next most recent London gold price fix (AM or PM) determined prior to the Evaluation Time will be used, unless the Trustee, in consultation with the Sponsor determines that such price is inappropriate as a basis for evaluation. In the event the Trustee and the Sponsor determine that the London PM Fix or last prior London "fix" is not an appropriate basis for evaluation of the Trust's gold, they will identify an alternative basis for such evaluation to be employed by the Trustee.

Once the value of the gold has been determined, the Trustee subtracts all estimated accrued but unpaid fees (other than the fees to be computed by reference to the value of the ANAV of the Trust or custody fees computed by reference to the value of gold held in the Trust), expenses and other liabilities of the Trust from the total value of the gold and all other assets of the Trust (other than any amounts credited to the Trust's reserve account, if established). The resulting figure is the ANAV of the Trust. The ANAV of the Trust is used to compute the fees of the Trustee, the Sponsor and the Marketing Agent.

To determine the Trust's NAV, the Trustee subtracts from the ANAV of the Trust the amount of estimated accrued but unpaid fees computed by reference to the value of the ANAV of the Trust and computed by reference to the value of the gold held in the Trust (i.e., the fees of the Trustee, the Sponsor, the Marketing Agent and HSBC Bank USA, N.A., our Custodian). The Trustee determines the NAV per Share by dividing the NAV of the Trust by the number of shares outstanding as of the close of trading on the NYSE.

Gold acquired, or disposed of, by the Trust is recorded at average cost. The table below summarizes the impact of unrealized gains or losses on the Trust's gold holdings during the period November 12, 2004 (Date of Inception) through March 31, 2005:

Gold acquired, or disposed of, by the Trust is recorded at average cost. Gold is valued at the lower of cost or market.

The Trust's loss on gold for the three months ending March 31, 2005 is made up of $30,399 of unrealized loss on gold holdings and realized loss of $45 on the sale of gold to pay expenses plus realized loss of $284 on gold distributed on the redemption of shares.

The Trust's loss on gold from November 12, 2004 (Date of Inception) to March 31, 2005 is made up of $50,696 of unrealized loss on gold holdings and realized loss of $44 on the sale of gold to pay expenses offset by realized gain of $2,425 of gold distributed on the redemption of shares.

Selected Supplemental Data - As of November 12, 2004 (Date of Inception) and for the period November 12, 2004 (Date of Inception) through March 31, 2005

|  |  |  |  |  |  |  |  |  |  |

| (All amounts, except per ounce and per share, are in 000's) |  | Mar-31,

2005 |  | Nov-12,

2004

(Date of

Inception) |

| Ounces of Gold: |  | | | |  | | | |

| Opening Balance |  | | 30.0 | |  | | — | |

| Creations |  | | 5,888.2 | |  | | 30.0 | |

| Redemptions |  | | (639.8 | ) |  | | — | |

| Sales of gold |  | | (4.0 | ) |  | | — | |

| Closing Balance |  | | 5,274.4 | |  | | 30.0 | |

| Gold price per ounce - London PM fix |  | $ | 427.50 | |  | $ | 436.03 | |

| Value of gold holdings |  | $ | 2,254,801 | |  | $ | 13,081 | |

| Number of Shares: |  | | | |  | | | |

| Opening Balance |  | | 300 | |  | | — | |

| Creations |  | | 58,900 | |  | | 300 | |

| Redemptions |  | | (6,400 | ) |  | | — | |

| Closing Balance |  | | 52,800 | |  | | 300 | |

| Net Asset Value per share: |  | | | |  | | | |

| Creations |  | $ | 43.78 | |  | $ | 43.60 | |

| Redemptions |  | $ | (44.83 | ) |  | $ | 0.00 | |

| Net Loss for the period |  | $ | (1.21 | ) |  | $ | 0.00 | |

| At Period End |  | $ | 42.69 | |  | $ | 43.60 | |

| Net Asset Value at Period End |  | $ | 2,253,879 | |  | $ | 13,081 | |

| Change in Net Asset Value from inception |  | | 17,131.3 | % |  | | N/A | |

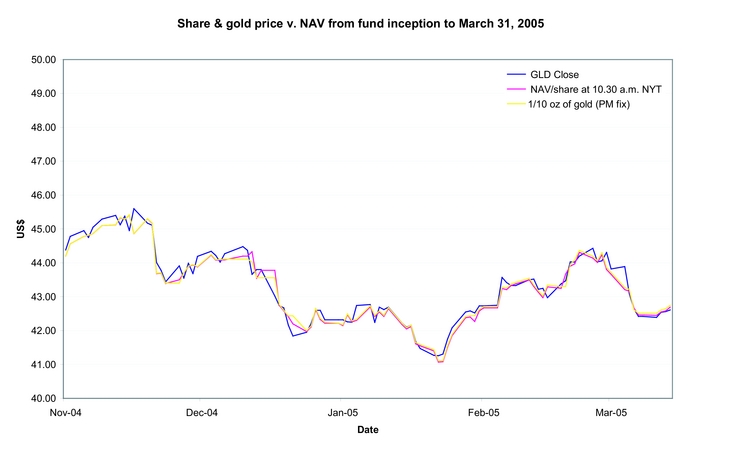

% Difference between Net Asset Value per share and market value of ounces

represented by each share |  | | (0.041 | )% |  | | N/A | |

|

Results of Operations

On November 12, 2004, the date of formation of the Trust, the Custodian received 30,000 ounces of gold on behalf of the Trust in exchange for 300,000 shares (3 Baskets). Trading in the shares in the Trust commenced on November 18, 2004 and on that date the Trust offered 2,300,000 shares (23 Baskets) through UBS Securities LLC, as underwriter, in exchange for 230,000 ounces of gold. Through December 31, 2004 an additional 33,700,000 shares (337 Baskets) were created in exchange for 3,369,804 ounces of gold and 5,800,000 shares (58 Baskets) were redeemed in exchange for 579,871 ounces of gold and 211 ounces of gold were sold to pay expenses. In the three months ended March 31, 2005, 22,900,000 shares (229 Baskets) were created in exchange for 2,288,422 ounces of gold and 600,000 shares (6 Baskets) were redeemed in exchange for 59,936 ounces of gold, and 3,820 ounces of gold were sold to pay expenses.

As at March 31, 2005 the amount of gold owned by the Trust was 5,274,388 ounces with a value of $2,254,801, based on that day's PM Fix (in accordance with the Trust Indenture).

Cash flow from operations

The Trust had no cash flow from operations in the period November 12, 2004 (Date of Inception) to March 31, 2005. Cash received in respect of gold sold to pay expenses in the period November 12 to March 31, 2005 was the same as those expenses, resulting in a zero cash balance at March 31, 2005.

13

Cash Resources and Liquidity

At March 31, 2005 the Trust did not have any cash balances.

When selling gold to pay expenses, the Trustee endeavors to sell the exact amount of gold needed to pay expenses in order to minimize the Trust's holdings of assets other than gold. As a consequence, we expect that the Trust will not record any cash flow from its operations and that its cash balance will be zero at the end of each reporting period.

Analysis of Movements in the Price of Gold

As movements in the price of gold are expected to directly affect the price of the Trust's shares, investors should understand what the recent movements in the price of gold have been. Investors, however, should also be aware that past movements in the gold price are not indicators of future movements. This section identifies recent trends in the movements of the gold price and discusses some of the important events that have influenced these movements.

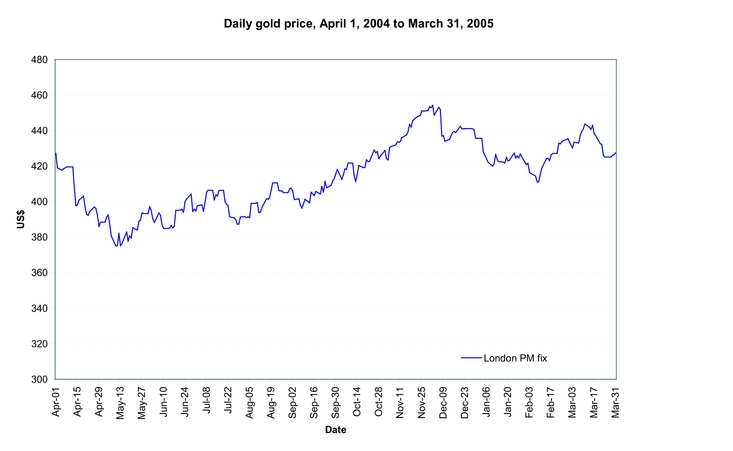

The following chart provides historical background on the price of gold. The chart illustrates movements in the price of gold in US dollars per ounce over the period from April 1, 2004 to March 31, 2005, and is based on the London PM Fix.

The gold price, at the London PM fix at March 31, 2005 was $427.50 per ounce and during the three months ended March 31, 2005 the gold price, at the London PM fix, traded in the range $411.10 per ounce (February 8, 2005) to $443.70 (March 11, 2005) and the average price over this period was $427.35.

During the year ending on March 31 2005 the gold price, at the London PM Fix, traded in the range $375.00 per ounce (May 10, 2004) to $454.20 (December 2, 2004) and the average price per ounce over that period, based on the London PM fix, was $414.21, compared to the average price of $409.17 for 2004.

The evolution of the gold price over the 12 month period ended March 31, 2005 was dominated by the weakening of the dollar relative to other currencies and swings in investment demand. The second Central Bank Gold Agreement came into effect in September 2004, removing a degree of uncertainty.

14

Physical demand for gold was stronger in 2004 than during the previous year, indicating that participants in the physical market had become accustomed to the generally higher price level. Demand data for the three months ended March 31, 2005 is not yet available. Continuing political tension, particularly in the Middle East, contributed to the rally in the gold price in the second half of calendar 2004. The rise in oil prices over the past six months and a general increase in commodity investment have influenced the gold price.

Cautionary Statement Regarding Forward-Looking Information and Risk Factors

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are predictions and actual events or results may differ materially from those expressed in our forward-looking statements. Risks and uncertainties may cause our actual results to differ materially from those expressed in our forward-looking statements. These uncertainties and other factors include, but are not limited to, the following:

The value of the shares relates directly to the value of the gold held by the Trust and fluctuations in the price of gold could materially adversely affect an investment in the shares.

The Shares are designed to mirror as closely as possible the price of gold bullion, and the value of the Shares relates directly to the value of the gold held by the Trust, less the Trust's liabilities (including estimated accrued but unpaid expenses). The price of gold has fluctuated widely over the past several years. Several factors may affect the price of gold, including:

|  |

| • | Global gold supply and demand, which is influenced by such factors as forward selling by gold producers, purchases made by gold producers to unwind gold hedge positions, central bank purchases and sales, and production and cost levels in major gold-producing countries such as South Africa, the United States and Australia; |

|  |

| • | Investors' expectations with respect to the rate of inflation; |

|  |

| • | Currency exchange rates; |

|  |

| • | Interest rates; |

|  |

| • | Investment and trading activities of hedge funds and commodity funds; and |

|  |

| • | Global or regional political, economic or financial events and situations. |

In addition, investors should be aware that there is no assurance that gold will maintain its long term value in terms of purchasing power in the future. In the event that the price of gold declines, the Sponsor expects the value of an investment in the Shares to decline proportionately.

The sale of gold by the Trust to pay expenses will reduce the amount of gold represented by each share on an ongoing basis irrespective of whether the trading price of the shares rises or falls in response to changes in the price of gold.

Each outstanding Share will represent a proportional interest in the gold held by the Trust. As the Trust will not generate any income and as the Trust will regularly sell gold over time to pay for its ongoing expenses, the amount of gold represented by each Share will gradually decline over time. This is true even if additional Shares are issued in exchange for additional deposits of gold into the Trust, as the amount of gold required to create Shares will proportionately reflect the amount of gold represented by the Shares outstanding at the time of creation. Assuming a constant gold price, the trading price of the Shares is expected to gradually decline relative to the price of gold as the amount of gold represented by the Shares gradually declines. The Shares will only maintain their original price if the price of gold increases.

Investors should be aware that the gradual decline in the amount of gold represented by the Shares will occur regardless of whether the trading price of the Shares rises or falls in response to changes in the price of gold.

Readers are urged to review the Risk Factors section contained in the Prospectus for a description of other risks and uncertainties that may affect an investment in our shares.

15

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Not applicable.

Item 4. Controls and Procedures

Under the supervision and with the participation of the sponsor, World Gold Trust Services, LLC, including its chief executive officer and chief financial officer, we carried out an evaluation of the effectiveness of the design and operation of our company's disclosure controls and procedures pursuant to Rule 13a-14 of the Securities Exchange Act of 1934. Based upon that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this quarterly report.

There have been no significant changes in our internal controls during the most recent fiscal quarter or other factors, which could significantly affect internal controls subsequent to the date we carried out the evaluation.

16

PART II - OTHER INFORMATION:

Item 1. Legal Proceedings

The Sponsor, World Gold Trust Services, LLC, the World Gold Council, the Trust and BNY, as Trustee of the Trust, have been named as defendants in a civil lawsuit filed by plaintiffs Gemini Diversified Holdings LLC and Dan Ascani in the Supreme Court of the State of New York, County of New York, on November 6, 2003 (Index No. 119243/03). The complaint alleges breach of contract and misappropriation of trade secrets under the Trade Secrets Act of the State of Georgia, and seeks compensatory damages in excess of $450,000, preliminary and permanent injunctive relief, costs and attorneys fees and other relief. The lawsuit is in its discovery phase. The Sponsor believes it has good defenses against these claims. The Sponsor and the World Gold Council have agreed to indemnify the Marketing Agent and UBS Securities LLC, as Purchaser in the initial public offering of 2,300,000 Shares, against liabilities arising out of the complaint.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

As of the date of the formation of the Trust on November 12, 2004, the NAV of the Trust, which represents the value of the gold deposited into the Trust, was $13,081,500, and the NAV per Share was $43.60. Since formation and through April 29, 2005, 641 Baskets (64,100,000 Shares) have been created, including 23 Baskets (2,300,000 Shares) issued in connection with the initial public offering of our Shares on November 18, 2004 (Registration No. 333-105202). As of April 29, 2005, 57,600,000 Shares were outstanding and the estimated NAV per Share as determined by the Trustee for April 29, 2005 was $43.49.

Item 3. Defaults Upon Senior Securities

None

Item 4. Submission of Matters to a Vote of Security Holders

None

Item 5. Other Information

None

Item 6. Exhibits and Reports on Form 8-K

|  |

| (a) | Exhibits |

|  |  |

| 31.1 | Certification by Principal Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|  |  |

| 31.2 | Certification by Principal Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|  |  |

| 32.1 | Certification by Principal Executive Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|  |  |

| 32.2 | Certification by Principal Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|  |

| (b) | Reports on Form 8-K filed during the quarter for which this report is filed: |

None.

17

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned in the capacities* indicated thereunto duly authorized.

| WORLD GOLD TRUST SERVICES, LLC

Sponsor of the Equity Gold Trust

(Registrant) |

/s/ J. Stuart Thomas

| J. Stuart Thomas

Managing Director

(principal executive officer) |

/s/ James Lowe

| James Lowe

Chief Financial Officer and Treasurer

(principal financial officer and

principal accounting officer) |

Date: May 11, 2005

|  |

| * | The Registrant is a trust and the persons are signing in their capacities as officers of World Gold Trust Services, LLC, the Sponsor of the Registrant. |

18