AXIS Capital Holdings Limited (AXS) 425Business combination disclosure

Filed: 24 Jun 15, 12:00am

Filed by PartnerRe Ltd.

pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: AXIS Capital Holdings Limited

Commission File No.: 001-31721

PartnerRe & AXIS: A Compelling Merger of Equals June 24, 2015

1 PartnerRe, AXIS, their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of PartnerRe is set forth in its Annual Report on Form 10 - K for the year ended December 31, 2014, which was filed with the SEC on February 26, 2015, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on April 1, 2014, its Quarterly Report on Form 10 - Q for the quarter ended March 31, 2015, which was filed with the SEC on May 4, 2015 and its Current Reports on Form 8 - K, which were filed with the SEC on January 29, 2015, May 16, 2014 and March 27, 2014. Information about the directors and executive officers of AXIS is set forth in its Annual Report on Form 10 - K for the year ended December 31, 2014, which was filed with the SEC on February 23, 2015, its proxy statement for its 2014 annual meeting of stockholders, which was filed with the SEC on March 28, 2014, its Quarterly Report on Form 10 - Q for the quarter ended March 31, 2015, which was filed with the SEC on May 4, 2015 and its Current Report on Form 8 - K, which was filed with the SEC on March 11, 2015, January 29, 2015, August 7, 2014, June 26, 2014, March 27, 2014 and February 26, 2014. These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. DISCLAIMER Participants in Solicitation

2 The merger of equals between PartnerRe and AXIS has strong strategic merits The merger of equals with AXIS creates compelling value and continuity of interest for PartnerRe shareholders, with significant valuation upside The merger of equals with AXIS is a result of a rigorous and extensive process by the Board to explore all strategic alternatives for PartnerRe The PartnerRe Board has acted in the best interests of shareholders and made a good faith effort to negotiate with EXOR AXIS transaction is superior; EXOR Offer is inadequate as a change - of - control cash offer EXOR’s Offer is illusory; EXOR’s proposed terms and conditions expose PartnerRe shareholders to significant risks Merger with AXIS provides superior protection for preferred shareholders, vs. significant risks introduced by EXOR Offer Executive Summary 1 2 3 4 5 7 6

3 Merger with AXIS: The Best Alternative in Challenging Times ▪ The reinsurance industry is undergoing changes that present great challenges but also great opportunities for companies that will successfully position themselves for that environment ─ For a pure - play reinsurer, this is not a time to realize value but rather a time to find new ways to create value ▪ PartnerRe’s Board has taken proactive steps to best position the company in this environment, including thoroughly evaluating and engaging with two potential counterparties prior to AXIS ▪ The merger of equals (“MOE”) with AXIS represents the best possible response to the challenges and opportunities of the time ─ Creates a world - leading reinsurance and insurance company with a clear common vision and culture ─ Value creation through combined franchise strengths, significant capital efficiencies, highly achievable operational synergies and greater growth potential ▪ The low, uncertain and opportunistic offer from EXOR clearly demonstrates that there are no opportunities for a cash sale that would allow the PartnerRe shareholders to fully realize the value of their investment ─ No likely full - price strategic buyer at this time (from the insurance / reinsurance industry) for a pure - play reinsurance company of the size and quality of PartnerRe ─ A “NO” to the merger would deprive PartnerRe shareholders from the best opportunity available to them at this time ▪ In spite of the unnecessary rhetoric and personal attacks used by EXOR, the PartnerRe Board has evaluated and will continue to evaluate EXOR’s offers on their merits and would have no objection to a deal with EXOR should the offer evolve into a better value and risk proposition than the MOE

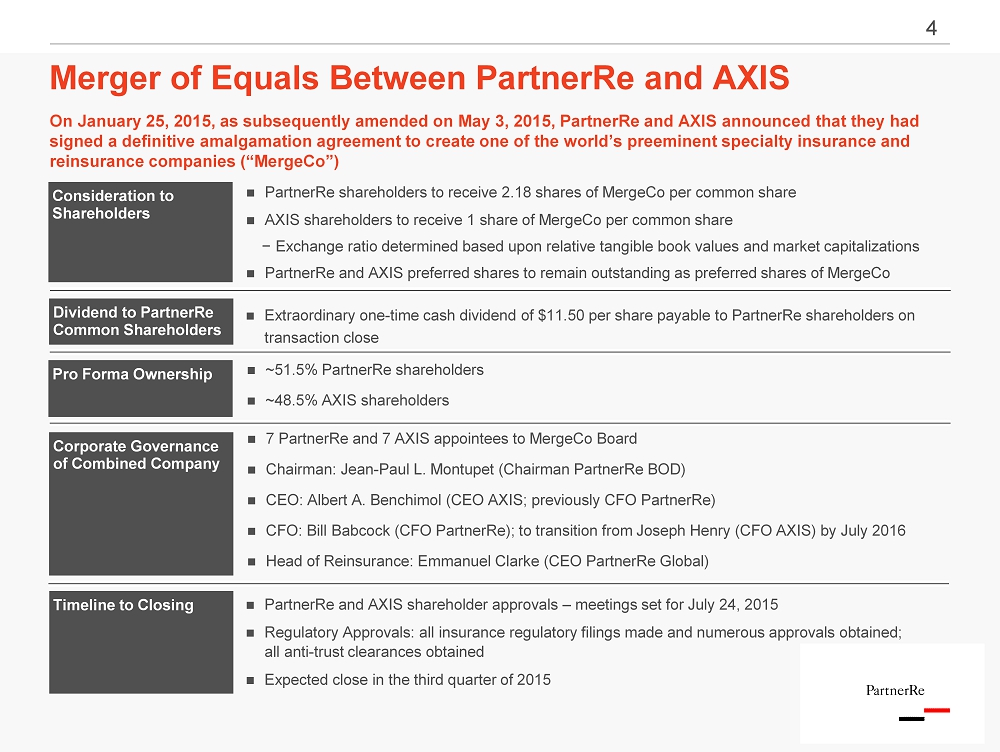

4 On January 25, 2015, as subsequently amended on May 3, 2015, PartnerRe and AXIS announced that they had signed a definitive amalgamation agreement to create one of the world’s preeminent specialty insurance and reinsurance companies (“ MergeCo ”) Merger of Equals Between PartnerRe and AXIS Consideration to Shareholders Dividend to PartnerRe Common Shareholders Pro Forma Ownership Corporate Governance of Combined Company PartnerRe shareholders to receive 2.18 shares of MergeCo per common share AXIS shareholders to receive 1 share of MergeCo per common share − Exchange ratio determined based upon relative tangible book values and market capitalizations PartnerRe and AXIS preferred shares to remain outstanding as preferred shares of MergeCo Extraordinary one - time cash dividend of $11.50 per share payable to PartnerRe shareholders on transaction close ~51.5% PartnerRe shareholders ~48.5% AXIS shareholders 7 PartnerRe and 7 AXIS appointees to MergeCo Board Chairman: Jean - Paul L. Montupet (Chairman PartnerRe BOD) CEO: Albert A. Benchimol (CEO AXIS; previously CFO PartnerRe) CFO: Bill Babcock (CFO PartnerRe); to transition from Joseph Henry (CFO AXIS) by July 2016 Head of Reinsurance: Emmanuel Clarke (CEO PartnerRe Global) Timeline to Closing PartnerRe and AXIS shareholder approvals – meetings set for July 24, 2015 Regulatory Approvals: all insurance regulatory filings made and numerous approvals obtained; all anti - trust clearances obtained Expected close in the third quarter of 2015

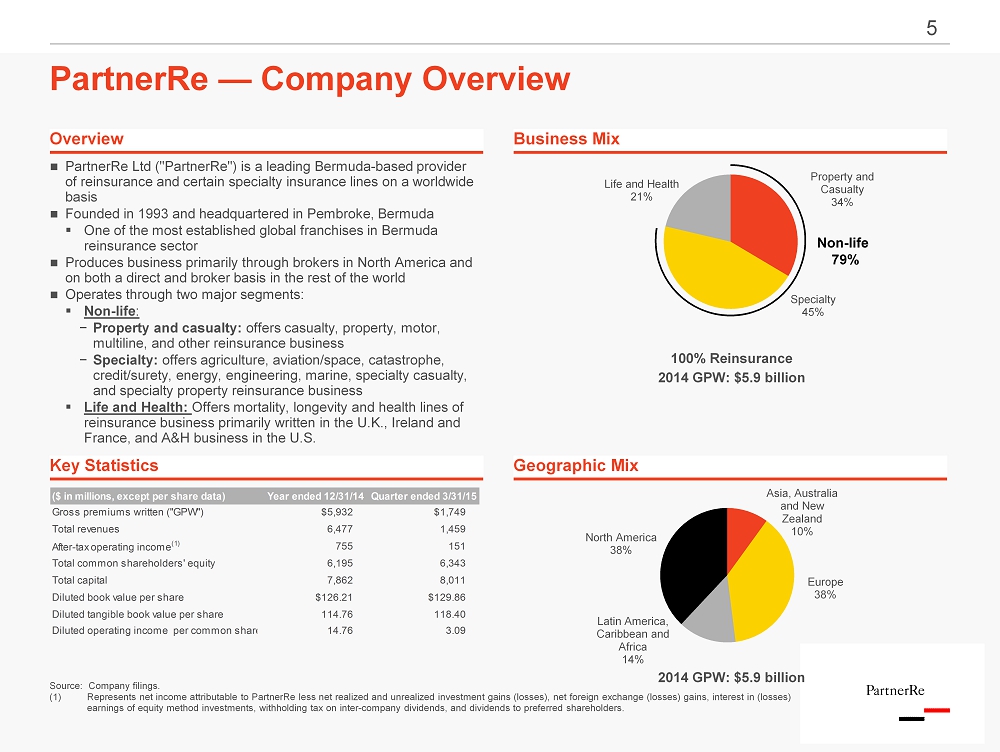

5 Property and Casualty 34% Specialty 45% Life and Health 21% PartnerRe — C ompany Overview 2014 GPW: $5.9 billion PartnerRe Ltd ("PartnerRe") is a leading Bermuda - based provider of reinsurance and certain specialty insurance lines on a worldwide basis Founded in 1993 and headquartered in Pembroke, Bermuda ▪ One of the most established global franchises in Bermuda reinsurance sector Produces business primarily through brokers in North America and on both a direct and broker basis in the rest of the world Operates through two major segments: ▪ Non - life : − Property and casualty: offers casualty, property, motor, multiline, and other reinsurance business − Specialty: offers agriculture, aviation/space, catastrophe, credit/surety, energy, engineering, marine, specialty casualty, and specialty property reinsurance business ▪ Life and Health: Offers mortality, longevity and health lines of reinsurance business primarily written in the U.K., Ireland and France, and A&H business in the U.S. 2014 GPW: $5.9 billion Source: Company filings. (1) Represents net income attributable to PartnerRe less net realized and unrealized investment gains (losses), net foreign exchange (losses) gains, i nterest in (losses) earnings of equity method investments, withholding tax on inter - company dividends, and dividends to preferred shareholders. 100% Reinsurance Key Statistics Business Mix Geographic Mix Overview Non - life Asia, Australia and New Zealand 10% Europe 38% Latin America, Caribbean and Africa 14% North America 38% 79% ($ in millions, except per share data) Year ended 12/31/14 Quarter ended 3/31/15 Gross premiums written ("GPW") $5,932 $1,749 Total revenues 6,477 1,459 After-tax operating income (1) 755 151 Total common shareholders' equity 6,195 6,343 Total capital 7,862 8,011 Diluted book value per share $126.21 $129.86 Diluted tangible book value per share 114.76 118.40 Diluted operating income per common share 14.76 3.09

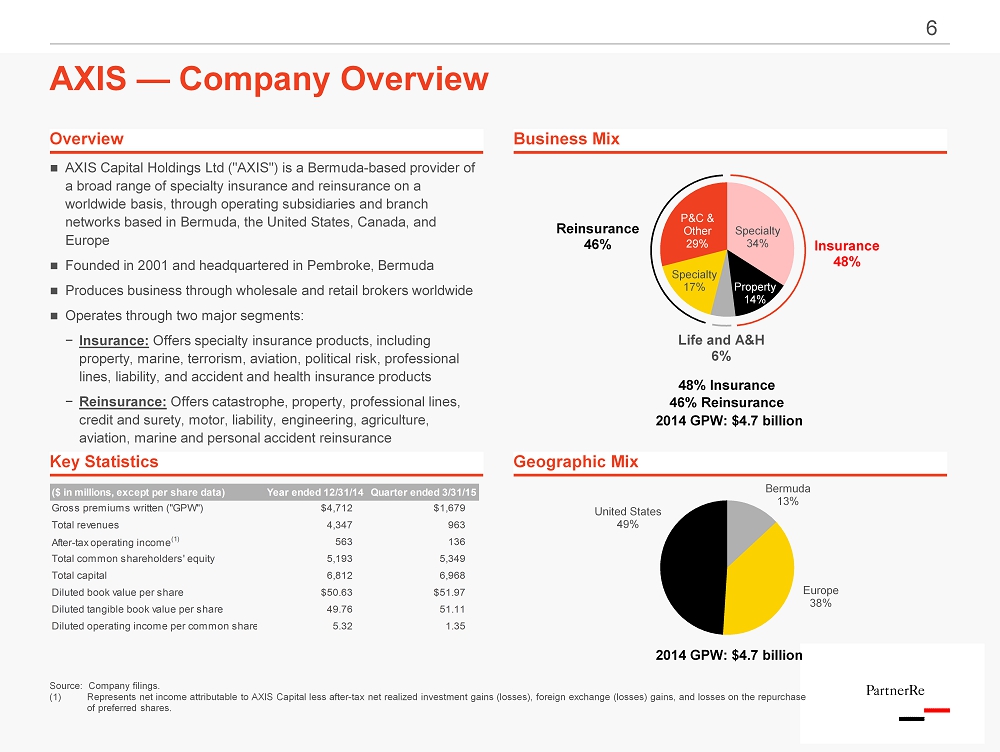

6 Specialty 34% Property 14% Specialty 17% P&C & Other 29% AXIS — C ompany Overview 2014 GPW: $4.7 billion AXIS Capital Holdings Ltd ("AXIS") is a Bermuda - based provider of a broad range of specialty insurance and reinsurance on a worldwide basis, through operating subsidiaries and branch networks based in Bermuda, the United States, Canada, and Europe Founded in 2001 and headquartered in Pembroke, Bermuda Produces business through wholesale and retail brokers worldwide Operates through two major segments: − Insurance: Offers specialty insurance products, including property, marine, terrorism, aviation, political risk, professional lines, liability, and accident and health insurance products − Reinsurance: Offers catastrophe, property, professional lines, credit and surety, motor, liability, engineering, agriculture, aviation, marine and personal accident reinsurance Source: Company filings. (1) Represents net income attributable to AXIS Capital less after - tax net realized investment gains (losses), foreign exchange ( losses) gains, and losses on the repurchase of preferred shares. 48% Insurance 46% Reinsurance Key Statistics Business Mix Geographic Mix Overview Bermuda 13% Europe 38% United States 49% Life and A&H 6 % Insurance 48% Reinsurance 46% 2014 GPW: $4.7 billion ($ in millions, except per share data) Year ended 12/31/14 Quarter ended 3/31/15 Gross premiums written ("GPW") $4,712 $1,679 Total revenues 4,347 963 After-tax operating income (1) 563 136 Total common shareholders' equity 5,193 5,349 Total capital 6,812 6,968 Diluted book value per share $50.63 $51.97 Diluted tangible book value per share 49.76 51.11 Diluted operating income per common share 5.32 1.35

1. Strong strategic m erits of the merger of equals

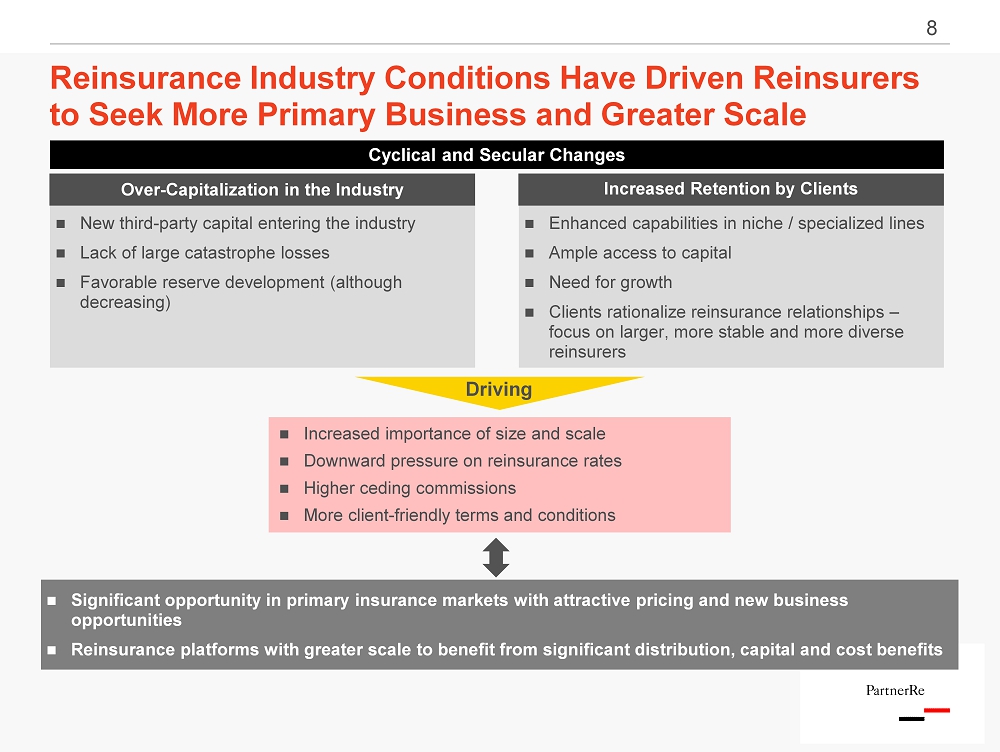

8 Increased importance of size and scale Downward pressure on reinsurance rates Higher ceding commissions More client - friendly terms and conditions Enhanced capabilities in niche / specialized lines Ample access to capital Need for growth Clients rationalize reinsurance relationships – focus on larger, more stable and more diverse reinsurers New third - party capital entering the industry Lack of large catastrophe losses Favorable reserve development (although decreasing ) Reinsurance Industry Conditions Have Driven Reinsurers to Seek More Primary Business and Greater Scale Over - Capitalization in the Industry Increased Retention by Clients Driving Significant opportunity in primary insurance markets with attractive pricing and new business opportunities Reinsurance platforms with greater scale to benefit from significant distribution, capital and cost benefits Cyclical and Secular Changes

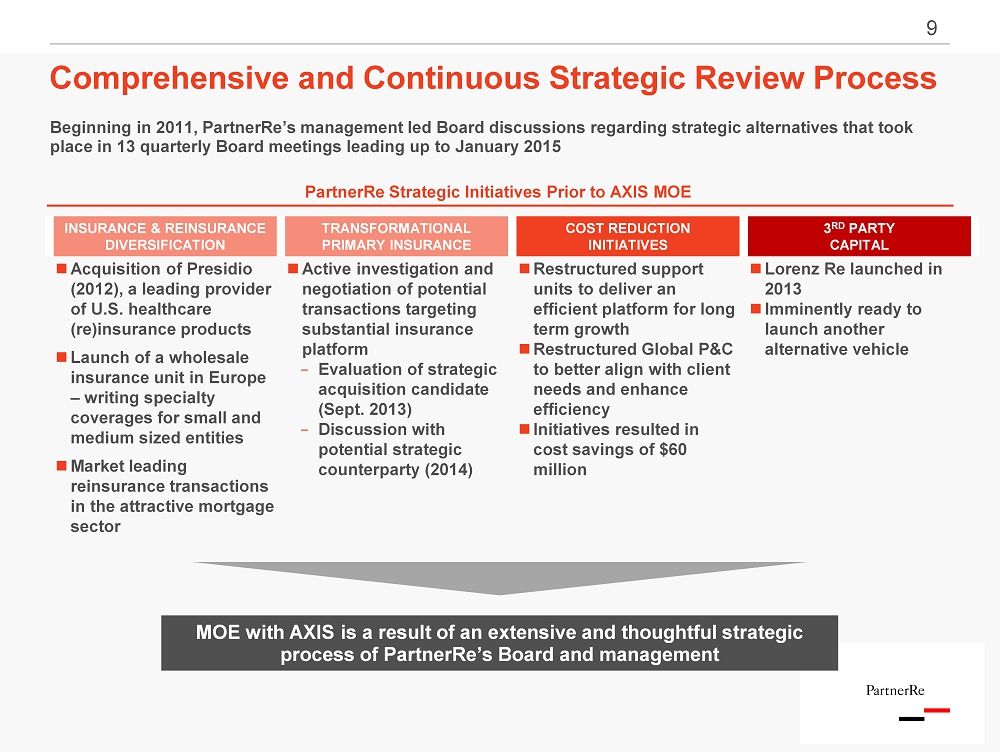

9 Comprehensive and Continuous Strategic Review Process INSURANCE & REINSURANCE DIVERSIFICATION TRANSFORMATIONAL PRIMARY INSURANCE COST REDUCTION INITIATIVES 3 RD PARTY CAPITAL Acquisition of Presidio (2012), a leading provider of U.S. healthcare (re)insurance products Launch of a wholesale insurance unit in Europe – writing specialty coverages for small and medium sized entities Market leading reinsurance transactions in the attractive mortgage sector Active investigation and negotiation of potential transactions targeting substantial insurance platform - Evaluation of strategic acquisition candidate (Sept. 2013) - Discussion with potential strategic counterparty (2014) Restructured support units to deliver an efficient platform for long term growth Restructured Global P&C to better align with client needs and enhance efficiency Initiatives resulted in cost savings of $60 million Lorenz Re launched in 2013 Imminently ready to launch another alternative vehicle Beginning in 2011, PartnerRe’s management led Board discussions regarding strategic alternatives that took place in 13 quarterly B oard meetings leading up to January 2015 MOE with AXIS is a result of an extensive and thoughtful strategic process of PartnerRe’s B oard and management PartnerRe Strategic Initiatives Prior to AXIS MOE

10 (Re)insurance Companies are Actively Pursuing M&A to Reposition Themselves in the Current Environment “ An acquisition of Western World would further diversify VR’s business mix, which we would view favorably as property reinsurance prices decline sharply . ” “ The acquisition expands XL’s presence in specialty lines, enhances scale and should result in meaningful expense savings . The acquisition of Catlin should result in a double - digit ROE at XL by 2017 . ” Primary insurance offers higher growth prospects Reinsurers are seeking increased scale / Source: Wall Street research. “ We expect growth in insurance to outpace growth in reinsurance (at least organically) for most companies that have both operations . From a profitability perspective, the reinsurance c . ratio deteriorated for fully 10 out of 13 companies . Generally we expect continuing deterioration in the underlying margins in reinsurance, while several companies still have the capacity to show some improvement in primary . ” 5/14/15 6/23/14 6/01/15 / �� We expect the wave of reinsurance consolidation to continue as reinsurers seek increased scale in the face of challenging market conditions . Although reinsurance prices are falling, the potential for M&A could support favorable valuations . Companies that could pursue M&A are ones that could seek further scale, have sizable reinsurance operations or would like to diversify the business mix . ” 5/12/15 / /

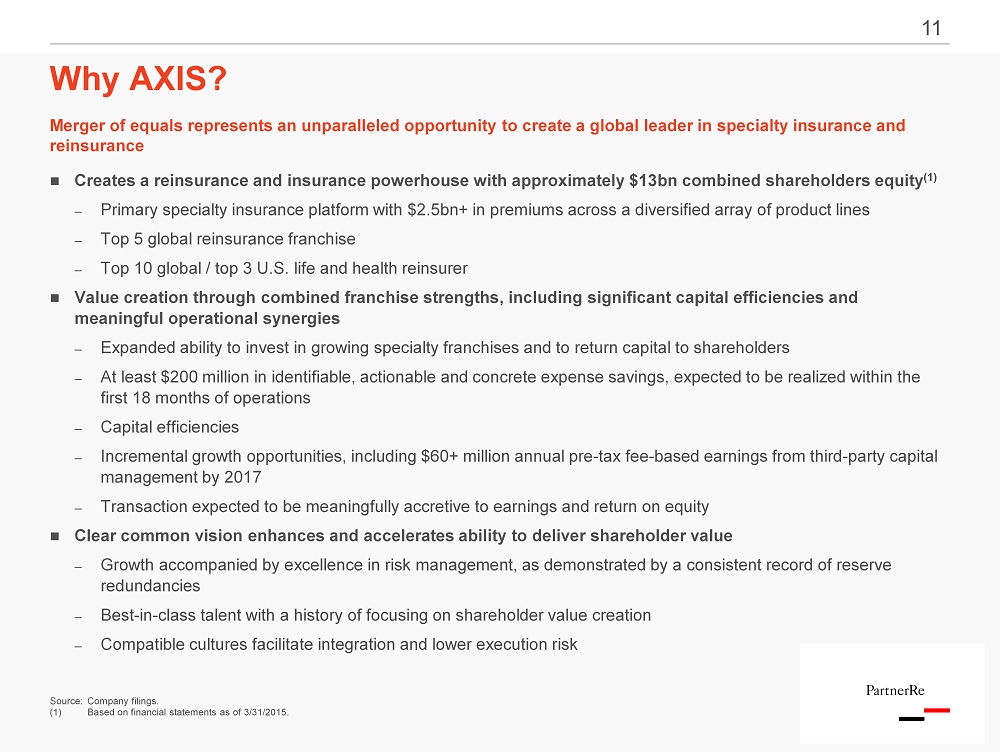

11 Merger of equals represents an unparalleled opportunity to create a global leader in specialty insurance and reinsurance Creates a reinsurance and insurance powerhouse with approximately $13bn combined shareholders equity (1) ─ Primary specialty insurance platform with $2.5bn+ in premiums across a diversified array of product lines ─ Top 5 global reinsurance franchise ─ Top 10 global / top 3 U.S. life and health reinsurer Value creation through combined franchise strengths, including significant capital efficiencies and meaningful operational synergies ─ Expanded ability to invest in growing specialty franchises and to return capital to shareholders ─ At least $200 million in identifiable, actionable and concrete expense savings, expected to be realized within the first 18 months of operations ─ Capital efficiencies ─ Incremental growth opportunities, including $60+ million annual pre - tax fee - based earnings from third - party capital management by 2017 ─ Transaction expected to be meaningfully accretive to earnings and return on equity Clear common vision enhances and accelerates ability to deliver shareholder value ─ Growth accompanied by excellence in risk management, as demonstrated by a consistent record of reserve redundancies ─ Best - in - class talent with a history of focusing on shareholder value creation ─ Compatible cultures facilitate integration and lower execution risk Why AXIS? Source : Company filings. (1 ) Based on financial statements as of 3/31/2015.

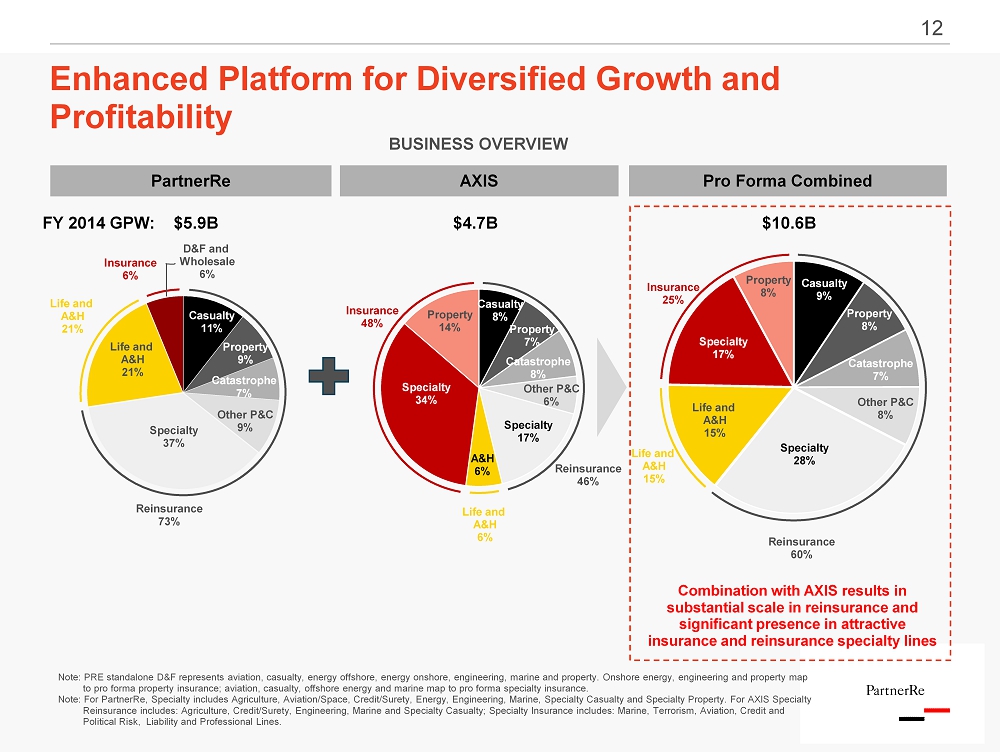

12 FY 2014 GPW: $5.9B PartnerRe Pro Forma Combined $4.7B $10.6B AXIS BUSINESS OVERVIEW Note: PRE standalone D&F represents aviation, casualty, energy offshore, energy onshore, engineering, marine and property. On sho re energy, engineering and property map to pro forma property insurance; aviation, casualty, offshore energy and marine map to pro forma specialty insurance. Note: For PartnerRe, Specialty includes Agriculture, Aviation/Space, Credit/Surety, Energy, Engineering, Marine, Specialty Casualty and Specialty Pro perty. For AXIS Specialty Reinsurance includes: Agriculture, Credit/Surety, Engineering, Marine and Specialty Casualty; Specialty Insurance includes: Marine, Terro ris m, Aviation, Credit and Political Risk, Liability and Professional Lines. Property 8 % Other P&C 8% Specialty 17% Property 8% Specialty 28% Casualty 11% Property 9 % Other P&C 6% Specialty 34% Reinsurance 73% Life and A&H 15% Insurance 6% Specialty 37% Property 14% Reinsurance 46% Specialty 17% Insurance 48% Life and A&H 6% Reinsurance 60% Insurance 25% Life and A&H 21% Life and A&H 21% Life and A&H 15% Catastrophe 7% Other P&C 9% Casualty 8 % Property 7% Catastrophe 8 % A&H 6% Casualty 9% Catastrophe 7 % D&F and Wholesale 6% Enhanced Platform for Diversified Growth and Profitability Combination with AXIS results in substantial scale in reinsurance and significant presence in attractive insurance and reinsurance specialty lines

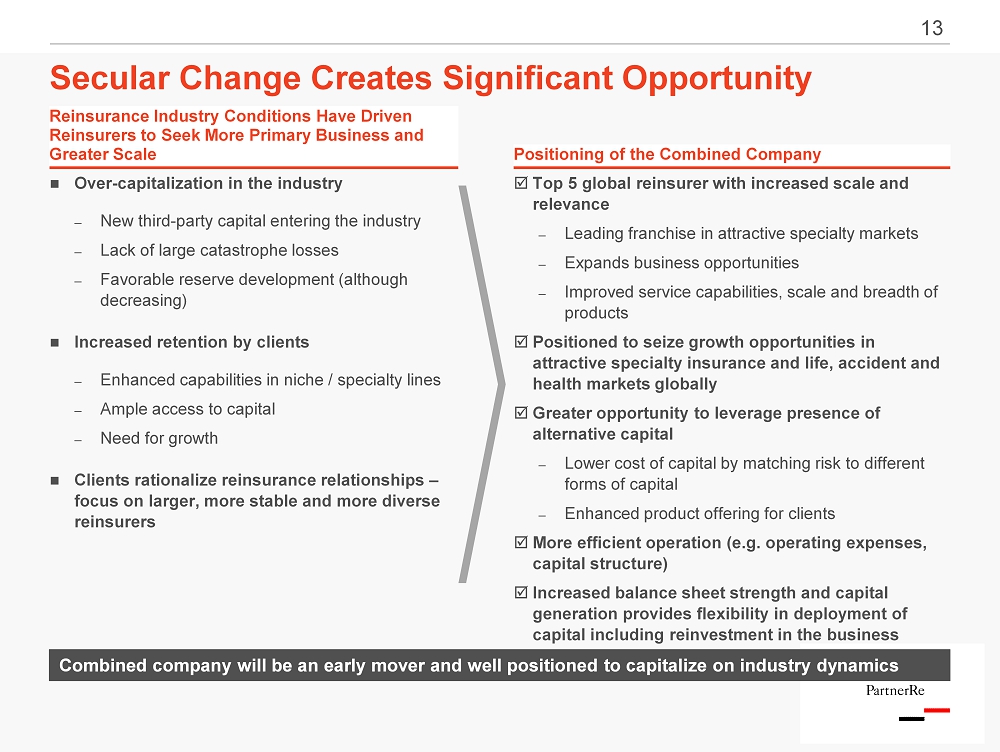

13 Over - capitalization in the industry ─ New third - party capital entering the industry ─ Lack of large catastrophe losses ─ Favorable reserve development (although decreasing) Increased retention by clients ─ Enhanced capabilities in niche / specialty lines ─ Ample access to capital ─ Need for growth Clients rationalize reinsurance relationships – focus on larger, more stable and more diverse reinsurers Reinsurance Industry Conditions Have Driven Reinsurers to Seek More Primary Business and Greater Scale Top 5 global reinsurer with increased scale and relevance ─ Leading franchise in attractive specialty markets ─ Expands business opportunities ─ Improved service capabilities, scale and breadth of products Positioned to seize growth opportunities in attractive specialty insurance and life, accident and health markets globally Greater opportunity to leverage presence of alternative capital ─ Lower cost of capital by matching risk to different forms of capital ─ Enhanced product offering for clients More efficient operation (e.g. operating expenses, capital structure) Increased balance sheet strength and capital generation provides flexibility in deployment of capital including reinvestment in the business Positioning of the Combined Company Combined company will be an early mover and well positioned to capitalize on industry dynamics Secular Change Creates Significant Opportunity

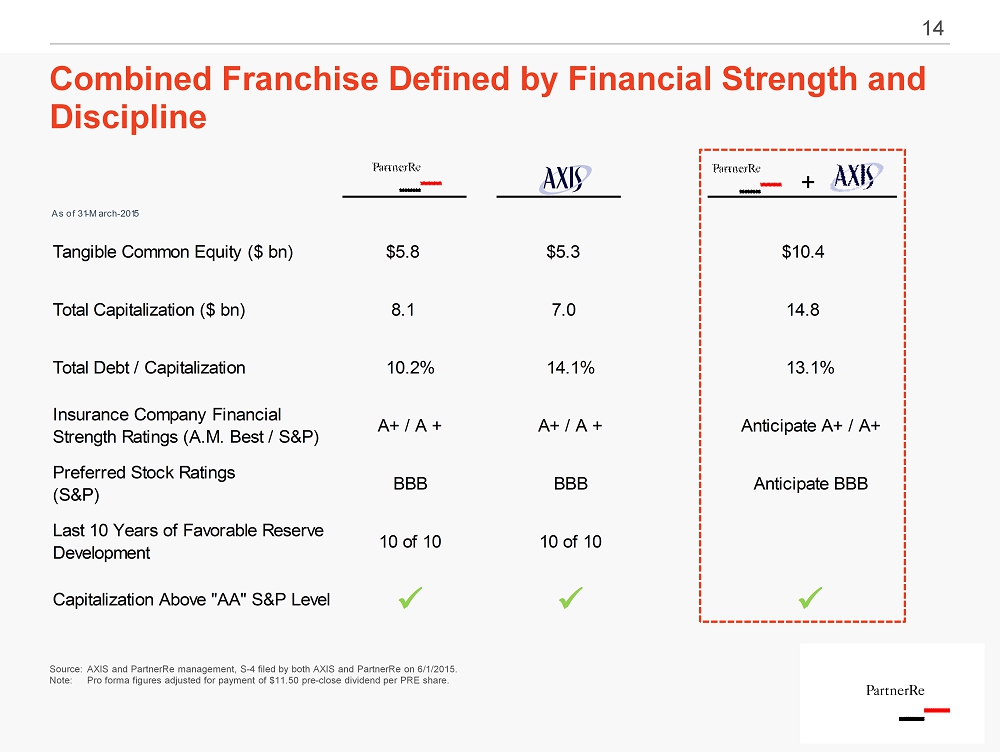

Combined Franchise Defined by Financial Strength and Discipline 14 As of 31-March-2015 Tangible Common Equity ($ bn) $5.8 $5.3 $10.4 Total Capitalization ($ bn) 8.1 7.0 14.8 Total Debt / Capitalization 10.2% 14.1% 13.1% Insurance Company Financial Strength Ratings (A.M. Best / S&P) A+ / A + A+ / A + Anticipate A+ / A+ Preferred Stock Ratings (S&P) BBB BBB Anticipate BBB Last 10 Years of Favorable Reserve Development 10 of 10 10 of 10 Capitalization Above "AA" S&P Level x x x + Source: AXIS and PartnerRe management, S - 4 filed by both AXIS and PartnerRe on 6/1/2015. Note: Pro forma figures adjusted for payment of $11.50 pre - close dividend per PRE share .

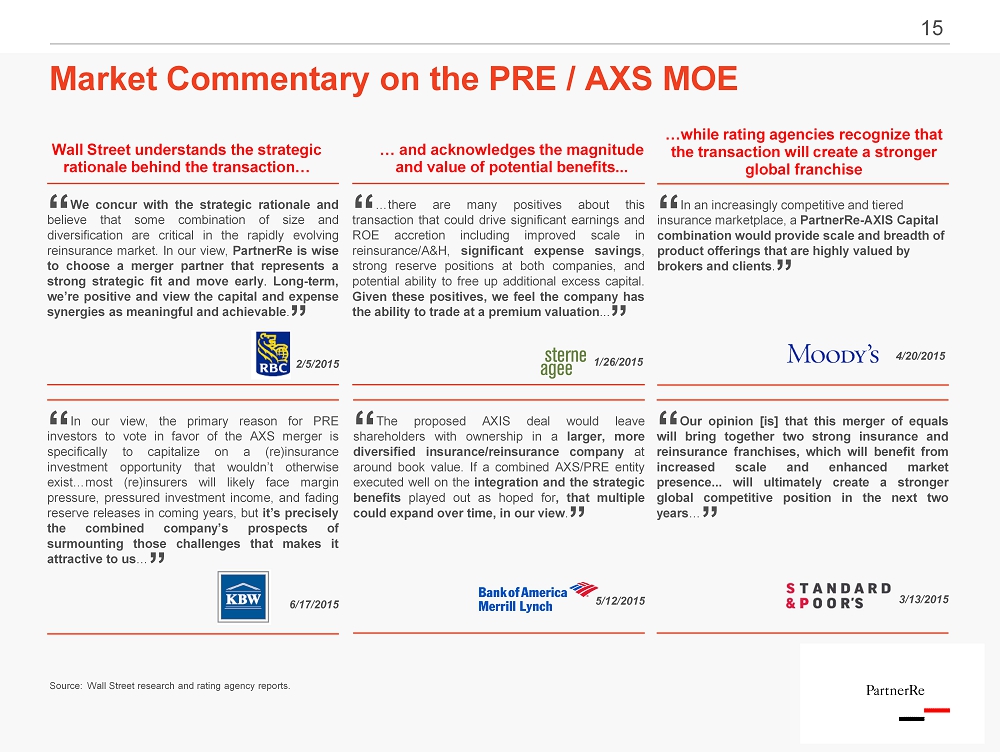

15 Market Commentary on the PRE / AXS MOE Source : Wall Street research and rating agency reports. “ I n our view, the primary reason for PRE investors to vote in favor of the AXS merger is specifically to capitalize on a (re)insurance investment opportunity that wouldn’t otherwise exist … most (re)insurers will likely face margin pressure, pressured investment income, and fading reserve releases in coming years, but it’s precisely the combined company’s prospects of surmounting those challenges that makes it attractive to us … ” 6 /17/2015 “ We concur with the strategic rationale and believe that some combination of size and diversification are critical in the rapidly evolving reinsurance market . In our view, PartnerRe is wise to choose a merger partner that represents a strong strategic fit and move early . Long - term, we’re positive and view the capital and expense synergies as meaningful and achievable . ” 2/5/2015 “ The proposed AXIS deal would leave shareholders with ownership in a larger, more diversified insurance/reinsurance company at around book value . If a combined AXS/PRE entity executed well on the integration and the strategic benefits played out as hoped for , that multiple could expand over time, in our view . ” 5/12/2015 “ … there are many positives about this transaction that could drive significant earnings and ROE accretion including improved scale in reinsurance/A&H, significant expense savings , strong reserve positions at both companies, and potential ability to free up additional excess capital . Given these positives, we feel the company has the ability to trade at a premium valuation ... ” 1/26/2015 “ In an increasingly competitive and tiered insurance marketplace, a PartnerRe - AXIS Capital combination would provide scale and breadth of product offerings that are highly valued by brokers and clients . ” 4/20/2015 “ Our opinion [is] that this merger of equals will bring together two strong insurance and reinsurance franchises, which will benefit from increased scale and enhanced market presence ... will ultimately create a stronger global competitive position in the next two years … ” 3 /13/2015 … and acknowledges the magnitude and value of potential benefits... Wall Street understands the strategic rationale behind the transaction… …while rating agencies recognize that the transaction will c reate a stronger global franchise

2 . Attractive valuation with significant value upside

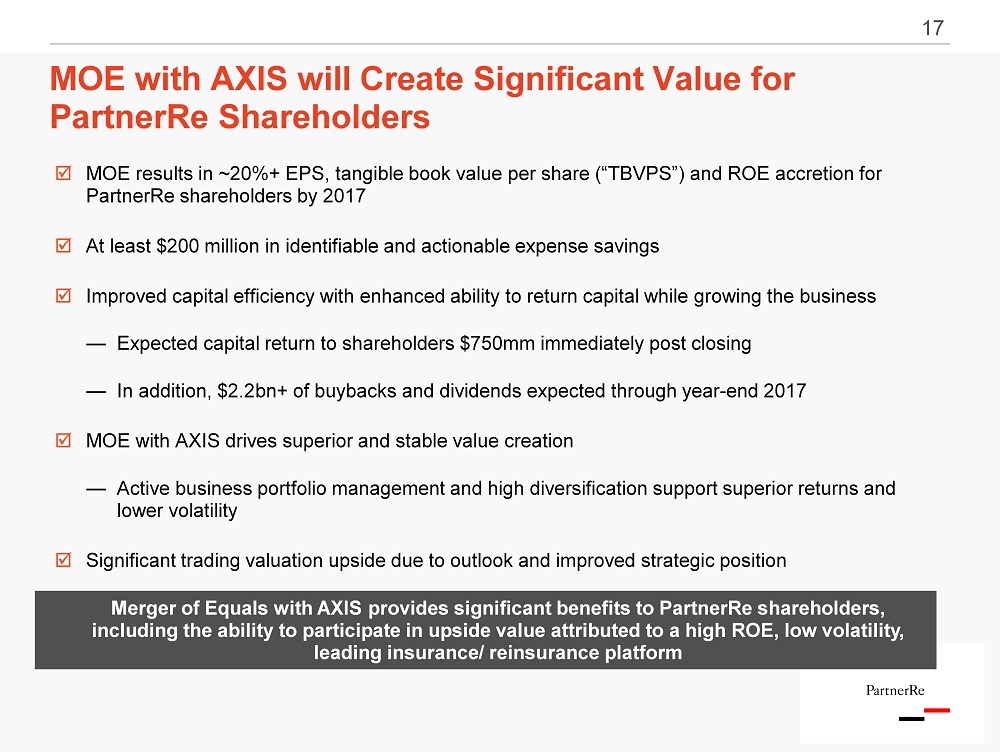

MOE with AXIS will Create Significant Value for PartnerRe Shareholders 17 MOE results in ~20%+ EPS , tangible book value per share (“TBVPS”) and ROE accretion for PartnerRe shareholders by 2017 At least $200 million in identifiable and actionable expense savings Improved capital efficiency with enhanced ability to return capital while growing the business — Expected capital return to shareholders $750mm immediately post closing — In addition, $2.2bn+ of buybacks and dividends expected through year - end 2017 MOE with AXIS drives superior and stable value creation — Active business portfolio management and high diversification support superior returns and lower volatility Significant trading valuation upside due to outlook and improved strategic position Merger of Equals with AXIS provides significant benefits to PartnerRe shareholders, including the ability to participate in upside value attributed to a high ROE, low volatility, leading insurance / reinsurance platform

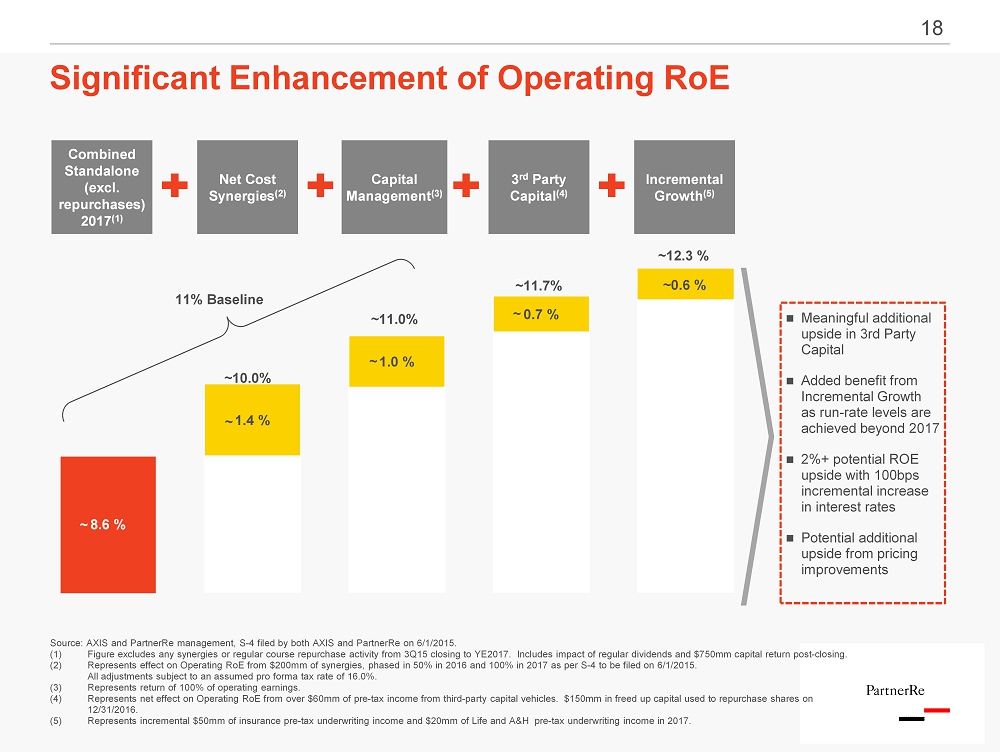

18 Meaningful additional upside in 3rd Party Capital Added benefit from Incremental Growth as run - rate levels are achieved beyond 2017 2%+ potential ROE upside with 100bps incremental increase in interest rates Potential additional upside from pricing improvements Significant Enhancement of Operating RoE 8.6 % 1.4 % 1.0 % 0.7 % ~0.6 % ~12.3 % Combined Standalone (excl. repurchases) 2017 (1) Net Cost Synergies (2) Capital Management (3) 3 rd Party Capital (4 ) Incremental Growth (5) ~ ~ ~ ~ ~11.0% ~10.0% ~11.7% 11% Baseline ~ Source: AXIS and PartnerRe management, S - 4 filed by both AXIS and PartnerRe on 6/1/2015. (1) Figure excludes any synergies or regular course repurchase activity from 3Q15 closing to YE2017. Includes impact of regular dividends and $750mm capital return post - closing. (2) Represents effect on Operating RoE from $200mm of synergies, phased in 50% in 2016 and 100% in 2017 as per S - 4 to be filed on 6/1/2015. All adjustments subject to an assumed pro forma tax rate of 16.0%. (3) Represents return of 100% of operating earnings . (4) Represents net effect on Operating RoE from over $60mm of pre - tax income from third - party capital vehicles. $150mm in freed up capital used to repurchase shares on 12/31/2016. (5) Represents incremental $50mm of insurance pre - tax underwriting income and $20mm of Life and A&H pre - tax underwriting income in 2017.

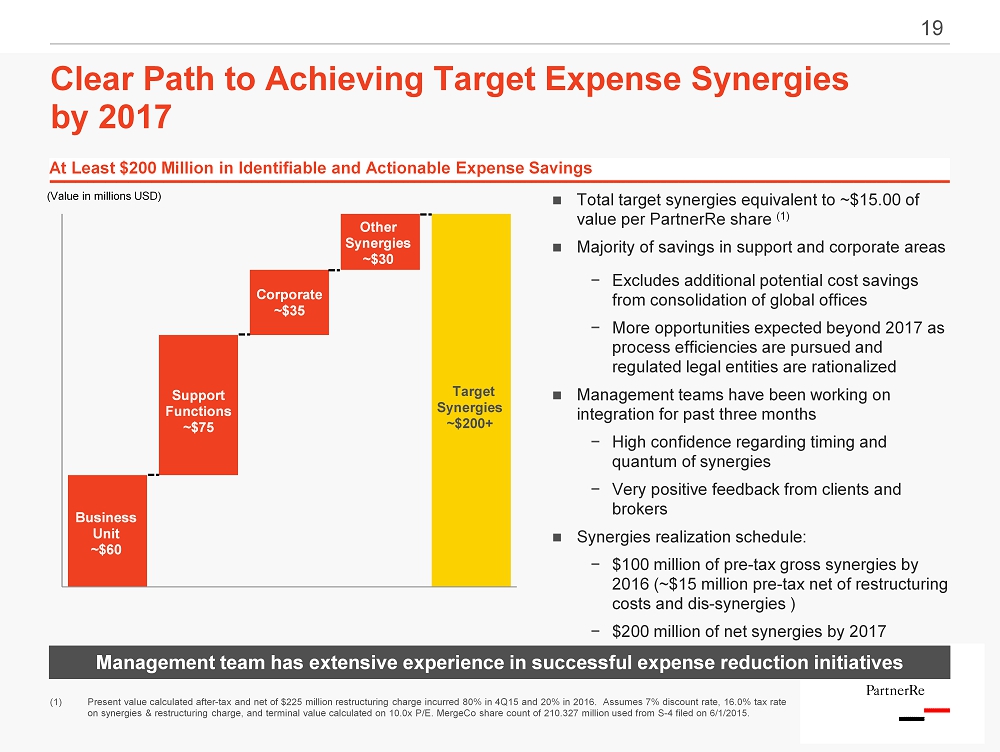

19 Management team has extensive experience in successful expense reduction initiatives Clear Path to Achieving Target Expense Synergies by 2017 At Least $200 Million in Identifiable and Actionable Expense Savings Business Unit ~$ 60 Support Functions ~$ 75 Corporate ~$ 35 Other Synergies ~$ 30 Target Synergies ~$200+ (Value in millions USD) Total target synergies equivalent to ~$15.00 of value per PartnerRe share (1) Majority of savings in support and corporate areas − Excludes additional potential cost savings from consolidation of global offices − More opportunities expected beyond 2017 as process efficiencies are pursued and regulated legal entities are rationalized Management teams have been working on integration for past three months − High confidence regarding timing and quantum of synergies − Very positive feedback from clients and brokers Synergies realization schedule: − $ 100 million of pre - tax gross synergies by 2016 (~$15 million pre - tax net of restructuring costs and dis - synergies ) − $ 200 million of net synergies by 2017 (1) Present value calculated after - tax and net of $225 million restructuring charge incurred 80% in 4Q15 and 20% in 2016. Assumes 7 % discount rate, 16.0% tax rate on synergies & restructuring charge, and terminal value calculated on 10.0x P/E. MergeCo share count of 210.327 million used from S - 4 filed on 6/1/2015.

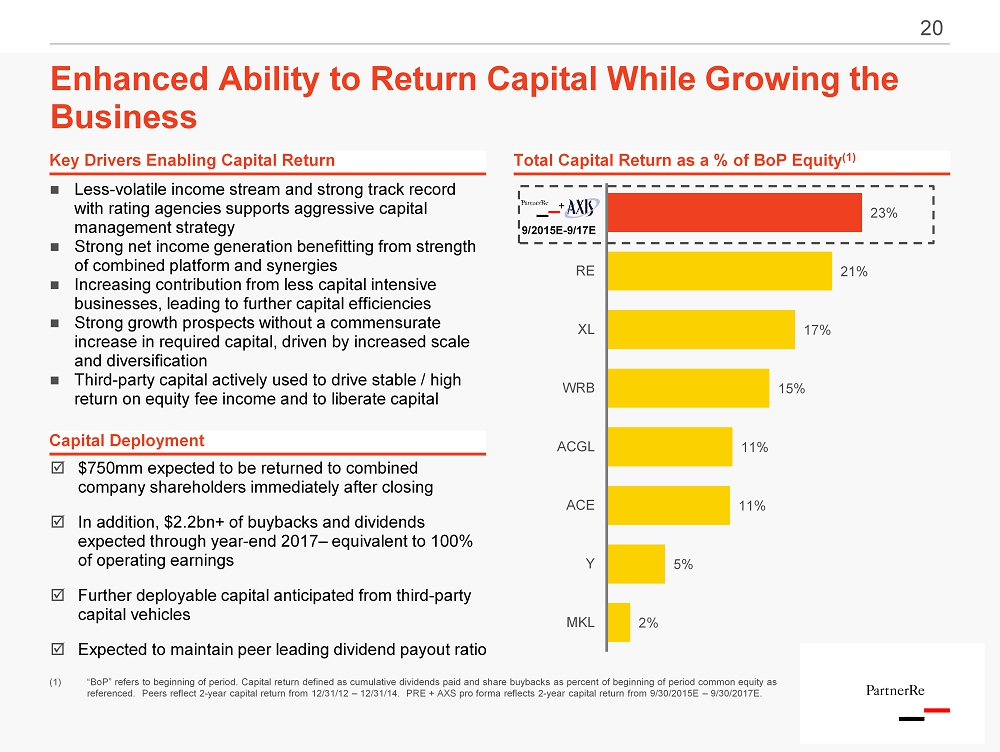

20 23% 21% 17% 15% 11% 11% 5% 2% RE XL WRB ACGL ACE Y MKL Capital Deployment Key Drivers Enabling Capital Return Less - volatile income stream and strong track record with rating agencies supports aggressive capital management strategy Strong net income generation benefitting from strength of combined platform and synergies Increasing contribution from less capital intensive businesses, leading to further capital efficiencies Strong growth prospects without a commensurate increase in required capital, driven by increased scale and diversification Third - party capital actively used to drive stable / high return on equity fee income and to liberate capital Total Capital Return as a % of BoP Equity (1) Enhanced Ability to Return Capital While Growing the Business $ 750mm expected to be returned to combined company shareholders immediately after closing In addition, $2.2bn+ of buybacks and dividends expected through year - end 2017 – equivalent to 100% of operating earnings Further deployable capital anticipated from third - party capital vehicles Expected to maintain peer leading dividend payout ratio (1 ) “ BoP ” refers to beginning of period. Capital return defined as cumulative dividends paid and share buybacks as percent of beginni ng of period common equity as referenced. Peers reflect 2 - year capital return from 12/31/12 – 12/31/14. PRE + AXS pro forma reflects 2 - year capital return f rom 9/30/2015E – 9/30/2017E . 9/2015E - 9/17E +

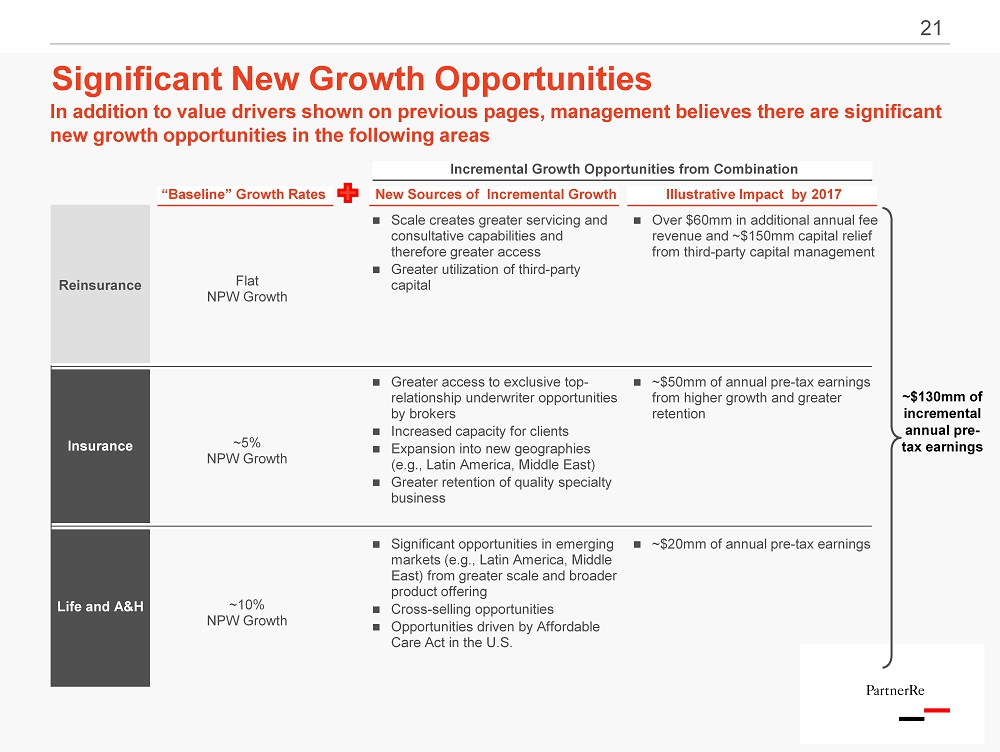

21 In addition to value drivers shown on previous pages, management believes there are significant new growth opportunities in the following areas Reinsurance Insurance Life and A&H Scale creates greater servicing and consultative capabilities and therefore greater access Greater utilization of third - party capital Greater access to exclusive top - relationship underwriter opportunities by brokers Increased capacity for clients Expansion into new geographies (e.g., Latin America, Middle East) Greater retention of quality specialty business Significant opportunities in emerging markets (e.g., Latin America, Middle East) from greater scale and broader product offering Cross - selling opportunities Opportunities driven by Affordable Care Act in the U.S. Significant New Growth Opportunities Flat NPW Growth ~5% NPW Growth ~10% NPW Growth “Baseline” Growth Rates New Sources of Incremental Growth Illustrative Impact by 2017 Over $60mm in additional annual fee revenue and ~$150mm capital relief from third - party capital management ~$50mm of annual pre - tax earnings from higher growth and greater retention ~$20mm of annual pre - tax earnings Incremental Growth Opportunities from Combination ~$ 130mm of incremental annual pre - tax earnings

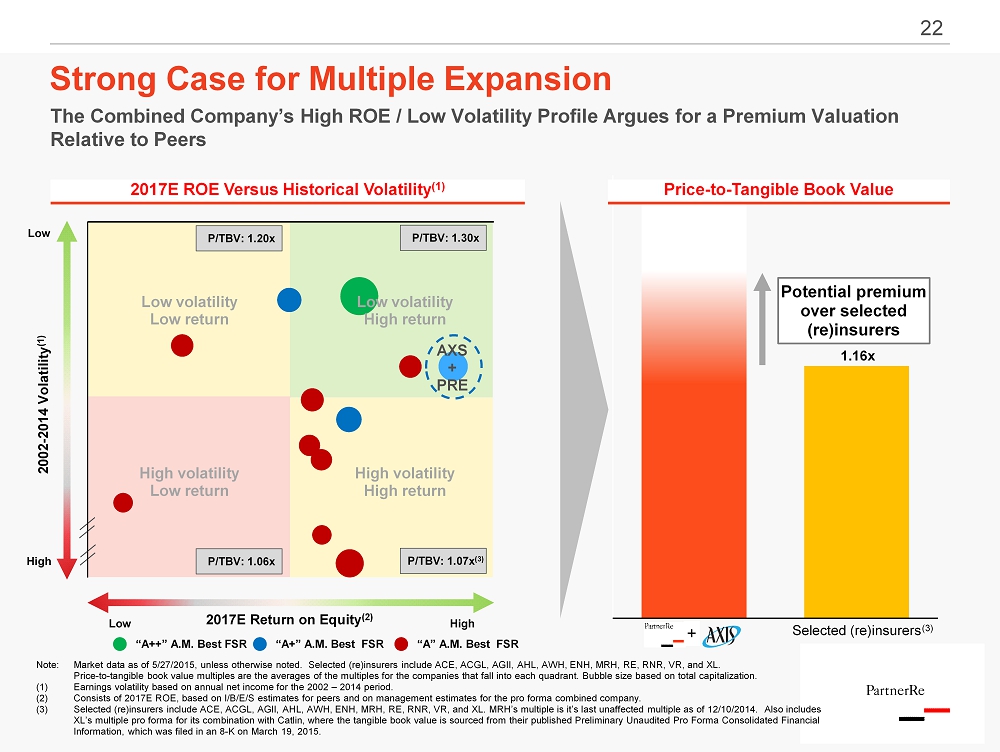

22 1.16x PRE + AXS Selected (re)insurers Price - to - Tangible Book V alue 2017E ROE V ersus Historical Volatility (1) + Note: Market data as of 5/27/2015, unless otherwise noted. Selected (re)insurers include ACE, ACGL , AGII , AHL , AWH , ENH , MRH , RE, RNR , VR, and XL. Price - to - tangible book value multiples are the averages of the multiples for the companies that fall into each quadrant. Bubble size based on total capitalization. (1) Earnings volatility based on annual net income for the 2002 – 2014 period. ( 2 ) Consists of 2017E ROE, b ased on I/B/E/S estimates for peers and on management estimates for the pro forma combined company. ( 3 ) Selected (re)insurers include ACE, ACGL, AGII, AHL, AWH, ENH, MRH, RE, RNR, VR, and XL. MRH’s multiple is it’s last unaffected multiple as of 12/10/2014. Also includes XL’s multiple pro forma for its combination with Catlin, where the tangible book value is sourced from their published Prelim ina ry U naudited Pro Forma C onsolidated Financial Information, which was filed in an 8 - K on March 19, 2015. (3) Potential premium over selected (re)insurers Strong Case for Multiple Expansion 2002 - 2014 Volatility (1) P/TBV: 1.30x P/TBV: 1.06x P/TBV: 1.20x High volatility Low return High volatility High return Low volatility Low return 2017E Return on Equity (2) P/TBV: 1.07x (3) Low volatility High return The Combined Company’s High ROE / Low Volatility Profile Argues for a Premium Valuation Relative to Peers High Low High Low “A++” A.M. Best FSR “A+” A.M. Best FSR “A” A.M. Best FSR AXS + PRE

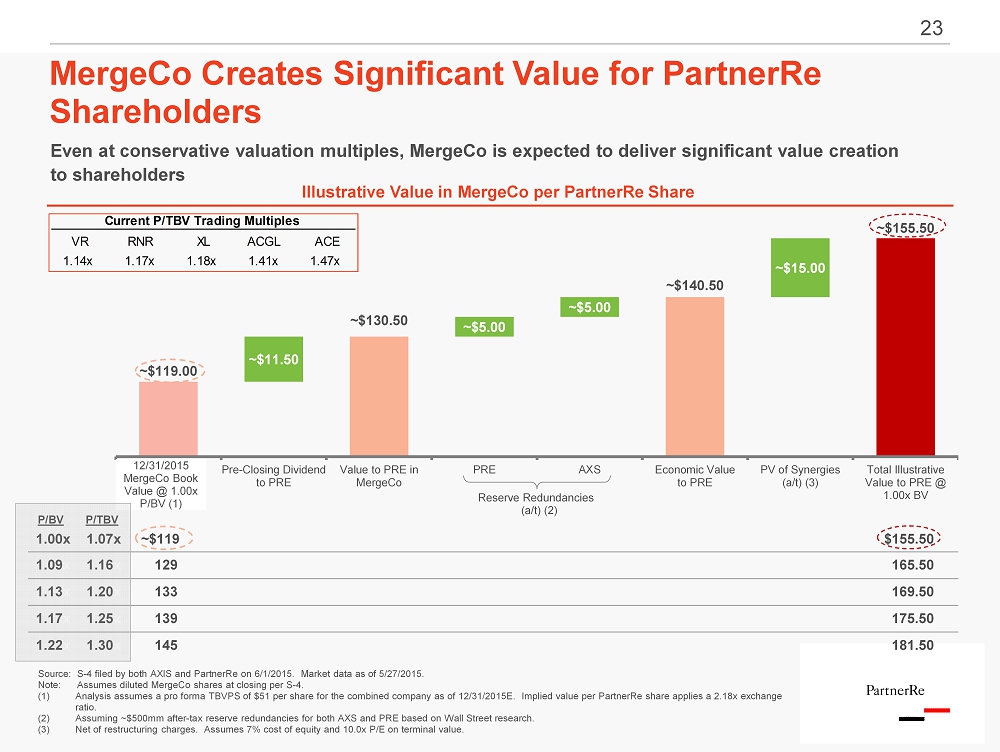

23 23 Current P/TBV Trading Multiples VR RNR XL ACGL ACE 1.14x 1.17x 1.18x 1.41x 1.47x MergeCo Creates Significant Value for PartnerRe Shareholders Source: S - 4 filed by both AXIS and PartnerRe on 6/1/2015. Market data as of 5/27/2015. Note: Assumes diluted MergeCo shares at closing per S - 4. (1) Analysis assumes a pro forma TBVPS of $ 51 per share for the combined company as of 12/31/2015E. Implied value per PartnerRe share applies a 2.18x exchange ratio. (2) Assuming ~$500mm after - tax reserve redundancies for both AXS and PRE based on Wall Street research. (3) Net of restructuring charges. Assumes 7% cost of equity and 10.0x P/E on terminal value. ~$119.00 ~$11.50 ~$130.50 ~$5.00 ~$5.00 ~$140.50 ~$15.00 ~$155.50 Pre-Closing Dividend to PRE Value to PRE in MergeCo PRE AXS Economic Value to PRE PV of Synergies (a/t) (3) Total Illustrative Value to PRE @ 1.00x BV Reserve Redundancies (a/t) (2) 1.00x 1.07x ~$119 $155.50 1.09 x 1.16 x 129 165.50 1.13 x 1.20 x 133 169.50 1.17 x 1.25 x 139 175.50 1.22 x 1.30 x 145 181.50 P/BV P/TBV 12/31/2015 MergeCo Book Value @ 1.00x P/BV (1) Illustrative Value in MergeCo per PartnerRe Share Even at conservative valuation multiples, MergeCo is expected to deliver significant value creation to shareholders

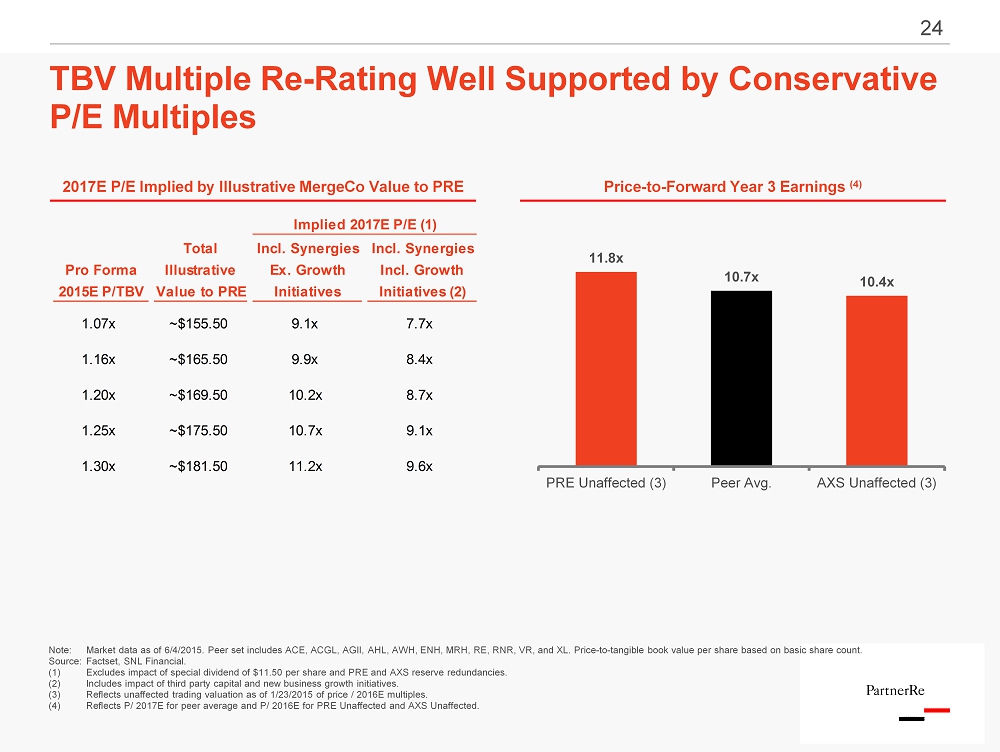

24 Note: Market data as of 6/4/2015. Peer set includes ACE, ACGL, AGII, AHL, AWH, ENH, MRH, RE, RNR, VR, and XL. Price - to - tangible book value per share based on basic share count. Source : Factset , SNL Financial. (1) Excludes impact of special dividend of $11.50 per share and PRE and AXS reserve redundancies. (2) Includes impact of third party capital and new business growth initiatives. (3) Reflects unaffected trading valuation as of 1/23/2015 of price / 2016E multiples. (4) Reflects P/ 2017E for peer average and P/ 2016E for PRE Unaffected and AXS Unaffected. TBV Multiple Re - Rating Well Supported by Conservative P/E Multiples 3.0x 8.0x 13.0x 18.0x 23.0x 28.0x Jun-05 Jun-07 Jun-09 Jun-11 Jun-13 Jun-15 PRE AXS Peers Implied 2017E P/E (1) Total Incl. Synergies Incl. Synergies Pro Forma Illustrative Ex. Growth Incl. Growth 2015E P/TBV Value to PRE Initiatives Initiatives (2) 1.07x ~$155.50 9.1x 7.7x 1.16x ~$165.50 9.9x 8.4x 1.20x ~$169.50 10.2x 8.7x 1.25x ~$175.50 10.7x 9.1x 1.30x ~$181.50 11.2x 9.6x 11.8x 10.7x 10.4x PRE Unaffected (3) Peer Avg. AXS Unaffected (3) 2017E P/E Implied by Illustrative MergeCo Value to PRE Price - to - Forward Year 3 Earnings (4)

3. The deal is a result of a rigorous and extensive process by the Board to explore strategic alternatives

26 In response to trends in the reinsurance industry, PartnerRe’s Board of Directors (“BOD”) and management have conducted a thorough exploration of various strategic options and a range of potential transactions PartnerRe’s BOD and management concluded that diversifying into the primary insurance market would be the next logical step to reposition its business to create superior long - term shareholder value PartnerRe has actively looked at organic and inorganic growth in the primary insurance sector ─ Organic initiatives or small acquisitions do not “move the needle” ─ Acquisitions of attractive primary insurance platforms of significant size would have required premium valuations, likely resulting in meaningful dilution and value destruction for PartnerRe’s shareholders ─ BOD established a transaction committee to evaluate potential strategic transactions. They evaluated a potential acquisition candidate in September 2013 and a potential strategic transaction in spring and early summer 2014 , but ultimately concluded that neither transaction was compelling for shareholders The BOD concluded that depressed valuations meant that it was not in the best interests of shareholders to pursue a sale of the Company After evaluating a full range of alternatives, it became clear that a combination with AXIS was the most compelling opportunity for PartnerRe’s shareholders The merger with AXIS allows PartnerRe to invest in the primary insurance business without paying a control premium and benefit from the ongoing consolidation of the reinsurance industry The BOD also concluded that continuity of interest allows shareholders to benefit from substantial financial and operational synergies and significant immediate and future value creation PartnerRe Board of Directors’ Commitment to Maximizing Shareholder Value

27 Strategic Review and Screening Process Undertaken PartnerRe’s management, BOD and advisors undertook comprehensive analysis of potential M&A counter parties over a four - year period (2011 through 2015) ─ Evaluation of acquisition targets, potential acquirers, as well as merger of equals partners ─ Process continued through time of negotiation of the MOE with AXIS Considerations included: ─ Value to be received by PRE shareholders ─ Participation in future value creation ─ Relative size of PRE and potential partners ─ Ability to pay analysis Screening process included full universe of U.S. and international insurance and reinsurance targets and other potential counterparties Specific work undertaken for the two deals evaluated included: ─ Comprehensive financial and valuation analyses ─ Negotiation / discussions with counterparties ─ Numerous discussions among management, BOD and advisors

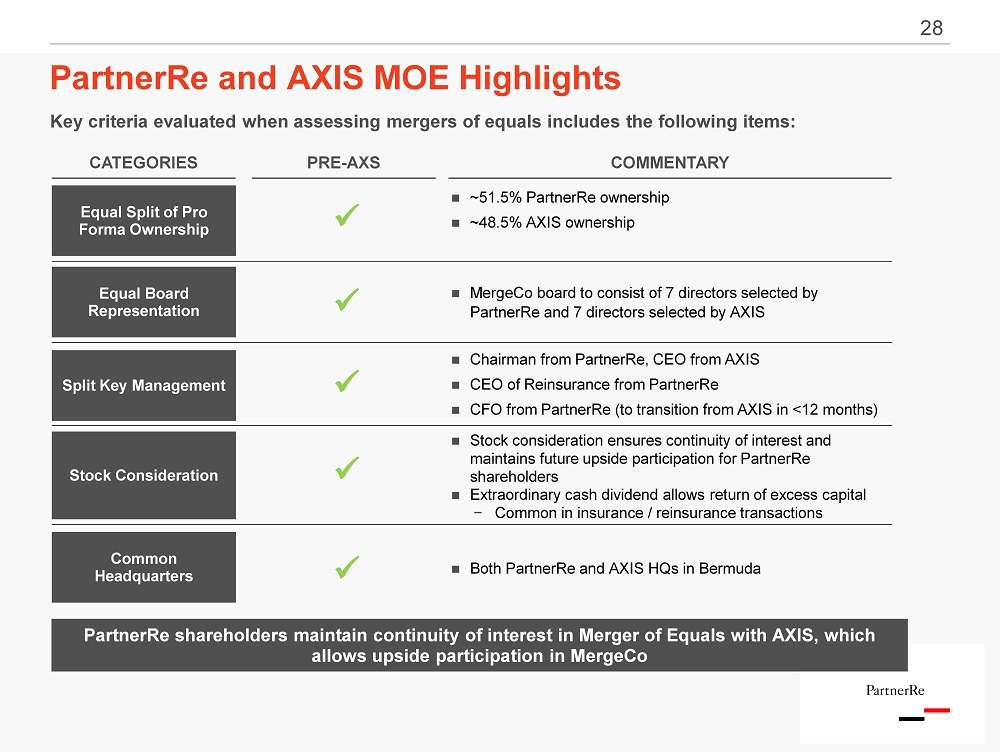

28 PartnerRe and AXIS MOE Highlights CATEGORIES Equal Split of Pro Forma Ownership Equal Board Representation Super - Majority Provision Split Key Management Common Headquarters Stock Consideration PRE - AXS COMMENTARY x x x x x x ~51.5% PartnerRe ownership ~48.5% AXIS ownership Stock consideration ensures continuity of interest and maintains future upside participation for PartnerRe shareholders Extraordinary cash dividend allows return of excess capital − Common in insurance / reinsurance transactions MergeCo board to consist of 7 directors selected by PartnerRe and 7 directors selected by AXIS Both PartnerRe and AXIS require >50% of shareholders to approve the merger of equals Chairman from PartnerRe, CEO from AXIS CEO of Reinsurance from PartnerRe CFO from PartnerRe (to transition from AXIS in <12 months) Both PartnerRe and AXIS HQs in Bermuda Key criteria evaluated when assessing mergers of equals includes the following items: PartnerRe shareholders maintain continuity of interest in Merger of Equals with AXIS, which allows upside participation in MergeCo

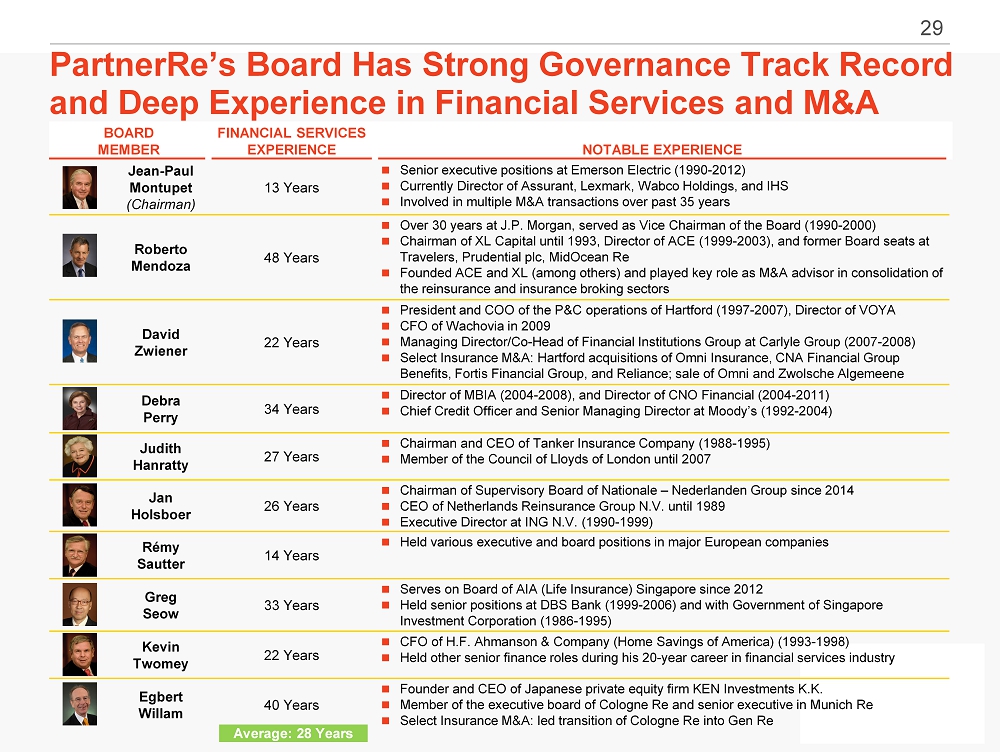

29 PartnerRe’s Board Has Strong Governance Track Record and Deep Experience in Financial Services and M&A Average: 28 Years BOARD MEMBER FINANCIAL SERVICES EXPERIENCE NOTABLE EXPERIENCE Jean - Paul Montupet (Chairman) 13 Years Senior executive positions at Emerson Electric (1990 - 2012) Currently Director of Assurant, Lexmark, Wabco Holdings, and IHS Involved in multiple M&A transactions over past 35 years Roberto Mendoza 48 Years Over 30 years at J.P. Morgan, served as Vice Chairman of the Board (1990 - 2000) Chairman of XL Capital until 1993, Director of ACE ( 1999 - 2003), and former Board seats at Travelers, Prudential plc, MidOcean Re Founded ACE and XL (among others) and played key role as M&A advisor in consolidation of the reinsurance and insurance broking sectors David Zwiener 22 Years President and COO of the P&C operations of Hartford (1997 - 2007), Director of VOYA CFO of Wachovia in 2009 Managing Director/Co - Head of Financial Institutions Group at Carlyle Group (2007 - 2008) Select Insurance M&A: Hartford acquisitions of Omni Insurance, CNA Financial Group Benefits, Fortis Financial Group, and Reliance; sale of Omni and Zwolsche Algemeene Debra Perry 34 Years Director of MBIA (2004 - 2008), and Director of CNO Financial (2004 - 2011) Chief Credit Officer and Senior Managing Director at Moody’s (1992 - 2004) Judith Hanratty 27 Years Chairman and CEO of Tanker Insurance Company (1988 - 1995) Member of the Council of Lloyds of London until 2007 Jan Holsboer 26 Years Chairman of Supervisory Board of Nationale – Nederlanden Group since 2014 CEO of Netherlands Reinsurance Group N.V. until 1989 Executive Director at ING N.V. (1990 - 1999) Rémy Sautter 14 Years Held various executive and board positions in major European companies Greg Seow 33 Years Serves on Board of AIA (Life Insurance) Singapore since 2012 Held senior positions at DBS Bank (1999 - 2006) and with Government of Singapore Investment Corporation (1986 - 1995) Kevin Twomey 22 Years CFO of H.F. Ahmanson & Company (Home Savings of America) (1993 - 1998) Held other senior finance roles during his 20 - year career in financial services industry Egbert Willam 40 Years Founder and CEO of Japanese private equity firm KEN Investments K.K. Member of the executive board of Cologne Re and senior executive in Munich Re Select Insurance M&A: led transition of Cologne Re into Gen Re

4. The PartnerRe Board has acted in the best interests of shareholders and made a good faith effort to negotiate with EXOR

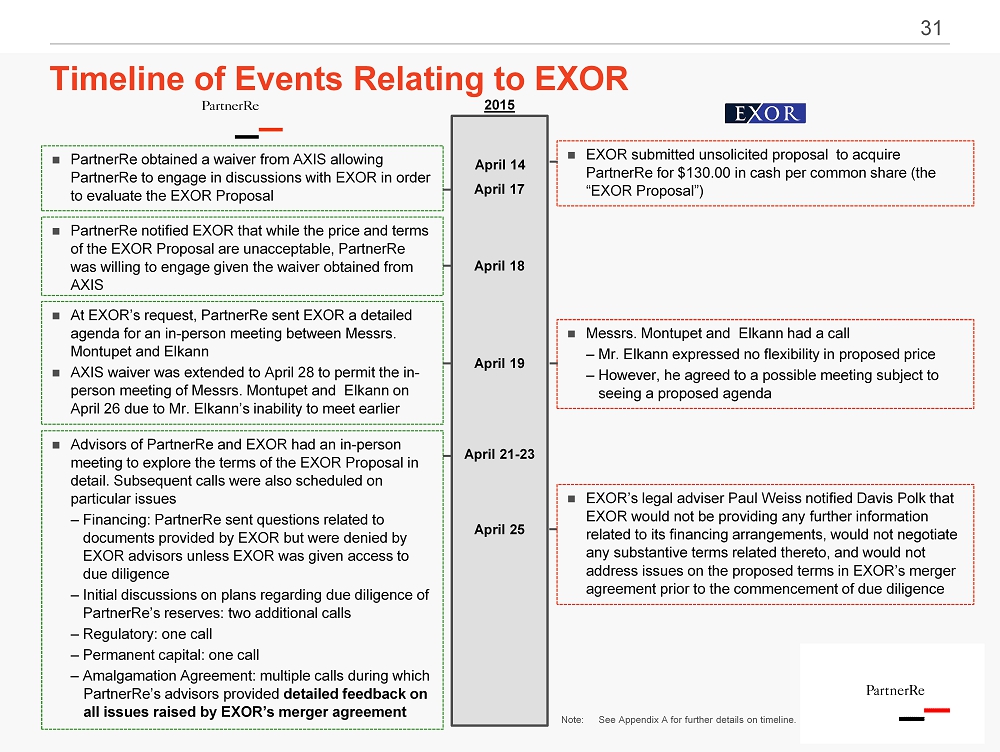

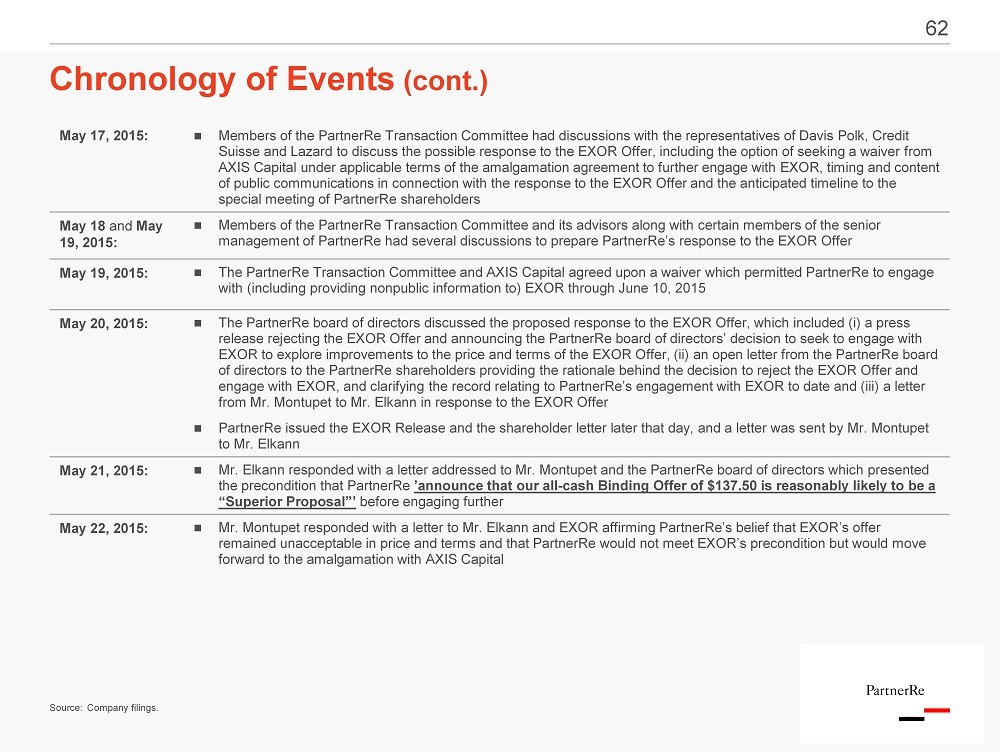

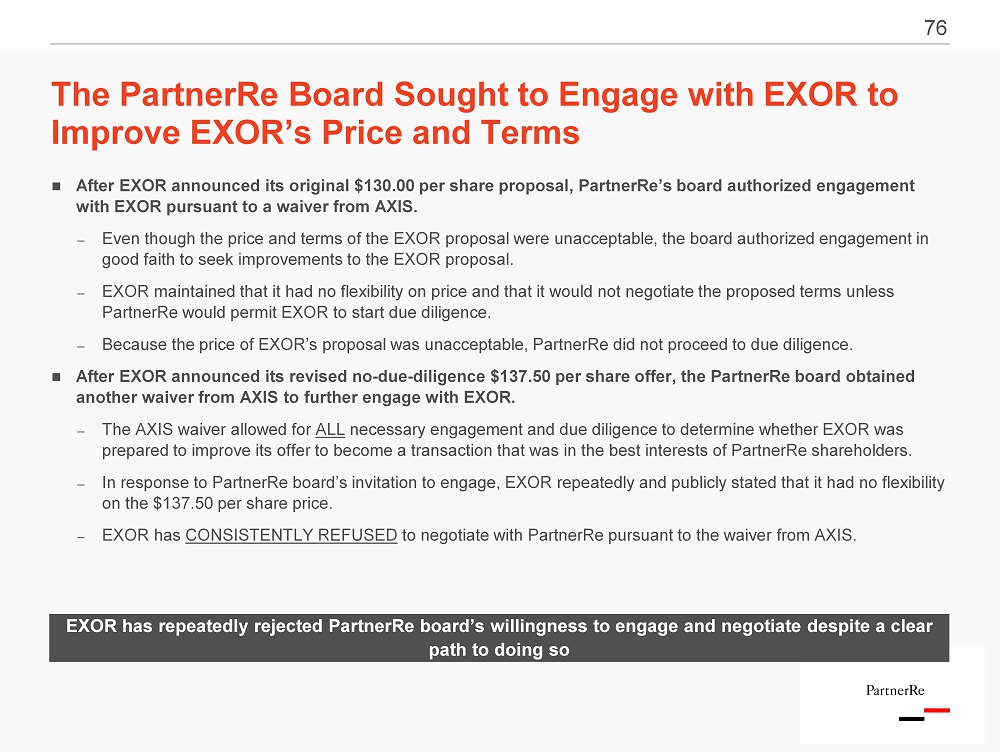

31 April 14 April 21 - 23 April 17 2015 EXOR submitted unsolicited proposal to acquire PartnerRe for $130.00 in cash per common share (the “EXOR Proposal”) Advisors of PartnerRe and EXOR had an in - person meeting to explore the terms of the EXOR Proposal in detail. Subsequent calls were also scheduled on particular issues – Financing: PartnerRe sent questions related to documents provided by EXOR but were denied by EXOR advisors unless EXOR was given access to due diligence – Initial discussions on plans regarding due diligence of PartnerRe’s reserves: two additional calls – Regulatory: one call – Permanent capital: one call – Amalgamation Agreement: multiple calls during which PartnerRe’s advisors provided detailed feedback on all issues raised by EXOR’s merger agreement PartnerRe obtained a waiver from AXIS allowing PartnerRe to engage in discussions with EXOR in order to evaluate the EXOR Proposal Timeline of Events Relating to EXOR April 18 PartnerRe notified EXOR that while the price and terms of the EXOR Proposal are unacceptable, PartnerRe was willing to engage given the waiver obtained from AXIS April 19 Messrs. Montupet and Elkann had a call – Mr. Elkann expressed no flexibility in proposed price – However, he agreed to a possible meeting subject to seeing a proposed agenda At EXOR’s request, PartnerRe sent EXOR a detailed agenda for an in - person meeting between Messrs. Montupet and Elkann AXIS waiver was extended to April 28 to permit the in - person meeting of Messrs. Montupet and Elkann on April 26 due to Mr. Elkann’s inability to meet earlier April 25 EXOR’s legal adviser Paul Weiss notified Davis Polk that EXOR would not be providing any further information related to its financing arrangements, would not negotiate any substantive terms related thereto, and would not address issues on the proposed terms in EXOR’s merger agreement prior to the commencement of due diligence Note: See Appendix A for further details on timeline .

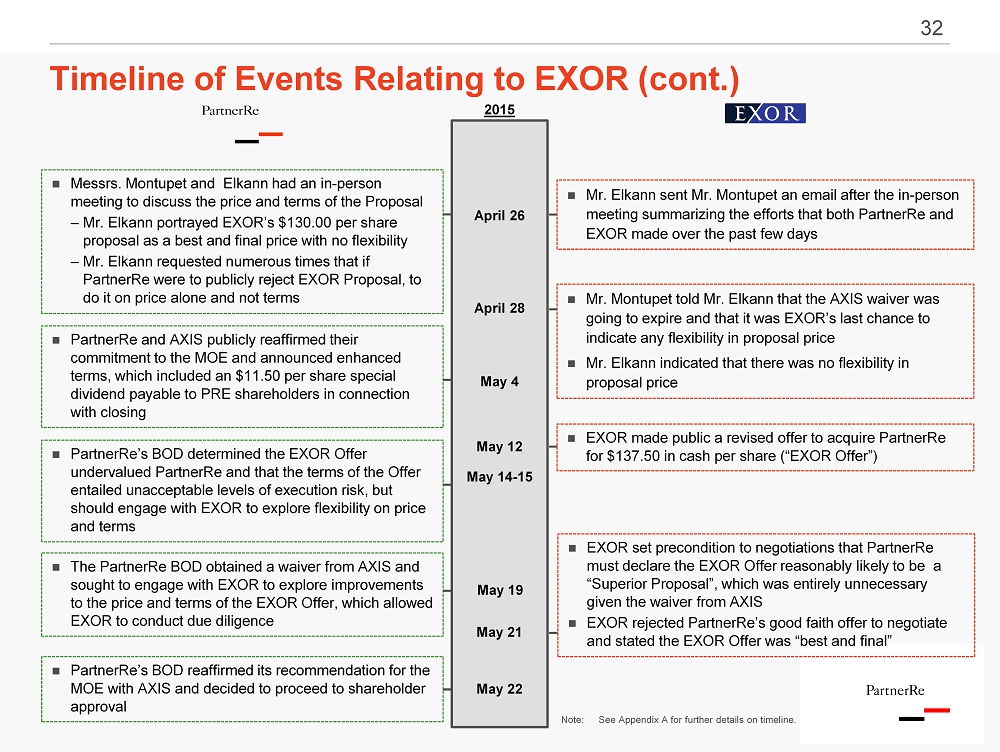

32 May 22 May 19 May 21 May 14 - 15 2015 The PartnerRe BOD obtained a waiver from AXIS and sought to engage with EXOR to explore improvements to the price and terms of the EXOR Offer, which allowed EXOR to conduct due diligence EXOR set precondition to negotiations that PartnerRe must declare the EXOR Offer reasonably likely to be a “Superior Proposal”, which was entirely unnecessary given the waiver from AXIS EXOR rejected PartnerRe’s good faith offer to negotiate and stated the EXOR Offer was “best and final” PartnerRe’s BOD determined the EXOR Offer undervalued PartnerRe and that the terms of the Offer entailed unacceptable levels of execution risk, but should engage with EXOR to explore flexibility on price and terms Timeline of Events Relating to EXOR (cont.) PartnerRe’s BOD reaffirmed its recommendation for the MOE with AXIS and decided to proceed to shareholder approval May 12 PartnerRe and AXIS publicly reaffirmed their commitment to the MOE and announced enhanced terms , which included an $11.50 per share special dividend payable to PRE shareholders in connection with closing April 28 Mr. Montupet told Mr. Elkann that the AXIS waiver was going to expire and that it was EXOR’s last chance to indicate any flexibility in proposal price Mr. Elkann indicated that there was no flexibility in proposal price Messrs . Montupet and Elkann had an in - person meeting to discuss the price and terms of the Proposal – Mr. Elkann portrayed EXOR’s $130.00 per share proposal as a best and final price with no flexibility – Mr . Elkann requested numerous times that if PartnerRe were to publicly reject EXOR Proposal, to do it on price alone and not terms April 26 May 4 Mr. Elkann sent Mr. Montupet an email after the in - person meeting summarizing the efforts that both PartnerRe and EXOR made over the past few days EXOR made public a revised offer to acquire PartnerRe for $137.50 in cash per share (“EXOR Offer”) Note: See Appendix A for further details on timeline .

33 The PartnerRe Board is Focused on Maximizing Shareholder Value The PartnerRe Board was open and willing to negotiate with EXOR from day one, even though EXOR’s price and terms are unacceptable − EXOR stated repeatedly that they will not improve their offer price EXOR’s allegations regarding the waiver are erroneous − The waiver allowed full engagement, including due diligence – which EXOR refused to pursue EXOR has set an artificial pre - condition requiring the Board to declare their offer reasonably likely to be a “Superior Proposal” in order to begin negotiations – which raises questions regarding their intentions to engage EXOR’s tactics and rhetoric are an attempt to cause the Board to sell PartnerRe for a price, and with terms, that are not in the best interest of the shareholders The Board has considered in its decision implications to all classes of shareholders (including Preferred shareholders) The Board’s commitment to shareholders to - date has resulted in material value creation The Board has not been entrenched against a transaction with EXOR; price and terms of the EXOR Offer are simply not acceptable The Board is determined to continue to act in the best interest of its shareholders and to maximize shareholders’ value

34 The Interests of the PartnerRe Board are Aligned with the Long - Term Interests of the PartnerRe Shareholders ▪ The compensation of PartnerRe’s directors aligns the interests of the directors with the long - term interests of the PartnerRe shareholders. ▪ Director compensation is comprised of significant equity, and therefore aligns directors’ interest with shareholders ▪ Total equity owned by the Board reflects ~15x annual Board compensation ▪ The Board’s compensation has been benchmarked against an appropriate peer group ▪ The Board selected Mr. David Zwiener to serve as the interim CEO because he has been a director of PartnerRe since 2009 and has extensive executive experience in the insurance industry ▪ The Board was conscious of the risk that PartnerRe faced if the AXIS Capital deal were to fail to close and therefore contracted Mr. Zwiener through April 2016 ▪ Mr. Zwiener is not only incentivized with respect to the AXIS Capital transaction ▪ The Board consciously included a discretionary bonus to ensure they could adjust Mr. Zwiener’s compensation in the event the AXIS Capital transaction does not close

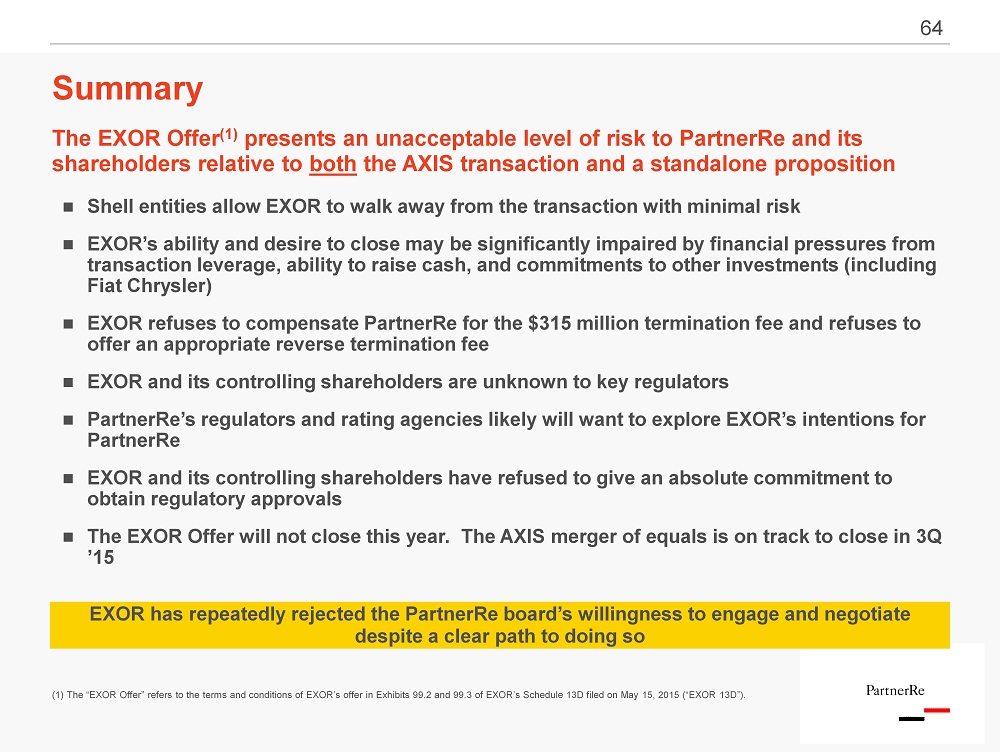

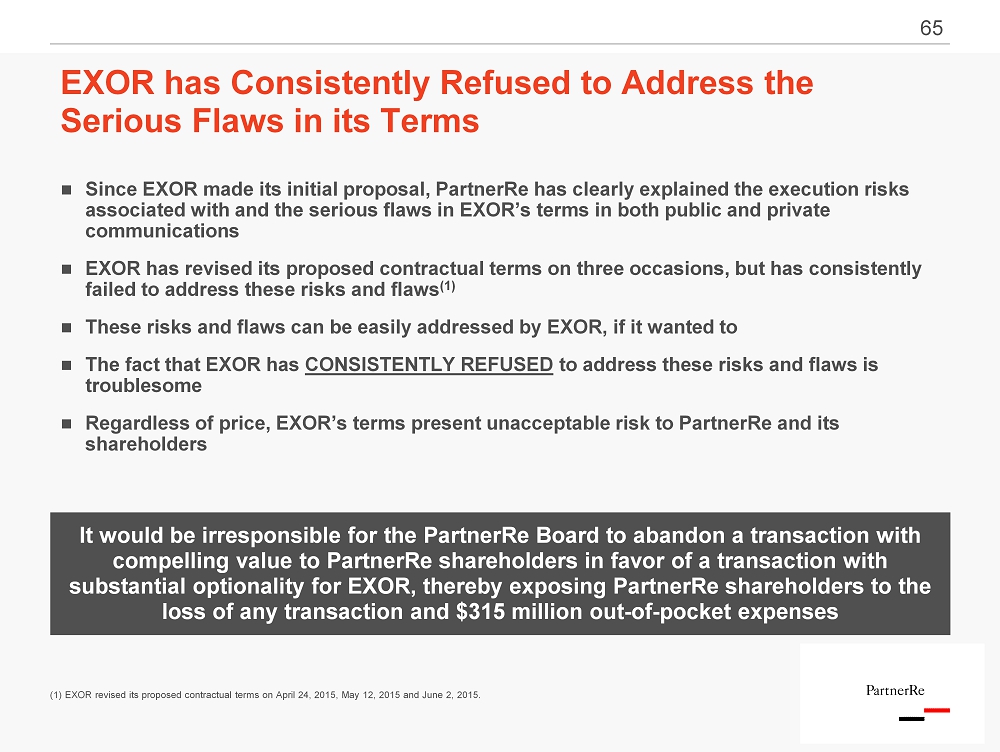

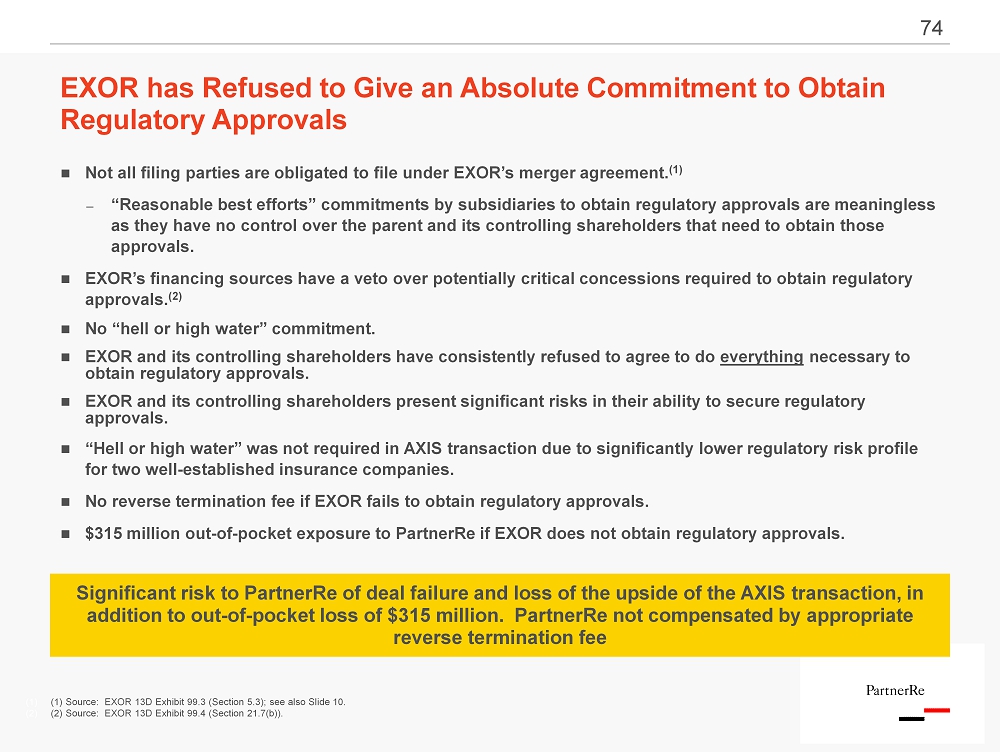

35 Since EXOR made its initial proposal, PartnerRe has clearly explained the execution risks associated with and the serious flaws in EXOR’s terms in both public and private communications EXOR has revised its proposed contractual terms on three occasions, but has consistently failed to address these risks and flaws (1) These risks and flaws can be easily addressed by EXOR, if it wanted to The fact that EXOR has CONSISTENTLY REFUSED to address these risks and flaws is troublesome Regardless of price, EXOR’s terms present unacceptable risk to PartnerRe and its shareholders EXOR has Consistently Refused to Address the Serious Flaws in its Terms It would be irresponsible for the PartnerRe Board to abandon a transaction with compelling value to PartnerRe shareholders in favor of a transaction with substantial optionality for EXOR, thereby exposing PartnerRe shareholders to the loss of any transaction and $315 million out - of - pocket expenses (1) EXOR revised its proposed contractual terms on April 24, 2015, May 12, 2015 and June 2, 2015.

5. AXIS transaction is superior; EXOR Offer is inadequate as a change - of - control cash offer

37 EXOR’s Inferior Current Offer is Not in the Best Interests of PartnerRe Shareholders EXOR’s inferior offer significantly undervalues PartnerRe’s standalone franchise Precedent acquisition transaction multiples and premiums paid imply a valuation well in excess of $ 137.50 − EXOR offer of $137.50 reflects a multiple of 1.02x PartnerRe’s 12/31/15E BVPS Cash consideration removes upside participation for PartnerRe shareholders − PartnerRe’s reserve redundancy is expected to generate significant value to shareholders − Interest rate increase and improved pricing would have material valuation benefit to shareholders − Valuation and pricing environment is currently low and has significant upside potential PartnerRe’s MOE with AXIS has significant value upside that is not captured in EXOR’s inferior offer − Scale, diversification, and improved distribution resulting from an MOE with AXIS would likely lead to a multiple re - rating − Continuity of interest maintained in MOE with AXIS allows PartnerRe shareholders to benefit from future upside participation EXOR’s opportunistic offer meaningfully undervalues PartnerRe and removes upside from PartnerRe shareholders

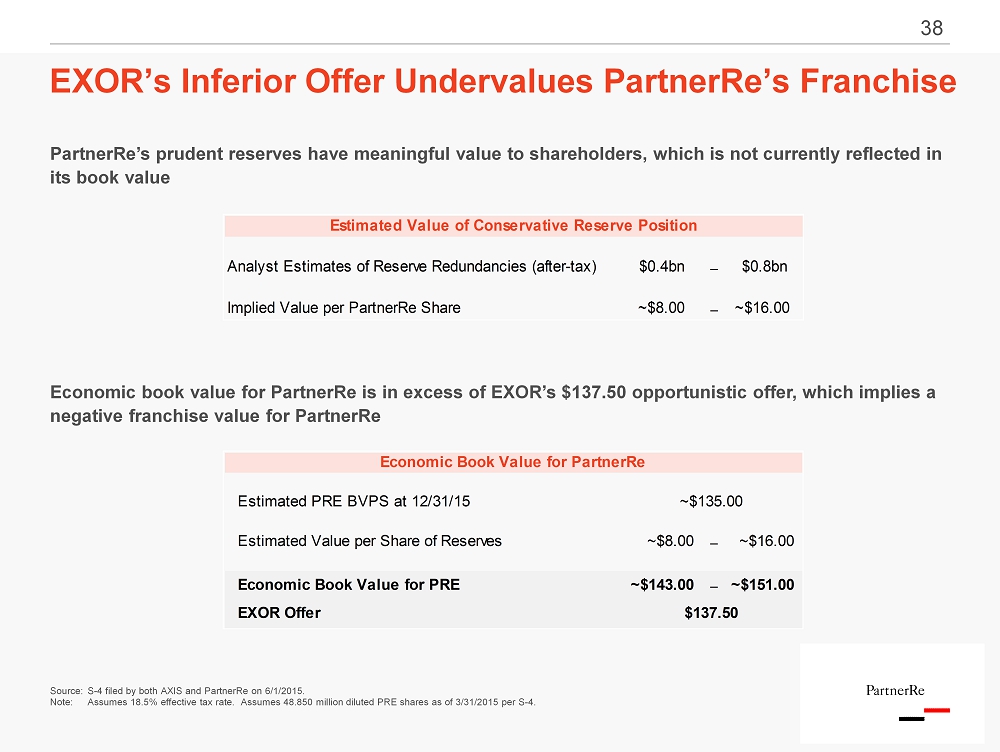

38 Source: S - 4 filed by both AXIS and PartnerRe on 6/1/2015. Note: Assumes 18.5% effective tax rate. Assumes 48.850 million diluted PRE shares as of 3/31/2015 per S - 4 . EXOR’s Inferior Offer Undervalues PartnerRe’s Franchise PartnerRe’s prudent reserves have meaningful value to shareholders, which is not currently reflected in its book value Estimated Value of Conservative Reserve Position Analyst Estimates of Reserve Redundancies (after-tax) $0.4bn ─ $0.8bn Implied Value per PartnerRe Share ~$8.00 ─ ~$16.00 Economic book value for PartnerRe is in excess of EXOR’s $137.50 opportunistic offer, which implies a negative franchise value for PartnerRe Economic Book Value for PartnerRe Estimated PRE BVPS at 12/31/15 ~$135.00 Estimated Value per Share of Reserves ~$8.00 ─ ~$16.00 Economic Book Value for PRE ~$143.00 ─ ~$151.00 EXOR Offer $137.50

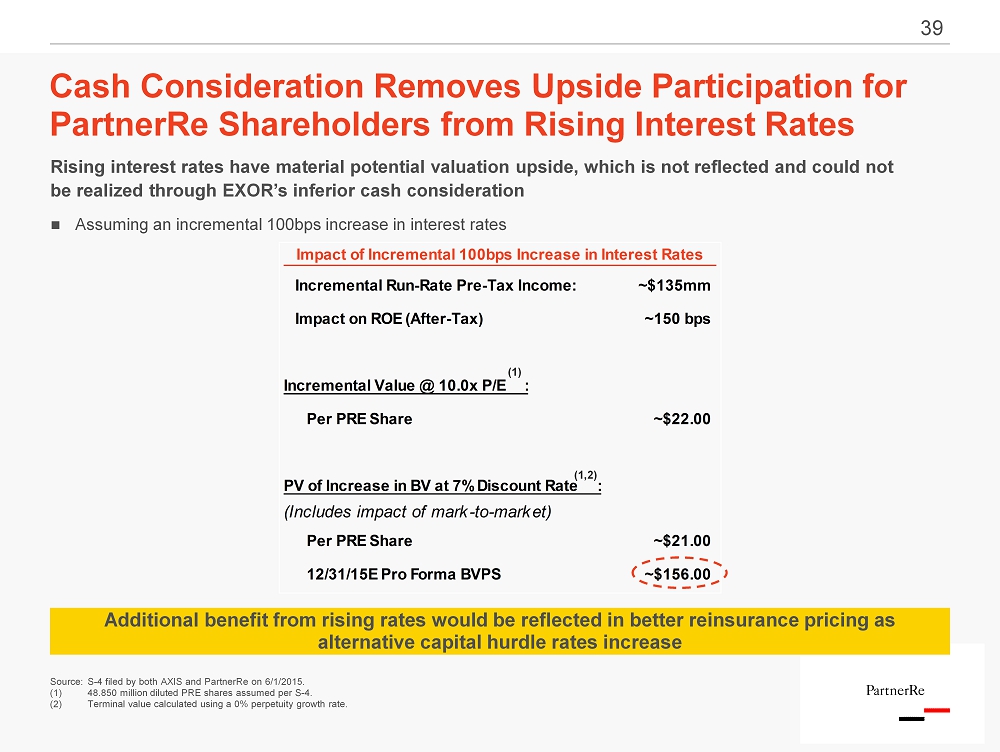

39 Rising interest rates have material potential valuation upside, which is not reflected and could not be realized through EXOR’s inferior cash consideration Assuming an incremental 100bps increase in interest rates Source: S - 4 filed by both AXIS and PartnerRe on 6/1/2015. (1) 48.850 million diluted PRE shares assumed per S - 4. (2) Terminal value calculated using a 0% perpetuity growth rate. Impact of Incremental 100bps Increase in Interest Rates Impact of Incremental 100bps Increase in Interest Rates Incremental Run-Rate Pre-Tax Income: ~$135mm Impact on ROE (After-Tax) ~150 bps Incremental Value @ 10.0x P/E : Per PRE Share ~$22.00 PV of Increase in BV at 7% Discount Rate : (Includes impact of mark-to-market) Per PRE Share ~$21.00 12/31/15E Pro Forma BVPS ~$156.00 (1) (1,2) Cash Consideration Removes Upside Participation for PartnerRe Shareholders from Rising Interest Rates Additional benefit from rising rates would be reflected in better reinsurance pricing as alternative capital hurdle rates increase

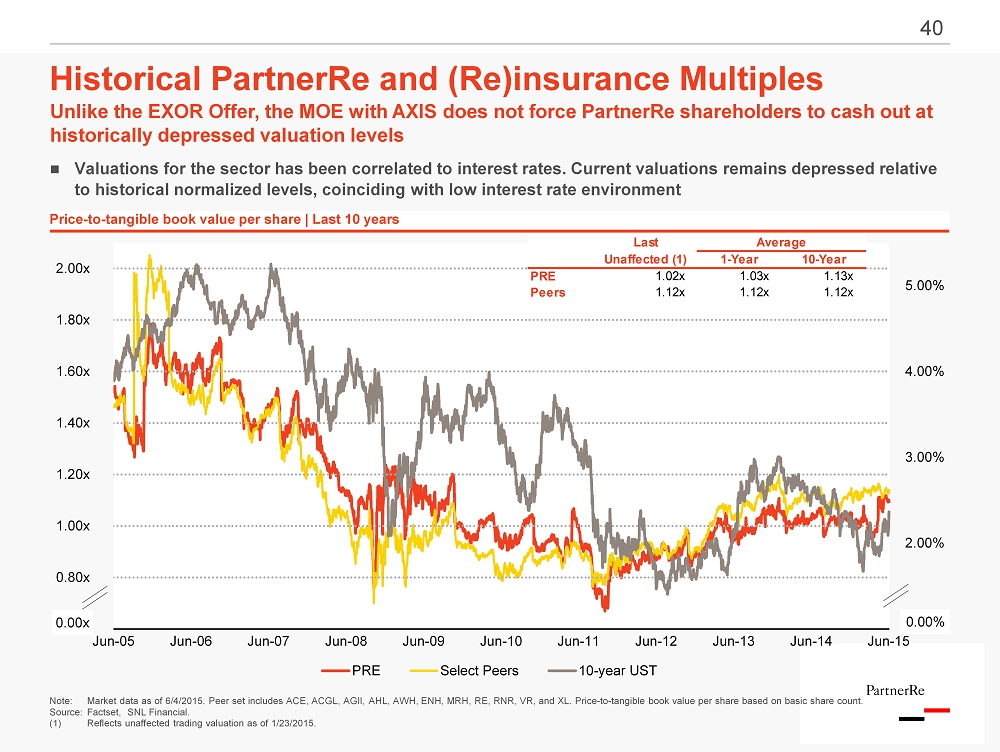

40 Note: Market data as of 6/4/2015. Peer set includes ACE, ACGL, AGII, AHL, AWH, ENH, MRH, RE, RNR, VR, and XL. Price - to - tangible book value per share based on basic share count. Source : Factset , SNL Financial. (1) Reflects unaffected trading valuation as of 1/23/2015 . Historical PartnerRe and (Re)insurance Multiples 1.00% 2.00% 3.00% 4.00% 5.00% 0.60x 0.80x 1.00x 1.20x 1.40x 1.60x 1.80x 2.00x Jun-05 Jun-06 Jun-07 Jun-08 Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 PRE Select Peers 10-year UST Price - to - tangible book value per share | Last 10 years Last Average Unaffected (1) 1-Year 10-Year PRE 1.02x 1.03x 1.13x Peers 1.12x 1.12x 1.12x Unlike the EXOR Offer, the MOE with AXIS does not force PartnerRe shareholders to cash out at historically depressed valuation levels Valuations for the sector has been correlated to interest rates. Current valuations remains depressed relative to historical normalized levels, coinciding with low interest rate environment 0.00% 0.00x

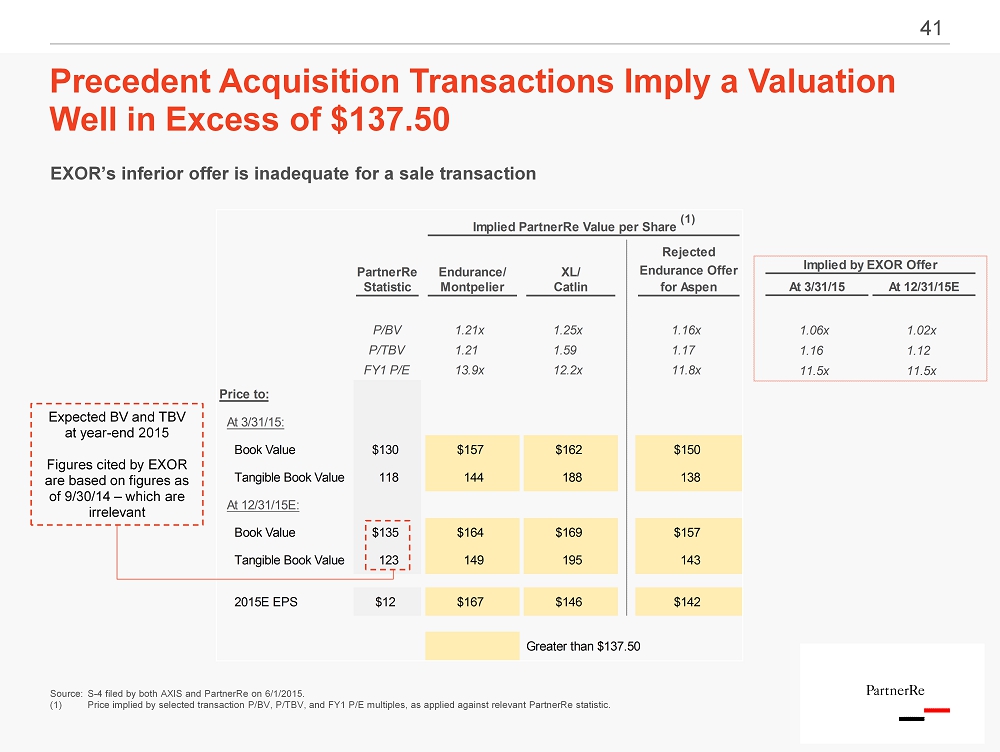

41 EXOR’s inferior offer is inadequate for a sale transaction Source: S - 4 filed by both AXIS and PartnerRe on 6/1/2015. (1) Price implied by selected transaction P/BV, P/TBV, and FY1 P/E multiples, as applied against relevant PartnerRe statistic. Precedent Acquisition Transactions Imply a Valuation Well in Excess of $137.50 Implied PartnerRe Value per Share (1) Rejected PartnerRe Endurance/ XL/ Endurance Offer Statistic Montpelier Catlin for Aspen P/BV 1.21x 1.25x 1.16x P/TBV 1.21 1.59 1.17 FY1 P/E 13.9x 12.2x 11.8x Price to: At 3/31/15: Book Value $130 $157 $162 $150 Tangible Book Value 118 144 188 138 At 12/31/15E: Book Value $135 $164 $169 $157 Tangible Book Value 123 149 195 143 2015E EPS $12 $167 $146 $142 Greater than $137.50 Expected BV and TBV at year - end 2015 Figures cited by EXOR are based on figures as of 9/30/14 – which are irrelevant Implied by EXOR Offer At 3/31/15 At 12/31/15E 1.06x 1.02x 1.16 1.12 11.5x 11.5x

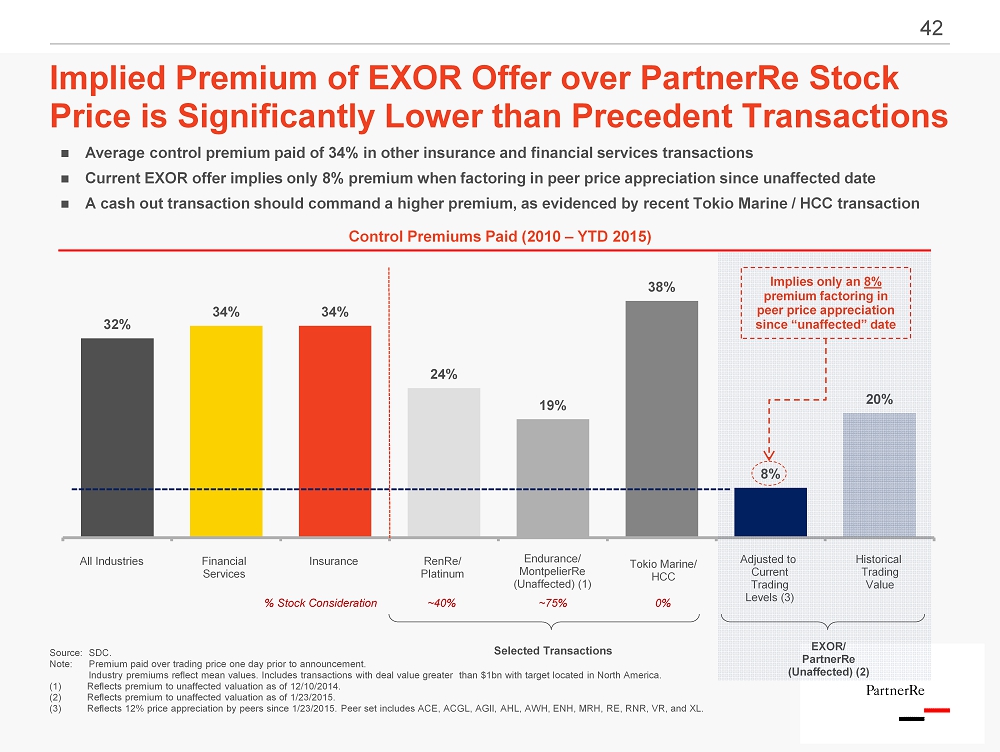

42 Implied Premium of EXOR Offer over PartnerRe Stock Price is Significantly Lower than Precedent Transactions Source: SDC. Note: Premium paid over trading price one day prior to announcement. Industry premiums reflect mean values. Includes transactions with deal value greater than $1bn with target located in North America. (1) Reflects premium to unaffected valuation as of 12/10/2014. (2) Reflects premium to unaffected valuation as of 1/23/2015. (3) Reflects 12% price appreciation by peers since 1/23/2015. Peer set includes ACE, ACGL, AGII, AHL, AWH, ENH, MRH, RE, RNR, VR, and XL. 32% 34% 34% 24% 19% 38% 8% 20% Insurance Adjusted to Current Trading Levels (3) Financial Services All Industries RenRe / Platinum Endurance/ MontpelierRe (Unaffected) (1) Tokio Marine/ HCC ~40% ~75% 0% % Stock Consideration Control Premiums Paid (2010 – YTD 2015) Implies only an 8% premium factoring in peer price appreciation since “unaffected” date EXOR/ PartnerRe (Unaffected) (2) Selected Transactions Historical Trading Value Average control premium paid of 34 % in other insurance and financial services transactions Current EXOR offer implies only 8% premium when factoring in peer price appreciation since unaffected date A cash out transaction should command a higher premium, as evidenced by recent Tokio Marine / HCC transaction

6. EXOR’s Offer is illusory; EXOR’s proposed terms and conditions expose P artnerRe shareholders to significant risks

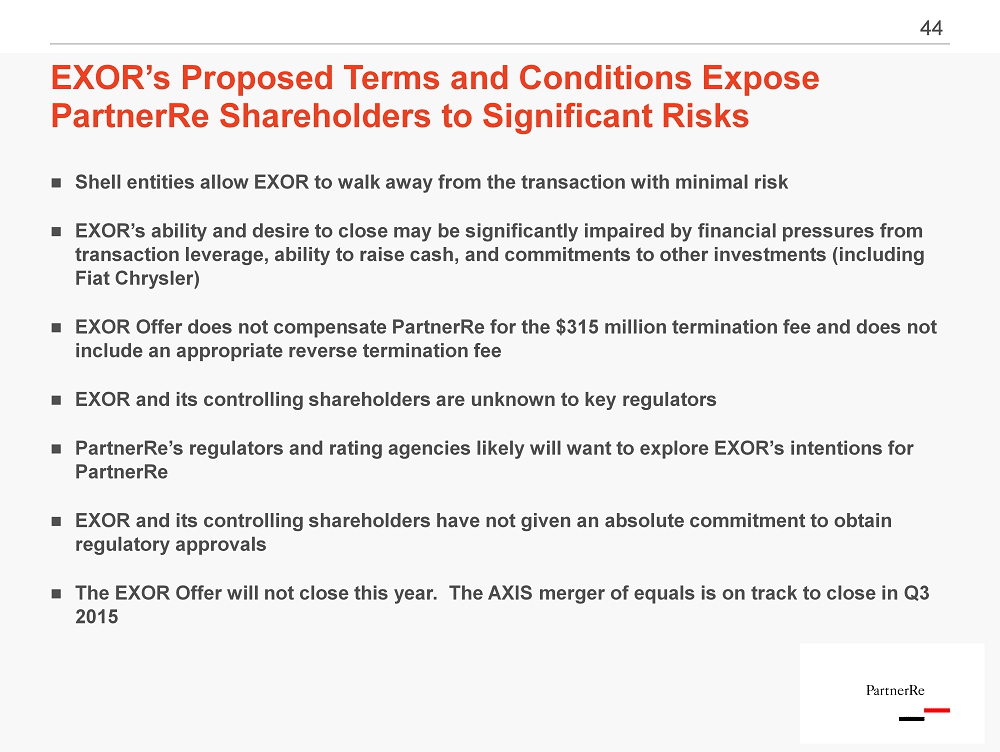

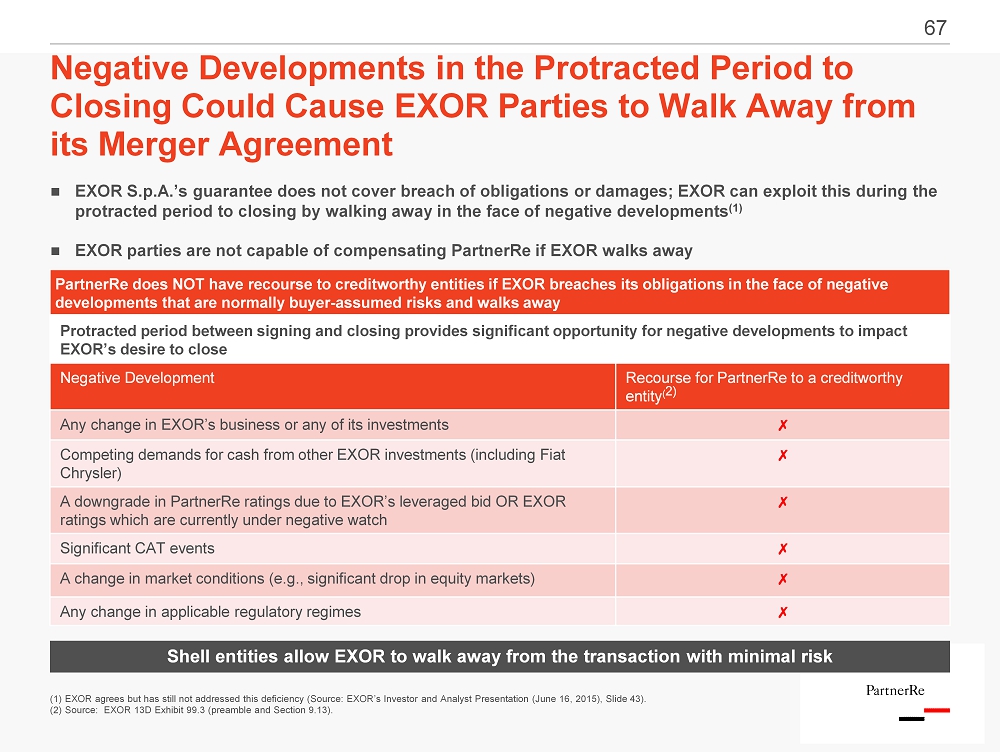

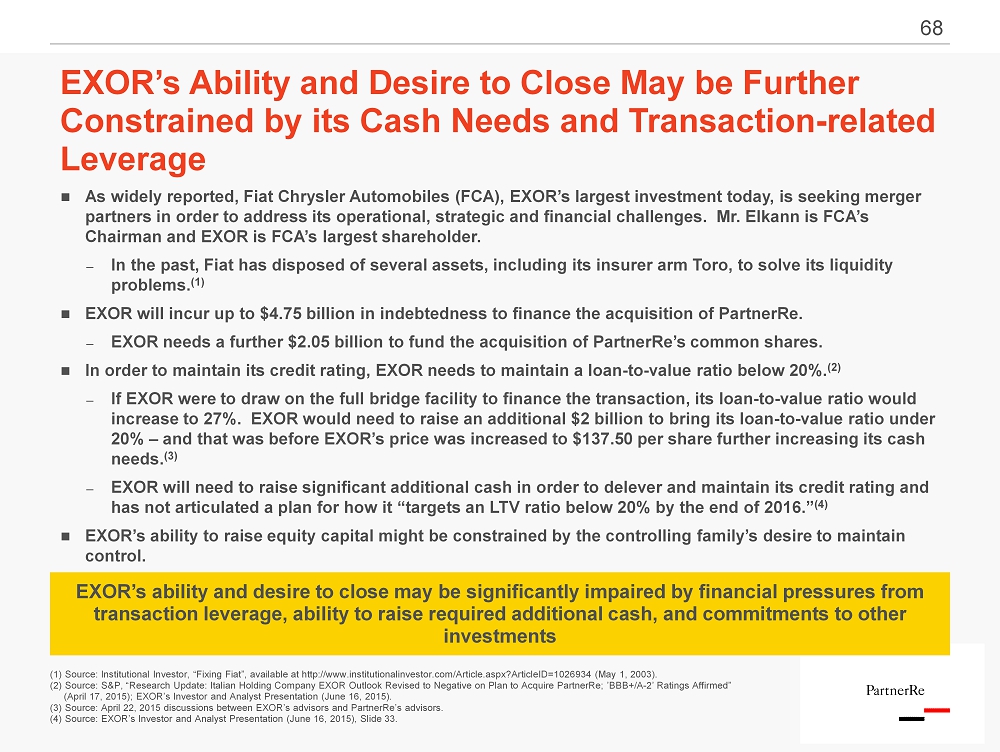

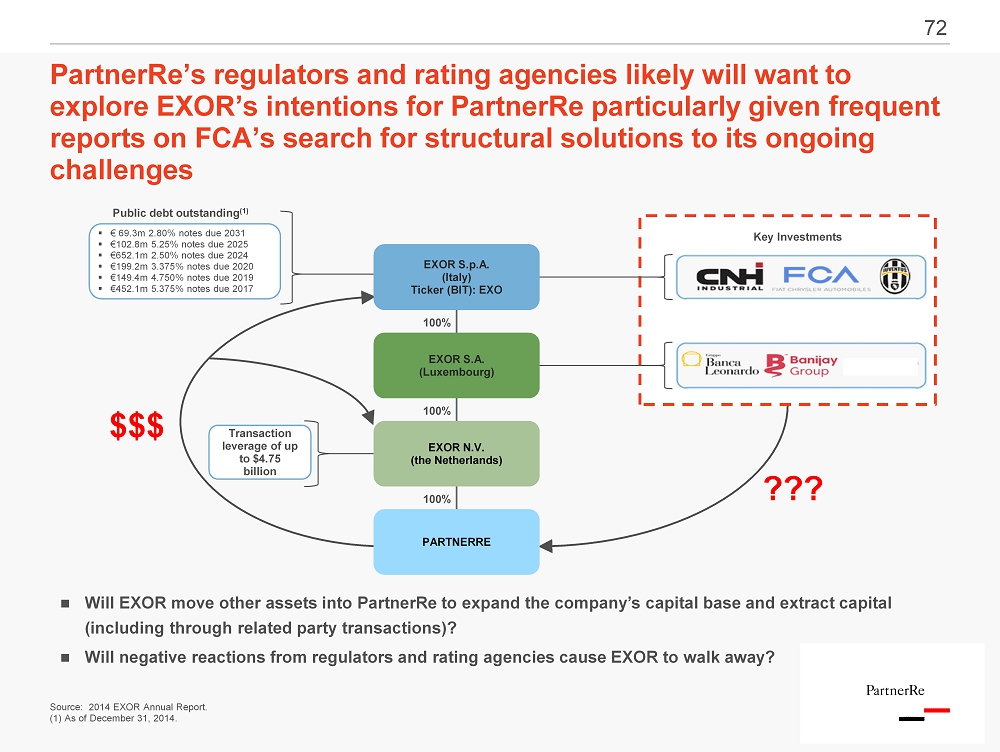

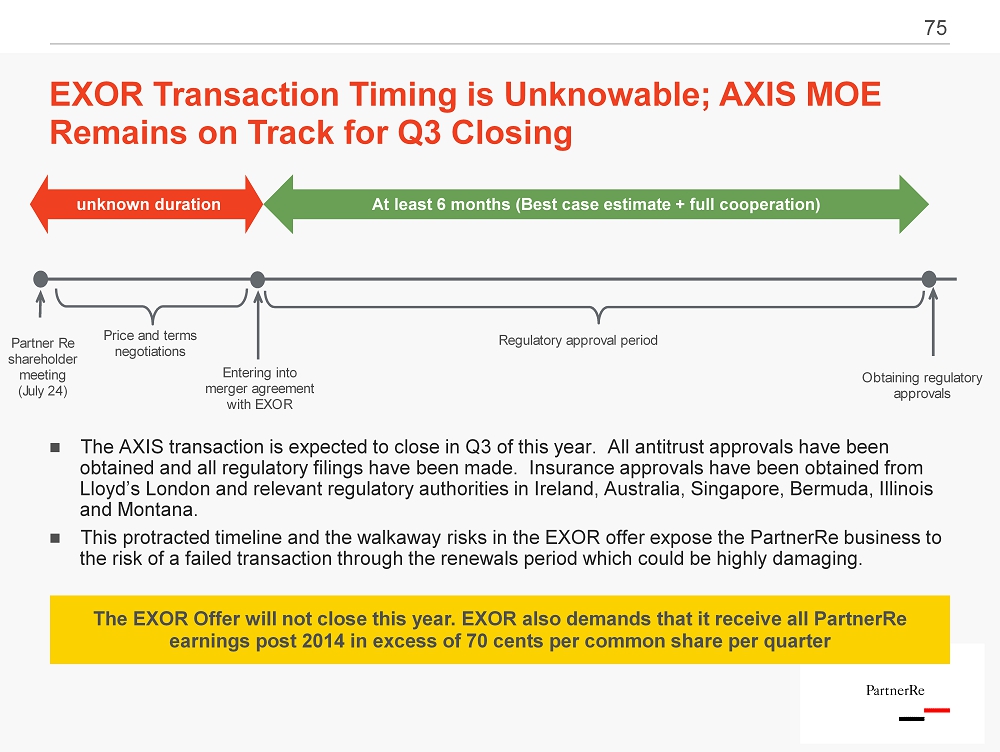

44 44 EXOR’s Proposed Terms and Conditions Expose PartnerRe Shareholders to Significant Risks Shell entities allow EXOR to walk away from the transaction with minimal risk EXOR’s ability and desire to close may be significantly impaired by financial pressures from transaction leverage, ability to raise cash, and commitments to other investments (including Fiat Chrysler) EXOR Offer does not compensate PartnerRe for the $315 million termination fee and does not include an appropriate reverse termination fee EXOR and its controlling shareholders are unknown to key regulators PartnerRe’s regulators and rating agencies likely will want to explore EXOR’s intentions for PartnerRe EXOR and its controlling shareholders have not given an absolute commitment to obtain regulatory approvals The EXOR Offer will not close this year. The AXIS merger of equals is on track to close in Q3 2015 To discuss – V1 (Per DPW)

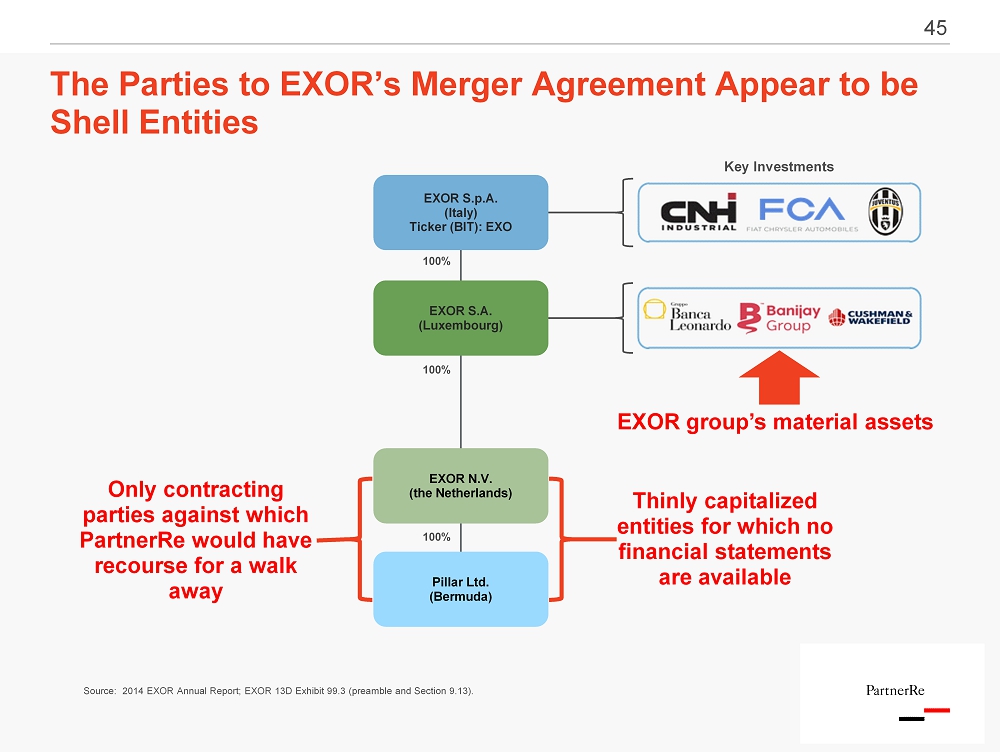

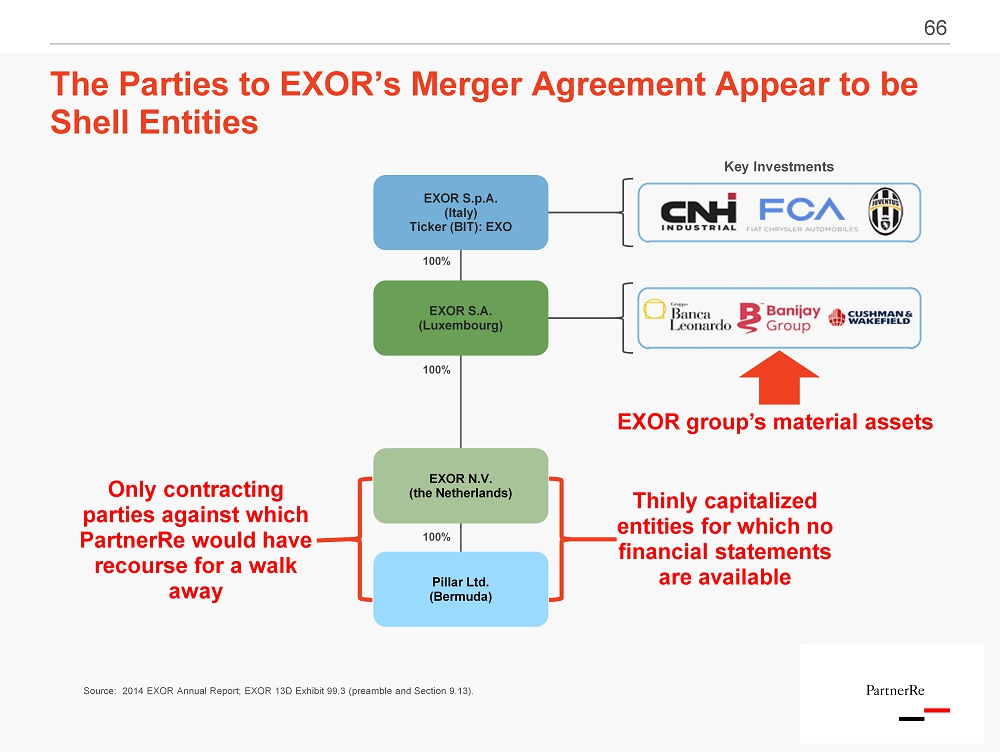

The Parties to EXOR’s Merger Agreement Appear to be Shell Entities 45 EXOR S.p.A. (Italy) Ticker (BIT): EXO Key Investments Source: 2014 EXOR Annual Report; EXOR 13D Exhibit 99.3 (preamble and Section 9.13). 100% 100% 100% EXOR group’s material assets Only contracting parties against which PartnerRe would have recourse for a walk away Thinly capitalized entities for which no financial statements are available Pillar Ltd. (Bermuda) EXOR S.A. (Luxembourg) EXOR N.V. (the Netherlands) 45

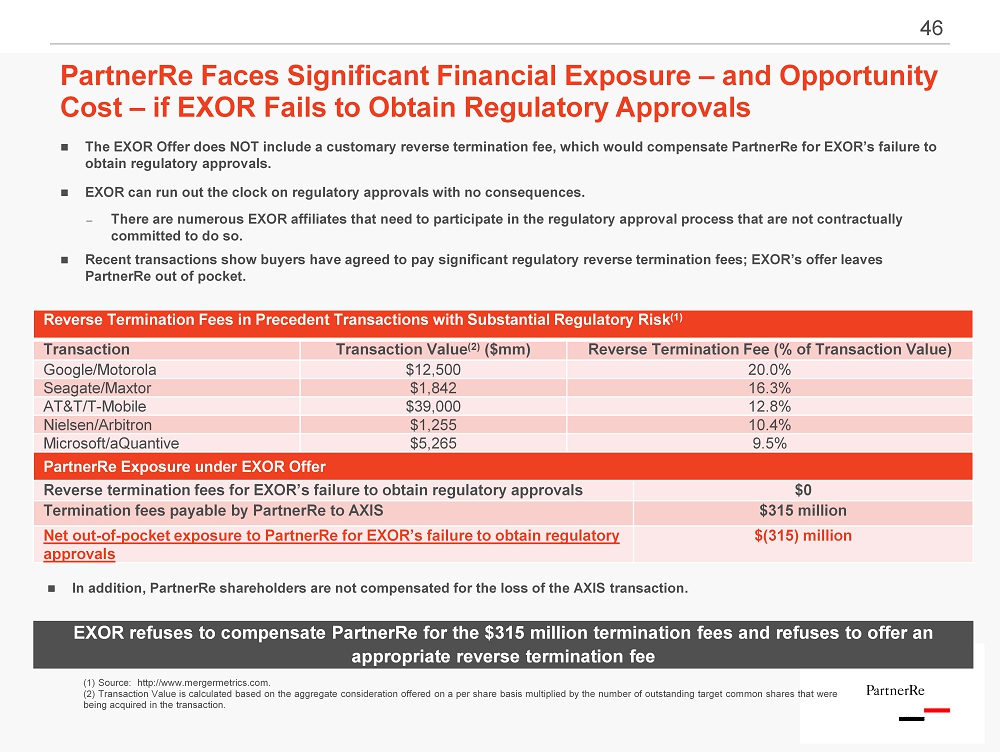

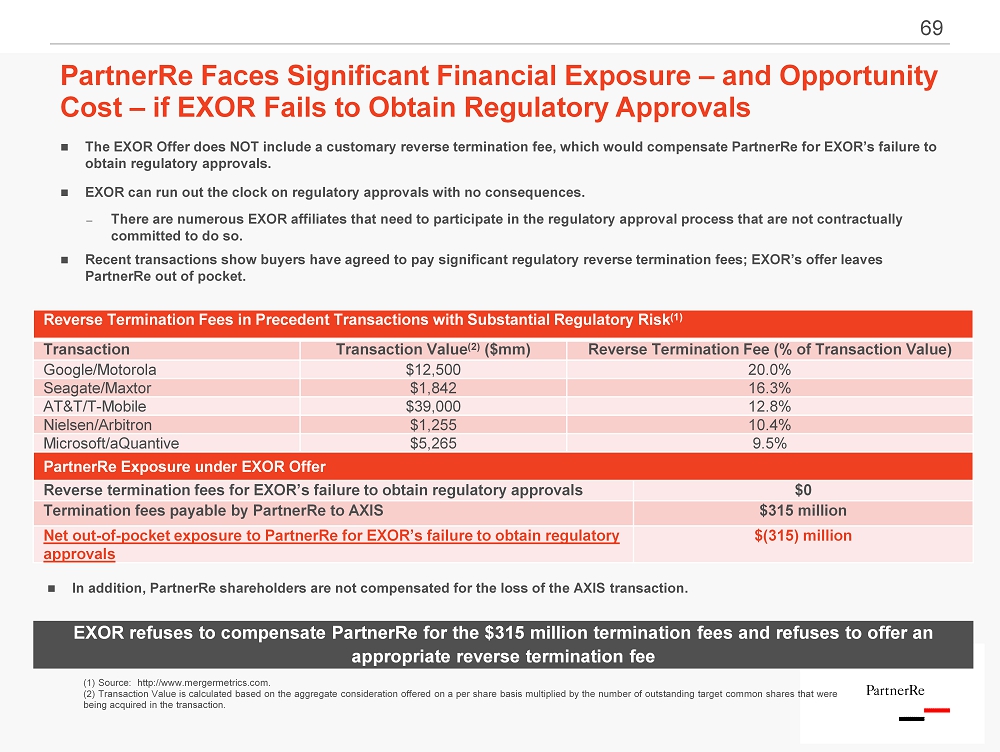

46 46 The EXOR Offer does NOT include a customary reverse termination fee, which would compensate PartnerRe for EXOR’s failure to obtain regulatory approvals. EXOR can run out the clock on regulatory approvals with no consequences. ─ There are numerous EXOR affiliates that need to participate in the regulatory approval process that are not contractually committed to do so. Recent transactions show buyers have agreed to pay significant regulatory reverse termination fees; EXOR’s offer leaves PartnerRe out of pocket. PartnerRe Faces Significant Financial Exposure – and Opportunity Cost – if EXOR Fails to Obtain Regulatory Approvals Reverse Termination Fees in Precedent Transactions with Substantial Regulatory Risk (1) Transaction Transaction Value (2) ($mm) Reverse Termination Fee (% of Transaction Value) Google/Motorola $12,500 20.0% Seagate/Maxtor $1,842 16.3% AT&T/T - Mobile $39,000 12.8% Nielsen/Arbitron $1,255 10.4% Microsoft/aQuantive $5,265 9.5% PartnerRe Exposure under EXOR Offer Reverse termination fees for EXOR’s failure to obtain regulatory approvals $0 Termination fees payable by PartnerRe to AXIS $315 million Net out - of - pocket exposure to PartnerRe for EXOR’s failure to obtain regulatory approvals $(315) million (1) Source: http://www.mergermetrics.com. (2) Transaction Value is calculated based on the aggregate consideration offered on a per share basis multiplied by the number of outstanding targe t c ommon shares that were being acquired in the transaction. In addition, PartnerRe shareholders are not compensated for the loss of the AXIS transaction. EXOR refuses to compensate PartnerRe for the $315 million termination fees and refuses to offer an appropriate reverse termination fee

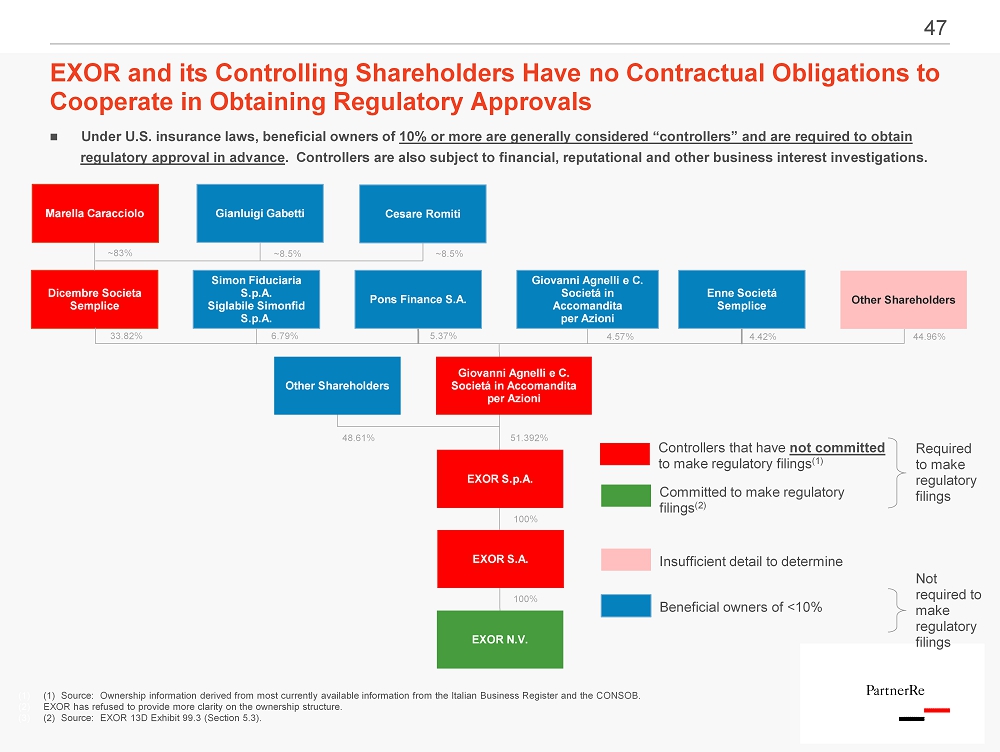

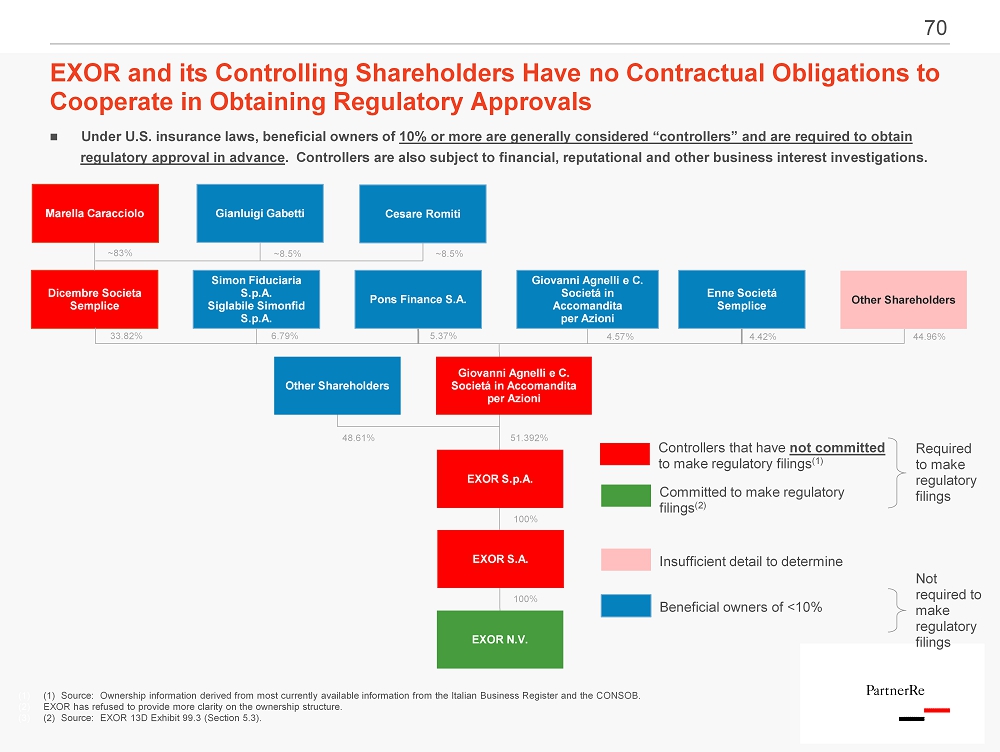

EXOR and its Controlling Shareholders Have no Contractual Obligations to Cooperate in Obtaining Regulatory Approvals 47 Dicembre Societa Semplice Simon Fiduciaria S.p.A. Siglabile Simonfid S.p.A. Pons Finance S.A. Giovanni Agnelli e C. Societ á in Accomandita p er Azioni Enne Societ á Semplice Other Shareholders EXOR S.p.A. EXOR S.A. EXOR N.V. Other Shareholders Giovanni Agnelli e C. Societ á in Accomandita per Azioni (1) (1) Source: Ownership information derived from most currently available information from the Italian Business Register and the CONSOB. (2) EXOR has refused to provide more clarity on the ownership structure. (3) (2) Source: EXOR 13D Exhibit 99.3 (Section 5.3). Controllers that have not committed to make regulatory filings (1) 33.82% 6.79% 5.37% 4.57% 4.42% 44.96% 48.61% 51.392% 100% 100% Under U.S. insurance laws, beneficial owners of 10% or more are generally considered “controllers” and are required to obtain regulatory approval in advance . Controllers are also subject to financial, reputational and other business interest investigations. Marella Caracciolo Committed to make regulatory filings (2) Gianluigi Gabetti Cesare Romiti ~83% ~8.5% ~8.5% 47 Beneficial owners of <10% Insufficient detail to determine Required to make regulatory filings Not required to make regulatory filings

7 . Merger with AXIS provides superior protection for preferred shareholders , vs. significant risks introduced by EXOR Offer

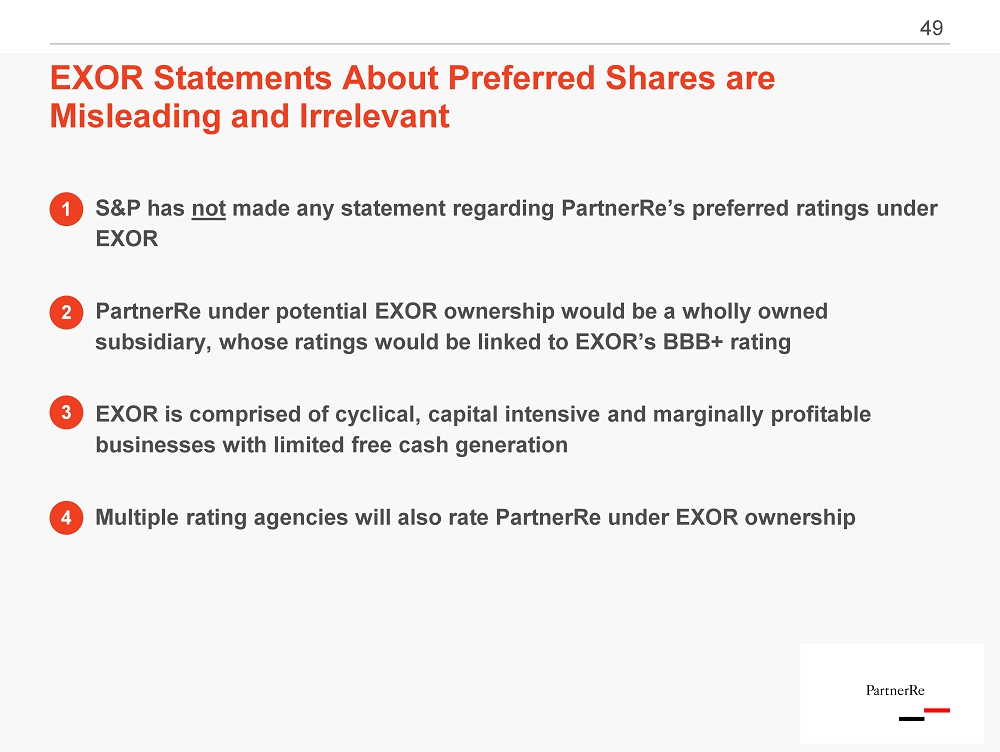

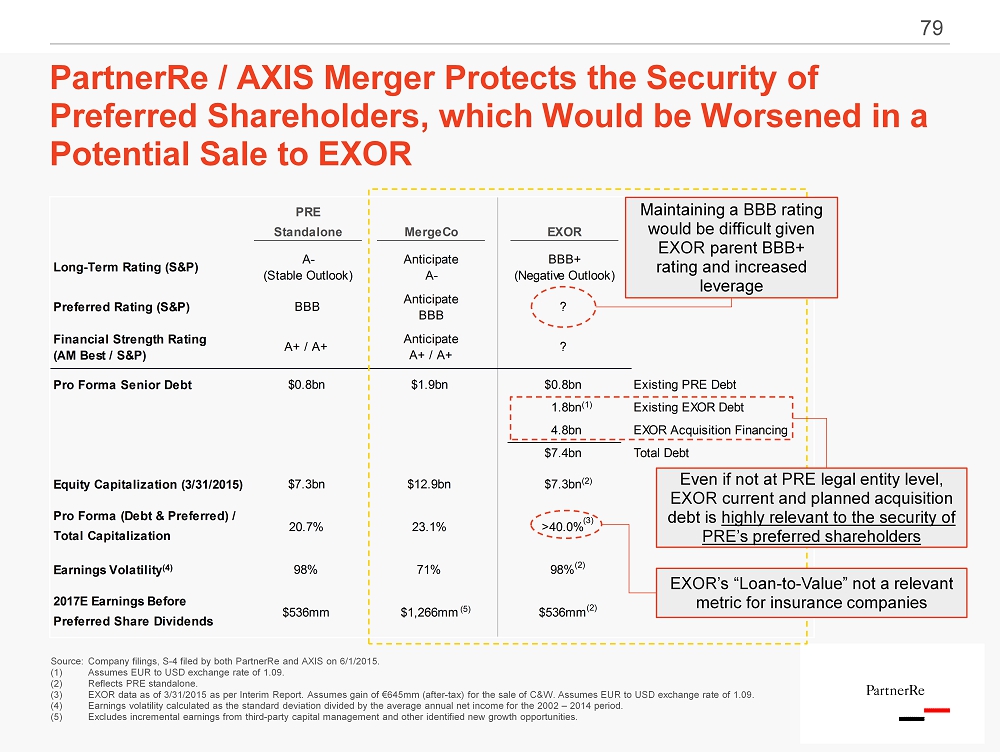

49 EXOR Statements About Preferred Shares are Misleading and Irrelevant S&P has not made any statement regarding PartnerRe’s preferred ratings under EXOR PartnerRe under potential EXOR ownership would be a wholly owned subsidiary, whose ratings would be linked to EXOR’s BBB + rating EXOR is comprised of cyclical, capital intensive and marginally profitable businesses with limited free cash generation Multiple rating agencies will also rate PartnerRe under EXOR ownership 1 2 3 4

50 PartnerRe’s Merger with AXIS Protects the Security of Preferred Shareholders Preferred shares are hybrid securities with both equity and debt characteristics: perpetual, dividend paying Rated by four agencies along with all other fixed income securities in PartnerRe’s capital structure ( Moody’s , S&P, Fitch, AM Best) Like all creditors, preferred shareholders will have a continuing economic interest in the company and a significant stake in PartnerRe’s future ownership. The credit considerations for preferred shareholders and creditors will include: Market position, business and geographic diversification Asset quality Capital adequacy, r eserve adequacy and financial flexibility Profitability Risk management PartnerRe / AXIS Merger preserves and enhances all of these typical credit considerations for insurance / reinsurance companies PartnerRe’s capital structure includes three series of perpetual preferred shares with a total of 34.1 million shares outstanding that together comprise 41.7% of the total shareholder vote for the merger with AXIS

51 PartnerRe’s Merger with AXIS Protects the Security of Preferred Shareholders ( con’t .) Both PartnerRe and Axis have met with all four rating agencies to outline the proposed MOE and the related capital plan. Discussions focused on the business plan and importantly, the pre - close dividend and the planned return of capital Based on initial feedback from the agencies, we are confident that MergeCo’s financial strength and debt ratings – including those of the preferred securities – would remain at the same strong level Moreover , as investors in MergeCo , preferred shareholders will benefit from trading liquidity supported by the publicly listed common equity “ Despite the announced approximately $560 million special cash dividend, we expect the combined company’s capitalization will remain very strong and materially redundant to ’AA’ level after the deal closes and through 2017.” S&P Press Release, May 4, 2015 “ Successful execution of the PRE - AXIS combination could provide positive credit benefits relating to diversification of earnings and business profile , leveraging the benefits of a larger organization.” “…if the transaction with AXIS closes as planned, Fitch would likely affirm PRE’s current ratings… ” Fitch Press Release, May 4, 2015 x x

52 Board has Focused on Significant Uncertainties to Preferred Shareholders that a Sale to EXOR Presents Under a potential EXOR acquisition of PartnerRe, the credit considerations will include EXOR’s degree of influence over PartnerRe’s strategy, management, risk appetite, and dividend policy − With 100% ownership of PartnerRe, EXOR will have control of all key business and financial decisions Preferred shares would be a fundamentally different security if PartnerRe were owned by EXOR vs. merged with AXIS: − Wholly owned subsidiary of leveraged operating holding company with controlling stakes in FCA and CNH – non - investment grade industrial entities that are marginally profitable, capital intensive, cyclical − Industrial operations provide weak dividend income to parent company − FCA : reportedly seeking industry consolidation through merger with GM − Directly exposed to parent company decisions about corporate structure, management, dividend policy and enterprise risk profile which may be driven by factors extraneous to insurance markets Credit profile of EXOR parent company under pressure (S&P “Negative Outlook”) due to significant increase in leverage associated with potential PartnerRe acquisition Rating agencies will examine EXOR’s strategy for PartnerRe and the credibility of its assertions with regards to capital distributions over time “… there are instances where group affiliation may constrain the public rating of [a reinsurer] relative to its standalone level. For example, if the reinsurer is affiliated with weak or highly levered entities, such association usually, in turn, weakens the reinsurer . History has shown that capital often flows from stronger to weaker companies within a controlled group, and frequently, before regulatory action can occur.” Moody’s Rating Methodology: Global Reinsurers, October 13, 2014

53 Potential PartnerRe Sale to EXOR Expected to be Credit Negative Notwithstanding EXOR’s assertions, PartnerRe’s credit standing and ratings will be impacted by developments at EXOR and vice versa − Rating agency communications are clear on this point and are supported by rating methodologies for operating holding companies “On balance, we see [a successful EXOR bid] as credit negative since PartnerRe would miss out on an opportunity to strengthen its market position and improve its product diversification by gaining access to AXIS Capital’s profitable specialty primary insurance platform. In an increasingly competitive and tiered insurance marketplace, a PartnerRe - AXIS Capital combination would provide the scale and breadth of product offerings that are highly valued by brokers and clients .” “One critical wildcard related to EXOR’s bid for PartnerRe is how EXOR’s capital structure would evolve post - acquisition. EXOR’s debt would significantly increase through the use of up to $4.75 billion in bridge loans to finance the deal and the consolidation of PartnerRe’s debt.” Moody’s, Apr 20, 2015 “The negative outlook reflects our view that if the PartnerRe acquisition is completed, EXOR’s LTV may exceed our 20% threshold for the ratings . It also reflects our view that EXOR’s listed assets may fall below 60% of total assets, which we believe would not be commensurate with our current assessment of a ’satisfactory’ business risk profile .” “Additional investments in FCA or FNH Industrial N.V., EXOR’s largest assets, could also put pressure on the ratings. Increas ed operational and financial risk at FCA or CNH Industrial could also have negative implications for the ratings, in our view.” “We would likely revise [EXOR’s] outlook to stable if the [PartnerRe] acquisition does not close .” S&P, Apr 17, 2015

8 . Conclusion

55 Merger with AXIS: The Best Alternative in Challenging Times ▪ The reinsurance industry is undergoing changes that present great challenges but also great opportunities for companies that will successfully position themselves for that environment ─ For a pure - play reinsurer, this is not a time to realize value but rather a time to find new ways to create value ▪ PartnerRe’s Board has taken proactive steps to best position the company in this environment, including thoroughly evaluating and engaging with two potential counterparties prior to AXIS ▪ The MOE with AXIS represents the best possible response to the challenges and opportunities of the time ─ Creates a world - leading reinsurance and insurance company with a clear common vision and culture ─ Value creation through combined franchise strengths, significant capital efficiencies, highly achievable operational synergies and greater growth potential ▪ The low, uncertain and opportunistic offer from EXOR clearly demonstrates that there are no opportunities for a cash sale that would allow the PartnerRe shareholders to fully realize the value of their investment ─ No likely full - price strategic buyer at this time (from the insurance / reinsurance industry) for a pure - play reinsurance company of the size and quality of PartnerRe ─ A “NO” to the merger would deprive PartnerRe shareholders from the best opportunity available to them at this time ▪ In spite of the unnecessary rhetoric and personal attacks used by EXOR, the PartnerRe Board has evaluated and will continue to evaluate EXOR’s offers on their merits and would have no objection to a deal with EXOR should the offer evolve into a better value and risk proposition than the MOE

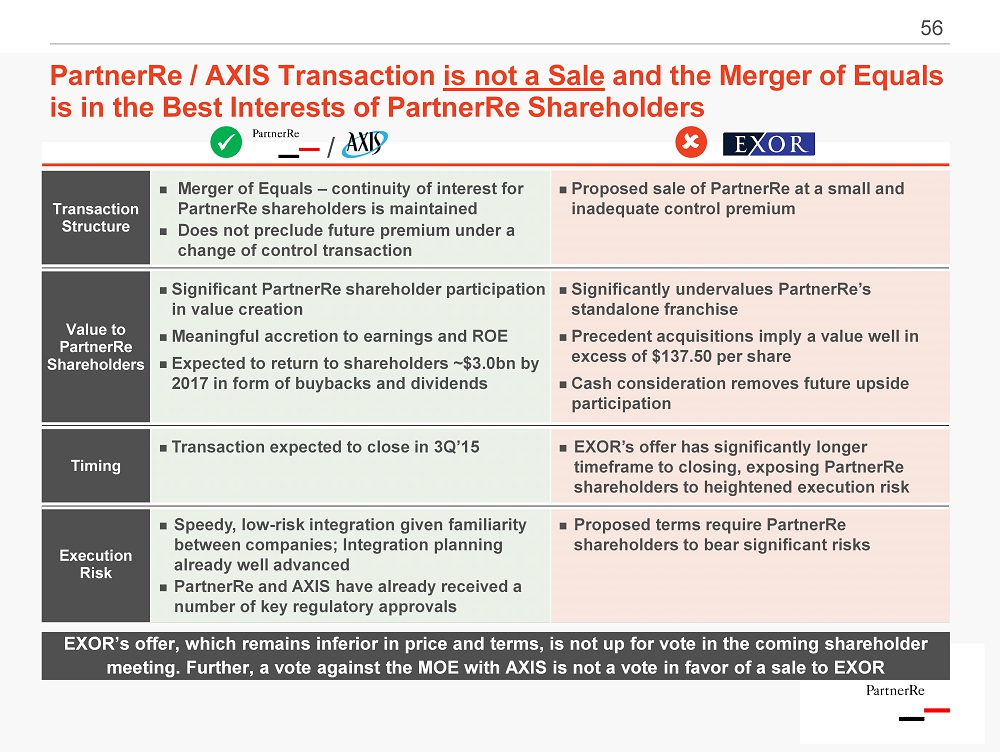

56 PartnerRe / AXIS Transaction is not a Sale and the Merger of Equals is in the Best I nterests of PartnerRe Shareholders Transaction Structure Value to PartnerRe Shareholders Timing Significantly undervalues PartnerRe’s standalone franchise Precedent acquisitions imply a value well in excess of $137.50 per share Cash consideration removes future upside participation EXOR’s offer has significantly longer timeframe to closing, exposing PartnerRe shareholders to heightened execution risk / Proposed sale of PartnerRe at a small and inadequate control premium Significant PartnerRe shareholder participation in value creation Meaningful accretion to earnings and ROE Expected to return to shareholders ~$3.0bn by 2017 in form of buybacks and dividends Transaction expected to close in 3Q’15 Merger of Equals – continuity of interest for PartnerRe shareholders is maintained Does not preclude future premium under a change of control transaction Execution Risk Proposed terms require PartnerRe shareholders to bear significant risks Speedy, low - risk integration given familiarity between companies; Integration planning already well advanced PartnerRe and AXIS have already received a number of key regulatory approvals x EXOR’s offer, which remains inferior in price and terms, is not up for vote in the coming shareholder meeting. Further, a vote against the MOE with AXIS is not a vote in favor of a sale to EXOR

Appendix A . Chronology of Events

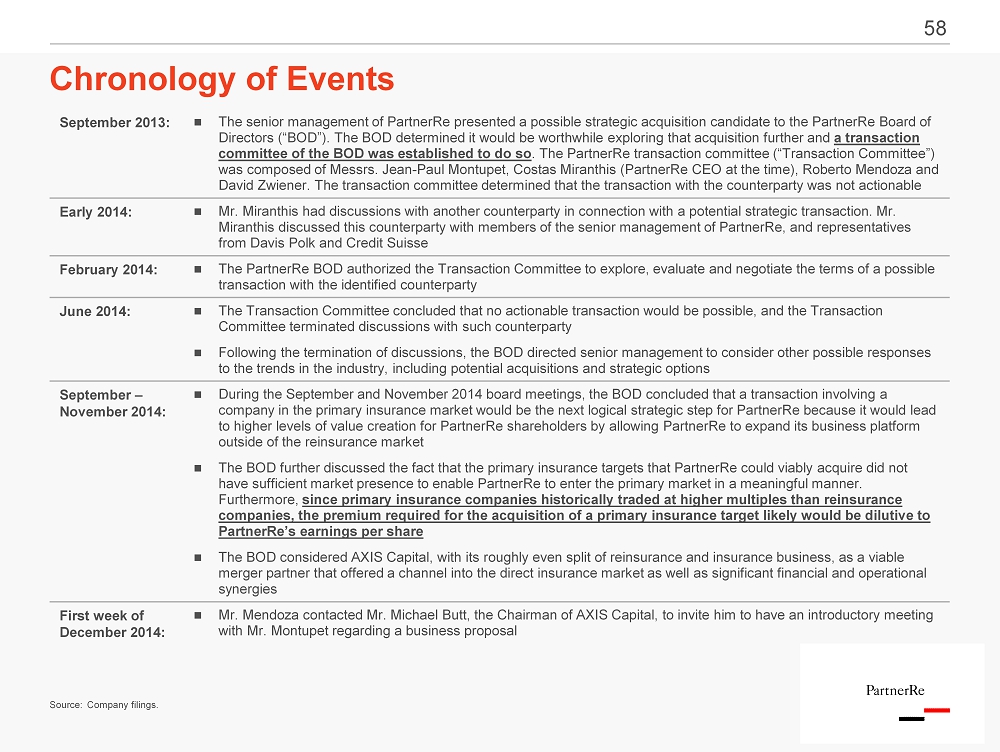

Chronology of E vents 58 Source : Company filings . September 2013: The senior management of PartnerRe presented a possible strategic acquisition candidate to the PartnerRe Board of Directors (“BOD”). The BOD determined it would be worthwhile exploring that acquisition further and a transaction committee of the BOD was established to do so . The PartnerRe transaction committee (“Transaction Committee”) was composed of Messrs. Jean - Paul Montupet , Costas Miranthis (PartnerRe CEO at the time), Roberto Mendoza and David Zwiener . The transaction committee determined that the transaction with the counterparty was not actionable Early 2014: Mr. Miranthis had discussions with another counterparty in connection with a potential strategic transaction. Mr. Miranthis discussed this counterparty with members of the senior management of PartnerRe, and representatives from Davis Polk and Credit Suisse February 2014: The PartnerRe BOD authorized the Transaction Committee to explore, evaluate and negotiate the terms of a possible transaction with the identified counterparty June 2014: The Transaction Committee concluded that no actionable transaction would be possible, and the Transaction Committee terminated discussions with such counterparty Following the termination of discussions, the BOD directed senior management to consider other possible responses to the trends in the industry, including potential acquisitions and strategic options September – November 2014: During the September and November 2014 board meetings, the BOD concluded that a transaction involving a company in the primary insurance market would be the next logical strategic step for PartnerRe because it would lead to higher levels of value creation for PartnerRe shareholders by allowing PartnerRe to expand its business platform outside of the reinsurance market The BOD further discussed the fact that the primary insurance targets that PartnerRe could viably acquire did not have sufficient market presence to enable PartnerRe to enter the primary market in a meaningful manner. Furthermore, since primary insurance companies historically traded at higher multiples than reinsurance companies, the premium required for the acquisition of a primary insurance target likely would be dilutive to PartnerRe’s earnings per share The BOD considered AXIS Capital, with its roughly even split of reinsurance and insurance business, as a viable merger partner that offered a channel into the direct insurance market as well as significant financial and operational synergies First week of December 2014: Mr. Mendoza contacted Mr. Michael Butt, the Chairman of AXIS Capital, to invite him to have an introductory meeting with Mr. Montupet regarding a business proposal

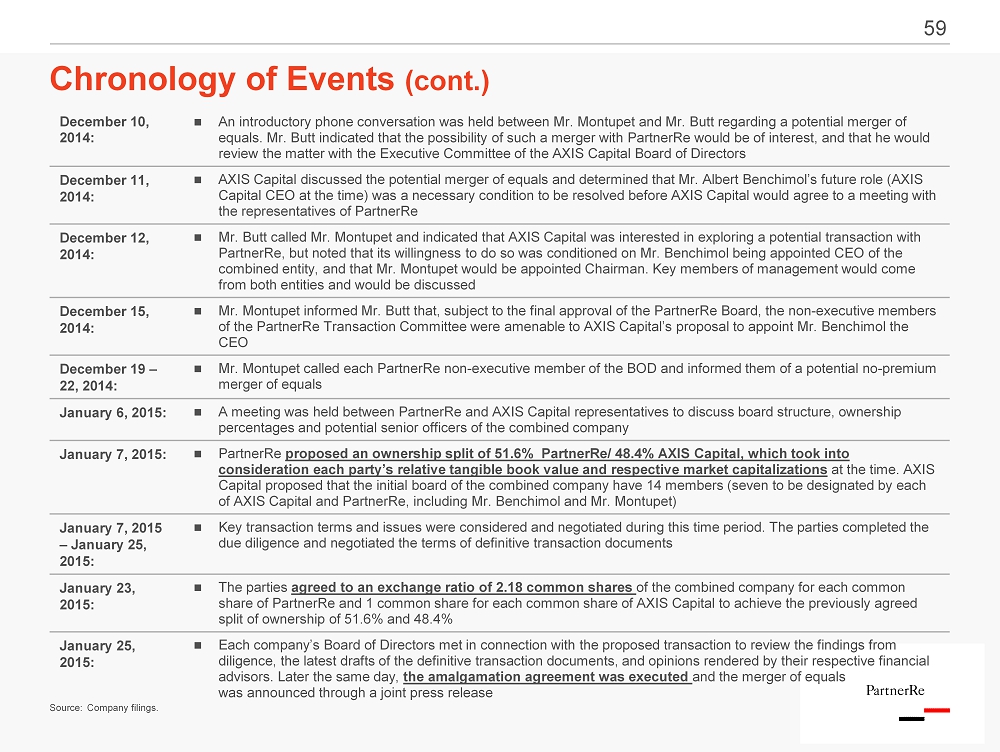

Chronology of Events (cont .) 59 Source : Company filings . December 10, 2014: An introductory phone conversation was held between Mr. Montupet and Mr. Butt regarding a potential merger of equals. Mr. Butt indicated that the possibility of such a merger with PartnerRe would be of interest, and that he would review the matter with the Executive Committee of the AXIS Capital Board of Directors December 11, 2014: AXIS Capital discussed the potential merger of equals and determined that Mr. Albert Benchimol’s future role (AXIS Capital CEO at the time) was a necessary condition to be resolved before AXIS Capital would agree to a meeting with the representatives of PartnerRe December 12, 2014: Mr. Butt called Mr. Montupet and indicated that AXIS Capital was interested in exploring a potential transaction with PartnerRe, but noted that its willingness to do so was conditioned on Mr. Benchimol being appointed CEO of the combined entity, and that Mr. Montupet would be appointed Chairman. Key members of management would come from both entities and would be discussed December 15, 2014: Mr. Montupet informed Mr. Butt that, subject to the final approval of the PartnerRe Board, the non - executive members of the PartnerRe Transaction Committee were amenable to AXIS Capital’s proposal to appoint Mr. Benchimol the CEO December 19 – 22, 2014: Mr. Montupet called each PartnerRe non - executive member of the BOD and informed them of a potential no - premium merger of equals January 6, 2015: A meeting was held between PartnerRe and AXIS Capital representatives to discuss board structure, ownership percentages and potential senior officers of the combined company January 7, 2015: PartnerRe proposed an ownership split of 51.6% PartnerRe/ 48.4% AXIS Capital, which took into consideration each party’s relative tangible book value and respective market capitalizations at the time. AXIS Capital proposed that the initial board of the combined company have 14 members (seven to be designated by each of AXIS Capital and PartnerRe, including Mr. Benchimol and Mr. Montupet ) January 7, 2015 – January 25, 2015: Key transaction terms and issues were considered and negotiated during this time period. The parties completed the due diligence and negotiated the terms of definitive transaction documents January 23, 2015: The parties agreed to an exchange ratio of 2.18 common shares of the combined company for each common share of PartnerRe and 1 common share for each common share of AXIS Capital to achieve the previously agreed split of ownership of 51.6% and 48.4% January 25, 2015: Each company’s Board of Directors met in connection with the proposed transaction to review the findings from diligence, the latest drafts of the definitive transaction documents, and opinions rendered by their respective financial advisors. Later the same day, the amalgamation agreement was executed and the merger of equals was announced through a joint press release

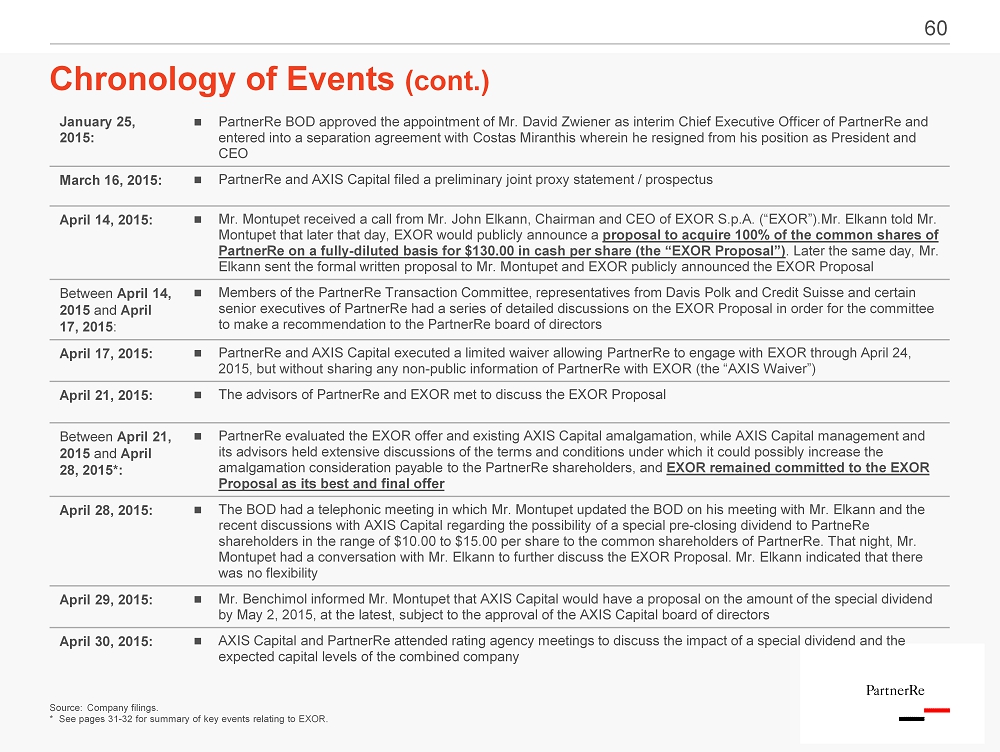

Chronology of Events (cont .) 60 January 25, 2015: PartnerRe BOD approved the appointment of Mr. David Zwiener as interim Chief Executive Officer of PartnerRe and entered into a separation agreement with Costas Miranthis wherein he resigned from his position as President and CEO March 16, 2015: PartnerRe and AXIS Capital filed a preliminary joint proxy statement / prospectus April 14, 2015: Mr. Montupet received a call from Mr. John Elkann , Chairman and CEO of EXOR S.p.A . (“EXOR”).Mr. Elkann told Mr. Montupet that later that day, EXOR would publicly announce a proposal to acquire 100% of the common shares of PartnerRe on a fully - diluted basis for $130.00 in cash per share (the “EXOR Proposal”) . Later the same day, Mr. Elkann sent the formal written proposal to Mr. Montupet and EXOR publicly announced the EXOR Proposal Between April 14, 2015 and April 17, 2015 : Members of the PartnerRe Transaction Committee, representatives from Davis Polk and Credit Suisse and certain senior executives of PartnerRe had a series of detailed discussions on the EXOR Proposal in order for the committee to make a recommendation to the PartnerRe board of directors April 17, 2015: PartnerRe and AXIS Capital executed a limited waiver allowing PartnerRe to engage with EXOR through April 24, 2015, but without sharing any non - public information of PartnerRe with EXOR (the “AXIS Waiver”) April 21, 2015: The advisors of PartnerRe and EXOR met to discuss the EXOR Proposal Between April 21, 2015 and April 28, 2015*: PartnerRe evaluated the EXOR offer and existing AXIS Capital amalgamation, while AXIS Capital management and its advisors held extensive discussions of the terms and conditions under which it could possibly increase the amalgamation consideration payable to the PartnerRe shareholders, and EXOR remained committed to the EXOR Proposal as its best and final offer April 28, 2015: The BOD had a telephonic meeting in which Mr. Montupet updated the BOD on his meeting with Mr. Elkann and the recent discussions with AXIS Capital regarding the possibility of a special pre - closing dividend to PartneRe shareholders in the range of $10.00 to $15.00 per share to the common shareholders of PartnerRe. That night, Mr. Montupet had a conversation with Mr. Elkann to further discuss the EXOR Proposal. Mr. Elkann indicated that there was no flexibility April 29, 2015: Mr. Benchimol informed Mr. Montupet that AXIS Capital would have a proposal on the amount of the special dividend by May 2, 2015, at the latest, subject to the approval of the AXIS Capital board of directors April 30, 2015: AXIS Capital and PartnerRe attended rating agency meetings to discuss the impact of a special dividend and the expected capital levels of the combined company Source : Company filings . * See pages 31 - 32 for summary of key events relating to EXOR.

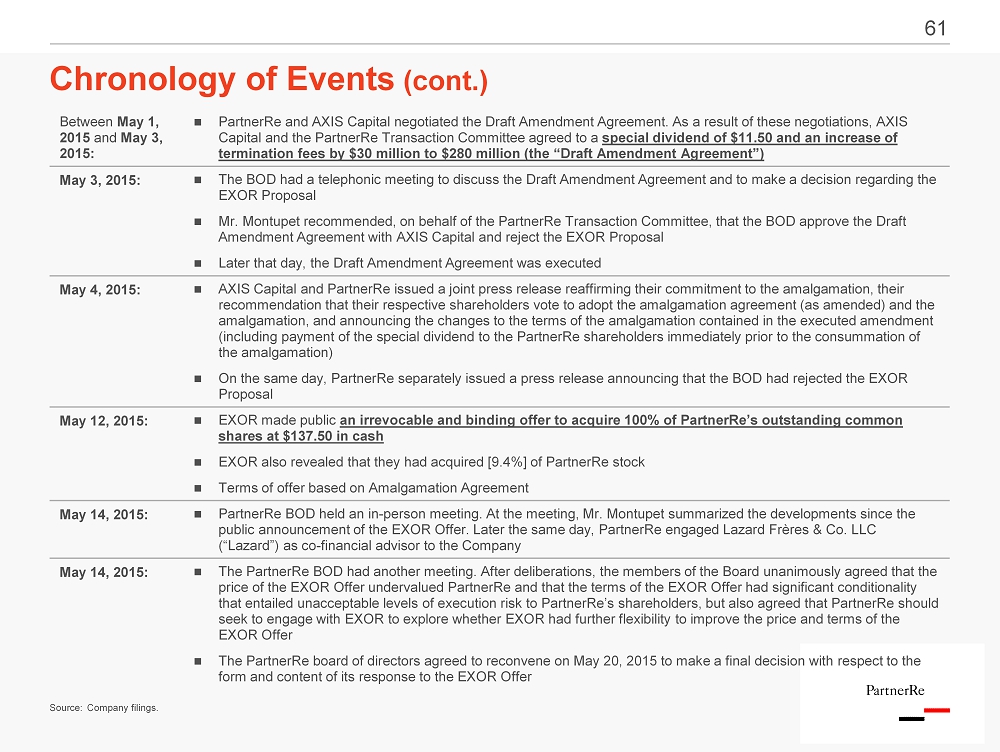

Chronology of Events ( cont.) 61 Between May 1, 2015 and May 3, 2015: PartnerRe and AXIS Capital negotiated the Draft Amendment Agreement. As a result of these negotiations, AXIS Capital and the PartnerRe Transaction Committee agreed to a special dividend of $11.50 and an increase of termination fees by $30 million to $280 million (the “Draft Amendment Agreement”) May 3, 2015: The BOD had a telephonic meeting to discuss the Draft Amendment Agreement and to make a decision regarding the EXOR Proposal Mr. Montupet recommended, on behalf of the PartnerRe Transaction Committee, that the BOD approve the Draft Amendment Agreement with AXIS Capital and reject the EXOR Proposal Later that day, the Draft Amendment Agreement was executed May 4, 2015: AXIS Capital and PartnerRe issued a joint press release reaffirming their commitment to the amalgamation, their recommendation that their respective shareholders vote to adopt the amalgamation agreement (as amended) and the amalgamation, and announcing the changes to the terms of the amalgamation contained in the executed amendment (including payment of the special dividend to the PartnerRe shareholders immediately prior to the consummation of the amalgamation) On the same day, PartnerRe separately issued a press release announcing that the BOD had rejected the EXOR Proposal May 12, 2015: EXOR made public an irrevocable and binding offer to acquire 100% of PartnerRe’s outstanding common shares at $137.50 in cash EXOR also revealed that they had acquired [9.4%] of PartnerRe stock Terms of offer based on Amalgamation Agreement May 14, 2015: PartnerRe BOD held an in - person meeting. At the meeting, Mr. Montupet summarized the developments since the public announcement of the EXOR Offer. Later the same day, PartnerRe engaged Lazard Frères & Co. LLC (“Lazard”) as co - financial advisor to the Company May 14, 2015: The PartnerRe BOD had another meeting. After deliberations, the members of the Board unanimously agreed that the price of the EXOR Offer undervalued PartnerRe and that the terms of the EXOR Offer had significant conditionality that entailed unacceptable levels of execution risk to PartnerRe’s shareholders, but also agreed that PartnerRe should seek to engage with EXOR to explore whether EXOR had further flexibility to improve the price and terms of the EXOR Offer The PartnerRe board of directors agreed to reconvene on May 20, 2015 to make a final decision with respect to the form and content of its response to the EXOR Offer Source : Company filings .