united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive. Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 08/31

Date of reporting period: 08/31/22

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| |

| |

| Tactical Multi-Purpose Fund |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Annual Report |

| |

| |

| August 31, 2022 |

| |

| |

| |

| |

| |

| Fund Adviser: |

| |

| |

| Fisher Asset Management, LLC |

| |

| 5525 NW Fisher Creek Drive |

| Camas, Washington 98607 |

| (800) 550-1071 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Tactical Multi-Purpose Fund |

| Management’s Discussion of Fund Performance (Unaudited) |

| |

Dear Shareholder:

Market Commentary and Outlook

After relatively steady and strong stock returns in 2021, negative market volatility resurfaced in 2022. By August 31, 2022 Global stocks declined -15% over the prior year—entering bear market territory from their January 4 high. While many headlines in June focused on stocks crossing this threshold, we argued at the time there wasn’t anything magical about the -20% mark and that investors should prepare for stocks to rebound faster than many believed. Following June’s low, Global stocks recovered over half their decline by mid-August but encountered another bout of negativity in late August. We continue to believe the best course of action is to remain disciplined and position for stocks to rebound. In our view, today’s combination of overly dour sentiment and underappreciated fundamentals sets the stage for a strong market recovery, which may already be underway. But even if stocks re-test this year’s lows, a new bull market is likely close by and ready to deliver the returns investors seeking long-term growth will need.

Coming into 2022, we anticipated a positive, back-end loaded year with frustration and grind earlier on—typical of US midterm election years. However, we did not anticipate the magnitude of the decline we’ve seen this year. In our view, this year’s market downturn has been fueled by multiple narratives converging and interacting in ways that create more uncertainty than each would on its own. We’ve seen corrections sparked by fears about wars, inflation, monetary policy, China’s economy, and COVID where investors were able to move on from these concerns reasonably quickly. Now these issues are all happening at once, which could take investors longer to wrap their heads around. But stocks don’t wait for clarity—they eventually look past present uncertainties and focus on the future, which we believe will likely be brighter than many imagine.

We believe current concerns are blinding many investors to underappreciated positive economic fundamentals. For example, Q2 2022 S&P 500 blended earnings and revenue—combining reported results with remaining consensus expectations—remain nicely positive (+6.0% y/y EPS and +12.3% y/y sales). We believe this illustrates how many companies have continued to remain profitable despite commonly cited headwinds and tough year-over-year comparisons. Additionally, data indicate American households entered 2022 relatively well positioned to weather market volatility, rising inflation and other economic hardships. For example, household liabilities as a ratio of total assets have fallen substantially since 2009 to nearly 11% and household net worth remains near all-time highs.

Inflation has spiked higher for longer than we initially expected as continued COVID disruptions, the war in Ukraine and high oil prices have all added to price pressures. With US inflation running at +8.3% y/y in August, many worry higher inflation levels are becoming entrenched. While higher prices are frustrating for consumers and month-to-month data remain volatile, we still believe inflation is likely to slow further before too long. It is unlikely inflation continues accelerating or lingers over 8% for years, in our view. This sets the stage for reality to prove better than most anticipate as inflation eventually moderates.

Supply chain issues remain a widespread concern related to inflation. Some headwinds clearly persist, but there are signs of easing. The New York Fed’s Global Supply Chain Pressure Index, which aggregates transportation costs, input-output prices and several purchasing managers’ index components, is falling from recent highs, indicating supply bottlenecks are moderating.

Fed rate hike expectations have been evolving rapidly this year as investors try to discern the Fed’s policy trajectory amid current economic uncertainty. While hyper focus on the Fed helps markets pre-price the most likely Fed moves in the near term, Fed decisions are ultimately made by a group of individuals whose choices defy exact prediction. Thus, it’s always possible the Fed does something different than widely expected. Additionally, shifting inflation expectations can also move long-term investor rates in unexpected ways. However, investors’ intense scrutiny of inflation reports and Fed moves once they are announced helps reduce the likelihood a monetary policy error would go unnoticed—lessening the surprise power of such a scenario.

As another indication credit markets appear healthy, global loan growth has been robust this year and ended June at 7.9% y/y. Banks are flush with cash and have historically high Tier 1 capital ratios, which reflect strong balance sheets and capacity to lend. We believe all this suggests credit markets are in good shape.

| Tactical Multi-Purpose Fund |

| Management’s Discussion of Fund Performance (Unaudited) – (continued) |

| |

Performance Attribution

The Tactical Multi-Purpose Fund (the “Fund”) seeks positive total returns over the long-term regardless of market conditions in the U.S. and foreign equity markets. The Fund is designed to be used by the Adviser to facilitate moving groups of clients into and out of defensive and special situation investments efficiently, based on the Adviser’s perceptions of market risks and opportunities.

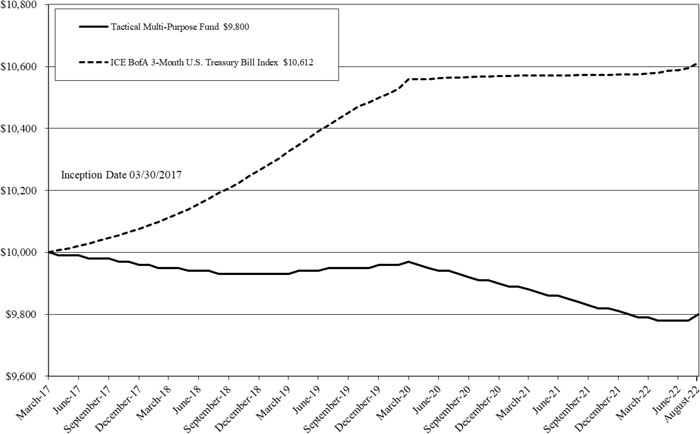

During the fiscal year ended August 31, 2022, the Adviser did not take a defensive position; therefore the Fund was limited in size, with its assets invested mostly in T-Bills and cash equivalents. The Fund returned -0.41% during the fiscal year ended August 31, 2022. During the same period, the Fund’s primary benchmark, the ICE BofA 3-month U.S. Treasury Bill Index returned 0.38%.

The Fund’s underperformance is reflective of its modest investment in T-Bills and cash equivalents for the period, which generated minimal interest. Underperformance as compared to the index is also in part due to the Fund’s 1.00% expense ratio (the performance of the index does not reflect the deduction of expenses). Due to the size of the investment, the Fund maintained a sizeable portion of the investments in cash equivalents to meet expense obligations. However, T-Bills were purchased in June 2022 with a portion of the Fund to opportunistically benefit from changes by the Fed to short rates. It is anticipated that similar returns will continue until the Adviser utilizes the Fund for defensive purposes or prevailing short-term interest rates meaningfully change.

Fisher Investments

August 2022

| Tactical Multi-Purpose Fund |

| Investment Results (Unaudited) |

Average Annual Total Returns(a)

(for the periods ended August 31, 2022) |

| | | | Since |

| | | | Inception |

| | One Year | Three Year | (3/30/17) |

| Tactical Multi-Purpose Fund | (0.41)% | (0.51)% | (0.37)% |

| ICE BofA 3-Month U.S. Treasury Bill Index(b) | 0.38% | 0.57% | 1.10% |

| Total annual operating expenses, as disclosed in the Tactical Multi-Purpose Fund (the “Fund”) prospectus dated November 30, 2021, were 635.29% of average daily net assets (1.00% after fee waivers/expense reimbursements). Fisher Asset Management, LLC, d/b/a Fisher Investments (the “Adviser”) is contractually obligated to limit the Fund’s total annual operating expenses to 1.00% of the Fund’s average daily net assets through December 31, 2026 (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business). This expense cap may not be terminated prior to this date except by the Board of Trustees. Each expense payment by the Adviser (but not management fee waiver) is subject to recoupment by the Adviser from the Fund in the three years following the date the particular expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the expense payment and any expense limitation in effect at the time of recoupment. Additional information pertaining to the Fund’s expense ratios as of August 31, 2022 can be found in the financial highlights. |

| |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 550-1071.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (b) | The ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”) is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, three months from the rebalancing date. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index. However, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month-end by calling (800) 550-1071.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

| Tactical Multi-Purpose Fund |

| Investment Results (Unaudited) – (continued) |

| |

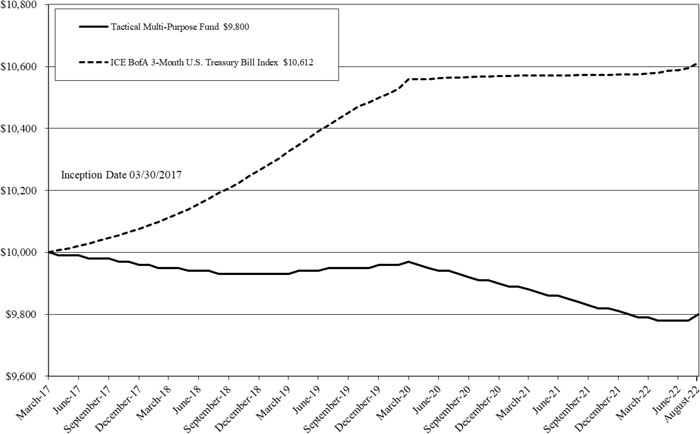

Comparison of the Growth of a $10,000 Investment in the Tactical Multi-Purpose Fund and the

ICE BofA ML 3-Month U.S. Treasury Bill Index (Unaudited)

This graph shows the value of a hypothetical initial investment of $10,000 made on March 30, 2017 (commencement of operations) and held through August 31, 2022. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The ICE BofA 3 -Month U.S. Treasury Bill Index is an unmanaged index of Treasury securities that assumes reinvestment of all income. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (800) 550-1071. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

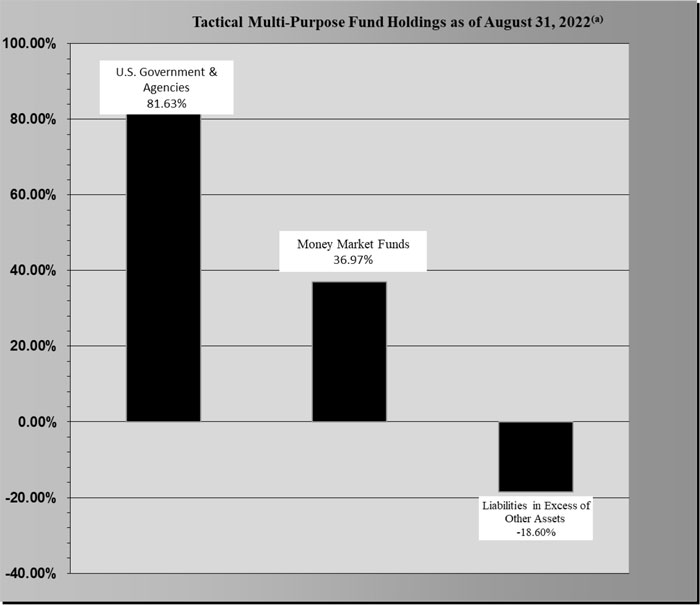

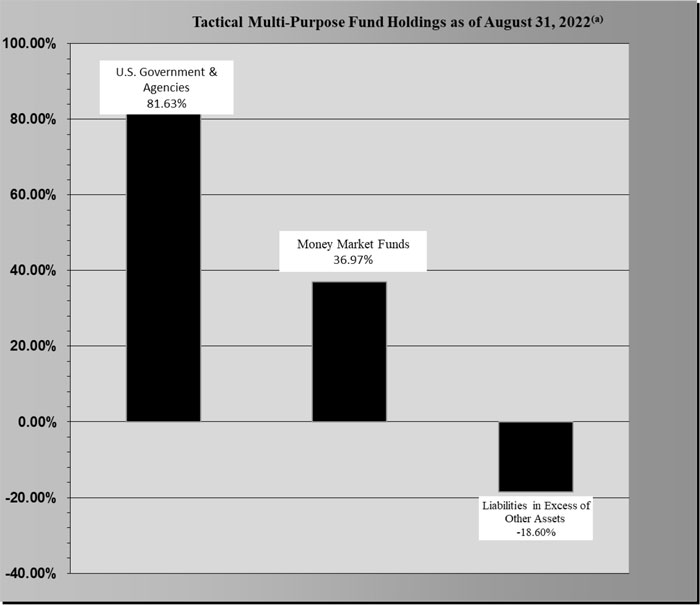

| Tactical Multi-Purpose Fund |

| Fund Holdings (Unaudited) |

| (a) | As a percentage of net assets. |

The investment objective of the Fund is to seek positive total returns over the long-term regardless of market conditions in the U.S. and foreign equity markets.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

| Tactical Multi-Purpose Fund |

| Schedule of Investments |

| August 31, 2022 |

| U.S. GOVERNMENT & AGENCIES — 81.63% | | Principal Amount | | | Fair Value | |

| | | | | | | |

| United States Treasury Bill, 1.53%, 9/8/2022(a) | | $ | 20,000 | | | $ | 19,992 | |

| | | | | | | | | |

| Total U.S. Government & Agencies (Cost $19,994) | | | | | | | 19,992 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 36.97% | | Shares | | | Fair Value | |

| | | | | | | | | |

| First American Government Obligations Fund, Class X, 2.04% (b) | | | 9,054 | | | | 9,054 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $9,054) | | | | | | | 9,054 | |

| | | | | | | | | |

| Total Investments — 118.60% (Cost $29,048) | | | | | | | 29,046 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (18.60)% | | | | | | | (4,556 | ) |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 24,490 | |

| | | | | | | | | |

| (a) | Discount security. Rate shown is the effective yield at time of purchase. |

| (b) | Rate disclosed is the seven day effective yield as of August 31, 2022. |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Statement of Assets and Liabilities |

| August 31, 2022 |

| Assets | | | | |

| Investments in securities at fair value (cost $29,048) | | $ | 29,046 | |

| Interest receivable | | | 17 | |

| Receivable from Adviser | | | 11,702 | |

| Prepaid expenses | | | 2,178 | |

| Total Assets | | | 42,943 | |

| Liabilities | | | | |

| Payable to affiliates | | | 6,360 | |

| Other accrued expenses | | | 12,093 | |

| Total Liabilities | | | 18,453 | |

| Net Assets | | $ | 24,490 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | | 24,520 | |

| Accumulated deficit | | | (30 | ) |

| Net Assets | | $ | 24,490 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,500 | |

| Net asset value, offering and redemption price per share | | $ | 9.80 | |

| | | | | |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Statement of Operations |

| For the year ended August 31, 2022 |

| Investment Income | | | | |

| Dividend income | | $ | 70 | |

| Interest income | | | 66 | |

| Total investment income | | | 136 | |

| | | | | |

| Expenses | | | | |

| Fund accounting | | | 30,003 | |

| Administration | | | 30,001 | |

| Legal | | | 22,001 | |

| Trustee | | | 14,582 | |

| Audit and tax | | | 12,250 | |

| Transfer agent | | | 12,000 | |

| Compliance services | | | 12,000 | |

| Custodian | | | 5,000 | |

| Report printing | | | 2,650 | |

| Registration | | | 352 | |

| Adviser | | | 62 | |

| Miscellaneous | | | 16,974 | |

| Total expenses | | | 157,875 | |

| Fees waived and expenses reimbursed by Adviser | | | (156,021 | ) |

| Fees reduced by Administrator | | | (1,610 | ) |

| Net operating expenses | | | 244 | |

| Net investment loss | | | (108 | ) |

| | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net change in unrealized depreciation of investment securities | | | (2 | ) |

| Net realized and change in unrealized loss on investments | | | (2 | ) |

| Net decrease in net assets resulting from operations | | $ | (110 | ) |

| | | | | |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Statements of Changes in Net Assets |

| | | For the Year | | | For the Year | |

| | | Ended August 31, | | | Ended August 31, | |

| | | 2022 | | | 2021 | |

| Decrease in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment loss | | $ | (108 | ) | | $ | (224 | ) |

| Net change in unrealized depreciation of investment securities | | | (2 | ) | | | — | |

| Net decrease in net assets resulting from operations | | | (110 | ) | | | (224 | ) |

| | | | | | | | | |

| Capital Transactions | | | | | | | | |

| Amount paid for shares redeemed | | $ | (10 | ) | | $ | — | |

| | | | | | | | | |

| Net decrease in net assets resulting from capital transactions | | | (10 | ) | | | — | |

| | | | | | | | | |

| Total Decrease in Net Assets | | | (120 | ) | | | (224 | ) |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 24,610 | | | | 24,834 | |

| End of year | | $ | 24,490 | | | $ | 24,610 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares redeemed | | | (1 | ) | | | — | |

| Net decrease in shares | | | (1 | ) | | | — | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Financial Highlights |

| |

| (For a share outstanding during each year) |

| | | For the Year | | | For the Year | | | For the Year | | | For the Year | | | For the Year | |

| | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | August 31, | | | August 31, | | | August 31, | | | August 31, | | | August 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 9.84 | | | $ | 9.93 | | | $ | 9.95 | | | $ | 9.93 | | | $ | 9.98 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.04 | ) | | | (0.09 | ) | | | (0.02 | ) | | | 0.02 | | | | (0.05 | ) |

| Net realized and unrealized gain | | | — | (a) | | | — | | | | — | (a) | | | — | (a) | | | — | |

| Total from investment operations | | | (0.04 | ) | | | (0.09 | ) | | | (0.02 | ) | | | 0.02 | | | | (0.05 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 9.80 | | | $ | 9.84 | | | $ | 9.93 | | | $ | 9.95 | | | $ | 9.93 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(b) | | | (0.41 | )% | | | (0.91 | )% | | | (0.20 | )% | | | 0.20 | % | | | (0.50 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 24 | | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | |

| Ratio of net expenses to average net assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Ratio of gross expenses to average net assets before waiver and reimbursement | | | 644.19 | % | | | 635.29 | % | | | 596.00 | % | | | 589.45 | % | | | 534.46 | % |

| Ratio of net investment income (loss) to average net assets | | | (0.44 | )% | | | (0.91 | )% | | | (0.20 | )% | | | 0.15 | % | | | (0.46 | )% |

| Portfolio turnover rate | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | | | | | | | | | | | | | | | | | |

| (a) | Rounds to less than $0.005 per share. |

| (b) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

Tactical Multi-Purpose Fund

Notes to the Financial Statements

August 31, 2022

NOTE 1. ORGANIZATION

Tactical Multi-Purpose Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a non-diversified series of Unified Series Trust (the “Trust”) on November 14, 2016. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 14, 2002 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds currently authorized by the Board. The Fund commenced operations on March 30, 2017. The investment adviser to the Fund is Fisher Asset Management, LLC, d/b/a Fisher Investments (the “Adviser”). The investment objective of the Fund is to seek positive total returns over the long-term regardless of market conditions in the U.S. and foreign equity markets.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies” including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended August 31, 2022, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the year, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to

Tactical Multi-Purpose Fund

Notes to the Financial Statements (continued)

August 31, 2022

shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

For the fiscal year ended August 31, 2022, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | | | Accumulated | |

| Paid-In Capital | | | Earnings (Deficit) | |

| $ | (231 | ) | | $ | 231 | |

NOTE 3. NON-DIVERSIFICATION RISK

The Fund is non-diversified, which means it may invest a greater percentage of its assets in a limited number of issuers as compared to other mutual funds that are more broadly diversified. As a result, the Fund’s share price may be more volatile than the share price of some other mutual funds, and the poor performance of an individual holding in the Fund’s portfolio may have a significant negative impact on the Fund’s performance.

NOTE 4. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

Tactical Multi-Purpose Fund

Notes to the Financial Statements (continued)

August 31, 2022

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Debt securities are valued by using the mean between the closing bid and ask prices provided by a pricing service. If the closing bid and ask prices are not readily available, the pricing service may provide a price determined by a matrix pricing method. Matrix pricing is a mathematical technique used to value fixed income securities without relying exclusively on quoted prices. Matrix pricing takes into consideration recent transactions, yield, liquidity, risk, credit quality, coupon, maturity, type of issue and any other factors or market data the pricing service deems relevant for the actual security being priced and for other securities with similar characteristics. These securities will generally be categorized as Level 2 securities. If the Board or the Adviser as Valuation Designee decides that a price provided by the pricing service does not accurately reflect the fair value of the securities or when prices are not readily available from a pricing service, securities are valued at fair value as determined by the Valuation Designee, in conformity with guidelines adopted by and subject to review of the Board. These securities will generally be categorized as Level 3 securities.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the -counter market are generally valued at the NASDAQ Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Valuation Designee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Valuation Designee would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair -value pricing is permitted if, in the Valuation Designee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Valuation Designee is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of August 31, 2022:

| | | Valuation Inputs | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| U.S. Government & Agencies | | $ | — | | | $ | 19,992 | | | $ | — | | | $ | 19,992 | |

| Money Market Funds | | | 9,054 | | | | — | | | | — | | | | 9,054 | |

| Total | | $ | 9,054 | | | $ | 19,992 | | | $ | — | | | $ | 29,046 | |

Tactical Multi-Purpose Fund

Notes to the Financial Statements (continued)

August 31, 2022

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund did not hold any derivative instruments during the reporting period.

NOTE 5. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

The Adviser, under the terms of the management agreement (the “Agreement”) with the Trust with respect to the Fund, manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.25% of the Fund’s average daily net assets. For the fiscal year ended August 31, 2022, the Adviser earned fees of $62 from the Fund before the waiver and reimbursement described below.

The Adviser is contractually obligated to limit the Fund’s total annual operating expenses to 1.00% of the Fund’s average daily net assets through December 31, 2026 (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the 1940 Act; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business. This expense cap may not be terminated prior to this date except by the Board.

Each expense payment by the Adviser (but not management fee waiver) is subject to recoupment by the Adviser from the Fund in the three years following the date the particular expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the expense payment and any expense limitation in effect at the time of the recoupment. As of August 31, 2022, the Adviser may seek repayment of expense reimbursements in the amounts as follows:

| Recoverable through | | | |

| August 31, 2023 | | $ | 146,296 | |

| August 31, 2024 | | | 155,999 | |

| August 31, 2025 | | | 155,959 | |

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting and transfer agent services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services.

The Administrator has agreed to waive fees to the extent necessary that the Fund’s total annual operating expenses (excluding taxes, borrowing costs such as interest and dividend expenses on securities sold short, brokerage commissions, acquired fund fees and expenses, shareholder servicing fees paid to financial intermediaries, extraordinary expenses and expenses outside the normal course of business) do not exceed $156,000 annually, based on a twelve-month period commencing April 1 and ending March 31 (the “Annual Period”). The waiver will accrue on a monthly basis such that the Fund’s operating expenses for any month during the Annual Period will not exceed the sum of $13,000 (the “Monthly Expense Cap”), provided that Ultimus may recoup any fees waived by Ultimus in a prior month during the Annual Period to the extent of any unused amount of the Monthly Expense Cap in the current month. The waiver will be suspended and forfeited in any month that the Adviser is not the sole shareholder of the Fund. During the fiscal year ended August 31, 2022, the total amount waived by the Administrator was $1,610.

Tactical Multi-Purpose Fund

Notes to the Financial Statements (continued)

August 31, 2022

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board. Prior to April 1, 2021, Ultimus provided certain compliance services and Buttonwood Compliance Partners provided the Chief Compliance Officer to the Trust.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also employees of Ultimus and such persons are not paid by the Fund for serving in such capacities.

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” as defined in the 1940 Act. Each Independent Trustee of the Trust receives annual compensation of $2,785 per fund from the Trust, except that the Chairman of the Audit Committee, the Chairman of the Governance & Nominating Committee, and the Chairman of the Pricing & Liquidity Committee each receives annual compensation of $3,235 per fund from the Trust, and the Independent Chairman of the Board receives $3,435 per fund from the Trust. Independent Trustees also receive $1,000 for attending any special meeting that requires an in person approval of a contract and $250 for the first hour and $200 for each additional hour for attending other special meetings. In addition, the Trust reimburses Independent Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings.

NOTE 6. INVESTMENT TRANSACTIONS

For the fiscal year ended August 31, 2022, there were no purchases or sales of investment securities, other than short-term investments.

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. As of August 31, 2022, the Adviser owned 100% of the Fund’s outstanding shares. As a result, the Adviser may be deemed to control the Fund.

NOTE 8. FEDERAL TAX INFORMATION

At August 31, 2022, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | — | |

| Gross unrealized depreciation | | | (2 | ) |

| Net unrealized depreciation on investments | | $ | (2 | ) |

| Tax cost of investments | | $ | 29,048 | |

Tactical Multi-Purpose Fund

Notes to the Financial Statements (continued)

August 31, 2022

At August 31, 2022, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Accumulated capital and other losses | | $ | (28 | ) |

| Unrealized depreciation on investments | | | (2 | ) |

| Total accumulated deficit | | $ | (30 | ) |

For tax purposes no distributions were paid by the Fund for the fiscal years 2021 and 2022.

Certain capital losses and specified gains realized after October 31, and net investment losses realized after December 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the Fund’s following taxable year. For the tax period ended August 31, 2022, the Fund deferred qualified late year ordinary losses in the amount of $28.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Report of Independent Registered Public Accounting Firm

To the Shareholders of Tactical Multi-Purpose Fund and

Board of Trustees of Unified Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Tactical Multi-Purpose Fund (the “Fund”), a series of Unified Series Trust, as of August 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2022, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2022, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Fisher Asset Management, LLC since 2017.

COHEN & COMPANY, LTD.

Chicago, Illinois

October 28, 2022

Liquidity Risk Management Program (Unaudited)

The Fund has adopted and implemented a written liquidity risk management program (the “Program”) as required by Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act. The Program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long -term cash flow projections; and its cash holdings and access to other funding sources. The Board approved the appointment of the Liquidity Administrator Committee, comprising certain Trust officers and employees of the Adviser. The Liquidity Administrator Committee maintains Program oversight and reports to the Board on at least an annual basis regarding the Program’s operational effectiveness through a written report (the “Report”). The Program’s most recent report, which was presented to the Board for consideration at its meeting held on August 15- 16, 2022, outlined the operation of the Program and the adequacy and effectiveness of the Program’s implementation. During the review period, the Fund did not experience unusual stress or disruption to their operations related to purchase and redemption activity. Also, during the review period the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that the Program is reasonably designed to prevent violation of the Liquidity Rule and has been effectively implemented.

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from March 1, 2022 through August 31, 2022.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | Beginning | | | Ending | | | | | | | |

| | | Account | | | Account | | | Expenses | | | | |

| | | Value | | | Value | | | Paid | | | Annualized | |

| | | March 1, | | | August 31, | | | During | | | Expense | |

| | | 2022 | | | 2022 | | | Period(a) | | | Ratio | |

| Actual | | $ | 1,000.00 | | | $ | 1,001.00 | | | $ | 5.03 | | | | 1.00 | % |

| Hypothetical(b) | | $ | 1,000.00 | | | $ | 1,020.18 | | | $ | 5.07 | | | | 1.00 | % |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

Shareholder Voting Results (Unaudited)

At a Special Shareholder Meeting at which a quorum was present, held on September 6, 2022, Fund shareholders of record as of the close of business on July 5, 2022 voted to approve the following proposal:

Proposal 1: To elect the following individuals to serve on the Board of Trustees of the Trust:

Freddie Jacobs Jr.

Catharine Barrow McGauley

Kenneth G.Y. Grant

Daniel J. Condon

Gary A. Hippenstiel

Stephen A. Little

Ronald C. Tritschler

David R. Carson

| | Shares Voted in | Shares Voted Against | Shares Needed to |

| Fund | Favor* | or Abstain* | Approve* |

| Tactical Multi-Purpose Fund | 2,501 (100%) | 0 (0.00%) | Plurality (greater than 50%) |

| * | as a percentage of the total voting securities of the Fund voted at the meeting at which a quorum was present |

Trustees and Officers (Unaudited)

GENERAL QUALIFICATIONS. The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” (as defined in the 1940 Act) of the Trust or any adviser, sub-adviser or distributor of the Trust.

The following table provides information regarding the Independent Trustees.

Name, Address*, (Year of Birth),

Position with Trust**,

Term of Position with Trust | Principal Occupation During Past 5 Years and Other

Directorships |

Daniel J. Condon (1950)

Chairman, May 2022 to present; Chairman of the Audit Committee; Chairman of the Governance & Nominating Committee, May 2020 to May 2022; Independent Trustee, December 2002 to present | Current: Retired (2017 - present); Trustee, Peak Income Plus Fund (2022 – present). |

Kenneth G.Y. Grant (1949)

Chairman of the Governance & Nominating Committee, May 2022 to present; Chairman, January 2017 to May 2022; Independent Trustee, May 2008 to present | Current: Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2019 – present); Director, Advisors Charitable Gift Fund (2020 - present), a Donor Advised Fund; Trustee, Peak Income Plus Fund (2022 – present). Previous: EVP, Benefit Plans Administrative Services, Inc., provider of retirement benefit plans administration (2019 – 2020); Director, Northeast Retirement Services (NRS) LLC, a transfer agent and fund administrator; and Director, Global Trust Company (GTC), a non-depository trust company sponsoring private investment product (2003 – 2019); EVP, NRS (2003 – 2019); GTC, EVP (2008 – 2019); EVP, Savings Banks Retirement Association (2003 – 2019), provider of qualified retirement benefit plans. |

Gary E. Hippenstiel (1947)

Chairman of the Pricing & Liquidity Committee; Independent Trustee, December 2002 to present | Current: President and founder of Hippenstiel Investment Counsel LLC (“Hippenstiel”) since 2008. Hippenstiel was registered as an investment adviser from 2008 to December 31, 2019; Trustee, Peak Income Plus Fund (2022 – present). |

Stephen A. Little (1946)

Independent Trustee, December 2002 to present; Chairman, December 2004 to December 2016 | Current: President and founder of The Rose, Inc., a registered investment adviser, since 1993; Trustee, Peak Income Plus Fund (2022 – present). |

Ronald C. Tritschler (1952)

Independent Trustee, January 2007 to present; Interested Trustee, December 2002 to December 2006 | Current: Chief Executive Officer, Director and Legal Counsel of The Webb Companies, a national real estate company, since 2001; Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2020 – present; Director of First State Bank of the Southeast (2000 – present); Trustee, Peak Income Plus Fund (2022 – present). |

Catharine B. McGauley (1977)

Independent Trustee, September 2022 to present | Current: Lead Portfolio Manager of Atlantic Charter Insurance, a workers’ compensation insurer, since 2010; Investment Councilor of a Family Office (2015 – present); Senior Analyst/Advisor for a Boston real estate company and related family (2010 – present); Trustee, Peak Income Plus Fund (2002 – present). |

Freddie Jacobs, Jr. (1970)

Independent Trustee, September 2022 to present | Current: Chief Operating Officer and Chief Risk Officer Northeast Retirement Services (NRS) LLC, a transfer agent and fund administrator; and Director, Global Trust Company (GTC), a non-depository trust company sponsoring private investment product (2021- present); Trustee of Buckingham Browne & Nichols (BBN) (2018 – present); Chair of the Finance Committee, BBN (2020 – present); Chairman Board of Directors of Crispus Attucks Fund (2020– present); Board Member and Treasurer of New England Tennis Association (2017 –present); Board Member of Camp Harbor View (2020 – present); Trustee, Peak Income Plus Fund (2002 – present). Previous: SVP, Senior Risk Officer NRS (2013 – 2019). |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 31 series. |

Trustees and Officers (Unaudited) (continued)

The following table provides information regarding the Interested Trustee and Officers of the Trust.

Name, Address*, (Year of Birth), Position

with Trust,

Term of Position with Trust | Principal Occupation During Past 5 Years and Other

Directorships |

David R. Carson (1958)

President, January 2016 to August 2021; Interested Trustee, August 2020 to present | Current: Senior Vice President Client Strategies of Ultimus Fund Solutions, LLC, since 2013; Interested Trustee of Ultimus Mangers Trust, since 2020; Trustee, Peak Income Plus Fund (2022 – present). |

Martin R. Dean (1963)

President, August 2021 to present; Vice President, November 2020 to August 2021; Chief Compliance Officer, April 2021 to August 2021; Assistant Chief Compliance Officer, January 2016 to April 2021 | Current: Senior Vice President, Head of Fund Compliance of Ultimus Fund Solutions, LLC, since 2016. |

Zachary P. Richmond (1980)

Treasurer and Chief Financial Officer, November 2014 to present | Current: Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC, since 2015. |

Gweneth K. Gosselink (1955)

Chief Compliance Officer, August 2021 to present | Current: Assistant Vice President, Senior Compliance Officer of Ultimus Fund Solutions, LLC, since 2019. Previous: Chief Operating Officer & CCO at Miles Capital, Inc. (2013 – 2019). |

Elisabeth Dahl (1962)

Secretary, May 2017 to present; Assistant Secretary, March 2016 to May 2017 | Current: Attorney, Ultimus Fund Solutions, LLC since March 2016. |

Stephen Preston (1966)

AML Compliance Officer, May 2017 to present | Current: Vice President and Chief Compliance Officer, Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC, since 2011. |

Lynn E. Wood (1946)

Assistant Chief Compliance Officer, April 2021 to present; Chief Compliance Officer, October 2004 to April 2021 | Current: Managing Member, Buttonwood Compliance Partners, LLC, since 2013. |

| * | The address for each Officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

Other Information (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (800) 550-1071 to request a copy of the SAI or to make shareholder inquiries.

PRIVACY NOTICE

Rev: January 2020

| FACTS | WHAT DOES TACTICAL MULTI-PURPOSE FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ● Social Security number ● account balances and account transactions ● transaction or loss history and purchase history When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the Fund share? | Can you limit this

sharing? |

| For our everyday business purposes— | | |

| such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes— | | |

| to offer our products and services to you | No | We don’t share |

| For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes—

information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes—

information about your creditworthiness | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| Questions? | Call (800) 550-1071 |

| Who we are |

| Who is providing this notice? | Tactical Multi-Purpose Fund Ultimus Fund Distributors, LLC (Distributor) Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ● open an account or deposit money ● make deposits or withdrawals from your account or provide account information We also collect your personal information from other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ● sharing for affiliates’ everyday business purposes—information about your creditworthiness ● affiliates from using your information to market to you ● sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ● Fisher Asset Management, LLC, d/b/a Fisher Investments, the investment adviser to the Fund, could be deemed to be an affiliate. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ● The Fund does not share your personal information with nonaffiliates so they can market to you |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

● The Fund doesn’t jointly market. |

| | |

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (800) 550-1071 and (2) in Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

Daniel J. Condon, Chairman

David R. Carson

Kenneth G.Y. Grant

Gary E. Hippenstiel

Freddie Jacobs, Jr.

Stephen A. Little

Catharine B. McGauley

Ronald C. Tritschler | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

151 N Franklin Street, Suite 575

Chicago, IL 60606 |

| | |

OFFICERS

Martin R. Dean, President

Gweneth K. Gosselink, Chief Compliance Officer Zachary P. Richmond, Treasurer and Chief Financial Officer

Lynn E. Wood, Assistant Chief

Compliance Officer | LEGAL COUNSEL

Thompson Hine LLP

312 Walnut Street, 20th Floor

Cincinnati, OH 45202 |

| | |

INVESTMENT ADVISER

Fisher Asset Management, LLC

5525 NW Fisher Creek Drive

Camas, WA 98607 | CUSTODIAN

U.S. Bank, N.A.

425 Walnut Street

Cincinnati, OH 45202 |

| | |

DISTRIBUTOR

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 | ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC

Member FINRA/SIPC

FISHER INVESTMENTS INSTITUTIONAL GROUP FUND FAMILY |

Annual Report

August 31, 2022

Fisher Investments Institutional Group

Stock Fund for Retirement Plans

Fisher Investments Institutional Group

ESG Stock Fund for Retirement Plans

Fisher Investments Institutional Group

Fixed Income Fund for Retirement Plans

Fisher Investments Institutional Group

ESG Fixed Income Fund for Retirement Plans

Fund Adviser:

Fisher Asset Management, LLC

5525 NW Fisher Creek Drive,

Camas, Washington 98607

(800) 851-8845

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited)

Dear Shareholder:

Market Outlook

Global developed equities (MSCI World) extended their decline in Q2, ending 2022’s first half down -19.6%. Developed markets (MSCI World ex-US) hit a new low on June 17, down -22.5% since September 6, 2021’s high—past the -20% threshold commonly used to determine bear markets. Though more declines are possible in the near term, we still believe this market downturn is sentiment-driven, with a myriad of concerning headlines, from the Russia – Ukraine war to China’s COVID restrictions and elevated inflation, weighing heavily on investors’ moods. In our view, a rebound is more likely than an extended downturn, and we expect a recovery to start sooner than many anticipate.

Elevated inflation continued dominating headlines across the developed world in Q2. For instance, UK Consumer Price Index (CPI) rose 9.0% y/y in April, accelerating from March’s 7.0%, while the eurozone’s harmonized index of consumer prices (HICP) sped from 7.4% y/y in April to 8.1% in May. High prices are a burden on companies and households alike, and the war in Ukraine added supply-side price spikes—so elevated inflation may linger. But this is largely a supply issue, so despite plenty of calls for central banks to do something, monetary tools can’t resolve supply bottlenecks, reopen Chinese ports or bring energy online immediately. Moreover, elevated inflation isn’t automatically bad for equities. Last year, Europe, Australasia and Far East (EAFE), UK and eurozone were all nicely positive even as CPI accelerated throughout the year. Although sentiment may be hitting equities so far this year, we see no fundamental reason equities can’t continue overcoming inflation.

Recession fears led to value-oriented sectors—namely Materials—underperforming late in Q2, a reversal from its big outperformance in Q1. Where fears of supply shortages drove commodity prices higher earlier in the year—benefiting Materials— the sector fell on expectations for a recession to destroy demand in the near term. Other cyclical sectors and industries, including Industrials and Banks, also underperformed. In our view, there is mounting evidence that equities are pricing in a potential shallow recession—likely limiting the surprise power if this comes to pass.

Energy outperformed during Q2, but also retreated toward the end of Q2. While we think recent negative sentiment’s impact on oil prices is perhaps overdone, the late quarter decline illustrates why early-year fears of indefinitely high and rising oil prices were off base. They extrapolated a potential acute supply shortage forward without acknowledging the potential for production to rise and demand to fluctuate. For example, focus on projected shortages overlooks other sources of supply, whether

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

from other countries (such as the US) or black and grey markets. Russian producers have found ways to work around sanctions like obscuring their oil’s origins or transferring products at sea. Additionally, it isn’t clear that Russian oil refined in third countries is subject to sanctions—a loophole refineries in India are reportedly exploiting already. In our view, supply and demand in oil markets likely will be in better balance than many believe and we don’t think a recession is likely to destroy oil demand. However, we do think oil prices are likely to stay range-bound for the foreseeable future, making Energy’s early-year run unlikely to last.

As for recession, it is possible, but data released thus far doesn’t indicate the developed world is necessarily in one already. Purchasing managers’ indexes (PMIs) for the UK, eurozone and Japan remained expansionary in June, albeit with eurozone surveys signaling slower growth. UK monthly GDP also contracted again in April, its second straight decline, although this stemmed primarily from the end of COVID testing and tracing and the vaccination drive. Yet there were also plenty of positive data, which— combined with PMIs—point to a global economy that is muddling through the extant headwinds, with pockets of strength counterbalancing the weak areas. Yet with several eurozone nations dealing with Russia’s increasingly widespread clampdown on natural gas flows—and warning of potential energy rationing this winter—recession could emerge in the months ahead. We aren’t blind to this possibility, and neither are equities, whose decline this year has coincided with escalating economic fear.

Italian equities fell -17.6% in Q2 on renewed concerns regarding the country’s debt. Italy’s 10-year government bond yields climbed past 3% in late May, and after the European Central Bank (ECB) didn’t address Italian debt at its regularly scheduled June meeting—and discussed hiking its policy rate later in the summer—the Italian 10-year BTP yield crossed over 4% seemingly tied to negative sentiment. That prompted an emergency ECB meeting on June 15 where officials discussed an “anti-fragmentation instrument” to address the divergence in eurozone nations’ borrowing costs. While details remain scant, many pundits think the ECB’s response will resemble its Outright Monetary Transactions (OMT) program along with altering the geographic breakdown of its bond portfolio. For instance, the central bank may invest the proceeds of one nation’s maturing bonds into Italian bonds.

The dialogue surrounding the ECB’s plans overstates the concerns surrounding Italian debt, in our view. The most pressing question about debt isn’t the amount outstanding but a country’s ability to service its obligations by making its interest payments. As of Q1’s end, Italy’s interest payments comprised 12.4% of tax revenues, down from around 20% during the eurozone sovereign debt crisis—and much lower than the 40% levels in the mid-1990s. As of the end of 2021, the average maturity of Italian debt was just over 7 years, so even if rates climb and stay higher, they aren’t likely

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

to cause problems overnight. In our view, Italy offers an opportunity for uncertainty to fall, especially since the country isn’t in economic jeopardy. Since hitting 4% in mid-June, 10-year Italian bond yields have eased, ending the month at 3.29%. Should reality prove better than feared, that positive outcome can boost sentiment higher.

France’s legislative elections yielded unexpected results. President Emmanuel Macron’s Together! bloc won 245 seats, falling short of the 289 necessary for a parliamentary majority. While that wasn’t surprising, other parties’ results contrasted with poll projections. Many forecast the leftist alliance known as Nupes to benefit most from any Together! losses, but after winning just 131 seats collectively, the four parties comprising the group decided to form their own parliamentary groups rather than combine forces under leftist leader Jean-Luc Mélenchon’s France Unbowed party. The splintered leftist alliance left Marine Le Pen’s National Rally—whose parliamentary seats jumped from 8 to 89, surprising many observers—the single-largest opposition party. Since the vote, President Macron carried out a limited reshuffle of his cabinet, with no opponents joining his camp, and his minority government will have to negotiate on a bill-by-bill basis with the opposition. This doesn’t mean President Macron and the French legislature won’t pass anything, but it looks unlikely contentious items, including pension reform, will sail through. Despite the recent discussion of bills aimed at workers getting a share of dividends paid to shareholders, it is unclear whether this can pass—or if President Macron would even try. In our view, gridlock looks likely in France’s political future—an outcome equities like, as it reduces uncertainty.

Hong Kong equities only fell slightly in Q2, -1.1%, though with volatility. The special administrative region’s outperformance was likely tied to mainland developments, as China scaled back many COVID measures, including travel restrictions. Hong Kong equities likely rose late in Q2 in sympathy with mainland equities as regulators relaxed their tough approach to China’s tech sector—a source of lingering uncertainty for past 12 months. The mid-June rally also coincided with the release of May Chinese economic data, including widely watched industrial production (0.7% y/y) and retail sales (-6.7% y/y)—both better than consensus expectations. Hong Kong’s prospects are tied to the mainland, and in our view, there is room for uncertainty to fall ahead. While many focus on the possibility of new lockdowns, the government likely prioritizes economic stability ahead of autumn’s National People Congress. A return to normal—an underappreciated positive—seems to go overlooked by many.

Japanese equities fell in line with other developed markets in Q2. Headlines highlighted several stories, including the Bank of Japan’s ineffective and arguably counterproductive policy; the weak yen’s weighing on businesses and households due to expensive imported energy (and not to mention international investors’ returns);

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

and developments ahead of July’s upper house election. However, one widely overlooked potential positive long-term development: giant industrial conglomerate Toshiba agreed to add two directors from activist hedge fund investors. Japanese conglomerates have long struggled with improving corporate governance. Though former Prime Minister Shinzo Abe implemented some reforms, change has been glacial, especially among biggest conglomerates, due largely to cross-shareholdings insulating boards from outside influence. The announcement at Toshiba is perhaps a sign of progress on that front, though it doesn’t mean a sea change is underway. We have long argued Japanese conglomerates’ resistance to corporate governance reform is a long-running structural headwind, as change would encourage creative destruction that could help free up stagnant business.

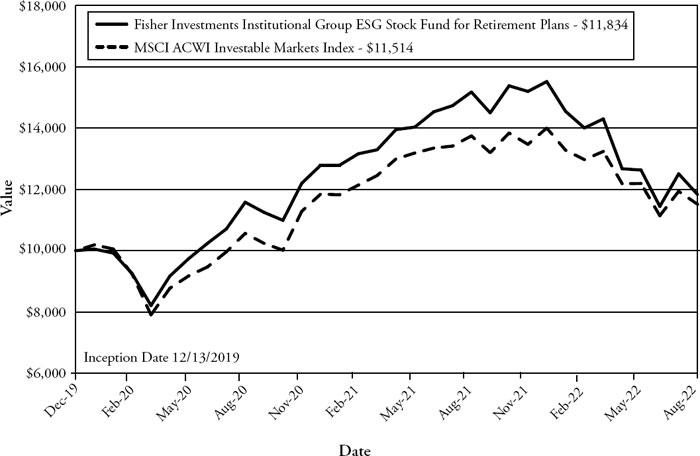

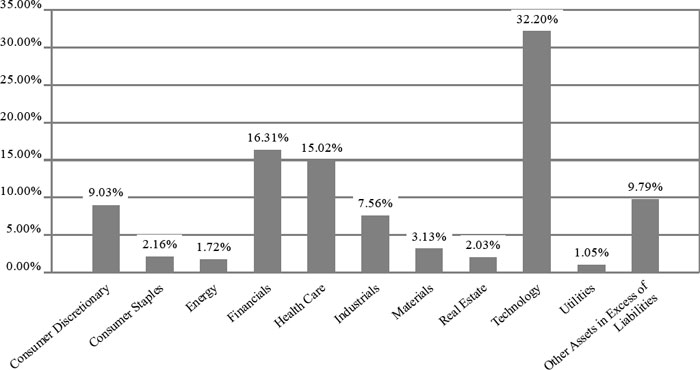

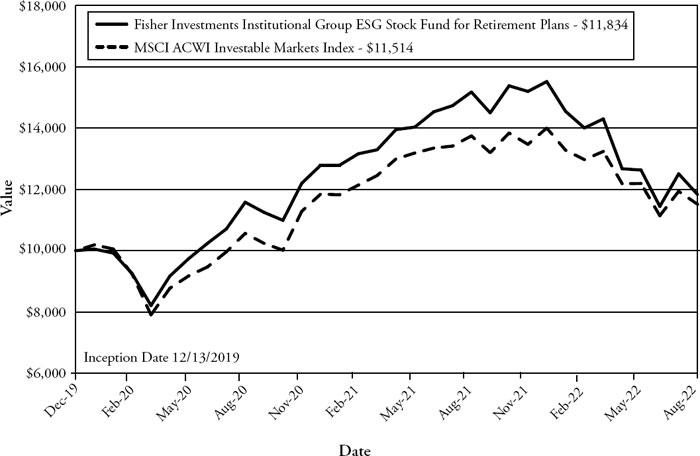

Fisher Investments Institutional Group Stock Fund for Retirement Plans

Performance Attribution

The Fisher Investments Institutional Group Stock Fund for Retirement Plans underperformed the MSCI ACWI Investable Markets Index for the one-year period ended August 31, 2022. During this period, the Fund returned -22.55% while the Fund’s primary benchmark, the MSCI ACWI Investable Markets Index, returned -16.24%. Country and sector allocation as well as equity selection detracted from relative return. An overweight to and selection within Energy was the largest contributor to relative return, driven by natural gas company ExxonMobil, oil company Chevron and petroleum refineries company Marathon Oil. Additionally, a strategic lack of exposure to Sweden contributed to fund performance, as the country underperformed the MSCI ACWI Investable Markets Index. Conversely, stock selection within United States was the largest detractor, driven by semiconductor company Nvidia, medical device company Align Technology and multinational conglomerate Alphabet. Further, an overweight to and selection within Information Technology detracted, as computer software company Adobe, semiconductor manufacturers ASML and Taiwan Semiconductor Manufacturing underperformed relative to sector peers.

Portfolio Shifts