AXIS Capital Holdings Limited (AXS) 425Business combination disclosure

Filed: 3 Jun 15, 12:00am

| The Merger with AXIS Capital Provides Superior Protection for Preferred Shareholders, vs. Significant Risks Introduced by EXOR's Offer June 2015 |

|

1

DISCLAIMER

Participants in Solicitation

PartnerRe, AXIS, their respective directors and certain of their respective

executive officers may be considered participants in the solicitation of

proxies in connection with the proposed transaction. Information about the

directors and executive officers of PartnerRe is set forth in its Annual Report

on Form 10-K for the year ended December 31, 2014, which was filed with the SEC

on February 26, 2015, its proxy statement for its 2014 annual meeting of

stockholders, which was filed with the SEC on April 1, 2014, its Quarterly

Report on Form 10-Q for the quarter ended March 31, 2015, which was filed with

the SEC on May 4, 2015 and its Current Reports on Form 8-K, which were filed

with the SEC on January 29, 2015, May 16, 2014 and March 27, 2014. Information

about the directors and executive officers of AXIS is set forth in its Annual

Report on Form 10-K for the year ended December 31, 2014, which was filed with

the SEC on February 23, 2015, its proxy statement for its 2014 annual meeting

of stockholders, which was filed with the SEC on March 28, 2014, its Quarterly

Report on Form 10-Q for the quarter ended March 31, 2015, which was filed with

the SEC on May 4, 2015 and its Current Reports on Form 8-K, which were filed

with the SEC on March 11, 2015, January 29, 2015, August 7, 2014, June 26,

2014, March 27, 2014 and February 26, 2014.

These documents can be obtained free of charge from the sources indicated

above. Additional information regarding the participants in the proxy

solicitations and a description of their direct and indirect interests, by

security holdings or otherwise, is contained in the joint proxy

statement/prospectus and other relevant materials filed with the SEC.

|

|

2

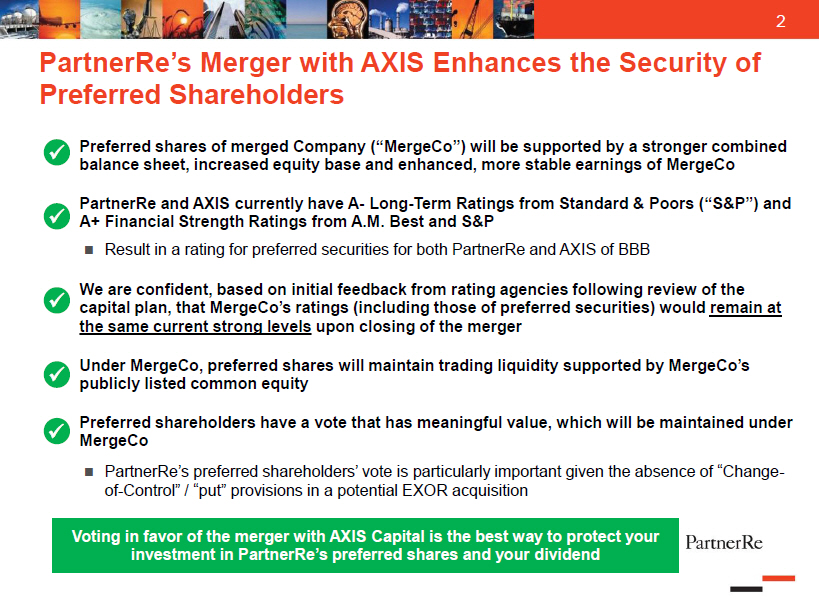

PartnerRe's Merger with AXIS Enhances the Security of Preferred Shareholders

[] Preferred shares of merged Company ([]MergeCo ") will be supported by a

stronger combined balance sheet, increased equity base and enhanced, more

stable earnings of MergeCo

[] PartnerRe and AXIS currently have A- Long-Term Ratings from Standard and

Poors ("SandP") and A+ Financial Strength Ratings from A. M. Best and

SandP

[] Result in a rating for preferred securities for both PartnerRe and

AXIS of BBB

[] We are confident, based on initial feedback from rating agencies following

review of the capital plan, that MergeCo's ratings (including those of

preferred securities) would remain at the same current strong levels upon

closing of the merger

[] Under MergeCo, preferred shares will maintain trading liquidity supported

by MergeCo's publicly listed common equity Preferred shareholders have a

vote that has meaningful value, which will be maintained under[] MergeCo

[] PartnerRe's preferred shareholders' vote is particularly important

given the absence of "Change- of-Control" / "put" provisions in a

potential EXOR acquisition

Voting in favor of the merger with AXIS Capital is the best way to protect your

investment in PartnerRe's preferred shares and your dividend

|

|

3

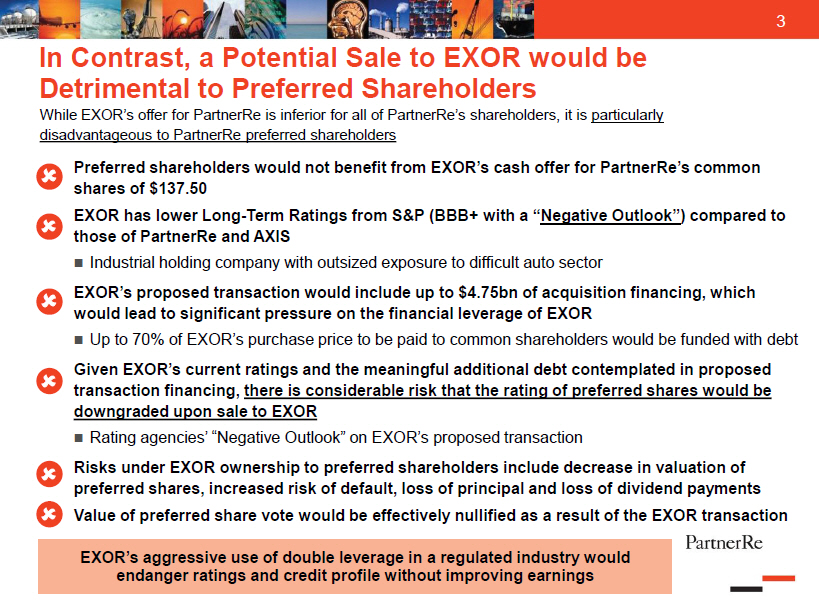

In Contrast, a Potential Sale to EXOR would be Detrimental to Preferred

Shareholders

While EXOR's offer for PartnerRe is inferior for all of PartnerRe's

shareholders, it is particularly disadvantageous to PartnerRe preferred

shareholders

[] Preferred shareholders would not benefit from EXOR's cash offer for

PartnerRe's common shares of $137.50

[] EXOR has lower Long-Term Ratings from SandP (BBB+ with a []Negative

Outlook") compared to those of PartnerRe and AXIS

[] Industrial holding company with outsized exposure to difficult auto sector

[] EXOR's proposed transaction would include up to $4.75bn of acquisition

financing, which would lead to significant pressure on the financial

leverage of EXOR

[] Up to 70% of EXOR's purchase price to be paid to common shareholders would

be funded with debt

[] Given EXOR's current ratings and the meaningful additional debt

contemplated in proposed transaction financing, there is considerable risk

that the rating of preferred shares would be downgraded upon sale to EXOR

[] Rating agencies' "Negative Outlook" on EXOR's proposed transaction

[] Risks under EXOR ownership to preferred shareholders include decrease in

valuation of preferred shares, increased risk of default, loss of

principal and loss of dividend payments

[] Value of preferred share vote would be effectively nullified as a result

of the EXOR transaction

EXOR's aggressive use of double leverage in a regulated industry would endanger

ratings and credit profile without improving earnings

|

|

4

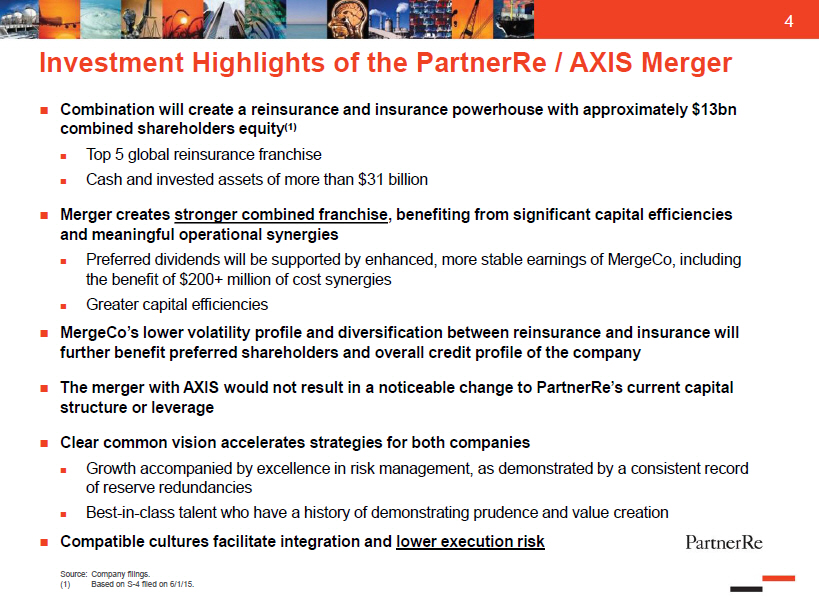

Investment Highlights of the PartnerRe / AXIS Merger

[] Combination will create a reinsurance and insurance powerhouse with

approximately $13bn combined shareholders equity(1)

[] Top 5 global reinsurance franchise

[] Cash and invested assets of more than $31 billion

[] Merger creates stronger combined franchise, benefiting from significant

capital efficiencies and meaningful operational synergies

[] Preferred dividends will be supported by enhanced, more stable

earnings of MergeCo, including the benefit of $200+ million of cost

synergies

[] Greater capital efficiencies

[] MergeCo's lower volatility profile and diversification between reinsurance

and insurance will further benefit preferred shareholders and overall

credit profile of the company

[] The merger with AXIS would not result in a noticeable change to

PartnerRe's current capital structure or leverage

[] Clear common vision accelerates strategies for both companies

[] Growth accompanied by excellence in risk management, as demonstrated

by a consistent record of reserve redundancies

[] Best-in-class talent who have a history of demonstrating prudence

and value creation

[] Compatible cultures facilitate integration and lower execution risk

Source: Company filings.

(1) Based on S-4 filed on 6/1/15.

|

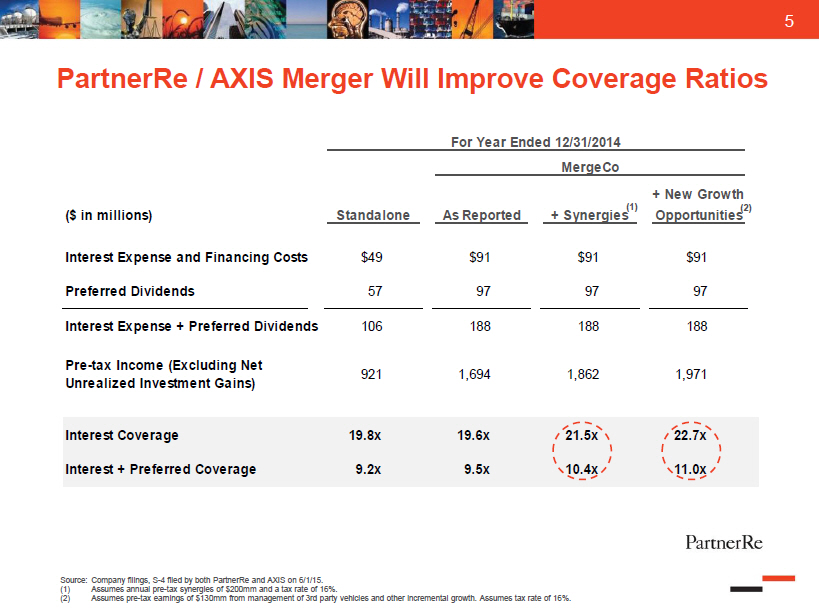

| Partnerre/axis Merger Will Improve Coverage Ratios [GRAPHIC OMITTED] Source: Company filings, S-4 filed by both PartnerRe and AXIS on 6/1/15. (1) Assumes annual pre-tax synergies of $200mm and a tax rate of 16%. (2) Assumes pre-tax earnings of $130mm from management of 3rd party vehicles and other incremental growth. Assumes tax rate of 16%. |

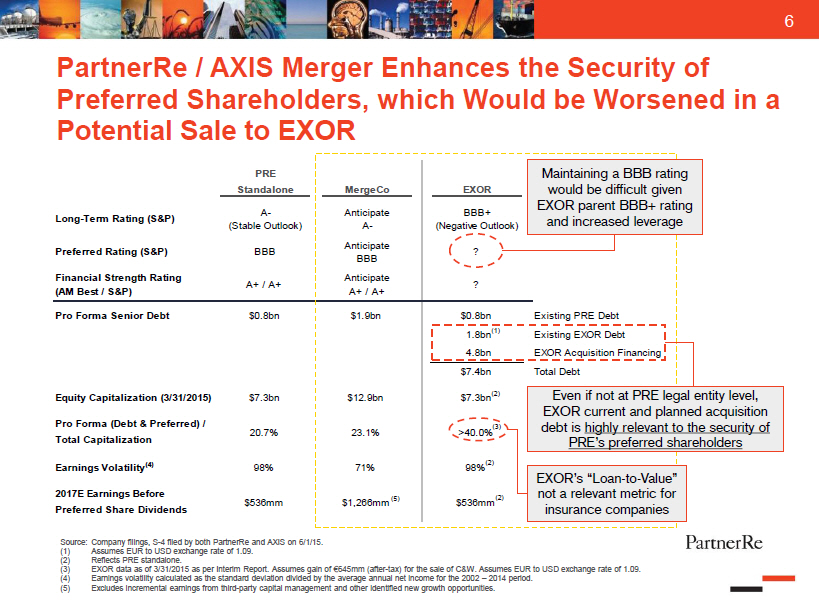

| PartnerRe / AXIS Merger Enhances the Security of Preferred Shareholders, which Would be Worsened in a Potential Sale to EXOR [GRAPHIC OMITTED] Source: Company filings, S-4 filed by both PartnerRe and AXIS on 6/1/15. (1) Assumes EUR to USD exchange rate of 1.09. (2) Reflects PRE standalone. (3) EXOR data as of 3/31/2015 as per Interim Report. Assumes gain of Euro645mm (after-tax) for the sale of CandW. Assumes EUR to USD exchange rate of 1.09. (4) Earnings volatility calculated as the standard deviation divided by the average annual net income for the 2002 -- 2014 period. (5) Excludes incremental earnings from third-party capital management and other identified new growth opportunities. |

|

7

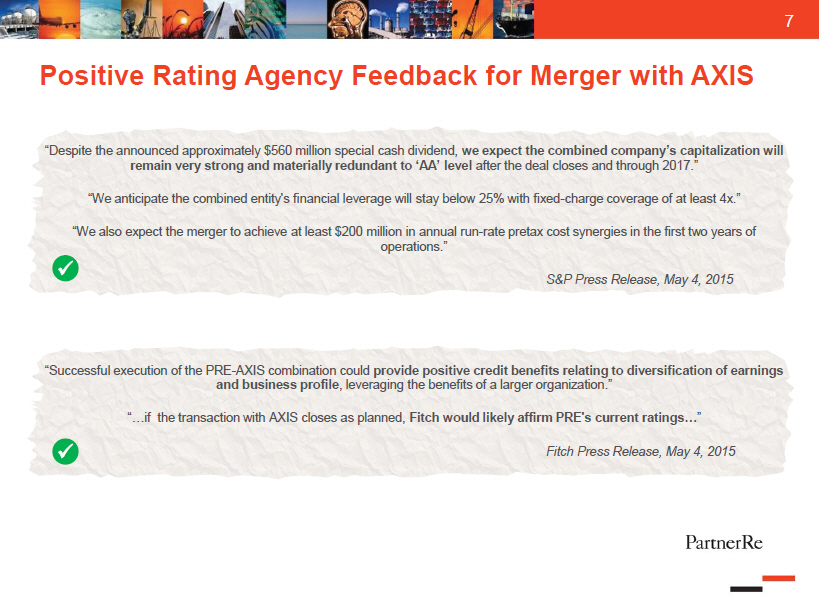

Positive Rating Agency Feedback for Merger with AXIS

"Despite the announced approximately $560 million special cash dividend, we

expect the combined company's capitalization will remain very strong and

materially redundant to 'AA' level after the deal closes and through 2017."

"We anticipate the combined entity's financial leverage will stay below 25%

with fixed-charge coverage of at least 4x."

"We also expect the merger to achieve at least $200 million in annual run-rate

pretax cost synergies in the first two years of operations."

SandP Press Release, May 4, 2015

"Successful execution of the PRE-AXIS combination could provide positive

credit benefits relating to diversification of earnings and business profile,

leveraging the benefits of a larger organization."

"...if the transaction with AXIS closes as planned, Fitch would likely affirm

PRE's current ratings..."

" Fitch Press Release, May 4, 2015

|

|

8

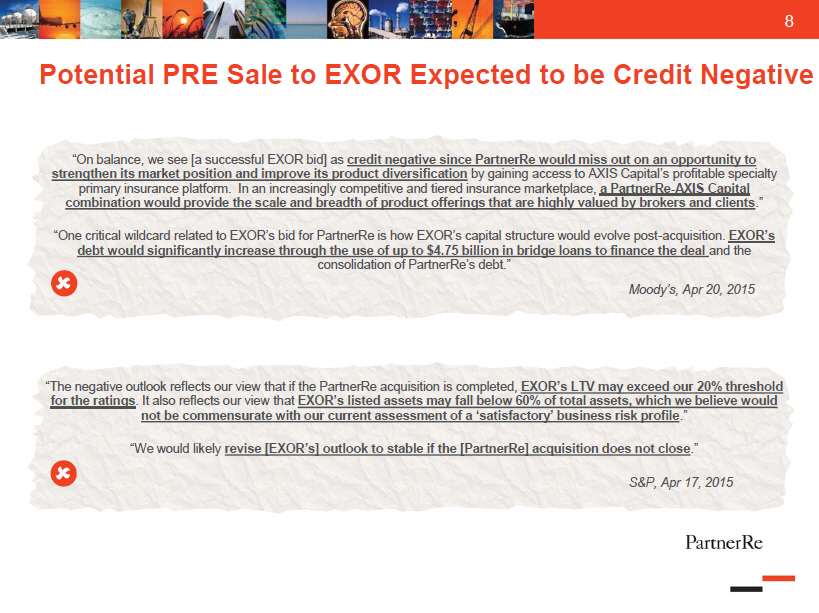

Potential PRE Sale to EXOR Expected to be Credit Negative

"On balance, we see [a successful EXOR bid] as credit negative since

PartnerRe would miss out on an opportunity to strengthen its market position

and improve its product diversification by gaining access to AXIS Capital's

profitable specialty primary insurance platform. In an increasingly competitive

and tiered insurance marketplace, a PartnerRe-AXIS Capital combination would

provide the scale and breadth of product offerings that are highly valued by

brokers and clients."

"One critical wildcard related to EXOR's bid for PartnerRe is how EXOR's

capital structure would evolve post-acquisition. EXOR's debt would

significantly increase through the use of up to $4.75 billion in bridge loans

to finance the deal and the consolidation of PartnerRe's debt."

Moody's, Apr 20, 2015

"The negative outlook reflects our view that if the PartnerRe acquisition is

completed, EXOR's LTV may exceed our 20% threshold for the ratings. It also

reflects our view that EXOR's listed assets may fall below 60% of total assets,

which we believe would not be commensurate with our current assessment of a

'satisfactory' business risk profile."

"We would likely revise [EXOR's] outlook to stable if the [PartnerRe]

acquisition does not close."

SandP, Apr 17, 2015

|

|

Ability to Return Capital Even While Enhancing the Capitalization and Credit

Profile

* Preferred shareholders are protected by enhanced fixed charge coverage

profile

* After preferred payout MergeCo will produce significant cash flows

* Initial feedback from rating agencies in support of planned capital

management strategy

* Plan maintains capitalization at above "AA" SandP level

Key Drivers Enabling Capital Return Capital Deployment

* Less-volatile income stream and strong track record [] $750mm expected to be returned to combined

with rating agencies supports capital management company shareholders immediately after closing

strategy

[] In addition, $2.2bn+ of buybacks and dividends

* Strong net income generation benefitting from strength expected through year-end 2017-- equivalent to 100%

of combined platform and synergies of operating earnings

* Increasing contribution from less capital intensive [] Further deployable capital anticipated from third-party

businesses, leading to further capital efficiencies capital vehicles

* Strong growth prospects without a commensurate [] Expected to maintain peer leading dividend payout

increase in required capital, driven by increased scale ratio

and diversification

* Third-party capital actively used to drive stable / high

return on equity fee income and to liberate capital

(1) []BoP" refers to beginning of period. Capital return defined as cumulative

dividends paid and share buybacks as percent of beginning of period common

equity as referenced. Peers reflect 2-year capital return from 12/31/12 --

12/31/14. PRE + AXS pro forma reflects 2-year capital return from 9/30/15E --

9/30/17E.

9

|

|

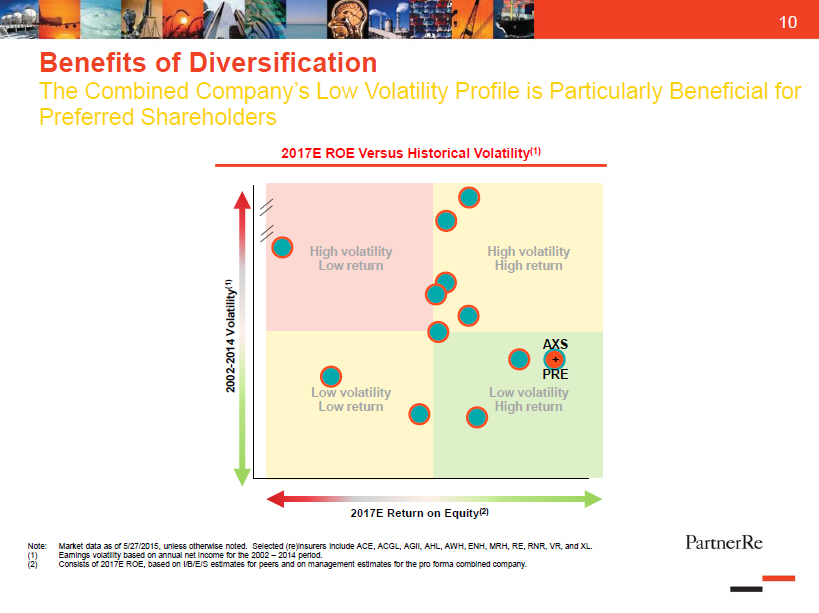

Benefits of Diversification

The Combined Company's Low Volatility Profile is Particularly Beneficial for

Preferred Shareholders

2017E ROE Versus Historical Volatility(1)

[GRAPHIC OMITTED]

Note: Market data as of 5/27/2015, unless otherwise noted. Selected

(re)insurers include ACE, ACGL, AGII, AHL, AWH, ENH, MRH, RE, RNR, VR, and XL.

(1) Earnings volatility based on annual net income for the 2002 -- 2014

period.

(2) Consists of 2017E ROE, based on I/B/E/S estimates for peers and on

management estimates for the pro forma combined company.

10

|

|

11

DISCLAIMER

Important Information for Investors and Shareholders

This communication does not constitute an offer to buy or sell or the

solicitation of an offer to buy or sell any securities or a solicitation of any

vote or approval. This communication relates to a proposed business combination

between PartnerRe Ltd. ("PartnerRe") and AXIS Capital Holdings Limited

("AXIS"). In connection with this proposed business combination, PartnerRe and

AXIS have filed a registration statement on Form S-4 with the Securities and

Exchange Commission (the "SEC"), and a definitive joint proxy

statement/prospectus of PartnerRe and AXIS and other documents related to the

proposed transaction. This communication is not a substitute for any such

documents. The registration statement was declared effective by the SEC on June

1, 2015. INVESTORS AND SECURITY HOLDERS OF PARTNERRE AND AXIS ARE URGED TO READ

THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER

DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR

ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Definitive

proxy statement(s) will be mailed to shareholders of PartnerRe and/or AXIS, as

applicable. Investors and security holders may obtain free copies of these

documents and other documents filed with the SEC by PartnerRe and/or AXIS

through the website maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with the SEC by PartnerRe are available free of charge on

PartnerRe's internet website at http://www.partnerre.com or by contacting

PartnerRe's Investor Relations Director by email at robin.sidders@partnerre.com

or by phone at 1-441-294-5216. Copies of the documents filed with the SEC by

AXIS are available free of charge on AXIS' internet website at

http://www.axiscapital.com or by contacting AXIS' Investor

Relations Contact by email at linda.ventresca@axiscapital.com or by phone at

1-441-405-2727.

|

|

12

DISCLAIMER

Forward Looking Statements

Certain statements in this communication regarding the proposed transaction

between PartnerRe and AXIS are "forward-looking" statements. The words

"anticipate," "believe," "ensure," "expect," "if," "illustrative,"

"intend," "estimate," "probable," "project," "forecasts," "predict,"

"outlook," "aim," "will," "could," "should," "would," "potential,"

"may," "might," "anticipate," "likely" "plan," "positioned," "strategy,"

and similar expressions, and the negative thereof, are intended to identify

forward-looking statements. These forward-looking statements, which are subject

to risks, uncertainties and assumptions about PartnerRe and AXIS, may include

projections of their respective future financial performance, their respective

anticipated growth strategies and anticipated trends in their respective

businesses. These statements are only predictions based on current expectations

and projections about future events. There are important factors that could

cause actual results, level of activity, performance or achievements to differ

materially from the results, level of activity, performance or achievements

expressed or implied by the forward-looking statements, including the risk

factors set forth in PartnerRe's and AXIS' most recent reports on Form 10-K,

Form 10-Q and other documents on file with the SEC and the factors given below:

[] the failure to obtain the approval of shareholders of PartnerRe or AXIS in

connection with the proposed transaction;

[] the failure to consummate or delay in consummating the proposed

transaction for other reasons;

[] the timing to consummate the proposed transaction;

[] the risk that a condition to closing of the proposed transaction may not

be satisfied;

[] the risk that a regulatory approval that may be required for the proposed

transaction is delayed, is not obtained, or is obtained subject to

conditions that are not anticipated;

[] AXIS' or PartnerRe's ability to achieve the synergies and value creation

contemplated by the proposed transaction;

[] the ability of either PartnerRe or AXIS to effectively integrate their

businesses; and

[] the diversion of management time on transaction-related issues.

PartnerRe's forward-looking statements are based on assumptions that PartnerRe

believes to be reasonable but that may not prove to be accurate. AXIS'

forward-looking statements are based on assumptions that AXIS believes to be

reasonable but that may not prove to be accurate. Neither PartnerRe nor AXIS

can guarantee future results, level of activity, performance or achievements.

Moreover, neither PartnerRe nor AXIS assumes responsibility for the accuracy

and completeness of any of these forward-looking statements.

PartnerRe and AXIS assume no obligation to update or revise any forward-looking

statements as a result of new information, future events or otherwise, except

as may be required by law. Readers are cautioned not to place undue reliance on

these forward-looking statements that speak only as of the date hereof.

|