UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21295

JPMorgan Trust I

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: August 31

Date of reporting period: September 1, 2013 through August 31, 2014

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

J.P. Morgan Funds

August 31, 2014

JPMorgan Diversified Real Return Fund

CONTENTS

Investments in the Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Fund.

Prospective investors should refer to the Fund’s prospectus for a discussion of the Fund’s investment objective, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Fund, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

SEPTEMBER 18, 2014 (Unaudited)

Dear Shareholder:

With a backdrop of continued accommodative policies among the world’s central banks and a trend toward low growth, low inflation and low volatility, global financial markets stabilized and provided positive returns for the twelve months ended August 31, 2014. In the U.S., low borrowing costs, a surge in corporate mergers and healthy corporate earnings drove U.S. equity indices to successive record highs during the latter half of the period. Fixed income markets struggled early on but then swung to gains as long-term interest rates declined in 2014 and demand for debt securities outpaced supply. Bond yields, which generally move in the opposite direction of prices, tumbled lower over the second half of the twelve month period and yields on longer maturity U.S. Treasury Securities reached their lowest levels in more than a year. From May through June, market volatility retreated to lows not consistently seen since 2007, before spiking in July on geopolitical tensions, and then retreating again at the end of August. The Barclays U.S. Aggregate Index returned 5.66% for the twelve month period. The Standard & Poor’s 500 Index put an exclamation point on the twelve months by breaching the 2,000-point level for the first time and closing at a record high 2003.37 points on August 29, 2014.

| | |

| | “While both global bond and equity markets performed well during the past twelve months, there remained notable investor uncertainty about the timing and scope of any change in Fed interest rate policy and uneasiness about the run up in equity prices.” |

In the broader U.S. economy, growth returned after a notable drop in the winter months and business investment and spending on durable goods improved in the latter part of the 12 month period. While housing data was mixed, the unemployment rate dropped to 6.10% in August from 7.20% in September 2013, and other jobs numbers showed meaningful improvement. In response to sustained economic improvement — particularly in jobs data — the U.S. Federal Reserve (the “Fed”) announced in December that it would begin to taper off its Quantitative Easing program. During 2014, the Fed incrementally decreased its monthly purchases of U.S. Treasury bonds and mortgage-backed securities to $25 billion by the end of August. In 2014, Janet Yellen became chairwoman of the Fed and sought to reassure investors and the public at large that central bank policy would remain accommodative into 2015. In August, she reiterated that stance at a closely watched global economic conference in Jackson Hole, Wyoming.

The European Union (EU) returned to positive growth in 2013 and by December, Ireland had become the first member nation of the EU to exit its bailout program. However, overall unemployment in the EU remained exceptionally high and in 2014 the threat of price deflation arose. In an unprecedented move in June, European Central Bank President Mario Draghi cut the deposit rate to negative 0.10% from 0.00% in a bid to push banks to extend lending by effectively charging them for parking excess cash with the central bank. Draghi followed up at the Jackson Hole conference in August with a clear statement that acknowledged the need to spur

job creation and signaled his commitment to support growth and head off a destructive deflationary spiral. In Japan, Prime Minister Shinzo Abe’s efforts to stimulate economic growth appeared to have some success in 2013, but by mid-2014 weaker-than-expected economic data fueled fears that his policies were faltering. Consumer spending declined sharply, potentially due to an April increase in the nation’s consumption tax. The Bank of Japan continued its aggressive program of bond purchases throughout 2014. The MSCI Europe, Australasia and Far East Index returned 16.09% for the twelve months ended August 31, 2014.

Isolated conflicts in Ukraine, Gaza and Iraq drove some investors toward so-called safe havens, particularly U.S. fixed income securities, but financial markets in general shrugged off much of the impact from these events. Elsewhere, a long-running dispute over restructured payments to holders of Argentina’s sovereign debt made headlines but had little effect on global bond markets.

Emerging markets generally performed well during the period, rebounding from a sell-off in late 2013. In China, domestic economic data weakened toward the end of the twelve month period. However, the government’s targeted stimulus appeared to be working to counter any slowdown in growth. Two of the world’s largest democracies, India and Indonesia, held generally peaceful elections, and Turkey’s prime minister was elected the next president, as expected. In Brazil, the death of opposition presidential candidate Eduardo Campos in an airplane crash raised uncertainty about the upcoming elections and prospects for change in Brazil’s economic policies. In Thailand, months of political unrest led to a military coup in May. For the twelve months ended August 31, 2014, the MSCI Emerging Markets Index returned 18.26%.

While both global bond and equity markets performed well during the past twelve months, there remained notable investor uncertainty about the timing and scope of any change in Fed interest rate policy and uneasiness about the run-up in equity prices. Policymakers and economists stated their fear that investors had grown complacent amid the extended period of low volatility seen across stock, bond, foreign exchange and commodities markets. At the same time, moderate price inflation and a stronger dollar helped to dispel warnings that Fed policies would unleash rapid inflation and debase the U.S. currency. In the face of these concerns, both bonds and equities generated positive solid returns for the twelve month period and rewarded those investors who maintained a diversified portfolio and a long-term perspective.

On behalf of everyone at J.P. Morgan Asset Management, thank you for your continued support. We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 1 | |

JPMorgan Diversified Real Return Fund

FUND COMMENTARY

TWELVE MONTHS ENDED AUGUST 31, 2014 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | |

| Fund (Select Class Shares)* | | | 8.16% | |

| Barclays 1-10 Year U.S. TIPS Index | | | 3.74% | |

| |

| Net Assets as of 8/31/2014 | | $ | 64,436,088 | |

INVESTMENT OBJECTIVE**

The JPMorgan Diversified Real Return Fund (the “Fund”) seeks to maximize long-term real return.

HOW DID THE MARKET PERFORM?

Financial markets generally performed well, primarily driven by the accommodative stance of central banks throughout the twelve months ended August 31, 2014. Demand for longer maturity debt outpaced supply as investors sought the relatively attractive yields of U.S. Treasury securities compared with yields on foreign government bonds in other developed markets.

High yield bonds (also known as “junk bonds”) and floating rate securities generated solid returns. Tightening credit spreads, low default rates and overall positive investor demand supported these securities during the reporting period.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund seeks to have lower volatility than that of U.S. equities, as represented by the S&P 500 Index. The Fund sought to achieve this lower volatility by maintaining meaningful allocation to Treasury Inflation Protected Securities (“TIPS”) and inflation sensitive fixed income investment strategies, gaining exposure to these asset classes primarily through its investments in underlying J.P. Morgan Funds. For the twelve months ended August 31, 2014, the Fund’s Select Class shares outperformed the Barclays 1-10 Year U.S. TIPS Index (the “Benchmark”). The Benchmark only tracks TIPS, while the Fund is invested in a broader range of assets.

The Fund’s allocation to real estate investment trusts and its allocation to the agriculture sectors were significant contributors to absolute performance. The Fund’s allocation to global infrastructure and the metals & mining and energy sectors through the use of exchange traded funds also contributed to absolute performance.

The Fund’s allocation to the gold mining sector and its overall allocation to commodities detracted from absolute performance for the twelve month period.

HOW WAS THE FUND POSITIONED?

During the period, the Fund’s portfolio managers targeted a long-term strategic asset allocation, consisting of the following weights: 16% in TIPS; 30% in other inflation protected fixed income securities; 14% in floating rate securities; 10% in real estate securities; 10% in commodities; 10% in natural

resources equities including a direct equity investment in securities of agriculture and agricultural-related companies; 5% in infrastructure equities and 5% in cash and cash equivalents, such as money market funds. The Fund’s portfolio managers employed a momentum-based rebalancing strategy, making tactical investments based on the market conditions facing each asset class in their view of longer-term strategic allocation. At the end of the reporting period, the Fund had significantly less exposure to TIPS, while maintaining overweight exposures to floating rate securities and inflation managed bonds compared with the target weights in its longer-term strategic asset allocation.

| | | | | | | | |

| TOP TEN HOLDINGS OF THE PORTFOLIO*** | |

| | 1. | | | JPMorgan Inflation Managed Bond Fund, Class R6 Shares | | | 33.9 | % |

| | 2. | | | JPMorgan Floating Rate Income Fund, Class R6 Shares | | | 18.5 | |

| | 3. | | | JPMorgan Realty Income Fund, Class R5 Shares | | | 11.8 | |

| | 4. | | | iShares Global Infrastructure ETF | | | 9.6 | |

| | 5. | | | JPMorgan Commodities Strategy Fund, Class R6 Shares | | | 8.5 | |

| | 6. | | | JPMorgan Real Return Fund, Institutional Class Shares | | | 4.9 | |

| | 7. | | | iShares Global Energy ETF | | | 4.2 | |

| | 8. | | | JPMorgan Prime Money Market Fund, Institutional Class Shares, 0.010% | | | 2.1 | |

| | 9. | | | iShares MSCI Global Metals & Mining Producers ETF | | | 2.0 | |

| | 10. | | | Market Vectors Gold Miners ETF | | | 1.2 | |

| | | | |

PORTFOLIO COMPOSITION BY ASSET CLASS*** | |

| Fixed Income | | | 57.3 | % |

| Alternative Assets | | | 20.2 | |

| International Equity | | | 18.7 | |

| U.S. Equity | | | 1.7 | |

| Short-Term Investment | | | 2.1 | |

| * | | The return shown is based on the net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based on total investments as of August 31, 2014. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN FUNDS | | AUGUST 31, 2014 |

| | | | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF AUGUST 31, 2014 | |

| | | | |

| | | INCEPTION DATE

OF CLASS | | | 1 YEAR | | | 3 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | | March 31, 2011 | | | | | | | | | | | | | |

Without Sales Charge | | | | | | | 7.88 | % | | | 1.48 | % | | | 1.65 | % |

With Sales Charge* | | | | | | | 3.03 | | | | (0.06 | ) | | | 0.29 | |

CLASS C SHARES | | | March 31, 2011 | | | | | | | | | | | | | |

Without CDSC | | | | | | | 7.34 | | | | 0.96 | | | | 1.15 | |

With CDSC** | | | | | | | 6.34 | | | | 0.96 | | | | 1.15 | |

CLASS R2 SHARES | | | March 31, 2011 | | | | 7.60 | | | | 1.23 | | | | 1.41 | |

CLASS R5 SHARES | | | March 31, 2011 | | | | 8.24 | | | | 1.85 | | | | 2.03 | |

SELECT CLASS SHARES | | | March 31, 2011 | | | | 8.16 | | | | 1.73 | | | | 1.92 | |

| * | | Sales Charge for Class A Shares is 4.50%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

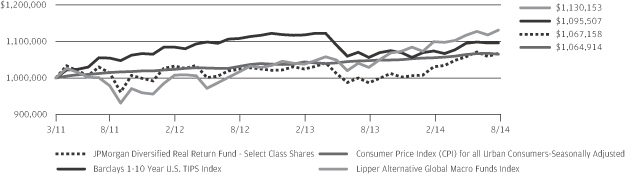

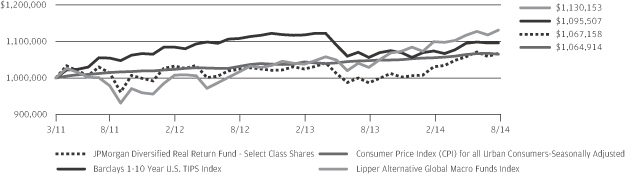

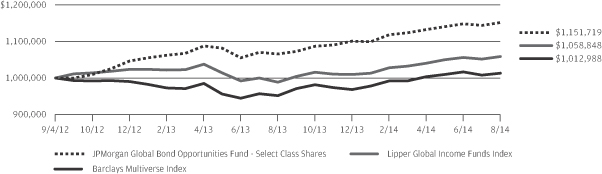

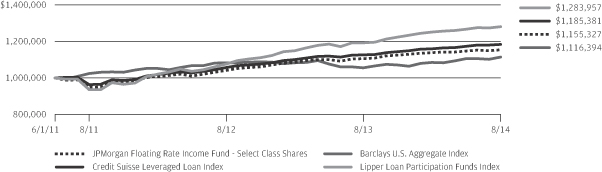

LIFE OF FUND PERFORMANCE (3/31/11 — 8/31/14)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date, month-end performance information please call 1-800-480-4111.

The Fund commenced operations on March 31, 2011.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Diversified Real Return Fund, the Barclays 1-10 Year U.S. TIPS Index, the Consumer Price Index (CPI) for All Urban Consumers-Seasonally Adjusted and the Lipper Alternative Global Macro Funds Index from March 31, 2011 to August 31, 2014. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the Barclays 1-10 Year U.S. TIPS Index and the Consumer Price Index (CPI) for All Urban Consumers-Seasonally Adjusted does not reflect the deduction of expenses or a sales charge associated with a mutual fund. The performance of the Barclays 1-10 Year U.S. TIPS Index has been adjusted to reflect reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Alternative Global Macro Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The Barclays 1-10 Year U.S. TIPS Index represents the performance

of intermediate (1-10 year) U.S. Treasury Inflation Protection Securities. The Consumer Price Index (CPI) for All Urban Consumers-Seasonally Adjusted of the Bureau of Labor Statistics (BLS) is a measure of the change in prices of goods and services purchased by urban consumers. Seasonal adjustment removes the effects of recurring seasonal influences from many economic series, including consumer prices. The adjustment process quantifies seasonal patterns and then factors them out of the series to permit analysis of non-seasonal price movements. Changing climatic conditions, production cycles, model changeovers, holidays, and sales can cause seasonal variation in prices. The Lipper Alternative Global Macro Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an Index.

Select Class Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 3 | |

JPMorgan Diversified Real Return Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF AUGUST 31, 2014

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| Common Stocks — 3.4% | |

| | | | Consumer Staples — 1.3% | |

| | | | Food Products — 1.3% | |

| | 127 | | | AAK AB, (Sweden) | | | 7,447 | |

| | 3,525 | | | Archer-Daniels-Midland Co. | | | 175,756 | |

| | 1,938 | | | Associated British Foods plc, (United Kingdom) | | | 92,187 | |

| | 550 | | | Austevoll Seafood ASA, (Norway) | | | 3,505 | |

| | 200 | | | Bakkafrost P/F, (Denmark) | | | 4,325 | |

| | 11 | | | Barry Callebaut AG, (Switzerland) (a) | | | 13,504 | |

| | 3,416 | | | BRF S.A., (Brazil), ADR | | | 91,071 | |

| | 794 | | | Bunge Ltd. | | | 67,212 | |

| | 85 | | | Cal-Maine Foods, Inc. | | | 6,724 | |

| | 13,000 | | | China Agri-Industries Holdings Ltd., (Hong Kong) | | | 5,317 | |

| | 8,000 | | | China Yurun Food Group Ltd., (China) (a) | | | 3,901 | |

| | 50 | | | CJ CheilJedang Corp., (South Korea) | | | 18,645 | |

| | 824 | | | Darling Ingredients, Inc. (a) | | | 15,887 | |

| | 3,000 | | | First Resources Ltd., (Singapore) | | | 4,850 | |

| | 187 | | | Fresh Del Monte Produce, Inc. | | | 5,973 | |

| | 900 | | | Glanbia plc, (Ireland) | | | 13,718 | |

| | 37,000 | | | Golden Agri-Resources Ltd., (Singapore) | | | 15,105 | |

| | 1,121 | | | GrainCorp Ltd., (Australia), Class A | | | 9,493 | |

| | 200 | | | Hokuto Corp., (Japan) | | | 3,780 | |

| | 3,000 | | | Indofood Agri Resources Ltd., (Singapore) | | | 2,076 | |

| | 400 | | | Ingredion, Inc. | | | 31,904 | |

| | 386 | | | Maple Leaf Foods, Inc., (Canada) | | | 7,189 | |

| | 1,648 | | | Marine Harvest ASA, (Norway) | | | 22,354 | |

| | 300 | | | Maruha Nichiro Corp., (Japan) | | | 4,668 | |

| | 1,000 | | | NH Foods Ltd., (Japan) | | | 21,180 | |

| | 2,000 | | | Nichirei Corp., (Japan) | | | 9,423 | |

| | 1,000 | | | Nippon Flour Mills Co., Ltd., (Japan) | | | 5,029 | |

| | 1,500 | | | Nippon Suisan Kaisha Ltd., (Japan) (a) | | | 4,358 | |

| | 368 | | | Nutreco N.V., (Netherlands) | | | 14,159 | |

| | 306 | | | Pilgrim’s Pride Corp. (a) | | | 9,140 | |

| | 268 | | | Salmar ASA, (Norway) | | | 4,982 | |

| | 106 | | | Sanderson Farms, Inc. | | | 9,892 | |

| | 2 | | | Seaboard Corp. (a) | | | 5,798 | |

| | 379 | | | Suedzucker AG, (Germany) | | | 6,528 | |

| | 2,416 | | | Tate & Lyle plc, (United Kingdom) | | | 27,136 | |

| | 1,485 | | | Tyson Foods, Inc., Class A | | | 56,519 | |

| | 30 | | | Vilmorin & Cie S.A., (France) | | | 3,406 | |

| | 14,000 | | | Wilmar International Ltd., (Singapore) | | | 35,397 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 839,538 | |

| | | | | | | | |

| | | | Industrials — 0.4% | |

| | | | Machinery — 0.4% | |

| | 461 | | | AGCO Corp. | | | 22,515 | |

| | 912 | | | CNH Industrial N.V., (United Kingdom) | | | 7,970 | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | Machinery — continued | |

| | 1,994 | | | Deere & Co. | | | 167,675 | |

| | 2,000 | | | Iseki & Co., Ltd., (Japan) | | | 5,370 | |

| | 6,000 | | | Kubota Corp., (Japan) | | | 85,925 | |

| | 75 | | | Lindsay Corp. | | | 5,834 | |

| | 263 | | | Titan International, Inc. | | | 3,814 | |

| | | | | | | | |

| | | | Total Industrials | | | 299,103 | |

| | | | | | | | |

| | | | Materials — 1.7% | |

| | | | Chemicals — 1.7% | |

| | 770 | | | Agrium, Inc., (Canada) | | | 72,815 | |

| | 131 | | | American Vanguard Corp. | | | 1,761 | |

| | 76 | | | Auriga Industries A/S, (Denmark), Class B (a) | | | 4,217 | |

| | 285 | | | CF Industries Holdings, Inc. | | | 73,436 | |

| | 12,000 | | | China BlueChemical Ltd., (China), Class H | | | 5,914 | |

| | 282 | | | Intrepid Potash, Inc. (a) | | | 4,323 | |

| | 2,201 | | | Israel Chemicals Ltd., (Israel) | | | 17,043 | |

| | 16 | | | Israel Corp., Ltd. (The), (Israel) (a) | | | 9,027 | |

| | 898 | | | K+S AG, (Germany) | | | 27,941 | |

| | 2,846 | | | Monsanto Co. | | | 329,140 | |

| | 1,778 | | | Mosaic Co. (The) | | | 84,917 | |

| | 856 | | | Nufarm Ltd., (Australia) | | | 3,448 | |

| | 390 | | | PhosAgro OAO, (Russia), Reg. S, GDR | | | 4,407 | |

| | 4,595 | | | Potash Corp. of Saskatchewan, Inc., (Canada) | | | 161,393 | |

| | 230 | | | Scotts Miracle-Gro Co. (The), Class A | | | 13,278 | |

| | 463 | | | Sociedad Quimica y Minera de Chile S.A., (Chile), ADR | | | 12,677 | |

| | 502 | | | Syngenta AG, (Switzerland) | | | 180,300 | |

| | 1,405 | | | Uralkali OJSC, (Russia), Reg. S, GDR | | | 26,215 | |

| | 946 | | | Yara International ASA, (Norway) | | | 47,468 | |

| | | | | | | | |

| | | | Total Materials | | | 1,079,720 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $1,963,296) | | | 2,218,361 | |

| | | | | | | | |

| Exchange Traded Funds — 17.0% | |

| | | | International Equity — 17.0% | |

| | 56,051 | | | iShares Global Energy ETF | | | 2,669,709 | |

| | 140,053 | | | iShares Global Infrastructure ETF | | | 6,202,948 | |

| | 63,572 | | | iShares MSCI Global Metals & Mining Producers ETF | | | 1,294,962 | |

| | 28,296 | | | Market Vectors Gold Miners ETF | | | 755,220 | |

| | | | | | | | |

| | | | Total Exchange Traded Funds

(Cost $9,222,243) | | | 10,922,839 | |

| | | | | | | | |

| Investment Companies — 77.6% (b) | |

| | | | Alternative Assets — 20.3% | |

| | 407,455 | | | JPMorgan Commodities Strategy Fund, Class R6 Shares | | | 5,451,751 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN FUNDS | | AUGUST 31, 2014 |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| Investment Companies — continued | |

| | | | Alternative Assets — continued | |

| | 567,698 | | | JPMorgan Realty Income Fund, Class R5 Shares (m) | | | 7,595,802 | |

| | | | | | | | |

| | | | Total Alternative Assets | | | 13,047,553 | |

| | | | | | | | |

| | | | Fixed Income — 57.3% | |

| | 1,187,935 | | | JPMorgan Floating Rate Income Fund, Class R6 Shares | | | 11,938,745 | |

| | 2,062,197 | | | JPMorgan Inflation Managed Bond Fund, Class R6 Shares | | | 21,859,288 | |

| | 304,476 | | | JPMorgan Real Return Fund, Institutional Class Shares (m) | | | 3,136,098 | |

| | | | | | | | |

| | | | Total Fixed Income | | | 36,934,131 | |

| | | | | | | | |

| | | | Total Investment Companies

(Cost $47,883,928) | | | 49,981,684 | |

| | | | | | | | |

| Short-Term Investment — 2.1% | |

| | | | Investment Company — 2.1% | |

| | 1,378,004 | | | JPMorgan Prime Money Market Fund, Institutional Class Shares, 0.010% (b) (l) (m) (Cost $1,378,004) | | | 1,378,004 | |

| | | | | | | | |

| | | | Total Investments — 100.1%

(Cost $60,447,471) | | | 64,500,888 | |

| | | | Liabilities in Excess of Other Assets — (0.1)% | | | (64,800 | ) |

| | | | | | | | |

| | | | NET ASSETS — 100.0% | | $ | 64,436,088 | |

| | | | | | | | |

Percentages indicated are based on net assets.

NOTES TO SCHEDULE OF PORTFOLIO INVESTMENTS:

| | |

| ADR | | — American Depositary Receipt |

| ETF | | — Exchange Traded Fund |

| GDR | | — Global Depositary Receipt |

| MSCI | | — Morgan Stanley Capital International |

| Reg. S | | — Security was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. |

| (a) | | — Non-income producing security. |

| (b) | | — Investment in affiliate. Fund is registered under the Investment Company Act of 1940, as amended, and advised by J.P. Morgan Investment Management Inc. |

| (l) | | — The rate shown is the current yield as of August 31, 2014. |

| (m) | | — All or a portion of this security is reserved and/or pledged with the custodian for current or potential holdings of futures, swaps, options, TBAs, when-issued securities, delayed delivery securities, reverse repurchase agreements, unfunded commitments and/or forward foreign currency exchange contracts. |

The value and percentage, based on total investments, of the investments that apply the fair valuation policy for the international investments as described in Note 2.A. of the Notes to Financial Statements are $773,748 and 1.2%, respectively.

Detailed information about investment portfolios of the underlying funds can be found in shareholder reports filed with the Securities and Exchange Commission (SEC) by each such underlying fund semi-annually on Form N-CSR and in certified portfolio holdings filed quarterly on Form N-Q, and are available for download from both the SEC’s as well as each respective underlying fund’s website. Detailed information about underlying J.P. Morgan Funds can also be found at www.jpmorganfunds.com or by calling 1-800-480-4111.

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 5 | |

STATEMENT OF ASSETS AND LIABILITIES

AS OF AUGUST 31, 2014

| | | | |

| | |

Diversified Real

Return Fund | |

ASSETS: | | | | |

Investments in non-affiliates, at value | | $ | 13,141,200 | |

Investments in affiliates, at value | | | 51,359,688 | |

| | | | |

Total investment securities, at value | | | 64,500,888 | |

Cash | | | 15,238 | |

Foreign currency, at value | | | 17,883 | |

Receivables: | | | | |

Fund shares sold | | | 41,584 | |

Dividends from non-affiliates | | | 1,947 | |

Dividends from affiliates | | | 72,336 | |

Tax reclaims | | | 3,104 | |

Due from Adviser | | | 15,858 | |

| | | | |

Total Assets | | | 64,668,838 | |

| | | | |

| |

LIABILITIES: | | | | |

Payables: | | | | |

Investment securities purchased | | | 72,323 | |

Fund shares redeemed | | | 12,140 | |

Accrued liabilities: | | | | |

Shareholder servicing fees | | | 1,837 | |

Distribution fees | | | 729 | |

Custodian and accounting fees | | | 52,402 | |

Audit fees | | | 55,522 | |

Transfer agent fees | | | 14,580 | |

Other | | | 23,217 | |

| | | | |

Total Liabilities | | | 232,750 | |

| | | | |

Net Assets | | $ | 64,436,088 | |

| | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN FUNDS | | AUGUST 31, 2014 |

| | | | |

| | |

Diversified Real

Return Fund | |

NET ASSETS: | | | | |

Paid-in-Capital | | $ | 64,049,195 | |

Accumulated undistributed (distributions in excess of) net investment income | | | 110,659 | |

Accumulated net realized gains (losses) | | | (3,776,923 | ) |

Net unrealized appreciation (depreciation) | | | 4,053,157 | |

| | | | |

Total Net Assets | | $ | 64,436,088 | |

| | | | |

| |

Net Assets: | | | | |

Class A | | $ | 2,001,598 | |

Class C | | | 443,103 | |

Class R2 | | | 50,821 | |

Class R5 | | | 42,715,599 | |

Select Class | | | 19,224,967 | |

| | | | |

Total | | $ | 64,436,088 | |

| | | | |

| |

Outstanding units of beneficial interest (shares) | | | | |

($0.0001 par value; unlimited number of shares authorized): | | | | |

Class A | | | 132,688 | |

Class C | | | 29,441 | |

Class R2 | | | 3,361 | |

Class R5 | | | 2,820,378 | |

Select Class | | | 1,270,848 | |

| |

Net Asset Value (a): | | | | |

Class A — Redemption price per share | | $ | 15.08 | |

Class C — Offering price per share (b) | | | 15.05 | |

Class R2 — Offering and redemption price per share | | | 15.12 | |

Class R5 — Offering and redemption price per share | | | 15.15 | |

Select Class — Offering and redemption price per share | | | 15.13 | |

Class A maximum sales charge | | | 4.50 | % |

Class A maximum public offering price per share

[net asset value per share/(100% — maximum sales charge)] | | $ | 15.79 | |

| | | | |

| |

Cost of investments in non-affiliates | | $ | 11,185,539 | |

Cost of investments in affiliates | | | 49,261,932 | |

Cost of foreign currency | | | 18,103 | |

| (a) | Per share amounts may not recalculate due to rounding of net assets and/or shares outstanding. |

| (b) | Redemption price for Class C Shares varies based upon length of time the shares are held. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 7 | |

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED AUGUST 31, 2014

| | | | |

| | |

Diversified Real

Return Fund | |

INVESTMENT INCOME: | | | | |

Dividend income from non-affiliates | | $ | 326,600 | |

Dividend income from affiliates | | | 1,197,861 | |

Foreign taxes withheld | | | (4,256 | ) |

| | | | |

Total investment income | | | 1,520,205 | |

| | | | |

| |

EXPENSES: | | | | |

Investment advisory fees | | | 74,816 | |

Administration fees | | | 74,816 | |

Distribution fees: | | | | |

Class A | | | 7,228 | |

Class C | | | 10,588 | |

Class R2 | | | 4,549 | |

Shareholder servicing fees: | | | | |

Class A | | | 7,228 | |

Class C | | | 3,529 | |

Class R2 | | | 2,275 | |

Class R5 | | | 25,554 | |

Select Class | | | 46,245 | |

Custodian and accounting fees | | | 73,302 | |

Interest expense to affiliates | | | 25 | |

Professional fees | | | 76,801 | |

Trustees’ and Chief Compliance Officer’s fees | | | 725 | |

Printing and mailing costs | | | 23,000 | |

Registration and filing fees | | | 93,148 | |

Transfer agent fees | | | 37,350 | |

Other | | | 8,835 | |

| | | | |

Total expenses | | | 570,014 | |

| | | | |

Less amounts waived | | | (202,466 | ) |

Less expense reimbursements | | | (127,703 | ) |

| | | | |

Net expenses | | | 239,845 | |

| | | | |

Net investment income (loss) | | | 1,280,360 | |

| | | | |

| |

REALIZED/UNREALIZED GAINS (LOSSES): | | | | |

Net realized gain (loss) on transactions from: | | | | |

Investments in non-affiliates | | | 22,588 | |

Investments in affiliates | | | (1,441,283 | ) |

Foreign currency transactions | | | (51 | ) |

| | | | |

Net realized gain (loss) | | | (1,418,746 | ) |

| | | | |

Distributions of capital gains received from investment company affiliates | | | 255,927 | |

| | | | |

Change in net unrealized appreciation/depreciation of: | | | | |

Investments in non-affiliates | | | 2,659,479 | |

Investments in affiliates | | | 3,335,738 | |

Foreign currency translations | | | (165 | ) |

| | | | |

Change in net unrealized appreciation/depreciation | | | 5,995,052 | |

| | | | |

Net realized/unrealized gains (losses) | | | 4,832,233 | |

| | | | |

Change in net assets resulting from operations | | $ | 6,112,593 | |

| | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN FUNDS | | AUGUST 31, 2014 |

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED

| | | | | | | | |

| | | Diversified Real Return Fund | |

| | | Year Ended

August 31, 2014 | | | Year Ended

August 31, 2013 | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | | | | | | |

Net investment income (loss) | | $ | 1,280,360 | | | $ | 1,360,792 | |

Net realized gain (loss) | | | (1,418,746 | ) | | | (2,195,649 | ) |

Distributions of capital gains received from investment company affiliates | | | 255,927 | | | | 425,869 | |

Change in net unrealized appreciation/depreciation | | | 5,995,052 | | | | (3,156,499 | ) |

| | | | | | | | |

Change in net assets resulting from operations | | | 6,112,593 | | | | (3,565,487 | ) |

| | | | | | | | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

Class A | | | | | | | | |

From net investment income | | | (58,121 | ) | | | (44,417 | ) |

From net realized gains | | | — | | | | (1,134 | ) |

Class C | | | | | | | | |

From net investment income | | | (22,202 | ) | | | (27,584 | ) |

From net realized gains | | | — | | | | (1,080 | ) |

Class R2 | | | | | | | | |

From net investment income | | | (17,739 | ) | | | (18,987 | ) |

From net realized gains | | | — | | | | (657 | ) |

Class R5 | | | | | | | | |

From net investment income | | | (981,802 | ) | | | (1,182,252 | ) |

From net realized gains | | | — | | | | (26,784 | ) |

Select Class | | | | | | | | |

From net investment income | | | (386,832 | ) | | | (239,655 | ) |

From net realized gains | | | — | | | | (4,754 | ) |

| | | | | | | | |

Total distributions to shareholders | | | (1,466,696 | ) | | | (1,547,304 | ) |

| | | | | | | | |

| | |

CAPITAL TRANSACTIONS: | | | | | | | | |

Change in net assets resulting from capital transactions | | | (35,400,942 | ) | | | 39,559,709 | |

| | | | | | | | |

| | |

NET ASSETS: | | | | | | | | |

Change in net assets | | | (30,755,045 | ) | | | 34,446,918 | |

Beginning of period | | | 95,191,133 | | | | 60,744,215 | |

| | | | | | | | |

End of period | | $ | 64,436,088 | | | $ | 95,191,133 | |

| | | | | | | | |

Accumulated undistributed (distributions in excess of) net investment income | | $ | 110,659 | | | $ | 194,961 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 9 | |

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED (continued)

| | | | | | | | |

| | | Diversified Real Return Fund | |

| | | Year Ended

August 31, 2014 | | | Year Ended

August 31, 2013 | |

CAPITAL TRANSACTIONS: | | | | | | | | |

Class A | | | | | | | | |

Proceeds from shares issued | | $ | 640,623 | | | $ | 2,233,166 | |

Distributions reinvested | | | 58,121 | | | | 43,731 | |

Cost of shares redeemed | | | (2,215,174 | ) | | | (696,714 | ) |

| | | | | | | | |

Change in net assets resulting from Class A capital transactions | | $ | (1,516,430 | ) | | $ | 1,580,183 | |

| | | | | | | | |

Class C | | | | | | | | |

Proceeds from shares issued | | $ | 37,174 | | | $ | 384,993 | |

Distributions reinvested | | | 21,585 | | | | 27,902 | |

Cost of shares redeemed | | | (1,778,174 | ) | | | (301,849 | ) |

| | | | | | | | |

Change in net assets resulting from Class C capital transactions | | $ | (1,719,415 | ) | | $ | 111,046 | |

| | | | | | | | |

Class R2 | | | | | | | | |

Proceeds from shares issued | | $ | 5,144 | | | $ | 36,453 | |

Distributions reinvested | | | 17,261 | | | | 19,391 | |

Cost of shares redeemed | | | (1,341,312 | ) | | | (542 | ) |

| | | | | | | | |

Change in net assets resulting from Class R2 capital transactions | | $ | (1,318,907 | ) | | $ | 55,302 | |

| | | | | | | | |

Class R5 | | | | | | | | |

Proceeds from shares issued | | $ | 43,629,505 | | | $ | 43,122,266 | |

Distributions reinvested | | | 978,295 | | | | 1,207,212 | |

Cost of shares redeemed | | | (75,735,934 | ) | | | (12,413,669 | ) |

| | | | | | | | |

Change in net assets resulting from Class R5 capital transactions | | $ | (31,128,134 | ) | | $ | 31,915,809 | |

| | | | | | | | |

Select Class | | | | | | | | |

Proceeds from shares issued | | $ | 2,238,888 | | | $ | 11,590,948 | |

Distributions reinvested | | | 383,931 | | | | 243,956 | |

Cost of shares redeemed | | | (2,340,875 | ) | | | (5,937,535 | ) |

| | | | | | | | |

Change in net assets resulting from Select Class capital transactions | | $ | 281,944 | | | $ | 5,897,369 | |

| | | | | | | | |

Total change in net assets resulting from capital transactions | | $ | (35,400,942 | ) | | $ | 39,559,709 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN FUNDS | | AUGUST 31, 2014 |

| | | | | | | | |

| | | Diversified Real Return Fund | |

| | | Year Ended

August 31, 2014 | | | Year Ended

August 31, 2013 | |

SHARE TRANSACTIONS: | | | | | | | | |

Class A | | | | | | | | |

Issued | | | 43,670 | | | | 152,787 | |

Reinvested | | | 3,997 | | | | 2,987 | |

Redeemed | | | (149,658 | ) | | | (47,443 | ) |

| | | | | | | | |

Change in Class A Shares | | | (101,991 | ) | | | 108,331 | |

| | | | | | | | |

Class C | | | | | | | | |

Issued | | | 2,538 | | | | 25,678 | |

Reinvested | | | 1,503 | | | | 1,906 | |

Redeemed | | | (120,622 | ) | | | (20,679 | ) |

| | | | | | | | |

Change in Class C Shares | | | (116,581 | ) | | | 6,905 | |

| | | | | | | | |

Class R2 | | | | | | | | |

Issued | | | 354 | | | | 2,427 | |

Reinvested | | | 1,199 | | | | 1,320 | |

Redeemed | | | (90,134 | ) | | | (37 | ) |

| | | | | | | | |

Change in Class R2 Shares | | | (88,581 | ) | | | 3,710 | |

| | | | | | | | |

Class R5 | | | | | | | | |

Issued | | | 2,990,640 | | | | 2,868,288 | |

Reinvested | | | 66,779 | | | | 82,017 | |

Redeemed | | | (5,168,503 | ) | | | (832,730 | ) |

| | | | | | | | |

Change in Class R5 Shares | | | (2,111,084 | ) | | | 2,117,575 | |

| | | | | | | | |

Select Class | | | | | | | | |

Issued | | | 152,058 | | | | 775,825 | |

Reinvested | | | 26,213 | | | | 16,616 | |

Redeemed | | | (160,725 | ) | | | (393,455 | ) |

| | | | | | | | |

Change in Select Class Shares | | | 17,546 | | | | 398,986 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 11 | |

FINANCIAL HIGHLIGHTS

FOR THE PERIODS INDICATED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Per share operating performance | |

| | | | | | Investment operations | | | Distributions | |

| | | Net asset

value,

beginning

of period | | | Net

investment

income

(loss) (b) | | | Net realized

and unrealized

gains

(losses) on

investments | | | Total from

investment

operations | | | Net

investment

income | | | Net

realized

gain | | | Total

distributions | |

Diversified Real Return Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended August 31, 2014 | | $ | 14.25 | | | $ | 0.22 | (h)(l) | | $ | 0.89 | | | $ | 1.11 | | | $ | (0.28 | ) | | $ | — | | | $ | (0.28 | ) |

Year Ended August 31, 2013 | | | 15.07 | | | | 0.21 | (h) | | | (0.78 | ) | | | (0.57 | ) | | | (0.24 | ) | | | (0.01 | ) | | | (0.25 | ) |

Year Ended August 31, 2012 | | | 15.14 | | | | 0.21 | (h)(l) | | | (0.11 | ) | | | 0.10 | | | | (0.17 | ) | | | — | (i) | | | (0.17 | ) |

March 31, 2011(j) through August 31, 2011 | | | 15.00 | | | | 0.10 | (h) | | | 0.08 | | | | 0.18 | | | | (0.04 | ) | | | — | | | | (0.04 | ) |

| | | | | | | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended August 31, 2014 | | | 14.20 | | | | 0.14 | (h)(l) | | | 0.89 | | | | 1.03 | | | | (0.18 | ) | | | — | | | | (0.18 | ) |

Year Ended August 31, 2013 | | | 15.03 | | | | 0.12 | (h) | | | (0.76 | ) | | | (0.64 | ) | | | (0.18 | ) | | | (0.01 | ) | | | (0.19 | ) |

Year Ended August 31, 2012 | | | 15.13 | | | | 0.14 | (h) | | | (0.12 | ) | | | 0.02 | | | | (0.12 | ) | | | — | (i) | | | (0.12 | ) |

March 31, 2011(j) through August 31, 2011 | | | 15.00 | | | | 0.08 | (h) | | | 0.08 | | | | 0.16 | | | | (0.03 | ) | | | — | | | | (0.03 | ) |

| | | | | | | |

Class R2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended August 31, 2014 | | | 14.24 | | | | 0.18 | (h)(l) | | | 0.89 | | | | 1.07 | | | | (0.19 | ) | | | — | | | | (0.19 | ) |

Year Ended August 31, 2013 | | | 15.06 | | | | 0.16 | (h) | | | (0.76 | ) | | | (0.60 | ) | | | (0.21 | ) | | | (0.01 | ) | | | (0.22 | ) |

Year Ended August 31, 2012 | | | 15.14 | | | | 0.18 | (h) | | | (0.12 | ) | | | 0.06 | | | | (0.14 | ) | | | — | (i) | | | (0.14 | ) |

March 31, 2011(j) through August 31, 2011 | | | 15.00 | | | | 0.09 | (h) | | | 0.08 | | | | 0.17 | | | | (0.03 | ) | | | — | | | | (0.03 | ) |

| | | | | | | |

Class R5 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended August 31, 2014 | | | 14.31 | | | | 0.26 | (h)(l) | | | 0.91 | | | | 1.17 | | | | (0.33 | ) | | | — | | | | (0.33 | ) |

Year Ended August 31, 2013 | | | 15.11 | | | | 0.26 | (h) | | | (0.78 | ) | | | (0.52 | ) | | | (0.27 | ) | | | (0.01 | ) | | | (0.28 | ) |

Year Ended August 31, 2012 | | | 15.16 | | | | 0.19 | (h) | | | (0.03 | ) | | | 0.16 | | | | (0.21 | ) | | | — | (i) | | | (0.21 | ) |

March 31, 2011(j) through August 31, 2011 | | | 15.00 | | | | 0.12 | (h) | | | 0.09 | | | | 0.21 | | | | (0.05 | ) | | | — | | | | (0.05 | ) |

| | | | | | | |

Select Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Year Ended August 31, 2014 | | | 14.29 | | | | 0.26 | (h)(l) | | | 0.89 | | | | 1.15 | | | | (0.31 | ) | | | — | | | | (0.31 | ) |

Year Ended August 31, 2013 | | | 15.10 | | | | 0.24 | (h) | | | (0.78 | ) | | | (0.54 | ) | | | (0.26 | ) | | | (0.01 | ) | | | (0.27 | ) |

Year Ended August 31, 2012 | | | 15.16 | | | | 0.28 | (h)(l) | | | (0.14 | ) | | | 0.14 | | | | (0.20 | ) | | | — | (i) | | | (0.20 | ) |

March 31, 2011(j) through August 31, 2011 | | | 15.00 | | | | 0.12 | (h)(l) | | | 0.08 | | | | 0.20 | | | | (0.04 | ) | | | — | | | | (0.04 | ) |

| (a) | Annualized for periods less than one year, unless otherwise noted. |

| (b) | Net investment income (loss) is affected by timing of distributions from Underlying Funds. |

| (c) | Not annualized for periods less than one year. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (e) | Includes earnings credits and interest expense, if applicable, each of which is less than 0.01% unless otherwise noted. |

| (f) | Does not include expenses of Underlying Funds. |

| (g) | Portfolio turnover is calculated by dividing the lesser of total purchases or sales of portfolio securities for the reporting period by the monthly average value of portfolio securities owned during the reporting period. Excluded from both the numerator and denominator are amounts relating to derivatives and securities whose maturities or expiration dates at the time of acquisition were one year or less. |

| (h) | Calculated based upon average shares outstanding. |

| (i) | Amount rounds to less than $0.01. |

| (j) | Commencement of operations. |

| (k) | Certain non-recurring expenses incurred by the Fund were not annualized for the period ended August 31, 2011. |

| (l) | Net investment income (loss) may appear disproportionate among classes due to the timing of recognition of income and changes in the relative size of the classes. |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN FUNDS | | AUGUST 31, 2014 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Ratios/Supplemental data | |

| | | | | | | | | | Ratios to average net assets (a) | | | | |

Net asset

value,

end of

period | | | Total return

(excludes

sales charge) (c)(d) | | | Net assets,

end of

period | | | Net

expenses (e)(f) | | | Net

investment

income

(loss) (b)(e) | | | Expenses

without waivers,

reimbursements and

earnings credits (f) | | | Portfolio

turnover

rate (c)(g) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ | 15.08 | | | | 7.88 | % | | $ | 2,001,598 | | | | 0.61 | % | | | 1.51 | %(l) | | | 1.13 | % | | | 59 | % |

| | 14.25 | | | | (3.81 | ) | | | 3,345,116 | | | | 0.61 | | | | 1.39 | | | | 0.99 | | | | 39 | |

| | 15.07 | | | | 0.70 | | | | 1,904,463 | | | | 0.61 | | | | 1.43 | | | | 1.29 | | | | 42 | |

| | 15.14 | | | | 1.21 | | | | 189,874 | | | | 0.61 | (k) | | | 1.64 | (k)(l) | | | 31.73 | (k) | | | 13 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 15.05 | | | | 7.34 | | | | 443,103 | | | | 1.11 | | | | 0.98 | (l) | | | 1.60 | | | | 59 | |

| | 14.20 | | | | (4.29 | ) | | | 2,073,901 | | | | 1.11 | | | | 0.82 | | | | 1.49 | | | | 39 | |

| | 15.03 | | | | 0.16 | | | | 2,091,357 | | | | 1.11 | | | | 0.96 | | | | 1.88 | | | | 42 | |

| | 15.13 | | | | 1.06 | | | | 338,775 | | | | 1.11 | (k) | | | 1.28 | (k)(l) | | | 30.38 | (k) | | | 13 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 15.12 | | | | 7.60 | | | | 50,821 | | | | 0.86 | | | | 1.25 | (l) | | | 1.34 | | | | 59 | |

| | 14.24 | | | | (4.03 | ) | | | 1,309,391 | | | | 0.86 | | | | 1.06 | | | | 1.24 | | | | 39 | |

| | 15.06 | | | | 0.45 | | | | 1,329,140 | | | | 0.86 | | | | 1.23 | | | | 1.47 | | | | 42 | |

| | 15.14 | | | | 1.12 | | | | 50,563 | | | | 0.86 | (k) | | | 1.37 | (k)(l) | | | 33.56 | (k) | | | 13 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 15.15 | | | | 8.24 | | | | 42,715,599 | | | | 0.26 | | | | 1.74 | (l) | | | 0.66 | | | | 59 | |

| | 14.31 | | | | (3.44 | ) | | | 70,551,417 | | | | 0.26 | | | | 1.73 | | | | 0.54 | | | | 39 | |

| | 15.11 | | | | 1.08 | | | | 42,521,881 | | | | 0.26 | | | | 1.26 | | | | 0.64 | | | | 42 | |

| | 15.16 | | | | 1.39 | | | | 60,354 | | | | 0.26 | (k) | | | 1.93 | (k)(l) | | | 32.71 | (k) | | | 13 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 15.13 | | | | 8.16 | | | | 19,224,967 | | | | 0.36 | | | | 1.75 | (l) | | | 0.90 | | | | 59 | |

| | 14.29 | | | | (3.58 | ) | | | 17,911,308 | | | | 0.36 | | | | 1.59 | | | | 0.74 | | | | 39 | |

| | 15.10 | | | | 0.95 | | | | 12,897,374 | | | | 0.36 | | | | 1.86 | | | | 1.00 | | | | 42 | |

| | 15.16 | | | | 1.37 | | | | 1,097,846 | | | | 0.36 | (k) | | | 1.82 | (k)(l) | | | 32.78 | (k) | | | 13 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 13 | |

NOTES TO FINANCIAL STATEMENTS

AS OF AUGUST 31, 2014

1. Organization

JPMorgan Trust I (the “Trust”) was formed on November 12, 2004, as a Delaware statutory trust, pursuant to a Declaration of Trust dated November 5, 2004 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The following is a separate fund of the Trust (the “Fund”) covered by this report:

| | | | | | |

| | | Classes Offered | | Diversified/Non-Diversified | |

| | |

Diversified Real Return Fund | | Class A, Class C, Class R2, Class R5 and Select Class | | | Diversified | |

The investment objective of the Fund is to seek to maximize long-term real return.

Class A Shares generally provide for a front-end sales charge while Class C Shares provide for a contingent deferred sales charge (“CDSC”). No sales charges are assessed with respect to Class R2, Class R5 and Select Class Shares. All classes of shares have equal rights as to earnings, assets and voting privileges, except that each class may bear different distribution and shareholder servicing fees and each class has exclusive voting rights with respect to its distribution plan and shareholder servicing agreements. Certain Class A Shares, for which front-end sales charges have been waived, may be subject to a CDSC as described in the Fund’s prospectus.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 — Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A. Valuation of Investments — Investments in open-end investment companies, including J.P. Morgan Funds (the “Underlying Funds”), are valued at each investment company’s net asset value per share (“NAV”) as of the report date. Equity securities, including investments in Exchange Traded Funds (“ETFs”), listed on a North American, Central American, South American or Caribbean securities exchange shall generally be valued at the last sale price on the exchange on which the security is principally traded that is reported before the time when the net assets of the Fund are valued. Securities listed on the NASDAQ Stock Market LLC are generally valued at the NASDAQ Official Closing Price. Generally, short-term investments of sufficient credit quality maturing in less than 61 days are valued at amortized cost, which approximates fair value.

Certain investments of the Fund may, depending upon market conditions, trade in relatively thin markets and/or in markets that experience significant volatility. As a result of these conditions, the prices used by the Fund to value these securities may differ from the value that would be realized if these securities were sold, and the differences could be material. If valuations are not available from such pricing services or values received are deemed not representative of fair value, values will be obtained from a third party broker-dealer or counterparty.

Securities or other assets for which market quotations are not readily available or for which market quotations are deemed to not represent the fair value of the security or asset at the time of pricing (including certain illiquid securities) are fair valued in accordance with procedures established by and under the supervision and responsibility of the Board of Trustees. The Board of Trustees has established an Audit and Valuation Committee to assist with the oversight of the valuation of the Fund’s securities. JPMorgan Funds Management, Inc. (the “Administrator” or “JPMFM”) has established a Valuation Committee (“VC”) that is comprised of senior representatives from JPMFM, J.P. Morgan Investment Management Inc. (the “Adviser” or “JPMIM”), and J.P. Morgan Asset Management’s Legal, Compliance and Risk Management groups and the Fund’s Chief Compliance Officer. The VC’s responsibilities include making determinations regarding Level 3 fair value measurements (“Fair Values”) and/or providing recommendations for approval to the Board of Trustees’ Audit and Valuation Committee, in accordance with the Fund’s valuation policies.

The VC or Board of Trustees, as applicable, primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. The VC or Board of Trustees may also use an income-based valuation approach in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Valuations may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry. Trading in securities on most foreign exchanges and over-the-counter markets is normally completed before the close of the domestic market and may also take place on days when the domestic market is closed. In accordance with procedures adopted by the Board of Trustees, the Fund applies fair value pricing on equity securities on a daily basis, except for North American, Central American, South American and Caribbean equity securities held in its portfolio, by utilizing the quotations of an independent pricing service, unless the Adviser determines that use of another valuation methodology is appropriate. The pricing service uses statistical analyses and quantitative models to adjust local market prices using factors such as subsequent movement and changes in the prices of indices, securities and exchange rates in other markets, in determining fair value as of the time the Fund calculates its net asset values.

It is possible that the estimated values may differ significantly from the values that would have been used had a ready market for the investments existed, and such differences could be material. JPMFM and JPMIM are responsible for monitoring developments that may impact Fair Values and for discussing and assessing Fair Values on an ongoing, and at least a quarterly basis with the VC and Board of Trustees, as applicable. The appropriateness of Fair Values is assessed based on results of unchanged price review and consideration of macro or security specific events, back testing, and broker and vendor due diligence.

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN FUNDS | | AUGUST 31, 2014 |

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the fair value of the Fund’s investments are summarized into the three broad levels listed below.

| Ÿ | | Level 1 — quoted prices in active markets for identical securities |

| Ÿ | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| Ÿ | | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table represents each valuation input by sector as presented on the Schedule of Portfolio Investments (“SOI”):

| | | | | | | | | | | | | | | | |

| | | Level 1

Quoted prices | | | Level 2

Other significant

observable inputs | | | Level 3

Significant

unobservable inputs | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Consumer Staples | | $ | 496,783 | | | $ | 342,755 | | | $ | — | | | $ | 839,538 | |

Industrials | | | 207,808 | | | | 91,295 | | | | — | | | | 299,103 | |

Materials | | | 805,615 | | | | 274,105 | | | | — | | | | 1,079,720 | |

| | | | | | | | | | | | | | | | |

Total Common Stocks | | | 1,510,206 | | | | 708,155 | | | | — | | | | 2,218,361 | |

| | | | | | | | | | | | | | | | |

Exchange Traded Funds | | | 10,922,839 | | | | — | | | | — | | | | 10,922,839 | |

Investment Companies | | | 49,981,684 | | | | — | | | | — | | | | 49,981,684 | |

Short-Term Investment | | | | | | | | | | | | | | | | |

Investment Company | | | 1,378,004 | | | | — | | | | — | | | | 1,378,004 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 63,792,733 | | | $ | 708,155 | | | $ | — | | | $ | 64,500,888 | |

| | | | | | | | | | | | | | | | |

There were no transfers among any levels during the year ended August 31, 2014.

B. Investment Transactions with Affiliates — The Fund invests in certain Underlying Funds which are advised by the Adviser or its affiliates pursuant to Section 12(d)(1)(G) of the 1940 Act. An issuer which is under common control with the Fund may be considered an affiliate. For the purposes of the financial statements, the Fund assumes the following to be affiliated issuers. Included in the purchases and sales amounts in the table below are exchanges between certain share classes of the affiliated Underlying Funds. Such exchanges are not treated as purchases and sales for the purpose of recognizing realized gains (losses) or portfolio turnover. Included in the realized gain (loss) amounts in the table below are distributions of realized capital gains, if any, received from the affiliated Underlying Funds:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the year ended August 31,2014 | |

| Affiliate | | Value at

August 31,

2013 | | | Purchase

Cost | | | Sales

Proceeds | | | Realized

Gain (Loss) | | | Dividend

Income | | | Shares at

August 31,

2014 | | | Value at

August 31,

2014 | |

JPMorgan Commodities Strategy Fund, Class R6 Shares | | $ | 7,707,558 | | | $ | 3,620,522 | | | $ | 5,502,000 | | | $ | (498,530 | ) | | $ | 523 | | | | 407,455 | | | $ | 5,451,751 | |

JPMorgan Floating Rate Income Fund, R6 Class Shares | | | — | | | | 18,057,702 | | | | 6,168,000 | | | | 7,467 | | | | 264,475 | | | | 1,187,935 | | | | 11,938,745 | |

JPMorgan Floating Rate Income Fund, Select Class Shares | | | 20,095,750 | | | | 8,769,142 | | | | 28,916,566 | | | | 53,429 | | | | 397,748 | | | | — | | | | — | |

JPMorgan Inflation Managed Bond Fund, Class R6 Shares | | | 27,450,391 | | | | 15,609,714 | | | | 21,745,000 | | | | (332,392 | ) | | | 353,059 | | | | 2,062,197 | | | | 21,859,288 | |

JPMorgan Prime Money Market Fund, Institutional Class Shares | | | 396,897 | | | | 43,219,771 | | | | 42,238,664 | | | | 13 | | | | 208 | | | | 1,378,004 | | | | 1,378,004 | |

JPMorgan Real Return Fund, Institutional Class Shares | | | 11,608,970 | | | | 1,047,234 | | | | 9,725,000 | | | | (647,333 | ) | | | 27,120 | | | | 304,476 | | | | 3,136,098 | |

JPMorgan Realty Income Fund, Class R5 Shares | | | 11,030,995 | | | | 4,845,816 | | | | 9,700,000 | | | | 231,990 | | | | 154,728 | | | | 567,698 | | | | 7,595,802 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 78,290,561 | | | | | | | | | | | $ | (1,185,356 | ) | | $ | 1,197,861 | | | | | | | $ | 51,359,688 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

C. Foreign Currency Translation — The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the prevailing exchange rates of such currencies against the U.S. dollar. The market value of investment securities and other assets and liabilities are translated at the exchange rate as of the valuation date. Purchases and sales of investment securities, income and expenses are translated at the exchange rate prevailing on the respective dates of such transactions.

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 15 | |

NOTES TO FINANCIAL STATEMENTS

AS OF AUGUST 31, 2014 (continued)

Although the net assets of the Fund are presented at the foreign exchange rates and market values at the close of the period, the Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the fluctuations arising from changes in the market prices of securities held. Accordingly, such foreign currency gains (losses) are included in the reported Change in net unrealized appreciation/depreciation on investment transactions on the Statement of Operations. The Fund does isolate the effect of changes in foreign exchange rates from fluctuations in market prices of securities when determining realized gain or loss for sales of fixed income securities.

Reported realized foreign currency gains and losses arise from the disposition of foreign currency, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books on the transaction date and the U.S. dollar equivalent of the amounts actually received or paid. These reported realized foreign currency gains and losses are included in Net realized gain (loss) on foreign currency transactions on the Statement of Operations. Unrealized foreign currency gains and losses arise from changes (due to changes in exchange rates) in the value of foreign currency and other assets and liabilities denominated in foreign currencies, which are held at year end and are included in Change in net unrealized appreciation/ depreciation on foreign currency translations on the Statement of Operations.

D. Security Transactions and Investment Income — Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Securities gains and losses are calculated on a specifically identified cost basis. Dividend income net of foreign taxes withheld, if any, and distributions of net investment income and realized capital gains from the Underlying Funds and ETFs, if any, are recorded on the ex-dividend date or when the Fund first learns of the dividend.

E. Allocation of Income and Expenses — Expenses directly attributable to a fund are charged directly to that fund, while the expenses attributable to more than one fund of the Trust are allocated among the respective funds. In calculating the NAV of each class, investment income, realized and unrealized gains and losses and expenses, other than class specific expenses, are allocated daily to each class of shares based upon the proportion of net assets of each class at the beginning of each day.

The Fund invests in Underlying Funds and ETFs and, as a result, bears a portion of the expenses incurred by these Underlying Funds and ETFs. These expenses are not reflected in the expenses shown in the Statement of Operations and are not included in the ratios to average net assets shown in the Financial Highlights. Certain expenses of affiliated Underlying Funds are waived by the Fund as described in Note 3.F.

F. Federal Income Taxes — The Fund is treated as a separate taxable entity for Federal income tax purposes. The Fund’s policy is to comply with the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized capital gains on investments. Accordingly, no provision for Federal income tax is necessary. Management has reviewed the Fund’s tax positions for all open tax years and has determined that as of August 31, 2014, no liability for income tax is required in the Fund’s financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Fund’s Federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

G. Foreign Taxes — The Fund may be subject to foreign taxes on income, gains on investments or currency purchases/repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

H. Distributions to Shareholders — Distributions from net investment income are generally declared and paid quarterly and are declared separately for each class. No class has preferential dividend rights; differences in per share rates are due to differences in separate class expenses. Net realized capital gains, if any, are distributed at least annually. The amount of distributions from net investment income and net realized capital gains is determined in accordance with Federal income tax regulations, which may differ from GAAP. To the extent these “book/tax” differences are permanent in nature (i.e., that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax-basis treatment.

The following amounts were reclassified within the capital accounts:

| | | | | | | | | | | | |

| | | Paid-in-Capital | | | Accumulated

undistributed

(distributions in excess of)

net investment

income | | | Accumulated

net realized

gains

(losses) | |

| | $ | — | | | $ | 102,034 | | | $ | (102,034 | ) |

The reclassifications for the Fund relate primarily to investments in regulated investment companies.

3. Fees and Other Transactions with Affiliates

A. Investment Advisory Fee — Pursuant to the Investment Advisory Agreement, the Adviser, an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan”), supervises the investments of the Fund and for such services is paid a fee. The fee is accrued daily and paid monthly at an annual rate of 0.10% of the Fund’s average daily net assets.

The Adviser waived Investment Advisory fees and/or reimbursed expenses as outlined in Note 3.F.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN FUNDS | | AUGUST 31, 2014 |

B. Administration Fee — Pursuant to an Administration Agreement, the Administrator, an indirect, wholly-owned subsidiary of JPMorgan, provides certain administration services to the Fund. In consideration of these services, the Administrator receives a fee accrued daily and paid monthly at an annual rate of 0.10% of the Fund’s average daily net assets on the first $500 million in Fund assets; 0.075% of the Fund’s average daily net assets between $500 million and $1 billion and 0.05% of the Fund’s average daily net assets in excess of $1 billion. For the year ended August 31, 2014 the effective rate was 0.10% of the Fund’s average daily net assets, notwithstanding any fee waivers and reimbursements.

The Administrator waived Administration fees as outlined in Note 3.F.

JPMorgan Chase Bank, N.A. (“JPMCB”), a wholly-owned subsidiary of JPMorgan, serves as the Fund’s sub-administrator (the “Sub-administrator”). For its services as Sub-administrator, JPMCB receives a portion of the fees payable to the Administrator.

C. Distribution Fees — Pursuant to a Distribution Agreement, JPMorgan Distribution Services, Inc. (the “Distributor”), a wholly-owned subsidiary of JPMorgan, serves as the Trust’s exclusive underwriter and promotes and arranges for the sale of the Fund’s shares.

The Board of Trustees has adopted a Distribution Plan (the “Distribution Plan”) for Class A, Class C and Class R2 Shares of the Fund in accordance with Rule 12b-1 under the 1940 Act. The Distribution Plan provides that the Fund shall pay distribution fees, including payments to the Distributor, at annual rates of 0.25%, 0.75% and 0.50% of the average daily net assets of Class A, Class C and Class R2 Shares, respectively.

In addition, the Distributor is entitled to receive the front-end sales charges from purchases of Class A Shares and the CDSC from redemptions of Class C Shares and certain Class A Shares for which front-end sales charges have been waived. For the year ended August 31, 2014, the Distributor retained the following amounts:

| | | | | | |

| | | Front-End Sales Charge | | CDSC | |

| | $491 | | $ | — | |

D. Shareholder Servicing Fees — The Trust, on behalf of the Fund, has entered into a Shareholder Servicing Agreement with the Distributor under which the Distributor provides certain support services to the shareholders. For performing these services, the Distributor receives a fee that is accrued daily and paid monthly equal to a percentage of the average daily net assets as shown in the table below:

| | | | | | | | | | | | | | | | | | |

| | | Class A | | Class C | | | Class R2 | | | Class R5 | | | Select Class | |

| | 0.25% | | | 0.25 | % | | | 0.25 | % | | | 0.05 | % | | | 0.25 | % |

The Distributor has entered into shareholder services contracts with affiliated and unaffiliated financial intermediaries who provide shareholder services and other related services to their clients or customers who invest in the Fund under which the Distributor will pay all or a portion of such fees earned to financial intermediaries for performing such services.

The Distributor waived Shareholder Servicing fees as outlined in Note 3.F.

E. Custodian and Accounting Fees — JPMCB provides portfolio custody and accounting services to the Fund. For these services, the Fund pays JPMCB transaction and asset-based fees that vary according to the number of transactions and positions, plus out-of-pocket expenses. The amounts paid directly to JPMCB by the Fund for custody and accounting services are included in Custodian and accounting fees in the Statement of Operations. Payments to the custodian may be reduced by credits earned by the Fund, based on uninvested cash balances held by the custodian. Such earnings credits, if any, are presented separately in the Statement of Operations.

Interest income earned on cash balances at the custodian, if any, is included in Interest income from affiliates in the Statement of Operations

Interest expense paid to the custodian related to cash overdrafts, if any, is included in Interest expense to affiliates in the Statement of Operations.

F. Waivers and Reimbursements — The Adviser, Administrator and Distributor have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees “Underlying Funds and ETFs”, dividend expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, extraordinary expenses and expenses related to the Board of Trustees’ deferred compensation plan) exceed the percentages of the Fund’s average daily net assets as shown in the table below:

| | | | | | | | | | | | | | | | | | | | |

| | | Class A | | | Class C | | | Class R2 | | | Class R5 | | | Select Class | |

| | | 0.61 | % | | | 1.11 | % | | | 0.86 | % | | | 0.26 | % | | | 0.36 | % |

The expense limitation agreement was in effect for the year ended August 31, 2014. The contractual expense limitation percentages in the table above are in place until at least December 31, 2014.

For the year ended August 31, 2014, the Fund’s service providers waived fees and/or reimbursed expenses for the Fund as follows. None of these parties expect the Fund to repay any such waived fees and/or reimbursed expenses in future years.

| | | | | | | | | | | | | | | | | | | | |

| | | Contractual Waivers | | | | |

| | | Investment

Advisory | | | Administration | | | Shareholder

Servicing | | | Total | | | Contractual

Reimbursements | |

| | $ | 65,729 | | | $ | 74,816 | | | $ | 61,121 | | | $ | 201,666 | | | $ | 127,703 | |

| | | | | | | | |

| | | |

| AUGUST 31, 2014 | | J.P. MORGAN FUNDS | | | | | 17 | |

NOTES TO FINANCIAL STATEMENTS

AS OF AUGUST 31, 2014 (continued)

Additionally, the Fund may invest in one or more money market funds advised by the Adviser or its affiliates. The Adviser, Administrator and Distributor, as shareholder servicing agent, waive fees in an amount sufficient to offset the respective fees each charges to the affiliated money market fund on the Fund’s investment in such affiliated money market fund. A portion of the waiver and/or reimbursement is voluntary.

The amount of waivers resulting from investments in these money market funds for the year ended August 31, 2014 was $800.

The Underlying Funds may impose separate shareholder servicing fees. To avoid charging a shareholder servicing fee at an effective rate above 0.25% for Class A, Class C, Class R2 and Select Class Shares and above 0.05% for Class R5 Shares, the Fund’s Distributor may waive shareholder servicing fees with respect to the Fund in an amount equal to the weighted average pro-rata amount of shareholder servicing fees charged by the affiliated Underlying Funds. This waiver may be in addition to any waivers required to meet the Fund’s contractual expense limitations, but will not exceed the Fund’s shareholder serving fees.

G. Other — Certain officers of the Trust are affiliated with the Adviser, the Administrator and the Distributor. Such officers, with the exception of the Chief Compliance Officer, receive no compensation from the Fund for serving in their respective roles.

The Board of Trustees appointed a Chief Compliance Officer to the Fund in accordance with Federal securities regulations. The Fund, along with other affiliated funds, makes reimbursement payments, on a pro-rata basis, to the Administrator for a portion of the fees associated with the Office of the Chief Compliance Officer. Such fees are included in Trustees’ and Chief Compliance Officer’s fees in the Statement of Operations.

The Trust adopted a Trustee Deferred Compensation Plan (the “Plan”) which allows the Independent Trustees to defer the receipt of all or a portion of compensation related to performance of their duties as Trustees. The deferred fees are invested in various J.P. Morgan Funds until distribution in accordance with the Plan.