UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period endedJune 29, 2013

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number:000-50367

CRAILAR TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

British Columbia | 98-0359306 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

305-4420 Chatterton Way | |

Victoria, British Columbia, Canada | V8X 5J2 |

| (Address of principal executive offices) | (Zip Code) |

(250) 658-8582

Registrant’s telephone number, including area code

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date.

44,472,698 shares of common stock as of August 2, 2013.

1

CRAILAR TECHNOLOGIES INC.

Quarterly Report On Form 10-Q

For The Quarterly Period Ended

June 29, 2013

INDEX

2

FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this quarterly report include, among others, statements regarding our capital needs, business plans and expectations. Such forward-looking statements include, but are not limited to, statements with respect to the following:

- our need for additional financing;

- the competitive environment in which we operate;

- our dependence on key personnel;

- conflicts of interest of our directors and officers;

- our ability to fully implement our business plan;

- our ability to effectively manage our growth; and

- other regulatory, legislative and judicial developments.

Forward-looking statements are made, without limitation, in relation to operating plans, property exploration and development, availability of funds, environmental reclamation, operating costs and permit acquisition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks outlined in our annual report on Form 10-K for the year ended December 31, 2012, this quarterly report on Form 10-Q, and, from time to time, in other reports that we file with the Securities and Exchange Commission (the “SEC”). These factors may cause our actual results to differ materially from any forward-looking statement. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

3

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

The following unaudited interim financial statements of Crailar Technologies Inc. (formerly Naturally Advanced Technologies, Inc.) (sometimes referred to as “we”, “us” or “our Company”) are included in this quarterly report on Form 10-Q:

4

| CRAiLAR Technologies Inc. |

| (formerly Naturally Advanced Technologies Inc.) |

| (A Development Stage Company) |

| Consolidated Balance Sheets |

| (In US Dollars) |

| | | June 29, 2013 | | | December 31, 2012 | |

| ASSETS | | | | | | |

| Current | | | | | | |

| Cash and cash equivalents | $ | 593,855 | | $ | 2,877,210 | |

| Accounts receivable | | 174,510 | | | 72,292 | |

| Inventory (Note 2) | | 2,503,525 | | | 2,904,652 | |

| Prepaid expenses and other | | 272,012 | | | 106,785 | |

| | | 3,543,902 | | | 5,960,939 | |

| Deferred Debt Issuance Costs(Note 6) | | 1,341,844 | | | 1,024,294 | |

| Property and Equipment, net(Notes 3) | | 15,171,757 | | | 13,248,688 | |

| Intangible Assets, net(Note 4) | | 127,780 | | | 94,619 | |

| | $ | 20,185,283 | | $ | 20,328,540 | |

| | | | | | | |

| LIABILITIES | | | | | | |

| Current | | | | | | |

| Accounts payable | $ | 2,253,301 | | $ | 1,406,418 | |

| Accrued liabilities | | 1,054,836 | | | 1,480,624 | |

| Derivative Liability (Note 5) | | 6,436 | | | 488,035 | |

| | | 3,314,573 | | | 3,375,077 | |

| Long Term Debt(Note 6) | | 14,269,406 | | | 10,051,262 | |

| | | 17,583,979 | | | 13,426,339 | |

| STOCKHOLDERS' DEFICIT | | | | | | |

| Capital Stock(Note 7) | | | | | | |

Authorized: 100,000,000 common shares without par value

Issued and outstanding : 44,472,698 commons shares

(December 31, 2012 - 44,239,198 and December 31, 2011 - 41,701,604) | | 32,974,780 | | | 32,616,795 | |

| Subscription receivable | | (64,050 | ) | | (64,050 | ) |

| Additional Paid-in Capital | | 7,931,511 | | | 7,061,406 | |

| Accumulated Other Comprehensive Loss | | 264,217 | | | (459,036 | ) |

| Deficit | | (11,485,251 | ) | | (11,485,251 | ) |

| Deficit accumulated in the development stage | | (27,019,903 | ) | | (20,767,663 | ) |

| | | 2,601,304 | | | 6,902,201 | |

| | $ | 20,185,283 | | $ | 20,328,540 | |

| | | | | | | |

| Commitments (Note 3) | | | | | | |

| Subsequent Events (Note 9) | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

5

| CRAiLAR Technologies Inc. |

| (formerly Naturally Advanced Technologies Inc.) |

| (A Development Stage Company) |

| Consolidated Statements of Operations |

| (In US Dollars) |

| | | Thirteen | | | | | | | | | | | | | |

| | | weeks | | | | | | | | | | | | | |

| | | ended | | | Thirteen weeks | | | Twenty-six | | | Twenty-six | | | Cumulative from | |

| | | June 29, | | | ended | | | weeks ended | | | weeks ended | | | October 1, 2009 to | |

| | | 2013 | | | June 30, 2012 | | | June 29, 2013 | | | June 30, 2012 | | | June 29, 2013 | |

| | | | | | | | | | | | | | | | |

| Revenues | $ | 182,376 | | $ | - | | $ | 182,376 | | $ | - | | $ | 182,376 | |

| | | | | | | | | | | | | | | | |

| Cost of sales | | 200,819 | | | - | | | 200,819 | | | - | | | 200,819 | |

| | | | | | | | | | | | | | | | |

| Gross profit | | (18,442 | ) | | - | | | (18,442 | ) | | - | | | (18,442 | ) |

| | | | | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | | | | |

| Advertising and promotion | | 180,625 | | | 57,905 | | | 325,053 | | | 117,775 | | | 1,256,090 | |

| Amortization and depreciation | | 302,781 | | | 54,226 | | | 344,880 | | | 104,598 | | | 730,743 | |

| Consulting and contract labour (Note 7) | | 89,372 | | | 215,871 | | | 293,547 | | | 432,179 | | | 3,166,326 | |

| General and administrative | | 302,353 | | | 226,574 | | | 579,218 | | | 412,505 | | | 2,602,184 | |

| Interest | | 483,248 | | | - | | | 794,773 | | | - | | | 1,191,435 | |

| Facility costs | | 378,619 | | | - | | | 1,109,521 | | | - | | | 1,109,521 | |

| Professional fees | | 225,699 | | | 261,027 | | | 479,135 | | | 398,582 | | | 2,020,621 | |

| Research and development | | 36,686 | | | 214,669 | | | 92,955 | | | 353,105 | | | 2,344,289 | |

| Salaries and benefits (Note 7) | | 945,016 | | | 1,034,504 | | | 1,823,349 | | | 2,142,777 | | | 10,640,712 | |

| | | | | | | | | | | | | | | | |

| | | 2,944,399 | | | 2,064,776 | | | 5,842,431 | | | 3,961,521 | | | 25,061,921 | |

| | | | | | | | | | | | | | | | |

| Loss before other items | | (2,962,842 | ) | | (2,064,776 | ) | | (5,860,873 | ) | | (3,961,521 | ) | | (25,080,364 | ) |

| | | | | | | | | | | | | | | | |

| Other items: | | | | | | | | | | | | | | | |

| Gain on disposal of assets (Note 3) | | 790 | | | | | | 790 | | | | | | 790 | |

| Write down of assets | | - | | | | | | - | | | | | | (691,148 | ) |

| Write down of inventory (Note 2) | | (477,378 | ) | | | | | (873,755 | ) | | | | | (1,177,418 | ) |

| Fair Value adjustment deriviative liabilities (Note 5) | | 407,620 | | | 623,052 | | | 481,599 | | | (269,169 | ) | | (84,257 | ) |

| Other income | | | | | | | | | | | | | | 1,177 | |

| | | | | | | | | | | | | | | | |

| Loss from continuing operations | | (3,031,810 | ) | | (1,441,724 | ) | | (6,252,239 | ) | | (4,230,690 | ) | | (27,031,220 | ) |

| | | | | | | | | | | | | | | | |

| Profit from discontinued operations | | | | | | | | | | | | | | 11,317 | |

| | | | | | | | | | | | | | | | |

| Net loss | | (3,031,810 | ) | | (1,441,724 | ) | | (6,252,239 | ) | | (4,230,690 | ) | | (27,019,903 | ) |

| | | | | | | | | | | | | | | | |

| Other comprehensive income (loss) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Exchange differences on translating to presentation currency | | 525,273 | | | (23,465 | ) | | 723,253 | | | 34,734 | | | | |

| | | | | | | | | | | | | | | | |

| Total comprehensive loss | $ | (2,506,537 | ) | $ | (1,465,189 | ) | $ | (5,528,987 | ) | $ | (4,195,956 | ) | | | |

| | | | | | | | | | | | | | | | |

| Loss from continuing operations per share (basic and diluted) | | ($0.07 | ) | | ($0.03 | ) | $ | ($0.14 | ) | $ | ($0.10 | ) | | | |

| | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding | | 44,407,621 | | | 42,542,218 | | | 44,392,374 | | | 42,285,245 | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

6

| CRAiLAR Technologies Inc. |

| (formerly Naturally Advanced Technologies Inc.) |

| (A Development Stage Company) |

| Consolidated Statements of Cash Flows |

| | | For twenty-six week | | | For twenty-six | | | Cumulative from | |

| | | period ended June | | | period ended June | | | October 1, 2009 to | |

| | | 29, 2013 | | | 30, 2012 | | | June 29, 2013 | |

| | | | | | | | | | |

| Cash flows used in operating activities | | | | | | | | | |

| Net loss from continuing operations | $ | (6,252,239 | ) | $ | (4,230,690 | ) | $ | (27,031,220 | ) |

| Adjustments to reconcile net loss to net cash from operating activities | | | | | | | | | |

| Amortization and depreciation | | 586,638 | | | 104,598 | | | 972,501 | |

| Amortization of deferred debt issuance costs (Note 6) | | 176,712 | | | - | | | 266,932 | |

| Rent | | 73,859 | | | - | | | 193,695 | |

| Stock based compensation | | 1,035,217 | | | 1,454,417 | | | 7,173,526 | |

| Gain on disposal of assets | | (790 | ) | | - | | | 690,358 | |

| Write down of inventory | | 873,755 | | | | | | 1,177,418 | |

| Fair value adjustment of derivative liability | | (481,599 | ) | | 269,169 | | | 84,257 | |

| Gain on foreign exchange | | - | | | - | | | (71,990 | ) |

| | | | | | | | | | |

| Changes in working capital assets and liabilities | | | | | | | | | |

| (Increase) decrease in accounts receivable | | (102,218 | ) | | 88,581 | | | (97,563 | ) |

| (Increase) decrease in inventory | | (472,628 | ) | | (1,152,509 | ) | | (3,680,943 | ) |

| (Increase) decrease in prepaid expenses | | (165,227 | ) | | (2,239 | ) | | (201,887 | ) |

| Increase in accounts payable | | 441,302 | | | 730,872 | | | 1,509,859 | |

| Decrease in accrued liabilities | | (94,070 | ) | | (350,955 | ) | | 650,438 | |

| Increase in due to related parties | | - | | | | | | 56,945 | |

| Net cash used in operating activities of continuing operations | | (4,381,288 | ) | | (3,088,756 | ) | | (18,307,673 | ) |

| | | | | | | | | | |

| Net cash provided by discontinued operations | | | | | - | | | 79,982 | |

| Net cash flows used in operating activities | | (4,381,288 | ) | | (3,088,756 | ) | | (18,227,691 | ) |

| | | | | | | | | | |

| Cash flows used in investing activities | | | | | | | | | |

| Purchase of property and equipment | | (2,492,533 | ) | | (3,463,452 | ) | | (16,131,955 | ) |

| Acquisition of intangible assets | | (49,545 | ) | | (19,897 | ) | | (154,414 | ) |

| | | | | | | | | | |

| Net cash flows used in investing activities | | (2,542,078 | ) | | (3,483,349 | ) | | (16,286,369 | ) |

| | | | | | | | | | |

| Cash flows used in financing activities | | | | | | | | | |

| Issuance of capital stock and warrants | | 192,876 | | | 1,001,821 | | | 22,156,857 | |

| Notes payable | | - | | | - | | | (200,000 | ) |

| Convertible Debenture | | 4,218,144 | | | | | | 14,269,406 | |

| Deferred issuance costs for convertible debenture | | (494,262 | ) | | | | | (1,578,198 | ) |

| Related parties payments | | - | | | | | | (1,025,960 | ) |

| | | | | | | | | | |

| Net cash flows from financing activities | | 3,916,758 | | | 1,001,821 | | | 33,622,106 | |

| | | | | | | | | | |

| Effect of exchange rate changes on cash and cash equivalents | | 723,253 | | | 34,734 | | | 432,363 | |

| | | | | | | | | | |

| Increase (decrease) in cash and cash equivalents | | (2,283,355 | ) | | (5,535,550 | ) | | (459,592 | ) |

| | | | | | | | | | |

| Cash and cash equivalents, beginning | | 2,877,210 | | | 6,340,505 | | | 1,053,477 | |

| | | | | | | | | | |

| Cash and cash equivalents, ending | $ | 593,855 | | $ | 804,955 | | $ | 593,855 | |

| SUPPLEMENTAL CASH FLOW INFORMATIONAND NON-CASH FINANCING AND INVESTINGACTIVITIES: | | | | | | | | | |

| Cash paid for interest | $ | 277,397 | | $ | | | | | |

| Cash paid for income taxes | $ | | | $ | | | | | |

| Capital stock issued as share issue costs | $ | | | $ | | | | | |

The accompanying notes are an integral part of these consolidated financial statements

7

Crailar Technologies Inc.

(A Development Stage Company)

Notes to Consolidated Financial Statements

June 29, 2013

(Unaudited)

| 1. | Basis of Presentation |

| | |

| These unaudited consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles for interim financial reporting and the rules and regulations of the Securities and Exchange Commission. They do not include all information and footnotes required by United States generally accepted accounting principles (“U.S. GAAP”) for complete financial statement disclosure. However, except as disclosed herein, there have been no material changes in the information contained in the audited consolidated financial statements for the year ended December 31, 2012, included in the Company’s Form 10-K filed with the U.S. Securities and Exchange Commission. Operating results for the period ended June 29, 2013 are not necessarily indicative of the results that may be expected for the year ending December 31, 2013. These interim unaudited consolidated financial statements should be read in conjunction with the information included in the Company’s Form 10-K filed on March 18, 2013 with the U.S. Securities and Exchange Commission. |

| | |

| Effective fiscal 2013, the Company began to report quarterly results on a 4-4-5 basis, with the quarter ending on the Saturday closest to the last day of each third month. In fiscal 2013, the Company's first quarter ended on March 30, 2013, the second quarter ended on June 29, 2013, the third quarter will end on September 28, 2013 and the fourth quarter will end on December 28, 2013. |

| | |

| In the opinion of management, the accompanying interim balance sheet and related interim statement of operations and cash flows include all adjustments, consisting only of normal recurring items, necessary for their fair presentation in conformity with U.S. GAAP. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Actual results and outcomes may differ from management’s estimates and assumptions. |

| | |

| The Company evaluated events occurring between, June 29, 2013, and the date financial statements were issued. |

| | |

| Recent accounting pronouncements with future effective dates are not expected to have an impact on the Company’s financial statements. |

| | |

| 2. | Inventory |

| | |

| As at June 29, 2013, inventory consists of: |

| | | | June 29, 2013 | | | December 31, 2012 | |

| | CRAiLAR fiber | $ | 166,750 | | $ | - | |

| | Decorticated fiber | | 276,977 | | | 51,504 | |

| | Flax seed | | 1,186,390 | | | 1,172,155 | |

| | Raw flax fiber feedstock | | 851,499 | | | 1,680,993 | |

| | Others | | 21,909 | | | - | |

| | | $ | 2,503,525 | | $ | 2,904,652 | |

During the twenty-six week period ended June 29, 2013, the Company wrote off $873,755 (2012 - $Nil) of raw flax fiber feedstock and decorticated fiber to net realizable value.

8

Crailar Technologies Inc.

(A Development Stage Company)

Notes to Consolidated Financial Statements

June 29, 2013

(Unaudited)

| | | | | | | | | | | | | Net Book Value | |

| | | | | | | Accumulated | | | Net Book Value | | | December 31, | |

| | | | Cost | | | Depreciation | | | June 29, 2013 | | | 2012 | |

| | Automobiles | $ | 58,745 | | $ | 6,958 | | $ | 51,787 | | $ | 57,559 | |

| | Computer equipment | | 124,888 | | | 59,112 | | | 65,777 | | | 48,398 | |

| | Equipment | | 535,108 | | | 76,468 | | | 458,640 | | | 359,445 | |

| | Equipment held for sale | | 70,000 | | | - | | | 70,000 | | | 105,045 | |

| | Furniture and fixtures | | 62,847 | | | 34,255 | | | 28,592 | | | 29,980 | |

| | Leasehold improvements | | 6,219,754 | | | 269,580 | | | 5,950,174 | | | 4,979,548 | |

| | Production equipment | | 3,283,792 | | | 201,894 | | | 3,081,897 | | | - | |

| | Production equipment in construction | | 5,430,868 | | | - | | | 5,430,868 | | | 7,606,837 | |

| | Website development costs | | 122,820 | | | 88,798 | | | 34,022 | | | 105,045 | |

| | | $ | 15,908,823 | | $ | 737,066 | | $ | 15,171,757 | | $ | 13,248,688 | |

| Depreciation of production equipment and leasehold improvements commenced on January 1, 2013 as the Company’s manufacturing facility started production. During the year, the Company disposed of equipment held for sale for a gain of $790. |

| | |

| 4. | Intangible Assets |

| | | | | | | | | | | | | Net Book Value | |

| | | | | | | Accumulated | | | Net Book Value | | | December 31, | |

| | | | Cost | | | Amortization | | | June 29, 2013 | | | 2012 | |

| | Patents | $ | 149,646 | | $ | 58,576 | | $ | 91,071 | | $ | 77,961 | |

| | Trademarks | | 123,310 | | | 93,948 | | | 29,362 | | | 7,639 | |

| | License fee | | 23,782 | | | 16,435 | | | 7,347 | | | 9,019 | |

| | | | | | | | | | | | | | |

| | | $ | 296,738 | | $ | 168,958 | | $ | 127,780 | | $ | 94,619 | |

| 5. | Derivative liabilities |

| | |

| Derivate liabilities consist of warrants that were originally issued in private placements which have exercise prices denominated in a currency other the Company’s functional currency. These warrants are non-cash liabilities and the Company is not required to expend any cash to settle these liabilities. The fair value of these warrants as at June 29, 2012 and December 31, 2012 are as follows: |

9

Crailar Technologies Inc.

(A Development Stage Company)

Notes to Consolidated Financial Statements

June 29, 2013

(Unaudited)

| | | | Exercise | | | June 29, 2013 | | | December 31, 2012 | |

| | | | price | | | | | | | |

| | | | | | | | | | | |

| | 275,506 warrants expiring on May 19, 2013 | $ | 1.25 | | $ | - | | $ | 257,564 | |

| | 533,887 warrants expiring on Oct 14, 2014 | $ | 3.45 | | | 6,436 | | | 230,471 | |

| | | | | | $ | 6,436 | | $ | 488,035 | |

The fair value of these warrants was determined using the Black-Scholes option pricing model, using the following assumptions:

| | | June 29, 2013 | December 31, 2012 |

| | Volatility | 65% | 57% - 66% |

| | Dividend yield | - | - |

| | Risk-free interest rate | 0.36% | 0.12 – 0.25% |

| | Expected life, in years | 0.84 | 0.38 – 1.73 |

| 6. | Long term debt |

| | |

| On September 20, 2012, the Company completed the offering of $10,051,262 (CDN$10,000,000) convertible debentures (the “Notes 2012”). The Notes 2012 mature on September 20, 2017. The Notes 2012 bear interest at a rate of 10% per year, payable semi-annually on March 31 and September 30, starting March 31, 2013. As at June 29, 2013, accrued interest of $240,937 (CDN$246,575) was included in accrued liabilities. |

| | |

| On February 26, 2013, the Company completed an offering for net proceeds of $4,218,144 (CDN$3,975,236) convertible debentures (the “Notes 2013”). The Notes 2013 mature on September 30, 2017. The Notes 2013 bear interest at a rate of 10% per year, payable semi-annually on March 31 and September 30, starting September 30, 2013. As at June 29, 2013, accrued interest of $164,640 (CDN$168,493) was included in accrued liabilities. Non-Canadian resident holders of Note 2013 will be ranked subordinately to Note 2012. Holders of Note 2013 will receive additional interest for the amount equal to the withholding taxes paid by the Company for Canadian tax purposes. |

| | |

| Holders of Notes 2012 and Notes 2013 have the option to convert at a price of $2.85 (CDN$2.90) per common share in the Capital of the Company at any time prior to the maturity date. The Company may redeem the Notes 2012 and Notes 2013 after September 30, 2015 provided that the market price at the time of the redemption notice is not less than 125% of the conversion price. The conversion rate is subject to standard anti-dilution provisions. |

| | |

| Notes 2012 and Notes 2013 are secured by a Guaranty and Security Agreement signed with the Company’s wholly-owned subsidiary, Crailar Inc. (“CI”), a Nevada incorporated company. CI provides a security interest over its assets, having an aggregate acquisition cost of no less than US$5,500,000, as security for its guarantee obligation which shall rank in priority to all other indebtedness of CI. |

| | |

| In accordance with Accounting Standards Codification 470-20, the Notes do not contain a beneficial conversion feature, as the fair value of the Company’s common stock on the date of issuance was less than the conversion price. All proceeds from the Notes were recorded as a debt instrument. |

| | |

| The Company paid a total of $481,962 (CDN$496,556) for agent commission and other expenses for Note 2013 which has been recorded as deferred debt issuance costs. |

| | |

| During the twenty-six week period ended June 29, 2013, the Company recorded $158,043 (CDN$154,430) as interest expenses for the amortization of the deferred issuance costs. |

10

| 7. | Capital Stock |

| | | |

| During the twenty-six week period ended June 29, 2013, the Company issued shares as follows: |

| | | |

| a. | A total of 196,000 shares were issued pursuant to the exercise of employee and consultants options for proceeds of $192,876. |

| | | |

| b. | Options totaling 191,000, with proceeds of $186,770 were exercised by the directors and officers of the Company. |

Share purchase warrants outstanding as at June 29, 2013 are:

| | | Warrants | Weighted-Average Exercise |

| | | | Price |

| | Warrants outstanding, December 31, 2012 | 3,168,212 | $4.01 |

| | Warrants exercised | (37,500) | $1.25 |

| | Warrants expired | (249,370) | $1.25 |

| | Warrants outstanding, June 29, 2013 | 2,881,342 | $4.29 |

The weighted average remaining contractual life of outstanding warrants at June 29, 2013, is 0.84 years.

Stock options outstanding are summarized as follows:

| | | Shares | Weighted-Average Exercise |

| | | | Price |

| | Options outstanding, December 31, 2012 | 6,416,045 | $1.77 |

| | Options granted | 285,000 | 2.25 |

| | Options exercised | (196,000) | 0.98 |

| | Options expired | (6,253) | 1.91 |

| | Options outstanding, June 29, 2013 | 6,498,792 | $1.81 |

Stock options outstanding at June 29, 2013, are summarized as follows:

| | | Weighted Average | Weighted | | Weighted |

| Range of | | Remaining | Average | | Average |

| Exercise | Number | Contractual Life | Exercise | Number | Exercise |

| Prices | Outstanding | (yr) | Price | Exercisable | Price |

| $0.87 - $3.05 | 6,498,792 | 2.98 | $1.81 | 4,959,418 | $1.82 |

11

Crailar Technologies Inc.

(A Development Stage Company)

Notes to Consolidated Financial Statements

June 29, 2013

(Unaudited)

| 7. | Capital Stock (cont.) |

| | |

| During the twenty-six week period ended June 29, 2013, 196,000 options were exercised and a total of $118,239 has been reclassified from additional paid-in capital to capital stock. |

| | |

| During the twenty-six week period ended June 29, 2013, the Company granted a total of 285,000, five year common stock options to employees, exercisable between $2.24 and $2.30 per share, with a fair value of $351,832. These options were granted under the terms of the Company’s amended 2011 Fixed Share Option Plan. |

| | |

| The fair value of options issued during the period ended June 29, 2013, was determined using the Black- Scholes option pricing model with the following assumptions: |

| Risk-free interest rate | 0.75% to 0.90% |

| Volatility factor | 66% to 67% |

| Expected life of option, in years | 5 |

| Weighted average fair value of options granted | $1.23 |

| During the twenty-six week period ended June 29, 2013, 862,715 (2012 – 1,032,087) options vested under the Company’s amended 2011 Fixed Share Option Plan. A total expense of $1,035,217 (2012 - $1,454,417) was recorded as stock-based compensation, of this amount $897,744 (2012 - $1,318,755) was included in salaries and benefits expense and $137,473 (2012 - $135,662) was included in consulting and contract labour expense. |

| | |

| 8. | Related Parties Transactions |

| | |

| During the twenty-six week period ended June 29, 2013, $754,921 (June 30, 2012 - $479,202) was incurred for remuneration to officers and directors of the Company. Of this amount, $754,921 (2012 - $479,202) was recorded as salaries and benefits expense. |

| | |

| 9. | Subsequent Events |

| | |

| On July 26, 2013, the Company closed the first tranche of a subordinated convertible debenture for gross proceeds of $3,434,960 (CDN$3,535,000). These debentures will mature on July 26, 2016 and will accrue interest at a rate of 10% per year, payable semi-annually in arrears on March 31 and September 30 of each year commencing September 30, 2013. At the holder’s option, the debentures may be converted into common shares in the capital of the Company at any time up to the earlier of the maturity date and the business day immediately preceding the date specified by the Company for redemption of the debentures. The conversion price, subject to adjustment in certain circumstances, will be C$2 per share, being a conversion rate of approximately 500 shares for each $1,000 principal amount of debentures. |

| | |

| In addition, the Company issued 800 transferable common share purchase warrants ("Warrant") for each C$1,000 of principal amount, resulting in an aggregate of 2,828,000 Warrants, with each Warrant entitling the holder thereof to purchase one additional Share ("Warrant Share") at an exercise price of $1.25 per Warrant Share until July 26, 2016. |

| | |

| In connection with this financing, the Company paid finder's fees of $233,645 (CDN$240,450) in cash and 192,360 finder's warrants ("Finder's Warrant"). The Finder's Warrants have the same attributes as the Warrants. |

12

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of OperationsManagement’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our results of operations and financial position should be read in conjunction with our financial statements and the notes thereto included elsewhere in this Report. Our consolidated financial statements are prepared in accordance with U.S. GAAP. All references to dollar amounts in this section are in U.S. dollars unless expressly stated otherwise.

The matters discussed in these sections that are not historical or current facts deal with potential future circumstances and developments. Such forward-looking statements include, but are not limited to, the development plans for the Company’s growth, trends in the results of the Company’s development, anticipated development plans, operating expenses and the Company’s anticipated capital requirements and capital resources. As such, these forward-looking statements may include words such as “plans”, “intends”, “anticipates”, “should”, “estimates”, “expects”, “believes”, “indicates”, “targeting”, “suggests”, and similar expressions. The actual results are expected to differ from these forward-looking statements and these differences may be material.

RESULTS OF OPERATIONS

Thirteen-Week Period Ended June 29, 2013 Compared to Three Month Period Ended June 30, 2012

| Thirteen-Week Period Ended June 29, 2013 and Three Month Period Ended June 30, 2012 |

| 2013

| 2012

|

| Revenues | $182,376 | $- |

| Gross margin | ($18,442) | $- |

| Loss before other items | ($2,962, 842) | ($2,064,776) |

| Net Loss | ($3,031,810) | ($1,441,724) |

| Exchange differences on translating foreign controlled entities | $525,273 | ($23,465) |

| Total comprehensive loss | ($2,506,537) | ($1,465,189) |

| Loss/share | ($0.07) | ($0.03) |

Revenue and Gross Margins

Revenues and cost of sales consisted of:

- $182,376 (2012: $Nil), in revenues

- $200,819 (2012: $Nil), in cost of sales

Our revenues for the thirteen-week period ended June 29, 2013 were $182,376 compared with $Nil for the same period in 2012. The increase in revenues for the second quarter of 2013 reflects our first revenue quarter where we sold 139,000 pounds of CRAiLAR Flax to customers that began integrating our fiber into their supply chain.

Our gross profit (loss) was ($18,442) caused by higher production and transportation costs incurred using temporary third party production facilities as we develop company-owned and operated facilities.

13

Operating Expenses

During the thirteen-week period ended June 29, 2013, we recorded operating expenses of $2,944,399, compared to operating expenses of $2,064,776 for the same period in 2012.

Operating expenses consisted of:

- $180,625 (2012: $57,905) in advertising and promotion;

- $302,871 (2012: $54,226) in amortization and depreciation;

- $89,372 (2012: $215,871) in consulting and contract labour;

- $302,353 (2012: $226,574) in general and administrative;

- $483,248 (2012: $Nil) in interest;

- $378,619 (2012: $Nil) in facility costs;

- $225,699 (2012: $261,027) in professional fees;

- $36,686 (2012: $214,669) in research and development; and

- $945,016 (2012: $1,034,504) in salaries and benefits

Advertising and promotion expenses increased to $180,625 for the thirteen-week period ended June 29, 2013, from $57,905 for the same period in 2012. The increase in advertising and promotion was primarily due to an increase in sales development costs the Company incurred that were made to facilitate future revenue streams and customer relations.

Amortization and depreciation expenses increased to $302,871 for the thirteen-week period ended June 29, 2013, from $54,226 for the same period in 2012. The increase is due to the decortication equipment and leasehold improvements placed into production commencing January 1, 2013 as the facility in Pamplico started production.

Consulting and contract labor expenses decreased to $89,372 for the thirteen-week period ended June 29, 2013, from $215,871, compared to the same period in 2012 was primarily due to decrease in stock-based compensation and the reduction of consultants that were utilized during the thirteen-week period for 2013.

General and administrative expenses increased to $302,353 for the thirteen-week period ended June 29, 2013, compared to $226,574 for the same period in 2012. The increase in general and administrative expenses was primarily due to travel and office costs. Repairs and maintenance expenses are now included in this expense category where they previously were classified under research and development expense.

Interest expenses increased to $483,248 for the thirteen-week period ended June 29, 2013, compared to $Nil for the same period in 2012. The increase is directly attributable to the interest incurred on the existing convertible debentures.

Facility costs were $378,619 for the thirteen-week period ended June 29, 2013, compared to $Nil for the same period in 2012. Production did not commence until January 1, 2013 which is the reason there were no expenses in 2012.

Professional fees were $225,699 for the thirteen-week period ended June 29, 2013, compared to $261,027 for the same period in 2012. The decrease is a primarily due to a decrease in accounting fees.

Research and development costs were $36,686 for the thirteen-week period ended June 29, 2013, compared to $214,669 for the same period in 2012. The decrease is a result of the Company coming out of the development stage and into production. Furthermore, repairs and maintenance expenses were classified under this category in 2012.

Salaries and benefits expenses decreased to $945,016 for the thirteen-week period ended June 29, 2013, compared with $1,034,504 for the three month period in 2013. This decrease was caused primarily by a reduction in stock based compensation due to the fact that there were fewer stock options outstanding and exercisable as at June 29, 2013.

Net Loss

Our net loss during the thirteen-week period ended June 29, 2013, was ($3,031,810), or ($0.07) loss per share, compared to ($1,441,724), or ($0.03) loss per share, during the three month period ended June 30, 2012. During the thirteen week period ended June 29, 2013, the Company wrote down the value of its raw flax fiber feedstock and decorticated fiber inventory to a lower net realizable value by $477,378 (2012 – $Nil) due to the expected decortication yield rate that was experienced during production. There was also a gain of $407,620 (2012 – $623,052) due to the change in the value of the derivative liabilities as at June 29, 2013.

14

For the thirteen-week period ended June 29, 2013, the weighted average number of shares outstanding was 44,407,621 compared to 42,542,218 at June 30, 2012.

| Twenty-Six Week Period Ended June 29, 2013 and Six Month Week Period Ended June 30, 2012 |

| 2013

| 2012

|

| Revenues | $182,376 | $- |

| Gross loss | ($18,442) | $- |

| Loss before other items | ($5,860,873) | ($3,961,521) |

| Net Loss | ($6,252,239) | ($4,230,690) |

| Exchange differences on translating foreign controlled entities | $723,253 | $34,734 |

| Total comprehensive loss | ($5,528,987) | ($4,195,956) |

| Loss/share | ($0.14) | ($0.10) |

Revenue and Gross Margins

Our net gross loss during the twenty-six week period ended June 29, 2013, was ($18,442) compared to ($Nil) during the same period in 2012. Revenues were generated during the most recent thirteen-week period by the sale of CRAiLAR® Flax Fiber for the first time since the commencement of production.

Revenues and cost of sales consisted of:

- $182,376 (2012: $Nil), in revenues

- $200,819 (2012: $Nil), in cost of sales

Our revenues for the thirteen-week period ended June 29, 2013 were $182,376 compared with $Nil for the same period in 2012. The increase in revenues for the second quarter of 2013 reflects our first revenue quarter where we sold 139,000 pounds of CRAiLAR Flax to customers that began integrating our fiber into their supply chain.

Our gross profit (loss) was ($18,442) caused by higher production and transportation costs incurred using temporary third party production facilities as we develop company-owned and operated facilities.

Operating Expenses

During the twenty-six week period ended June 29, 2013, we recorded operating expenses of $5,842,431 compared to operating expenses of $3,961,521 for the same period in 2012. The continued increase in operating expenses reflects the growing preparation of the Company for commercialization in 2013.

Operating expenses consisted of:

- $325,053 (2012: $117,775), in advertising and promotion;

- $344,880 (2012: $104,598), in amortization and depreciation;

- $293,547 (2012: $432,179), in consulting and contract labour;

15

- $579,218 (2012: $412,505), in general and administrative;

- $794,773 (2012: $Nil), in interest;

- $1,109,521 (2012: $Nil), in facility costs

- $479,135 (2012: $398,582), in professional fees;

- $92,955 (2012: $353,105), in research and development;

- $1,823,349 (2012: $2,142,777), in salaries and benefits;

Advertising and promotion expenses increased to $325,053 for the twenty-six week period ended June 29, 2013, from $117,775 for the same period in 2012. The increase is due to the hiring of two new public relations consultants in the United States and Canada. Furthermore, the Company incurred additional expenses for sales development. These expenses include additional extraordinary processing costs that were incurred to further customer relations and to secure future revenue streams with its existing partners.

Amortization and depreciation expenses increased to $344,880 for the twenty-six week period ended June 29, 2013, from $104,598, for the same period in 2012. There was an overall increase of amortization expense which is due to the amortization of the decortication equipment and leasehold improvements that commenced January 1, 2013 as the facility in Pamplico started production.

Consulting and contract labor expenses decreased to $293,547 for the twenty-six week period ended June 29, 2013, from $432,179 for the same period in 2012. The decrease was due to a reduction in the amount of stock based compensation expense for consultants and contractors as well as a reduction in the number of contractors used during the period.

General and administrative expenses increased to $579,218 for the twenty-six week period ended June 29, 2013, from $412,505 for the same period in 2012. The expansion of the Company’s activities has led to an increase in general and administrative expenses, primarily office administration costs, travel, insurance, property taxes. Repairs and maintenance expenses have been classified under this expense category as a result of moving to production.

Interest expenses increased to $794,773 for the twenty-six week period ended June 29, 2013, from $Nil for the same period in 2012. Interest expense is directly attributable to the interest incurred on the existing convertible debentures.

Facility costs were $1,109,521 for the twenty-six week period ended June 29, 2013, compared to $Nil for the same period in 2012. The reason for the increase is due commencement of production at January 1, 2013.

Professional fees were $479,135 for the twenty-six week period ended June 29, 2013, compared to $398,582 for the same period in 2012. The primary cause for the increase was fees related to the Company’s preparation for listing on a more senior exchange, and the fees involved in the completion of the 2012 year-end audit.

Research and development costs were $92,955 for the twenty-six week period ended June 29, 2013, compared to $353,105 for the same period in 2012. Increased amounts of CRAiLAR® fiber have been produced for testing purposes for our development partners and the cost of that fiber has been expensed to research and development. Additionally, some costs associated with scaling up the facility were charged to development expenses.

Salaries and benefits expenses decreased to $1,823,349 for the for the twenty-six week period ended June 29, 2013, compared to $2,142,777 for the same period in 2012. The decrease is primarily due to the decrease in stock based compensation for the period.

Net Loss

Our net operational loss from continuing operations during the twenty-six week period ended June 29, 2013, was ($6,252,239), or ($0.14) loss per share, compared to ($4,230,690) or ($0.10) loss per share for the same period in 2012. The Company has continued to increase expenses for the start of the commercialization process of CRAiLAR. Specifically, the increase in loss was due to an increase in advertising and promotion expense, amortization and depreciation expense, an increase in general and administrative expense, interest expense, professional fees, facility costs, as well as a loss from the write down of impaired inventory. During the twenty six week period ended June 29, 2013, the Company wrote down the value of its raw flax fiber feedstock and decorticated fiber inventory by $873,755 (2012 - $Nil) to a lower net realizable value due to the expected decortication yield rate that was experienced during production. There was also a gain of $481,599 (2012 – ($269,169)) due to the change in the value of the derivative liabilities as at June 29, 2013.

16

For the twenty-six week period ended June 29, 2013, the weighted average number of shares outstanding was 44,392,374 compared to 42,285,245 as at June 30, 2012.

Liquidity and Capital Resources

| June 29, 2013

| December 31, 2012

|

| Cash and cash equivalents | $593,855 | $2,877,210 |

| Working capital | $229,329 | $2,585,862 |

| Total assets | $20,185,283 | $20,328,540 |

| Total liabilities | $17,583,979 | $13,426,339 |

| Shareholders Equity | $2,601,305 | $6,902,201 |

Historically, the Company has been reliant on equity financings from the sale of its common shares, and more recently from the sale of convertible debentures, to fund its operations. In February 2013 the Company completed an additional convertible debt financing for net proceeds of $4,231,276. The Company expects to fund future operations and expansion through bank debt, government loan programs, partner financing, lease programs and equity financings. Initial stages of commercialization have commenced through previous financings, however, future phases of commercialization will be dependent on the financings described above.

As at June 29, 2013, total assets were $20,185,283, consisting of:

- $593,885 in cash and cash equivalents;

- $174,510 in accounts receivable;

- $2,503,525 in inventory;

- $272,012 in prepaid expenses and other;

- $1,341,844 in deferred debenture issuance costs;

- $15,171,757 in property and equipment; and

- $127,780 in intangible assets.

As at June 29, 2013, total liabilities were $17,583,979 and were comprised of:

- $2,253,301 in accounts payable;

- $1,054,836 in accrued liabilities;

- $6,436 in derivative liabilities; and

- $14,269,406 in convertible debenture.

Stockholders’ Equity decreased by $4,300,896 from $6,902,201 at December 31, 2012, to $2,601,305 at June 29, 2013.

Cash Flows from Operating Activities

The cash flows used in operations of continuing operations for the twenty-six week period ended June 29, 2013, were ($4,381,288) compared with ($3,088,756) for the same period in 2012. Cash flows used in operations for the twenty-six week period ended June 29, 2013, consisted primarily of a net loss of ($6,252,239) from continuing operations, offset by certain items, amortization & depreciation of $586,638 (2012 – $104,598); amortization of deferred debt issuance costs $176,712 (2012 - $Nil); rent $73,859 (2012 - $Nil); stock based compensation of $1,035,217 (2012 - $1,454,417); gain on disposal of assets of ($790) (2012 - $Nil); impairment of inventory of $873,755 (2012 - $Nil); fair value adjustment of derivative liability ($481,599) (2012 – $269,169); an increase in accounts receivable ($102,218) (2012 – $88,581); and increase in inventory of ($472,628) (2012 – ($1,152,509)); decrease in prepaid expenses of ($165,227) (2012 – ($2,239)); increase in accounts payable of $441,302 (2012 – $730,872); and a decrease in accrued liabilities of ($94,070) (2012 – ($350,955)).

17

Cash Flows from Investing Activities

The cash flows used in investing activities for the twenty-six week period ended June 29, 2013, were ($2,542,078) compared to (2012 - $3,483,349) for the same period in 2012. Cash flows used in investing activities consisted of a purchase of property and equipment totaling ($2,492,533) (2012 – ($3,463,452)), and the acquisition of intangible assets ($49,545) (2012 – ($19,897)).

Cash Flows from Financing Activities

Cash flows provided by financing activities for the twenty-six week period ended June 29, 2013, totaled $3,916,758 versus $1,001,821 during the six month period in 2012. The Company issued capital stock for proceeds of $192,876 (2012 - $1,001,821); convertible debentures for net proceeds of $4,218,144, (2012 - $Nil); and convertible issuance costs for convertible debenture of ($494,262) (2012 – $Nil).

Effect of Exchange Rate

The effect of exchange rates on cash resulted in an unrealized gain of $723,253 for the twenty-six week period ended June 29, 2013, as compared with an unrealized gain of $34,734 in the same period of 2012.

Discontinued Operations - HTNaturals

During fiscal 2009, we closed our apparel business, which operated under the brand name “HTnaturals”. The apparel business is classified as discontinued operations in our consolidated financial statements. We decided to close our apparel division to focus on our CRAiLAR® and CRAiLEXTM technology. The warehouse lease was not renewed, the sales team was terminated or re-assigned and all other elements of our apparel division were discontinued.

Plan of Operation

“With CRAiLAR®, we have seen fibers grown by sunlight and rainfall perform better than those engineered in a laboratory. At CRAiLAR, we employ environmentally sustainable farming and manufacturing practices because they yield a superior fiber, utilize fewer resources, and prove that the path forward begins with a return to nature.”

Partnerships and Industry Expertise

The Company has identified South and North Carolina as an ideal region for growing winter flax crops and is testing Minnesota for growing summer flax.

As a result of identifying this geographical area as an ideal growing region, we decided to locate our initial development in the Williamsburg and Florence counties of South Carolina. The Company is developing a flax fiber industry based around our CRAiLAR® fiber technology; from the contracting of crops through to the processing of the fiber.

Our first commercialization partner, Hanesbrands, is headquartered in North Carolina. Hanesbrands uses contract spinners located throughout the states of North and South Carolina. Therefore, being able to grow textile grade fiber in this region allows the Company to take advantage of strategic logistical opportunities.

We entered into a sub-lease of a low volume decortication facility located in Kingstree, South Carolina, in early August of 2010. The facility was originally established under a USDA flax initiative. The equipment in this facility is designed to mechanically separate the flax fiber from the rest of the plant. This stage is called decortication. This is the first step of our process before it goes through our patented CRAiLAR® wet process. We have used this facility to prove the viability of flax farming in this region, perfect our decortication process and to commence early volumes of CRAiLAR® fiber to our commercial partners. We have extended the original lease until December 31, 2013, and plan to use the facility for flax cleaning and storage purposes. The Company plans to decommission the facility during December 2013 at a minimum expense.

In addition to signing our joint development agreements with key consumer brands such as Hanesbrands and Georgia Pacific, CRAiLAR has licensed several industry leading third party processors to assist in the scale-up of our fiber processing and yarn development.

18

Earlier this year, CRAiLAR completed agreements with industry leaders, all of whom are critical to various parts of the overall process. In an effort to increase capacity, share industry knowledge and spur innovation, the following experts were enlisted to partner and participate in CRAiLAR’s growth and expansion:

Tuscarora Yarns of Greensboro NC are a highly innovative yarn spinner, capable of blending CRAiLAR® with fibers other than cotton, to broaden our market capabilities in performance sportswear, higher end fashion and outerwear. This is a strategic initiative that will add to the CRAiLAR® list of performance attributes, while strengthening our brand capabilities at the consumer interface.

Tintoria Piana, a textile company dating back to 1582 in Biella, Italy, which is a privately held family-owned business which has dyed fiber for the traditional apparel business for more than 60 years and operates principally out of Cartersville, Georgia, will execute the CRAiLAR® enzymatic process, augmenting the Company’s plans for manufacturing capacity. Tintoria Piana processed fiber for research and development purposes in 2012.

In an effort to further streamline the overall supply chain for brand partners, CRAiLAR is currently in discussions with Parkdale Mills of Gastonia, NC. Founded in 1916, Parkdale has successfully managed to sustain—and enhance its reputation as a market leading yarn spinner through a commitment to innovation. Parkdale Mills has 25 plants and 2,300 employees operating in three different countries: the U.S., Colombia and Mexico.

Agronomics Plan - USDA

In order to further develop our agronomic know-how and our ability to produce fiber capable of being spun into finer-gauge yarns suitable for undergarments, shirting and finer-knit garments CRAiLAR entered into growing trials with Hanesbrands and the USDA-ARS in January of 2012. These trials were designed to enable us to move to an unprecedented level of flax-fiber refinement by allowing us to develop flax strains capable of accessing all sectors of the industry. The research project has resulted in test acres of flax being planted in the Kingstree region the past two winters. Flax grown in South and North Carolina is typically harvested in May and the is left to dew ret in the fields before being baled for entering the CRAiLAR® process. Growers typically are able to plant summer crops, such as soybeans, in time for a full summer season proving the viability of flax as a winter rotation crop in the South East. We have also identified other suitable North American growing regions, such as Minnesota and Maine, and have planted test plots in Alabama and Georgia.

In March 2012, the Company appointed Mr. Steve Sandroni as Vice President of Agriculture. Mr. Sandroni brings more than 34 years of experience working in various aspects of agribusiness to the Company. Mr. Sandroni oversees the Company’s global agricultural efforts. He liaises with farmers and has hired regional support staff in the Company’s primary growing regions.

By July of 2012 harvesting of the contracted flax acreage in South and North Carolina was completed. All fiber from the harvest is now on CRAiLAR’s property in Pamplico, South Carolina and is being processed through the recently commissioned decortication line.

Planting for the 2013 spring harvest has taken place during October and November and the Company contracted with growers approximately 3,000 acres of flax fiber in South Carolina and North Carolina. The harvesting of the Carolina crop took place in late June and July. The Company also expects to have up to 3,000 acres under cultivation in Minnesota for harvest in the fall. For additional flax fiber, the Company also has a relationship with a European company to supply fiber to cover any shortfall in raw feedstock availability. With the experience gained from the 2012 crop the Company expects to receive higher yields from the 2013 crop as a result of improved planting and harvesting techniques.

In the fall of 2012 the Company undertook further flax trials with the USDA-ARS and the Pee-Dee REC on the suitability of various flax varietals and crop disease prevention. The results of these trials will be available to the Company in 2013.

The Company has initiated the necessary steps to obtain approval under the Federal Crop Insurance Act for crop insurance for growers.

CRAiLAR is expanding its agronomic focus to include multiple North American and International growing regions. Expansion of the growing region will mitigate climate risk and large expenditures associated with harvest. In the summer 2012, CRAiLAR contracted 770 acres of flax to be grown in Canada for the purpose of seed multiplication. For the summer of 2013, CRAiLAR plans to use the flax planted in Minnesota for seed multiplication and potentially for fiber feedstock. The seed produced from this harvest is expected to provide enough seed to plant approximately 20,000 acres of flax to be used as raw feedstock for the CRAiLAR® process.

19

Production Plan

One of the keys to the successful adoption of CRAiLAR® into the mainstream textile market is the scale up of our in-house production capabilities.

With the proceeds of our financing in July 2012, we began installing Phase I of our first fully integrated CRAiLAR® Fiber processing facility in the Florence region of South Carolina. The Company has signed a lease of an existing building in the region, for the housing of its first fully integrated decortication and enzyme treatment processing facility. The installation of our full-scale decortication facility is currently underway and purchase orders plus deposits for some of the equipment needed to enzymatically process CRAiLAR® Fiber have been issued. The installation of the equipment in the new facility commenced during the second quarter of 2012. With the completion of the September 2012 financing the Company will complete the Phase I portion (see below) of the facility build-out along with the necessary equipment purchases for the decortication process. The Company the decortication phase of the new facility became operational in the first quarter of 2013, and will ramp up production throughout 2013. At full capacity, the new facility will be capable of producing 400,000 pounds per week of decorticated bast fiber ready for the CRAiLAR® wet process. Feedstock in 2013 will come from the North America and Europe.

In addition to the installation of our full scale processing line, CRAiLAR continues to improve upon its patented enzymatic process increasing efficiencies.

In March 2012, we announced an improvement of our CRAiLAR® wet process time by 40 percent, thereby significantly increasing anticipated volume capabilities at planned facilities. The evaluation and resulting improvements were conducted internally in conjunction with research partners. The resulting changes encompass processes, as well as the utilization of industry standard equipment, including that which was purchased by the Company for its first production facility.

These reductions in overall cycle time increase throughput and production capacity in each planned facility. These efficiencies also allowed the Company to evaluate third-party manufacturers to increase overall production volume of CRAiLAR® Flax through a quicker expansion model.

As a result of this optimized process, we entered into the agreements with Tintoria Piana to execute the CRAiLAR® enzymatic process, augmenting the Company’s plans for manufacturing capacity.

During the third and fourth quarters of 2012, the Company processed fiber through its third party manufacturing partner using decorticated fiber from its smaller scale facility in Kingstree, S.C. and European sources. This fiber was used by the Company’s development partners to initiate their sales programs in preparation for commercialization in 2013.

The Company believes that outsourced manufacturing allows for earlier introduction of CRAiLAR Flax into our customers’ supply chain until an integrated facility is operational.

The Pamplico facility will start production in two phases:

| o | Phase I |

| | |

| In the first phase the Company will commence the mechanical separation of the bast fiber from the byproduct shive in a process called decortication. The line was commissioned in December 2012 and has been producing decorticated fiber in quarter one, 2013. CRAiLAR will then use third party manufacturers for the enzymatic process for initial CRAiLAR® sales. Using third party manufacturing for the enzyme process during Phase I allows CRAiLAR to manage its feedstock flow while simplifying its business model and building Phase II. At full capacity, the new facility will be capable of producing enough decorticated bast fiber for approximately 400,000 pounds of CRAiLAR®Fiber per week. Feedstock will come from the North America and Europe. Phase I has been financed from the proceeds of previous capital market financings. |

| | |

| o | Phase II |

| | |

| In the first or second quarter of 2014, the Company plans to complete its own wet processing facility. Once commissioned, this will provide an additional 600,000 lbs. per week of CRAiLAR®capacity to the 400,000 lbs. from third party manufacturers. Decorticated fiber for the additional capacity will come from the Company’s Pamplico decortication facility and European decorticated fiber. With the installation of the enzymatic wet processing facility the Company will have a fully integrated decortication/wet facility at its Pamplico location. |

20

Phase II will have an approximate initial cost of $19 million and will create an additional 30 – 40 jobs as production comes on-line. Included in the estimate for the initial cost is the equipment necessary for Phase II with an approximate cost of $8.4 million, of which $5.2 million has already been paid. The company plans to pay for the remainder of Phase II through bank financing, customer funding and or the sale of equity.

Pamplico decorticated fiber (Phase 1) production continued in shakedown mode to optimize throughput and yield. The facility encountered issues with peripheral equipment attached to the main decortication machinery which the Company continues to fix. These malfunctions meant that the Company could not achieve the decortication equipment’s nameplate capacity as expected. Over the course of the quarter and as of the date of this document the Company has made progress addressing these issues and machine uptime has improved.

The facility in Pamplico is large enough, and the product flow layout so designed, that we can easily expand its capacity (to 400,000 lbs. per week) by adding equipment without the need for large additional build-out costs.

The Company also plans to expand into Europe beginning in the third quarter, 2013. The Company will purchase special cleaning line equipment to be used in the cleaning of European fiber. The cost of this equipment, installed, will be approximately $800,000.

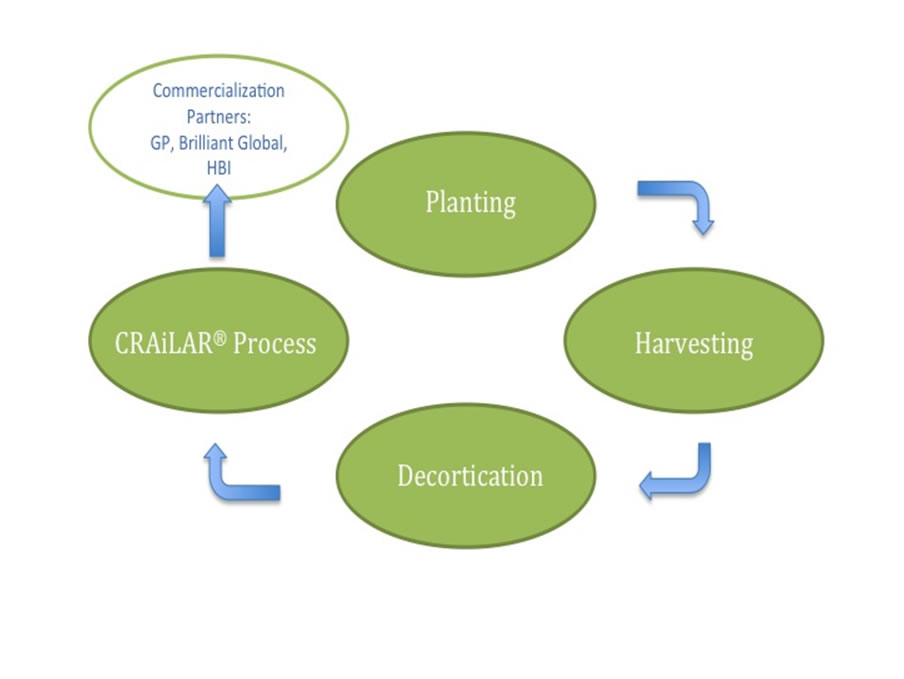

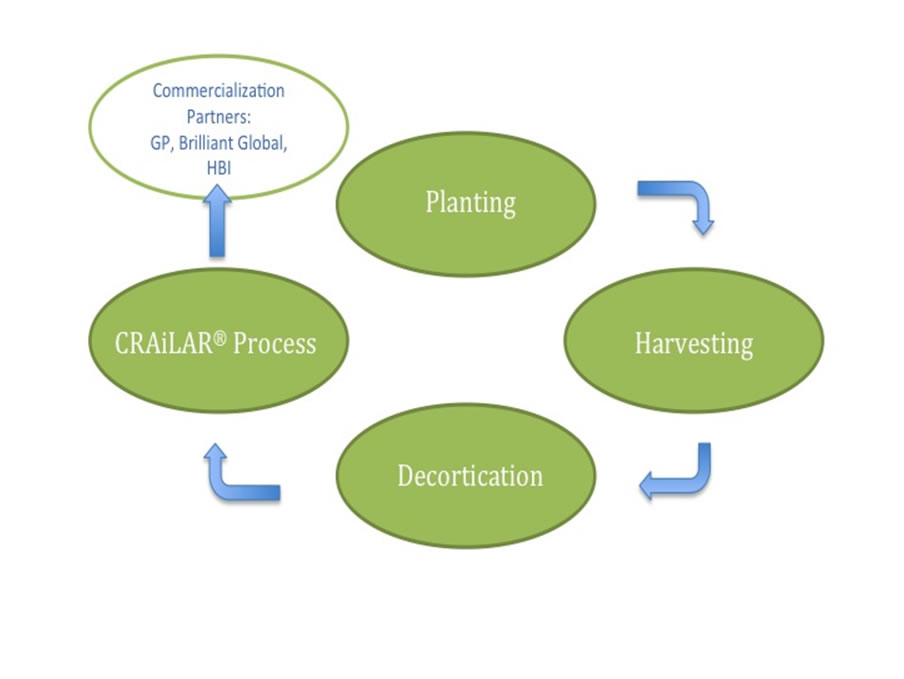

Production Model

Note on Plan of Operation

While the Company expects that profitable operations will be achieved in the future, there can be no assurance that revenue, margins, and profitability will increase, or be sufficient to support operations over the long term. Management expects that the Company will need to raise additional capital to meet short and long-term operating requirements. Management believes that private placements of equity capital and debt financing may be adequate to fund the Company’s long-term operating requirements. Management may also encounter business endeavors that require significant cash commitments or unanticipated problems or expenses that could result in a requirement for additional cash. If the Company raises additional funds through the issuance of equity or convertible debt securities other than to current shareholders, the percentage ownership of current shareholders would be reduced, and such securities might have rights, preferences or privileges senior to the Company’s common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, the Company may not be able to take advantage of prospective business endeavors or opportunities, which could significantly and materially restrict business operations. Management is continuing to pursue external financing alternatives to improve the Company’s working capital position and to grow the business to the greatest possible extent.

21

MATERIAL COMMITMENTS

Debentures

On September 20, 2012, the Company completed the offering of $10,051,261 ($10,000,000 CDN) worth of convertible debentures (the “Notes”). The Notes bear interest at a rate of 10% per year, payable semi-annually on March 31st and September 30th and mature on September 20, 2017. The holders of the Notes have the option to convert the Notes at a price of $2.90 per Common Stock for each $1,000 principal amount of Debentures at any time prior to the maturity date. On February 26, 2013, the Company completed another offering of $4,713,238 (CDN - $5,000,000) convertible debenture with essentially the same terms as the previously mentioned offering. Furthermore, on July 26, 2013 the Company completed a third offering of $3,434,960 (CDN - $3,535,000) convertible debenture with an interest rate of 10% payable semi-annually on March 31st and September 30th and matures on July 26, 2016. The holders of the Notes have the option to convert the Notes at a price of $2.00 per Common Stock for each $1,000 principal amount of Debentures at any time prior to the maturity date. The holders of the Notes will also receive 800 share purchase warrants with an exercise price of $1.25 for each $1,000 principal amount of Debentures exercisable at any time prior to the maturity date.

The Company is committed to annual interest payments over the next five years as follows:

| 2013 | | $ | 814,514 | |

| | | | | |

| 2014 | | | 1,535,100 | |

| | | | | |

| 2015 | | | 1,535,100 | |

| | | | | |

| 2016 | | | 1,535,100 | |

| | | | | |

| 2017 | | | 1,411,030 | |

| | | | | |

| Total | | $ | 6,830,844 | |

22

Annual Leases

The Company is committed to current annual lease payments totaling $831,905 for premises under lease. Approximate minimum lease payments over the remainder of the leases are as follows:

| 2013 | | $ | 70,426 | |

| | | | | |

| 2014 | | | 232,983 | |

| | | | | |

| 2015 | | | 200,983 | |

| | | | | |

| 2016 | | | 200,983 | |

| | | | | |

| 2017 | | | 146,930 | |

| | | | | |

| Total | | $ | 852,305 | |

National Research Council Agreements

Joint Collaboration Agreement

In October 2007, the Company entered into a joint collaboration agreement with the National Research Council (NRC) to continue to develop a patentable enzyme technology for the processing of hemp fibers. The agreement was for three years and expired on May 9, 2010. On February 19, 2010, the Company signed an amendment to the agreement to extend expiry to May 9, 2012. The Company intends to continue its joint collaboration of enzyme technology with the NRC, however the research will refocus on cellulose technology for the production of lignocellulosic ethanol. The NRC is to be paid as it conducts work on the joint collaboration. There are no further costs or other off-balance sheet liabilities associated with the NRC agreement.

Over the term of the amended agreement, the Company will pay the NRC a total of $280,536 (CDN$294,822) divided into nine payments up to May 9, 2012. As of the date of these statements all payments due in 2012 ($33,183) have been paid.

Technology License Agreement

On November 1, 2006, the Company entered into a technology license agreement with the NRC. The license agreement provides the Company a worldwide license to use and sublicense the NRC technology called CRAiLAR®. The Company paid an initial $20,525 (CDN $25,000) fee and will pay an ongoing royalty of 3% on sales of products derived from the CRAiLAR® process to the NRC with a minimum annual payment set at $14,750 (CDN$15,000) per year in two installments. During the twenty-six weeks ended June 29, 2013, the Company paid $7,440 (CDN$7,500) and accrued 7,135 (CDN$7,500) of the minimum annual royalty.

Investor Relations Agreement

On August 9, 2012, the Company renewed the agreement for a third party firm to perform investor relations activities. The agreement term is one year with ninety days notice of termination by either party. The monthly fee is $10,000 with 70,000 stock options exercisable at $2.77 expiring August 19, 2016. The options were granted under the 2010 Option Stock Plan and were valued at $148,862 using the Black-Scholes option pricing model with the assumptions disclosed in Note 12. During February 2013 the monthly amount payable was reduced to $4,000. The third party firm will continue to provide strategic advice to Crailar Technologies Inc.

On February 8,2013, the company retained another third party group to perform investor relations services. The monthly fee is $8,000 with 50,000 stock options exercisable at $2.30, expiring Feb 8, 2018. The options were granted under the 2012 option stock plan and were valued at $163,992 using the Black Scholes Option model with the assumptions disclosed in Note 6. The agreement term is one year with thirty days notice of termination by either party after six months from the effective date.

Research Agreement

Starting in December 2010, a co-operative research project designed to cultivate and evaluate the viability of various flax strains for use in CRAiLAR® technology was signed with the United States Department of Agriculture, Hanesbrands and CRAiLAR Inc. The project has an initial term of one year with a renewal option for two additional years. CRAiLAR Inc. will contribute annually $51,000 of in-kind expenses towards the project.

23

Farming and Consulting Agreements

During the previous year ended December 31, 2012, the Company signed agreements with farmers to plant and to produce flax using the seed provided by the Company. The resulting harvest of flax straw and flaw seed will be purchased by the Company at the agreed upon prices.

OFF-BALANCE SHEET ARRANGEMENTS

As of the date of this Quarterly Report, we do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors. The term “off-balance sheet arrangement” generally means any transaction, agreement or other contractual arrangement to which an entity unconsolidated with us is a party, under which we have any obligation arising under a guarantee contract, derivative instrument or variable interest; or a retained or contingent interest in assets transferred to such entity or similar arrangement that serves as credit, liquidity or market risk support for such assets.

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Currency risk

The Company is exposed to currency risk to the extent that certain inventory and equipment is purchased from Europe in Euros. In addition, the Company has long-term debt denominated in Canadian Dollars. The Company does not currently hedge its foreign currency exposure and accordingly is at risk for foreign currency exchange fluctuations. The Company and its subsidiaries do not have significant transactions or hold significant cash denominated in currencies other than their functional currencies.

Credit risk

The risk in cash accounts is managed through the use of a major financial institution which has high credit quality as determined by the rating agencies. As at June 29, 2013, the Company does not have significant concentrations of credit exposure.

Interest rate risk

All term debt has fixed interest rates and the Company has no significant exposure to interest rate fluctuation risk.

Commodity price risk

Commodity price risk is the risk that the fair value of future cash flows will fluctuate because of changes in the market prices of commodities. The Company is exposed to commodity price risk as it purchases flax seed in the production of fiber. The Company does not currently enter into futures contracts or otherwise hedge its exposure to commodity price risk.

24

Item 4. Controls and Procedures

Disclosure Controls and Procedures

Kenneth Barker, our Chief Executive Officer, and Theodore Sanders, our Chief Financial Officer, have evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) of the Exchange Act) as of the end of the period covered by this Quarterly Report. Based on that evaluation, they concluded that our disclosure controls and procedures were effective as of June 29, 2013.

No Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during our fiscal quarter ended June 29, 2013 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

Management is not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Report, no director, officer or affiliate is a party adverse to us in any legal proceeding, or has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

Item 1A. Risk Factors

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are all of the material risks that we are currently aware of that are facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

We Have a History of Operating Losses and There Can Be No Assurance We Will Be Profitable in the Future.

We have a history of operating losses, expect to continue to incur losses, may never be profitable, and must be considered to be in the development stage. Further, we have been dependent on sales of our equity securities and debt financing to meet our cash requirements. We have incurred net losses totaling approximately $6,268,096 for the twenty-six week period ended June 29, 2013 and $4,230,690 for the twenty-six week period ended June 30, 2012. As of June 29, 2013, we had accumulated deficits of $20,185,283. As at June 29, 2013 we had cash and cash equivalents of $593,855 and working capital of $229,329. Further, we do not expect positive cash flow until Q1 2014.

We Will Need to Raise Capital To Continue Our Operations.

Based upon our historical losses from operations, we may require additional funding in the future. If we cannot obtain capital through financings or otherwise, our ability to execute our development plans and achieve profitable operational levels will be greatly limited. Historically, we have funded our operations through the issuance of equity, convertible debenture and bank debt financing arrangements. We may not be able to obtain additional financing on favorable terms, if at all. Our future cash flows and the availability of financing will be subject to a number of variables, including demand for CRAiLAR® and CRAiLEXTM technologies. Further, debt financing could lead to a diversion of cash flow to satisfy debt-servicing obligations and create restrictions on business operations. If we are unable to raise additional funds, it would have a material adverse effect upon our operations.

A Commercial Market Must Be Found for Our By-products.

Markets need to be found and developed for the by-products of our decortication process or it could have an effect on our profitability. Although several opportunities for the sale of our by-products are being explored, no contracts for the off take of our by-products have been signed as of the date of this report.

25

Our Success is Dependent Upon the Acceptance of CRAiLAR®Technology.

Our success depends upon our achieving significant market acceptance of our CRAiLAR® Technology and demand for our products. Acceptance of our CRAiLAR®Technology will depend on the success of our and our partners’ promotional and marketing efforts and ability to attract customers. To date, we have not spent significant funds on marketing and promotional efforts, although in order to increase awareness of our products we expect our partners to spend a significant amount on promotion, marketing and advertising in the future. If these expenses fail to develop an awareness of our CRAiLAR® Technology and products, these expenses may never be recovered and we may never be able to generate any significant future revenues. In addition, even if awareness of our CRAiLAR® Technology increases, we may not be able to produce enough product to meet demand.

We May Be Unable to Retain Key Employees or Management Personnel.

The loss of any of our key officers and management personnel would have an adverse impact on our future development and could impair our ability to succeed. Our performance is substantially dependent upon the expertise of our Chief Executive Officer, Mr. Kenneth Barker and our Chief Innovation Officer, Mr. Jason Finnis, and other key management personnel and our ability to continue to hire and retain such personnel. Messrs. Barker, Sanders, Finnis, Prevost, Robinson and Nalbach spend substantially all, or most, of their working time with us and our subsidiaries. It may be difficult to find sufficiently qualified individuals to replace Mr. Barker, Mr. Sanders, Mr. Finnis, Mr. Prevost, Mr. Robinson, Mr. Nalbach, Ms. Harrison or other key management personnel if we were to lose any one or more of them. The loss of Mr. Barker, Mr. Sanders, Mr. Finnis, Mr. Robinson, Mr. Nalbach or Mr. Prevost, or any of our other key management personnel could have a material adverse effect on our business, development, financial condition, and operating results. We maintain “key person” life insurance on our senior executive officers.

Our Officers and Directors May Be Subject to Conflicts of Interest.

Certain of our officers and directors may be subject to conflicts of interest. Certain of our directors devote part of their working time to other business endeavors, including consulting relationships with other entities, and have responsibilities to other entities. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, certain of our directors may be subject to conflicts of interest. Currently, we have no policy in place to address such conflicts of interest. However, such directors have acknowledged their fiduciary duty to perform their duties in our best interest and those of our shareholders.

Government Regulation and Trade Restrictions Could Have a Negative Impact on Our Business.