UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

NORTEK , INC.

(Name of Registrant as Specified In Its Charter)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

| |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of the transaction: |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

March 30, 2012

Dear Stockholder:

The Company's 2012 Annual Meeting of Stockholders will be held on May 8, 2011 at 8:30 a.m., local time, at The Westin Providence, One West Exchange Street, Providence, RI 02903 (telephone: (401) 598-8000), and I hope you will join us.

At the meeting, we will be asking you:

1. To elect three Class III directors for a three-year term to expire in 2015;

2. To ratify the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for fiscal year 2012;

3. To approve the Company's 2009 Omnibus Incentive Plan, as Amended and Restated, and authorize the issuance of additional shares thereunder; and

4. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

As explained more fully in the proxy statement included with this Notice, you can vote using the Internet, by telephone, by mail, or in person, in each case by following the instructions in the proxy statement.

We urge you to vote your shares at your earliest convenience.

Thank you very much for your interest in our Company.

Sincerely,

Michael J. Clarke

President and Chief Executive Officer

Nortek, Inc.

NORTEK, INC.

________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 8, 2012

________________

Dear Stockholders:

The Annual Meeting of Stockholders (the “Annual Meeting”) of Nortek, Inc., a Delaware corporation (the “Company”), will be held at The Westin Providence, One West Exchange Street, Providence, RI 02903 (telephone: (401) 598-8000), on May 8, 2012 at 8:30 a.m., local time, to vote on the following proposals:

1. To elect Michael J. Clarke, Daniel C. Lukas and Bennett Rosenthal as the three Class III directors to serve a three-year term until the Company's Annual Meeting in 2015;

2. To ratify the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for fiscal year 2012;

3. To approve the Company's 2009 Omnibus Incentive Plan, as Amended and Restated, and authorize the issuance of additional shares thereunder; and

4. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The Board has fixed the close of business on March 14, 2012 as the record date for the determination of Stockholders entitled to notice of, and to vote at, the Annual Meeting. A complete list of those Stockholders will be open to examination by any Stockholder for any purpose germane to the Annual Meeting during ordinary business hours at the executive offices of the Company, 50 Kennedy Plaza, Providence, Rhode Island 02903, for a period of ten days prior to the Annual Meeting.

You can simplify your voting and save the Company expense by voting over the telephone or by Internet.

If your shares are held in “street name” in a stock brokerage account or by a bank or other nominee, you must provide your broker with instructions on how to vote your shares in order for your shares to be voted on important matters presented at the annual meeting. If you do not instruct your broker on how to vote in the election of directors, your shares will not be voted on these matters.

All Stockholders are cordially invited to attend the Annual Meeting. Whether or not you are able to attend the Annual Meeting in person, it is important that your shares be represented. Please vote as soon as possible.

Sincerely,

Kevin W. Donnelly

Senior Vice President, General Counsel and Secretary

Nortek, Inc.

Providence, Rhode Island

March 30, 2012

NORTEK, INC.

Proxy Statement - Table of Contents

|

| | |

| 5 |

|

| 7 |

|

| 9 |

|

| 9 |

|

| 9 |

|

| 10 |

|

| 12 |

|

| 14 |

|

| 14 |

|

| 14 |

|

| 15 |

|

| 15 |

|

| 16 |

|

| 16 |

|

| 17 |

|

| 18 |

|

| 18 |

|

| 19 |

|

| 19 |

|

| 20 |

|

| 22 |

|

| 22 |

|

| 22 |

|

| 23 |

|

| 23 |

|

| 24 |

|

| 25 |

|

| 25 |

|

| 26 |

|

| 26 |

|

| 27 |

|

| 27 |

|

| 27 |

|

| 30 |

|

| 31 |

|

| 33 |

|

| 33 |

|

| 35 |

|

| 41 |

|

| 41 |

|

| 41 |

|

| 41 |

|

| 42 |

|

| 42 |

|

| 42 |

|

| 43 |

|

| 43 |

|

| 45 |

|

| 46 |

|

| 46 |

|

| 46 |

|

| 46 |

|

| 49 |

|

| 50 |

|

ABOUT THE ANNUAL MEETING

Nortek, Inc. (the “Company”) is required by Delaware law (the state in which the Company is incorporated) to hold an annual meeting of stockholders for the express purpose of allowing the Company's stockholders to vote on those matters reserved to them under Delaware law or the Company's Amended and Restated Certificate of Incorporation or Amended and Restated By-Laws. The State of Delaware, the Securities and Exchange Commission (the “SEC”) and the NASDAQ Global Market (“Nasdaq”) have rules that govern how we must conduct the Annual Meeting and what rights you may or may not have therein, especially related to how we solicit your votes for the Annual Meeting, the form of proxy that we may use, and the information that we must provide to you. Below you will find a summary of matters that specifically relate to the Annual Meeting and that we are required to disclose to you. We hope that you find this summary useful in your understanding of the Annual Meeting process, the Company's business, the directors, and the other matters that are pertinent to all of the above.

|

| |

| Date of Annual Meeting (the “Annual Meeting”) | May 8, 2012 |

| | |

| Time of Annual Meeting | 8:30 a.m., local time |

| | |

| Place of Annual Meeting | The Westin Providence, One West Exchange Street, Providence, RI 02903 (telephone: (401) 598-8000) |

| | |

| Record Date for Annual Meeting (the “Record Date”) | March 14, 2012 |

| | |

| Attending the Annual Meeting | All stockholders of record are welcome at the Annual Meeting. If you are intending to attend, please have proper identification. If your shares are held in street name, please have your most current brokerage account statement with you. |

| | |

| Mailing Date of Proxy Materials | On or about April 4, 2012 |

| | |

|

| | |

| Votes to Be Taken at the Annual Meeting | You are voting on: |

| | |

| | l | Proposal 1: Election of Michael J. Clarke, Daniel C. Lukas and Bennett Rosenthal to the class of directors whose term expires in 2015 (see page 16); |

| | |

| | l | Proposal 2: Ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for fiscal year 2012 (see page 40); |

| | |

| | l | Proposal 3: Approval of the Nortek, Inc. 2009 Omnibus Incentive Plan, as Amended and Restated, (the “Amended Plan”) and authorization of the issuance of additional shares under the Amended Plan (see page 42); and |

| | |

| | l | Any other business properly coming before the Annual Meeting. |

| | |

| Recommended Vote on Each Proposal | The Board of Director's recommendation can be found with the description of each proposal in this proxy statement. In summary, the Board of Directors recommends that you vote: |

| | |

| | 1 | FOR each of the three nominees for Class III director; |

| | |

| | 2 | FOR the ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the 2012 fiscal year; and |

| | | |

| | 3 | FOR the approval of the Amended Plan and the authorization of the issuance of additional shares under the Amended Plan.

|

|

| |

| Vote Required to Pass Each Proposal | |

|

| |

| Proposal 1 - Election of Directors | Directors are elected by plurality vote, which means that the three nominees for director receiving the highest number of votes FOR election will be elected as directors. Stockholders may not cumulate votes for the election of directors. If a nominee for director is unable to serve as a director, the Proxy Committee (as defined later in this proxy statement) may, in its discretion, vote for another person as director or vote to reduce the number of directors to less than nine, as the Board may recommend. |

| | |

| Proposal 2 - Ratification of Public Accountants | To ratify Proposal 2, stockholders holding a majority of the common stock present or represented by proxy at the Annual Meeting and voting on the matter must vote FOR this proposal. |

| | |

| Proposal 3 - Approval of the Amended Plan and Authorization of Share Issuance | To approve Proposal 3, stockholders holding a majority of the common stock present or represented by proxy at the Annual Meeting and voting on the matter must vote FOR this proposal. |

| | |

| Shares Outstanding on the Record Date and Entitled to Notice of and to Vote at the Annual Meeting | 15,675,445 shares of common stock, which includes 543,206 shares of restricted common stock awarded under Nortek's 2009 Omnibus Incentive Plan. |

| | |

| Voting of Shares | Each stockholder is entitled to one vote for each share of common stock and to one vote for each share of restricted common stock held as of the Record Date. |

| | |

| Company Headquarters | 50 Kennedy Plaza, Providence, Rhode Island 02903 |

| | |

| Company Telephone Number | (401) 751-1600 |

VOTING YOUR SHARES

|

| |

| Who is soliciting your proxy? | The Company's Board of Directors (the “Board”) |

| | |

| Who can vote? | Stockholders of record or beneficial owners at the close of business on the Record Date, March 14, 2012, are entitled to notice of and to vote at the Annual Meeting. |

| | |

| Who is a “stockholder of record”? | You are a stockholder of record if your shares of the Company's stock are registered directly in your own name with the Company's transfer agent, BNY Mellon Shareowner Services (the “Transfer Agent”), as of the Record Date. |

| | |

| Who is a “beneficial owner”? | You are a beneficial owner if a brokerage firm, bank, trustee or other agent (called a “nominee”) holds your stock, and who is often the stockholder of record. This is often called ownership in “street name” because your name does not appear in the records of the Transfer Agent. If your shares are held in street name, you will receive instructions from the stockholder of record. You must follow the instructions of the stockholder of record in order for your shares to be voted. Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker's proxy card and bring it to the Annual Meeting in order to vote. |

| | |

| | If you are a beneficial owner and hold your shares in street name and do not provide the organization that holds your shares with voting instructions, the broker or other nominee will determine if it has the discretionary authority to vote on the particular matter. As a general matter, brokers have the discretion to vote on routine matters but cannot vote on non-routine matters. We believe that only Proposal 2: Ratification of Accountants will be considered a routine matter for the Annual Meeting. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” Broker non-votes will be considered as represented for purposes of determining a quorum, but will not otherwise affect voting results. |

| | |

| What is the quorum? | A quorum is required for stockholders to approve or reject proposals. For the purposes of the Annual Meeting, a quorum is the presence in person or by proxy (which includes voting over the Internet) of a majority of the total number of issued and outstanding shares of common stock as of the Record Date entitled to vote at the Annual Meeting. |

| | |

What happens if I don't give specific voting instructions? | If you are a stockholder of record and sign and return your proxy card or vote electronically without making any specific selections, then your shares will be voted in accordance with the recommendations of the Proxy Committee (as defined later in this proxy statement) on all matters presented in this proxy statement and as the Proxy Committee may determine in its discretion regarding any other matters properly presented for a vote at the Annual Meeting. |

| | |

| How are abstentions treated? | Abstentions are counted for purposes of determining whether a quorum is present, but will not be included in vote totals and will not affect the outcome of the vote on any proposal. |

| | |

| What is the “Proxy Committee”? | The Proxy Committee was appointed by the Board and is comprised of Michael J. Clarke, Kevin W. Donnelly and Edward J. Cooney. The Proxy Committee has the authority to vote properly executed proxies that do not otherwise specify specific voting instructions. |

| | |

|

| |

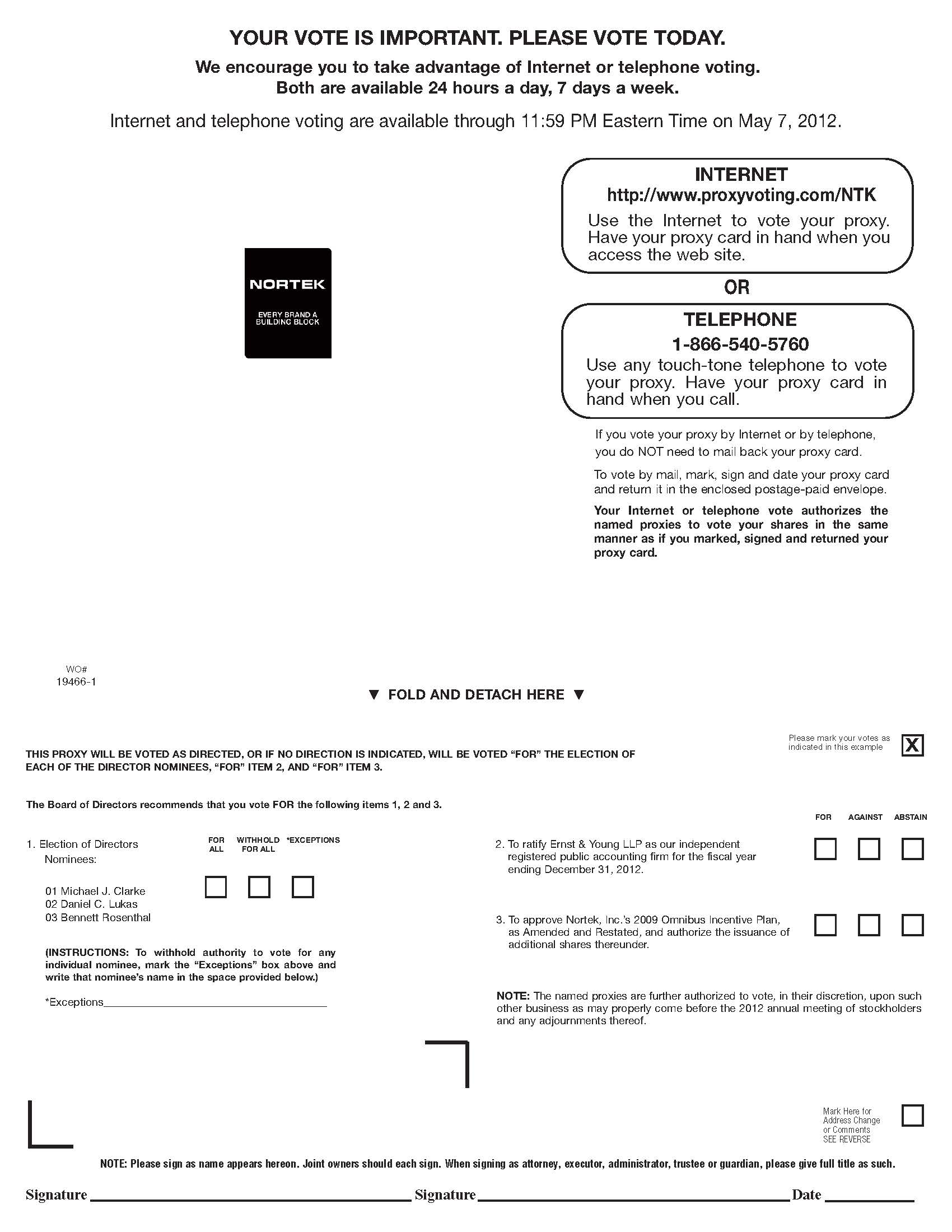

| How can I vote my shares? | By Internet. You can vote over the Internet at www.proxyvoting.com/NTK by following the instructions on the proxy card. |

| | |

| | By Telephone. You can vote your proxy over the telephone by calling 1-866-540-5760 from any touch-tone telephone. You must have your proxy card available when you call. |

| | |

| | By Mail. You can vote by mail by signing, dating and mailing the enclosed proxy card in the postage-paid envelope provided. If the envelope is missing, please mail your completed proxy card or voting instruction card to BNY Mellon Shareowner Services, P.O. Box 3550, South Hackensack, NJ 07606-9250. Please allow sufficient time for delivery if you decide to vote by mail. |

| | |

| | At the Annual Meeting. If you attend the Annual Meeting in person, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. However, if your shares are held in street name, you must obtain a legal proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the stockholder of record. |

| | |

| | The shares voted electronically or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting. Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on Monday, May 7, 2012. |

| | |

| How can I change my vote? | You may change your vote at any time before the proxy is exercised. If you voted by mail, you may revoke your proxy at any time before it is voted by executing and delivering a timely and valid later-dated proxy, or by voting by ballot at the Annual Meeting. Attending the Annual Meeting will not automatically revoke your proxy unless you specifically request it. If you voted via the Internet or by telephone you may also change your vote with a timely and valid later Internet or telephone vote or by voting by ballot at the Annual Meeting. |

| | |

| Are there other matters to be voted on at the Annual Meeting? | The Board is not aware of any matters not set forth in this proxy statement that may come before the Annual Meeting. However, if other matters are properly brought before the Annual Meeting, it is intended that the persons named as the Proxy Committee in this proxy statement will vote as the Board directs. |

| | |

| What is the cost of solicitation? | The Company will bear the entire cost of soliciting the proxies, including the preparation, assembly, printing and mailing of this proxy statement. The Company has retained Georgeson Inc. (“Georgeson”) to act as a proxy solicitor in conjunction with the Annual Meeting and has agreed to pay $8,000, plus reasonable out-of-pocket expenses, to Georgeson for proxy solicitation services. In addition to solicitation by mail, the directors, officers and other employees of the Company may solicit proxies in person, by telephone, electronic communications, or by other means without additional compensation. |

| | |

| Where can I find the voting results of the Annual Meeting? | The Company will announce preliminary voting results at the Annual Meeting. The Company will publish final voting results in a Current Report on Form 8-K to be filed with the SEC within four business days following the date of the Annual Meeting. |

NORTEK BOARD OF DIRECTORS

The Company's business and affairs are managed under the direction of Nortek's Board of Directors (the “Board”). The Board consists of nine directors divided into three classes of three directors who serve in staggered three-year terms. The Company believes that a staggered Board is the most effective way for the Board to be organized because it ensures greater certainty of continuity from year-to-year, which provides stability in organization and experience. As a result of the three classes, at each Annual Meeting, three directors are elected for a three-year term, while the other six directors do not have to stand for election as their term is not then expiring. The Company's current directors are as follows:

| |

• | Class I directors are John T. Coleman, Thomas A. Keenan and J. David Smith, and their terms will expire at the annual meeting of stockholders to be held in 2013; |

| |

• | Class II directors are Jeffrey C. Bloomberg, Joseph M. Cianciolo and James B. Hirshorn, and their terms will expire at the annual meeting of stockholders to be held in 2014; and |

| |

• | Class III directors are Michael J. Clarke, Daniel C. Lukas and Bennett Rosenthal, and their terms will expire at this year's Annual Meeting. |

In fiscal year 2011, the Board met 15 times for both regular and special meetings. Each of the directors attended at least 75% of the aggregate of all meetings of the Board and committees on which he was a member. The Company does not have a formal policy regarding attendance by members of the Board at the Company's annual meeting, but each is encouraged to do so. All directors then in office attended the Company's 2011 annual meeting.

The Company is committed to ensuring that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. Stockholders may communicate with any of the directors by sending a letter to the director, c/o Secretary, Nortek, Inc., 50 Kennedy Plaza, Providence, Rhode Island 02903. All such letters will be promptly forwarded to the respective director.

The common stock of the Company is listed on Nasdaq. The Board has determined that all directors except Messrs. Clarke and Hirshorn are considered “independent directors” within the meaning of the Nasdaq Listing Rules (the “Nasdaq Rules”). Mr. Smith served as Interim Chief Executive Officer commencing July 1, 2011 and ending December 30, 2011, during which period he was not an independent director. The Board has determined that Mr. Smith has qualified as an independent director since the end of his service as Interim Chief Executive Officer.

Leadership of the Board

The Board is responsible for the oversight of the Company's overall strategy and operations. The Board is committed to objective oversight of the Company's management, especially through its independent leadership and committee membership.

Prior to July 1, 2011, the positions of Chairman of the Board and Chief Executive Officer were held by the same person. In connection with a change in the Chief Executive Officer of the Company in 2011, the Board reassessed its leadership structure. To strengthen its independence and enhance objective corporate governance generally, the Board elected Mr. Bloomberg as Lead Director on February 1, 2011. Thereafter, the Board decided to separate the positions of Chairman of the Board and Chief Executive Officer and elected Mr. Smith as its independent Chairman effective March 9, 2012.

The Company separates the roles of Chief Executive Officer and Chairman of the Board in recognition of the different responsibilities associated with the two roles. The Chief Executive Officer is responsible for the general management, oversight, leadership, supervision and control of the day-to-day business and affairs of the Company, and ensures that all directions of the Board are carried into effect. The Chairman is charged with presiding over all meetings of the Board and the Company's stockholders, and providing advice and counsel to the Chief Executive Officer and other Company officers regarding the Company's business and operations. Separating these roles allows the Chief Executive Officer and the Chairman to focus their time and energy where they are best used.

The Board's Role in Risk Oversight

The role of the Board in managing risk at the Company is to have ultimate oversight for the risk management process. Management has day-to-day responsibility for the identification and control of risk facing the Company including timely

identifying, monitoring, mitigating and managing those risks that could have a material effect on the Company. Further, management has the responsibility to report these risks as they arise to the Board and its committees and the Company's auditors. The Board has delegated certain risk assessment responsibilities to the Audit Committee, its compensation committee (the “Compensation Committee”) and its nominating and corporate governance committee (the “Nominating and Corporate Governance Committee”). In particular, the Audit Committee focuses on enterprise and financial risk, including internal controls covering the safeguarding of assets and the accuracy and completeness of financial reporting. The Compensation Committee sets compensation programs for management that take into consideration alignment of management compensation with building shareholder value while avoiding compensation policies that reward excessive risk taking. The Nominating and Corporate Governance Committee oversees the annual Board self-evaluation and director nomination process in order to ensure a diverse and well balanced Board, and it provides input to the Board regarding the appointment of the Company's executive officers. These Committees meet regularly and report their findings to the Board throughout the year.

Committees of the Board

The Board has a complex set of duties and responsibilities, both practically and as provided under Delaware law, rules and regulations promulgated by the SEC and Nasdaq, the Company's Amended and Restated Certificate of Incorporation and the Company's Amended and Restated By-Laws. However, to govern a modern corporation, there are a myriad of activities that must be performed and that are more effectively and efficiently performed by smaller groups of people. To do this, Delaware law gives the Board the authority to establish “committees” of the Board to take on directed duties. Moreover, various regulatory bodies with jurisdiction over the Company mandate certain committees, and, other various applicable laws give the Board the latitude to satisfy some of its duties and responsibilities through these committees.

To this end, the Board has established three committees: the Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee. Each committee operates under a charter approved by the Board. Copies of each committee's charter are posted on the Corporate Governance section of the Investors section of the Company's website, www.nortek-inc.com. The Company's website is included in this proxy statement as a textual reference only and the information in the website is not incorporated by reference into this proxy statement. The membership, principal duties, and responsibilities of each committee are set forth below.

The membership of the Committees is set forth below:

|

| | | |

| Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Jeffrey C. Bloomberg .................................................................................................. | l | l | |

| Joseph M. Cianciolo .................................................................................................... | Chair(1) | | l |

| John T. Coleman .......................................................................................................... | | | Chair |

| Michael J. Clarke ......................................................................................................... | | | |

| Thomas A. Keenan ...................................................................................................... | l | | |

| James B. Hirshorn ....................................................................................................... | | | |

| Daniel C. Lukas .......................................................................................................... | | Chair | l |

| Bennett Rosenthal ....................................................................................................... | | | l |

| J. David Smith ............................................................................................................ | | | |

____________

|

| |

| (1) | The Board has determined that Mr. Cianciolo is an “audit committee financial expert” as defined in applicable SEC rules and has “financial sophistication” as defined in the applicable Nasdaq Rules. |

Under applicable rules and regulations, and as determined by the Board, each of the committee members is an “independent director” as “independence” is defined by the Nasdaq Rules. Pursuant to the Nasdaq Rules, the Audit Committee of the Company must consist entirely of independent members. Each of the four members of the Audit Committee of the Company also is independent within the meaning of Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee consists of “outside” directors, as defined by Rule 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

Audit Committee

The committee's charter provides that the principal duties and responsibilities of the Audit Committee include:

| |

| • | appointing, evaluating, overseeing and replacing, if necessary, the Company's independent registered public accounting firm; |

| |

| • | reviewing the design, implementation, adequacy and effectiveness of the Company's internal controls and critical accounting policies; |

| |

| • | reviewing certain regulatory filings with management and the Company's independent registered public accounting firm; and |

| |

| • | reviewing earnings press releases and earnings guidance provided to analysts. |

In addition, all audit and non-audit services, other than de minimis non-audit services, provided by the Company's independent registered public accounting firm must be approved in advance by the Audit Committee. In fiscal year 2011, the Audit Committee met nine times for both regular and special meetings.

Additional information regarding the Audit Committee and the Company's independent registered public accounting firm is disclosed under the heading “Independent Registered Public Accounting Firm” and “Audit Committee Report” elsewhere in this proxy statement.

Compensation Committee

The committee's charter provides that the principal duties and responsibilities of the Compensation Committee include:

| |

| • | reviewing and approving annual goals and objectives of the Company's chief executive officer (the “CEO”), evaluating the performance of the CEO in light of those goals and objectives, determining or assisting to determine the CEO's compensation level and making all other determinations with respect to the compensation of the CEO; |

| |

| • | recommending to the Board the compensation of the Company's executive officers other than the CEO and, to the extent such authority is delegated to it by the Board, approving the compensation payable to these executive officers, other than the base salaries of Messrs. Donnelly and Hall, which are set by the CEO; |

| |

| • | reviewing and approving the compensation of the chief executive officer of each of the Company's business segments and such other subsidiary officers as the Committee may from time to time designate (collectively, the “Subsidiary designated officers”); |

| |

| • | considering with respect to the compensation of the Company's executive officers and Subsidiary designated officers: (a) annual base salary; (b) any bonus or other short-term incentive program; (c) any long-term incentive compensation (including cash-based and equity-based awards); (d) any employment agreements, severance arrangements, change-in-control arrangements and similar agreements or arrangements; and (e) any perquisites and other special or supplemental benefits; |

| |

| • | reviewing and approving (and in the case of any Company executive officer other than the CEO, recommending to the Board) any termination or other severance pay at the time of the termination of any Company executive officer or Subsidiary designated officer which was not previously approved by the Compensation Committee or the Board or otherwise provided by contract; |

| |

| • | reviewing and making recommendations to the Board regarding compensation, if any, of the Board and its committees; and |

| |

| • | reviewing and making recommendations to the Board regarding incentive compensation and equity-based plans that are subject to approval by the Board. |

In fiscal year 2011, the Compensation Committee met 11 times for both regular and special meetings.

Nominating and Corporate Governance Committee

The committee's charter provides that the principal duties and responsibilities of the Nominating and Corporate Governance Committee include:

| |

| • | evaluating and selecting or recommending for selection candidates for election to the Board; |

| |

| • | developing and recommending to the Board a set of corporate governance principles and code of ethics; |

| |

| • | evaluating the functions, duties and composition of committees of the Board and making recommendations to the Board with respect thereto; |

| |

| • | recommending to the Board or to the appropriate committee processes for annual evaluations of the performance of the Board, the Company's Chairman and the CEO; and |

| |

| • | considering and reporting to the Board any questions of possible conflicts of interest of members of the Board. |

In fiscal year 2011, the Nominating and Corporate Governance Committee met three times for both regular and special meetings.

The Nominating and Corporate Governance Committee is responsible for reviewing with the entire Board from time to time the appropriate skills and characteristics required of Board members in the context of the current make-up of the Board. The Board believes that directors should bring to the Company a variety of perspectives and skills that are derived from high quality business and professional experience and that are aligned with the Company's strategic objectives. Although the Company does not have a formal policy considering diversity in identifying nominees for director, the Board and the Nominating and Corporate Governance Committee generally consider an array of factors, including all aspects of diversity. The composition of the Board should at all times adhere to the standards of independence promulgated by applicable Nasdaq and SEC rules. We also require that directors be able to attend all board and applicable committee meetings. In this respect, directors are expected to advise the Chairman of the Board and the Chair of the Nominating and Corporate Governance Committee in advance of accepting any other public company directorship or assignment to the audit committee of the board of directors of any other public company.

The Nominating and Corporate Governance Committee identifies nominees for election to the Board by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company's business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the Nominating and Corporate Governance Committee or the Board decides not to re-nominate a member for re-election, the Committee will identify the desired skills and experience of a new nominee in light of the criteria above. Current members of the Committee and Board may be consulted for suggestions as to individuals meeting the criteria above. Research may also be performed to identify qualified individuals.

Director Compensation

For their services as directors during 2011, the Company's directors who were not officers, employees or consultants of the Company or its subsidiaries received directors' fees.

Under the Company's prior director compensation policy, which became effective in April 2010, the non-employee directors were compensated as follows:

| |

| • | annual retainer fee of $50,000, payable quarterly in advance; |

| |

| • | additional annual retainer fee of $10,000 for the chair of the Audit Committee and an annual retainer fee of $5,000 for the other members of the Audit Committee; |

| |

| • | fee for board meetings of $1,500 per meeting; and |

| |

| • | fee for committee meetings of $1,500 per meeting, for meetings held on a day when there was not a Board meeting. |

Under the Company's current director compensation policy, which became effective in August 2011, the non-employee directors are compensated as follows:

| |

| • | annual retainer fee of $50,000, payable quarterly in advance; |

| |

| • | additional annual retainer fee of $15,000 for the chair of the Audit Committee and an additional annual retainer fee of $2,500 for the other members of the Audit Committee; |

| |

| • | additional annual retainer fee of $12,500 for the chair of the Compensation Committee and an additional annual retainer fee of $2,500 for the other members of the Compensation Committee; |

| |

| • | additional annual retainer fee of $7,500 for the chair of the Nominating and Corporate Governance Committee; |

| |

| • | fee for board meetings of $1,500 per meeting; |

| |

| • | fee for committee meetings of $1,500 per meeting, for meetings held independently of a Board meeting; and |

| |

| • | additional annual retainer fee of $20,000 for the Lead Director, retroactive to October 18, 2010. |

In addition, effective March 29, 2012, the Chairman of the Board will earn an additional annual retainer fee of $55,000 and non-Chairman members of the Nominating and Corporate Governance Committee will earn an additional annual retainer fee of $2,500.

Each annual retainer fee is payable in advance in four equal quarterly installments on the first day of each quarter, provided that the amount of such payment will be prorated for any portion of the quarter that the director was not serving on the Board. Each non-employee director is also reimbursed for reasonable travel and other expenses incurred in connection with attending meetings of the Board and any committee on which he or she serves.

The following table provides a summary of compensation paid for the year ended December 31, 2011 to the members of the Board except for Mr. Smith, whose compensation for service as a director is disclosed at “Executive Compensation - Compensation Disclosure & Analysis - Summary Compensation Table” below. The table shows amounts earned by such persons for services rendered to the Company in all capacities in which they served:

|

| | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1) | Option Awards ($)(2) | Non- Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($)(3) | Total ($) |

| Jeffrey C. Bloomberg ..................... | 122,000 |

| 40,016 |

| — | — | — | — | 162,016 |

|

| Joseph M. Cianciolo ...................... | 97,984 |

| 40,016 |

| — | — | — | — | 138,000 |

|

| John T. Coleman ............................ | 101,476 |

| 40,016 |

| — | — | — | — | 141,492 |

|

| James B. Hirshorn ......................... | 74,000 |

| 40,016 |

| — | — | — | 305,000 |

| 419,016 |

|

| Thomas A. Keenan ........................ | 87,008 |

| 40,016 |

| — | — | — | — | 127,024 |

|

| Daniel C. Lukas ............................. | 89,250 |

| 40,016 |

| — | — | — | — | 129,266 |

|

| Bennett Rosenthal .......................... | 74,000 |

| 40,016 |

| — | — | — | — | 114,016 |

|

| |

| (1) | This amount represents the dollar amount of the aggregate grant date fair value of the restricted stock granted during fiscal year 2011 determined in accordance with ASC 718 and based on a grant date fair value of a share of restricted stock of $20.50 for the 1,952 shares granted each listed director on August 8, 2011. Each listed director had 1,952 shares of restricted stock awards outstanding at the end of fiscal year 2011. |

| |

| (2) | Messrs. Bloomberg, Cianciolo, Coleman, Hirshorn, Keenan, Lukas and Rosenthal each had 10,000 option awards outstanding at the end of fiscal year 2011. |

| |

| (3) | For Mr. Hirshorn, such amount includes compensation arising from his consulting agreement effective July 1, 2011, Mr. Hirshorn received $210,000 in fee compensation, and a discretionary cash bonus of $95,000. For additional information, see “Employment Agreements - Consulting Agreement of James B. Hirshorn” below. |

Neither Mr. Clarke, our current President and Chief Executive Officer, nor Richard L. Bready, our former President and Chief Executive Officer received additional compensation for his respective service as a director of the Company.

On August 8, 2011, the Board of Directors granted awards of 1,952 shares of restricted stock to each director under the Nortek,

Inc. 2009 Omnibus Incentive Plan (the “2009 Plan”). One-third of each director's award vests on August 8 in each of 2012, 2013 and 2014. Unvested shares of restricted stock are forfeited upon the termination of a director's service with the Company, and shares of restricted stock that have not vested prior to a Change of Control (as defined in the 2009 Plan) fully vest upon a Change of Control. These shares of restricted stock have voting rights and accumulated cash dividends are withheld and paid without interest upon vesting.

The shares of restricted stock awarded to each of Messrs. Rosenthal and Lukas are held for the benefit of Ares Management LLC (“Ares”) and certain entities and funds managed by or affiliated with (collectively, the “Ares Entities”). Pursuant to policies of the Ares Entities, each of Messrs. Rosenthal and Lukas holds such restricted stock as nominee for the sole benefit of Ares and has assigned all economic, pecuniary and voting rights in respect of such restricted stock to Ares. Each of Messrs. Rosenthal and Lukas expressly disclaims beneficial ownership of such restricted stock.

CORPORATE GOVERNANCE

Code of Conduct

The Company has adopted a written code of business conduct and ethics that applies to the Company's directors, officers, employees and certain other persons, including the Company's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The current version of the code is posted on the Corporate Governance section of the Investors section of the Company's website, www.nortek-inc.com. The Company's website is included in this proxy statement as a textual reference only and the information in the website is not incorporated by reference into this proxy statement.

Certain Relationships and Related Transactions

The Board has adopted written policies and procedures for the review, approval or ratification of any transaction, arrangement or relationship in which the Company is a participant, the amount involved exceeds $120,000 and one of the Company's executive officers, directors, director nominees, 5% stockholders (or their immediate family or household members) or any firm, corporation or other entity in which any of the foregoing persons has a position or relationship (or, together with his or her immediate family members, a 10% or greater beneficial ownership interest) (each, a “Related Person”) has a direct or indirect material interest.

If a Related Person proposes to enter into such a transaction, arrangement or relationship (a “Related Person Transaction”), the Related Person must report the proposed transaction to the Company's General Counsel. If the General Counsel determines that the proposed transaction is a Related Person Transaction, it shall be submitted to the Audit Committee for consideration. No member of the Audit Committee may participate in any review of any Related Person Transaction with respect to which such member or any of his or her immediate family members is the Related Person. The policy also permits the chair of the Audit Committee to review and, if deemed appropriate, approve proposed Related Person Transactions that arise between Audit Committee meetings.

In the event the Company becomes aware of a Related Person Transaction that has not been previously approved or previously ratified under this policy, such ongoing or pending transactions will be submitted to the Audit Committee or the chair of the Audit Committee promptly. Based on the conclusions reached, the Audit Committee or the chair will evaluate all options, including ratification, amendment or termination. If the transaction is completed, the Audit Committee or the chair will determine if rescission of the transaction and/or any disciplinary action is appropriate, and will ask the General Counsel to evaluate the Company's controls and procedures to determine the reason the transaction was not submitted for prior approval.

A Related Person Transaction reviewed under the policy will be considered approved or ratified if it is authorized by the Audit Committee after full disclosure of the Related Person's interest in the transaction. As appropriate for the circumstances, the Audit Committee will review and consider:

| |

• | the benefits to the Company; |

| |

• | the impact on a director's independence in the event the Related Person is a director, an immediate family member of a director or an entity in which a director has a position or relationship; |

| |

• | the availability of other sources for comparable products or services; |

| |

• | the terms of the transaction; and |

| |

• | the terms available to unrelated third parties or to employees generally. |

The Audit Committee may approve or ratify a Related Person Transaction only if the Audit Committee determines that, under all of the circumstances, the transaction is in, or is not inconsistent, with the Company's best interests. The Audit Committee may impose any conditions on the Related Person Transaction that it deems appropriate.

Except as described in “Executive Compensation - Employment Agreements,” there were no other Related Person Transactions in fiscal year 2011.

Procedures for Stockholders to Recommend Director Nominees

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders in accordance with the Company's by-laws. In order to recommend a candidate, a stockholder must notify the Company's Secretary in writing at Secretary, Nortek, Inc., 50 Kennedy Plaza, Providence, Rhode Island 02903.

For a stockholder's recommendation to be considered for the Company's 2013 annual meeting, a stockholder's notice must be delivered by a date not less than 90 nor more than 120 days prior to May 8, 2013. Any notice to the Secretary must include the following:

as to each candidate that the stockholder proposes for election or reelection as a director:

| |

| • | the candidate's name, age and address; |

| |

| • | the candidate's principal occupation or employment; |

| |

| • | the class and number of shares of the Company's stock, if any, owned beneficially or of record by the candidate; |

| |

| • | a description of all direct and indirect compensation and other material monetary arrangements, agreements or understandings during the past three years, and any other material relationship, if any, between or concerning such stockholder and its respective affiliates or associates, or others with whom they are acting in concert, on the one hand, and the candidate, and his or her respective affiliates or associates, on the other hand; and |

as to the stockholder:

| |

| • | the name and address of the stockholder; |

| |

| • | the class (and, if applicable, series) and number of shares of stock of the Company that are, directly or indirectly, owned beneficially or of record by the stockholder; |

| |

| • | any other material financial or voting interest in the Company that is, directly or indirectly, owned beneficially or of record by the stockholder and its respective affiliates or associates, or others with whom they are acting in concert; and |

| |

| • | whether the stockholder intends to deliver a proxy statement and form of proxy to holders of a sufficient number of holders of the Company's voting shares reasonably believed by such stockholder to be sufficient to elect such nominee or nominees. |

In addition, any nominee proposed by a stockholder shall complete a questionnaire, in a form provided by the Company, within 10 days of receipt of the form of questionnaire from the Company.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during 2011 were as set forth above under “Committees of the Board.” During the 2011 fiscal year, there were no compensation committee interlocks between the Company and any other entity involving the Company's or such entity's executive officers or board members.

PROPOSAL 1: ELECTION OF DIRECTORS

At the 2012 Annual Meeting, three individuals are to be elected as Class III directors to hold a three-year term of office from the date of their election until the Company's 2015 annual meeting and until their successors are duly elected and qualified.

The three nominees for election as Class III directors are Michael J. Clarke, Daniel C. Lukas and Bennett Rosenthal, each of whom is currently a Class III director and each of whom has agreed to serve as a director if elected.

If a nominee for director is unable to serve as a director, the persons appointed as the Proxy Committee for the Annual Meeting may, at their discretion, vote for another person as director.

See the section of this proxy statement entitled “Security Ownership of Certain Beneficial Owners and Management” for information as to ownership of Company securities by nominees for director.

As set forth under “Nortek Board of Directors - Committees of the Board - Nominating and Corporate Governance Committee” above, the Nominating and Corporate Governance Committee annually reviews the composition of the Board and the committees of the Board to ensure there is the proper combination of skill, expertise, competence, qualification and experience on the Board and that each committee is properly constituted to maximize its efficiency and effectiveness. In addition, the Nominating and Corporate Governance Committee also annually reviews the criteria that it and the Board consider important for the totality of the Board to possess as well as the overall effectiveness of the Board and each committee. To that end, the Nominating and Corporate Governance Committee seeks to populate the Board with a set of individuals that possess as many of such criteria as practical, realizing that it is merely aspirational to seek a Board where every member has every desirable skill, qualification, experience and attribute. Nevertheless, the Nominating and Corporate Governance Committee believes that it has assembled an exemplary group of leaders who possess the skills, qualifications, experience and attributes necessary to guide the Company to continued successes.

At a minimum, each director should possess the highest ethics and integrity, and demonstrate an unwavering commitment to representing your long-term interests. Each director should also have individual business experience and sound business judgment. All of the director nominees have experience in the oversight of public companies as a result of their service on the Board and those of other public companies and their involvement in the other organizations described below. This diverse and complimentary set of skills, experience and backgrounds creates a highly qualified and independent Board.

Set forth below you will find certain information for each of the directors, including the nominees, which we believe evidences the director's qualifications to sit on the Board.

Nominees for Election as Class III Directors for a Term Ending 2015

Michael J. Clarke has been a member of the Board, President and Chief Executive Officer of the Company since joining the Company on December 30, 2011. Mr. Clarke has more than 25 years of senior executive, business development and hands-on operational experience managing global companies in a myriad of industries including electronics, telecommunications, industrial, aerospace and automotive. From January 2006 until his appointment as the Company's Chief Executive Officer, Mr. Clarke served as President, FlexInfrastructure and Group President of Integrated Network Solutions of Flextronics International, Ltd, a publicly traded provider of design and electronics manufacturing services to original equipment manufacturers. Prior to Mr. Clarke's position at Flextronics International, he served as a President and General Manager of Sanmina-SCI Corporation, an electronic manufacturing services provider, from October 1999 to December 2005. Previously, Mr. Clarke held senior positions with international companies including Devtek Corporation Ltd., an aerospace, defense, telecommunications and aftermarket automotive company, Hawker Siddeley Group Ltd., an aerospace, defense and industrial company, and Cementation (Pty) Ltd. (Africa), a mining and industrial equipment company. Mr. Clarke serves on the board of Vubiz Ltd. Mr. Clarke's brings experience in a broad array of sectors relevant to Company's business and long track record of expanding several manufacturing divisions through multiple market cycles to the Board.

Daniel C. Lukas has been a member of the Board since July 1, 2010. Mr. Lukas is a Partner in the Private Equity Group of Ares Management LLC, a global alternative asset management firm (“Ares”). Prior to joining Ares in 2008, Mr. Lukas served as a Managing Director of GSC Group from 2006 through 2008, and Vice President of GSC Group from 2003 through 2005. Prior to that, he served as Vice President in the private equity and distressed debt funds at Thomas Weisel Capital Partners from 2000 to 2002, and before that, he was with Consolidated Press Holdings Limited, the private investment vehicle of Kerry Packer in Sydney, Australia. Earlier, Mr. Lukas was at Hellman & Friedman after beginning his career at Goldman, Sachs & Co. Mr. Lukas

served as a director of RAM Holdings Ltd. from 2004 until his resignation in 2007, and as a director of Cherokee International Corporation from 2006 until his resignation in 2008. Mr. Lukas serves on the board of directors of City Ventures, LLC, Jacuzzi Brands Corporation and Sotera Defense Solutions, Inc. Mr. Lukas's experience with acquisitions and debt and equity investments, as well as his experience serving on other boards of public companies, allows him to bring valuable insight to the Board.

Bennett Rosenthal has been a member of the Board since December 17, 2009. Mr. Rosenthal is a founding member and Senior Partner of Ares Management where he serves on the Executive Committee and co-heads the Private Equity Group of Ares. Mr. Rosenthal joined Ares in 1998 from Merrill Lynch & Co. where he served as a Managing Director in the Global Leveraged Finance Group and was responsible for originating, structuring, and negotiating many leveraged loan and high yield financings. Mr. Rosenthal was also a senior member of Merrill Lynch's Leveraged Transaction Commitment Committee. Mr. Rosenthal is the Chairman of Ares Capital Corporation and also currently serves on the Boards of Directors of AmeriQual Group, LLC, Aspen Dental Management, Inc., City Ventures LLC, Jacuzzi Brands Corporation and AOT Bedding Super Holdings, LLC (the parent company of Serta International Holdco LLC and Simmons Bedding Company). Mr. Rosenthal previously served on the Boards of Directors of Maidenform Brands, Inc. and Hanger Orthopedic Group, Inc. Mr. Rosenthal's experience with leverage finance and high yield offerings and serving on other boards of directors makes him well-positioned to serve as a director for the Company.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE ELECTION OF EACH OF THE THREE NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS AS CLASS III DIRECTORS.

Directors Continuing in Office

Class I Directors - Term Ending 2013

John T. Coleman has been a member of the Board since July 1, 2010. Mr. Coleman served as President, Chief Operating Officer and a Director of Bose Corp., a manufacturer of high end audio products, from July 2001 to July 2005. Prior to that, he was Executive Vice President and Vice President of Human Resources at Bose, and before that, he was General Manager of Bose's European manufacturing operations. Prior to joining Bose, Mr. Coleman was Director of Human Resources for General Electric in Ireland. Mr. Coleman was Head of the College of Business and Law at University College Cork in Ireland from May 2006 until June 2007. He is a member of the Board of Advisors of the School of Economics at University College Cork and is currently serving as a director of Rosetta Stone Inc. Mr. Coleman has a background in the retail industry building an international brand. He brings experience in management, operations, technology, human resources and education to the Board.

Thomas A. Keenan has been a member of the Board since December 17, 2009. Mr. Keenan is the owner and founder of Keenan LLC, a real estate investment and development company focused on high end custom homes and the acquisition of multi-unit apartment buildings and commercial complexes. Prior to founding Keenan LLC, Mr. Keenan served as an investment principal for First Media LLC, the private investment arm of the Richard Marriott family, from 1997-2006, formulating investment strategies for private and public equity investments and prior to that, he was a consultant at McKinsey & Company from 1995 to 1997, focused on media and software clients. Mr. Keenan is currently serving as a director of Stanley Martin Companies. Mr. Keenan's experience with real estate and the development industry equip him with valuable insight about the markets for the Company's products.

J. David Smith has been a member of the Board since February 18, 2010 and was elected as Chairman of the Board on March 9, 2012. He served as Interim Chief Executive Officer of the Company from July 1, 2011 until December 30, 2011. Mr. Smith served as President of Alumax Fabricated Products, Inc. and as an officer of Alumax, Inc. from 1989-1996. Mr. Smith held the positions of Chief Executive Officer and President of Euramax International, Inc. from 1996 and also served as its Chairman from 2002 until his retirement in 2008. Mr. Smith also serves as a director of Commercial Metals Company. Mr. Smith's extensive operating and management experience in private and public international metals and building products companies make him well positioned for his role as a director and Chairman of the Board.

Class II Directors - Term Ending 2014

Jeffrey C. Bloomberg has been a member of the Board since April 19, 2005 and has served as Lead Director since February 1, 2011. Mr. Bloomberg was previously a member of the Board from January 9, 2003 to August 27, 2004. Mr. Bloomberg has served since 2001 in the Office of the Chairman of Gordon Brothers Group LLC, a company which assists retail, consumer goods and industrial companies in asset redeployment and provides capital solutions to middle market companies. From 1994 to 2001, Mr. Bloomberg served as the President of Bloomberg Associates, an investment banking company. Mr. Bloomberg served as a director of RHI Entertainment, Inc. from 2009-2011 and served as a director of Tweeter Home Entertainment Group from

1986-2007. Mr. Bloomberg's extensive experience with retailers and consumer goods and his experience in dealing with issues facing the Company make him well positioned for his role as a director.

Joseph M. Cianciolo has been a member of the Board since 2003. Mr. Cianciolo retired in June 1999 as the managing partner of the Providence, Rhode Island office of KPMG LLP. At the time of his retirement, Mr. Cianciolo had been a partner of KPMG LLP since 1970. Mr. Cianciolo currently serves as a director of United Natural Foods, Inc. and Eagle Bulk Shipping, Inc. and as Vice Chairman of Rhode Island Airport Corporation. Mr. Cianciolo's extensive knowledge and experience with accounting matters allows him to provide valuable insight to the Board.

James B. Hirshorn has been a member of the Board since December 17, 2009. Mr. Hirshorn is an Operating Advisor to Ares where he focuses his time on portfolio investments across the Ares platform. Mr. Hirshorn has been engaged by the Company to provide operational advice and guidance on a consulting basis since July 1, 2011. Mr. Hirshorn has over 18 years of leadership experience in the manufacturing, retail, private equity and consulting businesses. From 2007-2008, Mr. Hirshorn was the President of Potbelly Sandwich Works and prior to that he served as the Senior Executive VP of Finance, Operations and R&D for Sealy Mattress Corporation from 2002-2006. Prior to joining Sealy, Mr. Hirshorn was a Vice President at Bain Capital from 1999-2002 in their portfolio group, providing operating leadership to a number of Bain Capital's retail and consumer products businesses. Prior to joining Bain Capital, Mr. Hirshorn was a manager at Bain & Company from 1993-1998. Mr. Hirshorn also spent three years with Procter & Gamble in their product development organization from 1988-1991. Mr. Hirshorn served as a director of Sealy Corporation from 2004 to 2006. Mr. Hirshorn's experience in operations at numerous portfolio companies provides him with valuable expertise to assist the Company.

Below you will find a tabular summary of the entire Board, their ages as of March 14, 2012, the year they were each elected and the year in which their term ends.

|

| | | | |

| Name | Position(s) with the Company | Age | Company Director Since | Term Ending |

| Class I | | | | |

| John T. Coleman ...................................... | Director | 65 | 2010 | 2013 |

| Thomas A. Keenan ................................... | Director | 46 | 2009 | 2013 |

| J. David Smith .......................................... | Director and Chairman of the Board | 63 | 2010 | 2013 |

| | | | | |

| Class II | | | | |

| Jeffrey C. Bloomberg ............................... | Director | 64 | 2005 | 2014 |

| Joseph M. Cianciolo ................................ | Director | 72 | 2003 | 2014 |

| James B. Hirshorn ................................... | Director | 45 | 2009 | 2014 |

| | | | | |

| Class III | | | | |

| Michael J. Clarke ..................................... | President, Chief Executive Officer and Director | 57 | 2011 | 2015(1) |

| Daniel C. Lukas ....................................... | Director | 40 | 2010 | 2015(1) |

| Bennett Rosenthal ................................... | Director | 48 | 2009 | 2015(1) |

____________

|

| |

| (1) | If elected at the Annual Meeting. |

EXECUTIVE COMPENSATION

Executive Officers of the Company

The following table sets forth the names of the executive officers of the Company, their positions and ages as of March 14, 2012:

|

| | |

| Name | Age | Positions with the Company |

| Michael J. Clarke ...................................................... | 57 | President, Chief Executive Officer and Director (1) |

| Almon C. Hall ........................................................... | 65 | Senior Vice President and Chief Financial Officer (2) |

| Kevin W. Donnelly ................................................... | 57 | Senior Vice President, General Counsel and Secretary (2) |

| Edward J. Cooney ..................................................... | 64 | Senior Vice President and Treasurer (2) |

(1) The Board appointed Mr. Clarke as President and Chief Executive Officer of the Company, and elected him as a director, effective December 30, 2011. For further information, see “Proposal 1: Election of Directors - Nominees for Election as Class III Directors for a Term Ending 2015 - Michael J. Clarke” above and “Executive Compensation - Compensation Discussion and Analysis - Executive Summary - Appointment of Michael J. Clarke as President and Chief Executive Officer” below.

(2) Each of Messrs. Hall, Donnelly and Cooney has served in the same or substantially similar executive positions with the Company for at least the past five years.

These executive officers, together with Richard L. Bready, who retired from his positions as Chairman, President and Chief Executive Officer effective July 1, 2011, J. David Smith, who resigned from his position as Interim Chief Executive Officer effective December 30, 2011 in connection with the appointment of Mr. Clarke, and Bruce E. Fleming, who retired from his position of Vice President - Corporate Development effective September 1, 2011, are listed in the “Summary Compensation Table” below and are referred to in this proxy statement and in the “Compensation Discussion and Analysis” section below as the Company's “named executive officers.”

Our executive officers are elected annually by Nortek's Board of Directors and serve until their successors are chosen and qualified. Nortek's executive officers include only those officers of Nortek who perform policy-making functions and have managerial responsibility for major aspects of Nortek's overall operations. A number of other individuals who serve as officers of Nortek's subsidiaries perform policy-making functions and have managerial responsibilities for the subsidiary or division by which they are employed and a number of other individuals who serve as officers of Nortek have discrete areas of responsibility within Nortek. However, none of these individuals perform policy-making functions or have managerial responsibility for major aspects on Nortek's overall operations. Certain of these individuals could, depending on the earnings of their subsidiary or division, be more highly compensated than some executive officers of Nortek.

There are no family relationships between any director, executive officer or other significant employee of the Company and any other director, executive officer or other significant employee.

Messrs. Hall, Donnelly and Cooney were executive officers at the Company when it filed voluntary petitions in the Bankruptcy Court seeking relief under the provisions of chapter 11 of the Bankruptcy Code on October 21, 2009.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the “Compensation Discussion and Analysis” set forth below with management. Based on these reviews and discussions, we recommended to the Board, and the Board approved, that the Compensation Discussion and Analysis be included in this proxy statement.

Submitted by the Compensation Committee

Daniel C. Lukas (Chair)

Jeffrey C. Bloomberg

John T. Coleman

Compensation Discussion and Analysis

This section discusses the principles underlying the Company's policies and decisions with respect to the compensation of the Company's named executive officers and the most important factors relevant to an analysis of these policies and decisions.

Executive Summary

Company Performance in 2011

Key highlights of the Company's 2011 performance included the following:

| |

• | The Company's financial performance improved compared to 2010 despite challenging economic conditions that continued to impact the majority of the markets in which the Company operates. Net sales for 2011 increased 12.7% to $2,140.5 million compared to $1,899.3 million in 2010, principally as a result of the acquisition of Ergotron in December 2010. Net cash provided by operating activities for 2011 increased to $80.9 million from $46.9 million in 2010. |

| |

• | The Company continued to improve its financial position after emerging from bankruptcy reorganization in December 2009 (the “Reorganization”). The Company refinanced certain debt in April 2011 which extended maturities from 2013 to 2017 and 2021 and is expected to lower annual cash interest expense by approximately $22 million. The Company ended the year with a cash balance of $58.2 million and availability under its asset-based revolving credit facility of approximately $203.9 million on December 31, 2011. |

| |

• | The Company filed an amendment to its registration statement on Form 10 with the SEC to register its common stock and listed its common stock on Nasdaq. |

Executive Compensation for Fiscal Year 2011

In 2011, the annual base salary of Messrs. Hall, Donnelly, Cooney and Fleming were increased as follows: Mr. Hall, from $500,000 to $520,000; Mr. Donnelly, from $375,000 to $450,000; Mr. Cooney, from $300,000 to $375,000; and Mr. Fleming, from $300,000 to $312,000 prior to his retirement effective September 1, 2011. Mr. Bready received no increase in 2011 prior to his retirement effective July 1, 2011. These base salary increases were granted in light of the Company's operating performance in 2010 compared to its 2010 operating plan, among other factors including input from Hay Group, the Company's independent compensation consultant.

Effective July 1, 2011, the Board, based on the recommendation of the Compensation Committee, granted 10,000 shares of restricted stock to each of Messrs. Hall, Cooney and Donnelly and 5,000 shares of restricted stock to Mr. Fleming under the 2009 Plan. In each case, one-third of the shares granted vests on July 1 in each of 2012, 2013 and 2014, provided the named executive officer remains continuously employed through such date. All of the shares of restricted stock granted to Mr. Fleming on July 1, 2011 were forfeited upon his retirement effective September 1, 2011.

On October 21, 2011, the Board, based upon the recommendation of the Compensation Committee, approved the Nortek, Inc. 2011 Short-Term Cash Incentive Plan for Nortek Executives (the “2011 Plan”). The Board selected Messrs. Hall, Cooney and Donnelly as participants in the 2011 Plan. The target bonus amount under the 2011 Plan for each of these named executive officers was 75% of his respective annual base salary. The actual amount of each named executive officer's bonus for fiscal 2011 was determined by the Compensation Committee taking into account Company and individual performance, as described below. In fiscal year 2011, Messrs. Hall, Donnelly and Cooney each received a bonus of $200,000. In addition, pursuant to the terms of his employment agreement, Mr. Smith received a cash bonus of $370,000. For additional information, see “- Annual Bonus Awards” below.

Retirement of Richard L. Bready and Appointment of J. David Smith as Interim Chief Executive Officer

On June 30, 2011, the Company announced that Richard L. Bready planned to retire from the positions of Chairman of the Board, President and Chief Executive Officer of the Company, effective as of July 1, 2011 (the “Bready Retirement Date”). Mr. Bready remained an employee of the Company through the close of business on July 1, 2011, at which time his resignation from all positions with the Company became effective.

In connection with his retirement, Mr. Bready entered into a separation agreement with the Company dated June 30, 2011 (the “Bready Separation Agreement”). Pursuant to the terms of the Bready Separation Agreement, Mr. Bready was entitled to receive: (i) severance equal to $5,250,000, payable over 18 months in equal installments; (ii) a lump sum payment equal to $1,000,000 in lieu of the lifetime health and medical coverage Mr. Bready would have been entitled to receive under his employment agreement, with a tax gross-up to cover all state and federal income taxes in connection with this payment; and (iii) approximately $750,000, payable over 18 months in equal installments in lieu of certain perquisites set forth in Mr. Bready's employment agreement. Due to the requirements of Section 409A of the Code, and pursuant to Company policy, payment of the cash payments described in (i)

and (iii) above commenced on January 3, 2012 (with the first payment equal to six months' payment) and payment of the cash payment described in (ii) above occurred on January 3, 2012. In addition, pursuant to the terms of the Separation Agreement, one-half of Mr. Bready's stock options that were scheduled to vest in December 2011 vested on the Bready Retirement Date. These vested stock options will remain exercisable until the earlier of (i) five years from the Bready Retirement Date or (ii) their original expiration date. All of the remaining unvested equity awards held by Mr. Bready were forfeited on the Bready Retirement Date. Mr. Bready is subject to non-competition and non-solicitation restrictions for a period of one-year following the Bready Retirement Date and has agreed to a release of claims against the Company.

On July 1, 2011, the Board appointed J. David Smith, who has been a director of the Company since February 2010, as Interim Chief Executive Officer of the Company.

In connection with Mr. Smith's appointment as Interim Chief Executive Officer of the Company, the Company entered into an Interim Chief Executive Officer Agreement (the “Interim CEO Agreement”) with Mr. Smith, dated June 30, 2011. Mr. Smith commenced employment as Interim Chief Executive Officer on July 1, 2011 and served as Interim Chief Executive Officer until the commencement of Michael J. Clarke's employment with the Company as President and Chief Executive Officer on December 30, 2011 (for further information, see “- Appointment of Michael J. Clarke as President and Chief Executive Officer” below). During his employment, Mr. Smith received a monthly salary of $105,000. Pursuant to the Interim Chief Executive Officer Agreement, Mr. Smith was not entitled to any severance or other payments upon his termination of employment. Mr. Smith received an annual incentive bonus for 2011 of $370,000. Although Mr. Smith's bonus was not tied to any specific performance goals and he was not formally a participant in the 2011 Plan, the Compensation Committee determined the amount of his bonus based on the same principles as it applied to the bonuses awarded to Messrs. Hall, Donnelly and Cooney, as described below under “- Annual Bonus Awards”. This bonus was pro-rated to reflect Mr. Smith's period of employment with the Company in 2011. Mr. Smith was not entitled to receive fees for attending Board and committee meetings while serving as the Interim Chief Executive Officer and his retainer for membership on the Board was pro-rated for 2011 such that he was paid fees totaling $61,500 for the portion of 2011 in which he was providing services to the Company solely in his capacity as a member of the Board.

Retirement of Bruce E. Fleming

On August 17, 2011, the Company announced that Bruce E. Fleming planned to retire from his position as Vice President - Corporate Development of the Company effective as of September 1, 2011 (the “Fleming Retirement Date”).

In connection with his retirement, Mr. Fleming entered into a Separation Agreement with the Company dated August 23, 2011 (the “Fleming Separation Agreement”). Pursuant to the Fleming Separation Agreement, Mr. Fleming became entitled to receive: (i) a lump-sum severance payment equal to $500,000 on September 1, 2011 and (ii) continued coverage under the Company's health insurance benefits for a period of 12 months after Fleming Retirement Date. All unvested equity awards held by Mr. Fleming as of the Fleming Retirement Date were forfeited. All of Mr. Fleming's vested stock options remained exercisable until November 29, 2011, at which date any unexercised options were forfeited. Mr. Fleming is subject to non-competition and non-solicitation restrictions for a period of 12-months and 24-months, respectively, and has agreed to a release of claims against the Company.

Appointment of Michael J. Clarke as President and Chief Executive Officer and Resignation of J. David Smith as Interim Chief Executive Officer

On December 20, 2011, the Company announced that Michael J. Clarke was appointed as our President and Chief Executive Officer, effective as of December 30, 2011. In connection with the commencement of his employment, we entered into an Employment Agreement with Mr. Clarke, the terms of which are summarized under “Executive Compensation - Employment Agreements - Employment Agreement of Michael J. Clarke” below.

In making its determination on the amount and terms of the pay package for Mr. Clarke, the Compensation Committee considered a variety of factors, including Mr. Clarke's existing compensation arrangements at his prior employer, the compensation levels of the other named executive officers, and CEO market compensation data provided by its compensation consultant, The Hay Group (“Hay Group”). In structuring Mr. Clarke's base salary and target annual incentive compensation, the Compensation Committee sought to provide compensation opportunities close to the median of the market. In structuring Mr. Clarke's long-term incentive compensation grants and opportunities, the Compensation Committee viewed his compensation opportunity over a longer-term time horizon: specifically, in order to provide Mr. Clark with sufficient immediate alignment with shareholder interests, the Compensation Committee decided to provide a larger equity grant up-front (to vest over five years) than would be provided on an ongoing basis annually. This equity award was provided in the form of stock options, time-vested restricted stock and performance-vested stock. The Company has adopted this same long-term compensation award mix for the other named executive officers for fiscal year 2012.

Compensation Philosophy and Objectives