SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

(Mark One)

| x | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

¨ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2001

OR

¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: [ ]

WMC RESOURCES LTD

Australian Business Number 76 004 184 598

(Exact name of Registrant as specified in its charter)

COMMONWEALTH OF AUSTRALIA

(Jurisdiction of incorporation or organization)

Level 16,

IBM Centre,

60 City Road,

Southbank,

Victoria 3006, Australia

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each Class

| | Name of each exchange on which registered

|

| Ordinary Shares (1) | | New York Stock Exchange |

| American Depositary Shares (2) | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the registration statement.

Shares outstanding :

| | |

| Fully Paid Ordinary Shares: | | 1,136,615,216(3) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 x

| (1) | | Not for trading but only in connection with the listing of the American Depositary Shares. |

| (2) | | Evidenced by American Depositary Receipts, each American Depositary Share representing four fully paid Ordinary Shares. |

| (3) | | Number of Ordinary Shares outstanding on a fully diluted basis assuming conversion of options in the demerger. |

| | | Page

|

|

| | 1 |

|

| | 1 |

|

| | 2 |

|

| | 5 |

|

| ITEM 1. | | | | 6 |

|

| ITEM 2. | | | | 8 |

|

| ITEM 3. | | | | 9 |

|

| ITEM 4. | | | | 18 |

|

| ITEM 5. | | | | 64 |

|

| ITEM 6. | | | | 94 |

|

| ITEM 7. | | | | 111 |

|

| ITEM 8. | | | | 116 |

|

| ITEM 9. | | | | 120 |

|

| ITEM 10. | | | | 123 |

|

| ITEM 11. | | | | 141 |

|

| ITEM 12. | | | | 154 |

|

| ITEM 13. | | | | 160 |

|

| ITEM 14. | | | | 160 |

|

| ITEM 15. | | | | 160 |

|

| ITEM 16. | | | | 160 |

|

| ITEM 17. | | | | 161 |

|

| ITEM 18. | | | | 161 |

|

| ITEM 19. | | | | 162 |

|

| EXHIBIT 1 – CONSTITUTION OF WMC RESOURCES | | 164 |

|

| EXHIBIT 4 – MATERIAL CONTRACTS | | 165 |

|

| EXHIBIT 8 – SIGNIFICANT SUBSIDIARIES | | 166 |

|

| EXHIBIT 10 – OTHER EXHIBITS | | 167 |

On November 21, 2001, WMC Limited announced a proposal to demerge its interest in the Alcoa World Alumina and Chemicals venture from its copper/uranium, nickel and fertilizer businesses and exploration and development interests. The demerger has been effected through an Australian court-approved scheme of arrangement and associated capital reduction and dividend distribution. As a result of the demerger, WMC Limited continues to hold its interest in AWAC, but has changed its name to Alumina Limited, and WMC Resources holds the nickel, copper/uranium and fertilizer businesses and exploration and development interests previously held within the WMC Limited group.

This registration statement on Form 20-F relates to the registration of WMC Resources shares under Section 12(b) of the Securities Exchange Act of 1934. WMC Resources has been admitted to the official list of the Australian Stock Exchange and its shares have been quoted on the stock market conducted by the Australian Stock Exchange. WMC Resources shares have also been approved for listing on the New York Stock Exchange in the form of American Depositary Receipts.

FORWARD LOOKING STATEMENTS

This registration statement contains forward-looking statements, including statements regarding (i) estimated reserves, (ii) certain plans, strategies and objectives of management, (iii) scheduled closure of certain operations or facilities, (iv) anticipated production or construction commencement dates, (v) expected costs or production output, (vi) the anticipated productive lives of projects and mines, (vii) the anticipated prices and market dynamics of commodities produced and (viii) the expected impact of the demerger of WMC Limited’s interests in the Alcoa World Alumina and Chemicals businesses from its other operating businesses, which are owned by WMC Resources following the demerger. Such forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond the control of WMC Resources, which may cause actual results to differ materially from those expressed in the statements contained in this registration statement.

For example, future revenues from operations, projects or mines described in this registration statement will be based in part on the market price of the minerals or metals produced, which may vary significantly from current levels. Such variations, if materially adverse, may impact the timing or feasibility of the development of a particular project or the expansion of certain facilities or mines. Other factors that may affect the actual construction or production commencement dates, costs or production output and anticipated lives of operations, mines or facilities include:

| | • | | the ability to profitably produce and transport the minerals or metals extracted to applicable markets; |

| | • | | the impact of foreign currency exchange rates on the market prices of the minerals or metals produced; |

| | • | | activities of governmental authorities in certain countries where such projects, facilities or mines are being explored or developed, including increases in taxes, changes in environmental and other regulations, and political uncertainty; and |

| | • | | the ability of WMC Resources to operate as an independent company following the demerger. |

WMC Resources can give no assurances that the estimated reserve figures, the scheduled closure of such operations or facilities, actual production or commencement dates, cost or production output, or anticipated lives of the projects, mines and facilities and its expected operating and financial performance following the demerger discussed herein will not differ materially from the statements contained in this registration statement.

The historical financial information may not be indicative of WMC Resources’ future performance and does not reflect what WMC Resources’ financial position and results of operations would have been had it operated as a separate, stand-alone entity during the periods presented.

-1-

“ADR” means an American Depositary Receipt evidencing one or more ADSs.

“ADS” means an American Depositary Share.

“ASX” means the Australian Stock Exchange.

“AWAC” means Alcoa World Alumina and Chemicals.

“Cash Flow Hedge” means a contract which hedges an exposure to changes in cash flows from an expected future transaction related to a forecast purchase or sale or an existing asset or liability.

“Commissioned” means the bringing into operation of plant and/or equipment at a rate approximating its design capacity.

“Combined” means the 100% combination of entities controlled by WMC Resources. Unincorporated joint ventures are consolidated on a proportionate basis.

“Counterparty Credit Risk” means the risk of financial loss arising out of holding a particular contract or portfolio of contracts as a result of one or more parties to the relevant contract(s) failing to fulfil its financial obligations under the contract.

“Cross-Currency Swap” means the exchange of cash flows in one currency for those in another, often requiring an exchange of principal.

“Currency Forward” means an agreement to exchange a specified amount of one currency for another at a future date at a certain rate.

“Decline” means a downwards sloping tunnel providing road access from the surface to underground mine operations.

“Demerger” means the demerger of WMC Limited’s interest in AWAC from its other operating businesses pursuant to an Australian scheme of arrangement and associated capital reduction and dividend distribution.

“Depositary” means The Bank of New York Company, Inc., 101 Barclay Street New York NY 10286.

“Derivative” means an instrument or product whose value changes with changes in one or more underlying market variables, such as equity or commodity prices, interest rates or foreign exchange rates. Basic derivatives include, forwards, futures, swaps, options, warrants and convertible bonds.

“Dilution” means the incorporation of waste rock with the ore during the mining process resulting in lower grade.

“Fair Value” means the current market value (mark-to-market) of financial positions.

“Fair Value Hedge” means a contract which hedges an exposure to the change in fair value of a recognized asset, liability or an unrecognized firm commitment (or a part thereof) attributable to a particular risk.

“Foreign Currency Hedge” means a contract which hedges the foreign exchange exposure of:

| | • | | an unrecognized firm commitment (fair value hedge); |

| | • | | an available for sale security (fair value hedge); |

-2-

| | • | | a forecast transaction (cash flow hedge); or |

| | • | | a net investment in a foreign operation |

“Grass Roots Exploration” is exploration undertaken at new sites not related to existing operations (also known as “green fields” exploration).

“Hedge” means to reduce risk by making transactions that reduce exposure to market fluctuations. A hedge is also the term for the transactions made to effect this reduction.

“Hedge Accounting” means the practice of deferring accounting recognition of gains and losses on financial market hedges until the corresponding gain or loss of the underlying exposure is recognized.

“HSRA” means the Australian/US dollar Hedge Settlement Rate quoted on Reuters Screen HSRA.

“Indenture” means the agreement between the Government of South Australia and WMC (Olympic Dam Corporation) Pty Ltd, a form of which is filed herewith as Exhibit 4.A.

“Interest Rate Swap” means an agreement to exchange net future cash flows. Interest rate swaps most commonly change the basis on which liabilities are paid on a specified principal. They are also used to transform the interest basis of assets. In its commonest form, the fixed-floating swap, one counterparty pays a fixed rate and the other pays a floating rate based on a reference rate, such as Libor. There is no exchange of principal – the interest rate payments are made on a notional amount.

“LME” means the London Metal Exchange.

“Marking-to-Market” means to calculate the value of a financial instrument (or portfolio of such instruments) based on the current market rates or prices of the underlying.

“Mineral” is a naturally occurring element or chemical compound.

“Mineralization” is a concentration of a valuable mineral or minerals.

“Nickel Matte” is the output of a nickel smelter, being predominantly nickel sulphides plus some impurities. This is typically fed to a refinery for nickel metal production. Matte can be sold as a commercial product in its own right.

“NYSE” means the New York Stock Exchange.

“Open-cut” or “Open-pit” means a mine at the earth’s surface as distinct from an underground mine.

“Option” means a contract that gives the purchaser the right, but not the obligation, to buy or sell an underlying security or instrument at a certain price (the exercise, or strike price) on or before an agreed date (the exercise period). For this right, the purchaser pays a premium to the seller. The seller (writer) of an option has a duty to buy or sell at the strike price, should the purchaser exercise his right.

“Ore” means a naturally occurring solid resource (often rock) from which a mineral or minerals can be economically extracted.

“Ore Reserve” means that part of a mineral deposit which could be economically mined and legally extracted or produced at the time of the reserve determination. Ore reserve estimates in this registration statement include adjustments for dilution and mine recovery loss during the mining process but do not include adjustments for

-3-

metallurgical recovery. These ore reserves comply with those prescribed by the United States Securities and Exchange Commission’s Industry Guide 7.

“Proven Ore Reserves” means reserves for which (a) the quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; the grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established.

“Probable Ore Reserves” means reserves for which quantity and grade and/or quality are computed from information similar to that used for proven ore reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven ore reserves, is high enough to assume continuity between points of observation.

“SCH” means a transfer of securities on the Clearing House Electronic Subregister System operated by ASX Settlement and Transfer Corporation Pty Ltd.

“Stoping” means the extraction of ore in an underground mine, leaving behind a void.

“Sulphides” means a compound of metal elements and sulphur.

“Tailings” are the residue remaining after extraction of the valuable components from ore.

“WA Mining Act 1978” refers to legislation passed by the Government of the State of Western Australia with which all mining operations in that State must comply.

“WMC Resources” means WMC Resources Ltd, the registrant. Unless indicated otherwise, references to WMC Resources prior to the effective date of the demerger are to the assets and businesses of WMC Limited that WMC Resources owned immediately upon effectiveness of the demerger.

-4-

| 1 troy ounce | | = | | 31.103 grams |

|

| 1 kilogram | | = | | 32.15 troy ounces |

|

| 1 kilogram | | = | | 2.205 pounds |

|

| 1 tonne | | = | | 1,000 kilograms |

|

| 1 tonne | | = | | 2,205 pounds |

|

| 1 gram per tonne | | = | | 0.0292 troy ounces per (short) ton |

|

| 1 kilometer | | = | | 0.6214 miles |

Gold recovered is reported in troy ounces (expressed as “ounces” in this registration statement), the customary market unit, whereas ore production and grades are quoted in metric units, that is tonnes and grams per tonne.

-5-

| | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors | | and Senior Management |

Directors

Name

| | Position

|

| Hugh M. Morgan | | Chief Executive Officer and Executive Director |

|

| Andrew G. Michelmore | | Chief Executive Officer Elect and Executive Director |

|

| Ian G.R. Burgess | | Non-Executive Chairman |

|

| Tommie C.-E. Bergman | | Non-Executive Director |

|

| Adrienne E. Clarke | | Non-Executive Director |

|

| Peter J. Knight | | Non-Executive Director |

|

| David E. Meiklejohn | | Non-Executive Director |

|

| Roger A. G. Vines | | Non-Executive Director |

|

| Ian E. Webber | | Non-Executive Director |

Senior Management

Name

| | Position

|

| Bruce R. Brook | | Executive General Manager – Finance and Chief Financial Officer |

|

| Alan K. Dundas | | Executive General Manager – Operations |

|

| Andrew G. Michelmore | | Executive General Manager – Business Strategy &

Development (and Chief Executive Officer Elect) |

|

| Greg J. Travers | | Executive General Manager – Group Services |

|

All Directors and senior management have a business address of:

WMC Resources Ltd,

Level 16,

60 City Road,

Southbank, Victoria 3006

AUSTRALIA

-6-

| | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

B. Advisers

Financial Advisers | | U.S. Legal Advisers | | Australian Legal Advisers |

|

Deutsche Bank AG Level 23 333 Collins Street Melbourne, Victoria 3000 AUSTRALIA | | Sullivan & Cromwell Level 32, 101 Collins Street Melbourne, Victoria 3000 AUSTRALIA | | Arthur Robinson & Hedderwicks Level 27, 530 Collins Street Melbourne, Victoria 3000 AUSTRALIA |

C. Auditors

PricewaterhouseCoopers

Level 14,

333 Collins Street

Melbourne, Victoria 3000

AUSTRALIA

The auditors are subject to the requirements of the Institute of Chartered Accountants in Australia.

-7-

| | OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

A. Offer Statistics

Not applicable.

B. Method and Expected Timetable

Not applicable.

-8-

A. Selected Financial Data

The selected financial data appearing below as at December 31, 2001 and 2000 and for the fiscal years ended December 31, 2001, 2000 and 1999 are set forth in Australian dollars (except as otherwise indicated), and are extracted, in relevant part, from the audited Combined Financial Statements of WMC Resources which appear elsewhere herein. The selected financial data appearing below as at June 30, 2002 and for the six month periods ended June 30, 2002 and 2001 are set forth in Australian dollars (except as otherwise indicated), and are extracted, in relevant part from the unaudited Interim Combined Financial Statements of WMC Resources which appear elsewhere herein. As discussed in Note 1 in the Combined Financial Statements and the unaudited Interim Combined Financial Statements, the financial statements herein reflect the statements of income and comprehensive income and balance sheets of WMC Resources as if it were a separate entity for all periods presented. The historical financial information may not be indicative of WMC Resources’ future performance and does not reflect what WMC Resources’ financial position and results of operations would have been had it operated as a separate, stand-alone entity during the periods presented. These Combined Financial Statements and unaudited Interim Combined Financial Statements have been prepared in accordance with accounting principles generally accepted in Australia (“Australian GAAP”), which differ in certain respects from accounting principles generally accepted in the United States of America (“US GAAP”). Note 44 to the Combined Financial Statements and Note 32 to the unaudited Interim Combined Financial Statements provides an explanation of these differences as they affect WMC Resources and reconciliations from Australian GAAP to US GAAP of net income, comprehensive income, certain balance sheet items, shareholders’ equity and cashflows. The selected financial data appearing below as at December 31, 1999, 1998, and 1997 and for the fiscal years ended December 31, 1998 and 1997 are derived from WMC Resources’ unaudited combined financial data that is not included herein.

WMC Resources’ net income under Australian GAAP was A$46.3 million for the six months ended June 30, 2002 (A$126.0 million for the year ended December 31, 2001) . Under US GAAP, WMC Resources would have reported net income of A$142.5 million for the six months ended June 30, 2002 (A$37.7 million for the year ended December 31, 2001). Comprehensive income under US GAAP for the six months ended June 30, 2002 was a profit of A$366.4 million (for the year ended December 31, 2001 a loss of A$804.7 million was reported) . WMC Resources’ unaudited Interim Combined Financial Statements and the Combined Financial Statements are prepared in accordance with Australian GAAP. The principal differences between Australian GAAP and US GAAP that affect WMC Resources’ net income and comprehensive income, as well as its shareholders’ equity, relate to the treatment of the following items:

| | (i) | | research and development costs; |

| | (ii) | | revenue from insurance proceeds; |

| | (iv) | | exploration expenditure; |

| | (vi) | | recognition of profit on real estate disposal; |

| | (vii) | | deferral of cost of option payments; and |

| | (viii) | | fair value of accounting for derivatives; |

Differences that affect the Combined Statement of Cashflows are that under US GAAP, bank overdrafts are not considered to be part of net cash equivalents, and payments for exploration and research and development would be classified as part of cashflows from operating activities, rather than investing activities.

-9-

The following selected financial data should be read in conjunction with, and is qualified in its entirety by reference to the unaudited Interim Combined Financial Statements and the Combined Financial Statements, including the Notes thereto, and comments following below.

WMC Resources’ financial year end changed from June 30 to December 31 commencing from January 1, 1999. Pursuant to the Australian Corporations Act 2001, WMC Resources had an 18-month transitional accounting period from July 1, 1997 to December 31, 1998. As a result, certain financial information presented in this registration statement reflects this 18-month transitional accounting period.

The following selected financial data should be read in conjunction with, and is qualified in its entirety by reference to those statements, including the notes thereto, and comments following below.

SELECTED FINANCIAL DATA UNDER AUSTRALIAN GAAP

| | | Six Months Ended June 30, 2002

| | Six Months Ended June 30, 2001

| | Year Ended December 31, 2001

| | | Year Ended December 31, 2000

| | Year Ended December 31, 1999

| | | Year Ended December 31, 1998

| | | Six Months Ended December 31, 1997

| | | Year Ended June 30, 1997

| |

| | | (A$ million, except where indicated) | |

| Net Sales Revenue (from Continuing Operations) | | 1,196.3 | | 1,339.1 | | 2,364.1 | | | 2,666.0 | | 1,672.7 | | | 1,315.1 | | | 758.0 | | | 1,688.0 | |

|

| Income / (Loss) from Continuing Operations: | | 12.1 | | 41.5 | | (157.5 | ) | | 327.2 | | (5.7 | ) | | (215.9 | ) | | (35.8 | ) | | (80.7 | ) |

|

| Net Income / (Loss) | | 46.3 | | 116.1 | | 126.0 | | | 399.9 | | 84.1 | | | (48.5 | ) | | 3.7 | | | 110.8 | |

| Comprehensive Income/ (Loss) | | 84.0 | | 91.5 | | 111.9 | | | 380.7 | | 79.8 | | | (86.9 | ) | | 62.9 | | | 134.8 | |

|

Pro forma Net Income / (Loss) from Continuing Operations per Ordinary Share (A$/share) (1) | | 0.01 | | 0.04 | | (0.14 | ) | | 0.29 | | (0.01 | ) | | (0.19 | ) | | (0.03 | ) | | (0.07 | ) |

|

Pro forma Diluted Net Income / (Loss) from Continuing Operations per Ordinary Share (A$/share) (2) | | 0.01 | | 0.04 | | (0.14 | ) | | 0.29 | | (0.01 | ) | | (0.19 | ) | | (0.03 | ) | | (0.06 | ) |

| | | At June 30, 2002

| | At December 31, 2001

| | At December 31, 2000

| | At December 31, 1999

| | At December 31, 1998

| | At December 31, 1997

| | At June 30, 1997

|

| | | (A$ million, except where indicated) |

| Total assets | | 7,461.8 | | 8,242.9 | | 8,597.0 | | 7,275.8 | | 7,374.3 | | 6,008.7 | | 5,257.5 |

| Long-term obligations | | 3,087.8 | | 3,476.3 | | 4,304.2 | | 3,053.1 | | 3,592.6 | | 2,275.6 | | 2,095.4 |

| Net assets | | 3,358.6 | | 3,220.3 | | 3,123.8 | | 3,214.3 | | 3,010.8 | | 2,542.8 | | 2,563.3 |

| | |

| |

| |

| |

| |

| |

| |

|

| Shareholders’ equity | | 3,358.6 | | 3,220.3 | | 3,123.8 | | 3,214.3 | | 3,010.8 | | 2,542.8 | | 2,563.3 |

| | |

| |

| |

| |

| |

| |

| |

|

| | | Millions of shares |

| Number of shares | | 1,112.4 | | 1,108.8 | | 1,098.0 | | 1,149.9 | | 1,143.0 | | 1,139.0 | | 1,132.7 |

| | |

| |

| |

| |

| |

| |

| |

|

(1) | | The number of WMC Resources’ shares used in the pro forma basic net income per share calculation was determined on the basis of the weighted average number of outstanding WMC Limited shares for the periods indicated as in the demerger each WMC Limited shareholder received one share in WMC Resources for each share in WMC Limited it held. Refer also to Note 6 to the unaudited Interim Combined Financial Statements and Notes 1(m) and 6 to the Combined Financial Statements. |

(2) | | The number of WMC Resources’ shares used in the pro forma diluted net income per share calculation was determined on the basis of the weighted average of the number of outstanding WMC Limited shares for the periods indicated, including potential shares from the conversion of partly paid shares and options into shares of WMC Limited. Refer also to Note 6 to the unaudited Interim Combined Financial Statements and Notes 1(m) and 6 to the Combined Financial Statements. |

-10-

SELECTED FINANCIAL DATA UNDER US GAAP

| | | Six Months Ended June 30, 2002

| | Six Months Ended June 30, 2001

| | | Year Ended December 31, 2001

| | | Year Ended December 31, 2000

| | Year Ended December 31, 1999

| | | Year Ended December 31, 1998

| | | Six Months Ended December 31, 1997

| | | Year Ended June 30, 1997

| |

| | | (A$ million, except where indicated) | |

| Net Sales Revenue | | 1,196.3 | | 1,339.1 | | | 2,364.1 | | | 2,666.0 | | 1,672.7 | | | 1,315.1 | | | 758.0 | | | 1,688.0 | |

| Income / (Loss) from Continuing Operations: | | 99.3 | | (75.4 | ) | | (231.5 | ) | | 241.6 | | (22.2 | ) | | (220.8 | ) | | (42.7 | ) | | (99.5 | ) |

| Net Income / (Loss) | | 142.5 | | (0.8 | ) | | 37.7 | | | 307.6 | | 52.1 | | | (60.1 | ) | | (7.3 | ) | | 91.9 | |

| Comprehensive Income/ (Loss) | | 366.4 | | (899.1 | ) | | (804.7 | ) | | 288.4 | | 2.1 | | | (98.5 | ) | | 51.9 | | | 115.9 | |

Pro forma Net Income / (Loss) from Continuing Operations per Ordinary Share (A$/share) ) (1)(2) | | 0.09 | | (0.07 | ) | | (0.21 | ) | | 0.21 | | (0.02 | ) | | (0.19 | ) | | (0.04 | ) | | (0.09 | ) |

Pro forma Diluted Net Income / (Loss) from Continuing Operations per Ordinary Share (A$/share) (3) | | 0.09 | | (0.07 | ) | | (0.21 | ) | | 0.21 | | (0.02 | ) | | (0.19 | ) | | (0.04 | ) | | (0.09 | ) |

| | | At June 30, 2002

| | At December 31, 2001

| | At December 31, 2000

| | At December 31, 1999

| | At December 31, 1998

| | At December 31, 1997

| | At June 30, 1997

|

| | | (A$ million, except where indicated) |

| Total assets | | 6,438.3 | | 6,691.4 | | 8,368.2 | | 7,146.7 | | 7,296.6 | | 5,936.5 | | 5,189.1 |

| Long-term obligations | | 3,087.8 | | 3,476.3 | | 4,304.2 | | 3,053.1 | | 3,592.6 | | 2,275.6 | | 2,095.4 |

| Net assets | | 2,489.1 | | 2,068.8 | | 2,888.9 | | 3,071.7 | | 2,893.7 | | 2,437.4 | | 2,469.1 |

| | |

| |

| |

| |

| |

| |

| |

|

| Shareholders’ equity | | 2,489.1 | | 2,068.8 | | 2,888.9 | | 3,071.7 | | 2,893.7 | | 2,437.4 | | 2,469.1 |

| | |

| |

| |

| |

| |

| |

| |

|

| | | Millions of shares |

| Number of Shares | | 1,112.4 | | 1,108.8 | | 1,098.0 | | 1,149.9 | | 1,143.0 | | 1,139.0 | | 1,132.7 |

| | |

| |

| |

| |

| |

| |

| |

|

(1) | | The number of WMC Resources’ shares used in the pro forma basic net income per share calculation was determined on the basis of the weighted average number of outstanding WMC Limited shares for the periods indicated as in the demerger each WMC Limited shareholder received one share in WMC Resources for each share in WMC Limited it held. Refer also to Note 6 to the unaudited Interim Combined Financial Statements and Notes 1(m) and 6 to the Combined Financial Statements. |

(2) | | In 1999, net loss per share was A$0.04 before the cumulative effect of an accounting change in policy for start-up costs. Refer to Note 44(e) to the Combined Financial Statements. |

(3) | | The number of WMC Resources’ shares used in the pro forma diluted net income per share calculation was determined on the basis of the weighted average number of outstanding WMC Limited shares for the periods indicated, including potential shares from the conversion of partly paid shares and options into shares of WMC Limited. Refer also to Note 6 to the unaudited Interim Combined Financial Statements and Notes 1(m) and 6 to the Combined Financial Statements. |

Exchange Rates

WMC Resources’ has published its combined financial statements in Australian dollars (“A$” or “$”). In this registration statement, references to “US$” are to United States dollars.

-11-

The following table sets forth, for the periods and dates indicated, certain information concerning the rates of exchange of A$1.00 into US$ based on the noon buying rate in New York City for cable transfers in Australian dollars as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”).

Period

| | At Period End

| | Average Rate(1)

| | High

| | Low

|

| | | (all figures in US$ per A$1.00) |

| Year Ended December 31, 1997 | | 0.6515 | | 0.7385 | | 0.7978 | | 0.6490 |

| Year Ended December 31, 1998 | | 0.6123 | | 0.6300 | | 0.6868 | | 0.5586 |

| Year Ended December 31, 1999 | | 0.6539 | | 0.6444 | | 0.6719 | | 0.6123 |

| Year Ended December 31, 2000 | | 0.5560 | | 0.5757 | | 0.6687 | | 0.5112 |

| Year Ended December 31, 2001 | | 0.5117 | | 0.5129 | | 0.5714 | | 0.4812 |

| Six Months Ended June 30, 2002 | | 0.5628 | | 0.5372 | | 0.5748 | | 0.5060 |

|

| May 2002 | | | | | | 0.5660 | | 0.5365 |

| June 2002 | | | | | | 0.5748 | | 0.5583 |

| July 2002 | | | | | | 0.5688 | | 0.5445 |

| August 2002 | | | | | | 0.5396 | | 0.5280 |

| September 2002 | | | | | | 0.5518 | | 0.5419 |

| October 2002 | | | | | | 0.5585 | | 0.5422 |

(1) | | The average of the exchange rates on the last day of each month during the financial period. |

On November 27, 2002, the Noon Buying Rate was A$1.00 = US$0.5563

-12-

B. Capitalization and Indebtedness

The following tables set out the capitalization of WMC Resources at June 30, 2002, in accordance with US GAAP and Australian GAAP. These capitalization tables show the pro forma effect of the demerger which includes the internal reorganization and court-approved scheme of arrangement through a capital reduction and dividend distribution as if the demerger had occurred on June 30, 2002. As part of the scheme of arrangement, WMC Resources acquired from WMC Limited the shares it holds in the legal entities controlling Queensland Fertilizer Operation and the Olympic Dam mining operations in return for the issue of WMC Resources Ltd shares. Under Australian GAAP, the transfers were accounted for at fair value. Under US GAAP, the transfers will be accounted for at book value. The pro forma adjustments are based upon currently available information and estimates and assumptions. Actual adjustments may differ from the pro forma adjustments shown.

| | | At June 30, 2002

| | At June 30, 2002

| | | At June 30, 2002

|

| | | Actual

| | Adjustment

| | | Pro forma

|

| | | (in A$ millions unaudited) |

Amounts in Accordance with Australian GAAP | | | | | | | |

|

| Short-term debt | | 467.6 | | (267.6 | ) | | 200.0 |

|

| Long-term debt (unsecured) | | 1,633.4 | | (134.2 | ) | | 1,499.2 |

|

Shareholders’ funds(1) | | 3,358.6 | | 165.0 | | | 3,523.6 |

| | |

| |

|

| |

|

|

Total Capitalization (2) | | 5,459.6 | | (236.8 | ) | | 5,222.8 |

| | |

| |

|

| |

|

| | | At June 30, 2002

| | At June 30, 2002

| | | At June 30, 2002

|

| | | Actual

| | Adjustment

| | | Pro forma

|

| | | (in A$ millions unaudited) |

Amounts in Accordance with US GAAP | | | | | | | |

|

| Short-term debt | | 467.6 | | (267.6 | ) | | 200.0 |

|

| Long-term debt (unsecured) | | 1,633.4 | | (134.2 | ) | | 1,499.2 |

|

Shareholders’ equity(1) | | 2,492.0 | | 254.8 | | | 2,746.8 |

| | |

| |

|

| |

|

|

Total Capitalization (2) | | 4,593.0 | | (147.0 | ) | | 4,446.0 |

| | |

| |

|

| |

|

(1) | | Upon demerger this balance will be credited to the share capital account. |

(2) | | Does not include ascertainable, unsecured contingent liabilities of A$51.1 million represented by guarantees, insurance bonds and other liabilities including performance bonds for minimum work commitments in exploration blocks. |

For a discussion of the principal differences between Australian GAAP and US GAAP, and reconciliation to US GAAP net income and shareholders’ equity, see Note 44 to the “Combined Financial Statements of WMC Resources for

-13-

the Fiscal Years Ended December 31, 2001, 2000, and 1999” and Note 32 in the “Combined Financial Statements of WMC Resources for the six month periods ended June 30, 2002 and 2001” included in this registration statement.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

This section describes some of the risks that could affect WMC Resources’ businesses. The factors below should be considered in connection with any forward-looking statements in this registration statement and the cautionary statements on page 1. The risks below are not the only ones WMC Resources faces – some risks may not be known to WMC Resources, and some that are not currently believed to be material could later turn out to be material. One or more or a combination of these risks could materially impact WMC Resources’ businesses, its revenues, operating income, net income, net assets, liquidity and capital resources.

Risks relating to the demerger of WMC Resources from WMC Limited

WMC Resources’ share price performance cannot be predicted and may be more volatile than WMC Limited’s before the demerger.

No public market existed for WMC Resources shares prior to the demerger, and therefore there can be no assurance as to the performance of shares in WMC Resources or that a liquid market will develop for its shares following the demerger. The share prices of WMC Resources will be influenced by a number of factors, some of which may have a negative impact on the share prices. It is possible that the combined market values of WMC Limited and WMC Resources after the demerger will be lower than the market value of WMC Limited prior to the demerger. The market prices of shares in WMC Resources may be volatile following its listing on the ASX.

WMC Resources will have less earnings diversification than WMC Limited had prior to the demerger.

Before the demerger, the earnings of WMC Limited were diversified across the different markets in which it operated. Following the demerger, WMC Resources as a separate company will be exposed only to its respective markets, without the diversification provided by exposure to the markets of the remainder of WMC Limited. The reduced diversification of earnings of WMC Resources means that its earnings volatility, as a stand alone company following the demerger, may be greater than that of WMC Limited before the demerger.

WMC Resources will have less ability to pay and frank dividends than WMC Limited had prior to the demerger.

Prior to the demerger, a high percentage of WMC Limited’s dividends were funded by cashflows from AWAC. Following the demerger, WMC Resources will not have the benefit of those AWAC cashflows which is expected to have a negative impact on its ability to pay dividends to its shareholders. As a consequence, dividend distributions declared by the WMC Resources Board may for some time be relatively modest.

In addition, WMC Resources is not expected to generate sufficient franking credits in the short to medium term to pay fully franked dividends to its shareholders, as it is anticipated that the profits of WMC Resources will largely be sheltered by existing carried-forward tax losses. Franked dividends are those paid out of profits which have borne Australian corporate tax (i.e. to which franking credits have been allocated) while unfranked dividends are paid out of untaxed profits. Generally, franking credits are generated by income tax paid, or franked dividends received, by the company. Shareholders who receive franked dividends are generally entitled to some form of relief from Australian tax in respect of those dividends. Broadly, dividends paid to non Australian resident shareholders will be exempt from Australian dividend withholding tax to the extent the dividends are franked and dividends paid to Australian resident shareholders would entitle those shareholders to an Australian tax offset (and therefore affect the degree to which the dividends are subject to Australian tax) to the extent the dividends are franked. For further information regarding franking credits and

-14-

franked dividends, see Item 10.E “Additional Information – Taxation – Commonwealth of Australia Taxation” at pages 133 to 134.

WMC Resources’ credit rating and access to debt markets are affected by it no longer having access to cash flows from AWAC following the demerger.

WMC Limited currently has a Standard & Poor’s long term credit rating of A (negative watch) and a short term credit rating of A-1. Moody’s Investors Service’s has a long term credit rating for WMC Limited of A3 (negative watch) and its short term credit rating of P-2. The credit ratings used by Standard and Poor’s and Moody’s in Australia are based on the same scale as used in the U.S.

WMC Limited’s cash flows from its interest in AWAC has been taken into account by ratings agencies in assessing WMC Limited’s creditworthiness. It has also been a factor considered by financiers in agreeing to lend funds to WMC Limited for its non-AWAC related projects, which historically have principally been debt funded.

After considering the impact of the demerger on the financial profile of WMC Resources, Standard & Poor’s has indicated that it is likely that WMC Resources will be assigned a long-term credit rating of BBB (stable) and a short-term credit rating of A2 post the demerger. Moody’s has stated that it is likely that WMC Resources will be assigned a long-term credit rating of Baa2 and a short term credit rating of P-2 following the demerger. Both agencies have indicated they expect to assign a credit rating to WMC Resources lower than WMC Limited’s credit rating because WMC Resources will no longer have the benefit of income provided by the AWAC assets or the same diversity of income streams that WMC Limited had.

WMC Resources could be exposed to the risk of reduced access to debt and capital markets if its credit rating were downgraded in the future, to a level below investment grade, or if the debt markets became more restrictive in the terms and conditions available to BBB rated borrowers. In addition, following the demerger, WMC Resources will be reliant on its own cash flows and financing capabilities based on its stand-alone financial position to fund new projects and any such financing may not be on terms WMC Resources considers favourable.

Risks relating to WMC Resources’ business

A reduction in commodity prices could materially reduce WMC Resources’ revenues and profits.

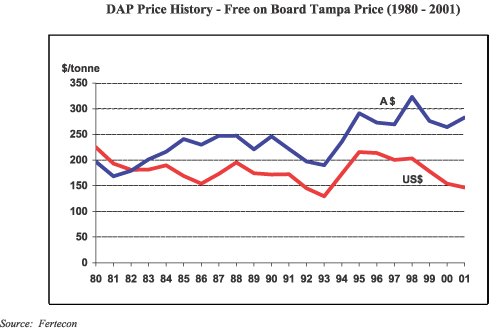

WMC Resources’ revenue is derived from sales of nickel, copper, uranium, gold and fertilizers. The prices obtained for WMC Resources’ products are determined by, or linked to, prices in the world markets which have historically been subject to substantial fluctuations arising from changes in supply and demand and the speculative activities of various market participants. This will have a consequent effect on the prices and revenues received by WMC Resources for its products, including under supply contracts the pricing terms of which track market prices, and its profitability. The general trend in commodity prices has been characterized by an increase from 1999 through the end of 2000, followed by a decline over the course of 2001 into 2002. For further information about historical commodity price movements in the commodities WMC Resources produces, refer to pages 46 (nickel), 52 (copper), 53 (uranium oxide) and 58 (DAP). WMC Resources expects that commodity prices may not rise until economic activity in the markets it serves starts to increase significantly. The general volatility in commodity prices makes it difficult for WMC Resources to predict the extent and duration of any decline or increase in the cyclical commodity prices relating to its products. WMC Resources expects that volatility in prices and in demand for most of its products will continue for the foreseeable future. WMC Resources may enter into hedging transactions with respect to nickel, gold, copper and fertilizer with a view to reducing the potentially adverse effects of commodity price fluctuations. Since 2000, any new hedging activity has been limited to securing acceptable rates of return for new projects. For a statement of current hedging, and movements in the selling price of nickel, gold, fertilizer and copper over the last five years, see Item 11 “Quantitative and Qualitative Disclosure about Market Risk”.

-15-

Fluctuations in foreign exchange could adversely affect WMC Resources’ revenues and profits.

Products exported from Australia by WMC Resources are predominantly sold in US$. In the year ended December 31, 2001, 90% of WMC Resources’ sales revenue was denominated in or linked to US$. However, WMC Resources’ dividend payments and the majority of WMC Resources’ operating costs are denominated in A$. Therefore, in the absence of other changes, if the A$ strengthens in value relative to the value of the US$, WMC Resources’ financial results will be adversely affected. Conversely, a weakening of the A$ relative to the US$ will tend to have a favorable effect on WMC Resources’ financial results. In addition, some of WMC Resources’ liabilities and assets are denominated in US$, particularly much of its borrowings and the majority of the receivables. As at June 30, 2002, WMC Resources had US$818.6 million of debt denominated in US$ and US$ receivables of US$103.5 million. Thus movements in the A$/US$ exchange rate will also affect WMC Resources’ net asset value.

Fluctuations in the A$/US$ exchange rate will also affect the US$ equivalent of the A$ price of WMC Resources’ ordinary shares on the ASX and, as a result, are likely to affect the market price of WMC Resources’ ADSs in the United States. Such fluctuations would also affect the US$ amounts received by holders of ADSs on conversion of cash dividends paid in A$ on the ordinary shares underlying the ADSs. WMC Resources has from time to time sought to hedge its foreign currency exchange position. See Item 11 “Quantitative and Qualitative Disclosure about Market Risk”.

WMC Resources may have fewer ore reserves than our estimates indicate.

WMC Resources’ reserves estimations may change substantially if new information subsequently becomes available. Fluctuations in the price of commodities, variation in production costs or different recovery rates may ultimately result in WMC Resources’ estimated reserves being revised. If such a revision were to indicate a substantial reduction in proven or probable reserves at one or more of its major projects, it could negatively affect WMC Resources’ financial condition and prospects.

An increase in production costs could reduce WMC Resources’ profitability.

Changes in WMC Resources’ costs have a major impact on its profitability. WMC Resources’ main costs are: salaries and wages, energy, transport, materials and amortization and depreciation of property, plant and equipment. In addition, industrial disruptions, work stoppages, refurbishments, installation of new plants, accidents or bad weather at WMC Resources’ operations can result in production losses and delays in delivery of products, which may adversely affect profitability. Some costs are also affected by government imposts and regulations. WMC Resources’ costs depend upon the efficient design and construction of mining and processing facilities and competent operation of those facilities. Changes in costs of mining and processing operations can occur as a result of unforeseen events or changes in reserve estimates.

WMC Resources’ ability to sustain or increase its current level of production in the medium to long term is partly dependent on the development of new projects and expansion of existing operations

WMC Resources’ ability to sustain or increase its current level of production, and therefore its potential revenues and profits, in the medium to long term is partly dependent on the development of new projects and on the expansion of existing operations. Planned development or expansion projects may not result in the entire planned additional production. The economics of any project is based upon, among other factors, estimates of non-reserve mineralization and reserves, recovery rates, production rates, capital and operating costs of these development projects and future commodity prices. The uncertainty and volatility of some or all of these factors contributes to the risks associated with project development and expansion activities. See Item 4 “Information about the Company - Capitalization Expenditure” at page 34.

WMC Resources is exposed to regulatory, legislative and judicial action.

WMC Resources’ operations in each of the jurisdictions in which WMC Resources conducts operations could be affected by government actions, such as controls on imports, exports and prices, variations in taxation laws (including royalties), government directions, guidelines and regulations, particularly in relation to the environment and mine operations, legislation, indigenous people’s rights and court decisions, particularly those that impact on land access and

-16-

freedom to conduct mining operations. Any such government action or court decisions may require increased capital or operating expenditures or both, or could prevent or delay the development of certain operations by WMC Resources. A number of WMC Resources’ exploration and potential projects and activities are in developing countries where these political risk factors may be more acute than in developed countries.

Of particular relevance to the operations of WMC Resources in Australia is the impact of pending judicial decisions and potential legislative action concerning the effect of native title in land held under mining or other leases or waters used in WMC Resources’ operations. This is discussed in detail in Item 8A “Legal Proceedings” at page 116 to 117. WMC Resources is also subject to the requirements of Australian mining law and the conditions of leases granted to it by state or territorial governments. See “Information on the Company – Australian Mining Law and Leases” at pages 60 to 63. Finally, WMC Resources must comply with extensive environmental regulation in Australia and the other countries where it has operations, see Item 4 “Information on the Company – Environmental Matters” at page 60.

Service of process, enforcement of judgments and bringing of original actions in the United States may be more difficult

Since WMC Resources and its officers and directors reside outside the United States and a substantial portion of their assets is located outside the United States, there is a risk that service of process, enforcement of judgments and bringing of original actions will be more difficult.

-17-

| | INFORMATION ON THE COMPANY |

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of WMC Resources

Background

WMC Resources was incorporated under the laws of the Commonwealth of Australia on March 2, 1933. From 1978 until the demerger, WMC Resources had been operating as a wholly owned subsidiary of WMC Limited, holding principally the group’s nickel assets. Through the transactions to effect the demerger of WMC Limited’s interest in the Alcoa World Alumina and Chemicals (“AWAC”) joint venture with Alcoa, from WMC Limited’s other businesses in conjunction with the demerger approved by WMC Limited’s shareholders on November 29, 2002 and the Australian court on December 2, 2002, WMC Resources will be an independent diversified resources company. WMC Resources’ main businesses consist of the discovery, development, production, processing and marketing of minerals and metals. WMC Resources produces nickel, copper, phosphate fertilizers, uranium oxide, gold and a range of other intermediate products. As at June 30, 2002, WMC Resources had total combined assets of A$7.5 billion. WMC Resources generated net sales revenue from operations of A$1.2 billion in the six months ended June 30, 2002.

WMC Resources has its registered office and principal executive offices at Level 16, 60 City Road, Southbank, Victoria, 3006, Australia. Its telephone number is +61 3 9685 6000 and its facsimile number is +61 3 9685 3569.

The demerger

On November 21, 2001, WMC Limited announced a proposal to demerge its interests in AWAC from its other mineral businesses. The demerger has been effected through an Australian court-approved scheme of arrangement and associated capital reduction and dividend distribution. As a result of the demerger, WMC Limited has continued to hold its interest in AWAC (but changed its name to Alumina Limited) and WMC Resources holds the nickel, copper/uranium and fertilizer businesses and exploration and development interests previously held within the WMC Limited group.

Immediately prior to effecting the demerger, through a series of share sale transactions internal to the WMC Limited group, WMC Resources acquired those of WMC Limited’s subsidiaries which held its copper/uranium and fertilizer businesses and exploration and development interests (other than those relating to AWAC), together with those subsidiaries which provide administrative or financial support to, or otherwise relate to activities conducted by, the WMC Resources group. The subsidiaries shares were transferred to WMC Resources in return for newly issued shares in WMC Resources and, for accounting purposes, at their fair value which was determined by using discounted cash flows in accordance with Australian GAAP. (Under Australian GAAP, fair value is defined as the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction. However, in circumstances such as these where the transaction does not take place in an active market, fair value can be determined using alternative estimation techniques such as discounted cash flows.)

The demerger was effected in two simultaneous stages. First, WMC Limited reduced its share capital by a notional cash amount of A$2.78 per share and declared a notional cash dividend of A$0.73 per share. Second, under the scheme of arrangement effected by an order of the Court and binding on all WMC Limited shareholders and WMC Limited, WMC Limited shareholders agreed to purchase all of the shares in WMC Resources utilizing as consideration their capital reduction and dividend entitlements from WMC Limited. WMC Limited shareholders received WMC Resources shares on a pro-rata basis.

The amount of the capital reduction and dividend together represents what WMC Limited’s carrying value in WMC Resources would have been had the internal transfers and other pre-demerger capital transactions occurred on June 30, 2002. This pro forma carrying value amounted to A$3,908 million.

-18-

| | INFORMATION ON THE COMPANY |

To be effected, the demerger required the approval of a majority in number of WMC Limited shareholders present and voting, and holding at least 75% of the total number of WMC Limited shares voted, at the shareholders’ meeting held to consider the demerger. The implementation of the demerger was subject to the approval of the Australian court considering the scheme of arrangement. The approval of the ASX was also required in order to admit WMC Resources to the official list of the ASX.

Following the demerger, WMC Limited has continued to be an operating company with its primary assets comprising the interests in the AWAC joint venture with Alcoa, Inc. that it previously owned. AWAC has interests in bauxite mining, alumina refining, alumina chemicals and two operating aluminium smelters. Coincident with the demerger, WMC Limited changed its name to “Alumina Limited” and has continued its listings on the ASX and the NYSE. As a result, following the demerger, Alumina Limited has continued to be a reporting company under the Securities Exchange Act of 1934.

Rationale for the demerger

Over the two years leading up to October 2001, there was an unprecedented level of consolidation within the global metals and mining industry. In the context of that consolidation, a number of parties made approaches to WMC Limited seeking to discuss the possibility of a merger with WMC Limited or alternative transactions regarding WMC Limited and its businesses. In considering options for WMC Limited’s future, the WMC Limited Board has always been concerned to ensure that WMC Limited Shareholders derive full value from WMC Limited’s assets. In this regard, the WMC Limited Board formed the view that the stock market had not fully valued WMC Limited’s asset portfolio, and that this under-valuation had been partly attributable to the lack of recognition of WMC Limited’s 40% interest in AWAC. Accordingly, one initiative considered by the WMC Limited Board was to separate its interest in AWAC from its other operating businesses. WMC Limited received legal, taxation, accounting and financial advice regarding such a separation over a period commencing prior to October 2001.

In October 2001, Alcoa made a confidential approach to the WMC Limited Board with a conditional proposal to acquire all the outstanding ordinary shares in WMC Limited at a price of A$10.20 per share. A key condition of the proposal was that it be recommended by the WMC Limited Board to the WMC Limited shareholders at that price. The WMC Limited Board carefully evaluated this proposal and obtained independent valuation reports from Grant Samuel & Associates and JP Morgan. Grant Samuel’s report concluded that the value of WMC Limited to a potential acquirer lay in the range of A$11.18 to A$12.91 per share (based on the assumptions made at that time).

At that time, having regard to these valuations and to the considerable interest in the assets of WMC Limited expressed by other major mining companies, the WMC Limited Board determined that, if an offer of A$10.20 per WMC Limited share was to have been made, it would not have been fair and reasonable, particularly since it was substantially below the range determined by its independent experts. For these reasons, the WMC Limited Board could not recommend Alcoa’s proposal. Alcoa remained free to make an offer directly to WMC Shareholders, but chose not to.

The WMC Limited Board was particularly mindful that Alcoa’s primary interest in WMC Limited was WMC Limited’s 40% interest in AWAC. It was anticipated that, if Alcoa acquired WMC Limited, it would most probably seek to on-sell the assets other than WMC Limited’s interest in AWAC, and accordingly any offer it made for WMC Limited as a whole would likely be at less than full value, in order to compensate for any risks associated with holding and divesting these assets. Furthermore, uncertainties existed under the terms of the agreements governing the AWAC joint venture as to whether an acquiror of WMC Limited would be required to contribute its own alumina assets to the AWAC joint venture. These agreements also contain pre-emptive rights with respect to a proposed sale of a party’s interest in AWAC. As a result of these uncertainties, the WMC Limited Board was concerned that there would be insufficient competition from other potentially interested parties if Alcoa were to bid for WMC Limited, potentially resulting in WMC Limited shareholders receiving a price less than full value.

-19-

| | INFORMATION ON THE COMPANY |

The WMC Limited Board was also aware that following Alcoa’s merger with Reynolds Metals Company, international competition authorities had required the sale of Reynolds’ alumina assets and Alcoa’s controlling interest in the AWAC entities had been taken into account by the European competition authority in reaching its decision. The WMC Limited Board believed that these decisions:

| | • | | were likely to have the effect of restricting Alcoa’s ability to acquire any further substantial alumina assets other than WMC Limited’s 40% interest in AWAC; and |

| | • | | were instrumental in Alcoa making its proposal to WMC Limited. |

Therefore, without a significant change in the relevant competition authorities’ view on Alcoa’s ability to acquire third party owned alumina assets, the WMC Limited Board believed that Alcoa would remain interested in acquiring WMC Limited’s 40% share of AWAC.

As a result, the WMC Limited Board recognized that, for WMC Limited to pursue its non-AWAC related activities (including pursuing business opportunities requiring an issue of equity, such as acquisitions or expansions), without concern for what Alcoa may do, it had to separate its interest in AWAC from its non-AWAC businesses and interests.

While the WMC Limited Board considered a number of alternatives to the demerger, the WMC Limited Board determined that, of all the available alternatives, the demerger would be in the best interests of WMC Limited’s shareholders. The WMC Limited Board actively considered other forms of restructuring before announcing the demerger proposal in November 2001. The alternatives the WMC Limited Board considered included:

| | • | | selling WMC Limited’s interest in AWAC to Alcoa or another party; |

| | • | | selling WMC Limited’s nickel, copper-uranium and fertilizer operations as a group or separately; |

| | • | | merging with or being acquired by another party; and |

| | • | | continuing to operate WMC Limited in its current form. |

In order to assess the prospects of each of these alternatives, in October 2001 WMC Limited invited selected major resource companies to undertake due diligence with a view to providing an indication of their interest in WMC Limited’s operations. Following this due diligence process, which was subject to appropriate confidentiality arrangements, and subsequent discussions between WMC Limited and the parties involved, the WMC Limited Board concluded that implementing the demerger proposal was the best way to maximise value for WMC Limited’s shareholders in the medium to long-term.

In reaching its decision to put the demerger proposal to WMC Limited’ shareholders, the WMC Limited Board considered the following material factors in relation to each alternative:

Selling WMC Limited’s interest in AWAC

The assets of the AWAC joint venture are world class and WMC Limited’s share of AWAC has attracted substantial interest from other parties. However, the AWAC agreements provide that each party has a pre-emptive right in the event the other were to sell its interest in AWAC and, although there is no pre-emptive right triggered by a change of control of WMC Limited, or by the demerger proposal, the AWAC Agreements require the AWAC enterprise to be the

-20-

| | INFORMATION ON THE COMPANY |

exclusive vehicle for the bauxite, alumina and industrial chemicals businesses of both WMC Limited and Alcoa. This latter provision may also have affected an acquirer of either WMC Limited or Alcoa.

Although these provisions of the AWAC Agreements are subject to conflicting interpretations, the provisions, and the resulting anti-trust issues that could arise, represented impediments to the sale of WMC Limited’s interest in AWAC to any interested parties which then held significant alumina assets. In these circumstances, the WMC Limited Board believed it would be difficult to conduct a competitive sale process for WMC Limited’s interest in AWAC or achieve a fair price through a sale to Alcoa.

Further, there would be difficulties in distributing the cash proceeds of the sale to WMC Limited’s shareholders in an efficient and timely manner, and the sale of WMC Limited’s share of AWAC to Alcoa or another party could potentially be subject to adverse income tax and stamp duty consequences. Accordingly, the WMC Limited Board believed that this alternative would be unlikely to maximise value for WMC Limited shareholders.

Selling WMC Limited’s nickel, copper-uranium and fertilizer operations

There was strong interest from third parties in WMC Limited’s nickel, copper-uranium and fertilizer operations which has been evidenced by indications of interest made to WMC Limited since the announcement of the demerger proposal on November 21, 2001. The WMC Limited Board believed that the sale of these operations (together or separately) by means of a formal tender process represented a viable alternative to the demerger proposal. However, there was no certainty that this strategy would maximise shareholder value in a medium to long-term context because:

| | • | | selling all of the individual assets may have taken some considerable time and there was a risk that an acceptable price may not be achieved for one or other of the assets; |

| | • | | as part of the WMC Limited ownership structure, WMC Limited in selling the assets could only contemplate cash consideration, not scrip consideration, and this would limit the universe of viable buyers; and |

| | • | | the significant transaction costs which could be incurred in the sales of the individual assets could reduce any value derived from an overall asset sale. |

Further, there would be difficulties in distributing the cash proceeds of the sale to WMC Limited’s shareholders in an efficient and timely manner, and the sale of WMC Limited’s non-AWAC businesses (together or separately) could potentially be subject to adverse income tax and stamp duty consequences.

WMC Limited merging with or being acquired by another party

While there has been a high level of interest in all of WMC Limited’s operations, as discussed above, the structure of WMC Limited was a significant impediment to the ability and motivation of interested parties to make an offer to merge with or acquire the company. In particular, the uncertainties which existed under the terms of the AWAC Agreements as to whether an acquirer of WMC Limited would be required to contribute its own alumina assets to the AWAC joint venture, could act as a deterrent to potential acquirers, as could the pre-emptive rights in the AWAC Agreements. The WMC Limited Board believed it was likely that, for these and other reasons set out above in relation to the sale of WMC Limited’s interest in AWAC, the only party likely to make such an offer for WMC Limited in its current form is Alcoa and that, accordingly, if such an offer were to be made by Alcoa, there would probably not be sufficient competition to maximise value for WMC Limited shareholders.

-21-

| | INFORMATION ON THE COMPANY |

| |

|

Continuing to operate WMC Limited in its then-current form

WMC Limited has had a long and distinguished history as one of Australia’s premier resource companies, and, in different circumstances, the WMC Limited Board would have chosen to continue to operate the company in accordance with its established long-term strategy of growth by exploration, brownfield expansion and acquisition.

However, for the reasons discussed above, the WMC Limited Board concluded that the best interests of WMC Limited shareholders would not be served by continuing to operate WMC Limited in its then-current form.

Summaries of the Valuation Reports and Independent Expert’s Reports

Grant Samuel & Associates Pty Limited

Grant Samuel & Associates Pty Limited was retained by WMC Limited to provide independent valuation advice to the board of Directors of WMC Limited following the approach from Alcoa in October 2001. Grant Samuel was asked to provide an estimate of the full underlying value of WMC Limited at that time. The WMC Limited board subsequently requested Grant Samuel to prepare an independent expert’s report stating whether the demerger is in the best interests of WMC Limited’s shareholders and optionholders and the reasons for that opinion. Grant Samuel received compensation of approximately A$1,040,000 for the valuation report engagement and approximately A$300,000 for the independent expert’s reports on the fairness of the demerger.

Grant Samuel is an Australian-based corporate advisory firm providing services in relation to mergers and acquisitions, capital raisings, corporate restructuring, property and financial matters generally. One of Grant Samuel’s activities is the preparation of corporate and business valuations and the provision of independent advice and expert’s reports in connection with takeovers and capital reconstructions. Grant Samuel has acted as an independent expert in relation to a number of significant transactions in the Australian market. WMC Limited selected Grant Samuel primarily due to its strong reputation and high level of recognition as an independent expert in the Australian investment community.

Fairness of the Demerger

The following is a summary of Grant Samuel’s report regarding the fairness of the demerger to WMC Limited’s shareholders. The summary is qualified by the report itself, dated October 28, 2002, a copy of which is included as Exhibit 10A to this registration statement. Grant Samuel concluded in its report that the demerger is in the best interests of shareholders because, on balance, it believes that the shareholders are likely to be better off if the demerger proceeds than if it does not. Its conclusion is based upon an assessment of the benefits and detriments of the demerger to WMC Limited’s shareholders.

WMC Limited engaged Grant Samuel to provide its independent expert’s opinion to assist its shareholders and optionholders in considering the demerger proposal and to meet the requirements under the Australian law to provide an independent expert’s report that the transaction is “in the best interests” of shareholders. Under Australian requirements, the determination of whether a particular transaction is “in the best interests” of shareholders involves a judgment on the part of the expert as to the overall commercial effect of the transaction, the circumstances that have led to the proposal and the alternatives available. The expert must weigh up the advantages and disadvantages of the proposal and form an overall view as to whether the shareholders are likely to be better off if the proposal is implemented than if it is not.

In determining whether the demerger is in the best interests of WMC Limited’s shareholders, Grant Samuel considered a ranges of factors, including:

| | • | | The impact on business operations if the demerger proceeded |

-22-

| | INFORMATION ON THE COMPANY |

| |

|

| | • | | The effect on earnings and dividends attributable to existing shareholders |

| | • | | The financial position of Alumina Ltd and WMC Resources |

| | • | | The impact on the markets for Alumina Ltd and WMC Resources shares |

| | • | | The effect on competition for WMC Limited’s assets in the event of a takeover, and |

| | • | | The costs, disadvantages and risks of the demerger. |

In performing its work, Grant Samuel reviewed, (a) the Scheme Booklet for the demerger, (b) WMC Limited’s annual and interim financial statements, (c) industry data and reports, (d) press articles and broker reports, (e) other information on industries and listed companies in Australia comparable to Alumina Ltd and WMC Resources, (f) board papers, (g) five year forecasts for each of Alumina Ltd and WMC Resources, (h) other documentation, including taxation advice, legal advice and work papers and (i) discussions with senior management of WMC Limited and their financial and taxation advisors. Grant Samuel notes that the information provided to it has been evaluated through analysis, enquiry and review for purposes of forming an opinion as to whether the demerger is in the best interests of WMC Limited’s shareholders and optionholders. Grant Samuel does not warrant that its enquiries have identified or verified all of the matters that an audit, extensive examination or due diligence investigation might disclose. Except as set out in its report, Grant Samuel has not attempted to independently verify the completeness, accuracy or fair presentation of any of the information provided to it by WMC Limited and notes that an opinion as to whether a transaction is in the best interests of shareholders is more in the nature of an overall review than a detailed audit or investigation.

In its report, Grant Samuel concluded as a preliminary matter that the demerger will have no direct impact on the asset portfolio in which WMC Limited shareholders have an economic interest since WMC Limited shareholders will continue to hold interests in the same set of assets, albeit through different corporate structures. Accordingly, its analysis of the benefits of the demerger focused upon whether it was likely to promote more efficient utilization of the assets, enhance share market perceptions of the value of the assets, as reflected in share prices, or increase the price that could be realized for the assets in the context of a takeover or similar transaction. These potential benefits were then weighed against the costs of the demerger, which primarily comprised the tax consequences of the transaction for WMC Limited’s shareholders and WMC Limited.

In Grant Samuel’s opinion, the demerger will result in the creation of two more focused companies, with expected benefits in terms of investor flexibility, transparency and the alignment of management incentives with corporate performance. According to Grant Samuel, these factors suggest that the demerger should result in more efficient utilization of assets of WMC Resources and should increase investor interest in both Alumina Ltd and WMC Resources. On the other hand, Grant Samuel notes that the demerger will result in some inefficiencies, including the duplication of some corporate costs, a sub-optimal capital structure for Alumina Ltd, higher proportion of debt relative to total assets in WMC Resources and, potentially, an increase in the cost of capital for Alumina Ltd and WMC Resources by comparison with the cost of capital of WMC Limited in its form prior to the demerger.

Grant Samuel also noted in its opinion that WMC Limited’s structure prior to the demerger severely limited the number of parties that could realistically be considered potential acquirers of WMC Limited. In Grant Samuel’s view, the demerger will significantly increase the competitive tension between potential buyers of WMC Limited or its assets, and materially enhance the prospect that any change of control by way of takeover or otherwise will occur at prices reflecting full underlying value. Grant Samuel noted that in recent years there has been a substantial degree of rationalization in the resources sector. In this context, Grant Samuel believes that the demerger’s promotion of a more competitive market for control of WMC Limited represents a compelling advantage of the demerger and that market expectations of corporate activity are likely to provide material support for the share prices of Alumina Ltd and WMC Resources following the demerger.

-23-

| | INFORMATION ON THE COMPANY |

| |

|

In forming its opinion, Grant Samuel considered background issues, the impact on the underlying business, the impact on the capital structure, equity market issues, the impact on corporate control, taxation and other issues.

Background. Grant Samuel reviewed the performance of other entities before and after demerger or spin-out transactions. Grant Samuel noted that most of the demergers that have occurred in Australia in recent years involved spin-outs of subsidiaries exposed to unrelated industries or distinctly different markets, but also that there is an absence of reliable benchmarks to measure performance of the two entities after a demerger. Grant Samuel observed that in both the demerger of PaperlinX Limited from Amcor Limited and the demerger of Origin Energy Limited from Boral Limited, the share price performance of the resulting entities suggested that the demergers may have enhanced shareholder value. Grant Samuel, however, also noted the existence of some recent studies that have found that demergers may negatively impact value and that conglomerates have outperformed the market over some periods.

Impact on Underlying Business. In considering the key impacts that the demerger would have on the underlying businesses of WMC Limited, Grant Samuel focused on management and board focus, duplication of corporate costs, loss of synergies and loss of diversification.

Grant Samuel noted that the demerger will result in the creation of two companies with separate boards and management teams, creating the potential for greater board and management focus and consequent improvement in the returns from, in particular, WMC Resources. Grant Samuel also noted that to the extent that remuneration is linked to share price performance, the demerger will ensure that management remuneration is more directly related to performance over which management has exclusive control. Grant Samuel concluded, however, that the benefits that arise from greater board and management focus are hard to quantify and are only likely to emerge over the longer term.

Grant Samuel believes that the demerger will result in the duplication of some corporate costs, such as listed company costs, annual reports, shareholder communications, legal and regulatory compliance costs, central administration costs, accounting, information technology and taxation and other general services. Grant Samuel noted, however, that WMC Limited estimated these costs to be approximately A$4.6 million per year and concluded that in the context of the earnings, assets and likely market values of each of the demerged companies, the additional expense would not be substantial.

Grant Samuel observed that the demerger will result in the loss of any synergies that may have been derived from holding WMC Limited’s interest in AWAC together with its non-alumina businesses, although it noted that WMC Limited’s scope to extract operational synergies from its investment in AWAC is limited by Alcoa’s operational management of AWAC. Grant Samuel also noted that WMC Resources is expected to produce strong cash flows and that the funding requirements for its assets in the short-to-medium term are not expected to be significant, which further limits the availability of synergistic benefits of combining WMC Limited’s interest in AWAC with its non-alumina businesses.

Grant Samuel also considered the impact on diversification that the demerger would have on the two companies, noting that Alumina Ltd’s income would derive solely from the alumina, aluminium and alumina-based chemicals businesses of AWAC and that while WMC Resources would retain some diversification in its portfolio, its earnings would likely be more volatile than WMC Limited’s earnings prior to the demerger. Grant Samuel noted, however, that there should be no overall increase in investment volatility for WMC Limited’s shareholders as they will retain their existing economic and risk exposures following the demerger, albeit in two separate companies rather than a single company.

Impact on Capital Structure. Grant Samuel reviewed the proposed capital of Alumina Ltd, noting that it would hold A$600 million of WMC Limited’s debt prior to the demerger, which it believed was conservative relative to other aluminium/alumina producers. Grant Samuel believes that this debt creates a sub-optimal capital structure for Alumina Ltd insofar as it will not be able to fully utilize the tax deductibility of interest payments because Alumina Ltd’s primary source of income will be after tax dividends from AWAC. Grant Samuel believes, however, that any unutilized tax benefits are unlikely to be material in the context of the earnings and market value of Alumina Ltd.

-24-

| | INFORMATION ON THE COMPANY |

| |

|