SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Materials Pursuant to § 240.14a-12 |

MAGUIRE PROPERTIES

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

April 30, 2007

DEAR STOCKHOLDER:

You are invited to attend the 2007 Annual Meeting of Stockholders of Maguire Properties, Inc. (the “Company”) to be held on Tuesday, June 5, 2007, at 8:00 A.M., local time, at the Loews Santa Monica Hotel, 1700 Ocean Avenue, Santa Monica, California, 90401.

The purposes of this year’s meeting are to:

| | (ii) | ratify the selection of the Company’s independent registered public accounting firm; |

| | (iii) | approve a second amendment and restatement of the Company’s 2003 Incentive Award Plan; and |

| | (iv) | transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The accompanying Notice of Annual Meeting and Proxy Statement describe these matters. We urge you to read this information carefully.

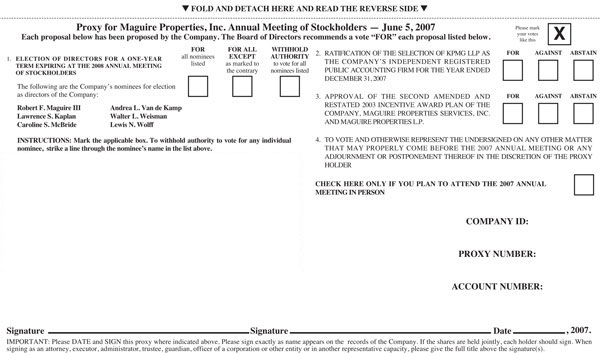

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. If you choose not to attend and vote at the Annual Meeting in person, you may vote by completing and mailing the enclosed proxy card. Voting by written proxy will ensure your shares are represented at the Annual Meeting. Please review the instructions on the proxy card or the information forwarded by your bank, broker or other holder of record regarding each of these voting options.

Sincerely,

Robert F. Maguire III

Chairman and Chief Executive Officer

| | |

| | Maguire Properties |

| |

| | 333 South Grand Avenue |

| | Suite 400 |

| | Los Angeles, California 90071 |

| |

| | 213 626 3300 Main |

| | 213 687 4758 Fax |

| | www.maguireproperties.com |

MAGUIRE PROPERTIES, INC.

1733 Ocean Avenue, Suite 400

Santa Monica, California 90401

NOTICE OF 2007 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 5, 2007

TO THE STOCKHOLDERS OF MAGUIRE PROPERTIES, INC.:

NOTICE IS HEREBY GIVEN that the 2007 Annual Meeting of Stockholders (the “Annual Meeting”) of Maguire Properties, Inc., a Maryland corporation (the “Company”), will be held on Tuesday, June 5, 2007, at 8:00 A.M., local time, at the Loews Santa Monica Hotel, 1700 Ocean Avenue, Santa Monica, California, 90401, to consider the following:

| | • | | the election of six directors to a one-year term of office expiring at the 2008 Annual Meeting of Stockholders and until their successors are duly elected and qualify; |

| | • | | the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2007; |

| | • | | the approval of a second amendment and restatement of the Company’s 2003 Incentive Award Plan; and |

| | • | | the transaction of such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting.

The enclosed proxy card is solicited by our Board of Directors (the “Board”), which recommends that our stockholders vote FOR the election of the Board’s nominees named therein, FOR the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2007 and FOR the approval of the second amendment and restatement of the Company’s 2003 Incentive Award Plan. Please refer to the attached Proxy Statement, which forms a part of this Notice of Annual Meeting and is incorporated herein by reference, for further information with respect to the business to be transacted at the Annual Meeting.

STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN PERSON. YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE URGED TO COMPLETE, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

The Board has fixed the close of business on April 27, 2007 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any continuation, postponement or adjournment thereof.

By Order of Our Board of Directors

Mark T. Lammas

Executive Vice President and Secretary

Los Angeles, California

April 30, 2007

PLEASE SUBMIT A PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN BE VOTED AT THE ANNUAL MEETING IN ACCORDANCE WITH YOUR INSTRUCTIONS. FOR SPECIFIC INSTRUCTIONS ON VOTING, PLEASE REFER TO THE INSTRUCTIONS ON THE PROXY CARD OR THE INFORMATION FORWARDED BY YOUR BROKER, BANK OR OTHER HOLDER OF RECORD. EVEN IF YOU HAVE VOTED YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE IN PERSON AT THE ANNUAL MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM SUCH BROKER, BANK OR OTHER NOMINEE.

MAGUIRE PROPERTIES, INC.

1733 Ocean Avenue, Suite 400

Santa Monica, California 90401

PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

General

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of Maguire Properties, Inc., a Maryland corporation (the “Company”), for use at the 2007 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Tuesday, June 5, 2007, at 8:00 A.M., local time, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this Proxy Statement and in the accompanying Notice of Annual Meeting. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting. The Company intends to mail this Proxy Statement and the accompanying proxy card on or about April 30, 2007 to all stockholders entitled notice of and to vote at the Annual Meeting. The Annual Meeting will be held at the Loews Santa Monica Hotel, 1700 Ocean Avenue, Santa Monica, California, 90401.

Who Can Vote

You are entitled to vote if you were a stockholder of record of the Company’s common stock, par value $.01 per share (the “Common Stock”), as of the close of business on April 27, 2007. Your shares can be voted at the Annual Meeting only if you are present in person or represented by a valid proxy.

Shares Outstanding and Quorum

At the close of business on April 27, 2007, 46,999,100 shares of Common Stock were outstanding and entitled to vote. A majority of the outstanding shares of Common Stock represented in person or by proxy will constitute a quorum at the Annual Meeting.

Proxy Card and Revocation of Proxy

If you sign the proxy card but do not specify how you want your shares to be voted, your shares will be voted by the proxy holders named in the enclosed proxy in favor of the election of all of the director nominees, in favor of ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2007 and in favor of approval of the second amendment and restatement of the Company’s 2003 Incentive Award Plan. In their discretion, the proxy holders named in the enclosed proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment thereof. The Board knows of no other items of business that will be presented for consideration at the Annual Meeting other than those described in this Proxy Statement. In addition, no stockholder proposals or nominations were received on a timely basis, and therefore no such matters may be brought to a vote at the Annual Meeting.

If you vote by proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. You may revoke your proxy by sending to Mark T. Lammas, Executive Vice President and Secretary, Maguire Properties, Inc., 1733 Ocean Avenue, Suite 400, Santa Monica, California 90401, a written notice of revocation

1

or a duly executed proxy bearing a later date or by attending the Annual Meeting in person and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Voting of Shares

Stockholders of record as of the close of business on April 27, 2007 are entitled to one vote for each share of Common Stock held on all matters to be voted upon at the meeting. You may vote by attending the Annual Meeting and voting in person. If you choose not to attend the Annual Meeting, you may still vote by marking, signing, dating and returning the enclosed proxy card in the envelope that we have provided.

All shares entitled to vote and represented by properly executed proxies received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. YOUR VOTE IS IMPORTANT.

Counting of Votes

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, a representative of MacKenzie Partners, Inc., who will separately tabulate affirmative and negative votes and abstentions. Shares held by persons attending the Annual Meeting but not voting, shares represented by proxies that reflect abstentions or withheld votes as to a particular proposal and broker “non-votes” will be counted as present for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares.

In order to be elected as a director, a nominee must receive a plurality of the votes cast at the Annual Meeting at which a quorum is present. For purposes of calculating votes cast in the election of directors, abstentions or broker non-votes will not be counted as votes cast and will have no effect on the result of the vote on the proposal regarding the election of the directors. The affirmative vote of a majority of the votes cast at the Annual Meeting is required for the ratification of the selection of KPMG LLP as our independent registered public accounting firm. For purposes of the vote on the ratification of the selection of KPMG LLP as our independent registered public accounting firm, abstentions or broker non-votes will not be counted as votes cast and will have no effect on the result of the vote. The affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve the second amendment and restatement of the Company’s 2003 Incentive Award Plan, provided that the total votes cast on the proposal represent over 50% in interest of the outstanding shares of common stock entitled to vote on the proposal. For purposes of the vote on the approval of the second amendment and restatement of the Company’s 2003 Incentive Award Plan, abstentions will have the same effect as votes against the proposal1 and broker non-votes will have the same effect as votes against the proposal, unless holders of more than 50% in interest of the outstanding shares of common stock entitled to vote on the proposal cast votes, in which event broker non-votes will not have any effect on the result of the vote.

Solicitation of Proxies

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly and mailing of this Proxy Statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding shares of our Common Stock in their names that are beneficially owned by others to forward to these beneficial owners. The Company may reimburse persons representing beneficial owners for their costs of forwarding the solicitation

1 | Note: although abstentions are not votes cast under Maryland law, the New York Stock Exchange has an unwritten policy that abstentions are votes cast for purposes of the approval of transactions under Section 312.03 of the Listed Company Manual. |

2

material to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, facsimile, electronic mail or personal solicitation by directors, officers or employees of the Company. No additional compensation will be paid to directors, officers or employees for such services. In addition, the Company has retained MacKenzie Partners, Inc. to assist in the solicitation of proxies.

NO PERSON IS AUTHORIZED ON BEHALF OF THE COMPANY TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS WITH RESPECT TO THE PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING, OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION AND/OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED, AND THE DELIVERY OF THIS PROXY STATEMENT SHALL, UNDER NO CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE HEREOF.

The Company’s principal executive offices are located at 1733 Ocean Avenue, Suite 400, Santa Monica, California 90401, our telephone number is (310) 857-1100 and our website is located at http://www.maguireproperties.com.2 References herein to the “Company” refer to Maguire Properties, Inc. and its subsidiaries, unless the context otherwise requires.

The date of this Proxy Statement is April 30, 2007.

2 | Website addresses referred to in this Proxy Statement are not intended to function as hyperlinks, and the information contained on our website is not a part of this Proxy Statement. |

3

ELECTION OF DIRECTORS

Under the Company’s charter and the Company’s Amended and Restated Bylaws (“Bylaws”), each member of the Board serves for a one-year term and until his or her successor is duly elected and qualifies. Vacancies on the Board may be filled only by individuals elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the size of the Board) will serve for the remainder of the applicable term and until such director’s successor is elected and qualifies, or until such director’s earlier death, resignation or removal.

Directors are elected by a plurality of the votes cast at the Annual Meeting, which means the six nominees who receive the largest number of properly cast votes will be elected as directors. Each share of Common Stock is entitled to one vote for each of the six director nominees. Cumulative voting is not permitted. It is the intention of the proxy holders named in the enclosed proxy to vote the proxies received by them for the election of the nominees named below unless authorization to do so is withheld. If any nominee should become unavailable for election prior to the Annual Meeting, an event which the Board does not currently anticipate, the proxies will be voted for the election of a substitute nominee or nominees proposed by the Board.

Mr. Robert F. Maguire III, Mr. Lawrence S. Kaplan, Ms. Caroline S. McBride, Ms. Andrea L. Van de Kamp, Mr. Walter L. Weisman and Mr. Lewis N. Wolff are all of our nominees for election to the Board. Each such nominee has consented to be named in this Proxy Statement and to serve as a director if elected, and our management has no reason to believe that any nominee will be unable to serve. The information below relating to the nominees for election as director has been furnished to the Company by the respective individuals. Each of the nominees would serve until his or her successor is elected and qualifies, or until such director’s earlier death, resignation or removal. If elected at the Annual Meeting, Messrs. Maguire, Kaplan, Weisman and Wolff and Mses. McBride and Van de Kamp would each serve until the 2008 Annual Meeting.

Nominees for Election for a One-Year Term Expiring at the 2008 Annual Meeting

The following table sets forth the name and age of the individuals who are our nominees for election as directors of the Company:

| | |

Name | | Age |

Robert F. Maguire III | | 72 |

Lawrence S. Kaplan | | 64 |

Caroline S. McBride | | 53 |

Andrea L. Van de Kamp | | 63 |

Walter L. Weisman | | 71 |

Lewis N. Wolff | | 71 |

The following is a biographical summary of the experience of the individuals who are our nominees for election as directors of the Company:

Robert F. Maguire IIIhas served as Chairman of the Board since June 26, 2002, Chief Executive Officer since January 1, 2006 and from June 26, 2002 to November 11, 2002, and Co-Chief Executive Officer from November 12, 2002 to December 31, 2005. Mr. Maguire received his bachelor’s degree in political science from UCLA in 1961. Thereafter, he joined Security Pacific National Bank and progressed to the role of vice president, working with many of the country’s largest corporations and real estate developers. In 1965, he established the Maguire Organization, comprised of Maguire Partners Development, Ltd. and its more than 125 predecessor and related entities. All were predominantly owned by or otherwise affiliated with Mr. Maguire, and collectively did business as Maguire Partners. Maguire Partners initially specialized in industrial and housing projects and commenced commercial office building development in 1968. Mr. Maguire has directed the development of

4

more than 25 million square feet of institutional-quality projects nationally, generally with major tenants such as Sempra Energy, IBM, Wells Fargo Bank, Bank of America, The Walt Disney Company, MGM and Time Warner. Recognized for the architectural quality of its properties, Maguire Partners received numerous awards for design excellence. Under Mr. Maguire’s direction, the firm developed some of the most significant landmark projects in the country. These include premier projects such as US Bank Tower, Gas Company Tower, Wells Fargo Tower and KPMG Tower in downtown Los Angeles, California; Plaza Las Fuentes in Pasadena, California; Glendale Center in Glendale, California; Commerce Square in downtown Philadelphia, Pennsylvania; and Solana in Dallas, Texas. Mr. Maguire is a trustee of St. John’s Hospital and a board member of the Los Angeles County Museum of Art and the Los Angeles Music Center.

Lawrence S. Kaplanhas served on the Board since May 14, 2003. Mr. Kaplan is a Certified Public Accountant and retired as a partner from Ernst & Young LLP in September of 2000, where he was the national director of that firm’s REIT Advisory Services group. Mr. Kaplan joined Ernst & Young LLP as a partner in 1995 and was actively involved in the formation of numerous publicly traded REITs. After his retirement in 2000, Mr. Kaplan was retained by Ernst & Young LLP as a consultant through 2001. Mr. Kaplan has served on the board of governors of the National Association of Real Estate Investment Trusts and has been actively involved in REIT legislative and regulatory matters for more than 20 years. He is a member of the board of directors of Highwoods Properties, Inc. and Feldman Mall Properties, Inc., publicly held REITs, where he serves as Chairman of their audit committees, and until December 2005, was a director of Endeavour Real Estate Securities Limited, a privately held REIT. At Feldman Mall Properties, Mr. Kaplan is also a member of their compensation and nomination/governance committees. Mr. Kaplan holds a bachelor of science degree from the University of Chicago and an MBA from Columbia University. He serves as one of our Independent Directors (as defined below under the heading “– Independent Directors”), as Chair of our Audit Committee and as a member of our Compensation Committee and Nominating and Corporate Governance Committee.

Caroline S. McBride has served on the Board since May 14, 2003. Ms. McBride is co-Founder, Chief Investment Officer and a Managing Director of Forum Partners Investment Management LLC, a real estate investment management firm that specializes in value-added indirect investments. Prior to founding Forum Partners, Ms. McBride was a Managing Director at Security Capital Group, where she provided investment and operating oversight for public and private real estate companies in which Security Capital Group had a significant ownership position. Ms. McBride holds a bachelor of arts degree from Middlebury College and an MBA from New York University. She serves as one of our Independent Directors, as Chair of our Compensation Committee and as a member of our Audit Committee and Nominating and Corporate Governance Committee.

Andrea L. Van de Kamphas served on the Board since April 23, 2003. Ms. Van de Kamp has served as President of the West Coast Division of Fernwood Art Investments, LLC since January 2006. Prior to joining Fernwood, she served as Chairman of Sotheby’s west coast business activities, and until 2005, was a Senior Vice President for Sotheby’s North America. Ms. Van de Kamp is the Chairman Emeritus of the Performing Arts Center of Los Angeles County, which is the second largest performance arts center in the United States. Prior to joining Sotheby’s in 1989, Ms. Van de Kamp was President and CEO of the Independent Colleges of Southern California, where she administered annual fundraising campaigns for fifteen independent colleges. Earlier in her career, she served as Director for Public Affairs for Carter Hawley Hale Stores, Director of Development of the Museum of Contemporary Art, Executive Director of the Southern California Coro Foundation and Associate Director of Admissions for Dartmouth College. Ms. Van de Kamp served on the board of directors of Jenny Craig, Inc. from August 1994 until May 2002, The Walt Disney Company from December 1998 until March 2003, and City National Bank from 1993 until 2006. Ms. Van de Kamp is a graduate of Michigan State University and received a Master’s degree from Teacher’s College of Columbia University. She serves as one of our Independent Directors and as a member of our Compensation Committee and Nominating and Corporate Governance Committee.

Walter L. Weisman has served on the Board since April 23, 2003. Mr. Weisman is a past Chairman and Chief Executive Officer of American Medical International, Inc. (“AMI”). Mr. Weisman was admitted to the

5

California bar in 1960, practiced law for several years, entered the healthcare field in 1969 and joined AMI in 1972. He became Chief Operating Officer of AMI in 1976, President in 1978 and Chief Executive Officer in 1985. When Mr. Weisman left AMI in 1988, AMI was primarily a hospital management company that owned and operated acute care hospitals across the United States and in Europe, the Middle East, Latin America, Asia and Australia. At the time, AMI had more than 50,000 employees and annual revenues of approximately $4 billion. Since 1988, Mr. Weisman has been involved in private investments and volunteer activities. He is presently Vice Chairman of the Board of Trustees of the California Institute of Technology and a Member of the Institute’s oversight committee for the Jet Propulsion Laboratory. Mr. Weisman is the former Chairman and is now a Life Trustee of the Board of Trustees of the Los Angeles County Museum of Art and Chairman of the Board of Trustees of the Sundance Institute. He is also a trustee of the Kress Foundation. Mr. Weisman is a director of Occidental Petroleum Corporation (Los Angeles) and Fresenius Medical Care (Frankfurt, Germany), and until March 2005 was a director of Community Care Health Network, Inc. (New York City). Mr. Weisman holds a bachelor’s degree from Stanford University and a juris doctor degree from Stanford Law School. On February 2, 2006, the board of directors approved the appointment of Walter L. Weisman as non-executive Vice Chairman and lead director of the board of directors of the Company. Mr. Weisman also serves as one of our Independent Directors, as Chair of our Nominating and Corporate Governance Committee and as a member of our Audit Committee and Compensation Committee.

Lewis N. Wolff has served on the Board since December 8, 2005. Mr. Wolff is Chairman of Wolff Urban Management, Inc., a real estate acquisition, investment, development and management firm. He co-founded and, since 1994, served as Chairman of Maritz, Wolff & Co., a privately held hotel investment group that manages top-tier luxury hotels. Maritz, Wolff & Co.’s investments exceed $1.0 billion. Mr. Wolff serves as Chairman of Sunstone Hotel Investors, Inc., serves as Vice Chairman of Rosewood Hotels & Resorts and, from 1999 through the summer of 2004, served as Co-Chairman of Fairmont Hotels & Resorts, a hotel management company formed by Fairmont Hotel Management Company and Canadian Pacific Hotels & Resorts, Inc. In April of 2005, Mr. Wolff acquired ownership of Major League Baseball’s Oakland Athletics. He serves on the Board of Directors for Grill Concepts, Inc., First Century Bank and the Museum of Contemporary Art. Mr. Wolff entered the hotel business in the 1980s by becoming developer/owner/operator of the San Jose Holiday Inn in Northern California and the Burbank Airport Hilton and the La Mirada Gateway Plaza Holiday Inn in Southern California. He expanded his portfolio by acquiring office buildings, theaters and additional hotels. Mr. Wolff’s career began in St. Louis, Louisiana at Roy Wenzlick & Company, a real estate economics, appraisal and publishing firm, and he eventually opened and managed its West Coast office in Los Angeles. Mr. Wolff’s accomplishments in the real estate field earned him an appointment in 1977 as a permanent staff member of the University of California Extension Program. Mr. Wolff also served as President of Twentieth Century Fox Realty & Development Company, where he managed Twentieth Century Fox’s worldwide corporate real estate activities. Mr. Wolff is a former primary owner of the St. Louis Blues National Hockey League Team and a former primary owner of the Golden State Warriors National Basketball Team. Mr. Wolff holds a bachelor’s degree in business administration from the University of Wisconsin, Madison and received his MBA from Washington University in St. Louis. He is a member of the American Institute of Real Estate Appraisers. He serves as one of our Independent Directors and as a member of our Compensation Committee and Nominating and Corporate Governance Committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF MESSRS. MAGUIRE, KAPLAN, WEISMAN AND WOLFF AND MSES. MCBRIDE AND VAN DE KAMP TO SERVE ON OUR BOARD OF DIRECTORS UNTIL THE 2008 ANNUAL MEETING AND UNTIL THEIR RESPECTIVE SUCCESSORS ARE DULY ELECTED AND QUALIFY.

Board Governance Documents

The Board maintains charters for each of its committees. In addition, the Board has adopted a written set of corporate governance guidelines and a code of business conduct and ethics. To view our committee charters, corporate governance guidelines and code of business conduct and ethics, please visit our website at http://www.maguireproperties.com. Each of such documents is also available in print to any stockholder who

6

sends a written request to such effect to Mark T. Lammas, Executive Vice President and Secretary, Maguire Properties, Inc., 1733 Ocean Avenue, Suite 400, Santa Monica, California 90401.

Independent Directors

New York Stock Exchange (“NYSE”) listing standards require NYSE-listed companies to have a majority of independent board members and a nominating/corporate governance committee, compensation committee and audit committee each comprised solely of independent directors. Under the NYSE listing standards, no director of a company qualifies as “independent” unless the board of directors of such company affirmatively determines that the director has no material relationship with such company (either directly or as a partner, stockholder or officer of an organization that has a relationship with such company). In addition, the NYSE listing standards provide that a listed company’s director is not independent if: (i) the director is, or has been within the last three years, an employee of the listed company, or an immediate family member is, or has been within the last three years, an executive officer of the listed company; (ii) the director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $100,000 in direct compensation from the listed company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); (iii) (A) the director or an immediate family member is a current partner of a firm that is the listed company’s internal or external auditor; (B) the director is a current employee of such a firm; (C) the director has an immediate family member who is a current employee of such a firm and who participates in the firm’s audit, assurance or tax compliance (but not tax planning) practice; or (D) the director or an immediate family member was within the last three years (but is no longer) a partner or employee of such a firm and personally worked on the listed company’s audit within that time; (iv) the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of the listed company’s present executive officers at the same time serves or served on that company’s compensation committee; and (v) the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the listed company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues. The Board by resolution adopted such standards as the Company’s standards for independence of Board members, and has affirmatively determined that all nominees for election to the Board at the Annual Meeting are independent under such standards (“Independent Directors”), except for Mr. Maguire.

Board Meetings

The Board held 12 meetings and the non-management directors (which includes all the members of the Board except for Mr. Maguire) met in executive sessions 4 times during the year ended December 31, 2006. Walter L. Weisman presided over such executive sessions. The number of meetings for each Board committee is set forth below under the heading “– Board Committees.” During the year ended December 31, 2006, all of the directors attended at least 75% of the total number of meetings of the Board and of the Board committees on which they served. The Board expects all directors to attend each Annual Meeting of Stockholders barring unforeseen circumstances or unresolvable conflicts. All of our directors at the time of our 2006 Annual Meeting of Stockholders, which was held on June 6, 2006, were in attendance at such Annual Meeting.

Board Committees

Audit Committee

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The function of the Audit Committee is to help ensure the

7

integrity of our financial statements, the qualifications and independence of our independent registered public accounting firm and the performance of our internal audit function and independent registered public accounting firm. The Audit Committee is to select, assist and meet with the independent registered public accounting firm, oversee each annual audit and quarterly review, establish and maintain our internal audit controls and prepare the report that federal securities laws require be included in our Proxy Statement each year (see page 51 for the current Audit Committee Report). The Board has approved a charter of the Audit Committee and the Audit Committee carries out its responsibilities in accordance with those terms. The charter is located on our website at http://www.maguireproperties.com and is available in print to any stockholder who requests it by writing to our Secretary, as provided for in “– Board Governance Documents.” Mr. Kaplan is Chair and Ms. McBride and Mr. Weisman are members of the Audit Committee, all of whom are Independent Directors. The Board has determined that Mr. Kaplan is an “audit committee financial expert” as defined by the Securities and Exchange Commission (the “SEC”). The Audit Committee meets the NYSE composition requirements, including the requirements dealing with financial literacy and financial sophistication. The members of the Audit Committee satisfy the enhanced independence standards applicable to audit committees pursuant to Rule 10A-3(b)(i) under the Exchange Act and the NYSE listing standards. During the year ended December 31, 2006, the Audit Committee met 10 times.

Before the independent registered public accounting firm is engaged by the Company or its subsidiaries to render audit or non-audit services, the Audit Committee shall pre-approve the engagement. Audit Committee pre-approval of audit and non-audit services will not be required if the engagement for the services is entered into pursuant to pre-approval policies and procedures established by the Audit Committee regarding the Company’s engagement of the independent registered public accounting firm, provided the policies and procedures are detailed as to the particular service, the Audit Committee is informed of each service provided and such policies and procedures do not include delegation of the Audit Committee’s responsibilities under the Exchange Act to the Company’s management. The Audit Committee may delegate to one or more designated members of the Audit Committee the authority to grant pre-approvals, provided such approvals are presented to the Audit Committee at a subsequent meeting. If the Audit Committee elects to establish pre-approval policies and procedures regarding non-audit services, the Audit Committee must be informed of each non-audit service provided by the independent registered public accounting firm. Audit Committee pre-approval of non-audit services (other than review and attest services) also will not be required if such services fall within available exceptions established by the SEC. Further information regarding the specific functions performed by the Audit Committee is set forth below in “Audit Matters – Audit Committee Report.”

Compensation Committee

The Compensation Committee establishes, reviews, modifies and approves the compensation and benefits of our executive officers, administers our Amended and Restated 2003 Incentive Award Plan (our “Incentive Award Plan”) of the Company, Maguire Properties Services, Inc., a Maryland corporation (the “Services Company”) and Maguire Properties, L.P., a Maryland limited partnership (the “Operating Partnership”), and any other incentive programs and produces an annual report on executive compensation for inclusion in our Proxy Statement each year (see page 41 for the current Compensation Committee Report on Executive Compensation). Our Compensation Committee Charter is located on our website at http://www.maguireproperties.com and is available in print to any stockholder who requests it by writing to our Secretary, as provided for in “– Board Governance Documents.” Ms. McBride is Chair and Mr. Kaplan, Ms. Van de Kamp, Mr. Weisman and Mr. Wolff are members of the Compensation Committee, all of whom are Independent Directors. During the year ended December 31, 2006, the Compensation Committee met 4 times. Further information regarding the specific functions performed by the Compensation Committee is set forth below in “– Compensation Committee Report on Executive Compensation.”

Nominating and Corporate Governance Committee

The Company has a standing Nominating and Corporate Governance Committee, which committee’s function is to develop and recommend to the Board a set of corporate governance principles, adopt a code of

8

ethics, adopt policies with respect to conflicts of interest, monitor our compliance with corporate governance requirements of state and federal law and the rules and regulations of the NYSE, establish criteria for prospective members of the Board, conduct candidate searches and interviews, oversee and evaluate the Board and our management, evaluate from time to time the appropriate size and composition of the Board and recommend, as appropriate, increases, decreases and changes in the composition of the Board and formally propose the slate of directors to be elected at each Annual Meeting of Stockholders. Our Nominating and Governance Committee Charter is located on our website at http://www.maguireproperties.com and is available in print to any stockholder who requests it by writing to our Secretary, as provided for in “– Board Governance Documents.” Mr. Weisman is Chair and Mr. Kaplan, Ms. McBride, Ms. Van de Kamp and Mr. Wolff are members of the Nominating and Corporate Governance Committee, all of whom are Independent Directors. During the year ended December 31, 2006, the Nominating and Corporate Governance Committee met 4 times. Further information regarding the Nominating and Corporate Governance Committee is set forth below in “– Qualifications of Director Nominees” and “– Nominating and Corporate Governance Committee’s Process for Considering Director Nominees.”

Qualifications of Director Nominees

The Nominating and Corporate Governance Committee has not set forth minimum qualifications for Board nominees. However, pursuant to its charter, in identifying candidates to recommend for election to the Board, the Nominating and Corporate Governance Committee considers the following criteria:

| | • | | experience in corporate governance, such as service as an officer or former officer of a publicly held company; |

| | • | | experience in the Company’s industry; |

| | • | | experience as a board member of another publicly held company; and |

| | • | | academic expertise in an area of the Company’s operations. |

Nominating and Corporate Governance Committee’s Process for Considering Director Nominees

At an appropriate time prior to each Annual Meeting at which directors are to be elected or re-elected, the Nominating and Corporate Governance Committee shall recommend to the Board for nomination by the Board such candidates as the Nominating and Corporate Governance Committee, in the exercise of its judgment, has found to be well qualified and willing and available to serve. The Nominating and Corporate Governance Committee shall, at least annually, evaluate the performance of each current director.

At an appropriate time after a vacancy arises on the Board or a director advises the Board of his or her intention to resign, the Nominating and Corporate Governance Committee shall recommend to the Board for election by the Board to fill such vacancy such prospective member of the Board as the Nominating and Corporate Governance Committee, in the exercise of its judgment, has found to be well qualified and willing and available to serve. In determining whether a prospective member is qualified to serve, the Nominating and Corporate Governance Committee will consider the factors listed above in “– Qualifications of Director Nominees.”

Notwithstanding the foregoing, if the Company is legally required by contract or otherwise to permit a third party to designate one or more of the directors to be elected (for example, pursuant to rights contained in Articles Supplementary designating a class or series of preferred stock to elect one or more directors upon a dividend default), then the nomination or election of such directors shall be governed by such requirements. Additionally, recommendations received by stockholders will be considered and are subject to the same criteria as are candidates recommended by the Nominating and Corporate Governance Committee.

9

Manner by which Stockholders May Recommend Director Candidates

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders of the Company. All recommendations must be directed to Walter L. Weisman, Chair of the Nominating and Corporate Governance Committee, c/o Mark T. Lammas, Executive Vice President and Secretary, Maguire Properties, Inc., 1733 Ocean Avenue, Suite 400, Santa Monica, California 90401. Recommendations for director nominees to be considered at the 2008 Annual Meeting of Stockholders must be received in writing not later than January 1, 2008. Each stockholder recommending a person as a director candidate must provide the Company with the following information so that the Nominating and Corporate Governance Committee may determine whether the recommended director candidate is independent from the stockholder, or each member of the stockholder group, that has recommended the director candidate:

| | • | | if the recommending stockholder or any member of the recommending stockholder group is a natural person, whether the recommended director candidate is the recommending stockholder, a member of the recommending stockholder group, or a member of the immediate family of the recommending stockholder or any member of the recommending stockholder group; |

| | • | | if the recommending stockholder or any member of the recommending stockholder group is an entity, whether the recommended director candidate or any immediate family member of the recommended director candidate is or has been at any time during the current or preceding calendar year an employee of the recommending stockholder or any member of the recommending stockholder group; |

| | • | | whether the recommended director candidate or any immediate family member of the recommended director candidate has accepted, directly or indirectly, any consulting, advisory, or other compensatory fees from the recommending stockholder or any member of the group of recommending stockholders, or any of their respective affiliates, during the current or preceding calendar year; |

| | • | | whether the recommended director candidate is an executive officer or director (or person fulfilling similar functions) of the recommending stockholder or any member of the recommending stockholder group, or any of their respective affiliates; and |

| | • | | whether the recommended director candidate controls the recommending stockholder or any member of the recommending stockholder group. |

The recommending stockholder must also provide supplemental information that the Nominating and Corporate Governance Committee may request to determine whether the recommended director candidate (i) is qualified to serve on the Audit Committee, (ii) meets the standards of an Independent Director, and (iii) satisfies the standards for our directors set forth above in “– Qualifications of Director Nominees.” In addition, the recommending stockholder must include the consent of the recommended director candidate in the information provided to the Company and the recommended director candidate must make himself or herself reasonably available to be interviewed by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will consider all recommended director candidates submitted to it in accordance with these established procedures, though it will only recommend to the Board as potential nominees those candidates it believes are most qualified. However, the Nominating and Corporate Governance Committee will not consider any director candidate if the candidate’s candidacy or, if elected, Board membership, would violate controlling federal or state law.

Communications with the Board

Stockholders or other interested persons wishing to communicate with the Board may send correspondence directed to the Board, c/o Mark T. Lammas, Executive Vice President and Secretary, Maguire Properties, Inc.,

10

1733 Ocean Avenue, Suite 400, Santa Monica, California 90401. Mr. Lammas will review all correspondence addressed to the Board, or any individual Board member, for any inappropriate correspondence and correspondence more suitably directed to the Company’s management. Mr. Lammas will summarize all correspondence not forwarded to the Board and make the correspondence available to the Board for its review at the Board’s request. Mr. Lammas will forward all such communications to the Board prior to the next regularly scheduled meeting of the Board following the receipt of the communication as appropriate. Correspondence intended for our non-management directors as a group should be addressed to the Company at the address above, “Attention: Non-Management Directors.”

Compensation of Directors

In fiscal 2006, each of our directors who is not an employee of the Company or one of our subsidiaries received an annual fee of $90,000 for services as a director. The chair of the Audit Committee, Lawrence S. Kaplan, received an additional $25,000 annual fee. No additional fee is paid for attendance at Board committee meetings. Directors who are employees of the Company or our subsidiaries do not receive compensation for their services as directors. As non-executive Vice Chairman and lead director of the Board, Walter L. Weisman received an additional annual fee of $100,000 as approved by the Compensation Committee of the Board.

Effective upon the election of directors at the 2007 Annual Meeting, we made certain changes to the cash compensation awarded to directors, including increasing the annual fee for director services to $100,000; increasing the additional annual fee for the chair of the Audit Committee to $35,000; and providing that the chair of the Compensation Committee will receive an additional annual fee of $25,000.

Our Incentive Award Plan provides for formula grants of stock options to non-employee directors on and after the consummation of our initial public offering (our “IPO”), which occurred on June 27, 2003. On June 27, 2003, each non-employee director received an option to purchase 7,500 shares of our Common Stock at an exercise price of $19.00 per share. Thereafter, on the date of each Annual Meeting of Stockholders at which the non-employee director is re-elected to the Board, such non-employee director will receive an option to purchase 5,000 shares of our Common Stock at an exercise price equal to 100% of the fair market value of our Common Stock on the date of grant. Such options were granted in connection with the Company’s 2004, 2005 and 2006 Annual Meetings to all non-employee directors. Similarly, each non-employee director who is initially elected to the Board after our IPO will receive an option to purchase 7,500 shares of our Common Stock on the date of such initial election and an option to purchase 5,000 shares of our Common Stock on the date of each subsequent Annual Meeting of Stockholders at which the non-employee director is re-elected to the Board. The exercise price will be equal to 100% of the fair market value of our Common Stock on the date of grant. The options granted to non-employee directors are exercisable in three equal annual installments beginning on the first anniversary of the date of grant. For further detail on the actual compensation earned by our Board during fiscal 2006, see the table under the heading “Executive Compensation – Director Compensation Table.”

Pursuant to a proposed amendment to the Incentive Award Plan and commencing with the Company’s 2007 Annual Meeting, on the date of each Annual Meeting of Stockholders at which the non-employee director is elected or re-elected to the Board, such non-employee director will be granted 1,000 restricted shares of our Common Stock at a price equal to $0.01 per share. The restricted stock granted to non-employee directors are exercisable in three equal annual installments beginning on the first anniversary of the date of grant. For further detail on the proposed amendment to the Incentive Award Plan, see the discussion under the heading “Item 3 – Approval of Second Amended and Restated Incentive Award Plan.”

11

ITEM 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2007, and has further directed that management submit the selection of the independent registered public accounting firm for ratification by the Company’s stockholders at the Annual Meeting. KPMG LLP has audited the Company’s financial statements since the Company’s inception in 2002. A representative of KPMG LLP is expected to be present at the Annual Meeting, and, if present, will have an opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Stockholder ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm is not required by the Bylaws or otherwise. However, the Board is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company.

The affirmative vote of a majority of the votes cast at the Annual Meeting is required for the ratification of the selection of KPMG LLP as our independent registered public accounting firm.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF KPMG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2007.

12

ITEM 3

APPROVAL OF SECOND AMENDED AND RESTATED INCENTIVE AWARD PLAN

The Board has adopted, subject to approval by our stockholders, the Second Amended and Restated 2003 Incentive Award Plan of the Company, the Services Company and the Operating Partnership (the “Amended Incentive Award Plan”). If approved, the Amended Incentive Award Plan would amend and restate our Incentive Award Plan, to, among other things, (i) increase the aggregate number of shares of stock which may be issued or transferred under the plan by 1,233,159 shares to a total of 6,050,000 shares (the “Plan Limit”); (ii) provide that the maximum number of shares of stock with respect to awards granted to any one participant during a calendar year will be 1,500,000 and the maximum amount that may be paid in cash during any calendar year with respect to any performance-based award not denominated in stock or otherwise for which the foregoing share-based limitation would not be an effective limitation for purposes of Section 162(m) of the Code will be $2,000,000 (the “Award Limit”); (iii) allow the administrator of the Amended Incentive Award Plan (the “Administrator”) to grant profits interest units in the Operating Partnership as incentive awards; (iv) specify how various awards will count against the Plan Limit and Award Limit respectively; and (v) revise certain provisions relating to stock option and SAR grants. The Amended Incentive Award Plan will become effective upon approval by the Company’s stockholders. If the Company’s stockholders do not approve the amendment and restatement of the Incentive Award Plan, the amendment and restatement will not become effective and the Incentive Award Plan, as in effect prior to the amendment and restatement, will continue in full force and effect in accordance with its terms.

A summary of the material features of the Amended Incentive Award Plan is set forth below. This summary also identifies the material differences between the Amended Incentive Award Plan and the Incentive Award Plan as in effect prior to this amendment and restatement. This summary is qualified in its entirety by reference to the Amended Incentive Award Plan itself, which is included herein asAppendix I.

General

The Amended Incentive Award Plan generally provides for the grant of long-term incentive awards to eligible employees, consultants and directors of the Company, the Operating Partnership, the Services Company and our and their subsidiaries. The purpose of the Amended Incentive Award Plan is to promote the success and enhance the value of the Company by linking the personal interests of employees (including executives), consultants and directors to those of the Company’s stockholders by providing such individuals with an incentive for outstanding performance to generate superior returns to the Company’s stockholders.

Types of Awards

Awards issuable under the plan, prior to this amendment and restatement, include stock options, restricted stock, dividend equivalents, stock appreciation rights (SARs), performance awards, deferred stock awards and stock payment awards. The Amended Incentive Award Plan amends the plan to permit the plan administrator to grant awards of profits interest units in the Operating Partnership under the plan in addition to the awards already authorized under the plan.

Shares Available for Awards

The Incentive Award Plan, prior to this amendment and restatement, provides that a total of 4,816,841 shares of our Common Stock will be reserved for issuance pursuant to the plan, subject to certain adjustments set forth therein. The Amended Incentive Award Plan would amend the plan to increase the Plan Limit by 1,233,159 shares to a total of 6,050,000 shares. Under the Amended Incentive Award Plan each profits interest unit issued pursuant to an award shall be counted against each of the Plan Limit and the Award Limit as one share of Common Stock. The counting provision relating to profits interest units is not contained in the Incentive Award Plan prior to this amendment and restatement.

13

To the extent that an award terminates, expires, or is canceled without having been fully exercised, any shares of Common Stock subject to the award will again be available for the grant of awards under the Amended Incentive Award Plan. Any shares of Common Stock tendered or withheld to satisfy the grant or exercise price or tax withholding obligation pursuant to any award will be counted as issued or transferred under the Amended Incentive Award Plan and will not subsequently be available for the grant of an award pursuant to the Amended Incentive Award Plan. Under the Incentive Award Plan prior to this amendment and restatement, shares tendered or withheld to satisfy the grant or exercise price or tax withholding obligations were not counted as issued or transferred under the plan and were available for subsequent grant. The Amended Incentive Award Plan also provides that shares issued in assumption of, or in substitution for, any outstanding awards of any entity acquired in any form of combination by the Company or any of its subsidiaries will not be counted against the Plan Limit. As of December 31, 2006, there were 1,750,080 shares or units subject to outstanding awards under the Incentive Award Plan and an aggregate of 3,066,761 shares of our Common Stock remained available for future grant pursuant to the Incentive Award Plan.

Prior to amendment and restatement, the Incentive Award Plan provides that

| | • | | subject to adjustment as provided therein, the maximum number of shares which may be subject to awards granted to any individual in any calendar year will not exceed 1,000,000 shares of Common Stock for incentive awards other than performance awards; and |

| | • | | the maximum amount of any performance award for any calendar year may not exceed $2,000,000. |

However, this limit did not apply until the earliest of the first material modification of the Incentive Award Plan, the issuance of all of the shares reserved for issuance under the Incentive Award Plan, the expiration of the Incentive Award Plan, or the first meeting of our stockholders at which directors are to be elected that occurs after the close of the third calendar year following the calendar year of our initial public offering.

As set forth in the Amended Incentive Award Plan, the Company is seeking stockholder approval to amend these limits to provide that the maximum number of shares of stock with respect to awards granted to any one participant during a calendar year will be 1,500,000 and the maximum amount that may be paid in cash during any calendar year with respect to any performance award not denominated in stock or otherwise for which the foregoing share-based limitation would not be an effective limitation will be $2,000,000. These limits will apply effective as of the date on which our stockholders approve the Amended Incentive Award Plan.

Eligibility

Employees and consultants of the Company, the Operating Partnership, the Services Company or any subsidiary, and directors of the Company, are eligible to be granted non-qualified stock options, restricted stock, stock appreciation rights, performance share awards, performance stock units, dividend equivalents, stock payments, deferred stock, restricted stock units, profits interest units, other incentive awards and performance awards under the Amended Incentive Award Plan. Only employees of the Company and its qualifying corporate subsidiaries are eligible to be granted options that are intended to qualify as “incentive stock options” under Section 422 of the Code. As of December 31, 2006, we had 163 employees and consultants worldwide, 10 of whom constitute our executive group, and our board of directors consisted of five non-employee directors who were eligible to participate in the Amended Incentive Award Plan.

Administration

The Amended Incentive Award Plan is administered by the Compensation Committee. Each member of the Compensation Committee that administers the Amended Incentive Award Plan will be both a “non-employee director” within the meaning of Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and an “outside director” within the meaning of Section 162(m) of the Code. The Amended Incentive

14

Award Plan also requires that each such director be an “independent director” under the rules of the New York Stock Exchange (or other securities market on which our shares are then trades), a requirement that was not included in the Incentive Award Plan prior to this amendment and restatement. Under the Amended Incentive Award Plan, any action taken by the Compensation Committee will be valid and effective, whether or not members of the Committee are later determined not to have satisfied these membership requirements or otherwise provided in the Committee’s charter. This provision was not expressly included in the Incentive Award Plan prior to this amendment and restatement. The Amended Incentive Award Plan provides that the Administrator has the authority to designate recipients of awards and to determine the terms and provisions of awards, including the exercise or purchase price, expiration date, vesting schedule and terms of exercise.

Stock Options

The exercise price of nonqualified stock options and incentive stock options granted under the Amended Incentive Award Plan, prior to amendment and restatement, must be at least 85% and 100%, respectively, of the fair market value of our Common Stock on the date of grant. As amended and restated, the Amended Incentive Award Plan provides that the exercise price of all stock options (whether nonqualified stock options or incentive stock options) must be at least 100% of the fair market value of our Common Stock on the date of grant. Incentive stock options granted to optionees who own more than 10% of our outstanding Common Stock on the date of grant must have an exercise price that is at least 110% of fair market value of our Common Stock on the grant date. For purposes of the Amended Incentive Award Plan, provided that our Common Stock continues to be traded on the NYSE or another exchange, the “fair market value” of the common stock on any given date will be the closing price of a share as reported in theWall Street Journal (or such other source as the Company may deem reliable) for that date, or if no sale occurred on that date, the first trading day immediately prior to such date during which a sale occurred. The closing price of a share of our Common Stock on the NYSE on April 27, 2007 was $35.41 per share.

Stock options granted under the Amended Incentive Award Plan will expire no later than 10 years after the date of grant, or five years after the date of grant with respect to incentive stock options granted to individuals who own more than 10% of our outstanding Common Stock on the grant date.

Restricted Stock and Other Awards

The Amended Incentive Award Plan also provides for the issuance of restricted stock awards and other incentive awards to eligible individuals. Restricted stock awards will generally be subject to such transferability and vesting restrictions as the Administrator shall determine. With respect to other incentive awards under the Amended Incentive Award Plan, such as SARs, performance awards, dividend equivalents, deferred stock, stock payments and other stock-based awards, the Administrator will determine the terms and conditions of such awards, including the purchase or exercise price, if any, of such awards, vesting and other exercisability conditions, and whether the awards will be based on specified performance criteria. The Amended Incentive Award Plan provides that the exercise price of a SAR will not be less than 100% of the fair market value of our Common Stock on the date on which the SAR is granted. The Incentive Award Plan prior to this amendment and restatement did not contain a minimum exercise price for SARs. Other awards issuable under the Amended Incentive Award Plan include the following:

| | • | | Dividend Equivalents. Dividend equivalents are rights to receive the equivalent value (in cash or our Common Stock) of dividends paid on our Common Stock. They represent the value of the dividends per share paid by us, calculated with reference to the number of shares that are subject to any award held by the participant. |

| | • | | Deferred Stock.Deferred stock may be awarded to participants and may be linked to any performance criteria determined to be appropriate by the plan administrator. Common Stock underlying a deferred stock award will not be issued until the deferred stock award has vested, pursuant to a vesting schedule |

15

| | or upon the satisfaction of performance criteria set by the plan administrator, and unless otherwise provided by the plan administrator, a recipient of deferred stock generally will have no rights as a stockholder with respect to such deferred stock until the time the vesting conditions are satisfied and the Common Stock underlying the deferred stock award has been issued. |

| | • | | Stock Payments. Stock payments include payments in the form of our Common Stock or options or other rights to purchase our Common Stock, in each case made in lieu of all or any portion of the compensation that would otherwise be paid to the participant. The number of shares will be determined by the plan administrator and may be based upon specific performance criteria determined appropriate by the plan administrator, determined on the date such stock payment is made or on any date thereafter. |

| | • | | Performance Awards.Any participant selected by the plan administrator may be granted a performance award in the form of a cash bonus, stock bonus or other incentive award payable in cash, our Common Stock or profits interest units, the value of which may be linked to any specific performance criteria determined appropriate by the plan administrator. |

Profits Interest Awards

Profits interest units in the Operating Partnership may be issued to eligible participants for the performance of services to or for the benefit of the Operating Partnership. At the time of grant, the Administrator shall specify the date or dates on which the profits interest units will vest and become nonforfeitable, and may specify such conditions to vesting as it deems appropriate. Profits interest units shall be subject to such restrictions on transferability and other restrictions as the Administrator may impose. These restrictions may lapse separately or in combination at such times, pursuant to such circumstances, in such installments, or otherwise, as the Administrator determines at the time of the grant of the award or thereafter. The Administrator will specify the purchase price, if any, to be paid by the grantee to the Operating Partnership for the profits interest units. The Incentive Award Plan prior to this amendment and restatement did not provide for the issuance of profits interest units.

Non-Employee Director Awards

Each person who was a non-employee director as of the date of the pricing of our initial public offering (the “pricing date”) was granted an option to purchase 7,500 shares of Common Stock on that date. During the term of the Amended Incentive Award Plan, each person who was a non-employee director as of the pricing date will automatically be granted an option to purchase 5,000 shares of Common Stock on the date of each annual meeting of stockholders after the date of our initial public offering at which the director is re-elected to the Board. During the term of the Amended Incentive Award Plan, each person who is initially elected to the Board after the pricing date and who is a non-employee director at the time of his or her initial election will automatically be granted (i) an option to purchase 7,500 shares of Common Stock on the date of the initial election, and (ii) an option to purchase 5,000 shares of Common Stock on the date of each annual meeting of stockholders after the initial election at which the director is re-elected to the Board. The price per share of the shares subject to each option granted to a non-employee director will equal 100% of the fair market value of a share of Common Stock on the date the option is granted; provided, that the price of each share subject to each option granted to non-employee directors on the pricing date was equal to the initial public offering price per share of Common Stock. Options granted to non-employee directors become exercisable in cumulative annual installments of 33 1/3% on each of the first, second and third anniversaries of the date of option grant and, subject to certain restrictions imposed by the Administrator, the term of each option granted to a non-employee director is 10 years from the date the option is granted, except that any option granted to a non-employee director may by its terms become immediately exercisable in full upon the retirement of the non-employee director in accordance with the Company’s retirement policy applicable to directors.No portion of an option which is unexercisable upon the termination of a directorship will thereafter become exercisable.

16

Commencing with the Company’s 2007 annual meeting of stockholders, on the date of each annual meeting of stockholders of the Company, each individual who is elected or re-elected as a non-employee director at such annual meeting and each individual who otherwise continues to be a non-employee director immediately following such meeting will automatically be granted 1,000 shares of Restricted Stock at a purchase price equal to $0.01 per share. Subject to the non-employee director’s continued service with the Company, each such restricted stock award shall vest with respect to 33 1/3% of the shares on each of the first, second and third anniversaries of the date of grant. To the extent otherwise eligible, members of the Board who are employees of the Company who subsequently retire from the Company and remain on the Board will receive, at each annual meeting of stockholders after his or her retirement from employment with the Company, a restricted stock award as described herein. The Incentive Award Plan prior to this amendment and restatement did not provide for this grant of restricted stock to non-employee directors.

Performance Awards

The plan administrator may grant performance awards to employees who are or may be “covered employees,” as defined in Section 162(m) of the Internal Revenue Code, that are intended to be performance-based awards within the meaning of Section 162(m) of the Internal Revenue Code in order to preserve the deductibility of these awards for federal income tax purposes. Participants are only entitled to receive payment for a performance-based award for any given performance period to the extent that pre-established performance goals set by the plan administrator for the period are satisfied. These pre-established performance goals must be based on one or more of the following performance criteria: net earnings (either before or after interest, taxes, depreciation and amortization), economic value-added, sales or revenue, net income (either before or after taxes), operating earnings, cash flow (including, but not limited to, operating cash flow and free cash flow), cash flow return on capital, return on net assets, return on stockholders’ equity, return on assets, return on capital, stockholder returns, return on sales, gross or net profit margin, productivity, expense, margins, operating efficiency, customer satisfaction, working capital, earnings per share, price per share of Common Stock, and market share. These performance criteria may be measured in absolute terms or as compared to performance in an earlier period or as compared to results of a peer group, industry index or other companies. Generally, a recipient of a performance award will have to be employed by the Company, the Operating Partnership, the Services Company or a subsidiary on the date the performance award is paid.

Adjustments and Corporate Transactions

In the event of certain corporate transactions and changes in our corporate structure or capitalization, the Administrator will make appropriate adjustments to (i) the aggregate number and type of shares issuable under the Amended Incentive Award Plan, (ii) the terms and conditions of any outstanding awards, including the number and type of shares or profits interest units issuable thereunder, and (iii) the grant or exercise price of each outstanding award. In addition, except as may be provided in an individual award agreement, in the event of the merger of the Company with or into another corporation, the sale of substantially all of the assets of the Company or a change in control (as defined in the Amended Incentive Award Plan), each outstanding option which is not converted, assumed or replaced by the successor corporation will become exercisable in full. The Administrator also has the authority under the Amended Incentive Award Plan to take certain other actions with respect to outstanding awards in the event of a corporate transaction, including provision for the cash-out, termination, assumption or substitution of such awards. Prior to amendment and restatement, the Incentive Award Plan provided that any direct or indirect acquisition of securities by Robert F. Maguire III or his family, or any entity controlled thereby would be a change in control. Under the Amended Incentive Plan, such an acquisition would not constitute a change in control.

Termination and Amendment

With the approval of the Board, the plan administrator may at any time terminate, amend, suspend or modify the Amended Incentive Award Plan, provided that to the extent necessary and desirable to comply with any applicable law, regulation, or stock exchange rule, we must obtain stockholder approval of any amendment in such a manner and to such a degree as required, and without the approval of our stockholders, no amendment may increase the Plan Limit. In addition, the Amended Incentive Award Plan provides that, without the approval

17

of our stockholders, no amendment or other action by the plan administrator may permit the grant of options or SARs with an exercise price that is below the fair market value on the date of grant, and no award may be granted in connection with the cancellation or surrender of any award having a higher per share exercise price. Neither of these limitations was included in the Incentive Award Plan prior to this amendment and restatement. No award outstanding under the Amended Incentive Award Plan may be amended to reduce its exercise price below the per share exercise price as of the date the award is granted. Unless the award itself expressly provides otherwise, any termination, amendment or modification of the Amended Incentive Award Plan which materially adversely affects any outstanding award requires the prior written consent of the affected holder. Unless sooner terminated by the Board, the Amended Incentive Award Plan will automatically terminate on the 10th anniversary of the date on which the plan, prior to amendment and restatement, was originally adopted by the Board. No award may be granted under the Amended Incentive Award Plan after its termination, but awards that are outstanding at such time will remain in effect. The amended and restated Incentive Award Plan will become effective if and when it is approved by our stockholders.

Additional Restrictions on Awards

The Amended Incentive Award Plan provides that no participant in the Amended Incentive Award Plan will be permitted to acquire, or will have any right to acquire, shares thereunder if such acquisition would be prohibited by the stock ownership limits contained in our charter or would impair our status as a REIT.

Federal Income Tax Consequences

The federal income tax consequences of the Amended Incentive Award Plan under current federal income tax law are summarized in the following discussion which deals with the general tax principles applicable to the Amended Incentive Award Plan, and is intended for general information only. The following discussion of federal income tax consequences does not purport to be a complete analysis of all of the potential tax effects of the Amended Incentive Award Plan. It is based upon laws, regulations, rulings and decisions now in effect, all of which are subject to change. Foreign, state and local tax laws, and estate and gift tax considerations are not discussed, and may vary depending on individual circumstances and from locality to locality.

Stock Options

With respect to nonqualified stock options, the Company, the Operating Partnership, the Services Company or the participant’s employer, as applicable, is generally entitled to deduct, and the optionee recognizes taxable income in an amount equal to, the difference between the option exercise price and the fair market value of the shares at the time of exercise. A participant receiving incentive stock options will not recognize taxable income upon grant. Additionally, if applicable holding period requirements are met, the participant will not recognize taxable income at the time of exercise. However, the excess of the fair market value of the shares received over the option exercise price is an item of tax preference income potentially subject to the alternative minimum tax. If stock acquired upon exercise of an incentive stock option is held for a minimum of two years from the date of grant and one year from the date of exercise, the gain or loss (in an amount equal to the difference between the fair market value on the date of sale and the exercise price) upon disposition of the stock will be treated as a long-term capital gain or loss, and the Company, the Operating Partnership, the Services Company or the participant’s employer, as applicable, will not be entitled to any deduction. If the holding period requirements are not met, the incentive stock option will be treated as an option which does not meet the requirements of the Code for incentive stock options and the tax consequences described for nonqualified stock options will apply.

Profits Interest Units

Profits interest units that constitute “profits interests” within the meaning of the Code and published Internal Revenue Service guidance will generally not be taxed at the time of grant, though the holder will be required to report on his income tax return his allocable share of the issuing partnership’s income, gain, loss, deduction, and

18

credit, regardless of whether the issuing partnership makes a distribution of cash. Instead, such units are generally taxed upon a disposition of the unit or distributions of money to the extent that such amounts received exceed the basis in the units. Generally, no deduction is available to the Company, the Operating Partnership, the Services Company or the participant’s employer upon the grant, vesting or disposition of the profits interest units.