united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive. Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 03/31

Date of reporting period: 03/31/22

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Absolute Core Strategy ETF (ABEQ)

NYSE Arca, Inc.

Annual Report

March 31, 2022

Fund Adviser:

Absolute Investment Advisers, LLC

4 North Street, Suite 2

Hingham, MA 02043

1 -833-CORE ETF (267-3383)

| Management Discussion of Fund Performance – (Unaudited) |

For the year ended March 31, 2022, the Absolute Core Equity ETF (ABEQ) returned 14.66%. By comparison, the S&P 500 Index returned 15.65%.

Berkshire Hathaway, Pfizer, and Enbridge were the largest gainers during the period. Unilever, Comcast, and Starbucks were detractors.

ABEQ utilizes a bottoms up fundamentally driven strategy focused on a concentrated group of individual equities. Over the past year, the Fund was helped by central banks beginning the process of intervening less in financial markets allowing individual company dynamics to be more influential towards share prices.

Our view is that this may continue since the central bank has now painted itself into a corner. High consumer inflation complicates the headwinds presented by record valuations. The last time that the consumer price index (CPI), the Government’s measure of inflation, stood at 7.9% was back in 1982. However, the federal funds rate (the overnight bank lending rate) in the summer of 1982 stood at 10%. Today, the federal funds target rate is only 0.50%--the Federal Reserve has never fallen further behind the yield curve. The longer the Federal Reserve waits to raise interest rates to a level more appropriate with the current rate of inflation, the more likely it becomes forced to do so in an aggressive manner, one that may shock complacent investors. Whether it was ignorance or overconfidence, enabling the “buy the dip” mantra among investors now hinders the central bank’s ability to tighten financial conditions to levels required to address today’s rate of inflation.

Despite the obscene valuations in the overall market, today there are extraordinary bargains for the thoughtful, contrarian investor. Further, market drawdowns reward patient investors, offering opportunities to shop on sale when others panic. While one can only speculate about future market price movements, investors can remain focused on what they do control—their emotions and their actions. Or, as Benjamin Graham said, “Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal.”

| Investment Results (Unaudited) |

Average Annual Total Returns* as of March 31, 2022

| | | | | Since |

| | | | | Inception |

| | | | | January 21, |

| | | One Year | | 2020 |

| Absolute Core Strategy ETF - NAV | | 14.66% | | 9.09% |

| Absolute Core Strategy ETF - Market Price | | 14.77% | | 9.16% |

| S&P 500® Index(a) | | 15.65% | | 17.09% |

Total annual operating expenses, as disclosed in the Absolute Core Strategy ETF’s (the “Fund”) prospectus dated July 29, 2021, were 0.85% of average daily net assets (1.51% before fee waivers/ expense reimbursements by Absolute Investment Advisers, LLC (the “Adviser”)). The Adviser contractually has agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business, do not exceed 0.85% of the Fund’s average daily net assets through July 31, 2024. This expense cap may not be terminated prior to this date except by the Board of Trustees. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. Additional information pertaining to the Fund’s expense ratios (not including acquired fund fees and expenses) as of March 31, 2022 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (833) 267-3383. The Fund’s per share net asset value (“NAV”) is the value of one share of the Fund as calculated in accordance with the standard formula for valuing shares. The NAV return is based on the NAV of the Fund and the market return is based on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest offer on the primary stock exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at Market Price and NAV, respectively. Since exchange-traded funds are bought and sold at prices set by the market, which can result in a premium or discount to NAV, the returns calculated using Market Price can differ from those calculated using NAV.

| Investment Results (Unaudited) (continued) |

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (a) | The S&P 500 Total Return Index (“Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling (833) 267-3383. Please read it carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, member FINRA/SIPC

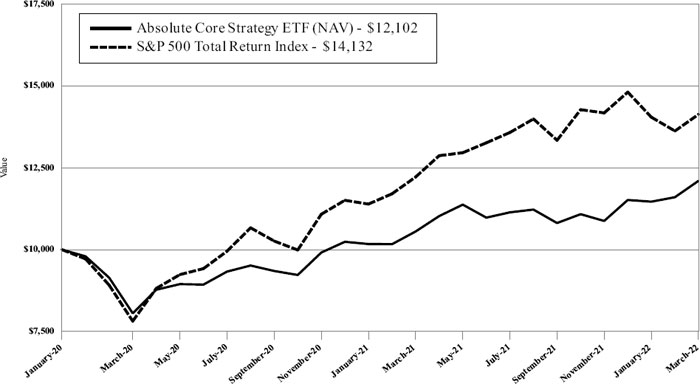

| Investment Results (Unaudited) (continued) |

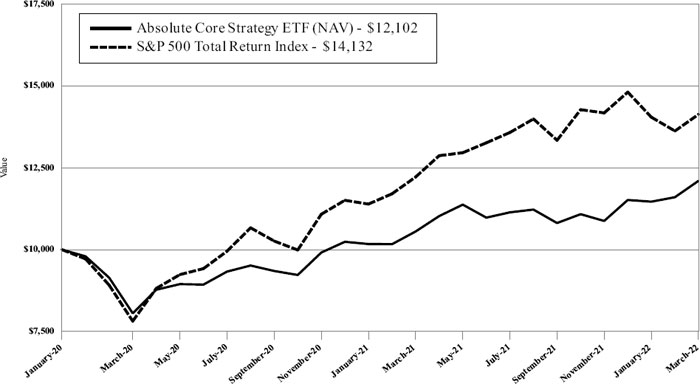

Comparison of the Growth of a $10,000 Investment in the Absolute Core Strategy ETF and the S&P 500® Total Return Index (Unaudited)

The graph shows the value of a hypothetical initial investment of $10,000 made on January 21, 2020 (commencement of operations) and held through March 31, 2022.

The S&P 500 Total Return Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (833) 267-3383. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, Member FINRA/SIPC.

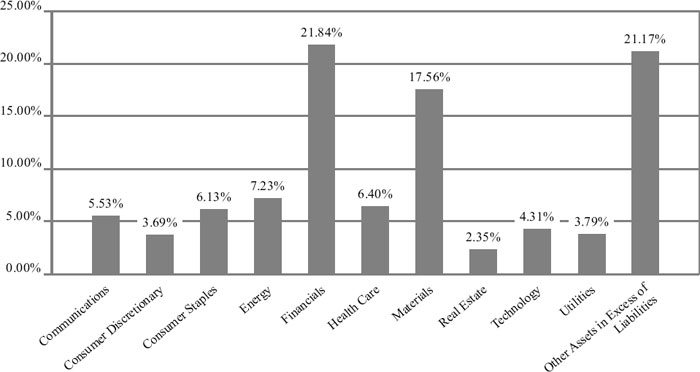

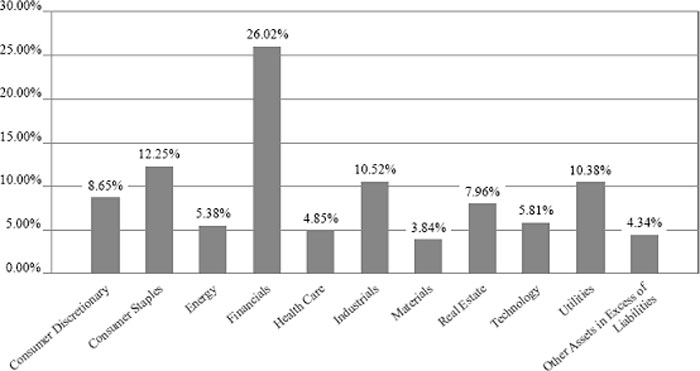

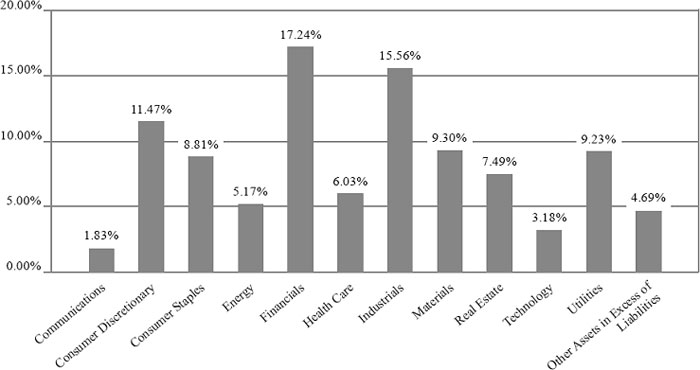

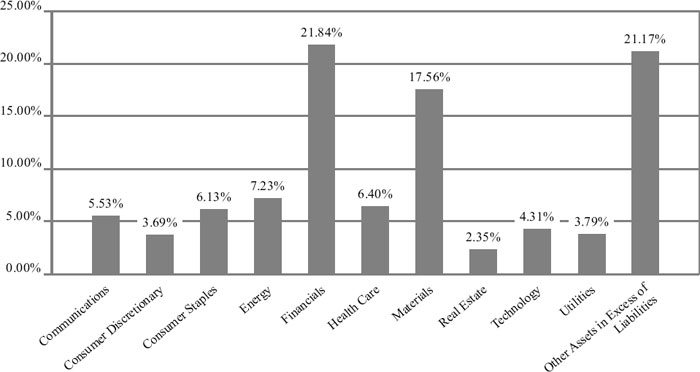

| Fund Holdings (Unaudited) |

Absolute Core Strategy ETF Holdings as of March 31, 2022.*

| * | As a percentage of net assets. |

As its investment objective, of the Absolute Core Strategy ETF (the “Fund”) seeks positive absolute returns.

Portfolio holdings are subject to change.

Availability of Portfolio Schedule (Unaudited)

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http:// www.sec.gov or on the Fund’s website at https://absoluteadvisers.com/.

| Absolute Core Strategy ETF |

| Schedule of Investments |

| March 31, 2022 |

| Common Stocks — 78.83% | | Shares | | | Fair Value | |

| Canada — 15.08% | | | | | | | | |

| Energy — 4.89% | | | | | | | | |

| Enbridge, Inc. | | | 68,273 | | | $ | 3,146,703 | |

| | | | | | | | | |

| Materials — 10.19% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 62,573 | | | | 3,831,971 | |

| Barrick Gold Corp. | | | 110,560 | | | | 2,712,037 | |

| | | | | | | | 6,544,008 | |

| Total Canada | | | | | | | 9,690,711 | |

| | | | | | | | | |

| Ireland — 2.82% | | | | | | | | |

| Health Care — 2.82% | | | | | | | | |

| Medtronic PLC | | | 16,342 | | | | 1,813,145 | |

| | | | | | | | | |

| Total Ireland | | | | | | | 1,813,145 | |

| | | | | | | | | |

| United Kingdom — 3.26% | | | | | | | | |

| Consumer Staples — 3.26% | | | | | | | | |

| Unilever PLC - ADR | | | 45,862 | | | | 2,089,932 | |

| | | | | | | | | |

| Total United Kingdom | | | | | | | 2,089,932 | |

| | | | | | | | | |

| United States — 57.67% | | | | | | | | |

| Communications — 5.53% | | | | | | | | |

| Comcast Corp., Class A | | | 24,610 | | | | 1,152,240 | |

| Verizon Communications, Inc. | | | 47,174 | | | | 2,403,044 | |

| | | | | | | | 3,555,284 | |

| Consumer Discretionary — 3.69% | | | | | | | | |

| Graham Holdings Co., Class B | | | 1,327 | | | | 811,421 | |

| Starbucks Corp. | | | 9,373 | | | | 852,661 | |

| TJX Cos., Inc. (The) | | | 11,693 | | | | 708,362 | |

| | | | | | | | 2,372,444 | |

| Consumer Staples — 2.87% | | | | | | | | |

| Ingredion, Inc. | | | 21,183 | | | | 1,846,098 | |

| | | | | | | | | |

| Energy — 2.34% | | | | | | | | |

| EOG Resources, Inc. | | | 12,587 | | | | 1,500,748 | |

| | | | | | | | | |

| Financials — 21.84% | | | | | | | | |

| Alleghany Corp.(a) | | | 2,422 | | | | 2,051,434 | |

| Berkshire Hathaway, Inc., Class B(a) | | | 17,802 | | | | 6,282,505 | |

| Loews Corp. | | | 53,494 | | | | 3,467,481 | |

| Travelers Cos., Inc. (The) | | | 12,177 | | | | 2,225,103 | |

| | | | | | | | 14,026,523 | |

| Health Care — 3.58% | | | | | | | | |

| Merck & Co., Inc. | | | 28,045 | | | | 2,301,092 | |

| | | | | | | | | |

| Materials — 7.37% | | | | | | | | |

| Corteva, Inc. | | | 39,966 | | | | 2,297,246 | |

| DuPont de Nemours, Inc. | | | 33,158 | | | | 2,439,765 | |

| | | | | | | | 4,737,011 | |

| Real Estate — 2.35% | | | | | | | | |

| Equity Commonwealth(a) | | | 25,908 | | | | 730,865 | |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Schedule of Investments (continued) |

| March 31, 2022 |

| Common Stocks — 78.83% (continued) | | Shares | | | Fair Value | |

| United States — 57.67% (continued) | | | | | | | | |

| Real Estate — 2.35% - continued | | | | | | | | |

| Jones Lang LaSalle, Inc.(a) | | | 3,243 | | | $ | 776,568 | |

| | | | | | | | 1,507,433 | |

| Technology — 4.31% | | | | | | | | |

| Cisco Systems, Inc. | | | 33,207 | | | | 1,851,622 | |

| Guidewire Software, Inc.(a) | | | 9,676 | | | | 915,543 | |

| | | | | | | | 2,767,165 | |

| Utilities — 3.79% | | | | | | | | |

| Dominion Energy, Inc. | | | 28,627 | | | | 2,432,436 | |

| Total United States | | | | | | | 37,046,234 | |

| | | | | | | | | |

| Total Common Stocks/Investments — 78.83% (Cost $41,643,274) | | | | | | | 50,640,022 | |

| Other Assets in Excess of Liabilities — 21.17% | | | | | | | 13,603,372 | |

| Net Assets — 100.00% | | | | | | $ | 64,243,394 | |

| (a) | Non-income producing security. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

Absolute Core Strategy ETF Statement of Assets and Liabilities |

| March 31, 2022 |

| Assets | | | | |

| Investments in securities, at fair value (cost $41,643,274) | | $ | 50,640,022 | |

| Cash | | | 11,774,140 | |

| Receivable for fund shares sold | | | 753,880 | |

| Receivable for investments sold | | | 1,625,067 | |

| Dividends receivable | | | 48,064 | |

| Tax reclaims receivable | | | 51,891 | |

| Prepaid expenses | | | 2,766 | |

| Total Assets | | | 64,895,830 | |

| Liabilities | | | | |

| Payable for investments purchased | | | 590,089 | |

| Payable to Adviser, net of waiver | | | 23,929 | |

| Payable to affiliates | | | 13,417 | |

| Other accrued expenses | | | 25,001 | |

| Total Liabilities | | | 652,436 | |

| Net Assets | | $ | 64,243,394 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 55,516,798 | |

| Accumulated earnings | | | 8,726,596 | |

| Net Assets | | $ | 64,243,394 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,150,000 | |

| Net asset value per share | | $ | 29.88 | |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Statement of Operations |

| For the year ended March 31, 2022 |

| Investment Income | | | |

| Dividend income (net of foreign taxes withheld of $39,535) | | $ | 896,865 | |

| Total investment income | | | 896,865 | |

| Expenses | | | | |

| Adviser | | | 447,938 | |

| Administration | | | 53,004 | |

| Compliance services | | | 27,048 | |

| Legal | | | 24,032 | |

| Audit and tax | | | 18,607 | |

| Custodian | | | 18,387 | |

| Trustee | | | 14,463 | |

| Report printing | | | 9,526 | |

| Transfer agent | | | 7,657 | |

| Insurance | | | 2,143 | |

| Pricing | | | 661 | |

| Miscellaneous | | | 30,724 | |

| Total expenses | | | 654,190 | |

| Fees waived by Adviser | | | (205,812 | ) |

| Net operating expenses | | | 448,378 | |

| Net investment income | | | 448,487 | |

| | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain (loss) on: | | | | |

| Investment securities | | | 2,774,737 | |

| Foreign currency translations | | | (741 | ) |

| Change in unrealized appreciation on: | | | | |

| Investment securities | | | 4,112,356 | |

| Foreign currency translations | | | 137 | |

| Net realized and unrealized gain (loss) on investment securities and foreign currency translations | | | 6,886,489 | |

| Net increase in net assets resulting from operations | | $ | 7,334,976 | |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Statements of Changes in Net Assets |

| | | For the Year | | | For the Year | |

| | | Ended March 31, | | | Ended March 31, | |

| | | 2022 | | | 2021 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 448,487 | | | $ | 188,643 | |

| Net realized gain on investment securities and foreign currency translations | | | 2,773,996 | | | | 985,128 | |

| Change in unrealized appreciation on investment securities | | | 4,112,493 | | | | 7,054,715 | |

| Net increase in net assets resulting from operations | | | 7,334,976 | | | | 8,228,486 | |

| Distributions to Shareholders From: | | | | | | | | |

| Earnings | | | (329,315 | ) | | | (212,839 | ) |

| Total distributions | | | (329,315 | ) | | | (212,839 | ) |

| | | | | | | | | |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 20,651,378 | | | | 21,233,292 | |

| Amount paid for shares redeemed | | | (9,300,348 | ) | | | (5,513,094 | ) |

| Net increase in net assets resulting from capital transactions | | | 11,351,030 | | | | 15,720,198 | |

| Total Increase in Net Assets | | | 18,356,691 | | | | 23,735,845 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | $ | 45,886,703 | | | $ | 22,150,858 | |

| End of year | | $ | 64,243,394 | | | $ | 45,886,703 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 725,000 | | | | 875,000 | |

| Shares redeemed | | | (325,000 | ) | | | (225,000 | ) |

| Net increase in shares outstanding | | | 400,000 | | | | 650,000 | |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Financial Highlights |

| (For a share outstanding during each period) |

| | | For the | | | For the | | | For the | |

| | | Year | | | Year | | | Period | |

| | | Ended | | | Ended | | | Ended | |

| | | March 31, | | | March 31, | | | March 31, | |

| | | 2022 | | | 2021 | | | 2020(a) | |

| Selected Per Share Data: | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 26.22 | | | $ | 20.14 | | | $ | 25.00 | |

| Investment operations: | | | | | | | | | | | | |

| Net investment income | | | 0.22 | | | | 0.13 | | | | 0.03 | |

| Net realized and unrealized gain (loss) on investments | | | 3.61 | | | | 6.10 | | | | (4.89 | ) |

| Total from investment operations | | | 3.83 | | | | 6.23 | | | | (4.86 | ) |

| Less distributions to shareholders from: | | | | | | | | | | | | |

| Net investment income | | | (0.17 | ) | | | (0.15 | ) | | | — | |

| Total distributions | | | (0.17 | ) | | | (0.15 | ) | | | — | |

| Net asset value, end of period | | $ | 29.88 | | | $ | 26.22 | | | $ | 20.14 | |

| Market price, end of period | | $ | 29.92 | | | $ | 26.23 | | | $ | 20.21 | |

| | | | | | | | | | | | | |

| Total Return(b) | | | 14.66 | % | | | 31.02 | % | | | (19.44 | )% (c) |

| | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 64,243 | | | $ | 45,887 | | | $ | 22,151 | |

| Ratio of net expenses to average net assets | | | 0.85 | % | | | 0.85 | % | | | 0.85 | % (d) |

| Ratio of expenses to average net assets before waiver and reimbursement | | | 1.24 | % | | | 1.51 | % | | | 3.88 | % (d) |

| Ratio of net investment income to average net assets | | | 0.85 | % | | | 0.58 | % | | | 1.40 | % (d) |

| Portfolio turnover rate(e) | | | 23 | % | | | 36 | % | | | 30 | % (c) |

| (a) | For the period January 21, 2020 (commencement of operations) to March 31, 2020. |

| (b) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (e) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Notes to the Financial Statements |

| March 31, 2022 |

NOTE 1. ORGANIZATION

Absolute Core Strategy ETF (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a non-diversified series of Unified Series Trust (the “Trust”) on August 20, 2019. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 14, 2002, as amended from time to time (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Absolute Investment Advisers LLC (the “Adviser”). The Adviser has retained St. James Investment Company, LLC (the “Sub-Adviser”) to serve as Sub-Adviser to the Fund. As its investment objective, the Fund seeks positive absolute returns.

Non-Diversification Risk – The Fund is non-diversified, which means it may invest a greater percentage of its assets in a fewer number of stocks as compared to other mutual funds that are more broadly diversified. As a result, the Fund’s share price may be more volatile than the share price of some other mutual funds, and the poor performance of an individual stock in the Fund’s portfolio may have a significant negative impact on the Fund’s performance.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”, including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2022 |

in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the realized and unrealized gain or loss from investments. Net realized gain (loss) on foreign currency translations on the Statement of Operations represents currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amount of investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. The change in unrealized currency gains (losses) on foreign currency translations for the period is reflected in the Statement of Operations.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended March 31, 2022, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the year, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three years tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Distributions received from investments in real estate investment trusts (“REITs”) that represent a return of capital or capital gain are recorded as a reduction of the cost of investment or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2022 |

included in distributions received from the Fund’s investments in REITs are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported. Estimates are based on the most recent REIT distributions information available. Withholding taxes on foreign dividends and related reclaims have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, if any, at least semi-annually. The Fund intends to distribute its net realized long-term and short-term capital gains, if any, annually. Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

For the fiscal year ended March 31, 2022, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | | | Accumulated Earnings | |

| Paid-In Capital | | | (Deficit) | |

| $ | 2,503,554 | | | $ | (2,503,554 | ) |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable.

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2022 |

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

In accordance with the Trust’s valuation policies, the Adviser and/or Sub-Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2022 |

security being valued by the Adviser and/or Sub-Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser and/or Sub-Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser and/or Sub-Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of March 31, 2022:

| | | Valuation Inputs | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks (a) | | $ | 50,640,022 | | | $ | — | | | $ | — | | | $ | 50,640,022 | |

| Total | | $ | 50,640,022 | | | $ | — | | | $ | — | | | $ | 50,640,022 | |

| (a) | Refer to Schedule of Investments for sector classifications. |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Adviser, under the terms of the management agreement with the Trust with respect to the Fund (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.85% of the Fund’s average daily net assets. For the fiscal year ended March 31, 2022, before the waiver described below, the Adviser earned a fee of $447,938 from the Fund.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2022 |

and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the 1940 Act; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business) do not exceed 0.85% of the Fund’s average daily net assets through July 31, 2024. For the fiscal year ended March 31, 2022, the Adviser waived fees of $205,812. At March 31, 2022, the Fund owed the Adviser $23,929.

Each fee waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date in which that particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. As of March 31, 2022 the Adviser may seek repayment of investment advisory fees waived and expense reimbursements pursuant to the aforementioned conditions, from the Fund no later than the dates stated below:

| Recoverable Through | | | |

| March 31, 2023 | | $ | 59,995 | |

| March 31, 2024 | | | 217,326 | |

| March 31, 2025 | | | 205,812 | |

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration and fund accounting services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board.

Under the terms of a Distribution Agreement with the Trust, Northern Lights Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is an affiliate of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also employees of Ultimus and such persons are not paid by the Fund for serving in such capacities.

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2022 |

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” as defined in the 1940 Act. Each Independent Trustee of the Trust receives annual compensation of $2,785 per fund from the Trust, except that the Chairman of the Audit Committee, the Chairman of the Governance & Nominating Committee, and the Chairman of the Pricing & Liquidity Committee each receives annual compensation of $3,235 per fund from the Trust, and the Independent Chairman of the Board receives $3,435 per fund from the Trust. Independent Trustees also receive $1,000 for attending any special meeting that requires an in person approval of a contract and $250 for the first hour and $200 for each additional hour for attending other special meetings. In addition, the Trust reimburses Independent Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings.

NOTE 5. INVESTMENT TRANSACTIONS

For the fiscal year ended March 31, 2022, purchases and sales of investment securities, other than short-term investments, were $9,931,771 and $11,450,344, respectively.

For the fiscal year ended March 31, 2022, purchases and sales for in-kind transactions were $16,560,238 and $8,451,847, respectively.

For the fiscal year ended March 31, 2022, the Fund had in-kind net realized gains of $2,503,554.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended March 31, 2022.

NOTE 6. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. As of March 31, 2022, Tectonic Advisors LLC owned 30.07% of the Fund’s outstanding shares. As a result, Tectonic Advisors LLC may be deemed to control the Fund.

NOTE 7. CAPITAL SHARE TRANSACTIONS

Shares are not individually redeemable and may be redeemed by the Fund at NAV only in large blocks known as “Creation Units.” Only Authorized Participants or transactions done through an Authorized Participant are permitted to purchase or redeem Creation Units from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2022 |

National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Such transactions are generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the NAV per share of the Fund on the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in sufficient quantity for delivery, not eligible for trading by the Authorized Participant or as a result of other market circumstances. In addition, the Fund may impose transaction fees on purchases and redemptions of Fund shares to cover the custodial and other costs incurred by the Fund in effecting trades. A fixed fee payable to the Custodian may be imposed on each creation and redemption transaction regardless of the number of Creation Units involved in the transaction (“Fixed Fee”). Purchases and redemptions of Creation Units for cash or involving cash-in-lieu are required to pay an additional variable charge to compensate the Fund and its ongoing shareholders for brokerage and market impact expenses relating to Creation Unit transactions (“Variable Charge,” and together with the Fixed Fee, the “Transaction Fees”). Transactions in capital shares for the Fund are disclosed in the Statement of Changes in Net Assets. For the fiscal year ended March 31, 2022, the Fund received $3,750 and $0 in fixed fees and variable fees, respectively. The Transaction Fees for the Fund are listed in the table below:

| Fixed Fee | | Variable Charge |

| $250 | | 2.00%* |

| * | The maximum Transaction Fee may be up to 2.00% of the amount invested. |

NOTE 8. FEDERAL TAX INFORMATION

At March 31, 2022, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 9,470,019 | |

| Gross unrealized depreciation | | | (474,738 | ) |

| Net unrealized appreciation on investments | | $ | 8,995,281 | |

| Tax cost of investments | | $ | 41,644,741 | |

The tax character of distributions paid for the fiscal years ended March 31, 2022 and March 31, 2021 were as follows:

| | | 2022 | | | 2021 | |

| Distributions paid from: | | | |

| Ordinary income(a) | | $ | 329,315 | | | $ | 212,839 | |

| Total distributions paid | | $ | 329,315 | | | $ | 212,839 | |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2022 |

At March 31, 2022, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 123,110 | |

| Accumulated capital and other losses | | | (392,318 | ) |

| Unrealized appreciation on investments | | | 8,995,804 | |

| Total accumulated earnings | | $ | 8,726,596 | |

The difference between book basis and tax basis undistributed net investment income/ (loss), accumulated net realized gain/(loss), and unrealized appreciation/(depreciation) from investments is primarily attributable to the tax deferral of losses on wash sales.

Capital losses incurred after October 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Fund incurred and elected to defer such capital losses of $65,506.

At March 31, 2022, the Fund had $324,795 short-term and $2,017 long-term capital loss carry forwards for federal income tax purposes available to offset future capital gains. At March 31, 2022 the Fund utilized $338,156 capital loss carry forwards.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

| Report of Independent Registered Public Accounting Firm |

To the Shareholders of Absolute Core Strategy ETF and

Board of Trustees of Unified Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Absolute Core Strategy ETF (the “Fund”), a series of Unified Series Trust, as of March 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the three periods in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2022, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2022, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2020.

COHEN & COMPANY, LTD.

Chicago, Illinois

May 26, 2022

| Summary of Fund Expenses (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. You may pay brokerage commissions on purchases and sales of exchange-traded fund shares, which are not reflected in the example. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2021 through March 31, 2022.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | Beginning | | Ending | | | | |

| | | Account | | Account | | Expenses | | |

| | | Value | | Value | | Paid | | Annualized |

| | | October 1, | | March 31, | | During | | Expense |

| | | 2021 | | 2022 | | Period(a) | | Ratio |

| Actual | | $1,000.00 | | $1,119.10 | | $4.49 | | 0.85% |

| Hypothetical(b) | | $1,000.00 | | $1,020.69 | | $4.28 | | 0.85% |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

| Trustees and Officers (Unaudited) |

GENERAL QUALIFICATIONS. The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” (as defined in the 1940 Act) of the Trust or any adviser, sub-adviser or distributor of the Trust.

The following table provides information regarding the Independent Trustees.

Name, Address*, (Year of Birth),

Position with Trust**,

Term of Position with Trust | Principal Occupation During Past 5 Years and Other

Directorships |

Kenneth G.Y. Grant (1949)

Chairman, January 2017 to present;

Independent Trustee, May 2008 to

present | Current: Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2019 – present); Director, Advisors Charitable Gift Fund (2020 - present), a Donor Advised Fund. Previous: EVP, Benefit Plans Administrative Services, Inc., provider of retirement benefit plans administration (2019 – 2020); Director, Northeast Retirement Services (NRS) LLC, a transfer agent and fund administrator; and Director, Global Trust Company (GTC), a non-depository trust company sponsoring private investment product (2003 – 2019); EVP, NRS (2003 – 2019); GTC, EVP (2008 – 2019); EVP, Savings Banks Retirement Association (2003 – 2019), provider of qualified retirement benefit plans. |

Daniel J. Condon (1950)

Chairman of the Audit Committee;

Chairman of the Governance &

Nominating Committee; Independent

Trustee, December 2002 to present | Current: Retired (2017 - present). |

Gary E. Hippenstiel (1947)

Chairman of the Pricing & Liquidity

Committee; Independent Trustee,

December 2002 to present | Current: President and founder of Hippenstiel Investment Counsel LLC (“Hippenstiel”) since 2008. Hippenstiel was registered as an investment adviser from 2008 to December 31, 2019. |

Stephen A. Little (1946)

Independent Trustee, December 2002

to present; Chairman, December 2004

to December 2016 | Current: President and founder of The Rose, Inc., a registered investment adviser, since 1993. |

Ronald C. Tritschler (1952)

Independent Trustee, January 2007 to

present; Interested Trustee,

December 2002 to December 2006 | Current: Chief Executive Officer, Director and Legal Counsel of The Webb Companies, a national real estate company, since 2001; Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2020 – present). |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 23 series. |

| Trustees and Officers (Unaudited) (continued) |

The following table provides information regarding the Interested Trustees and Officers of the Trust.

Name, Address*, (Year of Birth),

Position with Trust,

Term of Position with Trust | Principal Occupation During Past 5 Years and Other

Directorships |

David R. Carson (1958)

President, January 2016 to August

2021; Interested Trustee, August 2020

to present | Current: Senior Vice President Client Strategies of Ultimus Fund Solutions, LLC, since 2013; Interested Trustee of Ultimus Managers Trust, since 2020. |

Zachary P. Richmond (1980)

Treasurer and Chief Financial Officer,

November 2014 to present | Current: Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC, since 2015. |

Martin R. Dean (1963)

President, August 2021 to present; Vice

President, November 2020 to August

2021; Chief Compliance Officer, April

2021 to August 2021; Assistant Chief

Compliance Officer, January 2016 to

April 2021 | Current: Senior Vice President, Head of Fund Compliance of Ultimus Fund Solutions, LLC, since 2016. |

Gweneth K. Gosselink (1955)

Chief Compliance Officer, August

2021 to present | Current: Assistant Vice President, Senior Compliance Officer of Ultimus Fund Solutions, LLC, since 2019. Previous: Chief Operating Officer & CCO at Miles Capital, Inc. (2013 – 2019). |

Elisabeth Dahl (1962)

Secretary, May 2017 to present;

Assistant Secretary, March 2016 to

May 2017 | Current: Attorney, Ultimus Fund Solutions, LLC since March 2016. |

Stephen Preston (1966)

AML Compliance Officer, May 2017

to present | Current: Vice President and Chief Compliance Officer, Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC, since 2011. |

Lynn E. Wood (1946)

Assistant Chief Compliance Officer,

April 2021 to present; Chief

Compliance Officer, October 2004 to

April 2021 | Current: Managing Member, Buttonwood Compliance Partners, LLC, since 2013. |

| * | The address for each Officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| Other Information (Unaudited) |

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (833) 267-3383 to request a copy of the SAI or to make shareholder inquiries.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (833) 267-3383 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

TRUSTEES Kenneth G.Y. Grant, Chairman David R. Carson Daniel J. Condon Gary E. Hippenstiel Stephen A. Little Ronald C. Tritschler OFFICERS Martin R. Dean, President Gweneth K. Gosselink, Chief Compliance Officer Zachary P. Richmond, Treasurer and Chief Financial Officer Lynn E. Wood, Assistant Chief Compliance Officer INVESTMENT ADVISER Absolute Investment Advisers LLC 4 North Street, Suite 2 Hingham, MA 02043 DISTRIBUTOR Northern Lights Distributors, LLC 4221 North 203rd Street, Suite 100 Elkhorn, NE 68022 | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Cohen & Company, Ltd. 151 N Franklin Street, Suite 575 Chicago, IL 60606 LEGAL COUNSEL Thompson Hine LLP 312 Walnut Street, 20th Floor Cincinnati, OH 45202 CUSTODIAN Brown Brothers Harriman & Co. 50 Post Office Square Boston, MA 02110 ADMINISTRATOR Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Northern Lights Distributors, LLC Member FINRA/SIPC

Absolute Core-AR-22

Dean Small Cap Value Fund

Dean Mid Cap Value Fund

Annual Report

March 31, 2022

Dean Small Cap Value Fund

Management Discussion of Fund Performance (Unaudited)

Management’s Discussion & Analysis

The Dean Small Cap Value Fund returned +7.98% net of fees for the twelve months ended March 31, 2022, compared with a +3.32% return for the benchmark Russell 2000 Value Index and a -5.79% return for the broader Russell 2000 Index.

Macro Factors Impacting Performance

Macro factors were a strong tailwind for the portfolio in the past fiscal year. The portfolio benefited from holding stocks that were less volatile than the benchmark (a proxy for quality) and from holding stocks that had lower valuations than the benchmark (value stocks). The rising cost of capital is beginning to have an impact on the market environment leading to more emphasis being placed on valuation and quality. This is causing a shift in investor appetite towards higher-quality, value-oriented stocks which represent the two most important tenets to our investment philosophy: “Value Driven, Quality Focused.”

Sector Performance (best/worst relative to benchmark)

The best performing sector relative to the benchmark for the twelve-month period ended March 31, 2022, was Financials. The outperformance resulted from better stock selection than that of the benchmark, especially in the Insurance and Diversified Financials industries. One of the insurance companies held by the Fund was acquired for a large premium, and the Fund holds idiosyncratic positions in the Diversified Financials industry which, in their own unique ways, have benefited from the volatility in the markets as well as from the Fed beginning a rate hiking cycle.

The second-best performing sector relative to the benchmark was Health Care. The bulk of the outperformance was a result of the Fund not holding any Biotech companies. Biotech stocks typically have a wide range of outcomes that tend to be binary in nature (they are either homeruns or strikeouts). Our process tends to shy away from these types of investments, and this fiscal year, as the market shifted its preference to higher quality companies, Biotech stocks sold off relative to the market. Thus, the Fund’s lack of ownership of Biotech stocks was a benefit to performance.

The worst performing sector relative to the benchmark for the last twelve months was Energy. The underperformance was due to the Fund’s underweight positioning versus the benchmark as well as below benchmark stock selection. Energy was, by a large margin, the best performing sector in the benchmark as oil prices rose sharply from a lack of supply combined with concerns over the consequences from the war in Ukraine. In addition, some of the most volatile, widest range of outcome stocks turned into the best performing stocks.

Dean Small Cap Value Fund

Management Discussion of Fund Performance (Unaudited)

(continued)

We are concerned with how the higher price of oil flows through to small cap companies’ economics during the recent oil price spike, as many of the dynamics in the industry have changed since the last price spike. We believe the stocks in the benchmark have high expectations built into their valuations, coupled with high risk to boot.

The second worst performing sector relative to the benchmark was Industrials. The underperformance was a result of the Fund’s stock selection, specifically, the portfolio’s overweight in trucking stocks. Investors are concerned over a slowing economy and a deceleration in freight rates at a time when fuel and labor costs are rising. We own stocks of two high-quality trucking companies from the Midwest who have managed many cycles before. They both have steadier than average end markets, and we believe they represent attractive opportunities, notwithstanding the potential for a slowing economy.

Individual Securities Performance (best/worst absolute contributors)

The largest contributing company in the fiscal year was American National Group (ANAT). ANAT is a diversified insurer offering life, annuities, house, business, health, auto, renters, and farm insurance services. Brookfield Asset Management Reinsurance Partners acquired ANAT for $190 per share in cash, which represented a 55% premium to ANAT’s price before rumors of a sale surfaced. Our private market value estimate range for ANAT was $138 per share to $168 per share. We were pleased to see the actual sale price come in 13% higher than the top end of our range. We have a high degree of confidence the deal will close on time with no issues; thus, we continue to hold the position until the closing of the deal.

The second largest contributing stock was Encore Wire (WIRE). WIRE manufactures electrical building wire and cable. It supplies building wire for interior electrical wiring in commercial and industrial buildings, homes, apartments, and manufactured housing. WIRE benefited from being a vertically integrated business as it was able to fulfill orders while its competitors struggled with supply chain issues. It also benefited from a strong housing market and anticipation of new infrastructure spending. We lowered the weight in the Fund’s portfolio because of the strong price performance; however, the Fund continues to hold a small position in WIRE.

The largest detracting stock for the period was Heartland Express (HTLD). HTLD is a short-to-medium haul trucking company. The market is increasingly growing concerned about peak growth rates in the economy, and as a result, in the trucking industry as well. We feel the current valuations in the group compensate for this possible deceleration of economic growth, while ignoring how well HTLD has managed past full economic cycles.

Dean Small Cap Value Fund

Management Discussion of Fund Performance (Unaudited)

(continued)

HTLD is one of the highest quality trucking companies we can own in the small cap value space. The portfolio holds a sizable position in HTLD.

The second largest detracting stock was Treehouse Foods (THS). THS is a private label packaged food manufacturer. Commodity prices have been on the rise, which is impacting the input costs for THS. Due to the nature of THS’s private label product, the ability to pass along rising input costs to customers is much less than that of branded goods, which consumers are already willing to ‘pay up’ for; thus, the fear of continued inflation has put pressure on THS’s stock price. THS is in the process of rightsizing its product portfolio by selling product lines that are unprofitable while pursuing internal cost containment procedures which should offset input cost inflation on the remaining product lines. The Fund maintains a position in THS.

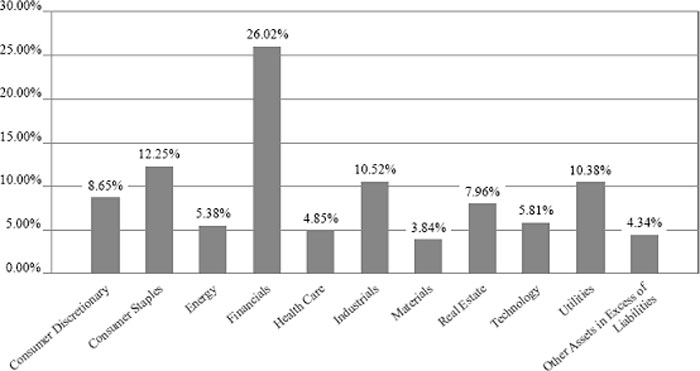

Current Positioning and Opportunities

The Fund’s largest overweight sectors relative to the benchmark are currently in the Consumer Staples and Utilities sectors. The largest underweight sectors relative to the benchmark are currently in the Energy and Industrials sectors. Throughout the fiscal year, the Health Care and Information Technology sectors increased the most in weight, while the Financials and Industrials sectors decreased the most in weight. As always, these relative weights are a residual of our bottom-up opportunities and not based on a top-down macro call on the market or economy.

We remain focused on the fundamentals of the companies we own, and the price we are paying for those fundamentals. We are confident that a steadfast application of our proven and disciplined process should produce favorable results over time.

Thank you for your continued confidence in Dean.

Investment Results (Unaudited)

Average Annual Total Returns(a) as of March 31, 2022

| | | One Year | | Five Year | | Ten Year |

| Dean Small Cap Value Fund | | 7.98% | | 6.74% | | 9.85% |

| Russell 2000 Value Index(b) | | 3.32% | | 8.57% | | 10.54% |

| Russell 2000 Index(b) | | (5.79)% | | 9.74% | | 11.04% |

Total annual operating expenses, which include acquired fund fees and expenses of 0.01%, as disclosed in the Dean Small Cap Value Fund (the “Fund”) prospectus dated July 29, 2021, were 1.20% of the Fund’s average daily net assets. Additional information pertaining to the expense ratios as of March 31, 2022 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 899-8343.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (b) | The Russell 2000 and Russell 2000 Value Indices are unmanaged indices that assume reinvestment of all distributions and exclude the effect of taxes and fees. The indices are widely recognized unmanaged indices of equity prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. An individual cannot invest directly in an index or the indices. However, an individual may be able to invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. |

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month end by calling (888) 899-8343.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

Investment Results (Unaudited) (continued)

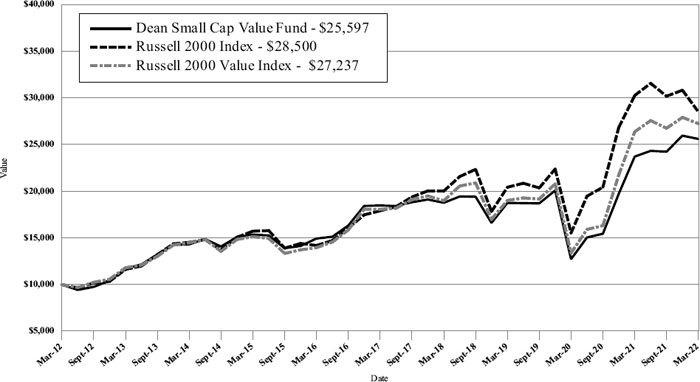

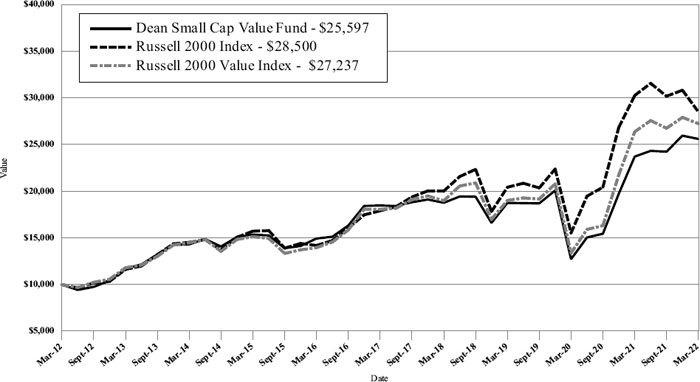

Comparison of the Change in Value of a $10,000 Investment in the Dean Small Cap Value Fund, the Russell 2000 Index and the Russell 2000 Value Index (Unaudited)

The graph shows the value of a hypothetical initial investment of $10,000 in the Fund, the Russell 2000 Index and the Russell 2000 Value Index on March 31, 2012 and held through March 31, 2022.

The Russell 2000 Index and the Russell 2000 Value Index are widely recognized unmanaged indices of common stock prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 899-8343. You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Dean Mid Cap Value Fund

Management Discussion of Fund Performance (Unaudited)

Management’s Discussion & Analysis

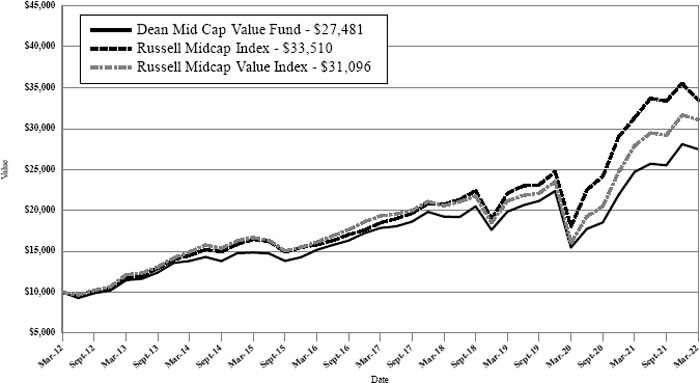

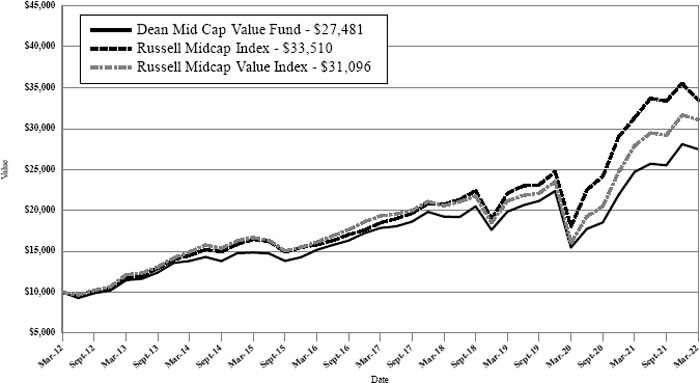

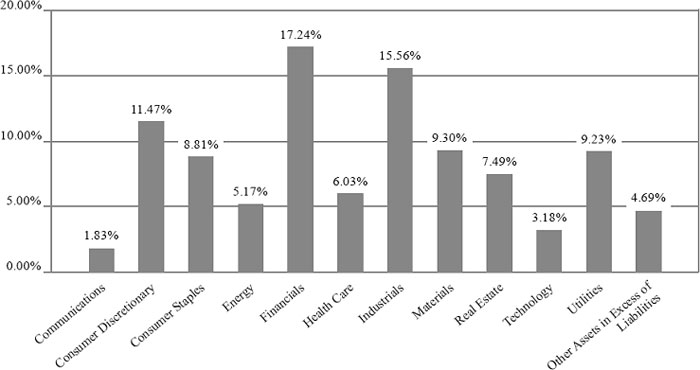

The Dean Mid Cap Value Fund (DALCX) returned 11.22% (net of fees) for the year ended March 31, 2022, compared with the Russell Midcap Value Index, up 11.45%, and the broader Russell Midcap Index, up 6.92%.

Macro Factors Impacting Performance

Macro style factors were a benefit to the portfolio in the fiscal year. The portfolio benefitted from owning stocks with lower valuations and lower volatility than those of the Russell Midcap Value Index. A strong economy coupled with shortages of goods and labor is driving the cost of capital higher as policy makers push to tighten liquidity in order to fight rampant inflation. The rise in the cost of capital is negatively impacting the present value of companies with growth far into the future, leading to a greater focus on valuation and quality as the market is fraught with uncertainty on a fiscal and geopolitical front.

Sector Performance (best/worst relative to benchmark)

The best performing sector relative to the Russell Midcap Value Index for the 12 months ended March 31, 2022, was Consumer Discretionary. The outperformance was driven by stock selection, mostly within the retail holdings of the Fund. Auto parts retailer AutoZone (AZO) was up 42.5% for the period held as the increase in miles driven and increasing age of cars positively impacted AZO’s sales. In addition, AZO took share in the professional delivery parts business with its strategy to increase the number of distribution points to improve speed of delivery and in stock parts. Cosmetic products retailer Ulta Beauty (ULTA) was up 28.8% over the period on strong results as customers returned to work and social gatherings. Auto parts retailer and industrial distributor Genuine Parts (GPC) also benefitted from the positive fundamentals in the parts business and increased demand in its distribution segment. The stock was up 11.9% in the 12 months ended March 31, 2022. These results compare to the benchmark’s Consumer Discretionary sector down -6.5% and the Retailing industry group up 2.7% over the period.

Industrials were the second-best performing sector relative to the benchmark. The Fund’s outperformance was primarily driven by stock selection with waste company Republic Services Group (RSG), electrical contractor nVent Electric (NVT), defense company Curtis-Wright (CW) and industrial product maker Dover (DOV) up 35.3%, 27.4%, 27.3%, and 15.8%, respectively, compared to the benchmark Industrials sector down -0.14%. While the companies listed have different end markets driving their performance, they are similar in characteristics in which they each benefit from overall economic activity and are relatively high quality with above average returns on invested capital. The Fund also benefitted being underweight in the Transportation industry group, primarily within the airlines, which saw severe headwinds with travel curtailed due to Covid and rising jet fuel prices.

Dean Mid Cap Value Fund

Management Discussion of Fund Performance (Unaudited)

(continued)

The worst performing sector was Information Technology for the trailing twelve-month period ended March 31, 2022. The Fund’s underweight in the sector was beneficial as the sector underperformed the overall benchmark by more than -8.0%. However, stock selection was not up to par and accounted for the sector underperformance. The stocks held by the Fund underperformed due to weak end markets served, coupled with rising costs impacting margins and supply disruptions curtailing revenue. Supply disruptions negatively impacted semiconductor instrument company MKS Instruments (MKSI) and network communication company Ciena (CIEN). Weak end markets impacted storage maker Western Digital (WDC) as it witnessed a decrease in pricing and Littlefuse (LFUS), which sells circuit protection into the auto market, which was negatively impacted by the lack of semiconductor products.