united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive. Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 11/30

Date of reporting period: 11/30/23

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Auer Growth Fund

Annual Report

November 30, 2023

Fund Adviser:

SBAuer Funds, LLC

8801 River Crossing Blvd, Suite 100

Indianapolis, IN 46240

Toll Free (888) 711-AUER (2837)

www.sbauerfunds.com

Auer Growth Fund

Management’s Discussion of Fund Performance (Unaudited)

November 30, 2023

In the year since our last message, we have seen interest rates peak and inflation begin to decline. The US Federal Reserve’s aggressive moves in 2022 appear to have had the desired effect on the inflationary environment. In reflection, 2023 was a tale of two halves. If we were writing this letter in May, we would have reported that the Auer Growth Fund was down somewhere in the 9% range for the year with the regional banks and energy leading the way lower as they felt the twin blows of high inflation and rising interest rates. Fortunately, we saw inflationary pressures mitigate in the second half of the year as well as the economy expand, despite higher interest rates. Because we always stick with discipline, which we have discussed many times, the portfolio was well positioned to take advantage of the improving economic conditions.

As of November 30, 2023, the Auer Growth Fund was up 6.35% for the year. This compares to the S&P 500® Index that was up 13.84%. While our underperformance in the first half of the year was driven primarily by the Fund’s investments in Energy and Banks, we are very pleased with the way the portfolio responded to the improving economy in the second half of 2023. While we are disappointed to fall short of the S&P 500® Index, we see that the performance in the S&P 500® was driven by Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla or, as the market dubbed them, “Magnificent 7.” We see these stocks as the epitome of overvalued, bloated and price inflated. While it’s hard to argue with the “magnificent’’ price increase these seven stocks have had this year, based on their PE Ratio, Sales Growth and Revenue Growth, we do not believe their market price is deserved or sustainable. On the other hand, the Auer Growth Fund maintained a diversified portfolio of companies that were increasing sales by over 20% quarterly year over year and increasing earnings 25% quarterly year over year - all with a 12 Price to Earnings Ratio or less at the time of purchase. When we look at the 5-year period, the Auer Growth Fund was up 14.60%, which as compared to the S&P 500® that was up 12.51%, you can see our longer term fundamentally based approach provided strong results. Over the 10-year period the Auer Growth Fund was up 6.44% compared to the S&P 500® which was up 11.82%. We consider this performance lag the result of very loose monetary policy inflating the large cap sector.

Looking forward, we believe that inflation is beginning to trend lower, but several factors remain that could continue to push it higher. In general, the United States is a victim of its own success. The economy is beginning to hit its stride following COVID, and we are seeing work force expansion and massive infrastructure investment. Additionally, we are seeing US companies mitigate the supply chain issues that have persisted through COVID by onshoring or near shoring the means of production. All this is to say that while inflation may be trending lower, we believe there are still longer-term pressures

Auer Growth Fund

Management’s Discussion of Fund Performance (Unaudited) (continued)

November 30, 2023

that could cause inflationary pressure continue. Our hope is the Federal Reserve does not act too aggressively lowering interest rates as it sees inflationary pressure ease. Fiscal responsibility and a strong growing economic base is the formula needed for continued growth in the domestic market. We strongly believe that by selecting companies which have growing sales and profitability that are trading at a reasonable price, the Auer Growth Fund is well-positioned to maneuver through market uncertainty and navigate through inflationary environments.

As a side note to shareholders. In the last month of 2023, which falls outside the prevue of this report, the Auer Growth Fund was able to close quite a bit of the performance gap. The Fund finished the calendar year of 2023 up 21.29% compared to the S&P 500® which was up 26.29%. This strong finish pushed the Fund’s 5-year return to 143.09% compared to the S & P 500 which was up 107.21%. Over the 10-year period ended December 31, 2023, the Fund is still trailing the S&P 500® 92.42% compared to 211.49%.

Investment Results (Unaudited)

Average Annual Total Returns*

as of November 30, 2023

| | One Year | | Five Year | | Ten Year |

| Auer Growth Fund | 6.35% | | 14.60% | | 6.44% |

| S&P 500® Index(a) | 13.84% | | 12.51% | | 11.82% |

Total annual operating expenses, as disclosed in the Auer Growth Fund (the “Fund”) prospectus dated March 30, 2023, were 2.21% of average daily net assets. Additional information pertaining to the Fund’s expense ratios as of November 30, 2023 can be found in the financial highlights.

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The Fund’s investment objective, risks, charges and expenses should be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 711-2837.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (a) | The S&P 500® Index (the “Index”) is an unmanaged index generally representing the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. Individuals cannot invest directly in the Index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

You should consider the Fund’s investment objective, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objective, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling (888) 711-2837.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Investment Results (Unaudited) (continued)

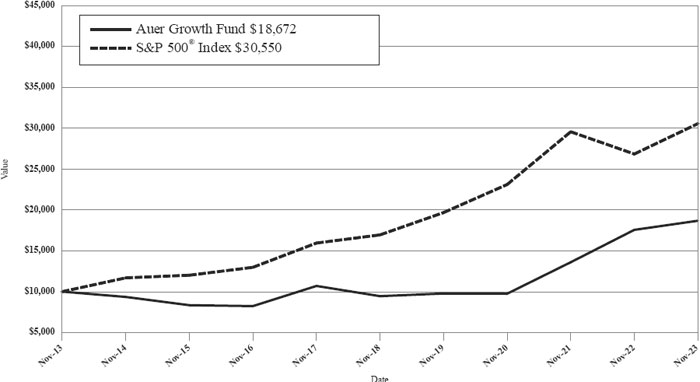

Comparison of the Growth of a $10,000 Investment in the Auer Growth Fund and the S&P 500® Index.

The chart above assumes an initial investment of $10,000 made on November 30, 2013 and held through November 30, 2023. The S&P 500® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 711-2837. You should carefully consider the investment objective, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

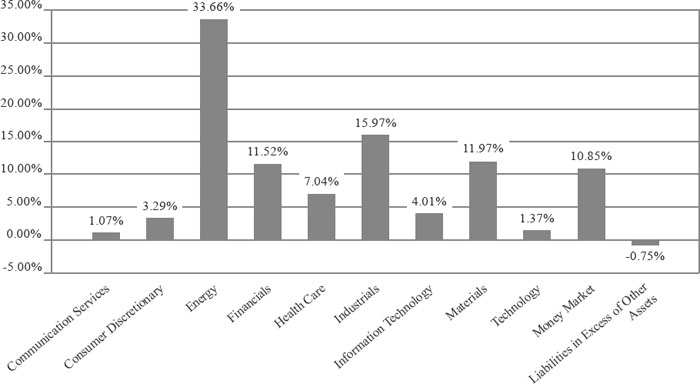

Fund Holdings (Unaudited)

Auer Growth Fund Holdings as of November 30, 2023*

| * | As a percentage of net assets. |

The investment objective of the Fund is long-term capital appreciation.

The Fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of common stocks traded on major U.S. exchanges, markets, and bulletin boards that SBAuer Funds, LLC (the “Adviser”) believes present the most favorable potential for capital appreciation.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov and the Fund’s portfolio holdings, as disclosed on its most recent Form N-PORT, are listed on the Fund’s website at www.sbauerfunds.com.

| Auer Growth Fund |

| Schedule of Investments |

| November 30, 2023 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 89.90% | | | | | | | | |

| Communication Services — 1.07% | | | | | | | | |

| Gravity Company Ltd. - ADR(a) | | | 6,500 | | | $ | 474,630 | |

| | | | | | | | | |

| Consumer Discretionary — 3.29% | | | | | | | | |

| Forestar Group, Inc.(a) | | | 14,000 | | | | 427,420 | |

| General Motors Co. | | | 21,000 | | | | 663,600 | |

| Sadot Group Inc.(a) | | | 200,000 | | | | 100,000 | |

| Virco Manufacturing Corp.(a) | | | 40,000 | | | | 268,400 | |

| | | | | | | | 1,459,420 | |

| Energy — 33.66% | | | | | | | | |

| Borr Drilling Ltd(a) | | | 60,000 | | | | 378,000 | |

| CNX Resources Corp.(a) | | | 20,000 | | | | 417,200 | |

| CONSOL Energy, Inc. | | | 15,000 | | | | 1,600,050 | |

| DHT Holdings, Inc. | | | 23,000 | | | | 229,080 | |

| Dorian LPT Ltd. | | | 38,000 | | | | 1,609,680 | |

| Euronav NV | | | 13,000 | | | | 233,870 | |

| Hallador Energy Co.(a) | | | 43,000 | | | | 543,090 | |

| International Seaways, Inc. | | | 12,000 | | | | 547,680 | |

| Matador Resources Co. | | | 10,500 | | | | 607,740 | |

| Noble Corp PLC | | | 8,500 | | | | 392,190 | |

| Obsidian Energy Ltd.(a) | | | 70,000 | | | | 529,900 | |

| Patterson-UTI Energy, Inc. | | | 46,920 | | | | 549,433 | |

| PBF Energy, Inc., Class A | | | 21,000 | | | | 932,400 | |

| Peabody Energy Corp. | | | 17,000 | | | | 405,280 | |

| Phillips 66 | | | 9,500 | | | | 1,224,455 | |

| Precision Drilling Corp.(a) | | | 17,000 | | | | 982,600 | |

| ProPetro Holding Corp.(a) | | | 60,000 | | | | 546,600 | |

| Ring Energy, Inc.(a) | | | 250,000 | | | | 412,500 | |

| Seadrill Ltd(a) | | | 10,000 | | | | 443,800 | |

| Teekay Tankers Ltd., Class A | | | 30,000 | | | | 1,490,700 | |

| Tidewater, Inc.(a) | | | 14,000 | | | | 841,120 | |

| | | | | | | | 14,917,368 | |

| Financials — 11.52% | | | | | | | | |

| Banco Latinoamericano de Comercio Exterior, S.A., Class E | | | 15,500 | | | | 377,735 | |

| Bank OZK | | | 6,000 | | | | 251,160 | |

| Bayfirst Financial Corp. | | | 12,500 | | | | 132,500 | |

| BCB Bancorp, Inc. | | | 12,500 | | | | 144,750 | |

| Greenlight Capital Re, Ltd., Class A(a) | | | 39,000 | | | | 432,120 | |

| HomeTrust Bancshares, Inc. | | | 10,000 | | | | 230,800 | |

| Investar Holding Corp. | | | 11,500 | | | | 126,615 | |

| Mercantile Bank Corp. | | | 7,800 | | | | 268,242 | |

| Merchants Bancorp | | | 7,000 | | | | 235,550 | |

| Northeast Bank | | | 4,500 | | | | 230,715 | |

| Northeast Community Bancorp, Inc. | | | 13,500 | | | | 226,395 | |

| OptimumBank Holdings, Inc.(a) | | | 67,000 | | | | 226,460 | |

| Primis Financial Corp | | | 22,500 | | | | 225,225 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Schedule of Investments (continued) |

| November 30, 2023 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 89.90% | | | | | | | | |

| Financials — 11.52% - (continued) | | | | | | | | |

| SiriusPoint Ltd.(a) | | | 43,000 | | | $ | 459,240 | |

| Texas Capital Bancshares, Inc.(a) | | | 7,800 | | | | 428,064 | |

| Wells Fargo & Co. | | | 20,000 | | | | 891,800 | |

| Westwood Holdings Group, Inc. | | | 20,000 | | | | 220,000 | |

| | | | | | | | 5,107,371 | |

| Health Care — 7.04% | | | | | | | | |

| Amylyx Pharmaceuticals, Inc.(a) | | | 51,000 | | | | 722,160 | |

| ANI Pharmaceuticals, Inc.(a) | | | 17,000 | | | | 846,770 | |

| Harmony Biosciences Holdings, Inc.(a) | | | 26,000 | | | | 755,560 | |

| Protalix Biotherapeutics Inc.(a) | | | 120,000 | | | | 181,200 | |

| Semler Scientific Inc.(a) | | | 16,000 | | | | 616,640 | |

| | | | | | | | 3,122,330 | |

| Industrials — 15.97% | | | | | | | | |

| Argan, Inc. | | | 9,300 | | | | 433,752 | |

| Broadwind Energy, Inc.(a) | | | 207,000 | | | | 463,680 | |

| Costamare, Inc. | | | 32,000 | | | | 323,520 | |

| Emeren Group Ltd. - ADR(a) | | | 53,000 | | | | 128,260 | |

| Euroseas Ltd. | | | 37,500 | | | | 1,104,375 | |

| Greenbrier Companies, Inc. (The) | | | 15,300 | | | | 576,963 | |

| H&E Equipment Services, Inc. | | | 9,500 | | | | 420,945 | |

| Hyster-Yale Materials Handling, Inc., Class A | | | 17,500 | | | | 834,225 | |

| Miller Industries, Inc. | | | 12,200 | | | | 484,828 | |

| Oshkosh Corp. | | | 4,800 | | | | 466,992 | |

| TAT Technologies Ltd(a) | | | 23,000 | | | | 222,870 | |

| Thermon Group Holdings, Inc.(a) | | | 20,000 | | | | 603,000 | |

| Titan Machinery, Inc.(a) | | | 7,000 | | | | 160,020 | |

| VirTra, Inc.(a) | | | 59,000 | | | | 434,240 | |

| Willis Lease Finance Corp.(a) | | | 9,200 | | | | 420,624 | |

| | | | | | | | 7,078,294 | |

| Information Technology — 4.01% | | | | | | | | |

| ACM Research, Inc., Class A(a) | | | 60,000 | | | | 998,400 | |

| Daktronics, Inc.(a) | | | 31,000 | | | | 323,330 | |

| Frequency Electronics Inc. | | | 21,000 | | | | 207,480 | |

| InterDigital, Inc. | | | 2,500 | | | | 249,800 | |

| | | | | | | | 1,779,010 | |

| Materials — 11.97% | | | | | | | | |

| B2Gold Corp. | | | 250,000 | | | | 845,000 | |

| Centerra Gold Inc. | | | 75,000 | | | | 459,750 | |

| Fortuna Silver Mines, Inc.(a) | | | 140,000 | | | | 546,000 | |

| Friedman Industries, Inc. | | | 23,000 | | | | 276,000 | |

| Hudbay Minerals, Inc. | | | 100,000 | | | | 455,000 | |

| Kinross Gold Corp. | | | 87,000 | | | | 512,430 | |

| MAG Silver Corp.(a) | | | 20,000 | | | | 237,400 | |

| Ramaco Resources, Inc. | | | 64,000 | | | | 1,068,800 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Schedule of Investments (continued) |

| November 30, 2023 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 89.90% | | | | | | | | |

| Materials — 11.97% - (continued) | | | | | | | | |

| SSR Mining, Inc. | | | 38,000 | | | $ | 448,400 | |

| TRX Gold Corp.(a) | | | 470,000 | | | | 186,966 | |

| Universal Stainless & Alloy Products, Inc.(a) | | | 16,000 | | | | 270,400 | |

| | | | | | | | 5,306,146 | |

| Technology — 1.37% | | | | | | | | |

| Alarum Technologies Ltd(a) | | | 20,000 | | | | 89,600 | |

| Canadian Solar, Inc.(a) | | | 11,500 | | | | 241,845 | |

| Valero Energy Corp. | | | 2,200 | | | | 275,792 | |

| | | | | | | | 607,237 | |

| Total Common Stocks (Cost $36,559,067) | | | | | | | 39,851,806 | |

| MONEY MARKET FUNDS — 10.85% | | | | | | | | |

| Fidelity Investments Money Market Government Portfolio, Class I, 5.25%(b) | | | 4,809,263 | | | | 4,809,263 | |

| Total Money Market Funds (Cost $4,809,263) | | | | | | | 4,809,263 | |

| Total Investments — 100.75% | | | | | | | | |

| (Cost $41,368,330) | | | | | | | 44,661,069 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.75)% | | | | | | | (331,027 | ) |

| NET ASSETS — 100.00% | | | | | | $ | 44,330,042 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of November 30, 2023. |

ADR - American Depositary Receipt

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Statement of Assets and Liabilities |

| November 30, 2023 |

| Assets | | | |

| Investments in securities at fair value (cost $41,368,330) | | $ | 44,661,069 | |

| Receivable for investments sold | | | 211,738 | |

| Dividends receivable | | | 75,802 | |

| Prepaid expenses | | | 11,548 | |

| Total Assets | | | 44,960,157 | |

| | | | | |

| Liabilities | | | | |

| Payable for investments purchased | | | 540,937 | |

| Payable to Adviser | | | 53,241 | |

| Payable to affiliates | | | 10,471 | |

| Other accrued expenses | | | 25,466 | |

| Total Liabilities | | | 630,115 | |

| Net Assets | | $ | 44,330,042 | |

| | | | | |

| Net Assets consist of: | | | | |

| Paid-in capital | | $ | 39,666,630 | |

| Accumulated earnings | | | 4,663,412 | |

| Net Assets | | $ | 44,330,042 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 3,024,650 | |

| Net asset value, offering and redemption price per share(a) | | $ | 14.66 | |

| (a) | The Fund charges a 1.00% redemption fee on shares redeemed within 7 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Statement of Operations |

| For the Year ended November 30, 2023 |

| Investment Income | | | |

| Dividend income (net of foreign taxes withheld of $20,782) | | $ | 1,206,490 | |

| Total investment income | | | 1,206,490 | |

| | | | | |

| Expenses | | | | |

| Adviser | | | 648,844 | |

| Administration | | | 44,411 | |

| Fund accounting | | | 37,664 | |

| Legal | | | 23,117 | |

| Transfer agent | | | 19,467 | |

| Audit and tax preparation | | | 19,315 | |

| Registration | | | 17,261 | |

| Trustee | | | 16,675 | |

| Compliance services | | | 12,000 | |

| Report printing | | | 10,622 | |

| Custodian | | | 7,445 | |

| Insurance | | | 2,789 | |

| Pricing | | | 2,538 | |

| Miscellaneous | | | 30,995 | |

| Total expenses | | | 893,143 | |

| Net investment income | | | 313,347 | |

| | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain on investment securities transactions | | | 1,059,107 | |

| Net realized gain on foreign currency translations | | | 150 | |

| Net change in unrealized appreciation of investment securities | | | 629,969 | |

| Net realized and change in unrealized gain on investments | | | 1,689,226 | |

| Net increase in net assets resulting from operations | | $ | 2,002,573 | |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | November 30, | | | November 30, | |

| | | 2023 | | | 2022 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | $ | 313,347 | | | $ | (16,504 | ) |

| Net realized gain on investment securities and foreign currency translations | | | 1,059,257 | | | | 6,172,654 | |

| Net change in unrealized appreciation of investment securities | | | 629,969 | | | | 1,123,728 | |

| Net increase in net assets resulting from operations | | | 2,002,573 | | | | 7,279,878 | |

| | | | | | | | | |

| Distributions From | | | | | | | | |

| Earnings | | | (2,139,895 | ) | | | — | |

| | | | | | | | | |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 15,218,656 | | | | 15,979,053 | |

| Proceeds from redemption fees(a) | | | 148 | | | | 1,028 | |

| Reinvestment of distributions | | | 1,820,710 | | | | — | |

| Amount paid for shares redeemed | | | (13,551,876 | ) | | | (6,118,299 | ) |

| Net increase in net assets resulting from capital transactions | | | 3,487,638 | | | | 9,861,782 | |

| Total Increase in Net Assets | | | 3,350,316 | | | | 17,141,660 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 40,979,726 | | | | 23,838,066 | |

| End of year | | $ | 44,330,042 | | | $ | 40,979,726 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 1,120,240 | | | | 1,174,336 | |

| Shares issued in reinvestment of distributions | | | 139,625 | | | | — | |

| Shares redeemed | | | (1,044,284 | ) | | | (475,535 | ) |

| Net increase in shares outstanding | | | 215,581 | | | | 698,801 | |

| (a) | The Fund charges a 1.00% redemption fee on shares redeemed within 7 days of purchase. |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Financial Highlights |

| (For a share outstanding during each year) |

| | | For the Years Ended November 30, | |

| | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 14.59 | | | $ | 11.30 | | | $ | 8.10 | | | $ | 8.12 | | | $ | 7.85 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.10 | | | | (0.01 | ) (a) | | | (0.08 | ) | | | (0.02 | ) | | | (0.06 | ) |

| Net realized and unrealized gain | | | 0.73 | | | | 3.30 | | | | 3.28 | | | | — | (b)(c) | | | 0.33 | |

| Total from investment operations | | | 0.83 | | | | 3.29 | | | | 3.20 | | | | (0.02 | ) | | | 0.27 | |

| Net realized gains | | | (0.76 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.76 | ) | | | — | | | | — | | | | — | | | | — | |

| Paid in capital from redemption fees | | | — | (b) | | | — | (b) | | | — | | | | — | | | | — | |

| Net asset value, end of year | | $ | 14.66 | | | $ | 14.59 | | | $ | 11.30 | | | $ | 8.10 | | | $ | 8.12 | |

| Total Return(d) | | | 6.35 | % | | | 29.12 | % | | | 39.51 | % | | | (0.25 | )% | | | 3.44 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 44,330 | | | $ | 40,980 | | | $ | 23,838 | | | $ | 18,434 | | | $ | 23,963 | |

| Ratio of expenses to average net assets | | | 2.06 | % | | | 2.20 | % | | | 2.37 | % | | | 2.56 | % | | | 2.31 | % |

| Ratio of net investment income (loss) to average net assets | | | 0.72 | % | | | (0.05 | )% | | | (0.76 | )% | | | (0.09 | )% | | | (0.64 | )% |

| Portfolio turnover rate | | | 134 | % | | | 149 | % | | | 150 | % | | | 169 | % | | | 210 | % |

| (a) | Calculation based on the average number of shares outstanding during the period. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Realized and unrealized gains and losses in the caption are balancing amounts necessary to reconcile the change in net in net asset value for the period and may not reconcile with the Statement of Operations due to share transactions for the period. |

| (d) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| Auer Growth Fund |

| Notes to the Financial Statements |

| November 30, 2023 |

NOTE 1. ORGANIZATION

The Auer Growth Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a diversified series of Unified Series Trust (the “Trust”) on September 10, 2007. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 14, 2002, as amended (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. The investment objective of the Fund is long-term capital appreciation. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is SBAuer Funds, LLC (the “Adviser”).

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”, including Accounting Standards Update 2013-08. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Regulatory Update – Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – Effective January 24, 2023, the SEC adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. At this time, management is evaluating the impact of these amendments on the shareholder reports for the Fund.

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2023 |

all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended November 30, 2023, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the year, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds of the Trust based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Distributions received from investments in real estate investment trusts (“REITs”) that represent a return of capital or capital gain are recorded as a reduction of the cost of investment or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Fund’s investments in REITs are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported. Estimates are based on the most recent REIT distributions information available. Withholding taxes on foreign dividends and related reclaims have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Discounts and premiums on securities purchased are accreted or amortized using the effective interest method.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions.

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2023 |

The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in market prices of securities held. These fluctuations are included with the realized and unrealized gain or loss from investments. Net realized gain (loss) on foreign currency translations on the Statement of Operations represents currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amount of investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. The change in unrealized currency gains (losses) on foreign currency translations for the period is reflected in the Statement of Operations.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

Redemption Fees – The Fund charges a 1.00% redemption fee for shares redeemed within 7 days of purchase. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily NAV calculation.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern Time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2023 |

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the Nasdaq over-the-counter market are generally valued at the Nasdaq Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser, as Valuation Designee, under oversight of the Board’s Pricing & Liquidity Committee. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2023 |

in conformity with guidelines adopted by the Board. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Valuation Designee pursuant to its policies and procedures. Any fair value provided by the Valuation Designee is subject to the ultimate review of the pricing methodology by the Pricing & Liquidity Committee of the Board on a quarterly basis. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

In accordance with the Trust’s valuation policies and fair value determinations pursuant to Rule 2a-5 under the 1940 Act, the Valuation Designee is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Valuation Designee would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Valuation Designee’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Valuation Designee is aware of any other data that calls into question the reliability of market quotations. The Valuation Designee may obtain assistance from others in fulfilling its duties. For example, it may seek assistance from pricing services, fund administrators, sub-advisers, accountants, or counsel; it may also consult the Trust’s Fair Value Committee. The Valuation Designee, however, remains responsible for the final fair value determination any may not designate or assign that responsibility to any third party.

The following is a summary of the inputs used to value the Fund’s investments as of November 30, 2023:

| | | Valuation Inputs | |

| Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks(a) | | $ | 39,851,807 | | | $ | — | | | $ | — | | | $ | 39,851,807 | |

| Money Market Funds | | | 4,809,263 | | | | — | | | | — | | | | 4,809,263 | |

| Total | | $ | 44,661,070 | | | $ | — | | | $ | — | | | $ | 44,661,070 | |

| (a) | Refer to Schedule of Investments for sector classifications. |

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2023 |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

The Adviser, under the terms of the management agreement (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a management fee computed and accrued daily and paid monthly at an annual rate of 1.50% of the Fund’s average daily net assets. For the fiscal year ended November 30, 2023, the Adviser earned a management fee of $648,844 from the Fund. At November 30, 2023, the Fund owed the Adviser $53,241 for management services.

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting and transfer agent services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers of the Trust are also employees of Ultimus and such persons are not paid by the Fund for serving in such capacities. One Trustee is a former employee of Ultimus who is not currently paid by the Fund for serving in such capacity.

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chair of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” as defined in the 1940 Act. The Independent Trustees review and establish compensation at least annually. Each Independent Trustee of the Trust receives annual compensation, which is an established amount paid quarterly per fund in the Trust at the time of the regular quarterly Board meetings. The Chair of the Board receives the highest compensation, commensurate with his additional duties and each Chair of a committee receives additional compensation as well. Independent

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2023 |

Trustees also receive additional fees for attending any special meetings. In addition, the Trust reimburses Independent Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings.

The Trust, with respect to the Fund, has adopted a distribution plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Fund can pay the Distributor, the Adviser and/or other financial institutions or any other person (the “Recipient”) a fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Adviser may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that compensation is provided regardless of 12b-1 expenses actually incurred. The Fund has not implemented its 12b-1 Plan, although the Fund may do so at any time upon 60 days notice to shareholders.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended November 30, 2023, purchases and sales of investment securities, other than short-term investments, were $55,225,346 and $57,239,185, respectively.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended November 30, 2023.

NOTE 6. BENEFICIAL OWNERSHIP

As of November 30, 2023, the following entity owned beneficially 25% or greater of the Fund’s outstanding shares. The shares are held under omnibus accounts (whereby the transactions of two or more shareholders are combined and carried in the name of the origination broker rather than designated separately).

| | Percentage |

| Charles Schwab & Co. | 61% |

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2023 |

NOTE 7. FEDERAL TAX INFORMATION

At November 30, 2023, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 5,487,867 | |

| Gross unrealized depreciation | | | (2,241,805 | ) |

| Net unrealized appreciation/(depreciation) on investments | | $ | 3,246,062 | |

| Tax cost of investments | | $ | 41,415,007 | |

The tax character of distributions paid for the fiscal years ended November 30, 2023 and November 30, 2022 were as follows:

| | | 2023 | | | 2022 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 2,139,895 | | | $ | — | |

| Total distributions paid | | $ | 2,139,895 | | | $ | — | |

At November 30, 2023, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 906,842 | |

| Undistributed long-term capital gains | | | 510,508 | |

| Accumulated capital and other losses | | | — | |

| Unrealized appreciation on investments | | | 3,246,062 | |

| Total accumulated earnings | | $ | 4,663,412 | |

As of November 30, 2023, the difference between book basis and tax basis unrealized appreciation (depreciation) is attributable to the passive foreign investment company basis adjustments of underlying securities.

Capital losses and specified gains realized after October 31, and net investment losses realized after December 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the flowing fiscal year for tax purposes. For the year ended November 30, 2023, the Fund didn’t defer late year ordinary losses.

NOTE 8. SECTOR RISK

If the Fund has significant investments in the securities of issuers within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss in the Fund and increase the volatility of the Fund’s NAV per share. For instance, economic or market factors, regulatory

| Auer Growth Fund |

| Notes to the Financial Statements (continued) |

| November 30, 2023 |

changes or other developments may negatively impact all companies in a particular sector, and therefore the value of the Fund’s portfolio will be adversely affected. As of November 30, 2023, the Fund had 33.66% of the value of its net assets invested in stocks within the Energy sector.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Report of Independent Registered Public Accounting Firm

To the Shareholders of Auer Growth Fund and

Board of Trustees of Unified Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Auer Growth Fund (the “Fund”), a series of Unified Series Trust, as of November 30, 2023, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of November 30, 2023, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2023, by correspondence with the custodian and broker; when replies were not received from broker, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2008.

COHEN & COMPANY, LTD.

Chicago, Illinois

January 29, 2024

Liquidity Risk Management Program (Unaudited)

The Trust has adopted and implemented a written liquidity risk management program (the “Program”) as required by Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act. The Program is reasonably designed to assess and manage the Fund’s liquidity risk of each individual series of the Trust (each a “Fund” and collectively, the “Funds”), taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Board approved the appointment of the Liquidity Administrator Committee, comprising certain Trust officers and employees of the Adviser. The Liquidity Administrator Committee maintains Program oversight and reports to the Board on at least an annual basis regarding the Program’s operational effectiveness through a written report (the “Report”). The most recent Report, which was presented to the Board for consideration at its meeting held on August 14-15, 2023, outlined the operation of the Program and the adequacy and effectiveness of the Program’s implementation. During the review period, the Funds did not experience unusual stress or disruption to their operations related to purchase and redemption activity. Also, during the review period each Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with such Fund’s prospectus and within the requirements of the 1940 Act. The Report concluded that the Program is reasonably designed to prevent violation of the Liquidity Rule and has been effectively implemented.

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including redemption fees; and (2) ongoing costs, including mAs a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. You may pay brokerage commissions on purchases and sales of exchange-traded fund shares, which are not reflected in the example. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from June 1, 2023 through November 30, 2023.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | | | | Ending | | | | | | | |

| | | Beginning | | | Account | | | Expenses | | | | |

| | | Account | | | Value | | | Paid | | | Annualized | |

| | | Value | | | November | | | During | | | Expense | |

| | | June 1, 2023 | | | 30, 2023 | | | Period(a) | | | Ratio | |

| Actual | | $ | 1,000.00 | | | $ | 1,231.90 | | | $ | 11.67 | | | | 2.09 | % |

| Hypothetical(b) | | $ | 1,000.00 | | | $ | 1,014.61 | | | $ | 10.53 | | | | 2.09 | % |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

Additional Federal Income Tax Information (Unaudited)

The Form 1099-DIV you receive in January 2024 will show the tax status of all distributions paid to your account in calendar year 2023. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 21.35% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Qualified Business Income. The Fund designates approximately 0% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2023 ordinary income dividends, 18.17% qualifies for the corporate dividends received deduction.

For the year ended November 30, 2023, the Fund designated $– as long-term capital gain distributions.

Trustees and Officers (Unaudited)

GENERAL QUALIFICATIONS. The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chair of the Board and more than 75% of the Trustees are “Independent Trustees”, which means that they are not “interested persons” (as defined in the 1940 Act) of the Trust or any adviser, sub-adviser or distributor of the Trust.

The following table provides information regarding the Independent Trustees.

Name, Address*, (Year of Birth),

Position with Trust**,

Term of Position with Trust | | Principal Occupation During Past 5 Years and Other

Directorships |

Daniel J. Condon (1950)

Chair, May 2022 to present; Chair of

the Audit Committee;

Chair of the Governance &

Nominating Committee, May 2020

to May 2022; Independent Trustee,

December 2002 to present | | Current: Retired (2017 – present). Previous: Peak Income Plus Fund (May 2022 – February 2023). |

Kenneth G.Y. Grant (1949)

Chair of the Governance & Nominating

Committee, May 2022 to present;

Chair, January 2017 to May 2022;

Independent Trustee, May 2008 to

present | | Current: Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2019 – present); Director, Advisors Charitable Gift Fund (2020 – present), a Donor Advised Fund; Trustee. Trustee, Peak Income Plus Fund (May 2022 – present); and Advisory Board Member, AKRA Investment Services, Inc. (January 2024 – present). Previous: EVP, Benefit Plans Administrative Services, Inc., provider of retirement benefit plans administration (2019 – 2020); Director, Northeast Retirement Services (NRS) LLC, a transfer agent and fund administrator; and Director, Global Trust Company (GTC), a non-depository trust company sponsoring private investment products (2003 – 2019); EVP, NRS (2003 – 2019); GTC, EVP (2008 – 2019); EVP, Savings Banks Retirement Association (2003 – 2019), provider of qualified retirement benefit plans. |

Ronald C. Tritschler (1952)

Chair of the Audit Committee, May

2022 to present; Independent Trustee,

January 2007 to present; Interested

Trustee, December 2002 to December

2006 | | Current: Chief Executive Officer, Director and Legal Counsel of The Webb Companies, a national real estate company, (2001– present); Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2020 – present); Director of First State Bank of the Southeast (2000 – present). Previous: Trustee, Peak Income Plus Fund (May 2022 – February 2023). |

Catharine B. McGauley (1977)

Chair of the Pricing & Liquidity Committee, November 2022 to present; Independent Trustee, September 2022 to present | | Current: Lead Portfolio Manager of Atlantic Charter Insurance, a workers’ compensation insurer, (2010 – present); Investment Advisor for a Family Office (2015 – present); Senior Analyst/Advisor for a Boston real estate company and related family (2010 – present). Previous:Trustee, Peak Income Plus Fund (May 2022 – February 2023). |

Freddie Jacobs, Jr. (1970)

Independent Trustee, September 2022 to present | | Current: Chief Operating Officer and Chief Risk Officer Northeast Retirement Services LLC (NRS), and its subsidiary, Global Trust Company (GTC). NRS is a transfer agent and fund administrator, GTC is a non-depository trust company sponsoring private investment products (2021 – present); Chair, Board of Crispus Attucks Fund (2020 – present); Board Member of Camp Harbor View (2020 – present); Director, Sportsmen’s Tennis and Education Center (2019 – present). Previous: SVP, Senior Risk Officer NRS (2013 – 2021); Trustee, Peak Income Plus Fund (May 2022 – February 2023); Trustee of Buckingham Browne & Nichols (2017 - June 2023). |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 29 series. |

Trustees and Officers (Unaudited) (continued)

The following table provides information regarding the Interested Trustees and Officers of the Trust.

Name, Address*, (Year of Birth),

Position with Trust,

Term of Position with Trust | | Principal Occupation During Past 5 Yearsand Other

Directorships |

David R. Carson (1958)

Interested Trustee, August 2020 to

present; President, January 2016 to

August 2021 | | Current: Retired (2023 – present); Interested Trustee, Mammoth Institutional Credit Access Fund and Mammoth Institutional Equity Access Fund (November 2022 – present); Interested Trustee, Peak Income Plus Fund (May 2022 – present). Previous: Interested Trustee of Ultimus Managers Trust, (January 2021 – April 2023); Senior Vice President Client Strategies of Ultimus Fund Solutions, LLC (2013 – April 2023). |

Martin R. Dean (1963)

President, August 2021 to present; Vice

President, November 2020 to August

2021; Chief Compliance Officer, April

2021 to August 2021; Assistant Chief

Compliance Officer, January 2016 to

April 2021 | | Current: President, Northern Lights Compliance Services (2023 – present). Previous: Senior Vice President, Head of Fund Compliance of Ultimus Fund Solutions, LLC (2016 – January 2023). |

Zachary P. Richmond (1980)

Treasurer and Chief Financial Officer,

November 2014 to present | | Current: Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC, (2015 – present). |

Gweneth K. Gosselink (1955)

Chief Compliance Officer, August 2021

to present | | Current: Vice President, Senior Compliance Officer of Ultimus Fund Solutions, LLC, since 2019. Previous: Chief Operating Officer & CCO at Miles Capital, Inc. (2013 – 2019). |

Elisabeth Dahl (1962)

Secretary, May 2017 to present;

Assistant Secretary, March 2016 to

May 2017 | | Current: Attorney, Ultimus Fund Solutions, LLC since March 2016. |

Timothy J. Shaloo (1970)

AML Compliance Officer, August 2023

to present | | Current: Assistant Vice President, Compliance Officer, Northern Lights Compliance Services, LLC (2021 – present). Previous: Compliance Specialist, Ultimus Fund Solutions, LLC (2016 – 2020). |

| * | The address for each Officer and Interested Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

Other Information (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (888) 711-2837 to request a copy of the SAI or to make shareholder inquiries.

Management Agreement Renewal (Unaudited)

The Auer Growth Fund (the “Fund”) is a series of Unified Series Trust (the “Trust”). The Trust’s Board of Trustees (the “Board”) oversees the management of the Fund and, as required by law, has considered the renewal of the management agreement with its investment adviser, SBAuer Funds, LLC (“Auer”). In connection with such approval, the Board requested and evaluated all information that the Trustees deemed reasonably necessary under the circumstances.

The Trustees held a teleconference on August 9, 2023 to review and discuss materials compiled by Ultimus Fund Solutions, LLC, the Trust’s administrator, with regard to the management agreement between the Trust and Auer. At the Trustees’ quarterly meeting held in August 2023, the Board interviewed certain executives of Auer, including Auer’s Chief Compliance Officer, its Portfolio Manager and Operations Manager, and its Senior Portfolio Manager. After discussion, the Trustees, including the Trustees who are not “interested persons” (as that term is defined in the Investment Company Act of 1940, as amended) of the Trust or Auer (the “Independent Trustees”), approved the renewal of the management agreement between the Trust and Auer for an additional year. The Trustees’ renewal of the Fund’s management agreement was based on a consideration of all the information provided to the Trustees, and was not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations are described below, although individual Trustees may have evaluated this information differently, ascribing different weights to various factors.

(i) The Nature, Extent, and Quality of Services. The Trustees reviewed and considered information regarding the nature, extent, and quality of services that Auer provides to the Fund, which include, but are not limited to, providing a continuous investment program for the Fund, adhering to the Fund’s investment restrictions, complying with the Trust’s policies and procedures, and voting proxies on behalf of the Fund. The Trustees considered the qualifications and experience of Auer’s portfolio managers who are responsible for the day-to-day management of the Fund’s portfolio, as well as the qualifications and experience of the other individuals at Auer who provide services to the Fund. They noted the systematic and manual approach to investment process, comprehensive compliance program, and quality of the Auer personnel, having discussed Auer’s investment strategy and process in depth with its management team. The Trustees concluded that they were satisfied with the nature, extent, and quality of investment management services provided by Auer to the Fund.

(ii) Fund Performance. The Trustees next reviewed and discussed the Fund’s performance for periods ended May 31, 2023. The Trustees observed that the Fund had outperformed its benchmark, the S&P 500 Index, the median return of its Morningstar Small Value Category, and the peer group median, for the three-year period, but underperformed each for the one-year and since inception periods. The Trustees noted that the Fund had outperformed the Morningstar category median and the peer group median for the five-year period but underperformed its benchmark over the same period. The Trustees noted Auer’s explanation that the Fund’s investments in regional banks were negatively impacted by the recent bank failures. The Trustees acknowledged that Auer also attributed underperformance to the Fund’s weighting in certain sectors which was driven by the Fund’s focus on high growth companies, and that Auer provided feedback about the comparisons made in the Broadridge report. It was the consensus of the Trustees that it was reasonable to conclude that Auer has the ability to manage the Fund from a performance standpoint.

(iii) Fee Rate and Profitability. The Trustees reviewed a fee and expense comparison for funds in the Morningstar Small Value Category and peer group, which indicated that the Fund’s

Management Agreement Renewal (Unaudited) (continued)

management fee and net expense ratio are higher than the averages and medians of the Morningstar category and peer group. The Trustees considered Auer’s explanation that the actively managed nature of the Fund, including the high level of touch in qualitative and quantitative analysis, supported a higher-than-average management fee. The Trustees also noted that Auer justified the higher net expense ratio due to the inability to benefit from economies of scale in the same manner as the larger funds in its peer group or Morningstar category.

The Trustees also considered a profitability analysis prepared by Auer for its management of the Fund, which indicated that Auer is earning a slight profit as a result of managing the Fund before deduction of marketing expenses. They also discussed and considered the financial status of the firm.

The Trustees considered other potential benefits that Auer may receive in connection with its management of the Fund, noting Auer’s representation that it does not enter into soft dollar arrangements on behalf of the Fund. After considering the above information, the Trustees concluded that the current management fee for the Fund represents reasonable compensation in light of the nature and quality of Auer’s services to the Fund, the fees paid by competitive mutual funds, and the profitability of Auer’s services to the Fund.

(iv) Economies of Scale. In determining the reasonableness of the management fee, the Trustees also considered the extent to which Auer will realize economies of scale as the Fund grows larger. The Trustees determined that, in light of the current size of the Fund and Auer’s level of profitability in managing the Fund, Auer is not realizing benefits from economies of scale in managing the Fund and therefore it is premature to reduce the management fee or introduce breakpoints at this time.

Privacy Notice

Rev. January 2020

| FACTS | WHAT DOES AUER GROWTH FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| | |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

■ Social Security number ■ account balances and account transactions ■ transaction or loss history and purchase history ■ checking account information and wire transfer instructions |

| When you are no longer our customer, we continue to share your information as described in this notice. |

| | |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Funds choose to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the Fund share? |

For our everyday business purposes—

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes |

For our marketing purposes—

to offer our products and services to you | No |

| For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes—

information about your transactions and experiences | No |

For our affiliates’ everyday business purposes—

information about your creditworthiness | No |

| For nonaffiliates to market to you | No |

| Questions? | Call (888) 711-2837 |

| Who we are |

| Who is providing this notice? | Auer Growth Fund

Ultimus Fund Distributors, LLC (Distributor)

Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you |

■ open an account or deposit money ■ buy securities from us or sell securities to us ■ make deposits or withdrawals from your account ■ give us your account information ■ make a wire transfer ■ tell us who receives the money ■ tell us where to send the money ■ show your government-issued ID ■ show your driver’s license |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only |

■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you |

| State laws and individual companies may give you additional rights to limit sharing. |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. |

■ SBAuer Funds, LLC., the investment adviser to the Fund, could be deemed to be an affiliate. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. |

■ The Fund does not share your personal information with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. |

■ The Fund does not jointly market. |

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (888) 711-2837 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

TRUSTEES

Daniel J. Condon, Chair

David R. Carson

Kenneth G.Y. Grant

Freddie Jacobs, Jr.

Catharine B. McGauley

Ronald C. Tritschler | INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

151 North Franklin Street, Suite 575

Chicago, IL 60606 |

| | |

| | |

OFFICERS

Martin R. Dean, President

GwenethK. Gosselink,

Chief Compliance Officer

Zachary P. Richmond,

Treasurer and Chief Financial Officer | LEGAL COUNSEL

Thompson Hine LLP

312 Walnut Street, 20th Floor

Cincinnati, OH 45202 |

| | |

| | |

INVESTMENT ADVISER

SBAuer Funds, LLC

8801 River Crossing Blvd, Suite 100

Indianapolis, IN 46240 | CUSTODIAN

Huntington National Bank

41 South High Street

Columbus, OH 43215 |

| | |

| | |

DISTRIBUTOR

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 | ADMINISTRATOR, TRANSFER

AGENT AND FUND ACCOUNTANT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 |

| | |

| | |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC

Member FINRA/SIPC

AUER-AR-23

Item 2. Code of Ethics.