UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21317

Stadion Investment Trust

(Exact name of registrant as specified in charter)

1061 Cliff Dawson Road, Watkinsville, Georgia 30677

(Address of principal executive offices)(Zip code)

Jennifer T. Welsh, Esq.

ALPS Fund Services, Inc., 1290 Broadway, Suite 1100, Denver, CO 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: (706) 583-5207

Date of fiscal year end: May 31, 2015

Date of reporting period: June 1, 2014 through May 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

May 31, 2015

STADION TACTICAL GROWTH FUND

STADION TACTICAL DEFENSIVE FUND

STADION DEFENSIVE INTERNATIONAL FUND

STADION TRILOGY ALTERNATIVE RETURN FUND

STADION ALTERNATIVE INCOME FUND

STADION MANAGED RISK 100 FUND

| Letter to Shareholders | | 1 |

| Performance Information | | 6 |

| Disclosure of Fund Expenses | | 18 |

| Schedules of Investments | | 20 |

| Statements of Assets and Liabilities | | 33 |

| Statements of Operations | | 35 |

| Statements of Changes in Net Assets | | 37 |

| Financial Highlights | | 40 |

| Notes to Financial Statements | | 57 |

| Report of Independent Registered Public Accounting Firm | | 70 |

| Additional Information | | 71 |

| Board of Trustees and Executive Officers | | 72 |

| Approval of Investment Advisory Agreements | | 74 |

| Stadion Investment Trust | Letter to Shareholders |

| | May 31, 2015 (Unaudited) |

Dear Stadion Shareholder,

We are pleased to present the annual report for the fiscal year ended May 31, 2015 for the Stadion family of funds. In this letter, we will include an overview of the market and the prevailing market conditions during the past year, and briefly highlight the purpose and approach of each of our funds during the past 12 months. Also occurring during this time period, and following a successful shareholder proxy, the Stadion Tactical Income Fund was repurposed into the Stadion Alternative Income Fund effective April 30, 2015. The details of this change will be described below. Now, let us take a short look at financial market conditions over the past year.

12 Month Market Overview

Equity Markets

The last twelve months have experienced some interesting market moves. During the previous fiscal year (June 1, 2014 to May 31, 2015), the S&P 500 Index was up 11.81%. However, the path taken to this return was nowhere near smooth.

The first six months (through November 30, 2014) had the S&P 500 Index return 8.58%, but during this period the market also experienced two sizable selloffs. The first occurred in late July and early August in which the S&P 500 Index sold off approximately 4%. The second, and more severe, selloff occurred in late September and early October. A rapid selloff in oil prices and slight reversal in what had been a steadily appreciating U.S. Dollar had the S&P 500 Index selloff over 7%.

During this 6-month period, the U.S. markets benefitted from a flight-to-quality trade out of international markets. The MSCI EAFE Index traded nearly 12% lower by mid-October but rallied to trade about 5% lower by the end of November.

During the latter six months of the fiscal year, the S&P 500 Index experienced two choppy sideways trading environments, both in the December to mid-February period and the March to May period, separated by a strong late February return that helped buoy performance.

The December and January period saw rampant oscillation in the S&P 500 Index between the 2000-2080 levels. In mid-February when the S&P 500 Index broke through the top side of the range and continued to cross the 2100 level, it appeared as if the uptrend was back in place. However, this late February blip was only a temporary respite from sideways range-bound trading. The S&P 500 Index managed to eke out only minimal returns over the last three months.

Some of this activity coincided with a leveling off in what had been very weak performance in other asset classes. The Euro experienced rampant depreciation from the beginning of the fiscal year through March 2015, seeing its level drop from $1.36/Euro to $1.05/Euro. Another headline item was weakness in oil prices, which traded from a peak of nearly $97/barrel at the end of June 2014 down to $50/barrel in March 2015.

On a more general theme, risk assets across the globe benefitted from Central Bank intervention. Like the Federal Reserve’s Quantitative Easing program, the European Central Bank (ECB) and the Bank of Japan (BOJ) deployed similar asset purchase programs. Whether or not strength in risk assets is true market strength or just an unnatural buoying effect by these central bank policies will come to play out soon enough.

Bond Markets

The fiscal year started with the 10-year U.S. treasury trading near the 2.6% level. For the first three months, rates trended steadily lower and closed near the 2.4% level by the end of August. In early September, the markets ramped up very quickly, erasing the aforementioned move by September 12. This inevitably brought out the ‘bond bull market is over’ talk. However, what followed was a rapid and sizable move lower, wherein the 10-year treasury moved nearly 1% lower by the end of January. Eventually this strength in rates faded, and over the last four month of the fiscal year, the 10-year treasury retraced nearly half this move lower, eventually closing at 2.12% on May 31.

For almost the entire period, European interest rates experienced a very steady and sizable move lower. The benchmark German 10-year rate moved from 1.4% to almost trading at 0% by mid-April. During this time, many shorter-dated European rates did trade in negative territory, essentially penalizing investors looking to put money in these assets. However, in mid-April, the same benchmark rate moved furiously higher, climbing nearly 0.6% in a manner of days.

Stadion’s Tactical Equity Portfolio Line-up

The tactical equity funds within our line-up provide various levels of risk management and the ability to diversify across markets. If you are looking for a more growth oriented strategy that still has a defensive element, then the Tactical Growth Fund might be a logical choice. If you are looking to play a little more defense, Stadion’s Tactical Defensive Fund provides a level of persistent market exposure with an eye always on risk management. The Stadion Managed Risk 100 Fund is our most defensive and most conservative equity strategy offering our most conservative exposure to equity markets. The Stadion Defensive International Fund provides measured access to international and emerging markets while attempting to manage risk and volatility.

| | |

| Annual Report | May 31, 2015 | 1 |

| Stadion Investment Trust | Letter to Shareholders |

| | May 31, 2015 (Unaudited) |

Stadion Tactical Growth Fund

The Stadion Tactical Growth Fund follows a rules based, disciplined, proprietary model. The model quantitatively ranks all actively traded Exchange Traded Funds (“ETFs”) that have first passed a fundamental review. The ranking is based upon risk-adjusted return. The holdings of the Tactical Growth Fund are adjusted so that the ETFs showing strength in the model are purchased and held. Those showing weakness in the model are sold or not considered for purchase. The goal of the Tactical Growth Fund’s investment process is to produce market-like returns while assuming below-market risk. What differentiates Tactical Growth Fund from Stadion’s trend following strategies is that instead of going to cash, the model will attempt to allocate among a mix of defensive and non-correlated assets during turbulent times.

For the year ending May 31, 2015, the Stadion Tactical Growth Fund – Class A returned 8.78%. These numbers exclude the impact of the 5.75% sales load. The two main contributors to the Tactical Growth Fund’s performance were allocation decisions and market performance. Its benchmark, the S&P 500 Index, gained 11.81% for the same period while the Morningstar Tactical Allocation Category returned 1.67%. In general, the security selection ranking process for the Tactical Growth Fund is used to allocate approximately three-quarters of the portfolio into U.S. equities. Our allocations to sectors such as small caps and health care were identified by our model and were strong performers in the portfolio during the past year. The remaining allocation of the Tactical Growth Fund is generally allocated to ETFs that are showing strength in our rankings, but are non-correlated to U.S. equities. The purpose of this allocation is to help achieve the fund’s goal of market-like returns while assuming below-market risk. While we were happy with the diversification and risk reduction this segment of the portfolio achieved last year, it did not perform as strongly as the U.S. equity market and was the main cause of our underperformance versus its benchmark. Much of this dispersion occurred late in the year when previous long-term trends paused or reversed course. However, given these market conditions, we have been happy with the performance of the Tactical Growth Fund.

Stadion Defensive International Fund

Similar to Stadion’s other trend following strategies, the Stadion Defensive International Fund uses a model to help assess market conditions to identify when to be invested. With a security ranking measure to identify leading asset classes, it can move to fully defensive positions when risk levels are deemed high. The Defensive International Fund borrows from Stadion’s domestic model by leveraging cyclical price measures for long-term trend exposure, intermediate term price measures for more reactive and adaptive allocations, and a risk management overlay incorporating speculative Emerging Market trends and volatility to help guide shorter-term allocations within the intermediate and longer-term mandates. When fully defensive, the Defensive International Fund has the ability to invest in cash and non-U.S. short duration fixed income. Due to including both Emerging and Developed market indications into the investment process, analyzing the Defensive International Fund’s returns relative to both of its benchmarks, a developed market benchmark, MSCI EAFE, and an emerging market benchmark, MSCI EM, is prudent.

For the year ending May 31, 2015, the Stadion Defensive International Fund – Class A was down 2.40%, which does not include a deduction for the 5.75% sales load. The MSCI EM Index was up 0.33% and the MSCI EAFE Index was down 0.06% for the same period.

As mentioned previously, a major theme over the past year was the appreciation of the U.S. Dollar or, conversely, weakness in foreign currencies, particularly the Euro. This caused major dispersion between international exposure that takes in the currency effect and the local market returns, which is now easily accessed via the proliferation of currency-hedged ETFs. An example is the local currency EAFE Index return which was up 17.66% versus the aforementioned 0.06% loss in the MSCI EAFE Index. This hedged/unhedged decision adds another layer of decision making when determining an international allocation.

For a majority of the period, the Defensive International Fund was able to balance between Developed and Emerging Market performance. However, a massive spike in the Chinese markets in early April (with some markets trading over 20% in a matter of days) had the fund lag Emerging Markets, as the models could not react to such a quick move higher. Additionally, once our models did catch up to the move higher, the rally faded and we experienced a small drawdown towards the end of the period.

Stadion Trilogy Alternative Return Fund

The Stadion Trilogy Alternative Return Fund is a multi-strategy portfolio designed to generate positive returns regardless of market direction, with an emphasis on lower risk and volatility than the U.S. Equity markets. The portfolio is designed to be uncorrelated to traditional asset classes and maintains risk management positions at all times. The portfolio consists of an equity component, an option income component and a market movement component. The allocation to each component varies based on Trilogy’s investment model. While Trilogy’s goal is to produce positive returns annually, monthly returns within the components may be asymmetrical according to the periodic valuations of positions.

| Stadion Investment Trust | Letter to Shareholders |

| | May 31, 2015 (Unaudited) |

For the year ended May 31, 2015, the Stadion Trilogy Alternative Return Fund – Class A returned 1.54%. This number excludes the impact of the 5.75% sales load. For the same period, its benchmark, the S&P 500 Index, was up 11.81%. The Morningstar Multi-alternative category was up 2.77%. During this period, the fund maintained a 45-50% allocation to equities that participated in the upward equity trend. These gains were partially offset by an S&P 500 Index option collar overlaid on the equities designed to minimize volatility. The strategy also continued to hold 45%-50% in low duration fixed income ETFs, which contributed to performance as rates declined. The VIX Index, a measure of implied volatility for the S&P 500, saw some spike during the year but generally remained near historic low levels. Although this volatility remained low, which hampers the ability to collect ample premium for the risk taken in the option income strategy, the fund still maintained a positive return for the year and is positioned well if volatility returns to the markets.

Stadion Alternative Income Fund

For the fiscal year, the Stadion Alternative Income Fund - Class A returned 0.24% as compared a 3.03% gain for its benchmark, the Barclays U.S. Aggregate Bond Index.

Prior to April 30, 2015 dispersion relative to the benchmark occurred during the August through December rally in interest rates and duration differentials between the fund and the benchmark. Additionally, a quick selloff in high yield due to a shock in oil prices caused some dispersion in late July.

On April 30, the Stadion Tactical Income Fund was repurposed into the Stadion Alternative Income Fund. The Alternative Income Fund looks to generate income outside of traditional sources, i.e. fixed income. The fund looks to capture income from two main sources. First, the fund looks to capture income from dividend paying equities, while utilizing an option hedging strategy to protect against large selloffs. Second, the fund looks to capture income by selling volatility on a rolling basis through the use of options, while also hedging against large absolute moves in volatility.

Stadion Managed Risk 100 and Stadion Tactical Defensive Funds

We incorporate Stadion Managed Risk 100 Fund and Stadion Tactical Defensive Fund together since both are guided by Stadion’s proprietary, long-term, technically based trend following model. The difference is that the Managed Risk 100 Fund is ‘fully unconstrained,’ ranging from 100% equity exposure to 100% cash or cash equivalents, while the Tactical Defensive Fund employs a core-satellite structure, with 50% (satellite) actively managed using our tactical model, and 50% (core) tactically managed and fully invested at all times. Both employ broad-based market index ETFs, major sector-based, international and, at times, specialty ETFs. Percentages of holdings are determined by the relative strength of employed asset classes as determined by our proprietary model. Our process for entering newly up-trending markets is to generally stick with large liquid market-based ETFs, and then as a trend fully develops, broaden exposure according to where our model identifies the best opportunities. During favorable conditions, we also utilize an active trade-up process, which means we constantly evaluate holdings, using our technical ranking and screening system to replace under-performers with what we believe will be better performing holdings.

During the 12 months ending May 31, 2015, major U.S. equity indices were positive, albeit with some dispersion. The S&P 500 Index was up 11.81% for the period and the Dow Jones Industrial Average Index was up 10.28%, while the Nasdaq Composite Index was up 21.07%. During the same period, the Managed Risk 100 Fund – Class A was down 4.75% and the Tactical Defensive Fund – Class A was up 2.67%. These numbers exclude the impact of the 5.75% sales load.

As noted previously, it was a bit of a tale of two halves for the markets this fiscal year. The price appreciation during the latter six months in the markets was choppier in nature with periods of declines followed by sharp increases or sideways choppy price action. This type of price action typically provides challenges for trend following strategies, and is especially difficult for the fully tactical strategy employed by the Managed Risk 100 Fund. It also provided challenges for the Tactical Defensive Fund, but the more persistent exposure in that strategy allowed the portfolio to achieve positive returns over the last 12 months. With the longer-term market trend remaining positive, Tactical Defensive’s Long-Term indicator remained on for the entirety of the period. As such, the Tactical Defensive Fund maintained a minimum 50% equity exposure from the core position throughout the period. As the prevailing market trend favored large-cap securities for the period, our core holdings remained allocated towards these broad large cap indices.

Entering June 2014, both funds were fully invested with both broad and top-performing sector exposure. Given the relatively smooth uptrend in the market during June and July, both funds maintained equity exposure through the end of July and traded in line with the market. However, the quick selloff in late July and early August had the Managed Risk 100 Fund move to a fully defensive position. The market continued to selloff but eventually rebounded off the early August lows, and the Managed Risk 100 Fund was fully invested towards the end of the month, avoiding volatility in the process. During this period, the Tactical Defensive Fund maintained exposure due to its wider sell criteria.

| | |

| Annual Report | May 31, 2015 | 3 |

| Stadion Investment Trust | Letter to Shareholders |

| | May 31, 2015 (Unaudited) |

During the latter part of September, the market once again sold off, this time to a much larger degree. The Managed Risk 100 Fund was again defensively positioned and, soon after, the Tactical Defensive Fund hit its minimum 50% exposure. As was the case with the earlier selloff, the funds were able to sidestep market volatility as the selloff continued.

This time around, the recovery was just as rampant as the selloff, as the S&P 500 Index traded over 8% higher from the mid-October lows through the end of the month. Given the depth of the selloff, our models needed a bit more time to confirm the trend, eventually having us fully invested by the end of the month. A smooth up-move in the markets in November kept both funds fully invested through the end of that month. As mentioned above, both strategies were able to produce solid returns (just under 6% while the S&P 500 was up 8.58%) and avoiding volatility.

From the end of November through the end of January, the bear market for tactical strategies - which is a choppy, sideways, range bound market - took full effect. The magnitude and length of the up-moves proved just enough to get the strategies invested, which often coincided with a selloff and subsequent reduction in equity exposure. These months saw a few different 0% to 100% moves in equity exposure in the Managed Risk 100 Fund and 50% to 100% moves in the Tactical Defensive Fund.

The March through May period saw similar choppy moves, just with smaller oscillations. As such, both strategies were able to maintain equity exposure to a larger degree and traded in line with the market for a majority of the period, outside of a small dispersion period in early May.

Stadion Observations and Market Outlook

Although the market continues to trade near all-time highs, some of the sideways markets experienced this year can add a bit of trepidation to the increasingly extending cyclical bull market. All markets move in cycles and we believe that the need for risk management within a portfolio is as important now as ever. It is precisely why we have a full suite of investment strategies offering a defensive bias.

At Stadion, we emphasize lasting results. Our defensive fund strategies incorporate a disciplined, long-term approach to investing over full market cycles (FMC). FMC’s are not specified durations but rather the time it takes for the market to experience the full range of market conditions. The risk-averse methodology applied in many of the Stadion Funds may result in underperformance during up-markets because our defensive focus may cause us to miss some upswings. However, when the market experiences major declines (there have been two bear markets since 2000), we hope to avoid most of the downside. In the last 113 years, there have been 33 bear markets (declines greater than 20% as measured by the Dow Jones Industrial Average). Thus, for our trend following strategies, we believe there are times when the best approach to the equity markets is to exit them. Further, we do not forecast the market; in fact, we strongly believe no one can accurately do so consistently. Rather than predict, we react with discipline, using our rules-based processes designed to measure market conditions and inform and direct our trades. We are quite comfortable with the defensive nature of all of our products, particularly with many equity markets at or very near all-time highs, bond yields at or near all-time lows and showing signs of instability, and the Federal Reserve contemplating raising rates. Coupled with much of the remaining global fiscal uncertainty yet to be resolved and continued global unrest, we believe that prudence favors measured market participation with

solid defense.

Thank you for your continued support and allowing us to serve you and the Funds. Please feel free to contact us with any questions or concerns.

Sincerely,

Stadion Money Management

Brad Thompson, CFA

Chief Investment Officer

The views in this report were those of the Funds’ investment adviser as of the date of this Report and may not reflect their views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Funds and do not constitute investment advice.

Investment in the Funds are subject to investment risks, including, without limitation, market risk, management style risk, risks related to “fund of funds” structure, sector risk, fixed income risk, tracking risk, risks related to ETF net asset value and market price, foreign securities risk, risks related to portfolio turnover and small capitalization companies risk. Since the Funds are a “fund of funds,” an investor will indirectly bear fees and expenses charged by the underlying ETFs and investment companies in which the Funds invest in addition to the Funds’ direct fees and expenses.

| Stadion Investment Trust | Letter to Shareholders |

| | May 31, 2015 (Unaudited) |

Derivative instruments can be volatile and the potential loss to the Funds may exceed the Funds’ initial investment. Derivative instruments may be difficult to value and may be subject to wide swings in valuations caused by changes in the value of the underlying instrument. The use of these instruments requires special skills and knowledge of investment techniques that are different than those normally required for purchasing and selling securities. The Funds could also experience losses if they are unable to close out a position because the market for an instrument or position is or becomes illiquid.

Options are financial derivatives that represent a contract sold by one party (option writer) to another party (option holder). The contract offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security or other financial asset at an agreed-upon price (the strike price) during a certain period of time or on a specific date (exercise date).

An Option Collar is a protective options strategy that is implemented after a long position in a stock has experienced substantial gains. It is created by purchasing an out of the money put option while simultaneously writing an out of the money call option.

The Funds’ foreign investments generally carry more risks than funds that invest strictly in U.S. assets, including currency risk, geographic risk, and emerging market risk. Risks can also result from varying stages of economic and political development; differing regulatory environments, trading days, and accounting standards; and higher transaction costs of non-U.S. markets. More information about these risks and other risks can be found in the Funds’ prospectus.

Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of prices of U.S. dollar-denominated investment-grade fixed income securities with remaining maturities of one year and longer.

Dow Jones Industrial Average is a stock market index that shows how 30 large publicly owned companies based in the U.S. have traded during a standard trading session.

Local currency MSCI EAFE Index (Europe, Australasia, Far East) is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada, that uses the respective currency of each country.

MSCI EM Index is an unmanaged free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

MSCI EAFE Index (Europe, Australasia, Far East) is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

The Morningstar Multi-alternative Category is a benchmark created and published by Morningstar and defines Alternative as “Alternative funds may take short positions or invest in currencies, derivatives, or other instruments.”

The Morningstar Tactical Allocation Category is a benchmark created and published by Morningstar and is defined as “Portfolios seek to provide capital appreciation and income by actively shifting allocations between asset classes.”

Nasdaq Composite Index is a stock market index of common stocks and similar securities listed on the Nasdaq stock market. It is highly followed in the U.S. as an indicator of the performance of technology and growth company stocks.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index.

The VIX Index measures annualized implied volatility as conveyed by S&P 500 stock option prices and is quoted in percentage points per annum.

The United States Dollar is the official currency of the United States and its overseas territories.

The euro is the official currency of the Eurozone, which consists of 19 of the 28 member states of the European Union.

One may not invest directly in indexes, which are unmanaged and do not incur fees, expenses or taxes.

Correlation is a measure of how investments move in relation to one another. A correlation of 1 means the two asset classes move exactly in line with each other, while a correlation of -1 means they move in the exact opposite direction.

| | |

| Annual Report | May 31, 2015 | 5 |

| Stadion Tactical Growth Fund | Performance Information |

| | May 31, 2015 (Unaudited) |

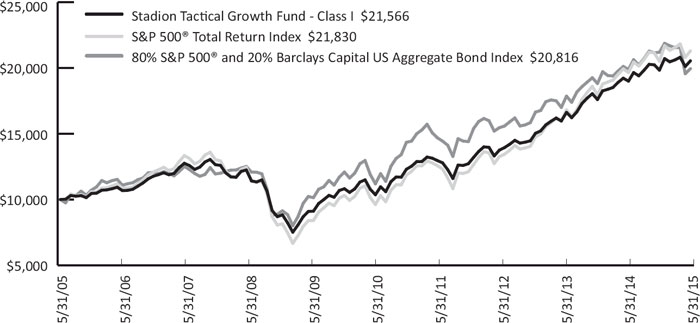

Comparison of the Change in Value of a $10,000 Investment in Stadion Tactical Growth Fund(a), the S&P 500® Total Return Index and 80% S&P 500® and 20% Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns(b) (for periods ended May 31, 2015)

| | 1 Year | 5 Year | 10 Year | Since Inception(d) |

Stadion Tactical Growth Fund - A – NAV(C) | 8.78% | 12.35% | 7.72% | 7.00% |

Stadion Tactical Growth Fund - A - POP(C) | 2.54% | 11.02% | 7.08% | 6.43% |

Stadion Tactical Growth Fund - C - NAV(C) | 7.96% | 11.51% | 6.91% | 6.20% |

Stadion Tactical Growth Fund - C - CDSC(C) | 6.96% | 11.51% | 6.91% | 6.20% |

| Stadion Tactical Growth Fund - I - NAV | 9.07% | 12.63% | 7.99% | 7.26% |

S&P 500® Total Return Index | 11.81% | 16.54% | 8.12% | 8.14%(e) |

80% S&P 500® and 20% Barclays Capital US Aggregate Bond Index | 10.08% | 14.06% | 7.61% | 7.64%(e) |

(a) The line graph above represents performance of Class I shares only, which will vary from the performance of Class A and Class C shares based on the difference in loads and fees paid by shareholders in different classes.

(b) Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads.

(c) The performance shown includes that of the predecessor Fund, the ETF Market Opportunity Fund, a series of Aviemore Trust, which was reorganized into the Fund, as of the close of business on March 29, 2013. Performance information for Class A and Class C shares prior to April 1, 2013, reflects the performance of Class I shares adjusted for the higher expenses paid by Class A and Class C shares.

(d) Class I, Class A and C shares of the Fund commenced operations on May 3, 2004, April 1, 2013 and April 1, 2013, respectively. The performance shown for Class A and C shares for periods pre-dating the commencement of operations of those classes reflects the performance of the Fund’s Class I shares, the initial share class, calculated using the fees and expenses of Class A and C shares respectively and without the effect of any fee and expense limitations or waivers. If Class A and C shares of the Fund had been available during periods prior to April 1, 2013, the performance shown may have been different.

(e) Represents the period from May 3, 2004 (date of original public offering of Class I shares) through May 31, 2015.

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

| Stadion Tactical Growth Fund | Performance Information |

| | May 31, 2015 (Unaudited) |

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 2.10%, 2.89% and 1.84%, respectively. The Fund’s investment adviser, Stadion Money Management, LLC (the “Adviser”) has entered into an Expense Limitation Agreement with the Fund under which it has contractually agreed to waive Management Fees and to assume other expenses of the Fund, if necessary, in an amount that limits annual operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, Acquired Fund Fees and Expenses and payments, if any, under a Rule 12b-1 Distribution Plan) of Class A, Class C and Class I shares to not more than 1.30% of the average daily net assets allocable to each Class of the Fund. The Expense Limitation Agreement is currently in effect until October 1, 2016.

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased share are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund’s prospectus.

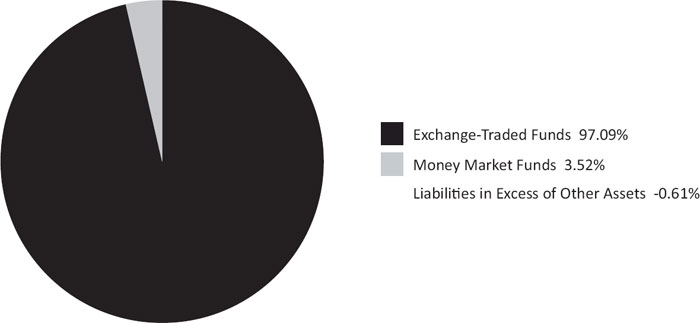

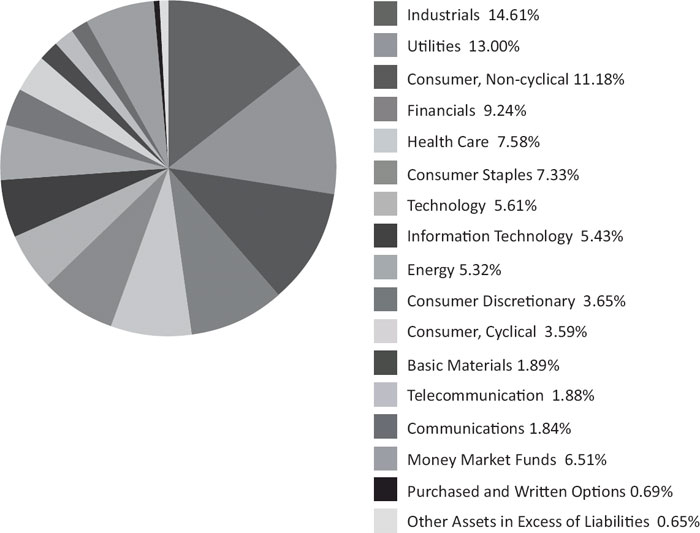

Portfolio Composition (as a % of net assets)

| | |

| Annual Report | May 31, 2015 | 7 |

| Stadion Tactical Defensive Fund | Performance Information |

| | May 31, 2015 (Unaudited) |

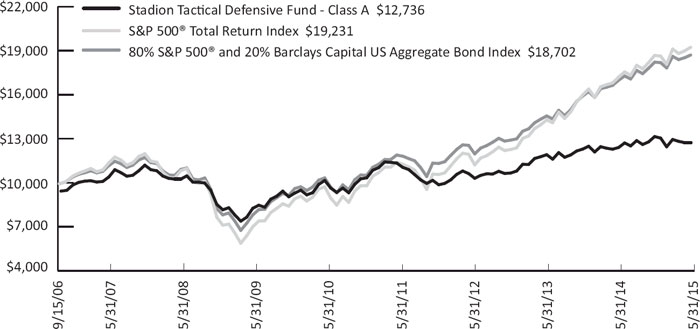

Comparison of the Change in Value of a $10,000 Investment in Stadion Tactical Defensive Fund(a), the S&P 500® Total Return Index and 80% S&P 500® and 20% Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns(b) (for periods ended May 31, 2015)

| | | 1 Year | | 5 Year | | Since Inception(c) |

| Stadion Tactical Defensive Fund - A - NAV | | 2.67% | | 5.74% | | 3.51% |

| Stadion Tactical Defensive Fund - A - POP | | -3.20% | | 4.50% | | 2.82% |

| Stadion Tactical Defensive Fund - C - NAV | | 1.80% | | 4.92% | | 2.71% |

| Stadion Tactical Defensive Fund - C - CDSC | | 0.80% | | 4.92% | | 2.71% |

| Stadion Tactical Defensive Fund - I - NAV | | 2.82% | | 5.96% | | 3.72% |

S&P 500® Total Return Index | | 11.81% | | 16.54% | | 7.80%(d) |

80% S&P 500® and 20% Barclays Capital US Aggregate Bond Index | | 10.08% | | 14.06% | | 7.46%(d) |

(a) The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%.

(b) Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads.

(c) Class A, Class C and I shares of the Fund commenced operations on September 15, 2006, October 1, 2009 and May 28, 2010, respectively. The performance shown for Class C and I shares for periods pre-dating the commencement of operations of those classes reflects the performance of the Fund’s Class A shares, the initial share class, calculated using the fees and expenses of Class C and I shares respectively and without the effect of any fee and expense limitations or waivers. If Class C and I shares of the Fund had been available during periods prior to October 1, 2009 and May 28, 2010, respectively, the performance shown may have been different.

(d) Represents the period from September 15, 2006 (date of original public offering of Class A shares) through May 31, 2015.

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

| Stadion Tactical Defensive Fund | Performance Information |

May 31, 2015 (Unaudited)

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 2.17%, 2.95%and 2.01%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.70% of the average daily net assets for Class A, Class C, and Class I, until at least October 1, 2016.

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased shares are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

Portfolio Composition (as a % of net assets)

| Annual Report | May 31, 2015 | 9 |

Stadion Defensive International Fund | Performance Information |

May 31, 2015 (Unaudited)

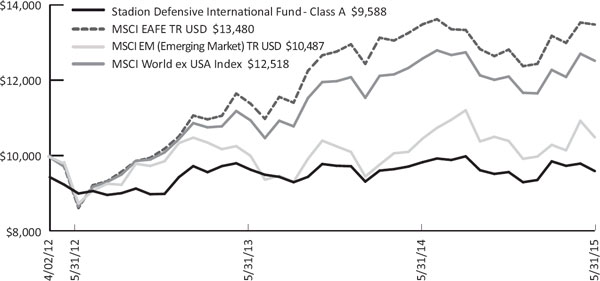

Comparison of the Change in Value of a $10,000 Investment in Stadion Defensive International Fund(a), MSCI EAFE TR USD, MSCI EM (Emerging Market) TR USD and the MSCI World ex USA Index

Average Annual Total Returns(b) (for periods ended May 31, 2015)

| | 1 Year | Since Inception(c) |

| Stadion Defensive International Fund - A - NAV | -2.40% | 0.54% |

| Stadion Defensive International Fund - A - POP | -8.04% | -1.32% |

| Stadion Defensive International Fund - C - NAV | -3.06% | -0.19% |

| Stadion Defensive International Fund - C - CDSC | -4.02% | -0.19% |

| Stadion Defensive International Fund - I - NAV | -2.15% | 0.80% |

| MSCI EAFE TR USD | -0.06% | 9.90%(d) |

| MSCI EM (Emerging Markets) TR USD | 0.33% | 1.51%(d) |

| MSCI World ex USA Index | -0.47% | 7.36%(d) |

(a) The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%.

(b) Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads.

(c) Class A inception: 04/02/12; Class C inception: 04/02/12; Class I inception: 04/02/12.

(d) Represents the period from April 2, 2012 (date of original public offering of Class A shares) through May 31, 2015.

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 2.47%, 3.20% and 2.29%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.70% of the average daily net assets for Class A, Class C, and Class I, until at least October 1, 2016.

| Stadion Defensive International Fund | Performance Information |

May 31, 2015 (Unaudited)

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased shares are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

MSCI EAFE TR USD Index (is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada.

MSCI EM (Emerging Market) TR USD Index is an unmanaged free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The MSCI World ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets excluding the United States.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

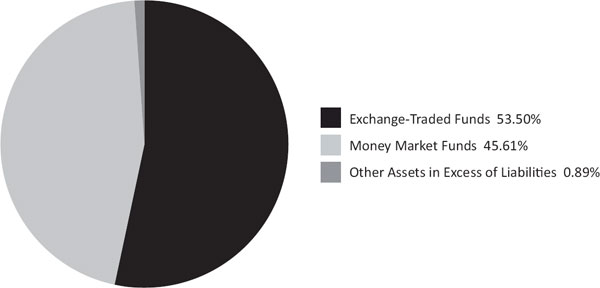

Portfolio Composition (as a % of net assets)

| Annual Report | May 31, 2015 | 11 |

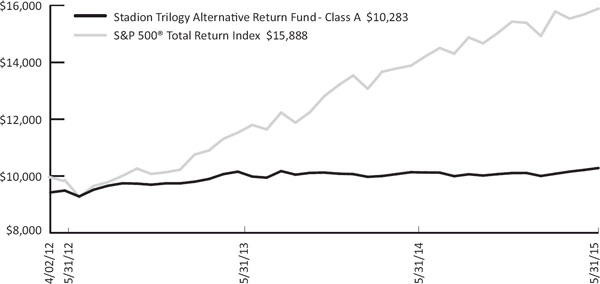

| Stadion Trilogy Alternative Return Fund | Performance Information |

May 31, 2015 (Unaudited)

Comparison of the Change in Value of a $10,000 Investment in Stadion Trilogy Alternative Return Fund(a) and the S&P 500® Total

Return Index

Average Annual Total Returns(b) (for periods ended May 31, 2015)

| | 1 Year | Since Inception(c) |

| Stadion Trilogy Alternative Return Fund - A - NAV | 1.54% | 2.80% |

| Stadion Trilogy Alternative Return Fund - A - POP | -4.28% | 0.89% |

| Stadion Trilogy Alternative Return Fund - C - NAV | 0.75% | 2.05% |

| Stadion Trilogy Alternative Return Fund - C - CDSC | -0.25% | 2.05% |

| Stadion Trilogy Alternative Return Fund - I - NAV | 1.78% | 3.03% |

S&P 500® Total Return Index | 11.81% | 15.77%(d) |

(a) | The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

(c) | Class A inception: 04/02/12; Class C inception: 04/02/12; Class I inception: 04/02/12. |

(d) | Represents the period from April 2, 2012 (date of original public offering of Class A shares) through May 31, 2015. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 1.91%, 2.67% and 1.72%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.70% of the average daily net assets for Class A, Class C, and Class I, until at least October 1, 2016.

| Stadion Trilogy Alternative Return Fund | Performance Information |

May 31, 2015 (Unaudited)

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased shares are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

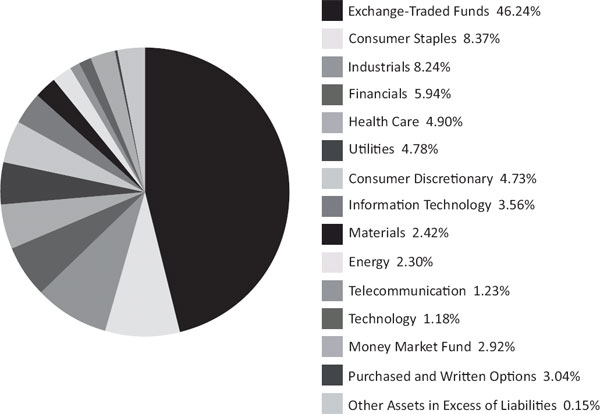

Portfolio Composition (as a % of net assets)

| Annual Report | May 31, 2015 | 13 |

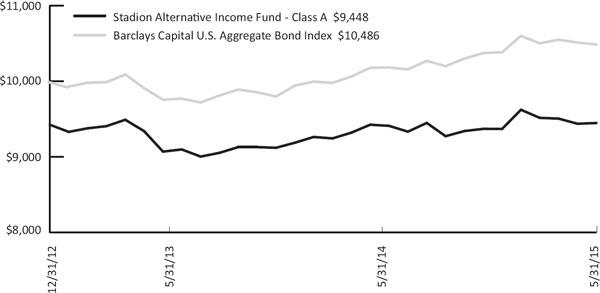

| Stadion Alternative Income Fund | Performance Information |

| May 31, 2015 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Stadion Alternative Income Fund(a) and Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns(b) (for periods ended May 31, 2015)

| | 1 Year | Since Inception(c) |

| Stadion Alternative Income Fund - A - NAV | 0.24% | 0.10% |

| Stadion Alternative Income Fund - A - POP | -5.50% | -2.33% |

| Stadion Alternative Income Fund - I - NAV | 0.58% | 0.33% |

| Barclays Capital U.S. Aggregate Bond Index | 3.03% | 1.98%(d) |

(a) | The line graph above represents performance of Class A shares only, which will vary from the performance of Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

(c) | Class A inception: 12/31/12; Class I inception: 2/14/13. The performance shown for Class I shares for periods pre-dating the commencement of operations of Class I shares reflects the performance of the Fund’s Class A shares, the initial share class, calculated using the fees and expenses of Class I and without the effect of any fee and expense limitations or waivers. If Class I shares of the Fund had been available prior to February 14, 2013, the performance shown may have been different. |

(d) | Represents the period from December 31, 2012 (date of original public offering of Class A shares) through May 31, 2015. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

The Total Annual Fund Operating Expenses for Class A and Class I are 3.03% and 2.77%, respectively. The Fund’s investment advisor, Stadion Money Management, LLC (the “Advisor”) has agreed to waive fees and reimburse for other operating expenses (exclusive of interest expense on any borrowings, taxes, brokerage commissions, extraordinary expenses, acquired fund fees and expenses and payments, if any, under a Rule 12b-1 Distribution Plan) in excess of 1.15% of the average daily net assets for Class A and Class I, until at least October 1, 2016.

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A shares at the time of purchase. For additional information please consult the Fund’s Prospectus.

| Stadion Alternative Income Fund | Performance Information |

| May 31, 2015 (Unaudited) |

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

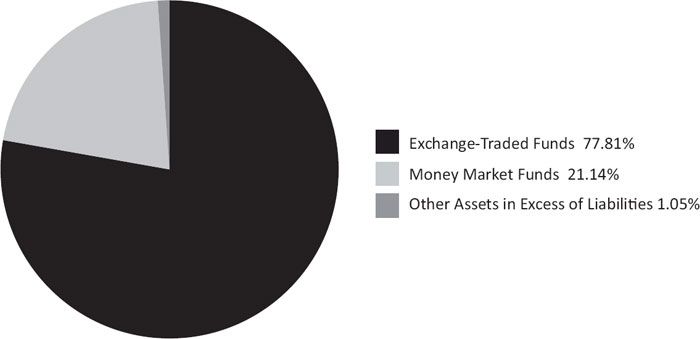

Portfolio Composition (as a % of net assets)

| Annual Report | May 31, 2015 | 15 |

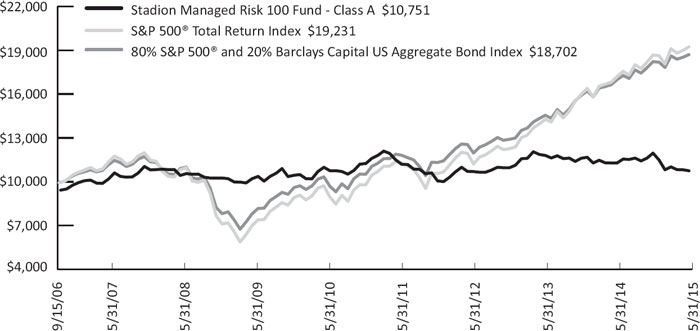

| Stadion Managed Risk 100 Fund | Performance Information |

| May 31, 2015 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in Stadion Managed Risk 100 Fund(a), the S&P 500® Total Return Index and 80% S&P 500® and 20% Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns(b) (for periods ended May 31, 2015)

| | 1 Year | 5 Year | Since Inception(c) |

| Stadion Managed Risk 100 Fund - A - NAV | -4.75% | -0.01% | 1.53% |

| Stadion Managed Risk 100 Fund - A - POP | -10.19% | -1.19% | 0.84% |

| Stadion Managed Risk 100 Fund - C - NAV | -5.45% | -0.78% | 0.73% |

| Stadion Managed Risk 100 Fund - C - CDSC | -6.40% | -0.78% | 0.73% |

| Stadion Managed Risk 100 Fund - I - NAV | -4.50% | 0.22% | 1.76% |

S&P 500® Total Return Index | 11.81% | 16.54% | 7.80%(d) |

80% S&P 500® and 20% Barclays Capital US Aggregate Bond Index | 10.08% | 14.06% | 7.46%(d) |

(a) | The line graph above represents performance of Class A shares only, which will vary from the performance of Class C and Class I shares based on the difference in loads and fees paid by shareholders in different classes. The change in value of the initial $10,000 investment shown for Class A shares in the line graph reflects the maximum front-end sales load of 5.75%. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the periods covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. Total returns shown do include the effect of applicable sales loads. |

(c) | Class A, Class C and I shares of the Fund commenced operations on September 15, 2006, October 1, 2009 and May 28, 2010, respectively. The performance shown for Class C and I shares for periods pre-dating the commencement of operations of those classes reflects the performance of the Fund’s Class A shares, the initial share class, calculated using the fees and expenses of Class C and I shares respectively and without the effect of any fee and expense limitations or waivers. If Class C and I shares of the Fund had been available during periods prior to October 1, 2009 and May 28, 2010, respectively, the performance shown may have been different. |

(d) | Represents the period from September 15, 2006 (date of original public offering of Class A shares) through May 31, 2015. |

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling 1-800-222-7636. An investor should consider a Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s prospectus contains this and other important information. For information on the Fund’s expense ratios, please see the Financial Highlights tables found within this Report.

The Total Annual Fund Operating Expenses for Class A, Class C and Class I are 1.70%, 2.46% and 1.48%, respectively.

| Stadion Managed Risk 100 Fund | Performance Information |

| May 31, 2015 (Unaudited) |

POP, the “Public Offering Price”, and NAV, the “Net Asset Value” price, are terms used to describe what share price was applied to Class A and/or Class C shares at the time of purchase. A CDSC (“Contingent Deferred Sales Charge”) is a redemption fee that can be applied if purchased shares are redeemed prior to a specified holding period. For additional information please consult the Fund’s Prospectus.

The S&P 500® Total Return Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation. It is a market-value weighted index. The index is not actively managed and does not reflect any deduction for fees, expenses or taxes.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

Diversification does not eliminate the risk of experiencing investment losses.

Information included or referred to on, or otherwise accessible through, our website is not intended to form part of or be incorporated into this report or the Fund's prospectus.

Portfolio Composition (as a % of net assets)

| Annual Report | May 31, 2015 | 17 |

| Stadion Investment Trust | Disclosure of Fund Expenses |

| | May 31, 2015 (Unaudited) |

We believe it is important for you to understand the impact of costs on your investment. As a shareholder of the Funds, you may incur two types of costs: (1) transaction costs, possibly including front-end and contingent deferred sales loads; and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. The following examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

A mutual funds’ ongoing costs are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The expenses in the tables that follow are based on an investment of $1,000 made at the beginning of the most recent semi-annual period (December 1, 2014) and held until the end of the period (May 31, 2015).

The tables that follow illustrate the Funds’ costs in two ways:

Actual fund return – This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the Funds’ actual returns, and the third column shows the dollar amount of operating expenses that would have been paid by an investor who started with $1,000 in the Funds. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund under the heading “Expenses Paid During Period.”

Hypothetical 5% return – This section is intended to help you compare the Funds’ ongoing costs with those of other mutual funds. It assumes that each Fund had an annual return of 5% before expenses during the period shown, but that the expense ratio is unchanged. In this case, because the returns used are not the Funds’ actual returns, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% return. You can assess the Funds’ ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that expenses shown in the tables are meant to highlight and help you compare ongoing costs only and do not reflect any transaction costs, such as sales charges (loads). The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

More information about the Funds’ expenses, including historical annual expense ratios, can be found in this report. For additional information on operating expenses and other shareholder costs, please refer to the Funds’ prospectus.

| | | Beginning

Account Value

12/1/14 | | Ending

Account Value

5/31/15 | | Expense Ratio(a) | | Expenses Paid

During period

12/1/14 - 5/31/15(b) |

| | | | | | | | | | | | | | |

Stadion Tactical Growth Fund - Class A | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,012.50 | | | 1.58 | % | | | $ | 7.93 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,017.05 | | | 1.58 | % | | | $ | 7.95 | |

Stadion Tactical Growth Fund - Class C | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,008.80 | | | 2.32 | % | | | $ | 11.62 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,013.36 | | | 2.32 | % | | | $ | 11.65 | |

Stadion Tactical Growth Fund - Class I | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,013.60 | | | 1.33 | % | | | $ | 6.68 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,018.30 | | | 1.33 | % | | | $ | 6.69 | |

| | | | | | | | | | | | | | | | | |

Stadion Tactical Defensive Fund - Class A | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 968.70 | | | 1.91 | % | | | $ | 9.37 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,015.41 | | | 1.91 | % | | | $ | 9.60 | |

Stadion Tactical Defensive Fund - Class C | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 964.90 | | | 2.69 | % | | | $ | 13.18 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,011.52 | | | 2.69 | % | | | $ | 13.49 | |

Stadion Tactical Defensive Fund - Class I | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 969.80 | | | 1.73 | % | | | $ | 8.50 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,016.31 | | | 1.73 | % | | | $ | 8.70 | |

| | | | | | | | | | | | | | | | | |

| Stadion Investment Trust | Disclosure of Fund Expenses |

| | May 31, 2015 (Unaudited) |

| | | Beginning

Account Value

12/1/14 | | Ending

Account Value

5/31/15 | | Expense Ratio(a) | | Expenses Paid

During period

12/1/14 - 5/31/15(b) |

Stadion Defensive International Fund - Class A | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,002.80 | | | 1.95 | % | | | $ | 9.74 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,015.21 | | | 1.95 | % | | | $ | 9.80 | |

Stadion Defensive International Fund - Class C | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 999.50 | | | 2.70 | % | | | $ | 13.46 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,011.47 | | | 2.70 | % | | | $ | 13.54 | |

Stadion Defensive International Fund - Class I | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,004.20 | | | 1.70 | % | | | $ | 8.49 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,016.45 | | | 1.70 | % | | | $ | 8.55 | |

| | | | | | | | | | | | | | | | | |

Stadion Trilogy Alternative Return Fund - Class A | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,017.50 | | | 1.85 | % | | | $ | 9.31 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,015.71 | | | 1.85 | % | | | $ | 9.30 | |

Stadion Trilogy Alternative Return Fund - Class C | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,013.50 | | | 2.63 | % | | | $ | 13.20 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,011.82 | | | 2.63 | % | | | $ | 13.19 | |

Stadion Trilogy Alternative Return Fund - Class I | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,017.90 | | | 1.65 | % | | | $ | 8.30 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,016.70 | | | 1.65 | % | | | $ | 8.30 | |

| | | | | | | | | | | | | | | | | |

Stadion Alternative Income Fund - Class A | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,008.20 | | | 1.40 | % | | | $ | 7.01 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,017.95 | | | 1.40 | % | | | $ | 7.04 | |

Stadion Alternative Income Fund - Class I | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 1,009.80 | | | 1.15 | % | | | $ | 5.76 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,019.20 | | | 1.15 | % | | | $ | 5.79 | |

| | | | | | | | | | | | | | | | | |

Stadion Managed Risk 100 Fund - Class A | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 899.00 | | | 1.69 | % | | | $ | 8.00 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,016.50 | | | 1.69 | % | | | $ | 8.50 | |

Stadion Managed Risk 100 Fund - Class C | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 895.70 | | | 2.49 | % | | | $ | 11.77 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,012.52 | | | 2.49 | % | | | $ | 12.49 | |

Stadion Managed Risk 100 Fund - Class I | | | | | | | | | | | | | | | | |

| Based on Actual Fund Return | | | $ 1,000.00 | | | $ | 900.00 | | | 1.53 | % | | | $ | 7.25 | |

| Based on Hypothetical 5% Return (before expenses) | | | $ 1,000.00 | | | $ | 1,017.30 | | | 1.53 | % | | | $ | 7.70 | |

| | | | | | | | | | | | | | | | | |

(a) | The Fund’s expense ratios have been based on the Fund's most recent fiscal half-year expenses. |

(b) | Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (182/365). |

| Annual Report | May 31, 2015 | 19 |

| Stadion Tactical Growth Fund | Schedule of Investments |

| | May 31, 2015 |

| EXCHANGE-TRADED FUNDS - 97.09% | Shares | | Value | |

Consumer Staples Select Sector SPDR® Fund | | | 195,169 | | | $ | 9,522,295 | |

| Global X Silver Miners ETF | | | 818,190 | | | | 7,363,710 | |

iShares® Core S&P 500® ETF | | | 134,430 | | | | 28,577,129 | |

iShares® Core S&P® Mid-Cap ETF | | | 187,382 | | | | 28,528,909 | |

iShares® MSCI Austria Capped ETF | | | 328,470 | | | | 5,508,442 | |

iShares® MSCI Europe Financial Sector Index Fund | | | 396,710 | | | | 9,469,468 | |

iShares® Russell 2000® Growth ETF | | | 62,384 | | | | 9,507,322 | |

Powershares® QQQ Trust Series 1 | | | 172,817 | | | | 19,018,511 | |

ProShares® Short 20+ Year Treasury(a) | | | 379,460 | | | | 9,592,749 | |

SPDR® S&P China ETF | | | 59,100 | | | | 5,586,723 | |

SPDR® S&P International Small Cap ETF(a) | | | 185,620 | | | | 5,713,384 | |

Vanguard® Growth ETF | | | 261,101 | | | | 28,496,563 | |

Vanguard® Health Care ETF | | | 136,740 | | | | 19,118,987 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | |

| (Cost $179,721,972) | | | | | | | 186,004,192 | |

| | | | | | | | | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 3.52% | Shares | | Value | |

| Morgan Stanley Institutional Liquidity Fund - Government Portfolio, 0.040%, 7-day effective yield | | | 6,735,809 | | | $ | 6,735,809 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $6,735,809) | | | | | | | 6,735,809 | |

| | | | | | | | | |

| Total Investments, at Value - 100.61% | | | | | |

| (Cost $186,457,781) | | | | | | | 192,740,001 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.61)% | | | | | | | (1,168,064 | ) |

| | | | | | | | | |

| | | | | | | | | |

| Net Assets - 100.00% | | | | | | $ | 191,571,937 | |

(a) | Non-income producing security. |

See Notes to Financial Statements.

| Stadion Tactical Defensive Fund | Schedule of Investments |

| | May 31, 2015 |

| EXCHANGE-TRADED FUNDS - 87.69% | Shares | | Value | |

First Trust NASDAQ-100® Equal Weighted Index Fund | | | 149,830 | | | $ | 6,748,343 | |

Guggenheim® S&P 500® Equal Weight ETF | | | 181,932 | | | | 14,912,966 | |

iShares® MSCI EAFE Index Fund | | | 24,590 | | | | 1,638,678 | |

iShares® MSCI Emerging Markets ETF | | | 32,400 | | | | 1,618,380 | |

iShares® Russell® 1000 Value Index Fund | | | 63,580 | | | | 6,693,702 | |

iShares® Russell® 2000 Growth ETF | | | 22,160 | | | | 3,377,184 | |

iShares® S&P 100® Index Fund | | | 71,750 | | | | 6,670,598 | |

iShares® US Technology ETF | | | 61,260 | | | | 6,724,510 | |

SPDR® Dow Jones® Industrial Average ETF Trust | | | 55,120 | | | | 9,927,663 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | |

| (Cost $54,873,274) | | | | | | | 58,312,024 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 12.33% | Shares | | Value | |

| Morgan Stanley Institutional Liquidity Fund - Government Portfolio, 0.040%, 7-day effective yield | | | 8,198,656 | | | $ | 8,198,656 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $8,198,656) | | | | | | | 8,198,656 | |

| | | | | | | | | |

| Total Investments, at Value - 100.02% | | | | | |

| (Cost $63,071,930) | | | | | | | 66,510,680 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.02)% | | | | | | | (11,895 | ) |

| | | | | | | | | |

| Net Assets - 100.00% | | | | | | $ | 66,498,785 | |

See Notes to Financial Statements.

| Annual Report | May 31, 2015 | 21 |

| Stadion Defensive International Fund | Schedule of Investments |

| | May 31, 2015 |

| EXCHANGE-TRADED FUNDS - 53.50% | Shares | | Value | |

iShares® MSCI China ETF | | | 14,420 | | | $ | 863,037 | |

iShares® MSCI EAFE Index Fund | | | 18,390 | | | | 1,225,510 | |

iShares® MSCI Emerging Markets ETF | | | 54,310 | | | | 2,233,227 | |

iShares® MSCI Japan ETF | | | 59,610 | | | | 777,910 | |

iShares® MSCI United Kingdom Index Fund | | | 39,760 | | | | 768,561 | |

WisdomTree® Europe Hedged Equity Fund | | | 22,840 | | | | 1,487,112 | |

WisdomTree® Japan Hedged Equity Fund | | | 13,570 | | | | 811,215 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | |

| (Cost $8,284,260) | | | | | | | 8,166,572 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 45.61% | Shares | | Value | |

| Morgan Stanley Institutional Liquidity Fund - Government Portfolio, 0.040%, 7-day effective yield | | | 6,961,172 | | | $ | 6,961,172 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS | | | | | | | | |

| (Cost $6,961,172) | | | | | | | 6,961,172 | |

| | | | | | | | | |

| Total Investments, at Value - 99.11% | | | | | |

| (Cost $15,245,432) | | | | | | | 15,127,744 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities - 0.89% | | | | | | | 136,599 | |

| | | | | | | | | |

| | | | | | | | | |

| Net Assets - 100.00% | | | | | | $ | 15,264,343 | |

See Notes to Financial Statements.

| Stadion Trilogy Alternative Return Fund | Schedule of Investments |

| | May 31, 2015 |

| COMMON STOCKS - 47.65% | | Shares | | | Value | |

| Consumer Discretionary - 4.73% | | | | |

| Distributors - 1.15% | | | | | | |

Genuine Parts Co.(a) | | | 13,310 | | | $ | 1,204,156 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure - 1.18% | | | | | | | | |

McDonald’s Corp.(a) | | | 12,864 | | | | 1,234,044 | |

| | | | | | | | | |

| Leisure Equipment & Products - 1.20% | | | | | | | | |

Polaris Industries, Inc.(a) | | | 8,769 | | | | 1,254,405 | |

| | | | | | | | | |

| Media - 1.20% | | | | | | | | |

Time Warner, Inc.(a) | | | 14,886 | | | | 1,257,569 | |

| | | | | | | | | |

| Consumer Staples - 8.37% | | | | | |

| Food & Staples Retailing - 2.40% | | | | | | | | |

Costco Wholesale Corp.(a) | | | 8,620 | | | | 1,229,126 | |

Sysco Corp.(a) | | | 34,392 | | | | 1,278,007 | |

| | | | | | | | 2,507,133 | |

| | | | | | | | | |

| Food Products - 3.60% | | | | | | | | |

General Mills, Inc.(a) | | | 22,283 | | | | 1,251,190 | |

Kellogg Co.(a) | | | 19,672 | | | | 1,234,811 | |

McCormick & Co., Inc. - Non-Voting Shares(a) | | | 16,307 | | | | 1,280,100 | |

| | | | | | | | 3,766,101 | |

| | | | | | | | | |

| Household Products - 1.16% | | | | | | | | |

Procter & Gamble Co.(a) | | | 15,521 | | | | 1,216,691 | |

| | | | | | | | | |

| Tobacco - 1.21% | | | | | | | | |

Reynolds American, Inc.(a) | | | 16,423 | | | | 1,260,465 | |

| | | | | | | | | |

| Energy - 2.30% | | | | | |

| Oil, Gas & Consumable Fuels - 2.30% | | | | | | | | |

Chevron Corp.(a) | | | 11,644 | | | | 1,199,332 | |

ConocoPhillips(a) | | | 18,975 | | | | 1,208,328 | |

| | | | | | | | 2,407,660 | |

| | | | | | | | | |

| Financials - 5.94% | | | | | |

| Banks - 2.38% | | | | | | | | |

US Bancorp(a) | | | 28,620 | | | | 1,233,808 | |

| Wells Fargo & Co. | | | 22,502 | | | | 1,259,212 | |

| | | | | | | | 2,493,020 | |

| | | | | | | | | |

| Capital Markets - 1.18% | | | | | | | | |

Eaton Vance Corp.(a) | | | 30,518 | | | | 1,239,031 | |

| | | | | | | | | |

| Insurance - 2.38% | | | | | | | | |

Aflac, Inc.(a) | | | 19,523 | | | | 1,214,721 | |

Brown & Brown, Inc.(a) | | | 39,192 | | | | 1,269,429 | |

| | | | | | | | 2,484,150 | |

| | | | | | | | | |

| Health Care - 4.90% | | | | | |

| Health Care Equipment & Supplies - 1.22% | | | | | | | | |

Abbott Laboratories(a) | | | 26,349 | | | | 1,280,561 | |

| Annual Report | May 31, 2015 | 23 |

| Stadion Trilogy Alternative Return Fund | Schedule of Investments |

| | May 31, 2015 |

| COMMON STOCKS - 47.65% (continued) | | Shares | | | Value | |

| Health Care - 4.90% (continued) | | | | |

| Pharmaceuticals - 3.68% | | | | | | |

Eli Lilly & Co.(a) | | | 17,030 | | | $ | 1,343,667 | |

Johnson & Johnson(a) | | | 12,380 | | | | 1,239,733 | |

Merck & Co., Inc.(a) | | | 20,749 | | | | 1,263,407 | |

| | | | | | | | 3,846,807 | |

| | | | | | | | | |

| Industrials - 8.24% | | | | | |

| Aerospace & Defense - 2.38% | | | | | | | | |

Lockheed Martin Corp.(a) | | | 6,579 | | | | 1,238,168 | |

United Technologies Corp.(a) | | | 10,640 | | | | 1,246,689 | |

| | | | | | | | 2,484,857 | |

| | | | | | | | | |

| Commercial Services & Supplies - 1.21% | | | | | | | | |

| Waste Management, Inc. | | | 25,407 | | | | 1,261,458 | |

| | | | | | | | | |

| Electrical Equipment - 1.23% | | | | | | | | |

Emerson Electric Co.(a) | | | 21,337 | | | | 1,286,834 | |

| | | | | | | | | |

| Machinery - 1.17% | | | | | | | | |

Illinois Tool Works, Inc.(a) | | | 13,033 | | | | 1,222,886 | |

| | | | | | | | | |

| Road & Rail - 1.09% | | | | | | | | |

Norfolk Southern Corp.(a) | | | 12,431 | | | | 1,143,652 | |

| | | | | | | | | |

| Trading Companies & Distributors - 1.16% | | | | | | | | |

WW Grainger, Inc.(a) | | | 5,048 | | | | 1,213,186 | |

| | | | | | | | | |

| Information Technology - 3.56% | | | | | |

| Communications Equipment - 1.21% | | | | | | | | |

Harris Corp.(a) | | | 15,912 | | | | 1,260,549 | |

| | | | | | | | | |

| IT Services - 1.17% | | | | | | | | |

Automatic Data Processing, Inc.(a) | | | 14,351 | | | | 1,227,154 | |

| | | | | | | | | |

| Software - 1.18% | | | | | | | | |

Microsoft Corp.(a) | | | 26,326 | | | | 1,233,636 | |

| | | | | | | | | |

| Materials - 2.42% | | | | | |

| Chemicals - 1.20% | | | | | | | | |

Ecolab, Inc.(a) | | | 10,989 | | | | 1,259,889 | |

| | | | | | | | | |

| Containers & Packaging - 1.22% | | | | | | | | |

AptarGroup, Inc.(a) | | | 19,941 | | | | 1,271,637 | |

| | | | | | | | | |

| Technology - 1.18% | | | | | |

| Computers - 1.18% | | | | | | | | |

International Business Machines Corp.(a) | | | 7,280 | | | | 1,235,052 | |

| | | | | | | | | |

| Telecommunication - 1.23% | | | | | |

| Diversified Telecommunication Services - 1.23% | | | | | | | | |

AT&T, Inc.(a) | | | 37,365 | | | | 1,290,587 | |

| Stadion Trilogy Alternative Return Fund | Schedule of Investments |

| | May 31, 2015 |