Exhibit 1.02

Nortek, Inc.

Conflict Minerals Report

For the Reporting Period Ended December 31, 2013

This report for the calendar-year reporting period beginning January 1, 2013 and ending December 31, 2013, has been prepared and filed with the Securities and Exchange Commission (“SEC” or “Commission”) under cover of Form SD by Nortek, Inc. (together with all consolidated subsidiaries, “Nortek,” “Company,” “we” or “us”) to comply with Section 13(p) of the Securities Exchange Act of 1934 (“Exchange Act Section 13(p)”) and associated SEC Rule 13p-1 (17 CFR 240.13p-1) and Form SD (17 CFR 249b.400) (together, the “Rule”). The Rule was adopted by the SEC to implement reporting and disclosure requirements related to conflict minerals as directed by Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”). Exchange Act Section 13(p) and the Rule impose certain reporting obligations on those SEC registrants whose manufactured products contain conflict minerals which are necessary to the functionality or production of their products. Conflict Minerals are defined as cassiterite, columbite-tantalite, gold, wolframite, or their derivatives, which are limited to tin, tantalum and tungsten (collectively, “3TG”). These requirements apply to registrants whatever the geographic origin of the conflict minerals and whether or not they fund armed conflict.

If a registrant can establish, based on a good-faith, reasonable country of origin inquiry (“RCOI”), that those conflict minerals necessary to the functionality or production of its products (“necessary conflict minerals”) originated from sources other than the Democratic Republic of the Congo (“DRC”) or an adjoining country (together, the “Covered Countries”), or were derived from recycled and scrap sources, the registrant must file a Form SD which describes the RCOI completed, and post that Form SD on its Internet web site. No further due diligence is required.

However, if a registrant has reason to believe that any of the necessary conflict minerals in its supply chain may have originated in the Covered Countries or did not come from recycled or scrap sources, or if that registrant is unable to determine the country of origin of its necessary conflict minerals and/or whether they came from recycled or scrap sources, then the registrant must go on to exercise due diligence on the conflict minerals’ source and chain of custody. The registrant must file a report, the Conflict Minerals Report (“CMR”), with the SEC (under cover of Form SD) that includes a description of those due diligence measures, and must post this report (along with the accompanying Form SD) on the registrant’s Internet web site.

In accordance with Exchange Act Section 13(p) and the Rule, this CMR is publicly available on our website at www.nortekinc.com under "SEC Filings" on the "Investors" portion of our website. The content of this website, or any other website referred to herein, is not incorporated by reference into this CMR or the accompanying Form SD, or any other document filed by Nortek with the SEC.

Certain of the Company’s businesses manufactured, or contracted to manufacture, products during the reporting period that contain necessary conflict minerals. After conducting our RCOI for the reporting period (January 1 through December 31, 2013), we were unable to determine the country or countries of origin of our necessary conflict minerals. Accordingly, we performed due diligence pursuant to a process designed to conform to the framework set forth in the Organisation for Economic Co-operation and Development Due Diligence Guidance for Responsible Supply Chain of Minerals from Conflict-Affected and High- Risk Areas: Second Edition, including the supplements thereto for gold, tin, tantalum and tungsten (together, “OECD Due Diligence Guidance”).

Company Overview and Description of Nortek Products Covered by this CMR

This report has been prepared by the Company, and includes information relating to the activities and efforts undertaken by the Company in order to comply with its obligations under Exchange Act Section 13(p) and the Rule.

Nortek was founded in 1967 and is headquartered in Providence, Rhode Island. The Company is incorporated in the State of Delaware.

Operating within five reporting segments, we are a global, diversified company whose many market-leading brands deliver broad capabilities and a wide array of innovative, technology-driven products and solutions for lifestyle improvement at home and at work. Our reporting segments are as follows:

| |

| • | the Residential Ventilation (“RESV”) segment, which produces residential ventilation products, including range hoods, exhaust fans and indoor air quality products; |

| |

| • | the Technology Solutions (“TECH”) segment provides wireless residential security systems, access control, intercoms, garage door operators, gate operators, audio systems and control products, and home automation and security functions; |

| |

| • | the Display Mount Solutions ("DMS") segment provides mounting and mobility products for computer monitors, notebooks, tablets and large flat panel displays and TVs; |

| |

| • | the Residential Heating and Cooling (“RHC”) segment produces solutions for heating, ventilation, cooling and air conditioning incorporated in its extended range of gas fired air heaters, air handling units, condensing units and rooftop units; and |

| |

| • | the Custom & Engineered Solutions (“CES”) segment manufactures custom heating, ventilation, and air conditioning (HVAC) products for use in commercial, industrial, or institutional applications. |

Through these segments, we manufacture and sell our products, primarily in the United States, Canada, and Europe, with additional manufacturing in China and Mexico. We provide a wide variety of products for the following markets: remodeling and replacement markets; the residential and commercial new construction markets; the manufactured housing market; and the personal and enterprise computer markets. Some of these products contain necessary conflict minerals, as discussed further below.

This CMR relates only to those products either manufactured, or contracted to be manufactured, by the Company that contain necessary conflict minerals (“Covered Products”). Based on our due diligence process, which is described below, we have been unable to determine whether the manufacture of these Covered Products was completed during, or prior to, the calendar-year reporting period ended December 31, 2013. Accordingly, our due diligence and this CMR may include products containing necessary conflict minerals that were manufactured, or contracted to be manufactured, prior to 2013, even though the Rule requires only that we report on such products whose manufacture was completed in 2013.

Our Covered Products are as follows:

Bath & Ventilation Fans, Hot and Cold Air Quality Exchangers, Heaters, Attic Ventilation, Security and Access Controls, Video Signal Management, Home Integration and Climate and Lighting Controls, TV Mounts, AV Furniture, Sit-Stand Stations, Air Conditioners, Heat Pumps, Furnaces, Air Handlers and Coils, Cleanroom Systems, Operating Room Systems, Energy Recovery Solutions, and Data Center and Cooling Systems.

Nortek’s Supply Chain

We are dependent upon raw materials and components, and in some cases finished products, purchased from other manufacturers or suppliers. These materials and components include, among others, steel, electronics, motors, plastics, compressors, printed circuit boards, electrical components , microprocessors, batteries, and paint, as well as standard nuts, bolts and fasteners, all of which we purchase from third parties and some of which may contain one or more 3TGs. As a result, we have a large supply base, with many suppliers unique to each of our individual business segment’s requirements. Due to the complex nature of our business, our segments may manufacture in-house or contract with third parties to manufacture specific components that we then incorporate into our end products. Because of our size, the complexity of our products, and the depth and breadth of our supply chain, it has been difficult to identify all the upstream suppliers of materials, components and finished products containing necessary conflict minerals beyond our direct suppliers.

Conflict Minerals Policy

Nortek has adopted the following Conflict Minerals Policy (“CM Policy”):

Background

In 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) requiring the Securities and Exchange Commission (“SEC”) to issue rules specifically relating to the use of “Conflict Minerals” within manufactured products. Conflict Minerals are currently defined by US Law as tin, tantalum, tungsten and gold (also known as “3TG”) and related derivatives. The SEC rules require any SEC registrant whose commercial products contain any 3TG (“3TG Product”) to determine whether the 3TG in the 3TG Product originated from the Democratic Republic of the Congo (“DRC”) or adjoining countries (collectively, the “DRC Region”) and, if so, whether the 3TG is “conflict free”. “3TG Conflict Free” means that the supply chain is transparent and the 3TG in 3TG Products does not directly or indirectly benefit armed groups responsible for serious human rights abuses in the DRC Region. By enacting this provision, Congress intends to further the humanitarian goal of ending the extremely violent conflict in the DRC Region, which has been partially financed by the exploitation and trade of 3TG originating in the DRC Region.

Commitment

In accordance with the law and SEC rule, but more importantly in the spirit set forth in our Code of Conduct, Nortek and its subsidiaries (collectively, “Nortek”) will work with our supply chain partners to take reasonable steps to ensure Nortek’s compliance with the law and regulations and to strive towards sourcing product which is considered “3TG Conflict Free” .

If “3TG Conflict Free” status cannot be determined by a supplier, or if, after allowing the supplier a reasonable timeframe to achieve “3TG Conflict Free” status, the supplier is unable to achieve such status, Nortek will execute remediation steps to evaluate and procure, as necessary, alternate products and materials.

It is the desire of Nortek to eventually reach “3TG Conflict Free” status; however, due to the complexity of our supply chain and the number of suppliers involved, it is a goal we will seek to achieve over time. In the meantime, Nortek will take reasonable steps working with our suppliers to map our 3TG Products back to the smelter to determine if the 3TG in our 3TG Products is coming from a smelter considered “conflict free” by a recognized organization or program, such as the Conflict Free Smelter (“CFS”) program.

Nortek expects our suppliers to partner with us to reach “3TG Conflict Free” status, because we do not purchase conflict minerals directly from mines, smelters or refineries. We therefore require our suppliers, at a minimum, to:

| |

| • | Establish a conflict mineral policy consistent with our CM Policy, implement management systems to support compliance with their policy and require their suppliers of any tier to take the same steps towards achieving "3TG Conflict Free" status. |

| |

| • | Complete Nortek’s Conflict Minerals survey, identifying 3TG Product they sell to Nortek and the smelter that provided the original 3TG material. Nortek’s direct suppliers may have to require successive upstream suppliers to complete Nortek’s Conflict Minerals survey, or an equivalent survey form reasonably acceptable to Nortek, until the smelter is identified. |

| |

| • | On an annual basis, provide a report to support Nortek’s SEC reporting requirements. |

| |

| • | Ultimately, supply Product that is 3TG Conflict Free. |

Our CM policy is publicly available on our website at www.nortekinc.com under "Corporate Governance" on the "Investors" portion of our website.

| |

| 1.1 | Design of Due Diligence |

Our due diligence measures have been designed to conform, in all material respects, to the “OECD Due Diligence Guidance”. The following is a general discussion of how we applied the five-step framework of the OECD Due Diligence Guidance in designing our own supply chain due diligence process.

Nortek has designed a due diligence process that is consistent with the OECD Due Diligence Guidance framework. The due diligence process includes:

| |

| • | Educating our sourcing and procurement team, our Conflict Minerals Steering Committee consisting of executive-level representatives (“Steering Committee”) (which is discussed further below), as well as a select group of Nortek employees which includes representatives from risk management, legal, and finance, to ensure there is a clear understanding on the part of all responsible personnel with respect to the background and policy underpinnings of the Rule, provide the group with an understanding of the requirements of the Rule, and set the foundation to enable us to manage the complexities of compliance with the Rule on an ongoing basis. |

| |

| • | Communicating Nortek expectations and CM Policy to selected “in-scope” suppliers. “In-scope” suppliers are defined as direct suppliers whose parts or components may contain 3TGs. |

| |

| • | Using the EICC-GeSI template to request from selected suppliers relevant source information regarding products (including components) or materials purchased by Nortek that may contain necessary conflict minerals; i.e., 3TG content, country of origin, and smelting/refining facility. |

| |

| • | Performing due diligence on supplier responses using key indicators and provisional red flags to ascertain the need for follow-up inquiries. |

| |

| • | Developing a roadmap to enhance and improve the Company’s due diligence design framework over a three-year period. A copy of that due diligence strategy is outlined below in Section 1.1.d, below, “Design & Implement a Strategy to Respond to Risks”. |

1.1.a. Management Systems

As described above, Nortek has adopted a CM Policy as recommended in the OECD Due Diligence Guidance. This CM Policy is posted on our company’s website at www.nortekinc.com under "Corporate Governance" on the "Investors" portion of our website.

In addition, we have built processes, tools and teams to help support each aspect of its conflict minerals compliance activities under the Rule, as discussed below.

Internal Team

Nortek has established a management infrastructure to support its conflict minerals compliance activities under the Rule. Our infrastructure includes a Steering Committee which includes: Nortek’s Senior Vice President, General Counsel & Secretary; Vice President and Chief Supply Chain Officer; and Vice President, Corporate Controller & Chief Accounting Officer. In addition, Nortek has established a core team of subject-matter experts and/or relevant functions such as legal, SEC Compliance, Risk and Sustainability, and Sourcing Leads. The core team is responsible for implementing our conflict minerals compliance strategy and is led by a Conflict Minerals Project Lead who acts as the conflict minerals program manager, reporting to the Steering Committee.

1.1.b. Control Systems

As we do not typically have a direct relationship with 3TG smelters and refiners, we have identified those business segments which manufacture or contract to manufacture products reasonably believed to contain one or more conflict minerals. We then identified 44 top-tier suppliers (as more fully described in Section 1.2 “Due Diligence Measures and Results ” below) which provided raw materials or components, and in some cases finished products, reasonably believed to contain necessary conflict minerals, and surveyed that supplier population in 2013. As part of that survey, these top-tier suppliers were required to make an inquiry of their suppliers and sub-suppliers to facilitate identification of the relevant smelter or refinery and, ultimately, the country of origin of the particular conflict mineral(s).

Additional controls include, but are not limited to, Nortek’s Code of Conduct which outlines expected behaviors for all Nortek employees, our CM Policy, and a supplier conflict minerals contract clause which is further described below.

1.1.c. Supplier Engagement

We rely on our direct suppliers to provide information on the origin of the 3TG contained in components and materials supplied to us for inclusion in our Covered Products and, in some cases finished products supplied to us- including sources of 3TG that are supplied to them from their suppliers and sub-suppliers. A supply contract executed after the Dodd-Frank Act was passed (July 2010), as well as all purchase order standard terms and conditions sent to our suppliers since that time, contain conflict minerals flow-down requirements.

Nortek’s supplier flow-down requirements contained in our standard supply contract (the “Contract”) under Section 12 of the Contract. Compliance Matters are as follows:

Conflict Minerals Compliance. Supplier shall comply with the conflict minerals laws, including the requirements set forth in Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, as it may be amended from time to time and any regulations, rules, decisions or orders relating thereto adopted by the Securities and Exchange Commission or any successor governmental agency responsible for adopting regulations relating thereto (collectively, “Dodd-Frank”). For purposes of this Section, the term “Conflict Minerals” includes the materials defined in or listed as such in Dodd-Frank (including tin, tantalum, tungsten and gold) and any related derivatives, and any other mineral or derivatives that may later be determined by the Secretary of State to be financing conflict in the Democratic Republic of the Congo or an adjoining country. In order to enable Nortek, Inc. (“Nortek”) to comply with the conflict minerals laws, Supplier shall take the following actions:

| |

| (i) | Promptly designate an internal resource to handle all activities related to Conflict Minerals compliance and serve as a single point of contact to Nortek representatives. |

| |

| (ii) | Establish a written Conflict Minerals policy (which shall include appropriate provisions requiring sub-suppliers to comply with Dodd-Frank) and develop internal procedures regarding compliance with Dodd-Frank. |

| |

| (iii) | Provide an annual certification of compliance with Nortek’s Conflict Minerals Policy and expression of intent to work towards conflict-free status, and, if there are any changes to Supplier’s supply base that affect such certification, provide an amended certification of compliance. |

| |

| (iv) | Provide an annual declaration of all Products containing Conflict Minerals that were supplied to Nortek during the relevant calendar year. The declaration must include the following information: |

| |

| • | The Products containing Conflict Minerals; |

| |

| • | The Conflict Minerals contained in such Products; |

| |

| • | Whether the origin of the material was from recycled or scrap sources. For the purposes of this Section, the terms “Recycled Metals” and “Scrap Metals” mean metals that are reclaimed end-user or post-consumer products, or scrap processed metals created during product manufacturing. Recycled metal includes excess, obsolete, defective, and scrap metal materials which contain refined or processed metals that are appropriate to recycle in the production of tin, tantalum, tungsten and/or gold. Minerals partially processed, unprocessed or a byproduct from another ore are not recycled metals; |

| |

| • | For all Products not identified as Recycled Metals or Scrap Metals, the sources, including smelter and/or mine, of all Conflict Minerals contained in such Products and evidence of inquiry regarding the country of origin, using the EICC - GeSI Conflict Minerals Reporting Template or similar template provided by Nortek; |

| |

| • | A description of Supplier’s Conflict Minerals due diligence activities, which, at a minimum, must include an explanation of the Supplier’s due diligence efforts to identify smelters and/or mines in the supply chain; and |

| |

| • | Any documentation requested by Nortek to support any of the statements made in the declaration as required above. |

| |

| (v) | If Supplier is not able to provide any information required in the declaration described in Section 1(a)(iv), Supplier will cooperate with Company so that such information can be accurately determined and reported. |

| |

| (vi) | Provide such further cooperation as Company may reasonably require in order to meet any obligations it may have under Dodd-Frank. |

If any of the requirements in this Section are not satisfactorily completed or performed in good faith, Company reserves the right to de-source Supplier and terminate this Agreement.

1.1.d. Identify & Assess Risk in the Supply Chain

Due to Nortek’s size, the complexity of our products, and the depth and extensiveness of our supply chain it has been challenging to identify all upstream suppliers beyond our direct suppliers. Accordingly, we made a reasonable, good-faith judgment to use a risk-based sampling methodology to identify and survey certain direct suppliers for the first reporting period (CY 2013). Our use of this methodology for the 2013 reporting period is discussed in more detail in section 1.2 of this CMR.

1.1.e. Design & Implement a Strategy to Respond to Risks

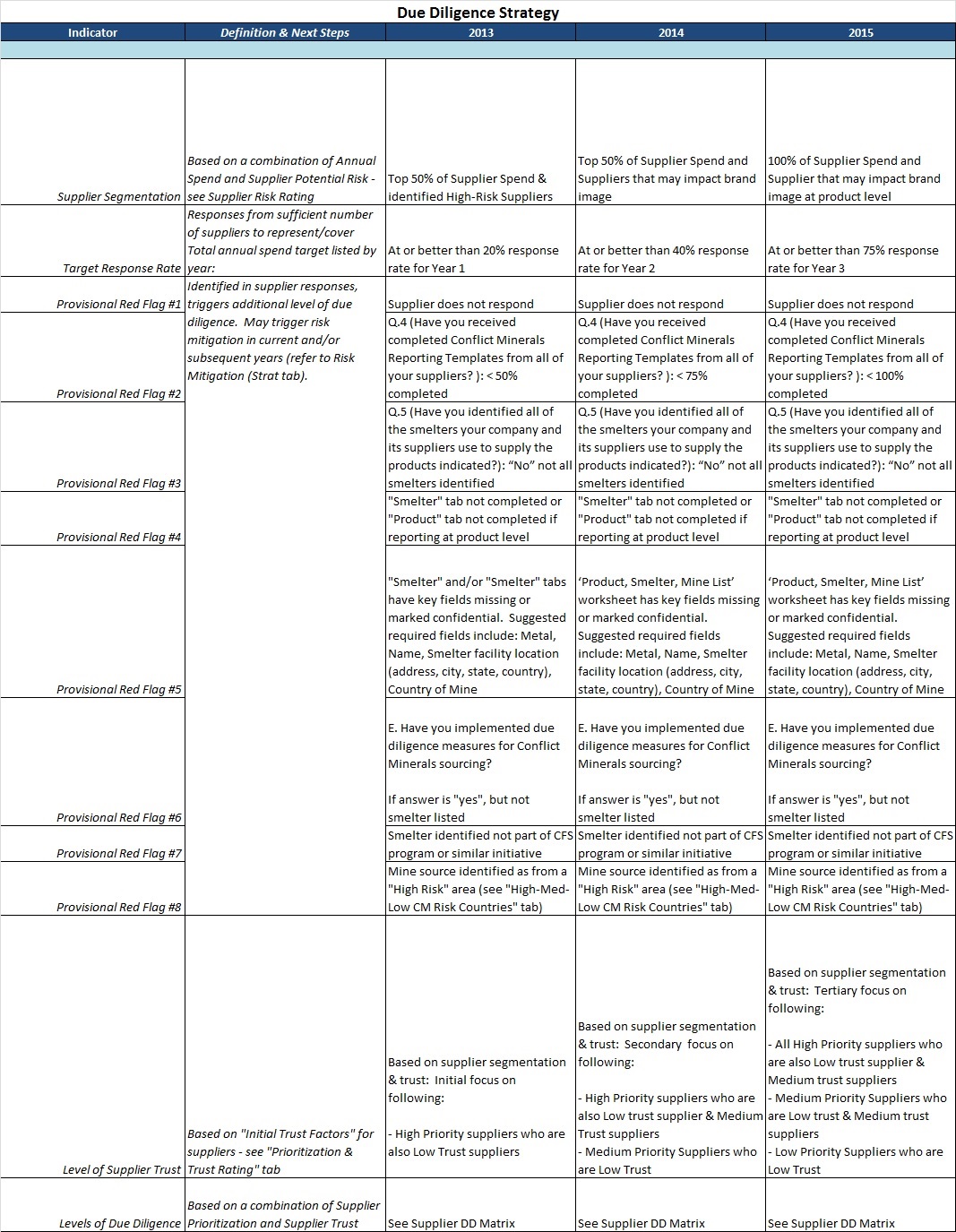

In an effort to identify, manage and otherwise address the risk that our supply chains for Covered Products that may contain one or more suppliers who are not in compliance with our CM Policy, Nortek developed a Reasonable Country of Origin Inquiry and Due Diligence (“RCOI/DD”) framework strategy which was approved by the Nortek’s Steering Committee. This 3-year framework as depicted in the table below establishes Nortek’s conflict minerals compliance plan, and outlines the following:

| |

| a. | Scope of the program for the given year (i.e., # of suppliers surveyed, product detail) |

| |

| b. | How we will determine supplier risks (i.e., qualitative and quantitative criteria) |

| |

| c. | Tools used collect data (i.e., EICC/GeSI template, supplier portal, collection/analytic tool) |

| |

| d. | How we will assess survey responses/red flags (i.e., collection/analytic tool) |

| |

| e. | Outlines our follow up and due diligence process (i.e., from email notification for non-responders to letter from VP - Chief Supply Chain Officer regarding non-compliance with Policy) |

| |

| f. | Risk mitigation strategies (based on defined criteria - follow the escalation process identified) |

| |

| g. | Approach to customer responses (i.e., centralized or local response) |

| |

| h. | Defines performance management metrics (i.e., outlines our goals to upper management) |

It is our intention that each year’s framework continues to build upon the prior year’s scope by increasing our supplier population to be surveyed and otherwise enhance and improve our due diligence procedures. This flexible framework will allow us to manage and monitor our progress year over year, and to make any necessary improvements. Any change to this plan must be approved by the Steering Committee.

1.2 Due Diligence Measures Performed and Results

Request Information from a Representative Sample of Direct Suppliers in 2013

Like many large, complex global companies, Nortek has thousands of suppliers of numerous raw materials and components, and, in some cases finished products, some of which may contain necessary conflict minerals. These suppliers are located around the globe. During this first year of compliance with the Rule, we have been unable to contact all of these suppliers without incurring unreasonable costs and other burdens. For this reason, we undertook in good faith what we believe to be a reasonable sampling methodology that, consistent with the OECD Due Diligence Guidance, targeted the “highest-risk” areas of our supply chain involving conflict minerals. We focused on the top tier of our suppliers based on the highest expenditures incurred by the Company in 2013 for raw materials or components or finished products containing necessary conflict minerals, and selected a total of 44 “in-scope” suppliers by spend (Top Tier Suppliers).

The Top Tier Suppliers were then reviewed based on a set of qualitative measures designed to flag higher risks of sourcing inconsistent with our CM Policy. Those measures included: length of supplier relationship, supplier performance, position within the supply chain (closeness to smelter), and supplier location. The Top Tier Suppliers represented 41% of our expenditures for components/materials/finished products that do or may contain necessary conflict minerals. We assessed our sampling methodology against those used by our industry peers and confirmed that this risk-based approach was consistent with how many of our peer companies were approaching the first year of compliance with the Rule.

We conducted a survey of the Top Tier Suppliers described above using the template developed by the Electronic Industry Citizenship Coalition ® (EICC ®) and the Global e-Sustainability Initiative (GeSI), known as the EICC/GeSI Template (the Template). The Template was developed under the auspices of the OECD Due Diligence Guidance to facilitate disclosure and communication of information regarding smelters or refineries that provide material to a company’s supply chain. It includes questions regarding a company’s conflict-free policy, engagement with its direct suppliers, and a listing of the smelters and/or refineries the company and its suppliers may use. In addition, the Template contains questions about the origin of conflict minerals included in their supplier products, as well as a supplier’s due diligence process. Written instructions and recorded training illustrating the use of the tool are available on EICC’s website and have also been included in our supplier training module, which Nortek will roll out for the 2014 reporting period as discussed below.

Survey Responses & Red Flag Review

We received some level of response from 77% of the Top Tier Suppliers surveyed. We reviewed the responses against red flag criteria we developed to identify areas of heightened risk of noncompliance. These criteria included untimely or incomplete responses as well as inconsistencies within the data reported in the Template. We defined a set of rules to assess each surveyed supplier’s reliability as well as the trustworthiness of its response. This “if/then” methodology allowed us to determine with a reasonable certainty where we should “bucket” or categorize each supplier’s response (see first table under “Our Results” below).

Our Results

There were ten suppliers who did not respond, even after multiple email reminders from us that their survey response was required. We therefore deemed these suppliers non-compliant for 2013. There were 18 suppliers who did respond but provided either incomplete information or their response contained one or more red flags. We followed up with the supplier, requesting that it provide revised responses. If the supplier had additional information or was able to correct discrepancies, it provided updated information. Some suppliers were so “early on” in the development of their conflict mineral compliance procedures that we determined their responses, whether incomplete or containing red flags, constituted the best information we were going to receive for the 2013 reporting year. These suppliers are targeted to receive our training package in 2014.

|

| | | | |

| Total Suppliers Surveyed | Responses Complete & Trustworthy | Incomplete Surveys requiring further follow up | Surveys with red flags; Planned for 2014 training | Non-Responsive |

| 44 | 16 | 5 | 13 | 10 |

Below is the list of smelters or refineries identified by our sample of Top Tier Suppliers in 2013:

|

| | | | |

| Metal (*) | Smelter Reference List (*) | Standard Smelter Names (*) | Smelter Facility Location: Country (*) | Smelter ID |

| Gold | Western Australian Mint trading as The Perth Mint | Western Australian Mint trading as The Perth Mint | AUSTRALIA | 1AUS046 |

| Gold | Umicore SA Business Unit Precious Metals Refining | Umicore SA Business Unit Precious Metals Refining | BELGIUM | 1BEL062 |

| Gold | AngloGold Ashanti Mineração Ltda | AngloGold Ashanti Mineração Ltda | BRAZIL | 1BRA003 |

| Gold | Umicore Brasil Ltda | Umicore Brasil Ltda | BRAZIL | 1BRA061 |

| Gold | Johnson Matthey Limited | Johnson Matthey Limited | CANADA | 1CAN024 |

| Gold | Royal Canadian Mint | Royal Canadian Mint | CANADA | 1CAN050 |

| Gold | Xstrata Canada Corporation | Xstrata Canada Corporation | CANADA | 1CAN064 |

| Gold | Argor-Heraeus SA | Argor-Heraeus SA | SWITZERLAND | 1CHE004 |

| Gold | Cendres & Métaux SA | Cendres & Métaux SA | SWITZERLAND | 1CHE011 |

| Gold | Metalor Technologies SA | Metalor Technologies SA | SWITZERLAND | 1CHE035 |

| Gold | PAMP SA | PAMP SA | SWITZERLAND | 1CHE045 |

| Gold | Valcambi SA | Valcambi SA | SWITZERLAND | 1CHE063 |

| Gold | PX Précinox SA | PX Précinox SA | SWITZERLAND | 1CHE068 |

| Gold | Codelco | Codelco | CHILE | 1CHL014 |

| Gold | Jiangxi Copper Company Limited | Jiangxi Copper Company Limited | CHINA | 1CHN023 |

| Gold | The Refinery of Shandong Gold Mining Co. Ltd | The Refinery of Shandong Gold Mining Co. Ltd | CHINA | 1CHN053 |

| Gold | Shandong Zhaojin Gold & Silver Refinery Co. Ltd | Shandong Zhaojin Gold & Silver Refinery Co. Ltd | CHINA | 1CHN054 |

| Gold | The Great Wall Gold and Silver Refinery of China | The Great Wall Gold and Silver Refinery of China | CHINA | 1CHN059 |

| Gold | Shandong Zhaoyuan Gold Argentine refining company limited | Zhongyuan Gold Smelter of Zhongjin Gold Corporation | CHINA | 1CHN065 |

| Gold | Zijin Mining Group Co. Ltd | Zijin Mining Group Co. Ltd | CHINA | 1CHN066 |

| Gold | Allgemeine Gold- und Silberscheideanstalt A.G. | Allgemeine Gold- und Silberscheideanstalt A.G. | GERMANY | 1DEU001 |

| Gold | Aurubis AG | Aurubis AG | GERMANY | 1DEU007 |

| Gold | Heimerle + Meule GmbH | Heimerle + Meule GmbH | GERMANY | 1DEU017 |

| Gold | Heraeus Precious Metals GmbH & Co. KG | Heraeus Precious Metals GmbH & Co. KG | GERMANY | 1DEU018 |

| Gold | SEMPSA Joyeria Plateria SA | SEMPSA Joyeria Plateria SA | SPAIN | 1ESP052 |

| Gold | Heraeus Hong Kong | Heraeus Ltd Hong Kong | HONG KONG | 1HKG019 |

|

| | | | |

| Gold | Metalor Technologies (Hong Kong) Ltd | Metalor Technologies (Hong Kong) Ltd | HONG KONG | 1HKG036 |

| Gold | PT Aneka Tambang (Persero) Tbk | PT Aneka Tambang (Persero) Tbk | INDONESIA | 1IDN048 |

| Gold | Chimet SpA | Chimet SpA | ITALY | 1ITA013 |

| Gold | Asahi Pretec Corp koube koujyo | Asahi Pretec Corporation | JAPAN | 1JPN005 |

| Gold | Dowa Metals & Mining Co. Ltd | Dowa | JAPAN | 1JPN015 |

| Gold | Ishifuku Metal Industry Co., Ltd. | Ishifuku Metal Industry Co., Ltd. | JAPAN | 1JPN021 |

| Gold | Japan Mint | Japan Mint | JAPAN | 1JPN022 |

| Gold | Nippon Mining | JX Nippon Mining & Metals Co., Ltd | JAPAN | 1JPN028 |

| Gold | Matsuda Sangyo Co. Ltd | Matsuda Sangyo Co. Ltd | JAPAN | 1JPN034 |

| Gold | Mitsubishi Materials Corporation | Mitsubishi Materials Corporation | JAPAN | 1JPN039 |

| Gold | Mitsui Mining and Smelting Co., Ltd. | Mitsui Mining and Smelting Co., Ltd. | JAPAN | 1JPN040 |

| Gold | Toyo Smelter & Refinery | Sumitomo Metal Mining Co. Ltd. | JAPAN | 1JPN057 |

| Gold | Tanaka Kikinzoku Hanbai K.K. | Tanaka Kikinzoku Kogyo K.K. | JAPAN | 1JPN058 |

| Gold | Tokuriki Tokyo Melters Assayers | Tokuriki Honten Co. Ltd | JAPAN | 1JPN060 |

| Gold | Nihon Material Co. LTD | Nihon Material Co. LTD | JAPAN | 1JPN071 |

| Gold | Aida Chemical Industries Co. Ltd. | Aida Chemical Industries Co. Ltd. | JAPAN | 1JPN072 |

| Gold | Asaka Riken Co Ltd | Asaka Riken Co Ltd | JAPAN | 1JPN073 |

| Gold | Kojima Chemicals Co. Ltd | Kojima Chemicals Co. Ltd | JAPAN | 1JPN074 |

| Gold | Yokohama Metal Co Ltd | Yokohama Metal Co Ltd | JAPAN | 1JPN077 |

| Gold | Chugai Mining | Chugai Mining | JAPAN | 1JPN078 |

| Gold | Pan Pacific Copper Co. LTD | Pan Pacific Copper Co. LTD | JAPAN | 1JPN080 |

| Gold | Kazzinc Ltd | Kazzinc Ltd | KAZAKHSTAN | 1KAZ029 |

| Gold | Kyrgyzaltyn JSC | Kyrgyzaltyn JSC | KYRGYZSTAN | 1KGZ030 |

| Gold | Central Bank of the DPR of Korea | Central Bank of the DPR of Korea | KOREA, REPUBLIC OF | 1KOR012 |

| Gold | LS-Nikko Copper Inc | LS-Nikko Copper Inc | KOREA, REPUBLIC OF | 1KOR032 |

| Gold | Torecom | Torecom | KOREA, REPUBLIC OF | 1KOR081 |

| Gold | Daejin Indus Co. Ltd | Daejin Indus Co. Ltd | KOREA, REPUBLIC OF | 1KOR082 |

| Gold | DaeryongENC | DaeryongENC | KOREA, REPUBLIC OF | 1KOR083 |

| Gold | Do Sung Corporation | Do Sung Corporation | KOREA, REPUBLIC OF | 1KOR084 |

| Gold | Hwasung CJ Co. Ltd | Hwasung CJ Co. Ltd | KOREA, REPUBLIC OF | 1KOR085 |

| Gold | Korea Metal | Korea Metal | KOREA, REPUBLIC OF | 1KOR086 |

| Gold | SAMWON METALS Corp. | SAMWON METALS Corp. | KOREA, REPUBLIC OF | 1KOR087 |

| Gold | Caridad | Caridad | MEXICO | 1MEX010 |

| Gold | Met-Mex Peñoles, S.A. | Met-Mex Peñoles, S.A. | MEXICO | 1MEX038 |

| Gold | Schone Edelmetaal | Schone Edelmetaal | NETHERLANDS | 1NLD051 |

| Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | PHILIPPINES | 1PHL008 |

| Gold | FSE Novosibirsk Refinery | FSE Novosibirsk Refinery | RUSSIAN FEDERATION | 1RUS016 |

| Gold | JSC Ekaterinburg Non-Ferrous Metal Processing Plant | JSC Ekaterinburg Non-Ferrous Metal Processing Plant | RUSSIAN FEDERATION | 1RUS026 |

|

| | | | |

| Gold | JSC Uralectromed | JSC Uralectromed | RUSSIAN FEDERATION | 1RUS027 |

| Gold | Moscow Special Alloys Processing Plant | Moscow Special Alloys Processing Plant | RUSSIAN FEDERATION | 1RUS041 |

| Gold | OJSC “The Gulidov Krasnoyarsk Non-Ferrous Metals Plant” (OJSC Krastvetmet) | OJSC “The Gulidov Krasnoyarsk Non-Ferrous Metals Plant” (OJSC Krastvetmet) | RUSSIAN FEDERATION | 1RUS044 |

| Gold | Prioksky Plant of Non-Ferrous Metals | Prioksky Plant of Non-Ferrous Metals | RUSSIAN FEDERATION | 1RUS047 |

| Gold | SOE Shyolkovsky Factory of Secondary Precious Metals | SOE Shyolkovsky Factory of Secondary Precious Metals | RUSSIAN FEDERATION | 1RUS055 |

| Gold | OJSC Kolyma Refinery | OJSC Kolyma Refinery | RUSSIAN FEDERATION | 1RUS067 |

| Gold | L' azurde Company For Jewelry | L' azurde Company For Jewelry | SAUDI ARABIA | 1SAU031 |

| Gold | Boliden Mineral AB | Boliden AB | SWEDEN | 1SWE009 |

| Gold | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | TURKEY | 1TUR006 |

| Gold | Istanbul Gold Refinery | Istanbul Gold Refinery | TURKEY | 1TUR069 |

| Gold | Nadir Metal Rafineri San. Ve Tic. A.ª. | Nadir Metal Rafineri San. Ve Tic. A.ª. | TURKEY | 1TUR070 |

| Gold | Solar Applied Materials Technology Corp. | Solar Applied Materials Technology Corp. | TAIWAN | 1TWN056 |

| Gold | Johnson Matthey Inc | Johnson Matthey Inc | UNITED STATES | 1USA025 |

| Gold | Materion Advanced Metals | Materion | UNITED STATES | 1USA033 |

| Gold | Metalor USA Refining Corporation | Metalor USA Refining Corporation | UNITED STATES | 1USA037 |

| Gold | Ohio Precious Metals LLC. | Ohio Precious Metals,OPM Metals,USPM,United States Precious Metals | UNITED STATES | 1USA043 |

| Gold | Sabin Metal Corp. | Sabin Metal Corp. | UNITED STATES | 1USA075 |

| Gold | United Precious Metal Refining, Inc. | United Precious Metal Refining, Inc. | UNITED STATES | 1USA076 |

| Gold | Almalyk Mining and Metallurgical Complex (AMMC) | Almalyk Mining and Metallurgical Complex (AMMC) | UZBEKISTAN | 1UZB002 |

| Gold | Navoi Mining and Metallurgical Combinat | Navoi Mining and Metallurgical Combinat | UZBEKISTAN | 1UZB042 |

| Gold | Rand Refinery Limited | Rand Refinery (Pty) Ltd | SOUTH AFRICA | 1ZAF049 |

| Tin | Metallo Chimique | Metallo Chimique | BELGIUM | 2BEL017 |

| Tin | Complejo Metalurico Vinto S.A. | EM Vinto | BOLIVIA | 2BOL010 |

| Tin | OMSA | OMSA | BOLIVIA | 2BOL022 |

| Tin | Mineração Taboca S.A. | Mineração Taboca S.A. | BRAZIL | 2BRA018 |

| Tin | White Solder Metalurgia | White Solder Metalurgia | BRAZIL | 2BRA054 |

| Tin | Cooper Santa | Cooper Santa | BRAZIL | 2BRA063 |

| Tin | Gejiu Zili Metallurgy Co. | Gejiu Zi-Li | CHINA | 2CHN011 |

| Tin | Geiju Non-Ferrous Metal Processing Co. Ltd. | Geiju Non-Ferrous Metal Processing Co. Ltd. | CHINA | 2CHN012 |

| Tin | Gold Bell Group | Gold Bell Group | CHINA | 2CHN013 |

| Tin | Jiangxi Nanshan | Jiangxi Nanshan | CHINA | 2CHN014 |

| Tin | Liuzhou China Tin | Liuzhou China Tin Group Co. Ltd. | CHINA | 2CHN015 |

| Tin | Yunnan Chengfeng Non-Ferrous Metals Co Ltd | Yunnan Chengfeng Non-Ferrous Metals Co Ltd | CHINA | 2CHN047 |

| Tin | Yunnan Tin Company Limited | Yunnan Tin Company Limited | CHINA | 2CHN048 |

| Tin | CNMC (Guangxi) PGMA Co. Ltd. | CNMC (Guangxi) PGMA Co. Ltd. | CHINA | 2CHN050 |

| Tin | Minmetals Ganzhou Tin Co. Ltd. | Minmetals Ganzhou Tin Co. Ltd. | CHINA | 2CHN051 |

| Tin | Huichang Jinshunda Tin Co. Ltd | Huichang Jinshunda Tin Co. Ltd | CHINA | 2CHN052 |

|

| | | | |

| Tin | Kai Unita Trade Limited Liability Company | Kai Unita Trade Limited Liability Company | CHINA | 2CHN053 |

| Tin | CV Duta Putra Bangka | CV Duta Putra Bangka | INDONESIA | 2IDN003 |

| Tin | CV JusTindo | CV JusTindo | INDONESIA | 2IDN004 |

| Tin | CV Makmur Jaya | CV Makmur Jaya | INDONESIA | 2IDN005 |

| Tin | CV Nurjanah | CV Nurjanah | INDONESIA | 2IDN006 |

| Tin | CV Prima Timah Utama | CV Prima Timah Utama | INDONESIA | 2IDN007 |

| Tin | CV Serumpun Sebalai | CV Serumpun Sebalai | INDONESIA | 2IDN008 |

| Tin | CV United Smelting | CV United Smelting | INDONESIA | 2IDN009 |

| Tin | PT Alam Lestari Kencana | PT Alam Lestari Kencana | INDONESIA | 2IDN023 |

| Tin | PT Artha Cipta Langgeng | PT Artha Cipta Langgeng | INDONESIA | 2IDN024 |

| Tin | PT Babel Inti Perkasa | PT Babel Inti Perkasa | INDONESIA | 2IDN025 |

| Tin | PT Babel Surya Alam Lestari | PT Babel Surya Alam Lestari | INDONESIA | 2IDN026 |

| Tin | PT Bangka Kudai Tin | PT Bangka Kudai Tin | INDONESIA | 2IDN027 |

| Tin | PT Bangka Putra Karya | PT Bangka Putra Karya | INDONESIA | 2IDN028 |

| Tin | PT Bangka Timah Utama Sejahtera | PT Bangka Timah Utama Sejahtera | INDONESIA | 2IDN029 |

| Tin | PT Belitung Industri Sejahtera | PT Belitung Industri Sejahtera | INDONESIA | 2IDN030 |

| Tin | PT BilliTin Makmur Lestari | PT BilliTin Makmur Lestari | INDONESIA | 2IDN031 |

| Tin | Indra Eramulti Logam | PT Bukit Timah | INDONESIA | 2IDN032 |

| Tin | PT Eunindo Usaha Mandiri | PT Eunindo Usaha Mandiri | INDONESIA | 2IDN033 |

| Tin | PT Fang Di MulTindo | PT Fang Di MulTindo | INDONESIA | 2IDN034 |

| Tin | PT HP Metals Indonesia | PT HP Metals Indonesia | INDONESIA | 2IDN035 |

| Tin | PT Koba Tin | PT Koba Tin | INDONESIA | 2IDN036 |

| Tin | PT Mitra Stania Prima | PT Mitra Stania Prima | INDONESIA | 2IDN037 |

| Tin | PT Refined Banka Tin | PT Refined Banka Tin | INDONESIA | 2IDN038 |

| Tin | PT Sariwiguna Binasentosa | PT Sariwiguna Binasentosa | INDONESIA | 2IDN039 |

| Tin | PT Stanindo Inti Perkasa | PT Stanindo Inti Perkasa | INDONESIA | 2IDN040 |

| Tin | PT Sumber Jaya Indah | PT Sumber Jaya Indah | INDONESIA | 2IDN041 |

| Tin | PT Timah | PT Timah | INDONESIA | 2IDN042 |

| Tin | PT Timah Nusantara | PT Timah Nusantara | INDONESIA | 2IDN043 |

| Tin | PT Tinindo Inter Nusa | PT Tinindo Inter Nusa | INDONESIA | 2IDN044 |

| Tin | PT Yinchendo Mining Industry | PT Yinchendo Mining Industry | INDONESIA | 2IDN045 |

| Tin | PT Tambang Timah | PT Tambang Timah | INDONESIA | 2IDN049 |

| Tin | PT DS Jaya Abadi | PT DS Jaya Abadi | INDONESIA | 2IDN059 |

| Tin | Cooper Santa | Cooper Santa | BRAZIL | 2IDN063 |

| Tin | Mitsubishi Materials Corporation | Mitsubishi Materials Corporation | JAPAN | 2JPN020 |

| Tin | Malaysia Smelting Corporation (MSC) | MSC,Malaysia Smelting Corp,Malaysia Smelting Corporation Berhad | MALAYSIA | 2MYS016 |

| Tin | Minsur S.A. Tin Metal | Minsur | PERU | 2PER019 |

| Tin | Novosibirsk Integrated Tin Works | Novosibirsk Integrated Tin Works | RUSSIAN FEDERATION | 2RUS021 |

| Tin | Thailand Smelting and Refining Co. Ltd. | Thaisarco | THAILAND | 2THA046 |

| Tin | Alpha Metals | Cookson | UNITED STATES | 2USA001 |

| Tantalum | Plansee | Plansee | AUSTRIA | 3AUT011 |

| Tantalum | Duoluoshan Sapphire Rare Metal Co. Ltd | Duoluoshan | CHINA | 3CHN001 |

| Tantalum | F&X Electro-Materials Limited | F&X | CHINA | 3CHN003 |

| Tantalum | Jiujiang Tanbre | JiuJiang Tambre Co. Ltd. | CHINA | 3CHN007 |

| Tantalum | Ningxia Orient Tantalum Industry Co., Ltd. | Ningxia Orient Tantalum Industry Co., Ltd. | CHINA | 3CHN009 |

| Tantalum | Zhuzhou Cement Carbide | Zhuzhou Cement Carbide | CHINA | 3CHN015 |

| Tantalum | JiuJiang JinXin Nonferrous Metals Co. Ltd. | JiuJiang JinXin Nonferrous Metals Co. Ltd. | CHINA | 3CHN017 |

|

| | | | |

| Tantalum | Conghua Tantalum and Niobium Smeltry | Conghua Tantalum and Niobium Smeltry | CHINA | 3CHN019 |

| Tantalum | H.C. Starck GmbH | H.C. Starck GmbH | GERMANY | 3DEU006 |

| Tantalum | Mitsui Mining & Smelting | Mitsui Mining & Smelting | JAPAN | 3JPN008 |

| Tantalum | Ulba Metallurgical Plant JSC | Ulba | KAZAKHSTAN | 3KAZ014 |

| Tantalum | Solikamsk Metal Works | Solikamsk Metal Works | RUSSIAN FEDERATION | 3RUS012 |

| Tantalum | Exotech Inc. | Exotech Inc. | UNITED STATES | 3USA002 |

| Tantalum | Gannon & Scott | Gannon & Scott | UNITED STATES | 3USA004 |

| Tantalum | Global Advanced Metals | Global Advanced Metals | UNITED STATES | 3USA005 |

| Tantalum | Kemet Blue Powder | Kemet Blue Powder | UNITED STATES | 3USA010 |

| Tantalum | Hi-Temp | Hi-Temp | UNITED STATES | 3USA016 |

| Tantalum | Telex | Telex | UNITED STATES | 3USA018 |

| Tungsten | Wolfram Bergbau und Hütten AG | Wolfram Bergbau und Hütten AG | AUSTRIA | 4AUT012 |

| Tungsten | Xianglu Tungsten Industry Co. Ltd. | Chaozhou Xianglu Tungsten Industry Co Ltd | CHINA | 4CHN002 |

| Tungsten | China Minmetals Nonferrous Metals Co Ltd | China Minmetals Nonferrous Metals Co Ltd | CHINA | 4CHN003 |

| Tungsten | Chongyi Zhangyuan Tungsten Co Ltd | Chongyi Zhangyuan Tungsten Co Ltd | CHINA | 4CHN004 |

| Tungsten | Jiangxi Rare Earth & Rare Metals Tungsten Group Imp.& Exp. Co. Ltd. | Jiangxi Rare Earth & Rare Metals Tungsten Group Corp | CHINA | 4CHN009 |

| Tungsten | China National Nonferrous | Jiangxi Tungsten Industry Group Co Ltd | CHINA | 4CHN010 |

| Tungsten | Xiamen Tungsten Co Ltd | Xiamen Tungsten Co Ltd | CHINA | 4CHN014 |

| Tungsten | Zhuzhou Cemented Carbide Works Imp. & Exp. Co. | Zhuzhou Cemented Carbide Group Co Ltd | CHINA | 4CHN015 |

| Tungsten | Ganzhou Hailong W & Mo Co. Ltd. | Ganzhou Grand Sea W & Mo Group Co Ltd | CHINA | 4CHN016 |

| Tungsten | Hunan Chenzhou Mining Group Co | Hunan Chenzhou Mining Group Co | CHINA | 4CHN018 |

| Tungsten | ALMT | ALMT | CHINA | 4CHN020 |

| Tungsten | HC Starck GmbH | HC Starck GmbH | GERMANY | 4DEU008 |

| Tungsten | Japan New Metals Co Ltd | JNM,Mitsubishi Materials Corporation,Mitsubishi | JAPAN | 4JPN017 |

| Tungsten | Wolfram Company CJSC | Wolfram Company CJSC | RUSSIAN FEDERATION | 4RUS013 |

| Tungsten | ATI Metalworking Products | ATI Tungsten Materials | UNITED STATES | 4USA001 |

| Tungsten | Global Tungsten & Powders Corp USA | Global Tungsten & Powders Corp | UNITED STATES | 4USA007 |

| Tungsten | Tejing (Vietnam) Tungsten Co Ltd | Tejing (Vietnam) Tungsten Co Ltd | VIETNAM | 4VNM019 |

As further explained below, we were able to determine that some of the necessary conflict minerals contained in our Covered Products that flowed through the smelters and refineries listed above may have originated in a Covered Country. By the same token, some of the necessary conflict minerals contained in our Covered Products could be traced to various smelters and refineries designated as “conflict-free” by well-respected industry groups whose lists were compiled on the basis of their application of a third-party supply chain audit process developed under the auspices of the OECD Due Diligence Guidance. These lists are maintained and published on the Conflict-Free Sourcing Initiative (“CFSI”) website: http://www.conflictfreesourcing.org/conflict-free-smelter-refiner-lists/; with oversight by the Electronic Industry Citizenship Coalition ® (EICC ®) and the Global e-Sustainability Initiative (GeSI).

Certified Smelter Results

Tantalum

Of the tantalum smelters identified through our Top Tier Supplier responses and listed above, we reviewed those smelters against the Certified Smelter and Refiner lists provided at http://www.conflictfreesourcing.org/conflict-free-smelter-refiner-lists/ and have determined that of the Tantalum Smelters identified in 2013, 16 of the 18 listed are identified as Conflict-Free Tantalum Smelters as part of the EICC-GeSI CFS Program (“CFSP”).

Tin

With regard to tin, 11 of the 56 smelters identified by our Top Tier Suppliers are characterized as Conflict-Free Tin Smelters pursuant to the CFSP. In addition, 7 other smelters identified are on the “active list”. The “active list” is a list of smelters and refiners identified as Active under the CFSP. Per EICC-GeSI defined standards, these tin smelters have become qualified as “active” once they submit a signed Agreement for the Exchange of Confidential Information (AECI) and Auditee Agreement contracts. If a smelter or refiner that has been identified as Active is deemed by the CFSP to not be progressing toward an audit, gap closure, or re-audit for more than 90 days, that smelter or refiner will be removed from the Active list. Of the Tin smelters thus identified, only one smelter (Malaysia Smelting Corporation 2MYS016) is currently sourcing out of the DRC region. However, this smelter is currently part of the Conflict Free Tin Initiative (CFTI). The CFTI is a multi-stakeholder project focused on realistic and sustainable solutions to the issues of “conflict minerals” from the DRC and adjoining countries. The CFTI aims to show that companies can source conflict free minerals from the Democratic Republic of Congo in accordance with legislation (such as the US Dodd Frank Act, Section 1502) and international guidelines (OECD Due Diligence Guidance for Responsible Supply Chain of Minerals from Conflict-Affected and High-Risk Areas). For more information regarding the CFTI program visit: http://solutions-network.org/site-cfti/

Tungsten

With regard to Tungsten, 8 of the 17 smelters identified by our Top Tier Suppliers are classified by the Tungsten Industry Conflict Minerals Council (TI-CMC) as a tungsten smelter progressing toward certification as conflict-free. The TI-CMC is a list of members progressing toward becoming a Conflict-Free Smelter Program Tungsten Smelter Validation as part of the EICC-GeSI CFSP. These smelters have agreed to complete a CFSP validation audit within two (2) years of attaining TI-CMC membership issuance. In addition, 4 other Tungsten smelters thus identified are on the “active list” meaning they submitted a signed Agreement for the Exchange of Confidential Information (AECI) and Auditee Agreement contracts.

Gold

Of the gold refineries, 35 of the 85 identified by our Top Tier Suppliers appear on the Conflict-Free Gold Refiners list. These gold refineries are considered compliant with the relevant CFSP assessment protocol as part of the EICC-GeSI CFS Program.

Conclusion

Based on the information we obtained pursuant to this due diligence process, the Company has been unable to determine the country of origin of any of its necessary conflict minerals, other than one smelter for tin, as discussed above.

2. Risk Mitigation - Efforts to Improve Due Diligence for 2014 and Beyond

We intend to continue taking the following steps in 2014 (and beyond, as necessary or appropriate) to improve upon and enhance the due diligence conducted for 2013, to further mitigate any risk that the necessary conflict minerals in our Covered Products could benefit armed groups in the Covered Countries:

| |

| a) | Continue to include a conflict minerals flow-down requirement in all new or renewed supplier agreements, which our direct suppliers must push down to their sub-suppliers via insertion in their agreements. |

| |

| b) | Expand the number of suppliers requested to provide conflict mineral information. |

| |

| c) | For 2013, we responded with a company-level declaration. For 2014, we will identify specific product level components within each of our business segments to obtain product level of detail within our 3TG supply chains. |

| |

| d) | Provide training resources to our suppliers to support a higher response rate with improved content, as well as encourage their sourcing from conflict-free smelters or refiners. Engage trade associations and other conflict free initiatives to define and incorporate best practices into our conflict mineral program. |

| |

| e) | Develop a grievance mechanism for suppliers to report violations up through the supply chain. |

Supplier Compliance & Risk Mitigation Activities:

| |

| • | With respect to the OECD Due Diligence Guidance requirement to strengthen engagement with suppliers, we have developed a specific conflict minerals supplier training package that will provide our suppliers an overview of the conflict mineral requirements and outline the requirements, commitment and expectations to meet our due diligence efforts. We will provide this supplier training to those suppliers who did not provide a declaration in response to our survey request for 2013 or provided one that did not “pass” our red-flag review. In addition, we will provide the training package to the expanded list of suppliers we intend to survey as part of the 2014 population. |

| |

| • | We also have plans to develop a supplier portal through which we will be able to easily collect supplier conflict mineral points of contact resulting in a more efficient and smoother collection of data. |

| |

| • | We will continue to work with our Top Tier Suppliers; both those suppliers surveyed in 2013 and add further direct suppliers to be surveyed in 2014 to ensure that Nortek’s flow-down requirements are passed further up the supply chain. As outlined in our CM Policy, we continue working with our suppliers to take reasonable steps to map our Covered Products back to the smelter (or refiner) to determine if the 3TG in our Covered Products is coming from a smelter or refiner considered “conflict free” by a recognized organization or program, such as the CFSP. |

| |

| • | As part of the RCOI/DD framework and to ensure our suppliers understand our expectations, we will execute remediation steps to evaluate and procure, as necessary, alternate products and materials. We have developed a set of “Escalation Procedures Guidelines” that: |

| |

| a. | Provides for potential actions of increasing severity by which the level of severity increases in out years of the program, and based on our supplier risk assessment would be more severe the higher the supplier risk. |

| |

| b. | Includes actions supported with a detailed escalation procedure plan (e.g., if "Follow Up" indicates how, with whom, frequency of attempts prior to next action, etc.). |

| |

| c. | Uses current risk mitigation framework to leverage any existing corporate vendor risk mitigation programs currently in place. |

| |

| d. | Ensures actions that align with the CM Policy and associated terms contained in supporting documents (Terms &Conditions, Contracts, Purchase Orders, etc.). |