UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-21269

Wells Fargo Income Opportunities Fund

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:800-222-8222

Date of fiscal year end: April 30

Date of reporting period: October 31, 2019

ITEM 1. REPORT TO STOCKHOLDERS

Semi-Annual Report

October 31, 2019

Wells Fargo

Income Opportunities Fund (EAD)

Beginning on January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, paper copies of the Wells Fargo Funds’ annual and semi-annual shareholder reports issued after this date will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-730-6001.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call 1-800-730-6001. Your election to receive reports in paper will apply to all Wells Fargo Funds held in your account with your financial intermediary or, if you are a direct investor, to all Wells Fargo Funds that you hold.

|

|

|

Reduce clutter. Save trees. |

Sign up for electronic delivery of prospectuses and shareholder reports atwellsfargo.com/advantagedelivery |

The views expressed and any forward-looking statements are as of October 31, 2019, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Asset Management. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT PRODUCTS: NOT FDIC INSURED ◾ NO BANK GUARANTEE ◾ MAY LOSE VALUE

Wells Fargo Income Opportunities Fund | 1

Letter to shareholders (unaudited)

Andrew Owen

President

Wells Fargo Funds

“Halfway through 2019, investors regrouped.”

Dear Shareholder:

We are pleased to offer you this semi-annual report for the Wells Fargo Income Opportunities Fund for the six-month period that ended October 31, 2019. U.S. stock and global bond investors generally saw markets recover during the second half amid intensifying market volatility, slowing global economic growth, international trade staredowns, and simmering geopolitical tensions.

Overall, fixed income kept pace with domestic stocks and outperformed foreign equities. For the period, U.S. stocks, based on the S&P 500 Index,1 gained 4.16% and international stocks, as measured by the MSCI ACWI ex USA Index (Net),2 added 1.97%. The MSCI EM Index (Net)3 fell by 1.67%. Among fixed income investors, the Bloomberg Barclays U.S. Aggregate Bond Index4 added 5.71%, the Bloomberg Barclays Global Aggregate ex-USD Index5 gained 4.45%, the Bloomberg Barclays Municipal Bond Index6 increased 3.54%, and the ICE BofAML U.S. High Yield Index7 was up 2.63%.

Market volatility rose in the second quarter on numerous concerns.

During May 2019, markets tumbled on mixed investment signals. In the U.S., partisan wrangling ramped up as Democrats and Republicans set their sights on 2020 presidential politics. The U.K.’s Brexit disagreements caused Prime Minister Theresa May to resign. Boris Johnson succeeded her only to exacerbate uncertainty about Brexit’s resolution ahead of an October 2019 deadline. The European Commission downgraded the 2019 growth forecast to 1.2%. The U.S. increased tariffs on products from China, China responded, and then talks broke down. President Donald Trump threatened to turn his foreign policy tariff tool to Mexico over immigration issues.

Halfway through 2019, investors regrouped. Just as the investment horizon appeared to darken, sentiment turned and U.S. equity markets gained during June and July. The gains, primarily driven by geopolitical and monetary policy events, pushed equity markets to new highs. European Central Bank President Mario Draghi said that if the outlook doesn’t improve, the bank would cut rates or buy more assets to prop up inflation. President Trump backed off of tariff threats against Mexico and China. In the U.S., the Federal Reserve (Fed) implemented a 0.25% federal funds rate cut in July.

Later in July 2019, the U.S. reversed course and threatened to impose higher tariffs on China’s exports after talks failed. China responded with tariff threats of its own and devalued the renminbi, a move that roiled global markets. Major U.S. stock market

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2019. ICE Data Indices, LLC. All rights reserved. |

2 | Wells Fargo Income Opportunities Fund

Letter to shareholders (unaudited)

indices closed July with the worst weekly results of the year. Bond prices gained as Treasury yields fell to levels not seen since November 2016 and the yield curve inverted at multiple points along the 30-year arc.

In microcosm, August 2019 encapsulated many of the unnerving events that plagued investors for months. The U.S.-China trade relationship swung from antagonistic to hopeful and back again with no signs of compromise. Evidence of a continued global economic slowdown mounted. Central banks in China, New Zealand, and Thailand cut interest rates. Industrial and manufacturing data declined in China, Canada, Japan, and Germany. Adding to the uncertain environment, Italy’s prime minister resigned, many feared a crackdown in Hong Kong as protestors sustained their calls for reform, and Boris Johnson planned to suspend Parliament as Brexit’s deadline neared.

In the U.S., September saw the Fed join other central banks in cutting interest rates. U.S. manufacturing data, as reported by the Institute for Supply Management, disappointed investors. The U.S. House of Representatives announced it would pursue an impeachment investigation of President Trump. Meanwhile, the Brexit impasse showed no signs of resolution. Officials in China said that hitting the country’s economic growth goals for the year would be difficult considering the weight of tariffs and trade restrictions. So while the S&P 500 Index finished the third quarter with the best year-to-date returns in more than 20 years, amid signs of equity investors taking money out of the stock market, concerns about future returns remained.

In October 2019, a relaxing of U.S.-China trade tensions and renewed optimism for a U.K. Brexit deal combined with positive macroeconomic data to support financial markets overall. The initial estimate of U.S. third-quarter gross domestic product growth, announced in late October, was a resilient 1.9% annualized rate while the U.S. unemployment rate fell to a 50-year low of 3.5% in September. However, despite resilience among U.S. consumers, business confidence declined while manufacturing activity contracted. Concerned with a potential economic slowdown, the Fed lowered interest rates another quarter point in late October, its third rate cut in four months. This helped push the S&P 500 Index to a newall-time high while emerging market equities rallied and global bonds declined overall, reflecting a broad pickup in risk appetite.

Don’t let short-term uncertainty derail long-term investment goals.

Periods of investment uncertainty can present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

“The Fed lowered interest rates another quarter point in late October, its third rate cut in four months.”

|

|

|

For further information about your Fund, contact your investment professional, visit our website atwfam.com, or call us directly at1-800-222-8222. |

Wells Fargo Income Opportunities Fund | 3

Notice to Shareholders

On November 22, 2019, the Fund announced an extension of its open-market share repurchase program (the “Buyback Program”). Under the extended Buyback Program, the Fund may repurchase up to 10% of its outstanding shares during the period in open-market transactions beginning on January 1, 2020 and ending on December 31, 2020. The Fund’s Board of Trustees has delegated to Wells Fargo Funds Management, LLC, the Fund’s adviser, discretion to administer the Buyback Program including the determination of the amount and timing of repurchases in accordance with the best interests of the Fund and subject to applicable legal limitations.

The Fund’s managed distribution plan provides for the declaration of monthly distributions to common shareholders of the Fund at an annual minimum fixed rate of 9% based on the Fund’s average monthly NAV per share over the prior 12 months. Under the managed distribution plan, monthly distributions may be sourced from income, paid-in capital, and/or capital gains, if any. To the extent that sufficient investment income is not available on a monthly basis, the Fund may distribute paid-in capital and/or capital gains, if any, in order to maintain its managed distribution level. You should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the managed distribution plan. Shareholders may elect to reinvest distributions received pursuant to the managed distribution plan in the Fund under the existing dividend reinvestment plan, which is described later in this report.

4 | Wells Fargo Income Opportunities Fund

This page is intentionally left blank.

Performance highlights (unaudited)

Investment objective

The Fund seeks a high level of current income. Capital appreciation is a secondary objective.

Strategy summary

Under normal market conditions, the Fund invests at least 80% of its total assets in below-investment-grade (high yield) debt securities, loans and preferred stocks. These securities are rated Ba or lower by Moody’s or BB or lower by S&P, or are unrated securities of comparable quality as determined by the subadviser.

Adviser

Wells Fargo Funds Management, LLC

Subadviser

Wells Capital Management Incorporated

Portfolio managers

Niklas Nordenfelt, CFA®‡

Phillip Susser

Average annual total returns (%) as of October 31, 20191

| | | | | | | | | | | | | | |

| | | | |

| | | 6 months | | 1 year | | | 5 year | | | 10 year | |

| | | | | |

| Based on market value | | 5.70 | | | 19.55 | | | | 7.26 | | | | 9.23 | |

| | | | | |

| Based on net asset value (NAV) | | 3.71 | | | 10.82 | | | | 7.24 | | | | 9.67 | |

| | | | | |

| ICE BofAML U.S. High Yield Constrained Index2 | | 2.63 | | | 8.32 | | | | 5.18 | | | | 7.67 | |

| | | | | |

| ICE BofAML U.S. High Yield Index3 | | 2.63 | | | 8.32 | | | | 5.17 | | | | 7.69 | |

Figures quoted represent past performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on fund distributions or the sales of fund shares. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Performance figures of the Fund do not reflect brokerage commissions that a shareholder would pay on the purchase and sale of shares. If taxes and such brokerage commissions had been reflected, performance would have been lower. To obtain performance information current to the most recentmonth-end, please call1-800-222-8222.

The Fund’s annualized expense ratios for the six months ended October 31, 2019 was 2.24%, which includes 1.26% of interest expense.

|

|

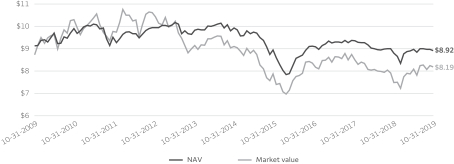

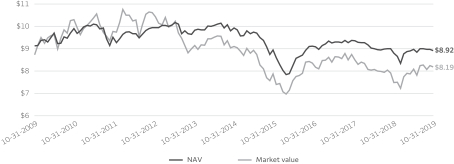

| Comparison of NAV vs. market value4 |

|

|

The Fund is leveraged through a revolving credit facility and also may incur leverage by issuing preferred shares in the future. The use of leverage results in certain risks including, among others, the likelihood of greater volatility of the net asset value and the market value of common shares. Derivatives involve additional risks including interest rate risk, credit risk, the risk of improper valuation, and the risk ofnon-correlation to the relevant instruments that they are designed to hedge or closely track. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the Fund and its share price can be sudden and unpredictable. High-yield securities have a greater risk of default and tend to be more volatile than higher rated debt securities. Thisclosed-end fund is no longer offered as an initial public offering and is only offered through broker-dealers on the secondary market. Aclosed-end fund is not required to buy its shares back from investors upon request.

Please see footnotes on page 8.

6 | Wells Fargo Income Opportunities Fund

Performance highlights (unaudited)

MANAGER’S DISCUSSION

The Fund’s return based on market value was 5.70% for the 6-month period that ended October 31, 2019. During the same period, the Fund’s return based on its net asset value (NAV) was 3.71%. Based on its market value and NAV returns, the Fund outperformed relative to the ICE BofAML U.S. High Yield Constrained Index, which returned 2.63% for the six-month period that ended October 31, 2019.

Overview

During the period, high-yield bonds returned 2.63%, as measured by the ICE BofAML U.S. High Yield Constrained Index, with positive returns in every month except May. Spread widening over the period was more than offset by a decline in Treasury yields. The market was supported by solid and consistent gross domestic product growth, lack of aggressive issuance over the past several years, and a relatively low default rate. Given the strong performance of Treasuries and spread widening, it is not surprising that higher-qualityBB-rated bonds outperformed lower-quality bonds over the period. Indeed, lower-qualityCCC-rated bonds had a negative return over the trailing six months.

Contributors to performance

Rating allocation contributed to performance over the period. Specifically, being overweightBBB-rated and underweightCCC-rated and lower credits during a period when risk underperformed was a positive. Credit selection also contributed, particularly within the exploration and production,oil-field services, midstream, and pharmaceuticals sectors. The Fund’s use of leverage had a positive impact on total return performance during this reporting period.

| | | | |

| |

| Ten largest holdings (%) as of October 31, 20195 | | | |

| | |

KAR Auction Services Incorporated, 5.13%,6-1-2025 | | | 2.25 | |

| | |

Pattern Energy Group Incorporated, 5.88%,2-1-2024 | | | 2.17 | |

| | |

Dell International LLC, 7.13%,6-15-2024 | | | 1.98 | |

| | |

Service Corporation International, 7.50%,4-1-2027 | | | 1.95 | |

| | |

NCR Corporation, 6.38%,12-15-2023 | | | 1.93 | |

| | |

Cheniere Energy Partners LP, 5.25%,10-1-2025 | | | 1.82 | |

| | |

Intelsat Jackson Holdings SA, 5.50%,8-1-2023 | | | 1.81 | |

| | |

Montreign Operating Company LLC, 10.37%,1-24-2023 | | | 1.63 | |

| | |

Ritchie Brothers Auctioneers Incorporated, 5.38%,1-15-2025 | | | 1.63 | |

| | |

Allison Transmission Incorporated, 5.00%, 10-1-2024 | | | 1.60 | |

|

|

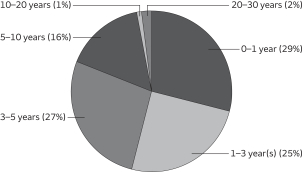

| Credit qualityas of October 31, 20196 |

|

|

Detractors from performance

Sector allocation was a detractor. Underweights to the banking, home construction, and wireless sectors and selection within cable/satellite all hurt relative performance. Duration positioning within the portfolio also detracted. A decline in rates combined with an underweight to bonds with maturities greater than seven years detracted from relative performance.

Management outlook

Overall, we believe U.S. economic fundamentals are on solid footing, with a healthy consumer offsetting lower business investment in the economy. This may be due to the strong employment market giving consumers confidence to increase their spending while uncertainty over trade and tariffs have delayed business investment. Absent something unexpected, we believe these conditions will continue and are a solid backdrop for high-yield bond performance in the coming year subject to new developments with trade and interest rate policy or potential other policy changes as a result of the 2020 presidential election.

Please see footnotes on page 8.

Wells Fargo Income Opportunities Fund | 7

Performance highlights (unaudited)

|

|

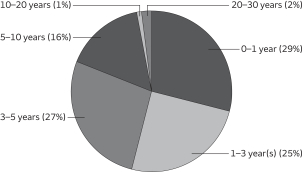

| Effective maturity distributionas of October 31, 20197 |

|

|

To that end, we think the market will continue to focus on U.S.-China trade and the U.S. Federal Reserve’s (Fed’s) monetary policy. As such, our outlook is unusually dependent on White House and Fed policies. If you take the view that the administration is committed to seeing fundamental changes to China and trade between the U.S. and China, then risk assets are likely on a long and challenging road, as we think China may be reluctant to make such changes. On the other hand, to the extent you view more limited changes to the trading relationship between the U.S. and China to be acceptable to the White House, we believe there is significant room for a deal to be reached.

The proposedphase-one trade deal mirrors this more limited approach. To the extent that thephase-one deal is completed and is designed to remain in place for some time, we believe it would likely result in a positive reaction from risk assets. The Fed has been relatively aggressive, cutting rates three times and buying government debt through its overnight repo operations. These actions have been very supportive of risk assets, and absent meaningful increases in inflation, we expect the Fed to continue its accommodative stance.

Over the longer term, most asset classes are richly valued based on historical measures, and we expect that, at some point in the future, there may be a better entry point to buy most asset classes, including high-yield bonds. High yield, however, is rather unique in that it has historically benefited from relatively high coupons, which cushioned downside risks of potential price declines. With a benign default outlook, stable economy, and accommodative Fed, high-yield bonds should continue to perform well on a relative basis, though idiosyncratic or individual bond risk is high. We lean toward spreads remaining flat from these levels in the short run before ultimately widening—potentially significantly—in themid- to longer term.

Over a full cycle, we believe the best way to insulate the Fund from periodic bouts of systemic fears and rebalancing is by following abottom-up investment process that attempts to minimize downside risk while capturing the return potential of high-yield issuers.

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | Total returns based on market value are calculated assuming a purchase of common stock on the first day and a sale on the last day of the period reported. Total returns based on NAV are calculated based on the NAV at the beginning of the period and at the end of period. Dividends and distributions, if any, are assumed for the purposes of these calculations to be reinvested at prices obtained under the Fund’s Automatic Dividend Reinvestment Plan. |

| 2 | Effective October 15, 2019, the Fund changed its primary index from ICE BofAML U.S. High Yield Index to ICE BofAML U.S. High Yield Constrained Index in order to better align with the Fund’s principal investment strategy. The ICE BofAML U.S. High Yield Constrained Index is a market-value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds andpayment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower thanBBB-/Baa3 but are not in default. The ICE BofAML U.S. High Yield Constrained Index limits any individual issuer to a maximum of 2% benchmark exposure. You cannot invest directly in an index. Copyright 2019. ICE Data Indices, LLC. All rights reserved. |

| 3 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the United States bond market. You cannot invest directly in an index. |

| 4 | This chart does not reflect any brokerage commissions charged on the purchase and sale of the Fund’s common stock. Dividends and distributions paid by the Fund are included in the Fund’s average annual total returns but have the effect of reducing the Fund’s NAV. |

| 5 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

| 6 | The credit quality distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/ or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not to the Fund itself. The percentages of the Fund’s portfolio with the ratings depicted in the chart are calculated based on the total market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes fromSP-1 (highest) toSP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S.tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified. |

| 7 | Amounts are calculated based on the total investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

8 | Wells Fargo Income Opportunities Fund

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | | Shares | | | Value | |

| Common Stocks: 0.62% | |

|

Energy: 0.62% | |

|

| Energy Equipment & Services: 0.62% | |

Bristow Group Incorporated (a)‡ | | | | 175,222 | | | $ | 3,361,459 | |

| | | | | | | | | |

|

Materials: 0.00% | |

|

| Chemicals: 0.00% | |

LyondellBasell Industries NV Class A | | | | 7 | | | | 628 | |

| | | | | | | | | |

| |

Total Common Stocks (Cost $5,807,185) | | | | 3,362,087 | |

| | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | | |

| Corporate Bonds and Notes: 117.68% | |

|

Communication Services: 20.04% | |

|

| Diversified Telecommunication Services: 1.15% | |

Level 3 Financing Incorporated | | | 5.13 | % | | | 5-1-2023 | | | $ | 1,595,000 | | | | 1,614,938 | |

Level 3 Financing Incorporated | | | 5.38 | | | | 8-15-2022 | | | | 2,139,000 | | | | 2,147,021 | |

Level 3 Financing Incorporated | | | 5.38 | | | | 1-15-2024 | | | | 1,125,000 | | | | 1,146,094 | |

Level 3 Financing Incorporated | | | 5.63 | | | | 2-1-2023 | | | | 1,350,000 | | | | 1,363,500 | |

| | | | |

| | | | | | | | | | | | | | | 6,271,553 | |

| | | | | | | | | | | | | | | | |

|

| Entertainment: 0.74% | |

Live Nation Entertainment Incorporated 144A | | | 4.75 | | | | 10-15-2027 | | | | 100,000 | | | | 104,260 | |

Live Nation Entertainment Incorporated 144A | | | 4.88 | | | | 11-1-2024 | | | | 2,450,000 | | | | 2,535,750 | |

Live Nation Entertainment Incorporated 144A | | | 5.38 | | | | 6-15-2022 | | | | 790,000 | | | | 800,610 | |

Live Nation Entertainment Incorporated 144A | | | 5.63 | | | | 3-15-2026 | | | | 525,000 | | | | 559,125 | |

| | | | |

| | | | | | | | | | | | | | | 3,999,745 | |

| | | | | | | | | | | | | | | | |

|

| Media: 15.32% | |

CCO Holdings LLC 144A | | | 4.00 | | | | 3-1-2023 | | | | 175,000 | | | | 178,063 | |

CCO Holdings LLC 144A | | | 5.00 | | | | 2-1-2028 | | | | 375,000 | | | | 392,344 | |

CCO Holdings LLC | | | 5.13 | | | | 2-15-2023 | | | | 2,266,000 | | | | 2,314,153 | |

CCO Holdings LLC 144A | | | 5.13 | | | | 5-1-2023 | | | | 2,700,000 | | | | 2,764,125 | |

CCO Holdings LLC 144A | | | 5.13 | | | | 5-1-2027 | | | | 750,000 | | | | 790,313 | |

CCO Holdings LLC | | | 5.25 | | | | 9-30-2022 | | | | 2,048,000 | | | | 2,076,160 | |

CCO Holdings LLC 144A | | | 5.38 | | | | 5-1-2025 | | | | 7,000,000 | | | | 7,262,500 | |

CCO Holdings LLC 144A | | | 5.50 | | | | 5-1-2026 | | | | 325,000 | | | | 342,469 | |

CCO Holdings LLC 144A | | | 5.75 | | | | 2-15-2026 | | | | 5,675,000 | | | | 5,992,800 | |

CCO Holdings LLC 144A | | | 5.88 | | | | 4-1-2024 | | | | 2,350,000 | | | | 2,449,875 | |

CSC Holdings LLC 144A | | | 5.38 | | | | 7-15-2023 | | | | 3,000,000 | | | | 3,074,940 | |

CSC Holdings LLC 144A | | | 5.38 | | | | 2-1-2028 | | | | 1,125,000 | | | | 1,189,688 | |

CSC Holdings LLC 144A | | | 5.50 | | | | 5-15-2026 | | | | 2,425,000 | | | | 2,555,344 | |

CSC Holdings LLC 144A | | | 7.50 | | | | 4-1-2028 | | | | 2,150,000 | | | | 2,418,750 | |

CSC Holdings LLC 144A | | | 7.75 | | | | 7-15-2025 | | | | 3,825,000 | | | | 4,102,313 | |

Diamond Sports Group LLC 144A | | | 5.38 | | | | 8-15-2026 | | | | 375,000 | | | | 391,406 | |

Diamond Sports Group LLC 144A | | | 6.63 | | | | 8-15-2027 | | | | 375,000 | | | | 386,250 | |

DISH Network Corporation | | | 3.38 | | | | 8-15-2026 | | | | 3,125,000 | | | | 2,922,066 | |

Gray Television Incorporated 144A | | | 5.13 | | | | 10-15-2024 | | | | 2,400,000 | | | | 2,487,000 | |

Gray Television Incorporated 144A | | | 5.88 | | | | 7-15-2026 | | | | 6,700,000 | | | | 7,043,509 | |

Gray Television Incorporated 144A | | | 7.00 | | | | 5-15-2027 | | | | 675,000 | | | | 738,632 | |

Lamar Media Corporation | | | 5.38 | | | | 1-15-2024 | | | | 725,000 | | | | 742,987 | |

Lamar Media Corporation | | | 5.75 | | | | 2-1-2026 | | | | 200,000 | | | | 211,750 | |

National CineMedia LLC 144A | | | 5.88 | | | | 4-15-2028 | | | | 4,050,000 | | | | 4,256,955 | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Income Opportunities Fund | 9

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | Value | |

|

| Media (continued) | |

National CineMedia LLC | | | 6.00 | % | | | 4-15-2022 | | | $ | 3,790,000 | | | $ | 3,828,279 | |

Nexstar Broadcasting Group Incorporated | | | 5.88 | | | | 11-15-2022 | | | | 425,000 | | | | 431,375 | |

Nexstar Broadcasting Group Incorporated 144A | | | 6.13 | | | | 2-15-2022 | | | | 3,040,000 | | | | 3,081,800 | |

Nexstar Escrow Incorporated 144A | | | 5.63 | | | | 7-15-2027 | | | | 300,000 | | | | 316,410 | |

Nielsen Finance LLC 144A | | | 5.00 | | | | 4-15-2022 | | | | 5,125,000 | | | | 5,150,728 | |

Outfront Media Capital Corporation | | | 5.63 | | | | 2-15-2024 | | | | 960,000 | | | | 985,200 | |

Outfront Media Capital Corporation | | | 5.88 | | | | 3-15-2025 | | | | 1,275,000 | | | | 1,316,438 | |

Salem Media Group Incorporated 144A | | | 6.75 | | | | 6-1-2024 | | | | 5,250,000 | | | | 4,515,000 | |

Scripps Escrow Incorporated 144A | | | 5.88 | | | | 7-15-2027 | | | | 400,000 | | | | 409,880 | |

The E.W. Scripps Company 144A | | | 5.13 | | | | 5-15-2025 | | | | 6,194,000 | | | | 6,279,168 | |

| | | | |

| | | | | | | | | | | | | | | 83,398,670 | |

| | | | | | | | | | | | | | | | |

|

| Wireless Telecommunication Services: 2.83% | |

Sprint Capital Corporation | | | 6.88 | | | | 11-15-2028 | | | | 375,000 | | | | 406,875 | |

Sprint Capital Corporation | | | 8.75 | | | | 3-15-2032 | | | | 1,975,000 | | | | 2,408,276 | |

Sprint Communications Incorporated 144A | | | 7.00 | | | | 3-1-2020 | | | | 200,000 | | | | 202,500 | |

Sprint Communications Incorporated | | | 7.00 | | | | 8-15-2020 | | | | 380,000 | | | | 391,465 | |

T-Mobile USA Incorporated | | | 4.00 | | | | 4-15-2022 | | | | 1,075,000 | | | | 1,109,626 | |

T-Mobile USA Incorporated | | | 4.50 | | | | 2-1-2026 | | | | 475,000 | | | | 489,844 | |

T-Mobile USA Incorporated | | | 4.75 | | | | 2-1-2028 | | | | 900,000 | | | | 948,375 | |

T-Mobile USA Incorporated | | | 5.13 | | | | 4-15-2025 | | | | 775,000 | | | | 805,264 | |

T-Mobile USA Incorporated | | | 5.38 | | | | 4-15-2027 | | | | 2,250,000 | | | | 2,418,750 | |

T-Mobile USA Incorporated | | | 6.00 | | | | 3-1-2023 | | | | 600,000 | | | | 611,250 | |

T-Mobile USA Incorporated | | | 6.00 | | | | 4-15-2024 | | | | 275,000 | | | | 285,313 | |

T-Mobile USA Incorporated | | | 6.38 | | | | 3-1-2025 | | | | 3,050,000 | | | | 3,165,016 | |

T-Mobile USA Incorporated | | | 6.50 | | | | 1-15-2024 | | | | 140,000 | | | | 145,425 | |

T-Mobile USA Incorporated | | | 6.50 | | | | 1-15-2026 | | | | 1,900,000 | | | | 2,033,190 | |

| | | | |

| | | | | | | | | | | | | | | 15,421,169 | |

| | | | | | | | | | | | | | | | |

|

| Consumer Discretionary: 17.75% | |

|

| Auto Components: 3.36% | |

Allison Transmission Incorporated 144A | | | 4.75 | | | | 10-1-2027 | | | | 1,695,000 | | | | 1,733,138 | |

Allison Transmission Incorporated 144A | | | 5.00 | | | | 10-1-2024 | | | | 8,475,000 | | | | 8,686,875 | |

Allison Transmission Incorporated 144A | | | 5.88 | | | | 6-1-2029 | | | | 1,050,000 | | | | 1,131,375 | |

Cooper Tire & Rubber Company | | | 7.63 | | | | 3-15-2027 | | | | 5,190,000 | | | | 5,974,988 | |

Cooper Tire & Rubber Company | | | 8.00 | | | | 12-15-2019 | | | | 400,000 | | | | 402,000 | |

Panther BF Aggregator 2 LP 144A | | | 6.25 | | | | 5-15-2026 | | | | 325,000 | | | | 343,590 | |

| | | | |

| | | | | | | | | | | | | | | 18,271,966 | |

| | | | | | | | | | | | | | | | |

|

| Distributors: 0.55% | |

LKQ Corporation | | | 4.75 | | | | 5-15-2023 | | | | 2,915,000 | | | | 2,972,367 | |

| | | | | | | | | | | | | | | | |

|

| Diversified Consumer Services: 3.08% | |

Carriage Services Incorporated 144A | | | 6.63 | | | | 6-1-2026 | | | | 2,800,000 | | | | 2,912,000 | |

Service Corporation International | | | 4.63 | | | | 12-15-2027 | | | | 1,325,000 | | | | 1,384,625 | |

Service Corporation International | | | 5.38 | | | | 5-15-2024 | | | | 75,000 | | | | 77,344 | |

Service Corporation International | | | 7.50 | | | | 4-1-2027 | | | | 8,700,000 | | | | 10,614,000 | |

Service Corporation International | | | 8.00 | | | | 11-15-2021 | | | | 1,635,000 | | | | 1,798,500 | |

| | | | |

| | | | | | | | | | | | | | | 16,786,469 | |

| | | | | | | | | | | | | | | | |

|

| Hotels, Restaurants & Leisure: 3.16% | |

CCM Merger Incorporated 144A | | | 6.00 | | | | 3-15-2022 | | | | 8,475,000 | | | | 8,676,281 | |

Hilton Domestic Operating Company Incorporated 144A | | | 4.88 | | | | 1-15-2030 | | | | 375,000 | | | | 398,438 | |

Hilton Domestic Operating Company Incorporated | | | 5.13 | | | | 5-1-2026 | | | | 1,175,000 | | | | 1,233,750 | |

The accompanying notes are an integral part of these financial statements.

10 | Wells Fargo Income Opportunities Fund

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | Value | |

|

| Hotels, Restaurants & Leisure (continued) | |

KFC Holding Company 144A | | | 5.00 | % | | | 6-1-2024 | | | $ | 2,075,000 | | | $ | 2,152,813 | |

Wyndham Hotels & Resorts Company 144A | | | 5.38 | | | | 4-15-2026 | | | | 4,025,000 | | | | 4,246,375 | |

Yum! Brands Incorporated 144A | | | 4.75 | | | | 1-15-2030 | | | | 450,000 | | | | 471,938 | |

| | | | |

| | | | | | | | | | | | | | | 17,179,595 | |

| | | | | | | | | | | | | | | | |

|

| Specialty Retail: 6.32% | |

Asbury Automotive Group Incorporated | | | 6.00 | | | | 12-15-2024 | | | | 7,200,000 | | | | 7,452,000 | |

Group 1 Automotive Incorporated | | | 5.00 | | | | 6-1-2022 | | | | 2,259,000 | | | | 2,285,091 | |

Group 1 Automotive Incorporated 144A | | | 5.25 | | | | 12-15-2023 | | | | 3,275,000 | | | | 3,356,875 | |

Lithia Motors Incorporated 144A | | | 5.25 | | | | 8-1-2025 | | | | 6,725,000 | | | | 7,044,438 | |

Penske Auto Group Incorporated | | | 3.75 | | | | 8-15-2020 | | | | 1,045,000 | | | | 1,050,225 | |

Penske Auto Group Incorporated | | | 5.38 | | | | 12-1-2024 | | | | 5,400,000 | | | | 5,548,500 | |

Penske Auto Group Incorporated | | | 5.75 | | | | 10-1-2022 | | | | 2,325,000 | | | | 2,354,063 | |

Sonic Automotive Incorporated | | | 5.00 | | | | 5-15-2023 | | | | 3,400,000 | | | | 3,451,000 | |

Sonic Automotive Incorporated | | | 6.13 | | | | 3-15-2027 | | | | 1,799,000 | | | | 1,861,965 | |

| | | | |

| | | | | | | | | | | | | | | 34,404,157 | |

| | | | | | | | | | | | | | | | |

|

| Textiles, Apparel & Luxury Goods: 1.28% | |

Levi Strauss & Company | | | 5.00 | | | | 5-1-2025 | | | | 200,000 | | | | 207,500 | |

The William Carter Company 144A | | | 5.63 | | | | 3-15-2027 | | | | 2,450,000 | | | | 2,612,313 | |

Wolverine World Wide Incorporated 144A | | | 5.00 | | | | 9-1-2026 | | | | 4,100,000 | | | | 4,151,250 | |

| | | | |

| | | | | | | | | | | | | | | 6,971,063 | |

| | | | | | | | | | | | | | | | |

|

Consumer Staples: 1.56% | |

|

| Beverages: 0.22% | |

Cott Beverages Incorporated 144A | | | 5.50 | | | | 4-1-2025 | | | | 1,125,000 | | | | 1,172,813 | |

| | | | | | | | | | | | | | | | |

|

| Food Products: 1.04% | |

Darling Ingredients Incorporated 144A | | | 5.25 | | | | 4-15-2027 | | | | 975,000 | | | | 1,023,750 | |

Lamb Weston Holdings Incorporated 144A | | | 4.63 | | | | 11-1-2024 | | | | 375,000 | | | | 394,219 | |

Pilgrim’s Pride Corporation 144A | | | 5.75 | | | | 3-15-2025 | | | | 2,360,000 | | | | 2,448,500 | |

Pilgrim’s Pride Corporation 144A | | | 5.88 | | | | 9-30-2027 | | | | 400,000 | | | | 428,608 | |

Prestige Brands Incorporated 144A | | | 6.38 | | | | 3-1-2024 | | | | 660,000 | | | | 688,875 | |

US Foods Incorporated 144A | | | 5.88 | | | | 6-15-2024 | | | | 670,000 | | | | 690,100 | |

| | | | |

| | | | | | | | | | | | | | | 5,674,052 | |

| | | | | | | | | | | | | | | | |

|

| Household Products: 0.30% | |

Central Garden & Pet Company | | | 5.13 | | | | 2-1-2028 | | | | 400,000 | | | | 410,920 | |

Central Garden & Pet Company | | | 6.13 | | | | 11-15-2023 | | | | 405,000 | | | | 418,669 | |

Spectrum Brands Incorporated | | | 5.75 | | | | 7-15-2025 | | | | 775,000 | | | | 807,938 | |

| | | | |

| | | | | | | | | | | | | | | 1,637,527 | |

| | | | | | | | | | | | | | | | |

|

Energy: 21.80% | |

|

| Energy Equipment & Services: 4.43% | |

Diamond Offshore Drilling Incorporated | | | 4.88 | | | | 11-1-2043 | | | | 2,875,000 | | | | 1,462,656 | |

Era Group Incorporated | | | 7.75 | | | | 12-15-2022 | | | | 4,820,000 | | | | 4,844,100 | |

Hilcorp Energy Company 144A | | | 5.00 | | | | 12-1-2024 | | | | 3,100,000 | | | | 2,752,180 | |

Hilcorp Energy Company 144A | | | 5.75 | | | | 10-1-2025 | | | | 4,195,000 | | | | 3,744,038 | |

Hilcorp Energy Company 144A | | | 6.25 | | | | 11-1-2028 | | | | 1,450,000 | | | | 1,225,250 | |

NGPL PipeCo LLC 144A | | | 4.38 | | | | 8-15-2022 | | | | 850,000 | | | | 882,517 | |

NGPL PipeCo LLC 144A | | | 7.77 | | | | 12-15-2037 | | | | 2,325,000 | | | | 2,995,862 | |

Oceaneering International Incorporated | | | 6.00 | | | | 2-1-2028 | | | | 4,350,000 | | | | 4,023,750 | |

USA Compression Partners LP | | | 6.88 | | | | 4-1-2026 | | | | 2,150,000 | | | | 2,171,500 | |

| | | | |

| | | | | | | | | | | | | | | 24,101,853 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Income Opportunities Fund | 11

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | Value | |

| Oil, Gas & Consumable Fuels: 17.37% | |

Antero Midstream Partners LP 144A | | | 5.75 | % | | | 1-15-2028 | | | $ | 1,800,000 | | | $ | 1,336,500 | |

Archrock Partners LP | | | 6.00 | | | | 10-1-2022 | | | | 1,650,000 | | | | 1,662,375 | |

Archrock Partners LP 144A | | | 6.88 | | | | 4-1-2027 | | | | 1,375,000 | | | | 1,419,550 | |

Buckeye Partners LP | | | 5.85 | | | | 11-15-2043 | | | | 3,425,000 | | | | 2,958,882 | |

Carrizo Oil & Gas Incorporated | | | 8.25 | | | | 7-15-2025 | | | | 2,075,000 | | | | 1,971,250 | |

Carrizo Oil & Gas Incorporated | | | 6.25 | | | | 4-15-2023 | | | | 700,000 | | | | 651,000 | |

Cheniere Corpus Christi Holdings LLC | | | 5.13 | | | | 6-30-2027 | | | | 2,200,000 | | | | 2,370,500 | |

Cheniere Energy Partners LP 144A | | | 4.50 | | | | 10-1-2029 | | | | 1,075,000 | | | | 1,097,844 | |

Cheniere Energy Partners LP | | | 5.25 | | | | 10-1-2025 | | | | 9,575,000 | | | | 9,910,125 | |

Cheniere Energy Partners LP | | | 5.63 | | | | 10-1-2026 | | | | 1,325,000 | | | | 1,399,531 | |

Denbury Resources Incorporated | | | 6.38 | | | | 12-31-2024 | | | | 1,713,000 | | | | 927,940 | |

Denbury Resources Incorporated 144A | | | 7.75 | | | | 2-15-2024 | | | | 2,399,000 | | | | 1,763,265 | |

Denbury Resources Incorporated 144A | | | 9.00 | | | | 5-15-2021 | | | | 1,625,000 | | | | 1,421,875 | |

Denbury Resources Incorporated 144A | | | 9.25 | | | | 3-31-2022 | | | | 1,362,000 | | | | 1,116,840 | |

Enable Oklahoma Intrastate Transmission LLC 144A | | | 6.25 | | | | 3-15-2020 | | | | 1,100,000 | | | | 1,115,269 | |

EnLink Midstream Partners LP | | | 4.15 | | | | 6-1-2025 | | | | 200,000 | | | | 180,474 | |

EnLink Midstream Partners LP | | | 4.40 | | | | 4-1-2024 | | | | 6,450,000 | | | | 6,046,875 | |

EnLink Midstream Partners LP | | | 4.85 | | | | 7-15-2026 | | | | 2,275,000 | | | | 2,081,625 | |

EnLink Midstream Partners LP | | | 5.38 | | | | 6-1-2029 | | | | 175,000 | | | | 155,313 | |

Gulfport Energy Corporation | | | 6.00 | | | | 10-15-2024 | | | | 3,990,000 | | | | 2,563,575 | |

Indigo Natural Resources LLC 144A | | | 6.88 | | | | 2-15-2026 | | | | 850,000 | | | | 773,500 | |

Kinder Morgan Incorporated | | | 6.50 | | | | 9-15-2020 | | | | 1,155,000 | | | | 1,198,085 | |

Kinder Morgan Incorporated | | | 7.42 | | | | 2-15-2037 | | | | 1,820,000 | | | | 2,301,711 | |

MPLX LP 144A | | | 5.25 | | | | 1-15-2025 | | | | 1,150,000 | | | | 1,208,733 | |

MPLX LP 144A | | | 6.38 | | | | 5-1-2024 | | | | 725,000 | | | | 761,390 | |

Murphy Oil Corporation | | | 4.20 | | | | 12-1-2022 | | | | 3,200,000 | | | | 3,256,000 | |

Murphy Oil Corporation | | | 4.75 | | | | 9-15-2029 | | | | 200,000 | | | | 208,750 | |

Murphy Oil Corporation | | | 5.75 | | | | 8-15-2025 | | | | 360,000 | | | | 364,957 | |

Murphy Oil Corporation | | | 6.88 | | | | 8-15-2024 | | | | 1,600,000 | | | | 1,687,744 | |

Nabors Industries Incorporated | | | 0.75 | | | | 1-15-2024 | | | | 2,850,000 | | | | 1,804,941 | |

Rockies Express Pipeline LLC 144A | | | 5.63 | | | | 4-15-2020 | | | | 5,495,000 | | | | 5,587,299 | |

Rockies Express Pipeline LLC 144A | | | 6.88 | | | | 4-15-2040 | | | | 3,300,000 | | | | 3,481,830 | |

Rockies Express Pipeline LLC 144A | | | 7.50 | | | | 7-15-2038 | | | | 1,150,000 | | | | 1,272,188 | |

Rose Rock Midstream LP | | | 5.63 | | | | 7-15-2022 | | | | 2,450,000 | | | | 2,476,999 | |

Rose Rock Midstream LP | | | 5.63 | | | | 11-15-2023 | | | | 1,850,000 | | | | 1,891,625 | |

SemGroup Corporation | | | 6.38 | | | | 3-15-2025 | | | | 5,625,000 | | | | 5,828,906 | |

SemGroup Corporation | | | 7.25 | | | | 3-15-2026 | | | | 2,869,000 | | | | 3,098,520 | |

Southern Star Central Corporation 144A | | | 5.13 | | | | 7-15-2022 | | | | 3,062,000 | | | | 3,099,693 | |

Southwestern Energy Company | | | 6.20 | | | | 1-23-2025 | | | | 75,000 | | | | 66,000 | |

Southwestern Energy Company | | | 7.50 | | | | 4-1-2026 | | | | 750,000 | | | | 658,193 | |

Southwestern Energy Company | | | 7.75 | | | | 10-1-2027 | | | | 750,000 | | | | 645,000 | |

Summit Midstream Holdings LLC | | | 5.75 | | | | 4-15-2025 | | | | 500,000 | | | | 387,500 | |

Tallgrass Energy Partners LP 144A | | | 5.50 | | | | 9-15-2024 | | | | 7,925,000 | | | | 7,707,063 | |

Ultra Resources Incorporated 144A | | | 7.13 | | | | 4-15-2025 | | | | 8,900,000 | | | | 890,000 | |

Whiting Petroleum Corporation | | | 1.25 | | | | 4-1-2020 | | | | 1,750,000 | | | | 1,720,099 | |

| | | | |

| | | | | | | | | | | | | | | 94,527,334 | |

| | | | | | | | | | | | | | | | |

|

Financials: 5.93% | |

|

| Banks: 0.07% | |

Citigroup Incorporated | | | 4.13 | | | | 3-9-2021 | | | | 115,000 | | | | 117,588 | |

Citigroup Incorporated | | | 6.13 | | | | 3-9-2028 | | | | 205,000 | | | | 241,900 | |

| | | | |

| | | | | | | | | | | | | | | 359,488 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

12 | Wells Fargo Income Opportunities Fund

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | Value | |

| Consumer Finance: 2.58% | |

Ally Financial Incorporated | | | 7.50 | % | | | 9-15-2020 | | | $ | 300,000 | | | $ | 312,750 | |

Ally Financial Incorporated | | | 8.00 | | | | 3-15-2020 | | | | 3,016,000 | | | | 3,071,253 | |

FirstCash Incorporated 144A | | | 5.38 | | | | 6-1-2024 | | | | 2,985,000 | | | | 3,089,475 | |

Navient Corporation | | | 8.00 | | | | 3-25-2020 | | | | 2,725,000 | | | | 2,782,906 | |

Springleaf Finance Corporation | | | 6.63 | | | | 1-15-2028 | | | | 350,000 | | | | 387,625 | |

Springleaf Finance Corporation | | | 7.13 | | | | 3-15-2026 | | | | 2,425,000 | | | | 2,770,563 | |

Springleaf Finance Corporation | | | 8.25 | | | | 12-15-2020 | | | | 75,000 | | | | 79,781 | |

Springleaf Finance Corporation | | | 8.25 | | | | 10-1-2023 | | | | 1,342,000 | | | | 1,563,430 | |

| | | | |

| | | | | | | | | | | | | | | 14,057,783 | |

| | | | | | | | | | | | | | | | |

|

| Diversified Financial Services: 1.88% | |

Jefferies Finance LLC 144A | | | 6.25 | | | | 6-3-2026 | | | | 2,225,000 | | | | 2,286,188 | |

LPL Holdings Incorporated 144A | | | 5.75 | | | | 9-15-2025 | | | | 7,650,000 | | | | 7,936,875 | |

| | | | |

| | | | | | | | | | | | | | | 10,223,063 | |

| | | | | | | | | | | | | | | | |

|

| Insurance: 1.40% | |

Alliant Holdings Intermediate LLC 144A | | | 6.75 | | | | 10-15-2027 | | | | 450,000 | | | | 468,050 | |

AmWINS Group Incorporated 144A | | | 7.75 | | | | 7-1-2026 | | | | 2,200,000 | | | | 2,365,000 | |

HUB International Limited 144A | | | 7.00 | | | | 5-1-2026 | | | | 2,000,000 | | | | 2,060,000 | |

USI Incorporated 144A | | | 6.88 | | | | 5-1-2025 | | | | 2,700,000 | | | | 2,747,250 | |

| | | | |

| | | | | | | | | | | | | | | 7,640,300 | |

| | | | | | | | | | | | | | | | |

|

Health Care: 10.24% | |

|

| Health Care Equipment & Supplies: 1.37% | |

Hill-Rom Holdings Incorporated 144A | | | 4.38 | | | | 9-15-2027 | | | | 200,000 | | | | 206,000 | |

Hill-Rom Holdings Incorporated 144A | | | 5.00 | | | | 2-15-2025 | | | | 975,000 | | | | 1,010,344 | |

Hologic Incorporated 144A | | | 4.38 | | | | 10-15-2025 | | | | 4,700,000 | | | | 4,815,291 | |

Hologic Incorporated 144A | | | 4.63 | | | | 2-1-2028 | | | | 475,000 | | | | 496,969 | |

Surgery Center Holdings Incorporated 144A | | | 6.75 | | | | 7-1-2025 | | | | 1,000,000 | | | | 915,000 | |

| | | | |

| | | | | | | | | | | | | | | 7,443,604 | |

| | | | | | | | | | | | | | | | |

|

| Health Care Providers & Services: 7.08% | |

Acadia Healthcare Company Incorporated | | | 5.13 | | | | 7-1-2022 | | | | 190,000 | | | | 191,663 | |

Acadia Healthcare Company Incorporated | | | 6.50 | | | | 3-1-2024 | | | | 310,000 | | | | 320,850 | |

Centene Corporation 144A | | | 5.38 | | | | 6-1-2026 | | | | 1,425,000 | | | | 1,508,363 | |

Centene Corporation | | | 6.13 | | | | 2-15-2024 | | | | 650,000 | | | | 675,799 | |

CHS Incorporated | | | 5.13 | | | | 8-1-2021 | | | | 6,350,000 | | | | 6,334,125 | |

Davita Incorporated | | | 5.00 | | | | 5-1-2025 | | | | 2,125,000 | | | | 2,151,563 | |

Encompass Health Corporation | | | 4.50 | | | | 2-1-2028 | | | | 400,000 | | | | 409,000 | |

Encompass Health Corporation | | | 4.75 | | | | 2-1-2030 | | | | 400,000 | | | | 412,500 | |

Encompass Health Corporation | | | 5.75 | | | | 11-1-2024 | | | | 102,000 | | | | 103,148 | |

HealthSouth Corporation | | | 5.75 | | | | 9-15-2025 | | | | 1,725,000 | | | | 1,800,469 | |

MEDNAX Incorporated 144A | | | 5.25 | | | | 12-1-2023 | | | | 1,220,000 | | | | 1,235,250 | |

MEDNAX Incorporated 144A | | | 6.25 | | | | 1-15-2027 | | | | 1,075,000 | | | | 1,063,605 | |

MPH Acquisition Holdings LLC 144A | | | 7.13 | | | | 6-1-2024 | | | | 6,900,000 | | | | 6,434,250 | |

MPT Operating Partnership LP | | | 4.63 | | | | 8-1-2029 | | | | 875,000 | | | | 912,748 | |

MPT Operating Partnership LP | | | 5.00 | | | | 10-15-2027 | | | | 2,275,000 | | | | 2,400,125 | |

MPT Operating Partnership LP | | | 5.25 | | | | 8-1-2026 | | | | 3,200,000 | | | | 3,360,000 | |

MPT Operating Partnership LP | | | 6.38 | | | | 3-1-2024 | | | | 515,000 | | | | 537,531 | |

NVA Holdings Company 144A | | | 6.88 | | | | 4-1-2026 | | | | 425,000 | | | | 455,813 | |

Polaris Intermediate Corporation 144A | | | 8.50 | | | | 12-1-2022 | | | | 1,200,000 | | | | 1,008,000 | |

Select Medical Corporation 144A | | | 6.25 | | | | 8-15-2026 | | | | 1,950,000 | | | | 2,076,750 | |

Tenet Healthcare Corporation | | | 4.63 | | | | 7-15-2024 | | | | 614,000 | | | | 632,420 | |

Tenet Healthcare Corporation 144A | | | 4.88 | | | | 1-1-2026 | | | | 2,950,000 | | | | 3,051,406 | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Income Opportunities Fund | 13

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | Value | |

|

| Health Care Providers & Services (continued) | |

Tenet Healthcare Corporation 144A | | | 5.13 | % | | | 11-1-2027 | | | $ | 650,000 | | | $ | 677,612 | |

Vizient Incorporated 144A | | | 6.25 | | | | 5-15-2027 | | | | 375,000 | | | | 404,411 | |

WellCare Health Plans Incorporated 144A | | | 5.38 | | | | 8-15-2026 | | | | 350,000 | | | | 372,313 | |

| | | | |

| | | | | | | | | | | | | | | 38,529,714 | |

| | | | | | | | | | | | | | | | |

|

| Health Care Technology: 1.26% | |

Change Healthcare Holdings Incorporated 144A | | | 5.75 | | | | 3-1-2025 | | | | 6,300,000 | | | | 6,446,160 | |

Quintiles IMS Holdings Incorporated 144A | | | 5.00 | | | | 10-15-2026 | | | | 375,000 | | | | 395,625 | |

| | | | |

| | | | | | | | | | | | | | | 6,841,785 | |

| | | | | | | | | | | | | | | | |

|

| Life Sciences Tools & Services: 0.20% | |

Charles River Laboratories Incorporated 144A | | | 5.50 | | | | 4-1-2026 | | | | 800,000 | | | | 852,000 | |

Charles River Laboratories Incorporated 144A | | | 4.25 | | | | 5-1-2028 | | | | 250,000 | | | | 254,713 | |

| | | | |

| | | | | | | | | | | | | | | 1,106,713 | |

| | | | | | | | | | | | | | | | |

|

| Pharmaceuticals: 0.33% | |

Bausch Health Companies Incorporated 144A | | | 5.75 | | | | 8-15-2027 | | | | 175,000 | | | | 190,039 | |

Bausch Health Companies Incorporated 144A | | | 7.00 | | | | 1-15-2028 | | | | 350,000 | | | | 377,563 | |

Bausch Health Companies Incorporated 144A | | | 7.25 | | | | 5-30-2029 | | | | 175,000 | | | | 192,719 | |

Bausch Health Companies Incorporated 144A | | | 8.50 | | | | 1-31-2027 | | | | 925,000 | | | | 1,040,625 | |

| | | | |

| | | | | | | | | | | | | | | 1,800,946 | |

| | | | | | | | | | | | | | | | |

|

Industrials: 9.55% | |

|

| Aerospace & Defense: 0.64% | |

BBA US Holdings Incorporated 144A%% | | | 4.00 | | | | 3-1-2028 | | | | 1,625,000 | | | | 1,612,813 | |

RBS Global & Rexnord LLC 144A | | | 4.88 | | | | 12-15-2025 | | | | 1,800,000 | | | | 1,856,250 | |

| | | | |

| | | | | | | | | | | | | | | 3,469,063 | |

| | | | | | | | | | | | | | | | |

|

| Airlines: 1.26% | |

Aviation Capital Group Corporation 144A | | | 6.75 | | | | 4-6-2021 | | | | 2,190,000 | | | | 2,320,208 | |

BBA US Holdings Incorporated 144A | | | 5.38 | | | | 5-1-2026 | | | | 4,350,000 | | | | 4,545,750 | |

| | | | |

| | | | | | | | | | | | | | | 6,865,958 | |

| | | | | | | | | | | | | | | | |

|

| Commercial Services & Supplies: 5.57% | |

ACCO Brands Corporation 144A | | | 5.25 | | | | 12-15-2024 | | | | 725,000 | | | | 752,188 | |

Advanced Disposal Services Incorporated 144A | | | 5.63 | | | | 11-15-2024 | | | | 6,150,000 | | | | 6,419,063 | |

Covanta Holding Corporation | | | 5.88 | | | | 3-1-2024 | | | | 5,000,000 | | | | 5,137,500 | |

Covanta Holding Corporation | | | 5.88 | | | | 7-1-2025 | | | | 1,500,000 | | | | 1,556,250 | |

Covanta Holding Corporation | | | 6.00 | | | | 1-1-2027 | | | | 375,000 | | | | 391,875 | |

IAA Spinco Incorporated 144A | | | 5.50 | | | | 6-15-2027 | | | | 3,550,000 | | | | 3,803,470 | |

KAR Auction Services Incorporated 144A | | | 5.13 | | | | 6-1-2025 | | | | 11,725,000 | | | | 12,237,969 | |

| | | | |

| | | | | | | | | | | | | | | 30,298,315 | |

| | | | | | | | | | | | | | | | |

|

| Machinery: 1.51% | |

Harsco Corporation 144A | | | 5.75 | | | | 7-31-2027 | | | | 125,000 | | | | 129,846 | |

Stevens Holding Company Incorporated 144A | | | 6.13 | | | | 10-1-2026 | | | | 3,600,000 | | | | 3,870,000 | |

Trimas Corporation 144A | | | 4.88 | | | | 10-15-2025 | | | | 4,175,000 | | | | 4,248,063 | |

| | | | |

| | | | | | | | | | | | | | | 8,247,909 | |

| | | | | | | | | | | | | | | | |

|

| Trading Companies & Distributors: 0.57% | |

Fortress Transportation and Infrastructure Investors LLC 144A | | | 6.50 | | | | 10-1-2025 | | | | 3,075,000 | | | | 3,105,750 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

14 | Wells Fargo Income Opportunities Fund

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | Value | |

Information Technology: 9.96% | |

|

| Communications Equipment: 0.28% | |

CommScope Technologies Finance LLC 144A | | | 6.00 | % | | | 6-15-2025 | | | $ | 1,550,000 | | | $ | 1,389,575 | |

CommScope Technologies Finance LLC 144A | | | 8.25 | | | | 3-1-2027 | | | | 150,000 | | | | 142,085 | |

| | | | |

| | | | | | | | | | | | | | | 1,531,660 | |

| | | | | | | | | | | | | | | | |

|

| IT Services: 3.30% | |

Cardtronics Incorporated 144A | | | 5.50 | | | | 5-1-2025 | | | | 5,596,000 | | | | 5,777,870 | |

Gartner Incorporated 144A | | | 5.13 | | | | 4-1-2025 | | | | 5,250,000 | | | | 5,505,675 | |

Infor US Incorporated | | | 6.50 | | | | 5-15-2022 | | | | 875,000 | | | | 887,031 | |

Zayo Group LLC 144A | | | 5.75 | | | | 1-15-2027 | | | | 1,350,000 | | | | 1,372,113 | |

Zayo Group LLC | | | 6.38 | | | | 5-15-2025 | | | | 4,326,000 | | | | 4,447,128 | |

| | | | |

| | | | | | | | | | | | | | | 17,989,817 | |

| | | | | | | | | | | | | | | | |

|

| Semiconductors & Semiconductor Equipment: 0.12% | |

Qorvo Incorporated 144A | | | 4.38 | | | | 10-15-2029 | | | | 650,000 | | | | 653,656 | |

| | | | | | | | | | | | | | | | |

|

| Software: 1.64% | |

CDK Global Incorporated | | | 4.88 | | | | 6-1-2027 | | | | 425,000 | | | | 447,844 | |

CDK Global Incorporated | | | 5.00 | | | | 10-15-2024 | | | | 1,050,000 | | | | 1,135,575 | |

CDK Global Incorporated 144A | | | 5.25 | | | | 5-15-2029 | | | | 350,000 | | | | 371,656 | |

CDK Global Incorporated | | | 5.88 | | | | 6-15-2026 | | | | 650,000 | | | | 695,500 | |

Fair Isaac Corporation 144A | | | 5.25 | | | | 5-15-2026 | | | | 2,375,000 | | | | 2,576,875 | |

IQVIA Incorporated 144A | | | 5.00 | | | | 5-15-2027 | | | | 725,000 | | | | 768,500 | |

SS&C Technologies Incorporated 144A | | | 5.50 | | | | 9-30-2027 | | | | 1,625,000 | | | | 1,733,672 | |

Symantec Corporation 144A | | | 5.00 | | | | 4-15-2025 | | | | 1,150,000 | | | | 1,178,750 | |

| | | | |

| | | | | | | | | | | | | | | 8,908,372 | |

| | | | | | | | | | | | | | | | |

|

| Technology Hardware, Storage & Peripherals: 4.62% | |

Dell International LLC 144A | | | 5.88 | | | | 6-15-2021 | | | | 3,390,000 | | | | 3,442,138 | |

Dell International LLC 144A | | | 7.13 | | | | 6-15-2024 | | | | 10,175,000 | | | | 10,788,044 | |

NCR Corporation | | | 5.88 | | | | 12-15-2021 | | | | 380,000 | | | | 380,950 | |

NCR Corporation | | | 6.38 | | | | 12-15-2023 | | | | 10,268,000 | | | | 10,524,700 | |

| | | | |

| | | | | | | | | | | | | | | 25,135,832 | |

| | | | | | | | | | | | | | | | |

|

Materials: 5.32% | |

|

| Chemicals: 0.12% | |

Valvoline Incorporated | | | 5.50 | | | | 7-15-2024 | | | | 625,000 | | | | 648,633 | |

| | | | | | | | | | | | | | | | |

|

| Containers & Packaging: 4.97% | |

Ball Corporation | | | 4.00 | | | | 11-15-2023 | | | | 250,000 | | | | 260,000 | |

Ball Corporation | | | 4.88 | | | | 3-15-2026 | | | | 1,100,000 | | | | 1,193,500 | |

Ball Corporation | | | 5.25 | | | | 7-1-2025 | | | | 630,000 | | | | 700,875 | |

Berry Global Incorporated | | | 5.13 | | | | 7-15-2023 | | | | 700,000 | | | | 717,500 | |

Berry Global Incorporated 144A | | | 5.63 | | | | 7-15-2027 | | | | 350,000 | | | | 371,438 | |

Berry Global Incorporated | | | 6.00 | | | | 10-15-2022 | | | | 750,000 | | | | 763,125 | |

Crown Americas Capital Corporation VI | | | 4.75 | | | | 2-1-2026 | | | | 1,700,000 | | | | 1,785,000 | |

Crown Cork & Seal Company Incorporated | | | 7.38 | | | | 12-15-2026 | | | | 2,910,000 | | | | 3,492,000 | |

Flex Acquisition Company Incorporated 144A | | | 6.88 | | | | 1-15-2025 | | | | 4,350,000 | | | | 4,078,125 | |

Flex Acquisition Company Incorporated 144A | | | 7.88 | | | | 7-15-2026 | | | | 750,000 | | | | 705,000 | |

Owens-Brockway Packaging Incorporated 144A | | | 5.38 | | | | 1-15-2025 | | | | 925,000 | | | | 933,094 | |

Owens-Brockway Packaging Incorporated 144A | | | 5.88 | | | | 8-15-2023 | | | | 1,300,000 | | | | 1,373,125 | |

Owens-Brockway Packaging Incorporated 144A | | | 6.38 | | | | 8-15-2025 | | | | 6,350,000 | | | | 6,683,375 | |

Reynolds Group Issuer Incorporated 144A | | | 5.13 | | | | 7-15-2023 | | | | 1,451,000 | | | | 1,488,653 | |

Sealed Air Corporation 144A | | | 5.13 | | | | 12-1-2024 | | | | 2,350,000 | | | | 2,532,125 | |

| | | | |

| | | | | | | | | | | | | | | 27,076,935 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Income Opportunities Fund | 15

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | Value | |

| Metals & Mining: 0.23% | |

Indalex Holdings Corporation (a)† | | | 11.50 | % | | | 2-1-2020 | | | $ | 5,869,098 | | | $ | 0 | |

Novelis Corporation 144A | | | 5.88 | | | | 9-30-2026 | | | | 850,000 | | | | 892,585 | |

Novelis Corporation 144A | | | 6.25 | | | | 8-15-2024 | | | | 325,000 | | | | 340,438 | |

| | | | |

| | | | | | | | | | | | | | | 1,233,023 | |

| | | | | | | | | | | | | | | | |

|

Real Estate: 7.59% | |

|

| Equity REITs: 7.59% | |

CoreCivic Incorporated | | | 4.63 | | | | 5-1-2023 | | | | 800,000 | | | | 749,000 | |

CoreCivic Incorporated | | | 5.00 | | | | 10-15-2022 | | | | 2,325,000 | | | | 2,304,656 | |

Crown Castle International Corporation | | | 5.25 | | | | 1-15-2023 | | | | 4,385,000 | | | | 4,790,128 | |

Equinix Incorporated | | | 5.75 | | | | 1-1-2025 | | | | 2,475,000 | | | | 2,558,606 | |

Equinix Incorporated | | | 5.88 | | | | 1-15-2026 | | | | 2,450,000 | | | | 2,602,390 | |

ESH Hospitality Incorporated 144A | | | 4.63 | | | | 10-1-2027 | | | | 400,000 | | | | 401,040 | |

ESH Hospitality Incorporated 144A | | | 5.25 | | | | 5-1-2025 | | | | 7,800,000 | | | | 8,043,750 | |

Iron Mountain Incorporated 144A | | | 4.38 | | | | 6-1-2021 | | | | 2,500,000 | | | | 2,528,125 | |

Iron Mountain Incorporated 144A | | | 5.38 | | | | 6-1-2026 | | | | 2,175,000 | | | | 2,256,563 | |

Iron Mountain Incorporated | | | 6.00 | | | | 8-15-2023 | | | | 5,185,000 | | | | 5,295,181 | |

SBA Communications Corporation | | | 4.00 | | | | 10-1-2022 | | | | 300,000 | | | | 306,045 | |

SBA Communications Corporation | | | 4.88 | | | | 7-15-2022 | | | | 1,485,000 | | | | 1,500,786 | |

The Geo Group Incorporated | | | 5.13 | | | | 4-1-2023 | | | | 1,874,000 | | | | 1,649,120 | |

The Geo Group Incorporated | | | 5.88 | | | | 1-15-2022 | | | | 2,595,000 | | | | 2,510,663 | |

The Geo Group Incorporated | | | 5.88 | | | | 10-15-2024 | | | | 2,925,000 | | | | 2,442,375 | |

The Geo Group Incorporated | | | 6.00 | | | | 4-15-2026 | | | | 1,760,000 | | | | 1,394,800 | |

| | | | |

| | | | | | | | | | | | | | | 41,333,228 | |

| | | | | | | | | | | | | | | | |

|

Utilities: 7.94% | |

|

| Electric Utilities: 1.12% | |

NextEra Energy Operating Partners LP 144A | | | 4.25 | | | | 7-15-2024 | | | | 2,150,000 | | | | 2,208,480 | |

NextEra Energy Operating Partners LP 144A | | | 4.25 | | | | 9-15-2024 | | | | 350,000 | | | | 364,000 | |

NextEra Energy Operating Partners LP 144A | | | 4.50 | | | | 9-15-2027 | | | | 3,450,000 | | | | 3,519,000 | |

| | | | |

| | | | | | | | | | | | | | | 6,091,480 | |

| | | | | | | | | | | | | | | | |

|

| Gas Utilities: 0.60% | |

AmeriGas Partners LP | | | 5.63 | | | | 5-20-2024 | | | | 200,000 | | | | 215,500 | |

AmeriGas Partners LP | | | 5.75 | | | | 5-20-2027 | | | | 2,250,000 | | | | 2,463,750 | |

Suburban Propane Partners LP | | | 5.88 | | | | 3-1-2027 | | | | 575,000 | | | | 595,125 | |

| | | | |

| | | | | | | | | | | | | | | 3,274,375 | |

| | | | | | | | | | | | | | | | |

|

| Independent Power & Renewable Electricity Producers: 6.22% | |

NSG Holdings LLC 144A | | | 7.75 | | | | 12-15-2025 | | | | 7,694,824 | | | | 8,310,409 | |

Pattern Energy Group Incorporated 144A | | | 5.88 | | | | 2-1-2024 | | | | 11,518,000 | | | | 11,805,950 | |

TerraForm Global Operating LLC 144A | | | 6.13 | | | | 3-1-2026 | | | | 2,800,000 | | | | 2,863,000 | |

TerraForm Power Operating LLC 144A | | | 4.25 | | | | 1-31-2023 | | | | 7,225,000 | | | | 7,441,750 | |

TerraForm Power Operating LLC 144A | | | 4.75 | | | | 1-15-2030 | | | | 1,000,000 | | | | 1,033,750 | |

TerraForm Power Operating LLC 144A | | | 5.00 | | | | 1-31-2028 | | | | 2,250,000 | | | | 2,373,075 | |

| | | | |

| | | | | | | | | | | | | | | 33,827,934 | |

| | | | | | | | | | | | | | | | |

| |

Total Corporate Bonds and Notes (Cost $635,135,884) | | | | 640,485,669 | |

| | | | | |

|

Loans: 7.75% | |

|

| Communication Services: 1.49% | |

|

| Media: 1.49% | |

Ancestry.com Incorporated (1 Month LIBOR +4.25%)±‡ | | | 6.04 | | | | 8-27-2026 | | | | 7,712,047 | | | | 6,825,161 | |

Hubbard Radio LLC (1 Month LIBOR +3.50%)± | | | 5.29 | | | | 3-28-2025 | | | | 1,320,339 | | | | 1,314,833 | |

| | | | |

| | | | | | | | | | | | | | | 8,139,994 | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo Income Opportunities Fund

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity date | | | Principal | | | Value | |

Consumer Discretionary: 1.75% | |

|

| Hotels, Restaurants & Leisure: 1.75% | |

CCM Merger Incorporated (1 Month LIBOR +2.25%)± | | | 4.04 | % | | | 8-8-2021 | | | $ | 616,935 | | | $ | 615,856 | |

Montreign Operating Company LLC (3 Month LIBOR +8.25%)± | | | 10.37 | | | | 1-24-2023 | | | | 9,970,063 | | | | 8,890,006 | |

| | | | |

| | | | | | | | | | | | | | | 9,505,862 | |

| | | | | | | | | | | | | | | | |

|

Energy: 1.78% | |

|

| Energy Equipment & Services: 0.27% | |

Hornbeck Offshore Services Incorporated (3 Month LIBOR +9.50%)± | | | 9.50 | | | | 2-5-2025 | | | | 2,082,500 | | | | 1,453,585 | |

| | | | | | | | | | | | | | | | |

|

| Oil, Gas & Consumable Fuels: 1.51% | |

Encino Acquisition Partners Holdings LLC (1 Month LIBOR +6.75%)± | | | 8.54 | | | | 10-29-2025 | | | | 1,225,000 | | | | 770,219 | |

EPIC Crude Services LP (6 Month LIBOR +5.00%)± | | | 7.04 | | | | 3-2-2026 | | | | 3,850,000 | | | | 3,616,613 | |

Stonepeak Lonestar Holdings LLC < | | | 0.00 | | | | 10-16-2026 | | | | 2,600,000 | | | | 2,564,250 | |

Ultra Resources Incorporated (1 Month LIBOR +3.75%)± | | | 5.80 | | | | 4-12-2024 | | | | 2,191,413 | | | | 1,290,589 | |

| | | | |

| | | | | | | | | | | | | | | 8,241,671 | |

| | | | | | | | | | | | | | | | |

|

Financials: 1.56% | |

|

| Capital Markets: 1.08% | |

Nexus Buyer LLC <‡ | | | 0.00 | | | | 10-31-2026 | | | | 1,425,000 | | | | 1,425,000 | |

Victory Capital Holdings Incorporated (3 Month LIBOR +3.25%)± | | | 5.35 | | | | 7-1-2026 | | | | 4,441,182 | | | | 4,454,505 | |

| | | | |

| | | | | | | | | | | | | | | 5,879,505 | |

| | | | | | | | | | | | | | | | |

|

| Diversified Financial Services: 0.39% | |

Resolute Investment Managers Incorporated (3 Month LIBOR +7.50%)±‡ | | | 9.43 | | | | 4-30-2023 | | | | 2,110,000 | | | | 2,110,000 | |

| | | | | | | | | | | | | | | | |

|

| Insurance: 0.09% | |

HUB International Limited < | | | 0.00 | | | | 4-25-2025 | | | | 500,000 | | | | 499,000 | |

| | | | | | | | | | | | | | | | |

|

Industrials: 0.30% | |

|

| Commercial Services & Supplies: 0.30% | |

Advantage Sales & Marketing LLC (1 Month LIBOR +6.50%)± | | | 8.29 | | | | 7-25-2022 | | | | 2,025,000 | | | | 1,636,322 | |

| | | | | | | | | | | | | | | | |

|

Information Technology: 0.39% | |

|

| Software: 0.39% | |

Emerald Topco Incorporated (1 Month LIBOR +3.50%)± | | | 5.29 | | | | 7-24-2026 | | | | 2,150,000 | | | | 2,114,525 | |

| | | | | | | | | | | | | | | | |

|

Materials: 0.30% | |

|

| Containers & Packaging: 0.22% | |

Reynolds Group Holdings Incorporated (1 Month LIBOR +2.75%)± | | | 4.54 | | | | 2-5-2023 | | | | 1,187,786 | | | | 1,187,133 | |

| | | | | | | | | | | | | | | | |

|

| Paper & Forest Products: 0.08% | |

Clearwater Paper Corporation (1 Month LIBOR +3.25%)±‡ | | | 5.06 | | | | 7-26-2026 | | | | 475,000 | | | | 473,813 | |

| | | | | | | | | | | | | | | | |

|

Real Estate: 0.18% | |

|

| Real Estate Management & Development: 0.18% | |

Capital Automotive LP (1 Month LIBOR +6.00%)± | | | 7.79 | | | | 3-24-2025 | | | | 969,711 | | | | 969,711 | |

| | | | | | | | | | | | | | | | |

| |

Total Loans (Cost $46,773,413) | | | | 42,211,121 | |

| | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Wells Fargo Income Opportunities Fund | 17

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Dividend

yield | | | | | | Shares | | | Value | |

Preferred Stocks: 1.27% | | | | | | | | | | | | | | | | |

| | | | |

Energy: 1.27% | | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 1.27% | | | | | | | | | | | | |

Bristow Group Incorporated ‡ | | | 10.00 | % | | | | | | | 178,215 | | | $ | 6,914,385 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Preferred Stocks (Cost $5,397,563) | | | | | | | | | | | | | | | 6,914,385 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Expiration

date | | | | | | | |

Rights: 0.09% | | | | | | | | | | | | | | | | |

| | | | |

Utilities: 0.09% | | | | | | | | | | | | | | | | |

| | | | |

| Independent Power & Renewable Electricity Producers: 0.09% | | | | | | | | | | | | |

Vistra Energy Corporation † | | | | | | | 12-31-2046 | | | | 559,650 | | | | 475,703 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Rights (Cost $582,794) | | | | | | | | | | | | | | | 475,703 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | | |

| Yankee Corporate Bonds and Notes: 11.84% | | | | | | | | | | | | | | | | |

| | | | |

Communication Services: 0.58% | | | | | | | | | | | | | | | | |

| | | | |

| Diversified Telecommunication Services: 0.23% | | | | | | | | | | | | |

Intelsat Luxembourg SA | | | 8.13 | | | | 6-1-2023 | | | $ | 1,000,000 | | | | 841,250 | |

Telesat Canada/ Telesat LLC 144A | | | 6.50 | | | | 10-15-2027 | | | | 375,000 | | | | 391,406 | |

| | | | |

| | | | | | | | | | | | | | | 1,232,656 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Media: 0.16% | | | | | | | | | | | | |

Nielsen Holding and Finance BV 144A | | | 5.50 | | | | 10-1-2021 | | | | 850,000 | | | | 852,125 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Wireless Telecommunication Services: 0.19% | | | | | | | | | | | | |

Connect Finco SARL/Connect US Finco LLC 144A | | | 6.75 | | | | 10-1-2026 | | | | 1,025,000 | | | | 1,062,156 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy: 2.13% | | | | | | | | | | | | | | | | |

| | | | |

| Energy Equipment & Services: 0.57% | | | | | | | | | | | | |

Valaris plc | | | 5.75 | | | | 10-1-2044 | | | | 7,652,000 | | | | 3,099,060 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Oil, Gas & Consumable Fuels: 1.56% | | | | | | | | | | | | |

Baytex Energy Corporation 144A | | | 5.13 | | | | 6-1-2021 | | | | 2,450,000 | | | | 2,400,971 | |

Baytex Energy Corporation 144A | | | 5.63 | | | | 6-1-2024 | | | | 3,584,000 | | | | 3,189,760 | |

Griffin Coal Mining Company Limited 144A †(a) | | | 9.50 | | | | 12-1-2016 | | | | 1,396,100 | | | | 0 | |

Griffin Coal Mining Company Limited †(a) | | | 9.50 | | | | 12-1-2016 | | | | 191,090 | | | | 0 | |

Rockpoint Gas Storage Canada Limited 144A | | | 7.00 | | | | 3-31-2023 | | | | 2,950,000 | | | | 2,942,625 | |

| | | | |

| | | | | | | | | | | | | | | 8,533,356 | |

| | | | | | | | | | | | | | | | |

| | | | |

Financials: 3.60% | | | | | | | | | | | | | | | | |

| | | | |

| Banks: 0.87% | | | | | | | | | | | | |

Intelsat Connect Finance Company 144A | | | 9.50 | | | | 2-15-2023 | | | | 825,000 | | | | 765,270 | |

Nielsen Holding and Finance BV 144A | | | 5.00 | | | | 2-1-2025 | | | | 4,000,000 | | | | 3,985,000 | |

| | | | |

| | | | | | | | | | | | | | | 4,750,270 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Diversified Financial Services: 2.73% | | | | | | | | | | | | |

Intelsat Jackson Holdings SA | | | 5.50 | | | | 8-1-2023 | | | | 10,515,000 | | | | 9,831,525 | |

Intelsat Jackson Holdings SA 144A | | | 8.00 | | | | 2-15-2024 | | | | 225,000 | | | | 232,088 | |

The accompanying notes are an integral part of these financial statements.

18 | Wells Fargo Income Opportunities Fund

Portfolio of investments—October 31, 2019 (unaudited)

| | | | | | | | | | | | | | | | |

| | | Interest

rate | | | Maturity

date | | | Principal | | | Value | |

| Diversified Financial Services (continued) | | | | | | | | | | | | |

Intelsat Jackson Holdings SA 144A | | | 8.50 | % | | | 10-15-2024 | | | $ | 3,400,000 | | | $ | 3,424,446 | |

Trivium Packaging Finance BV 144A | | | 5.50 | | | | 8-15-2026 | | | | 800,000 | | | | 839,000 | |

Trivium Packaging Finance BV 144A | | | 8.50 | | | | 8-15-2027 | | | | 475,000 | | | | 504,688 | |

| | | | |

| | | | | | | | | | | | | | | 14,831,747 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care: 3.15% | | | | | | | | | | | | | | | | |

| | | | |

| Pharmaceuticals: 3.15% | | | | | | | | | | | | |

Bausch Health Companies Incorporated 144A | | | 5.50 | | | | 3-1-2023 | | | | 1,632,000 | | | | 1,646,280 | |

Bausch Health Companies Incorporated 144A | | | 5.50 | | | | 11-1-2025 | | | | 925,000 | | | | 966,634 | |

Bausch Health Companies Incorporated 144A | | | 5.88 | | | | 5-15-2023 | | | | 3,367,000 | | | | 3,415,822 | |

Bausch Health Companies Incorporated 144A | | | 6.13 | | | | 4-15-2025 | | | | 3,875,000 | | | | 4,022,734 | |

Bausch Health Companies Incorporated 144A | | | 6.50 | | | | 3-15-2022 | | | | 525,000 | | | | 540,855 | |

Bausch Health Companies Incorporated 144A | | | 7.00 | | | | 3-15-2024 | | | | 1,100,000 | | | | 1,150,793 | |

Teva Pharmaceutical Finance Netherlands III BV | | | 4.10 | | | | 10-1-2046 | | | | 1,750,000 | | | | 1,198,750 | |

Teva Pharmaceutical Finance Netherlands III BV | | | 6.75 | | | | 3-1-2028 | | | | 4,675,000 | | | | 4,189,969 | |

| | | | |

| | | | | | | | | | | | | | | 17,131,837 | |

| | | | | | | | | | | | | | | | |

| | | | |

Industrials: 2.02% | | | | | | | | | | | | | | | | |

| | | | |

| Commercial Services & Supplies: 1.63% | | | | | | | | | | | | |

Ritchie Brothers Auctioneers Incorporated 144A | | | 5.38 | | | | 1-15-2025 | | | | 8,500,000 | | | | 8,861,250 | |

| | | | | | | | | | | | | | | | |

| | | | |

| Electrical Equipment: 0.39% | | | | | | | | | | | | |

Sensata Technologies BV 144A | | | 5.00 | | | | 10-1-2025 | | | | 770,000 | | | | 829,829 | |

Sensata Technologies BV 144A | | | 6.25 | | | | 2-15-2026 | | | | 1,225,000 | | | | 1,310,750 | |

| | | | |

| | | | | | | | | | | | | | | 2,140,579 | |

| | | | | | | | | | | | | | | | |

| | | | |

Materials: 0.36% | | | | | | | | | | | | | | | | |

| | | | |

| Containers & Packaging: 0.36% | | | | | | | | | | | | |

Ardagh Packaging Finance plc 144A | | | 4.25 | | | | 9-15-2022 | | | | 600,000 | | | | 607,500 | |

Ardagh Packaging Finance plc 144A | | | 4.63 | | | | 5-15-2023 | | | | 275,000 | | | | 281,050 | |

OI European Group BV 144A | | | 4.00 | | | | 3-15-2023 | | | | 1,075,000 | | | | 1,075,000 | |

| | | | |

| | | | | | | | | | | | | | | 1,963,550 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Yankee Corporate Bonds and Notes (Cost $66,941,887) | | | | | | | | | | | | | | | 64,458,586 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | | |

| | | Yield | | | | | | Shares | | | | |

| Short-Term Investments: 3.24% | | | | | | | | | | | | |

| | | | |

| Investment Companies: 3.24% | | | | | | | | | | | | |

Wells Fargo Government Money Market Fund Select Class (l)(u)## | | | 1.75 | | | | | | | | 17,633,191 | | | | 17,633,191 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Short-Term Investments (Cost $17,633,191) | | | | | | | | | | | | | | | 17,633,191 | |

| | | | | | | | | | | | | | | | |