UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21284

AllianzGI Convertible & Income Fund

(Exact name of registrant as specified in charter)

| | |

| 1633 Broadway, New York, NY | | 10019 |

| (Address of principal executive offices) | | (Zip code) |

Lawrence G. Altadonna – 1633 Broadway, New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: February 28, 2014

Date of reporting period: August 31, 2014

Item 1. Report to Shareholders

AllianzGI Convertible & Income Fund

AllianzGI Convertible & Income Fund II

Semi-Annual Report

August 31, 2014

Table of Contents

Letter from Chairman of the Board &

President

Hans W. Kertess

Chairman

Julian Sluyters

President & CEO

Dear Shareholder:

The US economy continued to expand during the fiscal six-month reporting period ended August 31, 2014, and both stocks and bonds posted strong returns.

Six Months in Review through August 31, 2014

| n | | AllianzGI Convertible & Income Fund returned 3.72% on net asset value (“NAV”) and 4.23% on market price. |

| n | | AllianzGI Convertible & Income Fund II returned 4.02% on NAV and 4.24% on market price. |

In comparison, the Standard & Poor’s (“S&P”) 500 Index, an unmanaged index generally representative of the US stock market, rose 8.84% and the BofA Merrill Lynch High Yield Master II Index, an unmanaged index generally representative of the high yield bond market, gained 2.97% during the six-month reporting period. Convertible securities, which share characteristics of both stocks and bonds, rose. The BofA Merrill Lynch All Convertibles Index, an unmanaged index generally representative of the convertible securities market, advanced 4.78% for the period.

After several years of positive growth, severe winter weather in parts of the country appeared to be a headwind for the US economy in early 2014. Looking back, gross domestic product (“GDP”), the value of goods and services produced in the country, the broadest measure of economic activity and the principal indicator of economic performance, contracted at an annual pace of 2.1% during the first quarter of 2014 but then expanded at a 4.6% annual pace during the second quarter of 2014.

The US Federal Reserve (the “Fed”) maintained an accommodative monetary policy during the reporting period. The reduction of the Fed’s monthly asset purchase program continued through the reporting period and markets continued to scrutinize Fed Statements related to when interest rates would begin to rise. In July, the Fed repeated it would not raise rates in the near future, saying that it “likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends, especially if projected inflation continues to run below the Committee’s 2 percent longer-run goal, and provided that longer-term inflation expectations remain well anchored.”

| | | | |

| 2 | | Semi-Annual Report | | | August 31, 2014 |

Outlook

The US economy has been resilient and appears to have overcome the headwinds associated with severe winter weather. We continue to expect US economic growth will be above-trend in 2014 due, in part, to the fact that fiscal policy will be less of a drag than it was last year. While we wouldn’t be surprised if rate hikes begin a bit sooner than expected, we think the Fed’s tightening cycle will progress at a thoughtful pace. That

Receive this report electronically and eliminate paper mailings.

To enroll, visit:

us.allianzgi.com/edelivery.

pace will be dictated by macro conditions and, in our view, ultimately settle at a lower rate than the accustomed target set by the Fed in recent years.

For specific information on the Funds and their performance, please refer to the following pages. If you have any questions regarding the information provided, we encourage you to contact your financial advisor or call the Funds’ shareholder servicing agent at (800) 254-5197. In addition, a wide range of information and resources is available on our website, us.allianzgi.com/closedendfunds.

Together with Allianz Global Investors Fund Management LLC, the Funds’ investment manager, and Allianz Global Investors U.S. LLC, the Funds’ sub-adviser, we thank you for investing with us.

We remain dedicated to serving your investment needs.

Sincerely,

| | |

| |  |

| Hans W. Kertess | | Julian Sluyters |

| Chairman of the Board of Trustees | | President & Chief Executive Officer |

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 3 | |

Fund Insights

AllianzGI Convertible & Income Funds

August 31, 2014 (unaudited)

For the period of March 1, 2014, through August 31, 2014, as provided by Doug Forsyth, CFA, Portfolio Manager.

For the fiscal six-month period ended August 31, 2014, AllianzGI Convertible & Income Fund and AllianzGI Convertible & Income Fund II (the “Funds”) returned 3.72% and 4.02% on net asset value (“NAV”) and 4.23% and 4.24% on market price, respectively.

Market Environment

Convertible and high-yield bond markets moved higher over the reporting period. Both asset classes benefited from higher equity prices, credit spread tightening and overall credit market strength.

With credit risk continuing to be minimal, the external factors that had the greatest identifiable influence on the market’s psychology and direction during the period included economic data points and corporate profits, Treasury rates, geopolitical uncertainty and the Fed outlook.

The first external factor that influenced the markets was economic statistics and corporate profits. Most looked past the final GDP number for the first quarter and viewed the data as an anomaly. This was due to the upward trajectory of second quarter economic statistics. The improving data points were welcome, but also led to increased investor concern that the Fed may tighten up sooner than expected. With respect to corporate profits, the majority of companies continued to meet or exceed expectations.

The convertible and high-yield markets were influenced by a decline in Treasury yields. Historically, convertible bonds and high yield bonds have had a low or even negative

correlation with Treasury bonds. However, some parts of the convertible market (the bond-like or busted convertibles) are correlated with Treasuries. In addition, within the high-yield universe, BB rated issuers are far more correlated with Treasuries today compared with previous cycles. This combination of higher correlation and the unexpected decline in Treasury yields had a positive influence on these markets.

In terms of geopolitical uncertainty the focus shifted from Russia and Ukraine, to Iraq. The added day-to-day volatility did not help the markets, but the concerns added to a flight-to-quality bid for the Treasury market.

Finally, global central banks remained generally accommodative and Janet Yellen maintained a dovish stance. This position has aided not only the renewed interest in buying Treasury bonds, but also reduced market volatility. Credit markets responded positively to these observations.

Against this backdrop, share buyback and dividend announcements were prevalent, M&A activity was elevated and the IPO market was robust. These trends confirmed a healthy corporate earnings environment.

Portfolio Specifics

The Funds rallied with the market in the reporting period. The attribution for the period included several positive single-name performers from a variety of sectors. The majority of the Funds’ issuers exceeded earnings expectations, which helped contribute to performance.

In the convertibles sleeve, sector allocations which benefitted performance in the period relative to the convertibles universe were

| | | | |

| 4 | | Semi-Annual Report | | | August 31, 2014 |

Utilities, Energy and Financials. The Funds benefited from an overweight and stronger issue-specific performance in the Utilities and Energy sectors. In Financials, an overweight was a detractor, but relative outperformance more than offset the impact. Conversely, sector allocations that hindered relative performance in the reporting period were Technology, Materials and Telecom. An underweight and negative security selection in Technology and Telecom hampered returns. The Funds’ holdings in the Materials sector lagged their peers and adversely impacted performance.

In the high yield bond sleeve, industry allocations which benefitted performance in

the period relative to the high yield universe were Publishing/Printing, Metals/Mining and Steel. The Funds benefited from an overweight and stronger issue-specific performance in the Publishing/Printing and Steel industries. In Metals/Mining, an underweight and positive security selection was a source of strength. In contrast, industry allocations that hindered relative performance during the period were Gaming, Utilities and Energy. Negative security selection and a lower-than-benchmark weight in Energy held back the Funds. In Gaming, both an overweight to the lagging industry, and weaker issuer-specific returns negatively impacted relative performance. Having no exposure to Utilities was a detractor.

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 5 | |

Performance & Statistics

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited)

| | | | | | | | |

| Total Return(1): | | Market Price | | | NAV | |

Six Month | | | 4.23% | | | | 3.72% | |

1 Year | | | 22.12% | | | | 16.22% | |

5 Year | | | 18.28% | | | | 17.37% | |

10 Year | | | 8.82% | | | | 8.46% | |

Commencement of Operations (3/31/03) to 8/31/14 | | | 9.62% | | | | 9.51% | |

| | |

| Market Price/NAV Performance: | | |

Commencement of Operations (3/31/03) to 8/31/14

| | | | |

| Market Price/NAV: | | | |

Market Price | | | $10.06 | |

NAV | | | $9.29 | |

Premium to NAV | | | 8.29% | |

Market Price Yield(2) | | | 10.74% | |

Leverage(3) | | | 30.54% | |

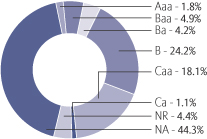

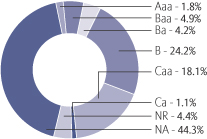

Moody’s Ratings*

(as a % of total investments)

| | | | |

| 6 | | Semi-Annual Report | | | August 31, 2014 |

Performance & Statistics

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited)

| | | | | | | | |

| Total Return(1): | | Market Price | | | NAV | |

Six Month | | | 4.24% | | | | 4.02% | |

1 Year | | | 24.95% | | | | 16.03% | |

5 Year | | | 19.23% | | | | 17.48% | |

10 Year | | | 8.81% | | | | 7.85% | |

Commencement of Operations (7/31/03) to 8/31/14 | | | 8.82% | | | | 8.18% | |

| | |

| Market Price/NAV Performance: | | |

Commencement of Operations (7/31/03) to 8/31/14

| | | | |

| Market Price/NAV: | | | |

Market Price | | | $9.58 | |

NAV | | | $8.34 | |

Premium to NAV | | | 14.87% | |

Market Price Yield(2) | | | 10.65% | |

Leverage(3) | | | 30.80% | |

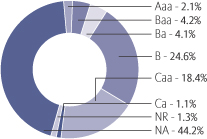

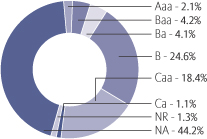

Moody’s Ratings*

(as a % of total investments)

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 7 | |

Performance & Statistics

AllianzGI Convertible & Income Funds

August 31, 2014 (unaudited)

* Bond ratings apply to the underlying holdings of the Funds and not the Funds themselves and are divided into categories ranging from highest to lowest credit quality, determined for purposes of this presentation by using ratings provided by Moody’s Investors Service, Inc. (“Moody’s”). The Funds use ratings provided by Moody’s for this purpose, among other reasons, because of the access to background information and other materials provided by Moody’s, as well as the Funds’ consideration of industry practice. When a bond is not rated by Moody’s, it is designated in the chart above as “NR” for not rated. Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change periodically, even as frequently as daily. Ratings assigned by Moody’s or another rating agency are not absolute standards of credit quality and do not evaluate market risk. Rating agencies may fail to make timely changes in credit ratings, and an issuer’s current financial condition may be better or worse than a rating indicates. In formulating investment decisions for the Funds, Allianz Global Investors U.S. LLC, the sub-adviser to the Funds, develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agencies or third-party research.

(1) Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return. Total return for a period of less than one year is not annualized.

Performance at market price will differ from results at NAV. Although market price returns typically reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about each Fund, market conditions, supply and demand for each Fund ‘s shares, or changes in each Fund’s dividends.

An investment in each Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets attributable to common shareholders less total liabilities divided by the number of common shares outstanding. Holdings are subject to change daily.

(2) Market Price Yield is determined by dividing the annualized current monthly dividend per common share (comprised of net investment income) by the market price per common share at August 31, 2014.

(3) Represents Preferred Shares (“Leverage”) outstanding, as a percentage of total managed assets. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

| | | | |

| 8 | | Semi-Annual Report | | | August 31, 2014 |

Schedule of Investments

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | Corporate Bonds & Notes – 41.4% | | | | | | |

| | | | Advertising – 0.5% | | | | | | |

| | $5,650 | | | Affinion Group, Inc., 7.875%, 12/15/18 | | | | | $5,190,937 | |

| | | | Aerospace & Defense – 0.5% | | | | | | |

| | 250 | | | Bombardier, Inc., 6.00%, 10/15/22 (a)(b) | | | | | 254,688 | |

| | 5,570 | | | Erickson, Inc., 8.25%, 5/1/20 | | | | | 5,556,075 | |

| | | | | | | | | | 5,810,763 | |

| | | | Auto Components – 0.9% | | | | | | |

| | 4,180 | | | Chassix, Inc., 9.25%, 8/1/18 (a)(b) | | | | | 4,347,200 | |

| | 5,280 | | | Goodyear Tire & Rubber Co., 8.25%, 8/15/20 | | | | | 5,768,400 | |

| | | | | | | | | | 10,115,600 | |

| | | | Auto Manufacturers – 0.7% | | | | | | |

| | 7,410 | | | Chrysler Group LLC, 8.25%, 6/15/21 | | | | | 8,317,725 | |

| | | | Commercial Services – 2.6% | | | | | | |

| | 4,000 | | | Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 9.75%, 3/15/20 | | | | | 4,500,000 | |

| | 11,500 | | | Cenveo Corp., 11.50%, 5/15/17 | | | | | 12,103,750 | |

| | 5,705 | | | DynCorp International, Inc., 10.375%, 7/1/17 | | | | | 5,434,012 | |

| | 7,375 | | | Monitronics International, Inc., 9.125%, 4/1/20 | | | | | 7,928,125 | |

| | | | | | | | | | 29,965,887 | |

| | | | Commercial Services & Supplies – 0.5% | | | | | | |

| | 5,645 | | | United Rentals North America, Inc., 8.375%, 9/15/20 | | | | | 6,181,275 | |

| | | | Construction Materials – 0.6% | | | | | | |

| | 6,810 | | | US Concrete, Inc., 8.50%, 12/1/18 | | | | | 7,388,850 | |

| | | | Consumer Finance – 0.8% | | | | | | |

| | 3,210 | | | Navient LLC, 8.45%, 6/15/18 | | | | | 3,743,502 | |

| | 4,935 | | | Springleaf Finance Corp., 8.25%, 10/1/23 | | | | | 5,736,938 | |

| | | | | | | | | | 9,480,440 | |

| | | | Distribution/Wholesale – 0.8% | | | | | | |

| | 8,170 | | | HD Supply, Inc., 11.00%, 4/15/20 | | | | | 9,497,625 | |

| | | | Diversified Consumer Services – 0.6% | | | | | | |

| | 6,815 | | | Cambium Learning Group, Inc., 9.75%, 2/15/17 | | | | | 6,917,225 | |

| | | | Diversified Financial Services – 2.0% | | | | | | |

| | 8,395 | | | Affinion Investments LLC, 13.50%, 8/15/18 (a)(b) | | | | | 8,331,640 | |

| | | | Community Choice Financial, Inc., | | | | | | |

| | 10,085 | | | 10.75%, 5/1/19 | | | | | 8,320,125 | |

| | 7,130 | | | 12.75%, 5/1/20 (a)(b) | | | | | 6,007,025 | |

| | | | | | | | | | 22,658,790 | |

| | | | Diversified Telecommunications – 0.5% | | | | | | |

| | 4,923 | | | Cincinnati Bell, Inc., 8.75%, 3/15/18 | | | | | 5,162,996 | |

| | | | Electrical Components & Equipment – 1.2% | | | | | | |

| | 13,585 | | | WireCo WorldGroup, Inc., 9.50%, 5/15/17 | | | | | 13,958,588 | |

| | | | Electronic Equipment, Instruments & Components – 1.4% | | | | | | |

| | 7,725 | | | Kemet Corp., 10.50%, 5/1/18 | | | | | 8,149,875 | |

| | 7,500 | | | Viasystems, Inc., 7.875%, 5/1/19 (a)(b) | | | | | 7,800,000 | |

| | | | | | | | | | 15,949,875 | |

| | | | Energy Equipment & Services – 0.6% | | | | | | |

| | 2,830 | | | Hercules Offshore, Inc., 8.75%, 7/15/21 (a)(b) | | | | | 2,872,450 | |

| | 3,749 | | | Pioneer Drilling Co., 9.875%, 3/15/18 | | | | | 3,946,010 | |

| | | | | | | | | | 6,818,460 | |

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 9 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Food & Staples Retailing – 0.9% | | | | | | |

| | $5,000 | | | Rite Aid Corp., 10.25%, 10/15/19 | | | | | $5,306,250 | |

| | 5,000 | | | US Foods, Inc., 8.50%, 6/30/19 | | | | | 5,335,000 | |

| | | | | | | | | | 10,641,250 | |

| | | | Health Care Providers & Services – 0.8% | | | | | | |

| | 8,875 | | | ExamWorks Group, Inc., 9.00%, 7/15/19 | | | | | 9,629,375 | |

| | | | Healthcare-Products – 0.9% | | | | | | |

| | 8,885 | | | Kinetic Concepts, Inc./KCI USA, Inc., 10.50%, 11/1/18 | | | | | 9,940,094 | |

| | | | Hotels, Restaurants & Leisure – 1.8% | | | | | | |

| | 9,120 | | | DineEquity, Inc., 9.50%, 10/30/18 | | | | | 9,704,592 | |

| | 8,405 | | | MGM Resorts International, 11.375%, 3/1/18 | | | | | 10,653,338 | |

| | | | | | | | | | 20,357,930 | |

| | | | Household Durables – 1.1% | | | | | | |

| | | | Beazer Homes USA, Inc., | | | | | | |

| | 2,945 | | | 7.25%, 2/1/23 | | | | | 3,040,713 | |

| | 5,045 | | | 9.125%, 5/15/19 | | | | | 5,354,006 | |

| | 3,950 | | | Jarden Corp., 7.50%, 5/1/17 | | | | | 4,428,937 | |

| | | | | | | | | | 12,823,656 | |

| | | | Household Products/Wares – 0.7% | | | | | | |

| | 7,610 | | | Reynolds Group Issuer, Inc., 9.875%, 8/15/19 | | | | | 8,475,638 | |

| | | | Internet Software & Services – 1.2% | | | | | | |

| | | | EarthLink, Inc., | | | | | | |

| | 2,800 | | | 7.375%, 6/1/20 | | | | | 2,961,000 | |

| | 10,060 | | | 8.875%, 5/15/19 | | | | | 10,336,650 | |

| | | | | | | | | | 13,297,650 | |

| | | | Iron/Steel – 0.7% | | | | | | |

| | 7,305 | | | AK Steel Corp., 8.375%, 4/1/22 | | | | | 7,743,300 | |

| | | | Leisure Time – 0.8% | | | | | | |

| | 8,855 | | | Travelport LLC, 11.875%, 9/1/16 | | | | | 8,888,206 | |

| | | | Lodging – 0.3% | | | | | | |

| | 12,385 | | | Caesars Entertainment Operating Co., Inc., 12.75%, 4/15/18 | | | | | 3,529,725 | |

| | | | Machinery – 0.6% | | | | | | |

| | 6,755 | | | Navistar International Corp., 8.25%, 11/1/21 | | | | | 7,033,644 | |

| | | | Media – 2.8% | | | | | | |

| | 5,500 | | | AMC Entertainment, Inc., 9.75%, 12/1/20 | | | | | 6,201,250 | |

| | 8,355 | | | McClatchy Co., 9.00%, 12/15/22 | | | | | 9,441,150 | |

| | | | McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance, | | | | | | |

| | 8,220 | | | 9.75%, 4/1/21 | | | | | 9,329,700 | |

| | 3,745 | | | Mood Media Corp., 9.25%, 10/15/20 (a)(b) | | | | | 3,276,875 | |

| | 3,871 | | | SFX Entertainment, Inc., 9.625%, 2/1/19 (a)(b) | | | | | 3,967,775 | |

| | | | | | | | | | 32,216,750 | |

| | | | Metals & Mining – 1.7% | | | | | | |

| | 6,590 | | | ArcelorMittal, 10.35%, 6/1/19 | | | | | 8,328,112 | |

| | | | Thompson Creek Metals Co., Inc., | | | | | | |

| | 8,295 | | | 7.375%, 6/1/18 | | | | | 8,336,475 | |

| | 2,830 | | | 12.50%, 5/1/19 | | | | | 3,212,050 | |

| | | | | | | | | | 19,876,637 | |

| | | | |

| 10 | | Semi-Annual Report | | | August 31, 2014 |

Schedule of Investments

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Miscellaneous Manufacturing – 0.5% | | | | | | |

| | $5,100 | | | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (a)(b) | | | | | $5,310,375 | |

| | | | Oil & Gas – 1.4% | | | | | | |

| | 9,050 | | | Energy XXI Gulf Coast, Inc., 9.25%, 12/15/17 | | | | | 9,638,250 | |

| | 6,038 | | | United Refining Co., 10.50%, 2/28/18 | | | | | 6,551,230 | |

| | | | | | | | | | 16,189,480 | |

| | | | Oil, Gas & Consumable Fuels – 1.9% | | | | | | |

| | 2,840 | | | Arch Coal, Inc., 9.875%, 6/15/19 | | | | | 2,314,600 | |

| | 9,890 | | | Endeavour International Corp., 12.00%, 3/1/18 | | | | | 9,049,350 | |

| | 5,050 | | | EP Energy LLC/Everest Acquisition Finance, Inc., 9.375%, 5/1/20 | | | | | 5,719,125 | |

| | 4,500 | | | Laredo Petroleum, Inc., 9.50%, 2/15/19 | | | | | 4,860,000 | |

| | | | | | | | | | 21,943,075 | |

| | | | Packaging & Containers – 0.6% | | | | | | |

| | 6,692 | | | Tekni-Plex, Inc., 9.75%, 6/1/19 (a)(b) | | | | | 7,377,930 | |

| | | | Paper & Forest Products – 0.3% | | | | | | |

| | 3,000 | | | Louisiana-Pacific Corp., 7.50%, 6/1/20 | | | | | 3,285,000 | |

| | | | Retail – 1.4% | | | | | | |

| | 9,465 | | | Neiman Marcus Group LTD LLC, 8.00%, 10/15/21 (a)(b) | | | | | 10,257,694 | |

| | 6,110 | | | Toys “R” Us, Inc., 10.375%, 8/15/17 | | | | | 5,361,525 | |

| | | | | | | | | | 15,619,219 | |

| | | | Semiconductors & Semiconductor Equipment – 0.7% | | | | | | |

| | 7,160 | | | Freescale Semiconductor, Inc., 10.75%, 8/1/20 | | | | | 8,072,900 | |

| | | | Software – 1.7% | | | | | | |

| | | | First Data Corp., | | | | | | |

| | 5,645 | | | 8.25%, 1/15/21 (a)(b) | | | | | 6,181,275 | |

| | 1,834 | | | 10.625%, 6/15/21 | | | | | 2,136,610 | |

| | 9,045 | | | 12.625%, 1/15/21 | | | | | 11,080,125 | |

| | | | | | | | | | 19,398,010 | |

| | | | Specialty Retail – 1.1% | | | | | | |

| | 4,160 | | | Brown Shoe Co., Inc., 7.125%, 5/15/19 | | | | | 4,399,200 | |

| | 3,500 | | | Claire’s Stores, Inc., 9.00%, 3/15/19 (a)(b) | | | | | 3,666,250 | |

| | 5,000 | | | Conn’s, Inc., 7.25%, 7/15/22 (a)(b) | | | | | 4,850,000 | |

| | | | | | | | | | 12,915,450 | |

| | | | Telecommunications – 1.0% | | | | | | |

| | 7,415 | | | Consolidated Communications Finance Co., 10.875%, 6/1/20 | | | | | 8,592,131 | |

| | 4,520 | | | NII International Telecom SCA, 11.375%, 8/15/19 (a)(b) | | | | | 3,028,400 | |

| | | | | | | | | | 11,620,531 | |

| | | | Transportation – 1.5% | | | | | | |

| | 7,239 | | | Quality Distribution LLC, 9.875%, 11/1/18 | | | | | 7,709,535 | |

| | 8,610 | | | Swift Services Holdings, Inc., 10.00%, 11/15/18 | | | | | 9,212,700 | |

| | | | | | | | | | 16,922,235 | |

| | | | Wireless Telecommunication Services – 0.8% | | | | | | |

| | 7,205 | | | Sprint Communications, Inc., 11.50%, 11/15/21 | | | | | 9,438,550 | |

| | Total Corporate Bonds & Notes (cost-$468,264,750) | | | | | 475,961,646 | |

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 11 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

| Shares | | | | | | | Value | |

| | Convertible Preferred Stock – 39.3% | | | | |

| | | | Aerospace & Defense – 1.3% | | | | | | |

| | 239,625 | | | United Technologies Corp., 7.50%, 8/1/15 | | | | | $14,391,878 | |

| | | | Airlines – 1.6% | | | | | | |

| | 361,355 | | | Continental Airlines Finance Trust II, 6.00%, 11/15/30 | | | | | 18,135,504 | |

| | | | Automobiles – 1.4% | | | | | | |

| | 495,375 | | | The Goldman Sachs Group, Inc., 8.50%, 12/16/14 (General Motors) (c) | | | | | 16,536,113 | |

| | | | Commercial Banks – 4.2% | | | | | | |

| | 9,695 | | | Huntington Bancshares, Inc., 8.50% (d) | | | | | 13,088,250 | |

| | 364,075 | | | The Goldman Sachs Group, Inc., 8.00%, 1/14/15 (Citigroup Inc.) (c) | | | | | 17,627,419 | |

| | 13,990 | | | Wells Fargo & Co., 7.50%, Ser. L (d) | | | | | 17,011,421 | |

| | | | | | | | | | 47,727,090 | |

| | | | Diversified Financial Services – 1.4% | | | | | | |

| | 13,790 | | | Bank of America Corp., 7.25%, Ser. L (d) | | | | | 16,148,090 | |

| | | | Diversified Telecommunication Services – 0.1% | | | | | | |

| | 25,335 | | | Intelsat SA, 5.75%, 5/1/16 | | | | | 1,214,813 | |

| | | | Electric Utilities – 1.8% | | | | | | |

| | 85,390 | | | Exelon Corp., 6.50%, 6/1/17 | | | | | 4,312,195 | |

| | 301,500 | | | NextEra Energy, Inc., 5.799%, 9/1/16 | | | | | 16,612,650 | |

| | | | | | | | | | 20,924,845 | |

| | | | Energy Equipment & Services – 1.7% | | | | | | |

| | 313,380 | | | Credit Suisse, 8.00%, 3/5/15 (Baker Hughes) (c) | | | | | 19,977,975 | |

| | | | Food Products – 0.2% | | | | | | |

| | 47,905 | | | Tyson Foods, Inc., 4.75%, 7/15/17 | | | | | 2,406,268 | |

| | | | Health Care Equipment & Supplies – 1.5% | | | | | | |

| | 273,890 | | | Credit Suisse AG, 8.00%, 6/23/15 (Medtronic, Inc.) (c) | | | | | 17,181,120 | |

| | | | Health Care Providers & Services – 1.8% | | | | | | |

| | 339,700 | | | JPMorgan Chase & Co., 8.00%, 5/5/15 (HCA Holdings, Inc.) (c) | | | | | 20,633,378 | |

| | | | Household Durables – 1.7% | | | | | | |

| | 171,185 | | | Stanley Black & Decker, Inc., 6.25%, 11/17/16 | | | | | 19,891,697 | |

| | | | Insurance – 0.5% | | | | | | |

| | 194,050 | | | MetLife, Inc., 5.00%, 10/8/14 | | | | | 6,087,348 | |

| | | | Metals & Mining – 2.2% | | | | | | |

| | 690,240 | | | ArcelorMittal, 6.00%, 1/15/16 | | | | | 15,659,820 | |

| | 662,000 | | | Cliffs Natural Resources, Inc., 7.00%, 2/1/16 | | | | | 9,910,140 | |

| | | | | | | | | | 25,569,960 | |

| | | | Multiline Retail – 1.6% | | | | | | |

| | 317,620 | | | The Goldman Sachs Group, Inc., 8.00%, 1/12/15 (Macy’s) (c) | | | | | 17,962,999 | |

| | | | Multi-Utilities – 1.6% | | | | | | |

| | 239,645 | | | AES Trust III, 6.75%, 10/15/29 | | | | | 12,217,102 | |

| | 128,500 | | | Dominion Resources, Inc., 6.375%, 7/1/17 | | | | | 6,531,655 | |

| | | | | | | | | | 18,748,757 | |

| | | | Oil, Gas & Consumable Fuels – 2.4% | | | | | | |

| | 191,170 | | | Credit Suisse, 8.00%, 3/5/15 (Occidental Petroleum Corp.) (c) | | | | | 18,551,137 | |

| | 14,100 | | | Energy XXI Bermuda Ltd., 5.625%, (d) | | | | | 3,309,094 | |

| | 124,235 | | | PetroQuest Energy, Inc., 6.875%, (d) | | | | | 5,683,751 | |

| | | | | | | | | | 27,543,982 | |

| | | | |

| 12 | | Semi-Annual Report | | | August 31, 2014 |

Schedule of Investments

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

| Shares | | | | | | | Value | |

| | | | Pharmaceuticals – 3.0% | | | | | | |

| | 143,430 | | | Bank of America Corp., 8.00%, 2/10/15 (Allergan, Inc.) (c) | | | | | $19,416,119 | |

| | 333,295 | | | JPMorgan Chase & Co., 8.00%, 4/30/15 (Mylan, Inc.) (c) | | | | | 15,314,905 | |

| | | | | | | | | | 34,731,024 | |

| | | | Real Estate Investment Trust – 4.2% | | | | | | |

| | 439,700 | | | Alexandria Real Estate Equities, Inc., 7.00%, (d) | | | | | 12,175,293 | |

| | 798,310 | | | FelCor Lodging Trust, Inc., 1.95%, Ser. A (d) | | | | | 20,157,327 | |

| | 208,680 | | | Health Care REIT, Inc., 6.50%, 4/20/18, Ser. I (d) | | | | | 12,712,786 | |

| | 56,930 | | | Weyerhaeuser Co., 6.375%, 7/1/16 | | | | | 3,288,277 | |

| | | | | | | | | | 48,333,683 | |

| | | | Semiconductors & Semiconductor Equipment – 1.5% | | | | | | |

| | 530,000 | | | Wells Fargo & Co., 8.00%, 6/18/15 (Micron Technology, Inc.) (c) | | | | | 16,859,300 | |

| | | | Specialty Retail – 2.0% | | | | | | |

| | 16,000 | | | Barnes & Noble, Inc., 7.75%, 8/18/21 (a) | | | | | 23,107,000 | |

| | | | Technology Hardware, Storage & Peripherals – 1.6% | | | | | | |

| | 27,900 | | | Bank of America Corp., 8.00%, 5/12/15 (Apple, Inc.) (c) | | | | | 18,434,367 | |

| | Total Convertible Preferred Stock (cost-$419,024,151) | | | | | 452,547,191 | |

| | | |

Principal

Amount

(000s) | | | | | | | | |

| | Convertible Bonds & Notes – 17.5% | | | | |

| | | | Biotechnology – 0.3% | | | | | | |

| | $5,385 | | | Dendreon Corp., 2.875%, 1/15/16 | | | | | 3,782,962 | |

| | | | Capital Markets – 2.6% | | | | | | |

| | 7,740 | | | Ares Capital Corp., 5.75%, 2/1/16 | | | | | 8,214,075 | |

| | 13,195 | | | BGC Partners, Inc., 4.50%, 7/15/16 | | | | | 13,994,947 | |

| | 8,460 | | | Walter Investment Management Corp., 4.50%, 11/1/19 | | | | | 7,603,425 | |

| | | | | | | | | | 29,812,447 | |

| | | | Commercial Services – 1.9% | | | | | | |

| | 20,305 | | | Cenveo Corp., 7.00%, 5/15/17 | | | | | 22,195,903 | |

| | | | Construction Materials – 0.8% | | | | | | |

| | 7,645 | | | Cemex S.A.B. de C.V., 4.875%, 3/15/15 | | | | | 9,341,234 | |

| | | | Hotels, Restaurants & Leisure – 1.9% | | | | | | |

| | 7,395 | | | MGM Resorts International, 4.25%, 4/15/15 | | | | | 10,029,469 | |

| | 11,940 | | | Morgans Hotel Group Co., 2.375%, 10/15/14 | | | | | 11,895,225 | |

| | | | | | | | | | 21,924,694 | |

| | | | Insurance – 0.3% | | | | | | |

| | 3,965 | | | HCI Group, Inc., 3.875%, 3/15/19 (a)(b) | | | | | 3,813,834 | |

| | | | Internet Software & Services – 0.1% | | | | | | |

| | 1,000 | | | Web.com Group, Inc., 1.00%, 8/15/18 | | | | | 907,500 | |

| | | | Life Sciences Tools & Services – 0.8% | | | | | | |

| | 8,125 | | | Sequenom, Inc., 5.00%, 10/1/17 | | | | | 8,759,766 | |

| | | | Machinery – 3.1% | | | | | | |

| | | | Meritor, Inc., | | | | | | |

| | 12,480 | | | 4.625%, 3/1/26 (e) | | | | | 13,915,200 | |

| | 5,655 | | | 7.875%, 3/1/26 | | | | | 9,373,163 | |

| | 11,335 | | | Navistar International Corp., 3.00%, 10/15/14 | | | | | 11,490,856 | |

| | 800 | | | Wabash National Corp., 3.375%, 5/1/18 | | | | | 1,114,500 | |

| | | | | | | | | | 35,893,719 | |

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 13 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Oil, Gas & Consumable Fuels – 0.4% | | | | | | |

| | $9,625 | | | Endeavour International Corp., 5.50%, 7/15/16 | | | | | $4,908,750 | |

| | | | Personal Products – 0.4% | | | | | | |

| | 5,385 | | | Herbalife Ltd., 2.00%, 8/15/19 (a)(b) | | | | | 4,223,886 | |

| | | | Real Estate Investment Trust – 0.6% | | | | | | |

| | 7,070 | | | IAS Operating Partnership LP, 5.00%, 3/15/18 (a)(b) | | | | | 6,933,019 | |

| | | | Software – 1.5% | | | | | | |

| | 6,335 | | | Nuance Communications, Inc., 2.75%, 8/15/27 | | | | | 6,346,878 | |

| | 10,320 | | | TeleCommunication Systems, Inc., 7.75%, 6/30/18 | | | | | 10,268,400 | |

| | | | | | | | | | 16,615,278 | |

| | | | Thrifts & Mortgage Finance – 0.6% | | | | | | |

| | 6,535 | | | MGIC Investment Corp., 5.00%, 5/1/17 | | | | | 7,315,116 | |

| | | | Tobacco – 2.1% | | | | | | |

| | | | Vector Group Ltd., (f) | | | | | | |

| | 5,665 | | | 1.75%, 4/15/20 | | | | | 6,397,909 | |

| | 11,865 | | | 2.50%, 1/15/19 | | | | | 17,307,001 | |

| | | | | | | | | | 23,704,910 | |

| | | | Trading Companies & Distribution – 0.1% | | | | | | |

| | 1,190 | | | Titan Machinery, Inc., 3.75%, 5/1/19 | | | | | 931,175 | |

| | Total Convertible Bonds & Notes (cost-$181,248,713) | | | | | 201,064,193 | |

| | Short-Term Investment – 1.8% | | | | | | |

| | | | Time Deposit – 1.8% | | | | | | |

| | 21,024 | | | Wells Fargo-Grand Cayman, 0.03%, 9/2/14 (cost-$21,023,575) | | | | | 21,023,575 | |

| | Total Investments (cost-$1,089,561,189) – 100.0% | | | | | $1,150,596,605 | |

Notes to Schedule of Investments:

| (a) | | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $115,607,316, representing 10.0% of total investments. | |

| (b) | | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. | |

| (c) | | Securities exchangeable or convertible into securities of an entity different than the issuer or structured by the issuer to provide exposure to securities of an entity different than the issuer (synthetic convertible securities). Such entity is identified in the parenthetical. | |

| (d) | | Perpetual maturity. The date shown, if any, is the next call date. | |

| (e) | | Step Bond–Coupon is a fixed rate for an initial period then resets at a specific date and rate. | |

| (f) | | In addition to the coupon rate shown, the issuer is expected to pay additional interest based on the actual dividends paid on its common stock. | |

| | | | |

| 14 | | Semi-Annual Report | | | August 31, 2014 |

Schedule of Investments

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited) (continued)

| (g) | | Fair Value Measurements–See Note 1(b) in Notes to Financial Statements. | |

| | | | | | | | | | | | | | | | |

| | | Level 1 –

Quoted

Prices | | | Level 2 –

Other Significant

Observable

Inputs | | | Level 3 –

Significant

Unobservable

Inputs | | | Value at

8/31/14 | |

Investments in Securities – Assets | |

Corporate Bonds & Notes | | $ | – | | | $ | 475,961,646 | | | $ | – | | | $ | 475,961,646 | |

Convertible Preferred Stock: | | | | | | | | | | | | | | | | |

Airlines | | | – | | | | 18,135,504 | | | | – | | | | 18,135,504 | |

Automobiles | | | – | | | | – | | | | 16,536,113 | | | | 16,536,113 | |

Commercial Banks | | | 30,099,671 | | | | – | | | | 17,627,419 | | | | 47,727,090 | |

Diversified Telecommunication Services | | | – | | | | 1,214,813 | | | | – | | | | 1,214,813 | |

Energy Equipment & Services | | | – | | | | – | | | | 19,977,975 | | | | 19,977,975 | |

Health Care Equipment & Supplies | | | – | | | | – | | | | 17,181,120 | | | | 17,181,120 | |

Health Care Providers & Services | | | – | | | | – | | | | 20,633,378 | | | | 20,633,378 | |

Metals & Mining | | | 9,910,140 | | | | 15,659,820 | | | | – | | | | 25,569,960 | |

Multiline Retail | | | – | | | | – | | | | 17,962,999 | | | | 17,962,999 | |

Oil, Gas & Consumable Fuels | | | – | | | | 8,992,845 | | | | 18,551,137 | | | | 27,543,982 | |

Pharmaceuticals | | | – | | | | – | | | | 34,731,024 | | | | 34,731,024 | |

Semiconductors & Semiconductor Equipment | | | – | | | | – | | | | 16,859,300 | | | | 16,859,300 | |

Technology Hardware, Storage & Peripherals | | | – | | | | – | | | | 18,434,367 | | | | 18,434,367 | |

All Other | | | 170,039,566 | | | | – | | | | – | | | | 170,039,566 | |

Convertible Bonds & Notes | | | – | | | | 201,064,193 | | | | – | | | | 201,064,193 | |

Short-Term Investment | | | – | | | | 21,023,575 | | | | – | | | | 21,023,575 | |

Totals | | $ | 210,049,377 | | | $ | 742,052,396 | | | $ | 198,494,832 | | | $ | 1,150,596,605 | |

At August 31, 2014, there were no transfers between Levels 1 and 2.

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 15 | |

Schedule of Investments

AllianzGI Convertible & Income Fund

August 31, 2014 (unaudited) (continued)

A roll forward of fair value measurements using significant unobservable inputs (Level 3) for the six months ended August 31, 2014, was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Balance

2/28/14 | | | Purchases | | | Sales | | | Accrued

Discounts

(Premiums) | | | Net

Realized

Gain

(Loss) | | | Net Change

in Unrealized

Appreciation/

Depreciation | | | Transfers

into

Level 3 | | | Transfers

out of

Level 3 | | | Ending

Balance

8/31/14 | |

Investments in Securities – Assets | | | | | | | | | | | | | | | | | | | | | | | | | |

Convertible Preferred Stock: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Automobiles | | | $13,802,523 | | | | $4,474,514 | | | | $ – | | | | $ – | | | | $ – | | | | $(1,740,924 | ) | | | $ – | | | | $ – | | | | $16,536,113 | |

Commercial Banks | | | 15,935,338 | | | | 2,428,330 | | | | – | | | | – | | | | – | | | | (736,249 | ) | | | – | | | | – | | | | 17,627,419 | |

Computers & Peripherals | | | 12,985,586 | | | | – | | | | (13,019,681 | )† | | | – | | | | – | | | | 34,095 | | | | – | | | | – | | | | – | |

Energy Equipment & Services | | | 39,698,096 | | | | – | | | | (22,376,924 | ) | | | – | | | | 3,560,974 | | | | (904,171 | ) | | | – | | | | – | | | | 19,977,975 | |

Health Care Equipment & Supplies | | | – | | | | 17,767,244 | | | | – | | | | – | | | | – | | | | (586,124 | ) | | | – | | | | – | | | | 17,181,120 | |

Health Care Providers & Services | | | – | | | | 18,043,098 | | | | – | | | | – | | | | – | | | | 2,590,280 | | | | – | | | | – | | | | 20,633,378 | |

Household Durables | | | 14,324,200 | | | | – | | | | (13,840,543 | )† | | | – | | | | – | | | | (483,657 | ) | | | – | | | | – | | | | – | |

Insurance | | | 14,641,250 | | | | – | | | | (14,915,891 | ) | | | – | | | | 1,319,888 | | | | (1,045,247 | ) | | | – | | | | – | | | | – | |

Internet & Catalog Retail | | | 14,992,436 | | | | – | | | | (13,224,046 | ) | | | – | | | | 2,121,459 | | | | (3,889,849 | ) | | | – | | | | – | | | | – | |

Multiline Retail | | | 17,715,255 | | | | – | | | | – | | | | – | | | | – | | | | 247,744 | | | | – | | | | – | | | | 17,962,999 | |

Oil, Gas & Consumable Fuels | | | 18,189,826 | | | | – | | | | – | | | | – | | | | – | | | | 361,311 | | | | – | | | | – | | | | 18,551,137 | |

Pharmaceuticals | | | 17,363,636 | | | | 16,702,079 | | | | – | | | | – | | | | – | | | | 665,309 | | | | – | | | | – | | | | 34,731,024 | |

Semiconductors & Semiconductor Equipment | | | – | | | | 17,187,582 | | | | – | | | | – | | | | – | | | | (328,282 | ) | | | – | | | | – | | | | 16,859,300 | |

Technology Hardware, Storage & Peripherals | | | – | | | | 16,735,165 | | | | – | | | | – | | | | – | | | | 1,699,202 | | | | – | | | | – | | | | 18,434,367 | |

Totals | | | $179,648,146 | | | | $93,338,012 | | | | $(77,377,085 | ) | | | $ – | | | | $7,002,321 | | | | $(4,116,562 | ) | | | $ – | | | | $ – | | | | $198,494,832 | |

The following table presents additional information about valuation techniques and inputs used for investments that are measured at fair value and categorized within Level 3 at August 31, 2014:

| | | | | | | | | | |

| | | Ending Balance

at 8/31/14 | | | Valuation

Technique Used | | Unobservable

Inputs | | Input Values |

Investments in Securities – Assets | | |

Convertible Preferred Stock | | | $198,494,832 | | | Third-Party Pricing Vendor | | Single Broker Quote | | $31.81 – $660.73 |

The net change in unrealized appreciation/depreciation of Level 3 investments held at August 31, 2014 was $2,585,345. Net realized gain (loss) and net change in unrealized appreciation/depreciation are reflected on the Statement of Operations.

Glossary :

| | | | |

| REIT | | - | | Real Estate Investment Trust |

| | | | | | |

| 16 | | Semi-Annual Report | | | August 31, 2014 | | | See accompanying Notes to Financial Statements |

Schedule of Investments

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | Corporate Bonds & Notes – 41.8% | | | | | | |

| | | | Advertising – 0.5% | | | | | | |

| | $4,350 | | | Affinion Group, Inc., 7.875%, 12/15/18 | | | | | $3,996,562 | |

| | | | Aerospace & Defense – 0.5% | | | | | | |

| | 250 | | | Bombardier, Inc., 6.00%, 10/15/22 (a)(b) | | | | | 254,688 | |

| | 4,430 | | | Erickson, Inc., 8.25%, 5/1/20 | | | | | 4,418,924 | |

| | | | | | | | | | 4,673,612 | |

| | | | Auto Components – 0.9% | | | | | | |

| | 3,320 | | | Chassix, Inc., 9.25%, 8/1/18 (a)(b) | | | | | 3,452,800 | |

| | 3,970 | | | Goodyear Tire & Rubber Co., 8.25%, 8/15/20 | | | | | 4,337,225 | |

| | | | | | | | | | 7,790,025 | |

| | | | Auto Manufacturers – 0.7% | | | | | | |

| | 5,590 | | | Chrysler Group LLC, 8.25%, 6/15/21 | | | | | 6,274,775 | |

| | | | Commercial Services – 2.6% | | | | | | |

| | 3,000 | | | Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 9.75%, 3/15/20 | | | | | 3,375,000 | |

| | 8,535 | | | Cenveo Corp., 11.50%, 5/15/17 | | | | | 8,983,087 | |

| | 4,295 | | | DynCorp International, Inc., 10.375%, 7/1/17 | | | | | 4,090,988 | |

| | 5,925 | | | Monitronics International, Inc., 9.125%, 4/1/20 | | | | | 6,369,375 | |

| | | | | | | | | | 22,818,450 | |

| | | | Commercial Services & Supplies – 0.5% | | | | | | |

| | 4,355 | | | United Rentals North America, Inc., 8.375%, 9/15/20 | | | | | 4,768,725 | |

| | | | Construction Materials – 0.7% | | | | | | |

| | 5,690 | | | US Concrete, Inc., 8.50%, 12/1/18 | | | | | 6,173,650 | |

| | | | Consumer Finance – 0.9% | | | | | | |

| | 2,605 | | | Navient LLC, 8.45%, 6/15/18 | | | | | 3,037,951 | |

| | 3,865 | | | Springleaf Finance Corp., 8.25%, 10/1/23 | | | | | 4,493,062 | |

| | | | | | | | | | 7,531,013 | |

| | | | Distribution/Wholesale – 0.8% | | | | | | |

| | 6,430 | | | HD Supply, Inc., 11.00%, 4/15/20 | | | | | 7,474,875 | |

| | | | Diversified Consumer Services – 0.6% | | | | | | |

| | 5,270 | | | Cambium Learning Group, Inc., 9.75%, 2/15/17 | | | | | 5,349,050 | |

| | | | Diversified Financial Services – 1.9% | | | | | | |

| | 6,462 | | | Affinion Investments LLC, 13.50%, 8/15/18 (a)(b) | | | | | 6,413,237 | |

| | | | Community Choice Financial, Inc., | | | | | | |

| | 7,465 | | | 10.75%, 5/1/19 | | | | | 6,158,625 | |

| | 5,370 | | | 12.75%, 5/1/20 (a)(b) | | | | | 4,524,225 | |

| | | | | | | | | | 17,096,087 | |

| | | | Diversified Telecommunications – 0.4% | | | | | | |

| | 3,692 | | | Cincinnati Bell, Inc., 8.75%, 3/15/18 | | | | | 3,871,985 | |

| | | | Electrical Components & Equipment – 1.2% | | | | | | |

| | 10,275 | | | WireCo WorldGroup, Inc., 9.50%, 5/15/17 | | | | | 10,557,563 | |

| | | | Electronic Equipment, Instruments & Components – 1.3% | | | | | | |

| | 5,815 | | | Kemet Corp., 10.50%, 5/1/18 | | | | | 6,134,825 | |

| | 5,500 | | | Viasystems, Inc., 7.875%, 5/1/19 (a)(b) | | | | | 5,720,000 | |

| | | | | | | | | | 11,854,825 | |

| | | | Energy Equipment & Services – 0.6% | | | | | | |

| | 2,170 | | | Hercules Offshore, Inc., 8.75%, 7/15/21 (a)(b) | | | | | 2,202,550 | |

| | 3,103 | | | Pioneer Drilling Co., 9.875%, 3/15/18 | | | | | 3,266,063 | |

| | | | | | | | | | 5,468,613 | |

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 17 | |

Schedule of Investments

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Food & Staples Retailing – 1.1% | | | | | | |

| | $4,000 | | | Rite Aid Corp., 10.25%, 10/15/19 | | | | | $4,245,000 | |

| | 5,000 | | | US Foods, Inc., 8.50%, 6/30/19 | | | | | 5,335,000 | |

| | | | | | | | | | 9,580,000 | |

| | | | Health Care Providers & Services – 0.8% | | | | | | |

| | 6,585 | | | ExamWorks Group, Inc., 9.00%, 7/15/19 | | | | | 7,144,725 | |

| | | | Healthcare-Products – 0.9% | | | | | | |

| | 6,785 | | | Kinetic Concepts, Inc./KCI USA, Inc., 10.50%, 11/1/18 | | | | | 7,590,719 | |

| | | | Hotels, Restaurants & Leisure – 1.8% | | | | | | |

| | 6,880 | | | DineEquity, Inc., 9.50%, 10/30/18 | | | | | 7,321,008 | |

| | 6,395 | | | MGM Resorts International, 11.375%, 3/1/18 | | | | | 8,105,662 | |

| | | | | | | | | | 15,426,670 | |

| | | | Household Durables – 0.9% | | | | | | |

| | | | Beazer Homes USA, Inc., | | | | | | |

| | 2,245 | | | 7.25%, 2/1/23 | | | | | 2,317,962 | |

| | 3,920 | | | 9.125%, 5/15/19 | | | | | 4,160,100 | |

| | 1,390 | | | Jarden Corp., 7.50%, 5/1/17 | | | | | 1,558,538 | |

| | | | | | | | | | 8,036,600 | |

| | | | Household Products/Wares – 0.7% | | | | | | |

| | 5,725 | | | Reynolds Group Issuer, Inc., 9.875%, 8/15/19 | | | | | 6,376,219 | |

| | | | Internet Software & Services – 1.2% | | | | | | |

| | | | EarthLink, Inc., | | | | | | |

| | 2,200 | | | 7.375%, 6/1/20 | | | | | 2,326,500 | |

| | 7,590 | | | 8.875%, 5/15/19 | | | | | 7,798,725 | |

| | | | | | | | | | 10,125,225 | |

| | | | Iron/Steel – 0.7% | | | | | | |

| | 5,600 | | | AK Steel Corp., 8.375%, 4/1/22 | | | | | 5,936,000 | |

| | | | Leisure Time – 0.9% | | | | | | |

| | 8,145 | | | Travelport LLC, 11.875%, 9/1/16 | | | | | 8,175,544 | |

| | | | Lodging – 0.3% | | | | | | |

| | 9,455 | | | Caesars Entertainment Operating Co., Inc., 12.75%, 4/15/18 | | | | | 2,694,675 | |

| | | | Machinery – 0.7% | | | | | | |

| | 5,495 | | | Navistar International Corp., 8.25%, 11/1/21 | | | | | 5,721,669 | |

| | | | Media – 3.0% | | | | | | |

| | 5,500 | | | AMC Entertainment, Inc., 9.75%, 12/1/20 | | | | | 6,201,250 | |

| | 6,645 | | | McClatchy Co., 9.00%, 12/15/22 | | | | | 7,508,850 | |

| | 6,280 | | | McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance, 9.75%, 4/1/21 | | | | | 7,127,800 | |

| | 2,850 | | | Mood Media Corp., 9.25%, 10/15/20 (a)(b) | | | | | 2,493,750 | |

| | 2,979 | | | SFX Entertainment, Inc., 9.625%, 2/1/19 (a)(b) | | | | | 3,053,475 | |

| | | | | | | | | | 26,385,125 | |

| | | | Metals & Mining – 1.7% | | | | | | |

| | 5,050 | | | ArcelorMittal, 10.35%, 6/1/19 | | | | | 6,381,937 | |

| | | | Thompson Creek Metals Co., Inc., | | | | | | |

| | 6,145 | | | 7.375%, 6/1/18 | | | | | 6,175,725 | |

| | 2,170 | | | 12.50%, 5/1/19 | | | | | 2,462,950 | |

| | | | | | | | | | 15,020,612 | |

| | | | |

| 18 | | Semi-Annual Report | | | August 31, 2014 |

Schedule of Investments

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Miscellaneous Manufacturing – 0.3% | | | | | | |

| | $2,900 | | | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (a)(b) | | | | | $3,019,625 | |

| | | | Oil & Gas – 1.4% | | | | | | |

| | 7,000 | | | Energy XXI Gulf Coast, Inc., 9.25%, 12/15/17 | | | | | 7,455,000 | |

| | 4,306 | | | United Refining Co., 10.50%, 2/28/18 | | | | | 4,672,010 | |

| | | | | | | | | | 12,127,010 | |

| | | | Oil, Gas & Consumable Fuels – 2.1% | | | | | | |

| | 2,160 | | | Arch Coal, Inc., 9.875%, 6/15/19 | | | | | 1,760,400 | |

| | 7,510 | | | Endeavour International Corp., 12.00%, 3/1/18 | | | | | 6,871,650 | |

| | 4,550 | | | EP Energy LLC / Everest Acquisition Finance, Inc., 9.375%, 5/1/20 | | | | | 5,152,875 | |

| | 4,200 | | | Laredo Petroleum, Inc., 9.50%, 2/15/19 | | | | | 4,536,000 | |

| | | | | | | | | | 18,320,925 | |

| | | | Packaging & Containers – 0.7% | | | | | | |

| | 5,903 | | | Tekni-Plex, Inc., 9.75%, 6/1/19 (a)(b) | | | | | 6,508,058 | |

| | | | Paper & Forest Products – 0.3% | | | | | | |

| | 2,000 | | | Louisiana-Pacific Corp., 7.50%, 6/1/20 | | | | | 2,190,000 | |

| | | | Retail – 1.3% | | | | | | |

| | 5,785 | | | Neiman Marcus Group Ltd., Inc., 8.00%, 10/15/21 (a)(b) | | | | | 6,269,494 | |

| | 5,890 | | | Toys “R” Us, Inc., 10.375%, 8/15/17 | | | | | 5,168,475 | |

| | | | | | | | | | 11,437,969 | |

| | | | Semiconductors & Semiconductor Equipment – 0.7% | | | | | | |

| | 5,545 | | | Freescale Semiconductor, Inc., 10.75%, 8/1/20 | | | | | 6,251,987 | |

| | | | Software – 1.7% | | | | | | |

| | | | First Data Corp., | | | | | | |

| | 4,355 | | | 8.25%, 1/15/21 (a)(b) | | | | | 4,768,725 | |

| | 1,465 | | | 10.625%, 6/15/21 | | | | | 1,706,725 | |

| | 6,955 | | | 12.625%, 1/15/21 | | | | | 8,519,875 | |

| | | | | | | | | | 14,995,325 | |

| | | | Specialty Retail – 1.2% | | | | | | |

| | 3,140 | | | Brown Shoe Co., Inc., 7.125%, 5/15/19 | | | | | 3,320,550 | |

| | 4,500 | | | Claire’s Stores, Inc., 9.00%, 3/15/19 (a)(b) | | | | | 4,713,750 | |

| | 3,000 | | | Conn’s, Inc., 7.25%, 7/15/22 (a)(b) | | | | | 2,910,000 | |

| | | | | | | | | | 10,944,300 | |

| | | | Telecommunications – 1.1% | | | | | | |

| | 6,085 | | | Consolidated Communications Finance Co., 10.875%, 6/1/20 | | | | | 7,050,994 | |

| | 3,475 | | | NII International Telecom SCA, 11.375%, 8/15/19 (a)(b) | | | | | 2,328,250 | |

| | | | | | | | | | 9,379,244 | |

| | | | Transportation – 1.4% | | | | | | |

| | 5,340 | | | Quality Distribution LLC, 9.875%, 11/1/18 | | | | | 5,687,100 | |

| | 6,590 | | | Swift Services Holdings, Inc., 10.00%, 11/15/18 | | | | | 7,051,300 | |

| | | | | | | | | | 12,738,400 | |

| | | | Wireless Telecommunication Services – 0.8% | | | | | | |

| | 5,545 | | | Sprint Communications, Inc., 11.50%, 11/15/21 | | | | | 7,263,950 | |

| | Total Corporate Bonds & Notes (cost-$363,562,611) | | | | | 369,090,386 | |

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 19 | |

Schedule of Investments

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

| Shares | | | | | | | Value | |

| | Convertible Preferred Stock – 39.1% | | | | | | |

| | | | Aerospace & Defense – 1.2% | | | | | | |

| | 181,200 | | | United Technologies Corp., 7.50%, 8/1/15 | | | | | $10,882,872 | |

| | | | Airlines – 1.7% | | | | | | |

| | 296,875 | | | Continental Airlines Finance Trust II, 6.00%, 11/15/30 | | | | | 14,899,414 | |

| | | | Automobiles – 1.4% | | | | | | |

| | 378,190 | | | The Goldman Sachs Group, Inc., 8.50%, 12/16/14 (General Motors) (c) | | | | | 12,624,360 | |

| | | | Commercial Banks – 4.1% | | | | | | |

| | 7,455 | | | Huntington Bancshares, Inc., 8.50%, (d) | | | | | 10,064,250 | |

| | 283,055 | | | The Goldman Sachs Group, Inc., 8.00%, 1/14/15 (Citigroup Inc.) (c) | | | | | 13,704,674 | |

| | 9,900 | | | Wells Fargo & Co., 7.50%, Ser. L (d) | | | | | 12,038,103 | |

| | | | | | | | | | 35,807,027 | |

| | | | Diversified Financial Services – 1.4% | | | | | | |

| | 10,530 | | | Bank of America Corp., 7.25%, 4/30/14, Ser. L (d) | | | | | 12,330,630 | |

| | | | Diversified Telecommunication Services – 0.1% | | | | | | |

| | 19,665 | | | Intelsat SA, 5.75%, 5/1/16 | | | | | 942,937 | |

| | | | Electric Utilities – 2.5% | | | | | | |

| | 134,610 | | | Exelon Corp., 6.50%, 6/1/17 | | | | | 6,797,805 | |

| | 273,500 | | | NextEra Energy, Inc., 5.799%, 9/1/16 | | | | | 15,069,850 | |

| | | | | | | | | | 21,867,655 | |

| | | | Energy Equipment & Services – 1.8% | | | | | | |

| | 240,590 | | | Credit Suisse, 8.00%, 3/5/15 (Baker Hughes) (c) | | | | | 15,337,612 | |

| | | | Food Products – 0.2% | | | | | | |

| | 36,255 | | | Tyson Foods, Inc., 4.75%, 7/15/17 | | | | | 1,821,089 | |

| | | | Health Care Equipment & Supplies – 1.5% | | | | | | |

| | 210,000 | | | Credit Suisse AG, 8.00%, 6/23/15 (Medtronic, Inc.) (c) | | | | | 13,173,300 | |

| | | | Health Care Providers & Services – 1.8% | | | | | | |

| | 257,800 | | | JPMorgan Chase & Co., 8.00%, 5/5/15 (HCA Holdings, Inc.) (c) | | | | | 15,658,772 | |

| | | | Household Durables – 1.7% | | | | | | |

| | 128,815 | | | Stanley Black & Decker, Inc., 6.25%, 11/17/16 | | | | | 14,968,303 | |

| | | | Insurance – 0.5% | | | | | | |

| | 148,125 | | | MetLife, Inc., 5.00%, 10/8/14 | | | | | 4,646,681 | |

| | | | Metals & Mining – 2.2% | | | | | | |

| | 527,150 | | | ArcelorMittal, 6.00%, 1/15/16 | | | | | 11,959,716 | |

| | 513,000 | | | Cliffs Natural Resources, Inc., 7.00%, 2/1/16 | | | | | 7,679,610 | |

| | | | | | | | | | 19,639,326 | |

| | | | Multiline Retail – 1.6% | | | | | | |

| | 247,500 | | | The Goldman Sachs Group, Inc., 8.00%, 1/12/15 (Macy’s) (c) | | | | | 13,997,362 | |

| | | | Multi-Utilities – 1.1% | | | | | | |

| | 186,560 | | | AES Trust III, 6.75%, 10/15/29 | | | | | 9,510,829 | |

| | | | Oil, Gas & Consumable Fuels – 2.4% | | | | | | |

| | 146,765 | | | Credit Suisse, 8.00%, 3/5/15 (Occidental Petroleum Corp.) (c) | | | | | 14,242,075 | |

| | 10,900 | | | Energy XXI Bermuda Ltd., 5.625%, (d) | | | | | 2,558,094 | |

| | 94,905 | | | PetroQuest Energy, Inc., 6.875%, (d) | | | | | 4,341,904 | |

| | | | | | | | | | 21,142,073 | |

| | | | Pharmaceuticals – 3.0% | | | | | | |

| | 110,990 | | | Bank of America Corp., 8.00%, 2/10/15 (Allergan, Inc.) (c) | | | | | 15,024,717 | |

| | 253,015 | | | JPMorgan Chase & Co., 8.00%, 4/30/15 (Mylan, Inc.) (c) | | | | | 11,626,039 | |

| | | | | | | | | | 26,650,756 | |

| | | | |

| 20 | | Semi-Annual Report | | | August 31, 2014 |

Schedule of Investments

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

| Shares | | | | | | | Value | |

| | | | Real Estate Investment Trust – 4.2% | | | | | | |

| | 335,200 | | | Alexandria Real Estate Equities, Inc., 7.00%, (d) | | | | | $9,281,688 | |

| | 610,095 | | | FelCor Lodging Trust, Inc., 1.95%, Ser. A (d) | | | | | 15,404,899 | |

| | 159,235 | | | Health Care REIT, Inc., 6.50%, 4/20/18, Ser. I (d) | | | | | 9,700,596 | |

| | 43,070 | | | Weyerhaeuser Co., 6.375%, 7/1/16 | | | | | 2,487,723 | |

| | | | | | | | | | 36,874,906 | |

| | | | Semiconductors & Semiconductor Equipment – 1.5% | | | | | | |

| | 420,000 | | | Wells Fargo & Co., 8.00%, 6/18/15 (Micron Technology, Inc.) (c) | | | | | 13,360,200 | |

| | | | Specialty Retail – 1.6% | | | | | | |

| | 10,000 | | | Barnes & Noble, Inc., 7.75%, 8/18/21 (a) | | | | | 14,441,875 | |

| | | | Technology Hardware, Storage & Peripherals – 1.6% | | | | | | |

| | 21,135 | | | Bank of America Corp., 8.00%, 5/12/15 (Apple, Inc.) (c) | | | | | 13,964,529 | |

| | Total Convertible Preferred Stock (cost-$317,130,944) | | | | | 344,542,508 | |

| | | |

Principal

Amount

(000s) | | | | | | | | |

| | Convertible Bonds & Notes – 17.0% | | | | | | |

| | | | Biotechnology – 0.3% | | | | | | |

| | $4,065 | | | Dendreon Corp., 2.875%, 1/15/16 | | | | | 2,855,662 | |

| | | | Capital Markets – 2.6% | | | | | | |

| | 5,880 | | | Ares Capital Corp., 5.75%, 2/1/16 | | | | | 6,240,150 | |

| | 10,075 | | | BGC Partners, Inc., 4.50%, 7/15/16 | | | | | 10,685,797 | |

| | 6,370 | | | Walter Investment Management Corp., 4.50%, 11/1/19 | | | | | 5,725,037 | |

| | | | | | | | | | 22,650,984 | |

| | | | Commercial Services – 1.9% | | | | | | |

| | 15,600 | | | Cenveo Corp., 7.00%, 5/15/17 | | | | | 17,052,750 | |

| | | | Construction Materials – 0.8% | | | | | | |

| | 5,850 | | | Cemex S.A.B. de C.V., 4.875%, 3/15/15 | | | | | 7,147,969 | |

| | | | Hotels, Restaurants & Leisure – 1.9% | | | | | | |

| | 5,615 | | | MGM Resorts International, 4.25%, 4/15/15 | | | | | 7,615,343 | |

| | 9,175 | | | Morgans Hotel Group Co., 2.375%, 10/15/14 | | | | | 9,140,594 | |

| | | | | | | | | | 16,755,937 | |

| | | | Insurance – 0.3% | | | | | | |

| | 3,035 | | | HCI Group, Inc., 3.875%, 3/15/19 (a)(b) | | | | | 2,919,291 | |

| | | | Life Sciences Tools & Services – 0.8% | | | | | | |

| | 6,265 | | | Sequenom, Inc., 5.00%, 10/1/17 | | | | | 6,754,453 | |

| | | | Machinery – 3.1% | | | | | | |

| | | | Meritor, Inc., | | | | | | |

| | 9,545 | | | 4.625%, 3/1/26 (e) | | | | | 10,642,675 | |

| | 4,325 | | | 7.875%, 3/1/26 | | | | | 7,168,687 | |

| | 8,665 | | | Navistar International Corp., 3.00%, 10/15/14 | | | | | 8,784,144 | |

| | 675 | | | Wabash National Corp., 3.375%, 5/1/18 | | | | | 940,359 | |

| | | | | | | | | | 27,535,865 | |

| | | | Oil, Gas & Consumable Fuels – 0.4% | | | | | | |

| | 7,135 | | | Endeavour International Corp., 5.50%, 7/15/16 | | | | | 3,638,850 | |

| | | | Personal Products – 0.4% | | | | | | |

| | 4,115 | | | Herbalife Ltd., 2.00%, 8/15/19 (a)(b) | | | | | 3,227,724 | |

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 21 | |

Schedule of Investments

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited) (continued)

| | | | | | | | | | |

Principal

Amount

(000s) | | | | | | | Value | |

| | | | Real Estate Investment Trust – 0.3% | | | | | | |

| | $2,430 | | | IAS Operating Partnership LP, 5.00%, 3/15/18 (a)(b) | | | | | $2,382,919 | |

| | | | Software – 1.4% | | | | | | |

| | 4,835 | | | Nuance Communications, Inc., 2.75%, 8/15/27 | | | | | 4,844,066 | |

| | 7,890 | | | TeleCommunication Systems, Inc., 7.75%, 6/30/18 | | | | | 7,850,550 | |

| | | | | | | | | | 12,694,616 | |

| | | | Thrifts & Mortgage Finance – 0.6% | | | | | | |

| | 4,965 | | | MGIC Investment Corp., 5.00%, 5/1/17 | | | | | 5,557,697 | |

| | | | Tobacco – 2.1% | | | | | | |

| | | | Vector Group Ltd., (f) | | | | | | |

| | 4,335 | | | 1.75%, 4/15/20 | | | | | 4,895,841 | |

| | 9,035 | | | 2.50%, 1/15/19 | | | | | 13,178,993 | |

| | | | | | | | | | 18,074,834 | |

| | | | Trading Companies & Distribution – 0.1% | | | | | | |

| | 910 | | | Titan Machinery, Inc., 3.75%, 5/1/19 | | | | | 712,075 | |

| | Total Convertible Bonds & Notes (cost-$134,716,615) | | | | | 149,961,626 | |

| | Short-Term Investment – 2.1% | | | | | | |

| | | | Time Deposit – 2.1% | | | | | | |

| | 18,405 | | | JP Morgan Chase & Co.-Nassau, 0.03%, 9/2/14 (cost-$18,405,183) | | | | | 18,405,183 | |

| | Total Investments (cost-$833,815,353) – 100.0% | | | | | $881,999,703 | |

Notes to Schedule of Investments:

| (a) | | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $81,604,436, representing 9.3% of total investments. | |

| (b) | | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. | |

| (c) | | Securities exchangeable or convertible into securities of an entity different than the issuer or structured by the issuer to provide exposure to securities of an entity different than the issuer (synthetic convertible securities). Such entity is identified in the parenthetical. | |

| (d) | | Perpetual maturity. The date shown, if any, is the next call date. | |

| (e) | | Step Bond–Coupon is a fixed rate for an initial period then resets at a specific date and rate. | |

| (f) | | In addition to the coupon rate shown, the issuer is expected to pay additional interest based on the actual dividends paid on its common stock. | |

| | | | |

| 22 | | Semi-Annual Report | | | August 31, 2014 |

Schedule of Investments

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited) (continued)

| (g) | | Fair Value Measurements–See Note 1(b) in Notes to Financial Statements. | |

| | | | | | | | | | | | | | | | |

| | | Level 1 –

Quoted

Prices | | | Level 2 –

Other Significant

Observable

Inputs | | | Level 3 –

Significant

Unobservable

Inputs | | | Value at

8/31/14 | |

Investments in Securities – Assets | | | | | | | | | | | | | | | | |

Corporate Bonds & Notes | | $ | – | | | $ | 369,090,386 | | | $ | – | | | $ | 369,090,386 | |

Convertible Preferred Stock: | | | | | | | | | | | | | | | | |

Airlines | | | – | | | | 14,899,414 | | | | – | | | | 14,899,414 | |

Automobiles | | | – | | | | – | | | | 12,624,360 | | | | 12,624,360 | |

Commercial Banks | | | 22,102,353 | | | | – | | | | 13,704,674 | | | | 35,807,027 | |

Diversified Telecommunication Services | | | – | | | | 942,937 | | | | – | | | | 942,937 | |

Energy Equipment & Services | | | – | | | | – | | | | 15,337,612 | | | | 15,337,612 | |

Health Care Equipment & Supplies | | | – | | | | – | | | | 13,173,300 | | | | 13,173,300 | |

Health Care Providers & Services | | | – | | | | – | | | | 15,658,772 | | | | 15,658,772 | |

Metals & Mining | | | 7,679,610 | | | | 11,959,716 | | | | – | | | | 19,639,326 | |

Multiline Retail | | | – | | | | – | | | | 13,997,362 | | | | 13,997,362 | |

Oil, Gas & Consumable Fuels | | | – | | | | 6,899,998 | | | | 14,242,075 | | | | 21,142,073 | |

Pharmaceuticals | | | – | | | | – | | | | 26,650,756 | | | | 26,650,756 | |

Semiconductors & Semiconductor Equipment | | | – | | | | – | | | | 13,360,200 | | | | 13,360,200 | |

Technology Hardware, Storage & Peripherals | | | – | | | | – | | | | 13,964,529 | | | | 13,964,529 | |

All Other | | | 127,344,840 | | | | – | | | | – | | | | 127,344,840 | |

Convertible Bonds & Notes | | | – | | | | 149,961,626 | | | | – | | | | 149,961,626 | |

Short-Term Investment | | | – | | | | 18,405,183 | | | | – | | | | 18,405,183 | |

Totals | | $ | 157,126,803 | | | $ | 572,159,260 | | | $ | 152,713,640 | | | $ | 881,999,703 | |

At August 31, 2014, there were no transfers between Levels 1 and 2.

| | | | | | |

| August 31, 2014 | | | Semi-Annual Report | | | 23 | |

Schedule of Investments

AllianzGI Convertible & Income Fund II

August 31, 2014 (unaudited) (continued)

A roll forward of fair value measurements using significant unobservable inputs (Level 3) for the six months ended August 31, 2014, was as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Balance

2/28/14 | | | Purchases | | | Sales | | | Accrued

Discounts

(Premiums) | | | Net

Realized

Gain

(Loss) | | | Net Change

in Unrealized

Appreciation/

Depreciation | | | Transfers

into

Level 3 | | | Transfers

out of

Level 3 | | | Ending

Balance

8/31/14 | |

Investments in Securities – Assets | | | | | | | | | | | | | | | | | | | | | | | | | |

Convertible Preferred Stock: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Automobiles | | $ | 10,665,088 | | | $ | 3,291,221 | | | $ | – | | | $ | – | | | $ | – | | | $ | (1,331,949 | ) | | $ | – | | | $ | – | | | $ | 12,624,360 | |

Commercial Banks | | | 12,419,982 | | | | 1,856,536 | | | | – | | | | – | | | | – | | | | (571,844 | ) | | | – | | | | – | | | | 13,704,674 | |

Computers & Peripherals | | | 9,953,184 | | | | – | | | | (9,979,317 | )† | | | – | | | | – | | | | 26,133 | | | | – | | | | – | | | | – | |

Energy Equipment & Services | | | 30,527,518 | | | | – | | | | (17,234,994 | ) | | | – | | | | 2,742,995 | | | | (697,907 | ) | | | – | | | | – | | | | 15,337,612 | |

Health Care Equipment & Supplies | | | – | | | | 13,622,700 | | | | – | | | | – | | | | – | | | | (449,400 | ) | | | – | | | | – | | | | 13,173,300 | |

Health Care Providers & Services | | | – | | | | 13,692,995 | | | | – | | | | – | | | | – | | | | 1,965,777 | | | | – | | | | – | | | | 15,658,772 | |

Household Durables | | | 11,014,697 | | | | – | | | | (10,642,786 | )† | | | – | | | | – | | | | (371,911 | ) | | | – | | | | – | | | | – | |

Insurance | | | 11,203,425 | | | | – | | | | (11,413,579 | ) | | | – | | | | 1,009,973 | | | | (799,819 | ) | | | – | | | | – | | | | – | |

Multiline Retail | | | 13,804,312 | | | | – | | | | – | | | | – | | | | – | | | | 193,050 | | | | – | | | | – | | | | 13,997,362 | |

Oil, Gas & Consumable Fuels | | | 13,964,690 | | | | – | | | | – | | | | – | | | | – | | | | 277,385 | | | | – | | | | – | | | | 14,242,075 | |

Pharmaceuticals | | | 13,436,449 | | | | 12,679,088 | | | | – | | | | – | | | | – | | | | 535,219 | | | | – | | | | – | | | | 26,650,756 | |

Semiconductors & Semiconductor Equipment | | | – | | | | 13,620,348 | | | | – | | | | – | | | | – | | | | (260,148 | ) | | | – | | | | – | | | | 13,360,200 | |

Technology Hardware, Storage & Peripherals | | | – | | | | 12,677,337 | | | | – | | | | – | | | | – | | | | 1,287,192 | | | | – | | | | – | | | | 13,964,529 | |

Totals | | $ | 126,989,345 | | | $ | 71,440,225 | | | $ | (49,270,676 | ) | | $ | – | | | $ | 3,752,968 | | | $ | (198,222 | ) | | $ | – | | | $ | – | | | $ | 152,713,640 | |

The following table presents additional information about valuation techniques and inputs used for investments that are measured at fair value and categorized within Level 3 at August 31, 2014:

| | | | | | | | | | |

| | | Ending Balance

at 8/31/14 | | | Valuation

Technique Used | | Unobservable

Inputs | | Input Values |

Investments in Securities – Assets | | |

Convertible Preferred Stock | | | $152,713,640 | | | Third-Party Pricing Vendor | | Single Broker Quote | | $31.81 – $660.73 |

The net change in unrealized appreciation/depreciation of Level 3 investments held at August 31, 2014 was $1,965,637. Net realized gain (loss) and net change in unrealized appreciation/depreciation are reflected on the Statement of Operations.

Glossary:

| | | | |

| REIT | | - | | Real Estate Investment Trust |

| | | | | | |

| 24 | | Semi-Annual Report | | | August 31, 2014 | | | See accompanying Notes to Financial Statements |

Statements of Assets and Liabilities

AllianzGI Convertible & Income Funds

August 31, 2014 (unaudited)

| | | | | | | | | | | | |

| | | | | Convertible &

Income | | | | | Convertible &

Income II | |

| Assets: | | | | | | | | | | | | |

| Investments, at value (cost-$1,089,561,189 and $833,815,353, respectively) | | | | | $1,150,596,605 | | | | | | $881,999,703 | |

| Dividends and interest receivable | | | | | 17,773,646 | | | | | | 13,763,307 | |

| Receivable for investments sold | | | | | 12,465,201 | | | | | | 9,433,345 | |

| Prepaid expenses | | | | | 93,368 | | | | | | 49,869 | |

Total Assets | | | | | 1,180,928,820 | | | | | | 905,246,224 | |

| | | | |

| Liabilities: | | | | | | | | | | | | |

| Dividends payable to common and preferred shareholders | | | | | 7,875,262 | | | | | | 6,273,394 | |

| Payable for investments purchased | | | | | 3,322,150 | | | | | | 8,805,599 | |

| Investment management fees payable | | | | | 689,760 | | | | | | 524,919 | |

| Accrued expenses | | | | | 158,511 | | | | | | 147,515 | |

Total Liabilities | | | | | 12,045,683 | | | | | | 15,751,427 | |

| Preferred Shares ($0.00001 par value; $25,000 liquidation preference per share applicable to an aggregate 14,280 and 10,960 shares issued and outstanding, respectively) | | | | | 357,000,000 | | | | | | 274,000,000 | |

| Net Assets Applicable to Common Shareholders | | | | | $811,883,137 | | | | | | $615,494,797 | |

| | | | |

| Composition of Net Assets Applicable to Common Shareholders: | | | | | | | | | | | | |

| Common Shares: | | | | | | | | | | | | |

Par value ($0.00001 per share) | | | | | $874 | | | | | | $738 | |

Paid-in-capital in excess of par | | | | | 1,170,619,181 | | | | | | 965,129,290 | |

| Undistributed (dividends in excess of) net investment income | | | | | 6,730,333 | | | | | | (281,088) | |

| Accumulated net realized loss | | | | | (426,502,667) | | | | | | (397,538,493) | |

| Net unrealized appreciation | | | | | 61,035,416 | | | | | | 48,184,350 | |

| Net Assets Applicable to Common Shareholders | | | | | $811,883,137 | | | | | | $615,494,797 | |

| Common Shares Issued and Outstanding | | | | | 87,427,482 | | | | | | 73,757,132 | |

| Net Asset Value Per Common Share | | | | | $9.29 | | | | | | $8.34 | |

| | | | | | | | |

| See accompanying Notes to Financial Statements | | | August 31, 2014 | | | Semi-Annual Report | | | 25 | |

Statements of Operations

AllianzGI Convertible & Income Funds

Six Months ended August 31, 2014 (unaudited)

| | | | | | | | | | | | |

| | | | | Convertible &

Income | | | | | Convertible &

Income II | |

| Investment Income: | | | | | | | | | | | | |

| Interest | | | | | $27,905,547 | | | | | | $21,489,487 | |

| Dividends | | | | | 18,835,663 | | | | | | 14,501,353 | |

| Miscellaneous | | | | | 113,550 | | | | | | 90,450 | |

Total Investment Income | | | | | 46,854,760 | | | | | | 36,081,290 | |

| | | | |

| Expenses: | | | | | | | | | | | | |

| Investment management | | | | | 4,130,601 | | | | | | 3,152,652 | |

| Auction agent | | | | | 283,031 | | | | | | 213,594 | |

| Custodian and accounting agent | | | | | 80,072 | | | | | | 75,606 | |

| New York Stock Exchange listing | | | | | 48,024 | | | | | | 40,876 | |

| Shareholder communications | | | | | 46,867 | | | | | | 38,943 | |

| Audit and tax services | | | | | 43,863 | | | | | | 46,863 | |

| Legal | | | | | 34,594 | | | | | | 19,276 | |

| Trustees | | | | | 33,092 | | | | | | 26,809 | |

| Insurance | | | | | 14,890 | | | | | | 12,056 | |

| Transfer agent | | | | | 12,963 | | | | | | 12,934 | |

| Miscellaneous | | | | | 8,429 | | | | | | 17,535 | |

Total Expenses | | | | | 4,736,426 | | | | | | 3,657,144 | |

| | | | |

| Net Investment Income | | | | | 42,118,334 | | | | | | 32,424,146 | |

| | | | |

| Realized and Change in Unrealized Gain (Loss): | | | | | | | | | | | | |

| Net realized gain on investments | | | | | 11,793,489 | | | | | | 8,547,875 | |

| Payments from affiliates (See Note 8) | | | | | 166,674 | | | | | | 120,146 | |

| Net change in unrealized appreciation/depreciation of investments | | | | | (25,469,599) | | | | | | (17,247,592) | |

| Net realized and change in unrealized loss | | | | | (13,509,436) | | | | | | (8,579,571) | |

| Net Increase in Net Assets Resulting from Investment Operations | | | | | 28,608,898 | | | | | | 23,844,575 | |

| Dividends on Preferred Shares from Net investment income | | | | | (204,030) | | | | | | (156,594) | |

| Net Increase in Net Assets Applicable to Common Shareholders Resulting from Investments Operations | | | | | $28,404,868 | | | | | | $23,687,981 | |

| | | | | | |

| 26 | | Semi-Annual Report | | | August 31, 2014 | | | See accompanying Notes to Financial Statements |

Statement of Changes in Net Assets Applicable to Common Shareholders

AllianzGI Convertible & Income Fund

August 31, 2014

| | | | | | | | | | | | |

| | | | | Six Months ended

August 31, 2014

(unaudited) | | | | | Year ended

February 28, 2014 | |

| Investments Operations: | | | | | | | | | | | | |

| Net investment income | | | | | $42,118,334 | | | | | | $82,352,257 | |

| Net realized gain | | | | | 11,960,163 | | | | | | 38,399,174 | |

| Net change in unrealized appreciation/depreciation | | | | | (25,469,599) | | | | | | 21,883,465 | |

| Net increase in net assets resulting from investment operations | | | | | 28,608,898 | | | | | | 142,634,896 | |

| | | | |

| Dividends on Preferred Shares from Net Investment Income | | | | | (204,030) | | | | | | (462,676) | |

| Net increase in net assets applicable to common shareholders resulting from investment operations | | | | | 28,404,868 | | | | | | 142,172,220 | |

| | | | |

| Dividends to Common Shareholders from Net Investment Income | | | | | (46,960,790) | | | | | | (87,527,246) | |

| | | | |

| Common Share Transactions: | | | | | | | | | | | | |

| Net proceeds from shares sold | | | | | 16,959,259 | | | | | | 72,694,937 | |

| Offering costs on sale of shares (See Note 7) | | | | | (16,983) | | | | | | (214,454) | |

| Reinvestment of dividends | | | | | 2,099,721 | | | | | | 4,249,654 | |

| Net increase in net assets from common share transactions | | | | | 19,041,997 | | | | | | 76,730,137 | |

| Total increase in net assets applicable to common shareholders | | | | | 486,075 | | | | | | 131,375,111 | |

| | | | |

| Net Assets Applicable to Common Shareholders: | | | | | | | | | | | | |

| Beginning of period | | | | | 811,397,062 | | | | | | 680,021,951 | |

| End of period* | | | | | $811,883,137 | | | | | | $811,397,062 | |

| *Including undistributed net investment income of: | | | | | $6,730,333 | | | | | | $11,776,819 | |

| | | | |

| Common Shares Issued: | | | | | | | | | | | | |

| Shares sold | | | | | 1,678,728 | | | | | | 7,635,105 | |

| Reinvestment of dividends | | | | | 215,494 | | | | | | 464,659 | |

| Total increase in shares outstanding | | | | | 1,894,222 | | | | | | 8,099,764 | |

| | | | | | | | |

| See accompanying Notes to Financial Statements | | | August 31, 2014 | | | Semi-Annual Report | | | 27 | |

Statement of Changes in Net Assets Applicable to Common Shareholders

AllianzGI Convertible & Income Fund II

August 31, 2014

| | | | | | | | | | | | |

| | | | | Six Months ended

August 31, 2014

(unaudited) | | | | | Year ended

February 28, 2014 | |

| Investments Operations: | | | | | | | | | | | | |

| Net investment income | | | | | $32,424,146 | | | | | | $66,319,859 | |

| Net realized gain | | | | | 8,668,021 | | | | | | 26,482,017 | |

| Net change in unrealized appreciation/depreciation | | | | | (17,247,592) | | | | | | 15,214,503 | |

| Net increase in net assets resulting from investment operations | | | | | 23,844,575 | | | | | | 108,016,379 | |

| | | | |

| Dividends on Preferred Shares from Net Investment Income | | | | | (156,594) | | | | | | (355,107) | |

| Net increase in net assets applicable to common shareholders resulting from investment operations | | | | | 23,687,981 | | | | | | 107,661,272 | |

| | | | |

| Dividends to Common Shareholders from Net Investment Income | | | | | (37,563,026) | | | | | | (71,177,580) | |

| | | | |

| Common Share Transactions: | | | | | | | | | | | | |

| Net proceeds from shares sold | | | | | – | | | | | | 67,744,043 | |

| Offering costs on sale of shares (See Note 7) | | | | | – | | | | | | (202,305) | |

| Reinvestment of dividends | | | | | 2,258,289 | | | | | | 4,809,455 | |

| Net increase in net assets from common share transactions | | | | | 2,258,289 | | | | | | 72,351,193 | |

| Total increase (decrease) in net assets applicable to common shareholders | | | | | (11,616,756) | | | | | | 108,834,885 | |

| | | | |

| Net Assets Applicable to Common Shareholders: | | | | | | | | | | | | |

| Beginning of period | | | | | 627,111,553 | | | | | | 518,276,668 | |

| End of period* | | | | | $615,494,797 | | | | | | $627,111,553 | |