UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21233

PARADIGM FUNDS

(Exact name of registrant as specified in charter)

Nine Elk Street, Albany, NY 12207-1002

(Address of principal executive offices)

(Zip code)

David DeLuca

Nine Elk Street, Albany, NY 12207-1002

(Name and address of agent for service)

Registrant's telephone number, including area code: (518) 431-3516

Date of fiscal year end: December 31

Date of reporting period: December 31, 2005

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Paradigm Value Fund

ANNUAL REPORT

December 31, 2005

Paradigm Value Fund

Annual Report

December 31, 2005

We enjoyed a very successful year in 2005. We handily beat our benchmark the Russell 2000 Value Index and registered one of the best performances for "small cap value" funds. The Russell 2000 Value Index was up a modest 4.71%, trailing the broad market and the average of the last decade. Stock selection, our chosen tool, seems to have worked well.

In 2005, the fund generated double-digit returns in nine out of the twelve Russell 2000 Value sectors and outperformed the Russell in nine of those sectors. Other/Multi-Sector was the top contributor to excess return, other sectors contributing to excess return included Other Energy, Producer Durables and Materials & Processing. No one sector was a material detractor from return, though Financial Services was challenging.

Our largest holding, Foster Wheeler, was the largest individual contributor. This engineering and construction company, on the brink of failure just a few years ago, completed a financial restructuring and worked through problem contracts. The firm is now positioned for strong demand for its services in refineries, petrochemical facilities and liquidified natural gas. Other top performers for the year were Frontier Oil, Intergraph Corp. and Blair Corp.

But that's all in the past. The New Year is looking challenging. While the economy is continuing to expand, valuations are high and rising interest rates are threatening to reduce equity valuations.

That sounds a lot like what we said last year and in fact we were right. Returns in the domestic equity markets were generally lackluster and we do not expect the New Year to be much different.

Your team at Paradigm Funds Advisor does not change its methods or goals due to market outlooks. We endeavor to use our skills in stock selection to add value over the long term. We are having to work harder to find great values and we are being more cautious in evaluating the financial strength and earnings power of the stocks which we select.

We continue to focus our analysis on the strength of the company's business franchise, the ability of the management team, the near-term prospects for improving returns and relative valuation. We believe that this simple strategy will reward our investors over the long term.

Thank you for your continued confidence.

Sincerely,

![[paradigmncsr2005annual001.jpg]](https://capedge.com/proxy/N-CSR/0001162044-06-000103/paradigmncsr2005annual001.jpg)

John B. Walthausen, CFA

2005 Annual Report 1

Paradigm Value Fund

PERFORMANCE INFORMATION

(Unaudited)

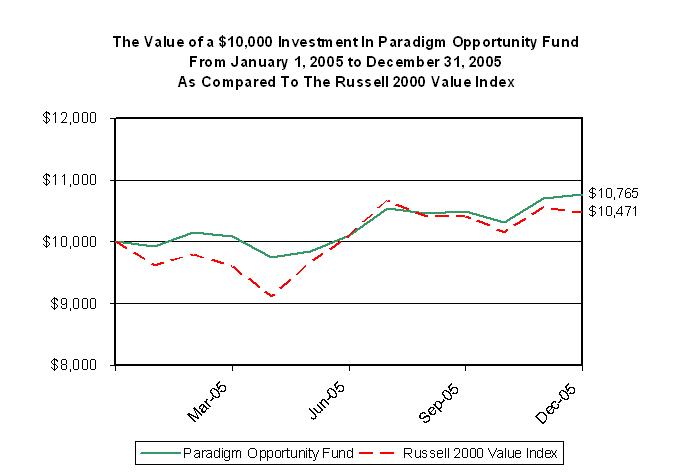

![[paradigmncsr2005annual002.jpg]](https://capedge.com/proxy/N-CSR/0001162044-06-000103/paradigmncsr2005annual002.jpg)

Average Annual Rate of Return (%) for The Periods Ended December 31, 2005

(Fund Inception January 1, 2003)

December 31, 2005 NAV $42.90

Since

1 Year(A) Inception(A)

Paradigm Value Fund

19.61%

36.43%

S&P 600 Index(B)

7.70%

22.39%

Russell 2000 Value Index(C)

4.71%

23.34%

(A)1 Year and Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions.

(B)The S&P 600 index is a small capitalization benchmark index made up of 600 domestic stocks chosen for market size, liquidity and industry group representation whose composition is different from the Fund.

(C)The Russell 2000® Value Index is an unmanaged index of small-capitalization stocks with lower price-to-book ratios and lower forecasted growth values than the total population of small-capitalization stocks whose composition is different from the Fund. For purposes of the graph and the accompanying table, it is assumed that all dividend and distributions were reinvested.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732.

2005 Annual Report 2

Paradigm Value Fund

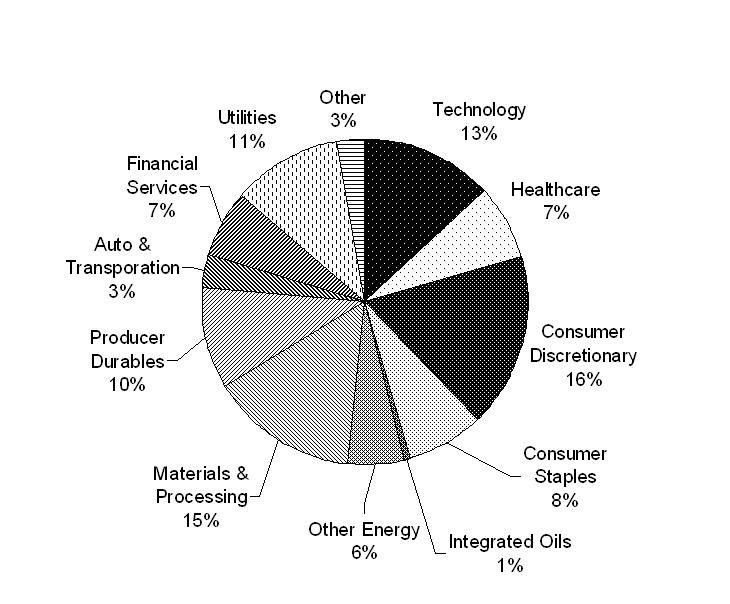

PARADIGM VALUE FUND

Sector Allocation (Unaudited)

(As a Percentage of Common Stock Held)

PROXY VOTING GUIDELINES (Unaudited)

Paradigm Funds Advisor LLC, the Fund’s Advisor, is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Advisor in fulfilling this responsibility is available without charge on the Fund’s web site at www.paradigm-funds.com. It is also included in the Fund’s Statement of Additional Information, which is available on the Securities and Exchange Commission’s web site at http://www.sec.gov.

Information regarding how the Fund voted proxies, Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling our toll free number(1-800-239-0732). This information is also available on the Securities and Exchange Commission’s web site at http://www.sec.gov.

2005 Annual Report 3

Availability of Quarterly Schedule of Investments

(Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC's Web site at http://www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Disclosure of Expenses

(Unaudited)

Shareholders of this Fund incur ongoing costs, including, management fees, interest expense and dividend expense on securities sold short. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Mutual Shareholder Services, LLC, the Fund's transfer agent. IRA accounts will be charged a $8.00 annual maintenance fee. The following example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with the costs of investing in other mutual funds. The example is based on an investment of $1,000 invested in the Fund on June 30, 2005 and held through December 31, 2005.

The first line of the table below provides information about the Fund’s actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) and then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period."

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by a shareholder for the period. In order to do so, shareholders can compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds' shareholder reports.

Expenses Paid

Beginning Ending

During the Period*

Account Value Account Value June 30, 2005 to

June 30, 2005 December 31, 2005 December 31, 2005

Actual $1,000.00 $1,114.92 $11.14

Hypothetical $1,000.00 $1,014.67 $10.61

(5% annual return

before expenses)

* Expenses are equal to the Fund’s annualized expense ratio of 2.09% for the period of

June 30, 2005 to December 31, 2005, multiplied by the average account value over the

period, multiplied by 184/365 (to reflect the one-half year period).

2005 Annual Report 4

Paradigm Value Fund |

|

|

| |

Schedule of Investments | ||||

December 31, 2005 | ||||

Shares/Principal Amount |

| Market Value | % of Net Assets | |

COMMON STOCKS | ||||

Agricultural Chemicals | ||||

19,500 | Lesco, Inc. * | $ 297,570 | 1.24% | |

Air Transportation, Scheduled | ||||

33,500 | Frontier Airlines * | 309,540 | 1.29% | |

Air-Cond & Warm Air Heating Equipment | ||||

1,900 | Mestek, Inc. * | 24,890 | 0.10% | |

Aircraft Engines & Engine Parts | ||||

8,200 | Heico Corp. | 212,216 | ||

1,000 | Heico Corp. New CL A | 20,520 | ||

232,736 | 0.97% | |||

Asphalt Paving & Roofing Materials | ||||

9,000 | Elk Corp. | 302,940 | 1.26% | |

Ball & Roller Bearings | ||||

1,000 | NN, Inc. | 10,600 | 0.04% | |

Canned, Frozen & Preserved Fruit, Veg & Food Specialties | ||||

23,500 | Corn Products International Inc. | 561,415 | 2.34% | |

Coating, Engraving & Allied Services | ||||

10,000 | Material Sciences Corp. * | 141,000 | 0.59% | |

Commercial Printing | ||||

21,900 | Cadmus Communications Corp. | 440,847 | 1.84% | |

Communications Services | ||||

132,500 | Raindance Communications * | 270,300 | 1.13% | |

Computer, Communication Equipment | ||||

8,200 | Black Box Corp. | 388,516 | 1.62% | |

Construction - Special Trade Contractors | ||||

13,800 | Layne Christensen Co. * | 350,934 | 1.46% | |

Crude Petroleum & Natural Gas | ||||

13,000 | Denbury Resources Inc. * | 296,140 | ||

6,100 | Whiting Petroleum Corp. * | 244,000 | ||

540,140 | 2.25% | |||

Deep Sea Foreign Transportation | ||||

7,600 | Seacor Smit, Inc. * | 517,560 | 2.16% | |

Electric Services | ||||

11,000 | Cleco Corporation | 229,350 | ||

115,000 | Aquila Inc. * | 414,000 | ||

643,350 | 2.68% | |||

Electrical Industrial Apparatuses | ||||

5,000 | Woodward Governor Company | 430,050 | 1.79% | |

Electromedical & Electrotherapeutic Apparatus | ||||

45,500 | Criticare Systems, Inc. * | 225,680 | 0.94% | |

Electronic Components & Accessories | ||||

31,000 | AVX Corp. | 448,880 | 1.87% | |

Electronic Components, NEC | ||||

4,000 | Spectrum Control * | 24,840 | 0.10% | |

Fire, Marine & Casualty Insurance | ||||

34,000 | 21st Century Insurance Group | 550,120 | 2.29% | |

Food and Kindred Products | ||||

18,500 | Flowers Foods, Inc. | 509,860 | 2.12% | |

Glass Products | ||||

21,600 | Apogee Enterprise, Inc. | 350,352 | 1.46% | |

Greeting Cards | ||||

17,335 | CSS Industries, Inc. | 532,705 | 2.22% | |

*Non-Income Producing Securities.

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 5

Paradigm Value Fund |

|

|

| |

Schedule of Investments (continued) | ||||

December 31, 2005 | ||||

Shares/Principal Amount |

| Market Value | % of Net Assets | |

COMMON STOCKS | ||||

Heating Equipment, Except Electric & Warm Air | ||||

18,288 | Omega Flex, Inc. | 318,028 | 1.33% | |

Heavy Construction Other Than Bldg Const - Contractors | ||||

42,000 | Foster Wheeler Ltd. * | 1,544,760 | 6.43% | |

Industrial Instruments For Measurement | ||||

13,500 | K-Tron International, Inc. * | 500,850 | 2.09% | |

Industrial Trucks, Tractors, Truck Parts | ||||

3,500 | Cascade Corp. | 164,185 | 0.68% | |

Insurance Agents & Brokers | ||||

55,700 | BioScrip, Inc. * | 419,978 | 1.75% | |

Insurance Carriers | ||||

9,500 | Pre-Paid Legal Services, Inc. | 362,995 | 1.51% | |

Life Insurance | ||||

17,500 | IPC Holdings Ltd. | 479,150 | ||

2,400 | National Western Life Insurance Co. * | 496,584 | ||

975,734 | 4.07% | |||

Magnetic & Optical Recording Machines | ||||

6,000 | Imation Corp. | 276,420 | 1.15% | |

Measuring & Controlling Devices & Equipment | ||||

16,000 | Measurement Specialties Inc. * | 389,600 | 1.62% | |

Metal Doors, Sash, Frames, Moldings | ||||

15,900 | Drew Industries, Inc. * | 448,221 | 1.87% | |

Misc. Industrial & Commercial Machinery | ||||

6,100 | Curtiss-Wright Corp. | 333,060 | 1.39% | |

Misc. Electrical Machinery, Equipment & Supplies | ||||

15,400 | United Industrial Corp. + | 637,098 | 2.65% | |

Mobile Homes | ||||

5,000 | Cavco Industries, Inc. * | 191,400 | 0.80% | |

Nonferrous Foundries | ||||

21,400 | Superior Essex Inc. * | 431,424 | 1.80% | |

Office Furniture | ||||

5,000 | Mity Enterprises, Inc. * | 89,100 | 0.37% | |

Oil & Gas Field Exploration Services | ||||

89,100 | Seitel Inc. * | 186,219 | 0.78% | |

Orthopedic, Prosthetic & Surgical Appliances & Supplies | ||||

14,500 | Synovis Life Technologies Inc. * | 145,435 | 0.61% | |

Petroleum Refining | ||||

16,500 | Frontier Oil Corp. | 619,245 | ||

7,000 | Suncor Energy, Inc. | 441,910 | ||

1,061,155 | 4.42% | |||

Plastic Materials, Synth Resins & Non-vulcan Elastomers | ||||

4,700 | Rogers Corp. * | 184,146 | 0.77% | |

Public Building & Related Furniture | ||||

17,859 | Virco Manufacturing Corp. * | 98,225 | 0.41% | |

Railroads, Line-Haul Operating | ||||

18,000 | Kansas City Southern * + | 439,740 | 1.83% | |

Real Estate Dealers (For Their Own Account) | ||||

1,400 | Texas Pacific Land Trust | 208,600 | 0.87% | |

Retail - Catalog & Mail-Order Houses | ||||

14,656 | Blair Corp. + | 570,705 | 2.38% | |

+ Securities partially pledged as collateral on securities

sold short.

*Non-Income Producing Securities.

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 6

Paradigm Value Fund |

|

|

| |

Schedule of Investments (continued) | ||||

December 31, 2005 | ||||

Shares/Principal Amount |

| Market Value | % of Net Assets | |

COMMON STOCKS | ||||

Retail - Grocery Stores | ||||

855 | Arden Group Inc. | 77,796 | 0.32% | |

Services - Automotive Repair & Service | ||||

27,500 | Monro Muffler Brake, Inc. | 833,800 | 3.47% | |

Services - Business Services, NEC | ||||

27,600 | CBIZ Inc. * | 166,152 | 0.69% | |

Services - Computer Integrated Systems Design | ||||

11,000 | Intergraph Corp. * | 547,910 | 2.28% | |

Services - Computer Programming | ||||

5,500 | CCC Information Services Group Inc. * | 144,210 | 0.60% | |

Services - Educational Services | ||||

32,200 | Nobel Learning Communities, Inc. * | 303,968 | 1.27% | |

Services - Engineering Services | ||||

1,000 | Washington Group International Inc. * | 52,970 | 0.22% | |

Services - Equipment Rental & Leasing | ||||

39,000 | Interpool, Inc. | 736,320 | 3.07% | |

Special Industry Machinery, NEC | ||||

27,200 | Gerber Scientific Inc. * | 260,304 | 1.08% | |

Telephone Communications | ||||

4,500 | Atlantic Tele-Network Inc. | 188,550 | ||

15,000 | Leap Wireless International Inc. * | 568,200 | ||

756,750 | 3.15% | |||

Water, Sewer & Pipeline | ||||

6,500 | Preformed Line Products Co. | 278,135 | 1.16% | |

Wholesale - Computers & Peripheral Equipment Software | ||||

65,400 | Navarre Corp. * | 361,662 | 1.51% | |

Wholesale - Medical, Dental & Hospital Equipment & Supplies | ||||

10,500 | Owens & Minor Inc. | 289,065 | 1.20% | |

Wood Household Furniture | ||||

12,000 | Ethan Allen Interiors | 438,360 | 1.84% | |

Total for Common Stock (Cost $17,623,811) | $ 23,329,305 | 97.20% | ||

Warrants | ||||

30,000 | Foster Wheeler Ltd. Class B (expires 9-27-2007) * | 60,600 | ||

Total for Warrants (Cost $0) | 60,600 | 0.25% | ||

Cash Equivalents | ||||

678,066 | SEI Daily Income Treasury Government CL B 3.47% ** | 678,066 | 2.83% | |

(Cost $678,066) | ||||

Total Investment Securities | 24,067,971 | 100.28% | ||

(Cost $18,301,877) | ||||

Liabilities In Excess of Other Assets | (66,081) | -0.28% | ||

| ||||

Net Assets | $ 24,001,890 | 100.00% | ||

Securities Sold Short | ||||

Common Stock | ||||

1,500 | William Lyon Homes * | $ 151,350 | 0.63% | |

Total Securities Sold Short (Proceeds - $ 187,974) | $ 151,350 | |||

*Non-Income Producing Securities.

**Variable Rate Security; The Yield Rate shown

represents the rate at December 31, 2005.

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 7

Paradigm Value Fund |

|

Statement of Assets and Liabilities | |

December 31, 2005 | |

Assets: | |

Investment Securities at Market Value | $ 24,067,971 |

(Cost - $18,301,877) | |

Cash | 1,791 |

Deposit with Brokers for Securities Sold Short | 88,512 |

Dividend Receivable | 32,817 |

Interest Receivable | 2,968 |

Receivable for Fund Shares Sold | 360 |

Total Assets | 24,194,419 |

Liabilities: | |

Securities Sold Short, at Market Value (Proceeds - $ 187,974) | 151,350 |

Payable to Advisor | 41,179 |

Total Liabilities | 192,529 |

Net Assets | $ 24,001,890 |

Net Assets Consist of: | |

Paid In Capital | $ 18,254,727 |

Accumulated Undistributed Realized Gain (Loss) on Investments - Net | (55,555) |

Unrealized Appreciation in Value | |

of Investments Based on Cost - Net | 5,802,718 |

Net Assets, for 559,488 Shares Outstanding | $ 24,001,890 |

(Unlimited shares authorized, without par value) | |

Net Asset Value, Offering Price and Redemption Price | |

Per Share ($24,001,890/559,488 shares) | $ 42.90 |

Statement of Operations | |

For the year ended December 31, 2005 | |

Investment Income: | |

Dividends | $ 176,877 |

Interest | 42,173 |

Total Investment Income | 219,050 |

Expenses: | |

Investment Advisor Fees | 404,930 |

Dividend Expense on Securities Sold Short | 5,600 |

Interest Expense | 7,045 |

Total Expenses | 417,575 |

Net Investment Loss | (198,525) |

Realized and Unrealized Gain (Loss) on Investments: | |

Net Realized Gain on Investments | 1,280,788 |

Net Realized Loss on Short Positions | (72,703) |

Net Change in Unrealized Appreciation on Investments | 2,608,343 |

Net Change in Unrealized Appreciation on Short Positions | 40,855 |

Net Realized and Unrealized Gain on Investments | 3,857,283 |

Net Increase in Net Assets from Operations | $ 3,658,758 |

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 8

Paradigm Value Fund |

|

|

|

| |

Statements of Changes in Net Assets | |||||

1/1/2005 | 1/1/2004 | ||||

to | to | ||||

12/31/2005 | 12/31/2004 | ||||

From Operations: | |||||

Net Investment Loss | $ (198,525) | $ (112,392) | |||

Net Realized Gain on Investments | 1,208,085 | 293,209 | |||

Change in Net Unrealized Appreciation | 2,649,198 | 2,353,721 | |||

Increase in Net Assets from Operations | 3,658,758 | 2,534,538 | |||

From Distributions to Shareholders: | |||||

Net Investment Income | 0 | 0 | |||

Net Realized Gain from Security Transactions | (1,056,140) | (189,792) | |||

Total Distributions to Shareholders | (1,056,140) | (189,792) | |||

From Capital Share Transactions: | |||||

Proceeds From Sale of Shares | 9,866,980 | 8,240,657 | |||

Shares Issued on Reinvestment of Dividends | 1,025,297 | 189,792 | |||

Cost of Shares Redeemed | (4,021,340) | (459,773) | |||

Net Increase from Shareholder Activity | 6,870,937 | 7,970,676 | |||

Net Increase in Net Assets | 9,473,555 | 10,315,422 | |||

Net Assets at Beginning of Period | 14,528,335 | 4,212,913 | |||

Net Assets at End of Period | $24,001,890 | $14,528,335 | |||

Share Transactions: | |||||

Issued | 245,658 | 250,688 | |||

Reinvested | 23,823 | 5,094 | |||

Redeemed | (97,330) | (14,558) | |||

Net Increase in Shares | 172,151 | 241,224 | |||

Shares Outstanding Beginning of Period | 387,337 | 146,113 | |||

Shares Outstanding End of Period | 559,488 | 387,337 | |||

Financial Highlights | |||||

Selected data for a share outstanding throughout the period: | 1/1/2005 | 1/1/2004 | 1/1/2003 * | ||

to | to | to | |||

12/31/2005 | 12/31/2004 | 12/31/2003 | |||

Net Asset Value - Beginning of Period | $ 37.51 | $ 28.83 | $ 20.00 | ||

Net Investment Loss ** | (0.40) | (0.44) | (0.33) | ||

Net Gains on Securities (realized and unrealized) | 7.75 | 9.69 | 12.52 | ||

Total from Investment Operations | 7.35 | 9.25 | 12.19 | ||

Distributions (From Net Investment Income) | 0.00 | 0.00 | 0.00 | ||

Distributions (From Capital Gains) | (1.96) | (0.57) | (3.36) | ||

Total Distributions | (1.96) | (0.57) | (3.36) | ||

Net Asset Value - End of Period | $ 42.90 | $ 37.51 | $ 28.83 | ||

Total Return *** | 19.61% | 32.09% | 60.89% | ||

Ratios/Supplemental Data | |||||

Net Assets - End of Period | $24,001,890 | $14,528,335 | $ 4,212,913 | ||

Ratio of Expenses to Average Net Assets, | |||||

Excluding Dividends on Securities Sold Short | |||||

and Interest Expense | 2.00% | 1.99% | 2.00% | ||

Ratio of Dividend Expense on Securities Sold Short | |||||

and Interest Expense | 0.06% | 0.04% | 0.00% | ||

Ratio of Expenses to Average Net Assets | 2.06% | 2.03% | 2.00% | ||

Ratio of Net Investment Loss to Average Net Assets | -0.98% | -1.34% | -1.28% | ||

Portfolio Turnover Rate | 67.39% | 91.66% | 138.81% |

* Commencement of operations.

**Per share amount calculated using the average shares

method.

***Total return in the above table represents the rate that the

investor would have earned or lost on an investment in the fund

assuming reinvestment of dividends.

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 9

NOTES TO THE FINANCIAL STATEMENTS

PARADIGM VALUE FUND

December 31, 2005

1.) ORGANIZATION

Paradigm Value Fund (the "Fund") is a non-diversified series of the Paradigm Funds (the "Trust"), an open-end management investment company. The Trust was organized in Ohio as a business trust on September 13, 2002 and may offer shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. The Fund commenced operation on January 1, 2003. At present, the Fund is one of three series authorized by the the Board of Trustees. The Fund's investment objective is long-term capital appreciation. The advisor to the Fund is Paradigm Funds Advisor LLC (the “Advisor”).

2.) SIGNIFICANT ACCOUNTING POLICIES

SECURITY VALUATION: Equity securities are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair market value of such securities. Securities that are traded on any exchange, including the NASDAQ, are generally valued by a pricing service at the last quoted sale price. Lacking a last sale price, an equity security is valued at its last bid price except when, in the Advisor's opinion, the last bid price does not accurately reflect the current value of the security. All

other securities for which over-the-counter market quotations are readily available are valued at their last bid price. When market quotations are not readily available, when the Advisor determines the last bid price does not accurately reflect the current value or when restricted securities are being valued, such securities are valued as determined in good faith by the Advisor, in conformity with guidelines adopted by and subject to review of the Board of Trustees of the Trust.

Fixed income securities generally are valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair market value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. If the Advisor decides that a price provided by the pricing service does not accurately reflect the fair market value of the securities, when prices are not readily available from a pricing service or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Advisor, in conformity with guidelines adopted by and subject to review of the Board of Trustees. Short term investments in fixed income securities with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity, are valued by using the amortized cost method of valuation, which the Board of Trustees has determined will represent fair value.

SHARE VALUATION: The net asset value per share of the Fund is calculated daily by dividing the total value of the Fund's assets, less liabilities, by the number of shares outstanding, rounded to the nearest cent. The offering and redemption price per share is equal to the net asset value per share.

SECURITY TRANSACTIONS AND OTHER: Security transactions are recorded based on a trade date. Dividend income is recognized on the ex-dividend date. Interest income is recognized on an accrual basis. The Fund uses the specific identification basis in computing gain or loss on sale of investment securities. Discounts and premiums on fixed income securities purchased are amortized over the lives of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

SHORT SALES: The Fund may sell a security it does not own in anticipation of a decline in the fair value of that security. When the Fund sells a security short, it must borrow the security sold short and deliver it to the broker-dealer through which it made the short sale. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale.

INCOME TAXES: The Fund’s policy is to continue to comply with the requirements of Subchapter M of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

ESTIMATES: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2005 Annual Report 10

Notes to the Financial Statements – continued

DISTRIBUTIONS TO SHAREHOLDERS: Distributions to shareholders, which are determined in accordance with income tax regulations are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassification will have no effect on net assets, results of operations or net asset values per share of the Fund. For the fiscal year and period ended December 31, 2005, net investment loss of $198,5 25 was reclassed to accumulated undistributed net realized short-term gains.

3.) INVESTMENT ADVISORY AGREEMENT

At the beginning of the fiscal year, the Fund had an investment advisory agreement with Paradigm Capital Management, Inc. (the “Company”). On December 16, 2005 Paradigm Funds Advisor LLC (“LLC”) assumed the obligations of the Company under the Management Agreement. The Company and the LLC are controlled by the same shareholders. Both the Company and the LLC are referred to as the “Advisor”. Under the terms of the Management Agreement, the Advisor manages the investment portfolio of the Fund, subject to policies adopted by the Trust’s Board of Trustees. Under the Management Agreement, the Advisor, at its own expense and without reimbursement from the Trust, furnishes office space and all necessary office facilities, equipment and executive personnel necessary for managing the assets of the Fund. The Advisor also pays the salaries and fees of all of its officers and employees that serve as officers and trustees of the Tru st. For its services, the Advisor receives an annual investment management fee from the Fund of 2.00% of the average daily net assets of the Fund. As a result of the above calculation, for the year ended December 31, 2005, the Advisor earned management fees totaling $404,930, of which $41,179 is still due to the Advisor at December 31, 2005. The Advisor pays all operating expenses of the Fund with the exception of taxes, brokerage fees and commissions, borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short), 12b-1 expenses and extraordinary expenses as defined under generally accepted accounting principles.

Certain officers and shareholders of the Advisor are also officers and/or a Trustee of the Trust. These individuals may receive benefits from the Advisor resulting from management fees paid to the Advisor from the Fund.

The Trustees who are not interested persons of the Fund were paid $2,000 for each meeting attended for the year ended December 31, 2005 for the Trust, which includes three separate series. Under the Management Agreement, the Advisor pays these fees.

4.) RENEWAL OF INVESTMENT ADVISORY AGREEMENT (Unaudited)

On December 9, 2005 the Board of Trustees for the Paradigm Value Fund met to consider the renewal of the Management Agreement (the "Agreement"). In renewing the Agreement, the Board of Trustees considered and evaluated the following factors: (i) the investment performance of the Fund and the investment advisor; (ii) the nature, extent and quality of the services provided by the investment advisor to the Fund; (iii) the cost of the services to be provided and the profits to be realized by the advisor and its affiliates from the relationship with the Fund; (iv) the extent to which economies of scale will be realized as the fund grows; and (v) whether the fee levels reflect these economies of scale to the benefit of shareholders.

As to the performance of the Fund, the Trustees reviewed information regarding the performance of the Fund compared to a group of funds of similar size, style and objective where fees and expenses had not been completely waived by the advisor to the fund (the "Peer Group"), as well as a larger group of funds categorized by Morningstar as small cap funds. The Trustees also reviewed comparative performance information for major indexes and other accounts managed by the Advisor. The Trustees concluded that the Fund's performance was excellent and leading nearly all of its peers.

As for the nature, extent and quality of the services provided by the Advisor the Trustees analyzed the Advisor's experience and the capabilities. The representatives of the Advisor reviewed and discussed with the Board the Advisor's ADV, and the 17j-1 certifications. They summarized the information provided to the Board regarding matters such as the Advisor's financial condition and investment personnel of the Advisor. They also discussed the portfolio manager's background and investment management experience. Furthermore, they reviewed the Advisor's financial information and discussed the firm's ability to meet its obligations under the Agreement. The Board concluded that the nature and extent of the services provided by the Advisor were consistent with their expectations, and that the quality of services, particularly those provided by the portfolio manager, was exceptional. The Trustees also concluded that the Advisor has the resources to provide qua lity advisory services to the Fund.

2005 Annual Report 11

Notes to the Financial Statements – continued

As to the costs of the services to be provided, the Board reviewed the fees under the Agreement compared to the Peer Group and noted that the expense ratio, although at the higher end of its peer group, was within the range of its peers. The Trustees also reviewed information regarding fees charged to other clients of the Advisor. They concluded that the advisory fee was reasonable, and that the shareholders were receiving value for the fees being paid. The Board also reviewed a profit and loss analysis prepared by the Advisor that detailed the expenses paid by the Advisor on behalf of the Fund, and the total revenue derived by the Advisor from the Fund.

As to the extent to which economies of scale will be realized as the Fund grows and whether the fee levels reflect these economies of scale to the benefit of shareholders the Trustees concluded that the Advisor was not overly profitable, and that an in depth discussion regarding economies of scale would be premature based on the current size of the Fund.

Upon review of all the factors discussed above, the Trustees concluded that the Management Agreement was fair and reasonable; that the Advisor's fees are reasonable in light of the services provided to the Fund and the benefits received by the Advisor; and that renewal of the Management Agreement would be in the best interests of the Fund.

5.) INVESTMENTS

For the fiscal year ended December 31, 2005, purchases and sales of investment securities other than U.S. Government obligations and short-term investments aggregated $20,045,254 and $12,689,552 respectively. There were no purchases or sales of U.S. Government obligations.

For federal income tax purposes, at December 31, 2005 the cost of securities on a tax basis and gross unrealized appreciation (depreciation) on investments were as follows:

Cost of Investments

$18,461,484

Proceeds from Short Positions

187,974

Gross Unrealized Appreciation

5,930,247

Gross Unrealized Depreciation

(198,624)

Net Unrealized Appreciation on Investments

$5,731,623

The difference between cost amounts for financial statements and federal income tax purposes consists of wash sales in the amount of $71,095.

6.) CAPITAL SHARES

At December 31, 2005 an indefinite number of shares of beneficial interest were authorized. 559,488 shares were issued and outstanding and paid in capital was $18,254,727.

7.) DISTRIBUTIONS TO SHAREHOLDERS

There was a year end long-term capital gain of $1.7954 per share and a short-term capital gain of $0.1105 paid on December 29, 2005. There was also a spillover dividend from 2004 paid on September 12, 2005 of long-term capital gain of $0.005 per share and a short-term capital gain of $0.0536 per share.

The tax character of distributions paid during fiscal years 2004 and 2005 was as follows:

Distributions paid from

2005

2004

Net Investment Income $ -0- $ -0-

Short-Term Capital Gain

90,235 27,490

Long-Term Capital Gain

965,905 62,302

$1,056,140 $ 189,792

As of December 31, 2005, the components of distributable earnings/(accumulated losses) on a tax basis were as follows:

Undistributed ordinary

income/(accumulated losses)

$ 15,507

Undistributed long-term capital

gain/(accumulated losses)

33

Unrealized appreciation/(depreciation)

5,731,623

$ 5,747,163

The difference between book basis and tax basis unrealized appreciation is attributable to the tax deferral of losses on wash sales.

2005 Annual Report 12

Cohen McCurdy

Cohen McCurdy, Ltd.

Certified Public Accountants

800 Westpoint Pkwy., Suite 1100

Westlake, OH 44145

(440) 835-8500

(440) 835-1093 fax

www.cohenmccurdy.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Shareholders and

Board of Trustees

Paradigm Value Fund

We have audited the accompanying statement of assets and liabilities of the Paradigm Value Fund (one of the funds constituting the Paradigm Funds) (the "Fund"), including the schedule of investments, as of December 31, 2005, and the related statements of operations for the year then ended, and the statement of changes in net assets and financial highlights for each of the two years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights for the periods indicated prior to the year ended December 31, 2004 were audited by McCurdy & Associates CPA's, Inc., whose audit practice was acquired by Cohen McCurdy, Ltd. McCurdy & Associates CPA's, Inc. expressed unqualified opinions on those statements and highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities and cash owned as of December 31, 2005 by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Paradigm Value Fund of the Paradigm Funds as of December 31, 2005, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

![[paradigmncsr2005annual004.jpg]](https://capedge.com/proxy/N-CSR/0001162044-06-000103/paradigmncsr2005annual004.jpg)

Cohen McCurdy, Ltd.

Westlake, Ohio

February 28, 2006

2005 Annual Report 13

TRUSTEES AND OFFICERS (Unaudited)

The Board of Trustees supervises the business activities of the Trust. Each Trustee serves as a trustee until the termination of the Trust unless the Trustee dies, resigns, retires or is removed.

The following table provides information regarding each Trustee who is an "interested person" of the Trust, as defined in the Investment Company Act of 1940, and each officer of the Trust. The Trustee who is an "interested person" of the Trust, as defined in the Investment Company Act of 1940, is indicated by a “2”.

Interested Trustees and Officers

Name, Address1, | Position with | Term of Office and | Principal Occupation(s) | Number of Portfolios | Other Directorships Held By |

Candace King Weir2, | President and Trustee | Indefinite Term, Since 2002 | Investment Manager of PCM Ventures International, LLC (November 2001-current) and PCM Ventures II, LLC (June 2003-current); Investment Manager and principal of PCM Ventures LLC (January 1997-current); Director and President of Paradigm Capital Management, Inc. (1993-current); Director and President of C.L. King & Associates, a registered broker dealer (1972-current); CEO, Portfolio Manager and Member of PCM Advisors LLC (December 2004-current). CEO and Member of Paradigm Funds Advisor LLC (July 2005-current). | 3 | None |

David J. DeLuca, | Secretary and Chief Compliance Officer | Indefinite Term, Since 2004 | Director, Senior Vice President and Chief Financial Officer of Paradigm Capital Management, Inc. (March 2004 - current);Chief Financial Officer of PCM Advisors, LLC (December 2004-current); Chief Financial Officer of Paradigm Funds Advisor LLC (July 2005-current); Senior Vice President and Chief Financial Officer of Troy Financial Corporation (December 2000 – January 2004). Vice President and Chief Financial Officer of Catskill Financial Corporation (August 1996 – November 2000). | NA | NA |

Robert A. Benton, | Treasurer and Chief Financial Officer | Indefinite Term, Since 2002 | Senior Vice President and Chief Financial Officer of C.L. King & Associates, a registered broker dealer (February 2001 - current); Senior Vice President and Chief Financial Officer of Paradigm Capital Management, Inc. (February 2001 - March 2004). | NA | NA |

Independent Trustees

Name, Address1, | Position with | Term of Office and | Principal Occupation(s) | Number of Portfolios | Other Directorships Held By |

Carl A. Florio, CPA3, | Independent Trustee | Indefinite Term, Since 2005 | Eastern Regional President of First Niagara Bank (2005-current); President and Chief Executive Officer of Hudson River Bank & Trust Company (1996-2005). | 3 | Director, Amer. Bio Medica; Director, Hudson River Bank & Trust Co. Foundation |

Lewis Golub4, | Independent Trustee | Indefinite Term, Since 2002 | Chairman of the Board, Golub Corporation - DBA Price Chopper Supermarkets (1950 - current). | 3 | Director, Racemark Int’l; Director, TaylorMade Inc.; Director, DOT Foods, Inc. |

Anthony J. Mashuta, | Independent Trustee | Indefinite Term, | President and Chairman of the Board of Cool Insuring Agency, Inc. (1988 - current). | 3 | Director, Proctor’s Theatre |

1 The address of each trustee and officer is c/o Paradigm Funds, Nine Elk Street, Albany, NY 12207.

2 Candace King Weir is considered an "interested person" as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended, by virtue of her affiliation with the Trust's investment advisor, Paradigm Funds Advisor LLC.

3 Carl A. Florio is a member of the Board of Directors of a non-profit foundation that recently retained Paradigm Capital Management, Inc. to manage a portion of the foundation's assets. Candace King Weir is a Director and the President of Paradigm Capital Management, Inc.; and an interested Trustee of the Trust; and CEO of the Trust's investment advisor, Paradigm Funds Advisor LLC.

4 Lewis Golub is a limited partner in PCM Partners, LP II. As of December 31, 2005 he owned 0.62% of the PCM Partners, LP II partnership, the value of which was $2.1 million. Candace King Weir is the general partner of PCM Partners, LP II; an interested Trustee of the Trust; and CEO of the Trust's investment advisor, Paradigm Funds Advisor LLC.

The Statement of Additional Information includes additional information about the Fund’s Trustees and may be obtained without charge by calling 1-800-239-0732.

Board of Trustees

Carl A. Florio

Lewis Golub

Candace King Weir

Anthony Mashuta

Investment Advisor

Paradigm Funds Advisor LLC

Nine Elk Street

Albany, NY 12207-1002

Counsel

Thompson Hine LLP

312 Walnut Street, 14th Floor

Cincinnati, OH 45202

Custodian

U.S. Bank, NA

425 Walnut Street

P.O. Box 1118

Cincinnati, OH 45201

Dividend Paying Agent,

Shareholders' Servicing Agent,

Transfer Agent

Mutual Shareholder Services

8869 Brecksville Rd., Suite C

Brecksville, OH 44141

Fund Administrator

Premier Fund Solutions, Inc.

480 N. Magnolia Avenue, Suite 103

El Cajon, CA 92020

Independent Auditors

Cohen McCurdy Ltd.

800 Westpoint Pkwy., Suite 1100

Westlake, OH 44145-1524

This report is provided for the general information of the shareholders of the Paradigm Opportunity Fund. This report is not intended for distribution to prospective investors in the Fund, unless preceded or accompanied by an effective prospectus.

Item 1. Reports to Stockholders.

Paradigm Select Fund

ANNUAL REPORT

December 31, 2005

PARADIGM SELECT FUND

ANNUAL REPORT

DECEMBER 31, 2005

We enjoyed a very successful year in 2005. We handily beat our benchmark, the Russell 2000 Index. We did this while sticking closely to our plan of concentrating on well run conservatively managed small to mid-cap companies. We screen rigorously for companies which have characteristics of good returns on capital, meaningful stock holdings by management, a lack of enthusiasm by the professional investors, strong balance sheets and evidence of improving financial performance.

In 2005, the fund generated double-digit returns in seven out of the twelve Russell 2000 sectors and outperformed that index in eight of those sectors. Other Energy and Technology were the top contributors to excess return; other sectors contributing to excess return included Producer Durables, and Utilities. Only the Consumer Discretionary sector adversely impacted returns. Top performers for the year were Intergraph Corporation, Tesoro Corporation, MEMC Electronic Materials, Inc. and Humana Inc.

But that's all in the past. The New Year is looking challenging. Although the economy is continuing to expand, equity returns will not necessarily follow. High prices for energy and raw materials could be a harbinger of coming inflation. While the economists seem confident that inflation is in check, we are hearing many more companies speak of successfully increasing prices this year than we did a year ago. The flattening yield curve suggests to this analyst that the easy credit-fed inflation in equity valuations is at risk.

Your team at Paradigm Funds Advisor does not change its methods or goals due to market outlooks. We endeavor to use our skills in stock selection to add value over the long term. We are working harder to find good values and we are being more cautious in evaluating the financial strength and earnings power of the stocks which we select.

We continue to focus our analysis on the strength of the company's business franchise, the ability of the management team, the near-term prospects for improving returns and relative valuation. We believe that this simple strategy will reward our investors over the long term.

Thank you for your continued confidence.

Sincerely,

![[paradigmncsr2005annual005.jpg]](https://capedge.com/proxy/N-CSR/0001162044-06-000103/paradigmncsr2005annual005.jpg)

John B. Walthausen, CFA

2005 Annual Report 1

Paradigm Select Fund

PERFORMANCE INFORMATION

(Unaudited)

![[paradigmncsr2005annual006.jpg]](https://capedge.com/proxy/N-CSR/0001162044-06-000103/paradigmncsr2005annual006.jpg)

Total Return (%) for The Period Ended December 31, 2005

(Fund Inception January 1, 2005)

December 31, 2005 NAV $22.33

Total Return(A)

Paradigm Select Fund

12.06%

Russell 2000 Index(B)

4.55%

(A)Total return includes change in share prices and includes reinvestment of any dividends and capital gain distributions.

(B)The Russell 2000® Index (the “Index”) consists of the smallest 2,000 companies in the Russell 3000 Index (which represents approximately 98% of the investable U.S. equity market). The Index is an unmanaged index generally considered as the premier of small capitalization stocks. For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732.

2005 Annual Report 2

Paradigm Select Fund

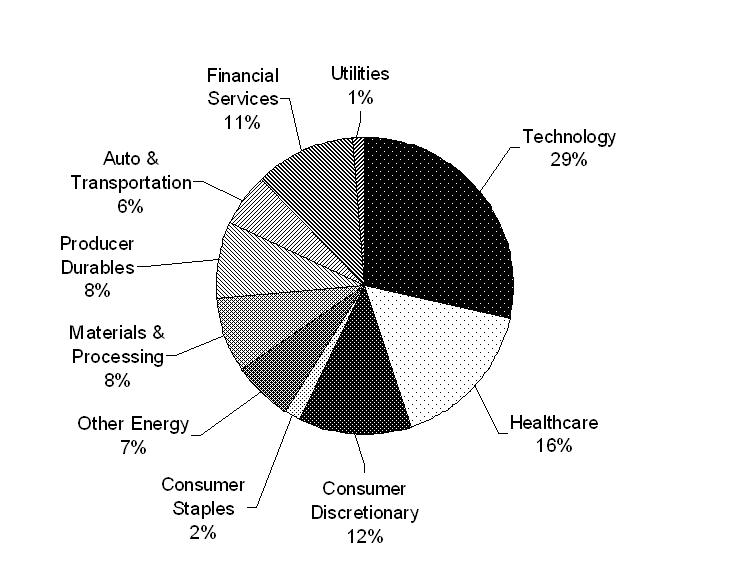

PARADIGM SELECT FUND

Sector Allocation (Unaudited)

(As a Percentage of Common Stock Held)

PROXY VOTING GUIDELINES (Unaudited)

Paradigm Funds Advisor, LLC the Fund’s Advisor, is responsible for exercising the voting rights associated with the securities held by the Fund. A description of the policies and procedures used by the Advisor in fulfilling this responsibility is available without charge on the Fund’s website at www.paradigm-funds.com. It is also included in the Fund’s Statement of Additional Information, which is available on the Securities and Exchange Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies, Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30, is available without charge, upon request, by calling our toll free number(1-800-239-0732). This information is also available on the Securities and Exchange Commission’s website at http://www.sec.gov.

2005 Annual Report 3

Availability of Quarterly Schedule of Investments

(Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC's Web site at http://www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Disclosure of Expenses

(Unaudited)

Shareholders of this Fund incur ongoing costs consisting of management fees. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by Mutual Shareholder Services, LLC, the Fund's transfer agent. IRA accounts will be charged a $8.00 annual maintenance fee. The following example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with similar costs of investing in other mutual funds. The example is based on an investment of $1,000 invested in the Fund on June 30, 2005 and held through December 31, 2005.

The first line of the table below provides information about the Fund’s actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) and then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period."

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by a shareholder for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. In order to do so, shareholders can compare the 5% hypothetical example with the 5% hypothetical examples that appear in other funds' shareholder reports.

Expenses Paid

Beginning Ending

During the Period*

Account Value Account Value June 30, 2005 to

June 30, 2005 December 31, 2005 December 31, 2005

Actual $1,000.00 $1,060.17 $7.79

Hypothetical $1,000.00 $1,017.64 $7.63

(5% annual return

before expenses)

* Expenses are equal to the Fund’s annualized expense ratio of 1.50% for the period of

June 30, 2005 to December 31, 2005, multiplied by the average account value over the

period, multiplied by 184/365 (to reflect the one-half year period).

2005 Annual Report 4

Paradigm Select Fund |

|

|

| |

Schedule of Investments | ||||

December 31, 2005 | ||||

Shares/Principal Amount |

| Market Value | % of Net Assets | |

COMMON STOCKS | ||||

Agricultural Production-Crops | ||||

1,400 | Chiquita Brands International, Inc. | $ 28,014 | 1.11% | |

Blankbooks, Looseleaf Binders & Bookbinding & Related Work | ||||

900 | John H. Harland Company | 33,840 | 1.34% | |

Books: Publishing or Publishing & Printing | ||||

1,100 | Scholastic Corp. * | 31,361 | 1.24% | |

Canned, Frozen & Preserved Fruits | ||||

800 | Lancaster Colony Corp. | 29,640 | 1.18% | |

Cement, Hydraulic | ||||

400 | Eagle Materials Inc. | 48,944 | 1.94% | |

Communications Equipment, NEC | ||||

1,500 | Checkpoint Systems Inc. * | 36,975 | 1.47% | |

Computer Storage Devices | ||||

3,600 | Overland Storage, Inc. * | 28,872 | 1.15% | |

Crude Petroleum & Natural Gas | ||||

1,700 | Denbury Resources, Inc. * | 38,726 | ||

600 | Swift Energy Co. * | 27,042 | ||

65,768 | 2.61% | |||

Drilling Oil & Gas Wells | ||||

2,300 | Parker Drilling Co. * | 24,909 | 0.99% | |

Electric & Other Services Combined | ||||

2,500 | CMS Energy Corp. * | 36,275 | ||

1,600 | Pepco Holdings, Inc. | 35,792 | ||

72,067 | 2.86% | |||

Electric Services | ||||

1,700 | Duquesne Light Holdings, Inc. | 27,744 | 1.10% | |

Electrical Industrial Apparatus | ||||

500 | Woodward Governor Co. | 43,005 | 1.71% | |

Electronic Components & Accessories | ||||

2,600 | AVX Corp. | 37,648 | 1.49% | |

Engines & Turbines | ||||

1,800 | Stewart & Stevenson Services Inc. | 38,034 | 1.51% | |

Fabricated Rubber Products | ||||

500 | Carlisle Companies, Inc. | 34,575 | ||

1,400 | West Pharmaceutical Services, Inc. | 35,042 | ||

69,617 | 2.76% | |||

Fire, Marine & Casualty Insurance | ||||

1,600 | 21st Century Insurance Group | 25,888 | ||

1,000 | HCC Insurance Holdings, Inc. | 29,680 | ||

55,568 | 2.20% | |||

Food & Kindred Products | ||||

1,750 | Flowers Foods, Inc. | 48,230 | 1.91% | |

Games, Toys & Children's Vehicles (No Dolls & Bicycles) | ||||

1,500 | JAKKS Pacific Inc. * | 31,410 | 1.25% | |

Heavy Construction | ||||

700 | Jacobs Engineering Group, Inc. * | 47,509 | 1.88% | |

Hospital & Medical Service Plans | ||||

700 | Humana, Inc. * | 38,031 | 1.51% | |

Insurance Agents & Brokers Service | ||||

4,100 | BioScrip, Inc. * | 30,914 | 1.23% | |

Magnetic & Optical Recording Media | ||||

900 | Imation Corp. | 41,463 | 1.64% | |

*Non-Income Producing Securities.

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 5

Paradigm Select Fund |

|

|

| |

Schedule of Investments (continued) | ||||

December 31, 2005 | ||||

Shares/Principal Amount |

| Market Value | % of Net Assets | |

COMMON STOCKS | ||||

Meat Packing Plants | ||||

1,200 | Hormel Foods Corp. | 39,216 | 1.56% | |

Miscellaneous Industrial & Commercial Machinery & Equipment | ||||

600 | Curtiss-Wright Corp. | 32,760 | 1.30% | |

Miscellaneous Electrical Machinery, Equipment, & Supplies | ||||

1,200 | United Industrial Corp. | 49,644 | 1.97% | |

Motor Vehicles Parts & Accessories | ||||

1,200 | Clarcor, Inc. | 35,652 | 1.41% | |

National Commercial Banks | ||||

700 | Commerce Bancorp., Inc. | 24,087 | 0.96% | |

Natural Gas Distribution | ||||

1,000 | Atmos Energy Corp. | 26,160 | 1.04% | |

Newspapers: Publishing or Publishing & Printing | ||||

2,300 | Journal Communications, Inc. | 32,085 | ||

400 | Media General, Inc. | 20,280 | ||

52,365 | 2.08% | |||

Office Furniture | ||||

700 | HNI Corp. | 38,451 | 1.53% | |

Petroleum Refining | ||||

200 | Suncor Energy, Inc. | 12,626 | ||

700 | Tesoro Corp. | 43,085 | ||

55,711 | 2.21% | |||

Plastic Materials, Synth Resins & Nonvulcan Elastomers | ||||

400 | Rogers Corp. * | 15,672 | 0.62% | |

Plastics Products | ||||

800 | Aptargroup, Inc. | 41,760 | 1.66% | |

Prefabricated Metal Buildings & Components | ||||

1,100 | NCI Building Systems, Inc. * | 46,728 | 1.85% | |

Radiotelephone Communications | ||||

1,000 | Telephone & Data Systems, Inc. Special | 34,610 | 1.37% | |

Railroad Equipment | ||||

1,300 | Westinghouse Air Brake Technologies Corp. | 34,970 | 1.39% | |

Railroad, Line-Haul Operating | ||||

1,800 | Kansas City Southern * | 43,974 | 1.74% | |

Retail - Department Stores | ||||

800 | Dillard's, Inc. | 19,856 | 0.79% | |

Retail - Radio, TV & Consumer Electronics Stores | ||||

1,500 | RadioShack Corp. | 31,545 | 1.25% | |

Retail - Shoe Stores | ||||

1,800 | Payless Shoesource, Inc. * | 45,180 | 1.79% | |

Semiconductors & Related Devices | ||||

1,300 | Cabot Microelectronics Corp. * | 38,077 | ||

2,000 | Memc Electronic Materials Inc. * | 44,340 | ||

82,417 | 3.27% | |||

Services - Advertising Agencies | ||||

1,600 | Catalina Marketing Corp. | 40,560 | 1.61% | |

Services - Business Services | ||||

1,800 | Moneygram International, Inc. | 46,944 | ||

4,800 | Premiere Global Services, Inc.* | 39,024 | ||

85,968 | 3.41% | |||

*Non-Income Producing Securities.

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 6

Paradigm Select Fund |

|

|

| |

Schedule of Investments (continued) | ||||

December 31, 2005 | ||||

Shares/Principal Amount |

| Market Value | % of Net Assets | |

COMMON STOCKS | ||||

Services - Computer Integrated Systems Design | ||||

2,700 | Convergys Corp. * | 42,795 | ||

1,000 | Intergraph Corp. * | 49,810 | ||

4,600 | Tyler Technologies, Inc. * | 40,388 | ||

132,993 | 5.27% | |||

Services - Computer Processing & Data Preparation | ||||

2,000 | Sabre Holdings Corp. | 48,220 | 1.91% | |

Services - Engineering Services | ||||

700 | Washington Group International, Inc. * | 37,079 | 1.47% | |

Services - Hospitals | ||||

300 | Magellan Health Services, Inc. * | 9,435 | 0.37% | |

Services - Management Consulting | ||||

1,300 | Watson Wyatt & Company Holdings | 36,270 | 1.44% | |

Services - Misc Health & Allied Services | ||||

800 | Lincare Holdings Inc. * | 33,528 | 1.33% | |

Services - Offices & Clinics of Doctors of Medicine | ||||

1,400 | Amsurg Corp. * | 32,004 | 1.27% | |

Services - Personal Services | ||||

2,100 | Angelica Corp. | 34,734 | 1.38% | |

Soap, Detergents, Cleaning Preparations, Perfumes, Cosmetics | ||||

1,300 | Church & Dwight Co., Inc. | 42,939 | 1.70% | |

Special Industry Machinery | ||||

900 | Varian Semiconductor Equipment Associates, Inc. * | 39,537 | 1.57% | |

Steel Works, Blast Furnaces & Rolling Mills | ||||

1,200 | Commercial Metals Co. | 45,048 | 1.79% | |

Sugar & Confectionery Products | ||||

1,200 | Tootsie Roll Industries, Inc. | 34,716 | 1.38% | |

Telephone Communications | ||||

1,000 | Century Tel, Inc. | 33,160 | ||

800 | Leap Wireless International, Inc. * | 30,304 | ||

63,464 | 2.51% | |||

Wholesale - Electronic Parts & Equipment | ||||

1,500 | Avnet, Inc. * | 35,910 | 1.42% | |

Total for Common Stock (Cost $2,229,125) | $ 2,412,726 | 95.70% | ||

Cash Equivalents | ||||

109,791 | SEI Daily Income Treasury Government CL B 3.47% ** | 109,791 | 4.36% | |

(Cost $109,791) | ||||

Total Investment Securities | 2,522,517 | 100.06% | ||

(Cost $2,338,916) | ||||

Liabilities in Excess of Other Assets | (1,560) | -0.06% | ||

| ||||

Net Assets | $ 2,520,957 | 100.00% | ||

*Non-Income Producing Securities.

**Variable Rate Security; The Yield Rate shown

represents the rate at December 31, 2005.

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 7

Paradigm Select Fund |

|

Statement of Assets and Liabilities | |

December 31, 2005 | |

Assets: | |

Investment Securities at Market Value | $ 2,522,517 |

(Cost - $2,338,916) | |

Dividend Receivable | 1,290 |

Interest Receivable | 390 |

Total Assets | 2,524,197 |

Liabilities: | |

Payable to Advisor | 3,240 |

Total Liabilities | 3,240 |

Net Assets | $ 2,520,957 |

Net Assets Consist of: | |

Paid In Capital | $ 2,351,764 |

Accumulated Realized Loss on Investments - Net | (14,408) |

Unrealized Appreciation in Value | |

of Investments Based on Cost - Net | 183,601 |

Net Assets, for 112,874 Shares Outstanding | $ 2,520,957 |

(Unlimited shares authorized, without par value) | |

Net Asset Value, Offering Price and Redemption Price | |

Per Share ($2,520,957/112,874 shares) | $ 22.33 |

Statement of Operations | |

For the year ended December 31, 2005 | |

Investment Income: | |

Dividends | $ 16,333 |

Interest | 2,955 |

Total Investment Income | 19,288 |

Expenses: | |

Investment Advisor Fees | 25,470 |

Total Expenses | 25,470 |

Net Investment Loss | (6,182) |

Realized and Unrealized Gain on Investments: | |

Realized Gain on Investments | 985 |

Net Change in Unrealized Appreciation on Investments | 183,601 |

Net Realized and Unrealized Gain on Investments | 184,586 |

Net Increase in Net Assets from Operations | $ 178,404 |

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 8

Paradigm Select Fund |

|

|

|

|

|

Statement of Changes in Net Assets | ||

1/1/2005* | ||

to | ||

12/31/2005 | ||

From Operations: | ||

Net Investment Loss | $ (6,182) | |

Net Realized Gains on Investments | 985 | |

Net Change in Net Unrealized Appreciation | 183,601 | |

Increase in Net Assets from Operations | 178,404 | |

From Distributions to Shareholders: | ||

Net Investment Income | 0 | |

Net Realized Gain from Security Transactions | (9,211) | |

Change in Net Assets from Distributions | (9,211) | |

From Capital Share Transactions: | ||

Proceeds From Sale of Shares | 2,749,506 | |

Shares Issued on Reinvestment of Dividends | 9,211 | |

Cost of Shares Redeemed | (406,953) | |

Net Increase from Shareholder Activity | 2,351,764 | |

Net Increase in Net Assets | 2,520,957 | |

Net Assets at Beginning of Period | 0 | |

Net Assets at End of Period | $ 2,520,957 | |

Share Transactions: | ||

Issued | 131,401 | |

Reinvested | 410 | |

Redeemed | (18,937) | |

Net Increase in Shares | 112,874 | |

Shares Outstanding Beginning of Period | - | |

Shares Outstanding End of Period | 112,874 | |

Financial Highlights | ||

Selected data for a share outstanding throughout the period: | 1/1/2005* | |

to | ||

12/31/2005 | ||

Net Asset Value - Beginning of Period | $ 20.00 | |

Net Investment Loss *** | (0.08) | |

Net Gains on Securities (realized and unrealized) | 2.49 | |

Total from Investment Operations | 2.41 | |

Distributions (From Net Investment Income) | 0.00 | |

Distributions (From Capital Gains) | (0.08) | |

Total Distributions | (0.08) | |

Net Asset Value - End of Period | $ 22.33 | |

Total Return **** | 12.06% | |

Ratios/Supplemental Data | ||

Net Assets - End of Period | $ 2,520,957 | |

Ratio of Expenses to Average Net Assets | 1.50% | ** |

Ratio of Net Investment Loss to Average Net Assets | -0.36% | ** |

Portfolio Turnover Rate | 68.56% | |

* Commencement of operations.

** Annualized.

*** Per share amount calculated using the average shares method.

**** Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends.

The accompanying notes are an integral part of these

financial statements.

2005 Annual Report 9

NOTES TO FINANCIAL STATEMENTS

PARADIGM SELECT FUND

December 31, 2005

1.) ORGANIZATION

Paradigm Select Fund (the "Fund") is a non-diversified series of the Paradigm Funds (the "Trust"), and commenced operations on January 1, 2005. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 13, 2002 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series. At present the Fund is one of three series authorized by the Board of Trustees. The Fund's investment objective is long-term capital appreciation. The advisor to the Fund is Paradigm Funds Advisor LLC (the “Advisor”).

2.) SIGNIFICANT ACCOUNTING POLICIES

SECURITY VALUATION: Equity securities are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair market value of such securities. Securities that are traded on any exchange, including the NASDAQ, are generally valued by a pricing service at the last quoted sale price. Lacking a last sale price, an equity security is generally valued by the pricing service at its last bid price. When market quotations are not readily available, when the Advisor determines that the market quotation or the price provided by the pricing service does not accurately reflect the current market value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Advisor, in conformity with guidelines adopted by and subject to review of the Board of Trustees of the Trust.

Fixed income securities generally are valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Advisor believes such prices accurately reflect the fair market value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. If the Advisor decides that a price provided by the pricing service does not accurately reflect the fair market value of the securities, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Advisor, subject to review of the Board of Trustees. Short term investments in fixed income securities with maturit ies of less than 60 days when acquired, or which subsequently are within 60 days of maturity, are valued by using the amortized cost method of valuation, which the Board of Trustees has determined will represent fair value.

SHARE VALUATION: The net asset value per share of the Fund is calculated daily by dividing the total value of the Fund's assets, less liabilities, by the number of shares outstanding, rounded to the nearest cent. The offering and redemption price per share is equal to the net asset value per share.

SECURITY TRANSACTIONS & OTHER: Security transactions are recorded based on trade date. Dividend income is recognized on the ex-dividend date. Interest income is recognized on an accrual basis. The Fund uses the specific identification basis in computing gain or loss on sale of investment securities. Discounts and premiums on fixed income securities purchased are amortized over the lives of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

2005 Annual Report 10

Notes to the Financial Statements - continued

INCOME TAXES: The Fund’s policy is to continue to comply with the requirements of Subchapter M of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no federal income tax provision is required.

ESTIMATES: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

DISTRIBUTIONS TO SHAREHOLDERS: Distributions to shareholders, which are determined in accordance with income tax regulations are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassification will have no effect on net assets, results of operations or net asset values per share of the Fund. For the fiscal year and period ended December 31, 2005, net investment loss of $6,182 was reclassed to accumulated undistributed net realized short-term gains.

3.) INVESTMENT ADVISORY AGREEMENT

At the beginning of the fiscal year, the Fund had an investment advisory agreement with Paradigm Capital Management, Inc. (the “Company”). On December 16, 2005 Paradigm Funds Advisor LLC (“LLC”) assumed the obligations of the Company under the Management Agreement. The Company and the LLC are controlled by the same shareholders. Both the Company and the LLC are referred to as the “Advisor”. Under the terms of the Management Agreement, the Advisor manages the investment portfolio of the Fund, subject to policies adopted by the Trust’s Board of Trustees. Under the Management Agreement, the Advisor, at its own expense and without reimbursement from the Trust, furnishes office space and all necessary office facilities, equipment and executive personnel necessary for managing the assets of the Fund. The Advisor also pays the salaries and fees of all of its officers and employees that serve as officers and trustees of the Trust. For its services, the Advisor receives an annual investment management fee from the Fund of 1.50% of the average daily net assets of the Fund. For the period ended December 31, 2005, the Advisor earned management fees totaling $25,470, of which $3,240 remained due to the Advisor at December 31, 2005. The Advisor pays all operating expenses of the Fund with the exception of taxes, brokerage fees and commissions, borrowing costs (such as (a) interest and (b) dividend expenses on securities sold short), and extraordinary expenses as defined under generally accepted accounting principles.

The Trustees who are not interested persons of the Fund were paid $2,000 for each meeting attended for the year ended December 31, 2005 for the Trust, which includes three separate series. Under the Management Agreement, the Advisor pays these fees.

4.) RELATED PARTY TRANSACTIONS

Certain officers and shareholders of the Advisor are also officers and/or a Trustee of the Trust. These individuals may receive benefits from the Advisor resulting from management fees paid to the Advisor from the Fund.

5.) CAPITAL SHARES

At December 31, 2005 an unlimited number of shares of beneficial interest were authorized. Shares of 112,874 were issued and outstanding and paid in capital was $2,351,764 at December 31, 2005.

6.) INVESTMENTS

For the period ended December 31, 2005, purchases and sales of investment securities, other than U.S. Government obligations and short-term investments, aggregated $3,292,416 and $1,064,276, respectively. There were no purchases or sales of U.S. Government obligations.

2005 Annual Report 11

Notes to the Financial Statements - continued

For federal income tax purposes, the cost of investments owned at December 31, 2005 was $2,355,060. The difference between book cost and tax cost consists of wash sales in the amount of $16,144. At December 31, 2005, the composition of unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value) was as follows:

Appreciation

(Depreciation)

Net Appreciation (Depreciation)

$265,144

($97,687)

$167,457

7.) CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting shares of a fund creates a presumption of control of the Fund, under Section 2(a)(9) of the Investment Company Act of 1940. At December 31, 2005, Candace King Weir CEO of the Advisor held, in aggregate, 31.12% of the Fund, and therefore may be deemed to control the Fund.

8.) DISTRIBUTION TO SHAREHOLDERS

There was a year end ordinary income distribution of $0.0819 per share paid on December 29, 2005.

The tax character of distributions paid during fiscal year 2005 were as follows:

2005

Net Investment Income $ -0-

Short-term Capital Gain 9,211

Long-term Capital Gain -0-

$ 9,211

As of December 31, 2005, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

Undistributed Ordinary

Income / (Accumulated Losses) $ 1,736

Undistributed Long-term Capital

Gain / (Accumulated Losses) -

Unrealized Appreciation / (Depreciation) 167,457

$ 169,193

The difference between book basis and tax basis unrealized appreciation is attributable to the tax deferral of losses on wash sales.

2005 Annual Report 12

Cohen McCurdy

Cohen McCurdy, Ltd.

Certified Public Accountants

800 Westpoint Pkwy., Suite 1100

Westlake, OH 44145

(440) 835-8500

(440) 835-1093 fax

www.cohenmccurdy.com

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Shareholders and

Board of Trustees of

Paradigm Select Fund