 | |

| | | | | | | | |

See notes to financial statements.

Statements of Changes in Net Assets

| | | Dynamic Dividend Fund | |

| | | Year Ended | | Year Ended | |

| | | | | | |

OPERATIONS: | | | | | |

Net investment income | | $ | 29,881,638 | | $ | 2,468,054 | |

Net realized gain (loss) on: | | | | | | | |

Long transactions | | | (5,293,810 | ) | | 1,483,063 | |

Foreign currency translation | | | (285,088 | ) | | (6,398 | ) |

Change in unrealized appreciation/(depreciation) on: | | | | | | | |

Investments | | | (12,570,661 | ) | | 1,067,523 | |

Foreign currency translation | | | (6,945 | ) | | (81 | ) |

| Change in net assets resulting from operations | | | 11,725,134 | | | 5,012,161 | |

| | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

Distributions to Shareholders: | | | | | | | |

From net investment income. | | | (26,364,397 | ) | | (2,259,008 | ) |

From net realized gain on investment | | | (1,494,879 | ) | | — | |

Change in net assets resulting from distributions to shareholders | | | (27,859,276 | ) | | (2,259,008 | ) |

| | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | |

Proceeds from shares sold | | | 328,736,945 | | | 29,533,128 | |

Dividends reinvested | | | 22,881,710 | | | 1,883,922 | |

Redemption fees | | | 80,834 | | | 7,373 | |

Cost of shares redeemed | | | (67,754,875 | ) | | (4,174,516 | ) |

Change in net assets from capital share transactions | | | 283,944,614 | | | 27,249,907 | |

Total change in net assets | | | 267,810,472 | | | 30,003,060 | |

| | | | | | | | |

NET ASSETS: | | | | | | | |

Beginning of period | | | 43,530,420 | | | 13,527,360 | |

End of period* | | $ | 311,340,892 | | $ | 43,530,420 | |

| | | | | | | | |

| * Including undistributed net investment income of: | | $ | 3,463,833 | | $ | 259,626 | |

| | | | | | | | |

See notes to financial statements.

Statements of Changes in Net Assets

| | | Municipal Money Market Fund | |

| | | Year Ended October 31, 2005 | | Year Ended October 31, 2004 | |

| | | | | | |

OPERATIONS: | | | | | |

Net investment income | | $ | 5,162,596 | | $ | 963,350 | |

Net realized gain on investments | | | 2,815 | | | — | |

Change in unrealized appreciation/depreciation on investments | | | — | | | — | |

Change in net assets resulting from operations | | | 5,165,411 | | | 963,350 | |

| | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

Distributions to Adviser Class Shareholders: | | | | | | | |

From net investment income | | | (4,859 | ) | | (115 | ) |

Distributions to Investor Class Shareholders: | | | | | | | |

From net investment income | | | (5,185,308 | ) | | (963,235 | ) |

Change in net assets resulting from distributions to shareholders | | | (5,190,167 | ) | | (963,350 | ) |

| | | | | | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | |

Proceeds from shares sold | | | 459,390,771 | | | 166,115,193 | |

Dividends reinvested | | | 2,955,883 | | | 866,133 | |

Cost of shares redeemed | | | (387,244,093 | ) | | (95,880,229 | ) |

Change in net assets from capital share transactions | | | 75,102,561 | | | 71,101,097 | |

Total change in net assets | | | 75,077,805 | | | 71,101,097 | |

| | | | | | | | |

NET ASSETS: | | | | | | | |

Beginning of period | | | 130,227,476 | | | 59,126,379 | |

End of period* | | $ | 205,305,281 | | $ | 130,227,476 | |

| | | | | | | | |

| * Including undistributed net investment income of | | $ | — | | $ | 2,815 | |

| | | | | | | | |

See notes to financial statements.

Statements of Changes in Net Assets

| | | Tax Optimized Income Fund | |

| | | Year Ended October 31, 2005 | | Year Ended October 31, 2004 | |

OPERATIONS: | | | | | |

Net investment income | | $ | 1,457,688 | | $ | 1,409,745 | |

Net realized gain/(loss) on investments | | | 46,520 | | | (35,452 | ) |

Change in unrealized/(depreciation) on investments | | | (616,587 | ) | | (60,107 | ) |

Change in net assets resulting from operations | | | 887,621 | | | 1,314,186 | |

| | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | |

Distributions to Adviser Class Shareholders: | | | | | | | |

From net investment income | | | (1,966 | ) | | (197 | ) |

Distributions to Investor Class Shareholders: | | | | | | | |

From net investment income | | | (1,461,892 | ) | | (1,397,873 | ) |

From net realized gain on investments | | | — | | | (31,474 | ) |

| Change in net assets resulting from distributions to shareholders | | | (1,463,858 | ) | | (1,429,544 | ) |

| | | | | | | | |

SHARES OF CAPITAL SHARE TRANSACTIONS; | | | | | | | |

Proceeds from shares sold | | | 1,774,244 | | | 9,292,083 | |

Dividends reinvested | | | 1,450,040 | | | 1,412,683 | |

Redemption fees | | | 274 | | | — | |

Cost of shares redeemed | | | (8,168,307 | ) | | (14,856,164 | ) |

Change in net assets from capital share transactions | | | (4,943,749 | ) | | (4,151,398 | ) |

Total change in net assets | | | (5,519,986 | ) | | (4,266,756 | ) |

| | | | | | | | |

NET ASSETS: | | | | | | | |

Beginning of period | | | 51,323,867 | | | 55,590,623 | |

End of period* | | $ | 45,803,881 | | $ | 51,323,867 | |

| | | | | | | | |

| * Including undistributed net investment income of | | $ | 5,475 | | $ | 11,645 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |