As filed with the Securities and Exchange Commission on January 11, 2007

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21210

Alpine Income Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

3rd Floor

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Samuel A. Lieber

Alpine Management & Research, LLC

2500 Westchester Avenue, Suite 215

Purchase, NY 10577

(Name and address of agent for service)

1-888-785-5578

Registrant's telephone number, including area code

Date of fiscal year end: 10/31/2006

Date of reporting period: 10/31/2006

Item 1. Report to Stockholders.

TABLE OF CONTENTS

| Alpine’s Investment Outlook | 1 |

| FUND MANAGER REPORTS | |

| Alpine Dynamic Balance Fund | 4 |

| Alpine Dynamic Dividend Fund | 8 |

| Alpine Dynamic Financial Services Fund | 14 |

| Alpine Dynamic Innovators Fund | 18 |

| Alpine Municipal Money Market Fund | 22 |

| Alpine Tax Optimized Income Fund | 24 |

| Schedules of Portfolio Investments | 28 |

| Statements of Assets and Liabilities | 44 |

| Statements of Operations | 46 |

| Statements of Changes in Net Assets | 48 |

| Financial Highlights | 54 |

| Notes to Financial Statements | 62 |

| Report of Independent Registered Public Accounting Firm | 71 |

| Additional Information | 72 |

Alpine’s Investment Outlook |

Dear Investor:

As 2006 draws to an end, most of the Alpine Funds have enjoyed a fiscal year ended October 31 with strong returns in spite of considerable uncertainty over both geopolitical problems and economic headwinds. We have experienced a broad bond market rally and positive equity markets in the U.S. and abroad. Positive index returns mask what has been quite a volatile year in the capital markets.

Initially, interest rates were driven higher by Federal Reserve Bank rate tightening, then when the Fed went to a neutral stance, bond prices rallied in anticipation of future easing. Oil prices accelerated in response to both mid-summer fears of growing tensions with Iran, as well as the anticipated peak summer driving season and the perceived inexhaustible demand for resources by China. Then, crude oil prices fell from a peak of $77 in August to less than $59 by October 31, eroding the speculative fervor underpinning commodity prices. The dollar initially strengthened during the year as the Fed was raising interest rates, yet it too has fallen back against other currencies as a more cautious view of the U.S. economy’s growth prospects for 2007 has become widespread within the capital markets. The abrupt fall in demand for new homes last spring raised fears that a collapse of home prices would induce a significant slowdown in domestic consumption. Signs of stability in the housing market have alleviated these fears. While lower mortgage costs have helped, another factor has been America’s ability to create new jobs, reflecting the great breadth of our economy, where pockets of previous excess and now current contraction are being offset by stability in other less volatile markets.

The Business Cycle: Growth and Risk

The legacy of ex-Fed Chairman Greenspan’s “Goldilocks Economy’’ is still with us. Even though the long-term decline in inflation and, hence, interest rates since 1981 may have hit bottom in 2003 there are no storm clouds on the horizon which suggest that we have to return to the boom-bust economic cyclicality of the 1970’s. However, the foundations of our current prosperity may be less secure than in the past two decades!

If inflation and interest rates remain at today’s historically moderate levels and modest employment growth can be sustained along with reasonable increases in income, then some of the economic imbalances of the past six years can be either absorbed or ameliorated. Eventually we must reverse the growth in our nation’s current account imbalance which has been propelled by the benefits of cheap imports whose profits have been recycled into relatively low-cost foreign financing of our government’s growing fiscal deficits. We must also shift our country’s popular preference from financing current consumption to expanding our national savings rate in order to protect against future uncertainties. These and other recent trends have left our national economy with much less of a cushion than we enjoyed either five or ten years ago. These concerns have been exacerbated by the costs of our war in Iraq, not only in terms of lives lost and of dollars spent, but also our self-esteem, our military’s capability and the country’s standing in the world. The total future impact of this war remains uncertain.

The great strength of this country remains in its range of innovation, entrepreneurship and capacity for reinvention. The combination of our collective local strength as a nation with our international integration of economic activity and, in some fields, dominance, have helped us to muddle through many of our problems which might otherwise undermine a smaller economy. Nonetheless, we cannot expect this “Goldilocks’’ era to last indefinitely.

As the business cycle progresses, we note that many economies throughout the world are beginning to de-link with regard to both direction and velocity. This means that if the U.S. were to slow down, it does not necessarily follow that France or China or Brazil would necessarily follow suit. Trade patterns, currencies, and interest rates can influence capital flows and thus connect the global capital markets via short-term adjustments. These appear to be less profound than has historically been the case. Specifically, we note that volatility in the equity markets has generally declined in 2006, with globalization’s efficient capital deployment. Because volatility has been reduced, we believe risk premiums have also declined in lock step with the current period’s relatively stable low interest rate environment. If volatility were to rise, the risk premium is where short-term adjustments may cause dislocation, just as they did following the May 10th round of coordinated central bank rate increases in Europe, India and South Korea. Subsequently, risk premiums have once again diminished in the second half of 2006.

1

Looking Toward 2007

It is significant that the current hot spot of merger and acquisition (M&A) activity in the global capital markets has been in fact between market places themselves. The New York Stock Exchange has bid to acquire the Euro-next Exchange and NASDAQ, has offered to acquire the London Stock Exchange. A merger has been agreed to between the Chicago Mercantile Exchange and the Chicago Board of Trade. These corporate linkages of global markets will further facilitate the globalization of capital, enhancing the communication and transparency of business activity to investors. Since we started studying and investing in foreign markets roughly 20 years ago, and created our first global fund, the Alpine International Real Estate Equity Fund in February of 1989, the quality and volume of information flow has risen dramatically. Our Dynamic Dividend Fund, which began operation in 2003, has also increased its focus on international opportunities so understanding the interaction and evolution of the global capital markets is critical for setting investment strategies.

Alpine’s near term view is of a relatively positive environment for equity investors. However it is not benign. There is the potential for a moderately rising interest rate backdrop to the ensuing years, although economic growth could slow a little next year, and then pick up speed gradually, which might sustain the “Goldilocks Economy’’ of low interest rates and moderate growth for several more years. This would be positive for leaders in our investment effort, namely dividend paying equities, financial firms and real estate.

The Alpine team has grown significantly over the past few years as have our assets under management and the number of funds which we offer. We hope this will permit Alpine to provide investors with meaningful relative returns and diversification.

Sincerely,

Samuel A. Lieber

President, Alpine Mutual Funds

__________

This letter and those that follow represent the opinions of Alpine Funds management and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

The Alpine International Real Estate Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company, and it may be obtained by calling 888-785-5578, or visiting www.alpinefunds.com. Read it carefully before investing.

Funds that concentrate their investments in a specific sector, such as the International Real Estate Fund, tend to experience more volatility and be exposed to greater risk than more diversified mutual funds. Alpine advocates the use of sector funds as part of an integrated investment strategy.

Price to earnings ratio is a common tool for comparing the prices of different common stocks and is calculated by dividing the current market price of a stock by the earnings per share.

2

EQUITY MANAGER REPORTS

| Alpine Dynamic Balance Fund | ||

| Alpine Dynamic Dividend Fund | ||

| Alpine Dynamic Financial Services Fund | ||

| Alpine Dynamic Innovators Fund |

| Alpine Dynamic Balance Fund |  |

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.

The Moody’s Equity Mutual Fund Balanced Index tracks a group of similar funds that typically correspond to standard classifications based on global funds. The S&P Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Mixed Target Growth Allocation Average is an average of Funds that, by portfolio practice, maintain a mix of between 60%-80% equity securities, with the remainder invested in bonds, cash, and cash equivalents. The Moody’s Equity Mutual Fund Balanced Index, the S&P 500 Index and the Lipper Mixed Target Growth Allocation Funds Average are unmanaged and do not reflect fees associated with a mutual fund, such as investment adviser fees. The performance for the Dynamic Balance Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges.

Comparative Annualized Total Returns as of 10/31/06 | ||||

Since Inception | ||||

1 Year | 3 Year | 5 Year | (6/7/01) | |

| Alpine Dynamic Balance Fund | 11.79% | 11.45% | 9.76% | 9.34% |

| Moody’s Equity Mutual Fund Balanced Index | 11.35% | 8.53% | 6.22% | 3.89% |

| S&P 500 Index | 16.34% | 11.44% | 7.26% | 3.18% |

| Lipper Mixed Target Growth Allocation Funds Average | 12.47% | 9.27% | 6.59% | 4.11% |

| Lipper Mixed Target Growth Allocation Fund Rank | 329/592 | 78/456 | 35/354 | 9/336 |

4

| Alpine Dynamic Balance Fund |  |

Commentary

The Alpine Dynamic Balance Fund had an 11.8% increase in net asset value in the fiscal year ended October 31, 2006. The Fund’s return compared with 11.35% for the Moody’s Balance Fund Average and 16.34% for the Standard & Poor’s 500 Index.

Since the Fund’s inception on June 7, 2001, the Fund has provided a total return of 61.93% equal to 9.34% per annum. This has placed it in the top 10% of all balanced funds in this period.

The majority of the portfolio return during this fiscal year was provided by the equity positions. Common stocks accounted for 73.6% of the portfolio at the end of the fiscal year, and 22.9% was in United States Treasury bonds and notes, with 3.5% in cash and cash equivalents. The average yield on the Treasury obligations was 4.7% at year-end.

The common stock portfolio performance encountered two extremes. On the positive side there were twenty six issues which appreciated 20% or more during the fiscal year, led by these top ten:

| Phelps Dodge Corp. | +83.7% | |

| Diamond Rock Hospitality Company | +59.3% | |

| Boston Properties Inc. | +59.1% | |

| Allegheny Energy, Inc. | +52.3% | |

| The Goldman Sachs Group Inc. | +51.4% | |

| JC Penney Company, Inc. | +48.5% | |

| Developers Diversified Realty Corp. | +45.7% | |

| Southside Bancshares Inc. | +42.2% | |

| Simon Property Group Inc. | +40.7% | |

| SJW Corp. | +40.5% |

In contrast, the portfolio was negatively impacted by a group of long term holdings in the homebuilding industry. The six in this group declined from 13.5% for Lennar Corporation—Class A, to 36.9% for Standard Pacific, LP. Notwithstanding these declines, a number of these issues still showed very sizable gains from purchase, including 100% for Pulte Homes, Inc. and 53.5% for Ryland Group, Inc. Apart from this group the only other major evidence of sizable decline was in the shares of Doral Financial Corp., down 45.3% as a result of a critical revaluation of its Puerto Rico mortgage financing activities.

Looking at key indicators of the portfolio, the ten largest holdings in market value provided significant gains. The largest, FedEx Corp., had a 25% gain for the year, followed by Goldman Sachs Group, Inc. 51.4%, Allegheny Energy, Inc. 52.27%, Consol Energy 17.2%, Sunstone Hotel Investors, Inc. 37.1%, Simon Property Group, Inc. 40.7%, Eagle Materials Inc. 5.0%, Black & Decker Corporation 3.9%, 3M Company 6.2%, and JP Morgan Chase & Co. 33.7%.

5

| Alpine Dynamic Balance Fund |  |

The foregoing suggests that the portfolio design and strategy is highly selective. The effort is not to build sector related positions, but rather value and growth opportunities selected at favorable inflection points across many industries. This approach has led to the Fund’s heaviest sector weighting, the financial industry, where we anticipated both significant individual corporate turnarounds and major merger and acquisition opportunities. Two merger deals were completed in 2006, the sale of MBNA—the credit card company—to Bank of America, and Golden West Financial to Wachovia Corp. The Bank of America shares held in the portfolio are now valued at 30% above our cost. Wachovia shares are held at 9.7% above our cost. Golden West Financial shares were sold with a 38% gain after the bid by Wachovia. Similarly, North Fork Bank Corporation shares were sold with a 40% gain after the bid was made for the company by Capital One Bancorp. Diversity of opportunity in our financial sector holdings is evident from the two top performers in the field. The first, Goldman Sachs Group, Inc., is a major, internationally active investment banking organization. The next, typical of our smaller holdings, is Southside Bancshares, Inc., a regional bank in Texas, held over a 3 year period with a 104% gain.

Our disappointment in the home building industry was not fully anticipated. We had expected a moderation of industry demand and sustained profitability after the extraordinary run-up in both volume and prices in the first half of 2005. Our basic analysis was both economically and demographically oriented. By mid-year it became apparent that a significant factor in demand—so-called “investment buying’’—had reversed from purchasing to selling. Suddenly, builders were confronted with contract cancellations, defaults, and re-offerings below their price structure. This suppressed demand and heightened the urgency of offerings in many sections of the country. It was particularly felt in Florida, Arizona, Northern California, and the Washington D.C. area. The rapid growth of builder profitability was reversed, although sustained above historical levels in most cases. Nonetheless builders have taken a cautious approach in many cases, cutting prices, writing off land options, and positioning themselves for a period of reduced demand. We reduced some holdings, notably taking a 300% profit in a portion of holdings in Ryland Group, Inc.

We currently see the home building group as approaching an inflection point. Any reduction in interest rates will likely lead to renewed buyer confidence so long as employment holds steady. Each of these factors remains uncertain at this writing, but the highly depressed valuation of the group, and the prospect of potential merger and acquisition activity, led us to maintain holdings.

Capital gains were taken in several positions. The largest single gain recorded in the fiscal year was in the above noted shares of Ryland Group. From the sale of Vornado Realty Trust, we realized a 91% profit.

The Bond Position

The fixed-income holdings have been less than normally volatile through the fiscal year. The reason is that the Fund’s positioning is primarily in longer maturities of United States government obligations. The vast worldwide liquidity and foreign holdings in dollars have sustained demand for longer maturity U.S. obligations, even when interest rates were rising significantly in the shorter maturities. This has produced a flat yield curve, largely sustained through the fiscal year. Thus, our usual practice of trying to add to holdings in periods of weakness and sell at moments of exaggerated strength has not been executed. The outlook as we write remains one of high demand in the long end of the Treasury market, with speculative interest tending to be focused more on possible lower rates if economic advances slow.

Strategic Focus

Our plans for the Fund’s strategies in the new fiscal year are based on expectations of moderating economic growth. Therefore, our commitments of new funds and proceeds from sales of equities will be focused on businesses with a sustained demand based on demographic and broad-based consumer income, but will focus particularly on growth opportunities from innovation in products and competitive strengths. With this viewpoint we have recently strengthened our research capability by adding a senior research analyst concentrating on the consumer field. We will also continue to benefit from the extensive research in strong dividend payment potential issues which are part of our growing program for tax-efficient dividend investment.

6

| Alpine Dynamic Balance Fund |  |

We thank our shareholders for their continuing interest and assure them of our sustained goals of further appreciation and yield in a low-risk strategy.

Stephen A. Lieber

Samuel A. Lieber

Co-Portfolio Managers

________

Please refer to the schedule of portfolio investments for fund holdings information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Investing in this fund involves special risks, including but not limited to, options and futures transactions. Please refer to the prospectus for further details. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

Lipper Analytical Services, Inc. is an independent mutual fund research and rating service. Each Lipper average presents a universe of Funds with similar invest objectives. Rankings for the periods shown include dividends and distributions reinvested and do not reflect sales charges.

7

| Alpine Dynamic Dividend Fund |  |

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees.

Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.

The Moody’s Equity Mutual Fund Growth Income Index tracks a group of similar funds that typically correspond to standard classifications based on investment objectives and fundamental policies. The S&P 500 Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Equity Income Funds Average is an average of funds that seek relatively high current income and income growth through investing 60% or more of their respective portfolios in equities. The Moody’s Equity Mutual Fund Growth Income Index, the S&P Index and the Lipper Equity Income Funds Average are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as advisor fees. The performance for the Dynamic Dividend Fund reflects fees for these value-added services. Investors cannot directly invest in an index. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges.

Comparative Annualized Total Returns as of 10/31/06 | |||

Since Inception | |||

1 Year | 3 Year | (9/22/03) | |

| Alpine Dynamic Dividend Fund | 18.68% | 18.36% | 20.23% |

| Moody’s Equity Mutual Fund Growth Income Index | 13.34% | 9.49% | 10.05% |

| S&P 500 Index | 16.34% | 11.44% | 12.06% |

| Lipper Equity Income Fund Average | 17.76% | 13.52% | 14.21% |

| Lipper Equity Income Fund Rank | 87/233 | 4/176 | 2/167 |

8

| Alpine Dynamic Dividend Fund |  |

Commentary

The Alpine Dynamic Dividend Fund (ADVDX) completed its third full year of operation with strong results, providing a total return of 18.68% for the fiscal year ended October 31, 2006. This compares to a 16.34% gain for the S&P 500 Stock Index and a 13.34% return for the Moody’s Equity Growth Income Index for the same time period. Since inception on September 22, 2003, ADVDX has produced an annualized return of 20.23%, which compares favorably to a return of 12.06% for the S&P 500 Index and a 10.05% return for the Moody’s Equity Growth Income Index.

ADVDX increased its dividend payment by 4.4% in fiscal 2006, providing a strong dividend yield

The shareholders of the Alpine Dynamic Dividend Fund received $1.574 in ordinary dividend income in fiscal 2006. This entire dividend payment is expected to be treated as qualified dividend income and available for the reduced federal tax rate on dividends. However, the final determination of the source of all distributions in 2006, including the percentage of qualified dividend income, will be made after year-end. This represents a 4.4% increase versus the $1.51 paid in fiscal 2005. Based on the Fund’s closing NAV per share of $12.52 on 10/31/06. This high level of dividend income is unique among equity oriented funds. For example, the dividend yield for the S&P 500 Electric Utility Index is currently 3.01% and the yield for the IShares DJ Select Dividend Index Fund (DVY) is 3.21%.

Beginning in March 2006, ADVDX increased its regular monthly minimum dividend by $0.01, from $0.06 to $0.07 per share. In addition, in the third month of each quarter the Fund distributes excess dividend income that has accumulated during the quarter.

Our investment approach combines three sub strategies—Dividend Capture, Value, and Growth

We believe ADVDX offers a balanced approach to optimizing both tax-qualified dividend income and long-term growth of capital while also offering some global diversification since a portion of the portfolio is invested in international dividend-paying equities. We scan the globe looking for what we feel are the best dividend opportunities for our investors, employing a multi-cap, multi-sector, and multi-style investment approach.

The Fund combines three research-driven investment strategies—Dividend Capture, Value, and Growth—to maximize the amount of distributed dividend income that is qualified for reduced Federal income tax rates and to identify companies with the potential for dividend increases and capital appreciation.

Our “Dividend Capture Strategy’’ enhances the qualified dividend income generated by the Fund

We run a portion of our portfolio with a dividend capture strategy, where we invest in typically high dividend yielding stocks or in special situations where large cash balances are being returned to shareholders as one-time special dividends. We enhance the return of this portfolio by electively rotating a portion of our high yielding holdings after the 61-day ownership period required to obtain the 15% dividend tax rate.

9

| Alpine Dynamic Dividend Fund |  |

One facet of our dividend capture strategy is our search for core, long term holdings in companies that historically generate consistent strong free cash flow and regular large dividend distributions, usually above 5%. Two of our largest holdings, Macquarie Infrastructure Trust (MIC) with a 6.9% current yield, and Regal Entertainment with a 5.7% yield, are examples of this strategy.

MIC owns and operates infrastructure businesses in the U.S. including airport service, parking facilities, and refined products bulk tank terminals. These businesses have high barriers to entry, long-term contracts and strong cash flow, and are growing through acquisition. Regal is the largest theater owner in the U.S., generating 20% of total U.S. box office revenue and is currently enjoying a rebound in theater attendance. In addition, we believe Regal can realize additional value by spinning off its in-theater advertising unit, National CineMedia, with the proceeds potentially being returned to investors as a special dividend in 2007.

The Fund captured over 100 dividend increases and 60 special dividends in fiscal 2006

In fiscal 2006, ADVDX owned over 60 stocks that declared special dividends and over 100 stocks that raised their dividends in that time period. Three of our current top 10 holdings have announced large special dividends payments associated with restructurings, and we believe there is additional upside value to be realized following the dividend payment.

Alberto-Culver paid a special dividend in November 2006 following the split of its company into two entities—the new Alberto-Culver, which manufactures personal care products, and Sally Beauty, which distributes professional beauty supplies. Mitchells & Butlers operates over 2,000 pubs and restaurants across the UK and Germany and is benefiting from the secular growth in the casual dining markets. Following a revaluation of its assets, the company returned excess cash in the form of a special dividend in October 2006 and the stock recently hit a 52-week high. And Banta Corporation, a leader in printing and supply-change management services, provided a special dividend payment in November 2006 as a return of excess cash following a restructuring of its businesses and balance sheet. In addition, we expect Banta to benefit from continued growth and cost savings from its recently announced merger with R.R. Donnelley & Sons.

Our “Growth and Income Strategy’’ targets capital appreciation in addition to yield

Our second strategy identifies core growth and income stocks that may have slightly lower but still attractive current dividend yields and predictable earnings streams plus a catalyst for capital appreciation and dividend increases. In our top 10 holdings, we would group Halliburton, Textron, and United Technologies in this category. These companies are estimated to grow earnings annually by 12-20% over the next two years and each raised their dividends by 11-20% in 2006. We would expect additional dividend increases in 2007.

We believe both UTX and Textron offer excellent upside potential as diversified manufacturers with strong international growth prospects, which should benefit from a declining dollar. UTX is well positioned in the aerospace and industrial sectors with its suite of industry leading companies including Otis elevators, Pratt & Whitney aircraft engines, Sikorsky helicopters, Carrier air conditioners and Chubb security and fire protection systems. And Textron is benefiting from a multi-year recovery in demand for two of its primary businesses, Cessna business jets and Bell helicopters used for military and industrial transportation.

Halliburton is currently experiencing strong demand for its range of products and services that enhance the exploration and production of oil and gas. In addition, we believe the company will unlock additional value following the IPO of its engineering and construction unit (KBR) by April 2007.

Our “Value/Restructuring Strategy’’ looks for attractively valued or restructuring dividend payers

Our third major strategy is what we call “value with a catalyst or restructuring strategy’’, where our internal research points to under-valued or mis-priced equity opportunities for companies with attractive dividend yields. We also look for turnaround situations or depressed earnings where we believe there is a catalyst for an earnings recovery or a restructuring or major corporate action that is expected to add value. The key characteristic for this strategy is low valuations relative to historical averages and above average dividend yields for a combined objective of capital appreciation and high qualified dividend income.

10

| Alpine Dynamic Dividend Fund |  |

We would categorize two of our top holdings in this strategy, Phelps Dodge and Bank of America. Phelps Dodge, the world’s second largest copper producer, has experienced a substantial rebound in earnings and cash flow as the price of copper has quadrupled over the past five years on increased global demand and constrained supply. The company returned $4 in excess cash to shareholders in 2006 and is now the target of a potential takeover, so we think there is still attractive value at these levels. We believe Bank of America offers upside earnings potential following the integration of its MBNA acquisition and the strong outlook for its diversified financial services. Both of these industry leaders are trading at what we believe are very attractive valuations relative to historical valuation ranges and future earnings prospects.

Capturing international dividend opportunities is an important component of our dividend strategy

In addition to our multi-strategy and multi-cap approach, we also invest approximately 30%-40% of our assets in international holdings. We have found attractive growth opportunities and traditionally larger dividend payouts than we see in the U.S.

As of October 31, 2006, ADVDX had invested 41% of the market value of its portfolio in international companies. The Fund currently invests in equities based in 15-20 different countries, of which most would be considered mature countries. Following the U.S., our top countries are Sweden, Britain, Australia, Finland, and Norway. The average dividend yield for the major indices in these five countries is currently 3.6% which is double the yield on the S&P 500 Index of 1.8%. We believe that our international strategy and the opportunities we see for growth and the continuation of the declining US dollar should be beneficial for our shareholders in 2007.

The Fund’s top performers in fiscal 2006 are a diverse group of industry leaders that reflect our bottoms up, fundamental research approach

Our top ten performers in fiscal 2006 provided ADVDX with total returns in excess of 48% for the 12 month period. This diverse group of top performers, with five being international companies and five U.S., reflects our investment approach of identifying strong growth companies globally that are committed to returning excess cash to shareholders. There is no one sector or country that provided us with these strong returns, but rather a stock by stock analysis based on our fundamental research.

Our two best performers returned over 70% in fiscal 2006, with each being strong growth companies in niche markets. Our top performer was the medical products company West Pharmaceuticals, which designs and manufactures packing and drug delivery systems, such as the medical device used for the inhalable diabetes drug Exubera, or rubber stoppers for sealing drug vials. West is growing earnings 15-20% plus it has raised its dividend every year for the past 10 years. Our second best performer was Anixter International, a global distributor of voice, data, and video cabling, connectivity, and support products to enterprises used to connect PCS, peripheral equipment and data networks. Anixter is benefiting from a resurgence in nonresidential construction and robust demand for data center builds and has returned cash in the form of a special dividend in both 2004 and 2005.

Two other top performers are international industrial companies that are experiencing a strong growth associated with its energy and shipping sectors. Aker Yards AS based in Norway is a ship builder that has experienced strong demand for its vessels used in offshore oil and gas industries as well as in the drybulk, container ship, cruise ship, and ferry sectors. And Wartsila is a Finnish manufacturer of power generation and marine propulsion equipment which announced a 4.1% special dividend payment in October 2006 based on the strong demand for its ship engines and the divestment of a unit.

Three of our best performers in fiscal 2006 are global financial leaders that each produced over 60% returns. Euronext, the pan-European stock exchange, saw strong price appreciation based on its growth and acquisition strategy and from takeover advances from the New York Stock Exchange and the Deutsche Boerse. D. Carnegie & Co. based in Sweden, experienced strong demand from its local Scandinavian markets for its financial services in areas like mergers and acquisitions, capital markets, research, and sales and trading. And Goldman Sachs based in the U.S. is a premier investment bank which is benefiting from strong mergers and acquisitions markets and profitable proprietary trading strategies.

Lastly, three of our fiscal 2006 top 10 are in the healthcare field, one being a drug developer and two providing services to healthcare providers. Alk-Abello A/S is a Danish producer of pharmaceuticals for allergy vaccinations. The company recently received approval for a new oral allergy medication for grass and ragweed in Europe and the company will began U.S. testing in 2007. Healthcare Services Group provides cleaning, laundry and food services to nursing home and hospitals and is growing earnings 20% annually in this attractive demographic and has been raising its dividend payment every quarter since 2003. And Angelica Corp, the provider of laundry services and uniform rentals to the healthcare and hospitality industry, saw its stock price rebound on some shareholder activism and a decline in its energy costs associated with the decline in natural gas prices.

11

| Alpine Dynamic Dividend Fund |  |

As of fiscal year end 2006, we no longer held positions in Angelica, D. Carnegie, or Euronext as the stocks achieved our price objectives and we believe had adequately reflected future positive news.

On the other side, our five worst performers in fiscal 2006 each declined in excess of 20%, but were all small positions that represented only a minor percentage of the ADVDX portfolio. Two of our bottom performers were Nam Tai, the maker of electronics, and Aldila, the maker of golf shafts. These are both strong small cap companies that had tempered their growth outlooks and the stocks overreacted in our view. We are maintaining our positions in these stocks based on their positive long term fundamentals and attractive valuations.

Another weak performer in fiscal 2006 was Pilgrim’s Pride, the producer of prepared and fresh chicken products, which was negatively impacted by declines in pricing over avian influenza concerns. Rounding out the bottom five performers were small positions in two operators in the drybulk shipping sector, Dryships and Diana Shipping. These companies provide very attractive dividend yields ranging between 5 and 10% but the stocks were hit as pricing for shipping commodities like grain, iron ore, and coal declined due primarily to excess shipping capacity that was exacerbated by a mild winter. As of fiscal year end, we no long hold positions in these three companies.

Outlook for 2007: We Believe Domestic and International Dividend Payers Should Outperform

As we look into 2007, we continue to be optimistic about the prospect for the dividend paying stocks around the world. Based on the outlook for a slowing global economy, we believe investors will continue to demand higher dividend yields as part of their total return expectations, particularly with the lower domestic 15% tax rate.

The current yield on the S&P 500 is 1.8%, but historically the dividend component of total return was much higher. The average annual total return on stocks from 1926 to 2005 was 10.4% per year, with dividends accounting for 41.2% of the total return, or 4.3% of the total 10.4%. Investors will likely look to put more money in attractive tax-advantaged dividend payers to enhance returns. And we believe investments outside the U.S. look even more attractive based on the outlook for stronger earnings growth, higher dividend payouts, and the continued decline in the U.S. dollar.

In addition, companies are still sitting on very high levels of cash. As expected, we have seen a record of merger and acquisition activity in 2006 as companies look to use some of their excess cash to supplement slowing organic growth and to expand globally. However, we still expect a substantial amount of cash should be returned to shareholders in 2007 either in the form of share repurchases or increased dividend payouts. Companies in the S&P 500 index currently payout approximately 34% of their earnings in the form of dividends versus a historical average of 54%. Given large cash positions, still solid earnings potential, low payout ratios and lack of other uses of cash, we continue to believe that companies should increase their dividends in 2007 and beyond.

Some of our favorite sectors for dividend increases and capital appreciation heading into 2007 continue to be in oil services, industrials, engineering, financial services, and business services. We remain cautious on consumer discretionary and look for better entry valuations in utilities and consumer staples.

We still like the long term secular story for many commodities in the basic materials and energy sectors based also on constrained supply and growing global demand. We also favor the industrial, engineering, and machinery companies that are supplying the commodity companies and the aerospace and defense sectors.

Among our favorite investment themes is a variation on investing in commodity companies, and that is through increasing global trade. We look to participate in the increasing need for the movement of commodities globally through producers, financers, and operators in the shipping industry. Commodities such as oil, grain, iron ore, and coal are moving longer distances than ever and with higher volumes and frequencies. These companies tend to benefit from the overall growth in the world economies regardless of the price of the underlying commodity with many committed to returning cash as large dividends.

We also concentrate on opportunities in long term secular themes on the aging demographics of the world, with some of our favorite sectors being asset managers and financial services and niche healthcare. The aging population will need to save more and also manage their assets more directly as countries and companies have cut back significantly on their pension promises. We believe this very positive for the asset managers around the globe. In addition, we like niche healthcare which is being stimulated by demographic trends and advances in biotechnology and yet there is more limited generic risk.

12

| Alpine Dynamic Dividend Fund |  |

In summary, in a moderate growth environment, we believe investors will be drawn to high quality, internationally oriented, and more defensive stocks and that should bode well for dividend payers and our fundamental strategy of searching globally and in multi-caps and multi-sectors. These positive fundamentals will be balanced with the risks of still high oil prices, potentially slower global growth and continued geopolitical uncertainties.

Our approach is to remain broadly diversified within the dividend-paying universe while actively looking for undervalued opportunities. We believe we will continue to be able to distribute attractive dividend payouts to our shareholders by capitalizing on our research driven approach to identifying attractive situations as well as through our active management of the portfolio.

Thank you for your participation and we look forward to a prosperous year in 2007.

Jill K. Evans

Kevin Shacknofsky

Co-Portfolio Managers

_______

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

Investing in small and mid cap stocks involves additional risks such as limited liquidity and greater volatility as compared to large cap stocks.

Investing in foreign securities tends to involve greater volatility and political, economic and currency risks and differences in accounting methods.

Neither the Fund nor any of its representatives may give tax advice. Investors should consult their tax advisor for information concerning their particular situation.

Free cash flow: Cash not required for operations or for reinvestment. Often defined as earnings before interest (often obtained from the operating income line on the income statement) less capital expenditures less the change in working capital.

13

| Alpine Dynamic Financial Services Fund |  |

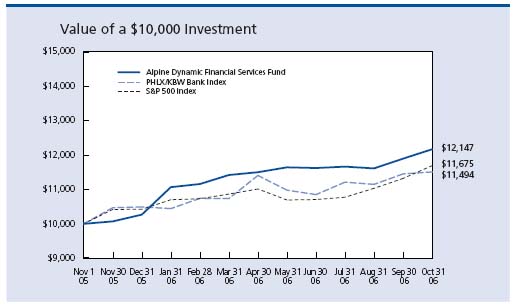

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.

The NASDAQ 100 Financial Index is a capitalization-weighted index of the 100 largest financial companies, as well as foreign issues, including American Depositary Receipts (ADRs), traded on the NASDAQ National Market System (NASDAQ/NMS) and SmallCap Market. The PHLX/KBW Bank Index is a modified cap-weighted index consisting of 24 exchange-listed and National Market System stocks, representing national money center banks and leading regional institutions. The S&P Index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Lipper Financial Services Funds Average is an average of funds whose primary objective is to invest primarily in equity securities of companies engaged in providing financial services. The NASDAQ Financial 100 Index, PHLX/KBW Bank Index, the S&P 500 Index and the Lipper Financial Services Funds Average are unmanaged and do not reflect fees associated with a mutual fund, such as investment adviser fees. The performance for the Dynamic Financial Services Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges.

Comparative Annualized Total Returns as of 10/31/06 | |

Since Inception | |

(11/1/2005) | |

| Alpine Dynamic Financial Services Fund | 21.47% |

| NASDAQ Financial—100 Index | 12.02% |

| PHLX/KBW Bank Index | 18.88% |

| S&P 500 Index | 16.80% |

| Lipper Financial Services Fund Average | N/A |

| Lipper Financial Services Fund Ranking | N/A |

14

| Alpine Dynamic Financial Services Fund |  |

Commentary

Since the date of inception on November 1, 2005 through fiscal year-end on October 31, 2006, Alpine Dynamic Financial Services Fund delivered a 21.5% total return. This compares favorably to returns for the NASDAQ 100 Financial Index of 12.02% and the PHLX/KBW Bank Index of 18.88%.

The performance of the Fund was aided by our investment strategy of actively investing in a broad range of financial services related companies, employing both a top-down and bottom-up approach in stock selections and acting quickly to changes in market sentiment and industry fundamentals.

Signs of moderation in U.S. economic growth during fiscal 2006 provided an ideal environment for us to implement our value timing strategy which contributed positively to the Fund’s return. During this period, monetary tightening by the Federal Reserve led to a cooling of the housing market, while persistent high oil prices pressured consumer spending. As the economy moved through a transition period from a strong recovery phase to a mature growth phase, investor sentiment seemed to hinge on the outcome of the latest economic data report. This lack of market consensus led to short-term investment opportunities as stocks within sub-sector groups fluctuated back and forth between over-sold and over-bought conditions. Our value timing strategy took advantage of these changes in investor sentiment and provided an opportunity to purchase good companies at attractive prices.

Another factor contributing to the Fund’s performance was the continued consolidation within the banking industry. Ten holdings within the Fund were acquired last year. These banks were primarily small-cap community banks and were dispersed among the different regions of the country. In the Northeast, Sound Federal Bancorp in New York was acquired by Hudson City Bancorp from neighboring New Jersey. Legacy Bank in Harrisburg, Pennsylvania was sold to FNB Corporation. The largest bank acquired in the Fund was Baltimore based Mercantile Bankshares by PNC Financial Services Group. In the Southeast, Albemarle First Bank in Virginia was merged with Premier Community Bankshares. Flag Financial Corp. in Atlanta was purchased by RBC Centura Banks, which is a subsidiary of Royal Bank of Canada. In the Midwest, First Oak Brook Bancshares was acquired by one of their Chicagoland competitors, MB Financial Inc. In the Southwest, two Texas banks were involved with in-state mergers. Summit Bancshares of Fort worth was purchased by Cullen/Frost Bankers, Inc. and Texas United Bancshares of LaGrange was sold to Prosperity Bancshares. In the West, FirstBank NW Corp. of Clarkston, Washington was acquired by Spokane based Sterling Financial Corporation. Lastly, BWC Financial Corp of Walnut Creek, California merged into First Republic Bank.

15

| Alpine Dynamic Financial Services Fund |  |

We expect the pace of industry consolidation to accelerate next year. Contributing to this trend is a more challenging revenue generation environment and a lack of core deposit growth which should push the weaker companies to sell and the stronger companies to seek external expansion in order to meet growth projections.

Top Five Holdings

The largest position in the Fund is Houston based Sanders Morris Harris Group. This is a diversified capital markets firm with brokerage, investment banking, asset/wealth management and merchant banking businesses. We feel this small-cap company is, at 1.4 times book value, undervalued relative to their peers due to the recent poor performance. If the company can meet our growth projections for next year, we project that the stock could outperform the group.

The second largest holding is another capital markets company, Cowen Group, Inc., a New York based investment banking firm. The company recently became public by the sale of shares owned by Societe Generale. Cowen is going through a transformation which should strengthen their market share position in the underwriting and advisory services to healthcare, technology, consumer and media and telecommunications industries.

Goldleaf Financial Solutions, located in Brentwood, Tennessee is the third largest financial services holding, providing a full compliment of software products and outsourcing services to community banks. It offers core data processing, check imaging, item processing, remote check capture and deposit processing, ACH origination and processing, and turnkey leasing solutions. These are essential services which enable small community banks to compete against the larger regional banks.

The largest bank holding is Bancshares of Florida. Headquartered in Naples, Florida, the company operates offices in Collier, Hillsborough and Lee Counties on the West Coast of Florida and Broward and Palm Beach Counties on the East Coast. Commencing operations seven years ago, it has grown deposits to $660 million through denovo branching and acquisitions. We expect the company will continue to grow their market share through future acquisitions.

Rounding out the top five holdings is Tidelands Bancshares of Mount Pleasant, South Carolina. The bank is three years old and serves the counties of Charleston, Dorchester, Berkeley, Horry and Beauford. Tidelands operates three full service offices with $255 million in deposits. Plans are underway for two additional branches. The company recently raised additional capital to support their future growth initiatives.

Industry Review and Outlook

Capital markets stocks were the best performing sub-sector group in the financial industry this year. Investment banks reported continued strength in fixed income underwriting along with a resurgence of equity underwriting. Advisory fees also increased strongly due to a pick-up in merger and acquisitions. Trading revenues improved during the year while asset management fees grew modestly. The exchange stocks also performed well this year as trading volumes increased in the equity, futures and derivative markets. We expect this group to continue to outperform going into next year. The current equity underwriting pipeline remains full. The outlook for merger and acquisition activity remains bright as corporations are flush with cash and interest rates on corporate debt are modest by historic standards.

The combination of higher short-term interest rates, due to the Federal Reserve tightening, and a flat to inverted yield curve contributed to net interest margin compression and lower consumer loan growth for the banks, thrifts and finance companies. The environment was especially difficult for mortgage finance companies which experienced a decline in loan volume and a reduction in gain on sale margins. Helping to offset the moderating consumer loan growing was healthy growth in business and commercial real estate lending. Loan quality remained good with only modest deterioration centered primarily in the consumer category. Companies with a high percentage of fee income performed better than those dependent on net interest spread income. As previously mentioned, fees from investment banking, brokerage and asset management grew last year.

Looking ahead, we expect margin compression to ease as it appears the Federal Reserve has completed their tightening. Both loan and deposit growth will be dependent on the pace of economic development, with low cost deposit growth having an inverse relationship with economic growth. Our outlook for loan quality is a continuation of modest deterioration in the consumer category.

16

| Alpine Dynamic Financial Services Fund |  |

We strive to build on the Fund’s initial performance as we enter its second year. We will search the broad financial services sector for long-term investment ideas, as well as act on any short-term opportunities.

We appreciate the confidence you have shown us through your investment in this new Fund and would like to wish you and your family a safe, healthy and prosperous New Year.

Peter J. Kovalski

Portfolio Manager

_______

The fund primarily invests in equity securities of financial services companies and will be affected by risk factors particular to this industry such as regulation, monetary and fiscal policies and interest rates, as well as general market risks. The fund invests in smaller companies, which involve additional risks such as liquidity and greater volatility. The fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

There is no assurance the fund will achieve its investment objective.

Book value: The net asset value of a company, calculated by subtracting total liabilities from total assets.

Please refer to the schedule of portfolio investments for fund holding information. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.

17

| Alpine Dynamic Innovators Fund |  |

This chart represents a comparison of a hypothetical $10,000 investment in the Fund versus a similar investment in the Fund’s benchmark. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver and recovery of certain fees. Without the waiver and recovery of fees, the Fund’s total return would have differed.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 888-785-5578. Performance data shown does not reflect the 1.00% redemption fee imposed on shares held for fewer than 60 days. If it did, total returns would be reduced.

The Russell 2000 Growth Index is constructed to provide a comprehensive and unbiased barometer of the small-cap growth market. Based on ongoing empirical research of investment manager behavior, the methodology used to determine growth probability approximates the aggregate small-cap growth manager’s opportunity set. The Lipper Small-Cap Growth Funds Average is an average of Funds that, by portfolio practice, invest at least 75% of their equity assets in companies with market capitalizations (on a three-year weighted basis) less than 250% of the dollar-weighted median of the smallest 500 of the middle 1,000 securities of the S&P SuperComposite 1500 Index. The Russell 2000 Growth Index, and the Lipper Small-Cap Growth Funds Average are unmanaged and do not reflect fees associated with a mutual fund, such as investment adviser fees. The performance for the Dynamic Innovators Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges.

Comparative Annualized Total Returns as of 10/31/06 | |

Since Inception | |

(07/11/2006) | |

| Alpine Dynamic Innovators Fund | 3.10% |

| Russell 2000 Growth Index | 7.15% |

| Lipper Small-Cap Growth Fund Average | N/A |

| Lipper Small-Cap Growth Fund Ranking | N/A |

18

| Alpine Dynamic Innovators Fund |  |

Commentary

This first annual report of the Alpine Dynamic Innovators Fund covers the brief period from its inception on July 11, 2006 to October 31, 2006. The Fund provided a return of 3.1% over this initial period, as compared with the Russell 2000 Growth Index, with a total return of 7.15%. The Fund was in its early stages of investment, and therefore had only a 27.5% commitment to common stocks, while holding cash and equivalents at 72.5%.

Our goal in developing the Fund’s portfolio is to participate in a dynamic selection of companies with growth potential based on innovative products or services and innovative management. A challenge is find both the high growth potential of innovation and the prospect of significant profitability. We believe that the eighteen issues already acquired in the portfolio are representative of the opportunities which we seek over the months ahead as we aim to develop a wide-ranging, varied portfolio. The following are the top ten initial holdings, ranked in order of performance, from the inception date to October 31:

| JLG Industries, Inc. . | +43.9% | |

| Manufacturer of work platforms and hydraulic | ||

| material handling devices. (Company acquisition | ||

| by OshKosh Truck Corp. announced October 15, 2006). | ||

| AngioDynamics, Inc. | +24% | |

Manufacturer of angiographic catheters and image-guided vascular access products. | ||

| Alvarion, Ltd. | +13.0% | |

Developer and manufacturer of wide area wireless access systems for telecommunications and data. | ||

| American Science and Engineering, Inc. | +12.8% | |

Producer of x-ray detection systems and imaging products for security needs. | ||

| +12.5% | ||

| Hexcel Corp. | ||

Manufacturer of reinforced synthetic composite materials for aerospace, space, defense, and electronics. | ||

| Sequenom, Inc. | +10.4% | |

Provider of genetic analysis products for biomedical research and molecular medicine. | ||

| Knot, Inc. | +7.6% | |

Operator of a website for wedding related shopping and publisher of wedding magazines and books. | ||

| Logitech International ADR | +12.5% | |

| Manufacturer of personal computer input devices. | ||

| FoxHollow Technologies, Inc. | +5.2% | |

Producer of medical devices to treat peripheral artery disease, with minimally invasive catheters. | ||

| Chicago Mercantile Exchange | +5.0% | |

Operator of the largest exchange for derivatives, futures contracts, and options. | ||

19

| Alpine Dynamic Innovators Fund |  |

Characteristics of these top ten holdings are a high proportion of technology related enterprises as one might expect in the search for innovation. Our investment strategy will not be limited to these fields. The present portfolio already includes an innovative garment manufacturer, Under Armour, Inc., a manufacturer of apparel and accessories based on synthetic micro-fibers. As the Fund develops, we anticipate substantial diversity in its holdings, suggesting that the portfolio will not reflect a narrow segment of the market. Our goal is to carefully build this portfolio into what we hope will be a selection of outstanding companies, that we believe should offer great opportunities for capital growth.

We greatly appreciate the interest and confidence shown by our initial investors and strive to meet their goals.

Stephen A. Lieber

Samuel A. Lieber

Co-Portfolio Managers

_______

The Fund may invest in smaller and medium size companies, which involve additional risks such as limited liquidity and greater volatility. The Fund may also invest in micro-cap company stocks which are more volatile than those of larger companies and tend to perform poorly during times of economic stress.

The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods.

The Fund may invest in debt securities which typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities.

The Fund portfolio will involve short positions, which involves unlimited risk including the possibility that losses may exceed the original amount invested. The fund may also use options and future contracts, which have risks associated with unlimited losses of the underlying holdings due to unanticipated market movements and failure to correctly predict the direction of securities prices, interest rates and currency exchange rates. However, a mutual fund investor’s risk is limited to one’s amount of investment in a mutual fund.

Please refer to the Schedule of Investments for fund holding information. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security.

20

FIXED INCOME MANAGER REPORTS

| Alpine Municipal Money Market Fund | ||

| Alpine Tax Optimized Income Fund | ||

| Alpine Municipal Money Market Fund |  |

| * | The Advisor Class return for 2004 is from 3/30/04 (inception)-12/31/04. |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver of certain fees. Without the waiver of fees, the Fund’s total return would have been lower.

22

| Alpine Municipal Money Market Fund |  |

Equivalent Taxable Yields as of 10/31/06 | ||||

Your Tax-Exempt Effective Yield | ||||

Marginal | of 3.53% is Equivalent to a | |||

Joint Return | Single Return | Tax Rate | Taxable Yield of: | |

| $59,401-119,950 | $ | 29,701-71,950 | 25% | 4.71% |

| $119,951-182,800 | $ | 71,951-150,150 | 28% | 4.90% |

| $182,801-326,450 | $150,151-326,450 | 33% | 5.27% | |

| Over $326,450 | Over $326,450 | 35% | 5.43% | |

The chart reflects projected 2005 marginal federal tax rates before limitations and phaseouts. Individuals with adjusted gross income in excess of $142,700 should consult a tax professional to determine their actual 2005 marginal tax rate.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost. Performance current to the most recent month end may be lower or higher than the performance quoted and may be obtained by calling 888-785-5578.

The Lipper Tax-Exempt Money Funds Average is an average of funds that invest in high quality municipal obligations with dollar-weighted average maturities of less than 90 days. The Lipper Tax-Exempt Money Market Funds Average is unmanaged and does not reflect the deduction of fees associated with a mutual fund, such as investment advisor fees. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The performance for the Municipal Money Market Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Comparative Annualized Total Returns as of 10/31/06 | |||

1 Year | 3 Years | Since Inception(1) | |

| Alpine Municipal Money Market Fund—Investor Class | 3.33% | 2.22% | 1.96% |

| Alpine Municipal Money Market Fund—Advisor Class | 3.07% | N/A | 2.15% |

| Lipper Tax—Exempt Money Market Funds Average | 2.65% | 1.54% | 1.32% |

| Lipper Tax—Exempt Money Market Fund Rank—Investor Class | 1/115 | 1/107 | 1/89 |

Alpine Municipal Money Market Fund—Investor Class, 7-day effective yield (as of 10/31/2006): 3.53% | |||

Alpine Municipal Money Market Fund—Advisor Class, 7-day effective yield (as of 10/31/2006): 3.27% | |||

(1) Advisor Class shares commenced on March 30, 2004 and Investor Class shares commenced on December 5, 2002. Returns for indices are since December 5, 2002.

23

| Alpine Tax Optimized Income Fund |  |

| * | The Advisor return for 2004 is from 3/30/04 (inception)-12/31/04. |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment performance reflects the waiver of certain fees. Without the waiver of fees, the Fund’s total return would have been lower.

Performance data quoted represents past performance and is not predictive of future results. Investment return and principal value of the Fund fluctuate, so that the shares, when redeemed, may be worth more or less than their original cost.

Performance current to the most recent month end may be lower or higher than performance quoted and may be obtained by calling 888-785-5578. Performance data shown does not reflect the 0.25% redemption fee imposed on shares held for fewer than 30 days. If it did, total returns would be reduced.

The Lehman Brothers Municipal 1 Year Bond Index is the 1-year (1-2) component of the Municipal Bond Index. The Lehman Brothers Municipal Bond Index is a rules-based, market-value weighted index engineered for the long-term, tax-exempt bond market. Lipper Short Municipal Debt Funds Index is an unmanaged index that tracks funds that invest in municipal debt issues with dollar-weighted average maturities of less than three years. The Lehman Brothers Municipal 1 Year Bond Index and the Lipper Short Municipal Debt Funds Average are unmanaged and do not reflect the deduction of fees associated with a mutual fund, such as investment advisor fees. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. The performance for the Tax Optimized Income Fund reflects the deduction of fees for these value-added services. Investors cannot directly invest in an index.

Comparative Annualized Total Returns as of 10/31/06 | |||

Since | |||

1 Year | 3 Year | Inception(1) | |

| Alpine Tax Optimized Income Fund—Investor Class | 3.88% | 2.71% | 3.14% |

| Alpine Tax Optimized Income Fund—Investor Class (Pre-liquidation, After-tax) | 3.62% | 2.31% | 2.71% |

| Alpine Tax Optimized Income Fund—Investor Class (Post-liquidation, After-tax) | 3.55% | 2.37% | 2.70% |

| Alpine Tax Optimized Income Fund—Advisor Class | 4.01% | N/A | 2.37% |

| Alpine Tax Optimized Income Fund—Advisor Class (Pre-liquidation, After-tax) | 3.79% | N/A | 2.02% |

| Alpine Tax Optimized Income Fund—Advisor Class (Post-liquidation, After-tax) | 3.54% | N/A | 2.10% |

| Lehman Brothers Municipal 1 Year Bond Index | 3.05% | 1.82% | 1.80% |

| Lipper Short Municipal Debt Funds Average | 3.05% | 1.75% | 1.96% |

| Lipper Short Municipal Debt Fund Rank—Investor Class | 7/58 | 3/51 | 2/49 |

(1) Advisor Class shares commenced on March 30, 2004 and Investor shares commenced on December 5, 2002. Returns for indices are since December 6, 2002.

24

| Alpine Tax Optimized Income Fund |  |

Alpine Municipal Money Market Fund / Alpine Tax Optimized Income Fund — Commentary

We are pleased to provide you with the commentary for the Alpine Income Trust for the period ending October 31, 2006. The Income Trust includes both the Alpine Tax Municipal Money Market Fund and the Alpine Tax Optimized Income Fund.

Performance Summary

For the one-year period, each Fund produced strong relative performance leadership when compared against its counterparts in their respective categories. Based on total returns, the Alpine Municipal Money Market Fund was ranked number one out of 115 Tax Exempt Money Market Funds according Lipper Analytical. It had a total return for the period of 3.33% outperforming the Lipper peer average of 2.65%. Lipper ranked the Alpine Tax Optimized Income Fund number seven out of 58 funds in the Short Municipal Debt category and had a total return of 3.88%. The Lipper average for the peer group of this fund was 3.05%. We would also like to report that as of the period ending September 30, 2006, the Fund was awarded the highest Overall Morningstar Rating of five stars among 122 Muni National Short funds (derived from the weighted average of the fund’s three-, five- and ten-year risk adjusted return measure, if applicable).

There was one very significant change that occurred over the summer. We are pleased to report that on July 28th, Fitch Ratings assigned their highest rating of AAA/V1+ to the Alpine Municipal Money Market Fund. According to Fitch, money market funds rated in this category carry the highest degree of credit quality, conservative investment policies and a strong ability to provide shareholders with a constant $1.00 per share valuation.

Market Overview

Economic growth, which accelerated at the beginning of 2006, moderated over the last six months. Rising mortgage rates helped cool the housing market, job growth softened, and consumer spending decelerated amid rising interest rates, stubbornly high oil and gas prices, and slower housing equity growth.

A tight labor market and higher energy prices have raised business production costs, spurring inflation of the comfort zone of Federal Reserve officials, in part because of elevated energy and commodity prices. In response, the central bank raised the federal funds target rate a quarter point in May and June from 4.75% to 5.25%. This has been a level not seen in more than five years.

25

| Alpine Tax Optimized Income Fund |  |

The highly anticipated Federal Open Market Committee (FOMC) meeting on August 8 brought rates to a screeching halt, as for the first time in 18 meetings, the target lending rate was left unchanged at 5.25%. The FOMC reported that a slowing housing market and lagged effects of increases in interest rate and energy prices were the main reasons for the pause. The Fed was careful to leave the door open for future tightening if inflation continues.

Subsequent FOMC meetings in September and October left the fed funds rate unchanged as economic data continued to be mixed. The Fed continued to reference the cooling housing market as the driving factor in their decision.

While the hikes by the Fed led to a sell-off at the front end, the longer rates failed to follow suit, leading to inverted curves on the taxable side and very flat curves on the tax exempt side. In fact, yields of municipal securities maturing in five years or less were virtually the same at the end of October and there was only a 60 to 70 basis point difference between municipal money market yields and 30-year municipal bond yields which is an unusually narrow spread.

Long-term municipals outperformed shorter-term issues in the last six months, thanks primarily to the decline in longer-term interest rates that started at the end of June. High yield maintained their performance advantage over investment grade issues for the entire reporting period although they trailed high quality bonds at the end of October. The spreads between higher yielding paper and high grade paper declined further as investors continued to search for higher yields in a flat yield environment.

Alpine Municipal Money Market Fund

With the Federal Reserve bringing the fed funds rate to 5.25%, money market rates continued their trend to higher levels, peaking in late June as the Fed announced a pause in its policy of tighter monetary policy. Markets reacted to both the Fed pause and indications of a slowing economy by anticipating that the Fed might begin cutting rates in early 2007. The sentiment shift caused rates to retrace somewhat over the last couple of months.

Changes in municipal issuance patterns, along with economic uncertainty and questions about the direction of the Fed’s next move, contributed to the flat money market yield curve. Fixed rate note issuance is down again for the third consecutive year, a result of strong tax receipts at the state and local levels, which reduced the need for short-term borrowing in the one-year note market. At the same time, new issues of synthetic variable rate demand notes have been surging.

With this in mind, we invested most of our assets in variable rate demand notes (VRDNs). These are short term, floating rate municipal notes with weekly resets though some are daily or monthly). This benefits the fund when interest rates are rising, as they were during most of the reporting period or when demand falls, as it did in late April and early May. VRDNs can capture higher yields more quickly than other short term securities, which have historically given the fund a boost. As of October 31st, VRDNs made up 98% of the portfolio’s holdings with the rest in municipal mandatory put bonds.

The fund’s average weighted maturity fell steadily between April and October, ending the period at 8 days. This is much shorter than the industry average of 26 days. Much of the decline resulted as we steered clear of municipal notes, which didn’t offer very attractive yields. These notes typically have a one-year maturity, and so push the fund’s weighted average maturity (WAM) higher.

We expect the municipal money market yield curve to remain flat going into the near term. Until a clearer picture of the economy and its implications for Fed policy emerge, we feel a more neutral investment is positive.

Alpine Tax Optimized Income Fund

While short term rates for cash and intermediate bonds marched steadily higher over the past six months, longer term rates in all sectors of the fixed income market declined as the period ended. As we discussed in our last report, our strategy was to maintain a barbell structure with a very high exposure to short maturities balanced with some long term bonds. With short term rates rising, it was the one to five year part of the yield curve that would suffer the most and as such we tried to insulate the fund from any capital depreciation. We therefore, invested most of our assets in high yielding securities maturing in one year and less while maintaining our existing position of long maturities. This strategy proved to be rewarding as we were able to generate an attractive yield with minimum NAV fluctuation. Our average weighted maturity at the end of October stood at 1.25 years.

Unfortunately, extraordinary investment opportunities are becoming harder to find for investors in both the taxable and tax exempt markets. We believe that valuations for medium and lower quality securities are expensive when compared with historic norms. Generally low interest rates, benign volatility, and a solid economic backdrop have bolstered the demand for incremental yield and risk taking in credit markets. This environment has driven risk premiums to historical lows in all markets. Therefore, we remain cautious and defensively postured.

26

| Alpine Tax Optimized Income Fund |  |

We sold most of our remaining positions in the three to five year sector and purchased mostly short term municipal securities as they continued to offer the highest after return. Recent purchases included 28 and 35-day student loan auction rate notes and Puerto Rico Government Development Bank commercial paper. Yields for Puerto Rico debt widened in the second quarter as it went through a brief period of budget turmoil. In addition, we also purchased select variable rate demand notes in the tobacco and utility sectors that are either corporate backed or have a liquidity provider and generated an attractive return for the fund.

The corporate bond market is still a challenging environment to find attractive investments as the after tax yields are still below their municipal counterparts. Furthermore, we find the risk/reward ratio to be much higher for corporate securities and therefore too risky in our opinion based on current levels. That said, we continue to scour the market for opportunities that offer capital appreciation or highly attractive yields.

At present, Fed officials seem prepared to keep short term rates steady as long as they believe the economy is slowing sufficiently to ease inflation pressures over time. We will continue to closely monitor the economic landscape and make adjustments to the funds as necessary.

Thank you for your investment in the Alpine Income Funds.

Steven C. Shachat

Portfolio Manager

_______

An investment in these Funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Funds.