UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

NORTEK , INC.

(Name of Registrant as Specified In Its Charter)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

| |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of the transaction: |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

March 21, 2014

Dear Stockholder:

The Company's 2014 Annual Meeting of Stockholders will be held on May 1, 2014 at 8:30 a.m., local time, at The Omni Providence Hotel, One West Exchange Street, Providence, RI 02903 (telephone: (401) 598-8000), and I hope you will join us.

At the meeting, we will be asking you:

1. To elect three Class II directors for a three-year term to expire in 2017.

2. To conduct an advisory vote to approve named executive officer compensation.

3. To ratify the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for fiscal year 2014; and

4. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

As explained more fully in the proxy statement, you can vote using the Internet, by telephone, by mail, or in person, in each case by following the instructions in the proxy statement.

We urge you to vote your shares at your earliest convenience.

Thank you very much for your interest in our Company.

Sincerely,

Michael J. Clarke

President and Chief Executive Officer

Nortek, Inc.

NORTEK, INC.

________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 1, 2014

________________

Dear Stockholders:

The Annual Meeting of Stockholders (the “Annual Meeting”) of Nortek, Inc., a Delaware corporation (the “Company”), will be held at The Omni Providence Hotel, One West Exchange Street, Providence, RI 02903 (telephone: (401) 598-8000), on May 1, 2014 at 8:30 a.m., local time, to vote on the following proposals:

| |

| 1. | To elect Jeffrey C. Bloomberg, James B. Hirshorn and Chris A. McWilton as Class II directors to serve a three-year term until the Company’s annual meeting in 2017. |

| |

| 2. | To conduct an advisory vote to approve named executive officer compensation. |

| |

| 3. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2014. |

| |

| 4. | To transact such other business as may properly come before the meeting or any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on March 3, 2014 as the record date for the determination of Stockholders entitled to notice of, and to vote at, the Annual Meeting.

You can simplify your voting and save the Company expense by voting over the telephone or by Internet.

If your shares are held in “street name” in a stock brokerage account or by a bank or other nominee, you must provide your broker with instructions on how to vote your shares in order for your shares to be voted in the election of directors. If you do not instruct your broker on how to vote in the election of directors, your shares will not be voted in the election of directors.

All Stockholders are cordially invited to attend the Annual Meeting. Whether or not you are able to attend the Annual Meeting in person, it is important that your shares be represented. Please vote as soon as possible.

Important notice regarding the availability of proxy materials for the stockholder meeting to be held on May 1, 2014. Our Proxy Statement and Annual Report to Stockholders are available at http://www.nortekinc.com/proxy.html.

Sincerely,

Kevin W. Donnelly

Senior Vice President, General Counsel and Secretary

Nortek, Inc.

Providence, Rhode Island

March 21, 2014

March 21 , 2014

NORTEK, INC.

Proxy Statement - Table of Contents

|

| | |

| 1 |

|

| 2 |

|

| 4 |

|

| 5 |

|

| 5 |

|

| 5 |

|

| 6 |

|

| 6 |

|

| 8 |

|

| 9 |

|

| 9 |

|

| 9 |

|

| 10 |

|

| 12 |

|

| 12 |

|

| 12 |

|

| 12 |

|

| 13 |

|

| 14 |

|

| 14 |

|

| 14 |

|

| 15 |

|

| 15 |

|

| 17 |

|

| 17 |

|

| 18 |

|

| 19 |

|

| 19 |

|

| 20 |

|

| 21 |

|

| 22 |

|

| 23 |

|

| 29 |

|

| 30 |

|

| 30 |

|

| 30 |

|

| 31 |

|

| 31 |

|

| 33 |

|

| 35 |

|

| 37 |

|

| 37 |

|

| 38 |

|

| 40 |

|

| 42 |

|

| 43 |

|

| 43 |

|

| 43 |

|

| 44 |

|

| 44 |

|

| 44 |

|

| 48 |

|

| 48 |

|

| 48 |

|

| 48 |

|

| 48 |

|

| 49 |

|

ABOUT THE ANNUAL MEETING

This proxy statement contains information related to the Annual Meeting of Stockholders of Nortek, Inc. (“Nortek” or the “Company”). The State of Delaware (the state in which the Company is incorporated), the Securities and Exchange Commission (the “SEC”) and the NASDAQ Global Market (“Nasdaq”) have rules that govern how we must conduct the Annual Meeting and what rights you may or may not have therein, especially related to how we solicit your votes for the Annual Meeting, the form of proxy that we may use, and the information that we must provide to you. Below you will find a summary of matters that specifically relate to the Annual Meeting and that we are required to disclose to you. We hope that you find this summary useful in your understanding of the Annual Meeting process, the Company's business, the directors, and the other matters that are pertinent to all of the foregoing.

|

| |

| Date of Annual Meeting (the “Annual Meeting”) | May 1, 2014 |

| | |

| Time of Annual Meeting | 8:30 a.m., local time |

| | |

| Place of Annual Meeting | The Omni Providence Hotel, One West Exchange Street, Providence, RI 02903 (telephone: (401) 598-8000) |

| | |

| Record Date for Annual Meeting (the “Record Date”) | March 3, 2014 |

| | |

| Attending the Annual Meeting | All stockholders of record are welcome at the Annual Meeting. If you are intending to attend, please have proper identification. If your shares are held in street name, please have your most current brokerage account statement with you.

Directions to the Annual Meeting are available at http://www.omnihotels.com/FindAHotel/Providence/MapAndDirections.aspx. |

| | |

| Mailing Date of Proxy Materials | On or about March 21, 2014 |

| | |

| Votes to Be Taken at the Annual Meeting | You are voting on: |

| | |

| | Proposal 1: Election of Jeffrey C. Bloomberg, James B. Hirshorn and Chris A. McWilton, to the class of directors whose term expires in 2017. |

| | |

| | Proposal 2: Advisory vote to approve named executive officer compensation. |

| | |

| | Proposal 3: Ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for fiscal year 2014. |

| | |

| | Any other business properly coming before the Annual Meeting. |

| | |

| Recommended Vote on Each Proposal | The Board of Director's recommendation can be found with the description of each proposal in this proxy statement. In summary, the Board of Directors recommends that you vote: |

| | |

| | 1. FOR each of the three nominees for Class II director. |

| | |

|

| |

| | 2. FOR the approval of named executive officer compensation (commonly referred to as "say-on-pay"). |

| | |

| | 3. FOR the ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm for the 2013 fiscal year. |

| Vote Required to Pass Each Proposal | |

| | |

| Proposal 1 - Election of Directors | Our directors are elected by plurality of the votes cast, which means that the three nominees for director receiving the highest number of votes FOR election will be elected as directors. Stockholders may not cumulate votes for the election of directors. If a nominee for director is unable to stand for election as a director, the Proxy Committee (as defined later in this proxy statement) may, in its discretion, vote for another person as director or vote to reduce the number of directors to less than nine, as the Board may recommend. |

| | |

| Proposal 2 - Advisory Vote on the Compensation of Our Named Executive Officers | As an advisory vote, the results of this vote will not be binding on the Board or the Company. However, the Board values the opinions of our stockholders, and will consider the outcome of the vote when making future decisions on the compensation of our named executive officers. A majority of the votes cast at the Annual Meeting and voting on the matter must vote FOR this proposal in order for this proposal to be deemed to “pass.” |

| | |

| Proposal 3 - Ratification of Public Accountants | Ratification of Proposal 3 requires a majority of the votes cast at the Annual Meeting and voting on the matter must vote FOR this proposal. |

| | |

| Shares Outstanding on the Record Date and Entitled to Notice of and to Vote at the Annual Meeting | 15,879,804 shares of common stock, which includes 458,051 shares of restricted common stock awarded under Nortek's 2009 Omnibus Incentive Plan as Amended and Restated. |

| | |

| Voting of Shares | Each stockholder is entitled to one vote for each share of common stock and to one vote for each share of restricted common stock held as of the Record Date. |

| | |

| Company Headquarters | 50 Kennedy Plaza, Providence, Rhode Island 02903 |

| | |

| Company Telephone Number | (401) 751-1600 |

VOTING YOUR SHARES

|

| |

| Who can vote? | Stockholders of record or beneficial owners at the close of business on the Record Date, March 3, 2014, are entitled to notice of and to vote at the Annual Meeting. |

| | |

| Who is a “stockholder of record”? | You are a stockholder of record if your shares of the Company's stock are registered directly in your own name with the Company's transfer agent, Computershare Shareowner Services (the “Transfer Agent”), as of the Record Date. |

|

| |

| Who is a “beneficial owner”? | You are a beneficial owner if a brokerage firm, bank, trustee or other agent (called a “nominee”) holds your stock, and who is often the stockholder of record. This is often called ownership in “street name” because your name does not appear in the records of the Transfer Agent. If your shares are held in street name, you will receive instructions from the stockholder of record. You must follow the instructions of the stockholder of record in order for your shares to be voted. Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker's proxy card and bring it to the Annual Meeting in order to vote. |

|

| |

| What is a “broker non-vote”? | If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform us that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

As a general matter, brokers have the discretion to vote on routine matters but cannot vote on non-routine matters. Proposal 1: Election of Directors and Proposal 2: Advisory Vote on Named Executive Officer Compensation are considered non-routine matters for the Annual Meeting and brokers will not have the authority to vote uninstructed shares on these matters. Proposal 3: Ratification of Accountants is considered a routine matter for the Annual Meeting.

Broker non-votes will be considered as represented for purposes of determining a quorum, but will not otherwise affect voting results. |

| | |

What happens if I am a stockholder of record and I don't give specific voting instructions? | If you are a stockholder of record and sign and return your proxy card or vote electronically without making any specific selections, then your shares will be voted in accordance with the recommendations of the Proxy Committee (as defined later in this proxy statement) on all matters presented in this proxy statement and as the Proxy Committee may determine in its discretion regarding any other matters properly presented for a vote at the Annual Meeting. |

| | |

| How are abstentions treated? | Abstentions are counted for purposes of determining whether a quorum is present, but will not be included in vote totals and will not affect the outcome of the vote on any proposal. |

| | |

| What is the “Proxy Committee”? | The Proxy Committee was appointed by the Board and is comprised of Michael J. Clarke and Kevin W. Donnelly. The Proxy Committee has the authority to vote properly executed proxies that do not otherwise specify specific voting instructions. |

| | |

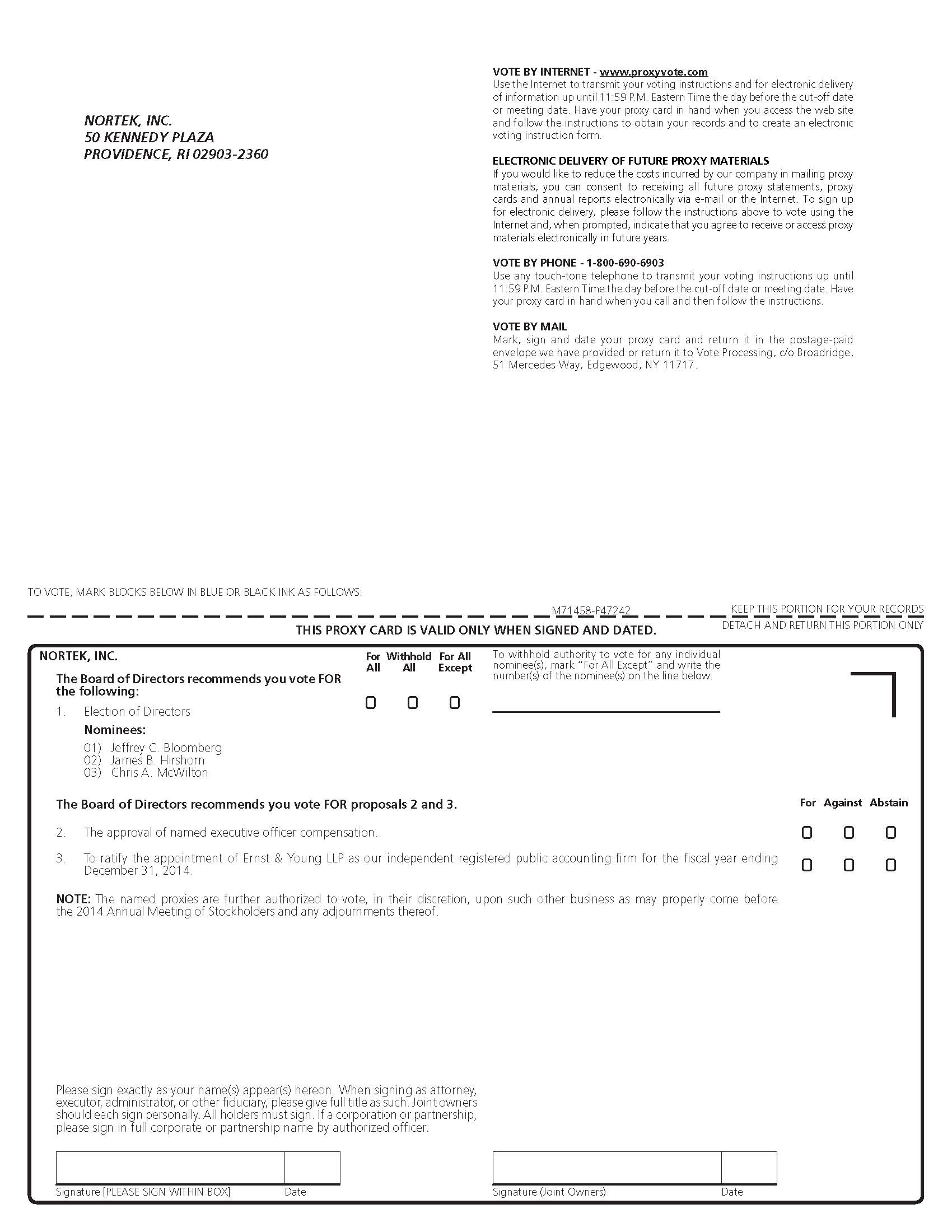

| How can I vote my shares? | By Internet. You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card. |

| | |

| | By Telephone. You can vote your proxy over the telephone by calling 1-800-690-6903 from any touch-tone telephone. You must have your proxy card available when you call. |

| | |

|

| |

| | By Mail. You can vote by mail by signing, dating and mailing the enclosed proxy card in the postage-paid envelope provided. If the envelope is missing, please mail your completed proxy card or voting instruction card to Vote Processing c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Please allow sufficient time for delivery if you decide to vote by mail. |

| | |

| | At the Annual Meeting. If you attend the Annual Meeting in person, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting. If your shares are held in street name, you must obtain a legal proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the stockholder of record. |

| | |

| | The shares voted electronically or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting. Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on Wednesday, April 30, 2014. |

| | |

| How can I change my vote? | You may change your vote at any time before the proxy is exercised. If you voted by mail, you may revoke your proxy at any time before it is voted by executing and delivering a timely and valid later-dated proxy, or by voting by ballot at the Annual Meeting. Attending the Annual Meeting will not automatically revoke your proxy unless you specifically request it. If you voted via the Internet or by telephone you may also change your vote with a timely and valid later Internet or telephone vote or by voting by ballot at the Annual Meeting. |

| | |

| Are there other matters to be voted on at the Annual Meeting? | The Board is not aware of any matters not set forth in this proxy statement that may come before the Annual Meeting. However, if other matters are properly brought before the Annual Meeting, it is intended that the persons named as the Proxy Committee in this proxy statement will vote as the Board directs. |

| | |

| What is the cost of solicitation? | The Company will bear the entire cost of soliciting the proxies, including the preparation, assembly, printing and mailing of this proxy statement. The Company has retained Georgeson Inc. to act as a proxy solicitor in conjunction with the Annual Meeting and has agreed to pay $8,000, plus reasonable out-of-pocket expenses, to Georgeson for proxy solicitation services. In addition to solicitation by mail, the directors, officers and other employees of the Company may solicit proxies in person, by telephone, electronic communications, or by other means without additional compensation. |

| | |

| Where can I find the voting results of the Annual Meeting? | The Company will announce preliminary voting results at the Annual Meeting. The Company will publish final voting results in a Current Report on Form 8-K to be filed with the SEC within four business days following the date of the Annual Meeting. |

NORTEK BOARD OF DIRECTORS

The Company’s business and affairs are managed under the direction of the Company’s Board. The Board consists of nine directors divided into three classes of three directors who serve in staggered three-year terms. The Company believes that a staggered Board is the most effective way for the Board to be organized because it ensures greater certainty of continuity from year-to-year, which provides stability in organization and experience. As a result of the three classes, at each Annual Meeting, three directors are elected for a three-year term, while the other six directors do not have to stand for election as their term is not then expiring. The Company’s current directors are as follows:

| |

| • | Class I directors are John T. Coleman, Thomas A. Keenan and J. David Smith, and their terms will expire at the annual meeting of stockholders to be held in 2016; |

| |

| • | Class II directors are Jeffrey C. Bloomberg, Joseph M. Cianciolo and James B. Hirshorn, and their terms will expire at this year’s Annual Meeting; and |

| |

| • | Class III directors are Michael J. Clarke, Daniel C. Lukas and Bennett Rosenthal, and their terms will expire at the annual meeting of stockholders to be held in 2015. |

As previously announced, Mr. Cianciolo will not be standing for re-election at the Annual Meeting.

Board Meetings and Annual Meeting of Stockholders

During fiscal year 2013, the Board met six times for both regular and special meetings. Each of the directors attended at least 75% of the aggregate of all meetings of the Board and committees on which he was a member. Our Corporate Governance Guidelines provide that absent compelling and stated reasons, directors that attend fewer than 75% of Board or committee meetings for two consecutive years should not be re-nominated for service on the Board.

During fiscal year 2013, the Board had an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. To promote open discussion among the non-management directors, the non-management directors generally meet in executive session after regularly scheduled Board meetings.

The Company does not have a formal policy regarding attendance by members of the Board at the Company’s annual meeting, but each director is encouraged to do so. All directors attended the Company’s 2013 annual meeting.

Stockholder Communication

The Company is committed to ensuring that the views of stockholders are heard by the Board or individual directors, as applicable, and that appropriate responses are provided to stockholders in a timely manner. Stockholders may communicate with any of the directors by sending a letter to the director, c/o Secretary, Nortek, Inc., 50 Kennedy Plaza, Providence, Rhode Island 02903. All such letters will be promptly forwarded to the respective director.

Director Independence

Our common stock is listed on Nasdaq and we evaluate the independence of our directors in accordance with the Nasdaq listing rules (the “Nasdaq Rules”). The Nominating and Corporate Governance Committee assesses director independence on an annual basis. To be considered independent (1) a director must not be an Executive Officer (as defined in the Nasdaq Rules) or employee of the Company or any of its subsidiaries and (2) must not have a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Persons described by Nasdaq Rules 5605(a)(2)(A) through 5605(a)(2)(F), inclusive, are not be considered independent. In addition, the Board has determined that a director will not be considered to have a relationship that interferes with the exercise of independence judgment if he or she is an executive officer of another company which is indebted to the Company, or to which the Company is indebted, unless the total amount of either company’s indebtedness to the other is more than one percent of the total consolidated assets of the company which he or she serves as an executive officer.

The Board has determined that all directors except Mr. Clarke, our CEO, and Mr. Hirshorn, who served as a consultant to the Company in 2012 and 2013 (see “Certain Relationships and Related Transactions” below), are considered “independent directors” within the meaning of the Nasdaq Rules. In making this determination, our Board also considered that Messrs. Hirshorn, Lukas and Rosenthal are partners in the Private Equity Group of Ares Management LLC, an affiliate.

Leadership of the Board

The Board is responsible for the oversight of the Company’s overall strategy and operations. The Board is committed to objective oversight of the Company’s management, especially through its independent leadership and committee membership.

The Company separates the roles of Chief Executive Officer and Chairman of the Board in recognition of the different responsibilities associated with the two roles. Mr. Michael J. Clarke, our CEO, is responsible for the general management, oversight, leadership, supervision and control of the day-to-day business and affairs of the Company, and ensures that all directions of the Board are carried into effect. Mr. J. David Smith, the Chairman of the Board, is charged with presiding over all meetings of the Board and the Company’s stockholders, and providing advice and counsel to the CEO and other Company officers regarding the Company’s business and operations. Separating these roles allows the CEO and the Chairman to focus their time and energy where they are best used.

Committees of the Board

The standing committees of the Board are: the Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee. Each committee operates under a charter approved by the Board. Copies of each committee’s charter are posted on the Corporate Governance section of the Investors section of the Company’s website, www.nortekinc.com.

The membership of our Committees as of March 21, 2014 is set forth below:

|

| | | |

Name |

Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee |

| Jeffrey C. Bloomberg | l | l | |

| Joseph M. Cianciolo | Chair | | l |

| John T. Coleman | l | l | Chair |

| Michael J. Clarke | | | |

| Thomas A. Keenan | l | l | |

| James B. Hirshorn | | | |

| Daniel C. Lukas | | Chair | l |

| Bennett Rosenthal | | | l |

| J. David Smith | | | |

____________

Below is a description of each standing committee of the Board. The Board has affirmatively determined that each of these standing committees consists entirely of independent directors pursuant to Nasdaq Rules.

Audit Committee

Established in accordance with Section 3(a)(58)(A) of the Exchange Act, the Audit Committee currently consists of Messrs. Cianciolo (Chairman), Bloomberg, Coleman and Keenan, each of whom is independent within the meaning of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board of Directors has determined that each Committee member has sufficient knowledge in financial and auditing matters to serve on the Committee and that Mr. Cianciolo is an “audit committee financial expert” as defined in applicable SEC rules and has “financial sophistication” as defined in the applicable Nasdaq Rules. As previously disclosed, Mr. Cianciolo is not standing for re-election to the Board at the Annual Meeting. The Board expects to appoint Mr. McWilton, if elected, to the Audit Committee as Chairman. The Board has determined that Mr. McWilton is independent within the meaning of Exchange Act Rule 10A-3 and pursuant to the Nasdaq Rules and that Mr. McWilton is an “audit committee financial expert” as defined in applicable SEC rules and has “financial sophistication” as defined in the applicable Nasdaq Rules.

The Audit Committee reviews and reassesses the adequacy of its charter annually and recommends any proposed changes to the Board for approval. The purposes of the Audit Committee are to: (a) appoint, oversee and replace, if necessary, the independent auditor, (b) assist the Board of Director’s oversight of (i) the integrity of the Company’s financial statements, (ii) the Company’s systems of internal control over financial reporting and disclosure controls and procedures, (iii) the Company’s compliance with legal and regulatory requirements, (iv) the independent auditor’s qualifications and independence, and (v) the performance of the Company’s internal audit function and independent auditor; and (c) prepare the report that the SEC rules require to be included in the Company’s annual proxy statement. In addition, the Audit Committee is responsible for the appointment, compensation, retention and oversight of the work of the independent auditors, including approval of all services and fees of the independent auditors. The Audit Committee also reviews the annual audited financial statements for the Company. In addition, the Audit Committee assists the Board in the oversight of the Company’s risk management processes (as described more fully below under the “The Board’s Role in Risk Oversight”).

In fiscal year 2013, the Audit Committee met five times for both regular and special meetings.

Additional information regarding the Audit Committee and the Company’s independent registered public accounting firm is disclosed under the heading “Audit Committee Matters” below.

Compensation Committee

During 2013, the Compensation Committee consisted of Messrs. Lukas (Chairman), Coleman, Bloomberg and Mr. Keenan, who joined the Compensation Committee effective as of March 5, 2013. The Compensation Committee reviews and reassesses the adequacy of its charter annually and recommends any proposed changes to the Board for approval.

The Compensation Committee’s primary responsibilities are to: (i) assist the Board in carrying out its responsibilities relating to executive compensation; (ii) review the Compensation Discussion and Analysis; and (iii) produce the annual report of the Committee on executive compensation. The Compensation Committee establishes and reviews and makes recommendations to the Board on the overall compensation philosophy of the Company. The Compensation Committee approves the corporate goals and objectives relevant to the compensation of the Chief Executive Officer (the “CEO”), the other Executive Officers (which include the chief executive officer of each of the Company’s five business segments (each a “Business Segment”)), and certain other Company or subsidiary officers that may be designated from time to time by the Compensation Committee (“Designated Officers”). The Compensation Committee evaluates the performance of the CEO, the other Executive Officers and Designated Officers in light of those goals and objectives and determines and approves the compensation levels of the CEO, the other Executive Officers and Designated Officers based on this evaluation and make all other determinations regarding the compensation of the CEO, the other Executive Officers and Designated Officers.

In addition, the Compensation Committee reviews and approves compensation arrangements for the Board and its committees. The Compensation Committee also administers the Company’s 2009 Omnibus Incentive Plan, as Amended and Restated (the “2009 Plan”), the Short-Term Cash Incentive Plan for Nortek Executives (the “2013 Plan”) and the Short-Term Cash Incentive Plan for Nortek Subsidiary Executives for executives employed by the subsidiaries in each of Nortek’s Business Segments (the “2013 Subsidiary Plan”), each established under the 2009 Plan. For a detailed description regarding the Compensation Committee’s role in setting executive compensation, see “Executive Compensation-Compensation Discussion and Analysis” below.

In fiscal year 2013, the Compensation Committee met six times for both regular and special meetings.

Role of the Compensation Consultant

The Compensation Committee retains Hay Group as its compensation consultant on director and executive compensation matters. Hay Group reports to the Chairman of the Compensation Committee and has direct access to the other members of the Compensation Committee. The Compensation Committee also authorizes Hay Group to share with, request and receive from management certain specified information in order to prepare for and respond to

the Compensation Committee meetings and requests. In fiscal year 2013, Hay Group only did work for the Compensation Committee. A representative of the Consultant generally attends meetings of the Compensation Committee, is available to participate in executive sessions and communicates directly with the Compensation Committee.

The Compensation Committee has assessed the independence of Hay Group pursuant to the Nasdaq Rules and concluded that Hay Group's work for the Compensation Committee does not raise any conflicts of interest. For further discussion of the role of the Compensation Committee in the executive compensation decision-making process, and for a description of the nature and scope of the consultant’s assignment, see “Compensation Discussion and Analysis - Role of Compensation Consultants” below.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of Messrs. Coleman (Chairman), Cianciolo, Lukas and Rosenthal. The Nominating and Corporate Governance Committee operates under a written charter. The Nominating and Corporate Governance Committee reviews and reassesses the adequacy of its charter annually and recommends any proposed changes to the Board for approval. The Nominating and Corporate Governance Committee’s purpose is to: (i) identify individuals qualified to become members of the Board; (ii) recommend to the Board, candidates for nomination for election at the annual meeting of shareholders and to fill vacancies; (iii) develop and recommend to the Board, and oversee the Company’s Corporate Governance Guidelines; (iv) oversee the evaluation of the Board and its dealings with management; (v) oversee shareholders’ concerns regarding corporate governance; and (vi) review, from time to time, the overall corporate governance of the Company and recommend improvements when necessary.

Procedures for Nominating Directors

The Nominating and Corporate Governance Committee reviews with the entire Board the appropriate skills and characteristics required of Board members in the context of the current make-up of the Board. The Board and the Nominating and Corporate Governance Committee believe that directors should bring to the Company a variety of perspectives and skills that are derived from high quality business and professional experience and that are aligned with the Company’s strategic objectives.

The Nominating and Corporate Governance Committee seeks to populate the Board with a set of individuals that possess many of the criteria that the Board and the Nominating and Corporate Governance Committee consider important for the totality of the Board to possess as practical, realizing that it is merely aspirational to seek a Board where every member has every desirable skill, qualification, experience and attribute. Characteristics expected of all directors include integrity, high personal and professional ethics, sound business judgment, and a commitment to representing the long-term interests of stockholders.

We also require that directors be able to dedicate the time and resources sufficient to ensure the diligent performance of the directors’ duties on our behalf, including attending all board and applicable committee meetings. In this respect, directors are expected to advise the Chairman of the Board and the Chair of the Nominating and Corporate Governance Committee in advance of accepting any other public company directorship or assignment to the audit committee of the board of directors of any other public company.

Although the Company does not have a formal policy considering diversity in identifying nominees for director, the Board and the Nominating and Corporate Governance Committee generally consider an array of factors, including all aspects of diversity.

The Nominating and Corporate Governance Committee identifies nominees for election to the Board by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the Nominating and Corporate Governance Committee or the Board decides not to re-nominate a member for re-election, the Committee will identify the desired

skills and experience of a new nominee in light of the criteria above. Current members of the Committee and Board may be consulted for suggestions as to individuals meeting the criteria above. Research may also be performed to identify qualified individuals. The Nominating and Corporate Governance Committee will consider stockholder recommendations for candidates for the Board of Directors, using the same criteria described above. See “Stockholder Proposals” below.

In fiscal year 2013, the Nominating and Corporate Governance Committee met four times for both regular and special meetings.

The Board's Role in Risk Oversight

We recognize the importance of effective risk management to the success of our business and our stockholders. The Board of Directors has principal responsibility for oversight of the Company’s risk management processes. Management has day-to-day responsibility for the identification and control of risk facing the Company including timely identifying, monitoring, mitigating and managing those risks that could have a material effect on the Company. Further, management has the responsibility to report these risks as they arise to the Board and its committees and the Company’s auditors. The Board has delegated certain risk assessment responsibilities to each of its three standing committees. In particular, the Audit Committee focuses on enterprise and financial risk, including internal controls covering the safeguarding of assets and the accuracy and completeness of financial reporting. The Compensation Committee sets compensation programs for management that take into consideration alignment of management compensation with building stockholder value while avoiding compensation policies that reward excessive risk taking. The Nominating and Corporate Governance Committee oversees matters of corporate governance, including the annual Board self-evaluation and director nomination process, and provides input to the Board regarding the appointment of the Company’s executive officers. These committees meet regularly and report their findings to the Board throughout the year. We do not believe that any risks arising from our compensation policies and practices create or encourage the taking of excessive risk that are reasonably likely to have a material adverse effect on the Company. For our executive compensation programs, we incorporate short-term and long-term incentive programs for cash and equity awards that are designed to reward successful execution of our business strategy and achievement of desired business results.

DIRECTOR COMPENSATION

Director Compensation Arrangements

From January 1, 2013 through April 30, 2013, the Company’s non-employee directors were compensated as follows:

Cash Compensation

|

| | | |

| Annual retainer all Board members | $ | 50,000 |

|

| Additional Annual retainer Chairman of the Board | $ | 55,000 |

|

| Additional per Board meeting fee | $ | 1,500 |

|

| Annual Audit Committee chair retainer | $ | 15,000 |

|

| Annual Audit Committee member retainer | $ | 2,500 |

|

| Annual Compensation Committee chair retainer | $ | 12,500 |

|

| Annual Compensation Committee member retainer | $ | 2,500 |

|

| Annual Nominating and Corporate Governance Committee chair retainer | $ | 7,500 |

|

| Annual Nominating and Corporate Governance Committee member retainer | $ | 2,500 |

|

Additional per Committee meeting fee (for meetings held independently of a Board meeting) | $ | 1,500 |

|

Effective May 1, 2013, the Compensation Committee, based upon analysis and recommendation of the Hay Group, determined to change the Board’s compensation structure to eliminate per meeting Board and committee fees. Effective May 1, 2013, the Company’s non-employee directors are compensated as follows:

|

| | | |

| Annual retainer all Board members | $ | 60,000 |

|

| Additional Annual retainer Chairman of the Board | $ | 62,500 |

|

| Annual Audit Committee chair retainer | $ | 30,000 |

|

| Annual Audit Committee member retainer | $ | 12,500 |

|

| Annual Compensation Committee chair retainer | $ | 20,000 |

|

| Annual Compensation Committee member retainer | $ | 7,500 |

|

| Annual Nominating and Corporate Governance Committee chair retainer | $ | 12,500 |

|

| Annual Nominating and Corporate Governance Committee member retainer | $ | 5,000 |

|

Each annual retainer fee is payable in advance in four equal quarterly installments on the first day of each quarter, provided that the amount of such payment will be prorated for any portion of the quarter that the director was not serving on the Board.

Stock-Based Compensation

Our Corporate Governance Guidelines provide that it is the policy of the Board of Directors that a significant portion of director compensation should be in the form of stock or stock based instruments in order to align their interest with those of stockholders. For fiscal year 2013, each of our non-employee directors also received 834 shares of time-based restricted stock for service on the Board, and Mr. Smith received an additional 875 shares of restricted stock for service as Chairman of the Board. One-third of each director’s award vests on the anniversary of the grant date in each of 2014, 2015 and 2016. Unvested shares of restricted stock are forfeited upon the termination of a director’s service with the Company, and shares of restricted stock that have not vested prior to a Change of Control (as defined in the 2009 Plan) fully vest upon a Change of Control. These shares of restricted stock have voting rights and accumulated cash dividends are withheld and paid without interest upon vesting.

Each non-employee director is also reimbursed for reasonable travel and other expenses incurred in connection with attending meetings of the Board and any committee on which he or she serves.

Mr. Clarke, our current President and CEO, does not receive additional compensation for service as a director of the Company.

In honor of Joseph Cianciolo’s years of service with the Company, in March 2014 the Board approved the accelerated vesting of all of Mr. Cianciolo’s outstanding restricted stock and unvested options as of May 1, 2014, the date of the Annual Meeting at which his term will expire.

Fiscal Year 2013 Director Compensation

The following table provides a summary of compensation paid for the year ended December 31, 2013 to our non-employee directors.

|

| | | | | | | | |

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($)(3) | All Other Compensation ($) |

Total ($) |

| Jeffrey C. Bloomberg | 82,167 |

| 60,590 |

| — | — | 142,757 |

|

| Joseph M. Cianciolo | 93,333 |

| 60,590 |

| — | — | 153,923 |

|

| John T. Coleman | 93,000 |

| 60,590 |

| — | — | 153,590 |

|

| James B. Hirshorn | 59,667 |

| 60,590 |

| | 105,000 (4) | 225,257 |

|

| Thomas A. Keenan | 77,042 |

| 60,590 |

| — | — | 137,632 |

|

| Daniel C. Lukas | 87,333 |

| 60,590 |

| — | — | 147,923 |

|

| Bennett Rosenthal | 63,833 |

| 60,590 |

| — | — | 124,423 |

|

| J. David Smith | 119,667 |

| 123,074 |

| — | — | 242,741 |

|

|

| |

| (1) | This column reports the amount of cash compensation earned in 2013 for Board and committee service and reflects a proration between the pre-May 1, 2013 compensation arrangement and the post-May 1, 2013 compensation arrangement described above. Mr. Keenan’s fees for service on the Compensation Committee were pro-rated from March 2013 through December 2013. |

| | |

| | Director fees paid to Messrs. Rosenthal and Lukas, and, as of April 1, 2013, Mr. Hirshorn, are held for the benefit of Ares Management LLC and certain entities and funds managed or affiliated with Ares Management LLC (“Ares”). |

|

| |

| (2) | This amount represents the ASC 718 aggregate grant date fair value of: the annual stock grant of (a) 834 shares made to all non-employee directors on March 5, 2013, and (b) an additional stock grant for Mr. Smith of 875 shares on May 9, 2013 for service as the Chairman of the Board. See “Compensation, Discussion & Analysis - Compensation Decisions in 2013 - Equity-Based Compensation.”

Each non-employee director had 2,161 shares of restricted stock outstanding at the end of fiscal year 2013, other than (i) Mr. Smith who had 3,458 shares of restricted stock outstanding at the end of fiscal year 2013 and (ii) Mr. Hirshorn who had 11,818 shares of restricted stock outstanding at the end of fiscal year 2013.

The shares of restricted stock awarded to each of Messrs. Rosenthal and Lukas, and, as of April 1, 2013, Mr. Hirshorn, are held for the benefit Ares. Each of Messrs. Rosenthal and Lukas and, as of April 1, 2013, Mr. Hirshorn, holds restricted stock as nominee for the sole benefit of Ares and has assigned all economic, pecuniary and voting rights in respect of such restricted stock to Ares. Each of Messrs. Rosenthal, Lukas and Hirshorn expressly disclaims beneficial ownership of such restricted stock. |

|

| |

| (3) | All non-employee directors (other than Mr. Hirshorn) had 6,000 vested option awards outstanding at the end of fiscal year 2013. Mr. Hirshorn had 13,016 vested option awards outstanding at the end of fiscal year 2013.

The options awarded to each of Messrs. Rosenthal and Lukas, and, as of April 1, 2013, Mr. Hirshorn, are held for the benefit Ares. Each of Messrs. Rosenthal and Lukas and, as of April 1, 2013, Mr. Hirshorn, holds option awards as nominee for the sole benefit of Ares and has assigned all economic, pecuniary and voting rights in respect of such options to Ares. Each of Messrs. Rosenthal, Lukas and Hirshorn expressly disclaims beneficial ownership of such options. |

|

| |

| (4) | Includes $105,000 in consulting fees from the Company pursuant to a consulting arrangement between the Company and Mr. Hirshorn in respect of consulting services provided by Mr. Hirshorn from January 1, 2013 to April 1, 2013 (see “Certain Relationships and Related Transactions” below).

In 2012, in connection with Mr. Hirshorn’s consulting services, he received, among other compensation: (i) an award of 4,828 shares of time-vested restricted stock; (ii) 9,657 shares of performance-vested restricted stock; and (ii) options to purchase 13,016 shares of Company common stock at an exercise price of $52.81 per share (together, the “2012 Hirshorn Equity Grants”). Mr. Hirshorn’s consulting arrangement with the Company terminated as of April 1, 2013. In July 2013, the Compensation Committee affirmed as required under the terms of the 2012 Hirshorn Equity Grants, that Mr. Hirshorn completed his consulting work in a satisfactory manner and that all such outstanding and unvested options shall immediately vest and all forfeiture restrictions on such restricted stock shall lapse and such shares vest in full in accordance with the terms of the awards. |

CORPORATE GOVERNANCE

The Company regularly monitors regulatory developments and reviews its policies, processes and procedures in the area of corporate governance to respond to such developments. As part of those efforts, we review federal laws affecting corporate governance, as well as corporate governance-related rules adopted by the SEC and Nasdaq.

2014 Corporate Governance Initiatives

In March 2014, we approved and implemented several key corporate governance policies described below.

Recoupment (or “Clawback”) Policy

To ensure financial statement accuracy and encourage ethical behavior, we instituted a recoupment (“clawback”) policy to recover excess incentive-based compensation (i.e., incentive-based compensation that was paid or would be payable in excess of what would have been paid or payable to the officer based on the restated financial statements) awarded to or received by any current or former "officer" subject to Section 16 of the Exchange Act in the event of a restatement of the Company’s financial statements resulting from material noncompliance with any financial reporting requirements under U.S. securities laws, if such officer engaged in intentional misconduct or fraud that caused or substantially caused the need for the restatement of the Company’s financial statements (as determined by the Board of Directors in its reasonable discretion).

No Hedging or Pledging of the Company’s Securities

To further ensure that our directors and employees exhibit ethical behavior relative to selling and trading our Common Stock, we amended our Policy Prohibiting Insider Trading to prohibit directors, officers and other employees from:

| |

◦ | Engaging in short sales of the Company’s securities; |

| |

◦ | Engaging in puts, calls or other derivative securities, on an exchange or in any other organized market involving the Company’s securities; |

| |

◦ | Holding the Company’s common stock in margin accounts or pledging such securities as collateral for loans or other obligations; and |

| |

◦ | Engaging in hedging transactions with respect to ownership in the Company’s securities, including trading in any derivative security relating to the Company’s securities. |

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines which are posted on the Corporate Governance section of the Investors section of the Company’s website, www.nortekinc.com. The Corporate Governance Guidelines set forth the practices the Board follows with respect to, among other things, the composition of the Board, director responsibilities, Board committees, board membership criteria and independence, access to management, employees and advisers, meetings of non-management directors, director orientation and continuing education, management succession and performance evaluation of the Board.

Code of Business Conduct and Ethics

The Company has adopted a written Code of Business Conduct and Ethics (the “Code”) that applies to the Company’s and its subsidiaries’ respective directors, officers, employees, including the Company’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The current version of the Code is posted on the Corporate Governance section of the Investors section of the Company’s website. We intend to satisfy the disclosure requirement regarding any amendment to or a waiver of, a provision of the Code for the Company’s principal executive officer, principal financial officer, principal accounting officer and controller, or persons performing similar functions, by posting such information on the Company’s website.

Certain Relationships and Related Transactions

Policies and Procedures with Respect to Transactions with Related Persons

The Board has adopted written policies and procedures for the review, approval or ratification of any transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company (including any of its subsidiaries) was, is, or will be a participant, the amount involved exceeds $120,000 and one of the Company’s executive officers, directors, director nominees, 5% stockholders (or their immediate family or household members) or any firm, corporation or other entity in which any of the foregoing persons has a position or relationship (or, together with his or her immediate family members, a 10% or greater beneficial ownership interest) (each, a “Related Person”) has a direct or indirect material interest.

This policy is administered by the Audit Committee. As appropriate for the circumstances, the Audit Committee will review and consider relevant facts and circumstances in determining whether or not to approve or ratify such transaction, including:

| |

• | the position within or relationship of the Related Person with the Company; |

| |

• | the impact on a director’s independence in the event the Related Person is a director, an immediate family member of a director, or an entity in which a director has a position or relationship; |

| |

• | the business purpose for and reasonableness of the transaction, taken in the context of the availability of other sources for comparable products or services for attaining the purposes of the transaction; |

| |

• | the materiality of the transaction to the Company and the Related Person, including the approximate dollar value (without regard to profit or loss); |

| |

• | whether the transaction is in the ordinary course of the Company’s business and was proposed and considered in the ordinary course of business; |

| |

• | the benefits to the Company of the proposed related person transaction; |

| |

• | whether the proposed transaction is on terms that are comparable to the terms available to an unrelated third party or to employees generally; and |

| |

• | any other information regarding the transaction or the Related Person in the context of the transaction that could be material to investors in light of the circumstances of the particular transaction. |

The Audit Committee may approve or ratify a related person transaction only if the Audit Committee determines that, under all of the circumstances, the transaction is in, or is not inconsistent, with the best interests of the Company and its stockholders. The Audit Committee may impose any conditions on the related person transaction that it deems appropriate.

Related Person Transactions

Hirshorn Consulting Engagement

In July 2012 the Board, based upon the recommendation of the Compensation Committee, approved the engagement of Mr. Hirshorn, a member of our Board of Directors, as a consultant for the Company for a period of twelve to eighteen months in connection with various transformation initiatives (the “Consulting Engagement”). For his services, the Board approved monthly cash compensation of $35,000 for Mr. Hirshorn and grants of (i) 14,485 shares of restricted stock comprised of (x) 4,828 shares of time-vested restricted stock and (y) 9,657 shares of performance-vested restricted stock, which is subject to the attainment of cumulative restricted stock Adjusted EBITDA targets established by the Compensation Committee and the Board for each of fiscal years 2012, 2013 and 2014, and (ii) 13,016 options. Mr.

Hirshorn was entitled to receive fees for attending Board and committee meetings while providing consulting services to the Company. Mr. Hirshorn’s Consulting Engagement with the Company terminated as of April 1, 2013, when Mr. Hirshorn became Partner, Head of Portfolio Management in the Private Equity Group of Ares. As of such date, any director compensation received for attending Board and committee meetings will be for the benefit of Ares. In July 2013, the Compensation Committee affirmed, as required under the terms of the time-vested restricted stock awards and the option awards, that Mr. Hirshorn completed his consulting work in a satisfactory manner and that all such outstanding and unvested options shall immediately vest and all forfeiture restrictions on such restricted stock shall lapse and such shares vest in full in accordance with the terms of the awards. See “Fiscal Year 2013 Director Compensation.”

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee during 2013 were as set forth above under “Committees of the Board.” During the 2013 fiscal year, there were no compensation committee interlocks between the Company and any other entity involving the Company’s or such entity’s executive officers or board members.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who beneficially own more than 10% of a registered class of our equity securities, to file reports of ownership and changes in ownership with the SEC. Based solely upon a review of the copies of the forms furnished to us and written representations from our reporting persons, we believe that during the year ended December 31, 2013, all of our executive officers and directors filed the required reports on a timely basis.

PROPOSAL 1: ELECTION OF DIRECTORS

At the 2014 Annual Meeting, three individuals are to be elected as Class II directors to hold a three-year term of office from the date of their election until the Company’s 2017 annual meeting and until their successors are duly elected and qualified. The three nominees for election as Class I directors are: Jeffrey C. Bloomberg, James B. Hirshorn and Chris A. McWilton. Messrs. Bloomberg and Hirshorn are each currently a Class II director and each has agreed to serve as a director if elected. Mr. Joseph M. Cianciolo, who is currently a Class II director, will not stand for re-election to the Board at the Annual Meeting, but that he will continue to serve as a director on the Board, the Chairman of the Audit Committee, and a member of the Nominating and Corporate Governance Committee until the expiration of his term at the Annual Meeting. The Nominating and Corporate Governance Committee identified, recommended and nominated Mr. McWilton to be elected as a Class II director at the Annual Meeting, and the Board approved the nomination of Mr. McWilton for election, and the nomination of Messrs. Bloomberg and Hirshorn for re-election to the Board. See “Procedures for Nominating Directors” above.

If a nominee for director is unable to serve as a director, the persons appointed as the Proxy Committee for the Annual Meeting may, at their discretion, vote for another person as director. See “Security Ownership of Certain Beneficial Owners and Management,” below for information as to ownership of Company securities by nominees for director.

The Nominating and Corporate Governance Committee and the Board believe that the nominees have the requisite skill, expertise, competence, qualification and experience to oversee the Company’s business. The Nominating and Corporate Governance Committee and Board believe that each nominee displays a high degree of personal and professional integrity, an ability to exercise sound business judgment on a broad range of issues, sufficient experience and background to have an appreciation of the issues facing our Company, a willingness to devote the necessary time to board duties, a commitment to representing the best interest of the Company and its stockholders and a dedication to enhancing stockholder value. All of the director nominees have experience in the oversight of public companies as a result of their service on the Board and those of other public companies and their involvement in the other organizations described below. The Nominating and Corporate Governance Committee and the Board believe that it has assembled an exemplary group of leaders that, as a whole, possess the skills, qualifications, experience and attributes necessary to deliberate on all issues that the Board might be likely to consider and to guide the Company to continued successes.

Set forth below you will find certain information for each of the directors, including the nominees, which we believe evidences the director’s qualifications to sit on the Board.

Nominees for Election as Class II Directors for a Term Ending 2017

Jeffrey C. Bloomberg has been a member of the Board since April 19, 2005. Mr. Bloomberg served as Lead Director from February 1, 2011 through March 29, 2012. Mr. Bloomberg was previously a member of the Board from January 9, 2003 to August 27, 2004. Mr. Bloomberg has served since 2001 in the Office of the Chairman of Gordon Brothers Group LLC, a company which assists retail, consumer goods and industrial companies in asset redeployment and provides capital solutions to middle market companies. From 1994 to 2001, Mr. Bloomberg served as the President of Bloomberg Associates, an investment banking company. Mr. Bloomberg served as a director of RHI Entertainment, Inc. from 2009-2011 and served as a director of Tweeter Home Entertainment Group from 1986-2007. Mr. Bloomberg also serves as a director of LogicSource Inc. Mr. Bloomberg’s extensive experience with retailers and consumer goods and his experience in dealing with issues facing the Company make him well positioned for his role as a director.

James B. Hirshorn has been a member of the Board since December 17, 2009. Effective April 1, 2013 Mr. Hirshorn became Partner, Head of Portfolio Management in the Private Equity Group of Ares. Mr. Hirshorn previously served as an Operating Advisor to Ares since 2009, and until his employment with Ares acted as a consultant to the Company since July 1, 2011. Mr. Hirshorn has over 18 years of leadership experience in the manufacturing, retail, private equity and consulting businesses. From 2007-2008, Mr. Hirshorn was the President of Potbelly Sandwich Works and prior to that he served as the Senior Executive VP of Finance, Operations and R&D for Sealy Mattress Corporation from 2002-2006. Prior to joining Sealy, Mr. Hirshorn was a Vice President at Bain Capital from 1999-2002 in their portfolio group, providing operating leadership to a number of Bain Capital’s retail and consumer products businesses. Prior to joining Bain Capital, Mr. Hirshorn was a manager at Bain & Company from 1993-1998. Mr. Hirshorn also spent three years with Procter & Gamble in their product development organization from 1988-1991. Mr. Hirshorn serves on the board of directors of Sotera Defense Solutions, Inc. and the parent entity of CPG International Inc., and he previously served as a director of Sealy Corporation from 2004 to 2006. Mr. Hirshorn’s experience in operations at numerous portfolio companies provides him with valuable expertise to assist the Company.

Chris A. McWilton is a director nominee. Mr. McWilton is currently the President of North America for MasterCard Incorporated, the global payment solutions company, and a member of MasterCard’s Executive Committee. Previously, Mr. McWilton served as MasterCard’s President of U.S. Markets from January 2009 until December 2012. He served as President of Global Accounts and Chief Financial Officer at MasterCard Incorporated from November 2007 until January 2009 and from October 2003 until November 2007, respectively. Prior to joining MasterCard, Mr. McWilton had a 22-year career with KPMG LLP, the international accounting and tax firm, where he specialized in financial and SEC reporting matters and was an SEC Reviewing Partner. Mr. McWilton is a Certified Public Accountant. Mr. McWilton’s experience as a Chief Financial Officer of a multinational public company and knowledge and expertise in accounting and financial reporting matters make him well-positioned to serve as a director of the Company.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

FOR THE ELECTION OF EACH OF THE THREE NOMINEES FOR ELECTION TO THE

BOARD OF DIRECTORS AS CLASS II DIRECTORS

Directors Continuing in Office

Class I Directors - Term Ending 2016

John T. Coleman has been a member of the Board since July 1, 2010. Mr. Coleman served as President, Chief Operating Officer and a Director of Bose Corporation, a manufacturer of high end audio products, from July 2001 to July 2005. Prior to that, he was Executive Vice President and Vice President of Human Resources at Bose, and before that, he was General Manager of Bose’s European manufacturing operations. Prior to joining Bose, Mr. Coleman was Director of Human Resources for General Electric in Ireland. Mr. Coleman was Head of the College of Business and Law at University College Cork in Ireland from May 2006 until June 2007. He is a director of Rosetta Stone Inc. Mr. Coleman

has a background in the retail industry building an international brand. He brings experience in management, operations, technology, human resources and education to the Board.

Thomas A. Keenan has been a member of the Board since December 17, 2009. Mr. Keenan is the owner and founder of Keenan LLC, a real estate investment and development company focused on high end custom homes and the acquisition of multi-unit apartment buildings and commercial complexes. Prior to founding Keenan LLC, Mr. Keenan served as an investment principal for First Media LLC, the private investment arm of the Richard Marriott family, from 1997-2006, formulating investment strategies for private and public equity investments and prior to that, he was a consultant at McKinsey & Company from 1995 to 1997, focused on media and software clients. Mr. Keenan is a director of Stanley Martin Companies. Mr. Keenan’s experience with real estate and the development industry equip him with valuable insight about the markets for the Company’s products.

J. David Smith has been a member of the Board since February 18, 2010 and was elected as Chairman of the Board on March 9, 2012. He served as Interim Chief Executive Officer of the Company from July 1, 2011 until December 30, 2011. Mr. Smith served as President of Alumax Fabricated Products, Inc. and as an officer of Alumax, Inc. from 1989-1996. Mr. Smith held the positions of Chief Executive Officer and President of Euramax International, Inc. from 1996 and also served as its Chairman, Chief Executive and President from 2002 until his retirement in 2008. Mr. Smith is a director of Commercial Metals Company. Mr. Smith is also a director of Air Distribution Technologies, Inc., and serves as Chairman of Siamons International, Inc., both privately held companies. Mr. Smith’s extensive operating and management experience in private and public international metals and building products companies make him well positioned for his role as a director and Chairman of the Board.

Class III Directors - Term Ending 2015

Michael J. Clarke has been a member of the Board, President and CEO of the Company since joining the Company on December 30, 2011. Mr. Clarke has more than 25 years of senior executive, business development and hands-on operational experience managing global companies in a myriad of industries including electronics, telecommunications, industrial, aerospace and automotive. From January 2006 until his appointment as the Company’s CEO, Mr. Clarke served as President, FlexInfrastructure and Group President of Integrated Network Solutions of Flextronics International, Ltd, a publicly traded provider of design and electronics manufacturing services to original equipment manufacturers. Prior to Mr. Clarke’s position at Flextronics International, he served as a President and General Manager of Sanmina-SCI Corporation, a publicly traded electronic manufacturing services provider, from October 1999 to December 2005. Previously, Mr. Clarke held senior positions with international companies including Devtek Corporation Ltd., an aerospace, defense, telecommunications and aftermarket automotive company, Hawker Siddeley Group Ltd., an aerospace, defense and industrial company, and Cementation (Pty) Ltd. (Africa), a mining and industrial equipment company. Mr. Clarke also serves as a member of the Board of Directors of Sanmina. Mr. Clarke brings experience in a broad array of sectors relevant to Company’s business and long track record of expanding businesses through multiple market cycles to the Board.

Daniel C. Lukas has been a member of the Board since July 1, 2010. Mr. Lukas is a Partner in the Private Equity Group of Ares. Prior to joining Ares in 2008, Mr. Lukas served as a Managing Director of GSC Group from 2006 through 2008, and Vice President of GSC Group from 2003 through 2005. Prior to that, he served as Vice President in the private equity and distressed debt funds at Thomas Weisel Capital Partners from 2000 to 2002, and before that, he was with Consolidated Press Holdings Limited, the private investment vehicle of Kerry Packer in Sydney, Australia. Earlier, Mr. Lukas was at Hellman & Friedman after beginning his career at Goldman, Sachs & Co. Mr. Lukas serves on the board of directors of City Ventures, LLC, Jacuzzi Brands Corporation, Sotera Defense Solutions, Inc. and the parent entity of CPG International Inc. Mr. Lukas previously served on the Boards of Directors of RAM Holdings Ltd., DTN, LLC, Envrirosource, Inc., and Cherokee International Corporation. Mr. Lukas’s experience with acquisitions and debt and equity investments, as well as his experience serving on other boards of public companies, allows him to bring valuable insight to the Board.

Bennett Rosenthal has been a member of the Board since December 17, 2009. Mr. Rosenthal is a founding member and Senior Partner of Ares where he serves on the Management Committee and co-heads the Private Equity Group. Mr. Rosenthal joined Ares in 1998 from Merrill Lynch & Co. where he served as a Managing Director in the Global

Leveraged Finance Group. Mr. Rosenthal was also a senior member of Merrill Lynch’s Leveraged Transaction Commitment Committee. Mr. Rosenthal is the Chairman of Ares Capital Corporation and also currently serves on the Boards of Directors of AmeriQual Group, LLC, Aspen Dental Management, Inc., City Ventures, LLC, Jacuzzi Brands Corporation, True Holdings Management LLC, Unified Physician Management LLC and Ob Hospitalist Group Inc. and the parent entities of CHG Healthcare Holdings L.P., CPG International Inc., Serta International Holdco LLC and Simmons Bedding Company. Mr. Rosenthal also serves on the Board of Trustees of Windward School in Los Angeles, California. Mr. Rosenthal previously served on the Boards of Directors of Maidenform Brands, Inc. and Hanger Orthopedic Group, Inc. Mr. Rosenthal’s experience with leveraged finance, acquisitions, and private debt and equity investments and serving on other boards of directors makes him well-positioned to serve as a director for the Company.

Below you will find a tabular summary of each director, their ages as of March 3, 2014, the year they were each elected and the year in which their term ends.

|

| | | | |

| Name | Position(s) with the Company | Age | Director Since | Term Ending |

| Class I | | | | |

| John T. Coleman | Director | 67 | 2010 | 2016 |

| Thomas A. Keenan | Director | 48 | 2009 | 2016 |

| J. David Smith | Director and Chairman of the Board | 65 | 2010 | 2016 |

| | | | | |

| Class II | | | | |

| Jeffrey C. Bloomberg | Director | 66 | 2005 | 2017(1) |

| Joseph M. Cianciolo | Director | 74 | 2003 | 2014(2) |

| James B. Hirshorn | Director | 47 | 2009 | 2017(1) |

| Chris A. McWilton | Director | 55 | New Director Nominee | 2017(1) |

| | | | | |

| Class III | | | | |

| Michael J. Clarke | President, CEO and Director | 59 | 2011 | 2015 |

| Daniel C. Lukas | Director | 42 | 2010 | 2015 |

| Bennett Rosenthal | Director | 50 | 2009 | 2015 |

____________

|

| |

| (1) | If elected at the Annual Meeting. |

| (2) | Mr. Cianciolo is not standing for re-election at the Annual Meeting. |

EXECUTIVE COMPENSATION

Compensation, Discussion & Analysis

Overview

This Compensation Discussion and Analysis provides a discussion of the principles and objectives underlying the Company’s decisions with respect to the compensation of the Company’s named executive officers, as well as an analysis of the awards made to these individuals.

This Compensation Discussion and Analysis focuses on the compensation of our “named executive officers” for fiscal year 2013:

|

| |

| Name | Title |

| Michael J. Clarke | President & Chief Executive Officer |

| Almon C. Hall | Senior Vice President & Chief Financial Officer |

| Kevin W. Donnelly | Senior Vice President, General Counsel & Secretary |

| David L. Pringle | President & Chief Executive Officer, Broan-NuTone LLC (Nortek's Residential Ventilation ("RESV") Business Segment) |

| Sean P. Burke | Group President, Technology Solutions Group, Linear LLC (Nortek’s Technology Solutions (“TECH”) Business Segment) |

This discussion should be read together with the compensation tables (and accompanying narratives) for the named executive officers. Unless otherwise indicated, any references to a particular year means the fiscal year ended December 31st of such year. Mr. Pringle has retired as President of Broan-NuTone LLC. See “Transition Employment and Separation Agreement of David L. Pringle” below.

Executive Summary

Company Performance in 2013

Key highlights of the Company’s 2013 performance included the following:

| |

| • | In 2013, the Company’s Net Cash provided by operating activities was $135.2 million. |

| |

| • | In 2013, the Company’s total shareholder return was 12.6%. |

| |

| • | In 2013, the Company’s cash conversion cycle was 67.3, as compared with 75.5 days in 2012. |

| |

| • | In 2013, the Company's Net Sales grew 3.9% over Net Sales in 2012. |

| |

| • | In 2013, the Company began implementing operational improvement initiatives planned for during 2012, including opening a new manufacturing campus in Mexico, entering into certain new supply agreements with vendors, consolidating our purchases with fewer vendors and outsourcing of logistics activities in North America resulting in the consolidation of six warehouse and distribution centers |

Summary of 2013 Executive Compensation Decisions

In determining executive compensation, the Compensation Committee considers Company performance, business segment performance, achievement of strategic goals and growth objectives, competitive market trends, and benchmarking data. In making its determinations in fiscal year 2013, the Compensation Committee relied heavily on company-wide financial performance for Messrs. Clarke, Hall and Donnelly and both company-side and business-segment financial performance for our Business Segment Presidents, while also considering individual contributions toward the achievement of strategic goals and growth objectives. The following summarizes the Compensation Committee’s compensation decisions in 2013 in light of these factors and the Company’s accomplishments highlighted above, which are explained in more detail under “Compensation Decisions in 2013” below.

| |

| • | Base Salary. Based upon the recommendation our CEO, 2013 base salaries of our named executive officers were not increased from their 2012 levels. |

| |

| • | Annual Cash Incentive Compensation. In 2013, annual cash incentive awards were granted to our named executive officers under the Short-Term Cash Incentive Plan for Nortek Executives (the “2013 |

Plan”) (for Messrs. Clarke, Hall and Donnelly) and the Short-Term Cash Incentive Plan for Nortek Subsidiary Executives (the “2013 Subsidiary Plan”) (for Messrs. Pringle and Burke), each established pursuant to the Company’s 2009 Omnibus Incentive Plan as Amended and Restated (the “2009 Plan”).

| |

| • | For Messrs. Clarke, Hall and Donnelly, 2013 cash incentive awards were achieved between target and maximum levels based on (i) the 2013 Company Adjusted EBITDA Goals (as defined below) and (ii) 2013 Cash Conversion Cycle Goal (as defined below). |

| |

| • | Mr. Pringle’s 2013 cash incentive award was achieved between target and maximum levels, and Mr. Burke’s 2013 cash incentive award was achieved between minimum and target levels, in each case, based on (i) the 2013 Company Adjusted EBITDA Goals (as defined below) and (ii) the applicable 2013 Business Segment Adjusted EBITDA Goals (as defined below). In addition, Messrs. Pringle and Burke each received the maximum 2013 Special Cash Conversion Bonus (defined below). |

| |

| • | Equity-Based Compensation. In 2013, each named executive officer was granted a mix of restricted stock, both time-vested and performance-vested, and stock options under the 2009 Plan. |

Changes to Compensation Program for 2014

Several key changes to the Company’s executive compensation program will be implemented in 2014 following a comprehensive review of compensation practices by the Compensation Committee and its independent consultant, Hay Group.

| |

| • | For 2014, base salaries will increase 3% for the named executive officers following a year in which they did not receive a base pay increase. |

| |

| • | The Compensation Committee refined performance measures under the 2013 Plan and the 2013 Subsidiary Plan to add a company-wide and subsidiary revenue metric, as applicable, under the Company's 2014 short-term incentive plans. |

| |

| • | In order to provide a more equal balance between stock price alignment, execution of the Company’s strategic plan, and executive stock-ownership, the mix of long-term incentive awards was modified in 2014 to include equal values (1/3 each) of stock options, performance-vested restricted stock and time-vested restricted stock. This is a transition from 40% stock options, 30% performance-vested restricted stock and 30% time-vested restricted stock in 2013. |

| |

| • | For 2014, certain changes to the Company’s peer group were made (see “Compensation Benchmarking,” below). |

| |

| • | The Board adopted a "Clawback Policy" to recover excess incentive-based compensation awarded to a Section 16 Officer in the event of a restatement (see "2014 Corporate Governance Initiatives," above). |

Compensation Program Philosophy and Objectives

Our compensation program is designed to attract, motivate, reward and retain high caliber executives to assist the Company in achieving its strategic and operating objectives, and to compensate them at a level that is commensurate with both corporate and individual performance achievement, with the ultimate goal of increasing the value of the stockholders’ investment. The Company has used a mix of short-term compensation, consisting of base salaries and cash bonuses, and long-term compensation, consisting of equity incentive compensation. The competitiveness of the executive compensation program is not targeted at a specific market level for any individual element of compensation

or for the program entirely. The Compensation Committee reviews the Company’s executive compensation program on an ongoing basis, including its philosophy and objectives.

Setting Compensation

Role of Board, Compensation Committee and CEO