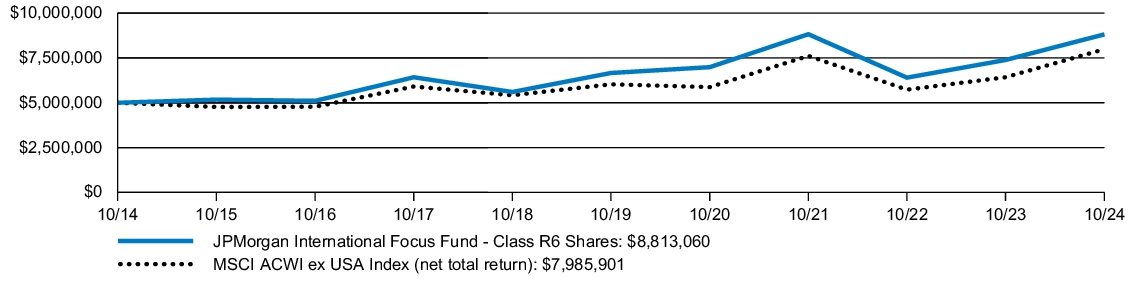

0001217286 jpmt:ICEBofA3MonthUSTreasuryBillIndexMember 2018-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

277 Park Avenue

New York, NY 10172

(Address of principal executive offices) (Zip code)

Gregory S. Samuels

277 Park Avenue

New York, NY 10172

(Name and Address of Agent for Service)

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

a.) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

b.) A copy of the notice transmitted to shareholders in reliance on Rule 30e-3 under the 1940 Act that contains disclosures specified by paragraph (c)(3) of that rule is included in the Annual Report. Not Applicable. Notices do not incorporate disclosures from the shareholder reports.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Developed International Value Fund

Class A Shares/Ticker: JFEAX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Developed International Value Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Developed International Value Fund

(Class A Shares) | $111 | 1.00% |

How did the Fund Perform?

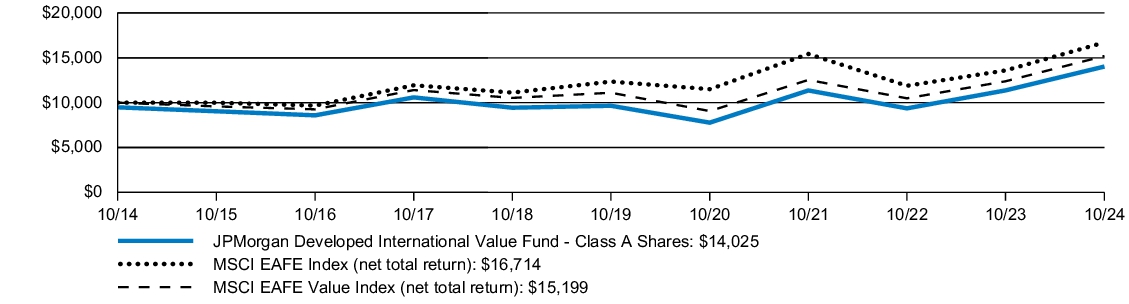

The JPMorgan Developed International Value Fund's Class A Shares, without a sales charge, returned 23.40% for the year ended October 31, 2024. The MSCI EAFE Index (net total return) returned 22.97% and the MSCI EAFE Value Index (net total return) (the "Index") returned 22.75% for the year ended October 31, 2024.

The Fund’s security selection in capital goods and insurance sectors contributed to performance relative to the Index.

The Fund’s security selection in telecommunication services and utilities sectors detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Developed International Value Fund (Class A Shares) | September 28, 2001 | 16.88 | % | 6.60 | % | 3.44 | % |

| JPMorgan Developed International Value Fund (Class A Shares) - excluding sales charge | | 23.40 | | 7.76 | | 4.00 | |

| MSCI EAFE Index (net total return) | | 22.97 | | 6.24 | | 5.27 | |

| MSCI EAFE Value Index (net total return) | | 22.75 | | 6.47 | | 4.28 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111. Effective May 2018, some of the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed under the current strategies.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Developed International Value Fund, the MSCI EAFE Index (net total return) and the MSCI EAFE Value Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the MSCI EAFE Index (net total return) and MSCI EAFE Value Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and midcap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. The MSCI EAFE Value Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of value-oriented large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index. As a result of new regulatory requirements, effective July 24, 2024, the Fund's regulatory index has changed from the Index, as defined above, to the MSCI EAFE Index, a broad-based securities market index. In addition to the Fund's performance, the tables in this section include performance of the new regulatory index and the Index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $637,882 | |

| Total number of portfolio holdings | 255 | |

| Portfolio turnover rate | 50 | % |

| Total advisory fees paid (000's) | $2,495 | |

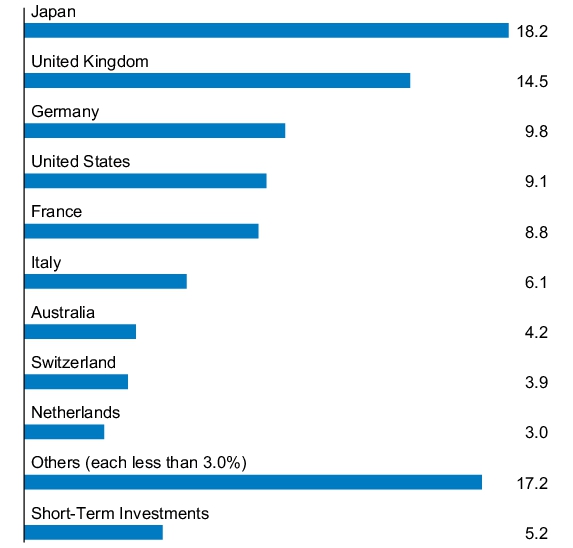

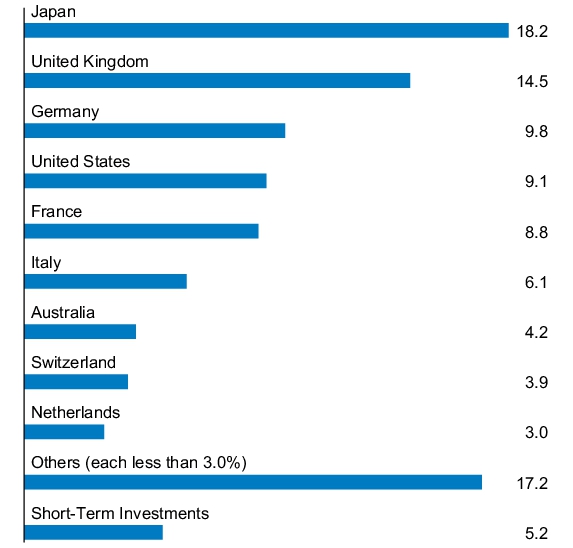

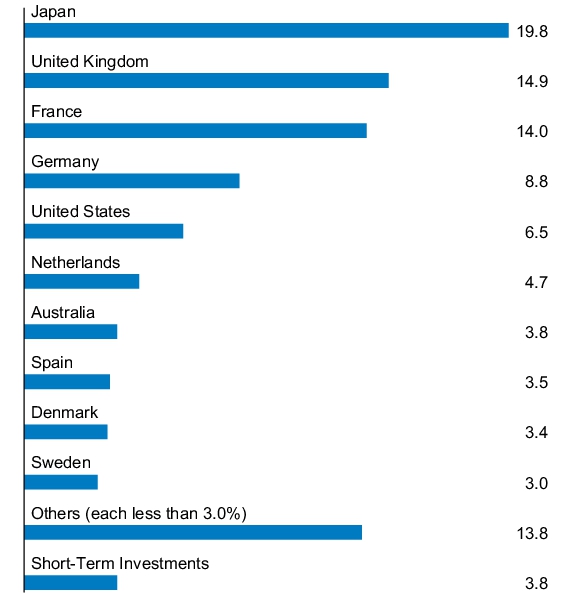

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Developed International Value Fund

Class C Shares/Ticker: JIUCX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Developed International Value Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Developed International Value Fund

(Class C Shares) | $167 | 1.50% |

How did the Fund Perform?

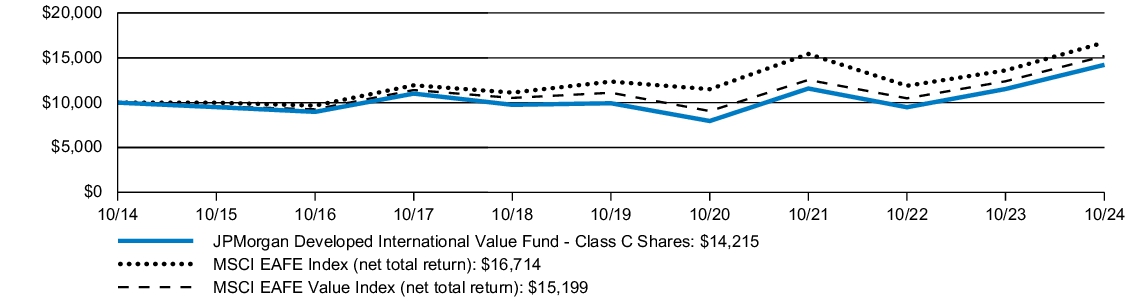

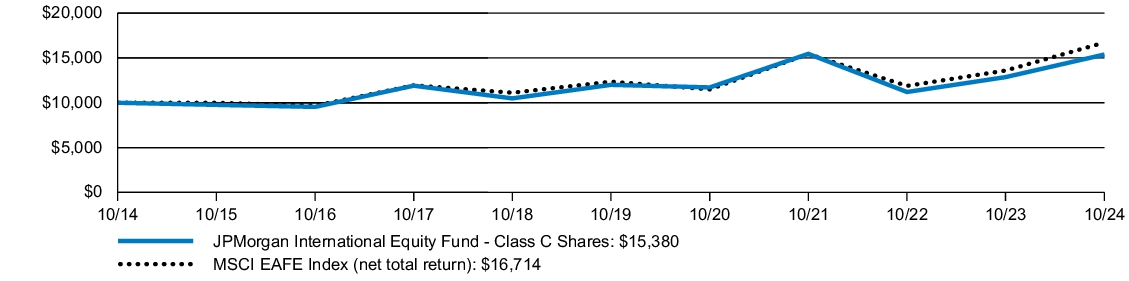

The JPMorgan Developed International Value Fund's Class C Shares, without a sales charge, returned 22.87% for the year ended October 31, 2024. The MSCI EAFE Index (net total return) returned 22.97% and the MSCI EAFE Value Index (net total return) (the "Index") returned 22.75% for the year ended October 31, 2024.

The Fund’s security selection in capital goods and insurance sectors contributed to performance relative to the Index.

The Fund’s security selection in telecommunication services and utilities sectors detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Developed International Value Fund (Class C Shares) | July 11, 2006 | 21.87 | % | 7.23 | % | 3.58 | % |

| JPMorgan Developed International Value Fund (Class C Shares) - excluding sales charge | | 22.87 | | 7.23 | | 3.58 | |

| MSCI EAFE Index (net total return) | | 22.97 | | 6.24 | | 5.27 | |

| MSCI EAFE Value Index (net total return) | | 22.75 | | 6.47 | | 4.28 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111. Effective May 2018, some of the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed under the current strategies.

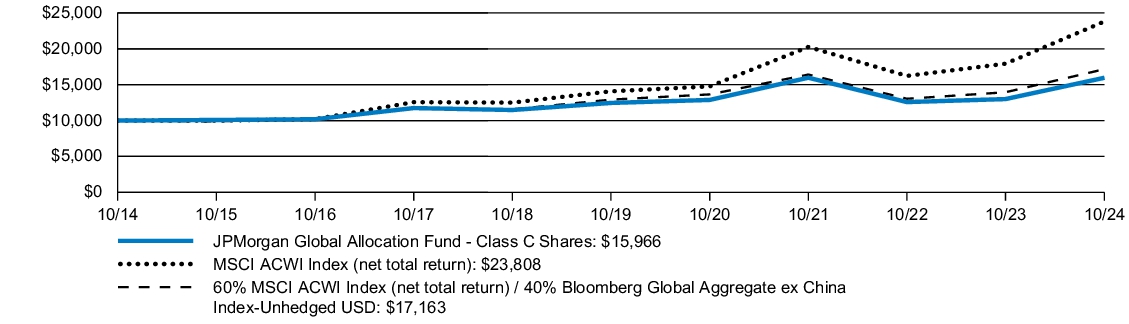

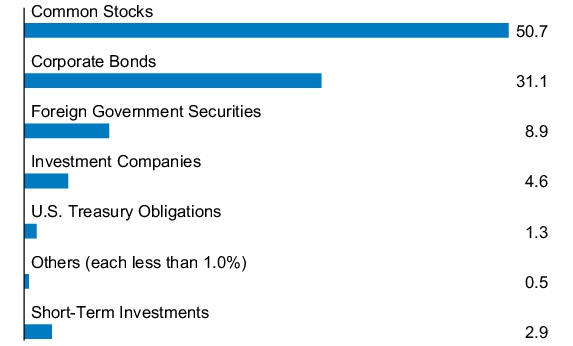

The graph illustrates comparative performance for $10,000 invested in Class C Shares of the JPMorgan Developed International Value Fund, the MSCI EAFE Index (net total return) and the MSCI EAFE Value Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net total return) and MSCI EAFE Value Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and midcap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. The MSCI EAFE Value Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of value-oriented large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index. As a result of new regulatory requirements, effective July 24, 2024, the Fund's regulatory index has changed from the Index, as defined above, to the MSCI EAFE Index, a broad-based securities market index. In addition to the Fund's performance, the tables in this section include performance of the new regulatory index and the Index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C Shares reflects Class A Share's performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $637,882 | |

| Total number of portfolio holdings | 255 | |

| Portfolio turnover rate | 50 | % |

| Total advisory fees paid (000's) | $2,495 | |

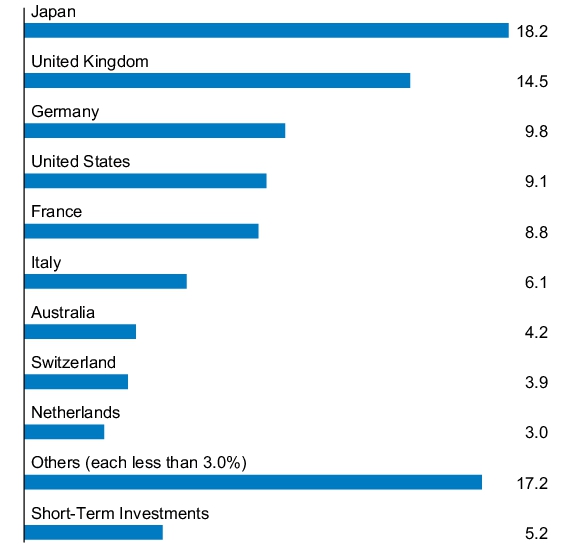

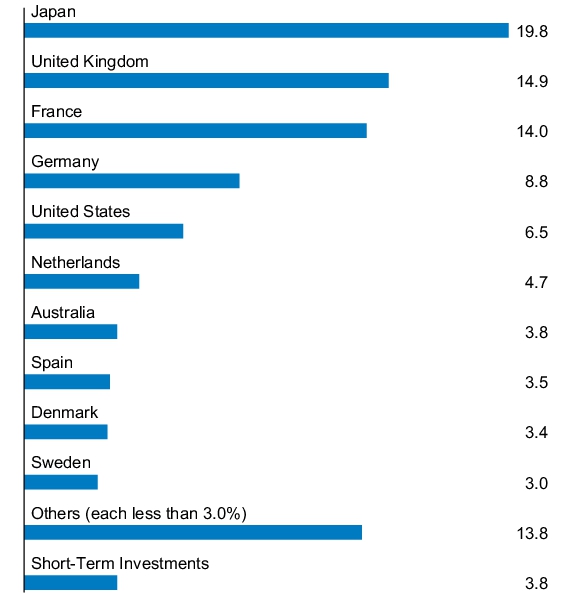

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Developed International Value Fund

Class I Shares/Ticker: JIESX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Developed International Value Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Developed International Value Fund

(Class I Shares) | $83 | 0.75% |

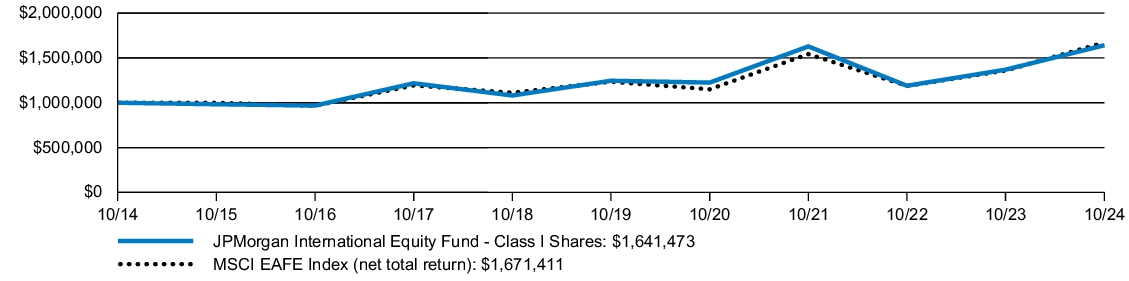

How did the Fund Perform?

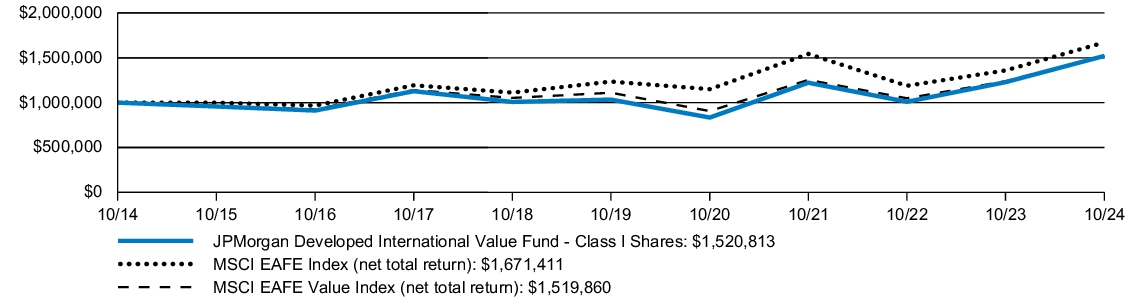

The JPMorgan Developed International Value Fund's Class I Shares returned 23.80% for the year ended October 31, 2024. The MSCI EAFE Index (net total return) returned 22.97% and the MSCI EAFE Value Index (net total return) (the "Index") returned 22.75% for the year ended October 31, 2024.

The Fund’s security selection in capital goods and insurance sectors contributed to performance relative to the Index.

The Fund’s security selection in telecommunication services and utilities sectors detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Developed International Value Fund (Class I Shares) | September 10, 2001 | 23.80 | % | 8.03 | % | 4.28 | % |

| MSCI EAFE Index (net total return) | | 22.97 | | 6.24 | | 5.27 | |

| MSCI EAFE Value Index (net total return) | | 22.75 | | 6.47 | | 4.28 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111. Effective May 2018, some of the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed under the current strategies.

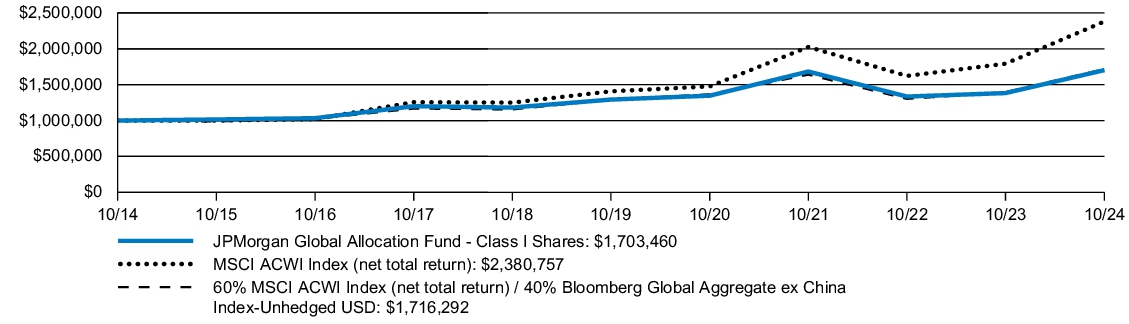

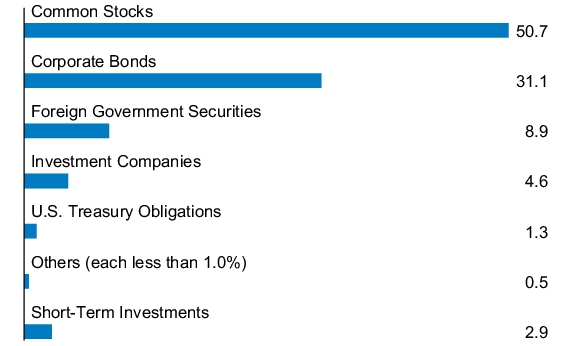

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Developed International Value Fund, the MSCI EAFE Index (net total return) and the MSCI EAFE Value Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net total return) and MSCI EAFE Value Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and midcap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. The MSCI EAFE Value Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of value-oriented large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index. As a result of new regulatory requirements, effective July 24, 2024, the Fund's regulatory index has changed from the Index, as defined above, to the MSCI EAFE Index, a broad-based securities market index. In addition to the Fund's performance, the tables in this section include performance of the new regulatory index and the Index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $637,882 | |

| Total number of portfolio holdings | 255 | |

| Portfolio turnover rate | 50 | % |

| Total advisory fees paid (000's) | $2,495 | |

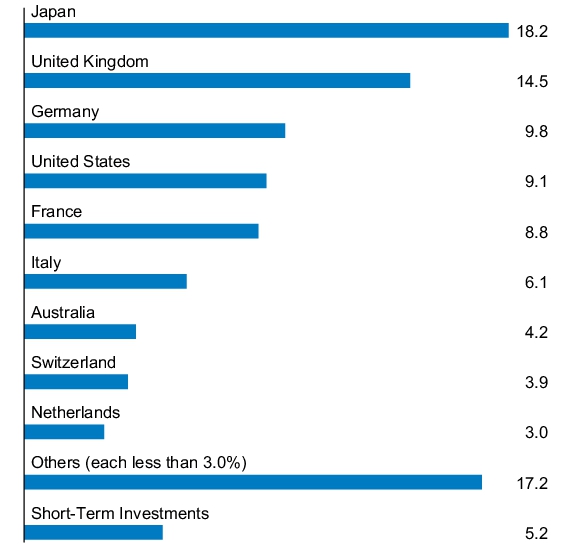

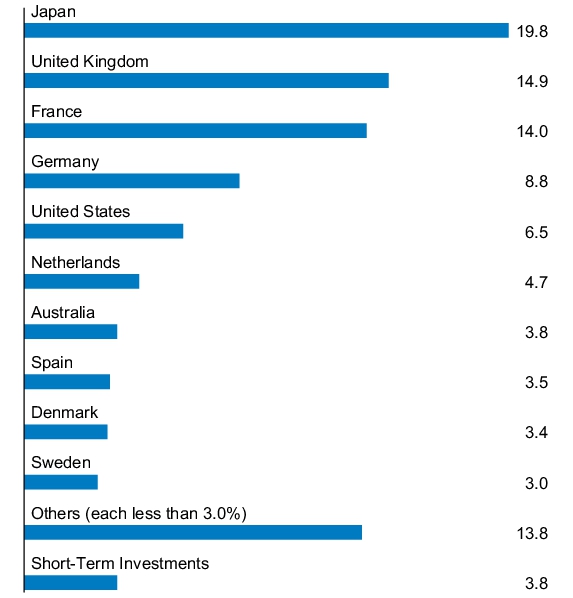

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Developed International Value Fund

Class L Shares/Ticker: JNUSX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Developed International Value Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Developed International Value Fund

(Class L Shares) | $73 | 0.65% |

How did the Fund Perform?

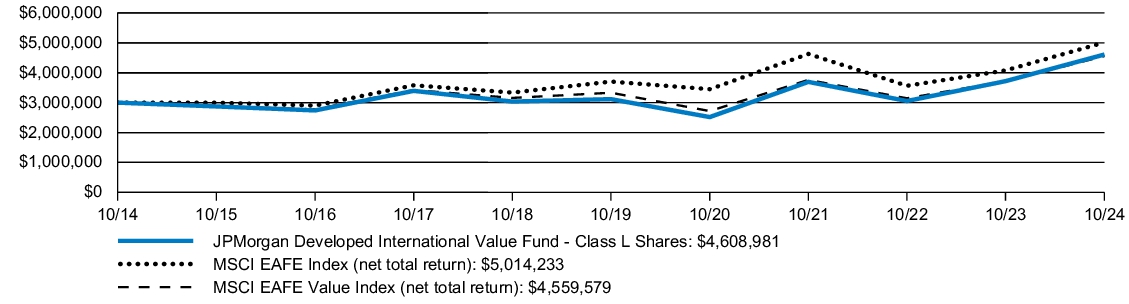

The JPMorgan Developed International Value Fund's Class L Shares returned 23.95% for the year ended October 31, 2024. The MSCI EAFE Index (net total return) returned 22.97% and the MSCI EAFE Value Index (net total return) (the "Index") returned 22.75% for the year ended October 31, 2024.

The Fund’s security selection in capital goods and insurance sectors contributed to performance relative to the Index.

The Fund’s security selection in telecommunication services and utilities sectors detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Developed International Value Fund (Class L Shares) | November 4, 1993 | 23.95 | % | 8.14 | % | 4.39 | % |

| MSCI EAFE Index (net total return) | | 22.97 | | 6.24 | | 5.27 | |

| MSCI EAFE Value Index (net total return) | | 22.75 | | 6.47 | | 4.28 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111. Effective May 2018, some of the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed under the current strategies.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan Developed International Value Fund, the MSCI EAFE Index (net total return) and the MSCI EAFE Value Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net total return) and MSCI EAFE Value Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and midcap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. The MSCI EAFE Value Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of value-oriented large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index. As a result of new regulatory requirements, effective July 24, 2024, the Fund's regulatory index has changed from the Index, as defined above, to the MSCI EAFE Index, a broad-based securities market index. In addition to the Fund's performance, the tables in this section include performance of the new regulatory index and the Index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $637,882 | |

| Total number of portfolio holdings | 255 | |

| Portfolio turnover rate | 50 | % |

| Total advisory fees paid (000's) | $2,495 | |

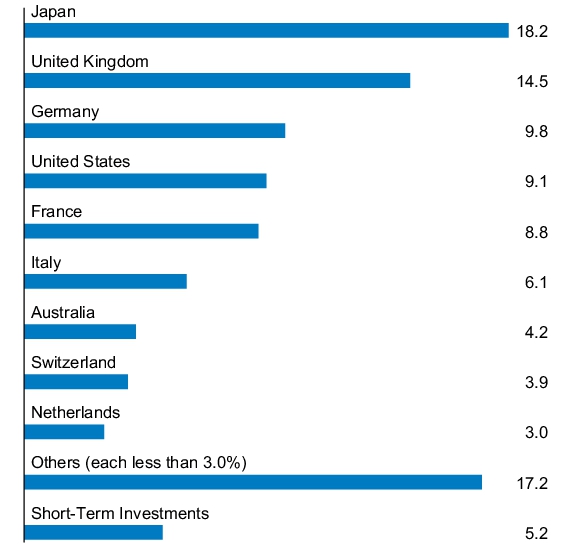

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Developed International Value Fund

Class R2 Shares/Ticker: JPVZX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Developed International Value Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Developed International Value Fund

(Class R2 Shares) | $144 | 1.30% |

How did the Fund Perform?

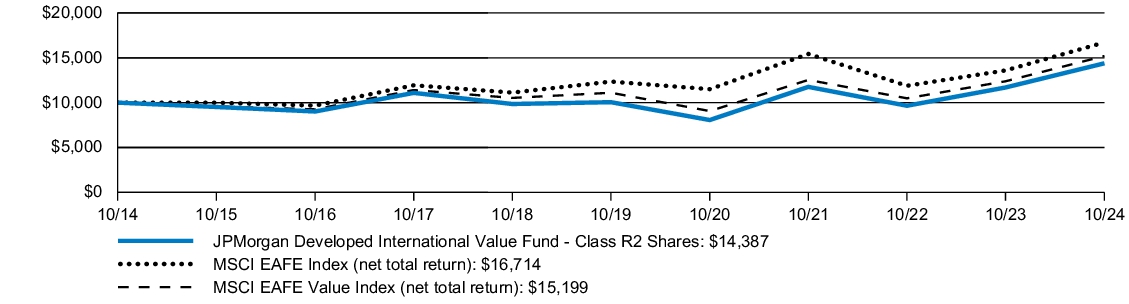

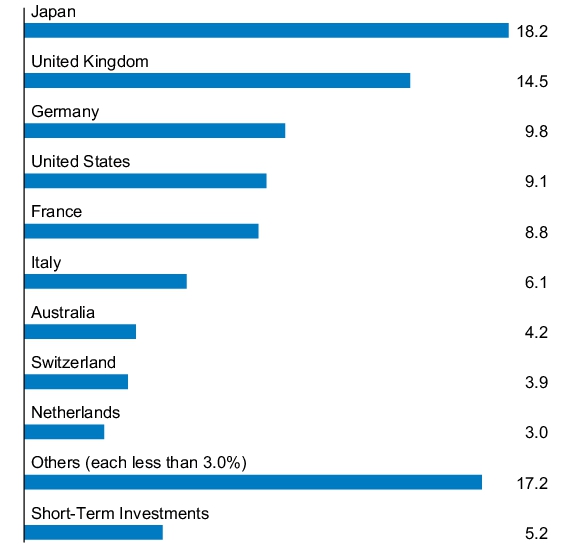

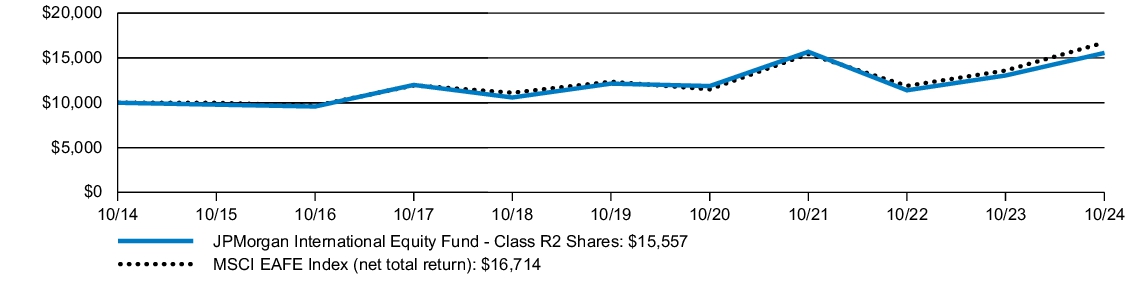

The JPMorgan Developed International Value Fund's Class R2 Shares returned 23.08% for the year ended October 31, 2024. The MSCI EAFE Index (net total return) returned 22.97% and the MSCI EAFE Value Index (net total return) (the "Index") returned 22.75% for the year ended October 31, 2024.

The Fund’s security selection in capital goods and insurance sectors contributed to performance relative to the Index.

The Fund’s security selection in telecommunication services and utilities sectors detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Developed International Value Fund (Class R2 Shares) | November 3, 2008 | 23.08 | % | 7.43 | % | 3.70 | % |

| MSCI EAFE Index (net total return) | | 22.97 | | 6.24 | | 5.27 | |

| MSCI EAFE Value Index (net total return) | | 22.75 | | 6.47 | | 4.28 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111. Effective May 2018, some of the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed under the current strategies.

The graph illustrates comparative performance for $10,000 invested in Class R2 Shares of the JPMorgan Developed International Value Fund, the MSCI EAFE Index (net total return) and the MSCI EAFE Value Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net total return) and MSCI EAFE Value Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and midcap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. The MSCI EAFE Value Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of value-oriented large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index. As a result of new regulatory requirements, effective July 24, 2024, the Fund's regulatory index has changed from the Index, as defined above, to the MSCI EAFE Index, a broad-based securities market index. In addition to the Fund's performance, the tables in this section include performance of the new regulatory index and the Index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $637,882 | |

| Total number of portfolio holdings | 255 | |

| Portfolio turnover rate | 50 | % |

| Total advisory fees paid (000's) | $2,495 | |

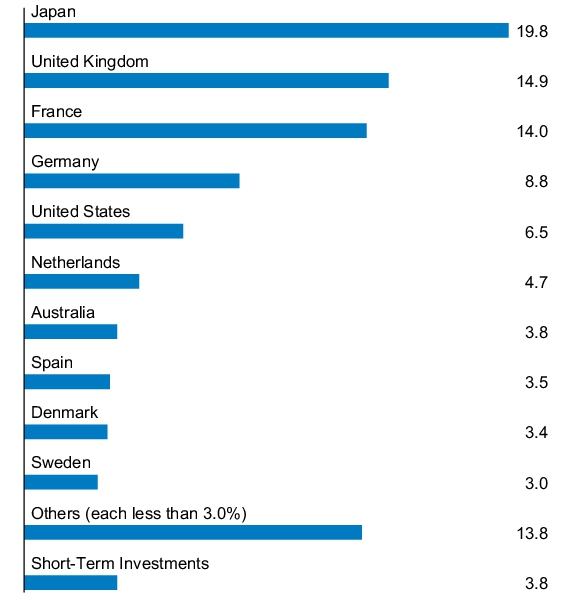

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Developed International Value Fund

Class R5 Shares/Ticker: JPVRX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Developed International Value Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Developed International Value Fund

(Class R5 Shares) | $72 | 0.64% |

How did the Fund Perform?

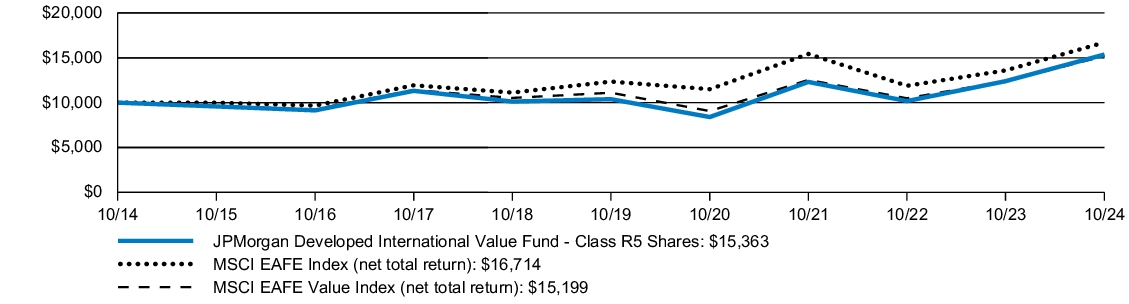

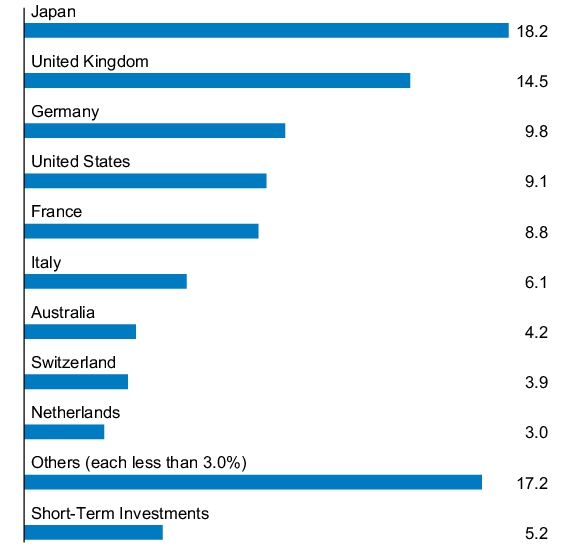

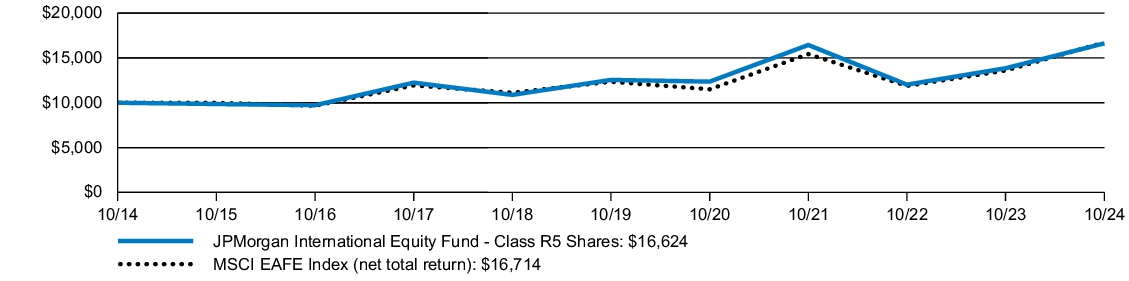

The JPMorgan Developed International Value Fund's Class R5 Shares returned 23.95% for the year ended October 31, 2024. The MSCI EAFE Index (net total return) returned 22.97% and the MSCI EAFE Value Index (net total return) (the "Index") returned 22.75% for the year ended October 31, 2024.

The Fund’s security selection in capital goods and insurance sectors contributed to performance relative to the Index.

The Fund’s security selection in telecommunication services and utilities sectors detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Developed International Value Fund (Class R5 Shares) | September 9, 2016 | 23.95 | % | 8.14 | % | 4.39 | % |

| MSCI EAFE Index (net total return) | | 22.97 | | 6.24 | | 5.27 | |

| MSCI EAFE Value Index (net total return) | | 22.75 | | 6.47 | | 4.28 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111. Effective May 2018, some of the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed under the current strategies.

Returns for Class R5 Shares prior to its inception date are based on the performance of Class L Shares. The actual returns of Class R5 Shares would have been different than those shown because Class R5 Shares have different expenses than Class L Shares.

The graph illustrates comparative performance for $10,000 invested in Class R5 Shares of the JPMorgan Developed International Value Fund, the MSCI EAFE Index (net total return) and the MSCI EAFE Value Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net total return) and MSCI EAFE Value Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and midcap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. The MSCI EAFE Value Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of value-oriented large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index. As a result of new regulatory requirements, effective July 24, 2024, the Fund's regulatory index has changed from the Index, as defined above, to the MSCI EAFE Index, a broad-based securities market index. In addition to the Fund's performance, the tables in this section include performance of the new regulatory index and the Index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $637,882 | |

| Total number of portfolio holdings | 255 | |

| Portfolio turnover rate | 50 | % |

| Total advisory fees paid (000's) | $2,495 | |

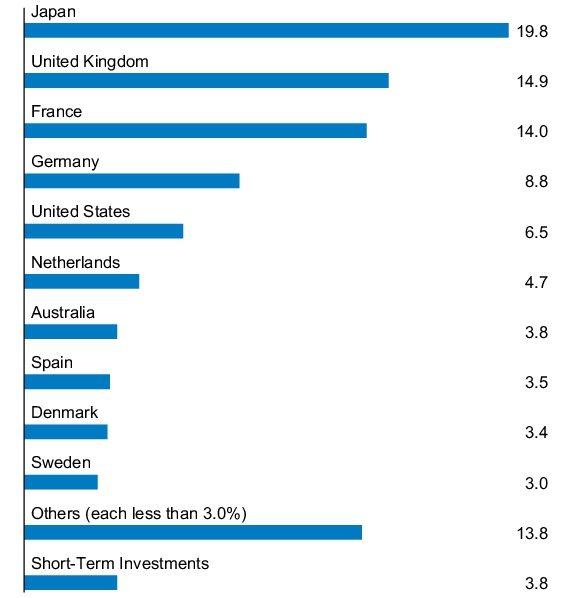

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Developed International Value Fund

Class R6 Shares/Ticker: JNVMX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Developed International Value Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Developed International Value Fund

(Class R6 Shares) | $61 | 0.55% |

How did the Fund Perform?

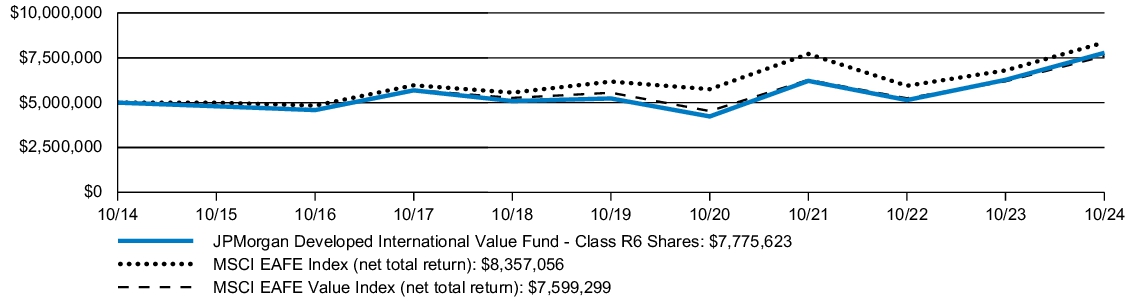

The JPMorgan Developed International Value Fund's Class R6 Shares returned 24.05% for the year ended October 31, 2024. The MSCI EAFE Index (net total return) returned 22.97% and the MSCI EAFE Value Index (net total return) (the "Index") returned 22.75% for the year ended October 31, 2024.

The Fund’s security selection in capital goods and insurance sectors contributed to performance relative to the Index.

The Fund’s security selection in telecommunication services and utilities sectors detracted from performance relative to the Index.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Developed International Value Fund (Class R6 Shares) | November 30, 2010 | 24.05 | % | 8.25 | % | 4.51 | % |

| MSCI EAFE Index (net total return) | | 22.97 | | 6.24 | | 5.27 | |

| MSCI EAFE Value Index (net total return) | | 22.75 | | 6.47 | | 4.28 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111. Effective May 2018, some of the Fund’s investment strategies changed. The Fund’s past performance would have been different if the Fund was managed under the current strategies.

The graph illustrates comparative performance for $5,000,000 invested in Class R6 Shares of the JPMorgan Developed International Value Fund, the MSCI EAFE Index (net total return) and the MSCI EAFE Value Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI EAFE Index (net total return) and MSCI EAFE Value Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI EAFE Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and midcap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. The MSCI EAFE Value Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of value-oriented large- and mid- cap stocks in developed markets, excluding the U.S. and Canada. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index. As a result of new regulatory requirements, effective July 24, 2024, the Fund's regulatory index has changed from the Index, as defined above, to the MSCI EAFE Index, a broad-based securities market index. In addition to the Fund's performance, the tables in this section include performance of the new regulatory index and the Index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $637,882 | |

| Total number of portfolio holdings | 255 | |

| Portfolio turnover rate | 50 | % |

| Total advisory fees paid (000's) | $2,495 | |

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Emerging Markets Equity Fund

Class A Shares/Ticker: JFAMX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Emerging Markets Equity Fund

(Class A Shares) | $136 | 1.24% |

How did the Fund Perform?

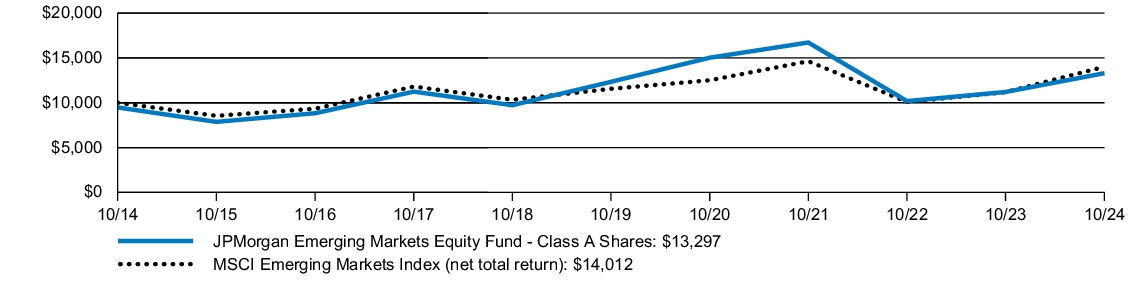

The JPMorgan Emerging Markets Equity Fund's Class A Shares, without a sales charge, returned 18.69% for the year ended October 31, 2024. The MSCI Emerging Markets Index (net total return) (the "Index") returned 25.32% for the year ended October 31, 2024.

The Fund's holdings in China detracted from performance relative to the Index.

The Fund's underweight position in India detracted from performance relative to the Index.

The Fund's overweight position in Taiwan contributed to performance relative to the Index, driven by strong returns in the region.

Exposure to Argentina also added to the Fund’s positive performance, reflecting favorable market conditions and investment decisions.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Emerging Markets Equity Fund (Class A Shares) | September 28, 2001 | 12.46 | % | 0.42 | % | 2.89 | % |

| JPMorgan Emerging Markets Equity Fund (Class A Shares) - excluding sales charge | | 18.69 | | 1.52 | | 3.44 | |

| MSCI Emerging Markets Index (net total return) | | 25.32 | | 3.93 | | 3.43 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Emerging Markets Equity Fund and the MSCI Emerging Markets Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and includes a sales charge. The performance of the MSCI Emerging Markets Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI Emerging Markets Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in emerging markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $6,959,199 | |

| Total number of portfolio holdings | 81 | |

| Portfolio turnover rate | 36 | % |

| Total advisory fees paid (000's) | $48,624 | |

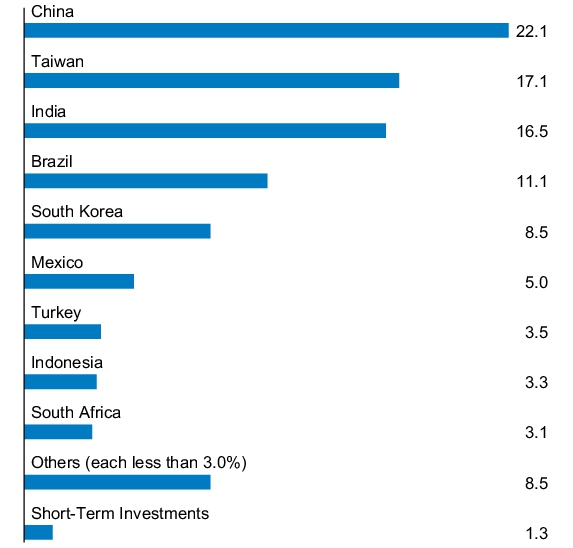

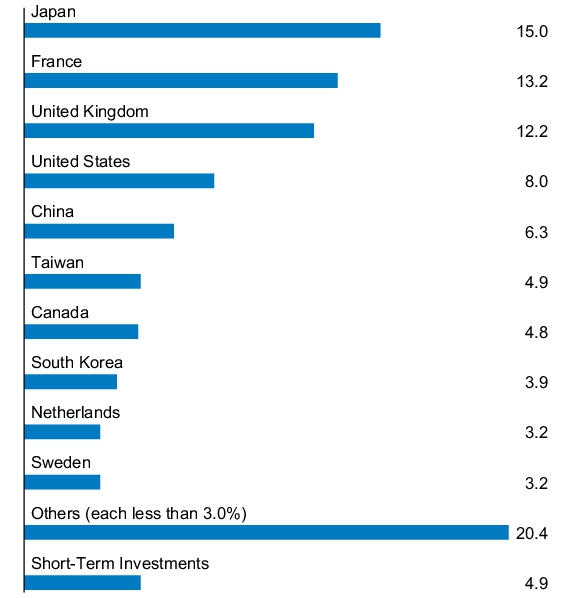

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Emerging Markets Equity Fund

Class C Shares/Ticker: JEMCX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Emerging Markets Equity Fund

(Class C Shares) | $190 | 1.74% |

How did the Fund Perform?

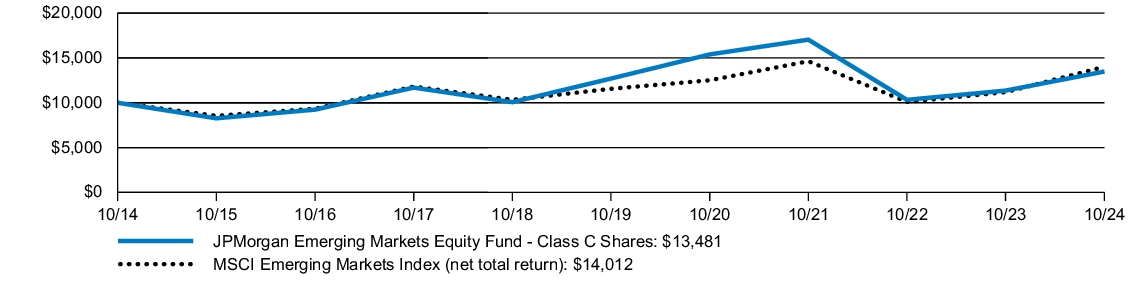

The JPMorgan Emerging Markets Equity Fund's Class C Shares, without a sales charge, returned 18.10% for the year ended October 31, 2024. The MSCI Emerging Markets Index (net total return) (the "Index") returned 25.32% for the year ended October 31, 2024.

The Fund's holdings in China detracted from performance relative to the Index.

The Fund's underweight position in India detracted from performance relative to the Index.

The Fund's overweight position in Taiwan contributed to performance relative to the Index, driven by strong returns in the region.

Exposure to Argentina also added to the Fund’s positive performance, reflecting favorable market conditions and investment decisions.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Emerging Markets Equity Fund (Class C Shares) | February 28, 2006 | 17.10 | % | 1.01 | % | 3.03 | % |

| JPMorgan Emerging Markets Equity Fund (Class C Shares) - excluding sales charge | | 18.10 | | 1.01 | | 3.03 | |

| MSCI Emerging Markets Index (net total return) | | 25.32 | | 3.93 | | 3.43 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $10,000 invested in Class C Shares of the JPMorgan Emerging Markets Equity Fund and the MSCI Emerging Markets Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI Emerging Markets Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in emerging markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

Because Class C Shares automatically convert to Class A Shares after 8 years, the 10 year average annual total return shown above for Class C Shares reflects Class A Share's performance for the period after conversion.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $6,959,199 | |

| Total number of portfolio holdings | 81 | |

| Portfolio turnover rate | 36 | % |

| Total advisory fees paid (000's) | $48,624 | |

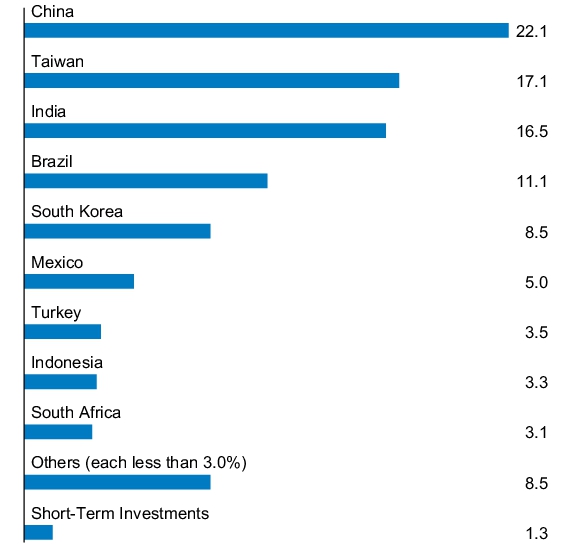

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Emerging Markets Equity Fund

Class I Shares/Ticker: JEMSX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Emerging Markets Equity Fund

(Class I Shares) | $108 | 0.99% |

How did the Fund Perform?

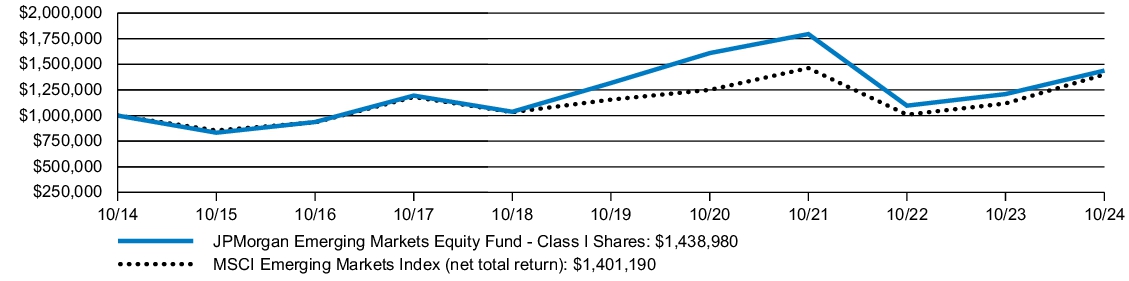

The JPMorgan Emerging Markets Equity Fund's Class I Shares returned 18.97% for the year ended October 31, 2024. The MSCI Emerging Markets Index (net total return) (the "Index") returned 25.32% for the year ended October 31, 2024.

The Fund's holdings in China detracted from performance relative to the Index.

The Fund's underweight position in India detracted from performance relative to the Index.

The Fund's overweight position in Taiwan contributed to performance relative to the Index, driven by strong returns in the region.

Exposure to Argentina also added to the Fund’s positive performance, reflecting favorable market conditions and investment decisions.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Emerging Markets Equity Fund (Class I Shares) | September 10, 2001 | 18.97 | % | 1.78 | % | 3.71 | % |

| MSCI Emerging Markets Index (net total return) | | 25.32 | | 3.93 | | 3.43 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $1,000,000 invested in Class I Shares of the JPMorgan Emerging Markets Equity Fund and the MSCI Emerging Markets Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI Emerging Markets Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in emerging markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $6,959,199 | |

| Total number of portfolio holdings | 81 | |

| Portfolio turnover rate | 36 | % |

| Total advisory fees paid (000's) | $48,624 | |

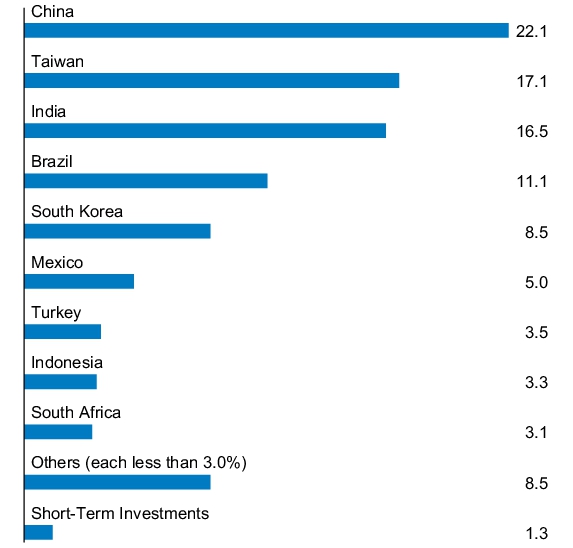

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Emerging Markets Equity Fund

Class L Shares/Ticker: JMIEX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Emerging Markets Equity Fund

(Class L Shares) | $98 | 0.89% |

How did the Fund Perform?

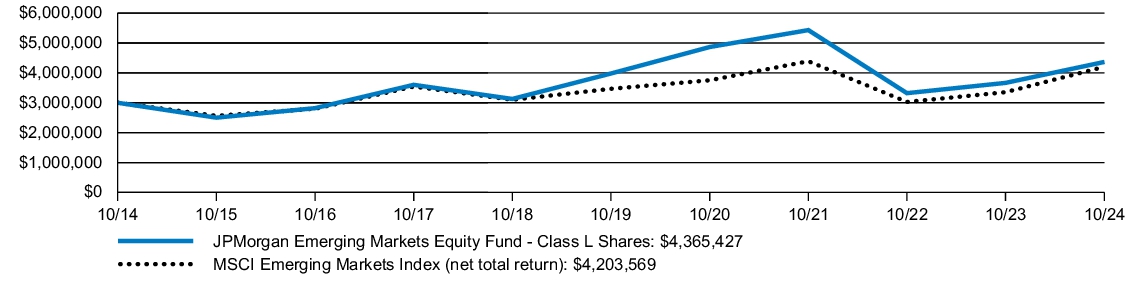

The JPMorgan Emerging Markets Equity Fund's Class L Shares returned 19.11% for the year ended October 31, 2024. The MSCI Emerging Markets Index (net total return) (the "Index") returned 25.32% for the year ended October 31, 2024.

The Fund's holdings in China detracted from performance relative to the Index.

The Fund's underweight position in India detracted from performance relative to the Index.

The Fund's overweight position in Taiwan contributed to performance relative to the Index, driven by strong returns in the region.

Exposure to Argentina also added to the Fund’s positive performance, reflecting favorable market conditions and investment decisions.

| AVERAGE ANNUAL TOTAL RETURNS | INCEPTION

DATE | 1 YEAR | | 5 YEAR | | 10 YEAR | |

| JPMorgan Emerging Markets Equity Fund (Class L Shares) | November 15, 1993 | 19.11 | % | 1.87 | % | 3.82 | % |

| MSCI Emerging Markets Index (net total return) | | 25.32 | | 3.93 | | 3.43 | |

The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111.

The graph illustrates comparative performance for $3,000,000 invested in Class L Shares of the JPMorgan Emerging Markets Equity Fund and the MSCI Emerging Markets Index (net total return) from October 31, 2014 to October 31, 2024. The performance of the Fund assumes reinvestment of all dividends and capital gain distributions, if any, and does not include a sales charge. The performance of the MSCI Emerging Markets Index (net total return) does not reflect the deduction of expenses or a sales charge associated with a mutual fund and approximates the minimum possible dividend reinvestment of the securities included in the benchmark, if applicable. The MSCI Emerging Markets Index (net total return) is a free float-adjusted market capitalization weighted index that is designed to measure the performance of large- and mid- cap stocks in emerging markets. Net total return figures assume the reinvestment of dividends after deduction of withholding tax, applying the maximum rate to nonresident individual investors who do not benefit from double taxation treaties. Investors cannot invest directly in an index.

Fund performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the applicable inception date. Without these waivers and reimbursements, performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on gains resulting from redemptions of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the returns shown in the financial highlights, which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

Source: MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast, or prediction. The MSCI information is provided on an "as is" basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the "MSCI Parties") expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

| Fund net assets (000's) | $6,959,199 | |

| Total number of portfolio holdings | 81 | |

| Portfolio turnover rate | 36 | % |

| Total advisory fees paid (000's) | $48,624 | |

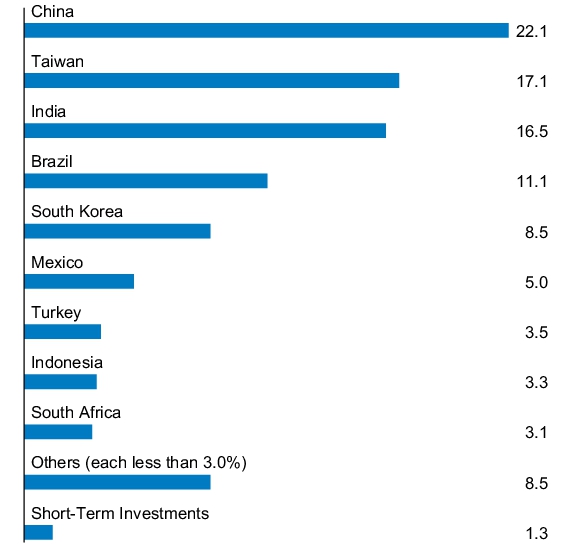

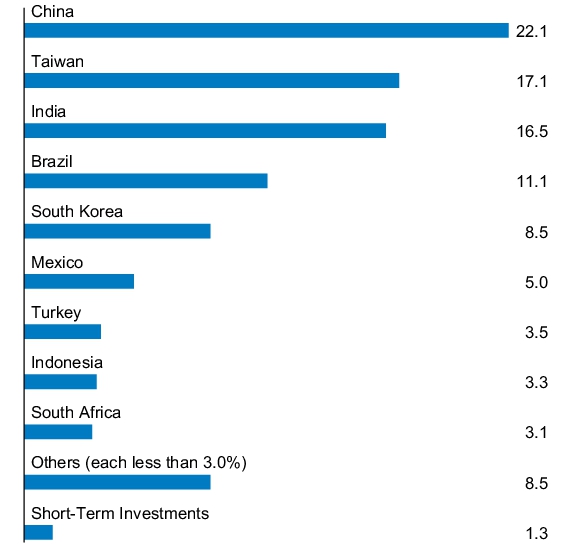

PORTFOLIO COMPOSITION - COUNTRY

(% of Total Investments)

Availability of Additional Information

At www.jpmorganfunds.com/funddocuments, you can find additional information about the Fund, including the Fund’s:

Prospectus

Financial information

Fund holdings

Proxy voting information

You can also request this information by contacting us at 1-800-480-4111.

ANNUAL SHAREHOLDER REPORT | October 31, 2024 (Unaudited)

JPMorgan Emerging Markets Equity Fund

Class R2 Shares/Ticker: JHUJX

ANNUAL SHAREHOLDER REPORT

This annual shareholder report contains important information about the JPMorgan Emerging Markets Equity Fund (the "Fund") for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.jpmorganfunds.com/funddocuments. You can also request this information by contacting us at 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com or by asking any financial intermediary that offers shares of the Fund.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a

$10,000 investment | Costs paid as a percentage

of a $10,000 investment |

JPMorgan Emerging Markets Equity Fund

(Class R2 Shares) | $168 | 1.54% |

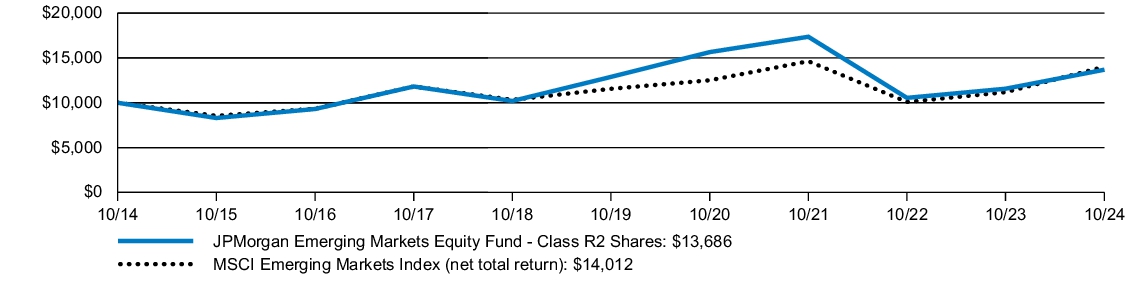

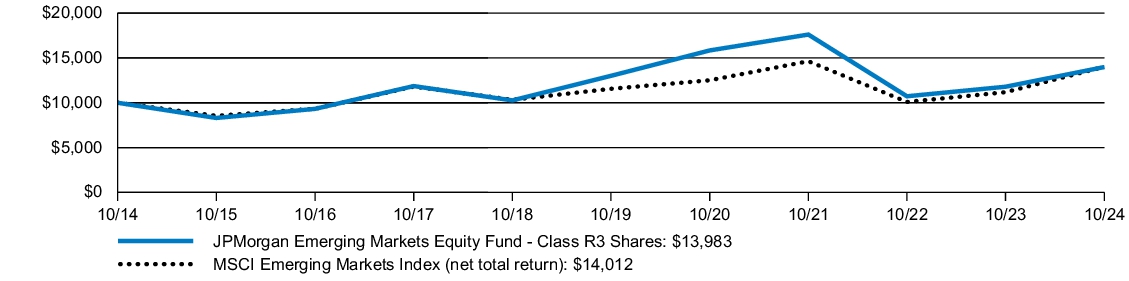

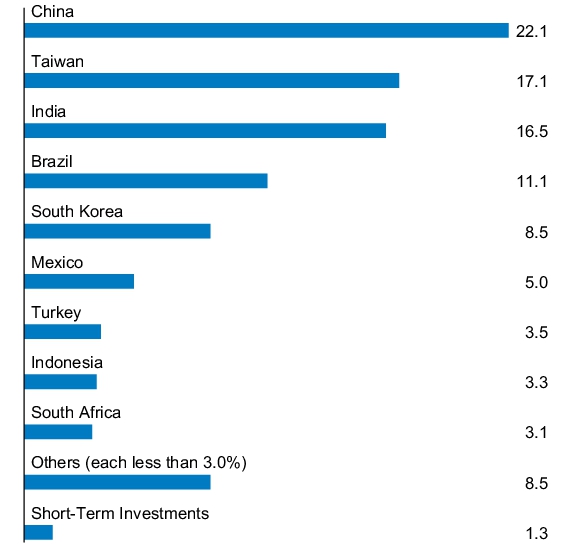

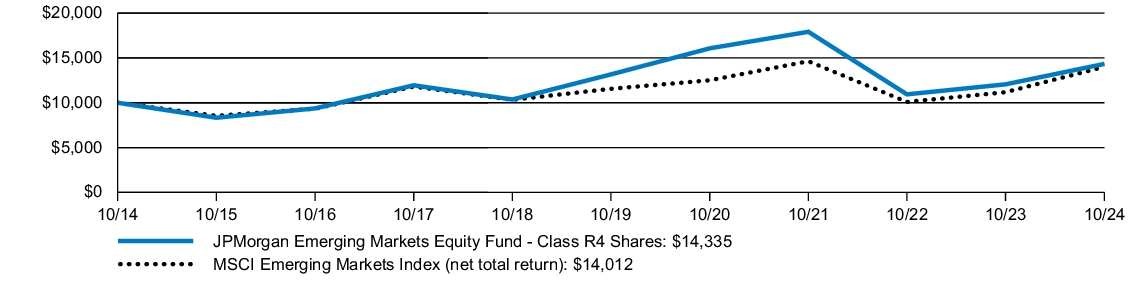

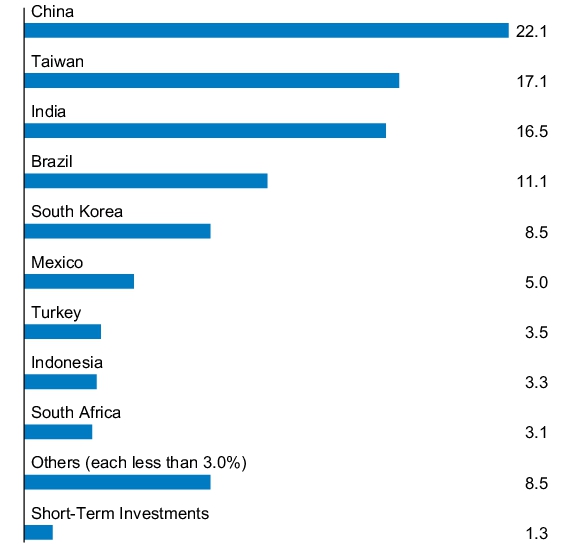

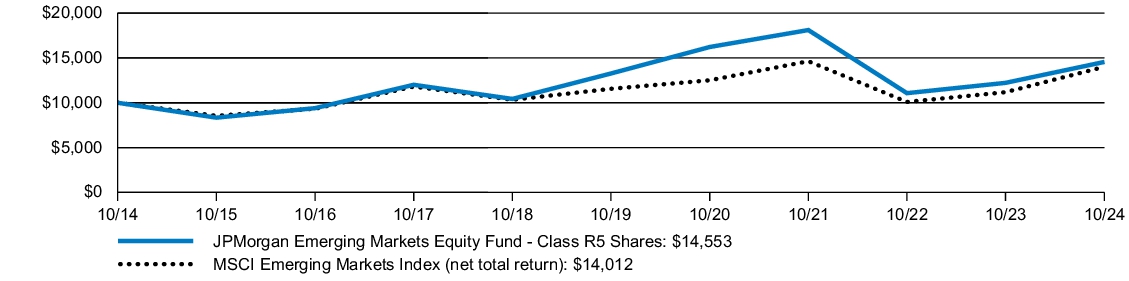

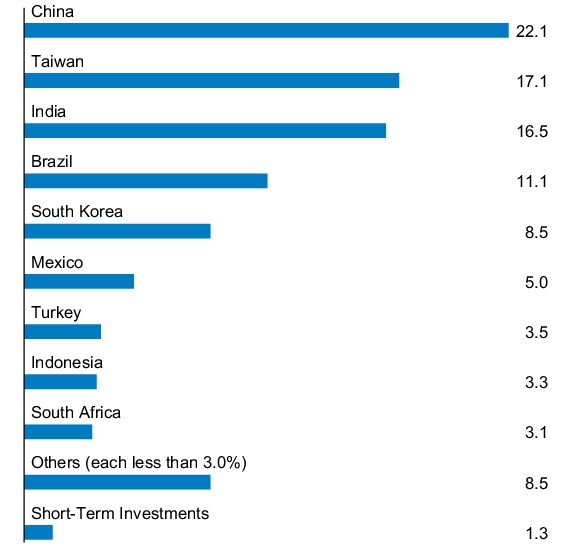

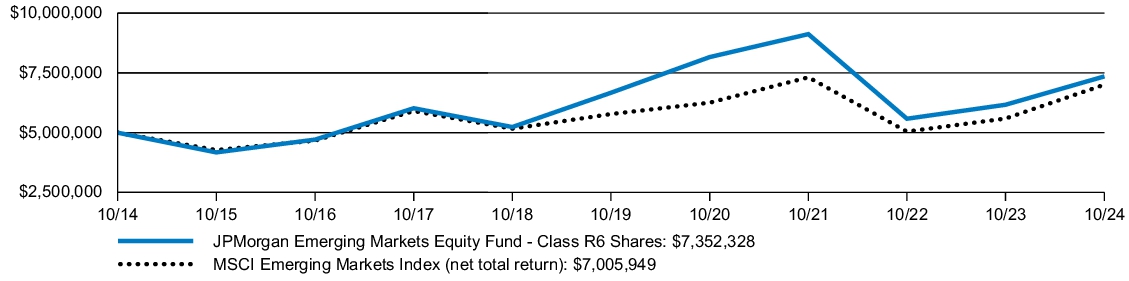

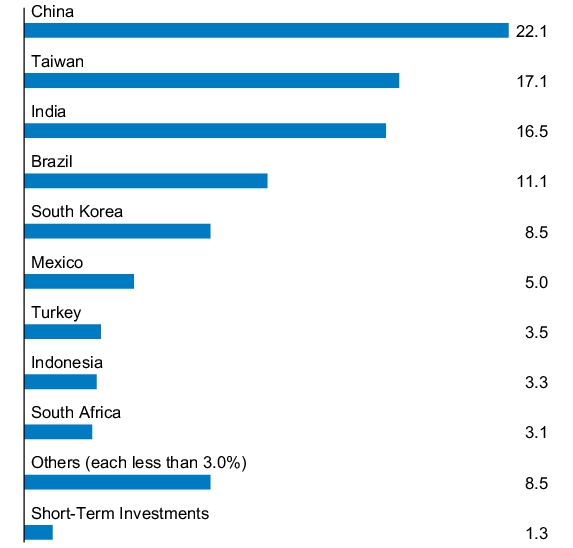

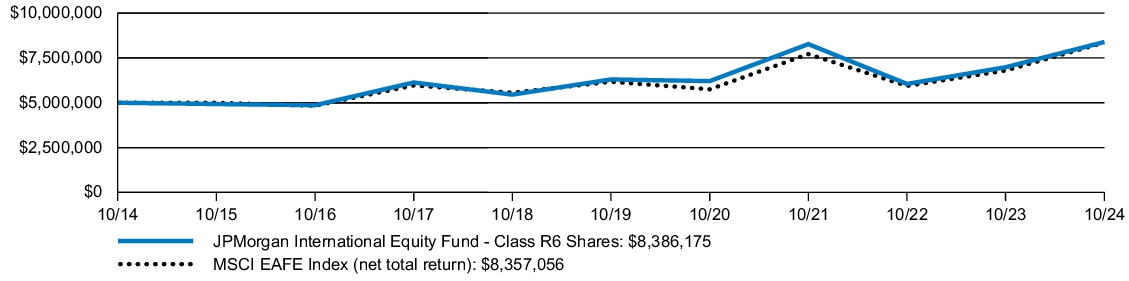

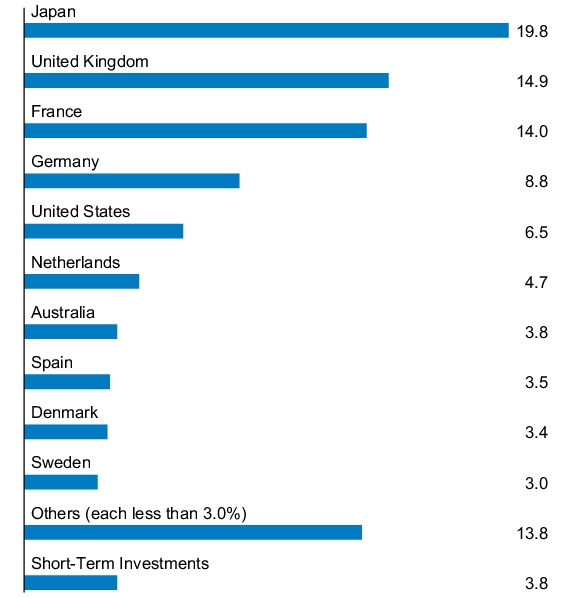

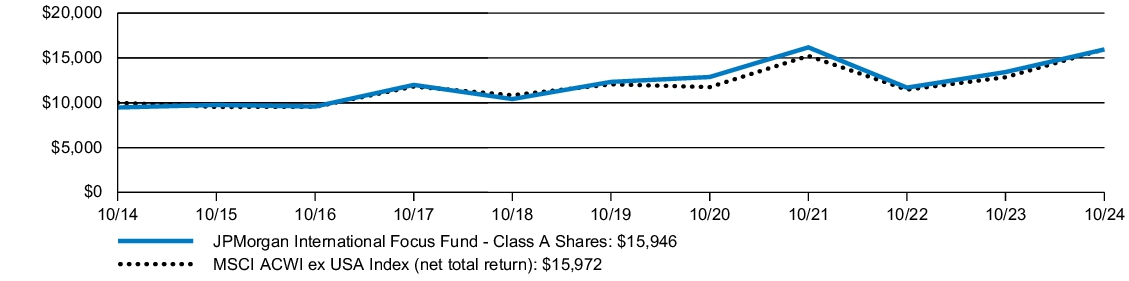

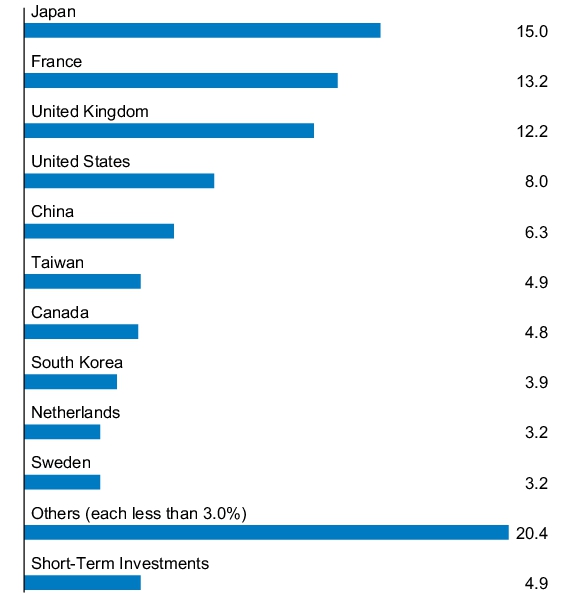

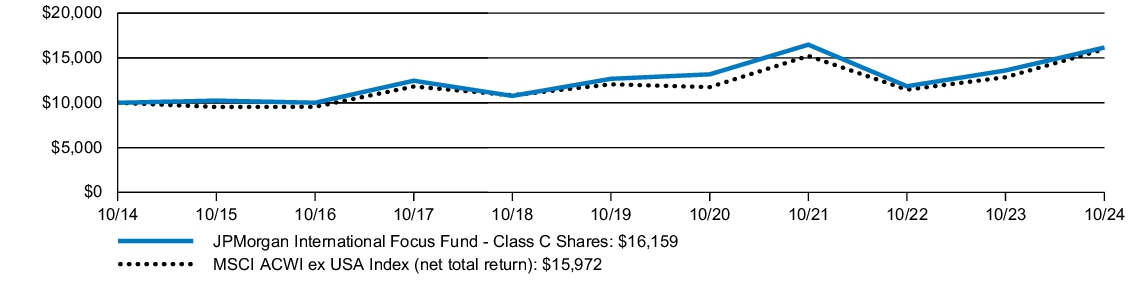

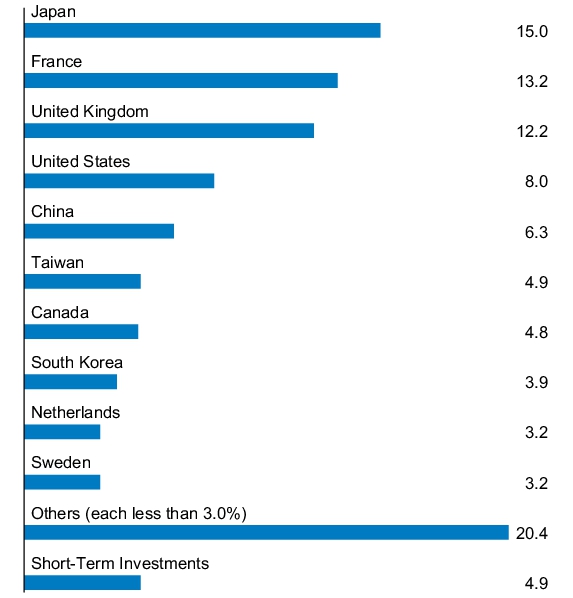

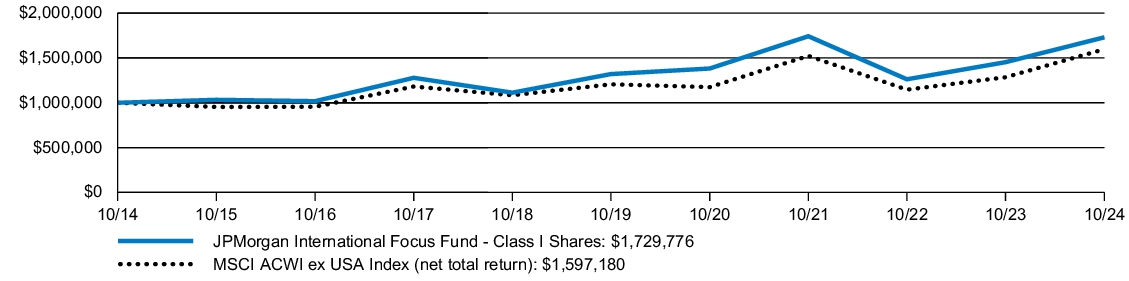

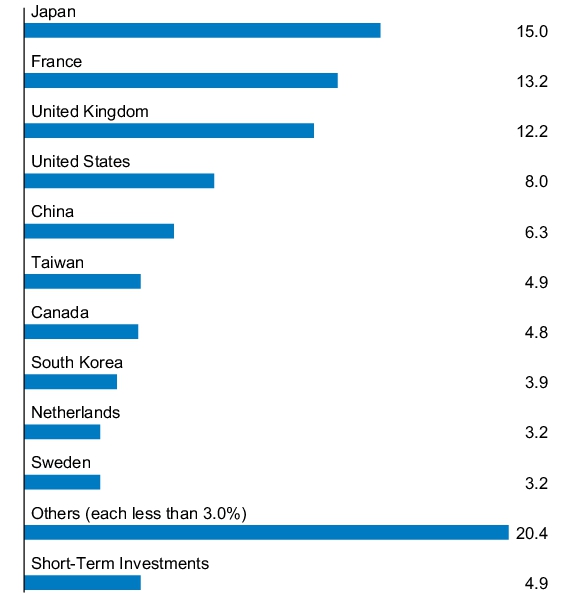

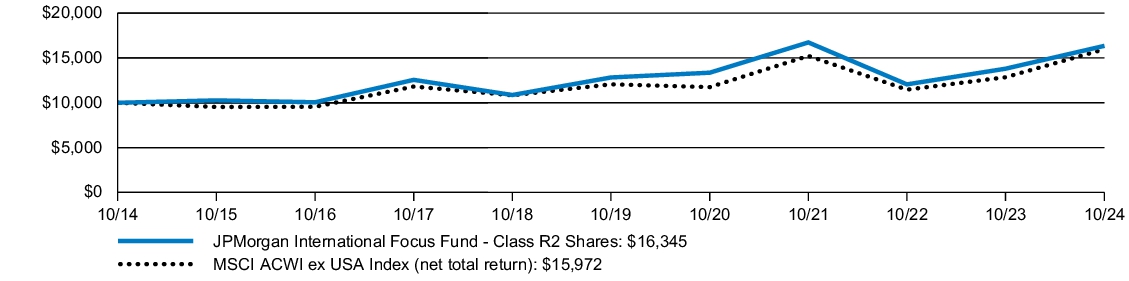

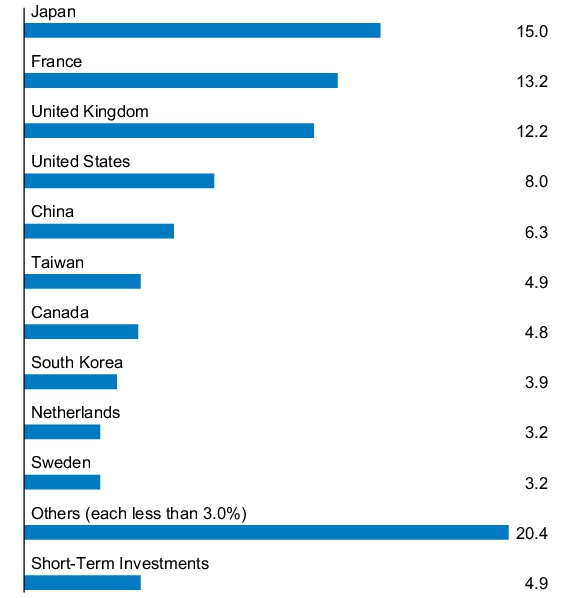

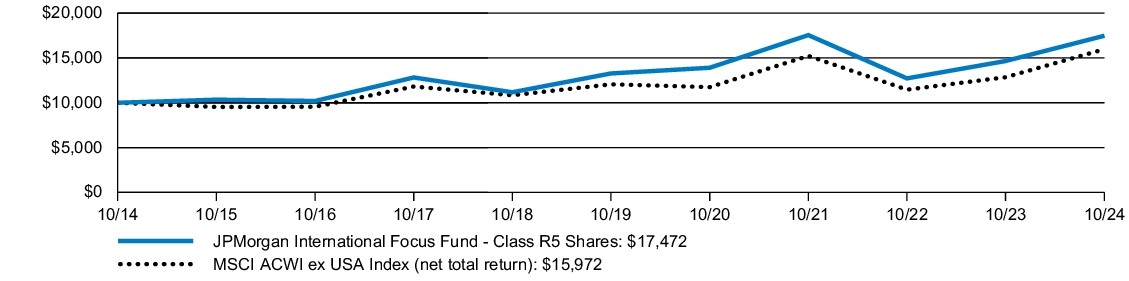

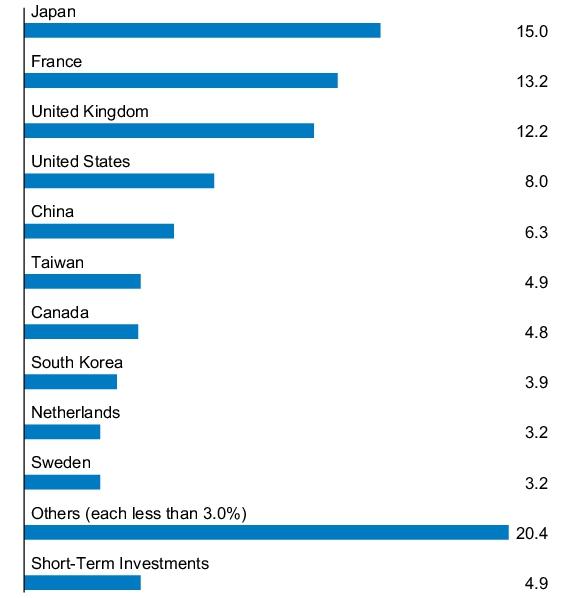

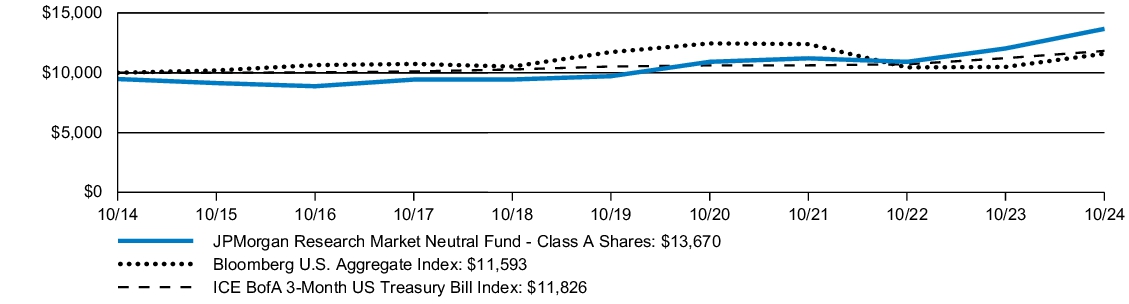

How did the Fund Perform?