UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

SEMI-ANNUAL SHAREHOLDER REPORT | April 30, 2024 (Unaudited)

JPMorgan Research Market Neutral Fund

Class A Shares/Ticker: JMNAX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Research Market Neutral Fund for the period of November 1, 2023 to April 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment* | Costs paid as a percentage

of a $10,000 investment** |

JPMorgan Research Market Neutral Fund

(Class A Shares) | $148 | 2.81% |

| * | This charge is annualized. |

| ** | Includes dividend expense on short sales. |

| Fund net assets after future share reacquisition adjustment (000's) | $254,063 | |

| Total number of portfolio holdings | $328 | |

| Portfolio turnover rate | $112 | %* |

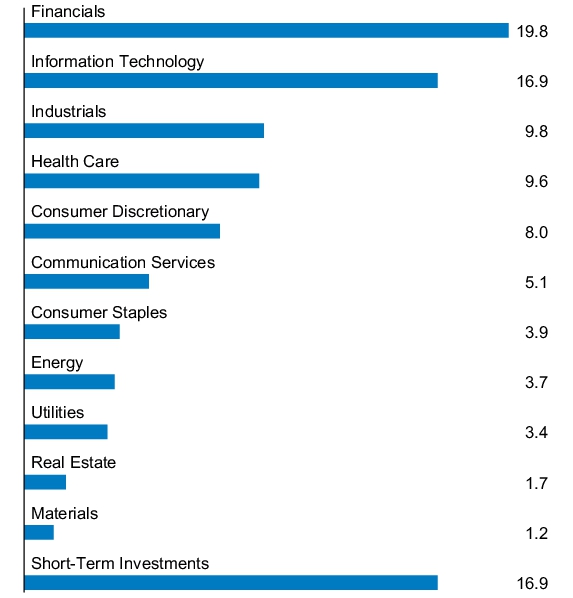

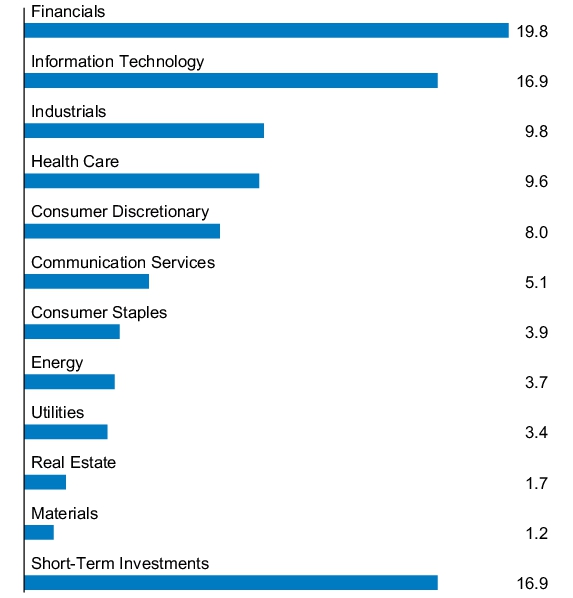

PORTFOLIO COMPOSITION - LONG

(% of Total Investments)

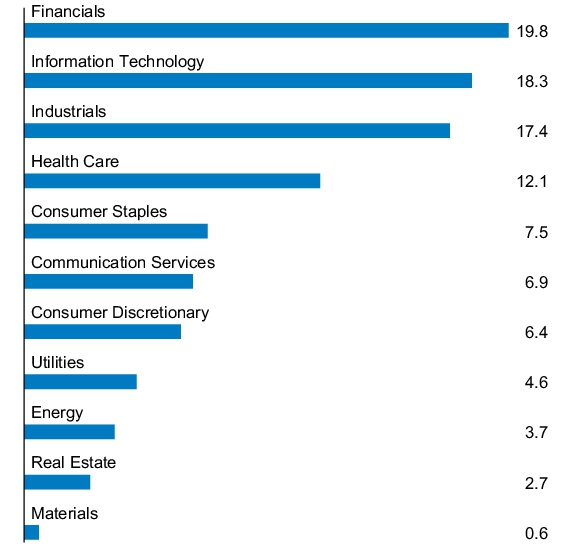

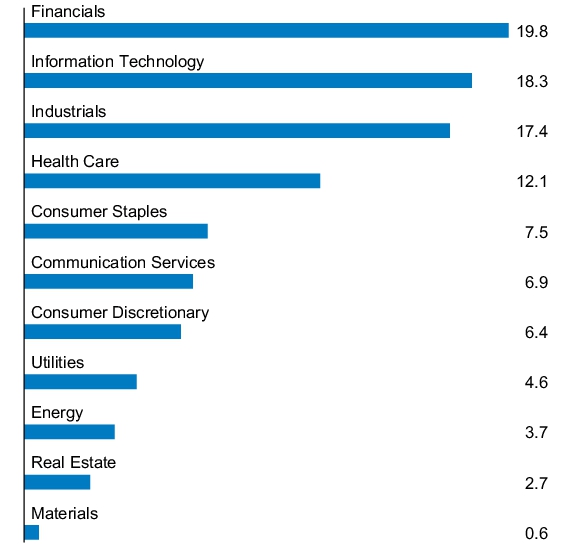

PORTFOLIO COMPOSITION - SHORT

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | April 30, 2024 (Unaudited)

JPMorgan Research Market Neutral Fund

Class C Shares/Ticker: JMNCX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Research Market Neutral Fund for the period of November 1, 2023 to April 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment* | Costs paid as a percentage

of a $10,000 investment** |

JPMorgan Research Market Neutral Fund

(Class C Shares) | $173 | 3.28% |

| * | This charge is annualized. |

| ** | Includes dividend expense on short sales. |

| Fund net assets after future share reacquisition adjustment (000's) | $254,063 | |

| Total number of portfolio holdings | $328 | |

| Portfolio turnover rate | $112 | %* |

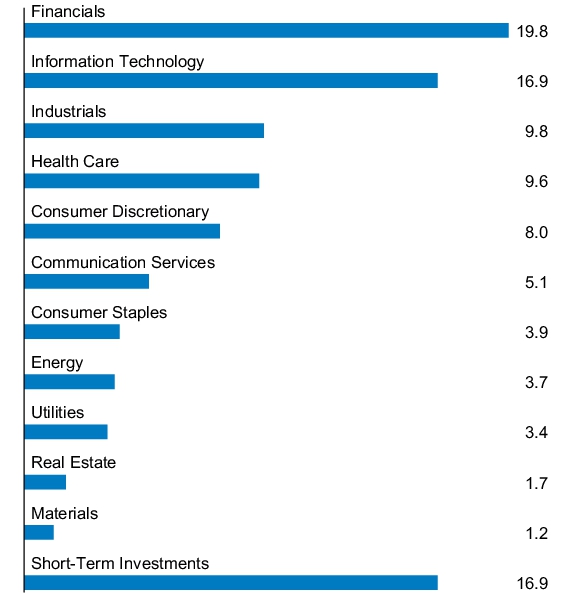

PORTFOLIO COMPOSITION - LONG

(% of Total Investments)

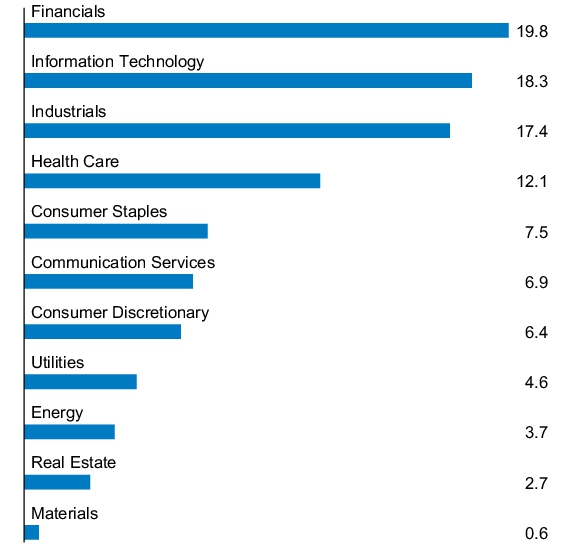

PORTFOLIO COMPOSITION - SHORT

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

SEMI-ANNUAL SHAREHOLDER REPORT | April 30, 2024 (Unaudited)

JPMorgan Research Market Neutral Fund

Class I Shares/Ticker: JMNSX

SEMI-ANNUAL SHAREHOLDER REPORT

This semi-annual shareholder report contains important information about the JPMorgan Research Market Neutral Fund for the period of November 1, 2023 to April 30, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111, by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment* | Costs paid as a percentage

of a $10,000 investment** |

JPMorgan Research Market Neutral Fund

(Class I Shares) | $134 | 2.55% |

| * | This charge is annualized. |

| ** | Includes dividend expense on short sales. |

| Fund net assets after future share reacquisition adjustment (000's) | $254,063 | |

| Total number of portfolio holdings | $328 | |

| Portfolio turnover rate | $112 | %* |

PORTFOLIO COMPOSITION - LONG

(% of Total Investments)

PORTFOLIO COMPOSITION - SHORT

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ITEM 2. CODE OF ETHICS.

Not applicable to a semi-annual report.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable to a semi-annual report.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable to a semi-annual report.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to a semi-annual report.

ITEM 6. INVESTMENTS.

File Schedule I – Investments in securities of unaffiliated issuers as of the close of the reporting period as set forth in Section 210.12-12 of Regulation S-X, unless the schedule is included as part of the report to shareholders filed under Item 7 of this Form.

Included in Item 1.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN-END MANAGEMENT INVESTMENT COMPANIES

Semi-Annual Report

J.P. Morgan Specialty Funds

April 30, 2024 (Unaudited)

JPMorgan Research Market Neutral Fund |

CONTENTS

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Fund or the securities markets.

Prospective investors should refer to the Fund's prospectuses for a discussion of the Fund's investment objectives, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Fund, including management fees and other expenses. Please read it carefully before investing.

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF April 30, 2024 (Unaudited)

| | |

|

|

Aerospace & Defense — 2.9% |

Howmet Aerospace, Inc. (a) | | |

| | |

| | |

| | |

Air Freight & Logistics — 0.1% |

United Parcel Service, Inc., Class B | | |

Automobile Components — 0.1% |

Mobileye Global, Inc., Class A (Israel) * | | |

|

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

BioMarin Pharmaceutical, Inc. * | | |

| | |

Neurocrine Biosciences, Inc. * | | |

Regeneron Pharmaceuticals, Inc. * | | |

Sarepta Therapeutics, Inc. * | | |

Vertex Pharmaceuticals, Inc. * (a) | | |

| | |

|

| | |

|

| | |

| | |

| | |

|

Ameriprise Financial, Inc. | | |

| | |

|

|

Capital Markets — continued |

Charles Schwab Corp. (The) | | |

Goldman Sachs Group, Inc. (The) | | |

| | |

Raymond James Financial, Inc. | | |

| | |

|

| | |

| | |

| | |

Communications Equipment — 0.3% |

| | |

Construction Materials — 0.9% |

Martin Marietta Materials, Inc. | | |

Consumer Staples Distribution & Retail — 0.9% |

| | |

| | |

| | |

Electric Utilities — 1.6% |

| | |

| | |

| | |

| | |

| | |

Electrical Equipment — 0.6% |

| | |

| | |

| | |

Electronic Equipment, Instruments & Components — 0.5% |

| | |

Keysight Technologies, Inc. * | | |

| | |

Energy Equipment & Services — 0.1% |

| | |

|

Take-Two Interactive Software, Inc. * | | |

Warner Music Group Corp., Class A | | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF April 30, 2024 (Unaudited) (continued)

| | |

Long Positions — continued |

Common Stocks — continued |

|

| | |

| | |

Fidelity National Information Services, Inc. | | |

| | |

Jack Henry & Associates, Inc. | | |

Mastercard, Inc., Class A (a) | | |

| | |

|

| | |

| | |

Mondelez International, Inc., Class A | | |

| | |

Ground Transportation — 1.5% |

| | |

| | |

| | |

Uber Technologies, Inc. * (a) | | |

| | |

| | |

Health Care Equipment & Supplies—2.2% |

Boston Scientific Corp. * | | |

| | |

Edwards Lifesciences Corp. * | | |

| | |

| | |

| | |

Health Care Providers & Services—0.7% |

| | |

UnitedHealth Group, Inc. (a) | | |

| | |

Health Care REITs — 0.0% ^ |

| | |

Hotels, Restaurants & Leisure — 3.0% |

Chipotle Mexican Grill, Inc. * | | |

| | |

Hilton Worldwide Holdings, Inc. | | |

Royal Caribbean Cruises Ltd. * | | |

| | |

| | |

| | |

|

|

Household Durables — 0.1% |

| | |

Household Products — 0.3% |

Church & Dwight Co., Inc. | | |

Independent Power and Renewable Electricity Producers — 0.2% |

| | |

Industrial Conglomerates — 0.4% |

Honeywell International, Inc. (a) | | |

|

| | |

|

| | |

| | |

| | |

| | |

Principal Financial Group, Inc. | | |

Progressive Corp. (The) (a) | | |

RenaissanceRe Holdings Ltd. (Bermuda) | | |

Travelers Cos., Inc. (The) | | |

| | |

Interactive Media & Services — 1.9% |

Alphabet, Inc., Class A * | | |

Meta Platforms, Inc., Class A (a) | | |

| | |

|

Cognizant Technology Solutions Corp., Class A | | |

| | |

Snowflake, Inc., Class A * | | |

| | |

Life Sciences Tools & Services — 1.5% |

| | |

Thermo Fisher Scientific, Inc. | | |

| | |

|

| | |

| | |

| | |

| | |

|

Charter Communications, Inc., Class A * | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

| | |

Long Positions — continued |

Common Stocks — continued |

|

| | |

Liberty Media Corp-Liberty SiriusXM, Class A * | | |

| | |

|

| | |

| | |

| | |

| | |

Public Service Enterprise Group, Inc. | | |

| | |

Oil, Gas & Consumable Fuels—3.4% |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Personal Care Products—0.6% |

Estee Lauder Cos., Inc. (The), Class A | | |

| | |

| | |

|

Bristol-Myers Squibb Co. (a) | | |

Elanco Animal Health, Inc. * | | |

| | |

Professional Services — 0.3% |

Booz Allen Hamilton Holding Corp. | | |

| | |

| | |

|

American Homes 4 Rent, Class A | | |

|

| | |

| | |

|

|

Semiconductors & Semiconductor Equipment—7.7% |

Advanced Micro Devices, Inc. * (a) | | |

| | |

ASML Holding NV (Registered), NYRS (Netherlands) | | |

| | |

Microchip Technology, Inc. | | |

Micron Technology, Inc. (a) | | |

| | |

NXP Semiconductors NV (China) (a) | | |

| | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR (Taiwan) | | |

Texas Instruments, Inc. (a) | | |

| | |

|

Crowdstrike Holdings, Inc., Class A * | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

Digital Realty Trust, Inc. | | |

| | |

|

| | |

| | |

Burlington Stores, Inc. * | | |

| | |

O'Reilly Automotive, Inc. * (a) | | |

| | |

Technology Hardware, Storage & Peripherals — 3.2% |

| | |

Hewlett Packard Enterprise Co. | | |

Seagate Technology Holdings plc | | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF April 30, 2024 (Unaudited) (continued)

| | |

Long Positions — continued |

Common Stocks — continued |

Trading Companies & Distributors — 0.3% |

| | |

| | |

| | |

Wireless Telecommunication Services — 0.4% |

| | |

Total Common Stocks

(Cost $162,224) | | |

| | |

Short-Term Investments—16.5% |

U.S. Treasury Obligations — 3.9% |

U.S. Treasury Bills 5.31%, 6/18/2024 (b)(Cost $9,930) | | |

| | |

Investment Companies—12.6% |

JPMorgan Prime Money Market Fund Class Institutional Shares, 5.33% (c) (d)(Cost $31,916) | | |

Total Short-Term Investments

(Cost $41,846) | | |

Total Long Positions

(Cost $204,070) | | |

|

|

Aerospace & Defense—(1.8)% |

| | |

Huntington Ingalls Industries, Inc. | | |

L3Harris Technologies, Inc. | | |

| | |

| | |

Air Freight & Logistics — (0.3)% |

Expeditors International of Washington, Inc. | | |

|

| | |

| | |

| | |

| | |

|

| | |

Huntington Bancshares, Inc. | | |

| | |

|

|

|

| | |

PNC Financial Services Group, Inc. (The) | | |

| | |

|

Brown-Forman Corp., Class B | | |

Molson Coors Beverage Co., Class B | | |

| | |

|

| | |

| | |

| | |

| | |

Building Products — (1.7)% |

| | |

Johnson Controls International plc | | |

Lennox International, Inc. | | |

| | |

|

Bank of New York Mellon Corp. (The) | | |

| | |

FactSet Research Systems, Inc. | | |

| | |

LPL Financial Holdings, Inc. | | |

| | |

| | |

| | |

T. Rowe Price Group, Inc. | | |

| | |

Commercial Services & Supplies — (0.1)% |

| | |

Communications Equipment — (1.7)% |

| | |

Consumer Finance — (0.7)% |

| | |

| | |

| | |

Consumer Staples Distribution & Retail—(3.1)% |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

| | |

Short Positions — continued |

Common Stocks — continued |

Consumer Staples Distribution & Retail — continued |

| | |

Walgreens Boots Alliance, Inc. | | |

| | |

| | |

Containers & Packaging — (0.5)% |

| | |

| | |

| | |

Diversified Telecommunication Services — (0.8)% |

| | |

Verizon Communications, Inc. | | |

| | |

Electric Utilities — (2.8)% |

American Electric Power Co., Inc. | | |

| | |

| | |

| | |

| | |

Pinnacle West Capital Corp. | | |

| | |

Electrical Equipment — (0.3)% |

| | |

Energy Equipment & Services — (0.4)% |

| | |

|

| | |

| | |

| | |

Financial Services — (3.3)% |

| | |

| | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

|

|

Food Products — continued |

| | |

| | |

| | |

|

| | |

Ground Transportation — (0.3)% |

| | |

JB Hunt Transport Services, Inc. | | |

Old Dominion Freight Line, Inc. | | |

| | |

| | |

Health Care Equipment & Supplies—(1.8)% |

| | |

| | |

Intuitive Surgical, Inc. * | | |

| | |

Zimmer Biomet Holdings, Inc. | | |

| | |

Health Care Providers & Services — (1.3)% |

| | |

| | |

| | |

| | |

| | |

Hotels, Restaurants & Leisure — (1.4)% |

| | |

| | |

| | |

| | |

Household Durables — (0.3)% |

| | |

Mohawk Industries, Inc. * | | |

| | |

| | |

| | |

Household Products — (0.3)% |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF April 30, 2024 (Unaudited) (continued)

| | |

Short Positions — continued |

Common Stocks — continued |

Household Products — continued |

| | |

| | |

| | |

Industrial Conglomerates — (0.9)% |

| | |

|

| | |

American International Group, Inc. | | |

Arch Capital Group Ltd. * | | |

| | |

Hartford Financial Services Group, Inc. (The) | | |

Kinsale Capital Group, Inc. | | |

Marsh & McLennan Cos., Inc. | | |

Ryan Specialty Holdings, Inc. | | |

| | |

| | |

Interactive Media & Services — (0.2)% |

Alphabet, Inc., Class C * | | |

|

| | |

| | |

| | |

International Business Machines Corp. | | |

| | |

Life Sciences Tools & Services — (1.7)% |

Agilent Technologies, Inc. | | |

| | |

| | |

| | |

| | |

|

| | |

| | |

| | |

Illinois Tool Works, Inc. | | |

| | |

Stanley Black & Decker, Inc. | | |

| | |

| | |

|

|

|

| | |

Interpublic Group of Cos., Inc. (The) | | |

| | |

Paramount Global, Class B | | |

| | |

|

Consolidated Edison, Inc. | | |

| | |

| | |

|

| | |

| | |

| | |

| | |

Oil, Gas & Consumable Fuels — (2.5)% |

| | |

| | |

| | |

| | |

| | |

| | |

Occidental Petroleum Corp. | | |

| | |

| | |

Williams Cos., Inc. (The) | | |

| | |

Passenger Airlines — (0.3)% |

American Airlines Group, Inc. * | | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

Professional Services — (4.0)% |

Automatic Data Processing, Inc. | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

| | |

Short Positions — continued |

Common Stocks — continued |

Professional Services — continued |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Essex Property Trust, Inc. | | |

|

| | |

Simon Property Group, Inc. | | |

| | |

Semiconductors & Semiconductor Equipment—(8.0)% |

| | |

| | |

| | |

| | |

| | |

Monolithic Power Systems, Inc. | | |

| | |

| | |

| | |

|

| | |

| | |

| | |

| | |

| | |

| | |

Specialized REITs — (0.3)% |

| | |

Specialty Retail — (1.1)% |

| | |

| | |

| | |

| | |

| | |

|

|

Technology Hardware, Storage & Peripherals — (0.9)% |

Dell Technologies, Inc., Class C | | |

| | |

| | |

| | |

Textiles, Apparel & Luxury Goods—(1.3)% |

| | |

On Holding AG (Switzerland), Class A * | | |

| | |

Trading Companies & Distributors — (0.6)% |

| | |

Total Common Stocks

(Proceeds $(189,816)) | | |

Total Short Positions

(Proceeds $(189,816)) | | |

Total Investments—21.6%

(Cost $14,254) | | |

Other Assets Less Liabilities—74.3% | | |

| | |

Future share reacquisition adjustment— 4.1% | | |

Net assets after future share reacquisition adjustment—100.0% | | |

Percentages indicated are based on net assets after future share reacquisition adjustment. |

Amounts presented as a dash ("-") represent amounts that round to less than a thousand. |

| |

| American Depositary Receipt |

| |

| Real Estate Investment Trust |

| Amount rounds to less than 0.1% of net assets. |

| Non-income producing security. | |

| All or a portion of this security is segregated as collateral for short sales. The total value of securities and cash segregated as collateral is $34,494 and $194,296, respectively. | |

| The rate shown is the effective yield as of April 30, 2024. | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

JPMorgan Research Market Neutral Fund

SCHEDULE OF PORTFOLIO INVESTMENTSAS OF April 30, 2024 (Unaudited) (continued)

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. | |

| The rate shown is the current yield as of April 30, 2024. | |

Futures contracts outstanding as of April 30, 2024 (amounts in thousands, except number of contracts):

| | | | | VALUE AND

UNREALIZED

APPRECIATION

(DEPRECIATION) ($) |

| | | | | |

| | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

STATEMENT OF ASSETS AND LIABILITIESAS OF April 30, 2024 (Unaudited)

(Amounts in thousands, except per share amounts)

| |

| |

Investments in non-affiliates, at value | |

Investments in affiliates, at value | |

Deposits at broker for futures contracts | |

Deposits at broker for securities sold short | |

| |

Investment securities sold | |

| |

Interest from non-affiliates | |

Dividends from non-affiliates | |

Dividends from affiliates | |

Variation margin on futures contracts | |

| |

| |

| |

| |

Securities sold short, at value | |

Dividend expense to non-affiliates on securities sold short | |

Investment securities purchased | |

| |

| |

| |

| |

| |

| |

Custodian and accounting fees | |

Trustees’ and Chief Compliance Officer’s fees | |

Due to shareholders upon reprocessing | |

| |

| |

| |

Future share reacquisition adjustment | |

Net Assets after future share reacquisition adjustment | |

| |

(a)

Amount rounds to less than one thousand.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

STATEMENT OF ASSETS AND LIABILITIESAS OF April 30, 2024 (Unaudited) (continued)

(Amounts in thousands, except per share amounts)

| |

| |

| |

Total distributable earnings (loss) | |

| |

Future share reacquisition adjustment | |

Net Assets after future share reacquisition adjustment | |

Net Assets after share reacquisition adjustment: | |

| |

| |

| |

| |

Outstanding units of beneficial interest (shares)

($0.0001 par value; unlimited number of shares authorized): | |

| |

| |

| |

| |

(after future share reacquisition adjustment) | |

Class A — Redemption price per share | |

Class C — Offering price per share (b) | |

Class I — Offering and redemption price per share | |

Class A maximum sales charge | |

Class A maximum public offering price per share

[net asset value per share/(100% – maximum sales charge)] | |

Cost of investments in non-affiliates | |

Cost of investments in affiliates | |

Proceeds from securities sold short | |

(a)

Per share amounts may not recalculate due to rounding of net assets and/or shares outstanding.

(b)

Redemption price for Class C Shares varies based upon length of time the shares are held.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

STATEMENT OF OPERATIONSFOR THE SIX MONTHS ENDED April 30, 2024 (Unaudited)

(Amounts in thousands)

| |

| |

Interest income from non-affiliates | |

Interest income from non-affiliates on securities sold short | |

Dividend income from non-affiliates | |

Dividend income from affiliates | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Custodian and accounting fees | |

Interest expense to affiliates | |

| |

Trustees’ and Chief Compliance Officer’s fees | |

Printing and mailing costs | |

Registration and filing fees | |

Transfer agency fees (See Note 2.H.) | |

Dividend expense to non-affiliates on securities sold short | |

| |

| |

| |

Less expense reimbursements | |

| |

Net investment income (loss) | |

(a)

Amount rounds to less than one thousand.

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

STATEMENT OF OPERATIONSFOR THE SIX MONTHS ENDED April 30, 2024 (Unaudited) (continued)

(Amounts in thousands)

| |

REALIZED/UNREALIZED GAINS (LOSSES): | |

Net realized gain (loss) on transactions from: | |

Investments in non-affiliates | |

Investments in affiliates | |

| |

| |

| |

Change in net unrealized appreciation/depreciation on: | |

Investments in non-affiliates | |

Investments in affiliates | |

| |

| |

Change in net unrealized appreciation/depreciation | |

Net realized/unrealized gains (losses) | |

Change in net assets resulting from operations | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

STATEMENTS OF CHANGES IN NET ASSETSFOR THE PERIODS INDICATED

(Amounts in thousands)

| JPMorgan

Research Market

Neutral Fund |

| Six Months Ended

April 30, 2024

(Unaudited) | Year Ended

October 31, 2023 |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | |

Net investment income (loss) | | |

| | |

Change in net unrealized appreciation/depreciation | | |

Change in net assets resulting from operations | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | |

| | |

| | |

| | |

Total distributions to shareholders | | |

| | |

Change in net assets resulting from capital transactions | | |

| | |

| | |

| | |

| | |

Future share reacquisition adjustment | | |

End of period after future share reacquisition adjustment | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

STATEMENTS OF CHANGES IN NET ASSETSFOR THE PERIODS INDICATED (continued)

(Amounts in thousands)

| JPMorgan

Research Market

Neutral Fund |

| Six Months Ended April 30, 2024

(Unaudited) | Year Ended October 31, 2023 |

| | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class A capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class C capital transactions | | |

| | |

Proceeds from shares issued | | |

| | |

| | |

Change in net assets resulting from Class I capital transactions | | |

Total change in net assets resulting from capital transactions | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

THIS PAGE IS INTENTIONALLY LEFT BLANK

FINANCIAL HIGHLIGHTSFOR THE PERIODS INDICATED

| Per share operating performance |

| | | |

| Net asset

value,

beginning

of period * | Net

investment

income

(loss)(b) | Net realized

and unrealized

gains

(losses) on

investments | Total from

investment

operations | | | |

JPMorgan Research Market Neutral Fund | | | | | | | |

| | | | | | | |

Six Months Ended April 30, 2024 (Unaudited) | | | | | | | |

Year Ended October 31, 2023 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2022 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2021 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2020 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2019 (as restated, See Note 8) | | | | | | | |

| | | | | | | |

Six Months Ended April 30, 2024 (Unaudited) | | | | | | | |

Year Ended October 31, 2023 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2022 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2021 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2020 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2019 (as restated, See Note 8) | | | | | | | |

| | | | | | | |

Six Months Ended April 30, 2024 (Unaudited) | | | | | | | |

Year Ended October 31, 2023 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2022 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2021 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2020 (as restated, See Note 8) | | | | | | | |

Year Ended October 31, 2019 (as restated, See Note 8) | | | | | | | |

|

| Net asset value per share has been calculated after future share reacquisition adjustment for the impacted periods. |

| Amount presented after future share reacquisition adjustment. |

| Annualized for periods less than one year, unless otherwise noted. |

| Calculated based upon average shares outstanding. |

| Not annualized for periods less than one year. |

| Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| Includes interest expense, if applicable, which is less than 0.005% unless otherwise noted. |

| |

| | October 31, 2023

(as restated,

See Note 8) | October 31, 2022

(as restated,

See Note 8) | October 31, 2021

(as restated,

See Note 8) | October 31, 2020

(as restated,

See Note 8) | October 31, 2019

(as restated,

See Note 8) |

Net expenses (excluding dividend and interest expense for securities sold short) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Expenses without waivers and reimbursements (excluding dividend and interest expense for securities sold short) | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

|

| Interest expense on securities sold short is 0.16%. |

| Amount rounds to less than $0.005. |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

| | |

| | | | Ratios to average net assets(a) |

Future

share

reacquisition

adjustment | Net asset

value,

end of

period * | Total return

(excludes

sales charge)(c)(d) | Net assets,

end of

period

(000's) ** | Net

expenses

(including dividend

expense for

securities sold

short)(e)(f) | Net

investment

income

(loss) | Expenses without

waivers and reimbursements

(including dividend

expense for

securities sold

short)(f) | Portfolio

turnover rate

(excluding

securities

sold short)(c) | Portfolio

turnover rate

(including

securities

sold short)(c) |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

SEE NOTES TO FINANCIAL STATEMENTS.

| J.P. Morgan Specialty Funds | |

NOTES TO FINANCIAL STATEMENTSAS OF April 30, 2024 (Unaudited)

(Dollar values in thousands)

1. Organization

JPMorgan Trust I (the “Trust”) was formed on November 12, 2004, as a Delaware statutory trust, pursuant to a Declaration of Trust dated November 5, 2004 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

The following is a separate fund of the Trust (the "Fund") covered by this report:

| | Diversification Classification |

JPMorgan Research Market Neutral Fund | Class A, Class C and Class I | |

The investment objective of the Fund is to seek to provide long-term capital appreciation from a broadly diversified portfolio of U.S. stocks while neutralizing the general risks associated with stock market investing.

Class A Shares generally provide for a front-end sales charge while Class C Shares provide for a contingent deferred sales charge ("CDSC"). No sales charges are assessed with respect to Class I Shares. Certain Class A Shares, for which front-end sales charges have been waived, may be subject to a CDSC as described in the Fund's prospectus. Class C Shares automatically convert to Class A Shares after eight years. All classes of shares have equal rights as to earnings, assets and voting privileges, except that each class may bear different transfer agency, distribution and service fees and each class has exclusive voting rights with respect to its distribution plan and shareholder servicing agreements.

J.P. Morgan Investment Management Inc. (“JPMIM”), an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan”), acts as adviser (the “Adviser”) and administrator (the “Administrator”) to the Fund.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 — Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect (i) the reported amounts of assets and liabilities, (ii) disclosure of contingent assets and liabilities at the date of the financial statements, and (iii) the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A. Valuation of Investments— Investments are valued in accordance with GAAP and the Fund's valuation policies set forth by, and under the supervision and responsibility of, the Board of Trustees of the Trust (the "Board"), which established the following approach to valuation, as described more fully below: (i) investments for which market quotations are readily available shall be valued at their market value and (ii) all other investments for which market quotations are not readily available shall be valued at their fair value as determined in good faith by the Board.

Under Section 2(a)(41) of the 1940 Act, the Board is required to determine fair value for securities that do not have readily available market quotations. Under SEC Rule 2a-5 (Good Faith Determinations of Fair Value), the Board may designate the performance of these fair valuation determinations to a valuation designee. The Board has designated the Adviser as the “Valuation Designee” to perform fair valuation determinations for the Fund on behalf of the Board subject to appropriate oversight by the Board. The Adviser, as Valuation Designee, leverages the J.P. Morgan Asset Management Americas Valuation Committee (“AVC”) to help oversee and carry out the policies for the valuation of investments held in the Fund. The Adviser, as Valuation Designee, remains responsible for the valuation determinations.

This oversight by the AVC includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight including, but not limited to, consideration of macro or security specific events, market events, and pricing vendor and broker due diligence. The Administrator is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and, at least on a quarterly basis, with the AVC and the Board.

Equities and other exchange-traded instruments are valued at the last sale price or official market closing price on the primary exchange on which the instrument is traded before the NAV of the Fund is calculated on a valuation date.

Investments in open-end investment companies (“Underlying Funds”) are valued at each Underlying Fund’s NAV per share as of the report date.

Futures contracts are generally valued on the basis of available market quotations.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer-related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the valuation of the Fund's investments are summarized into the three broad levels listed below.

•

Level 1 — Unadjusted inputs using quoted prices in active markets for identical investments.

| J.P. Morgan Specialty Funds | |

•

Level 2 — Other significant observable inputs including, but not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risk, etc.) or other market corroborated inputs.

•

Level 3 — Significant inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Fund's assumptions in determining the fair value of investments).

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing instruments are not necessarily an indication of the risk associated with investing in those instruments.

The following table represents each valuation input as presented on the Schedule of Portfolio Investments ("SOI"):

| | | | |

| | Level 2

Other significant

observable inputs | Level 3

Significant

unobservable inputs | |

Investments in Securities | | | | |

| | | | |

| | | | |

| | | | |

U.S. Treasury Obligations | | | | |

Total Short-Term Investments | | | | |

Total Investments in Securities | | | | |

| | | | |

| | | | |

Total Liabilities for Securities Sold Short | | | | |

Appreciation in Other Financial Instruments | | | | |

| | | | |

B. Restricted Securities— Certain securities held by the Fund may be subject to legal or contractual restrictions on resale. Restricted securities generally are resold in transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). Disposal of these securities may involve time-consuming negotiations and expense. Prompt sale at the current valuation may be difficult and could adversely affect the NAVs of the Fund.

As of April 30, 2024, the Fund had no investments in restricted securities other than securities sold to the Fund under Rule 144A and/or Regulation S under the Securities Act.

C. Securities Lending — The Fund is authorized to engage in securities lending in order to generate additional income. The Fund is able to lend to approved borrowers. Citibank N.A. (“Citibank”) serves as lending agent for the Fund, pursuant to a Securities Lending Agency Agreement (the “Securities Lending Agency Agreement”). Securities loaned are collateralized by cash equal to at least 100% of the market value plus accrued interest on the securities lent, which is invested in an affiliated money market fund. The Fund retains the interest earned on cash collateral investments but is required to pay the borrower a rebate for the use of the cash collateral. In cases where the lent security is of high value to borrowers, there may be a negative rebate (i.e., a net payment from the borrower to the Fund). Upon termination of a loan, the Fund is required to return to the borrower an amount equal to the cash collateral, plus any rebate owed to the borrowers. The remaining maturities of the securities lending transactions are considered overnight and continuous. Loans are subject to termination by the Fund or the borrower at any time.

The net income earned on the securities lending (after payment of rebates and Citibank’s fee) is included on the Statement of Operations as Income from securities lending (net). The Fund also receives payments from the borrower during the period of the loan, equivalent to dividends and interest earned on the securities loaned, which are recorded as Dividend or Interest income, respectively, on the Statement of Operations.

Under the Securities Lending Agency Agreement, Citibank marks to market the loaned securities on a daily basis. In the event the cash received from the borrower is less than 102% of the value of the loaned securities (105% for loans of non-U.S. securities), Citibank requests additional cash from the borrower so as to maintain a collateralization level of at least 102% of the value of the loaned securities plus accrued interest (105% for loans of non-U.S. securities), subject to certain de minimis amounts.

The value of securities out on loan is recorded as an asset on the Statement of Assets and Liabilities. The value of the cash collateral received is recorded as a liability on the Statement of Assets and Liabilities and details of collateral investments are disclosed on the SOI.

The Fund bears the risk of loss associated with the collateral investments and is not entitled to additional collateral from the borrower to cover any such losses. To the extent that the value of the collateral investments declines below the amount owed to a borrower, the Fund may incur losses that

| J.P. Morgan Specialty Funds | |

NOTES TO FINANCIAL STATEMENTSAS OF April 30, 2024 (Unaudited) (continued)

(Dollar values in thousands)

exceed the amount it earned on lending the security. Upon termination of a loan, the Fund may use leverage (borrow money) to repay the borrower for cash collateral posted if the Adviser does not believe that it is prudent to sell the collateral investments to fund the payment of this liability. Securities lending activity is subject to master netting arrangements.

Securities lending also involves counterparty risks, including the risk that the loaned securities may not be returned in a timely manner or at all. Subject to certain conditions, Citibank has agreed to indemnify the Fund from losses resulting from a borrower’s failure to return a loaned security.

The Fund did not lend out any securities during the six months ended April 30, 2024.

D. Investment Transactions with Affiliates— The Fund invested in an Underlying Fund advised by the Adviser. An issuer which is under common control with the Fund may be considered an affiliate. For the purposes of the financial statements, the Fund assumes the issuer listed in the table below to be an affiliated issuer. The Underlying Fund's distributions may be reinvested into the Underlying Fund. Reinvestment amounts are included in the purchases at cost amounts in the table below.

|

For the six months ended April 30, 2024 |

| | | | | Change in

Unrealized

Appreciation/

(Depreciation) | | | | Capital Gain

Distributions |

JPMorgan Prime Money Market Fund Class Institutional Shares, 5.33% (a) (b) | | | | | | | | | |

|

| Investment in an affiliated fund, which is registered under the Investment Company Act of 1940, as amended, and is advised by J.P. Morgan Investment Management Inc. |

| The rate shown is the current yield as of April 30, 2024. |

E. Futures Contracts—The Fund used index futures contracts to gain or reduce exposure to the stock market, or maintain liquidity or minimize transaction costs. The Fund also used index futures contracts to more effectively manage the long and short equity exposures in the portfolio. The Fund also purchased futures contracts to invest incoming cash in the market or sold futures in response to cash outflows, thereby simulating an invested position in the underlying index while maintaining a cash balance for liquidity.

Futures contracts provide for the delayed delivery of the underlying instrument at a fixed price or are settled for a cash amount based on the change in the value of the underlying instrument at a specific date in the future. Upon entering into a futures contract, the Fund is required to deposit with the broker, cash or securities in an amount equal to a certain percentage of the contract amount, which is referred to as the initial margin deposit. Subsequent payments, referred to as variation margin, are made or received by the Fund periodically and are based on changes in the market value of open futures contracts. Changes in the market value of open futures contracts are recorded as Change in net unrealized appreciation/depreciation on futures contracts on the Statement of Operations. Realized gains or losses, representing the difference between the value of the contract at the time it was opened and the value at the time it was closed, are reported on the Statement of Operations at the closing or expiration of the futures contract. Securities deposited as initial margin are designated on the SOI, while cash deposited, which is considered restricted, is recorded on the Statement of Assets and Liabilities. A receivable from and/or a payable to brokers for the daily variation margin is also recorded on the Statement of Assets and Liabilities.

The use of futures contracts exposes the Fund to equity price risk. The Fund may be subject to the risk that the change in the value of the futures contract may not correlate perfectly with the underlying instrument. Use of long futures contracts subjects the Fund to risk of loss in excess of the amounts shown on the Statement of Assets and Liabilities, up to the notional amount of the futures contracts. Use of short futures contracts subjects the Fund to unlimited risk of loss. The Fund may enter into futures contracts only on exchanges or boards of trade. The exchange or board of trade acts as the counterparty to each futures transaction; therefore, the Fund's credit risk is limited to failure of the exchange or board of trade. Under some circumstances, futures exchanges may establish daily limits on the amount that the price of a futures contract can vary from the previous day’s settlement price, which could effectively prevent liquidation of positions.

The Fund's futures contracts are not subject to master netting arrangements (the right to close out all transactions traded with a counterparty and net amounts owed or due across transactions).

The table below discloses the volume of the futures contracts activity during the six months ended April 30, 2024:

| |

| |

Average Notional Balance Short | |

Ending Notional Balance Short | |

| J.P. Morgan Specialty Funds | |

F. Short Sales— The Fund engaged in short sales as part of its normal investment activities. In a short sale, the Fund sells securities it does not own in anticipation of a decline in the market value of those securities. In order to deliver securities to the purchaser, the Fund borrows securities from a broker. To close out a short position, the Fund delivers the same securities to the broker.

The Fund is required to pledge cash or securities to the broker as collateral for the securities sold short. Collateral requirements are calculated daily based on the current market value of the short positions. Cash collateral deposited with the broker is recorded as Deposits at broker for securities sold short, while cash collateral deposited at the Fund's custodian for the benefit of the broker is recorded as Restricted cash for securities sold short on the Statement of Assets and Liabilities. Securities segregated as collateral are denoted on the SOI. The Fund may receive or pay the net of the following amounts: (i) a portion of the income from the investment of cash collateral; (ii) the broker’s fee on the borrowed securities (calculated daily based upon the market value of each borrowed security and a variable rate that is dependent on availability of the security); and (iii) a financing charge for the difference between the market value of the short position and cash collateral deposited with the broker. The net amounts of income or fees are included as interest income or interest expense on securities sold short on the Statement of Operations.

The Fund is obligated to pay the broker dividends declared on short positions when a position is open on the record date. Dividends on short positions are reported on ex-dividend date on the Statement of Operations as Dividend expense to non-affiliates on securities sold short. The Fund is obligated to pay the broker interest accrued on short positions while the position is outstanding. Interest expense on short positions is reported as Interest expense to non-affiliates on securities sold short on the Statement of Operations. Liabilities for securities sold short are reported at market value on the Statement of Assets and Liabilities and the change in market value is recorded as Change in net unrealized appreciation/depreciation on the Statement of Operations. Short sale transactions may result in unlimited losses as the security’s price increases and the short position loses value. There is no upward limit on the price a borrowed security could attain. The Fund is also subject to risk of loss if the broker were to fail to perform its obligations under the contractual terms.

The Fund will record a realized loss if the price of the borrowed security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund will record a realized gain if the price of the borrowed security declines between those dates.

As of April 30, 2024, The Fund had outstanding short sales as listed on its SOI.

G. Security Transactions and Investment Income— Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Securities gains and losses are calculated on a specifically identified cost basis. Interest income and interest expense on securities sold short, if any, is determined on the basis of coupon interest accrued using the effective interest method, which adjusts for amortization of premiums and accretion of discounts. Dividend income, net of foreign taxes withheld, if any, and dividend expense on securities sold short are recorded on the ex-dividend date or when the Fund first learns of the dividend.

To the extent such information is publicly available, the Fund records distributions received in excess of income earned from underlying investments as a reduction of cost of investments and/or realized gain. Such amounts are based on estimates if actual amounts are not available and actual amounts of income, realized gain and return of capital may differ from the estimated amounts. The Fund adjusts the estimated amounts of the components of distributions (and consequently its net investment income) as necessary, once the issuers provide information about the actual composition of the distributions.

H. Allocation of Income and Expenses— Expenses directly attributable to the Fund are charged directly to the Fund, while the expenses attributable to more than one fund of the Trust are allocated among the applicable funds. Investment income, realized and unrealized gains and losses and expenses, other than class-specific expenses, are allocated daily to each class of shares based upon the proportion of net assets of each class at the beginning of each day.

Transfer agency fees are class-specific expenses. The amount of the transfer agency fees charged to each share class of the Fund for the six months ended April 30, 2024 are as follows:

|

| Amount rounds to less than one thousand. |

| J.P. Morgan Specialty Funds | |

NOTES TO FINANCIAL STATEMENTSAS OF April 30, 2024 (Unaudited) (continued)

(Dollar values in thousands)

I. Federal Income Taxes— The Fund is treated as a separate taxable entity for Federal income tax purposes. The Fund's policy is to comply with the provisions of the Internal Revenue Code (the “Code”) applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized capital gains on investments. Accordingly, no provision for Federal income tax is necessary. Management has reviewed the Fund's tax positions for all open tax years and has determined that as of April 30, 2024, no liability for Federal income tax is required in the Fund's financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Fund's Federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

J. Distributions to Shareholders— Distributions from net investment income, if any, are generally declared and paid at least annually and are declared separately for each class. No class has preferential dividend rights; differences in per share rates are due to differences in separate class expenses. Net realized capital gains, if any, are distributed at least annually. The amount of distributions from net investment income and net realized capital gains is determined in accordance with Federal income tax regulations, which may differ from GAAP. To the extent these “book/tax” differences are permanent in nature (i.e., that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax basis treatment.

3. Fees and Other Transactions with Affiliates

A. Investment Advisory Fee— Pursuant to an Investment Advisory Agreement, the Adviser manages the investments of the Fund and for such services is paid a fee. The investment advisory fee is accrued daily and paid monthly at an annual rate of 0.35% of the Fund's average daily net assets.

The Adviser waived investment advisory fees and/or reimbursed expenses as outlined in Note 3.F.

B. Administration Fee— Pursuant to an Administration Agreement, the Administrator provides certain administration services to the Fund. In consideration of these services, the Administrator receives a fee accrued daily and paid monthly at an annual rate of 0.075% of the first $10 billion of the Fund's average daily net assets, plus 0.050% of the Fund's average daily net assets between $10 billion and $20 billion, plus 0.025% of the Fund's average daily net assets between $20 billion and $25 billion, plus 0.010% of the Fund's average daily net assets in excess of $25 billion. For the six months ended April 30, 2024, the effective annualized rate was 0.075% of the Fund's average daily net assets, notwithstanding any fee waivers and/or expense reimbursements.

The Administrator waived administration fees as outlined in Note 3.F.

JPMorgan Chase Bank, N.A. ("JPMCB"), a wholly-owned subsidiary of JPMorgan, serves as the Fund's sub-administrator (the “Sub-administrator”). For its services as Sub-administrator, JPMCB receives a portion of the fees payable to the Administrator.

C. Distribution Fees— Pursuant to a Distribution Agreement, JPMorgan Distribution Services, Inc. (“JPMDS”), an indirect, wholly-owned subsidiary of JPMorgan, serves as the Fund's principal underwriter and promotes and arranges for the sale of the Fund's shares.

The Board has adopted a Distribution Plan (the “Distribution Plan”) for Class A and Class C Shares of the Fund pursuant to Rule 12b-1 under the 1940 Act. Class I Shares of the Fund do not charge a distribution fee. The Distribution Plan provides that the Fund shall pay, with respect to the applicable share classes, distribution fees, including payments to JPMDS, at annual rates of the average daily net assets as shown in the table below:

In addition, JPMDS is entitled to receive the front-end sales charges from purchases of Class A Shares and the CDSC from redemptions of Class C Shares and certain Class A Shares for which front-end sales charges have been waived. For the six months ended April 30, 2024, JPMDS retained the following:

|

| Amount rounds to less than one thousand. |

D. Service Fees— The Trust, on behalf of the Fund, has entered into a Shareholder Servicing Agreement with JPMDS under which JPMDS provides certain support services to fund shareholders. For performing these services, JPMDS receives a fee with respect to all share classes, except Class R6 Shares which do not charge a service fee, that is accrued daily and paid monthly equal to a percentage of the average daily net assets as shown in the table below:

| J.P. Morgan Specialty Funds | |

JPMDS has entered into shareholder services contracts with affiliated and unaffiliated financial intermediaries who provide shareholder services and other related services to their clients or customers who invest in the Fund. Pursuant to such contracts, JPMDS will pay all or a portion of such fees earned to financial intermediaries for performing such services.

JPMDS waived service fees as outlined in Note 3.F.

E. Custodian and Accounting Fees— JPMCB provides portfolio custody and accounting services to the Fund. For performing these services, the Fund pays JPMCB transaction and asset-based fees that vary according to the number of transactions and positions, plus out-of-pocket expenses. The amounts paid directly to JPMCB by the Fund for custody and accounting services are included in Custodian and accounting fees on the Statement of Operations.

Interest income earned on cash balances at the custodian, if any, is included in Interest income from affiliates on the Statement of Operations.

Interest expense paid to the custodian related to cash overdrafts, if any, is included in Interest expense to affiliates on the Statement of Operations.

F. Waivers and Reimbursements— The Adviser, Administrator and/or JPMDS have contractually agreed to waive fees and/or reimburse the Fund to the extent that total annual operating expenses (excluding acquired fund fees and expenses other than certain money market fund fees as described below, dividend and interest expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, expenses related to trustee elections and extraordinary expenses) exceed the percentages of the Fund’s respective average daily net assets as shown in the table below:

The expense limitation agreement was in effect for the six months ended April 30, 2024 and is in place until at least February 28, 2025.

For the six months ended April 30, 2024, the Fund's service providers waived fees and/or reimbursed expenses for the Fund as follows. None of these parties expect the Fund to repay any such waived fees and/or reimbursed expenses in future years.

Additionally, the Fund may invest in one or more money market funds advised by the Adviser (affiliated money market funds). The Adviser, Administrator and/or JPMDS, as shareholder servicing agent, have contractually agreed to waive fees and/or reimburse expenses in an amount sufficient to offset the respective net fees each collects from the affiliated money market fund on the Fund's investment in such affiliated money market fund, except for investments of securities lending cash collateral. None of these parties expect the Fund to repay any such waived fees and/or reimbursed expenses in future years.

The amount of these waivers resulting from investments in these money market funds for the six months ended April 30, 2024 was $19.

JPMIM voluntarily agreed to reimburse the Fund for the Trustee Fees paid to one of the interested Trustees. For the six months ended April 30, 2024, the amount of this reimbursement was less than a thousand.

G. Other— Certain officers of the Trust are affiliated with the Adviser, the Administrator and JPMDS. Such officers, with the exception of the Chief Compliance Officer, receive no compensation from the Fund for serving in their respective roles.

The Board designated and appointed a Chief Compliance Officer to the Fund pursuant to Rule 38a-1 under the 1940 Act. The Fund, along with affiliated funds, makes reimbursement payments, on a pro-rata basis, to the Administrator for a portion of the fees associated with the office of the Chief Compliance Officer. Such fees are included in Trustees’ and Chief Compliance Officer’s fees on the Statement of Operations.

The Trust adopted a Trustee Deferred Compensation Plan (the “Plan”) which allows the independent Trustees to defer the receipt of all or a portion of compensation related to performance of their duties as Trustees. The deferred fees are invested in various J.P. Morgan Funds until distribution in accordance with the Plan.

During the six months ended April 30, 2024, the Fund purchased securities from an underwriting syndicate in which the principal underwriter or members of the syndicate were affiliated with the Adviser.

The Securities and Exchange Commission ("SEC") has granted an exemptive order permitting the Fund to engage in principal transactions with J.P. Morgan Securities LLC, an affiliated broker, involving taxable money market instruments, subject to certain conditions.

| J.P. Morgan Specialty Funds | |

NOTES TO FINANCIAL STATEMENTSAS OF April 30, 2024 (Unaudited) (continued)

(Dollar values in thousands)

4. Investment Transactions

During the six months ended April 30, 2024, purchases and sales of investments (excluding short-term investments) were as follows:

| Purchases

(excluding

U.S. Government) | Sales

(excluding

U.S. Government) | | Covers on

Securities

Sold Short |

| | | | |

5. Federal Income Tax Matters

For Federal income tax purposes, the estimated cost and unrealized appreciation (depreciation) in value of investments held at April 30, 2024 were as follows:

| | Gross

Unrealized

Appreciation | Gross

Unrealized

Depreciation | Net Unrealized

Appreciation

(Depreciation) |

| | | | |

|

| The tax cost includes the proceeds from short sales which may result in a net negative cost. |

At October 31, 2023, the Fund had net capital loss carryforwards, which are available to offset future realized gains:

| Capital Loss Carryforward Character |

| |

| |

|

| Amount includes capital loss carryforwards which are limited in future years under Internal Revenue Code sections 381-384. |

The Fund relies upon an exemptive order granted by the SEC (the “Order”) permitting the establishment and operation of an Interfund Lending Facility (the “Facility”). The Facility allows the Fund to directly lend and borrow money to or from any other fund relying upon the Order at rates beneficial to both the borrowing and lending funds. Advances under the Facility are taken primarily for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to the Fund's borrowing restrictions. The interfund loan rate is determined, as specified in the Order, by averaging the current repurchase agreement rate and the current bank loan rate. The Order was granted to JPMorgan Trust II ("JPM II") and may be relied upon by the Fund because the Fund and the series of JPM II are all investment companies in the same “group of investment companies” (as defined in Section 12(d)(1)(G) of the 1940 Act).

The Fund had no borrowings outstanding from another fund, or loans outstanding to another fund, during the six months ended April 30, 2024.

The Trust and JPMCB have entered into a financing arrangement. Under this arrangement, JPMCB provides an unsecured, uncommitted credit facility in the aggregate amount of $100 million to certain of the J.P. Morgan Funds, including the Fund. Advances under the arrangement are taken primarily for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to the Fund's borrowing restrictions. Interest on borrowings is payable at a rate determined by JPMCB at the time of borrowing. This agreement has been extended until October 29, 2024.

The Fund had no borrowings outstanding from the unsecured, uncommitted credit facility during the six months ended April 30, 2024.

The Trust, along with certain other trusts for J.P. Morgan Funds (“Borrowers”), has entered into a joint syndicated senior unsecured revolving credit facility totaling $1.5 billion (“Credit Facility”) with various lenders and The Bank of New York Mellon, as administrative agent for the lenders. This Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. Under the terms of the Credit Facility, a borrowing fund must have a minimum of $25 million in adjusted net asset value and not exceed certain adjusted net asset coverage ratios prior to and during the time in which any borrowings are outstanding. If a fund does not comply with the aforementioned requirements, the fund must remediate within three business days with respect to the $25 million minimum adjusted net asset value or within one business day with respect to certain asset coverage ratios or the administrative agent at the request of, or with the consent of, the lenders may terminate the Credit Facility and declare any outstanding borrowings to be due and payable immediately.

| J.P. Morgan Specialty Funds | |

Interest associated with any borrowing under the Credit Facility is charged to the borrowing fund at a rate of interest equal to 1.00% (the "Applicable Margin"), plus the greater on the day of the borrowing, of the federal funds effective rate, or the Adjusted Secured Overnight Financing Rate ("SOFR"). Effective August 8, 2023, the Credit Facility was amended and restated for a term of 364 days, unless extended.

The Fund did not utilize the Credit Facility during the six months ended April 30, 2024.

7. Risks, Concentrations and Indemnifications

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown. The amount of exposure would depend on future claims that may be brought against the Fund. However, based on experience, the Fund expects the risk of loss to be remote.

As of April 30, 2024, the Fund had three individual shareholders and/or non-affiliated omnibus accounts each owning more than 10% of the Fund's outstanding shares, and collectively owning 60.3% of the Fund's outstanding shares.

Significant shareholder transactions by these shareholders may impact the Fund's performance and liquidity.

As of April 30, 2024, the Fund pledged a significant portion of its assets to Citigroup Global Markets, Inc. for securities sold short. For the Fund,

deposits at broker for securities sold short, as noted on the Statement of Assets and Liabilities, are held at Citigroup Global Markets, Inc.

The Fund is subject to infectious disease epidemics/pandemics risk. For example, the outbreak of COVID-19 negatively affected economies, markets and individual companies throughout the world, including those in which the Fund invests. The effects of any future pandemic or other global event to business and market conditions may have a significant negative impact on the performance of the Fund's investments, increase the Fund's volatility, exacerbate other pre-existing political, social and economic risks to the Fund and negatively impact broad segments of businesses and populations. In addition, governments, their regulatory agencies, or self-regulatory organizations have taken or may take actions in response to a pandemic or other global event that affect the instruments in which the Fund invests, or the issuers of such instruments, in ways that could have a significant negative impact on the Fund's investment performance. The ultimate impact of any pandemic or other global event and the extent to which the associated conditions and governmental responses impact the Fund will also depend on future developments, which are highly uncertain, difficult to accurately predict and subject to frequent changes.

Subsequent to the issuance of the October 31, 2023 financial statements, management identified a material error in accounting for the receipt of class action litigation payments, which resulted in an understatement of the Fund’s net assets, realized gain and investment income beginning on March 12, 2015. As of April 29, 2019, the error became material. In accordance with the Fund’s NAV error correction policy, the Fund intends to reprocess shareholder transactions effected from April 29, 2019 through July 17, 2024, (the “Error Period”), which will include adjusting existing shareholder accounts to remove excess shares attributable to purchases made during the Error Period. The Fund’s Adviser will be responsible for any shortfall to the Fund to the extent reprocessing is not completed for any applicable purchases during the Error Period. In addition, the Fund’s Adviser will reimburse the Fund for any additional expenses as a result of this reprocessing.

The accompanying financial statements of the Fund for the year ended October 31, 2023 have been restated from amounts previously reported to correct the error. The following information presents the previously reported and corrected information on each of the impacted financial statements. The schedule of portfolio investments was required to be restated to reflect the impact of the restatement in net assets; there was no impact on fair value or cost of investments as previously reported.

STATEMENT OF ASSETS AND LIABILITIES

(Amounts in thousands, except per share amounts)

| | | |

| | | |

Interest from non-affiliates | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Due to shareholders upon reprocessing | | | |

| | | |

| | | |

| J.P. Morgan Specialty Funds | |

NOTES TO FINANCIAL STATEMENTSAS OF April 30, 2024 (Unaudited) (continued)

(Dollar values in thousands)

| | | |

Future share reacquisition adjustment | | | |

Net Assets after future share reacquisition adjustment | | | |

| | | |

| | | |

| | | |

Total distributable earnings (loss) | | | |

| | | |

Future share reacquisition adjustment | | | |

Net Assets after future share reacquisition adjustment | | | |

Net Assets after future share reacquisition adjustment: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

(after future share reacquisition adjustment) | | | |

Class A — Redemption price per share | | | |

Class C — Offering price per share (b) | | | |

Class I — Offering and redemption price per share | | | |

Class A maximum public offering price per share | | | |

[net asset value per share/(100% – maximum sales charge)] | | | |

___________________________

(a) Per share amounts may not recalculate due to rounding of net assets and/or shares outstanding.

(b) Redemption price for Class C Shares varies based upon length of time the shares are held.

As presented above, in order to correct the Fund’s net assets under the Fund’s NAV correction policy, the Fund has recorded a future share reacquisition adjustment to net assets. This amount represents the value of shares the Fund has a unilateral right to reacquire through reprocessing for the Error Period and is estimated by using the corrected NAV at each reprocessing date based on the subscription and redemption information currently available. The Fund’s Adviser will be responsible for any shortfall to the Fund to the extent reprocessing is not completed for any applicable purchases during the Error Period.

For the year ended October 31, 2023

| | | |

| | | |

Interest income from non-affiliates | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Less expense reimbursements | | | |

Net investment income (loss) | | | |

| | | |

REALIZED/UNREALIZED GAINS (LOSSES): | | | |

| J.P. Morgan Specialty Funds | |

| | | |

Net realized gain (loss) on transactions from: | | | |

Investments in non-affiliates | | | |

| | | |

Net realized/unrealized gains (losses) | | | |

Change in net assets resulting from operations | | | |

STATEMENT OF CHANGES IN NET ASSETS

For the year ended October 31, 2023

| | | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | |

Net investment income (loss) | | | |

| | | |

Change in net assets resulting from operations | | | |

| | | |

| | | |

Change in net assets resulting from capital transactions | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Future share reacquisition adjustment | | | |

End of period after future share reacquisition adjustment | | | |

| | | |

| | | |

| | | |

| | | |

Change in net assets resulting from Class A capital transactions | | | |

| | | |

| | | |

| | | |

Change in net assets resulting from Class C capital transactions | | | |

| | | |

| | | |

| | | |

Change in net assets resulting from Class I capital transactions | | | |

Total change in net assets resulting from capital transactions | | | |

STATEMENT OF CHANGES IN NET ASSETS

For the year ended October 31, 2022

| | | |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: | | | |

Net investment income (loss) | | | |

| | | |

| J.P. Morgan Specialty Funds | |

NOTES TO FINANCIAL STATEMENTSAS OF April 30, 2024 (Unaudited) (continued)

(Dollar values in thousands)

| | | |

Change in net assets resulting from operations | | | |

| | | |

| | | |

Change in net assets resulting from capital transactions | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Future share reacquisition adjustment | | | |

End of period after future share reacquisition adjustment | | | |

| | | |

| | | |

| | | |

| | | |

Change in net assets resulting from Class A capital transactions | | | |

| | | |

| | | |

| | | |

Change in net assets resulting from Class C capital transactions | | | |

| | | |

| | | |

| | | |

Change in net assets resulting from Class I capital transactions | | | |

Total change in net assets resulting from capital transactions | | | |

| J.P. Morgan Specialty Funds | |

FINANCIAL HIGHLIGHTSFOR THE PERIODS INDICATED

(Dollar values in thousands)

| Per share operating performance | |

| | | |

| Net asset

value,

beginning

of period * | Net

investment

income

(loss)(a) | Net realized

and unrealized

gains

(losses) on

investments | Total from

investment