UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21293 | |||||

| ||||||

Nuveen Multi-Strategy Income and Growth Fund | ||||||

(Exact name of registrant as specified in charter) | ||||||

| ||||||

Nuveen Investments | ||||||

(Address of principal executive offices) (Zip code) | ||||||

| ||||||

Kevin J. McCarthy | ||||||

(Name and address of agent for service) | ||||||

| ||||||

Registrant’s telephone number, including area code: | (312) 917-7700 |

| ||||

| ||||||

Date of fiscal year end: | December 31 |

| ||||

| ||||||

Date of reporting period: | December 31, 2010 |

| ||||

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

Nuveen Investments

Closed-End Funds

Seeks Attractive Distributions from a Portfolio of Preferred and Convertible Securities,

Domestic and Foreign Equities, and Debt Instruments

Annual Report

December 31, 2010

Nuveen Multi-Strategy Income and Growth Fund

JPC

Nuveen Multi-Strategy Income and Growth Fund 2

JQC

INVESTMENT ADVISER NAME CHANGE

Effective January 1, 2011, Nuveen Asset Management, the Funds' investment adviser, changed its name to Nuveen Fund Advisors, Inc. ("Nuveen Fund Advisors"). Concurrently, Nuveen Fund Advisors formed a wholly-owned subsidiary, Nuveen Asset Management, LLC, to house its portfolio management capabilities.

NUVEEN INVESTMENTS COMPLETES STRATEGIC COMBINATION WITH FAF ADVISORS

On December 31, 2010, Nuveen Investments completed the strategic combination between Nuveen Asset Management, LLC, the largest investment affiliate of Nuveen Investments, and FAF Advisors. As part of this transaction, U.S. Bancorp—the parent of FAF Advisors—received cash consideration and a 9.5% stake in Nuveen Investments in exchange for the long term investment business of FAF Advisors, including investment-management responsibilities for the non-money market mutual funds of the First American Funds family.

The approximately $27 billion of mutual fund and institutional assets managed by FAF Advisors, along with the investment professionals managing these assets and other key personnel, have become part of Nuveen Asset Management, LLC. With these additions to Nuveen Asset Management, LLC, this affiliate now manages more than $100 billion of assets across a broad range of strategies from municipal and taxable fixed income to traditional and specialized equity investments.

This combination does not affect the investment objectives or strategies of the Funds in this report. Over time, Nuveen Investments expects that the combination will provide even more ways to meet the needs of investors who work with financial advisors and consultants by enhancing the multi-boutique model of Nuveen Investments, which also includes highly respected investment teams at HydePark, NWQ Investment Management, Santa Barbara Asset Management, Symphony Asset Management, Tradewinds Global Investors and Winslow Capital. Nuveen Investments managed approximately $195 billion of assets as of December 31, 2010.

Table of Contents

| Chairman's Letter to Shareholders | 4 | ||||||

| Portfolio Managers' Comments | 5 | ||||||

| Common Share Distribution and Share Price Information | 13 | ||||||

| Performance Overviews | 16 | ||||||

| Report of Independent Registered Public Accounting Firm | 18 | ||||||

| Portfolio of Investments | 19 | ||||||

| Statement of Assets & Liabilities | 78 | ||||||

| Statement of Operations | 79 | ||||||

| Statement of Changes in Net Assets | 80 | ||||||

| Statement of Cash Flows | 81 | ||||||

| Financial Highlights | 82 | ||||||

| Notes to Financial Statements | 84 | ||||||

| Board Members & Officers | 97 | ||||||

| Annual Investment Management Agreement Approval Process | 103 | ||||||

| Reinvest Automatically Easily and Conveniently | 111 | ||||||

| Glossary of Terms Used in this Report | 113 | ||||||

| Other Useful Information | 115 | ||||||

Chairman's

Letter to Shareholders

Dear Shareholders,

The global economy recorded another year of recovery from the financial and economic crises of 2008, but many of the factors that caused the crises still weigh on the prospects for continued recovery. In the U.S., ongoing weakness in housing values is putting pressure on homeowners and mortgage lenders. Similarly, the strong earnings recovery for corporations and banks has not been translated into increased hiring or more active lending. In addition, media and analyst reports on the fiscal conditions of various state and local entities have raised concerns with some investors. Globally, deleveraging by private and public borrowers is inhibiting economic growth and this process is far from complete.

Encouragingly, a variety of constructive actions are being taken by governments around the world to stimulate further recovery. In the U.S., the recent passage of a stimulatory tax bill relieves some of the pressure on the Federal Reserve System to promote economic expansion through quantitative easing and offers the promise of faster economic growth. A number of European governments are undertaking programs that could significantly reduce their budget deficits. Governments across the emerging markets are implementing various steps to deal with global capital flows without undermining international trade and investment.

The success of these government actions could have an important impact on whether 2011 brings further economic recovery and financial market progress. One risk associated with the extraordinary efforts to strengthen U.S. economic growth is that the debt of the U.S. government will continue to grow to unprecedented levels. Another risk is that over time there could be upward pressures on asset values in the U.S. and abroad, because what happens in the U.S. impacts the rest of the world economy. We must hope that the progress made on the fiscal front in 2010 will continue into 2011. In this environment, your Nuveen investment team continues to seek sustainable investment opportunities and to remain alert to potential risks in a recovery still facing many headwinds. On your behalf, we monitor their activities to assure they maintain their investment disciplines.

As you will note elsewhere in this report, on January 1, 2011, Nuveen Investments completed the acquisition of FAF Advisors, Inc., the manager of the First American Funds. The acquisition adds highly respected and distinct investment teams to meet the needs of investors and their advisors and is designed to benefit all fund shareholders by creating a fund organization with the potential for further economies of scale and the ability to draw from even greater talent and expertise to meet these investor needs.

As always, I encourage you to contact your financial consultant if you have any questions about your investment in a Nuveen fund. On behalf of the other members of your Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Robert P. Bremner

Chairman of the Board and Lead Independent Director

February 22, 2011

Nuveen Investments

4

Portfolio Managers' Comments

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

Any reference to credit ratings for portfolio holdings denotes the highest rating assigned by a Nationally Recognized Statistical Rating Organization (NRSRO) such as Standard & Poor's, Moody's or Fitch. AAA, AA, A and BBB ratings are investment grade; BB, B, CCC, CC, C and D ratings are below investment grade. Holdings and ratings may change over time.

Nuveen Multi-Strategy Income and Growth Fund (JPC)

Nuveen Multi-Strategy Income and Growth Fund 2 (JQC)

These Funds are advised by Nuveen Fund Advisors, Inc., which determines and oversees the Funds' asset allocations. Nuveen Fund Advisors uses a team of sub-advisers with specialties in different asset classes to manage the Funds' portfolios. These sub-advisers include Spectrum Asset Management, Inc., Symphony Asset Management, LLC, and Tradewinds Global Investors, LLC. Symphony and Tradewinds are affiliates of Nuveen Investments.

Spectrum, a wholly-owned subsidiary of Principal Global Investors, LLC, manages the preferred securities positions within the income-oriented portion of each Fund's portfolio. Mark Lieb and Phil Jacoby, who have more than 50 years of combined experience in the preferred securities and other debt markets, lead the team at Spectrum.

Symphony has primary responsibility for investments in convertible, high yield and senior loan securities, and for domestic and international equity investments. The team at Symphony managing the convertible, high yield and senior loan portions of each portfolio is led by Gunther Stein, the firm's Chief Investment Officer, who has more than 20 years of investment management experience. The Symphony team responsible for managing domestic and international equity investments is led by Ross Sakamoto, who has more than 20 years of investment management experience. Ross took over the domestic equity investment duties from David Wang in June 2010, and international equity investment oversight from Eric Olson in July 2010.

Tradewinds invests its portion of each Fund's assets in global equities and manages the Funds' option strategy. The Tradewinds team is led by Dave Iben, who is Chief Investment Officer of that firm and has more than 25 years of investment management experience.

Here representatives from Spectrum, Symphony and Tradewinds talk about general economic and market conditions, their management strategies and the performance of both Funds for the twelve-month period ended December 31, 2010.

What were the general market conditions during the reporting period ending December 31, 2010?

During this reporting period, the U.S. economy remained under considerable stress, and both the Federal Reserve and the federal government continued their efforts to improve the overall economic environment. For its part, the Fed held the benchmark fed funds rate in a target range of zero to 0.25% after cutting it to this record low level in December 2008. At its September 2010 meeting, the central bank renewed its commitment to keep the fed funds rate at "exceptionally low levels" for an "extended period." The Fed also stated that

Nuveen Investments

5

it was "prepared to take further policy actions as needed" to support economic recovery. The federal government continued to focus on implementing the economic stimulus package passed early in 2009 that was intended to provide job creation, tax relief, fiscal assistance to state and local governments, and expand unemployment benefits and other federal social welfare programs. Cognizant of the fragility of the financial system, in the fall of 2010 the Federal Reserve announced a second round of quantitative easing designed to help stimulate increased economic growth.

Nearly all recent U.S. indicators of production, spending, and labor market activity have pointed toward an acceleration in economic growth. At the same time, inflation remained relatively tame, as the Consumer Price Index rose just 1.5% year-over-year as of December 31, 2010. However, unemployment remained at historically high levels. As of December 2010, the national unemployment rate was 9.4%. In addition, the housing market continued to show signs of weakness with the average home price in the Standard & Poor's/Case-Shiller Index of 20 large metro areas falling 1.6% over the twelve months ended November 2010 (the latest available figures at the time this report was prepared).

Overall, the U.S. stock market performed well during the twelve-month period, with the Dow Jones Industrial Average climbing 14%, the S&P 500 Index advancing 15% and the NASDAQ-100 Index gaining 19%. Looking overseas, Europe's central bankers announced a $1 trillion bailout package to contain the situation with Greece and possibly help Portugal, Spain, Italy and Ireland. Ireland subsequently applied for a bailout to rescue its banking system.

The liquidity environment for credit improved as the period progressed despite macro concerns about several European countries. An accommodative central bank policy in the United States and in Europe fostered declining volatility in the equity markets—supportive earnings were a byproduct of adequate fiscal and monetary support. Preferred securities, in particular, did well against a good fundamental backdrop and a lower interest rate trend over the period. Global bank capital improvement was a very strong theme for the improving credit environment of financial institutions. Bank capital reform led the headlines with new rules coming from the Basel Committee on Banking that will seek to forestall future financial shocks and broaden credit support in the industry. As a result, the structure of the preferred market will be changing with newer, more equity-like hybrids (i.e., higher yielding preferred securities) that will replace existing structures as they are retired. Rating agency changes in equity credit analysis have also helped to increase the likelihood of tenders and early retirement of some preferred securities. Consequently, the hybrid preferred securities market experienced a number of tender events from issuers, which have led to better prices and are leading to expectations for a generally lower volatility environment for preferred securities going forward.

The senior loan market represented an attractive asset class in 2010, driven by a strong risk-return relationship featuring interest income and principal appreciation from secured positions in the capital structure. Further, a recovering primary market generated more new loan deals than 2008 and 2009 combined, allowing companies to refinance debt and extend loan maturities while offering investors attractive terms. Fundamentals on the year were positively demonstrated by a significant decline in

Nuveen Investments

6

defaults and decreased corporate leverage with improved corporate earnings. For example, leveraged loans finished 2010 at a 2.58% default rate, according to Credit Suisse, compared with 2009 defaults of 9.58%. Similarly, Credit Suisse reported that high yield bonds experienced a significant improving default environment, finishing 2010 with defaults of 1.51% compared to 2009 defaults of 9.36%. An improving leveraged loan and high yield primary market enabled companies to refinance deals and extend maturities.

Convertibles benefited from a both a rally in equities and credit spread tightening, with the S&P 500 Index returning 15% and high yield spreads tightening 80 basis points during the period, according to JPMorgan Chase. The investor composition of the convertible market remained healthy with an even participation split between arbitrage investors and fundamental/outright investors, which continued to keep concentration risk low.

Global equity markets continued their upward trajectory through the end of 2010. In U.S. dollar terms, equity markets in the larger developed economies, namely Japan and the U.S., were the best performers, while the major European equity markets posted negative returns. The U.S. currency rallied against the euro and the British pound as concerns over sovereign debt defaults in Europe increased. Emerging market equity returns lagged their developed market brethren. In the second quarter of 2010, risk aversion returned with a vengeance as investors fled to the perceived safety of debt. The major market indices suffered their worst declines since early 2009 and volatility, as measured by the VIX Index, rose. Hard commodity prices also declined, led by copper, oil and zinc, on the perception that global domestic growth would slow and that supplies were adequate. On the other hand, precious metals gained favor among investors as a haven from volatility and a hedge against anticipated inflationary pressures emerging from loose monetary and fiscal policies. Global equity markets rebounded strongly in the third quarter with the MSCI All Country World Index posting one of its best returns for the past decade. While there was evidence of improving economic fundamentals and higher than expected earnings results, there were continued concerns over government debt, currency devaluations, and questions regarding the global banking system. The equity rally continued into the fourth quarter.

What key strategies were used to manage the Funds during this reporting period?

Within the preferred securities portion of both Funds' portfolios, changes in capital rules driven by the Basel Committee on Banking, the Dodd-Frank Act, and equity credit reductions on enhanced equity hybrid structures helped to drive hybrid prices higher against a generally favorable fundamental backdrop of earnings gains and liquidity improvements. We traded for longer call optionality in an effort to proactively protect the income objective. We also sold higher priced structures and switched into lower dollar priced structures in order to allow for more capital appreciation without sacrificing income. We sold foreign bank paper that had little upside left due to structural features and re-balanced into paper that we believe will perform well in the insurance sectors. Overall, our allocation went up in $1000 par capital securities because of our desire to emphasize certain structural benefits that are more prevalent in capital securities than in the more individual oriented $25 par market.

Nuveen Investments

7

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares.

For additional information, see the individual Performance Overview for your Fund in this report.

1. Comparative Benchmark performance is a blended return consisting of: 1) 27.5% of the Merrill Lynch Preferred Stock Hybrid Securities Index, an unmanaged index of investment-grade, exchange traded preferred issues with outstanding market values of at least $100 million and at least one year to maturity. 2) 22.5% of the Barclays Capital Tier 1 Capital Securities Index, an unmanaged index that includes securities that can generally be viewed as hybrid fixed-income securities that either receive regulatory capital treatment or a degree of "equity credit" from a rating agency. 3) 10.0% of the Russell 3000 Index. The Russell 3000 Index measures the performance of the largest 3000 U.S. companies representing approximately 98% of the investable U.S. equity market. 4) 10.0% of the MSCI EAFE Index. The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. 5) 10.0% of the MSCI ACWI (All Country World Index), a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. 6) 6.7% of the Merrill Lynch All U.S. Convertibles Index consisting of approximately 595 securities with par value greater than $50 million that were issued by U.S. companies or non-U.S. based issuers that have a significant business presence in the U.S. 7) 6.7% of the CSFB High Yield Index, which includes approximately $515 billion of $U.S.-denominated high yield debt with a minimum of $75 million in par value and at least one rating below investment-grade. 8) 6.6% of the CSFB Leverage Loan Index, which includes approximately $611 billion of $U.S.-denominated Leveraged Loans at least one rating below investment-grade. Benchmark returns do not include the effects of any sales charges or management fees. It is not possible to invest directly in this benchmark.

2. The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index that includes all investment-grade, publicly issued, fixed-rate, dollar denominated, nonconvertible debt issues and commercial mortgage backed securities with maturities of at least one year and outstanding par values of $150 million or more. Index returns do not include the effects of any sales charges or management fees. It is not possible to invest directly in an index.

In the senior loan and other debt portion of each Fund's portfolio, we focused on macro, technical, and fundamental factors. We maintained a neutral weighting between loans, high yield, and convertibles for the period, as each asset class benefited from relative market conditions. Our focus was on asset-rich, cyclical credits that would benefit from the improving fundamental and technical environments for the period. In addition, we focused on high quality new issues in the loan and high yield markets that came to market with attractive yields and terms after minimal issuance in the prior year.

In the core domestic and international equity portion of each Fund's portfolio that is managed by Symphony, we used both quantitative and qualitative methods to evaluate opportunities. The quantitative screening process served as the starting point for decision-making, with the qualitative process then providing a systematic way of researching companies from a broad perspective, as fundamental analysts actively sought catalysts that we believed would drive upside price movements. Symphony uses a "bottom-up" approach to stock picking, seeking to maximize return per unit of risk while obeying limits on position size, industry weights, beta, and other portfolio constraints. Quantitative tools provide the risk diagnostic measurements which guide these limits and keep forecasted risk within acceptable tolerances. The overall result is an investment process which is disciplined, repeatable, and what we think blends the most effective elements of both quantitative and qualitative investing.

For the global equity portion of each portfolio managed by Tradewinds, our basic investment philosophy continued to focus on buying good or improving business franchises around the globe whose securities were selling below their intrinsic value, maintaining a disciplined, opportunistic investing approach in this unique environment. We found that the best value opportunities were in the securities of those businesses that were the most leveraged to the growth of the global economy. We continued to like the materials, food, agriculture and energy sectors, which benefit from increased global demand, while we remained significantly underweight in the financials sector. During the period we maintained both our long and short equity exposures, and continued to write covered calls on selected long equity positions to enhance yield and expected total return.

For each Fund's option strategy we were writing covered call options on individual stocks held in the Fund's portfolio of investments to enhance returns while foregoing some upside potential, and bought put options on a single stock to benefit in the event its price declines.

How did the Funds perform over the reporting period?

The performance of JPC and JQC, as well as a comparative benchmark and a general market index, is presented in the accompanying table.

Average Annual Total Return on Common Share Net Asset Value

For periods ended 12/31/10

| 1-Year | 5-Year | ||||||||||

| JPC | 21.06 | % | 1.05 | % | |||||||

| JQC | 21.02 | % | 1.92 | % | |||||||

| Comparative Benchmark1 | 14.29 | % | 3.27 | % | |||||||

| Barclays Capital U.S. Aggregate Bond Index2 | 6.56 | % | 5.80 | % | |||||||

For the twelve-month period ended December 31, 2010, the total return on Common share net asset value (NAV) for both Funds outperformed the comparative benchmark and the general market index.

Nuveen Investments

8

Among the largest positive contributors in the preferred securities portion of both Funds over the period were Wachovia Bank, Deutsche Bank and ING. In general, the U.S. bank trust preferred sector benefited the performance of both Funds as a number of market observers believed that banks are likely to be gradually redeeming their preferred securities in response to certain provisions in the recently enacted financial sector reform bill. The main performance detractors for the Funds were AXA Insurance, Lloyd's Capital, Bank of America and HSBC Upper Tier 2 Floaters.

The senior loan and high yield sleeves of both Funds performed well relative to the broader credit market. Each Fund's exposure to relatively volatile, cyclical credits backed by significant tangible assets benefited performance for the period. Within loans and high yield, names like LNR Property and Greenbrier Companies generated returns through both significant price appreciation and interest income. For convertibles, more price volatile names like Pioneer Natural Resources and EMC Corporation contributed to performance. For all these examples, businesses benefited from improved fundamental and technical environments and improved valuation of each firm's assets.

Performance was constrained by each Fund's portfolio of higher quality assets, many of which are critical to maintaining an acceptable risk profile. These higher quality names underperformed riskier assets, which benefited from greater relative price appreciation over the course of the year stemming from improved fundamental and strong technical environments.

The core domestic equities portion of each Fund managed by Symphony outpaced the Russell 3000 Index during the period. We remained invested in companies that have experienced significant earnings leverage as revenues have continued to rebound following the recent recession. Looking at the market generally, as represented by the Russell 3000 Index, more volatile sectors like consumer discretionary and industrials held up the best, gaining 29.9% and 27.5% respectively. More defensive sectors like healthcare and utilities lagged the market, but still gained 5.4% and 7.7% respectively.

Relative to the Russell 3000 Index, the equity portion of the Funds benefited modestly from a slight overweight to the materials sector and a slight underweight of the financials sector. On the other hand, the Funds were negatively impacted by a modest underweight in the energy sector and overweight in consumer staples. Stock selection added to each Fund's return in most sectors, with the best selection coming in the consumer discretionary and materials sectors. Selection in the utilities and financials sectors detracted from performance. The worst performers were Western Digital, a hard drive manufacturer, and steel producer United States Steel Corporation. The best performers were Netflix, an online movie rental company, and Walter Energy, a producer of metallurgical coal.

In the global equity sleeve of the Funds managed by Tradewinds, each Fund's top long equity performer was a position in NovaGold Resources Incorporated, a member of the materials sector. In early January 2009, the Funds participated in a private placement of NovaGold Resources Incorporated units, which consisted of both equity shares and warrants to purchase additional equity shares at a price of $1.50 USD. NovaGold, a junior gold company, which focuses on gold exploration, development, and mining, benefited as the price of gold reached over $1,400 per ounce during 2010. The company's common equity share price appreciated more than 200% during the calendar year.

Nuveen Investments

9

Another significant contributor to performance was Cameco Corporation, another member of the materials sector. Cameco is the world's largest listed uranium producer and owns a significant interest in Cigar Lake, one of the largest underdeveloped uranium mines located in the northern Saskatchewan's Athabasca Basin. Uranium, a formerly out-of-favor commodity, has begun to elicit much more market appreciation as spot prices, which were weak during the first part of the year, started to recover in the second half of 2010.

The worst detractor from performance among the assets managed by Tradewinds during the period was Thales S.A., a French manufacturer of aerospace systems and industrial electronics products. The company underperformed due to a bloated cost structure and disparate non-core businesses. While the company still needs to adjust its cost structure, we are still attracted to its valuation and long-term fundamentals as a European leader and a top global defense electronics company.

Another detractor from performance was BP PLC, the largest oil and gas producer in the United States and fourth largest oil producer in the world. BP's share price declined significantly post the April 2010 Deepwater Horizon explosion and subsequent oil spill into the Gulf of Mexico, and troughed at the end of June 2010. The stock price rallied throughout the third and fourth quarters as the probability of a worst case scenario declined following successful subsea containment operations. The company underwent a material change in top management and organizational restructuring. The company also divested some of its assets to help meet its financial obligations arising from the Gulf of Mexico oil spill. While we believe that BP continues to trade at a significant discount to the value of its assets, it will take some time for the company to regain the trust of its partners, contractors, and the market. While we opportunistically increased our position near the bottom, we have since trimmed our position at recent highs.

In the international equity portion of the portfolio managed by Symphony, the Funds benefited from stock selection in Europe as well as our positions in regions outside the MSCI EAFE benchmark. Our top three performers were Umicore, Jeronimo Martins, and DnB NOR. Our holdings in Canada and Latin America contributed positively as well. For sector allocation, our energy overweight and utilities underweight added to performance, while our information technology overweight hurt performance. Our underweight positions in Royal Dutch Shell, Siemens, and BP also adversely affected relative performance. Given our underweight position in Japan, the strong rise in Japanese yen against the dollar was also a drag on relative performance. Overall, our emphasis on selecting companies with good growth characteristics and sound fundamentals drove outperformance in this period.

Each Fund's overall short equity positions detracted from performance for the period. Among the bucket of short equities, Strayer Education Incorporated contributed most to absolute performance, however, its gains were more than offset by the position in AutoZone Incorporated.

Our covered call writing strategy also detracted from both Fund's performance as stock prices rallied in excess of strike prices. However, given the uncertainty in the future direction of the global markets and the large market rebound, we will continue to utilize this strategy.

Nuveen Investments

10

IMPACT OF THE FUNDS' LEVERAGE STRATEGY ON PERFORMANCE

One important factor impacting the return of the Funds relative to the comparative indexes was the Funds' use of financial leverage through the use of bank borrowings. The Funds use leverage because their managers believe that, over time, leveraging provides opportunities for additional income and total return for common shareholders. However, use of leverage also can expose common shareholders to additional volatility. For example, as the prices of securities held by a Fund decline, the negative impact of these valuation changes on common share net asset value and common shareholder total return is magnified by the use of leverage. Conversely, leverage may enhance common share returns during periods when the prices of securities held by a Fund generally are rising. Leverage made a positive contribution to the performance of the Funds over this reporting period.

RECENT EVENTS CONCERNING THE FUNDS' REDEMPTION OF AUCTION RATE PREFERRED SHARES

Shortly after their inceptions, the Funds issued auction rate preferred shares (ARPS) to create financial leverage. As noted in past shareholder reports, the weekly auctions for those ARPS began in February 2008 to consistently fail, causing the Funds to pay the so-called "maximum rate" to ARPS shareholders under the terms of the ARPS in the Funds' charter documents. The Funds redeemed their ARPS at par in 2009 and since then have relied upon bank borrowings to create financial leverage.

During 2010, certain Nuveen leveraged closed-end funds (including these Funds) received a demand letter from a law firm on behalf of purported holders of common shares of each such fund, alleging that Nuveen and the funds' officers and Board of Directors/Trustees breached their fiduciary duties related to the redemption at par of the funds' ARPS. In response, the Board established an ad hoc Demand Committee consisting of certain of its disinterested and independent Board members to investigate the claims. The Demand Committee retained independent counsel to assist it in conducting an extensive investigation. Based upon its investigation, the Demand Committee found that it was not in the best interests of each fund or its shareholders to take the actions suggested in the demand letters, and recommended that the full Board reject the demands made in the demand letters. After reviewing the findings and recommendation of the Demand Committee, the full Board of each fund unanimously adopted the Demand Committee's recommendation.

Subsequently, the funds that received demand letters (including these Funds) were named in a consolidated complaint as nominal defendants in a putative shareholder derivative action captioned Martin Safier, et al. v. Nuveen Asset Management, et al. that was filed in the Circuit Court of Cook County, Illinois, Chancery Division (the "Cook County Chancery Court") on February 18, 2011 (the "Complaint"). The Complaint, filed on behalf of purported holders of each fund's common shares, also name Nuveen Asset Management as a defendant, together with current and former Officers and interested Director/Trustees of each of the funds (together with the nominal defendants, collectively, the "Defendants"). The Complaint contains the same basic allegations contained in the demand letters. The suits seek a declaration that the Defendants have breached

Nuveen Investments

11

their fiduciary duties, an order directing the Defendants not to redeem any ARPS at their liquidation value using fund assets, indeterminate monetary damages in favor of the funds and an award of plaintiffs' costs and disbursements in pursuing the action. Nuveen Asset Management believes that the Complaint is without merit, and intends to defend vigorously against these charges.

Nuveen Investments

12

Common Share Distribution

and Share Price Information

The following information regarding your Fund's distributions is current as of December 31, 2010, and likely will vary over time based on the Fund's investment activities and portfolio investment value changes.

During the twelve-month reporting period, the Funds did not make any changes to their quarterly distribution to common shareholders. Some of the important factors affecting the amount and composition of these distributions are summarized below.

The Funds employ financial leverage through the use of bank borrowings. Financial leverage provides the potential for higher earnings (net investment income), total returns and distributions over time, but—as noted earlier—also increases the variability of common shareholders' net asset value per share in response to changing market conditions.

Each Fund has a managed distribution program. The goal of this program is to provide common shareholders with relatively consistent and predictable cash flow by systematically converting the Fund's expected long-term return potential into regular distributions. As a result, regular common share distributions throughout the year are likely to include a portion of expected long-term gains (both realized and unrealized), along with net investment income.

Important points to understand about the managed distribution program are:

• Each Fund seeks to establish a relatively stable common share distribution rate that roughly corresponds to the projected total return from its investment strategy over an extended period of time. However, you should not draw any conclusions about a Fund's past or future investment performance from its current distribution rate.

• Actual common share returns will differ from projected long-term returns (and therefore a Fund's distribution rate), at least over shorter time periods. Over a specific timeframe, the difference between actual returns and total distributions will be reflected in an increasing (returns exceed distributions) or a decreasing (distributions exceed returns) Fund net asset value.

• Each distribution is expected to be paid from some or all of the following sources:

• net investment income (regular interest and dividends),

• realized capital gains, and

• unrealized gains, or, in certain cases, a return of principal (non-taxable distributions).

• A non-taxable distribution is a payment of a portion of a Fund's capital. When a Fund's returns exceed distributions, it may represent portfolio gains generated, but not realized as a taxable capital gain. In periods when a Fund's returns fall short of distributions, the shortfall will represent a portion of your original principal, unless the shortfall

Nuveen Investments

13

is offset during other time periods over the life of your investment (previous or subsequent) when a Fund's total return exceeds distributions.

• Because distribution source estimates are updated during the year based on a Fund's performance and forecast for its current fiscal year (which is the calendar year for each Fund), estimates on the nature of your distributions provided at the time distributions are paid may differ from both the tax information reported to you in your Fund's IRS Form 1099 statement provided at year end, as well as the ultimate economic sources of distributions over the life of your investment.

The following table provides information regarding each Fund's common share distributions and total return performance for the twelve months ended December 31, 2010. This information is intended to help you better understand whether the Fund's returns for the specified time period were sufficient to meet each Fund's distributions.

| As of 12/31/10 (Common Shares) | JPC | JQC | |||||||||

| Inception date | 3/26/03 | 6/25/03 | |||||||||

| Calendar year ended December 31, 2010: | |||||||||||

| Per share distribution: | |||||||||||

| From net investment income | $ | 0.57 | $ | 0.60 | |||||||

| From long-term capital gains | 0.00 | 0.00 | |||||||||

| From short-term capital gains | 0.00 | 0.00 | |||||||||

| Return of capital | 0.11 | 0.10 | |||||||||

| Total per share distribution | $ | 0.68 | $ | 0.70 | |||||||

| Distribution rate on NAV | 7.07 | % | 6.91 | % | |||||||

| Average annual total returns: | |||||||||||

| 1-Year on NAV | 21.06 | % | 21.02 | % | |||||||

| 5-Year on NAV | 1.05 | % | 1.92 | % | |||||||

| Since inception on NAV | 3.72 | % | 3.80 | % | |||||||

Common Share Repurchases and Share Price Information

As of December 31, 2010, and since the inception of the Funds' repurchase program, the Funds have cumulatively repurchased and retired shares of their common stock as shown in the accompanying table.

| Fund | Common Shares Repurchased and Retired | % of Outstanding Common Shares | |||||||||

| JPC | 2,123,250 | 2.2 | % | ||||||||

| JQC | 3,419,395 | 2.5 | % | ||||||||

Nuveen Investments

14

During the twelve-month reporting period, the Funds' common shares were repurchased and retired at a weighted average price and a weighted average discount per common share as shown in the accompanying table.

| Fund | Common Shares Repurchased and Retired | Weighted Average Price Per Common Share Repurchased and Retired | Weighted Average Discount Per Common Share Repurchased and Retired | ||||||||||||

| JPC | 485,500 | $ | 7.77 | 14.20 | % | ||||||||||

| JQC | 999,820 | $ | 8.18 | 14.30 | % | ||||||||||

At December 31, 2010, the Funds' common share prices were trading at (–) discounts to their common share NAVs as shown in the accompanying table.

| Fund | 12/31/10 (–) Discount | Twelve-Month Average (–) Discount | |||||||||

| JPC | -13.20 | % | -12.16 | % | |||||||

| JQC | -13.13 | % | -12.72 | % | |||||||

Nuveen Investments

15

Fund Snapshot

| Common Share Price | $ | 8.35 | |||||

| Common Share Net Asset Value (NAV) | $ | 9.62 | |||||

| Premium/(Discount) to NAV | -13.20 | % | |||||

| Current Distribution Rate1 | 8.14 | % | |||||

| Net Assets Applicable to Common Shares ($000) | $ | 938,844 | |||||

Average Annual Total Return

(Inception 3/26/03)

| On Share Price | On NAV | ||||||||||

| 1-Year | 21.28 | % | 21.06 | % | |||||||

| 5-Year | 2.90 | % | 1.05 | % | |||||||

| Since Inception | 2.27 | % | 3.72 | % | |||||||

Portfolio Composition

(as a % of total investments)2,4

| Commercial Banks | 13.6 | % | |||||

| Insurance | 13.4 | % | |||||

| Real Estate | 8.3 | % | |||||

| Oil, Gas & Consumable Fuels | 5.6 | % | |||||

| Media | 5.4 | % | |||||

| Diversified Financial Services | 3.9 | % | |||||

| Metals & Mining | 3.5 | % | |||||

| Capital Markets | 3.2 | % | |||||

| Pharmaceuticals | 2.2 | % | |||||

| Diversified Telecommunication Services | 2.2 | % | |||||

| Food Products | 2.2 | % | |||||

| Health Care Providers & Services | 2.0 | % | |||||

| Hotels, Restaurants & Leisure | 1.7 | % | |||||

| Communications Equipment | 1.5 | % | |||||

| Semiconductors & Equipment | 1.3 | % | |||||

| Energy Equipment & Services | 1.3 | % | |||||

| IT Services | 1.3 | % | |||||

| Aerospace & Defense | 1.2 | % | |||||

| Chemicals | 1.2 | % | |||||

| Multi-Utilities | 1.2 | % | |||||

| Short-Term Investments | 4.0 | % | |||||

| Other | 19.8 | % | |||||

Country Allocation

(as a % of total investments)2,4

| United States | 70.7 | % | |||||

| Canada | 4.4 | % | |||||

| United Kingdom | 4.3 | % | |||||

| Netherlands | 3.4 | % | |||||

| Bermuda | 3.0 | % | |||||

| France | 2.4 | % | |||||

| Japan | 2.0 | % | |||||

| Other | 9.8 | % | |||||

Top Five Issuers

(as a % of total investments)3,4

| Wachovia Corporation | 1.9 | % | |||||

| Deutsche Bank AG | 1.8 | % | |||||

| Union Planters Corporation | 1.4 | % | |||||

| Partners Re Limited | 1.4 | % | |||||

| Commonwealth REIT | 1.3 | % | |||||

JPC

Performance

OVERVIEW

Nuveen Multi-Strategy Income and Growth Fund

as of December 31, 2010

Portfolio Allocation (as a % of total investments)2,4

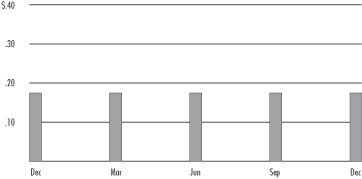

2009-2010 Distributions Per Common Share

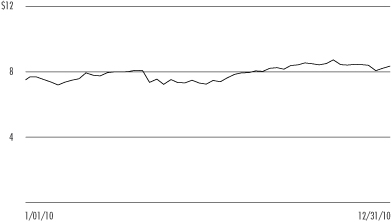

Common Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

2 Excluding common stocks sold short and investments in derivatives.

3 Excluding short-term investments, common stocks sold short and investments in derivatives.

4 Holdings are subject to change.

5 Rounds to less than 0.1%.

Nuveen Investments

16

JQC

Performance

OVERVIEW

Nuveen Multi-Strategy Income and Growth Fund 2

as of December 31, 2010

Portfolio Allocation (as a % of total investments)2,4

2009-2010 Distributions Per Common Share

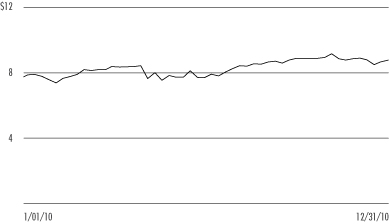

Common Share Price Performance — Weekly Closing Price

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this Fund's Performance Overview page.

1 Current Distribution Rate is based on the Fund's current annualized quarterly distribution divided by the Fund's current market price. The Fund's quarterly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the calendar year the Fund's cumulative net ordinary income and net realized gains are less than the amount of the Fund's distributions, a return of capital for tax purposes.

2 Excluding common stocks sold short and investments in derivatives.

3 Excluding short-term investments, common stocks sold short and investments in derivatives.

4 Holdings are subject to change.

5 Rounds to less than 0.1%.

Fund Snapshot

| Common Share Price | $ | 8.80 | |||||

| Common Share Net Asset Value (NAV) | $ | 10.13 | |||||

| Premium/(Discount) to NAV | -13.13 | % | |||||

| Current Distribution Rate1 | 7.95 | % | |||||

| Net Assets Applicable to Common Shares ($000) | $ | 1,388,235 | |||||

Average Annual Total Return

(Inception 6/25/03)

| On Share Price | On NAV | ||||||||||

| 1-Year | 24.26 | % | 21.02 | % | |||||||

| 5-Year | 3.67 | % | 1.92 | % | |||||||

| Since Inception | 2.36 | % | 3.80 | % | |||||||

Portfolio Composition

(as a % of total investments)2,4

| Insurance | 14.3 | % | |||||

| Commercial Banks | 13.7 | % | |||||

| Real Estate | 7.7 | % | |||||

| Media | 5.2 | % | |||||

| Oil, Gas & Consumable Fuels | 5.2 | % | |||||

| Metals & Mining | 3.6 | % | |||||

| Capital Markets | 3.6 | % | |||||

| Diversified Financial Services | 2.8 | % | |||||

| Diversified Telecommunication Services | 2.3 | % | |||||

| Electric Utilities | 2.3 | % | |||||

| Pharmaceuticals | 2.2 | % | |||||

| Food Products | 2.0 | % | |||||

| Health Care Providers & Services | 1.9 | % | |||||

| Hotels, Restaurants & Leisure | 1.6 | % | |||||

| Communications Equipment | 1.5 | % | |||||

| Investment Companies | 1.4 | % | |||||

| IT Services | 1.3 | % | |||||

| Semiconductors & Equipment | 1.3 | % | |||||

| Energy Equipment & Services | 1.3 | % | |||||

| Chemicals | 1.2 | % | |||||

| Short-Term Investments | 3.8 | % | |||||

| Other | 19.8 | % | |||||

Country Allocation

(as a % of total investments)2,4

| United States | 69.3 | % | |||||

| United Kingdom | 7.3 | % | |||||

| Canada | 3.8 | % | |||||

| Netherlands | 3.6 | % | |||||

| Bermuda | 2.8 | % | |||||

| France | 2.5 | % | |||||

| Japan | 2.1 | % | |||||

| Other | 8.6 | % | |||||

Top Five Issuers

(as a % of total investments)3,4

| Deutsche Bank AG | 1.7 | % | |||||

| Comcast Corporation | 1.6 | % | |||||

| Aegon N.V. | 1.4 | % | |||||

| ING Groep N.V. | 1.3 | % | |||||

| Partners Re Limited | 1.2 | % | |||||

Nuveen Investments

17

Report of INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Trustees and Shareholders

Nuveen Multi-Strategy Income and Growth Fund

Nuveen Multi-Strategy Income and Growth Fund 2

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Nuveen Multi-Strategy Income and Growth Fund and Nuveen Multi-Strategy Income and Growth Fund 2 (the "Funds") as of December 31, 2010, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Funds' management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Funds' internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds' internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2010, by correspondence with the custodian, selling or agent banks and brokers or by other appropriate auditing procedures where replies from selling or agent banks or brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial positions of Nuveen Multi-Strategy Income and Growth Fund and Nuveen Multi-Strategy Income and Growth Fund 2 at December 31, 2010, the results of their operations and their cash flows for the year then ended, the changes in their net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

February 25, 2011

Nuveen Investments

18

JPC

Nuveen Multi-Strategy Income and Growth Fund

Portfolio of INVESTMENTS

December 31, 2010

| Shares | Description (1) | Value | |||||||||

| Common Stocks – 35.4% (27.4% of Total Investments) | |||||||||||

| Aerospace & Defense – 1.1% | |||||||||||

| 29,962 | Aveos Fleet Performance Inc., (2), (16) | $ | 314,601 | ||||||||

| 11,280 | Boeing Company | 736,133 | |||||||||

| 2,220 | Esterline Technologies Corporation, (2) | 152,270 | |||||||||

| 98,500 | Finmeccanica SPA | 1,119,475 | |||||||||

| 3,475 | GeoEye, Inc., (2) | 147,305 | |||||||||

| 2,540 | L-3 Communications Holdings, Inc. | 179,045 | |||||||||

| 54,176 | Lockheed Martin Corporation, (3) | 3,787,444 | |||||||||

| 3,090 | Orbital Sciences Corporation | 52,932 | |||||||||

| 97,550 | Thales S.A. | 3,413,373 | |||||||||

| 2,340 | United Technologies Corporation | 184,205 | |||||||||

| Total Aerospace & Defense | 10,086,783 | ||||||||||

| Air Freight & Logistics – 0.1% | |||||||||||

| 8,500 | United Parcel Service, Inc., Class B | 616,930 | |||||||||

| Airlines – 0.0% | |||||||||||

| 13,960 | Hawaiian Holdings Inc., (2) | 109,446 | |||||||||

| Auto Components – 0.2% | |||||||||||

| 7,310 | Cooper Tire & Rubber | 172,370 | |||||||||

| 5,710 | Goodyear Tire & Rubber Company, (2) | 67,664 | |||||||||

| 31,020 | Johnson Controls, Inc. | 1,184,964 | |||||||||

| 5,840 | TRW Automotive Holdings Corporation, (2) | 307,768 | |||||||||

| Total Auto Components | 1,732,766 | ||||||||||

| Automobiles – 0.4% | |||||||||||

| 63,589 | Honda Motor Company Limited | 2,518,027 | |||||||||

| 1,008 | Toyota Motor Corporation, Sponsored ADR | 79,259 | |||||||||

| 25,580 | Toyota Motor Corporation | 1,014,504 | |||||||||

| Total Automobiles | 3,611,790 | ||||||||||

| Beverages – 0.7% | |||||||||||

| 220,983 | Coca-Cola Amatil Limited | 2,454,593 | |||||||||

| 21,881 | Coca-Cola Femsa SAB de CV | 1,803,651 | |||||||||

| 25,640 | Coca-Cola Company | 1,686,343 | |||||||||

| 15,005 | Dr. Pepper Snapple Group | 527,576 | |||||||||

| 8,490 | Molson Coors Brewing Company, Class B | 426,113 | |||||||||

| Total Beverages | 6,898,276 | ||||||||||

| Biotechnology – 0.2% | |||||||||||

| 12,410 | Amgen Inc., (2) | 681,309 | |||||||||

| 6,140 | Biogen Idec Inc., (2) | 411,687 | |||||||||

| 6,450 | BioMarin Pharmaceutical Inc., (2) | 173,699 | |||||||||

| 2,570 | Celgene Corporation, (2) | 151,990 | |||||||||

| 5,285 | Cubist Pharmaceuticals Inc., (2) | 113,099 | |||||||||

| 6,450 | Geron Corporation, (2) | 33,347 | |||||||||

| 14,270 | Gilead Sciences, Inc., (2) | 517,145 | |||||||||

Nuveen Investments

19

JPC

Nuveen Multi-Strategy Income and Growth Fund (continued)

Portfolio of INVESTMENTS December 31, 2010

| Shares | Description (1) | Value | |||||||||

| Biotechnology (continued) | |||||||||||

| 4,530 | Incyte Pharmaceuticals Inc., (2) | $ | 75,017 | ||||||||

| 11,461 | Nabi Biopharmaceuticals, (2) | 66,359 | |||||||||

| 11,160 | PDL Biopahrma Inc. | 69,527 | |||||||||

| Total Biotechnology | 2,293,179 | ||||||||||

| Building Products – 0.1% | |||||||||||

| 36,123 | Masonite Worldwide Holdings, (2) | 1,255,274 | |||||||||

| Capital Markets – 0.5% | |||||||||||

| 3,130 | Affiliated Managers Group Inc., (2) | 310,559 | |||||||||

| 3,410 | Ameriprise Financial, Inc. | 196,246 | |||||||||

| 2,810 | Artio Global Investors Inc. | 41,448 | |||||||||

| 4,380 | Calamos Asset Management, Inc. Class A | 61,320 | |||||||||

| 6,310 | Invesco LTD | 151,819 | |||||||||

| 15,455 | Legg Mason, Inc. | 560,553 | |||||||||

| 4,720 | T. Rowe Price Group Inc. | 304,629 | |||||||||

| 45,240 | UBS AG | 742,710 | |||||||||

| 111,272 | UBS AG, (2), (3) | 1,832,650 | |||||||||

| Total Capital Markets | 4,201,934 | ||||||||||

| Chemicals – 1.0% | |||||||||||

| 15,060 | Celanese Corporation, Series A | 620,020 | |||||||||

| 680 | CF Industries Holdings, Inc. | 91,902 | |||||||||

| 2,720 | Intrepid Potash Inc., (2) | 101,429 | |||||||||

| 80,252 | Kuraray Company Limited | 1,150,552 | |||||||||

| 3,060 | Minerals Technologies Inc. | 200,155 | |||||||||

| 16,750 | Mosaic Company | 1,279,030 | |||||||||

| 27,125 | Nitto Denko Corporation | 1,277,905 | |||||||||

| 8,120 | Potash Corporation of Saskatchewan | 1,261,324 | |||||||||

| 2,630 | PPG Industries, Inc. | 221,104 | |||||||||

| 1,387 | Shin-Etsu Chemical Company Limited, ADR, (16) | 75,246 | |||||||||

| 5,630 | Solutia Inc., (2) | 129,940 | |||||||||

| 49,607 | Umicore | 2,580,000 | |||||||||

| 3,410 | Westlake Chemical Corporation | 148,233 | |||||||||

| Total Chemicals | 9,136,840 | ||||||||||

| Commercial Banks – 2.4% | |||||||||||

| 71,973 | Associated Banc-Corp. | 1,090,391 | |||||||||

| 77,919 | Banco Itau Holdings Financeira, S.A., Sponsred ADR | 1,870,835 | |||||||||

| 81,280 | Banco Santander Central Hispano S.A. | 1,105,408 | |||||||||

| 87,249 | Banco Santander Central Hispano S.A., ADR | 924,332 | |||||||||

| 12,100 | BNP Paribas SA | 769,817 | |||||||||

| 14,590 | Canadian Imperial Bank of Commerce | 1,149,386 | |||||||||

| 6,300 | Columbia Banking Systems Inc. | 132,678 | |||||||||

| 9,496 | Commerce Bancshares Inc. | 377,276 | |||||||||

| 6,765 | Community Bank System Inc. | 187,864 | |||||||||

| 199,562 | DnB NOR ASA | 2,801,026 | |||||||||

| 7,810 | East West Bancorp Inc. | 152,686 | |||||||||

| 5,090 | First Financial Bancorp. | 94,063 | |||||||||

| 76,091 | Hang Seng Bank | 1,249,127 | |||||||||

| 156,530 | HSBC Holdings PLC | 1,588,982 | |||||||||

| 6,510 | M&T Bank Corporation | 566,696 | |||||||||

| 91,571 | Mitsubishi UFJ Financial Group, Inc., ADR | 495,131 | |||||||||

| 298,117 | Mizuho Financial Group | 561,792 | |||||||||

| 14,800 | Societe Generale | 795,441 | |||||||||

| 83,163 | Standard Chartered PLC | 2,237,272 | |||||||||

| 14,845 | Sumitomo Mitsui Financial Group | 528,781 | |||||||||

| 11,373 | Sumitomo Trust & Banking Company, ADR, (16) | 72,105 | |||||||||

Nuveen Investments

20

| Shares | Description (1) | Value | |||||||||

| Commercial Banks (continued) | |||||||||||

| 26,000 | Toronto-Dominion Bank | $ | 1,941,567 | ||||||||

| 28,290 | U.S. Bancorp | 762,981 | |||||||||

| 2,180 | UMB Financial Corporation | 90,296 | |||||||||

| 10,830 | Umpqua Holdings Corporation | 131,909 | |||||||||

| 15,430 | Wells Fargo & Company | 478,176 | |||||||||

| Total Commercial Banks | 22,156,018 | ||||||||||

| Commercial Services & Supplies – 0.4% | |||||||||||

| 27,660 | Aggreko PLC | 639,108 | |||||||||

| 1,390 | Clean Harbors, Inc., (2) | 116,871 | |||||||||

| 10,615 | Republic Services, Inc. | 316,964 | |||||||||

| 4,047 | Stericycle Inc., (2) | 327,483 | |||||||||

| 253,300 | Toppan Printing Company Limited | 2,314,923 | |||||||||

| 4,170 | Waste Management, Inc. | 153,748 | |||||||||

| Total Commercial Services & Supplies | 3,869,097 | ||||||||||

| Communications Equipment – 0.4% | |||||||||||

| 1,970 | Comtech Telecom Corporation | 54,628 | |||||||||

| 2,465 | Interdigital Inc., (2) | 102,643 | |||||||||

| 76,620 | Nokia Oyj | 792,478 | |||||||||

| 122,442 | Nokia Corporation, ADR, (3) | 1,263,601 | |||||||||

| 6,410 | Plantronics Inc. | 238,580 | |||||||||

| 27,520 | QUALCOMM, Inc. | 1,361,965 | |||||||||

| Total Communications Equipment | 3,813,895 | ||||||||||

| Computers & Peripherals – 0.5% | |||||||||||

| 11,771 | Apple, Inc., (2) | 3,796,854 | |||||||||

| 4,250 | Network Appliance Inc., (2) | 233,580 | |||||||||

| 5,590 | SanDisk Corporation, (2) | 278,717 | |||||||||

| 1,075 | Western Digital Corporation, (2) | 36,443 | |||||||||

| Total Computers & Peripherals | 4,345,594 | ||||||||||

| Construction & Engineering – 0.1% | |||||||||||

| 27,130 | Royal Boskalis Westminster NV | 1,294,261 | |||||||||

| 2,286 | Shaw Group Inc., (2) | 78,250 | |||||||||

| Total Construction & Engineering | 1,372,511 | ||||||||||

| Consumer Finance – 0.0% | |||||||||||

| 11,140 | Discover Financial Services | 206,424 | |||||||||

| Containers & Packaging – 0.0% | |||||||||||

| 10,930 | Boise Inc. | 86,675 | |||||||||

| 1,422 | Rock-Tenn Company | 76,717 | |||||||||

| Total Containers & Packaging | 163,392 | ||||||||||

| Diversified Consumer Services – 0.0% | |||||||||||

| 670 | Coinstar Inc., (2) | 37,815 | |||||||||

| 3,800 | Sothebys Holdings Inc. | 171,000 | |||||||||

| Total Diversified Consumer Services | 208,815 | ||||||||||

| Diversified Financial Services – 0.1% | |||||||||||

| 850 | CME Group, Inc. | 273,488 | |||||||||

| 3,072 | Guoco Group Ltd, ADR, (16) | 82,207 | |||||||||

| 52,000 | Guoco Group Ltd | 690,408 | |||||||||

| 4,300 | Nasdaq Stock Market, Inc., (2) | 101,953 | |||||||||

| Total Diversified Financial Services | 1,148,056 | ||||||||||

Nuveen Investments

21

JPC

Nuveen Multi-Strategy Income and Growth Fund (continued)

Portfolio of INVESTMENTS December 31, 2010

| Shares | Description (1) | Value | |||||||||

| Diversified Telecommunication Services – 0.8% | |||||||||||

| 6,870 | CenturyLink Inc. | $ | 317,188 | ||||||||

| 37,500 | KT Corporation, Sponsored ADR | 780,000 | |||||||||

| 167,667 | Nippon Telegraph and Telephone Corporation, ADR, (3) | 3,846,281 | |||||||||

| 1,455,000 | Telecom Italia S.p.A | 1,578,785 | |||||||||

| 2,884 | Telus Corporation | 125,627 | |||||||||

| 19,820 | Verizon Communications Inc. | 709,160 | |||||||||

| Total Diversified Telecommunication Services | 7,357,041 | ||||||||||

| Electric Utilities – 1.0% | |||||||||||

| 150,790 | Centrais Electricas Brasileiras S.A., PFD B ADR | 2,512,161 | |||||||||

| 9,710 | DPL Inc. | 249,644 | |||||||||

| 14,780 | Duke Energy Corporation | 263,232 | |||||||||

| 2,320 | Edison International | 89,552 | |||||||||

| 9,648 | Electricite de France S.A., ADR, (16) | 80,078 | |||||||||

| 26,600 | Electricite de France S.A. | 1,091,072 | |||||||||

| 16,851 | Exelon Corporation | 701,676 | |||||||||

| 152,632 | Korea Electric Power Corporation, Sponsored ADR, (3) | 2,062,058 | |||||||||

| 15,080 | Northeast Utilities | 480,750 | |||||||||

| 3,127 | PNM Resources Inc. | 40,714 | |||||||||

| 4,650 | Portland General Electric Company | 100,905 | |||||||||

| 12,710 | Progress Energy, Inc. | 552,631 | |||||||||

| 18,620 | Southern Company | 711,843 | |||||||||

| 4,870 | UIL Holdings Corporation | 145,905 | |||||||||

| Total Electric Utilities | 9,082,221 | ||||||||||

| Electrical Equipment – 0.9% | |||||||||||

| 51,392 | ABB Limited, ADR | 1,153,750 | |||||||||

| 67,689 | ABB Limited | 1,507,981 | |||||||||

| 18,500 | Areva CI | 902,337 | |||||||||

| 9,515 | GrafTech International Ltd, (2) | 188,778 | |||||||||

| 25,613 | Nidec Corporation | 2,590,008 | |||||||||

| 2,710 | Rockwell Automation, Inc. | 194,334 | |||||||||

| 53,350 | Sensata Techologies Holdings | 1,606,369 | |||||||||

| Total Electrical Equipment | 8,143,557 | ||||||||||

| Electronic Equipment & Instruments – 0.4% | |||||||||||

| 6,800 | Daktronics Inc. | 108,256 | |||||||||

| 2,570 | FLIR Systems Inc., (2) | 76,458 | |||||||||

| 59,801 | Hoya Corporation | 1,452,489 | |||||||||

| 8,170 | Ingram Micro, Inc., Class A, (2) | 155,965 | |||||||||

| 125,982 | Nippon Electric Glass Company Limited | 1,818,585 | |||||||||

| 10,290 | Power One Inc, (2) | 104,958 | |||||||||

| 1,459 | Tech Data Corporation, (2) | 64,225 | |||||||||

| Total Electronic Equipment & Instruments | 3,780,936 | ||||||||||

| Energy Equipment & Services – 0.7% | |||||||||||

| 75,240 | ACERGY S.A., ADR | 1,843,912 | |||||||||

| 126,281 | AMEC PLC | 2,264,173 | |||||||||

| 718 | Baker Hughes Incorporated | 41,048 | |||||||||

| 9,455 | Cooper Cameron Corporation, (2) | 479,652 | |||||||||

| 4,865 | FMC Technologies Inc., (2) | 432,547 | |||||||||

| 9,265 | Halliburton Company | 378,290 | |||||||||

| 3,980 | Hornbeck Offshore Services Inc. | 83,102 | |||||||||

| 7,970 | Oil States International Inc., (2) | 510,797 | |||||||||

| 10,240 | Patterson-UTI Energy, Inc. | 220,672 | |||||||||

| 8,010 | Schlumberger Limited | 668,835 | |||||||||

| Total Energy Equipment & Services | 6,923,028 | ||||||||||

Nuveen Investments

22

| Shares | Description (1) | Value | |||||||||

| Food & Staples Retailing – 1.2% | |||||||||||

| 162,921 | Jeronimo Martins SGPS | $ | 2,481,909 | ||||||||

| 83,645 | Koninklijke Ahold N.V. | 1,103,888 | |||||||||

| 118,352 | Kroger Co., (3) | 2,646,351 | |||||||||

| 97,928 | Wal-Mart Stores, Inc., (3) | 5,281,257 | |||||||||

| Total Food & Staples Retailing | 11,513,405 | ||||||||||

| Food Products – 1.7% | |||||||||||

| 6,330 | Archer-Daniels-Midland Company | 190,406 | |||||||||

| 6,260 | Corn Products International, Inc. | 287,960 | |||||||||

| 1,090 | Diamond Foods Inc. | 57,966 | |||||||||

| 9,020 | General Mills, Inc. | 321,022 | |||||||||

| 15,070 | H.J. Heinz Company | 745,362 | |||||||||

| 15,095 | Hershey Foods Corporation | 711,729 | |||||||||

| 9,550 | Kellogg Company | 487,814 | |||||||||

| 24,280 | Mead Johnson Nutrition Company, Class A Shares | 1,511,430 | |||||||||

| 31,966 | Nestle S.A. | 1,871,806 | |||||||||

| 10,630 | Ralcorp Holdings Inc., (2) | 691,056 | |||||||||

| 178,887 | Smithfield Foods, Inc., (2), (3) | 3,690,439 | |||||||||

| 184,736 | Tyson Foods, Inc., Class A, (3) | 3,181,154 | |||||||||

| 76,130 | Unilever PLC, ADR | 2,329,968 | |||||||||

| Total Food Products | 16,078,112 | ||||||||||

| Gas Utilities – 0.0% | |||||||||||

| 2,640 | National Fuel Gas Company | 173,237 | |||||||||

| Health Care Equipment & Supplies – 0.4% | |||||||||||

| 5,970 | Align Technology, Inc., (2) | 116,654 | |||||||||

| 2,560 | Beckman Coulter, Inc. | 192,589 | |||||||||

| 12,250 | Becton, Dickinson and Company | 1,035,370 | |||||||||

| 1,870 | C. R. Bard, Inc. | 171,610 | |||||||||

| 2,520 | Cooper Companies, Inc. | 141,977 | |||||||||

| 5,570 | Covidien PLC | 254,326 | |||||||||

| 11,740 | Edwards Lifesciences Corporation, (2) | 949,062 | |||||||||

| 13,220 | Hologic Inc., (2) | 248,800 | |||||||||

| 5,330 | Masimo Corporation | 154,943 | |||||||||

| 2,390 | Steris Corporation | 87,139 | |||||||||

| 1,761 | Zimmer Holdings, Inc., (2) | 94,530 | |||||||||

| Total Health Care Equipment & Supplies | 3,447,000 | ||||||||||

| Health Care Providers & Services – 0.9% | |||||||||||

| 80,533 | Aetna Inc., (3) | 2,457,062 | |||||||||

| 1,620 | Air Methods Corporation, (2) | 91,157 | |||||||||

| 30,240 | AmerisourceBergen Corporation | 1,031,789 | |||||||||

| 2,360 | Centene Corporation, (2) | 59,802 | |||||||||

| 7,820 | Express Scripts, Inc., (2) | 422,671 | |||||||||

| 26,233 | Fresenius Medical Care, ADR | 1,515,434 | |||||||||

| 9,620 | HealthSouth Corporation, (2) | 199,230 | |||||||||

| 2,740 | Humana Inc., (2) | 149,988 | |||||||||

| 1,920 | Laboratory Corporation of America Holdings, (2) | 168,806 | |||||||||

| 9,029 | Lincare Holdings | 242,248 | |||||||||

| 13,910 | McKesson HBOC Inc. | 978,986 | |||||||||

| 10,120 | Medco Health Solutions, Inc., (2) | 620,052 | |||||||||

| 3,337 | Omnicare, Inc. | 84,726 | |||||||||

| 3,770 | Owens and Minor Inc. | 110,951 | |||||||||

| 4,920 | Quest Diagnostics Incorporated | 265,532 | |||||||||

| Total Health Care Providers & Services | 8,398,434 | ||||||||||

Nuveen Investments

23

JPC

Nuveen Multi-Strategy Income and Growth Fund (continued)

Portfolio of INVESTMENTS December 31, 2010

| Shares | Description (1) | Value | |||||||||

| Hotels, Restaurants & Leisure – 0.5% | |||||||||||

| 10,230 | Bally Technologies, Inc., (2) | $ | 431,604 | ||||||||

| 40,075 | Carnival Corporation | 1,863,180 | |||||||||

| 1,650 | Chipotle Mexican Grill Inc., (2) | 350,889 | |||||||||

| 7,490 | Las Vegas Sands, (2) | 344,166 | |||||||||

| 2,260 | Marriott International, Inc., Class A | 93,880 | |||||||||

| 4,250 | MGM Mirage Inc., (2) | 63,113 | |||||||||

| 2,660 | Penn National Gaming, Inc., (2) | 93,499 | |||||||||

| 6,800 | Royal Caribbean Cruises Limited, (2) | 319,600 | |||||||||

| 14,030 | Starbucks Corporation | 450,784 | |||||||||

| 2,061 | Vail Resorts, Inc. | 107,254 | |||||||||

| 4,180 | YUM! Brands, Inc. | 205,029 | |||||||||

| Total Hotels, Restaurants & Leisure | 4,322,998 | ||||||||||

| Household Durables – 0.2% | |||||||||||

| 10,990 | D.R. Horton, Inc. | 131,111 | |||||||||

| 7,220 | Lennar Corporation, Class A | 135,375 | |||||||||

| 4,855 | Meritage Corporation, (2) | 107,781 | |||||||||

| 27,250 | Newell Rubbermaid Inc. | 495,405 | |||||||||

| 201,188 | Oriental Weavers Group | 1,187,027 | |||||||||

| 3,855 | Tempur Pedic International Inc., (2) | 154,431 | |||||||||

| Total Household Durables | 2,211,130 | ||||||||||

| Household Products – 0.2% | |||||||||||

| 8,890 | Colgate-Palmolive Company | 714,489 | |||||||||

| 10,190 | Kimberly-Clark Corporation | 642,378 | |||||||||

| 12,160 | Procter & Gamble Company | 782,253 | |||||||||

| Total Household Products | 2,139,120 | ||||||||||

| Independent Power Producers & Energy Traders – 0.1% | |||||||||||

| 19,190 | Constellation Energy Group | 587,790 | |||||||||

| Industrial Conglomerates – 0.5% | |||||||||||

| 3,850 | 3M Co | 332,255 | |||||||||

| 233,172 | Fraser and Neave Limited | 1,164,634 | |||||||||

| 22,820 | General Electric Company | 417,378 | |||||||||

| 14,980 | Rheinmetall AG | 1,204,469 | |||||||||

| 9,350 | Siemens AG, Sponsored ADR | 1,158,231 | |||||||||

| 5,340 | Textron Inc. | 126,238 | |||||||||

| Total Industrial Conglomerates | 4,403,205 | ||||||||||

| Insurance – 1.0% | |||||||||||

| 13,384 | AFLAC Incorporated | 755,259 | |||||||||

| 6,590 | Alterra Capital Holdings Limited | 142,608 | |||||||||

| 872 | Aon Corporation | 40,121 | |||||||||

| 6,614 | Axis Capital Holdings Limited | 237,310 | |||||||||

| 6,870 | Delphi Financial Group, Inc. | 198,131 | |||||||||

| 20,410 | Genworth Financial Inc., Class A, (2) | 268,187 | |||||||||

| 42,354 | Hannover Rueckversicherung AG | 2,271,547 | |||||||||

| 13,210 | Hartford Financial Services Group, Inc. | 349,933 | |||||||||

| 24,822 | Lincoln National Corporation | 690,300 | |||||||||

| 1,315 | Loews Corporation | 51,167 | |||||||||

| 5,759 | Marsh & McLennan Companies, Inc. | 157,451 | |||||||||

| 14,441 | Old Republic International Corporation | 196,831 | |||||||||

| 2,030 | PartnerRe Limited | 163,111 | |||||||||

| 4,610 | Primerica Inc. | 111,793 | |||||||||

| 14,270 | Progressive Corporation | 283,545 | |||||||||

| 105,446 | Prudential Corporation PLC | 1,098,197 | |||||||||

| 3,220 | Prudential Financial, Inc. | 189,046 | |||||||||

Nuveen Investments

24

| Shares | Description (1) | Value | |||||||||

| Insurance (continued) | |||||||||||

| 3,120 | Reinsurance Group of America Inc. | $ | 167,575 | ||||||||

| 18,860 | Symetra Financial Corporation | 258,382 | |||||||||

| 5,260 | Tower Group Inc. | 134,551 | |||||||||

| 33,560 | Willis Group Holdings PLC | 1,162,183 | |||||||||

| 5,930 | WR Berkley Corporation | 162,363 | |||||||||

| Total Insurance | 9,089,591 | ||||||||||

| Internet & Catalog Retail – 0.1% | |||||||||||

| 22,990 | Expedia, Inc. | 576,819 | |||||||||

| Internet Software & Services – 0.6% | |||||||||||

| 91,847 | eBay Inc., (2), (3) | 2,556,102 | |||||||||

| 3,100 | Google Inc., Class A, (2) | 1,841,307 | |||||||||

| 5,520 | IAC/InterActiveCorp., (2) | 158,424 | |||||||||

| 5,430 | Rackspace Hosting Inc., (2) | 170,556 | |||||||||

| 25,145 | Tencent Holdings Limited | 553,185 | |||||||||

| Total Internet Software & Services | 5,279,574 | ||||||||||

| IT Services – 0.4% | |||||||||||

| 7,670 | Accenture Limited | 371,918 | |||||||||

| 16,590 | Automatic Data Processing, Inc. | 767,785 | |||||||||

| 5,670 | CSG Systems International Inc., (2) | 107,390 | |||||||||

| 13,005 | International Business Machines Corporation (IBM) | 1,908,614 | |||||||||

| 2,110 | MasterCard, Inc. | 472,872 | |||||||||

| 1,980 | Maximus Inc. | 129,848 | |||||||||

| 3,721 | VeriFone Holdings Inc., (2) | 143,482 | |||||||||

| 3,225 | Wright Express Corporation, (2) | 148,350 | |||||||||

| Total IT Services | 4,050,259 | ||||||||||

| Leisure Equipment & Products – 0.0% | |||||||||||

| 6,410 | JAKKS Pacific Inc. | 116,790 | |||||||||

| Life Sciences Tools & Services – 0.1% | |||||||||||

| 7,870 | Affymetrix, Inc., (2) | 39,586 | |||||||||

| 950 | Bio-Rad Laboratories Inc., (2) | 98,658 | |||||||||

| 7,780 | Life Technologies Corporation, (2) | 431,790 | |||||||||

| 6,150 | Waters Corporation, (2) | 477,917 | |||||||||

| Total Life Sciences Tools & Services | 1,047,951 | ||||||||||

| Machinery – 1.0% | |||||||||||

| 4,527 | AGCO Corporation, (2) | 229,338 | |||||||||

| 4,110 | ArvinMeritor Inc., (2) | 84,337 | |||||||||

| 2,380 | Astecx Industries Inc. | 77,136 | |||||||||

| 10,030 | Caterpillar Inc. | 939,410 | |||||||||

| 1,350 | Crane Company | 55,445 | |||||||||

| 11,610 | Cummins Inc. | 1,277,216 | |||||||||

| 3,900 | Danaher Corporation | 183,963 | |||||||||

| 3,890 | Deere & Company | 323,065 | |||||||||

| 3,230 | Eaton Corporation | 327,877 | |||||||||

| 1,180 | Kaydon Corporation | 48,050 | |||||||||

| 35,991 | Kone OYJ | 2,000,742 | |||||||||

| 920 | Nordson Corporation | 84,530 | |||||||||

| 24,590 | Oshkosh Truck Corporation, (2) | 866,552 | |||||||||

| 7,700 | Parker Hannifin Corporation | 664,510 | |||||||||

| 15,690 | Timken Company | 748,884 | |||||||||

| 11,080 | Vallourec SA | 1,163,768 | |||||||||

| Total Machinery | 9,074,823 | ||||||||||

Nuveen Investments

25

JPC

Nuveen Multi-Strategy Income and Growth Fund (continued)

Portfolio of INVESTMENTS December 31, 2010

| Shares | Description (1) | Value | |||||||||

| Marine – 0.2% | |||||||||||

| 8,660 | Genco Shipping and Trading Limited, (2) | $ | 124,704 | ||||||||

| 68,000 | Stolt-Nielsen Ltd. | 1,660,654 | |||||||||

| Total Marine | 1,785,358 | ||||||||||

| Media – 0.6% | |||||||||||

| 14,050 | Cablevision Systems Corporation | 475,452 | |||||||||

| 32,027 | Citadel Broadcasting Corporation, (2) | 964,653 | |||||||||

| 23,975 | Comcast Corporation, Class A | 526,731 | |||||||||

| 20,376 | DIRECTV Group, Inc., (2) | 813,614 | |||||||||

| 2,495 | Madison Square Garden Inc., (2) | 64,321 | |||||||||

| 14,297 | Metro-Goldwyn-Mayer | 339,554 | |||||||||

| 2,669 | Philadelphia Newspapers LLC | 280,245 | |||||||||

| 16,449 | Readers Digest Association Inc., (2), (16) | 390,664 | |||||||||

| 10,180 | Scripps Networks Interactive, Class A Shares | 526,815 | |||||||||

| 1,322 | Time Warner Cable, Inc. | 87,292 | |||||||||

| 78,450 | WPP Group PLC | 965,648 | |||||||||

| Total Media | 5,434,989 | ||||||||||

| Metals & Mining – 3.4% | |||||||||||

| 31,000 | AngloGold Ashanti Limited, Sponsored ADR, (3) | 1,526,130 | |||||||||

| 132,868 | Barrick Gold Corporation, (3) | 7,065,920 | |||||||||

| 44,513 | BHP Billiton PLC, ADR | 2,060,138 | |||||||||

| 1,310 | Cliffs Natural Resources Inc. | 102,193 | |||||||||

| 15,995 | Freeport-McMoRan Copper & Gold, Inc. | 1,920,840 | |||||||||

| 220,631 | Gold Fields Limited, Sponsored ADR, (3) | 4,000,040 | |||||||||

| 31,200 | Ivanhoe Mines Ltd, (2), (3) | 715,104 | |||||||||

| 12,590 | Kinross Gold Corporation | 238,706 | |||||||||

| 1,808 | Newcrest Mining Limited, Sponsored ADR, (16) | 75,303 | |||||||||

| 18,000 | Newcrest Mining Limited | 744,517 | |||||||||

| 79,016 | Newmont Mining Corporation, (3) | 4,853,953 | |||||||||

| 5,010 | Noranda Aluminum Hodlings Corporation | 73,146 | |||||||||

| 4,977 | NovaGold Resources Inc., (2) | 71,022 | |||||||||

| 79,000 | NovaGold Resources Inc., 144A | 1,127,330 | |||||||||

| 52,073 | Polyus Gold Company, ADR, (16) | 1,887,646 | |||||||||

| 31,660 | Rio Tinto Limited | 2,767,677 | |||||||||

| 5,310 | Steel Dynamics Inc. | 97,173 | |||||||||

| 97,730 | Sterlite Industries India Ltd., ADR | 1,616,454 | |||||||||

| 10,880 | Walter Industries Inc. | 1,390,899 | |||||||||

| Total Metals & Mining | 32,334,191 | ||||||||||

| Multiline Retail – 0.3% | |||||||||||

| 2,905 | Dillard's, Inc., Class A | 110,216 | |||||||||

| 8,250 | Family Dollar Stores, Inc. | 410,108 | |||||||||

| 18,880 | Macy's, Inc. | 477,664 | |||||||||

| 46,951 | Next PLC | 1,445,725 | |||||||||

| Total Multiline Retail | 2,443,713 | ||||||||||

| Multi-Utilities – 0.2% | |||||||||||

| 15,921 | Ameren Corporation | 448,813 | |||||||||

| 7,970 | Consolidated Edison, Inc. | 395,073 | |||||||||

| 15,280 | Dominion Resources, Inc. | 652,762 | |||||||||

| 3,510 | Integrys Energy Group, Inc. | 170,270 | |||||||||