AXIS Capital Holdings Limited (AXS) 425Business combination disclosure

Filed: 29 Jun 15, 12:00am

Filed by PartnerRe Ltd.

pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: AXIS Capital Holdings Limited

Commission File No.: 001-31721

[GRAPHIC OMITTED] Special Meeting of Shareholders on July 24, 2015 to Approve the Merger of PartnerRe and AXIS Capital Please vote today FOR the merger-of-equals between PartnerRe and AXIS Capital. Your Vote is Important [GRAPHIC OMITTED] |  |

IMPORTANT INFORMATION

Important Information For Investors And Shareholders

This communication does not constitute an offer to buy or

sell or the solicitation of an offer to buy or sell any

securities or a solicitation of any vote or approval. This

communication relates to a proposed business combination

between PartnerRe Ltd. ("PartnerRe") and AXIS Capital

Holdings Limited ("AXIS"). In connection with this proposed

business combination, PartnerRe and AXIS have filed a

registration statement on Form S-4 with the Securities and

Exchange Commission (the "SEC"), and a definitive joint

proxy statement/prospectus of PartnerRe and AXIS and other

documents related to the proposed transaction. This

communication is not a substitute for any such documents.

The registration statement was declared effective by the

SEC on June 1, 2015 and the definitive proxy

statement/prospectus has been mailed to shareholders of

PartnerRe and AXIS. INVESTORS AND SECURITY HOLDERS OF

PARTNERRE AND AXIS ARE URGED TO READ THE REGISTRATION

STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER

DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR

WILL CONTAIN IMPORTANT INFORMATION. A definitive proxy

statement has been mailed to shareholders of PartnerRe and

AXIS. Investors and security holders may obtain free copies

of these documents and other documents filed with the SEC

by PartnerRe and/or AXIS through the website maintained by

the SEC at http://www.sec.gov. Copies of the documents

filed with the SEC by PartnerRe are available free of

charge on PartnerRe's internet website at

http://www.partnerre.com or by contacting PartnerRe's

Investor Relations Director by email at

robin.sidders@partnerre.com or by phone at 1-441-294-5216.

Copies of the documents filed with the SEC by AXIS are

available free of charge on AXIS' internet website at

http://www.axiscapital.com or by contacting AXIS' Investor

Relations Contact by email at

linda.ventresca@axiscapital.com or by phone at

1-441-405-2727.

Participants in Solicitation

PartnerRe, AXIS, their respective directors and certain of

their respective executive officers may be considered

participants in the solicitation of proxies in connection

with the proposed transaction. Information about the

directors and executive officers of PartnerRe is set forth

in its Annual Report on Form 10-K for the year ended

December 31, 2014, which was filed with the SEC on February

26, 2015, its proxy statement for its 2014 annual meeting

of stockholders, which was filed with the SEC on April 1,

2014, its Quarterly Report on Form 10-Q for the quarter

ended March 31, 2015, which was filed with the SEC on May

4, 2015 and its Current Reports on Form 8-K, which were

filed with the SEC on January 29, 2015, May 16, 2014 and

March 27, 2014. Information about the directors and

executive officers of AXIS is set forth in its Annual

Report on Form 10-K for the year ended December 31, 2014,

which was filed with the SEC on February 23, 2015, its

proxy statement for its 2014 annual meeting of

stockholders, which was filed with the SEC on March 28,

2014, its Quarterly Report on Form 10-Q for the quarter

ended March 31, 2015, which was filed with the SEC on May

4, 2015 and its Current Reports on Form 8-K, which were

filed with the SEC on March 11, 2015, January 29, 2015,

August 7, 2014, June 26, 2014, March 27, 2014 and February

26, 2014.

These documents can be obtained free of charge from the

sources indicated above. Additional information regarding

the participants in the proxy solicitations and a

description of their direct and indirect interests, by

security holdings or otherwise, is contained in the joint

proxy statement/ prospectus and other relevant materials

filed with the SEC.

Forward Looking Statements

Certain statements in this communication regarding the

proposed transaction between PartnerRe and AXIS are

"forward-looking" statements. The words "anticipate,"

"believe," "ensure," "expect," "if," "illustrative,"

"intend," "estimate," "probable," "project," "forecasts,"

"predict," "outlook," "aim," "will," "could," "should,"

"would," "potential," "may," "might," "anticipate,"

"likely" "plan," "positioned," "strategy," and similar

expressions, and the negative thereof, are intended to

identify forward-looking statements. These forward-looking

statements, which are subject to risks, uncertainties and

assumptions about PartnerRe and AXIS, may include

projections of their respective future financial

performance, their respective anticipated growth strategies

and anticipated trends in their respective businesses.

These statements are only predictions based on current

expectations and projections about future events. There are

important factors that could cause actual results, level of

activity, performance or achievements to differ materially

from the results, level of activity, performance or

achievements expressed or implied by the forward-looking

statements, including the risk factors set forth in

PartnerRe's and AXIS' most recent reports on Form 10-K,

Form 10-Q and other documents on file with the SEC and the

factors given below:

[] the failure to obtain the approval of shareholders of PartnerRe or AXIS in

connection with the proposed transaction; [] the failure to consummate or delay

in consummating the proposed transaction for other reasons; [] the timing to

consummate the proposed transaction; [] the risk that a condition to closing of

the proposed transaction may not be satisfied; [] the risk that a regulatory

approval that may be required for the proposed transaction is delayed, is not

obtained, or is obtained subject to conditions that are not anticipated; []

AXIS' or PartnerRe's ability to achieve the synergies and value creation

contemplated by the proposed transaction; [] the ability of either PartnerRe or

AXIS to effectively integrate their businesses; and [] the diversion of

management time on transaction-related issues.

PartnerRe's forward-looking statements are based on

assumptions that PartnerRe believes to be reasonable but

that may not prove to be accurate. AXIS' forward-looking

statements are based on assumptions that AXIS believes to

be reasonable but that may not prove to be accurate.

Neither PartnerRe nor AXIS can guarantee future results,

level of activity, performance or achievements. Moreover,

neither PartnerRe nor AXIS assumes responsibility for the

accuracy and completeness of any of these forward-looking

statements. PartnerRe and AXIS assume no obligation to

update or revise any forward-looking statements as a result

of new information, future events or otherwise, except as

may be required by law. Readers are cautioned not to place

undue reliance on these forward-looking statements that

speak only as of the date hereof.

|  |

PartnerRe and AXIS Capital Have Agreed to a

Merger-of-Equals That Will Create an Industry Powerhouse

[][] Brings together market-leading insurance

and reinsurance franchises that will

benefit from increased scale and a

stronger market presence

[][] Merger will result in an even stronger

company with higher, more diversified

earnings, lower volatility and an enhanced

business profile

[][] The merger of equals between PartnerRe

and AXIS Capital was unanimously

approved by the entire PartnerRe Board

[][] This merger will drive meaningful

value for all shareholders

[GRAPHIC OMITTED]

PLEASE VOTE THE

WHITE PROXY CARD TODAY!

You may vote by phone, by internet, or by signing, dating

and returning the enclosed WHITE proxy card in the

postage-paid envelope provided.

3

|  |

Strategic Merits of the Merger Top 5 global reinsurer with increased scale and relevance [][] Leading franchise in attractive specialty markets [][] Expanded business opportunities [][] Improved service capabilities and breadth of products Positioned to seize growth opportunities in attractive specialty insurance and life, accident and health markets globally Greater opportunity to leverage presence of alternative capital [][] Lower cost of capital by matching risk to different forms of capital [][] Enhanced product offering for clients Reduced operating expenses and efficient capital structure Increased balance sheet strength and capital generation provides flexibility in deployment of capital, including reinvestment in the business For more information, visit: www.partnerre-valuecreation.com 4 |  |

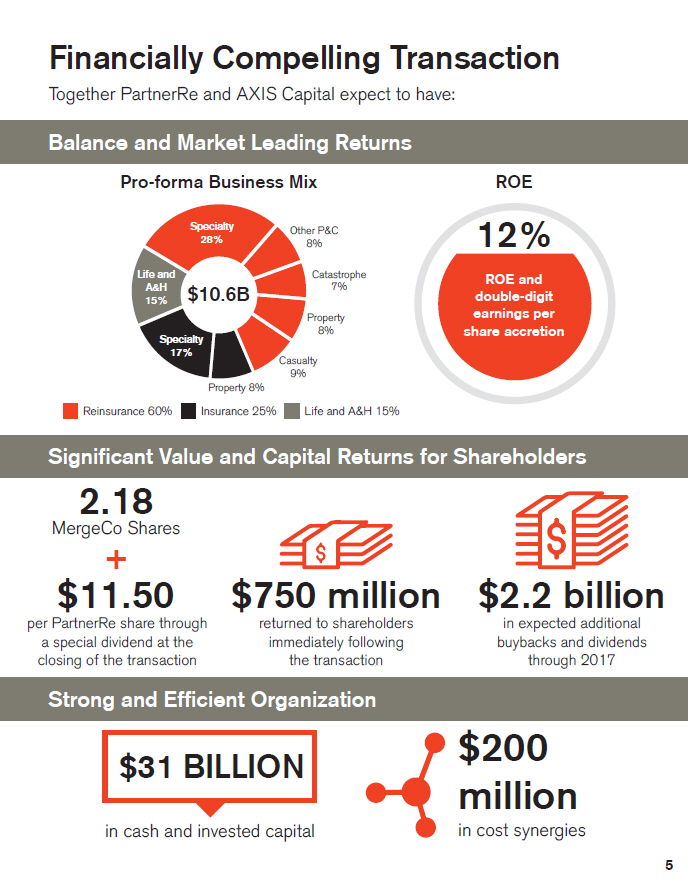

Financially Compelling Transaction Together PartnerRe and AXIS Capital expect to have: Balance and Market Leading Returns [GRAPHIC OMITTED] 5 |  |

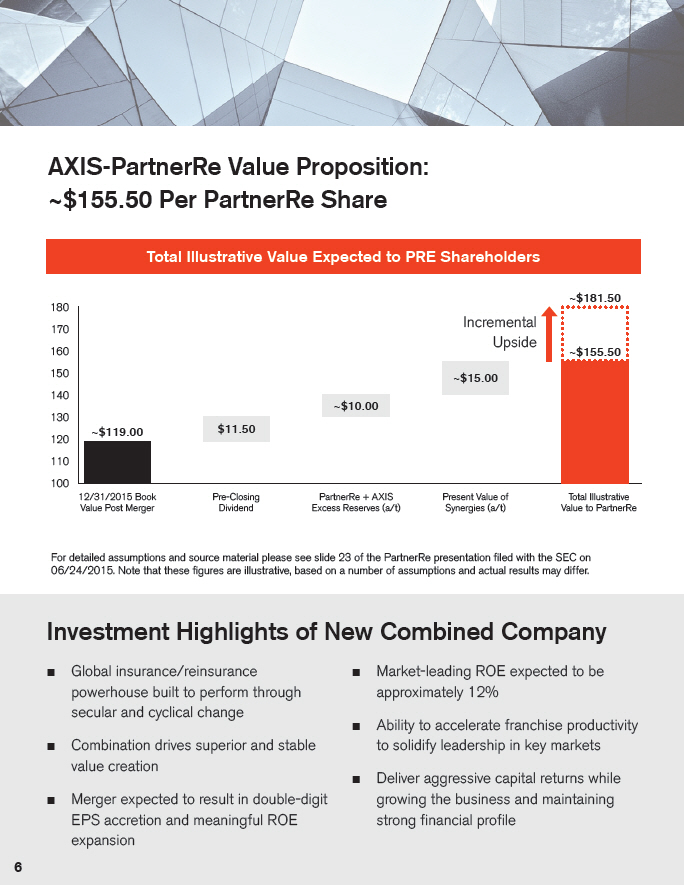

[GRAPHIC OMITTED] AXIS-PartnerRe Value Proposition: -$155.50 Per PartnerRe Share Total Illustrative Value Expected to PRE Shareholders -$181.50 ------------------- 180 170 Incremental Upside 160 -$155.50 ------------------- 150 -$15.00 140 -$10.00 130 120 -$119.00 $11.50 110 ----------------- ----------- --------------------- ---------------- ------------------- 100 12/31/2015 Book Pre-Closing PartnerRe + AXIS Present Value of Total Illustrative Value Post Merger Dividend Excess Reserves (a/t) Synergies (a/t) Value to PartnerRe For detailed assumptions and source material please see slide 23 of the PartnerRe presentation filed with the SEC on 06/24/2015. Note that these figures are illustrative, based on a number of assumptions and actual results may differ. Investment Highlights of New Combined Company [][] Global insurance/reinsurance [][] Market-leading ROE expected to be powerhouse built to perform through approximately 12% secular and cyclical change [][] Ability to accelerate franchise productivity [][] Combination drives superior and stable to solidify leadership in key markets value creation [][] Deliver aggressive capital returns while [][] Merger expected to result in double-digit growing the business and maintaining EPS accretion and meaningful ROE strong financial profile expansion 6 |  |

[GRAPHIC OMITTED] EXOR S.p.A. Has Made an Inferior Offer to Acquire PartnerRe On May 12, 2015, EXOR S.p.A. made an unsolicited and opportunistic offer to acquire all of the outstanding common shares of PartnerRe for $137.50 per share in cash. PartnerRe's Board of Directors believes that this INFERIOR offer is NOT in the best interest of PartnerRe's shareholders, and urges shareholders to IGNORE EXOR'S RHETORIC. Do not believe EXOR's MISLEADING STATEMENTS, and do not allow EXOR to disrupt the merger of equals with AXIS Capital and deprive you of this unique value creating opportunity. XX EXOR's inferior offer significantly undervalues PartnerRe's standalone franchise XX Precedent transactions imply a valuation WELL IN EXCESS of $137.50/share offered by EXOR XX EXOR's consideration removes the significant value upside available to PartnerRe shareholders in the AXIS Capital merger XX EXOR's proposed deal jeopardizes the security of PartnerRe's preferred shares and NULLIFIES their voting power XX Proposed terms and conditions expose PartnerRe shareholders to SIGNIFICANT EXECUTION RISKS in terms of certainty of closing [GRAPHIC OMITTED] |  |

[GRAPHIC OMITTED]

YOUR VOTE IS IMPORTANT

PartnerRe's Board of Directors Supports the Merger

Please Vote FOR the Merger Using the

Enclosed WHITE Proxy Card Today

REMEMBER: Regardless of the number of shares you own, we

urge you to vote today. You may vote by phone, by internet

or by signing, dating and returning the enclosed WHITE

proxy card in the postage-paid envelope provided.

IMPORTANT

We urge you to simply discard any

Gold proxy card sent to you by EXOR.

If you have any questions, or need assistance in voting

your shares, please contact: INNISFREE MandA INCORPORATED

(877) 825-8971 (Toll-free from the U.S. and Canada) +1

(412) 232-3651 (From other locations)

|  |