QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on March 5, 2003

Registration No. 333-101456

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

to

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

MDP ACQUISITIONS PLC

MDCP ACQUISITIONS I

(Exact name of registrants as specified in their respective charters)

Ireland

(State or other jurisdiction of incorporation or organization) | | 2670

(Primary Standard Industrial Classification Code Number) | | Not Applicable

(I.R.S. Employer Identification No.) |

Arthur Cox Building

Earlsfort Terrace

Dublin 2

Ireland

Telephone: +353 (1) 618-0000

(Address, including zip code, and telephone number, including area code, of registrants' principal executive offices) |

National Registered Agents, Inc.

875 Avenue of the Americas

Suite 501

New York, New York 10001

Telephone: (800) 767-1553

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to: |

Dennis M. Myers, Esq.

Kirkland & Ellis

200 E. Randolph Drive

Chicago, Illinois 60601

Telephone: (312) 861-2000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities

to be Registered

| | Amount

to be Registered

| | Proposed Maximum

Offering Price

Per Unit

| | Amount of

Registration Fee

|

|---|

|

| 101/8% Senior Notes due 2012 | | €350,000,000 | | 100% | | $32,148(1) |

|

| Guarantees of 101/8% Senior Notes due 2012(2) | | — | | — | | (3) |

|

| 95/8% Senior Notes due 2012 | | $545,000,000 | | 100% | | $50,140(1) |

|

| Guarantees of 95/8% Senior Notes due 2012(2) | | — | | — | | (3) |

|

| 15.5% Subordinated Notes due 2013 | | €103,831,945 | | 100% | | $9,521(1)(4) |

|

| 15.5% Subordinated Notes due 2013 | | $155,747,917 | | 100% | | $14,265(1)(5) |

|

- (1)

- Calculated in accordance with Rule 457 under the Securities Act of 1933, as amended. The registration fees are based on the Noon Buying Rate of €1.00=$0.9984 on November 21, 2002 and, except with respect to the registration fees relating to the 15.5% Subordinated Notes due 2013 as more fully described in notes (4) and (5) below, such fees were paid in connection with the original filing of this Registration Statement on November 25, 2002.

- (2)

- MDCP Acquisitions I is a subsidiary of MDP Acquisitions plc and has guaranteed each of the 101/8% Senior Notes due 2012 and 95/8% Senior Notes due 2012 being registered.

- (3)

- Pursuant to Rule 457(n), no separate fee is payable with respect to the guarantees being registered hereby.

- (4)

- $9,185 of such fee was paid in connection with the original filing on November 25, 2002. The remainder of such fee is based on the Noon Buying Rate of €1.00=$1.0835 on March 3, 2003.

- (5)

- $13,800 of such fee was paid in connection with the original filing on November 25, 2002.

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED MARCH 5, 2003

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

PROSPECTUS

MDP Acquisitions plc

the indirect owner of

Offer to Exchange

the four series of securities listed below for substantially identical securities

that have been registered under the U.S. Securities Act of 1933:

€350,000,000 101/8% Senior Notes due 2012

$545,000,000 95/8% Senior Notes due 2012 | €103,831,945 15.5% Subordinated Notes due 2013

$155,747,917 15.5% Subordinated Notes due 2013 |

Material Terms of Exchange Offers

- •

- MDP Acquisitions plc was recently formed to effect the acquisition of the business conducted by Jefferson Smurfit Group Limited and its consolidated subsidiaries. Substantially all of the financial information contained in this prospectus relates to the operations of JSG prior to its acquisition.

- •

- We sold the outstanding senior notes listed above on September 30, 2002 and 250,000 units, each of which consisted of $1,000 or €1,000 15.5% subordinated notes and one warrant to purchase 2.957576 ordinary shares of the parent company of MDP Acquisitions plc, on October 2, 2002, in each case to initial purchasers who subsequently re-sold such securities to qualified institutional buyers under Rule 144A and non-U.S. persons under Regulation S. The net proceeds from such sales were used to partially fund the acquisition of JSG by an investor group led by Madison Dearborn Partners.

- •

- The terms of the senior euro notes, the senior dollar notes, the subordinated euro notes and the subordinated dollar notes to be issued in the exchange offers described in this prospectus are substantially identical to the outstanding notes, except that the transfer restrictions and registration rights relating to the outstanding notes will not apply to the exchange notes. The exchange offers are independent of each other and neither exchange offer is conditioned upon the other exchange offer.

- •

- Based on interpretations by the staff of the SEC, we believe that, subject to some exceptions, the exchange notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act.

- •

- The existing notes are currently listed on the Luxembourg Stock Exchange. We currently intend to list the exchange notes on the Luxembourg Stock Exchange.

- •

- The units must be separated by the holder thereof to participate in the exchange offer for the subordinated dollar notes and the subordinated euro notes.

- •

- Each exchange offer expires at 5:00 p.m., London time, 12:00 p.m., New York City time, , 2003, unless extended.

- •

- You may withdraw tenders of outstanding notes at any time prior to the expiration of an exchange offer.

- •

- You may tender your outstanding notes in integral multiples of €1,000 or $1,000, as the case may be, with respect to the senior notes and integral multiples of €1 or $1, as the case may be, with respect to the subordinated notes.

- •

- We believe that the exchange of the notes will not be a taxable event for U.S. federal income tax purposes.

- •

- The exchange offers are subject to customary conditions, including that neither exchange offer violates applicable law or any applicable interpretation of the staff of the SEC.

- •

- We will not receive any proceeds from the exchange offers.

For a discussion of certain factors that you should consider before participating in these exchange offers, see "Risk Factors" beginning on page 23 of this prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the notes to be distributed in the exchange offers, nor have any of these organizations determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

, 2003

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offers must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letters of transmittal state that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for notes where the notes were acquired by the broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration date of each of the exchange offers (as defined herein), we will make this prospectus available to any broker-dealer in connection with any such resale. See "Plan of Distribution."

We have not authorized any dealer, salesperson or other person to give any information or represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus does not offer to sell or solicit any offer to buy any notes in any jurisdiction where the offer or sale is unlawful. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

TABLE OF CONTENTS

| | Page

|

|---|

| Summary | | 1 |

| Risk Factors | | 23 |

| Cautionary Note Regarding Forward-Looking Statements | | 37 |

| Presentation of Our Financial Information | | 38 |

| Exchange Rate Information | | 38 |

| Market, Ranking and Other Data | | 39 |

| The Transactions | | 40 |

| Senior Notes Exchange Offer | | 44 |

| Subordinated Notes Exchange Offer | | 56 |

| Use of Proceeds | | 68 |

| Capitalization | | 69 |

| Unaudited Pro Forma Financial Statements | | 70 |

| Selected Historical Financial Data | | 86 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 89 |

| Industry | | 115 |

| Business | | 117 |

| Management | | 133 |

| Certain Relationships and Related Transactions | | 141 |

| Security Ownership | | 146 |

| Description of Certain Indebtedness | | 148 |

| Description of the Senior Notes | | 157 |

| Description of the Subordinated Notes | | 219 |

| Book-Entry, Settlement and Clearance | | 277 |

| Taxation | | 283 |

| Plan of Distribution | | 298 |

| Service of Process and Enforcement of Civil Liabilities | | 299 |

| Experts | | 299 |

| Legal Matters | | 299 |

| Where You Can Find Other Information | | 300 |

| General Information | | 301 |

| Index to Financial Statements | | F-1 |

SUMMARY

This following summary highlights material information about our company and these exchange offers. This summary does not contain all of the information that may be important to you in deciding whether to participate in the exchange offers. We encourage you to read this entire prospectus, including the financial data and the information described under the heading "Risk Factors" and the other documents we have referred to you.

In this prospectus, unless the context otherwise requires:

- •

- "issuer" refers to MDP Acquisitions plc, a direct subsidiary of parent and indirect owner of JSG;

- •

- "parent" refers to MDCP Acquisitions Limited, an entity controlled by Madison Dearborn Partners, L.L.C. and its affiliates;

- •

- "guarantor" refers to MDCP Acquisition I, a direct subsidiary of issuer and guarantor of the senior notes;

- •

- "SSCC" refers to Smurfit-Stone Container Corporation;

- •

- "JSG" refers to Jefferson Smurfit Group Limited and its consolidated subsidiaries; and

- •

- "we," "us," and "our" and similar terms refer to the consolidated business of MDCP Acquisitions Limited and all of its consolidated subsidiaries and its predecessors, including JSG.

This summary has four major sections. The first section discusses our company, industry, competitive strengths, business strategy, recent developments, corporate structure and background information relating to the issuance of the outstanding notes. The second and third sections provide a summary of the terms of the senior notes exchange offer and the subordinated notes exchange offer and the material terms of the senior exchange notes and the subordinated exchange notes. The last section provides our summary historical and unaudited pro forma consolidated financial data and our recent operating results.

Our Company

We are the largest European-based integrated manufacturer of containerboard, corrugated containers and other paper-based packaging products, with operations in Europe, Latin America and the United States and Canada. JSG, which was incorporated in Ireland in 1934 as the owner of a single converting plant, has grown to its current global position, owning, after giving effect to the pending exchange of assets with SSCC, 46 mills, most of which produce containerboard used to manufacture our corrugated containers, 206 converting plants, most of which convert containerboard into corrugated containers, 31 reclamation facilities, which provide some of the wastepaper requirements for our mills, and 31 other production facilities worldwide. For the nine months ended September 30, 2002, we generated net sales, net loss and EBITDA of €3,614 million, €39 million and €451 million, respectively, on a pro forma basis. For the year ended December 31, 2001, we generated net sales, net loss and EBITDA of €4,951 million, €18 million and €688 million, respectively, on a pro forma basis. Our European, Latin American and North American operations accounted for approximately 71%, 16% and 13%, respectively, of our net sales for the nine months ended September 30, 2002 on a pro forma basis.

We command a leading share of the European corrugated container market and are one of Europe's largest producers of containerboard. In Latin America, we are the largest producer of corrugated containers and the second largest producer of containerboard. Through our North American operations, we are the second largest producer of corrugated containers in Canada. We are also a world leading producer of décor base paper, which is used as a laminate in furniture and flooring and is one of our fastest growing products.

1

Our containerboard mills and converting operations are highly integrated, as our corrugated container plants convert much of our containerboard production. For the nine months ended September 30, 2002, we produced approximately 2,000,000 metric tons of containerboard and a similar volume of corrugated containers. In addition, our mills produced over 680,000 metric tons of other grades of paperboard and paper, such as sack kraft, which is used to make industrial-grade paper sacks, and boxboard, which is used for folding cartons, together with non-packaging grades, such as décor base paper, graphic board and printing and writing paper. Our conversion plants produced over 170,000 metric tons of other paper-based packaging products, such as paper sacks and folding cartons.

We are highly leveraged as a result of the indebtedness we incurred in connection with the acquisition of JSG by MDCP Acquisitions I, a company newly formed by Madison Dearborn Partners, L.L.C. Our substantial indebtedness could adversely affect our ability to meet our debt service obligations, including those under the senior and subordinated notes. As of September 30, 2002, on a pro forma basis for the acquisition of JSG, we would have had outstanding long term indebtedness of approximately €3,238 million (including the current portion of €4 million) and shareholders' equity of approximately €869 million. On the same pro forma basis, our ratio of earnings to fixed charges for the nine months ended September 30, 2002 would have been 1.0x. Our substantial indebtedness could also require us to dedicate a substantial portion of our cash flow from operations to debt payments, limit our flexibility in planning for or reacting to changes in manufacture, production, distribution or marketing of our products, place us at a competitive disadvantage compared to any of our competitors that are less leveraged than we are, increase our vulnerability to general and industry-specific adverse economic conditions and limit our ability to borrow additional funds.

Industry Overview

Corrugated containers are a safe and economical means of transporting consumer and industrial products. More goods are shipped in corrugated containers than in any other type of packaging. Containerboard, which is a generic term used to describe various types of paperboard such as linerboard and corrugating medium, is the principal raw material used to manufacture corrugated containers. Linerboard is used as the inner and outer facing (lining) of a corrugated container. The two main types of linerboard are kraftliner, which is produced using primarily virgin fiber, and testliner, which is produced using primarily recycled fiber. Corrugating medium is the wavy or fluted interior of the corrugated sheet. It is fluted and laminated to linerboard in corrugating plants to produce corrugated sheets. The sheets are subsequently printed, cut, folded and glued either in a corrugating plant or in a converting plant to produce corrugated containers.

Our industry is highly competitive, and no single company is dominant. Our competitors include large, vertically integrated paperboard and packaging products companies and numerous smaller companies. The industry is particularly sensitive to price fluctuations as well as other factors, including innovation, design, quality and service. To the extent that one or more of our competitors becomes more successful with respect to any key competitive factor, our ability to attract and retain customers could be materially adversely affected, which could diminish our sales volumes and revenues.

Furthermore, the principal factor affecting the demand for our products, both globally and regionally, is the general level of economic growth and activity. Since the markets for paper-based packaging products in the developed world are generally mature, there is a close correlation between economic growth and demand for packaging products such as corrugated containers and their component materials, including containerboard. Accordingly, the demand for our products is adversely affected by an economic slowdown, particularly if such a slowdown affects the global economy rather than any one region. This occurred in 2000, 2001 and 2002.

2

Competitive Strengths

Leading Market Positions and Economies of Scale. We are the leading producer of kraftliner and the second largest producer of testliner in Europe and command a leading share of the European corrugated container market. In Latin America, we are the largest producer of corrugated containers and the second largest producer of containerboard. The scale and density of our production network allows us to benefit from economies of scale in purchasing, production, distribution, marketing, research and development and the application of best practices.

Highly Integrated Producer. We have the ability to utilize substantially all of our containerboard mills' production internally because our converting plants' volume requirements for containerboard generally meet or exceed our mills' production. We believe integration provides us with earnings stability, largely because fluctuations in the earnings of our mills tend to be offset by changes in the earnings of our converting operations. Moreover, our high level of integration ensures consistent demand for our mills' containerboard production, which allows us to optimize capacity utilization, even during trough demand periods.

Cost Competitive and Well-Positioned Manufacturing Base. We believe that we incur among the lowest delivered cost to our customers as a result of our efficient, long-lived manufacturing base and the close proximity of our mills to customers and raw material sources.

Diversified Product Offerings, Geographic Markets and Customer Base. With leading positions in the production of kraftliner, testliner, corrugated containers and specialties, an operating presence in 20 countries and thousands of customers, our cash flows are broadly diversified across product offerings, geography and customer type.

Experienced Management with Substantial Equity Interest. We have an experienced senior management team with an average of approximately 20 years of experience with JSG. Our senior executives have invested approximately €61.0 million in equity of our parent. In addition, 214 other JSG managers have invested approximately €13.0 million in equity of parent.

Principal Shareholder with Proven Paper and Packaging Sector Expertise. Madison Dearborn is considered to be among the most active private equity investors in the U.S. in the paper and packaging industry, having previously made investments in Packaging Corporation of America, Riverwood International Corp., Buckeye Cellulose Corporation and Bay State Paper Holdings.

Business Strategy

Aggressively Reduce Debt. Our top priority is to reduce debt. To do so, we will maximize our cash flow available for debt reduction through transaction-related cost reductions, the continuation of our disciplined capital expenditure program and the divestiture of non-core operating and non-operating assets. Management and Madison Dearborn have identified transaction-related cash cost reductions in overhead and procurement which we believe will have a positive annualized effect on EBITDA of approximately €31.5 million, independent of management's ongoing operating cost reduction programs.

Pursue Continuous Operating Improvements. We are implementing a program designed to improve profits across JSG by reducing costs in areas such as raw materials, services, transportation and spare parts through the sharing of information, increased coordination and exchange of best practices within JSG. We annually undertake a focused review of fixed and variable costs, and we intend to maintain our well-positioned manufacturing base through benchmarking, improving asset utilization and realizing centralization savings.

3

Optimize Business Portfolio. Management plans to review its portfolio of businesses on an ongoing basis to identify opportunities to realize value by exiting businesses that are both not critical for JSG from a strategic perspective and are capable of being sold to third parties at attractive prices. In addition, we consider acquisitions a more capital-efficient and responsible method of expanding our operations. Therefore, we plan to pursue selected acquisitions if opportunities arise that meet both our stringent return on capital requirements and our business objectives of increasing integration and otherwise strengthening our competitive position.

Asset Swap Transaction

On February 20, 2003, certain subsidiaries of JSG executed exchange and sale agreements with certain subsidiaries of SSCC pursuant to which JSG agreed to purchase substantially all of the assets that currently comprise SSCC's European operations for JSG's 50% ownership interest in Smurfit MBI Canada and a cash payment of approximately €185 million. The closing of this transaction is subject to certain conditions, including the accuracy of the parties' respective representations and warranties on the closing date, obtaining required consents and approvals and repayment of intercompany debt. The closing of this transaction is currently expected to occur in the first quarter of 2003. On February 14, 2003, we sold an additional $205 million in aggregate principal amount of our 95/8% senior notes due 2012 to fund the cash consideration for this transaction. The net proceeds of such offering were placed in a segregated account with Deutsche Bank AG London pending the completion of this transaction.

In connection with the asset swap transaction, we will acquire three paper mills (located in Hoya and Viersen, Germany and Cordoba, Spain), 21 corrugated container plants (11 located in Germany, three in Spain, four in Belgium, two in The Netherlands and one in France) and five reclamation plants located in Germany. The primary products produced in these facilities include corrugated containers, containerboard and coated recycled boxboard. Production for these mills and sales volumes for the corrugated container facilities for 1999, 2000 and 2001 were:

| | 1999

| | 2000

| | 2001

|

|---|

| Tons produced (in thousands): | | | | | | |

| | Containerboard | | 380 | | 405 | | 411 |

| | Coated boxboard | | 79 | | 85 | | 78 |

| Corrugated containers sold (in billion sq. ft.) | | 11.6 | | 12.1 | | 12.3 |

| | |

| |

| |

|

For ease of reference, we refer to the asset swap transaction with SSCC described above as the SSCC Asset Swap and the sale of the notes used to finance the SSCC Asset Swap as the additional senior notes.

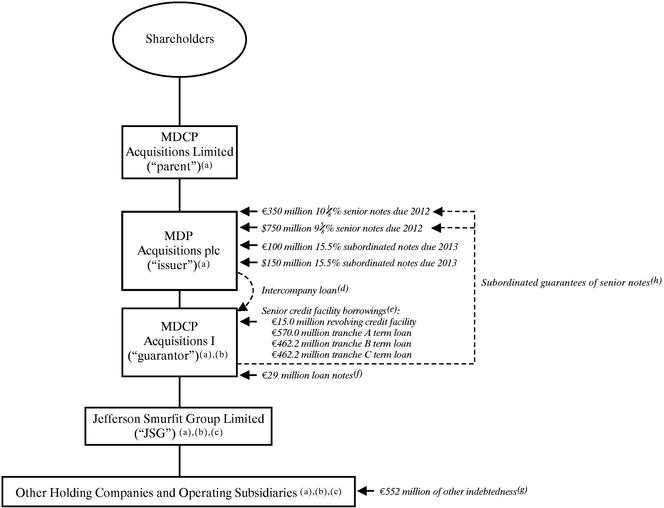

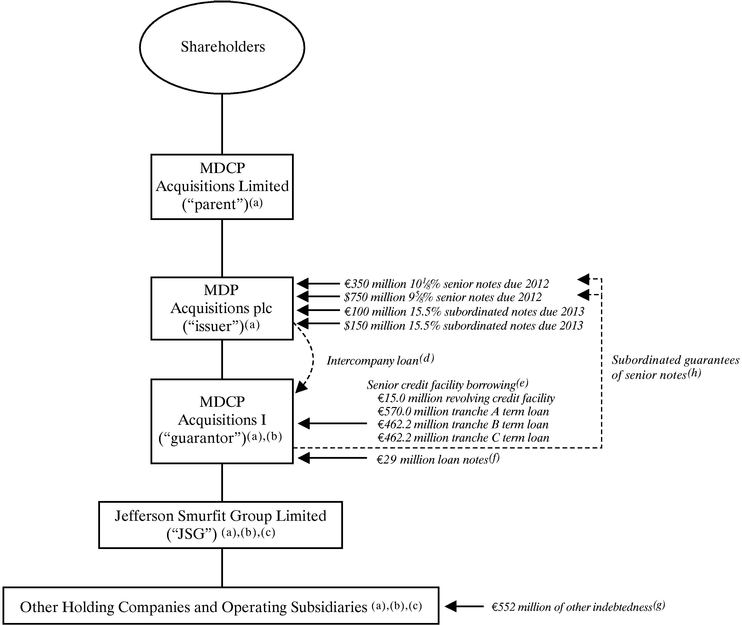

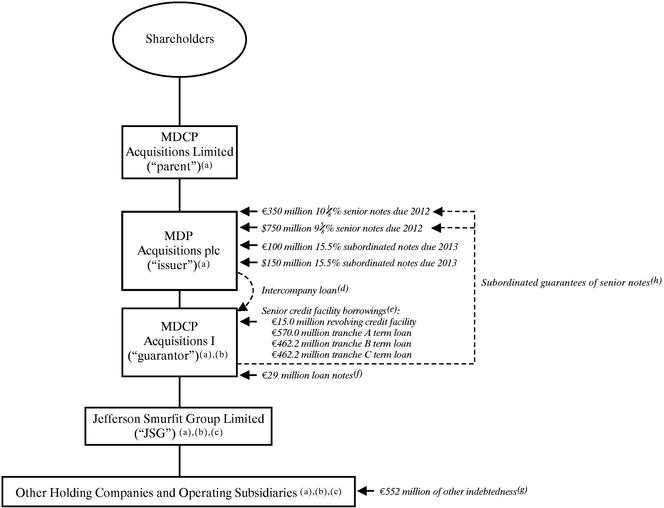

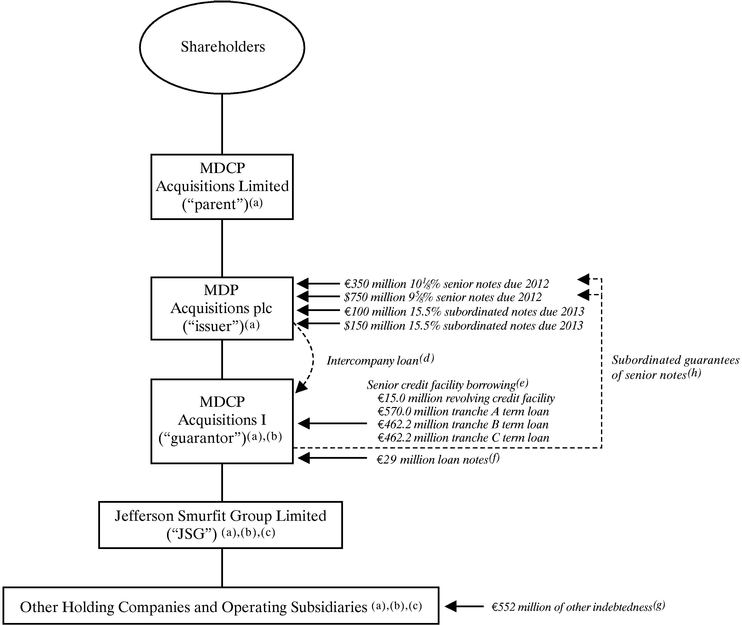

Corporate Structure

Issuer owns guarantor and guarantor owns JSG. Issuer, a public limited company, was incorporated in Ireland on June 12, 2002 to act as a financing company in connection with the acquisition of JSG by Madison Dearborn and management. Prior to the acquisition of JSG, issuer had not engaged in any business. Issuer and guarantor are holding companies and do not directly conduct any business operations. Consequently, issuer and guarantor are dependent on dividends and other payments from JSG and its subsidiaries to make payments on the notes and, if required, the guarantees of the senior notes. You will not have any direct claim on the cash flows or assets of our subsidiaries, and our operating subsidiaries have no obligation to pay amounts due under the notes or the guarantees or to make funds available to issuer or guarantor for these payments. The ability of our subsidiaries to make dividends and other payments to issuer will depend on their cash flows and earnings which, in turn, will be affected by all of the factors discussed in the "Risk Factors" section. In

4

addition, under Irish corporate law, our Irish subsidiaries may not pay dividends in excess of their distributable reserves—in general, the accumulated earnings of the relevant subsidiary.

The registered office of issuer is Arthur Cox Building, Earlsfort Terrace, Dublin 2, Ireland, and its telephone number is +353 1 618 0000. JSG was originally incorporated in Ireland as a private company on January 15, 1934 and became a public company in 1964 and a public limited company in 1985. On November 18, 2002, JSG converted to a private limited company. JSG's principal executive offices are located at Beech Hill, Clonskeagh, Dublin 4, Ireland and its telephone number is +353 1 202 7000.

The following chart illustrates our corporate structure and principal indebtedness after giving effect to the completion of the acquisition of JSG as further described below and the February 2003 offering of additional senior notes as at September 30, 2002.

- (a)

- Guarantors under the senior credit facility. Parent and issuer have also provided a first priority security interest over all their tangible and intangible assets (other than the intercompany loan) to the lenders under the senior credit facility.

- (b)

- Borrowers under the senior credit facility.

- (c)

- In addition to our holding companies, certain of our operating subsidiaries are guarantors of the senior credit facility. See "Description of Certain Indebtedness—Senior Credit Facility."

- (d)

- Intercompany loan is equal to principal amount of senior notes and subordinated notes. Amounts due to issuer under this intercompany loan are subordinated to all existing and future indebtedness of guarantor under the senior credit facility pursuant to a priority agreement governing the rights of guarantor's creditors. The intercompany loan is subject to

5

payment blockages and to restrictions on enforcement. For more information, see "Description of Certain Indebtedness—Intercompany Loan and Priority Agreements."

- (e)

- We had approximately €410 million of additional borrowing availability under our revolving credit facility and approximately €606 million of additional borrowing availability under our term loans as of September 30, 2002. See "Description of Certain Indebtedness—Senior Credit Facility."

- (f)

- As part of the acquisition of JSG, certain shareholders of JSG were able to elect to receive some or all of their consideration in the form of a loan note. See "Description of Certain Indebtedness—Loan Notes."

- (g)

- Includes indebtedness under our 6.75% notes due 2005, 7.50% debentures due 2025, certain local bank borrowing, capital lease obligations, Latin America funded debt and bank overdrafts. See "Description of Certain Indebtedness—Description of Existing 6.75% Notes and 7.50% Debentures," "Description of Certain Indebtedness—Other Indebtedness" and "Unaudited Pro Forma Financial Statements."

- (h)

- The guarantees are subordinated to all senior indebtedness of guarantor, including all amounts borrowed under the senior credit facility, and are not due unless certain conditions have been satisfied. See "Description of the Senior Notes."

Issuer sold on September 30, 2002 the original senior outstanding notes to Deutsche Bank AG London, Merrill Lynch International, Lehman Brothers International, J.P. Morgan Securities Ltd. and ABN AMRO Bank N.V., as initial purchasers, and on October 2, 2002, the units, which were comprised of the subordinated notes and warrants to purchase ordinary shares of issuer's parent company, to Deutsche Bank AG London and Merrill Lynch International, as initial purchasers. The initial purchasers subsequently resold the original senior outstanding notes and the units outside the United States to non-U.S. persons in reliance on Regulation S and within the United States to qualified institutional buyers in reliance upon Rule 144A under the Securities Act of 1933, as amended. The net proceeds from the sales of the original senior outstanding notes and the units were used to partially finance the acquisition of JSG as further described below. In order to participate in the subordinated notes exchange offer, you must first separate the units you obtained in the units offering.

The JSG Acquisition

On October 7, 2002, MDCP Acquisitions I, a company newly formed by Madison Dearborn Partners, L.L.C., completed the acquisition of all of the outstanding equity interests of JSG. In connection with the acquisition, JSG distributed to its shareholders by way of a share capital reduction its 29.3% interest in SSCC and transferred certain non-operating assets and non-core operating assets to newly formed, wholly owned subsidiaries of parent, which we collectively refer to as the Newcos, in exchange for one or more intercompany notes. The Newcos borrowed €125 million under a bank credit facility, which is completely non-recourse to issuer. The Newcos then loaned the proceeds to parent, and parent used them to make a capital contribution to issuer.

The funding required to purchase all of the outstanding equity interests of JSG, to refinance certain existing indebtedness of JSG and to pay related fees and expenses was approximately €3,510 million. These cash costs were financed by the following transactions:

- •

- approximately €857 million of cash equity contributed by parent, which we refer to as the equity contribution. The equity contribution was comprised of the following:

- •

- the purchase by Madison Dearborn co-investors, certain other co-investors, including DBCP Europe GP (Jersey) Limited, JP Morgan Partners co-investors and Merrill Lynch Private Equity Partners co-investors, and certain members of management, including Dr. Michael W.J. Smurfit, Gary W. McGann, Anthony P.J. Smufit and Ian J. Curley, of ordinary shares of parent of approximately €70 million in cash,

- •

- capital contributions to parent by Madison Dearborn co-investors and certain other co-investors, including DBCP Europe GP (Jersey) Limited, JP Morgan Partners co-investors and Merrill Lynch Private Equity Partners co-investors, of approximately €662 million in cash, and

6

- •

- a capital contribution by parent of €125 million in cash, which funds were provided by the Newcos to parent in the form of an intercompany loan;

- •

- proceeds from the issuance and sale of 250,000 units, which we refer to as the units, consisting of €100 million and $150 million aggregate principal amount of 151/2% subordinated notes due 2013, which we refer to as the subordinated notes, and warrants to purchase parent's ordinary shares;

- •

- proceeds from the issuance and sale of €350 million aggregate principal amount of 101/8% senior notes due 2012 and $545 million aggregate principal amount of 95/8% senior notes due 2012, which we collectively refer to as the original senior notes; and

- •

- borrowing by MDCP Acquisitions I under a new senior credit facility, which we refer to as the senior credit facility.

In addition, approximately €637 million of existing indebtedness of JSG was left outstanding. This indebtedness was comprised of amounts outstanding under its 6.75% notes due 2005 and 7.50% debentures due 2025 (after adjusting such amounts for related hedging obligations), certain local bank borrowing, capital lease obligations, Latin America funded debt and bank overdrafts.

For ease of reference, we collectively refer to the offer, the acquisition of JSG, the spin-off of the SSCC shares, the financing transactions described above and the transfer of assets to the Newcos as the transactions. In addition, we collectively refer to the senior notes and the subordinated notes as the notes.

In connection with the initial sale of the senior outstanding notes and the units, we entered into registration rights agreements. The pending exchange offers are being initiated to satisfy issuer's contractual obligations undertaken in such agreements. Following this section is a detailed summary of the terms of the exchange offers and the exchange notes.

7

SUMMARY OF EXCHANGE OFFERS

| Registration Rights Agreements | | Simultaneously with the initial sale of the senior outstanding notes and the units, we entered into registration rights agreements for the exchange offers. In the registration rights agreements, we agreed, among other things, to use our commercially reasonable efforts to file a registration statement with the SEC within 90 days of issuing the senior outstanding notes and selling the units, respectively, to have such registration statement declared effective within 180 days of issuing the outstanding senior notes and selling the units, respectively, and to complete the exchange offers within 30 business days of the effectiveness of the registration statement. The exchange offers are intended to satisfy your rights under the registration rights agreements. After the exchange offers are complete, you will no longer be entitled to any exchange or registration rights with respect to your outstanding notes. |

| Senior Notes Exchange Offer | | We are offering to exchange the senior exchange notes for outstanding senior notes. The exchange notes have been registered under the Securities Act. All senior outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue senior exchange notes promptly after the expiration of the senior notes exchange offer. The senior outstanding notes may be tendered only in integral multiples of €1,000 or $1,000, as the case may be. |

| Subordinated Notes Exchange Offer | | We are offering to exchange the subordinated exchange notes for subordinated outstanding notes. The subordinated exchange notes have been registered under the Securities Act. In order for the subordinated notes to be exchanged, the units must first be separated and the outstanding subordinated notes must be properly tendered and accepted. All subordinated outstanding notes that are validly tendered and not validly withdrawn will be exchanged. We will issue subordinated exchange notes promptly after the expiration of the subordinated notes exchange offer. The subordinated outstanding notes may be tendered only in integral multiples of €1 or $1, as the case may be. |

| Resales | | Based on interpretations by the staff of the SEC set forth in no-action letters issued to unrelated parties, we believe that the senior exchange notes issued in the senior notes exchange offer and the subordinated exchange notes issued in the subordinated notes exchange offer may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

| | | • | | the exchange notes are being acquired in the ordinary course of your business; |

| | | • | | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the exchange notes issued to you in an exchange offer; and |

| | | • | | you are not an affiliate of ours. |

8

| | | If any of these conditions are not satisfied and you transfer any exchange notes issued to you in an exchange offer without delivering a prospectus meeting the requirements of the Securities Act or without an exemption from registration of your exchange notes from these requirements, you may incur liability under the Securities Act. We will not assume, nor will we indemnify you against, any such liability. |

| | | Each broker-dealer that is issued exchange notes in an exchange offer for its own account in exchange for outstanding notes that were acquired by that broker-dealer as a result of market-making or other trading activities, must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the exchange notes. A broker-dealer may use this prospectus for an offer to resell, resale or other retransfer of the exchange notes issued to it in an exchange offer. |

| Record Date | | We mailed this prospectus and the related exchange offer documents to registered holders of senior outstanding notes or subordinated outstanding notes on , 2003. |

| Expiration Dates | | The senior notes exchange offer will expire at 5:00 p.m., London time, 12:00 p.m., New York City time, on , 2003, unless we decide to extend it. The subordinated notes exchange offer will expire at 5:00 p.m., London time, 12:00 p.m., New York City time, on , 2003, unless we decide to extend it. We may extend one exchange offer without extending the other exchange offer. |

| Conditions to the Exchange Offers | | The exchange offers are subject to customary conditions, including that the exchange offers do not violate applicable law or any applicable interpretation of the staff of the SEC. |

| Procedures for Tendering Senior Outstanding Notes | | We issued the senior outstanding notes as global securities. When the senior outstanding notes were issued, we deposited the global senior notes with the custodians for the book-entry depositaries. The book-entry depositaries issued depositary interests in respect of each global note representing the dollar notes to DTC and the euro notes to Euroclear or Clearstream, and then recorded such interests in their respective books and records in the name of DTC's nominee or the common depositary for Euroclear and Clearstream, as applicable. |

9

| | | You may tender your senior outstanding notes through the book-entry transfer systems of DTC and Euroclear and Clearstream. To tender your senior outstanding notes by a means other than book-entry transfer, a letter of transmittal must be completed and signed according to the instructions contained in the letter. The applicable letter of transmittal and any other documents required by the letter of transmittal must be delivered to the exchange agent by mail, facsimile, hand delivery or overnight carrier. In addition, you must deliver the senior outstanding notes to the exchange agent or comply with the procedures for guaranteed delivery. See "Senior Notes Exchange Offer—Procedures for Tendering" for more information. |

| | | Do not send letters of transmittal and certificates representing senior outstanding notes to us. Send these documents only to an exchange agent. See "Senior Notes Exchange Offer—Exchange Agents" for more information. |

| Procedures for Tendering Subordinated Outstanding Notes | | We issued the units as global securities. When the units were issued, we deposited the global units (which were comprised of depositary interests in the global subordinated notes and one or more global warrants) with the custodians for the book-entry depositaries. The book-entry depositaries issued depositary interests in respect of each global unit representing the dollar units to DTC and the euro units to Euroclear or Clearstream, and then recorded such interests in their respective books and records in the name of DTC's nominee or the common depositary for Euroclear and Clearstream, as applicable. |

| | | In order to be exchanged, the units must first be separated. If a participant chooses to separate its units, such participant's accounts will be credited with positions in the subordinated global notes and the global warrants in amounts corresponding to the number of units held by the participant immediately prior to separation. |

| | | You may tender your subordinated outstanding notes through the book-entry transfer systems of DTC and Euroclear and Clearstream. To tender your subordinated outstanding notes by a means other than book-entry transfer, a letter of transmittal must be completed and signed according to the instructions contained in the letter. The applicable letter of transmittal and any other documents required by the letter of transmittal must be delivered to the exchange agent by mail, facsimile, hand delivery or overnight carrier. In addition, you must deliver the subordinated outstanding notes to the exchange agent or comply with the procedures for guaranteed delivery. See "Subordinated Notes Exchange Offer—Procedures for Tendering" for more information. |

| | | Do not send letters of transmittal and certificates representing subordinated outstanding notes to us. Send these documents only to an exchange agent. See "Subordinated Notes Exchange Offer—Exchange Agents" for more information. |

10

| Special Procedures for Beneficial Owners | | If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC or Euroclear and Clearstream, as applicable, as the holder of the book-entry interests or if you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or outstanding notes in an exchange offer, you should contact the person in whose name your book-entry interests or outstanding notes are registered promptly and instruct that person to tender on your behalf. |

| Guaranteed Delivery Procedures | | If you wish to tender your outstanding notes and you cannot get your required documents to the exchange agent on time, you may tender your outstanding notes by completing a notice of guaranteed delivery and complying with the guaranteed delivery procedures. |

| Withdrawal Rights | | You may withdraw the tender of your senior outstanding notes at any time prior to 5:00 p.m., London time, 12:00 p.m., New York City time, on , 2003. You may withdraw the tender of your subordinated outstanding notes at any time prior to 5:00 p.m., London time, 12:00 p.m., New York City time, on , 2003. |

| Acceptance of Outstanding Notes and Delivery of Exchange Notes | | If you fulfill all conditions required for proper acceptance of outstanding notes, we will accept any and all outstanding notes that you properly tender in an exchange offer on or before 5:00 p.m., London time, 12:00 p.m., New York City time, on the expiration date. We will return any outstanding notes that we do not accept for exchange to you without expense as promptly as practicable after the expiration date. We will deliver the exchange notes as promptly as practicable after the expiration date and acceptance of the outstanding notes for exchange. See "Senior Notes Exchange Offer—Terms of Senior Notes Exchange Offer" and "Subordinated Notes Exchange Offer—Terms of Subordinated Notes Exchange Offer" for more information. |

| Use of Proceeds; Fees and Expenses | | We will not receive any proceeds from the issuance of the exchange notes pursuant to the exchange offers. We will pay all of our expenses incident to the exchange offers. |

| U.S. Federal Income Tax Considerations | | We believe that the exchange of outstanding notes will not be a taxable event for U.S. federal income tax purposes. |

11

| Exchange Agents | | Deutsche Bank Trust Company Americas is serving as the principal exchange agent in connection with the senior notes exchange offer for the senior dollar notes and with the subordinated notes exchange offer for the subordinated dollar notes, and Deutsche Bank AG London is serving as the principal exchange agent in connection with the senior notes exchange offer for the senior euro notes and with the subordinated notes exchange offer for the subordinated euro notes. Deutsche Bank Luxembourg S.A. is serving as the exchange agent in Luxembourg in connection with the exchange offers. |

SUMMARY OF TERMS OF EXCHANGE NOTES

The form and terms of the exchange notes are the same as the form and terms of the outstanding notes, except that the exchange notes will be registered under the Securities Act. As a result, the exchange notes will not bear legends restricting their transfer and will not contain the registration rights and liquidated damage provisions contained in the outstanding notes. The exchange notes represent the same debt as the outstanding notes. All of outstanding notes and the corresponding exchange notes are governed by the same indentures. We use the term notes in this prospectus to collectively refer to the outstanding notes and the exchange notes.

Terms of

€350,000,000 101/8% Senior Exchange Notes due 2012 and

$545,000,000 95/8% Senior Exchange Notes due 2012

| Issuer | | MDP Acquisitions plc, a public limited company incorporated under the laws of Ireland. |

| Notes Offered | | €350 million in aggregate principal amount of Series B 101/8% Senior Notes due 2012, which we refer to as the euro senior exchange notes and $545 million in aggregate principal amount of Series B 95/8% Senior Notes due 2012, which we refer to as the dollar senior exchange notes and, together with the euro notes, the senior exchange notes. |

| Maturity Date | | October 1, 2012. |

| Interest | | Annual rate: 101/8% per year for the euro senior exchange notes and 95/8% per year for the dollar senior exchange notes. |

| | | Payment frequency: every six months on April 1 and October 1. |

| | | First payment: April 1, 2003. |

| | | Interest and certain other scheduled payments due on the senior exchange notes will be paid to issuer by guarantor pursuant to the terms of the intercompany loans. The intercompany loans are subordinated to all senior debt of guarantor. |

12

| Ranking and Subordinated Guarantees | | The senior exchange notes are general, unsecured obligations of issuer and rank equally with or senior in right of payment to all current and future indebtedness of issuer. Each series of senior exchange notes ranks equally with the other and senior in right of payment to the subordinated notes. The senior exchange notes effectively rank junior to all of the existing and future indebtedness of issuer's subsidiaries, including those of guarantor and all borrowing under the senior credit facility, whether such debt is secured or unsecured. |

| | | MDCP Acquisitions I is a guarantor of each series of the senior exchange notes on a senior subordinated basis. The guarantees are senior subordinated obligations of the guarantor and rank behind all current and future senior indebtedness of the guarantor, including all borrowing under the senior credit facility. The guarantees also rank behind all liabilities of guarantor's subsidiaries. |

| | | As of September 30, 2002, after giving pro forma effect to the transactions and the February 2003 offering of additional senior notes, the senior exchange notes and the guarantees would have been effectively subordinated to approximately €2,298 million of indebtedness (and an additional €410 million would have been available for additional borrowing under the senior credit facility). |

| | | Guarantor will be released from all of its obligations under each guarantee |

| | | • | | in connection with the sale of guarantor |

| | | | | • | | on an enforcement of the senior security by the senior agent under the senior credit facility or by any receiver or administrative receiver or |

| | | | | • | | at the request of the senior agent after an event of default under the senior credit facility, or |

| | | • | | if guarantor merges, consolidates or amalgamates with, or transfers all or substantially all of its property or assets to, another entity and the surviving entity enters into a guarantee of the senior notes in compliance with the senior indentures. |

| | | Guarantor will also be released and discharged from its obligations in respect of a guarantee in the circumstances set forth in the section entitled "Description of the Senior Notes—Legal Defeasance and Covenant Defeasance." |

| Optional Redemption | | On or after October 1, 2007, issuer may redeem all or part of the senior exchange notes at any time at the redemption prices described in the section "Description of the Senior Notes—Optional Redemption." |

| | | At any time prior to October 1, 2005, issuer may redeem up to 35% of the aggregate principal amount of any series of the senior exchange notes with the net cash proceeds of certain equity offerings, in each case, at the redemption prices described in the section "Description of the Senior Notes— Optional Redemption." |

13

| | | In addition, prior to October 1, 2007, if issuer undergoes specific kinds of changes in control, issuer may also redeem all, but not part, of the senior exchange notes at the prices described in "Description of the Senior Notes—Optional Redemption." |

| | | Issuer may also redeem all of the senior exchange notes of a series, but not just a portion of a series, at any time upon giving proper notice if changes in tax laws impose certain withholding taxes on amounts payable on such series of the senior exchange notes. If issuer decides to do this, it must pay you a price equal to the principal amount of the series of senior exchange notes being redeemed plus accrued and unpaid interest and certain other amounts described in the section "Description of the Senior Notes—Redemption for Taxation Reasons." |

| Change of Control | | If issuer experiences specific kinds of changes in control, issuer must offer to repurchase the senior exchange notes at 101% of their respective principal amounts, plus accrued and unpaid interest and certain other amounts, if any, to the date of redemption. See "Description of the Senior Notes—Repurchase at the Option of Holders." |

| Basic Covenants of Indentures | | Issuer issued the euro senior exchange notes under an indenture among itself, the guarantor and a trustee, which we refer to as the euro senior notes indenture. Issuer issued the dollar exchange notes under an indenture among itself, the guarantor and a trustee, which we refer to as the dollar senior notes indenture and, together with the euro notes indenture, the senior notes indentures. We refer to the trustee under the euro senior notes indenture as the euro senior exchange trustee and the trustee under the dollar senior notes indenture as the dollar senior trustee. The senior notes indentures (among other things) limit issuer's ability and that of its restricted subsidiaries to: |

| | | • | | pay dividends or make other distributions; |

| | | • | | make other restricted payments and investments; |

| | | • | | incur additional indebtedness and issue preference shares; |

| | | • | | create liens; |

| | | • | | incur restrictions on the ability of issuer's subsidiaries to pay dividends or other payments to them; |

| | | • | | sell assets; |

| | | • | | merge or consolidate with other entities; and |

| | | • | | enter into transactions with affiliates. |

| | | In addition, the senior notes indentures limit guarantor's ability to incur debt that is senior to its guarantees but junior to senior debt of guarantor. |

| | | Each of the covenants is subject to a number of important exceptions and qualifications. See "Description of the Senior Notes." |

14

Terms of

€103,831,945 15.5% Subordinated Exchange Notes due 2013 and

$155,747,917 15.5% Subordinated Exchange Notes due 2013

| Issuer | | MDP Acquisitions plc, a public limited company incorporated under the laws of Ireland. |

| Notes Offered | | €103,831,945 in aggregate principal amount of Series B 15.5% Subordinated Exchange Notes due 2013 of issuer, which we refer to as the euro subordinated exchange notes, and $155,747,917 in aggregate principal amount of Series B 15.5% Subordinated Exchange Notes due 2013 of issuer, which we refer to as the dollar subordinated exchange notes, and, together with the euro subordinated exchange notes, the subordinated exchange notes. |

| Maturity Date | | October 1, 2013. |

| Interest | | 15.5% per year for each of the euro subordinated exchange notes and the dollar subordinated exchange notes. Interest accruing on the subordinated exchange notes is payable in cash or in the form of additional subordinated exchange notes, at issuer's option. Additional euro subordinated notes and dollar subordinated notes were issued in payment of interest on the outstanding subordinated notes on January 1, 2003. |

| | | Interest and certain other scheduled payments due on the subordinated exchange notes will be paid to issuer by guarantor pursuant to the terms of the intercompany loan. The intercompany loan is subordinated to all senior debt of guarantor. |

| Interest Payment Dates | | January 1, April 1, July 1 and October 1, commencing January 1, 2003. |

| Ranking | | The subordinated exchange notes are general, unsecured subordinated obligations of issuer and rank junior in right of payment to all current and future senior indebtedness of issuer. The subordinated exchange notes effectively rank junior to all of the existing and future indebtedness of issuer's subsidiaries, including those of guarantor and all borrowing under the senior credit facility, whether such debt is secured or unsecured. |

| | | As of September 30, 2002, after givingpro forma effect to the transactions and the February 2003 offering of the additional senior notes, the subordinated exchange notes would have been effectively subordinated to approximately €2,298 million of indebtedness (including the senior exchange notes) (and an additional €410 million would have been available for additional borrowing under the senior credit facility). |

| Subsidiary Guarantees | | None. |

| Optional Redemption | | On or after October 1, 2005, issuer may redeem all or part of the subordinated exchange notes at any time at the redemption prices described in the section "Description of the Subordinated Notes—Optional Redemption." |

15

| | | At any time prior to October 1, 2005, issuer may redeem up to 35% of the aggregate principal amount of either series of subordinated exchange notes with the net cash proceeds of certain equity offerings, in each case, at the redemption prices described in the section "Description of the Subordinated Notes—Optional Redemption." |

| | | Issuer may also redeem all of the subordinated exchange notes of a series, but not just a portion of a series, at any time upon giving proper notice if changes in tax laws impose certain withholding taxes on amounts payable on such series of subordinated exchange notes. If issuer decides to do this, it must pay you a price equal to the principal amount of the series of subordinated exchange notes being redeemed plus accrued and unpaid interest and certain other amounts described in the section "Description of the Subordinated Notes—Redemption for Taxation Reasons." |

| Mandatory Repurchase | | If issuer experiences specific kinds of changes in control, issuer must offer to repurchase the subordinated exchange notes at 101% of their respective principal amounts, plus accrued and unpaid interest and certain other amounts, if any, to the date of redemption. See "Description of the Subordinated Notes—Repurchase at the Option of Holders." |

| Basic Covenants of Indentures | | Issuer issued the euro subordinated exchange notes under an indenture among itself and a trustee, which we refer to as the euro subordinated notes indenture. Issuer issued the dollar subordinated exchange notes under an indenture among itself and a trustee, which we refer to as the dollar subordinated notes indenture and, together with the euro subordinated notes indenture, the subordinated notes indentures. We refer to the trustee under the euro subordinated notes indenture as the euro subordinated exchange trustee and the trustee under the dollar subordinated notes indenture as the dollar subordinated trustee. The subordinated notes indentures (among other things) limit issuer's ability and that of its restricted subsidiaries to: |

| | | • | | pay dividends or make other distributions; |

| | | • | | make other restricted payments and investments; |

| | | • | | incur additional indebtedness and issue preference shares; |

| | | • | | create liens; |

| | | • | | incur restrictions on the ability of their subsidiaries to pay dividends or other payments to them; |

| | | • | | sell assets; |

| | | • | | merge or consolidate with other entities; and |

| | | • | | enter into transactions with affiliates. |

| | | Each of the covenants is subject to a number of important exceptions and qualifications. See "Description of the Subordinated Notes—Certain Covenants." |

You should refer to the section entitled "Risk Factors" for an explanation of certain risks of participating in the exchange offers.

16

Summary Historical and Unaudited Pro Forma Consolidated Financial Data

The following table sets forth our summary audited historical and unaudited pro forma consolidated financial data for the periods ended and at the dates indicated below. The periods prior to and including September 2, 2002 reflect data of JSG, issuer's predecessor for financial accounting purposes. The periods beginning September 3, 2002 reflect data of issuer and its consolidated subsidiaries after the acquisition of JSG. Because of the revaluation of certain assets and liabilities acquired as part of the transactions and the related impact to the financial data, the consolidated financial statements of JSG, issuer's predecessor for the periods prior to September 3, 2002, are not comparable to those of issuer subsequent to that date. We have derived the historical consolidated financial data as of and for the fiscal years 1999, 2000 and 2001 from JSG's audited financial statements included elsewhere in this prospectus. We have derived the historical consolidated financial data for the nine month period ended September 30, 2001 from JSG's unaudited consolidated financial statements included elsewhere in this prospectus. We have derived the historical consolidated financial data for the period from January 1, 2002 to September 2, 2002 from the unaudited historical financial statements of JSG. We have derived the historical financial data for the period from September 3, 2002 through September 30, 2002 from the unaudited financial statements of issuer. The pro forma statement of income data for the year ended December 31, 2001 reflects the statement of income data for the year ended December 31, 2001 and adjusted to give pro forma effect to (among other things) (i) the transactions, which include the subsequent sale of certain non-operating and non-core operating assets to the Newcos, (ii) JSG's acquisition of Munksjö on March 28, 2002 and a smaller acquired business prior to the transactions and (iii) JSG's disposition of various businesses during 2002 prior to the transactions as if those transactions had been completed on January 1, 2001 and carried through to all periods presented. The pro forma statement of income data for the nine months ended September 30, 2002 reflects the statement of income for the nine months ended September 30, 2002 adjusted for the pro forma effects of the events described above, as if those events had occurred on January 1, 2002. The pro forma balance sheet data as of September 30, 2002 have been calculated by giving effect to the events listed above as if such events had occurred on September 30, 2002.

For the pro forma financial statements and a more detailed discussion of pro forma adjustments, see "Unaudited Pro Forma Financial Statements." In the opinion of JSG's management, our unaudited consolidated financial statements contain all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation of our financial position, results of operations and cash flows. The results of operations for any interim period are not necessarily indicative of the operating results to be expected for the full fiscal year.

The effects of the SSCC Asset Swap have not been included in the pro forma financial information because such information is not required pursuant to Article 11 of Regulation S-X, which governs the form and content of pro forma financial statements.

The historical audited combined financial statements were prepared in accordance with Irish GAAP, which differs in certain significant respects from U.S. GAAP. These differences, as they apply to JSG, are described in note 37 to JSG's audited historical consolidated financial statements included elsewhere in this prospectus.

17

| | Predecessor

| |

| |

| |

| |

|---|

| | Issuer

| | Pro Forma

| |

|---|

| |

Year Ended December 31,

| |

| |

| |

|---|

| | Nine Months

Ended

September 30,

2001

| | January 1,

2002 to

September 2,

2002

| | September 3,

2002 to

September 30,

2002

| | Year

Ended

December 31,

2001

| | Nine Months

Ended

September 30,

2002

| |

|---|

| | 1999

| | 2000

| | 2001

| |

|---|

| | (euro in thousands, except ratios)

| |

| |

| |

| |

|---|

| |

| |

| |

| | (unaudited)

| | (unaudited)

| |

| |

| |

|---|

| Consolidated Statement of Income Data: | | | | | | | | | | | | | | | | | | | | | | | | | |

Irish GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales | | € | 3,688,595 | | € | 4,565,244 | | € | 4,511,650 | | € | 3,422,054 | | € | 3,134,080 | | € | 411,008 | | € | 4,951,251 | | € | 3,614,005 | |

| Cost of sales | | | 2,723,193 | | | 3,330,937 | | | 3,234,552 | | | 2,467,092 | | | 2,272,287 | | | 297,489 | | | 3,501,307 | | | 2,577,937 | |

| Goodwill amortization | | | 4,857 | | | 5,734 | | | 8,820 | | | 5,916 | | | 5,794 | | | 1,406 | | | 37,039 | | | 27,779 | |

| Impairment of property, plant and equipment | | | 23,235 | | | — | | | 26,642 | | | — | | | — | | | — | | | 20,554 | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Gross profit | | | 937,310 | | | 1,228,573 | | | 1,241,636 | | | 954,362 | | | 861,793 | | | 113,519 | | | 1,392,351 | | | 1,008,289 | |

| Net operating expenses | | | 734,897 | | | 866,103 | | | 883,964 | | | 686,452 | | | 656,411 | | | 78,855 | | | 996,711 | | | 763,146 | |

| Reorganization and restructuring costs | | | 43,174 | | | 20,890 | | | 23,763 | | | — | | | 12,484 | | | 2,929 | | | 10,637 | | | 12,356 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Operating income subsidiaries—continuing | | | 159,239 | | | 341,580 | | | 333,909 | | | 267,910 | | | 192,898 | | | 31,735 | | | 385,003 | | | 232,787 | |

| Share of associates' operating income | | | 222,285 | | | 403,934 | | | 242,212 | | | 179,749 | | | 117,473 | | | 1,479 | | | 15,171 | | | 15,698 | |

| Share of associates' restructuring costs | | | (19,621 | ) | | (24,894 | ) | | (10,895 | ) | | (4,724 | ) | | (7,541 | ) | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Total operating income | | | 361,903 | | | 720,620 | | | 565,226 | | | 442,935 | | | 302,830 | | | 33,214 | | | 400,174 | | | 248,485 | |

| Income on sale of operations subsidiaries—continuing | | | 34,529 | | | — | | | — | | | — | | | 20,440 | | | — | | | (27 | ) | | — | |

| Share of associates' income on sale of operations | | | 148,060 | | | 3,105 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Interest income | | | 26,818 | | | 20,511 | | | 23,053 | | | 16,204 | | | 10,287 | | | 860 | | | 12,099 | | | 9,929 | |

| Interest expense | | | (120,470 | ) | | (120,370 | ) | | (108,621 | ) | | (84,589 | ) | | (65,882 | ) | | (12,082 | ) | | (318,053 | ) | | (242,870 | ) |

| Share of associates' net interest | | | (187,528 | ) | | (181,567 | ) | | (154,654 | ) | | (115,578 | ) | | (74,387 | ) | | (152 | ) | | (171 | ) | | (1,033 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Income before taxes and equity minority interests | | | 263,312 | | | 442,299 | | | 325,004 | | | 258,972 | | | 193,288 | | | 21,840 | | | 94,022 | | | 14,511 | |

| Taxes on income, as reported | | | (125,519 | ) | | (169,001 | ) | | (120,417 | ) | | (95,445 | ) | | (77,889 | ) | | (9,370 | ) | | (78,860 | ) | | (33,508 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Income before equity minority interests | | | 137,793 | | | 273,298 | | | 204,587 | | | 163,527 | | | 115,399 | | | 12,470 | | | 15,162 | | | (18,997 | ) |

| Equity minority interests | | | (16,187 | ) | | (30,816 | ) | | (37,022 | ) | | (21,937 | ) | | (19,969 | ) | | (2,537 | ) | | (33,339 | ) | | (20,233 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Net income | | € | 121,606 | | € | 242,482 | | € | 167,565 | | € | 141,590 | | € | 95,430 | | € | 9,933 | | € | (18,177 | ) | € | (39,230 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Unaudited and restated net income(1)(2) | | € | 110,537 | | € | 225,932 | | € | 150,417 | | € | 128,297 | | € | n/a | | € | n/a | | € | n/a | | € | n/a | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA(3) | | € | 411,672 | | € | 576,431 | | € | 572,673 | | € | 447,373 | | € | 384,056 | | € | 54,065 | | € | 688,191 | | € | 450,895 | |

| Net cash provided by (used in): | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Operating activities | | € | 392,417 | | € | 482,298 | | € | 584,492 | | € | 420,645 | | € | 356,514 | | € | 62,648 | | | n/a | | | n/a | |

| | Capital expenditure and financial investment | | | (125,356 | ) | | (116,327 | ) | | (136,627 | ) | | (98,377 | ) | | (131,167 | ) | | (20,757 | ) | | n/a | | | n/a | |

| | Acquisitions and disposals | | | 60,681 | | | (109,067 | ) | | (42,431 | ) | | (40,207 | ) | | (296,668 | ) | | (2,315,339 | ) | | n/a | | | n/a | |

| | Financing activities | | | (688,592 | ) | | (19,956 | ) | | (128,032 | ) | | (101,093 | ) | | 53,067 | | | 2,232,448 | | | n/a | | | n/a | |

| Depreciation, depletion and amortization expense | | | 217,904 | | | 234,851 | | | 238,764 | | | 179,463 | | | 170,718 | | | 22,330 | | | n/a | | | n/a | |

| Capital expenditures | | | 171,088 | | | 147,629 | | | 177,213 | | | 109,792 | | | 129,581 | | | 20,995 | | | n/a | | | n/a | |

| Ratio of earnings to fixed charges(4) | | | 1.9 | x | | 3.0 | x | | 3.3 | x | | 3.4 | x | | 3.4 | x | | 2.7 | x | | 1.3 | x | | 1.0 | x |

| Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash at bank and in hand | | € | 457,408 | | € | 427,092 | | € | 440,109 | | € | 417,240 | | € | n/a | | € | 101,183 | | | n/a | | | 303,183 | |

| Working capital(5) | | | 306,043 | | | 395,614 | | | 534,879 | | | 566,970 | | | n/a | | | 432,603 | | | n/a | | | 629,533 | |

| Property, plant and equipment | | | 2,085,678 | | | 2,138,827 | | | 2,088,019 | | | 2,083,061 | | | n/a | | | 2,278,214 | | | n/a | | | 2,270,068 | |

| Total assets, as reported | | | 5,390,423 | | | 5,901,002 | | | 5,936,617 | | | 5,896,894 | | | n/a | | | 5,559,702 | | | n/a | | | 6,047,939 | |

| Unaudited and restated total assets(1)(2) | | | 5,346,417 | | | 5,844,744 | | | 5,867,569 | | | 5,832,564 | | | n/a | | | n/a | | | n/a | | | n/a | |

| Long term debt and other long term liabilities | | | 1,205,363 | | | 1,337,515 | | | 1,404,432 | | | 1,376,358 | | | n/a | | | 2,988,560 | | | n/a | | | 3,211,797 | |

| Shareholders' equity, as reported | | | 2,263,984 | | | 2,505,175 | | | 2,664,532 | | | 2,645,921 | | | n/a | | | 744,059 | | | n/a | | | 869,059 | |

| Unaudited and restated shareholders' equity(1)(2) | | | 2,166,620 | | | 2,386,730 | | | 2,525,191 | | | 2,513,344 | | | n/a | | | n/a | | | n/a | | | n/a | |

U.S. GAAP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA(3) | | € | 402,751 | | € | 594,371 | | € | 589,382 | | € | 471,053 | | € | 377,463 | | € | 55,054 | | | n/a | | | 450,266 | |

| Net income | | | 116,732 | | | 245,670 | | | 151,921 | | | 152,392 | | | 95,981 | | | 12,002 | | | n/a | | | (25,995 | ) |

(Footnotes begin on following page)

18

(Footnotes for preceding page)

- (1)

- From January 1, 2002, we are adopting Financial Reporting Standard (FRS) 19—"Deferred Tax" which requires full provision to be made for deferred tax arising from timing differences between the recognition of gains and losses in the financial statements and the tax computation. FRS 19 applies to accounting periods ending on or after January 23, 2002. In adopting FRS 19, we have chosen not to discount deferred tax assets and liabilities. The cumulative effect of the change in policy has been accounted for as a prior year adjustment and for the sole purposes of this summary historical consolidated financial data, previously reported figures have been restated. As a consequence of this change in policy, accounting for deferred taxation under Irish GAAP is more closely aligned to U.S. GAAP.

- (2)

- The summary historical financial data for the fiscal years 1999, 2000 and 2001 were derived from JSG's audited financial statements and for the nine months ended September 30, 2001 were derived from JSG's unaudited consolidated financial statements included elsewhere in this prospectus. As outlined in footnote (1) above, we have reflected the impact of FRS 19 in the financial data for these periods. The financial impact of the new standard is as follows:

| | Year Ended December 31,

| |

| |

|---|

| | Nine Months Ended September 30,

2001

| |

|---|

| | 1999

| | 2000

| | 2001

| |

|---|

| | (euro in thousands)

(unaudited)

| |

|---|

| Decrease in net income | | €(11,069 | ) | €(16,550 | ) | €(17,148 | ) | €(13,293 | ) |

| Decrease in total assets | | (44,006 | ) | (56,258 | ) | (69,048 | ) | (64,330 | ) |

| Decrease in shareholders' equity | | (97,364 | ) | (118,445 | ) | (139,341 | ) | (132,577 | ) |

- (3)

- EBITDA represents "operating income subsidiaries—continuing," plus "income on sale of operations subsidiaries—continuing," and depreciation, depletion and amortization expense. EBITDA is included in this prospectus because it is a basis upon which issuer assesses its financial performance and debt service capabilities, and because certain covenants in issuer's (and subsidiaries') borrowing arrangements are tied to similar measures. You should not consider EBITDA in isolation from or as a substitute for cash flow from operations, net income, or other consolidated income or cash flow statement data prepared in accordance with Irish GAAP or U.S. GAAP or as a measure of a company's profitability or liquidity. Issuer understands that while EBITDA is frequently used by securities analysts, lenders and others in their evaluation of companies, EBITDA as used herein is not necessarily comparable to other similarly titled captions of other companies due to potential inconsistencies in the method of calculation. For example, we calculate EBITDA without deducting income attributable to, or adding losses attributable to, equity minority interests.

Set forth below is a reconciliation of actual EBITDA to pro forma EBITDA for the year ended December 31, 2001 and for the nine months ended September 30, 2002. See note (m) to Unaudited Pro Forma Condensed Consolidated Statements of Income for additional details regarding these adjustments.

| | Year

Ended

December 31, 2001

| | Nine Months Ended

September 30, 2002

| |

|---|

| | (euro in thousands)

(unaudited)

| |

|---|

| Actual EBITDA (Irish GAAP) | | € | 572,673 | | € | 438,121 | |

| Pro forma adjustments: | | | | | | | |

| | Munksjö and other acquisition | | | 82,591 | | | 23,661 | |

| | Disposal of businesses | | | 30,214 | | | (22,980 | ) |

| | Sale to Newcos | | | (787 | ) | | 12,620 | |

| | New compensation agreements | | | 7,700 | | | 441 | |

| | Deferred gain amortization | | | (4,200 | ) | | (968 | ) |

| | |

| |

| |

| Pro forma EBITDA (Irish GAAP) | | € | 688,191 | | € | 450,895 | |

| | |

| |

| |

19

Set forth below are additional supplemental adjustments to eliminate the effect of non-recurring items and to adjust for certain other stand-alone considerations. These supplemental adjustments do not qualify as pro forma adjustments under the SEC's published rules (principally Article 11 of Regulation S-X) or guidance of its staff. See note (o) to Unaudited Pro Forma Condensed Consolidated Statements of Income for additional details regarding these adjustments.

| | Year

Ended

December 31, 2001

| | Nine Months Ended

September 30, 2002

| |

|---|

| | (euro in thousands)

(unaudited)

| |

|---|

| Supplemental adjustments: | | | | | | | |

| | Non-recurring impairment charge | | € | 20,554 | | € | — | |

| | Non-recurring restructuring charge | | | 10,637 | | | 12,356 | |

| | Non-recurring income | | | (38,909 | ) | | (7,453 | ) |

| | Government grant amortization | | | (2,900 | ) | | (1,783 | ) |

| | Insurance recoveries | | | (5,800 | ) | | — | |

| | |

| |

| |

| Total supplemental adjustments | | € | (16,418 | ) | € | 3,120 | |

| | |

| |

| |

In addition to the foregoing, we have identified certain transaction-related cash cost expenses that we believe will not recur in future periods as a result of our cash cost reduction measures and operating improvements we are implementing as part of our business strategy. These cash expenses totaled €7,800 for the year ended December 31, 2001. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Impact of the Transactions—Potential Transaction-Related Cash Cost Savings" for more information.

- (4)

- For purposes of determining the ratio of earnings to fixed charges, earnings are defined as earnings before income taxes and extraordinary items, plus fixed charges. Fixed charges consist of interest expense, including amortization of debt issuance costs and a portion of operating lease rental expense deemed to be representative of the interest factor.

- (5)

- Working capital is defined as current assets less current liabilities.

- (6)

- Pro forma EBITDA for the year ended December 31, 2001 and for the nine months ended September 30, 2002 reconciled from Irish GAAP to U.S. GAAP is summarized as follows:

| | Year

Ended

December 31, 2001

| | Nine Months Ended

September 30, 2002

| |

|---|

| | (euro in thousands)

(unaudited)

| |

|---|

| Pro forma EBITDA (Irish GAAP) | | € | 688,191 | | € | 450,895 | |

| Reconciling items: | | | | | | | |

| | Consolidation of the Newcos | | | 787 | | | (12,620 | ) |

| | Stock compensation expense | | | (12,977 | ) | | (660 | ) |