UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 28, 2013

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number:000-50367

CRAILAR TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

| British Columbia | 98-0359306 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 305-4420 Chatterton Way | |

| Victoria, British Columbia, Canada | V8X 5J2 |

| (Address of principal executive offices) | (Zip Code) |

(250) 658-8582

Registrant’s telephone number, including area code

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] |

Non-accelerated filer [ ]

(Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date. 44,472,698 shares of common stock as of November 6, 2013.

CRAILAR TECHNOLOGIES INC.

Quarterly Report On Form 10-Q

For The Quarterly Period Ended

September 28, 2013

INDEX

2

FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q contains forward-looking statements that involve risks and uncertainties. Forward-looking statements in this quarterly report include, among others, statements regarding our capital needs, business plans and expectations. Such forward-looking statements include, but are not limited to, statements with respect to the following:

- our need for additional financing;

- the competitive environment in which we operate;

- our dependence on key personnel;

- conflicts of interest of our directors and officers;

- our ability to fully implement our business plan;

- our ability to effectively manage our growth; and

- other regulatory, legislative and judicial developments.

Forward-looking statements are made, without limitation, in relation to operating plans, property exploration and development, availability of funds, environmental reclamation, operating costs and permit acquisition. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue”, the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks outlined in our annual report on Form 10-K for the year ended December 31, 2012, this quarterly report on Form 10-Q, and, from time to time, in other reports that we file with the Securities and Exchange Commission (the “SEC”). These factors may cause our actual results to differ materially from any forward-looking statement. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

3

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

The following unaudited interim financial statements of Crailar Technologies Inc. (formerly Naturally Advanced Technologies, Inc.) (sometimes referred to as “we”, “us” or “our Company”) are included in this quarterly report on Form 10-Q:

4

| CRAiLAR Technologies Inc. |

| (formerly Naturally Advanced Technologies Inc.) |

| (A Development Stage Company) |

| Consolidated Balance Sheets |

| (In US Dollars) |

| | | September 28, | | | | |

| | | 2013 | | | December 31, 2012 | |

| ASSETS | | | | | | |

| Current | | | | | | |

| Cash and cash equivalents | $ | 346,974 | | $ | 2,877,210 | |

| Accounts receivable | | 39,030 | | | 72,292 | |

| Inventory (Note 2) | | 2,418,901 | | | 2,904,652 | |

| Prepaid expenses and other | | 271,695 | | | 106,785 | |

| | | 3,076,600 | | | 5,960,939 | |

| Deferred Debt Issuance Costs(Note 6) | | 1,575,421 | | | 1,024,294 | |

| Property and Equipment, net(Notes 3) | | 15,122,757 | | | 13,248,688 | |

| Intangible Assets, net(Note 4) | | 156,667 | | | 94,619 | |

| | $ | 19,931,445 | | $ | 20,328,540 | |

| | | | | | | |

| LIABILITIES | | | | | | |

| Current | | | | | | |

| Accounts payable | $ | 2,014,288 | | $ | 1,406,418 | |

| Accrued liabilities (Note 6) | | 2,553,590 | | | 1,480,624 | |

| Derivative Liability (Note 5) | | 327 | | | 488,035 | |

| | | 4,568,205 | | | 3,375,077 | |

| Long Term Debt(Note 6) | | 17,272,271 | | | 10,051,262 | |

| | | 21,840,476 | | | 13,426,339 | |

| STOCKHOLDERS' DEFICIT | | | | | | |

| Capital Stock(Note 7) | | | | | | |

Authorized: 100,000,000 common shares without par value

Issued and outstanding: 44,472,698 commons shares

(December 31, 2012 - 44,239,198 and December 31, 2011 - 41,701,604) | | 33,009,970 | | | 32,616,795 | |

| Subscription receivable | | (64,050 | ) | | (64,050 | ) |

| Additional Paid-in Capital | | 9,304,136 | | | 7,061,406 | |

| Accumulated Other Comprehensive Loss | | 24,296 | | | (459,036 | ) |

| Deficit | | (11,485,251 | ) | | (11,485,251 | ) |

| Deficit accumulated in the development stage | | (32,698,132 | ) | | (20,767,663 | ) |

| | | (1,909,031 | ) | | 6,902,201 | |

| | $ | 19,931,445 | | $ | 20,328,540 | |

| | | | | | | |

| Subsequent Events (Note 9) | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

5

| CRAiLAR Technologies Inc. |

| (formerly Naturally Advanced Technologies Inc.) |

| (A Development Stage Company) |

| Consolidated Statements of Operations |

| (In US Dollars) |

| | | Thirteen weeks | | | Thirteen | | | Thirty-nine | | | Thirty-nine | | | Cumulative from | |

| | | ended | | | weeks ended | | | weeks ended | | | weeks ended | | | October 1, 2009 to | |

| | | September 28, | | | September | | | September 28, | | | September 30, | | | September 28, | |

| | | 2013 | | | 30, 2012 | | | 2013 | | | 2012 | | | 2013 | |

| Revenues | $ | 15,438 | | $ | - | | $ | 197,814 | | $ | - | | $ | 197,814 | |

| Cost of sales | | 21,936 | | | - | | | 222,755 | | | - | | | 222,755 | |

| Gross profit | | (6,498 | ) | | - | | | (24,941 | ) | | - | | | (24,941 | ) |

| Expenses | | | | | | | | | | | | | | | |

| Advertising and promotion | | 125,849 | | | 225,074 | | | 450,902 | | | 342,850 | | | 1,381,939 | |

| Amortization and depreciation | | 288,661 | | | 60,080 | | | 636,270 | | | 164,678 | | | 1,019,133 | |

| Consulting and contract labour (Note 5) | | 104,682 | | | 201,137 | | | 398,229 | | | 590,706 | | | 3,271,008 | |

| Facility costs | | 350,834 | | | - | | | 1,460,355 | | | - | | | 1,460,355 | |

| General and administrative | | 355,361 | | | 259,492 | | | 934,396 | | | 671,994 | | | 2,957,362 | |

| Interest | | 588,028 | | | 41,421 | | | 1,382,879 | | | 41,425 | | | 1,779,541 | |

| Professional fees | | 125,050 | | | 96,636 | | | 604,186 | | | 495,217 | | | 2,145,672 | |

| Research and development | | 130,332 | | | 292,033 | | | 223,287 | | | 645,138 | | | 2,474,621 | |

| Salaries and benefits (Note 5) | | 1,009,033 | | | 935,827 | | | 2,832,382 | | | 3,123,469 | | | 11,649,745 | |

| | | 3,077,830 | | | 2,111,700 | | | 8,922,886 | | | 6,075,477 | | | 28,142,376 | |

| Loss before other items | | (3,084,328 | ) | | (2,111,700 | ) | | (8,947,827 | ) | | (6,075,477 | ) | | (28,167,317 | ) |

| Other items: | | | | | | | | | | | | | | | |

| Gain on disposal of assets (Note 3) | | - | | | - | | | 790 | | | - | | | 790 | |

| Write down of equipment (Note 3) | | (13,368 | ) | | - | | | (13,368 | ) | | - | | | (704,516 | ) |

| Write down of inventory (Note 2) | | (2,548,827 | ) | | - | | | (3,422,582 | ) | | - | | | (3,726,245 | ) |

Fair Value adjustment derivative liabilities

(Note 5) | | (27,695 | ) | | 80,197 | | | 452,518 | | | (188,972 | ) | | (113,338 | ) |

| Other income | | - | | | - | | | - | | | - | | | 1,177 | |

| Loss from continuing operations | | (5,674,218 | ) | | (2,031,503 | ) | | (11,930,469 | ) | | (6,264,449 | ) | | (32,709,449 | ) |

| Profit from discontinued operations | | - | | | - | | | - | | | - | | | 11,317 | |

| Net loss | $ | (5,674,218 | ) | $ | (2,031,503 | ) | $ | (11,930,469 | ) | $ | (6,264,449 | ) | $ | (32,698,132 | ) |

| Other comprehensive income (loss) | | | | | | | | | | | | | | | |

| Exchange differences on translating to presentation currency | | (443,006 | ) | | 78,935 | | | 304,688 | | | 113,669 | | | (10,643 | ) |

| Total comprehensive loss | $ | (6,117,224 | ) | $ | (1,952,568 | ) | $ | (11,625,781 | ) | $ | (6,150,780 | ) | $ | (32,708,775 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

6

| CRAiLAR Technologies Inc. |

| (formerly Naturally Advanced Technologies Inc.) |

| (A Development Stage Company) |

| Consolidated Statements of Cash Flows |

| | | For thirty-nine | | | For thirty-nine week | | | Cumulative from | |

| | | week period ended | | | period ended | | | October 1, 2009 to | |

| | | September 28, 2013 | | | September 30, 2012 | | | September 28, 2013 | |

| Cash flows used in operating activities | | | | | | | | | |

| Net loss from continuing operations | $ | (11,930,469 | ) | $ | (6,264,449 | ) | $ | (32,709,449 | ) |

Adjustments to reconcile net loss to net cash from

operating activities | | | | | | | | | |

| Amortization and depreciation | | 875,295 | | | 164,678 | | | 1,261,158 | |

| Amortization of deferred debt issuance costs (Note 6) | | 288,462 | | | - | | | 378,682 | |

| Amortization of debt discount | | 35,815 | | | | | | 35,815 | |

| Rent | | 114,199 | | | - | | | 234,035 | |

| Stock based compensation | | 1,642,532 | | | 1,944,411 | | | 7,780,841 | |

| Gain on disposal of assets (Note 3) | | (790 | ) | | - | | | (790 | ) |

| Write down of equipment (Note 3) | | 13,368 | | | - | | | 704,516 | |

| Write down of inventory (Note 2) | | 3,422,582 | | | - | | | 3,726,245 | |

| Fair value adjustment of derivative liability | | (452,518 | ) | | 188,972 | | | 113,338 | |

| Gain on foreign exchange | | - | | | - | | | (71,990 | ) |

| Changes in working capital assets and liabilities | | | | | | | | | |

| Decrease (increase) in accounts receivable | | 33,262 | | | (17,434 | ) | | 37,917 | |

| (Increase) in inventory | | (2,936,831 | ) | | (1,821,585 | ) | | (6,145,146 | ) |

| (Increase) decrease in prepaid expenses | | (164,910 | ) | | 10,974 | | | (201,570 | ) |

| Increase in accounts payable | | 607,870 | | | 445,889 | | | 1,676,427 | |

| Increase in accrued liabilities | | 958,767 | | | 115,583 | | | 1,703,275 | |

| Increase in due to related parties | | - | | | - | | | 56,945 | |

| Net cash used in operating activities of continuing operations | | (7,493,366 | ) | | (5,232,961 | ) | | (21,419,751 | ) |

| Net cash provided by discontinued operations | | | | | - | | | 79,982 | |

| Net cash flows used in operating activities | | (7,493,366 | ) | | (5,232,961 | ) | | (21,339,769 | ) |

| Cash flows used in investing activities | | | | | | | | | |

| Purchase of property and equipment | | (2,734,667 | ) | | (6,048,478 | ) | | (16,374,089 | ) |

| Acquisition of intangible assets | | (89,323 | ) | | (31,740 | ) | | (194,192 | ) |

| | | | | | | | | | |

| Net cash flows used in investing activities | | (2,823,990 | ) | | (6,080,218 | ) | | (16,568,281 | ) |

| Cash flows used in financing activities | | | | | | | | | |

| Issuance of capital stock and warrants | | 239,746 | | | 3,545,526 | | | 22,203,727 | |

| Notes payable | | - | | | - | | | (200,000 | ) |

| Convertible Debenture | | 8,143,108 | | | 10,231,000 | | | 18,194,370 | |

| Deferred issuance costs for convertible debenture | | (875,981 | ) | | (1,059,990 | ) | | (1,959,917 | ) |

| Related parties payments | | - | | | - | | | (1,025,960 | ) |

| Net cash flows from financing activities | | 7,506,873 | | | 12,716,536 | | | 37,212,220 | |

| Effect of exchange rate changes on cash and cash equivalents | | 280,247 | | | 113,669 | | | (10,643 | ) |

| Increase (decrease) in cash and cash equivalents | | (2,530,236 | ) | | 1,517,026 | | | (706,473 | ) |

| Cash and cash equivalents, beginning | | 2,877,210 | | | 6,340,505 | | | 1,053,477 | |

| Cash and cash equivalents, ending | $ | 346,974 | | $ | 7,857,531 | | $ | 346,974 | |

| SUPPLEMENTAL CASH FLOW INFORMATION | | | | | | | | | |

| AND NON-CASH FINANCING AND INVESTING | | | | | | | | | |

| ACTIVITIES: | | | | | | | | | |

| Cash paid for interest | $ | 277,485 | | $ | 7,985 | | | | |

| Cash paid for income taxes | $ | | | $ | | | | | |

| Capital stock issued as share issue costs | $ | | | $ | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

7

| 1. | Basis of Presentation |

| | |

| These unaudited consolidated financial statements of the Company have been prepared in accordance with generally accepted accounting principles for interim financial reporting and the rules and regulations of the Securities and Exchange Commission. They do not include all information and footnotes required by United States generally accepted accounting principles (“U.S. GAAP”) for complete financial statement disclosure. However, except as disclosed herein, there have been no material changes in the information contained in the audited consolidated financial statements for the year ended December 31, 2012, included in the Company’s Form 10-K filed with the U.S. Securities and Exchange Commission. Operating results for the period ended September 28, 2013 are not necessarily indicative of the results that may be expected for the year ending December 31, 2013. These interim unaudited consolidated financial statements should be read in conjunction with the information included in the Company’s Form 10-K filed on March 18, 2013 with the U.S. Securities and Exchange Commission. |

| | |

| Effective fiscal 2013, the Company began to report quarterly results on a 4-4-5 basis, with the quarter ending on the Saturday closest to the last day of each third month. In fiscal 2013, the Company's first quarter ended on March 30, 2013, the second quarter ended on June 29, 2013, the third quarter ended on September 28, 2013 and the fourth quarter will end on December 28, 2013. |

| | |

| In the opinion of management, the accompanying interim balance sheet and related interim statement of operations and cash flows include all adjustments, consisting only of normal recurring items, necessary for their fair presentation in conformity with U.S. GAAP. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. Actual results and outcomes may differ from management’s estimates and assumptions. |

| | |

| The Company’s consolidated financial statements are prepared using US GAAP applicable to a going concern, which contemplates the realization of assets and payment of liabilities in the normal course of business. The Company has incurred losses since inception of $44,163,920 and further losses are anticipated in the development of its business. There can be no assurance that the Company will be able to achieve or maintain profitability. Accordingly, these factors raise substantial doubt as to the Company’s ability to continue as a going concern. |

| | |

| The Company evaluated events occurring between September 28, 2013 and the date financial statements were issued. |

| | |

| Recent accounting pronouncements with future effective dates are not expected to have an impact on the Company’s financial statements. |

| | |

| 2. | Inventory |

| | |

| As at September 28, 2013, inventory consists of: |

| | | | September 28, 2013 | | | December 31, 2012 | |

| | CRAiLAR fiber | $ | 438,115 | | $ | - | |

| | Decorticated fiber | | 455,912 | | | 51,504 | |

| | Flax seed | | 199,928 | | | 1,172,155 | |

| | Raw flax fiber feedstock | | 1,293,250 | | | 1,680,993 | |

| | Other | | 31,696 | | | - | |

| | | $ | 2,418,901 | | $ | 2,904,652 | |

During the period ended September 28, 2013, the Company wrote off $3,422,582 (2012 - $Nil) of raw flax fiber feedstock, decorticated fiber and seed inventory to reduce the book value to net realizable value.

8

| | | | | | | | | | Net Book Value | | | Net Book Value | |

| | | | | | | Accumulated | | | September 28, | | | December 31, | |

| | | | Cost | | | Amortization | | | 2013 | | | 2012 | |

| | Automobiles | $ | 58,745 | | $ | 9,835 | | $ | 48,910 | | $ | 57,559 | |

| | Computer equipment | | 125,732 | | | 68,910 | | | 56,822 | | | 48,398 | |

| | Equipment | | 538,854 | | | 98,387 | | | 440,467 | | | 359,445 | |

| | Equipment held for sale | | 70,000 | | | - | | | 70,000 | | | 105,045 | |

| | Furniture and fixtures | | 63,607 | | | 36,345 | | | 27,262 | | | 29,980 | |

| | Leasehold improvements | | 6,157,226 | | | 409,152 | | | 5,748,114 | | | 4,979,548 | |

| | Production equipment | | 3,274,400 | | | 303,073 | | | 2,971,327 | | | - | |

| | Production equipment in construction | | 5,740,807 | | | - | | | 5,740,807 | | | 7,606,837 | |

| | Website development costs | | 125,311 | | | 106,263 | | | 19,048 | | | 105,045 | |

| | | | | | | | | | | | | | |

| | | $ | 16,154,722 | | $ | 1,031,965 | | $ | 15,122,757 | | $ | 13,248,688 | |

| Depreciation of production equipment and leasehold improvements commenced on January 1, 2013 as the Company’s manufacturing facility started production. During the period ended September 28, 2013, the Company disposed of assets held for sale for a gain of $790 and wrote down equipment for a loss of $13,368. |

| | |

| 4. | Intangible Assets |

| | | | | | | | | | Net Book Value | | | Net Book Value | |

| | | | | | | Accumulated | | | September 28, | | | December 31, | |

| | | | Cost | | | Amortization | | | 2013 | | | 2012 | |

| | Patents | $ | 158,020 | | $ | 67,478 | | $ | 90,543 | | $ | 77,961 | |

| | Trademarks | | 125,324 | | | 96,468 | | | 28,856 | | | 7,639 | |

| | License fee | | 56,669 | | | 19,401 | | | 37,268 | | | 9,019 | |

| | | | | | | | | | | | | | |

| | | $ | 340,013 | | $ | 183,346 | | $ | 156,667 | | $ | 94,619 | |

| 5. | Derivative Liability |

| | |

| The derivate liability consist of warrants that were originally issued in private placements which have exercise prices denominated in a currency other than the Company’s functional currency. These warrants are non-cash liabilities and the Company is not required to expend any cash to settle these liabilities. The fair value of these warrants as at September 28, 2013 and December 31, 2012 are as follows: |

9

| | | Exercise price | September 28, 2013 | December 31, 2012 |

| | 275,506 warrants expiring on May 19, 2013 | $1.25 | $ Nil | $ 257,564 |

| | 533,887 warrants expiring on Oct 14, 2014 | $3.45 | $ 327 | $ 230,471 |

| | | | $ 327 | $ 488,035 |

The fair value of these warrants was determined using the Black-Scholes option pricing model, using the following assumptions:

| | | September 28, 2013 | December 31, 2012 |

| | Volatility | 65% | 57% - 66% |

| | Dividend yield | - | - |

| | Risk-free interest rate | 0.36% | 0.12 – 0.25% |

| | Expected life, in years | 0.67 | 0.38 – 1.73 |

| 6. | Long Term Debt |

| | |

| On September 20, 2012, the Company completed the offering of $10,051,262 (CDN$10,000,000) convertible debentures (the “Notes 2012”). The Notes 2012 mature on September 20, 2017. The Notes 2012 bear interest at a rate of 10% per year, payable semi-annually on March 31 and September 30, starting March 31, 2013. As at September 28, 2013, accrued interest of $485,296 (CDN$500,000) was included in accrued liabilities. |

| | |

| On February 26, 2013, the Company completed an offering of $4,712,068 (CDN$5,000,000) convertible debentures (the “Notes 2013”). The Notes 2013 mature on September 30, 2017. The Notes 2013 bear interest at a rate of 10% per year, payable semi-annually on March 31 and September 30, starting September 30, 2013. As at September 28, 2013, accrued interest of $288,518 (CDN$297,260) was included in accrued liabilities. Non-Canadian resident holders of Note 2013 will be ranked subordinately to Note 2012. Holders of Note 2013 will receive additional interest for the amount equal to the withholding taxes paid by the Company for Canadian tax purpose. |

| | |

| Holders of Notes 2012 and Notes 2013 have the option to convert at a price of $2.85 (CDN$2.90) per common shares in the capital of the Company at any time prior to the maturity date. The Company may redeem the Notes 2012 and Notes 2013 after September 30, 2015 provided that the market price at the time of the redemption notice is not less than 125% of the conversion price. The conversion rate is subject to standard anti-dilution provisions. |

| | |

| Notes 2012 and Notes 2013 are secured by a Guaranty and Security Agreement signed with the Company’s wholly-owned subsidiary, Crailar Inc. (“CI”), a Nevada incorporated company. CI provides a security interest over its assets, having an aggregate acquisition cost of no less than US$5,500,000, as security for its guarantee obligation which shall rank in priority to all other indebtedness of CI. |

| | |

| The Notes 2012 and Notes 2013 do not contain a beneficial conversion feature, as the fair value of the Company’s common stock on the date of issuance was less than the conversion price. All proceeds from the notes were recorded as a debt instrument. |

| | |

| On July 26, 2013, the Company closed a subordinated convertible debenture for gross proceeds of $3,431,040 (CDN$3,535,000) (the “Notes 2013A). The Notes 2013A will mature on July 26, 2016 and will accrue interest at a rate of 10% per year, payable semi-annually in arrears on March 31 and September 30 commencing September 30, 2013. At the holder’s option, the debentures may be converted into common shares in the capital of the Company at any time up to the earlier of the maturity date and the business day immediately preceding the date specified by the Company for redemption of the debentures. The conversion price, subject to adjustment in certain circumstances, will be CDN$2.00 per share. |

10

| 6. | Long Term Debt (continued) |

| | |

| In addition, the Company issued 800 transferable common share purchase warrants (each, a "Warrant") for each CDN$1,000 of principal amount, resulting in an aggregate of 2,828,000 Warrants, with each Warrant entitling the holder thereof to purchase one additional Share (each, a "Warrant Share") at an exercise price of $1.25 per Warrant Share until July 26, 2016. The Company determined the fair value of the warrants to be $974,386 (CDN$1,003,910) using the Black-Scholes Option Pricing Model with the following assumptions: Expected dividend yield – 0; Expected stock price volatility – 56%; Risk-free interest rate – 0.59%; Expected life – 2.83 years. |

| | |

| The proceeds were allocated to the Notes 2013A and the Warrants based on their relative fair values and accordingly, $2,676,211 (CDN$2,757,300) was allocated to the Notes 2013A and $754,829 (CDN$777,700) was allocated to the Warrants and recorded as a reduction in the Notes 2013A and an increase in additional paid-in capital. |

| | |

| During the period ending September 28, 2013 the Company recorded amortization of the Notes 2013A discount in the amount of $35,815 (CDN$38,321) which was included in interest expense. |

| | |

| The Company paid a total of $400,404 (CDN$412,537) and issued 192,360 warrants for agent commission and other expenses for Notes 2013A which has been recorded as deferred debt issuance costs. Each broker warrant entitles the holder to purchase one common share for $1.25 per share for three years from the date of issuance. The fair value of the brokers’ warrant portion calculated using the Black-Scholes Option Pricing Model was $66,278 (CDN$68,286). Of the total costs incurred on the Notes 2013A $364,012 (CDN$375,042) was recorded as deferred debt issuance costs and $102,670 (CDN$105,781) was charged to additional paid-in capital. |

| | |

| Notes 2013A are secured by a Guaranty and Security Agreement signed with the Company’s wholly-owned subsidiary, Crailar Inc. (“CI”), a Nevada incorporated company. CI provides a security interest over its assets, having an aggregate acquisition cost of no less than US$5,000,000, as security for its guarantee obligation which shall rank in priority to all other indebtedness of CI. These assets are different assets than those referred to above for the Notes 2012 and Notes 2013. |

| | |

| During the period ended September 28, 2013, the Company recorded $288,462 (CDN$297,202) as interest expenses for the amortization of the deferred issuance costs. |

| | |

| 7. | Capital Stock |

| | |

| During the period ended September 28, 2013, the Company issued shares as follows: |

| | a. | A total of 196,000 shares were issued pursuant to the exercise of employee and consultants options for proceeds of $192,873. Options totaling 191,000, with proceeds of $186,770 were exercised by the directors and officers of the Company. |

| | | |

| | b. | A total of 37,500 shares were issued pursuant to the exercise of warrants for proceeds of $46,875. |

Share purchase warrants outstanding as at September 28, 2013 are:

11

| | | Warrants | Weighted-Average Exercise Price |

| | Warrants outstanding, December 31, 2012 | | |

| | | 3,168,212 | $4.01 |

| | Warrants exercised | (37,500) | $1.25 |

| | Warrants expired | (2,596,825) | $4.17 |

| | Warrants issued | 3,020,360 | $1.25 |

| | Warrants outstanding, September 28, 2013 | | |

| | | 3,554,247 | $1.58 |

The weighted average remaining contractual life of outstanding warrants at September 28, 2013, is 2.50.

Stock options outstanding as at September 28, 2013 are:

| | | Shares | Weighted-Average Exercise Price |

| | Options outstanding, December 31, 2012 | 6,416,043 | $1.77 |

| | Options granted | 285,000 | 2.25 |

| | Options exercised | (196,000) | 0.98 |

| | Options expired | (6,249) | 1.91 |

| | Options cancelled | (8,333) | 2.23 |

| | Options outstanding, September 28, 2013 | | |

| | | 6,490,461 | $1.81 |

Stock options outstanding at September 28, 2013, are summarized as follows:

| | | | Weighted Average | | | Weighted |

| | Range of | | Remaining | Weighted | | Average |

| | Exercise | Number | Contractual Life | Average | Number | Exercise |

| | Prices | Outstanding | (yr.) | Exercise Price | Exercisable | Price |

| | $0.87 - $3.05 | 6,490,461 | 2.73 | $1.81 | 5,490,547 | $1.86 |

| During the period ended September 28, 2013, 196,000 options were exercised and a total of $118,239 has been reclassified from additional paid-in capital to capital stock. |

| | |

| During the period ended September 28, 2013, 1,393,844 (2012 – 1,288,330) options vested under the Company’s amended 2011 Fixed Share Option Plan. A total expense of $1,642,532 (2012 - $1,944,411) was recorded as stock-based compensation, of this amount $214,398 (2012 - $185,147) was included in consulting and contract labour expense and $1,428,134 (2012 - $1,759,264) was included in salaries and benefits expense. |

| | |

| 8. | Related Parties Transactions |

| | |

| During the period ended September 28, 2013, $1,104,489 (2012 - $766,012) was incurred for remuneration to officers and directors of the Company which was recorded as salaries and benefits expense. |

| | |

| 9. | Subsequent Events |

| | |

| On October 11, 2013, the Company issued a demand convertible promissory note in favor of Mr. Robert Edmunds, one of its directors, pursuant to a loan from Mr. Edmunds to the Company in the principal amount of $481,464 (CDN$500,000). The promissory note provides for simple interest accruing on the principal amount at the rate of 20% per annum, which is payable in full on repayment of the principal amount. The principal amount, including outstanding interest, is due and payable on the second business day after Mr. Edmunds provides the Company with written notice demanding the repayment thereof (the “Final Repayment Date”). The Company may repay and redeem any portion of the principal amount and its then related interest, in whole or in part, at any time prior to the Final Repayment Date by providing Mr. Edmunds with no less than five calendar days’ prior written notice with such repayment being due and owing at the end of such five-day period. If the Company determines to issue securities by way of any equity and/or debt private placement or financing at the time any outstanding principal and interest on the promissory note is outstanding, then Mr. Edmunds has the right to convert any portion of the then outstanding principal amount and interest into identical securities issued by the Company pursuant to any such financing transaction. Subsequent to the period end, the Company issued 60 day convertible promissory notes in favor of three directors of the Company, pursuant to a loan to the Company in the principal amount of $146,293 (CDN$151,925). The promissory note provides for simple interest accruing on the principal amount at the rate of 12% per annum, which is payable in full on repayment of the principal amount. Subsequent to the period end, the Company acquired a European facility with no capital by retiring $1.2 million of the vendors’ debt over a three year period. Additionally, CRAiLAR entered into a ten-year lease and option to purchase agreement on the building housing the facility with a renewal option for an additional ten years. |

12

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our results of operations and financial position should be read in conjunction with our financial statements and the notes thereto included elsewhere in this Report. Our consolidated financial statements are prepared in accordance with U.S. GAAP. All references to dollar amounts in this section are in U.S. dollars unless expressly stated otherwise.

The matters discussed in these sections that are not historical or current facts deal with potential future circumstances and developments. Such forward-looking statements include, but are not limited to, the development plans for the Company’s growth, trends in the results of the Company’s development, anticipated development plans, operating expenses and the Company’s anticipated capital requirements and capital resources. As such, these forward-looking statements may include words such as “plans”, “intends”, “anticipates”, “should”, “estimates”, “expects”, “believes”, “indicates”, “targeting”, “suggests”, and similar expressions. The actual results are expected to differ from these forward-looking statements and these differences may be material.

The table below reconciles net loss to Adjusted EBITDA for the periods presented (in thousands):

| | | Thirteen Weeks Ended | | | Thirty-Nine Weeks Ended | |

| | | | | | | | | | | | | |

| | | Sept 28, | | | Sept 30, | | | Sept 28, | | | Sept 30, | |

| | | | | | | | | | | | | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | | | | | | | | | | | |

| Consolidated | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net loss | | ($5,675 | ) | | ($2,032 | ) | | ($11,930 | ) | | ($6,265 | ) |

| | | | | | | | | | | | | |

| Interest expense, net | | 588 | | | 41 | | | 1,383 | | | 42 | |

| | | | | | | | | | | | | |

| Income tax (benefit) provision | | - | | | - | | | - | | | - | |

| | | | | | | | | | | | | |

| Depreciation and amortization | | 289 | | | 60 | | | 636 | | | 165 | |

| | | | | | | | | | | | | |

| EBITDA | | (4,798 | ) | | (1,931 | ) | | (9,911 | ) | | (6,058 | ) |

| | | | | | | | | | | | | |

| Share-based compensation | | 607 | | | 490 | | | 1,643 | | | 1,944 | |

| | | | | | | | | | | | | |

| Write down of inventory | | 2,549 | | | - | | | 3,423 | | | - | |

| | | | | | | | | | | | | |

| Rent expense for rent-free period | | 40 | | | - | | | 114 | | | - | |

| | | | | | | | | | | | | |

| Fair value adjustment to derivative liabilities | | 28 | | | (80 | ) | | (453 | ) | | 189 | |

| | | | | | | | | | | | | |

| Adjusted EBITDA | | ($1,574 | ) | | ($1,521 | ) | | ($5,184 | ) | | ($3,925 | ) |

13

RESULTS OF OPERATIONS

Thirteen-Week Period Ended September 28, 2013 Compared to Thirteen-Week Period Ended September 30, 2012

| Thirteen-Week Period Ended September 28, 2013 Compared Thirteen-Week Period Ended | |

| September 30, 2012 | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Revenues | $ | 15,438 | | $ | - | |

| | | | | | | |

| Gross profit (loss) | | ($6,498 | ) | $ | - | |

| | | | | | | |

| Loss before other items | | ($3,077,830 | ) | | ($2,031,503 | ) |

| | | | | | | |

| Net Loss | | ($5,674,218 | ) | | ($2,031,503 | ) |

| | | | | | | |

| Exchange differences on translating foreign controlled entities | | ($443,006 | ) | $ | 78,935 | |

| | | | | | | |

| Total comprehensive loss | | ($6,117,224 | ) | | ($1,952,568 | ) |

| | | | | | | |

| Loss from continuing operations per share (basic and diluted) | | ($0.13 | ) | | ($0.05 | ) |

Revenue and Gross Margins

Revenues and cost of sales consisted of:

- $15,438 (2012: $Nil), in revenues

- $21,936 (2012: $Nil), in cost of sales

Our revenues for the thirteen-week period ended September 28, 2013 were $15,438 compared with $Nil for the same period in 2012. Revenues of approximately $369,000 expected for the third quarter were pushed to the fourth quarter as we relocated production to Europe.

Our gross profit (loss) was ($6,498) caused by higher production and transportation costs incurred using temporary third party production facilities as we transition to company-owned and operated facilities.

Operating Expenses

During the thirteen-week period ended September 28, 2013, we recorded operating expenses of $3,093,557, compared to operating expenses of $2,111,700 for the same period in 2012.

Operating expenses consisted of:

- $125,849 (2012: $225,074) in advertising and promotion;

- $288,661 (2012: $60,080) in amortization and depreciation;

- $104,682 (2012: $201,137) in consulting and contract labour;

- $350,834 (2012: $Nil) in facility costs;

- $355,361 (2012: $259,492) in general and administrative;

- $588,028 (2012: $41,421) in interest;

- $125,050 (2012: $96,636) in professional fees;

- $130,332 (2012: $292,033) in research and development; and

- $1,009,033 (2012: $935,827) in salaries and benefits

14

Advertising and promotion expenses decreased to $125,849 for the thirteen-week period ended September 28, 2013, from $225,074 for the same period in 2012. The decrease in advertising and promotion was primarily due to a decrease in sales development costs the Company incurred that were made to facilitate future revenue streams and customer relations.

Amortization and depreciation expenses increased to $288,661 for the thirteen-week period ended September 28, 2013, from $60,080 for the same period in 2012. The increase is due to the decortication equipment and leasehold improvements placed into production commencing January 1, 2013 as the facility in Pamplico started production.

Consulting and contract labour expenses decreased to $104,682 for the thirteen-week period ended September 28, 2013, from $201,137, compared to the same period in 2012. The decrease was primarily due to decrease in stock-based compensation and the reduction of consultants that were utilized during the thirteen-week period for 2013.

Facility costs were $350,834 for the thirteen-week period ended September 28, 2013, compared to $Nil for the same period in 2012. Production did not commence until January 1, 2013 which is the reason there were no expenses in 2012.

General and administrative expenses increased to $355,361 for the thirteen-week period ended September 28, 2013, compared to $259,492 for the same period in 2012. The increase in general and administrative expenses was primarily due to travel and office costs. Some repair and maintenance costs have been included in this expense category.

Interest expenses increased to $588,028 for the thirteen-week period ended September 28, 2013, compared to $41,421 for the same period in 2012. The increase is directly attributable to the interest incurred on the existing convertible debentures.

Professional fees were $125,050 for the thirteen-week period ended September 28, 2013, compared to $96,636 for the same period in 2012. The increase is a primarily due to the Company requiring additional services in both legal and accounting to support current economic growth.

Research and development costs were $130,332 for the thirteen-week period ended September 28, 2013, compared to $292,033 for the same period in 2012. The decrease is a result of the Company coming out of the development stage and into production. Furthermore, some repairs and maintenance expenses were classified under this category in 2012.

Salaries and benefits expenses increased to $1,009,033 for the thirteen-week period ended September 28, 2013, compared with $935,827 for the same period in 2012. This increase is a result of the increase in stock based compensation for the period.

Net Loss

Our net loss during the thirteen-week period ended September 28, 2013, was ($5,674,218), or ($0.13) loss per share, compared to ($2,031,503), or ($0.05) loss per share, during the same period in 2012. During the thirteen week period ended September 28, 2013, the Company wrote down the value of its raw flax fiber feedstock, decorticated fiber, and seed inventory to a lower net realizable value by $2,548,827 (2012 – $Nil). The raw flax fiber feedstock and decorticated fiber was written down due to the expected decortication yield rate that was experienced during production. Seed write downs were necessary as the Company is not planting in the fall of 2013 in North America and the seed germination rate diminishes over time. The seeds were sold into the flax oil market and the adjustment represents the difference between the sales proceeds and the cost of the seeds. The Company wrote down equipment for a loss of ($13,368) (2012 - $Nil). There was also a loss of ($27,695) (2012 – $80,197) due to the change in the value of the derivative liabilities as at September 28, 2013.

For the thirteen-week period ended September 28, 2013, the weighted average number of shares outstanding was 44,421,148 compared to 42,865,834 at September 28, 2012.

15

| Thirty-Nine Week Period Ended September 28, 2013 and Thirty-Nine Week Period Ended | |

| September 30, 2012 | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Revenues | $ | 197,814 | | $ | - | |

| | | | | | | |

| Gross profit (loss) | | ($24,941 | ) | $ | - | |

| | | | | | | |

| Loss before other items | | ($8,947,827 | ) | | ($6,075,477 | ) |

| | | | | | | |

| Net Loss | | ($11,930,469 | ) | | ($6,264,449 | ) |

| | | | | | | |

| Exchange differences on translating foreign controlled entities | $ | 280,247 | | $ | 113,669 | |

| | | | | | | |

| Total comprehensive loss | | ($11,650,222 | ) | | ($6,150,780 | ) |

| | | | | | | |

| Loss from continuing operations per share (basic and diluted) | | ($0.27 | ) | | ($0.15 | ) |

Revenue and Gross Margins

Our gross profit (loss) during the thirty-nine week period ended September 28, 2013, was ($24,941) compared to ($Nil) during the same period in 2012. Revenues were generated during the most recent thirteen-week period by the sale of CRAiLAR® Flax Fiber.

Revenues and cost of sales consisted of:

- $197,814 (2012: $Nil), in revenues

- $222,755 (2012: $Nil), in cost of sales

Our revenues for the thirty-nine week period ended September 28, 2013 were $197,814 compared with $Nil for the same period in 2012. Our gross profit (loss) was ($24,941) was caused by high production and transportation costs incurred using temporary third party production facilities as we transition to company-owned and operated facilities.

Operating Expenses

During the thirty-nine week period ended September 28, 2013, we recorded operating expenses of $8,422,886 compared to operating expenses of $6,075,477 for the same period in 2012. The continued increase in operating expenses reflects the growing preparation of the Company for commercialization in 2013.

Operating expenses consisted of:

- $450,902 (2012: $342,850), in advertising and promotion;

- $636,270 (2012: $164,678), in amortization and depreciation;

- $398,229 (2012: $590,706), in consulting and contract labour;

- $1,460,355 (2012: $Nil), in facility costs;

- $934,396 (2012: $671,994), in general and administrative;

- $1,382,879 (2012: $41,425), in interest;

- $604,186 (2012: $495,217), in professional fees;

- $223,287 (2012: $645,138), in research and development; and

- $2,832,382 (2012: $3,123,469), in salaries and benefits;

Advertising and promotion expenses increased to $450,902 for the thirty-nine week period ended September 28, 2013, from $342,850 for the same period in 2012. The increase is due to the hiring of two new public relations consultants in the United States and Canada. Furthermore, the Company incurred additional expenses for sales development. These expenses include extraordinary processing costs that were incurred to further customer relations and to secure future revenue streams with its existing partners.

16

Amortization and depreciation expenses increased to $636,270 for the thirty-nine week period ended September 28, 2013, from $164,678, for the same period in 2012. There was an overall increase of depreciation expense which is due to the depreciation of the decortication equipment and leasehold improvements that commenced January 1, 2013 as the facility in Pamplico started production.

Consulting and contract labour expenses decreased to $398,229 for the thirty-nine week period ended September 28, 2013, from $590,706 for the same period in 2012. The decrease was due to a reduction in the amount of stock based compensation expense for consultants and contractors as well as a reduction in the number of contractors used during the period.

Facility costs were $1,460,355 for the thirty-nine week period ended September 28, 2013, compared to $Nil for the same period in 2012. The reason for the increase is due commencement of production at January 1, 2013.

General and administrative expenses increased to $934,396 for the thirty-nine week period ended September 28, 2013, from $671,994 for the same period in 2012. The expansion of the Company’s activities has led to an increase in general and administrative expenses, primarily office administration costs, travel, insurance, property taxes. Repairs and maintenance expenses have been classified under this expense category as a result of moving to production.

Interest expenses increased to $1,382,879 for the thirty-nine week period ended September 28, 2013, from $41,425 for the same period in 2012. Interest expense is directly attributable to the interest incurred on the convertible debentures.

Professional fees were $604,186 for the thirty-nine week period ended September 28, 2013, compared to $495,217 for the same period in 2012. The primary cause for the increase was fees related to the Company’s preparation for listing on a more senior exchange, and the fees involved in the completion of the 2012 year-end audit.

Research and development costs were $223,287 for the thirty-nine week period ended September 28, 2013, compared to $645,138 for the same period in 2012. The Company is transitioning from research and development to commercial production.

Salaries and benefits expenses decreased to $2,832,382 for the for the thirty-nine week period ended September 28, 2013, compared to $3,123,469 for the same period in 2012. The decrease is primarily due to the decrease in stock based compensation for the period which is due to there being fewer options exercisable as at September 28, 2013.

Net Loss

Our net loss during the thirty-nine week period ended September 28, 2013, was ($11,930,469), or ($0.27) loss per share, compared to ($6,264,449) or ($0.15) loss per share for the same period in 2012. The Company has continued to increase expenses for the start of the commercialization process of CRAiLAR. Specifically, the increase in loss was due to an increase in advertising and promotion expense, amortization and depreciation expense, an increase in general and administrative expense, facility costs, general and administrative expenses, interest expense, professional fees, the write down of impaired inventory, as well as a loss from the fair value adjustment of derivative liabilities. During the thirty-nine week period ended September 28, 2013, the Company recorded a gain on disposal of assets held for sale of $790 (2012 - $Nil) and a loss on disposal of assets of ($13,368) (2012 - $Nil), a loss on write down the value of its raw flax fiber feedstock, decorticated fiber inventory, and seed inventory by $3,422,582 (2012 - $Nil) to a lower net realizable value due to the expected decortication yield rate that was experienced during production. Seed write downs were necessary as the Company is not planting in the fall of 2013 in North America and the seed germination rate diminishes over time. The seeds were sold into the flax oil market and the adjustment represents the difference between the sales proceeds and the cost of the seeds. There was also a gain of $452,518 (2012 – ($188,972)) due to the change in the value of the derivative liabilities as at September 28, 2013.

For the thirty-nine week period ended September 28, 2013, the weighted average number of shares outstanding was 44,421,148 compared to 42,617,860 as at September 30, 2012.

17

Liquidity and Capital Resources

| | | September 28, | | | December 31, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Cash and cash equivalents | $ | 346,974 | | $ | 2,877,210 | |

| | | | | | | |

| Working capital | | ($1,491,605 | ) | $ | 2,585,862 | |

| | | | | | | |

| Total assets | $ | 19,931,445 | | $ | 20,328,540 | |

| | | | | | | |

| Total liabilities | $ | 21,840,476 | | $ | 13,426,339 | |

| | | | | | | |

| Shareholders’ Equity | | ($1,909,031 | ) | $ | 6,902,201 | |

Historically, the Company has been reliant on equity financings from the sale of its common shares, and more recently from the sale of convertible debentures, to fund its operations. In July 2013, the Company completed an additional convertible debt financing for net proceeds of $3,431,040. The Company expects to fund future operations and expansion through bank debt, government loan programs, partner financing, lease programs and equity financings. Initial stages of commercialization have commenced through previous financings, however, future phases of commercialization will be dependent on the financings described above.

As at September 28, 2013, total assets were $19,975,349, consisting of:

- $346,974 in cash and cash equivalents;

- $39,030 in accounts receivable;

- $2,418,901 in inventory;

- 271,695 in prepaid expenses and other;

- $1,575,421 in deferred debenture issuance costs;

- $15,122,757 in property and equipment; and

- $156,667 in intangible assets.

As at September 28, 2013, total liabilities were $21,840,476 and were comprised of:

- $2,014,288 in accounts payable;

- $2,553,590 in accrued liabilities;

- $327 in derivative liabilities; and

- $17,272,271 in convertible debenture.

Stockholders’ Equity decreased by $8,811,232 from $6,902,201 at December 31, 2012, to ($1,909,031) at September 28, 2013.

Cash Flows from Operating Activities

The cash flows used in operations of continuing operations for the thirty-nine week period ended September 28, 2013, were ($7,493,366) compared with ($5,232,961) for the same period in 2012. Cash flows used in operations for the thirty-nine week period ended September 28, 2013, consisted primarily of a net loss of ($11,930,469) from continuing operations, offset by certain items, amortization & depreciation of $875,295 (2012 – $164,678); amortization of deferred debt issuance costs of $288,462 (2012 - $Nil); amortization of debt discount of $35,815 (2012 - $Nil); rent of $114,199 (2012 - $Nil); stock based compensation of $1,642,532 (2012 - $1,944,411); gain on disposal of assets of ($790) (2012 - $Nil), loss on write down of assets of $12,578 (2012 - $Nil), write down of inventory of $3,422,582 (2012 - $Nil); fair value adjustment of derivative liabilities ($452,518) (2012 – $188,972); an decrease in accounts receivable $33,262 (2012 – ($17,434)); and increase in inventory of ($2,936,831) (2012 – ($1,821,585)); increase in prepaid expenses of ($164,910) (2012 – $10,974); increase in accounts payable of $607,870 (2012 – $440,083); and an increase in accrued liabilities of $958,767 (2012 – $115,583).

18

Cash Flows from Investing Activities

The cash flows used in investing activities for the thirty-nine week period ended September 28, 2013, were ($2,823,990) compared to (2012 - $6,080,218) for the same period in 2012. Cash flows used in investing activities consisted of a purchase of property and equipment totaling ($2,734,667) (2012 – ($6,048,478)), and the acquisition of intangible assets ($89,323) (2012 – ($31,740)).

Cash Flows from Financing Activities

Cash flows provided by financing activities for the thirty-nine week period ended September 28, 2013, totaled $7,506,873 versus $12,716,536 during the same period in 2012. The Company issued capital stock for proceeds of $239,746 (2012 - $3,545,526); convertible debentures for net proceeds of $8,143,108, (2012 - $10,231,000); and convertible issuance costs for convertible debenture of ($875,981) (2012 – ($1,059,990)).

Effect of Exchange Rate

The effect of exchange rates on cash resulted in an unrealized gain of $280,247 for the thirty-nine week period ended September 28, 2013, as compared with an unrealized gain of $113,669 in the same period of 2012.

Plan of Operation

“With CRAiLAR®, we have seen fibers grown by sunlight and rainfall perform better than those engineered in a laboratory. At CRAiLAR, we employ environmentally sustainable farming and manufacturing practices because they yield a superior fiber, utilize fewer resources, and prove that the path forward begins with a return to nature.”

Sales & Marketing

We believe that our marketing model will drive a pull-through marketing strategy, which draws from detailed brand building and delivers marketed promises directly to consumers. Brand building strategies imply a strong direct to consumer platform, which will allow us to build equity in a consumer focused model ultimately allowing transfer of that equity to establishing branding partnerships with some of the world’s leading consumer brands. The key to this strategy is the co-branding opportunities afforded us by our major brand partners, as they communicate CRAiLAR® benefits in sustainability and performance to their consumers.

Our public partnerships with the National Research Council (NRC) have been very important to us. We believe additional partnerships with consumer brands will also be important for the branding opportunities that these global brands will provide.

Strategic Relationships/Customer Development and Partnerships

Because CRAiLAR® Fibers can be an ingredient in countless products, we believe that partnering with large, and successful consumer brands is the path to successful commercialization. We believe that the opportunity exists to partner with certain global brands, which we believe will allow us to leverage the considerable branding and marketing talent of these brands to increase the power of the CRAiLAR®brand.

To grow our business and our brand, we have entered into a number of partnership agreements including:

Ashland Inc.In June 2011, we entered a joint development agreement with Hercules Incorporated, a subsidiary of Ashland Inc., to support evaluation of CRAiLEXTMhigh grade dissolving pulps for multiple products.

Cone Denim LLC. On March 11, 2013, we entered into a Marketing and Development Agreement with Cone Denim LLC (“Cone”) to market and develop the use of CRAiLAR fiber®in Cone’s denim fabric line. Crailar has agreed to not sell CRAiLAR fiber®to any other denim manufacturer through December 31, 2015.

Cotswold Industries Inc. On February 12, 2013, we entered into a Development Agreement with Cotswold Industries Inc. (“Cotswold”). The Company and Cotswold will try to develop or create commercially viable CRAiLAR®fibers in order to facilitate the introduction of CRAiLAR®fibers into pocketing, interlining and waist banding products.

Hanesbrands Inc.We announced in January 2011 a cooperative research project with Hanesbrands Inc. and the U.S. Department of Agriculture’s Agricultural Research Service (USDA-ARS) designed to cultivate and evaluate the viability of various flax strains for use in CRAiLAR®technology.

19

On March 17, 2011, we announced that we signed a ten-year CRAiLAR®fiber supply agreement with Hanesbrands Inc. to commercialize the Company’s proprietary fibers.

Levi Strauss & Co.We announced that we had entered into a short term CRAiLAR®Flax fiber development agreement with Levi Strauss & Co. beginning in April 2011 to support evaluation of processing CRAiLAR®flax fiber in woven casual apparel products, specifically denim and non-denim, bottom and top weight fabrics.

Georgia Pacific Consumer Products LLC. In September, 2011, the Company entered into a three year CRAiLAR®Fiber supply agreement with Georgia Pacific Consumer Products LLC (“GP”), for the use of CRAiLAR®fiber in formed substrates for the industrial and personal care markets. Georgia Pacific may automatically extend the agreement for ten years.

Target Corp.In December 2011, the Company entered into an agreement with Target to evaluate the use of its CRAiLAR®Flax fiber in Target’s domestic textiles category beginning December 1, 2011. The agreement includes two years of exclusivity in the category and calls for Target’s evaluation of CRAiLAR®Flax in a number of products including sheets, top or bed, shower curtains, window treatments, table linens, decorative pillows, towels, and more. In July 2012, the Company announced it commenced delivery of an initial 100,000 pounds of fiber to Target’s designated vendor. In the spring of 2013 Target introduced a new drapery line, called Threshold, containing 20% CRAiLAR®Fiber. These items are sold on Target’s website and in their stores.

Lenzing AG.In May 2012, the company entered into a joint development agreement with Lenzing, headquartered in Austria, and the world’s largest supplier of viscose, Modal and Tencel® to the apparel, non-woven and auto industries. Crailar® and Lenzing are jointly developing fiber solutions in the performance apparel industries for global athletic brands, as well as fashion brands.

We are currently evaluating partnering opportunities for multiple product development and commercialization of our proprietary CRAiLAR®Technology for environmentally sustainable bast fiber processing and production. Exclusive international licensing rights to these patent applications allow us to protect our investment to date in the development of CRAiLAR®and confidently move forward in seeking an appropriate development and commercialization partner.

Production Plan

One of the keys to the successful adoption of CRAiLAR® into the mainstream textile market is the scale up of our in-house production capabilities.

In September 2013, we executed a Letter of Intent (“LOI”) to acquire a European fiber dyeing facility with the same equipment used to produce CRAiLAR Flax Fiber. The new facility allows us to accelerate the timeline for establishing a company controlled CRAiLAR enzyme processing capability by nine months. The facility has a capacity to produce over 280,000 pounds of CRAiLAR Flax fiber per week with space to expand to one million pounds per week. The fiber dyeing company has been family owned and operated for four generations.

The European wet processing facility is located in an area of flax growing excellence and offers an abundant supply of feedstock from a by-product of the linen industry. Purchasing the by-product of the linen industry has significant working capital advantages because it is bought as needed and is processed, shipped and billed shortly after receipt. This compares with straw purchased directly from farmers for approximately the same cost where a year’s supply of straw must be paid when harvested by the farmer. We have entered into an agreement with a European flax processor and broker to process the lower cost fiber. The necessary equipment, which we have purchased, will be capable of decorticating weather damaged flax straw. We expect this equipment to be operational this coming December-January and be capable of producing more than twice our current wet processing capacity. On an annual basis, the amount of fiber created in Europe during the linen scutching processing ranges from 80,000 – 140,000 metric tons.

We also believe that it is necessary to develop contracted acreage of flax grown in Eastern Europe to avoid disrupting supply and demand for by-product of the linen industry. We believe that there are opportunities to secure farm acreage in Eastern Europe dedicated to supplying our plants. This would require a decortication capability in Eastern Europe. Our European suppliers also believe that additional farmers would be attracted to grow flax for CRAiLAR because the farming techniques are very simple and efficient compared with traditional linen flax farming techniques. Also, the retting requirements are less stringent than linen flax for the CRAiLAR process.

We plan on resuming decortication in Pamplico once a new bale entry system is installed approximately six to nine months from now. This fiber will be used for CRAiLAR Flax in Belgium or sold in the U.S. paper market. We do not plan on planting flax in the U.S. this fall given that we have enough supply from the 2013 crop to last through the year. Also, given our focus on Europe we will have reduced operations unless a strategic customer will support our presence in South Carolina. Some of the assets used in Pamplico could be redeployed to other locations.

20

In addition to the installation of our full scale processing line, CRAiLAR continues to improve upon its patented enzymatic process increasing efficiencies. In March 2012, we announced an improvement of our CRAiLAR® wet process time by 40 percent, thereby significantly increasing anticipated volume capabilities at planned facilities. The evaluation and resulting improvements were conducted internally in conjunction with research partners. The resulting changes encompass processes, as well as the utilization of industry standard equipment, including that which was purchased by the Company for its first production facility.

These reductions in overall cycle time, increase throughput and production capacity in each planned facility. These efficiencies also allowed the Company to evaluate third-party manufacturers to increase overall production volume of CRAiLAR® Flax through a quicker expansion model. As a result of this optimized process, we entered into the agreements with Tintoria Piana to execute the CRAiLAR® enzymatic process, augmenting the Company’s plans for manufacturing capacity.

During the third and fourth quarters of 2012, we processed fiber through our third party manufacturing partner using decorticated fiber from its smaller scale facility in Kingstree, S.C. and European sources. This fiber was used by our development partners to initiate their sales programs in preparation for commercialization in 2013.

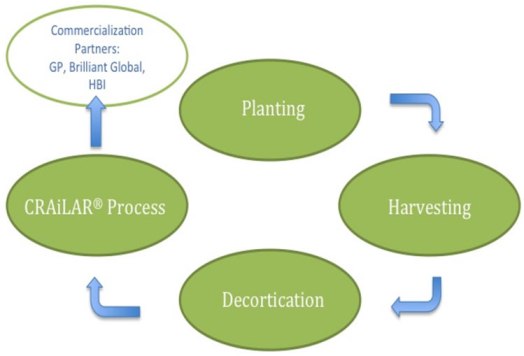

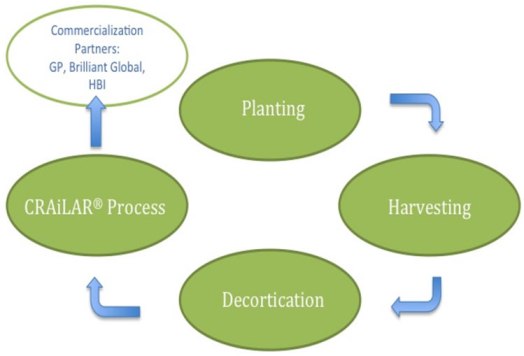

Production Model

Note on Plan of Operation

While the Company expects that profitable operations will be achieved in the future, there can be no assurance that revenue, margins, and profitability will increase, or be sufficient to support operations over the long term. Management expects that the Company will need to raise additional capital to meet short and long-term operating requirements. Management believes that private placements of equity capital and debt financing may be adequate to fund the Company’s long-term operating requirements. Management may also encounter business endeavors that require significant cash commitments or unanticipated problems or expenses that could result in a requirement for additional cash. If the Company raises additional funds through the issuance of equity or convertible debt securities other than to current shareholders, the percentage ownership of current shareholders would be reduced, and such securities might have rights, preferences or privileges senior to the Company’s common stock. Additional financing may not be available upon acceptable terms, or at all. If adequate funds are not available or are not available on acceptable terms, the Company may not be able to take advantage of prospective business endeavors or opportunities, which could significantly and materially restrict business operations. Management is continuing to pursue external financing alternatives to improve the Company’s working capital position and to grow the business to the greatest possible extent.

21

MATERIAL COMMITMENTS

Debentures

On September 20, 2012, the Company completed the offering of $10,051,261 ($10,000,000 CDN) worth of convertible debentures (the “Notes”). The Notes bear interest at a rate of 10% per year, payable semi-annually on March 31stand September 30thand mature on September 20, 2017. The holders of the Notes have the option to convert the Notes at a price of $2.90 per Common Stock for each $1,000 principal amount of Debentures at any time prior to the maturity date. On February 26, 2013, the Company completed another offering of $4,713,238 (CDN - $5,000,000) convertible debenture with essentially the same terms as the previously mentioned offering. Furthermore, on July 26, 2013 the Company completed a third offering of $3,431,040 (CDN - $3,535,000) convertible debenture (the “Notes 2013A”) with an interest rate of 10% payable semi-annually on March 31stand September 30thand matures on July 26, 2016. The holders of the Notes 2013A have the option to convert the Notes at a price of $2.00 per Common Stock for each $1,000 principal amount of Debentures at any time prior to the maturity date. The holders of the Notes will also receive 800 share purchase warrants with an exercise price of $1.25 for each $1,000 principal amount of Debentures exercisable at any time prior to the maturity date.

The Company is committed to annual interest payments over the next five years as follows:

| 2013 | $ | 829,255 | |

| 2014 | | 1,784,786 | |

| 2015 | | 1,784,786 | |

| 2016 | | 1,722,769 | |

| 2017 | | 1,402,840 | |

| Total | $ | 7,524,436 | |

Annual Leases

The Company is committed to current annual lease payments totaling $821,099 for premises under lease. Approximate minimum lease payments over the remainder of the leases are as follows:

| 2013 | $ | 42,445 | |

| 2014 | | 231,908 | |

| 2015 | | 199,908 | |

| 2016 | | 199,908 | |

| 2017 | | 146,930 | |

| Total | $ | 821,099 | |

National Research Council Agreements

Joint Collaboration Agreement

In October 2007, the Company entered into a joint collaboration agreement with the National Research Council (NRC) to continue to develop a patentable enzyme technology for the processing of hemp fibers. The agreement was for three years and expired on May 9, 2010. On February 19, 2010, the Company signed an amendment to the agreement to extend expiry to May 9, 2012. The Company intends to continue its joint collaboration of enzyme technology with the NRC; however the research will refocus on cellulose technology for the production of lignocellulosic ethanol. The NRC is to be paid as it conducts work on the joint collaboration. There are no further costs or other off-balance sheet liabilities associated with the NRC agreement.

Technology License Agreement

On November 1, 2006, the Company entered into a technology license agreement with the NRC. The license agreement provides the Company a worldwide license to use and sublicense the NRC technology called CRAiLAR®. The Company paid an initial $20,525 (CDN $25,000) fee and will pay an ongoing royalty of 3% on sales of products derived from the CRAiLAR®process to the NRC with a minimum annual payment set at $14,750 (CDN$15,000) per year in two installments. During the thirty-nine weeks ended September 28, 2013, the Company paid $7,440 (CDN$7,500) and accrued 7,135 (CDN$7,500) of the minimum annual royalty.

22

Investor Relations Agreement

On November 12, 2012, the company retained a third party group to perform investor relations services. The monthly fee is $15,000. The agreement term is one year with ten days’ notice of termination by either party after six months from the effective date. The Company may extend the term of this agreement for successive one-year terms by providing written notice of extension within 30 days prior to the expiration of initial term.

Research Agreement

Starting in December 2010, a co-operative research project designed to cultivate and evaluate the viability of various flax strains for use in CRAiLAR® technology was signed with the United States Department of Agriculture, Hanesbrands and CRAiLAR Inc. The project has an initial term of one year with a renewal option for two additional years. CRAiLAR Inc. will contribute annually $51,000 of in-kind expenses towards the project.

Farming and Consulting Agreements

During the previous year ended December 31, 2012, the Company signed agreements with farmers to plant and to produce flax using the seed provided by the Company. The resulting harvest of flax straw and flaw seed will be purchased by the Company at the agreed upon prices.

OFF-BALANCE SHEET ARRANGEMENTS

As of the date of this Quarterly Report, we do not have any off-balance sheet arrangements that have, or are reasonably likely to have, a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors. The term “off-balance sheet arrangement” generally means any transaction, agreement or other contractual arrangement to which an entity unconsolidated with us is a party, under which we have any obligation arising under a guarantee contract, derivative instrument or variable interest; or a retained or contingent interest in assets transferred to such entity or similar arrangement that serves as credit, liquidity or market risk support for such assets.

RECENTLY ADOPTED ACCOUNTING PRONOUNCEMENTS

The Company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Item 3. Quantitative and Qualitative Disclosures about Market Risk

Currency risk

The Company is exposed to currency risk to the extent that certain inventory and equipment is purchased from Europe in Euros. In addition, the Company has long term debt denominated in Canadian Dollars. The Company does not currently hedge its foreign currency exposure and accordingly is at risk for foreign currency exchange fluctuations. The Company and its subsidiaries do not have significant transactions or hold significant cash denominated in currencies other than their functional currencies.

Credit risk

The risk in cash accounts is managed through the use of a major financial institution which has high credit quality as determined by the rating agencies. As at September 28, 2013, the Company does not have significant concentrations of credit exposure.

Interest rate risk

All term debt has fixed interest rates and the Company has no significant exposure to interest rate fluctuation risk.

23

Commodity price risk

Commodity price risk is the risk that the fair value of future cash flows will fluctuate because of changes in the market prices of commodities. The Company is exposed to commodity price risk as it purchases flax seed in the production of fiber. The Company does not currently enter into futures contracts or otherwise hedge its exposure to commodity price risk.

Item 4. Controls and Procedures

Disclosure Controls and Procedures

Kenneth Barker, our Chief Executive Officer, and Theodore Sanders, our Chief Financial Officer, have evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) of the Exchange Act) as of the end of the period covered by this Quarterly Report. Based on that evaluation, they concluded that our disclosure controls and procedures were effective as of September 28, 2013.

No Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting that occurred during our fiscal quarter ended September 28, 2013 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

Management is not aware of any material legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Report, no director, officer or affiliate is a party adverse to us in any legal proceeding, or has an adverse interest to us in any legal proceedings. Management is not aware of any other material legal proceedings pending or that have been threatened against us or our properties.

Item 1A. Risk Factors

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are all of the material risks that we are currently aware of that are facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

We Have a History of Operating Losses and There Can Be No Assurance We Will Be Profitable in the Future.

We have a history of operating losses, expect to continue to incur losses, may never be profitable, and must be considered to be in the development stage. Further, we have been dependent on sales of our equity securities and debt financing to meet our cash requirements. We have incurred net losses totaling approximately $11,930,469 for the thirty-nine week period ended September 28, 2013 and $6,264,449 for the thirty-nine week period ended September 30, 2012. As of September 28, 2013, we had accumulated deficits of $32,698,132. As at September 28, 2013 we had cash and cash equivalents of $346,974 and negative working capital of $1,491,605.

We Will Need to Raise Capital To Continue Our Operations.

Based upon our historical losses from operations, we may require additional funding in the future. If we cannot obtain capital through financings or otherwise, our ability to execute our development plans and achieve profitable operational levels will be greatly limited. Historically, we have funded our operations through the issuance of equity, convertible debenture and bank debt financing arrangements. We may not be able to obtain additional financing on favorable terms, if at all. Our future cash flows and the availability of financing will be subject to a number of variables, including demand for CRAiLAR® and CRAiLEXTM technologies. Further, debt financing could lead to a diversion of cash flow to satisfy debt-servicing obligations and create restrictions on business operations. If we are unable to raise additional funds, it would have a material adverse effect upon our operations.

24

A Commercial Market Must Be Found for Our By-products.

Markets need to be found and developed for the by-products of our decortication process or it could have an effect on our profitability. Although several opportunities for the sale of our by-products are being explored, no contracts for the off take of our by-products have been signed as of the date of this report.

Our Success is Dependent Upon the Acceptance of CRAiLAR®Technology.

Our success depends upon our achieving significant market acceptance of our CRAiLAR® Technology and demand for our products. Acceptance of our CRAiLAR®Technology will depend on the success of our and our partners’ promotional and marketing efforts and ability to attract customers. To date, we have not spent significant funds on marketing and promotional efforts, although in order to increase awareness of our products we expect our partners to spend a significant amount on promotion, marketing and advertising in the future. If these expenses fail to develop an awareness of our CRAiLAR® Technology and products, these expenses may never be recovered and we may never be able to generate any significant future revenues. In addition, even if awareness of our CRAiLAR® Technology increases, we may not be able to produce enough product to meet demand.

We May Be Unable to Retain Key Employees or Management Personnel.

The loss of any of our key officers and management personnel would have an adverse impact on our future development and could impair our ability to succeed. Our performance is substantially dependent upon the expertise of our Chief Executive Officer, Mr. Kenneth Barker and our Chief Innovation Officer, Mr. Jason Finnis, and other key management personnel and our ability to continue to hire and retain such personnel. Messrs. Barker, Sanders, Finnis, Prevost, Robinson and Nalbach spend substantially all, or most, of their working time with us and our subsidiaries. It may be difficult to find sufficiently qualified individuals to replace Mr. Barker, Mr. Sanders, Mr. Finnis, Mr. Prevost, Mr. Robinson, Mr. Nalbach, Ms. Harrison or other key management personnel if we were to lose any one or more of them. The loss of Mr. Barker, Mr. Sanders, Mr. Finnis, Mr. Robinson, Mr. Nalbach or Mr. Prevost, or any of our other key management personnel could have a material adverse effect on our business, development, financial condition, and operating results. We maintain “key person” life insurance on our senior executive officers.

Our Officers and Directors May Be Subject to Conflicts of Interest.

Certain of our officers and directors may be subject to conflicts of interest. Certain of our directors devote part of their working time to other business endeavors, including consulting relationships with other entities, and have responsibilities to other entities. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, certain of our directors may be subject to conflicts of interest. Currently, we have no policy in place to address such conflicts of interest. However, such directors have acknowledged their fiduciary duty to perform their duties in our best interest and those of our shareholders.