UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21279

The Merger Fund VL

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301-9683

(Address of principal executive offices) (Zip code)

Jennifer Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-2608

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 367-5877

Date of fiscal year end: December 31

Date of reporting period: December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

| | |

ANNUAL REPORT THE MERGER FUND® VL | |  |

December 31, 2021

As permitted by regulations adopted by the Securities and Exchange Commission, you may no longer receive paper copies of The Merger Fund® VL’s shareholder reports from your insurance company unless you specifically request paper copies from the insurance company. If your insurance company elects to use this method of delivery, the shareholder reports will be made available on a website, and the insurance company will notify you by mail each time a report is posted and provide you with a website link to access the report. Instructions for requesting paper copies will be provided by your insurance company.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the insurance company electronically by following the instructions provided by the insurance company.

You may elect to receive paper copies of all future shareholder reports free of charge from the insurance company. You can do so by contacting the insurance company. Your election to receive reports in paper likely will apply to all of the funds available in your insurance product, but you should ask your insurance company whether this is the case.

Not FDIC Insured • No Bank Guarantee • May Lose Value

Table of Contents

Proxy Voting Procedures and Voting Record (Form N-PX)

The subadviser votes proxies relating to portfolio securities in accordance with procedures that have been approved by the Board of Trustees of the Fund (“Trustees,” the “Board”). You may obtain a description of these procedures, along with information regarding how the Fund voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-367-5877. This information is also available through the Securities and Exchange Commission’s (the “SEC”) website at http://www.sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The Fund files a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT-P. Form N-PORT-P is available on the SEC’s website at https://www.sec.gov.

This report is not authorized for distribution to prospective investors in the The Merger Fund VL unless preceded or accompanied by an effective prospectus which includes information concerning the sales charge, the Fund’s record and other pertinent information.

MESSAGE TO SHAREHOLDERS

To Shareholders of The Merger Fund® VL:

On October 1, 2021, Westchester Capital Management became an affiliated manager of Virtus Investment Partners and The Merger Fund® VL became part of the Virtus Funds, a family of distinctive investment options designed to help you preserve and grow your assets to meet your personal financial needs. I am pleased to welcome you to Virtus.

The relationship with Virtus Funds may be new, but the portfolio management team and process remain the same under the direction of Roy Behren and Michael Shannon, Co-Presidents and Co-Chief Investment Officers at Westchester Capital. We are excited that Roy, Mike and their team will continue to manage your Fund with the same dedication to seeking to deliver consistent, absolute returns through the disciplined execution of event-driven alternative investment strategies. Roy and Mike’s review of the markets and other factors that affected the performance of your Fund for the 12 months ended December 31, 2021 follows.

The Virtus team shares Westchester Capital’s unwavering commitment to exceptional client service and will be glad to address any questions you may have about The Merger Fund® VL at 800-367-5877.

Our entire team looks forward to serving you and your investment needs.

Sincerely,

George R. Aylward

President, The Merger Fund® VL

February 2022

Refer to the Fund Summary section for your Fund’s performance. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investing involves risk, including the risk of loss of principal invested.

1

The Merger Fund® VL

DISCLOSURE OF FUND EXPENSES (Unaudited)

FOR THE SIX-MONTH PERIOD OF JULY 1, 2021 TO DECEMBER 31, 2021

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As an investor in The Merger Fund VL (“the Fund”), you may incur certain types of costs including investment advisory fees, and other expenses. For further information regarding applicable sales charges, see Note 1 in the Notes to Financial Statements. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period. The Annualized Expense Ratios may be different from the expense ratios in the Financial Highlights which are for the fiscal year ended December 31, 2021.

Please note that the expenses shown in the accompanying tables are meant to highlight your ongoing costs only and do not reflect additional fees and expenses associated with the annuity or life insurance policy through which you invest. Therefore, the accompanying tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if the annuity or life insurance policy costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | | | | | | | | | | |

| | | Annualized Net

Expense Ratio

12/31/21 | | | Beginning

Account Value

7/1/21 | | | Ending

Account Value

12/31/21 | | | Expenses Paid

During Period

7/1/2021-

12/31/21(1) | |

Actual Expenses(2)(3) | | | 1.56 | % | | $ | 1,000.00 | | | $ | 983.44 | | | $ | 7.80 | |

| (1) | Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Based on the actual returns of (1.66)% for the six-month period ended December 31, 2021. |

| (3) | Excluding dividends and interest, borrowing expenses on securities sold short and professional fees related to tax reclaims processing, your actual cost of investment in the Fund would have been $7.00. |

You can find more information about the Fund’s expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to the Fund’s prospectus.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

| | | | | | | | | | | | | | | | |

| | | Annualized Net

Expense Ratio

12/31/21 | | | Beginning

Account Value

7/1/21 | | | Ending

Account Value

12/31/21 | | | Expenses Paid

During Period

7/1/2021-

12/31/21(1) | |

Hypothetical Example for Comparison Purposes (5% return before expenses)(2) | | | 1.56 | % | | $ | 1,000.00 | | | $ | 1,017.34 | | | $ | 7.93 | |

| (1) | Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period. |

| (2) | Excluding dividends and interest, borrowing expenses on securities sold short and professional fees related to tax reclaims processing, your actual cost of investment in the Fund would have been $7.12. |

You can find more information about the Fund’s expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to the Fund’s prospectus.

2

THE MERGER FUND® VL

KEY INVESTMENT TERMS (Unaudited)

DECEMBER 31, 2021

American Depositary Receipt (“ADR”)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a U.S. bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

Beta

Beta is a measure of the volatility – or systematic risk – of a security or portfolio compared to the market as a whole.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index measures the U.S. investment-grade fixed-rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Exchange-Traded Fund (“ETF”)

An open-end fund that is traded on a stock exchange. Most ETFs have a portfolio of stocks or bonds that track a specific market index.

Federal Reserve (the “Fed”)

The Central Bank of the U.S., responsible for controlling the money supply, interest rates, and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 branches, and all national and state banks that are part of the system.

The Global Industry Classification Standard (GICS)

The Global Industry Classification Standard is a method for assigning companies to a specific economic sector and industry group that best defines its business operations. It is one of two rival systems that are used by investors, analysts, and economists to compare competing companies.

ICE BofA 3-month U.S. Treasury Bill Index

The ICE BofA 3-month U.S. Treasury Bill Index measures performance of the three-month Treasury bill, based on monthly average auction rates. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

Leveraged Loans

Leveraged loans (also known as bank, senior or floating-rate loans) consists of below investment-grade credit quality loans that are arranged by banks and other financial institutions to help companies finance acquisitions, recapitalizations, or other highly leveraged transactions. Such loans may be especially vulnerable to adverse changes in economic or market conditions, although they are senior in the capital structure which typically provides investors/lenders a degree of potential credit risk protection.

London Interbank Offered Rate (“LIBOR”)

A benchmark rate that some of the world’s leading banks charge each other for short-term loans and that serves as the first step to calculating interest rates on various loans throughout the world.

Morningstar U.S. Insurance Fund Event Driven Category Average

The Morningstar U.S. Insurance Fund Event Driven Category Average contains strategies that attempt to profit when security prices change in response to certain corporate actions, such as bankruptcies, mergers and acquisitions, emergence from bankruptcy, shifts in corporate strategy, and other atypical events. Activist shareholder and distressed investment strategies also fall into this category. These portfolios typically focus on equity securities but can invest across the capital structure. The category average is calculated on a total return basis with dividends reinvested. The category average is unmanaged and is not available for direct investment.

Prime Rate

The federal funds rate commercial banks charge their most creditworthy corporate customers.

Real Estate Investment Trust (“REIT”)

A publicly traded company that owns, develops and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Secured Overnight Financing Rate (“SOFR”)

A broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities

Special Purpose Acquisition Company (SPAC)

A special purpose acquisition company (SPAC) is a company that has no commercial operations and is formed strictly to raise capital through an initial public offering for the purpose of acquiring or merging with an existing company.

Standard Deviation

The standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. The standard deviation is calculated as the square root of variance by determining each data point’s deviation relative to the mean.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Wilshire Liquid Alternative Event Driven Index

The Wilshire Liquid Alternative Event Driven Index measures the performance of the event-driven strategy component of the Wilshire Liquid Alternative Index. Event-driven strategies predominantly invest in companies involved in corporate transactions such as mergers, restructuring, distressed, buy backs, or other capital structure changes. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

3

| | |

The Merger Fund® VL Fund Summary (Unaudited) | | |

How did the markets perform during the Fund’s fiscal year ended December 31, 2021?

| ⬛ | | The Fund is diversified and has an investment objective of seeking to achieve capital growth by engaging in merger arbritage. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of publicly announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations and other corporate reorganizations. There is no guarantee that the Fund will meet its objectives. |

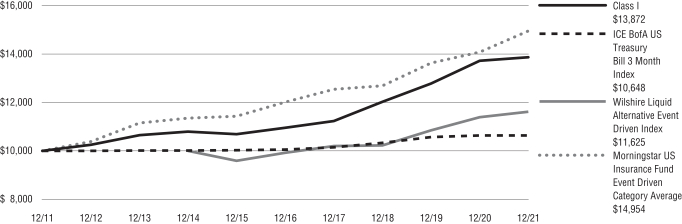

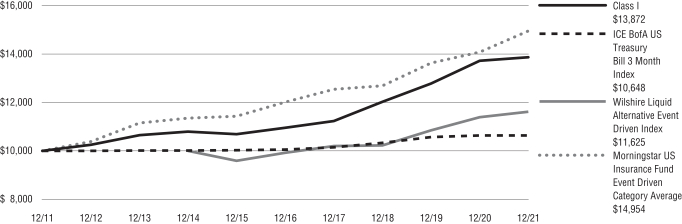

| ⬛ | | For the fiscal year ended December 31, 2021, the Fund’s Class I shares at NAV returned 1.08%.For the same period, the ICE BofA U.S. Treasury Bill 3-Month Index returned 0.05%, the Wilshire Liquid Alternative Event Driven Index returned 2.05%, and the Morningstar U.S. Insurance Fund Event Driven Category Average returned 6.18%. |

For the 12 months ended December 31, 2021, global merger and acquisition (M&A) deal value topped $5 trillion for the first time. This surpassed the previous record high set in 2007 by about 30%, with activity up roughly 65% year-over-year, according to Dealogic. In fact, each quarter in 2021 recorded more than $1 trillion in M&A volume for the first time in history. Fueled by pent-up demand coming out of the pandemic, low interest rates, and an aggressively growing economy, companies struck deals to boost growth, acquire new capabilities, realize operational efficiencies, or some combination of the three.

Largely undaunted by concerns around inflation and geopolitical factors, the increase in merger activity reflected a growing understanding among business leaders that creating value requires more than cost-cutting. During 2021, company leaders proved willing to purchase assets that created revenue synergies, accelerated long-term growth, and increased scale. Moreover, accommodative monetary policies from the U.S. Federal Reserve (the Fed) gave company executives access to cheap financing, which facilitated transaction activity. In 2021, there were 58 mega-deals – transactions with equity value in excess of $10 billion – the highest annual deal count ever, accounting for one-fifth of total M&A volumes, according to Citigroup. The number of deals worth $1 billion or more were also at their highest levels, up 90% year-over-year and 40% higher than the prior record in 2007.

Private equity-related M&A was a driver of deal flow as well, with spending on acquisitions accounting for a record 36% of global transaction volume this year, the highest share ever. No matter their size, most private equity firms were under pressure to deploy their investors’ funds, with more than $2.3 trillion of uninvested committed capital in their coffers, which can create multiples of that amount of potential transaction activity.

Despite a slowdown in the second half of 2021, the creation of new special purpose acquisition companies (SPACs) accounted for about 10% of the global M&A volumes. Additionally, there was approximately $140 billion of cash in trust inside existing SPACs searching for targets, which was estimated to amount to as much as a half-trillion U.S. dollars in combined cash and leverage specifically reserved for future M&A.

But this year’s burst of M&A was not without some headwinds. Because there is some risk of any M&A transaction being delayed or terminated, the target company will typically trade at a discount to the offer price. This discount, called the deal spread, measures potential returns for this strategy. During the fiscal year, deal spreads increased as a result of increased scrutiny from regulators around the globe, particularly the U.S. and China, which caused mark-to-market volatility, or unrealized losses, on existing deals awaiting regulatory approval. Rising inflation, rising interest rates, and the resurgence of COVID created additional execution uncertainty. However, our view on approvals remained consistent as of year end. Regardless of market movements and volatility, should deal spreads tighten to zero for those transactions that proceed to closure, the negative marks-to-market on those particular positions would be reversed. Unfortunately, this does not always happen on a calendar year basis.

What factors affected the Fund’s performance during its fiscal year?

The Fund has an absolute return focus and is not managed to a benchmark. However, because merger arbitrage has a historically low correlation to stocks and bonds, with volatility that has historically been similar to that of a short-to-medium-term bond, the Fund is often compared to the Bloomberg U.S. Aggregate Bond Index in addition to the U.S. 3-month Treasury bill. For the fiscal year ended

December 31, 2021, the Bloomberg U.S. Aggregate Bond Index was down 1.54% and the ICE BofA US Treasury Bill 3 Month Index return was 0.05%.

The Fund’s performance for the fiscal year ended December 31, 2021, was well below our targeted rate of return. While the Fund experienced its second down year in the 17 years since its inception in 2004, the Fund demonstrated lower volatility. At the end of the 12-month period, the Fund’s three-year standard deviation was approximately 3.66, and its beta, or volatility compared with the market, was 0.12 to the S&P 500® Index and 0.04 to the Bloomberg U.S. Aggregate Bond Index.

The second half of 2021 introduced a number of challenges, beginning with the deal break between Aon and Willis Towers Watson. The M&A space saw increased volatility in deal spreads in general, as investors began to question the impact of an increase in worldwide concerns relating to international and national security issues and consumer protections. Lack of transparency at China’s oversight agency, the State Administration for Market Regulation (SAMR), particularly regarding technology sector transactions, exacerbated China-U.S. tensions, causing wild fluctuations among deals that required Chinese approval.

As with any investment program, losses are inevitable from time to time. The Fund continues to manage concentration risk to minimize the impact of these periodic unpredictable events. The majority of the drawdowns in the Fund were unrealized losses, and we are confident that many of these positions will recover.

The biggest contributors to performance for the 12-month period were Coherent Inc./II-VI Inc., Athene Holding Ltd./Apollo Global Mgmt., and the FTAC Olympus Acquisition.

The Fund’s biggest detractors for the fiscal year were Willis Towers Watson PLC/Aon PLC., Xilinx Inc. /Advanced Micro Devices Inc., and the Macro Portfolio Hedge.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future

4

| | |

The Merger Fund® VL (Continued) Fund Summary (Unaudited) | | |

results, and there is no guarantee that market forecasts will be realized.

Fundamental Risk of Investing: There can be no assurance that the portfolio will achieve its investment objectives. An investment in the portfolio is subject to the risk of loss of principal; shares may decrease in value.

Merger-arbitrage & Event-driven Investing: Merger-arbitrage and event-driven investing involve the risk that the adviser’s evaluation of the outcome of a proposed event, whether it be a merger, reorganization, regulatory issue, or other event, will prove incorrect and that the Fund’s return on the investment may be negative.

Short Sales: The portfolio may engage in short sales, and may incur a loss if the price of a borrowed security increases before the date on which the portfolio replaces the security.

Foreign Investing: Investing in foreign securities subjects the portfolio to additional risks such as increased volatility, currency fluctuations, less liquidity, and political, regulatory, economic, and market risk.

Portfolio Turnover: The portfolio’s principal investment strategies may result in a consistently high portfolio turnover rate. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the portfolio is held in a taxable account.

Credit & Interest: Debt instruments are subject to various risks, including credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt instruments may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

Derivatives: Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

Hedging: The portfolio’s hedging strategy will be subject to the portfolio’s investment adviser’s ability to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged.

Sector Focused Investing: Events negatively affecting a particular industry or market sector in which the portfolio focuses its investments may cause the value of the portfolio to decrease.

Technology Concentration: Because the portfolio is presently heavily weighted in the technology sector, it will be impacted by that sector’s performance more than a portfolio with broader sector diversification.

Market Volatility: Local, regional, or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions, or other events could have a significant impact on the portfolio and its investments, including hampering the ability of the portfolio manager(s) to invest the portfolio’s assets as intended.

Prospectus: For additional information on risks, please see the Fund’s prospectus.

5

The Merger Fund VL

| | | | | | | | | | | | |

| |

Average Annual Total Returns1 for the period ended 12/31/21 | | | | |

| | | |

| | | 1 Yr | | | 5 Yr | | | 10 Yr | |

| | | | |

| The Merger Fund Class I | | | 1.08 | % | | | 4.83 | % | | | 3.33 | % |

| | | | |

| ICE BofA U.S. Treasury Bill 3 Month Index | | | 0.05 | | | | 1.14 | | | | 0.63 | |

| | | | |

| Wilshire Liquid Alternative Event Driven Index | | | 2.05 | | | | 3.21 | | | | — | |

| | | | |

| Morningstar U.S. Insurance Fund Event Driven Category Average | | | 6.18 | | | | 4.46 | | | | 4.11 | |

Fund Expense Ratio2: Class I shares: Gross 1.65%, Net 1.50%

All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end.

Growth of $10,000 for periods ended 12/31

This chart assumes an initial gross investment of $10,000 made on December 31, 2011. Returns shown include the reinvestment of all dividends. Past performance is not predictive of future performance. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or upon redemption of fund shares. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

| (*) | Prior to October 1, 2021, the Fund’s shares did not have a class designation; effective October 1, 2021, the Fund’s shares are referred to as Class I shares. The fees and expenses of Class I shares are the same as the fees and expenses of the shares prior to the change in designation. |

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective October 1, 2021, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through September 30, 2023. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 3.

6

DEAL COMPOSITION

The Merger Fund® VL (Unaudited)

| | | | | | | | | | | | |

| | | | | |

| Type of Buyer | | | | | | | Deal Terms* | | | |

| | | | | |

| Strategic | | | 95.7 | % | | | | Cash | | | 59.1 | % |

| | | | | |

| Financial | | | 4.3 | % | | | | Stock with Fixed Exchange Ratio | | | 27.5 | % |

| | | | |

| | | | | | | | Cash & Stock | | | 9.9 | % |

| | | | | |

| By Deal Type | | | | | | | | Stock and Stub(1) | | | 2.7 | % |

| | | | | |

| Friendly | | | 99.8 | % | | | | Risk Reversal | | | 0.7 | % |

| | | | | |

| Hostile | | | 0.2 | % | | | | Undetermined | | | 0.1 | % |

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of December 31, 2021. |

| (1) | “Stub” includes assets other than cash and stock (e.g., escrow notes). |

7

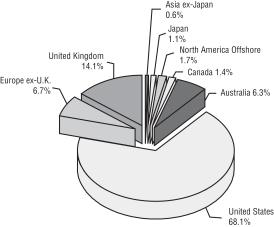

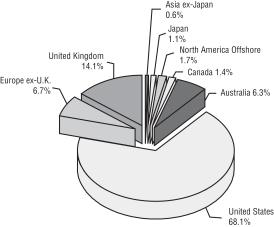

PORTFOLIO COMPOSITION*

The Merger Fund® VL (Unaudited)

By Sector

By Region

| * | Data expressed as a percentage of long common stocks, private investments in public equity, preferred stocks, contingent value rights, rights, warrants, bank loans, convertible bonds, corporate bonds and long total return swap contract positions as of December 31, 2021. Data expressed excludes special purpose acquisition companies, escrow notes, short- term investments, securities sold short, written and purchased options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments for more details on the Fund’s individual holdings. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”).

8

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares | | | | | | Value | |

| | | | | | | | | | | | |

| LONG INVESTMENTS — 98.03% | | | | | | | | | | | | |

| COMMON STOCKS — 51.04% | | | | | | | | | |

| AEROSPACE & DEFENSE — 1.48% | | | | | | | | | |

Aerojet Rocketdyne Holdings, Inc. | | | 17,195 | | | | | | | $ | 804,038 | |

| | | | | | | | | | | | |

| | | |

| AIRLINES — 0.00% | | | | | | | | | |

American Airlines Group, Inc. (a) | | | 78 | | | | | | | | 1,394 | |

| | | | | | | | | | | | |

| | | |

| AUTO COMPONENTS — 0.36% | | | | | | | | | |

Veoneer, Inc. (a) | | | 5,511 | | | | | | | | 195,530 | |

| | | | | | | | | | | | |

| | | |

| BANKS — 0.39% | | | | | | | | | |

People’s United Financial, Inc. | | | 11,944 | | | | | | | | 212,842 | |

| | | | | | | | | | | | |

| | | |

| BIOTECHNOLOGY — 0.42% | | | | | | | | | |

Arena Pharmaceuticals, Inc. (a)(j) | | | 2,406 | | | | | | | | 223,614 | |

Molecular Partners AG — ADR (a) | | | 150 | | | | | | | | 2,893 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 226,507 | |

| | | | | | | | | | | | |

| | | |

| CHEMICALS — 1.43% | | | | | | | | | |

Atotech Ltd. (a) | | | 17,854 | | | | | | | | 455,634 | |

Ferro Corporation (a) | | | 14,539 | | | | | | | | 317,386 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 773,020 | |

| | | | | | | | | | | | |

| | | |

| COMMERCIAL SERVICES & SUPPLIES — 0.16% | | | | | | | | | |

RR Donnelley & Sons Company (a) | | | 7,581 | | | | | | | | 85,362 | |

| | | | | | | | | | | | |

| | | |

| COMMERICAL BANKS — 0.13% | | | | | | | | | |

Flagstar Bancorp, Inc. | | | 1,466 | | | | | | | | 70,280 | |

| | | | | | | | | | | | |

| | | |

| COMPUTERS SERVICES — 0.09% | | | | | | | | | |

PAE, Inc. (a) | | | 4,711 | | | | | | | | 46,780 | |

| | | | | | | | | | | | |

| | | |

| CONSTRUCTION MATERIALS — 0.50% | | | | | | | | | |

Forterra, Inc. (a) | | | 11,406 | | | | | | | | 271,235 | |

| | | | | | | | | | | | |

| | | |

| ELECTRIC UTILITIES — 0.36% | | | | | | | | | |

PNM Resources, Inc. | | | 4,312 | | | | | | | | 196,670 | |

| | | | | | | | | | | | |

| | | |

| ELECTRONIC EQUIPMENT & INSTRUMENTS — 5.06% | | | | | | | | | |

Coherent, Inc. (a) | | | 10,269 | | | | | | | | 2,737,099 | |

| | | | | | | | | | | | |

| | | |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 1.14% | | | | | | | | | |

Rogers Corporation (a) | | | 2,260 | | | | | | | | 616,980 | |

| | | | | | | | | | | | |

| | | |

| ENTERTAINMENT — 0.56% | | | | | | | | | |

MGM Holdings, Inc. (a)(f) | | | 1,792 | | | | | | | | 240,128 | |

Sciplay Corporation (a) | | | 4,474 | | | | | | | | 61,652 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 301,780 | |

| | | | | | | | | | | | |

| | | |

| FOOD PRODUCTS — 0.25% | | | | | | | | | |

Sanderson Farms, Inc. | | | 702 | | | | | | | | 134,138 | |

| | | | | | | | | | | | |

| | | |

| HEALTH CARE EQUIPMENT & SUPPLIES — 0.34% | | | | | | | | | |

Intersect ENT, Inc. (a) | | | 6,783 | | | | | | | | 185,244 | |

| | | | | | | | | | | | |

| | | |

| HEALTH CARE PROVIDERS & SERVICES — 0.03% | | | | | | | | | |

ATI Physical Therapy, Inc. (a) | | | 4,111 | | | | | | | | 13,936 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

9

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares | | | | | | Value | |

| HEALTH CARE TECHNOLOGY — 1.94% | | | | | | | | | |

Cerner Corporation (j) | | | 11,306 | | | | | | | $ | 1,049,988 | |

Convey Health Solutions Holdings, Inc. (a) | | | 200 | | | | | | | | 1,672 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,051,660 | |

| | | | | | | | | | | | |

| | | |

| IT SERVICES — 0.45% | | | | | | | | | |

Afterpay Ltd. — ADR (a) | | | 4,117 | | | | | | | | 246,608 | |

| | | | | | | | | | | | |

| | | |

| LIFE & HEALTH INSURANCE — 3.69% | | | | | | | | | |

American National Group, Inc. | | | 1,598 | | | | | | | | 301,766 | |

Athene Holding Ltd. — ADR (a)(e) | | | 20,341 | | | | | | | | 1,695,016 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,996,782 | |

| | | | | | | | | | | | |

| | | |

| MACHINERY — 0.91% | | | | | | | | | |

Welbilt, Inc. (a) | | | 20,750 | | | | | | | | 493,228 | |

| | | | | | | | | | | | |

| | | |

| MEDIA — 0.97% | | | | | | | | | |

Shaw Communications, Inc. (b) | | | 17,292 | | | | | | | | 524,639 | |

| | | | | | | | | | | | |

| | | |

| METALS & MINING — 4.04% | | | | | | | | | |

BHP Group plc — ADR (e) | | | 36,570 | | | | | | | | 2,185,789 | |

| | | | | | | | | | | | |

| | | |

| MULTI-LINE INSURANCE — 0.62% | | | | | | | | | |

The Hartford Financial Services Group, Inc. (j) | | | 4,881 | | | | | | | | 336,984 | |

| | | | | | | | | | | | |

| | | |

| OIL, GAS & CONSUMABLE FUELS — 0.76% | | | | | | | | | |

Teekay LNG Partners LP (b) | | | 24,197 | | | | | | | | 409,655 | |

| | | | | | | | | | | | |

| | | |

| PHARMACEUTICALS — 0.05% | | | | | | | | | |

TPCO Holding Corporation — ADR (a) | | | 20,481 | | | | | | | | 28,059 | |

| | | | | | | | | | | | |

| | | |

| PROFESSIONAL SERVICES — 0.15% | | | | | | | | | |

51job, Inc. — ADR (a) | | | 1,703 | | | | | | | | 83,328 | |

| | | | | | | | | | | | |

| | | |

| REITs — 3.18% | | | | | | | | | |

Bluerock Residential Growth REIT, Inc. | | | 4,796 | | | | | | | | 126,567 | |

CyrusOne, Inc. | | | 17,774 | | | | | | | | 1,594,683 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 1,721,250 | |

| | | | | | | | | | | | |

| | | |

| RESEARCH & CONSULTING SERVICES — 6.84% | | | | | | | | | |

IHS Markit Ltd. (e) | | | 27,868 | | | | | | | | 3,704,215 | |

| | | | | | | | | | | | |

| | | |

| ROAD & RAIL — 0.01% | | | | | | | | | |

Hertz Global Holdings, Inc. (a) | | | 215 | | | | | | | | 5,373 | |

| | | | | | | | | | | | |

| | | |

| SEMICONDUCTORS — 6.42% | | | | | | | | | |

Magnachip Semiconductor Corporation (a) | | | 938 | | | | | | | | 19,670 | |

Xilinx, Inc. (e) | | | 16,289 | | | | | | | | 3,453,757 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 3,473,427 | |

| | | | | | | | | | | | |

| | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 0.26% | | | | | | | | | |

NeoPhotonics Corporation (a) | | | 9,144 | | | | | | | | 140,543 | |

| | | | | | | | | | | | |

| | | |

| SOFTWARE — 7.68% | | | | | | | | | |

Five9, Inc. (a)(j) | | | 1,500 | | | | | | | | 205,980 | |

Nuance Communications, Inc. (a)(e) | | | 50,112 | | | | | | | | 2,772,196 | |

UserTesting, Inc. (a) | | | 100 | | | | | | | | 842 | |

Vonage Holdings Corporation (a)(j) | | | 56,648 | | | | | | | | 1,177,712 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,156,730 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

10

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares | | | | | | Value | |

| SPECIALTY RETAIL — 0.37% | | | | | | | | | |

Sportsman’s Warehouse Holdings, Inc. (a)(j) | | | 16,862 | | | | | | | $ | 198,972 | |

| | | | | | | | | | | | |

| TOTAL COMMON STOCKS (Cost $24,648,081) | | | | | | | | 27,630,077 | |

| | | | | | | | | | | | |

| | | |

| | | Shares/Units | | | | | | | |

| | | |

| SPECIAL PURPOSE ACQUISITION COMPANIES — 18.22% (a) | | | | | | | | | |

26 Capital Acquisition Corporation | | | 1,800 | | | | | | | | 18,234 | |

Accelerate Acquisition Corporation Class A | | | 9,000 | | | | | | | | 87,480 | |

ACE Convergence Acquisition Corporation Class A — ADR | | | 17,419 | | | | | | | | 173,493 | |

AfterNext HealthTech Acquisition Corporation Class A — ADR | | | 6,731 | | | | | | | | 65,627 | |

Alpha Partners Technology Merger Corporation Class A — ADR | | | 5,646 | | | | | | | | 54,540 | |

AltEnergy Acquisition Corporation | | | 1,600 | | | | | | | | 16,144 | |

Altimar Acquisition Corporation III — ADR | | | 2,313 | | | | | | | | 22,737 | |

Altimeter Growth Corporation 2 Class A — ADR | | | 4,105 | | | | | | | | 40,475 | |

Anzu Special Acquisition Corporation I | | | 200 | | | | | | | | 1,992 | |

Anzu Special Acquisition Corporation I Class A | | | 5,592 | | | | | | | | 54,522 | |

Apollo Strategic Growth Capital Class A — ADR | | | 8,013 | | | | | | | | 79,088 | |

Archimedes Tech SPAC Partners Company | | | 187 | | | | | | | | 1,877 | |

ArcLight Clean Transition Corporation II Class A — ADR | | | 5,030 | | | | | | | | 50,199 | |

Ares Acquisition Corporation — ADR | | | 1,950 | | | | | | | | 19,364 | |

Arrowroot Acquisition Corporation Class A | | | 7,864 | | | | | | | | 76,281 | |

Artisan Acquisition Corporation Class A — ADR | | | 1,407 | | | | | | | | 13,943 | |

Astrea Acquisition Corporation Class A | | | 4,267 | | | | | | | | 42,158 | |

Athena Consumer Acquisition Corporation | | | 1,071 | | | | | | | | 10,892 | |

Atlas Crest Investment Corporation II | | | 1,450 | | | | | | | | 14,398 | |

Atlas Crest Investment Corporation II Class A | | | 3,919 | | | | | | | | 38,132 | |

Aurora Acquisition Corporation Class A (b) | | | 2,413 | | | | | | | | 23,889 | |

Austerlitz Acquisition Corporation I Class A — ADR | | | 11,528 | | | | | | | | 111,937 | |

Austerlitz Acquisition Corporation II — ADR | | | 900 | | | | | | | | 9,009 | |

Austerlitz Acquisition Corporation II Class A — ADR | | | 4,453 | | | | | | | | 43,283 | |

Authentic Equity Acquisition Corporation — ADR | | | 400 | | | | | | | | 4,000 | |

Avanti Acquisition Corporation Class A (b) | | | 8,716 | | | | | | | | 85,591 | |

Bilander Acquisition Corporation Class A | | | 5,641 | | | | | | | | 54,548 | |

Biotech Acquisition Company Class A — ADR | | | 5,539 | | | | | | | | 54,504 | |

BlueRiver Acquisition Corporation — ADR | | | 150 | | | | | | | | 1,481 | |

BOA Acquisition Corporation Class A | | | 1,148 | | | | | | | | 11,285 | |

Brigade-M3 European Acquisition Corporation (b) | | | 3,199 | | | | | | | | 31,350 | |

Build Acquisition Corporation | | | 1,053 | | | | | | | | 10,372 | |

Burgundy Technology Acquisition Corporation — ADR | | | 857 | | | | | | | | 8,793 | |

Burgundy Technology Acquisition Corporation Class A — ADR | | | 14,707 | | | | | | | | 147,217 | |

Capstar Special Purpose Acquisition Corporation Class A | | | 5,895 | | | | | | | | 58,714 | |

Catalyst Partners Acquisition Corporation Class A — ADR | | | 5,630 | | | | | | | | 54,836 | |

CC Neuberger Principal Holdings II Class A — ADR | | | 9,734 | | | | | | | | 96,367 | |

CC Neuberger Principal Holdings III — ADR | | | 1,500 | | | | | | | | 15,000 | |

CF Acquisition Corporation VI Class A | | | 470 | | | | | | | | 5,090 | |

CF Acquisition Corporation VIII | | | 3,028 | | | | | | | | 30,583 | |

CHP Merger Corporation Class A | | | 3,916 | | | | | | | | 39,630 | |

Churchill Capital Corporation V Class A | | | 1,825 | | | | | | | | 17,958 | |

Churchill Capital Corporation VII Class A | | | 11,792 | | | | | | | | 115,915 | |

CIIG Capital Partners II, Inc. | | | 4,645 | | | | | | | | 47,890 | |

Class Acceleration Corporation | | | 150 | | | | | | | | 1,485 | |

Climate Real Impact Solutions Acquisition Corporation II | | | 68 | | | | | | | | 678 | |

Climate Real Impact Solutions Acquisition Corporation II Class A | | | 6,007 | | | | | | | | 58,628 | |

Cohn Robbins Holdings Corporation Class A — ADR | | | 15,588 | | | | | | | | 153,230 | |

Colicity, Inc. Class A | | | 5,272 | | | | | | | | 52,404 | |

Colonnade Acquisition Corporation II — ADR | | | 1,000 | | | | | | | | 9,880 | |

Compute Health Acquisition Corporation | | | 5,691 | | | | | | | | 56,569 | |

Concord Acquisition Corporation II Class A | | | 5,651 | | | | | | | | 55,097 | |

Conx Corporation Class A (e) | | | 8,816 | | | | | | | | 86,573 | |

Conyers Park Acquisition Corporation III Class A | | | 5,588 | | | | | | | | 54,483 | |

Corazon Capital V838 Monoceros Corporation Class A — ADR | | | 2,795 | | | | | | | | 27,028 | |

Corner Growth Acquisition Corporation — ADR | | | 2,686 | | | | | | | | 26,726 | |

See Notes to Financial Statements.

11

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares/Units | | | | | | Value | |

| | | |

| SPECIAL PURPOSE ACQUISITION COMPANIES — continued | | | | | | | | | |

COVA Acquisition Corporation — ADR | | | 2,301 | | | | | | | $ | 23,010 | |

Crown PropTech Acquisitions Class A — ADR | | | 5,549 | | | | | | | | 54,935 | |

D & Z Media Acquisition Corporation | | | 2,350 | | | | | | | | 23,288 | |

Decarbonization Plus Acquisition Corporation II | | | 2 | | | | | | | | 21 | |

Decarbonization Plus Acquisition Corporation II Class A | | | 498 | | | | | | | | 4,965 | |

Decarbonization Plus Acquisition Corporation IV Class A — ADR | | | 5,194 | | | | | | | | 51,213 | |

Deep Lake Capital Acquisition Corporation Class A — ADR | | | 4,760 | | | | | | | | 46,553 | |

Dragoneer Growth Opportunities Corporation III Class A — ADR | | | 5,561 | | | | | | | | 54,331 | |

E.Merge Technology Acquisition Corporation Class A | | | 16,998 | | | | | | | | 167,260 | |

ECP Environmental Growth Opportunities Corporation Class A | | | 10,151 | | | | | | | | 100,089 | |

EdtechX Holdings Acquisition Corporation II Class A | | | 1,074 | | | | | | | | 10,761 | |

Elliott Opportunity Corporation II — ADR | | | 1,118 | | | | | | | | 11,191 | |

Elliott Opportunity Corporation II Class A — ADR | | | 5,998 | | | | | | | | 58,600 | |

Enterprise 4.0 Technology Acquisition Corporation — ADR | | | 1,694 | | | | | | | | 17,059 | |

Environmental Impact Acquisition Corporation Class A | | | 3,175 | | | | | | | | 31,496 | |

Equity Distribution Acquisition Corporation Class A | | | 24,951 | | | | | | | | 245,019 | |

ESGEN Acquisition Corporation — ADR | | | 1,873 | | | | | | | | 18,992 | |

ESM Acquisition Corporation (b) | | | 933 | | | | | | | | 9,265 | |

Eucrates Biomedical Acquisition Corporation — ADR | | | 13 | | | | | | | | 127 | |

Eve Mobility Acquisition Corporation — ADR | | | 589 | | | | | | | | 5,896 | |

ExcelFin Acquisition Corporation | | | 1,606 | | | | | | | | 16,140 | |

Fifth Wall Acquisition Corporation III Class A — ADR | | | 5,552 | | | | | | | | 55,242 | |

FinServ Acquisition Corporation II | | | 1,229 | | | | | | | | 12,118 | |

FinServ Acquisition Corporation II Class A | | | 1,651 | | | | | | | | 15,998 | |

FinTech Acquisition Corporation VI | | | 2,838 | | | | | | | | 28,238 | |

FinTech Acquisition Corporation VI Class A | | | 2,782 | | | | | | | | 27,264 | |

Fintech Evolution Acquisition Group — ADR | | | 5,096 | | | | | | | | 50,196 | |

FirstMark Horizon Acquisition Corporation | | | 4,182 | | | | | | | | 42,656 | |

FirstMark Horizon Acquisition Corporation Class A | | | 2,775 | | | | | | | | 27,445 | |

Fortistar Sustainable Solutions Corporation Class A | | | 5,601 | | | | | | | | 54,386 | |

Fortress Capital Acquisition Corporation Class A — ADR | | | 4,915 | | | | | | | | 47,970 | |

Fortress Value Acquisition Corporation III | | | 1,065 | | | | | | | | 10,554 | |

Fortress Value Acquisition Corporation III Class A | | | 3,709 | | | | | | | | 36,237 | |

Fortress Value Acquisition Corporation IV Class A | | | 5,570 | | | | | | | | 54,308 | |

Frazier Lifesciences Acquisition Corporation — ADR | | | 1,900 | | | | | | | | 18,810 | |

FTAC Athena Acquisition Corporation Class A — ADR | | | 8,473 | | | | | | | | 84,052 | |

FTAC Emerald Acquisition Corporation | | | 5,297 | | | | | | | | 52,811 | |

FTAC Hera Acquisition Corporation — ADR | | | 2,134 | | | | | | | | 21,255 | |

FTAC Parnassus Acquisition Corporation Class A | | | 3,086 | | | | | | | | 30,089 | |

FTAC Zeus Acquisition Corporation | | | 1,059 | | | | | | | | 10,590 | |

Fusion Acquisition Corporation II | | | 3,000 | | | | | | | | 29,685 | |

G Squared Ascend I, Inc. — ADR | | | 4,210 | | | | | | | | 42,374 | |

G Squared Ascend I, Inc. Class A — ADR | | | 5,942 | | | | | | | | 58,707 | |

G Squared Ascend II, Inc. — ADR | | | 2,391 | | | | | | | | 23,886 | |

Gesher I Acquisition Corporation — ADR | | | 1,707 | | | | | | | | 17,138 | |

Goal Acquisitions Corporation | | | 8,597 | | | | | | | | 83,391 | |

Golden Falcon Acquisition Corporation Class A | | | 4,958 | | | | | | | | 48,489 | |

Gores Holdings VIII, Inc. Class A | | | 75 | | | | | | | | 765 | |

Gores Technology Partners, Inc. Class A | | | 1,961 | | | | | | | | 19,434 | |

Gores Technology Partners II, Inc. Class A | | | 678 | | | | | | | | 6,712 | |

Graf Acquisition Corporation IV | | | 3,041 | | | | | | | | 30,106 | |

Haymaker Acquisition Corporation III | | | 4,762 | | | | | | | | 47,096 | |

Healthcare Assurance Acquisition Corporation Class A | | | 5,883 | | | | | | | | 57,477 | |

Healthcare Services Acquisition Corporation Class A | | | 6,430 | | | | | | | | 62,757 | |

Hennessy Capital Investment Corporation V | | | 100 | | | | | | | | 997 | |

Highland Transcend Partners Corporation I Class A — ADR | | | 50,169 | | | | | | | | 497,676 | |

Horizon Acquisition Corporation II Class A — ADR | | | 5,983 | | | | | | | | 58,813 | |

Hudson Executive Investment Corporation II | | | 200 | | | | | | | | 1,978 | |

Independence Holdings Corporation (b) | | | 1,500 | | | | | | | | 14,925 | |

Independence Holdings Corporation Class A (b) | | | 3,919 | | | | | | | | 38,093 | |

Infinite Acquisition Corporation — ADR | | | 1,324 | | | | | | | | 13,333 | |

INSU Acquisition Corporation III Class A | | | 5,558 | | | | | | | | 54,468 | |

See Notes to Financial Statements.

12

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares/Units | | | | | | Value | |

| | | |

| SPECIAL PURPOSE ACQUISITION COMPANIES — continued | | | | | | | | | |

InterPrivate II Acquisition Corporation | | | 897 | | | | | | | $ | 8,871 | |

InterPrivate III Financial Partners, Inc. Class A | | | 895 | | | | | | | | 8,869 | |

InterPrivate IV InfraTech Partners, Inc. | | | 231 | | | | | | | | 2,275 | |

ION Acquisition Corporation 3 Ltd. Class A — ADR | | | 6,032 | | | | | | | | 58,993 | |

Isleworth Healthcare Acquisition Corporation | | | 2,244 | | | | | | | | 22,081 | |

Jack Creek Investment Corporation (b) | | | 1,500 | | | | | | | | 15,000 | |

Jaws Hurricane Acquisition Corporation Class A | | | 5,394 | | | | | | | | 52,160 | |

Jaws Juggernaut Acquisition Corporation — ADR | | | 4,066 | | | | | | | | 40,579 | |

Jaws Juggernaut Acquisition Corporation Class A — ADR | | | 1,472 | | | | | | | | 14,470 | |

Jaws Mustang Acquisition Corporation — ADR | | | 600 | | | | | | | | 6,018 | |

Jaws Mustang Acquisition Corporation Class A — ADR | | | 5,976 | | | | | | | | 58,266 | |

Khosla Ventures Acquisition Company | | | 1,672 | | | | | | | | 16,218 | |

Khosla Ventures Acquisition Company III Class A | | | 5,273 | | | | | | | | 51,464 | |

Kismet Acquisition Three Corporation — ADR | | | 1 | | | | | | | | 10 | |

Kismet Acquisition Three Corporation Class A — ADR | | | 6,044 | | | | | | | | 58,566 | |

KKR Acquisition Holdings Corporation I | | | 5,844 | | | | | | | | 58,557 | |

KL Acquisition Corporation Class A | | | 12,891 | | | | | | | | 125,945 | |

KludeIn I Acquisition Corporation | | | 3,000 | | | | | | | | 30,120 | |

L. Catterton Asia Acquisition Corporation Class A — ADR | | | 6,050 | | | | | | | | 58,685 | |

Landcadia Holdings IV, Inc. Class A | | | 5,988 | | | | | | | | 58,084 | |

LDH Growth Corporation I Class A — ADR | | | 1,414 | | | | | | | | 13,885 | |

Lerer Hippeau Acquisition Corporation Class A | | | 2,989 | | | | | | | | 29,412 | |

Lionheart Acquisition Corporation II Class A | | | 5,904 | | | | | | | | 58,804 | |

Live Oak Crestview Climate Acquisition Corporation Class A | | | 5,937 | | | | | | | | 60,557 | |

Live Oak Mobility Acquisition Corporation Class A | | | 2,647 | | | | | | | | 25,861 | |

Longview Acquisition Corporation II Class A | | | 6,305 | | | | | | | | 62,041 | |

M3-Brigade Acquisition Corporation II Class A | | | 5,922 | | | | | | | | 58,687 | |

Macondray Capital Acquisition Corporation I — ADR | | | 2,600 | | | | | | | | 25,922 | |

Magnum Opus Acquisition Ltd. Class A — ADR | | | 5,909 | | | | | | | | 58,617 | |

Marlin Technology Corporation Class A — ADR | | | 9,417 | | | | | | | | 91,910 | |

Mason Industrial Technology, Inc. | | | 2,774 | | | | | | | | 27,518 | |

MedTech Acquisition Corporation Class A | | | 5,513 | | | | | | | | 54,468 | |

Motive Capital Corporation Class A — ADR | | | 13,200 | | | | | | | | 129,888 | |

Motive Capital Corporation II — ADR | | | 3,201 | | | | | | | | 31,914 | |

The Music Acquisition Corporation | | | 2,750 | | | | | | | | 26,125 | |

New Vista Acquisition Corporation Class A — ADR | | | 1,051 | | | | | | | | 10,226 | |

Newbury Street Acquisition Corporation | | | 838 | | | | | | | | 8,296 | |

Noble Rock Acquisition Corporation — ADR | | | 300 | | | | | | | | 2,940 | |

North Atlantic Acquisition Corporation Class A — ADR | | | 5,564 | | | | | | | | 54,527 | |

North Mountain Merger Corporation Class A | | | 2,783 | | | | | | | | 27,440 | |

Northern Genesis Acquisition Corporation III Class A | | | 6,025 | | | | | | | | 58,573 | |

Novus Capital Corporation II | | | 400 | | | | | | | | 4,116 | |

Pathfinder Acquisition Corporation Class A — ADR | | | 5,310 | | | | | | | | 51,507 | |

Peridot Acquisition Corporation II — ADR | | | 2,500 | | | | | | | | 24,825 | |

Peridot Acquisition Corporation II Class A — ADR | | | 6,038 | | | | | | | | 58,750 | |

Pershing Square Tontine Holdings Ltd. Class A | | | 7,392 | | | | | | | | 145,770 | |

Phoenix Biotech Acquisition Corporation | | | 1,719 | | | | | | | | 17,345 | |

Pioneer Merger Corporation Class A — ADR | | | 10,362 | | | | | | | | 102,273 | |

Pivotal Investment Corporation III | | | 852 | | | | | | | | 8,435 | |

Poema Global Holdings Corporation Class A — ADR | | | 3,177 | | | | | | | | 31,389 | |

Pontem Corporation Class A — ADR | | | 6,744 | | | | | | | | 66,091 | |

Post Holdings Partnering Corporation Class A | | | 8,951 | | | | | | | | 87,720 | |

Prime Impact Acquisition I — ADR | | | 57 | | | | | | | | 570 | |

Prime Impact Acquisition I Class A — ADR | | | 6,492 | | | | | | | | 63,881 | |

Progress Acquisition Corporation | | | 65 | | | | | | | | 649 | |

PROOF Acquisition Corporation I | | | 4,240 | | | | | | | | 42,442 | |

Property Solutions Acquisition Corporation II | | | 1,847 | | | | | | | | 18,267 | |

Prospector Capital Corporation Class A — ADR | | | 6,639 | | | | | | | | 64,664 | |

Pyrophyte Acquisition Corporation — ADR | | | 2,132 | | | | | | | | 21,533 | |

Queen’s Gambit Growth Capital Class A — ADR | | | 7,231 | | | | | | | | 71,587 | |

RedBall Acquisition Corporation Class A — ADR | | | 10,937 | | | | | | | | 108,495 | |

Revolution Healthcare Acquisition Corporation Class A | | | 11,543 | | | | | | | | 112,083 | |

See Notes to Financial Statements.

13

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares/Units | | | | | | Value | |

| | | |

| SPECIAL PURPOSE ACQUISITION COMPANIES — continued | | | | | | | | | |

RMG Acquisition Corporation III Class A | | | 11,557 | | | | | | | $ | 112,681 | |

Rocket Internet Growth Opportunities Corporation — ADR | | | 5,017 | | | | | | | | 49,668 | |

Ross Acquisition Corporation II — ADR | | | 153 | | | | | | | | 1,533 | |

Ross Acquisition Corporation II Class A — ADR | | | 5,518 | | | | | | | | 53,856 | |

ScION Tech Growth II (b) | | | 1,250 | | | | | | | | 12,388 | |

Semper Paratus Acquisition Corporation — ADR | | | 2,138 | | | | | | | | 21,530 | |

Senior Connect Acquisition Corporation I Class A | | | 4,566 | | | | | | | | 44,473 | |

Shelter Acquisition Corporation I | | | 5,172 | | | | | | | | 51,410 | |

Shelter Acquisition Corporation I — Sponsor (d)(g) | | | 718 | | | | | | | | — | |

Simon Property Group Acquisition Holdings, Inc. | | | 5,267 | | | | | | | | 52,117 | |

Simon Property Group Acquisition Holdings, Inc. Class A | | | 8,911 | | | | | | | | 86,793 | |

Slam Corporation — ADR | | | 5,203 | | | | | | | | 51,406 | |

Slam Corporation Class A — ADR | | | 401 | | | | | | | | 3,910 | |

Soar Technology Acquisition Corporation — ADR | | | 1,164 | | | | | | | | 11,291 | |

Social Capital Hedosophia Holdings Corporation VI Class A (b)(j) | | | 4,249 | | | | | | | | 43,297 | |

Spartan Acquisition Corporation III Class A | | | 12,473 | | | | | | | | 123,109 | |

Sports Entertainment Acquisition Corporation Class A | | | 3,802 | | | | | | | | 37,716 | |

Supernova Partners Acquisition Company III Ltd. Class A — ADR | | | 13,459 | | | | | | | | 130,687 | |

Sustainable Development Acquisition Corporation I | | | 300 | | | | | | | | 2,997 | |

SVF Investment Corporation Class A — ADR | | | 4,793 | | | | | | | | 48,122 | |

SVF Investment Corporation 2 Class A — ADR | | | 185 | | | | | | | | 1,839 | |

SVF Investment Corporation 3 Class A — ADR | | | 11 | | | | | | | | 110 | |

Tailwind Acquisition Corporation Class A | | | 15,365 | | | | | | | | 151,192 | |

Target Global Acquisition Corporation I — ADR | | | 4,801 | | | | | | | | 47,818 | |

Thunder Bridge Capital Partners III, Inc. Class A | | | 5,475 | | | | | | | | 53,491 | |

Tishman Speyer Innovation Corporation II Class A | | | 5,140 | | | | | | | | 50,115 | |

TortoiseEcofin Acquisition Corporation III Class A — ADR | | | 5,633 | | | | | | | | 54,584 | |

Tribe Capital Growth Corporation I | | | 3,142 | | | | | | | | 31,043 | |

Tribe Capital Growth Corporation I Class A | | | 2,236 | | | | | | | | 21,868 | |

Twelve Seas Investment Company II | | | 587 | | | | | | | | 5,829 | |

USHG Acquisition Corporation Class A | | | 5,301 | | | | | | | | 54,971 | |

VectoIQ Acquisition Corporation II Class A | | | 6,710 | | | | | | | | 65,355 | |

Virgin Group Acquisition Corporation II Class A — ADR | | | 11,130 | | | | | | | | 109,853 | |

Vy Global Growth Class A — ADR | | | 8,099 | | | | | | | | 79,451 | |

Warbug Pincus Capital Corporation I Class A — ADR | | | 3,004 | | | | | | | | 29,439 | |

Z-Work Acquisition Corporation Class A | | | 1,798 | | | | | | | | 17,495 | |

| | | | | | | | | | | | |

| TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES (Cost $9,905,088) | | | | | | | | 9,861,000 | |

| | | | | | | | | | | | |

| | | |

| | | Shares | | | | | | | |

| | | |

| PRIVATE INVESTMENTS IN PUBLIC EQUITY — 0.10% (a) | | | | | | | | | |

MarketWise, Inc. | | | 565 | | | | | | | | 4,260 | |

Microvast Holdings, Inc. (d)(g)(l) | | | 9,000 | | | | | | | | 48,393 | |

| | | | | | | | | | | | |

| TOTAL PRIVATE INVESTMENTS IN PUBLIC EQUITY (Cost $95,650) | | | | | | | | 52,653 | |

| | | | | | | | | | | | |

| | | |

| PREFERRED STOCKS — 0.08% | | | | | | | | | |

Babcock & Wilcox Enterprises, Inc.,

6.500%, 12/31/2026 | | | 1,856 | | | | | | | | 46,029 | |

| | | | | | | | | | | | |

| TOTAL PREFERRED STOCKS (Cost $46,400) | | | | | | | | 46,029 | |

| | | | | | | | | | | | |

| | | |

| CONTINGENT VALUE RIGHTS — 0.11% (a) | | | | | | | | | |

Alder Biopharmaceuticals, Inc. (f) | | | 31,310 | | | | | | | | 56,358 | |

Ligand Pharmaceuticals (g) | | | 7,028 | | | | | | | | 879 | |

Media General, Inc. (d)(e)(g) | | | 8,397 | | | | | | | | — | |

| | | | | | | | | | | | |

| TOTAL CONTINGENT VALUE RIGHTS (Cost $0) | | | | | | | | 57,237 | |

| | | | | | | | | | | | |

| | | |

| RIGHTS — 0.01% (a)(g) | | | | | | | | | |

Bristol-Myers Squibb Company | | | 6,945 | | | | | | | | 7,813 | |

| | | | | | | | | | | | |

| TOTAL RIGHTS (Cost $0) | | | | | | | | 7,813 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

14

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares | | | | | | Value | |

| WARRANTS — 0.30% (a) | | | | | | | | | |

Accelerate Acquisition Corporation Class A

Expiration: December 2027,

Exercise Price: $11.50 | | | 3,000 | | | | | | | $ | 2,490 | |

ACE Convergence Acquisition Corporation Class A

Expiration: September 2027,

Exercise Price: $11.50 (b) | | | 9,310 | | | | | | | | 6,145 | |

Akazoo S.A.

Expiration: December 2024,

Exercise Price: $11.50 (b)(d)(g) | | | 2,642 | | | | | | | | — | |

Apollo Strategic Growth Capital Class A

Expiration: October 2027,

Exercise Price: $11.50 (b) | | | 4,782 | | | | | | | | 6,121 | |

Ardagh Metal Packaging S.A.

Expiration: August 2026,

Exercise Price: $11.50 (b) | | | 542 | | | | | | | | 1,079 | |

Arrowroot Acquisition Corporation Class A

Expiration: March 2022,

Exercise Price: $11.50 | | | 6,162 | | | | | | | | 3,204 | |

Austerlitz Acquisition Corporation I

Expiration: February 2026,

Exercise Price: $11.50 (b) | | | 189 | | | | | | | | 198 | |

Avanti Acquisition Corporation Class A

Expiration: December 2025,

Exercise Price: $11.50 (b) | | | 1,800 | | | | | | | | 1,066 | |

Berkshire Grey, Inc.

Expiration: December 2026,

Exercise Price: $11.50 | | | 1,255 | | | | | | | | 1,129 | |

BigBear A.I. Holdings, Inc.

Expiration: December 2028,

Exercise Price: $11.50 | | | 619 | | | | | | | | 501 | |

BuzzFeed, Inc.

Expiration: December 2026,

Exercise Price: $11.50 | | | 1,666 | | | | | | | | 833 | |

Cazoo Group Ltd.

Expiration: August 2026,

Exercise Price: $11.50 (b) | | | 5,415 | | | | | | | | 4,873 | |

CEC Brands LLC

Expiration: December 2025,

Exercise Price: $21.88 (g) | | | 2,163 | | | | | | | | 6,489 | |

CF Acquisition Corporation VI

Expiration: February 2028,

Exercise Price: $11.50 | | | 225 | | | | | | | | 571 | |

CHP Merger Corporation Class A

Expiration: November 2024,

Exercise Price: $11.50 | | | 1,459 | | | | | | | | 700 | |

Cohn Robbins Holdings Corporation Class A

Expiration: August 2025,

Exercise Price: $11.50 (b) | | | 3,302 | | | | | | | | 2,642 | |

Conx Corporation Class A

Expiration: October 2027,

Exercise Price: $11.50 | | | 2,204 | | | | | | | | 1,895 | |

Decarbonization Plus Acquisition Corporation II Class A

Expiration: October 2025,

Exercise Price: $11.50 | | | 166 | | | | | | | | 261 | |

Deep Lake Capital Acquisition Corporation Class A

Expiration: December 2027,

Exercise Price: $11.50 (b) | | | 2,380 | | | | | | | | 1,475 | |

E.Merge Technology Acquisition Corporation Class A

Expiration: July 2025,

Exercise Price: $11.50 | | | 5,666 | | | | | | | | 3,173 | |

Embark Technology, Inc.

Expiration: December 2027,

Exercise Price: $11.50 | | | 66 | | | | | | | | 129 | |

See Notes to Financial Statements.

15

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares | | | | | | Value | |

| WARRANTS — continued | | | | | | | | | |

Enjoy Technology, Inc.

Expiration: December 2025,

Exercise Price: $11.50 | | | 193 | | | | | | | $ | 85 | |

Equity Distribution Acquisition Corporation Class A

Expiration: September 2025,

Exercise Price: $11.50 | | | 8,317 | | | | | | | | 6,155 | |

Fortress Capital Acquisition Corporation Class A

Expiration: December 2027,

Exercise Price: $11.50 (b) | | | 983 | | | | | | | | 767 | |

FTAC Athena Acquisition Corporation Class A

Expiration: March 2026,

Exercise Price: $11.50 (b) | | | 916 | | | | | | | | 1,017 | |

GCM Grosvenor, Inc. Class A

Expiration: November 2025,

Exercise Price: $11.50 | | | 2,381 | | | | | | | | 3,571 | |

Ginkgo Bioworks Holdings, Inc.

Expiration: August 2026,

Exercise Price: $11.50 | | | 40 | | | | | | | | 90 | |

Goal Acquisitions Corporation

Expiration: January 2022,

Exercise Price: $11.50 | | | 8,032 | | | | | | | | 4,388 | |

Golden Falcon Acquisition Corporation Class A

Expiration: November 2026,

Exercise Price: $11.50 | | | 2,479 | | | | | | | | 1,562 | |

Healthcare Services Acquisition Corporation Class A

Expiration: December 2027,

Exercise Price: $11.50 | | | 3,215 | | | | | | | | 1,672 | |

Highland Transcend Partners Corporation I Class A

Expiration: December 2027,

Exercise Price: $11.50 (b) | | | 16,723 | | | | | | | | 26,757 | |

InterPrivate III Financial Partners, Inc.

Expiration: December 2027,

Exercise Price: $11.50 | | | 179 | | | | | | | | 251 | |

KL Acquisition Corporation Class A

Expiration: January 2028,

Exercise Price: $11.50 | | | 4,297 | | | | | | | | 2,277 | |

Longview Acquisition Corporation II Class A

Expiration: May 2026,

Exercise Price: $11.50 | | | 1,261 | | | | | | | | 1,072 | |

Marlin Technology Corporation Class A

Expiration: March 2026,

Exercise Price: $11.50 (b) | | | 3,139 | | | | | | | | 2,166 | |

Moneylion, Inc.

Expiration: September 2026,

Exercise Price: $11.50 | | | 11,485 | | | | | | | | 7,121 | |

Motive Capital Corporation Class A

Expiration: December 2025,

Exercise Price: $11.50 (b) | | | 3,398 | | | | | | | | 3,466 | |

Origin Materials, Inc.

Expiration: July 2026,

Exercise Price: $11.50 | | | 7,146 | | | | | | | | 10,647 | |

Pathfinder Acquisition Corporation Class A

Expiration: December 2027,

Exercise Price: $11.50 (b) | | | 1,062 | | | | | | | | 603 | |

Pear Therapeutics, Inc.

Expiration: December 2026,

Exercise Price: $11.50 | | | 100 | | | | | | | | 60 | |

Pioneer Merger Corporation Class A

Expiration: December 2027,

Exercise Price: $11.50 (b) | | | 3,454 | | | | | | | | 2,245 | |

Pontem Corporation Class A

Expiration: December 2027,

Exercise Price: $11.50 (b) | | | 2,248 | | | | | | | | 2,000 | |

See Notes to Financial Statements.

16

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Shares | | | | | | Value | |

| WARRANTS — continued | | | | | | | | | |

Prospector Capital Corporation Class A

Expiration: January 2025,

Exercise Price: $11.50 (b) | | | 2,213 | | | | | | | $ | 1,372 | |

Quantum-SI, Inc.

Expiration: September 2027,

Exercise Price: $11.50 | | | 7,060 | | | | | | | | 12,355 | |

RMG Acquisition Corporation III Class A

Expiration: December 2027,

Exercise Price: $11.50 (b) | | | 1,196 | | | | | | | | 1,051 | |

Senior Connect Acquisition Corporation I Class A

Expiration: December 2027,

Exercise Price: $11.50 | | | 2,283 | | | | | | | | 1,199 | |

Spartan Acquisition Corporation III Class A

Expiration: February 2026,

Exercise Price: $11.50 | | | 2,306 | | | | | | | | 3,321 | |

Supernova Partners Acquisition Company III Ltd. Class A

Expiration: March 2027,

Exercise Price: $11.50 (b) | | | 1,493 | | | | | | | | 1,344 | |

Talkspace, Inc.

Expiration: June 2025,

Exercise Price: $11.50 | | | 17,327 | | | | | | | | 4,022 | |

Thunder Bridge Capital Partners III, Inc. Class A

Expiration: February 2028,

Exercise Price: $11.50 | | | 1,095 | | | | | | | | 909 | |

Tishman Speyer Innovation Corporation II Class A

Expiration: December 2027,

Exercise Price: $11.50 | | | 1,028 | | | | | | | | 793 | |

VectoIQ Acquisition Corporation II Class A

Expiration: December 2027,

Exercise Price: $11.50 | | | 1,342 | | | | | | | | 1,167 | |

Virgin Group Acquisition Corporation II Class A

Expiration: March 2026,

Exercise Price: $11.50 (b) | | | 1,063 | | | | | | | | 893 | |

Wejo Group Ltd.

Expiration: November 2026,

Exercise Price: $11.50 (b) | | | 3,597 | | | | | | | | 3,957 | |

Whole Earth Brands, Inc.

Expiration: June 2025,

Exercise Price: $11.50 | | | 7,310 | | | | | | | | 8,553 | |

| | | | | | | | | | | | |

| TOTAL WARRANTS (Cost $325,639) | | | | | | | | | | | 163,882 | |

| | | | | | | | | | | | |

| | | Principal

Amount | | | | | | | |

| BANK LOANS — 1.87% | | | | | | | | | | | | |

Mallinckrodt International Finance S.A.

4.250% (3 Month U.S. LIBOR + 2.750%), 2/28/2022 (f)(i)(k) | | $ | 175,000 | | | | | | | | 170,844 | |

RentPath LLC

8.000% (3 Month U.S. LIBOR + 4.750%), 12/17/2021 (g)(i)(k) | | | 17,879 | | | | | | | | 179 | |

Syniverse Holdings, Inc.

6.000% (3 Month U.S. LIBOR + 5.000%), 3/9/2023 (f)(i) | | | 583,000 | | | | | | | | 578,872 | |

Watts Guerra LLP

8.000%, 12/31/2022 (g) | | | 262,329 | | | | | | | | 261,673 | |

| | | | | | | | | | | | |

| TOTAL BANK LOANS (Cost $1,033,991) | | | | | | | | | | | 1,011,568 | |

| | | | | | | | | | | | |

| | | |

| CONVERTIBLE BONDS — 0.12% (f) | | | | | | | | | |

Nuance Communications, Inc.

1.000%, 12/15/2035 | | | 28,000 | | | | | | | | 63,980 | |

| | | | | | | | | | | | |

| TOTAL CONVERTIBLE BONDS (Cost $59,927) | | | | | | | | | | | 63,980 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

17

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | Principal

Amount | | | | | | Value | |

| | | |

| CORPORATE BONDS — 1.62% (f) | | | | | | | | | |

Devon Energy Corporation

5.875%, 6/15/2028 | | $ | 135,000 | | | | | | | $ | 146,216 | |

Forterra Finance LLC/FRTA Finance Corporation

6.500%, 7/15/2025 (h) | | | 250,000 | | | | | | | | 265,325 | |

GrubHub Holdings, Inc.

5.500%, 7/1/2027 (h) | | | 132,000 | | | | | | | | 131,076 | |

Teekay Corporation

9.250%, 11/15/2022 (b)(h) | | | 127,000 | | | | | | | | 130,175 | |

TreeHouse Foods, Inc.

4.000%, 9/1/2028 | | | 114,000 | | | | | | | | 109,440 | |

WeWork Companies, Inc.

7.875%, 5/1/2025 (h) | | | 91,000 | | | | | | | | 86,986 | |

WeWork Companies, Inc./WW Co-Obligor, Inc.

5.000%, 7/10/2025 (h) | | | 8,000 | | | | | | | | 6,945 | |

| | | | | | | | | | | | |

| TOTAL CORPORATE BONDS (Cost $860,842) | | | | | | | | | | | 876,163 | |

| | | | | | | | | | | | |

| | | |

| | | Contracts

(100 shares

per contract) | | | Notional

Amount | | | | |

PURCHASED OPTIONS — 0.03% (a) | | | | | | | | | | | | |

| PURCHASED PUT OPTIONS — 0.03% | | | | | | | | | |

The Hartford Financial Services Group, Inc.

Expiration: March 2022,

Exercise Price: $55.00 | | | 48 | | | $ | 331,392 | | | | 1,680 | |

SPDR S&P 500 ETF Trust | | | | | | | | | | | | |

Expiration: January 2022,

Exercise Price: $465.00 | | | 17 | | | | 807,432 | | | | 4,726 | |

Expiration: January 2022,

Exercise Price: $470.00 | | | 12 | | | | 569,952 | | | | 4,518 | |

Expiration: January 2022,

Exercise Price: $470.00 | | | 7 | | | | 332,472 | | | | 3,507 | |

| | | | | | | | | | | | |

| TOTAL PURCHASED OPTIONS (Cost $30,797) | | | | | | | | | | | 14,431 | |

| | | | | | | | | | | | |

| | | |

| | | Shares | | | | | | | |

| ESCROW NOTES — 2.39% (a) | | | | | | | | | | | | |

Altaba, Inc. (f) | | | 216,901 | | | | | | | | 1,291,646 | |

AMR Corporation (g) | | | 7,668 | | | | | | | | 153 | |

| | | | | | | | | | | | |

| TOTAL ESCROW NOTES (Cost $891,197) | | | | | | | | | | | 1,291,799 | |

| | | | | | | | | | | | |

| | | |

| SHORT-TERM INVESTMENTS — 22.14% | | | | | | | | | | | | |

| MONEY MARKET FUNDS — 22.14% (c)(m) | | | | | | | | | | | | |

Fidelity Institutional Government Portfolio, Institutional Share Class, 0.01% | | | 2,651,000 | | | | | | | | 2,651,000 | |

First American Government Obligations Fund, Institutional Share Class, 0.03% | | | 1,380,998 | | | | | | | | 1,380,998 | |

Goldman Sachs Financial Square Government Fund, Institutional Share Class, 0.03% | | | 2,651,000 | | | | | | | | 2,651,000 | |

The Government & Agency Portfolio, Institutional Share Class, 0.03% | | | 2,651,000 | | | | | | | | 2,651,000 | |

JPMorgan U.S. Government Money Market Fund, Institutional Share Class, 0.03% | | | 2,651,000 | | | | | | | | 2,651,000 | |

| | | | | | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $11,984,998) | | | | | | | | | | | 11,984,998 | |

| | | | | | | | | | | | |

TOTAL LONG INVESTMENTS

(Cost $49,882,610) — 98.03% | | | | | | | | | | | 53,061,630 | |

| | | | | | | | | | | | |

| | | |

| SHORT INVESTMENTS — (9.38)% | | | | | | | | | |

| COMMON STOCKS — (9.21)% | | | | | | | | | | | | |

| COMMERCIAL BANKS & THRIFTS — (0.13)% | | | | | | | | | | | | |

New York Community Bancorp, Inc. | | | (5,885 | ) | | | | | | | (71,856 | ) |

| | | | | | | | | | | | |

| | Shares of this fund are publicly offered, and its prospectus and annual report are publicly available. |

See Notes to Financial Statements.

18

THE MERGER FUND® VL

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2021

| | | | | | | | | | | | |

| | | |

| | | Shares | | | | | | Value | |

| ASSET MANAGEMENT & CUSTODY BANKS — (3.13)% | | | | | | | | | | | | |

Apollo Global Management, Inc. | | | (23,408 | ) | | | | | | $ | (1,695,441 | ) |

| | | | | | | | | | | | |

| BANKS — (0.40)% | | | | | | | | | | | | |

M&T Bank Corporation | | | (1,409 | ) | | | | | | | (216,394 | ) |

| | | | | | | | | | | | |

| HOTELS, RESTAURANTS & LEISURE — (0.14)% | | | | | | | | | | | | |

Scientific Games Corporation | | | (1,118 | ) | | | | | | | (74,716 | ) |

| | | | | | | | | | | | |

| INSURANCE — (0.92)% | | | | | | | | | | | | |

Aon plc | | | (1,658 | ) | | | | | | | (498,328 | ) |

| | | | | | | | | | | | |

| INTEGRATED OIL & GAS — (0.07)% | | | | | | | | | | | | |

BP plc — ADR | | | (1,473 | ) | | | | | | | (39,226 | ) |

| | | | | | | | | | | | |

| IT SERVICES — (0.04)% | | | | | | | | | | | | |

Block, Inc. | | | (132 | ) | | | | | | | (21,319 | ) |

| | | | | | | | | | | | |

| METALS & MINING — (1.72)% | | | | | | | | | | | | |

BHP Group Ltd. — ADR | | | (15,413 | ) | | | | | | | (930,175 | ) |

| | | | | | | | | | | | |

| OIL REFINING & MARKETING — (0.55)% | | | | | | | | | | | | |

Phillips 66 | | | (4,060 | ) | | | | | | | (294,188 | ) |

| | | | | | | | | | | | |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — (1.84)% | | | | | | | | | | | | |

Advanced Micro Devices, Inc. | | | (5,752 | ) | | | | | | | (827,713 | ) |

MKS Instruments, Inc. | | | (975 | ) | | | | | | | (169,816 | ) |

| | | | | | | | | | | | |

| | | | | | | | | | | (997,529 | ) |

| | | | | | | | | | | | |

| SOFTWARE — (0.27)% | | | | | | | | | | | | |

NortonLifeLock, Inc. | | | (5,546 | ) | | | | | | | (144,085 | ) |

| | | | | | | | | | | | |

TOTAL COMMON STOCKS

(Proceeds $4,912,143) | | | | | | | | | | | (4,983,257 | ) |

| | | | | | | | | | | | |

| | | Principal

Amount | | | | | | | |

| CORPORATE BONDS — (0.17)% (f) | | | | | | | | | | | | |

Devon Energy Corporation

5.850%, 12/15/2025 | | $ | (81,000 | ) | | | | | | | (92,614 | ) |

| | | | | | | | | | | | |

TOTAL CORPORATE BONDS

(Proceeds $88,747) | | | | | | | | | | | (92,614 | ) |

| | | | | | | | | | | | |

TOTAL SHORT INVESTMENTS

(Proceeds $5,000,890) — (9.38)% | | | | | | | | | | | (5,075,871 | ) |

| | | | | | | | | | | | |

| | | |

| TOTAL NET INVESTMENTS | | | | | | | | | |

(Cost $44,881,720) — 88.65% | | | | | | | | | | | 47,985,759 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 11.35% | | | | | | | | | | | 6,143,480 | |

| | | | | | | | | | | | |

| TOTAL NET ASSETS — 100.00% | | | | | | | | | | $ | 54,129,239 | |

| | | | | | | | | | | | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

LIBOR – London Interbank Offered Rate

plc – Public Limited Company

REIT – Real Estate Investment Trust

| (a) | Non-income producing security. |

| (c) | The rate quoted is the annualized seven-day yield as of December 31, 2021. |

| (d) | Security fair valued by the Valuation Committee in good faith in accordance with the policies adopted by the Board of Trustees. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short, written option contracts, swap contracts, and forward currency exchange contracts. |

| (f) | Level 2 Security. Please see Note 2 in the Notes to the Financial Statements for more information. |

| (g) | Level 3 Security. Please see Note 2 in the Notes to the Financial Statements for more information. |