UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Materials Pursuant to § 240.14a-12 |

MPG OFFICE TRUST, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

May 21, 2010

DEAR STOCKHOLDER:

You are invited to attend the 2010 Annual Meeting of Stockholders (the “Annual Meeting”) of MPG Office Trust, Inc. (the “Company”), to be held on Wednesday, June 30, 2010, at 8:00 A.M., local time, at the Omni Los Angeles Hotel, 251 South Olive Street, Los Angeles, California 90012.

The purposes of this year’s meeting are to consider proposals to:

| | (i) | Elect seven directors to serve until the 2011 Annual Meeting of Stockholders and until their successors are duly elected and qualify; |

| | (ii) | Ratify the selection of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010; and |

| | (iii) | Transact such other business as may properly come before the meeting or any continuation, postponement or adjournment thereof. |

The accompanying Notice of Annual Meeting and Proxy Statement describe these matters. We urge you to read this information carefully.

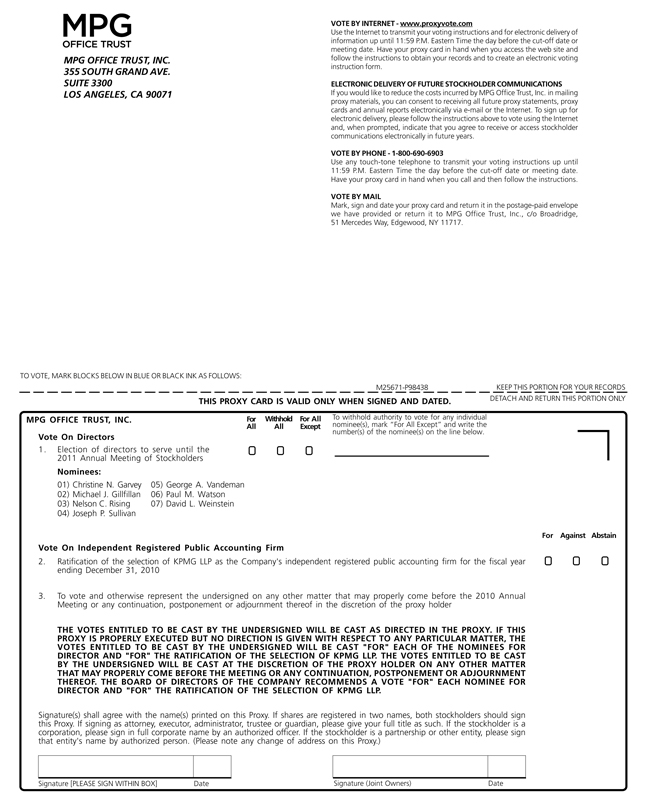

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. If you choose not to attend and vote at the Annual Meeting in person, you may authorize your proxy on the Internet, or if you are receiving a paper copy of this Proxy Statement, by telephone or by completing and mailing a proxy card. Authorizing your proxy over the Internet, by telephone or by mailing a proxy card will ensure that your shares are represented at the Annual Meeting. Please review the instructions contained in the Notice of Internet Availability of Proxy Materials regarding each of these options.

Sincerely,

Nelson C. Rising

President and Chief Executive Officer

NOTICE OF 2010 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 30, 2010

May 21, 2010

TO THE STOCKHOLDERS OF MPG OFFICE TRUST, INC.:

NOTICE IS HEREBY GIVEN that the 2010 Annual Meeting of Stockholders (the “Annual Meeting”) of MPG Office Trust, Inc., a Maryland corporation (the “Company”), will be held on Wednesday, June 30, 2010, at 8:00 A.M., local time, at the Omni Los Angeles Hotel, 251 South Olive Street, Los Angeles, California 90012, to consider the following:

| | • | | The election of seven directors to serve until the 2011 Annual Meeting of Stockholders and until their successors are duly elected and qualify; |

| | • | | The ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010; and |

| | • | | The transaction of such other business as may properly come before the meeting or any continuation, postponement or adjournment thereof. |

Our Board of Directors (the “Board”) has fixed the close of business on May 11, 2010 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any continuation, postponement or adjournment thereof.

Proxies are being solicited by our Board, which recommends that our stockholders vote FOR the election of the Board’s nominees named therein and FOR the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010. Please refer to the attached Proxy Statement, which forms a part of this Notice of Annual Meeting and is incorporated herein by reference, for further information with respect to the business to be transacted at the Annual Meeting.

Stockholders are cordially invited to attend the Annual Meeting in person. Your vote is important.If you are viewing the Proxy Statement on the Internet, you may authorize your proxy electronically via the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials mailed to you and the instructions listed on the Internet site. If you are receiving a paper copy of the Proxy Statement, you may authorize your proxy by completing and mailing the proxy card enclosed with the Proxy Statement, or you may authorize your proxy electronically via the Internet or by telephone by following the instructions on the proxy card. If your shares are held in “street name,” which means shares held of record through a broker, bank or other nominee, you should review the Notice of Internet Availability of Proxy Materials used by that firm to determine whether and how you will be able to submit your proxy by telephone or over the Internet. Submitting a proxy over the Internet, by telephone or by mailing a proxy card will ensure that your shares are represented at the Annual Meeting.

| | |

| By Order of the Board of Directors, |

|

| Jonathan L. Abrams |

| Secretary |

MPG OFFICE TRUST, INC.

355 South Grand Avenue, Suite 3300

Los Angeles, California 90071

PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

General

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of MPG Office Trust, Inc., a Maryland corporation (the “Company”), of proxies from the holders of the Company’s issued and outstanding shares of common stock, par value $0.01 per share (“common stock”), to be exercised at the 2010 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday, June 30, 2010, at 8:00 A.M., local time, or at any continuation, postponement or adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting and as further discussed in this Proxy Statement. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting. The Annual Meeting will be held at the Omni Los Angeles Hotel, 251 South Olive Street, Los Angeles, California 90012.

Pursuant to the rules of the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (a “Notice”) to our stockholders of record, while brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar Notice. All stockholders will have the ability to access proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this Proxy Statement available on the Internet and to mail the Notice to all stockholders entitled to vote at the Annual Meeting on May 21, 2010. We intend to mail this Proxy Statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who have properly requested paper copies of such materials, within three business days of such request.

Who Can Vote

You are entitled to vote if you were a stockholder of record of our common stock as of the close of business on May 11, 2010, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. Your shares can be voted at the Annual Meeting only if you are present in person or represented by a valid proxy.

Shares Outstanding and Quorum

At the close of business on May 11, 2010, 48,011,029 shares of common stock were outstanding and entitled to vote. The presence in person or by proxy of holders of a majority of the outstanding shares of common stock will constitute a quorum at the Annual Meeting.

Voting of Shares

Stockholders of record as of the close of business on May 11, 2010 are entitled to one vote for each share of common stock held on all matters to be voted upon at the Annual Meeting.

1

You may vote by attending the Annual Meeting and voting in person or you may vote by submitting a proxy. The method of voting by proxy differs (1) depending on whether you are viewing this Proxy Statement on the Internet or are receiving a paper copy, and (2) for shares held as a record holder and shares held in “street name.” If you hold your shares of common stock as a record holder and you are viewing this Proxy Statement on the Internet, you may vote by submitting a proxy over the Internet by following the instructions on the website referred to in the Notice previously mailed to you. If you hold your shares of common stock as a record holder and you are receiving a paper copy of this Proxy Statement, you may vote your shares by completing, dating and signing the proxy card included with the Proxy Statement and promptly returning it in the pre-addressed, postage paid envelope provided to you, or by submitting a proxy over the Internet or by telephone by following the instructions on the proxy card. If you hold your shares of common stock in street name, which means your shares are held of record through a broker, bank or nominee, you will receive a Notice from your broker, bank or nominee that includes instructions on how to vote your shares. Your broker, bank or nominee will allow you to deliver your voting instructions over the Internet and may also permit you to authorize your proxy by telephone. In addition, you may request paper copies of the Proxy Statement and proxy card from your broker by following the instructions on the Notice provided to you by your broker.

The Internet and telephone voting facilities will close at 11:59 P.M., Eastern Time, on June 29, 2010. If you authorize your proxy through the Internet, you should be aware that you may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers, and that these costs must be borne by you. If you authorize your proxy by Internet or telephone, then you do not need to return a proxy card by mail.

All shares entitled to vote and represented by properly executed proxies received before the polls are closed at the Annual Meeting, and which proxies have not been revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. YOUR VOTE IS IMPORTANT.

Proxy Card and Revocation of Proxy

If you sign the proxy card but do not specify how you want your shares to be voted, your shares will be voted by the proxy holders named in the enclosed proxy in favor of the election of all of the director nominees and in favor of ratification of the selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010. At their discretion, the proxy holders named in the enclosed proxy are authorized to vote on any other matters that may properly come before the Annual Meeting and at any continuation, postponement or adjournment thereof. The Board knows of no other items of business that will be presented for consideration at the Annual Meeting other than those described in this Proxy Statement. In addition, no stockholder proposals or nominations were received on a timely basis, and therefore no such matters may be brought to a vote at the Annual Meeting.

If you vote by proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. You may revoke your proxy by sending a written notice of revocation or a duly executed proxy bearing a later date to the attention of Jonathan L. Abrams, Secretary, MPG Office Trust, Inc., 355 South Grand Avenue, Suite 3300, Los Angeles, California 90071, or by attending the Annual Meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Counting of Votes

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, a representative of Broadridge Financial Solutions, Inc., who will separately tabulate affirmative and negative votes and abstentions. Shares held by persons attending the Annual Meeting but not voting, shares represented by proxies that reflect abstentions or withheld votes as to a particular proposal and broker “non-votes” will be counted as present for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares. We expect to pay Broadridge Financial Solutions, Inc. a fee of approximately $2,500 for these services.

2

In order to be elected as a director, a nominee must receive a plurality of the votes cast at the Annual Meeting at which a quorum is present. The affirmative vote of a majority of the votes cast at the Annual Meeting is required for the ratification of the selection of KPMG LLP as our independent registered public accounting firm. For purposes of calculating votes cast in the election of directors and as to the ratification of the selection of KPMG LLP as our independent registered public accounting firm, abstentions or broker non-votes will not be counted as votes cast and will have no effect on the result of the vote.

Solicitation of Proxies

We will bear the entire cost of solicitation of proxies. These costs will include reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation material regarding the Annual Meeting to beneficial owners of our common stock. Proxies may be solicited by directors, officers and employees of the Company in person or by mail, telephone, e-mail or facsimile transmission. No additional compensation will be paid to such directors, officers or employees for these services. In addition, we have retained MacKenzie Partners, Inc., a firm specializing in proxy solicitation, to solicit proxies and assist in the distribution and collection of proxy materials. We expect to pay MacKenzie Partners, Inc. a fee of approximately $5,000 for these services.

NO PERSON IS AUTHORIZED ON OUR BEHALF TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS WITH RESPECT TO THE PROPOSALS TO BE VOTED ON AT THE ANNUAL MEETING, OTHER THAN THE INFORMATION AND REPRESENTATIONS CONTAINED IN THIS PROXY STATEMENT, AND, IF GIVEN OR MADE, SUCH INFORMATION AND/OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL UNDER NO CIRCUMSTANCES CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN OUR AFFAIRS SINCE THE DATE OF THIS PROXY STATEMENT.

Our principal executive offices are located at 355 South Grand Avenue, Suite 3300, Los Angeles, California 90071, our telephone number is (213) 626-3300 and our website is located athttp://www.mpgoffice.com.1 References herein to the “Company” refer to MPG Office Trust, Inc. and its subsidiaries, unless the context indicates otherwise.

The date of this Proxy Statement is May 21, 2010.

| 1 | Website addresses referred to in this Proxy Statement are not intended to function as hyperlinks, and the information contained on our website is not a part of this Proxy Statement. |

3

ELECTION OF DIRECTORS

Under our charter and Fourth Amended and Restated Bylaws (the “Bylaws”), each member of the Board serves until the next annual meeting of stockholders and until his or her successor is duly elected and qualifies. Vacancies on the Board may be filled only by individuals elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the size of the Board) will serve until the next annual election of directors and until such director’s successor is elected and qualifies, or until such director’s earlier death, resignation or removal.

Directors are elected by a plurality of the votes cast at the Annual Meeting, which means the seven nominees who receive the largest number of properly cast votes will be elected as directors. Each share of common stock is entitled to one vote for each of the seven director nominees. Cumulative voting is not permitted. It is the intention of the proxy holders named in the enclosed proxy to vote the proxies received by them for the election of the nominees named below unless authorization to do so is withheld. If any nominee should become unavailable for election prior to the Annual Meeting, an event which the Board does not currently anticipate, the proxies will be voted for the election of a substitute nominee or nominees proposed by the Board.

Ms. Christine N. Garvey and Messrs. Michael J. Gillfillan, Nelson C. Rising, Joseph P. Sullivan, George A. Vandeman, Paul M. Watson and David L. Weinstein are our nominees for election to the Board. Each nominee has consented to be named in this Proxy Statement and to serve as a director if elected, and our management has no reason to believe that any nominee will be unable to serve. The information below relating to the nominees for election as directors has been furnished to us by the respective individuals. If elected at the Annual Meeting, Ms. Garvey and Messrs. Gillfillan, Rising, Sullivan, Vandeman, Watson and Weinstein would each serve until the 2011 Annual Meeting of Stockholders (the “2011 Annual Meeting”) and until their respective successors are duly elected and qualify.

Nominees for Election for a One-Year Term Expiring at the 2011 Annual Meeting

The following table sets forth information regarding the individuals who are our nominees for election as directors of the Company:

| | | | | | |

Name | | Age | | Position | | Director

Since |

Christine N. Garvey | | 64 | | Director | | 2008 |

Michael J. Gillfillan | | 62 | | Director | | 2009 |

Nelson C. Rising | | 68 | | Director | | 2008 |

Joseph P. Sullivan | | 67 | | Director | | 2009 |

George A. Vandeman | | 70 | | Director | | 2007 |

Paul M. Watson | | 70 | | Chairman of the Board | | 2008 |

David L. Weinstein | | 43 | | Director | | 2008 |

Christine N. Garvey has served on the Board since July 2008. Ms. Garvey retired from Deutsche Bank AG in May 2004, where she served as Global Head of Corporate Real Estate Services from May 2001. From December 1999 to April 2001, Ms. Garvey served as Vice President, Worldwide Real Estate and Workplace Resources for Cisco Systems, Inc. During her career, Ms. Garvey also held several positions with Bank of America, including Group Executive Vice President and Head of National Commercial Real Estate Services. Ms. Garvey holds a Bachelor of Arts degree,magna cum laude, from Immaculate Heart College in Los Angeles and a Juris Doctor from Suffolk University Law School. She is currently a member of the board of directors of HCP, Inc., ProLogis, Toll Brothers, Inc. and UnionBanCal Corporation. She also served on the board of directors of Hilton Hotels Corporation until the company was taken private in October 2007. Our Board and Nominating and Corporate Governance Committee nominated Ms. Garvey to serve as a director based, among other factors, on her real estate experience and commercial banking expertise.

4

Michael J. Gillfillan has served on the Board since May 2009. Since December 2002, Mr. Gillfillan has been a partner of Meriturn Partners, LLC, a private equity fund that purchases controlling interests in distressed middle market manufacturing and distribution companies. From March 2000 to January 2002, Mr. Gillfillan was a partner of Neveric, LLC. Mr. Gillfillan is the retired Vice Chairman and Chief Credit Officer of Wells Fargo Bank, N.A., where he was responsible for all facets of credit risk management, including direct oversight of the loan workout units that had peak problem assets in excess of $7 billion. During his tenure at Wells Fargo Bank, he also served as Vice Chairman and Group Head of the Commercial & Corporate Banking Group and Executive Vice President, Loan Adjustment Group, where he was responsible for marketing and servicing all bank loans, deposits and capital market products, as well as managing the loan workout function for the bank. Mr. Gillfillan holds a Bachelor of Arts degree from the University of California, Berkeley and a Master of Business Administration from the University of California, Los Angeles. He previously served on the board of directors of UnionBanCal Corporation. Our Board and Nominating and Corporate Governance Committee nominated Mr. Gillfillan to serve as a director based, among other factors, on his extensive experience in workouts and company turnarounds.

From August 1999 until February 2007, Mr. Gillfillan was a member of the board of directors of James Hardie Industries Limited (“Hardie”), an Australian company that was subject to asbestos claims arising out of its legacy business. In 2007, the Australian Securities and Investment Commission filed a civil lawsuit related to a February 2001 announcement by Hardie to the Australian Stock Exchange concerning the establishment of a foundation to compensate asbestos victims. In April 2009, a court in New South Wales, Australia issued a judgment finding that the directors of Hardie, including Mr. Gillfillan, and several members of management breached their duties of care and diligence by approving a draft of the February 2001 announcement. The court determined that the announcement was misleading because it incorrectly suggested that the foundation would have sufficient funds to pay all legitimate claims. The court imposed civil monetary penalties on each of the former independent directors, including Mr. Gillfillan, and precluded such individuals from managing an Australian corporation for a period of five years. Mr. Gillfillan has appealed this ruling and a decision on the appeal is expected in the near future.

Nelson C. Rising has served as our President and Chief Executive Officer and as a member of our Board since May 2008. Prior to joining the Company, Mr. Rising served as Chairman and Chief Executive Officer of Rising Realty Partners, LLC from January 2006 to May 2008. Mr. Rising served as Chairman and Chief Executive Officer of Catellus Development Corporation (“Catellus”) from 2000 to September 2005, when it was merged with and into a subsidiary of ProLogis, and as President and Chief Executive Officer of Catellus from 1994 to 2000. Prior to joining Catellus, Mr. Rising was, for ten years, a Senior Partner with Maguire Thomas Partners, a predecessor to the Company. Mr. Rising practiced law at O’Melveny & Myers, LLP prior to entering the real estate industry. He holds a Bachelor of Arts degree with honors in Economics from the University of California at Los Angeles and a Juris Doctor from the UCLA Law School, where he served as the Managing Editor of the UCLA Law Review. Mr. Rising is a former Chairman of the board of directors of the Federal Reserve Bank of San Francisco and is Chairman Emeritus of the Real Estate Roundtable and Chairman of the Grand Avenue Committee. He is a member of the board of directors of Trustees of the California Institute of Technology and the W.M. Keck Foundation. Mr. Rising is the father of Mr. Christopher Rising, our Senior Vice President, Asset Transactions. Our Board and Nominating and Corporate Governance Committee nominated Mr. Rising to serve as a director based on his knowledge of the Company and his experience in the real estate industry.

Joseph P. Sullivan has served on the Board since May 2009. Mr. Sullivan is the Chairman of the board of directors of Advisors of RAND Health, the largest non-profit institution dedicated to emerging health policy issues. From March 2000 through March 2003, Mr. Sullivan served as Chairman of the Board and Chief Executive Officer of Protocare, Inc., a health care clinical trials and consulting organization. Mr. Sullivan was Chairman of the Board, Chief Executive Officer and President of American Health Properties, Inc., a real estate investment trust (“REIT”), from 1993 until it was acquired by HCP, Inc. in 1999. Mr. Sullivan has 20 years of investment banking experience with Goldman, Sachs & Co. Mr. Sullivan holds a Bachelor of Science degree and

5

a Juris Doctor from the University of Minnesota Law School and a Master of Business Administration from the Harvard Graduate School of Business Administration. He serves as a member, and previously served as Chairman, of the Board of Advisors for UCLA Medical Center. He is also a member of the board of directors of CIGNA Corporation, HCP, Inc., Amylin Pharmaceuticals, Inc. and Cymetrix, Inc. Mr. Sullivan previously served as a director of Covenant Care, Inc. from 2000 until March 2006. Our Board and Nominating and Corporate Governance Committee nominated Mr. Sullivan to serve as a director based, among other factors, on his investment banking expertise and experience in the real estate industry.

George A. Vandeman has served on the Board since October 2007 and as Chairman of the Board from October 2008 to July 2009. Mr. Vandeman has been the principal of Vandeman & Co., a private investment firm, since he retired from Amgen, Inc. in July 2000. From 1995 to 2000, Mr. Vandeman was Senior Vice President and General Counsel of Amgen and a member of its Operating Committee. Immediately prior to joining Amgen in July 1995, Mr. Vandeman was a senior partner and head of the Mergers and Acquisitions Practice Group at the international law firm of Latham & Watkins LLP, where he worked for nearly three decades. Mr. Vandeman holds a Bachelor of Arts degree and a Juris Doctor from the University of Southern California. Mr. Vandeman is a member and past Chair of the Board of Councilors at the University of Southern California Law School and is a member of the board of directors of Rexair LLC. Mr. Vandeman is a former director of ValueVision Media and SymBio Pharmaceuticals Limited. Our Board and Nominating and Corporate Governance Committee nominated Mr. Vandeman to serve as a director based, among other factors, on his legal and corporate governance expertise and experience with complex strategic transactions.

Paul M. Watson has served on the Board since July 2008 and as Chairman of the Board since July 2009. Mr. Watson is the retired Vice Chairman of Wells Fargo Bank N.A., where he was responsible for wholesale and commercial banking, and headed Wells Fargo’s nationwide commercial, corporate and treasury management businesses. Prior to his 45-year tenure at Wells Fargo, Mr. Watson served as 1st Lieutenant in the United States Army. Mr. Watson holds a Bachelor of Arts degree from the University of San Francisco and a certificate from the Graduate School of Credit and Financial Management at Stanford University. Mr. Watson is the Chairman of the Finance Council of The Roman Catholic Archdiocese of Los Angeles. Mr. Watson is a director emeritus of the Hanna Boys Center and the Music Center of Los Angeles County. He previously served as a director of NorCal Environmental Corp. from February 2004 to September 2007. Our Board and Nominating and Corporate Governance Committee nominated Mr. Watson to serve as a director based, among other factors, on his commercial banking expertise.

David L. Weinstein has served on the Board since August 2008. Mr. Weinstein is currently a partner at Belvedere Capital, a real estate investment firm based in New York. From April 2007 until December 2008, Mr. Weinstein was a Managing Director of Westbridge Investment Group/Westmont Hospitality Group, a real estate investment fund focused on hospitality. From 1996 until January 2007, Mr. Weinstein worked at Goldman, Sachs & Co. in New York, first in the real estate investment banking group (focusing on mergers, asset sales and corporate finance) and then from 2004 in the Special Situations Group (focused on real estate debt investments). Mr. Weinstein holds a Bachelor of Science degree in Economics,magna cum laude, from The Wharton School and a Juris Doctor,cum laude, from the University of Pennsylvania Law School. He is a member of the New York State Bar Association. Our Board and Nominating and Corporate Governance Committee nominated Mr. Weinstein to serve as a director based, among other factors, on his investment banking expertise and experience in the real estate industry.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF MS. GARVEY AND MESSRS. GILLFILLAN, RISING, SULLIVAN, VANDEMAN, WATSON AND WEINSTEIN TO SERVE ON OUR BOARD OF DIRECTORS UNTIL THE 2011 ANNUAL MEETING AND UNTIL THEIR RESPECTIVE SUCCESSORS ARE DULY ELECTED AND QUALIFY.

6

Board Governance Documents

The Board maintains charters for each of its committees and has adopted written corporate governance guidelines and a code of business conduct and ethics applicable to independent directors, executive officers, employees and agents, each of which is available for viewing on the Company’s website athttp://www.mpgoffice.com under the heading “Investor Relations – Corporate Governance.” Each of such documents is also available in print to any stockholder who sends a written request to that effect to the attention of Jonathan L. Abrams, Secretary, MPG Office Trust, Inc., 355 South Grand Avenue, Suite 3300, Los Angeles, California 90071.

Any amendment to, or waiver of, any provision of the code of business conduct and ethics applicable to our independent directors and executive officers must be approved by the Board. Any such amendment or waiver that would otherwise be required to be disclosed under SEC rules or New York Stock Exchange (“NYSE”) listing standards or regulations will be promptly posted on our website.

Director Independence

The NYSE requires each NYSE-listed company to have a majority of independent board members and a nominating/corporate governance committee, compensation committee and audit committee each comprised solely of independent directors. Our Board has adopted independence standards as part of our corporate governance guidelines, which can be accessed on our website athttp://www.mpgoffice.com under the heading “Investor Relations – Corporate Governance.” This document is also available in print to any stockholder who requests it by writing to our Secretary, as provided for above under the heading “– Board Governance Documents.”

The independence standards contained in our corporate governance guidelines incorporate the categories of relationships between a director and a listed company that would make a director ineligible to be independent according to the standards issued by the NYSE.

In accordance with NYSE rules and our corporate governance guidelines, the Board in May 2010 affirmatively determined that each of the following directors is independent within the meaning of both our and the NYSE’s director independence standards, as then in effect:

Christine N. Garvey

Michael J. Gillfillan

Joseph P. Sullivan

George A. Vandeman

Paul M. Watson

David L. Weinstein

The persons listed above include all of our directors standing for re-election, other than Mr. Rising, our President and Chief Executive Officer.

Messrs. Jonathan M. Brooks and Cyrus S. Hadidi served on our Board from January 1, 2009 through the date of our annual meeting on July 23, 2009 (the “2009 Annual Meeting”). Each of Messrs. Brooks and Hadidi was affirmatively determined by the Board in June 2009 to be independent within the meaning of both our and the NYSE’s director independence standards.

The Board has also determined that each of the current members of our Audit, Compensation and Nominating and Corporate Governance Committees is independent within the meaning of both our and the NYSE’s director independence standards applicable to members of such committees. Additionally, our Audit Committee members satisfy the enhanced independence standards set forth in Rule 10A-3(b)(1)(i) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and NYSE listing standards.

7

Board Meetings

The Board held 15 meetings and the non-management directors (which includes all directors except for our Chief Executive Officer) met in executive session nine times during the fiscal year ended December 31, 2009. Mr. Vandeman, our Chairman until the 2009 Annual Meeting, presided over such executive sessions prior to July 23, 2009, and Mr. Watson, our current Chairman, presided over such executive sessions on and after July 23, 2009. The number of meetings for each Board committee is set forth below under the heading “– Board Committees.” During the fiscal year ended December 31, 2009, all of our directors attended at least 75% of the total number of meetings of the Board and of the Board committees on which they served. The Board expects all nominees for director to attend the Annual Meeting in person barring unforeseen circumstances or irresolvable conflicts. All of our directors at the time of our 2009 Annual Meeting, which was held on July 23, 2009, were in attendance in person at such Annual Meeting.

Board Leadership Structure and Risk Oversight

The Board has a policy that the positions of Chairman of the Board and Chief Executive Officer should be held by different persons. The Board has determined that having an independent director serve as Chairman is in the best interests of the Company, promoting enhanced Board oversight as well as active independent director participation in setting Board meeting agendas and establishing Board priorities and procedures. This policy is subject to review in the future based on the Company’s then-current circumstances and Board membership.

Our Board is actively involved in overseeing our risk management through the Audit Committee. Under its charter, the Audit Committee is responsible for discussing with management our policies with respect to risk assessment and management. The Audit Committee is also responsible for discussing with management any significant financial risk exposures and the actions management has taken to limit, monitor or control such exposures.

Board Committees

Audit Committee–

General

Our Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee helps ensure the integrity of our financial statements, the qualifications and independence of our independent registered public accounting firm, and the performance of our internal audit function and independent registered public accounting firm. The Audit Committee selects, assists and meets with the independent registered public accounting firm, oversees each annual audit and quarterly review, establishes and maintains our internal audit controls and prepares the report that federal securities laws require to be included in our proxy statement each year (see page 55 for the current Audit Committee Report). The Board has approved a charter of the Audit Committee and the Audit Committee carries out its responsibilities in accordance with those terms. The charter is located on our website athttp://www.mpgoffice.com and is available in print to any stockholder who requests it by writing to our Secretary, as provided for above under the heading “– Board Governance Documents.” Currently, Mr. Gillfillan is Chair and Messrs. Watson and Weinstein are members of the Audit Committee, each of whom is an independent director. Based on his experience and expertise, the Board has determined that Mr. Gillfillan is an “audit committee financial expert” as defined by the SEC. The Audit Committee meets the NYSE composition requirements, including the requirements dealing with financial literacy and financial sophistication. The members of our Audit Committee satisfy the enhanced independence standards applicable to audit committees set forth in Rule 10A-3(b)(i) under the Exchange Act and the NYSE listing standards. During the fiscal year ended December 31, 2009, the Audit Committee met ten times. The composition of the Audit Committee following the date of the Annual Meeting will be determined by the Board promptly after the Annual Meeting.

8

Pre-approval Policies and Procedures

Our Audit Committee charter provides that the Audit Committee is to pre-approve all audit services and permitted non-audit services to be performed for us by our independent registered public accounting firm, subject to thede minimis exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act.

In addition, consistent with SEC rules regarding auditor independence, the Audit Committee has adopted an Audit and Non-Audit Services Pre-Approval Policy, which provides that the Audit Committee is required to pre-approve the audit and non-audit services performed by our independent registered public accounting firm. The pre-approval policy sets forth procedures to be used for pre-approval requests relating to audit services, audit-related services, tax services and all other services and provides that:

| | • | | The Audit Committee may consider the amount of fees as a factor in determining whether a proposed service would impair the independence of the independent registered public accounting firm; |

| | • | | Requests or applications to provide services that require specific pre-approval by the Audit Committee will be submitted to the Audit Committee by both the independent registered public accounting firm and the Chief Financial Officer and must include a joint statement as to whether, in their view, the request or application is consistent with the SEC’s and Public Company Accounting Oversight Board’s rules on auditor independence; |

| | • | | The Audit Committee may delegate pre-approval authority to one or more of its members, and if the Audit Committee does so, the member or members to whom such authority is delegated shall report any pre-approval decisions to the Audit Committee at or prior to its next scheduled meeting; and |

| | • | | The Audit Committee may not delegate to management its responsibilities to pre-approve services performed by the independent registered public accounting firm. |

During the fiscal years ended December 31, 2009 and 2008, all audit services provided to us by KPMG LLP were pre-approved by the Audit Committee, and no non-audit services were performed for us by KPMG LLP.

Further information regarding the specific functions performed by the Audit Committee is set forth below under the heading “Audit Matters – Audit Committee Report.”

Compensation Committee–

The Compensation Committee establishes, reviews, modifies and approves the compensation and benefits of our executive officers, administers the Second Amended and Restated 2003 Incentive Award Plan (the “Incentive Award Plan”) of MPG Office Trust, Inc., MPG Office Trust Services, Inc. (the “Services Company”) and MPG Office Trust, L.P. (the “Operating Partnership”), and any other incentive programs, makes recommendations to the Board regarding our compensation and stock incentive plans, produces an annual report on executive compensation for inclusion in our proxy statement each year (see page 34 for the current Compensation Committee Report on Executive Compensation) and publishes an annual committee report for our stockholders. Our Compensation Committee Charter is located on our website athttp://www.mpgoffice.com and is available in print to any stockholder who requests it by writing to our Secretary, as provided for above under the heading “– Board Governance Documents.” Currently, Ms. Garvey is Chair and Messrs. Sullivan and Vandeman are members of the Compensation Committee, each of whom is an independent director. During the fiscal year ended December 31, 2009, the Compensation Committee met five times. The composition of our Compensation Committee following the date of the Annual Meeting will be determined by the Board promptly after the Annual Meeting. Further information regarding the specific functions performed by the Compensation Committee is set forth below under the headings “Compensation Discussion and Analysis” and “Compensation Committee Report on Executive Compensation.”

9

Nominating and Corporate Governance Committee–

The Nominating and Corporate Governance Committee develops and recommends to the Board a set of corporate governance principles, adopts a code of ethics, adopts policies with respect to conflicts of interest, monitors our compliance with corporate governance requirements of state and federal law and the rules and regulations of the NYSE, establishes criteria for prospective members of the Board, conducts candidate searches and interviews, oversees and evaluates the Board and management, evaluates from time to time the appropriate size and composition of the Board and recommends, as appropriate, increases, decreases and changes in the composition of the Board, and formally proposes the slate of directors to be elected at each annual meeting of stockholders. Our Nominating and Governance Committee Charter is located on our website athttp://www.mpgoffice.com and is available in print to any stockholder who requests it by writing to our Secretary, as provided for above under the heading “– Board Governance Documents.” Currently, Mr. Vandeman is Chair and Messrs. Watson and Weinstein are members of the Nominating and Corporate Governance Committee, each of whom is an independent director. During the fiscal year ended December 31, 2009, the Nominating and Corporate Governance Committee met one time. The composition of our Nominating and Corporate Governance Committee following the date of the Annual Meeting will be determined by the Board promptly after the Annual Meeting. Further information regarding the Nominating and Corporate Governance Committee is set forth below under the heading “– Qualifications of Director Nominees” and “– Nominating and Corporate Governance Committee’s Process for Considering Director Nominees.”

Finance Committee–

The Finance Committee oversees all areas of finance for the Company and its subsidiaries, including: capital structures; equity, debt and real estate financings; capital expenditures; cash management; banking activities and relationships; investments; foreign exchange activities; tender offers; stock repurchase activities; and other financing activities. Our Finance Committee Charter is located on our website athttp://www.mpgoffice.com and is available in print to any stockholder who requests it by writing to our Secretary, as provided for above under the heading “– Board Governance Documents.” Currently, Mr. Sullivan is Chair and Messrs. Gillfillan, Rising and Weinstein are members of the Finance Committee. During the fiscal year ended December 31, 2009, the Finance Committee met two times. The composition of our Finance Committee following the date of the Annual Meeting will be determined by the Board promptly after the Annual Meeting.

Qualifications of Director Nominees

The Nominating and Corporate Governance Committee has not set forth minimum qualifications for Board nominees. However, pursuant to its charter, the Nominating and Corporate Governance Committee considers the following criteria:

| | • | | Experience in corporate governance, such as service as an officer or former officer of a publicly-traded company; |

| | • | | Experience in the real estate industry; |

| | • | | Experience as a board member of another publicly-traded company; and |

| | • | | Academic expertise in an area of our operations. |

The Nominating and Governance Committee has not adopted any formal policy regarding an attempt to maintain a pre-determined mix of backgrounds of our Board nominees as such backgrounds relate to education, geography, race, gender, national origin or other factors not bearing on expertise. Rather, the Nominating and Corporate Governance Committee looks to that level and type of experience, expertise and credentials of our nominees which we determine is necessary or desirable for the Board at the time.

10

Nominating and Corporate Governance Committee’s Process for Considering Director Nominees

At an appropriate time prior to each Annual Meeting of Stockholders at which directors are to be elected or re-elected, the Nominating and Corporate Governance Committee recommends to the Board for nomination by the Board such candidates as the Nominating and Corporate Governance Committee, in the exercise of its judgment, has found to be well qualified and willing and available to serve. The Nominating and Corporate Governance Committee evaluates the performance of each current director in considering its recommendations. In accordance with certain new SEC disclosure rules regarding the qualification of candidates to be recommended by the Nominating and Corporate Governance Committee for nomination to the Board, the Nominating and Corporate Governance Committee has focused on the particular experience, qualifications and skills of each candidate that would qualify such candidate to serve on the Board. The basis for the Nominating and Corporate Governance Committee’s recommendation of each of Ms. Garvey and Messrs. Gillfillan, Rising, Sullivan, Vandeman, Watson and Weinstein is described above in the respective director’s biography.

At an appropriate time after a vacancy arises on the Board or a director advises the Board of his or her intention to resign, the Nominating and Corporate Governance Committee recommends to the Board for election by the Board to fill such vacancy such prospective member of the Board as the Nominating and Corporate Governance Committee, in the exercise of its judgment, has found to be well qualified and willing and available to serve. In determining whether a prospective member is qualified to serve, the Nominating and Corporate Governance Committee considers the factors listed above under the heading “– Qualifications of Director Nominees.”

Notwithstanding the foregoing, if we are legally required by contract or otherwise to permit a third party to designate one or more of the directors to be elected (for example, pursuant to rights contained in the Articles Supplementary for our 7.625% Series A Cumulative Redeemable Preferred Stock to elect directors upon non-payment of dividends or pursuant to a stockholder agreement), then the nomination or election of such directors shall be governed by such requirements. Any director nominations received from stockholders will be evaluated in the same manner that nominees suggested by our directors, management or other parties are evaluated.

Manner by Which Stockholders May Recommend Director Candidates

The Nominating and Corporate Governance Committee will consider director candidates recommended by our stockholders. All recommendations must be directed to the Chair of the Nominating and Corporate Governance Committee, c/o Jonathan L. Abrams, Secretary, MPG Office Trust, Inc., 355 South Grand Avenue, Suite 3300, Los Angeles, California 90071. Recommendations for director nominees to be considered at the 2011 Annual Meeting must be received in writing (i) not less than 60 days nor more than 90 days prior to the first anniversary of the date of the 2010 Annual Meeting or (ii) if the date of the 2011 Annual Meeting is advanced or delayed by more than 30 days from such anniversary date, not earlier than the 90th day prior to the 2011 Annual Meeting date and not later than the close of business on the later of the 60th day prior to the 2011 Annual Meeting date or the tenth day following the date on which public announcement of the 2011 Annual Meeting date is first made. Each stockholder recommending a person as a director candidate must provide us with the following information so that the Nominating and Corporate Governance Committee may determine whether the recommended director candidate is independent from the stockholder, or each member of the stockholder group, that has recommended the director candidate:

| | • | | If the recommending stockholder or any member of the recommending stockholder group is a natural person, whether the recommended director candidate is the recommending stockholder, a member of the recommending stockholder group, or a member of the immediate family of the recommending stockholder or any member of the recommending stockholder group; |

| | • | | If the recommending stockholder or any member of the recommending stockholder group is an entity, whether the recommended director candidate or any immediate family member of the recommended |

11

| | director candidate is or has been at any time during the current or preceding calendar year an employee of the recommending stockholder or any member of the recommending stockholder group; |

| | • | | Whether the recommended director candidate or any immediate family member of the recommended director candidate has accepted, directly or indirectly, any consulting, advisory, or other compensatory fees from the recommending stockholder or any member of the group of recommending stockholders, or any of their respective affiliates, during the current or preceding calendar year; |

| | • | | Whether the recommended director candidate is an executive officer or director (or person fulfilling similar functions) of the recommending stockholder or any member of the recommending stockholder group, or any of their respective affiliates; and |

| | • | | Whether the recommended director candidate controls the recommending stockholder or any member of the recommending stockholder group. |

The recommending stockholder must also provide supplemental information that the Nominating and Corporate Governance Committee may request to determine whether the recommended director candidate (i) is qualified to serve on the Audit Committee, (ii) meets the standards of an independent director, and (iii) satisfies the standards for our directors set forth above under the heading “– Qualifications of Director Nominees.” In addition, the recommending stockholder must include the consent of the recommended director candidate in the information provided to us and the recommended director candidate must make himself or herself reasonably available to be interviewed by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will consider all recommended director candidates submitted to it in accordance with these established procedures, though it will only recommend to the Board as potential nominees those candidates it believes are most qualified. However, the Nominating and Corporate Governance Committee will not consider any director candidate if such candidate’s candidacy or, if elected, Board membership, would violate controlling federal or state law.

Communications with the Board

Stockholders or other interested persons wishing to communicate with the Board may send correspondence directed to the Board, c/o Jonathan L. Abrams, Secretary, MPG Office Trust, Inc., 355 South Grand Avenue, Suite 3300, Los Angeles, California 90071. Mr. Abrams will review all correspondence addressed to the Board, or any individual Board member, for any inappropriate correspondence and correspondence more suitably directed to our management. Mr. Abrams will summarize all correspondence not forwarded to the Board and make the correspondence available to the Board for its review at the Board’s request. Mr. Abrams will forward all such communications to the Board prior to the next regularly scheduled meeting of the Board following the receipt of the communication, as appropriate. Correspondence intended for our non-management directors as a group should be delivered to the address above, “Attention: Non-Management Directors, c/o Jonathan L. Abrams, Secretary.”

12

Compensation of Directors

The following table summarizes the compensation earned by each of our independent directors during the fiscal year ended December 31, 2009:

DIRECTOR COMPENSATION

| | | | | | | | | | | | |

Name(1) | | Fees Earned

or Paid in Cash ($) (2) | | Stock

Awards

($) (3) | | Option

Awards

($) (4) | | Non-Equity

Incentive Plan

Compensation

($) | | All Other

Compensation

($) | | Total ($) |

| (a) | | (b) | | (c) | | (d) | | (e) | | (f) | | (g) |

Jonathan M. Brooks(5) | | 56,250 | | — | | — | | — | | — | | 56,250 |

Christine N. Garvey | | 127,201 | | — | | 12,826 | | — | | — | | 140,027 |

Michael J. Gillfillan(6) | | 76,671 | | — | | 17,260 | | — | | — | | 93,931 |

Cyrus S. Hadidi(5) | | 56,250 | | — | | — | | — | | — | | 56,250 |

Joseph P. Sullivan(6) | | 72,269 | | — | | 17,260 | | — | | — | | 89,529 |

George A. Vandeman | | 160,625 | | — | | 12,826 | | — | | — | | 173,451 |

Paul M. Watson | | 139,511 | | — | | 12,826 | | — | | — | | 152,337 |

David L. Weinstein | | 100,000 | | — | | 12,826 | | — | | — | | 112,826 |

| (1) | Our Chief Executive Officer, Mr. Rising, is a member of our Board. Mr. Rising does not receive any additional compensation for his services as a director. All compensation for his services as an employee of our company is shown in the Summary Compensation Table. |

| (2) | Amounts shown in Column (b) are those earned during the fiscal year ended December 31, 2009 for annual retainer fees, committee fees and/or chair fees. For further information, please see the discussion below under the heading “– Retainers and Fees.” |

| (3) | We did not grant any stock awards to members of our Board during the fiscal year ended December 31, 2009. As of December 31, 2009, our directors held the following number of shares of restricted stock that had not yet vested: Mr. Brooks, none; Ms. Garvey, 667; Mr. Gillfillan, none; Mr. Hadidi, none; Mr. Sullivan, none; Mr. Vandeman, 667; Mr. Watson, 667; and Mr. Weinstein, 667. |

| (4) | Amounts shown in Column (d) represent the aggregate grant date fair value of stock options granted during the fiscal year ended December 31, 2009 computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“FASB Codification”) Topic 718, Compensation – Stock Compensation. For a discussion of the assumptions made in the valuation reflected in this column, see Part II, Item 8. “Financial Statements and Supplementary Data – Notes 2 and 9 to the Consolidated Financial Statements” of our Annual Report on Form 10-K/A filed with the SEC on April 30, 2010. |

On May 21, 2009, Messrs. Gillfillan and Sullivan each received an award of 7,500 nonqualified stock options upon joining our Board that had a grant date fair value of $4,434. Ms. Garvey and Messrs. Gillfillan, Sullivan, Vandeman, Watson and Weinstein each received an annual grant of 45,000 nonqualified stock options upon their re-election to the Board on July 23, 2009 with a grant date fair value of $12,826.

As of December 31, 2009, our directors held the following number of outstanding nonqualified stock option awards: Mr. Brooks, none; Ms. Garvey, 57,500; Mr. Gillfillan, 52,500; Mr. Hadidi, none; Mr. Sullivan, 52,500; Mr. Vandeman, 57,500; Mr. Watson, 57,500; and Mr. Weinstein, 57,500.

| (5) | Messrs. Brooks and Hadidi did not stand for re-election to the Board on July 23, 2009. |

| (6) | Messrs. Gillfillan and Sullivan joined our Board on May 21, 2009. |

13

Retainers and Fees–

On July 23, 2009, the Board approved certain changes to our director compensation program. This program provides for the following cash fees:

| | | | | | | | | |

Fee Type(1) | | Amount per Year | | | | | | |

Retainer | | $ | 100,000 | | | | | | |

Chairman | | | 45,000 | | | | | | |

Committee Chair: | | | | | | | | | |

Audit | | | 35,000 | | | | | | |

Compensation | | | 25,000 | | | | | | |

Finance | | | 25,000 | | | | | | |

Nominating and Corporate Governance | | | 10,000 | | | | | | |

Committee Member: | | | | | | | | | |

Audit | | | 5,000 | | | | | | |

| (1) | Our board members do not receive any additional compensation for attending board or committee meetings. |

Prior to these changes, the Chairman of the Board received an annual fee of $100,000 in addition to the retainer. Previously, our Nominating and Corporate Governance Committee Chair, Finance Committee Chair or Audit Committee members did not receive an additional annual fee for committee service. Otherwise, the annual fees payable to our non-employee directors were the same as those described above.

On July 23, 2009, the Board also adopted the MPG Office Trust, Inc. Director Stock Plan, which generally provides, for each calendar year, that each non-employee director may irrevocably elect in advance to apply between 10% and 50% of the total annual compensation otherwise payable to him or her in cash during such calendar year (including any annual retainer fee and compensation for services rendered as a member of a committee of the Board or a chair of such committee) towards the purchase of shares of our common stock. During the fiscal year ended December 31, 2009, all of the annual fees described above were paid in cash to our non-employee directors.

Equity Awards–

The Incentive Award Plan was amended on July 23, 2009 to provide for the following formula grants of nonqualified stock options to non-employee directors as follows:

| | • | | Each individual who first becomes a non-employee director after the date of our 2009 Annual Meeting will be granted a nonqualified stock option to purchase 50,000 shares of our common stock under the Incentive Award Plan on the date on which he or she initially becomes a non-employee director. |

| | • | | Commencing as of our 2009 Annual Meeting, each non-employee director will be granted a nonqualified stock option to purchase 45,000 shares of our common stock under the Incentive Award Plan effective immediately following each annual meeting of stockholders, provided that he or she continues to serve as a non-employee director immediately following such annual meeting. |

The per share exercise price of each option will be equal to the closing price of a share of our common stock on the date of grant and, subject to the director’s continued service, the option will generally vest in equal annual installments on each of the first three anniversaries of the date of grant. In addition, options granted to non-employee directors become fully vested upon retirement from the Board. Vested options can be exercised up to 12 months from the date of death or leaving the Board due to permanent and total disability, up to six months from the date of leaving the Board for reasons other than death or permanent and total disability, or ten years from the date of grant. In the event of a change in control (as such term is defined in the Incentive Award Plan),

14

all options will accelerate and become fully exercisable immediately prior to the effective date of such change in control, unless such option has either previously expired or the successor company assumes or substitutes such option. Following such effective date, all options not assumed, substituted for or exercised will expire.

Prior to the July 23, 2009 amendment, the Incentive Award Plan provided for formula grants to non-employee directors as follows:

| | • | | Upon election to the Board, each non-employee director received a grant of 7,500 nonqualified stock options. The terms of these nonqualified stock options were the same as those described above. |

| | • | | Upon election or re-election to the Board, each director received an annual grant of 1,000 shares of restricted stock. These restricted stock awards vest in three equal annual installments on each of the first three anniversaries of the date of grant. Any unvested restricted stock awards are forfeited, except in limited circumstances, as determined by the Compensation Committee (including termination of directorship following a change in control) when a director leaves the Board for any reason. |

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2009, Ms. Garvey and Messrs. Brooks, Sullivan and Vandeman served on the Compensation Committee. Mr. Brooks resigned from the committee on July 23, 2009 when he did not stand for re-election to the Board. During the fiscal year ended December 31, 2009, there were no interlocks with other companies requiring disclosure under applicable SEC rules and regulations. None of the members of the Compensation Committee is or has been an officer or employee of the Company or any of its subsidiaries.

While the Compensation Committee retains ultimate approval authority for executive compensation, it has delegated the authority to negotiate specific terms of certain executive employment agreements to senior management.

15

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2010, and has further directed that management submit the selection of the independent registered public accounting firm for ratification by our stockholders at the Annual Meeting. KPMG LLP has audited our financial statements since our inception in 2002. A representative of KPMG LLP is expected to be present at the Annual Meeting, and, if present, will have an opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Principal Accounting Fees and Services

The following table summarizes the fees for professional services rendered by KPMG LLP related to the fiscal years ended December 31, 2009 and 2008:

| | | | | | |

| | | For the Year Ended December 31, |

| | | 2009 | | 2008 |

Audit fees(1) | | $ | 1,205,000 | | $ | 1,314,000 |

Audit-related fees(2) | | | 374,000 | | | 374,000 |

Tax fees(3) | | | — | | | — |

All other fees | | | — | | | — |

| | | | | | |

| | $ | 1,579,000 | | $ | 1,688,000 |

| | | | | | |

| (1) | Audit fees consist of fees for professional services provided in connection with the audits of our annual consolidated financial statements and internal control over financial reporting, the performance of interim reviews of our quarterly unaudited financial information and consents. |

| (2) | Audit-related fees consist of fees for agreed-upon procedures and stand-alone audits for certain of our properties. |

| (3) | We did not engage KPMG LLP for tax services during any year. |

Stockholder ratification of the selection of KPMG LLP as our independent registered public accounting firm is not required by our Bylaws or otherwise. However, the Board is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee may in its discretion direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s best interests.

The affirmative vote of a majority of the votes cast at the Annual Meeting is required for the ratification of the selection of KPMG LLP as our independent registered public accounting firm.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE SELECTION OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2010.

16

PRINCIPAL STOCKHOLDERS

The following table sets forth the only persons known to us to be the beneficial owner, or deemed to be the beneficial owner, of more than 5% of our common stock (or common stock currently outstanding and common stock issuable at our option upon the redemption of units in our Operating Partnership) as of May 14, 2010:

| | | | | | | | |

Name of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | Percent of

Common

Stock(1) | | | Percent of

Common

Stock and

Units(1) | |

| (a) | | (b) | | (c) | | | (d) | |

Robert F. Maguire III(2),(3) 1733 Ocean Avenue Suite 300 Santa Monica, CA 90401 | | 6,548,879 | | 12.00 | % | | 11.98 | % |

| | | |

Appaloosa Partners Inc.(4) c/o Appaloosa Management L.P. 51 John F. Kennedy Parkway Short Hills, NJ 07078 | | 4,300,000 | | 8.96 | % | | 7.86 | % |

| | | |

Balyasny Asset Management LLC(5) 181 West Madison Suite 3600 Chicago, IL 60602 | | 3,119,452 | | 6.50 | % | | 5.70 | % |

| | | |

Scoggin Capital Management, L.P. II(6) 660 Madison Avenue New York, NY 10065 | | 2,765,000 | | 5.76 | % | | 5.06 | % |

| (1) | Amounts and percentages in this table are based on 48,011,029 shares of our common stock and 6,674,573 Operating Partnership units (other than units held by MPG Office Trust, Inc.) outstanding as of May 14, 2010. Operating Partnership units are redeemable for cash or, at our option, shares of our common stock on a one-for-one basis. The total of shares outstanding used in calculating the percentages shown in Columns (c) and (d) for Mr. Maguire assumes that all common stock that he has the right to acquire upon redemption of Operating Partnership units are deemed to be outstanding, but are not deemed to be outstanding for the purpose of computing the ownership percentage of any other beneficial owner. |

| (2) | Amount shown in Column (b) for Mr. Maguire assumes that he has tendered all of his Operating Partnership units for redemption and that they have been exchanged by us for shares of our common stock at our option. |

| (3) | Information regarding Mr. Maguire is based solely on a Schedule 13D/A filed by Mr. Maguire with the SEC on April 2, 2010. The Schedule 13D/A indicates that (i) Mr. Maguire holds 3,444,045 Operating Partnership units directly, (ii) 1,772,901 Operating Partnership units are held by three entities that are wholly owned and controlled by Mr. Maguire, and (iii) 1,331,933 additional Operating Partnership units held by three entities that are wholly owned and controlled by Mr. Maguire that are not currently redeemable into common stock. The Schedule 13D/A also indicates that Mr. Maguire has sole voting and dispositive power with respect to all Operating Partnership units reported by him. |

| | The Schedule 13D/A indicates that, with the exception of 220,000 Operating Partnership units, all of the Operating Partnership units beneficially owned by Mr. Maguire are pledged to Wachovia Bank, N.A. as a portion of the collateral securing a personal loan made by Wachovia to Mr. Maguire. The loan matures on July 15, 2011, unless it is retired earlier. If an event of default occurs and is not cured or waived, Wachovia Bank, N.A. could foreclose on its collateral, including the Operating Partnership units that are pledged. |

17

| (4) | Information regarding Appaloosa Investment Limited Partnership I (“Appaloosa”), Palomino Fund Ltd. (“Palomino”), Thoroughbred Fund L.P. (“Thoroughbred”), Thoroughbred Master Ltd. (“Thoroughbred Master”), Appaloosa Management, L.P. (“Appaloosa Management”), Appaloosa Partners, Inc. (“Appaloosa Partners”) and David A. Tepper is based solely on a Schedule 13G/A filed with the SEC on February 12, 2010. The Schedule 13G/A indicates that (i) Appaloosa had shared voting and dispositive power with respect to 1,397,499 shares of our common stock and no sole voting or dispositive power; (ii) Palomino had shared voting and dispositive power with respect to 2,042,500 shares of our common stock and no sole voting or dispositive power; (iii) Thoroughbred had shared voting and dispositive power with respect to 420,711 shares of our common stock and no sole voting or dispositive power; (iv) Thoroughbred Master had shared voting and dispositive power with respect to 439,290 shares of our common stock and no sole voting or dispositive power; (v) Appaloosa Management had shared voting and dispositive power with respect to 4,300,000 shares of our common stock and no sole voting or dispositive power; (vi) Appaloosa Partners had shared voting and dispositive power with respect to 4,300,000 shares of our common stock and no sole voting or dispositive power; and (vii) Mr. Tepper had shared voting and dispositive power with respect to 4,300,000 shares of our common stock and no sole voting or dispositive power. |

| | The Schedule 13G/A indicates that Mr. Tepper is the sole stockholder and the President of Appaloosa Partners. Appaloosa Partners is the general partner of, and Mr. Tepper owns a majority of the limited partnership interest in, Appaloosa Management. Appaloosa Management is the general partner of Appaloosa and Thoroughbred, and acts as investment advisor to Palomino and Thoroughbred Master. |

| (5) | Information regarding Atlas Master Fund, Ltd. (“AMF”), Atlas Global, LLC. (“AG”), Atlas Global Investments, Ltd. (“AGI”), Atlas Institutional Fund, Ltd. (“AIF Ltd”), Atlas Institutional Fund, LLC (“AIF LLC”), Atlas Financial Master Fund, Ltd. (“AFF Master”), Atlas Financial Fund, LLC (“AFF LLC”), Atlas Fundamental Trading Master Fund Ltd. (“AFT Master”), Atlas Fundamental Trading Fund, L.P. (“AFT LP”), Atlas Fundamental Trading Fund, Ltd. (“AFT Ltd”), Atlas Fundamental Leveraged Trading Fund, L.P. (“AFTL”), Atlas Leveraged Fund, L.P. (“ALF”), Balamat Cayman Fund Limited (“BCF1”), Balyasny Dedicated Investor Master Fund, Ltd. (“BDI Master”), Balyasny Dedicated Investor Offshore Fund, Ltd. (“BDI Ltd”), Balyasny Dedicated Investor Onshore Fund, L.P. (“BDI LP”), Balyasny Asset Management L.P. (“BAM”) and Dmitry Balyasny is based solely on a Schedule 13G/A filed with the SEC on February 16, 2010. The Schedule 13G/A indicates that (i) AMF, AG, AGI, AIF Ltd and AIF LLC had sole voting and dispositive power with respect to 519,000 shares of our common stock and no shared voting or dispositive power; (ii) AFF Master and AFF LLC had sole voting and dispositive power with respect to 1,375,152 shares of our common stock and no shared voting or dispositive power; (iii) AFT Master, AFT LP and AFT Ltd had sole voting and dispositive power with respect to 483,900 shares of our common stock and no shared voting or dispositive power; (iv) AFTL had sole voting and dispositive power with respect to 73,700 shares of our common stock and no shared voting and dispositive power; (v) ALF had sole voting and dispositive power with respect to 137,100 shares of our common stock and no shared voting and dispositive power; (vi) BCF1 had sole voting and dispositive power with respect to 115,600 shares of our common stock and no shared voting and dispositive power; (vii) BDI Master, BDI Ltd and BDI LP had sole voting and dispositive power with respect to 415,000 shares of our common stock and no shared voting or dispositive power; (viii) BAM had sole dispositive power with respect to 3,119,452 shares of our common stock and no sole or shared voting power or no shared dispositive power; and (ix) Mr. Balyasny had sole voting and dispositive power with respect to 3,119,452 shares of our common stock and no shared voting or dispositive power. |

| | The Schedule 13G/A indicates that BAM is the investment manager to each of AMF, AG, AGI, AIF Ltd, AIF LLC, AFF Master, AFF LLC, AFT Master, AFT LP, AFT Ltd, AFTL, ALF, BCF1, BDI Master, BDI Ltd, and BDI LP and may be deemed to beneficially own the 3,119,452 shares of our common stock beneficially owned by the companies listed above. Mr. Balyasny is the sole managing member of the general partner of BAM. Mr. Balyasny may be deemed to beneficially own the 3,119,452 shares of our common stock beneficially owned by BAM. The principal address for AMF, AGI, AIF Ltd, AFF Master, AMF, AFT Master, AFT Ltd, BDI Master and BDI Ltd is c/o Walkers SPV Limited, Walker House, |

18

| | P.O. Box 908 GT, George Town, Grand Cayman, Cayman Islands, British West Indies. The principal address for BCF1 is c/o Citi Hedge Fund Services (Cayman), Ltd., P.O. Box 10293, 5th Floor, Cayman Corporate Centre, 27 Hospital Road, Georgetown, Grand Cayman KY1-1003, Cayman Islands, British West Indies. |

| (6) | Information regarding Scoggin Capital Management II LLC (“Scoggin Capital”), Scoggin International Fund, Ltd. (“Scoggin International”), Scoggin Worldwide Fund, Ltd. (“Scoggin Worldwide”), Old Bell Associates LLC (“Old Bell”), A. Dev Chodry, Scoggin, LLC, Craig Effron and Curtis Schenker is based solely on a Schedule 13G/A filed with the SEC on April 1, 2010. The Schedule 13G/A indicates that (i) Scoggin Capital had sole voting and dispositive power with respect to 1,000,000 shares of our common stock and no shared voting or dispositive power; (ii) Scoggin International had sole voting and dispositive power with respect to 1,440,000 shares of our common stock and no shared voting or dispositive power; (iii) Scoggin Worldwide had sole voting and dispositive power with respect to 120,000 shares of our common stock and no shared voting or dispositive power; (iv) Scoggin, LLC had sole voting and dispositive power with respect to 2,440,000 shares of our common stock and shared voting and dispositive power with respect to 80,000 shares of our common stock; (v) Mr. Effron had sole voting and dispositive power with respect to 125,000 shares of our common stock and shared voting and dispositive power with respect to 2,640,000 shares of our common stock; (vi) Mr. Schenker had sole voting and dispositive power with respect to 17,500 shares of our common stock and shared voting and dispositive power with respect to 2,640,000 shares of our common stock; and (vii) Old Bell and Mr. Chodry each had shared voting and dispositive power with respect to 120,000 shares of our common stock and no sole voting or dispositive power. |

| | The Schedule 13G/A indicates that the investment manager of Scoggin Capital and Scoggin International is Scoggin LLC. and that Messrs. Effron and Schenker are the managing members of Scoggin LLC. The Schedule 13G/A indicates that Old Bellows Partners LP is the investment manager of Scoggin Worldwide and that Old Bell is the general partner of Old Bellows Partners LP. Mr. Chodry is a principal of Old Bellow Partners LP, and Scoggin, LLC is also a principal of Old Bellows Partners LP and serves as investment sub-manager for equity and event-driven investing for Scoggin Worldwide. The principal address for Scoggin International and Scoggin Worldwide is c/o Mourant Cayman Nominees, Ltd., Third Floor, Harbour Centre, P.O. Box 1348, Grand Cayman KY1-1108, Cayman Islands. |

19

SECURITY OWNERSHIP OF OUR DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the beneficial ownership of our common stock (or common stock currently outstanding and common stock issuable at our option upon the redemption of units in our Operating Partnership) of (1) our current directors, (2) our current Chief Executive and Chief Financial Officers, (3) each of our three other most highly compensated executives, other than our Chief Executive and Chief Financial Officers, as of December 31, 2009, and (4) our current directors and our executive officers listed below under the heading “Executive Officers of the Registrant” as a group, in each case as of May 14, 2010. In preparing this information, we relied solely upon information provided to us by our directors and current executive officers.

| | | | | | |

Name of Beneficial Owner(1) | | Amount and

Nature of

Beneficial

Ownership (2) | | Percent of

Common

Stock(3) | | Percent of

Common

Stock and

Units(3) |

| (a) | | (b) | | (c) | | (d) |

Nelson C. Rising(4) | | — | | * | | * |

Shant Koumriqian(5) | | 48,608 | | * | | * |

Robert P. Goodwin(6) | | 30,263 | | * | | * |

Peter K. Johnston(7) | | 10,790 | | * | | * |

Christopher C. Rising(8) | | — | | * | | * |

Christine N. Garvey(9) | | 13,127 | | * | | * |

Michael J. Gillfillan(10) | | 2,500 | | * | | * |

Joseph P. Sullivan(10) | | 2,500 | | * | | * |

George A. Vandeman(11) | | 7,667 | | * | | * |

Paul M. Watson(12) | | 5,167 | | * | | * |

David L. Weinstein(12) | | 5,167 | | * | | * |

All directors and executive officers as a group (15 persons)(13) | | 184,296 | | * | | * |

| (1) | The address for each listed beneficial owner is c/o MPG Office Trust, Inc., 355 South Grand Avenue, Suite 3300, Los Angeles, CA 90071. |

| (2) | Unless otherwise indicated, each person is the direct owner of and has sole voting and dispositive power with respect to such common stock and Operating Partnership units, with the exception of restricted stock as to which the person has sole voting but no dispositive power. Amounts and percentages in this table are based on 48,011,029 shares of our common stock and 6,674,573 Operating Partnership units (other than units held by MPG Office Trust, Inc.) outstanding as of May 14, 2010. Operating Partnership units are redeemable for cash or, at our option, shares of our common stock on a one-for-one basis. |