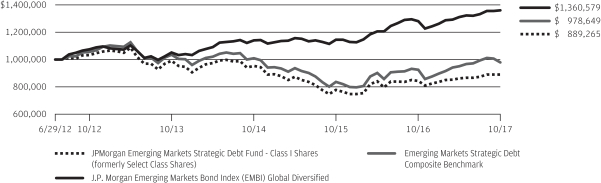

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21295

JPMorgan Trust I

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Frank J. Nasta

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: October 31

Date of reporting period: November 1, 2016 through October 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Annual Report

J.P. Morgan Specialty Funds

October 31, 2017

JPMorgan Opportunistic Equity Long/Short Fund

JPMorgan Research Market Neutral Fund

CONTENTS

Investments in a Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when a Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Funds’ prospectus for a discussion of the Funds’ investment objective, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

CEO’S LETTER

December 8, 2017 (Unaudited)

Dear Shareholder,

Global economic growth accelerated through the twelve months ended October 31, 2017, generally driving both asset prices and corporate profits to higher ground. Overall, financial markets provided positive returns and investor sentiment appeared to be largely immune to both intermittent and ongoing geo-political tensions.

| | |

| | “Globally, improvement in business and consumer confidence underpinned increases in business investment, trade and industrial output during the reporting period.” — George C.W. Gatch |

Economic data in the U.S., the European Union (EU) and the U.K. were sufficiently strong enough that each of their respective central banks began to move away from monetary stimulus and toward more normalized monetary policies. During the reporting period, the U.S. Federal Reserve raised interest rates three times and began to unwind its balance sheet of assets purchased under its Quantitative Easing program. In October 2017, the European Central Bank announced it would cut its own asset purchasing program by half to 30 billion euros a month, starting in January 2018. Subsequent to the end of the reporting period, the Bank of England raised its benchmark interest rate for the first time in a decade.

Meanwhile, global demand for goods and services, combined with historically low interest rates and stable oil prices drove robust growth in corporate earnings, particularly in the U.S., Europe and Asia.

In the U.S., third quarter 2017 gross domestic product (GDP) rose by 3.3%, the largest increase in two years. Meanwhile, the U.S. unemployment rate fell to 4.1% from 4.8% during the twelve month reporting period. Corporate earnings surged higher in the second half of the reporting period and business investment in new equipment and facilities grew amid a weakening U.S. dollar and synchronized global economic growth. U.S. consumer confidence stood at its highest level in nearly 17 years at the end of October 2017.

While powerful hurricanes struck Texas, Florida and then Puerto Rico late in the reporting period, economic data showed little lasting impact on the broader U.S. economy. Similarly, while geo-political events led to brief spikes in financial market volatility — in early November 2016 at the election victory of President Donald Trump and in late August 2017 amid rising military tensions between the U.S. and North Korea — there appeared to be little long-term effect on asset prices. Throughout the reporting period, leading equity market indexes reached fresh highs and

for the twelve months ended October 31, 2017, the Standard & Poor’s 500 Index returned 23.6%.

In the EU, business and consumer sentiment in October 2017 reached their highest levels since early 2001. Corporate profits rose on improving global demand and unemployment across the EU fell to 8.8% in October 2017, its lowest level since early 2009. GDP rose to 2.6% in the third quarter of 2017 from 1.9% in the fourth quarter of 2016. Despite a range of political uncertainties across Europe — including the U.K.’s planned exit from EU, a Catalan separatist movement in Spain and a challenge to EU legal and immigration policies from populist political parties in Poland, Hungary and Austria — for the twelve month reporting period, the MSCI Europe, Australasia and Far East Index (net of foreign withholding taxes) returned 24.0%.

The economies of most emerging market nations continued to expand with the rest of the global economy and emerging market equities generally outperformed equities in the U.S. and other developed markets. Global economic growth led to accelerated export growth in China during the reporting period, which allowed policymakers to reduce their reliance on debt financing and fixed asset investment. China’s GDP growth remained at 6.9% for the first half of 2017 and slowed to 6.8% in the third quarter of 2017 amid government efforts to curb financial speculation in the domestic real estate market and reduce corporate borrowing. For the twelve month reporting period, the MSCI Emerging Markets Index (net of foreign withholding taxes) returned 26.9%.

Globally, improvement in business and consumer confidence underpinned increases in business investment, trade and industrial output during the reporting period. By October 2017, the International Monetary Fund lifted its forecast for global economic growth by 0.1% to 3.6% for the full year 2017 and 3.7% for 2018. Amid the global economic expansion, there remain challenges as investors adapt to changes in central bank policies and face geo-political events. Against this backdrop, we believe the best-positioned investors are those who remain fully invested, properly diversified and patient.

We look forward to managing your investment needs for years to come. Should you have any questions, please visit www.jpmorganfunds.com or contact the J.P. Morgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

CEO, Global Funds Management

J.P. Morgan Asset Management

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 1 | |

J.P. Morgan Specialty Funds

MARKET OVERVIEW

TWELVE MONTHS ENDED OCTOBER 31, 2017 (Unaudited)

U.S. financial markets overall provided positive returns during the reporting period. The world’s leading economies continued to expand throughout the first ten months of 2017, lifting corporate profits and capital investment as well as business and consumer sentiment. Low interest rates generally weighed on bond prices, while investors’ search for higher yields helped push prices higher for emerging market bonds.

Synchronized global growth and industrial demand helped to lift commodities prices, particularly for copper and other metals, toward the end of the reporting period. While global oil prices declined in the early part of the reporting period, prices for benchmark Brent crude oil remained above $50 dollars a barrel through October 2017.

In the U.S., equities prices reached record highs throughout the twelve month reporting period and the Standard & Poor’s 500 Index hit fresh highs in 11 of the 22 trading days in October 2017.

For the twelve months ended October 31, 2017, the S&P 500 returned 23.63%, while the BofA Merrill Lynch 3-Month U.S. Treasury Index returned 0.72%.

| | | | | | |

| | | |

| 2 | | | | J.P. MORGAN SPECIALTY FUNDS | | OCTOBER 31, 2017 |

JPMorgan Opportunistic Equity Long/Short Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2017 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class I Shares)1* | | | 13.92% | |

| Standard & Poor’s 500 Index | | | 23.63% | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.72% | |

| |

| Net Assets as of 10/31/2017 (In Thousands) | | $ | 161,421 | |

INVESTMENT OBJECTIVE**

The JPMorgan Opportunistic Equity Long/Short Fund (the “Fund”) seeks capital appreciation.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund’s Class I Shares underperformed the Standard & Poor’s 500 Index (the “Benchmark”) for the twelve months ended October 31, 2017. The Fund’s short positions in the consumer discretionary and consumer staples sectors were leading detractors from performance relative to the Benchmark, while the Fund’s long positions in the utilities and telecommunications services sectors were leading contributors to relative performance.

Leading individual detractors from relative performance included the Fund’s long position in Newell Brands Inc. and its short positions in Nike Inc. and Host Hotels & Resorts Inc. Shares of Newell Brands, a household products company, fell after the company lowered its profit forecast. Shares of Nike, a maker of athletic footwear and apparel, rose after the company reported better-than-expected earnings and sales for its fiscal first quarter. Shares of Host Hotels & Resorts, a lodging sector real estate investment trust, rose amid strength in earnings and less-than-expected business disruption from Hurricanes Harvey and Irma.

Leading individual contributors to relative performance included the Fund’s long positions in Alphabet Inc., American Express Co. and Royal Caribbean Cruises Ltd. Shares of

Alphabet, parent company of Google, rose amid continued growth in the company’s earnings and revenue.

Shares of American Express, a credit card company, rose after the company reported better-than-expected third-quarter 2017 earnings and raised its earnings forecast. Shares of Royal Caribbean Cruises, a cruise ship operator, rose after the company reported better-than-expected earnings and sales and raised its quarterly dividend.

HOW WAS THE FUND POSITIONED?

During the twelve months ended October 31, 2017, the Fund invested an average of 111% of its assets under management in long and short positions in equity securities, selecting from a universe of equity securities with market capitalizations similar to those included in the Russell 1000 Index and/or S&P 500 Index. The Fund’s manager sought to achieve lower volatility than the Benchmark through a disciplined research process, security selection and risk management. For the twelve month reporting period, the Fund’s average gross exposure was 111% and its average net exposure was 54%.

| 1 | | Effective April 3, 2017, Select Class Shares were renamed Class I. |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 3 | |

JPMorgan Opportunistic Equity Long/Short Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2017 (Unaudited) (continued)

| | | | | | | | |

| TOP TEN LONG POSITIONS OF THE PORTFOLIO*** | |

| | 1. | | | Alphabet, Inc., Class A | | | 7.9 | % |

| | 2. | | | Coca-Cola Co. (The) | | | 5.8 | |

| | 3. | | | Intel Corp. | | | 5.7 | |

| | 4. | | | Eaton Corp. plc | | | 5.4 | |

| | 5. | | | Berkshire Hathaway, Inc., Class A | | | 5.4 | |

| | 6. | | | American Express Co. | | | 5.3 | |

| | 7. | | | UnitedHealth Group, Inc. | | | 5.1 | |

| | 8. | | | Wal-Mart Stores, Inc. | | | 4.9 | |

| | 9. | | | Brookfield Asset Management, Inc., Class A, (Canada) | | | 3.7 | |

| | 10. | | | Cummins, Inc. | | | 3.6 | |

| | | | | | | | |

| TOP TEN SHORT POSITIONS OF THE PORTFOLIO**** | |

| | 1. | | | Kimberly-Clark Corp., | | | 16.2 | % |

| | 2. | | | Harley-Davidson, Inc., | | | 7.8 | |

| | 3. | | | Starbucks Corp., | | | 6.5 | |

| | 4. | | | United Natural Foods, Inc., | | | 6.5 | |

| | 5. | | | TJX Cos., Inc. (The), | | | 5.7 | |

| | 6. | | | Church & Dwight Co., Inc., | | | 5.5 | |

| | 7. | | | Mondelez International, Inc., Class A, | | | 4.3 | |

| | 8. | | | Express Scripts Holding Co., | | | 4.2 | |

| | 9. | | | Johnson Controls International plc, | | | 4.2 | |

| | 10. | | | Costco Wholesale Corp., | | | 4.0 | |

| | | | |

LONG POSITION PORTFOLIO COMPOSITION BY SECTOR*** | |

Information Technology | | | 22.8 | % |

Consumer Staples | | | 17.8 | |

Industrials | | | 16.0 | |

Financials | | | 14.4 | |

Health Care | | | 7.7 | |

Consumer Discretionary | | | 7.7 | |

Materials | | | 3.9 | |

Utilities | | | 3.2 | |

Others (each less than 1.0%) | | | 0.2 | |

Short-Term Investment | | | 6.3 | |

| | | | |

SHORT POSITION PORTFOLIO COMPOSITION BY SECTOR**** | |

Consumer Staples | | | 43.0 | % |

Consumer Discretionary | | | 32.5 | |

Health Care | | | 11.3 | |

Industrials | | | 6.6 | |

Materials | | | 2.5 | |

Utilities | | | 1.8 | |

Real Estate | | | 1.2 | |

Financials | | | 1.1 | |

| *** | | Percentages indicated are based on total long investments as of October 31, 2017. The Fund’s portfolio composition is subject to change. |

| **** | | Percentages indicated are based on total short investments as of October 31, 2017. The Fund’s portfolio composition is subject to change. |

| | | | | | |

| | | |

| 4 | | | | J.P. MORGAN SPECIALTY FUNDS | | OCTOBER 31, 2017 |

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2017 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 3 YEAR | | | SINCE

INCEPTION | |

CLASS A SHARES | | August 29, 2014 | | | | | | | | | | | | |

With Sales Charge* | | | | | 7.67 | % | | | 5.86 | % | | | 7.17 | % |

Without Sales Charge | | | | | 13.64 | | | | 7.78 | | | | 9.00 | |

CLASS C SHARES | | August 29, 2014 | | | | | | | | | | | | |

With CDSC** | | | | | 12.07 | | | | 7.26 | | | | 8.47 | |

Without CDSC | | | | | 13.07 | | | | 7.26 | | | | 8.47 | |

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | August 29, 2014 | | | 13.92 | | | | 8.05 | | | | 9.26 | |

CLASS R2 SHARES | | August 29, 2014 | | | 13.35 | | | | 7.52 | | | | 8.73 | |

CLASS R5 SHARES | | August 29, 2014 | | | 14.15 | | | | 8.27 | | | | 9.49 | |

CLASS R6 SHARES | | August 29, 2014 | | | 14.19 | | | | 8.32 | | | | 9.54 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter. |

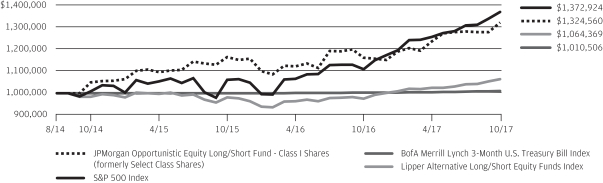

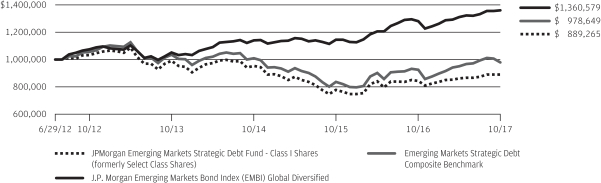

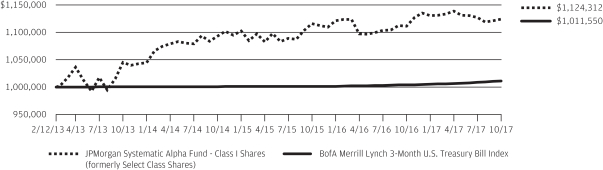

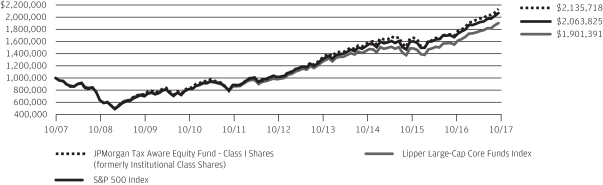

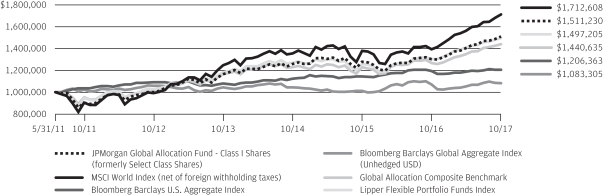

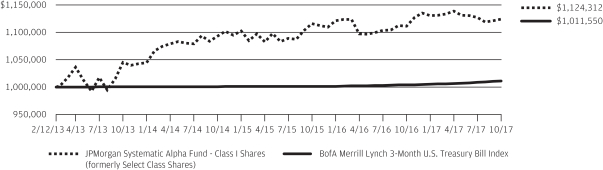

LIFE OF FUND PERFORMANCE (8/29/14 TO 10/31/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on August 29, 2014.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares (formerly Select Class Shares) of the JPMorgan Opportunistic Equity Long/Short Fund, the S&P 500 Index, the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index and Lipper Alternative Long/Short Equity Funds Index from August 29, 2014 to October 31, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the S&P 500 Index and BofA Merrill Lynch 3-Month U.S. Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gain distributions of securities included in the benchmarks, if applicable. The performance of the Lipper Alternative Long/Short Equity Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The S&P 500 Index is an unmanaged index generally representative of the performance of

large companies in the U.S. stock market. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. The Lipper Alternative Long/Short Equity Funds Index represents the total returns of the funds in the indicated category as defined by Lipper, Inc. Investors cannot invest directly in an index.

From the inception of the Fund through January 23, 2015, the Fund did not experience any shareholder activity. If such activity had occurred, the Fund’s performance may have been impacted.

Class I Shares have a $1,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 5 | |

JPMorgan Research Market Neutral Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2017 (Unaudited)

| | | | |

| REPORTING PERIOD RETURN: | | | |

| Fund (Class L Shares)1* | | | 6.57% | |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill Index | | | 0.72% | |

| |

| Net Assets as of 10/31/2017 (In Thousands) | | $ | 219,531 | |

INVESTMENT OBJECTIVE**

The JPMorgan Research Market Neutral Fund (the “Fund”) seeks to provide long-term capital appreciation from a broadly diversified portfolio of U.S. stocks while neutralizing the general risks associated with stock market investing.

WHAT WERE THE MAIN DRIVERS OF THE FUND’S PERFORMANCE?

The Fund (Class L Shares) outperformed the BofA Merrill Lynch 3-Month U.S. Treasury bill Index (the “Benchmark”) for the twelve months ended October 31, 2017.

The Fund’s security selection in the retail and banks & brokerages sectors was a leading contributor to performance relative to the Benchmark, while security selection in the industrial cyclical and financial services sectors was a leading detractor from relative performance. Leading individual contributors to the Fund’s relative performance included its short positions in Mattel Inc., Bed Bath & Beyond Inc. and Under Armour Inc. Shares of Mattel, a toy maker, fell after the company reported a drop in sales and a loss for the three months ended October 2017. Shares of Bed Bath & Beyond, a household products retail chain, fell after the company reported lower-than-expected earnings and a decline in sales for the second quarter of 2017. Shares of Under Armour, a maker of sports apparel, fell amid declines in sales.

Leading individual detractors from relative performance included the Fund’s short positions in Boeing Co., AbbVie Inc.

and Whole Foods Market Inc. Shares of Boeing, an airplanes and aerospace company, rose amid global demand and revenue growth. Shares of AbbVie, a pharmaceuticals company, rose amid continued growth in earnings and sales. Shares of Whole Foods Market, an upscale supermarket chain, rose in advance of its acquisition by Amazon.com Inc.

HOW WAS THE FUND POSITIONED?

The Fund’s portfolio managers aimed to construct a portfolio of long and short positions with a low correlation to traditional investments such as stocks and bonds. The Fund’s portfolio managers used fundamental research to estimate companies’ long-term earnings forecasts, ranking approximately 600 large and mid cap stocks into five quintiles. The Fund’s portfolio managers looked to the top two quintiles for potential long positions in stocks that they believed were undervalued and the bottom two quintiles for potential short positions in stocks that they believed were overvalued.

| 1 | | Effective December 1, 2016, Institutional Class Shares were renamed Class L Shares. |

| * | | The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The adviser seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| | | | | | |

| | | |

| 6 | | | | J.P. MORGAN SPECIALTY FUNDS | | OCTOBER 31, 2017 |

| | | | | | | | |

| TOP TEN LONG POSITIONS OF THE PORTFOLIO*** | |

| | 1. | | | Alphabet, Inc., Class C | | | 2.8 | % |

| | 2. | | | Union Pacific Corp. | | | 2.5 | |

| | 3. | | | UnitedHealth Group, Inc. | | | 2.0 | |

| | 4. | | | Morgan Stanley | | | 1.9 | |

| | 5. | | | EOG Resources, Inc. | | | 1.7 | |

| | 6. | | | Duke Energy Corp. | | | 1.6 | |

| | 7. | | | Texas Instruments, Inc. | | | 1.6 | |

| | 8. | | | NextEra Energy, Inc. | | | 1.5 | |

| | 9. | | | Norfolk Southern Corp. | | | 1.4 | |

| | 10. | | | Microsoft Corp. | | | 1.4 | |

| | | | | | | | |

| TOP TEN SHORT POSITIONS OF THE PORTFOLIO**** | |

| | 1. | | | Exxon Mobil Corp. | | | 2.9 | % |

| | 2. | | | LyondellBasell Industries NV, Class A | | | 2.5 | |

| | 3. | | | Southern Co. (The) | | | 2.5 | |

| | 4. | | | Intel Corp. | | | 2.3 | |

| | 5. | | | Dominion Energy, Inc. | | | 2.0 | |

| | 6. | | | Heartland Express, Inc. | | | 1.9 | |

| | 7. | | | Sempra Energy | | | 1.8 | |

| | 8. | | | Boeing Co. (The) | | | 1.8 | |

| | 9. | | | Schlumberger Ltd. | | | 1.7 | |

| | 10. | | | AT&T, Inc. | | | 1.5 | |

| | | | |

LONG POSITION PORTFOLIO COMPOSITION BY SECTOR*** | |

Information Technology | | | 15.4 | % |

Financials | | | 12.8 | |

Industrials | | | 12.6 | |

Consumer Discretionary | | | 11.3 | |

Utilities | | | 7.0 | |

Health Care | | | 6.2 | |

Energy | | | 5.8 | |

Materials | | | 5.4 | |

Consumer Staples | | | 4.2 | |

Real Estate | | | 1.4 | |

Others (each less than 1.0%) | | | 0.5 | |

Short-Term Investments | | | 17.4 | |

| | | | |

SHORT POSITION PORTFOLIO COMPOSITION BY SECTOR**** | |

Consumer Discretionary | | | 16.5 | % |

Financials | | | 15.4 | |

Information Technology | | | 14.4 | |

Industrials | | | 14.1 | |

Utilities | | | 9.4 | |

Consumer Staples | | | 6.6 | |

Energy | | | 6.4 | |

Health Care | | | 6.4 | |

Materials | | | 6.3 | |

Real Estate | | | 2.4 | |

Telecommunication Services | | | 2.1 | |

| *** | | Percentages indicated are based on total long investments as of October 31, 2017. The Fund’s portfolio composition is subject to change. |

| **** | | Percentages indicated are based on total short investments as of October 31, 2017. The Fund’s portfolio composition is subject to change. |

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 7 | |

JPMorgan Research Market Neutral Fund

FUND COMMENTARY

TWELVE MONTHS ENDED OCTOBER 31, 2017 (Unaudited) (continued)

| | | | | | | | | | | | | | |

AVERAGE ANNUAL TOTAL RETURNS AS OF OCTOBER 31, 2017 | |

| | | | |

| | | INCEPTION DATE OF

CLASS | | 1 YEAR | | | 5 YEAR | | | 10 YEAR | |

CLASS A SHARES | | February 28, 2002 | | | | | | | | | | | | |

With Sales Charge* | | | | | 0.55 | % | | | (0.21 | )% | | | 0.07 | % |

Without Sales Charge | | | | | 6.14 | | | | 0.87 | | | | 0.61 | |

CLASS C SHARES | | November 2, 2009 | | | | | | | | | | | | |

With CDSC** | | | | | 4.59 | | | | 0.36 | | | | 0.11 | |

Without CDSC | | | | | 5.59 | | | | 0.36 | | | | 0.11 | |

CLASS I SHARES (FORMERLY SELECT CLASS SHARES) | | November 2, 2009 | | | 6.47 | | | | 1.13 | | | | 0.92 | |

CLASS L SHARES (FORMERLY INSTITUTIONAL CLASS SHARES) | | December 31, 1998 | | | 6.57 | | | | 1.33 | | | | 1.10 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC (contingent deferred sales charge) for the one year period and 0% CDSC thereafter |

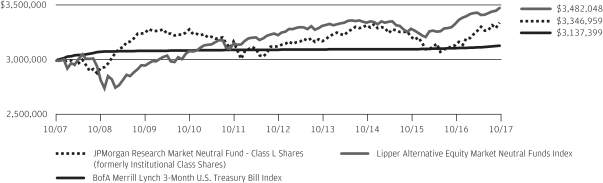

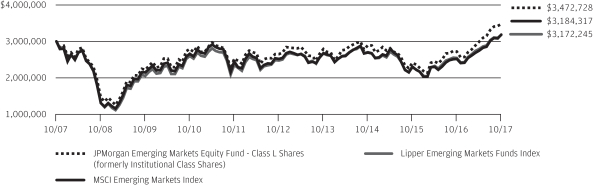

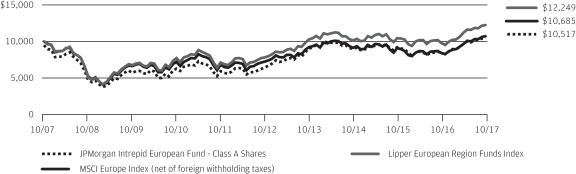

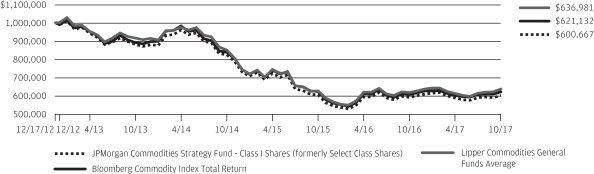

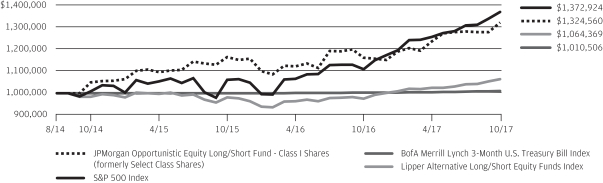

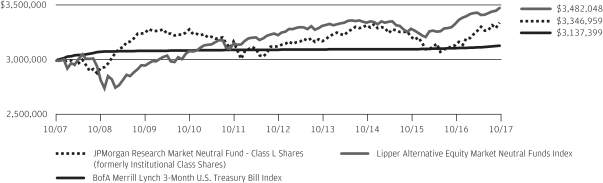

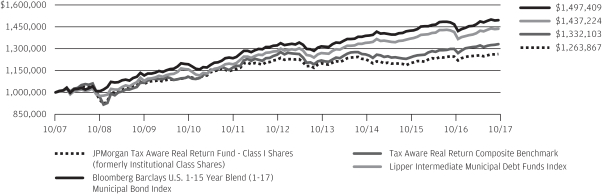

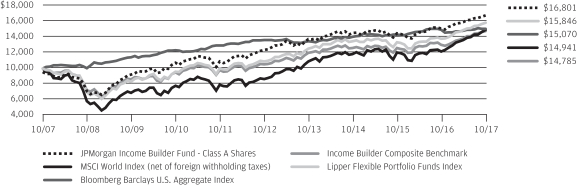

TEN YEAR FUND PERFORMANCE (10/31/07 TO 10/31/17)

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

Returns for Class I (formerly Select Class) Shares prior to its inception date are based on the performance of Class L Shares (formerly Institutional Class Shares). The actual returns for Class I Shares would have been lower than shown because Class I Shares have higher expenses than Class L Shares.

Returns for Class C Shares prior to its inception date are based on the performance of Class B Shares, all of which converted to Class A Shares on June 19, 2015. The actual returns of Class C Shares would have been similar to those shown because Class C Shares had similar expenses to Class B Shares.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan Research Market Neutral Fund, BofA Merrill Lynch 3-Month U.S. Treasury Bill Index and Lipper Alternative Equity Market Neutral Funds Index from October 31, 2007 to October 31, 2017. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the BofA Merrill Lynch 3-Month U.S. Treasury Bill Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect

reinvestment of all dividends and capital gain distributions of the securities included in the benchmark, if applicable. The performance of the Lipper Alternative Equity Market Neutral Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses incurred by the Fund. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond, 3 months from the rebalancing date. Investors cannot invest directly in an index. The Lipper Alternative Equity Market Neutral Funds Index is an average based on the total returns of all mutual funds within the Fund’s designated category as determined by Lipper, Inc.

Class L Shares have a $3,000,000 minimum initial investment.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

| | | | | | |

| | | |

| 8 | | | | J.P. MORGAN SPECIALTY FUNDS | | OCTOBER 31, 2017 |

JPMorgan Opportunistic Equity Long/Short Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2017

(Amounts in thousands)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | Long Positions — 93.0% | | | | |

| | Common Stocks — 87.0% | |

| | | | Consumer Discretionary — 7.1% | | | | |

| | | | Household Durables — 1.0% | | | | |

| | 41 | | | Newell Brands, Inc. (j) | | | 1,656 | |

| | | | | | | | |

| | | | Media — 1.1% | | | | |

| | 45 | | | Altice USA, Inc., Class A (a) | | | 1,070 | |

| | 14 | | | DISH Network Corp., Class A (a) | | | 681 | |

| | | | | | | | |

| | | | | | | 1,751 | |

| | | | | | | | |

| | | | Multiline Retail — 2.0% | | | | |

| | 44 | | | Kohl’s Corp. | | | 1,849 | |

| | 24 | | | Target Corp. | | | 1,405 | |

| | | | | | | | |

| | | | | | | 3,254 | |

| | | | | | | | |

| | | | Specialty Retail — 2.0% | | | | |

| | 20 | | | Home Depot, Inc. (The) | | | 3,268 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 1.0% | | | | |

| | 18 | | | Ralph Lauren Corp. | | | 1,596 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 11,525 | |

| | | | | | | | |

| | | | Consumer Staples — 16.6% | | | | |

| | | | Beverages — 9.3% | | | | |

| | 190 | | | Coca-Cola Co. (The) | | | 8,743 | |

| | 23 | | | Constellation Brands, Inc., Class A | | | 4,985 | |

| | 11 | | | PepsiCo, Inc. | | | 1,198 | |

| | | | | | | | |

| | | | | | | 14,926 | |

| | | | | | | | |

| | | | Food & Staples Retailing — 4.5% | | | | |

| | 84 | | | Wal-Mart Stores, Inc. | | | 7,305 | |

| | | | | | | | |

| | | | Personal Products — 1.8% | | | | |

| | 25 | | | Estee Lauder Cos., Inc. (The), Class A | | | 2,844 | |

| | | | | | | | |

| | | | Tobacco — 1.0% | | | | |

| | 16 | | | Philip Morris International, Inc. | | | 1,653 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 26,728 | |

| | | | | | | | |

| | | | Financials — 13.4% | | | | |

| | | | Capital Markets — 3.4% | | | | |

| | 131 | | | Brookfield Asset Management, Inc., (Canada), Class A | | | 5,514 | |

| | | | | | | | |

| | | | Consumer Finance — 5.0% | | | | |

| | 84 | | | American Express Co. (j) | | | 8,020 | |

| | | | | | | | |

| | | | Diversified Financial Services — 5.0% | | | | |

| | — | (h) | | Berkshire Hathaway, Inc., Class A (a) | | | 8,134 | |

| | | | | | | | |

| | | | Total Financials | | | 21,668 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | Health Care — 7.2% | | | | |

| | | | Health Care Providers & Services — 4.7% | | | | |

| | 36 | | | UnitedHealth Group, Inc. | | | 7,655 | |

| | | | | | | | |

| | | | Life Sciences Tools & Services — 2.5% | |

| | 20 | | | Thermo Fisher Scientific, Inc. (j) | | | 3,957 | |

| | | | | | | | |

| | | | Total Health Care | | | 11,612 | |

| | | | | | | | |

| | | | Industrials — 14.9% | |

| | | | Aerospace & Defense — 1.1% | |

| | 3 | | | Northrop Grumman Corp. | | | 807 | |

| | 5 | | | Raytheon Co. | | | 924 | |

| | | | | | | | |

| | | | | | | 1,731 | |

| | | | | | | | |

| | | | Electrical Equipment — 5.0% | |

| | 102 | | | Eaton Corp. plc | | | 8,135 | |

| | | | | | | | |

| | | | Machinery — 6.3% | |

| | 17 | | | Caterpillar, Inc. | | | 2,354 | |

| | 30 | | | Cummins, Inc. | | | 5,383 | |

| | 13 | | | Parker-Hannifin Corp. | | | 2,390 | |

| | | | | | | | |

| | | | | | | 10,127 | |

| | | | | | | | |

| | | | Road & Rail — 2.5% | |

| | 30 | | | Norfolk Southern Corp. | | | 3,993 | |

| | | | | | | | |

| | | | Total Industrials | | | 23,986 | |

| | | | | | | | |

| | | | Information Technology — 21.2% | |

| | | | Internet Software & Services — 7.3% | |

| | 11 | | | Alphabet, Inc., Class A (a) (j) | | | 11,829 | |

| | | | | | | | |

| | | | IT Services — 6.7% | |

| | 25 | | | Fidelity National Information Services, Inc. | | | 2,363 | |

| | 21 | | | Fiserv, Inc. (a) (j) | | | 2,722 | |

| | 17 | | | Mastercard, Inc., Class A (j) | | | 2,523 | |

| | 29 | | | Visa, Inc., Class A (j) | | | 3,186 | |

| | | | | | | | |

| | | | | | | 10,794 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 5.3% | |

| | 190 | | | Intel Corp. | | | 8,627 | |

| | | | | | | | |

| | | | Software — 1.9% | |

| | 37 | | | Microsoft Corp. | | | 3,044 | |

| | | | | | | | |

| | | | Total Information Technology | | | 34,294 | |

| | | | | | | | |

| | | | Materials — 3.6% | |

| | | | Chemicals — 1.6% | |

| | 20 | | | Ecolab, Inc. (j) | | | 2,590 | |

| | | | | | | | |

| | | | Containers & Packaging — 2.0% | |

| | 54 | | | Berry Global Group, Inc. (a) | | | 3,228 | |

| | | | | | | | |

| | | | Total Materials | | | 5,818 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 9 | |

JPMorgan Opportunistic Equity Long/Short Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2017 (continued)

(Amounts in thousands, except number of Options contracts)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | Long Positions — continued | | | | |

| | Common Stocks — continued | |

| | | | Utilities — 3.0% | |

| | | | Electric Utilities — 3.0% | |

| | 31 | | | NextEra Energy, Inc. (j) | | | 4,880 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $126,777) | | | 140,511 | |

| | | | | | | | |

| | |

NUMBER OF

CONTRACTS | | | | | | |

| | Options Purchased — 0.2% | | | | |

| | | | Call Option — 0.0% (g) | |

| | | | Household Durables — 0.0% (g) | |

| | 553 | | | Newell Brands, Inc., 01/19/2018 at USD 50.00, American Style (a) Notional Amount: USD 2,255 Exchange Traded | | | 6 | |

| | | | Put Option — 0.2% | |

| | | | Index Fund — 0.2% | |

| | 117 | | | S&P 500 Index, 12/29/2017 at USD 2,525.00, European Style (a) (o) Notional Amount: USD 30,131 Exchange Traded | | | 253 | |

| | | | | | | | |

| | | | Total Options Purchased

(Cost $493) | | | 259 | |

| | | | | | | | |

| | |

| SHARES | | | | | | |

| | Short-Term Investment — 5.8% | | | | |

| | | | Investment Company — 5.8% | | | | |

| | 9,415 | | | JPMorgan U.S. Government Money Market Fund, Institutional Class Shares, 0.92% (b) (l) (Cost $9,415) | | | 9,415 | |

| | | | | | | | |

| | | | Total Investments — 93.0%

(Cost $136,685) | | | 150,185 | |

| | | | Other Assets in Excess of

Liabilities — 7.0% | | | 11,236 | |

| | | | | | | | |

| | | | NET ASSETS — 100.0% | | $ | 161,421 | |

| | | | | | | | |

| | Short Positions — 24.9% | | | | |

| | Common Stocks — 24.9% | | | | |

| | | | Consumer Discretionary — 8.1% | |

| | | | Automobiles — 2.0% | |

| | 67 | | | Harley-Davidson, Inc. | | | 3,155 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 2.1% | |

| | 12 | | | Papa John’s International, Inc. | | | 809 | |

| | 48 | | | Starbucks Corp. | | | 2,616 | |

| | | | | | | | |

| | | | | | | 3,425 | |

| | | | | | | | |

| | | | Household Durables — 0.9% | |

| | 9 | | | Whirlpool Corp. | | | 1,485 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | |

| | | | | |

| | | | Media — 1.7% | |

| | 15 | | | CBS Corp. (Non-Voting), Class B | | | 868 | |

| | 14 | | | Omnicom Group, Inc. | | | 941 | |

| | 9 | | | Walt Disney Co. (The) | | | 868 | |

| | | | | | | | |

| | | | | | | 2,677 | |

| | | | | | | | |

| | | | Specialty Retail — 1.4% | |

| | 33 | | | TJX Cos., Inc. (The) | | | 2,291 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 13,033 | |

| | | | | | | | |

| | | | Consumer Staples — 10.7% | |

| | | | Food & Staples Retailing — 2.7% | |

| | 10 | | | Costco Wholesale Corp. | | | 1,612 | |

| | 4 | | | Sysco Corp. | | | 205 | |

| | 67 | | | United Natural Foods, Inc. (a) | | | 2,596 | |

| | | | | | | | |

| | | | | | | 4,413 | |

| | | | | | | | |

| | | | Food Products — 2.2% | |

| | 28 | | | General Mills, Inc. | | | 1,461 | |

| | 6 | | | Kellogg Co. | | | 379 | |

| | 42 | | | Mondelez International, Inc., Class A | | | 1,743 | |

| | | | | | | | |

| | | | | | | 3,583 | |

| | | | | | | | |

| | | | Household Products — 5.4% | |

| | 49 | | | Church & Dwight Co., Inc. | | | 2,214 | |

| | 58 | | | Kimberly-Clark Corp. | | | 6,505 | |

| | | | | | | | |

| | | | | | | 8,719 | |

| | | | | | | | |

| | | | Personal Products — 0.1% | |

| | 13 | | | Coty, Inc., Class A | | | 204 | |

| | | | | | | | |

| | | | Tobacco — 0.3% | |

| | 6 | | | Altria Group, Inc. | | | 402 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 17,321 | |

| | | | | | | | |

| | | | Financials — 0.3% | |

| | | | Capital Markets — 0.2% | |

| | 2 | | | CME Group, Inc. | | | 238 | |

| | | | | | | | |

| | | | Insurance — 0.1% | |

| | 3 | | | WR Berkley Corp. | | | 222 | |

| | | | | | | | |

| | | | Total Financials | | | 460 | |

| | | | | | | | |

| | | | Health Care — 2.8% | |

| | | | Health Care Providers & Services — 2.8% | |

| | 24 | | | Cardinal Health, Inc. | | | 1,492 | |

| | 27 | | | Express Scripts Holding Co. (a) | | | 1,681 | |

| | 18 | | | Henry Schein, Inc. (a) | | | 1,385 | |

| | | | | | | | |

| | | | Total Health Care | | | 4,558 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 10 | | | | J.P. MORGAN SPECIALTY FUNDS | | OCTOBER 31, 2017 |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | Short Positions — continued | | | | |

| | Common Stocks — continued | | | | |

| | | | Industrials — 1.7% | |

| | | | Building Products — 1.1% | |

| | 41 | | | Johnson Controls International plc | | | 1,681 | |

| | | | | | | | |

| | | | Industrial Conglomerates — 0.6% | |

| | 49 | | | General Electric Co. | | | 993 | |

| | | | | | | | |

| | | | Total Industrials | | | 2,674 | |

| | | | | | | | |

| | | | Materials — 0.6% | |

| | | | Containers & Packaging — 0.6% | |

| | 4 | | | International Paper Co. | | | 248 | |

| | 17 | | | Sealed Air Corp. | | | 757 | |

| | | | | | | | |

| | | | Total Materials | | | 1,005 | |

| | | | | | | | |

| | | | Real Estate — 0.3% | |

| | | | Equity Real Estate Investment Trusts (REITs) — 0.3% | |

| | 2 | | | Crown Castle International Corp. | | | 248 | |

| | 3 | | | Welltower, Inc. | | | 219 | |

| | | | | | | | |

| | | | Total Real Estate | | | 467 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | |

| | | | | |

| | | | Utilities — 0.4% | |

| | | | Gas Utilities — 0.1% | |

| | 4 | | | National Fuel Gas Co. | | | 225 | |

| | | | | | | | |

| | | | Multi-Utilities — 0.3% | |

| | 3 | | | Consolidated Edison, Inc. | | | 250 | |

| | 3 | | | Dominion Energy, Inc. | | | 252 | |

| | | | | | | | |

| | | | | | | 502 | |

| | | | | | | | |

| | | | Total Utilities | | | 727 | |

| | | | | | | | |

| | | | Total Securities Sold Short

(Proceeds $41,881) | | $ | 40,245 | |

| | | | | | | | |

Percentages indicated are based on net assets.

| | | | | | | | | | | | | | | | | | | | | | |

| Written Put Options Contracts as of October 31, 2017: | |

| DESCRIPTION | | COUNTERPARTY | | NUMBER OF

CONTRACTS | | | NOTIONAL

AMOUNT | | | EXERCISE

PRICE | | | EXPIRATION

DATE | | | VALUE ($) | |

S&P 500 Index, European Style | | Exchange Traded | | | 117 | | | | USD 30,131 | | | | USD 2,400.00 | | | | 12/29/2017 | | | | (100 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

Total Written Options Contracts (Premiums Received $123) | | | | (100 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 11 | |

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2017

(Amounts in thousands)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Long Positions — 99.6% | |

| | Common Stocks — 82.3% | |

| | | | Consumer Discretionary — 11.2% | |

| | | | Auto Components — 0.4% | |

| | 8 | | | Delphi Automotive plc | | | 843 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 1.5% | |

| | 3 | | | McDonald’s Corp. | | | 521 | |

| | 17 | | | Royal Caribbean Cruises Ltd. | | | 2,090 | |

| | 8 | | | Yum Brands, Inc. | | | 575 | |

| | | | | | | | |

| | | | | | | 3,186 | |

| | | | | | | | |

| | | | Household Durables — 1.0% | |

| | 15 | | | MDC Holdings, Inc. | | | 573 | |

| | 24 | | | PulteGroup, Inc. | | | 735 | |

| | 19 | | | Toll Brothers, Inc. | | | 877 | |

| | | | | | | | |

| | | | | | | 2,185 | |

| | | | | | | | |

| | | | Internet & Direct Marketing Retail — 0.4% | |

| | 1 | | | Amazon.com, Inc. (a) | | | 964 | |

| | | | | | | | |

| | | | Media — 2.4% | |

| | 13 | | | Altice USA, Inc., Class A (a) | | | 297 | |

| | 2 | | | Charter Communications, Inc., Class A (a) | | | 626 | |

| | 13 | | | Comcast Corp., Class A | | | 461 | |

| | 22 | | | DISH Network Corp., Class A (a) | | | 1,079 | |

| | 45 | | | Sirius XM Holdings, Inc. | | | 242 | |

| | 12 | | | Time Warner, Inc. | | | 1,165 | |

| | 20 | | | Twenty-First Century Fox, Inc., Class B | | | 519 | |

| | 9 | | | Walt Disney Co. (The) (j) | | | 903 | |

| | | | | | | | |

| | | | | | | 5,292 | |

| | | | | | | | |

| | | | Multiline Retail — 1.0% | |

| | 25 | | | Dollar Tree, Inc. (a) | | | 2,307 | |

| | | | | | | | |

| | | | Specialty Retail — 4.1% | | | | |

| | 2 | | | AutoZone, Inc. (a) | | | 1,390 | |

| | 13 | | | Home Depot, Inc. (The) | | | 2,089 | |

| | 19 | | | Lowe’s Cos., Inc. | | | 1,518 | |

| | 8 | | | O’Reilly Automotive, Inc. (a) | | | 1,713 | |

| | 19 | | | Ross Stores, Inc. | | | 1,213 | |

| | 15 | | | TJX Cos., Inc. (The) | | | 1,061 | |

| | | | | | | | |

| | | | | | | 8,984 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 0.4% | |

| | 16 | | | NIKE, Inc., Class B | | | 884 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 24,645 | |

| | | | | | | | |

| | | | Consumer Staples — 4.2% | |

| | | | Beverages — 1.4% | | | | |

| | 9 | | | Molson Coors Brewing Co., Class B | | | 706 | |

| | 22 | | | PepsiCo, Inc. (j) | | | 2,407 | |

| | | | | | | | |

| | | | | | | 3,113 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Food & Staples Retailing — 0.4% | |

| | 3 | | | Costco Wholesale Corp. | | | 514 | |

| | 7 | | | Walgreens Boots Alliance, Inc. | | | 441 | |

| | | | | | | | |

| | | | | | | 955 | |

| | | | | | | | |

| | | | Food Products — 1.4% | |

| | 7 | | | Kellogg Co. | | | 443 | |

| | 40 | | | Mondelez International, Inc., Class A | | | 1,661 | |

| | 11 | | | Post Holdings, Inc. (a) | | | 897 | |

| | | | | | | | |

| | | | | | | 3,001 | |

| | | | | | | | |

| | | | Tobacco — 1.0% | |

| | 20 | | | Philip Morris International, Inc. (j) | | | 2,121 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 9,190 | |

| | | | | | | | |

| | | | Energy — 5.7% | |

| | | | Oil, Gas & Consumable Fuels — 5.7% | |

| | 14 | | | Concho Resources, Inc. (a) | | | 1,913 | |

| | 21 | | | Diamondback Energy, Inc. (a) | | | 2,270 | |

| | 38 | | | EOG Resources, Inc. | | | 3,751 | |

| | 7 | | | Marathon Petroleum Corp. | | | 428 | |

| | 12 | | | Parsley Energy, Inc., Class A (a) | | | 326 | |

| | 19 | | | Pioneer Natural Resources Co. | | | 2,910 | |

| | 13 | | | RSP Permian, Inc. (a) | | | 443 | |

| | 7 | | | Valero Energy Corp. | | | 537 | |

| | | | | | | | |

| | | | Total Energy | | | 12,578 | |

| | | | | | | | |

| | | | Financials — 12.8% | |

| | | | Banks — 4.8% | |

| | 100 | | | Bank of America Corp. (j) | | | 2,738 | |

| | 40 | | | Citigroup, Inc. | | | 2,942 | |

| | 35 | | | Citizens Financial Group, Inc. | | | 1,349 | |

| | 17 | | | Comerica, Inc. | | | 1,329 | |

| | 44 | | | KeyCorp | | | 801 | |

| | 13 | | | SunTrust Banks, Inc. | | | 803 | |

| | 3 | | | SVB Financial Group (a) | | | 656 | |

| | | | | | | | |

| | | | | | | 10,618 | |

| | | | | | | | |

| | | | Capital Markets — 4.3% | |

| | 22 | | | Bank of New York Mellon Corp. (The) | | | 1,117 | |

| | 42 | | | Charles Schwab Corp. (The) | | | 1,871 | |

| | 20 | | | Intercontinental Exchange, Inc. | | | 1,291 | |

| | 84 | | | Morgan Stanley (j) | | | 4,184 | |

| | 11 | | | State Street Corp. | | | 1,000 | |

| | | | | | | | |

| | | | | | | 9,463 | |

| | | | | | | | |

| | | | Consumer Finance — 0.3% | |

| | 6 | | | Capital One Financial Corp. | | | 561 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 12 | | | | J.P. MORGAN SPECIALTY FUNDS | | OCTOBER 31, 2017 |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Long Positions — continued | |

| | Common Stocks — continued | |

| | | | Diversified Financial Services — 0.1% | |

| | 5 | | | Voya Financial, Inc. | | | 192 | |

| | | | | | | | |

| | | | Insurance — 3.3% | |

| | 21 | | | American International Group, Inc. | | | 1,389 | |

| | 17 | | | Arthur J Gallagher & Co. | | | 1,077 | |

| | 1 | | | Brighthouse Financial, Inc. (a) | | | 65 | |

| | 5 | | | Chubb Ltd. | | | 754 | |

| | 1 | | | Everest Re Group Ltd. | | | 224 | |

| | 25 | | | Hartford Financial Services Group, Inc. (The) | | | 1,404 | |

| | 12 | | | Lincoln National Corp. | | | 878 | |

| | 20 | | | MetLife, Inc. | | | 1,047 | |

| | 7 | | | Validus Holdings Ltd. | | | 347 | |

| | | | | | | | |

| | | | | | | 7,185 | |

| | | | | | | | |

| | | | Total Financials | | | 28,019 | |

| | | | | | | | |

| | | | Health Care — 6.2% | |

| | | | Biotechnology — 1.8% | |

| | 2 | | | Alexion Pharmaceuticals, Inc. (a) | | | 265 | |

| | 2 | | | Biogen, Inc. (a) | | | 523 | |

| | 3 | | | BioMarin Pharmaceutical, Inc. (a) | | | 233 | |

| | 5 | | | Bioverativ, Inc. (a) | | | 293 | |

| | 7 | | | Celgene Corp. (a) (j) | | | 729 | |

| | 2 | | | Incyte Corp. (a) | | | 192 | |

| | 11 | | | Vertex Pharmaceuticals, Inc. (a) | | | 1,670 | |

| | | | | | | | |

| | | | | | | 3,905 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies — 0.5% | |

| | 27 | | | Boston Scientific Corp. (a) | | | 767 | |

| | 3 | | | Zimmer Biomet Holdings, Inc. | | | 388 | |

| | | | | | | | |

| | | | | | | 1,155 | |

| | | | | | | | |

| | | | Health Care Providers & Services — 2.5% | |

| | 1 | | | Cigna Corp. | | | 266 | |

| | 4 | | | Humana, Inc. | | | 913 | |

| | 21 | | | UnitedHealth Group, Inc. (j) | | | 4,447 | |

| | | | | | | | |

| | | | | | | 5,626 | |

| | | | | | | | |

| | | | Life Sciences Tools & Services — 0.2% | |

| | 5 | | | Agilent Technologies, Inc. | | | 368 | |

| | | | | | | | |

| | | | Pharmaceuticals — 1.2% | |

| | 8 | | | Allergan plc | | | 1,377 | |

| | 34 | | | Pfizer, Inc. | | | 1,185 | |

| | | | | | | | |

| | | | | | | 2,562 | |

| | | | | | | | |

| | | | Total Health Care | | | 13,616 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Industrials — 12.6% | |

| | | | Aerospace & Defense — 1.7% | |

| | 7 | | | General Dynamics Corp. | | | 1,396 | |

| | 7 | | | Northrop Grumman Corp. | | | 1,985 | |

| | 6 | | | Textron, Inc. | | | 314 | |

| | | | | | | | |

| | | | | | | 3,695 | |

| | | | | | | | |

| | | | Airlines — 1.2% | |

| | 11 | | | Alaska Air Group, Inc. | | | 695 | |

| | 30 | | | Delta Air Lines, Inc. | | | 1,476 | |

| | 7 | | | United Continental Holdings, Inc. (a) | | | 397 | |

| | | | | | | | |

| | | | | | | 2,568 | |

| | | | | | | | |

| | | | Building Products — 0.3% | |

| | 8 | | | Allegion plc | | | 676 | |

| | | | | | | | |

| | | | Electrical Equipment — 1.2% | |

| | 19 | | | Eaton Corp. plc (j) | | | 1,542 | |

| | 6 | | | Rockwell Automation, Inc. | | | 1,160 | |

| | | | | | | | |

| | | | | | | 2,702 | |

| | | | | | | | |

| | | | Industrial Conglomerates — 0.8% | |

| | 11 | | | Honeywell International, Inc. | | | 1,638 | |

| | | | | | | | |

| | | | Machinery — 2.2% | |

| | 2 | | | Deere & Co. | | | 298 | |

| | 20 | | | Ingersoll-Rand plc | | | 1,751 | |

| | 17 | | | Stanley Black & Decker, Inc. (j) | | | 2,778 | |

| | | | | | | | |

| | | | | | | 4,827 | |

| | | | | | | | |

| | | | Road & Rail — 5.2% | |

| | 13 | | | Canadian Pacific Railway Ltd., (Canada) (j) | | | 2,307 | |

| | 5 | | | Kansas City Southern | | | 540 | |

| | 24 | | | Norfolk Southern Corp. | | | 3,161 | |

| | 47 | | | Union Pacific Corp. (j) | | | 5,456 | |

| | | | | | | | |

| | | | | | | 11,464 | |

| | | | | | | | |

| | | | Total Industrials | | | 27,570 | |

| | | | | | | | |

| | | | Information Technology — 15.3% | |

| | | | Internet Software & Services — 3.9% | |

| | 6 | | | Alphabet, Inc., Class C (a) (j) | | | 6,039 | |

| | 14 | | | Facebook, Inc., Class A (a) | | | 2,484 | |

| | | | | | | | |

| | | | | | | 8,523 | |

| | | | | | | | |

| | | | IT Services — 3.1% | |

| | 9 | | | Accenture plc, Class A (j) | | | 1,221 | |

| | 14 | | | International Business Machines Corp. | | | 2,105 | |

| | 6 | | | Square, Inc., Class A (a) | | | 232 | |

| | 14 | | | Vantiv, Inc., Class A (a) | | | 970 | |

| | 13 | | | Visa, Inc., Class A | | | 1,403 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 13 | |

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2017 (continued)

(Amounts in thousands)

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Long Positions — continued | |

| | Common Stocks — continued | |

| | | | IT Services — continued | |

| | 7 | | | WEX, Inc. (a) (j) | | | 891 | |

| | | | | | | | |

| | | | | | | 6,822 | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 5.3% | |

| | 18 | | | Analog Devices, Inc. | | | 1,659 | |

| | 11 | | | Broadcom Ltd. | | | 2,824 | |

| | 18 | | | Microchip Technology, Inc. | | | 1,735 | |

| | 22 | | | Micron Technology, Inc. (a) | | | 994 | |

| | 3 | | | NVIDIA Corp. | | | 674 | |

| | 16 | | | ON Semiconductor Corp. (a) | | | 342 | |

| | 36 | | | Texas Instruments, Inc. (j) | | | 3,450 | |

| | | | | | | | |

| | | | | | | 11,678 | |

| | | | | | | | |

| | | | Software — 2.4% | |

| | 6 | | | Adobe Systems, Inc. (a) (j) | | | 1,006 | |

| | 36 | | | Microsoft Corp. | | | 3,008 | |

| | 19 | | | Symantec Corp. | | | 601 | |

| | 6 | | | Workday, Inc., Class A (a) | | | 692 | |

| | | | | | | | |

| | | | | | | 5,307 | |

| | | | | | | | |

| | | | Technology Hardware, Storage & Peripherals — 0.6% | |

| | 4 | | | Apple, Inc. | | | 593 | |

| | 51 | | | Hewlett Packard Enterprise Co. | | | 709 | |

| | | | | | | | |

| | | | | | | 1,302 | |

| | | | | | | | |

| | | | Total Information Technology | | | 33,632 | |

| | | | | | | | |

| | | | Materials — 5.4% | |

| | | | Chemicals — 3.3% | |

| | 3 | | | Albemarle Corp. | | | 481 | |

| | 21 | | | Celanese Corp., Series A | | | 2,156 | |

| | 27 | | | DowDuPont, Inc. | | | 1,965 | |

| | 15 | | | Eastman Chemical Co. | | | 1,355 | |

| | 8 | | | Olin Corp. | | | 275 | |

| | 12 | | | Westlake Chemical Corp. | | | 1,023 | |

| | | | | | | | |

| | | | | | | 7,255 | |

| | | | | | | | |

| | | | Containers & Packaging — 1.6% | |

| | 9 | | | Avery Dennison Corp. | | | 1,006 | |

| | 8 | | | Crown Holdings, Inc. (a) | | | 470 | |

| | 32 | | | WestRock Co. | | | 1,951 | |

| | | | | | | | |

| | | | | | | 3,427 | |

| | | | | | | | |

| | | | Metals & Mining — 0.5% | |

| | 25 | | | Alcoa Corp. (a) | | | 1,211 | |

| | | | | | | | |

| | | | Total Materials | | | 11,893 | |

| | | | | | | | |

| | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Real Estate — 1.4% | |

| | | | Equity Real Estate Investment Trusts (REITs) — 1.4% | |

| | 6 | | | AvalonBay Communities, Inc. | | | 1,064 | |

| | 3 | | | Equity Residential | | | 223 | |

| | 3 | | | Extra Space Storage, Inc. | | | 225 | |

| | 2 | | | Public Storage | | | 418 | |

| | 16 | | | Vornado Realty Trust | | | 1,201 | |

| | | | | | | | |

| | | | Total Real Estate | | | 3,131 | |

| | | | | | | | |

| | | | Telecommunication Services — 0.5% | |

| | | | Wireless Telecommunication Services — 0.5% | |

| | 17 | | | T-Mobile US, Inc. (a) (j) | | | 1,038 | |

| | | | | | | | |

| | | | Utilities — 7.0% | |

| | | | Electric Utilities — 5.8% | |

| | 17 | | | American Electric Power Co., Inc. | | | 1,282 | |

| | 41 | | | Duke Energy Corp. | | | 3,580 | |

| | 23 | | | Exelon Corp. | | | 929 | |

| | 21 | | | NextEra Energy, Inc. (j) | | | 3,281 | |

| | 14 | | | PG&E Corp. | | | 782 | |

| | 56 | | | Xcel Energy, Inc. | | | 2,769 | |

| | | | | | | | |

| | | | | | | 12,623 | |

| | | | | | | | |

| | | | Multi-Utilities — 1.2% | |

| | 24 | | | CMS Energy Corp. (j) | | | 1,178 | |

| | 58 | | | NiSource, Inc. | | | 1,538 | |

| | | | | | | | |

| | | | | | | 2,716 | |

| | | | | | | | |

| | | | Total Utilities | | | 15,339 | |

| | | | | | | | |

| | | | Total Common Stocks

(Cost $132,529) | | | 180,651 | |

| | | | | | | | |

| | Short-Term Investments — 17.3% | |

| | | | Investment Company — 17.2% | |

| | 37,753 | | | JPMorgan U.S. Government Money Market Fund, Institutional Class Shares, 0.92% (b) (l)

(Cost $37,753) | | | 37,753 | |

| | | | | | | | |

| | |

PRINCIPAL

AMOUNT($) | | | | | | |

| | | | U.S. Treasury Obligation — 0.1% | |

| | 318 | | | U.S. Treasury Bills, 0.97%, 03/01/2018 (k) (n)

(Cost $317) | | | 317 | |

| | | | | | | | |

| | | | Total Short-Term Investments

(Cost $38,070) | | | 38,070 | |

| | | | | | | | |

| | | | Total Investments — 99.6%

(Cost $170,599) | | | 218,721 | |

| | | | Other Assets in Excess of

Liabilities — 0.4% | | | 810 | |

| | | | | | | | |

| | | | NET ASSETS — 100.0% | | $ | 219,531 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 14 | | | | J.P. MORGAN SPECIALTY FUNDS | | OCTOBER 31, 2017 |

| | | | | | | | |

| | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Short Positions — 80.0% | |

| | Common Stocks — 80.0% | |

| | | | Consumer Discretionary — 13.2% | |

| | | | Auto Components — 0.2% | |

| | 4 | | | Autoliv, Inc., (Sweden) | | | 437 | |

| | | | | | | | |

| | | | Automobiles — 0.9% | |

| | 40 | | | General Motors Co. | | | 1,703 | |

| | 5 | | | Harley-Davidson, Inc. | | | 217 | |

| | | | | | | | |

| | | | | | | 1,920 | |

| | | | | | | | |

| | | | Hotels, Restaurants & Leisure — 1.9% | |

| | 14 | | | Aramark | | | 593 | |

| | 8 | | | Bloomin’ Brands, Inc. | | | 148 | |

| | 13 | | | Brinker International, Inc. | | | 408 | |

| | 8 | | | Carnival Corp. | | | 550 | |

| | 6 | | | Chipotle Mexican Grill, Inc. (a) | | | 1,607 | |

| | 5 | | | Hyatt Hotels Corp., Class A (a) | | | 332 | |

| | 12 | | | Starbucks Corp. | | | 662 | |

| | | | | | | | |

| | | | | | | 4,300 | |

| | | | | | | | |

| | | | Household Durables — 0.1% | |

| | 6 | | | Garmin Ltd. | | | 333 | |

| | | | | | | | |

| | | | Internet & Direct Marketing Retail — 1.0% | |

| | 3 | | | Expedia, Inc. | | | 396 | |

| | 6 | | | Netflix, Inc. (a) | | | 1,172 | |

| | — | (h) | | Priceline Group, Inc. (The) (a) | | | 555 | |

| | | | | | | | |

| | | | | | | 2,123 | |

| | | | | | | | |

| | | | Leisure Products — 0.7% | |

| | 5 | | | Hasbro, Inc. | | | 472 | |

| | 69 | | | Mattel, Inc. | | | 974 | |

| | | | | | | | |

| | | | | | | 1,446 | |

| | | | | | | | |

| | | | Media — 4.1% | |

| | 21 | | | AMC Networks, Inc., Class A (a) | | | 1,045 | |

| | 5 | | | CBS Corp. (Non-Voting), Class B | | | 291 | |

| | 33 | | | Discovery Communications, Inc., Class A (a) | | | 626 | |

| | 48 | | | Interpublic Group of Cos., Inc. (The) | | | 930 | |

| | 161 | | | News Corp., Class A | | | 2,197 | |

| | 37 | | | Omnicom Group, Inc. | | | 2,507 | |

| | 41 | | | Regal Entertainment Group, Class A | | | 671 | |

| | 10 | | | Scripps Networks Interactive, Inc., Class A | | | 808 | |

| | | | | | | | |

| | | | | | | 9,075 | |

| | | | | | | | |

| | | | Multiline Retail — 1.7% | |

| | 18 | | | Kohl’s Corp. | | | 763 | |

| | 12 | | | Nordstrom, Inc. | | | 490 | |

| | 41 | | | Target Corp. | | | 2,417 | |

| | | | | | | | |

| | | | | | | 3,670 | |

| | | | | | | | |

| | | | | | | | |

| | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Specialty Retail — 1.7% | |

| | 19 | | | Abercrombie & Fitch Co., Class A | | | 256 | |

| | 10 | | | Advance Auto Parts, Inc. | | | 790 | |

| | 17 | | | American Eagle Outfitters, Inc. | | | 215 | |

| | 104 | | | Ascena Retail Group, Inc. (a) | | | 202 | |

| | 4 | | | AutoNation, Inc. (a) | | | 209 | |

| | 49 | | | Bed Bath & Beyond, Inc. | | | 974 | |

| | 6 | | | Buckle, Inc. (The) | | | 91 | |

| | 28 | | | DSW, Inc., Class A | | | 534 | |

| | 43 | | | Express, Inc. (a) | | | 293 | |

| | 5 | | | L Brands, Inc. | | | 221 | |

| | | | | | | | |

| | | | | | | 3,785 | |

| | | | | | | | |

| | | | Textiles, Apparel & Luxury Goods — 0.9% | |

| | 29 | | | Hanesbrands, Inc. | | | 641 | |

| | 4 | | | Michael Kors Holdings Ltd. (a) | | | 210 | |

| | 5 | | | Ralph Lauren Corp. | | | 436 | |

| | 33 | | | Under Armour, Inc., Class A (a) | | | 410 | |

| | 17 | | | Under Armour, Inc., Class C (a) | | | 202 | |

| | | | | | | | |

| | | | | | | 1,899 | |

| | | | | | | | |

| | | | Total Consumer Discretionary | | | 28,988 | |

| | | | | | | | |

| | | | Consumer Staples — 5.2% | |

| | | | Food & Staples Retailing — 0.9% | |

| | 24 | | | CVS Health Corp. | | | 1,670 | |

| | 7 | | | Sysco Corp. | | | 382 | |

| | | | | | | | |

| | | | | | | 2,052 | |

| | | | | | | | |

| | | | Food Products — 1.1% | |

| | 45 | | | General Mills, Inc. | | | 2,358 | |

| | | | | | | | |

| | | | Household Products — 3.0% | |

| | 33 | | | Church & Dwight Co., Inc. | | | 1,510 | |

| | 20 | | | Clorox Co. (The) | | | 2,528 | |

| | 31 | | | Procter & Gamble Co. (The) | | | 2,691 | |

| | | | | | | | |

| | | | | | | 6,729 | |

| | | | | | | | |

| | | | Personal Products — 0.2% | |

| | 25 | | | Coty, Inc., Class A | | | 391 | |

| | | | | | | | |

| | | | Total Consumer Staples | | | 11,530 | |

| | | | | | | | |

| | | | Energy — 5.1% | |

| | | | Energy Equipment & Services — 1.7% | |

| | 16 | | | Helmerich & Payne, Inc. | | | 867 | |

| | 46 | | | Schlumberger Ltd. | | | 2,922 | |

| | | | | | | | |

| | | | | | | 3,789 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 15 | |

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2017 (continued)

(Amounts in thousands)

| | | | | | | | |

| | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Short Positions — continued | |

| | Common Stocks — continued | |

| | | | Oil, Gas & Consumable Fuels — 3.4% | |

| | 10 | | | Apache Corp. | | | 423 | |

| | 16 | | | ConocoPhillips | | | 834 | |

| | 7 | | | Enbridge, Inc., (Canada) | | | 272 | |

| | 61 | | | Exxon Mobil Corp. | | | 5,055 | |

| | 10 | | | Hess Corp. | | | 452 | |

| | 13 | | | Murphy Oil Corp. | | | 355 | |

| | | | | | | | |

| | | | | | | 7,391 | |

| | | | | | | | |

| | | | Total Energy | | | 11,180 | |

| | | | | | | | |

| | | | Financials — 12.3% | |

| | | | Banks — 5.3% | |

| | 19 | | | Associated Banc-Corp. | | | 489 | |

| | 23 | | | Bank of Hawaii Corp. | | | 1,899 | |

| | 19 | | | Commerce Bancshares, Inc. | | | 1,118 | |

| | 8 | | | Fifth Third Bancorp | | | 232 | |

| | 57 | | | First Hawaiian, Inc. | | | 1,654 | |

| | 31 | | | Fulton Financial Corp. | | | 565 | |

| | 4 | | | M&T Bank Corp. | | | 642 | |

| | 118 | | | People’s United Financial, Inc. | | | 2,197 | |

| | 7 | | | PNC Financial Services Group, Inc. (The) | | | 969 | |

| | 20 | | | US Bancorp | | | 1,067 | |

| | 17 | | | Webster Financial Corp. | | | 909 | |

| | | | | | | | |

| | | | | | | 11,741 | |

| | | | | | | | |

| | | | Capital Markets — 3.1% | |

| | 2 | | | BlackRock, Inc. | | | 805 | |

| | 5 | | | CME Group, Inc. | | | 723 | |

| | 13 | | | Federated Investors, Inc., Class B | | | 390 | |

| | 6 | | | Goldman Sachs Group, Inc. (The) | | | 1,567 | |

| | 23 | | | Invesco Ltd. | | | 838 | |

| | 15 | | | Nasdaq, Inc. | | | 1,075 | |

| | 12 | | | Northern Trust Corp. | | | 1,123 | |

| | 3 | | | T Rowe Price Group, Inc. | | | 246 | |

| | | | | | | | |

| | | | | | | 6,767 | |

| | | | | | | | |

| | | | Consumer Finance — 0.2% | |

| | 4 | | | Discover Financial Services | | | 284 | |

| | 7 | | | Synchrony Financial | | | 244 | |

| | | | | | | | |

| | | | | | | 528 | |

| | | | | | | | |

| | | | Insurance — 3.7% | |

| | 7 | | | Aflac, Inc. | | | 622 | |

| | 7 | | | Allstate Corp. (The) | | | 629 | |

| | 15 | | | Arch Capital Group Ltd. (a) | | | 1,533 | |

| | 12 | | | Principal Financial Group, Inc. | | | 809 | |

| | 14 | | | Progressive Corp. (The) | | | 696 | |

| | | | | | | | |

| | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Insurance — continued | | | | |

| | 16 | | | Torchmark Corp. | | | 1,344 | |

| | 10 | | | Travelers Cos., Inc. (The) | | | 1,269 | |

| | 17 | | | WR Berkley Corp. | | | 1,154 | |

| | | | | | | | |

| | | | | | | 8,056 | |

| | | | | | | | |

| | | | Total Financials | | | 27,092 | |

| | | | | | | | |

| | | | Health Care — 5.1% | |

| | | | Biotechnology — 1.8% | |

| | 28 | | | AbbVie, Inc. | | | 2,520 | |

| | 8 | | | Amgen, Inc. | | | 1,412 | |

| | | | | | | | |

| | | | | | | 3,932 | |

| | | | | | | | |

| | | | Health Care Equipment & Supplies — 1.0% | |

| | 1 | | | CR Bard, Inc. | | | 347 | |

| | 9 | | | Medtronic plc | | | 739 | |

| | 11 | | | Varian Medical Systems, Inc. (a) | | | 1,158 | |

| | | | | | | | |

| | | | | | | 2,244 | |

| | | | | | | | |

| | | | Health Care Providers & Services — 1.2% | |

| | 28 | | | Cardinal Health, Inc. | | | 1,709 | |

| | 14 | | | Express Scripts Holding Co. (a) | | | 877 | |

| | | | | | | | |

| | | | | | | 2,586 | |

| | | | | | | | |

| | | | Pharmaceuticals — 1.1% | |

| | 14 | | | Johnson & Johnson | | | 1,967 | |

| | 8 | | | Merck & Co., Inc. | | | 435 | |

| | | | | | | | |

| | | | | | | 2,402 | |

| | | | | | | | |

| | | | Total Health Care | | | 11,164 | |

| | | | | | | | |

| | | | Industrials — 11.3% | |

| | | | Aerospace & Defense — 2.5% | |

| | 12 | | | Boeing Co. (The) | | | 3,164 | |

| | 8 | | | Lockheed Martin Corp. | | | 2,405 | |

| | | | | | | | |

| | | | | | | 5,569 | |

| | | | | | | | |

| | | | Air Freight & Logistics — 1.4% | |

| | 8 | | | CH Robinson Worldwide, Inc. | | | 640 | |

| | 16 | | | Expeditors International of Washington, Inc. | | | 925 | |

| | 13 | | | United Parcel Service, Inc., Class B | | | 1,506 | |

| | | | | | | | |

| | | | | | | 3,071 | |

| | | | | | | | |

| | | | Building Products — 0.6% | |

| | 33 | | | Johnson Controls International plc | | | 1,347 | |

| | | | | | | | |

| | | | Electrical Equipment — 0.5% | |

| | 17 | | | Emerson Electric Co. | | | 1,069 | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | |

| | | |

| 16 | | | | J.P. MORGAN SPECIALTY FUNDS | | OCTOBER 31, 2017 |

| | | | | | | | |

| | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Short Positions — continued | |

| | Common Stocks — continued | |

| | | | Industrial Conglomerates — 1.7% | |

| | 12 | | | 3M Co. | | | 2,672 | |

| | 52 | | | General Electric Co. | | | 1,055 | |

| | | | | | | | |

| | | | | | | 3,727 | |

| | | | | | | | |

| | | | Machinery — 0.4% | |

| | 9 | | | Donaldson Co., Inc. | | | 438 | |

| | 3 | | | Illinois Tool Works, Inc. | | | 482 | |

| | | | | | | | |

| | | | | | | 920 | |

| | | | | | | | |

| | | | Professional Services — 0.4% | |

| | 5 | | | Equifax, Inc. | | | 533 | |

| | 6 | | | Nielsen Holdings plc | | | 232 | |

| | | | | | | | |

| | | | | | | 765 | |

| | | | | | | | |

| | | | Road & Rail — 3.1% | |

| | 6 | | | Canadian National Railway Co., (Canada) | | | 520 | |

| | 154 | | | Heartland Express, Inc. | | | 3,277 | |

| | 34 | | | Knight-Swift Transportation Holdings, Inc. (a) | | | 1,420 | |

| | 43 | | | Werner Enterprises, Inc. | | | 1,536 | |

| | | | | | | | |

| | | | | | | 6,753 | |

| | | | | | | | |

| | | | Trading Companies & Distributors — 0.7% | |

| | 19 | | | Air Lease Corp. | | | 808 | |

| | 4 | | | WW Grainger, Inc. | | | 805 | |

| | | | | | | | |

| | | | | | | 1,613 | |

| | | | | | | | |

| | | | Total Industrials | | | 24,834 | |

| | | | | | | | |

| | | | Information Technology — 11.6% | |

| | | | Communications Equipment — 1.8% | |

| | 75 | | | Cisco Systems, Inc. | | | 2,547 | |

| | 53 | | | Juniper Networks, Inc. | | | 1,314 | |

| | | | | | | | |

| | | | | | | 3,861 | |

| | | | | | | | |

| | | | Electronic Equipment, Instruments & Components — 0.3% | |

| | 6 | | | Amphenol Corp., Class A | | | 544 | |

| | | | | | | | |

| | | | Internet Software & Services — 1.0% | |

| | 36 | | | eBay, Inc. (a) | | | 1,368 | |

| | 43 | | | Twitter, Inc. (a) | | | 890 | |

| | | | | | | | |

| | | | | | | 2,258 | |

| | | | | | | | |

| | | | IT Services — 1.4% | |

| | 12 | | | First Data Corp., Class A (a) | | | 219 | |

| | 3 | | | Fiserv, Inc. (a) | | | 326 | |

| | 3 | | | Jack Henry & Associates, Inc. | | | 340 | |

| | 8 | | | Mastercard, Inc., Class A | | | 1,247 | |

| | 14 | | | Paychex, Inc. | | | 918 | |

| | | | | | | | |

| | | | | | | 3,050 | |

| | | | | | | | |

| | | | | | | | |

| | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 5.1% | |

| | 18 | | | Applied Materials, Inc. | | | 1,020 | |

| | 89 | | | Intel Corp. | | | 4,065 | |

| | 2 | | | KLA-Tencor Corp. | | | 220 | |

| | 4 | | | Lam Research Corp. | | | 761 | |

| | 28 | | | QUALCOMM, Inc. | | | 1,411 | |

| | 3 | | | Skyworks Solutions, Inc. | | | 288 | |

| | 52 | | | Taiwan Semiconductor Manufacturing Co. Ltd., (Taiwan), ADR | | | 2,186 | |

| | 16 | | | Xilinx, Inc. | | | 1,211 | |

| | | | | | | | |

| | | | | | | 11,162 | |

| | | | | | | | |

| | | | Software — 0.7% | |

| | 18 | | | Oracle Corp. | | | 905 | |

| | 7 | | | salesforce.com, Inc. (a) | | | 685 | |

| | | | | | | | |

| | | | | | | 1,590 | |

| | | | | | | | |

| | | | Technology Hardware, Storage & Peripherals — 1.3% | |

| | 11 | | | NetApp, Inc. | | | 479 | |

| | 59 | | | Seagate Technology plc | | | 2,171 | |

| | 3 | | | Western Digital Corp. | | | 271 | |

| | | | | | | | |

| | | | | | | 2,921 | |

| | | | | | | | |

| | | | Total Information Technology | | | 25,386 | |

| | | | | | | | |

| | | | Materials — 5.1% | |

| | | | Chemicals — 3.4% | |

| | 8 | | | Air Products & Chemicals, Inc. | | | 1,268 | |

| | 9 | | | Ecolab, Inc. | | | 1,117 | |

| | 43 | | | LyondellBasell Industries NV, Class A | | | 4,426 | |

| | 4 | | | Praxair, Inc. | | | 647 | |

| | | | | | | | |

| | | | | | | 7,458 | |

| | | | | | | | |

| | | | Containers & Packaging — 0.7% | |

| | 4 | | | AptarGroup, Inc. | | | 331 | |

| | 10 | | | Sealed Air Corp. | | | 429 | |

| | 12 | | | Sonoco Products Co. | | | 637 | |

| | | | | | | | |

| | | | | | | 1,397 | |

| | | | | | | | |

| | | | Metals & Mining — 0.4% | |

| | 14 | | | Compass Minerals International, Inc. | | | 949 | |

| | | | | | | | |

| | | | Paper & Forest Products — 0.6% | |

| | 28 | | | Domtar Corp. | | | 1,318 | |

| | | | | | | | |

| | | | Total Materials | | | 11,122 | |

| | | | | | | | |

| | | | Real Estate — 1.9% | |

| | | | Equity Real Estate Investment Trusts (REITs) — 1.9% | |

| | 28 | | | Apple Hospitality REIT, Inc. | | | 533 | |

| | 2 | | | Camden Property Trust | | | 215 | |

SEE NOTES TO FINANCIAL STATEMENTS.

| | | | | | | | |

| | | |

| OCTOBER 31, 2017 | | J.P. MORGAN SPECIALTY FUNDS | | | | | 17 | |

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF OCTOBER 31, 2017 (continued)

(Amounts in thousands, except number of Futures contracts)

| | | | | | | | |

| | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | Short Positions — continued | |

| | Common Stocks — continued | |

| | | | Equity Real Estate Investment Trusts (REITs) — continued | |

| | 32 | | | CBL & Associates Properties, Inc. | | | 254 | |

| | 10 | | | GGP, Inc. | | | 186 | |

| | 25 | | | Host Hotels & Resorts, Inc. | | | 485 | |

| | 5 | | | Macerich Co. (The) | | | 296 | |

| | 16 | | | Pennsylvania REIT | | | 155 | |

| | 3 | | | Simon Property Group, Inc. | | | 534 | |

| | 6 | | | SL Green Realty Corp. | | | 526 | |

| | 4 | | | Taubman Centers, Inc. | | | 174 | |

| | 33 | | | Washington Prime Group, Inc. | | | 262 | |

| | 8 | | | Welltower, Inc. | | | 514 | |

| | | | | | | | |

| | | | Total Real Estate | | | 4,134 | |

| | | | | | | | |

| | | | Telecommunication Services — 1.7% | |

| | | | Diversified Telecommunication Services — 1.6% | |

| | 80 | | | AT&T, Inc. | | | 2,707 | |

| | 18 | | | Verizon Communications, Inc. | | | 862 | |

| | | | | | | | |

| | | | | | | 3,569 | |

| | | | | | | | |

| | | | Wireless Telecommunication Services — 0.1% | |

| | 31 | | | Sprint Corp. (a) | | | 201 | |

| | | | | | | | |

| | | | Total Telecommunication Services | | | 3,770 | |

| | | | | | | | |

| | | | | | | | |

| | |

| SHARES | | | SECURITY DESCRIPTION | | VALUE($) | |

| | | | | | | | |

| | | | | | | | |

| | | | Utilities — 7.5% | |

| | | | Electric Utilities — 2.8% | |

| | 10 | | | Eversource Energy | | | 648 | |

| | 30 | | | PPL Corp. | | | 1,123 | |

| | 83 | | | Southern Co. (The) | | | 4,315 | |

| | | | | | | | |

| | | | | | | 6,086 | |

| | | | | | | | |

| | | | Gas Utilities — 0.3% | |

| | 6 | | | National Fuel Gas Co. | | | 349 | |

| | 9 | | | UGI Corp. | | | 435 | |

| | | | | | | | |

| | | | | | | 784 | |

| | | | | | | | |

| | | | Multi-Utilities — 4.4% | |

| | 6 | | | Ameren Corp. | | | 341 | |